Buying

| Newer Posts | Older Posts |

Bold Buyers Bag Big Bargains |

|

I recently wrote a post entitled "Is it logical for a buyer to want 10% off of a "fair" asking price in today's economy?" where I concluded: There is nothing wrong with wanting to negotiate 10% off an asking price, or with making offers given such logic. But such a buyer should know that they may have to make an offer on ten or more properties before they find a seller willing to negotiate 10% or more below their asking price. Yet even given that perspective, there are deals to be had in the current real estate market --- and the buyers who are making aggressive offers are usually the ones finding the great opportunities. Here are the factors at play:

Thus, the stars must align --- a buyer must be willing to make an aggressive offer on a house that just so happens to have a seller who is ready to be overly flexible with their price. The natural question here is whether this actually ever happens. It does! But here's how --- these buyers who want to find that "great deal" often have to make offers on multiple houses before they find the one where the seller will be flexible. My advice to ALL buyers is to go ahead and make the offer that you think is reasonable, even if you are pretty sure the seller won't take it, and even if you aren't going to then skip around to house after house to find someone who will take your aggressive offer. | |

Harrisonburg & Rockingham County Home Sales Soar in November 2009! |

|

Take a look at this graph and see if you notice anything . . .  I notice a few things that are quite exciting: November 2009 home sales were 95% higher than a year ago (November 2008). Furthermore, there was a 30% increase between October 2009 and November 2009, when most other years there has been a decrease between October and November. November 2009 outperformed every other month of 2009 except for June and July. November is typically a very slow month for home sales, but this year buyers came out in droves! Read on for more good, bad, and neutral news . . .  Click here to download the PDF. If you find the information in this report to be helpful....

| |

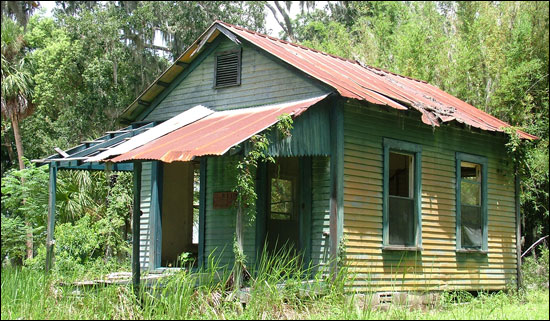

Buying a Fixer Upper in Harrisonburg? Check Out The FHA Section 203(k) Loan Program! |

|

If you're buying a fixer upper that you'll live in, you might want to consider the FHA Section 203(k) loan program! This program allows a buyer to finance their purchase and subsequent repairs into one loan. The alternative is for a fixer-upper buyer to obtain a secondary or short-term loan to finance the repairs or improvements that they will make after settlement. You can finance significantly more than the purchase price of the property in order to have cash on hand for repairs. The funds for improvements are placed into an escrow account, and the buyer (now owner) can draw on them through the rehabilitation process to pay for the repairs and improvements. There are a few basic guidelines that can quickly tell you whether this might work for your situation:

I have had clients consider this program, who didn't end up buying a fixer upper. Have you purchased a house in Harrisonburg (and surrounding) using this loan program? Or do you know someone who has? Please share! | |

Want To Buy? Have To Sell? Perhaps We Can Help! |

|

It seems that there are quite a few people in our current market who want to buy a house --- but they're at a standstill, because they have to sell their current home before they can buy. It can be a challenge to buy and sell simultaneously, as I pointed out this past September. But maybe there's another way . . . I market several neighborhoods of new homes for Scripture Communities, and just recently the builder (Jerry Scripture) has devised a move up program that has worked for him in the past, and is working again now in our current market. The concept is this: In certain circumstances, Scripture Communities will help you sell your current home, or will even commit to buying your home, if you are buying a new home in a Scripture Community. Does it sound to good to be true? It can be of tremendous help to someone who wants to buy, but most sell in order to do so. As a real, live, example --- we're in the process of building a home now (at Heritage Estates) for someone who is using the Scripture Community Move Up program. If they can't sell their current home themselves by the time their new home is complete, Scripture Communities will buy it from them at an already agreed upon price so that they can close on their new home. There are a few common sense guidelines that we're using when considering these move up scenarios:

| |

Reasonable Goals For Buying An Investment Property In Harrisonburg |

|

Every investor (or potential investor) comes to the table with different expectations for an investment property that they may choose to purchase. A few examples of this broad spectrum include: Having One's Cake And Eating It Too!

Put more specifically in today's context, most rental properties that an investor could purchase in Harrisonburg today will offer (how exciting!) negative cash flow --- even given a 20% down payment, self-management and self-maintenance. This leads me to two questions every potential investor should be asking.... 1. Should I be investing in real estate in Harrisonburg? If you are seriously considering investing in real estate, Harrisonburg is a great place to buy. While there are still some who believe our home values will eventually, somehow, start falling rapidly, we have seen relatively stable home values over the past several years despite the majority of the country seeing sharp declines. This is likely attributable to our low unemployment, a diverse economy, multiple local colleges/universities, and our proximity to D.C. --- all of which are great economic stabilizers that benefit real estate investors in this area. 2. What should I be buying as an investment property in Harrisonburg? And how should I be buying it? First, you'll need to be patient. As stated above, most properties currently for sale won't be very exciting, even given reasonable investment goals. However, there are, and there will continue to be some properties that can work well --- providing positive cash flow, likely appreciation, a stable tenant base, etc. To properly evaluate such opportunities, however, you'll want to (in my opinion) become comfortable with analyzing the properties and their potential financial benefits through several different lenses (cash flow, tax benefits, principal reduction, appreciation). Read up here for more details. If you are considering purchasing an investment property in Harrisonburg, I'd be delighted to assist you in that process. Get in touch (540-578-0102 or scott@HarrisonburgHousingToday.com) and we can start to discuss your situation and goals. | |

Is it logical for a buyer to want 10% off of a "fair" asking price in today's economy? |

|

Keston recently commented here as follows: That is a conundrum. In the early and mid 2000s sellers believed they should ramp up their prices relative to recent comps (usually with a successful sale) - hence, the upward pricing pressures on housing. Now, the opposite situation is occurring; buyers believe they should get a better deal than current comps. Indeed, even if prices haven't come down much, buyers have progressively gotten better deals in the last two years (i.e., lower interest rates and first-time buyer incentives). In the near term buyers are either going to require a good deal now or wait for a better deal. Remember that housing increased over 10% a year in the boom times. It's not illogical for a buyer to want 10% off of a "fair" asking price in today's economy. I can follow Keston's logic --- if prices went up 10% per year (or more) as the housing market accelerated, why shouldn't prices go down 10% per year (or more) as the housing market decelerates?!! Here are my thoughts: First, I definitely agree with Keston that it is very logical for a buyer to want 10% off a fair asking price. Furthermore, I imagine those logical buyers are quite perplexed (and perhaps frustrated) that prices haven't fallen by 10% a year as the market has declined. The law of supply and demand definitely suggests that prices should have adjusted as demand so drastically declined over the past three years. But, given that prices haven't fallen in this area, let's examine what is likely happening as those logical buyers try to buy in our local market with the perspective that they ought to be able to negotiate 10% off an asking price.

| |

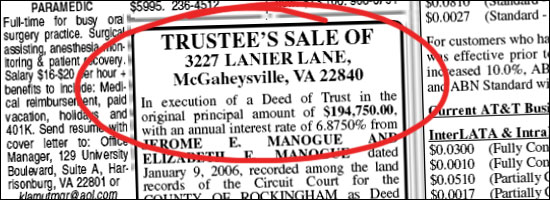

Buying A Foreclosure: Before, At, After The Trustee Sale |

|

There is often confusion about what it means to "buy a foreclosure" -- and it really all revolves around whether your potential purchase is happening before, at, or after the Trustee Sale. The Trustee Sale is the sale of the property on the courthouse steps to the highest bidder as a result of the borrower's default on their loan. BEFORE THE TRUSTEE SALE If a property is headed towards foreclosure, you may be able to buy it before it is sold on the courthouse steps. Sometimes a property headed towards foreclosure is on the market during that pre-foreclosure time period, so you could go tour the home, make an offer, and follow a traditional path towards purchasing the property. It's important to realize, however, that if a homeowner is headed towards foreclosure they are likely to be in a "short sale" scenario. A short sale is one in which the proceeds from the sale won't be sufficient to pay off the money owed against the house. If you are considering a property that would be a short sale, you may want to brush up on the typical timing of a short sale in Virginia. It's also crucial to know that there will be lots of uncertainty in trying to buy a short sale property because you'll be waiting on approval from the owner's lender, which can take weeks or months. During that time, other offers can come in, the property can be foreclosed on, etc. You'd know about these properties by reviewing notices of future Trustee Sales, or by asking your Realtor to look for properties in the MLS where a short sale is noted. AT THE TRUSTEE SALE This is where all the action is --- or not! Most trustee sales that I have attended do not have any bidders who exceed the bank's minimum bid. That is to say that the lenders typically take the properties back at or close to the amount of the outstanding loan balance. If the loan balance is a decent amount below perceived market value, then there may be bidders, but this is usually not the case. The uncertainty in buying at the Trustee Sale is that you usually will not have viewed the property (so you won't know the condition), and you won't be able to make your offer/contract contingent upon a home inspection. Thus, you're buying sight unseen, and as is. Quite a dangerous combination, which makes most potential bidders hesitant to bid too high, as they don't know what types of repairs they may have to make to the property. You'll also need to be prepared at the Trustee Sale with a cashier's check in hand, and be ready to close within just a few weeks. AFTER THE TRUSTEE SALE If you're "buying a foreclosure" after the Trustee Sale, you're really buying a bank owned property. That is to say that the lender was not able to sell the property on the courthouse steps, and thus have it back on the market after having foreclosed on the original borrower. Oftentimes, the new owner will not be the actual lender, but an asset management company. Some asset management companies will price the house quite evenly with the market, and try to sell it in a reasonable, but not overly fast time period. These properties are much like other properties on the market, except that they are owned by a bank or asset management company. Other lenders or asset management companies will list the property at a price where it is sure to sell quickly, and likely with multiple offers. A property such as this came on the market in Bridgewater this past week, and there were three offers on the property within the first few days of having been listed. Buying a bank owned property is relatively straight forward, though you may be dealing with multiple competing offers, you will definitely be dealing with lots of extra paperwork and disclosures from the bank, and you may be dealing with a slower than normal process for negotiations and closing. IN SUMMARY If you have been encouraged to "look at some of those foreclosure properties" or think that your best opportunity might be a "a foreclosure" -- maybe you should, and maybe it is. But bear in mind that the process, the risks, and the certainty of the purchase will vary quite drastically based on whether you buy before, at or after the trustee sale! | |

We're Seeing The Effects Of The $8,000 First Time Buyer Tax Credit In Harrisonburg, Rockingham County! |

|

I rarely make real estate sales predictions --- mainly because in the rare occasion that I do, I'm usually wrong. More on this in a few days. That being said, I believe we're seeing the specific effect of the $8,000 first time buyer tax credit (that was recently extended) here in Harrisonburg and Rockingham County. Check out how November sales figures will likely play out . . .  We've already seen 34 home sales in Harrisonburg and Rockingham County in the first 17 days of November. Compare that to how many occurred in Nov 1-17, 2008 versus Nov 18-30, 2008, and I have extrapolated a final sales count of 65 home sales this November. I will likely be wrong --- I think it will be even higher. The second version of the first time buyer tax credit was to end on November 30th, so there are quite a few purchasers already in the queue waiting to close at the end of this month. Do you want further evidence? The median sales price of the homes that have sold this month is $177,623, compared to the year to date median of $190,000. We're seeing more inexpensive (first time buyer type) homes selling this fall. Any counter prediction out there? What do you think? And what do you think we'll see in those typically stagnant months of December and January?? | |

The Puzzle (To Buyers) Of A Low List Price |

|

It can be difficult to price property as a seller, but another interesting puzzle is how a buyer should respond to a low (super-low) asking price. There are several scenarios where a list price might be quite a bit lower than expected:

The problem, of course, is that buyers are making a decision about an asking price in a vacuum! They don't know if there will be multiple offers, if any of the offers will be as high as asking price, if they will be above asking price, etc. The best solution, in my mind, is to use a relic from the recent past --- the escalation clause. This allows a buyer to make a bid that they hope will win the day, but also to provide an automatic method for increasing that offer should another outbid them. More specifically, if a house is listed at $125k that we think should sell at $225k, a serious buyer might want to:

My question, in that situation, is this --- if the above referenced property were not one with a low list price, but instead were listed at $229k, would you not be highly interested if you knew you could negotiate it down to only $185k? The issue at hand, I believe, is that it is hard to be comfortable with exceeding the asking price of a property in a buyer's market. | |

Has The First-Time Buyer Tax Credit Pulled More Buyers Into The Market In Harrisonburg, Rockingham County? |

|

Warning: This analysis, though numerically and statistically based, is an abstract answer to a nearly impossible question.  The question, raised today by Chad, is whether the first-time buyer tax credit (that was set to end on November 30, 2009 but has now been extended) has pulled any additional buyers into the market. I say.....maybe, but.... The chart above shows how I attempted to answer that question. For each year between 2000 and 2009, I determined the percentage of home sales that were at or below 80% of the median sales price that year. We can assume that most first time buyers are going to be in that general price range (under $93k for 2000, and under $152k for 2009). The chart, thus, shows how that segment of the market has fluctuated in relative size over the decade that is coming to a close. As you'll notice, the portion of supposed first-time buyers dropped off between 2005 and 2007 --- likely because home prices were increasing (mostly between 2005 and 2006) and lending requirements were becoming more restrictive (mostly between 2006 and 2007). But....the trend then reverses starting in 2008, and then continues in that new trajectory in 2009. There are thus (perhaps) more first-time buyers in our market today because of the tax credit, then there otherwise would have been. Yes, I know --- lots of mental leaps there. The additional caveat that I offered Chad is that while I believe the first-time home buyer tax credit did and is pulling buyers into the market now who might have otherwise waited until 2010 or 2011 to purchase --- I also think there have been first-time buyers that would have purchased in 2008 and 2009 that were waiting because of the economy. Thus --- the tax credit is borrowing buyers from the future who really would have been today's buyer anyhow. Again --- all of this is largely speculative, as I can't truly tell you the number of first-time buyers in our market, but hopefully this analysis sheds a bit of light on the topic. I welcome your suggestions for additional analysis to answer this question. | |

Several More Months Of An $8,000 First Time Buyer Tax Credit PLUS A New $6,500 Tax Credit For Long Time Residents Of Same Principal Residence |

|

THE NEW TAX CREDIT IS COMING, THE NEW TAX CREDIT IS COMING! The House has passed the bill, as has the Senate, and the President may sign it as soon as tomorrow (November 6, 2009). That's right --- the tax credits for home buyers are continuing --- and now they are being applied more widely. FIRST-TIME BUYERS You now have several more months to buy your new home --- you don't have to close by Nov 30 / Dec 1. In fact, as long as you have the property under contract by April 30, 2010, you'll have until July 1, 2010 to close on the property. The tax credit is still $8,000 with several imitations on income, home price, etc. LONG TIME RESIDENTS OF SAME PRINCIPLE RESIDENCE There's something for you too! If you have owned and used the same residence as your principal residence for 5 (consecutive) years out of the last 8 years, you will likely be eligible for a $6,500 tax credit. The deadline for closing is July 1, 2010 (as long as the property is under contract by April 31, 2010.) TIMING One important note here on timing --- if you're a first-time buyer, this new bill just extends your deadlines. If you're a "long time resident of same principle residence" you'll can close on your new house (and be eligible the tax credit) as soon as the bill is signed into law. That is to say that if you're a move-up (or down) buyer ready to close tomorrow (November 6th), you might want to wait another few days for the President to sign the bill. You'll enjoy an additional $6,500 net gain --- in the form of a tax credit. INCOME LIMITS The new income limits are $125,000 for single buyers and $225,000 for couples. THE ACTUAL LEGISLATION Interested in the details of the actual bill? Click here. | |

What Are Your Home Buying Goals: A Place To Live, An Investment, Or Both? |

|

Why do people buy homes? In a context stretching prior to 2002, people bought homes mostly because they needed a place to live --- and buying a home provided stability (your landlord won't kick you out), and had some financial side benefits (gradual appreciation, tax deductions). However, the paradigm of the American dream of home ownership shifted in the beginning of the 21st century when home values started to inflate by 10% - 50% per year in many markets. All of a sudden people weren't just buying houses because they needed somewhere to live --- but also because it would be an incredible investment. This new paradigm can be paralyzing to buyers in today's market. Certainly, people still need a place to live --- but now some buyers become hesitant and unable to act absent confidence that they will also have a strong financial return. I don't fault any buyer for desiring a good return on a home buying investment --- but I don't believe that keeping this new expectation on the forefront of our decision making is sustainable. Let me be more precise:

| |

Harrisonburg and Rockingham County Median and Average Sales Price Increase in September 2009, but . . . |

|

Perhaps as a result of the $8,000 tax credit, this month's home sales were not as low as could be expected given the year-to-date trends. During the first nine months of this year, we have seen an overall decline of 21% in home sales, yet September 2009 versus September 2008 only shows a 11% decline. Furthermore, both the median sales price and average sales price increased when comparing September 2009 sales to September 2008 sales. The year-to-date median and average sales prices are still showing declines (4%, 2%), so we won't call this a trend yet -- but hopefully a sign of positive changes to come. To learn more, review the entire September 2009 Harrisonburg & Rockingham County Real Estate Market Report: Read Report Online | Download PDF.  If you find the information in this report to be helpful....

| |

Why Are Home Values Remaining Stable In Harrisonburg and Rockingham County? |

|

In most areas of Virginia and the United States, home values have fallen quite dramatically over the past two years. Why, in Harrisonburg and Rockingham County, haven't we seen a similar decline? This video explores the reasons why I believe we haven't seen a decline in home values, primarily because of stubborn sellers, the non-effect of foreclosures, and because home prices didn't increase as much here as they did in other areas. Click here to view the video. | |

Buying a Home and Selling a Home Simultaneously |

|

Just buying, or just selling, can be challenging --- but doing them both at the same time often seems over daunting, especially if this is your first time to do so. There are several ways to tackle this challenge --- watch the video below to learn more... | |

Measuring Asking Prices By Assessed Values In The City of Harrisonburg |

|

I showed four homes in the City of Harrisonburg this afternoon to one of my buyer clients, and as my clients and I viewed the homes we sensed a very strange relationship between asking prices and our perception of their value. That is to say that we didn't sense much of a correlation between what the owners were asking for the houses and what we thought they were worth. To explore the relationship (somewhat) objectively, I thought I'd compare the asking prices to assessed values. But first, here is how sale prices and assessed values compare for the last three sales in the City of Harrisonburg between $240k and $260k. Sold properties are selling for 97% of assessed value --- based on an unreasonably small sample size of three properties:

| |

If You're Buying A Big Or Expensive Home, Will It Be In The City of Harrisonburg, or Rockingham County? |

|

Every five years (or so) the Harrisonburg Redevelopment and Housing Authority conducts a detailed analysis of City housing. In 2005, S. Patz & Associates, Inc conducted the analysis, available here: Citywide Housing Analysis for Harrisonburg, Virginia. One interesting "housing issue" that is identified as affecting the City of Harrisonburg was identified in the 2000 analysis, and re-confirmed in the 2005 analysis: "The loss of new construction of higher price new homes to sites in Rockingham County, while the City continues to attract only more modest single family detached and attached homes." I had never considered that this might be occuring --- that most higher price new homes were being built in Rockingham County instead of in the City of Harrisonburg --- but it makes sense, because undeveloped land is generally quite scarce in the City of Harrisonburg. To confirm (or reject) this conclusion, let's take a look at the homes that have sold each year since 2000, that were built within 3 years of when they were sold (thus, new-ish homes).... First, here's the break down of where all of these homes sold.... You'll note that the majority of the new-ish homes that were sold (and thus purchased) where in Harrisonburg, as opposed to in Rockingham County with a Harrisonburg address. Now, let's look at "large" new-ish homes, those with 2500+ square feet.... Here we do indeed find the phenomenon that the report described --- almost all of the large (and thus expensive) homes were built just outside Harrisonburg, and not within the City limits. Of note --- the City of Harrisonburg identifies this phenomenon as an "issue" because.... "An objective for the City is to help support development of higher priced/higher rent housing to provide a better mix of housing types and income levels in the City." For even more reading, read the full housing analysis! | |

Buying Real Estate in Harrisonburg As A JMU Student Or Parent To Qualify For In-State Tuition |

|

PLEASE NOTE: This post has been updated since it was originally published to reflect my now more thorough understanding of this issue based on additional input from some of the fine administrators from JMU.  I frequently receive questions from the parents of JMU students asking whether they can buy a property in Harrisonburg as an investment property in order to qualify for in-state tuition rates. If this seems like a far-fetched idea, check out the difference in tuition....

First -- if you want to start with the exact details, please check out the State Council of Higher Education for Virginia (SCHEV) web site where they provide a lengthy set of "Domicile Guidelines." OK -- here we go, the bottom line is that if a student arrives in Virginia in August, is enrolled in JMU and continues to be enrolled in JMU (fall and spring semesters) for several years, then the presumption is still that they are in Virginia for education and not as "bona fide" domiciles. So...how could a student establish themselves as a domicile in order to enjoy the in-state tuition rates?

Of note, SCHEV lists a variety of criteria that may indicate domiciliary intent, but these actions are not determinate in themselves:

My conclusion is this --- even if a student buys a house (or townhouse or condo) in Harrisonburg, lives in it, works in Virginia, pays income taxes in Virginia, has a car registered in Virginia, has a Virginia driver's license, votes in Virginia, intends to stay in Virginia after graduation, and is independent from their parents, that still doesn't necessarily mean that they will qualify for in-state tuition. The issue, again, is that it will be difficult to prove domiciliary intent when the move to Virginia and continued residency in Virginia is so immediately and directly tied to attending JMU. PLEASE NOTE: This is not an official interpretation of Virginia Domicile Requirements, it is solely my interpretation of SCHEV's guidelines to provide a hopefully-useful summary for you. If you have questions about these issues, contact the following people depending on your scenario....

| |

Pricing Competitively, But With Room To Negotiate |

|

Here's an interesting conundrum for a home seller...

Let's suppose, for a moment, that recently sold properties suggest that a home has a value of $250,000. Competitive pricing would, perhaps, mean pricing your home between $240k and $255k. With elevated inventory levels, you must stand out on price, being seen as a good buying opportunity. But then, when a buyer comes along, they'll likely want to negotiate you down $10k - $15k, or even more. If you priced the home at $260k or $265k to leave yourself room to come down $10k to $15k, you likely wouldn't have near the interest as compared to pricing the home at $249k. But if you price the home at $249k, you certainly won't be excited about coming down to $239k or lower. Suggestion #1 -- Use other "for sale" properties as a guideline. If comparable properties are available for $240k-$249k, you'll need to price your home lower, but if comparable properties are priced between $260k and $270k, you can likely get away with a higher asking price. Suggestion #2 -- Price your home "just above" the value suggested by recently sold homes. If that value is $250k, consider a price of $254,500, or something in that general range. Pricing is always an essential component of marketing a home to sell --- and in a fluctuating market, it becomes even more difficult than usual! | |

Is the Massanutten Home Sales Market Over or Under Performing the Harrisonburg Market? |

|

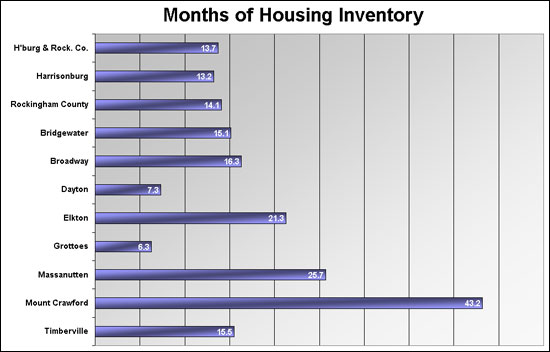

In response to my monthly home sales report, Keston asked... I'm guessing that even within Rockingham County that market conditions vary by locale. I was wondering if you have the ability to calculate the months of housing supply for Area 1 (Harrisonburg City) and Area 12 (Massanutten Resort). My hunch is Harrisonburg City is faring better than Massanutten. Let's take a look....at Massanutten, as well as other towns in Rockingham County...  Right off the bat, we see that Keston is correct. It would take 13.7 months to sell the housing inventory in Harrisonburg & Rockingham County -- but when examining Massanutten alone, it would take 25.7 months -- nearly twice as long. The other outliers are Dayton and Grottoes which are performing much better than the market as a whole, and Timberville which is performing very poorly (perhaps because of the small sample size). Click on the graph above or on the data chart below for a printable PDF of the data.  | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings