Buying

| Newer Posts | Older Posts |

A Year From Now, Mortgage Interest Rates Seem Unlikely To Be Much Below Six Percent |

|

The current average 30 year fixed mortgage interest rate is 6.82%. If you are waiting to buy a home until mortgage interest rates fall below 6% you might be waiting a while. A compilation of mortgage interest rate projections by Fast Company (here) show the following projected mortgage interest rates for the first and second quarter of 2025... Mortgage Bankers Association: 5.9% in 2025-Q1 5.8% in 2025-Q2 Fannie Mae: 6.3% in 2025-Q1 6.2% in 2025-Q2 Wells Fargo: 6.0% in 2025-Q1 5.9% in 2025-Q2 It seems that mortgage interest rates may very well stay near, at or above 6% for at least the next year. Read more here. | |

How Long Will You Stay In Your Home? |

|

It seems homeowners are staying in their homes much longer now than they did two decades ago... with the median homeowner tenure having risen from 6.5 years in 2006 to 11.9 years today. This analysis of homeowner tenure is thanks to a recent analysis by Redfin... A few reasons for this increase in homeowner tenure seem to include... [1] Older Americans staying in their homes longer. [2] More recently, the sticky-ness of low fixed mortgage interest rates. A few results of this increase in homeowner tenure seem to include... [1] Lower inventory levels of resale homes. [2] Continued increases in home values. When I ask folks that I encounter on a day to day basis how long they will stay in their current homes, I often am told that they will stay in their current homes for a very long time, if not forever. This is largely because... [1] They bought their home when home values were lower or significantly lower than they are now, and they are enjoying a relatively low mortgage balance compared to current home values. [2] They bought their home when mortgage interest rates were below 4%... or they refinanced their mortgage when interest rates were below 4%, and they do not want their housing payments to increase if they obtain a new mortgage above 6%. How long will you stay in your home? I plan to stay in mine for quite a while! | |

Another Buyer May Be Able Or Willing To Pay More Than You |

|

Many homes in many price ranges are still receiving multiple offers. Thus, a variety of questions may run through your mind if you are making an offer on a popular new listing... [1] How much is this home worth? [2] How much am I willing to pay for this house? [3] Will I win the bidding war? The challenge in answering #3 above is often not in the answer to #1 but in other buyer's answer to #2. It's note quite this black and white, but let's pretend that you and the three other buyers who are making an offer all conclude that the home is worth $350K. You love the house but your budget is capped at $360K. You offer to pay up to $360K. The second buyer won't pay a dime over market value, so they offer $350K. The third buyer has a budget that goes up to $500K, so they are willing to pay up to $370K for the house. Depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. As another example... Let's again pretend that the home in question is worth $350K, but it needs some updates. You love the house, but given the need for some updates you are not comfortable paying more than $350K. The second buyer offers $340K because of the need for updates. The third buyer is super handy and will make all of the updates themselves and has plenty of cash to spare for supplies, etc., so they offer to pay up to $360K. Again, depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. In any given multiple offer scenario, you must remember (as a buyer) that other buyers might be able or willing to pay more than you. | |

You Can Change A Lot About A House, But Not The Location Or Neighborhood |

|

That house is PERFECT! It has the right amount of bedrooms, it's the perfect size, I love the flow of the main living spaces, and the exterior siding and landscaping are just what I'm looking for in a home. But... it's not in the neighborhood or location where I'd like to live. Most buyers won't buy the house described above, because they won't be able to change the location or neighborhood of the house. You can finish some basement space to add a bedroom. You can build an addition to create more living space. You can open up some walls or close in some openings to affect the flow of the main living spaces. You can paint or replace exterior siding. You can add, remove or change the landscaping. But... you can't change the location or neighborhood where that house is situated. ** Yes, I understand that technically you could move a house, but it's rather cost prohibitive. ;-) So... if you see a house that you love, but it's in the wrong neighborhood or location... chances are, you won't end up buying it. Buy a house based on the things you cannot change... and be willing to change the things you can. | |

Make The Most Of Each New Listing This Spring! |

|

With mortgage interest rates still above 6% and with the vast majority of homeowners having mortgage interest rates below 4%, there will likely be far fewer new listings this spring. Why, after all, would a homeowner want to sell, pay off their mortgage with a 4% interest rate and buy, obtaining a new mortgage above 6%? Certainly, there are still plenty of reasons why homeowners will sell their homes even give the mortgage interest rate dynamic described above. Some may be moving out of the area, or moving to a different neighborhood or school district, or moving to have more space, or to have less maintenance. But the difference in most current mortgage holder's rates and current market rates is likely to continue to suppress the number of new listings we will see hitting the market. As such, if you're looking to buy a home this spring -- because you are moving into the area, or because you are currently renting, or for any other reason -- you should make the most of each new listing. Talk to your mortgage lender to get pre-approved... now. Go see each new listing of potential interest.. .quickly. Be ready to make a decision about an offer... quickly. | |

The Differential Value In Your Escalation Clause Should Likely Vary Based On The Other Terms Of Your Offer |

|

We're still in a housing market where many new listings will have multiple offers within a few days -- not all new listings, and maybe not most -- but many. As such, if you are hoping to buy a home this spring or summer you may find yourself competing against another buyer (or buyers) when you make an offer. If you are making an offer, and competing against one or more other offers, you may find yourself including an escalation clause in your contract. How does an escalation clause work, you might ask? An escalation clause allows you to make an offer at one price but include offer terms that will automatically increase that offer if another offer is at a higher price point. For example... offering $325K... but automatically increasing your offer up to $340K if there is another higher offer. One missing element of the description above is the differential value in your escalation clause. Here are two different versions of the escalation clause above, with differential values... [1] Offer of $325K, automatically increasing to be $1K above other offers, up to a maximum of $340K. [2] Offer of $325K, automatically increasing to be $5K above other offers, up to a maximum of $340K. Let's say, for illustrative purposes, that you are (unbeknownst to you) competing with an offer of $330K. The first escalation clause above [1] would cause your offer to be $331K. The second escalation clause above [2] would cause your offer to be $335K. Why would you include a differential of $1K vs. $5K vs. something even higher? Oftentimes, it depends on the other terms of your offer. If you are making a very clean offer with an 80% financing contingency, no home inspection, no home sale contingency and a speedy proposed settlement... you might just include a $1K differential in your escalation clause. The thought or hope in this instance is that your offer terms (other than price) will be equal to or better than the competing offer, and that your offer being $1K higher is enough of a difference to hopefully cause the seller to accept your offer. If you are making an offer with a smaller downpayment (95% financing), and with an inspection contingency... and if you suspect you are competing against buyers with larger downpayments or without inspection contingencies... you might include a larger differential in your escalation clause. The thought here is that if your offer with an inspection contingency is only $1K higher than a competing offer without an an inspection contingency, the seller will likely accept the other offer... but if you are offering (via the differential in your escalation clause) a price that is $3K (or $5K) higher than the competition, maybe that differential will be enough to cause the seller to still consider your offer despite the inspection contingency. And so on and so on. If you are proposing a delayed settlement date, increase the differential. If you have a home sale contingency as well, increase the differential. You can't know the details of the terms of the offer with which you are competing... but you can be strategic about how you craft the terms of your escalation clause based on the other terms of your offer. | |

Even If You LOVE A House, You Will Probably Only Be Willing To Pay So Much Or Remove So Many Contingencies |

|

Sometimes we end up searching for a home you LOVE for quite a while! Sometimes we never find a house that you completely LOVE but we find one that you like, a LOT. But, yes, sometimes we find a house that you absolutely LOVE!!! And yet... 1. You are probably only willing to pay so much for that house that you love. If a house is priced at $400K and that price is in line with recently sold properties, and it is an absolutely perfect fit for what you want in a home, and like nothing we have seen in over six months of searching... then you might be willing to pay $425K for the house. But you probably wouldn't pay $450K. There is a limit, for most buyers, of how much they'll pay even if it is an absolutely perfect fit. 2. You are probably only willing to remove so many contingencies from your offer. Will you remove an inspection contingency from your offer on an absolutely perfect house? Maybe, maybe not. Will you remove an appraisal contingency for said house? Maybe, maybe not. Will you liquidate assets to pay cash instead of having a financing contingency? Maybe, maybe not. Will you take on the risk of having two mortgages and remove a home sale contingency? Maybe, maybe not. For any given house, even one that you LOVE, we'll have to discuss how far you are willing to go to buy that house -- relative to price, and contingencies. | |

Consider Reverse Buyer Remorse When Deciding Whether To Make An Offer On A New Listing |

|

So, you followed my advice and we went to see that new listing on the first or second day it was listed for sale. Great! Buyers in most price ranges in Harrisonburg and Rockingham County still often need to see a home rather quickly when it hits the market in order to have a chance to make an offer. But now, you don't know what to do. You like the house a lot... but maybe you don't love it. You recognize that it checks off a lot of boxes of what you are looking for in a home... but you weren't immediately convinced that this was "the one" for you. So, what do you do? Do you make an offer? Do you decide not to make an offer? Do you keep thinking about it for a few days even though that might mean you miss out on the chance to buy it? It can often be helpful to think about this decision by considering the concept of reverse buyer's remorse. Buyer's remorse is a feeling of regret after having decided to buy something. It doesn't happen that often with real estate, in my experience, but more often with other purchases of things you don't necessarily need. Reverse buyer's remorse (as I'm using the phrase) is a feeling of regret for NOT having decided to buy something. If you don't make an offer on this house, and someone else buys it, will you be sad to have missed out on it? If you would be sad to have missed out on it, maybe you should make an offer. If you would not be sad to have missed out on it, maybe you shouldn't make an offer. | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

If Or As Mortgage Interest Rates Decline, Buyers Will Likely Jump Back In Sooner Than Sellers |

|

Mortgage interest rates peaked this past Fall at 7.79% and have been mostly declining since that time, to current levels of 6.74%. But, 6.74% can still feel high after interest rates were below 5% for 13 years... and below 4% for three years. As mortgage interest rates potentially continue to decline, perhaps back down to 6%, what will we see happening in the market? Will the lower mortgage interest rates spur on more home sales activity? Maybe, but perhaps not as much as you would likely expect. If / when / as mortgage interest rates move back down towards 6% -- or the low 6%'s or the high 5%'s we are likely to see more would be home buyers interested in buying. They will be able to afford higher sales prices and/or their monthly mortgage payment will be lower. But... in order for a home sale to take place... we need both a buyer AND a seller. Many homeowners (would be sellers) have mortgage interest rates below 4%. Quite a few have interest rates below 3%. Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 6% mortgage interest rate? Somewhere between no and probably not? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 5.5% mortgage interest rate? Somewhere between probably not and maybe? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 4.99% mortgage interest rate? Maybe? I expect that as we move through 2024 and 2025, and as mortgage interest rates (likely?) continue to decline (at least somewhat) we are likely to see more buyers jumping back into the market before sellers are doing the same. Which means... that we are likely to still see a competitive market... if buyer demand rises more quickly than seller supply. | |

Planning To Buy A Home? Yes, Talk To Me, But Talk To A Lender Too! |

|

If you are getting ready to buy a home -- whether your first or your last -- you will probably have plenty of questions.

If you're new to home buying, or new to the area, you'll probably have more questions than some other buyers, and that is OK! If you're getting ready to buy your fourth home and have lived in Harrisonburg for decades you might have fewer questions than some other buyers, and that is OK too! I am happy to meet with you to talk through all of this, and much more. We can do that in person, by phone, by Zoom, etc. But another important conversation to be having in parallel is with a mortgage lender. Unless you will be paying cash for your home, you'll need a loan to make your home purchase, and having a conversation with a lender sooner rather than later will serve you well. When meeting with a lender you will be...

So, if you're planning to buy a home this spring... Yes, talk to me... but talk to a lender too! Call/text me at 540-578-0102 or email me here. We can set up a time to meet and I can send you contact information for several qualified, professional and responsive local lenders. | |

How Many More Single Family Detached Homes Will Be Built In The City Of Harrisonburg? |

|

Over the past year this is where single family detached homes were built, as reflected by sales in the HRAR MLS... City of Harrisonburg = 3 homes Rockingham County = 58 homes When looking at development proposals in the City of Harrisonburg here's the breakdown of property types being proposed... Apartments = 74% or 2,747 homes Townhomes or Duplexes = 21% or 771 homes Single Family Detached Homes = 6% or 206 homes So, I suppose it is reasonable to ask or wonder... how many more single family detached homes be built in the City of Harrisonburg? Perhaps the vast majority of single family homes that will ever exist in Harrisonburg have already been built? Perhaps over the next 10, 20 and 30 years, 95% or more of new housing units will be apartments, townhouses or duplexes? After all, the City will eventually run out of land for building more housing. As it currently stands, if you are going to buy a new single family home in the next few years it seems almost certain that it will be in Rockingham County, not the City of Harrisonburg. | |

Moving Beyond Photos When Evaluating Homes For Sale |

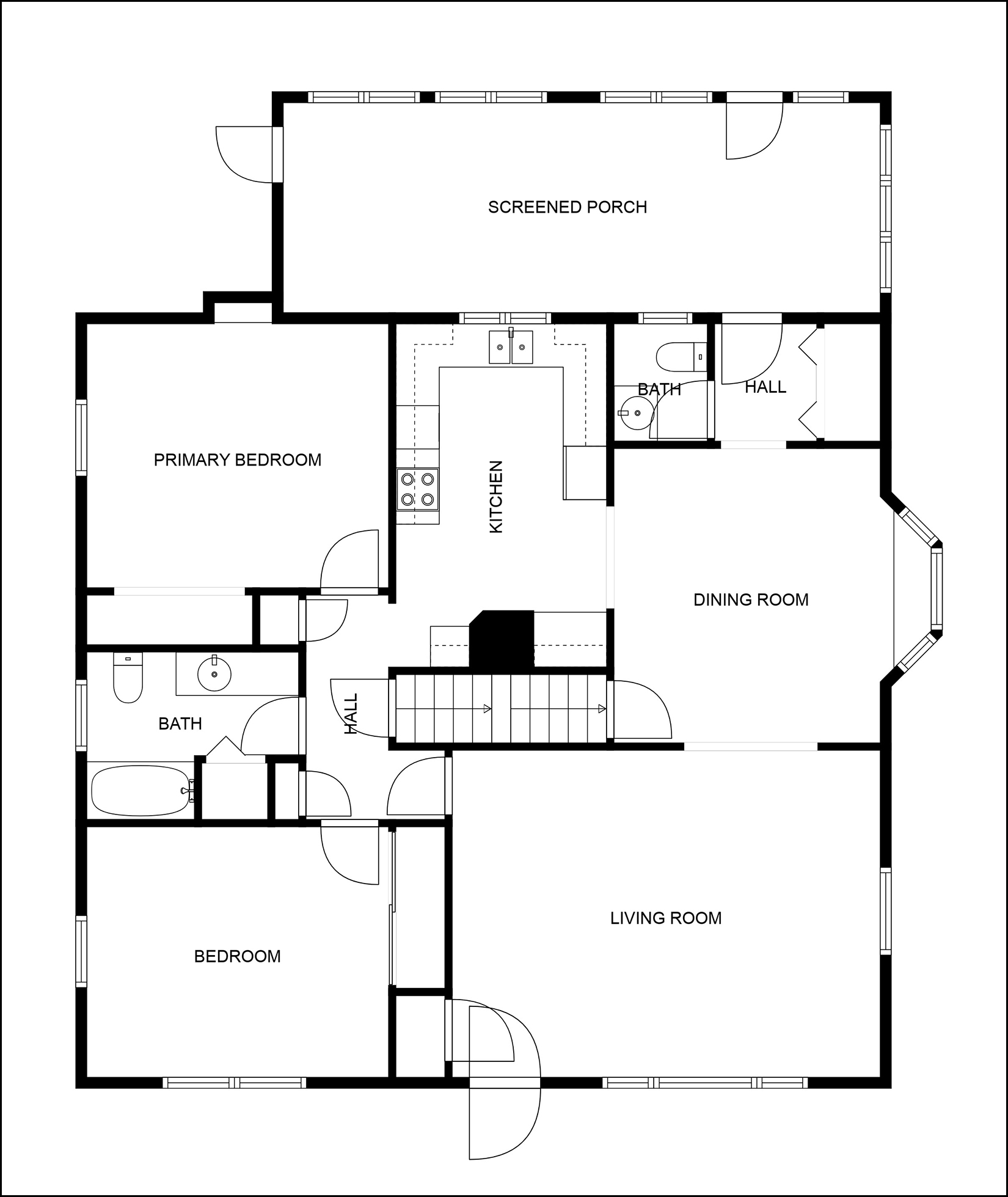

|

If you're searching for a home these days one of the first things you are likely evaluating when a new listing pops is all of the photos of the house. Thankfully, many or most new listings include great photos of the house, sometimes even including aerial photos. But, the photos only take you so far. Before you even step foot into the home you can often understand the house and its layout a bit more than what the photos might allow by reviewing the floor plan, a 3D walk through or a video of the home. Not all new listings include these additional ways to understand and evaluate the house -- and when they do, this additional information is not always easily accessible on all real estate websites and apps. If you see a new listing of interest, and you like what you see in the photos, but aren't quite sure how all of the spaces in the photos fit together -- feel free to text, email or call me and I can check to see if there are floor plans, a 3D walk through or a video for the listing of interest. We will then, of course, learn the most about the house by walking through it together... but let's start by reviewing as much information as is available to us about each new listing! | |

Most Homes You Consider Buying Will Not Be A Perfect Fit, So How Much Imperfection Will You Look Past? |

|

I'd love to think that we will find the absolute perfect home for you -- requiring no compromises at all -- perhaps even exceeding your expectations. And certainly, that is possible. But it's not necessarily likely. Most homes that you consider will not be an absolutely perfect fit. You might wish there were a bit more space in this room, or wish that they had updated that part over there, or wish the yard was a bit larger, or wish that the floor plan was a bit more open on the main level. As such, we'll likely see multiple versions of "not quite perfect" through the process of exploring potential homes -- along with at least a few "nowhere even close to perfect" options as well. Your decision as we work through the buying (exploring) process will be to decide how much imperfect you are willing to live with -- and what type(s) of imperfection you will accept. You might decide to purchase an imperfect house that you can make more perfect later through some renovations. You might decide to purchase an imperfect house because its imperfections make it more affordable and keep you in your price range. You might decide to purchase an imperfect because it is the least imperfect one we have seen yet. This is not intended to be a downer -- "you'll never find the perfect house" -- but rather, an encouragement to think about what versions of "not quite perfect" will be acceptable to you. You don't have to decide this up front, and it may change through the course of our exploration of homes to purchase. | |

Spring Is Coming, And Perhaps More New Listings Too |

|

Spring is coming. We had to wait one extra day this year, but March will be here tomorrow. With spring officially starting in about 20 days -- many would be home buyers in Harrisonburg and Rockingham County are wondering if we will start to see more resale listings popping onto the market as or once spring begins. I suspect that... [1] Yes, we'll see more new (resale) listings hitting the market this spring (Mar, Apr, May) than we have seen over the past few months. [2] We will likely see fewer new (resale) listings this spring than last spring. [3] There will likely be fewer new (resale) listings this spring than there are buyers who would like to buy said homes. While the above may differ a bit from price range to price range or from location to location, this likely means that... BUYERS should go see new listings quickly when they hit the market and be ready to make a decision and an offer quickly if you like the house. SELLERS should be relatively optimistic that if your house is prepared well, priced appropriately and marketed thoroughly that you will likely still see it go under contract within the first few weeks, if not the first few days. I'm ready for spring! Are you? | |

Instead Of Thinking About If It Is THE Right Time To Buy Or Sell, Think About If It Is YOUR Right Time |

|

It's a great time to buy a home. It's a great time to sell a home. Those words are often tossed about, in a balanced market, in a strong buyer's market and in a strong seller's market. Is it always a great time to buy a home or to sell a home? How could that be possible? Forget all of that. Don't get stuck on whether it is THE right time to buy or sell a home. Instead, we ought to be focusing on whether it is YOUR right time to buy or sell a home. There are plenty of times when it is definitely the right time for you to buy a home -- and some when it is not. For example, if you don't have stability in your job or if you might want to move out of the area for a job advancement, it probably is not your right time to buy a home. There are plenty of times when it is definitely the right time for you to sell your home -- and some when it is not. For example, if you don't know where you'll go next after you sell, we certainly shouldn't be getting all geared up to sell your home. So... let's focus less on whether this, right now, is THE right time (or THE best time) to buy or sell a home. Instead... let's focus on whether this is YOUR right time. If the time is right for you to buy or sell, let's get down to it. If it's not your time, don't let the market or other influences make you think that you should be buying or selling. | |

A Slightly Smaller Downpayment Allows You To Hold Onto Reserve Funds But Does Not Keep You From Paying Ahead On Your Slightly Larger Mortgage |

|

So... you're getting ready to buy a house... but you don't know how much of a downpayment you should plan to make. You have enough savings on hand to pay for your closing costs and have up to a 15% downpayment based on your purchase price. This would leave you with a bit of remaining savings, but not much. Should you... [1] Go for the 15% downpayment, financing 85% of the purchase price, and leaving you with minimal remaining savings? [2] Reduce your downpayment to 10%, financing 90% of the purchase price, and leave a bit more in savings. [3] Reduce your downpayment to 5%, financing 95% of the purchase price, and leaving a solid amount in savings. In most cases, I would recommend scenario #2 or #3. Reducing your downpayment *will* increase your monthly mortgage cost, but it will allow you to have savings on hand in the event that you need to pay some unexpected medical bills, make a major repair on your home, replace a vehicle, etc. And... you will still have the flexibility to pay more on your mortgage payment if you continue to have savings accrue and you want to pay down your mortgage more quickly. So, as you meet with a mortgage lender, don't assume that you will or you should put every last dollar of your savings into your downpayment and closing costs. Explore other possibilities that will result in a slightly larger mortgage but will allow you to still have some savings on hand in case you need them. | |

Given Current Low Inventory Levels, You May Want To Search More Broadly For Your Next Home |

|

Wouldn't it be grand if every would be buyer in the current market had (10) great homes to choose from on any given day? But we just aren't seeing that right now. If you'd like to buy a townhouse or duplex in the City of Harrisonburg for less than $275K, you have... one option. If you'd like to buy a detached home in the City of Harrisonburg for less than $300K, you have... five options. If you want to buy a detached home in the Turner Ashby school district for less than $400K, you have... three options. So, if you're are starting your home search right now (or continuing it) you might have to search a bit more broadly for homes than you had first imagined. Look a bit above and below your target price range. Look at homes with one fewer bedrooms than you would prefer. Look at homes in a nearby but different school district than where you hope to buy. Expanding your home search in this way will expose you to more options, one of which might be a great house for you, and it will help you further understand current market dynamics related to pricing. I hope we can find the perfect house for you, right away, amidst lots of other super options, but given lower inventory levels, we might have to look a bit more broadly to find some options. | |

Especially After Recent Increases In Property Values, Home Sellers Will Be Considering More Than Just The Offer Price |

|

Imagine you are a home seller... ...you purchased your home 10 years ago for $250K... ...you are ready to sell and hope it might sell for $340K... ...you list it for sale for $350K. After a few days on the market, you have three offers to consider... [1] Offer of $350K contingent on the buyer financing 80% of the purchase price. [2] Offer of $355K contingent on the buyer financing 95% of the purchase price. [3] Offer of $365K contingent on the buyer financing 97% of the purchase price and requesting a $5K closing cost credit. The first offer would get you $350K, the second $355K and the third $360K. Ignoring any other differences in the offer terms, which of these offers would you accept? Many buyers might think (or hope) that the highest offer price will win... but especially when home values have increased as much as they have over the past five years, home sellers might not always pick the highest sales price. Fictional Seller described above was hoping to sell for $340K, so all three of the offer are great -- they all results in higher prices than the goal of $340K. To pick on the third offer first, it provides for the highest sales price but the buyer has the least amount of funds to put into the transaction and is even asking the seller to pay for part of their closing costs. The artificially inflated sales price (to incorporate the closing cost credit) will mean that the property must appraise for $5K higher than it would otherwise. Furthermore, if there is an inspection contingency, this buyer seems likely to be the most concerned about any small or medium sized issues, as they do not appear to have a lot of funds to put towards the home purchase. The second offer ($355K with 95% financing) is certainly stronger than the first ($350K with 80% financing) but again, the smaller down payment can be an indication that something could go awry within the transaction to cause it not to make it to closing, such as discovering needed home repairs during the home inspection process. Thus, many sellers in this situation would end up choosing the lowest (!!) offer -- selling for $350K instead of $355K or $360K -- because of the greater certainty of the buyer successfully making it to closing given their seemingly more secure and stable financing situation. This is just one example of how home sellers these days will be comparing more than just the proposed purchase price when reviewing multiple offers -- especially if they bought their home 5+ years ago and have seen a sizable increase in their property value. | |

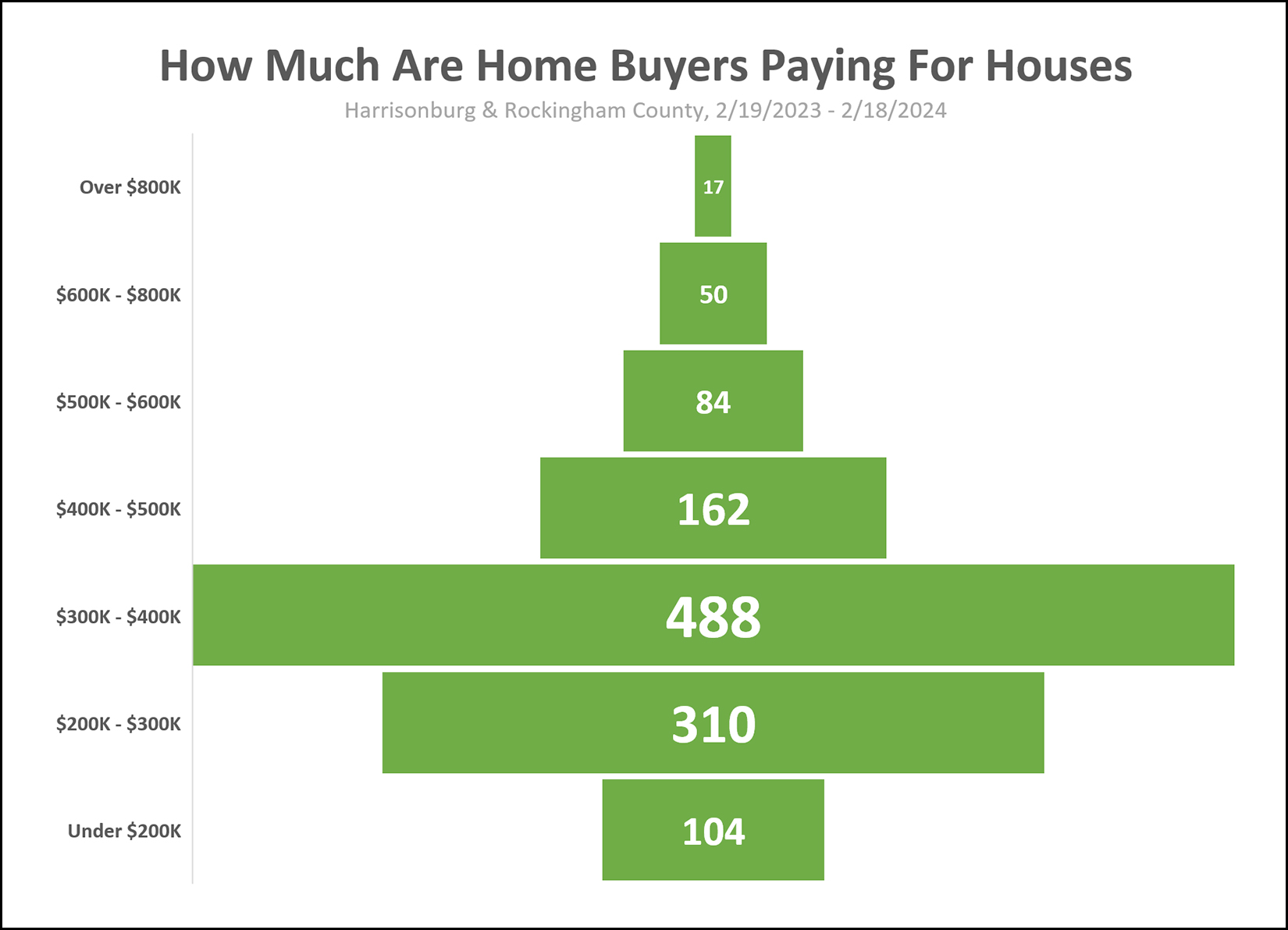

How Much Are Home Buyers Paying For Houses? |

|

How many buyers in the past year have been able to purchase a property for less than $200K? 104 buyers... or 9% of the buyers who bought in the past year. How many buyers paid more than half a million dollars for their homes? 151 buyers... or 12% of the buyers who bought in the past year. In what price range are the largest number of buyers buying? Just over 40% of home buyers paid $300K - $400K over the past year. As you prepare to sell your home you should take time to understand the size of the pool of buyers who will be potentially interested in buying your home. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings