Buying

| Newer Posts | Older Posts |

New-ish Townhouses in Harrisonburg |

|

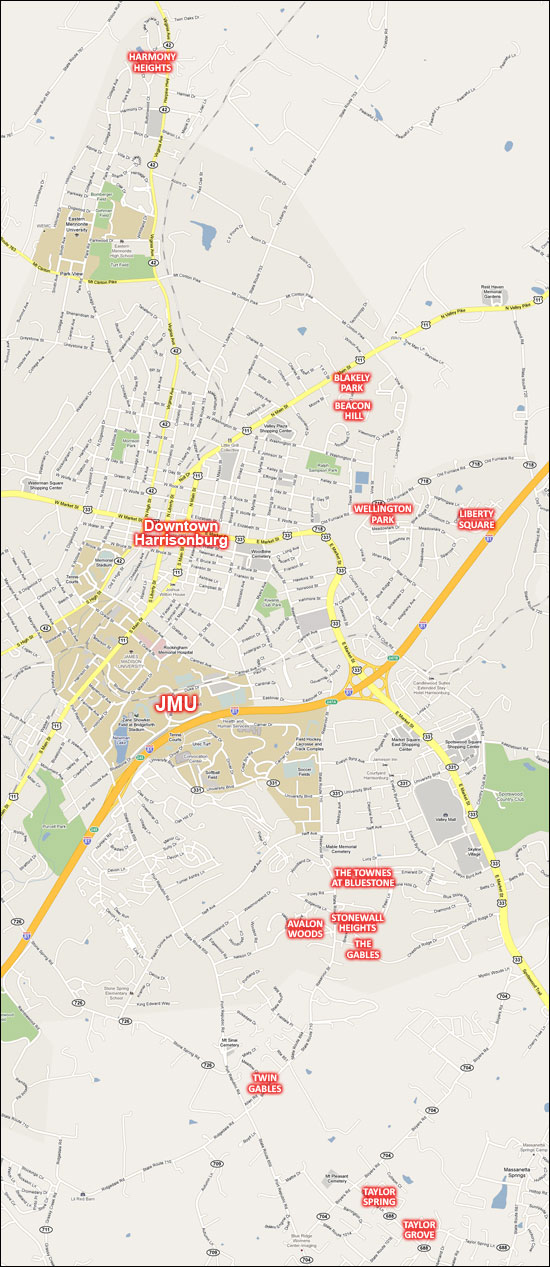

In working with several townhome buyers over the past few months, I developed the map below outlining the main "new-ish" townhome developments in and around Harrisonburg. There are certainly other smaller and/or older subdivisions, but this map shows the location of your main options for two and three story townhomes. Take a look below the map for links to properties for sale in each subdivision.  New-ish townhomes for sale in and around Harrisonburg:

| |

Standing Firm: The Harrisonburg and Rockingham County Real Estate Market Holds Steady In February 2010 |

|

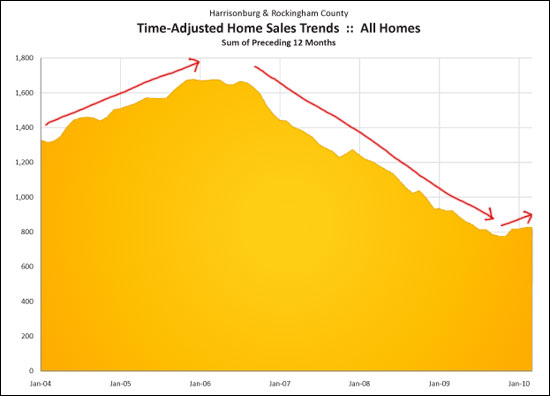

Click here or on the image below to view the full March 2010 Harrisonburg & Rockingham County Real Estate Market Report (PDF). Read on below for a few highlights.  Some high level February 2009 to February 2010 observations include:

Don't delay -- get all of the exciting (and not as exciting) details and beautiful charts by downloading the full March 2010 Harrisonburg & Rockingham County Real Estate Market Report (PDF). If you find the information in this report to be helpful....

| |

Multi-Generational Housing In Harrisonburg |

|

Many thanks to Sue Robertson for highlighting this article from Housing Watch regarding multi-generational housing. As this Housing Watch article reports.... "American families are going back to the future, with multiple generations shacking up together for the same reasons that young un-marrieds once did -- to save on housing costs. " The article is based on a study by Coldwell Banker, including the following observation.... "With two or three generations living under one roof, families often experience more flexible schedules, quality time with one another and can better juggle childcare and eldercare." I am definitely starting to see that trend occur, and quite a few of these buyers are ending up at The Glen at Cross Keys, where several of the floor plans work well for a multi-generational living situation. Of note, most of these scenarios are a parent and an adult child buying together, not necessarily four generations of a family as shown in the stock photography above.  Another house that I am currently marketing would work quite well for this as well because it has so much square footage and so many bedrooms and bathrooms:  Click here for details on 1911 Rhianon Lane, a 5 BR, 3 BA, 3600 SF home for $329,900. | |

The Buyers Rushed In, But Have Now Rushed Out (Or Have Been Pushed Out) |

|

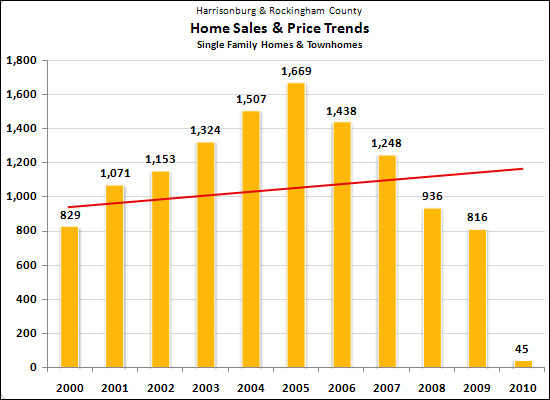

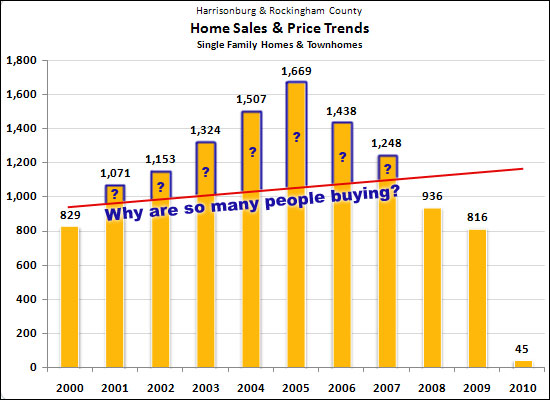

Harrisonburg has steadily grown over the past ten years, and thus I would expect that we would see a gradual, steady increase of home purchases. The recent history of home sales has not followed the slow and steady theory for the last ten years. Below I have charted a gradually increasing rate of home sales (the red line) as I might expect them to be occurring.  As you can see above, if there were approximately 900 home sales in 2000, I'd expect that we might be around 1100 home sales per year here in 2010. Let's examine why sales history strayed so far from this path....  While I didn't think to ask this at the time, I now think it would have been reasonable to ask between 2001 and 2007 why there were so many people buying houses. The blue sections of the yellow bars show the unexpectedly high home sales levels (per my rough calculations). Here are my theories on why so many people were buying at that time:

But now, as seen above, there are (if my red trend line is correct) fewer buyers in the market that could be or should be expected. If we flip around the three factors listed above, we'll understand why:

| |

Construction Is Underway On New Condos in Harrisonburg |

|

Less maintenance than a townhome, all of the amenities of Liberty Square (and more), one-level living, private entrances . . . . enjoy all of this and more in these 1,300 to 1,800 square foot new condos in Harrisonburg starting at $139,900, built by Scripture Communities.  Click here for more construction photos. Despite snowy weather, construction is moving along quickly at Founders Way. Below is a rendering of the finished product.  The first building of (12) condos will be complete in May 2010 or June 2010, thus making first time buyers for an $8,000 tax credit. PLUS....the builder is offering a free granite upgrade for reservations prior to March 31, 2010. PLUS....the builder is offering $3,000 of closing cost assistance. Find out more at FoundersWay.com, call (540-578-0102) or e-mail me, or stop by the Liberty Square model on Fridays, Saturdays, Sundays or Mondays between 1:30 p.m. and 4:30 p.m. Click here for Founders Way updates via Facebook | |

Understanding The Sales Market Via The Rental Market |

|

I was forwarded an article from CNN Money that offers an interesting perspective on understanding how home values may perform in the coming year(s).... "In normal times, people won't pay much less to lease a house than to own it. After all, if you're paying rent instead of a mortgage and taxes, you still get to enjoy the same rec room, chef's kitchen, and casita for visiting grandparents. So the surest sign of a frenzy appears when owning becomes far more expensive than renting. That's precisely what happened during the last bubble." This make sense to me. If it costs the same amount to buy as it does to rent, then someone would almost certainly buy instead of renting. "On average, DB [Deutsche Bank] found that families across America were spending about87% as much to rent as to own in 1999. Hence, they were traditionallywilling to pay a premium as homeowners, though not a big one." As one rough estimate, let's consider that new two-story Harrisonburg townhomes were selling for around $100k in 2000 (monthly cost of $720 with 100% financing at 6.75% fixed), and were leasing for around $725/month. Thus, per my rough estimates, the leasing and buying costs were quite similar. "But by mid-2006, with the craze in full swing, the figure fell below60%. At that point, Americans were spending an incredible 66% more toown than to rent." In 2006, these same townhomes were selling for $150k (monthly cost of $980 with 100% financing at 5.75% fixed), and were leasing for around $900/month. Thus, Harrisonburg also saw a shift in renting being much more affordable, but not nearly as significantly as in some areas. "So how did that happen? During the bubble, rents -- the real enginethat drives values -- were inching along at more or less their usualpace. From 1999 to 2007, apartment rents increased only 32%. But homeprices jumped more than three times as fast, around 105%." Per my numbers above, rents increased 24% in Harrisonburg (compared to 32% in the national study), and home prices jumped 50% (compared to 105% in the national study). "At the end of the third quarter of 2009, the overall number stood at83%, meaning renting was just a tad more attractive than owning." Interesting -- these townhomes are now selling at roughly $155k (monthly cost of $940 with 100% financing at 5% fixed), and are leasing for around $900/month. Still virtually equivant. "Given that analysis, it's likely that prices will fall another 5% or sonationwide. The drop could even be slightly greater. One reason: Rents,the force that govern housing prices, are still falling." Nationally, rental rates seem to be falling, though that is not largely the case in Harrisonburg. If prices had increased more drastically here, then prices would probably be falling more drastically here, and rental rates would also be falling more drastically. Yet again, the Harrisonburg and Rockingham County housing market seems to have performed, and be performing in a more healthy manner than much of the balance of the nation. | |

Get Ready: Lots Of Homes Will Be Coming On The Market Soon, Soon, Soon |

|

Or will they?? It's interesting, because most people assume that a LOT of sellers will be putting their homes on the market as we move into the spring and summer months. That is to some extent true --- look at the last two years of inventory levels (below) and you'll note that there are certainly more homes on the market between April and September than any other time of the year.  But wait --- the variation isn't actually very significant. The low inventory level has hovered around 800 for the past year, and the high around 940. While the spring/summer inventory levels are 17.5% higher than the fall/winter levels, here's how it translates into a buyer's perspective:

Furthermore, sellers ought not be overly concerned that they'll have dramatically more competition in the spring/summer months because of sky high inventory levels. | |

Power Search: Finding Cute Homes, Short Sales, Fixer Uppers and More! |

|

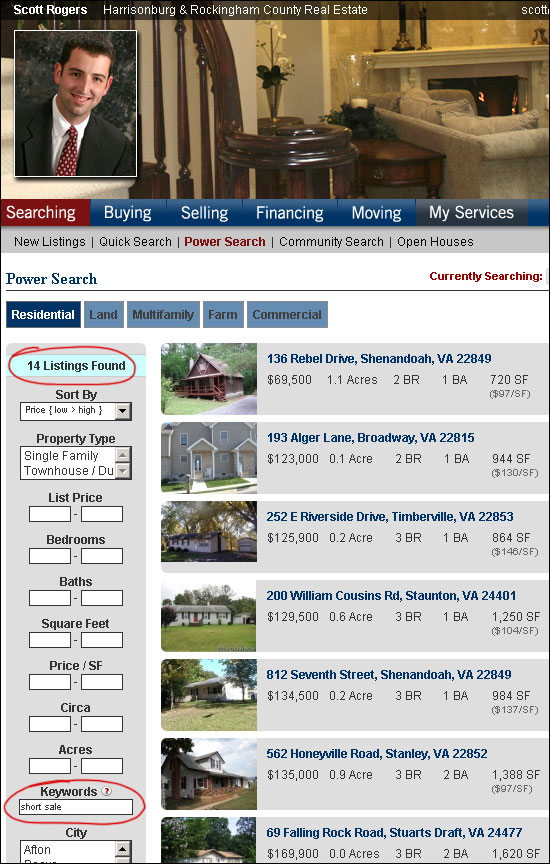

Just a brief public service announcement, reminding you of the ever-entertaining "Power Search" function on my web site. Use the "Keywords" field to search by all sorts of things, such as "short sale"......  As you can see, this gave us 14 search results. Thus, if you've ever wanted to search for current short sale listings, you can do so using the Keywords field in my web site's Powersearch function. Also, as some bonus analysis for today:

| |

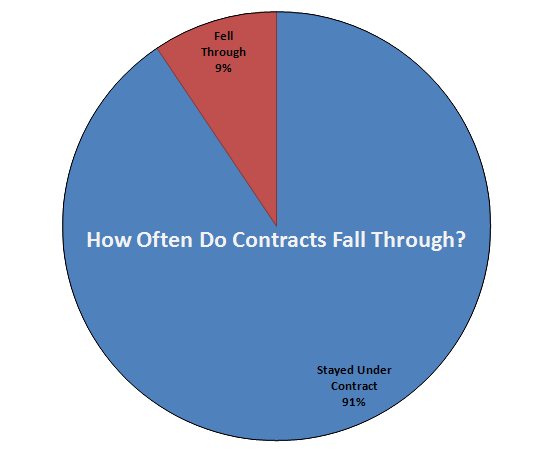

What Percentage Of Under Contract Homes Actually Sell? |

|

This was an interesting question from one of my clients --- relative to whether we should take the time to go look at a property that is currently under contract. Their perspective was that if quite a few contracts fall through, it could be worthwhile to go look at an under contract property -- but if most stay together, then maybe not. As it turns out, most homes stay under contract if they go under contract. In 2009, 818 homes went under contract. Only 77 homes came back from being under contract.  This contract success rate is a bit lower than past years, but much better than 2006!

| |

Looking For A Dutch Colonial In Rockingham County? |

|

Good Luck! There are only two listings on the market right now labeled as Dutch Colonial homes. Let's take a look at what IS for sale . . . .  As you can see, ranches, townhomes, contemporary homes and colonial homes are your best (or at least most prolific) option in Harrisonburg and Rockingham County. Also of note, here's what sold in 2009 . . . .  We find the same leaders -- ranches, townhomes, contemporary homes and colonials. Thus, we have a bit of a chicken/egg dilemma. Are these types of homes being sold because that's what people want, or because that's what is available. Here are the full numbers for those who are curious . . . .  . . | |

Are Foreclosure Rates Increasing In Harrisonburg and Rockingham County? |

|

Over at HarrisonburgForeclosures.com, I post notices of upcoming Trustee Sales (foreclosure auctions). The graph below shows how many trustee sale notices we've seen over the past 7 months.  As you can see, there has been a general increase over the past seven months, though it certainly could be a seasonal cycle since I don't have 12 months of data yet. Do remember that these numbers do not indicate how many properties are actually foreclosed on, but rather the number of properties for which a trustee sale is scheduled --- regardless of whether it ends up taking place. I'm working to get my hands on data about how many sales actually go through. Stay tuned! | |

Starter Home Buyers Increase, High End Home Buyers Decrease . . . And Prices Remain Constant?? |

|

Jennifer Chapman, one of my associates at Coldwell Banker Funkhouser Realtors brought some very interesting data to light yesterday. She noticed that there are fewer and fewer homes selling over $300k. I thought I'd take a look . . . . First, bear in mind that the median sales price has gone largely unchanged between 2006 and 2009, showing only a 3.5% decrease. (full market report) This would suggest (in some ways) that we've probably seen a roughly equivalent number of inexpensive and expensive homes selling over the past several years. This actually does not turn out to be true . . . .  I can make plenty of guesses as to why we're seeing these shifts, including:

| |

The State Of The Massanutten Resort Real Estate Market |

|

Yesterday's Daily News Record featured an article on the short term rental situation at Massanutten Resort. The latest update is that: "The Rockingham County Planning Commission is scheduled to continue a hearing it began in November about a zoning ordinance amendment, which, if approved by the Board of Supervisors, will allow the rentals and, in theory, end the debate." It has been an interesting four years (wow --- four years) that this debate has been going on, and it made me stop to think about the state of the Massanutten Resort housing market. Below is a brief summary of changes in that market over the past four years, within the context of the Harrisonburg and Rockingham County housing market as a whole.  As can be seen above, Massanutten has seen a steady decline in the number of home sales taking place in each of the past four years. That said, the Harrisonburg and Rockingham County market have seen a very similar decline. The only deviation here is that the Massanutten market continued to decline rather significantly (35% drop) between 2008 and 2009 while the rate of decline slowed down somewhat in the Harrisonburg and Rockingham County market as a whole (13% drop).  The graph above shows changes in the median sales price of homes in the Massanutten Resort market as compared to changes in median sales price for the market as a whole. The difference is staggering! Harrisonburg and Rockingham County have seen a median sales price decline of 3.4% over the past four years. During the same time period, Massanutten Resort has suffered a 16% decline in median sales price. It's impossible to know how much of a correlation exists between the soft Massanutten Resort market and the short term rental issue, but I believe this issue has certainly played some role in the changes depicted above. Also . . . enjoy the second edition of Harrisonburg Real Estate Radio: Assessments via Harrisonburg Real Estate Radio [11:55] | |

What Type Of Housing Is Being Built In Harrisonburg And Rockingham County |

|

One way to take a look at what is being built in and around Harrisonburg is by examining the Harrisonburg / Rockingham MLS to analyze listings circa 2009+. First, or note, a full 14% of listings currently for sale in Harrisonburg and Rockingham County appear to be new construction. (113 homes out of 793 homes). Here's a big picture summary of these new homes for sale in our market:

Also . . . enjoy the first edition of Harrisonburg Real Estate Radio: Home Inspections via Harrisonburg Real Estate Radio [08:38] | |

6,500 Reasons Why It's Great If You Have Owned And Lived In Your Home For Five Or More Years! |

|

Somehow, the $8,000 tax credit for first-time buyers is getting all of the attention, meaning that most people don't even know about the $6,500 tax credit available to you if you've lived in your home for five years. If you have owned your home for five or more years, you will (almost certainly) receive a $6,500 tax credit if you buy your next home by April 30th, 2010. To clarify -- you must have a contract on the house by April 30th and close by June 30th. Many people that I talk to who would be eligible for this $6,500 tax credit don't even know that it exists. If you're in this situation and planning to buy a new house in 2010, you really ought to consider making a move in the first four to six months of the year. Click here for more information (from the IRS) about both tax credits. Again, to try to really drive this point home: If you've owned your house (and lived in it) for more than five years, you are very likely eligible for a $6,500 tax credit if you buy a new home by the spring/summer. | |

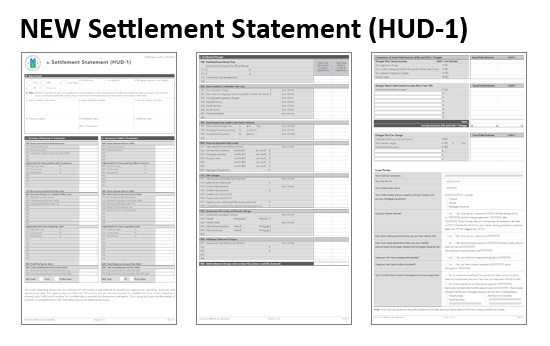

Brand New Good Faith Estimate AND Settlement Statement (HUD-1) Coming in 2010! |

|

The U.S. Department of Housing & Urban Development approved (some time ago) two updated forms that are CENTRAL to the real estate transaction. These two new forms will go into effect on January 1, 2010:

The new Good Faith Estimate (GFE) is now a standard form across all lenders. In the past a borrower would receive a GFE with a different format from each lender that they visited --- each having a slightly different set of disclosed loan terms, or vocabulary for referencing such terms. Now, a buyer can compare two proposed mortgage scenarios from two different lenders and be able to quickly and easily compare the exact same terms from each. I see this as a huge improvement for the financing process (for buyers), as in the past there has often been much confusion about how to determine which proposed loan program is better than the other. Here is an excerpt from Page 1 of the new Good Faith Estimate, which (surprisingly?) is quite intelligible!  But there's more! Beyond a buyer's (borrower's) loan terms and closing costs being easier to comparison shop, and easier to understand . . . there is also more accountability on the lender to make sure that those terms and costs stay intact through to closing. Some of the costs CANNOT change from the Good Faith Estimate, others can only change by a certain percentage, and others that can change without limit. This is a big improvement from current HUD guidelines whereby there was no guarantee that any of the closing costs or loan terms from a Good Faith Estimate would be carried through to closing. If you're buying in 2010, or beyond, you'll have the benefit of these new lending guidelines. Feel free to ask questions as you go through the process (of me, or of your lender) -- but hopefully the process will be much clearer and easy for you to navigate! | |

Selling For A Profit All Depends On When You Bought! |

|

Thankfully, the value of homes in Harrisonburg and Rockingham County hasn't taken a nose dive like has happened in many other markets. As you can see below, modest (normal?) growth in values occurred between 2000 and 2003, unbelievable (and unsustainable) growth in values occurred between 2003 and 2006, and prices became stagnant between 2006 and 2009.  That being said, since we haven't seen consistent growth in home values since 2006, there are some homeowners who are unable to sell their house (after costs) for as much as they bought it. Conventional wisdom pre-2003 said that you should only buy a house if you knew you'd be living in it for 5 or more years. You see, with the principal balance of the mortgage declining SO SLOWLY at the start of a 30-year mortgage, it would take a full five years to have paid down the mortgage enough to cover the costs of selling. As you might imagine from the graph above (or from talking to your friends), some people bought in 2003, 2004 or 2005, and then sold a year later at a tidy profit. The market was going up so quickly that they could sell one year later with no financial detriment because of the high rate of appreciation. Let's take a look at how our market has performed over the past decade by imagining that someone has to sell three years after they buy.  As per the chart above, a homeowner buying 2000 or 2001 would have been experienced a good sized gain.  The gain is starting to be more and more unbelievable at this point. Buying in 2003 and selling in 2006 would have resulted in a whopping $53,000 gain, or roughly $18,000 per year.  While things are starting to slow down, we see here that someone could have bought as late as 2005 and been just fine, given that there was such a big jump in median home values between 2005 and 2006.  OOPS! Wait a minute! A $16,000 loss?? It's true --- if you bought in 2006 or anytime thereafter, and you want to sell your house, you'll need to prepare to do so at a loss, given the costs of selling. The big question: When will the median sales price start to stabilize? When the supply of homes for sale starts decreasing more rapidly than it has, I believe we'll start to see the median price inch upwards again --- though not at the pace it did between 2003 and 2006! | |

Pondering The Future Of The Harrisonburg and Rockingham County Real Estate Market |

|

Over the last few days I have had quite a few discussions with developers, builders, buyers, sellers, and other Realtors regarding the exciting change of pace our local real estate market experienced in November 2009. To remind you of this astonishing news:

All of these are wonderful indicators, and we find yet another one at the top of this post, showing that while online property views (defined below) have been declining over the past few months, they are much higher than could be expected. In fact, there were more properties viewed online in November 2009 than in March 2009. Wow! We would typically expect that most buyers would be looking at properties online (and in person) at the start of the spring "buying season" -- but the graph above shows that there are still LOTS of buyers looking (at least online) at properties for sale. Online property views is the sum of all property views on the Coldwell Banker Funkhouser Realtors network of web sites, including our company web site, and all agent web sites. | |

The Most Frequently Used Driveway Materials in Harrisonburg and Rockingham County |

|

If you're building a home, what should you use as a driveway material? There are a lot of options!

Let's take a look at the most common types of driveways in Harrisonburg and Rockingham County. The data source for this analysis is the Harrisonburg/Rockingham Association of Realtors MLS, so it's an inexact analysis, but can still provide some helpful insights.  The chart above shows that the most common driveway material for single family homes in Harrisonburg and Rockingham County is gravel! Beyond gravel drives, which are likely found mostly in the County, the most frequently occurring driveway is an asphalt driveway. Let's take a closer look at driveways of single family homes in the City of Harrisonburg, to exclude the more "rustic" driveways found on homes further out in the County . . .  In the City of Harrisonburg, a full 1 in 5 driveways is still gravel, though asphalt driveways now lead the pack, with a full 10% greater market share than concrete driveways.  The graph above analyzes "expensive" homes --- those sold above $350k in the last year in Harrisonburg and Rockingham County. Here we find an even more overwhelming share of asphalt driveways, though we also see an increase in the percentage of exposed aggregate driveways.  Perhaps most interesting is that when examining homes sold since Jan 1 2000, we find that most have had concrete driveways. Is this perhaps the sign of a growing trend in our area, or the nation as a whole? Notes: In the last year, 570 single family homes sold in Harrisonburg and Rockingham County (per the HRAR MLS), and the analysis above is based on the 534 sales where driveway data was present and usable. | |

Are We Turning The Corner Towards More Positive Times? |

|

Take a look at home sales activity summarized by Quarter . . .  As you may notice, we've seen a steady decline in the number of residential sales in Harrisonburg and Rockingham County since 2005 . . . until the fourth quarter of 2009. Look again . . .  Please note, first, that the final fourth quarter 2009 sales figure is extrapolated based on data available as of November 30, 2009. So, my data could be wrong --- but I recently made some wild guesses about November 2009 sales (first I guessed 65, then I guessed 76) and they were both too low (the final figure was 82)! If we do see an year to year increase when comparing 2008-Q4 versus 2009-Q4, I think we can get excited about 2010 being the year when home sales finally started increasing again in Harrisonburg and Rockingham County. That being said, I will still allow for skeptics to blame it on the tax credit, or for other factors in the current market. Any skeptics out there? | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings