Buying

| Newer Posts | Older Posts |

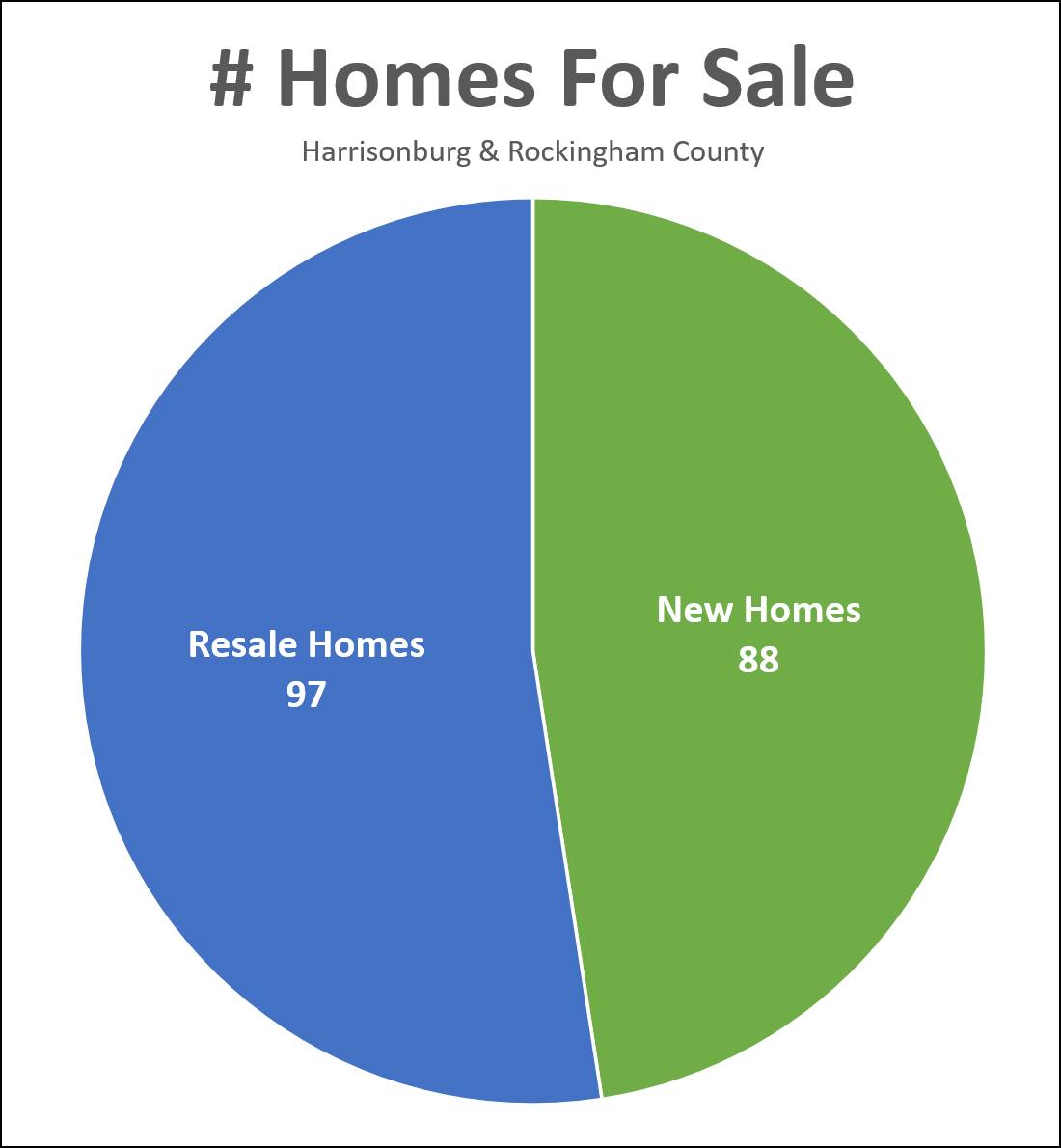

Almost Half Of Homes For Sale Are New Homes |

|

There are SOOOO many homes for sale... 185 of them right now, compared to only 109 a year ago. But... maybe there aren't as many homes for sale as you might think!?! As shown above, almost half of the homes currently listed for sale are new homes! New Homes For Sale = 88 Resale Homes For Sale = 97 So, even before we get to any price or location limitations, if you aren't looking to buy in a new home community you will only actually have 97 homes from which to choose, not 185 homes. These new homes for sale are mostly in these neighborhoods... | |

An Interesting Side Effect Of Buyers Being Slightly Pickier Given Higher Mortgage Interest Rates |

|

OK, see if you can follow me on this one... When mortgage interest rates were low (below 4% for a while) buyers could afford most houses they wanted to pursue, competition amongst buyers was fierce, and buyers were willing to compromise on some of the ways in which any given house wasn't quite the perfect house. If it was good enough, they would very likely make an offer. With mortgage interest rates now being quite a big higher (above 6%) buyers can't afford as many houses, and they are often (reasonably) being a bit pickier about how well a particular house fits their needs and desires. If they're going to spend *that much* on a house payment, they want it to be a pretty darn good fit for what they want in a house. Here's an interesting side effect of this shift... Before... most or all houses would rapidly have offers, and often have multiple offers. Now... some houses aren't getting many offers at all, and some are getting a TON of offers. The houses that are the most widely appealing to buyers are feeling "just right" to so may buyers that they are generating lots of offers. The houses that are mostly appealing to buyers but have some "flaws" or some "not quite right" features in the eyes of some or many buyers are seeing fewer offers, or slower offers, or no offers. I understand a buyer's logic in this type of a situation... monthly mortgage payments are high right now given higher home prices and higher mortgage interest rates... so you want to love the house you intend to buy. | |

Some Houses Are Still Selling Super Fast With Many Offers |

|

Plenty of houses are taking a while to sell these days... sometimes weeks and even months. But... some are selling VERY fast, with LOTS of offers. Case in point - a house that shall not be named - with 12 offers within three days of being listed. Some would-be sellers thus wonder --- will my house be a three month sale or a three day sale. Oversimplifying a bit... it's all about supply and demand. If a house is listed for sale in a neighborhood where there are already two houses for sale and there are very few buyers looking for the combination of features that the house offers -- it might take a bit for the house to sell. If a house is listed for sale in a neighborhood where homes have rarely been listed for sale over the past two years and there are a ton of buyers who would love to live in that neighborhood -- it might take just a few days for the house to sell. We ought to analyze and evaluate the type of market your house might fit into (of the two general types above) before we list your home for sale -- but we won't really know with certainty how the market will respond until we list your home for sale. | |

Lenders Will Likely Want To Compete For Your Mortgage Business Right Now |

|

Mortgage interest rates have been dropping for the past three months -- BUT -- they are still much higher now than where they have been for most of the past 10+years. As a result, we are seeing lower levels of home buying activity, which means fewer mortgages -- and there are definitely far fewer refinances happening right now. All of this means that lenders will very likely want to compete for your business. If you are buying a home, have good credit and maybe even a downpayment -- there will likely be many lenders who would love to finance your home purchase for you. Some general recommendations are... [1] Start by talking to one lender to get a pre-approval letter prior to making an offer. [2] Once you are under contract to buy a home, knowing the specific property and specific price, go back to that first lender as well as several others to compare rates and terms. [3] Try to get each lender to simplify things down as much as possible related to closing costs and monthly payments so you can compare apples to apples. [4] Don't hesitate to take one lender's quote to the other to ask them if they can match or beat it. [5] If two lenders are pretty close in the terms they can offer you, give some preference to a local lender (who you can meet with in person if things go awry) and to a lender that is prompt, professional and detail oriented in their communication. Happy mortgage shopping! | |

Most Buyers Include A Study Period In A Contract For A Building Lot Or Land |

|

Getting ready to build your dream home? Exciting!!! Did you find the perfect building lot in a neighborhood? Or an ideal 2.5 acre lot in the County where you plan to build? Fantastic!!! You have two options at this point... [1] Continue to do lots of research and planning, and then if it all pans out, make an offer and try to negotiate a deal with the seller. [2] Make an offer with a study period. Most buyers seem to be more comfortable with the second option -- going ahead and making an offer, with a study period. This strategy allows you to make sure you can negotiate a deal with the seller that works for you from a price (and other terms) perspective -- before then spending a good bit of time, and possibly money, on confirming that the lot or land is suitable for your building plans. During your study period (often 30, 60, 90 days or longer - depending on the property type) you will likely... [1] Walk the building lot with your builder. [2] Research details of utility locations and/or availability. [3] Confirm any easements that would affect where you could build. [4] Research how much rock may exist and whether that will affect your building plans. [5] Get pricing from your builder for building your dream home now that you have a proposed site/location for it. These are just a few of the items we might research during the study period in your contract -- all pointing us to a greater understanding of whether your plans for building on the lot will work well for you. If you're ready to explore some land or building lots, be in touch! | |

Depending On How Long You Plan To Be In Your Home, A Rate Buy Down May Make Lots Of Sense! |

|

One option you will have when finalizing your loan terms with your lender will be buying down your mortgage interest rate. Current mortgage interest rates are right around 6.7% -- but you very likely will have the option to pay some extra closing costs to buy down that mortgage interest rate. The more you pay, the lower that rate will go - and the that lower rate will last for the life of your loan. Of note, if you think you might be selling your home within two to three years, it might not make sense to pay thousands of dollars up front to secure a lower than market interest rate -- but your lender can help you determine the length of time you would need to be in your home to make the cost of the rate buy down make sense. If you know (or believe) you will be in your home for many (many!) years to come, you may very well want to go ahead and buy down that interest rate. There are lots of options to consider when securing a mortgage, and if you have questions about the many different options, feel free to run them by me. | |

Some Townhomes Owned By Investors Are Being Offered For Sale. Will They Be Purchased By Owner Occupants Or Other Investors? |

|

Lots and lots of townhouses in and near Harrisonburg are owned by investors. I know, that's a very exact and precise figure. ;-) Anecdotally, I've seen some of those townhouses hitting the market for sale over the past two months. Not an overwhelming number... more than five but fewer than ten. My curiosity is in whether these investor owned townhouses will remain investor owned -- if another investor will buy them -- or if an owner occupant will purchase them. I work with plenty of investor clients, and so in some sense I'm rooting for them, if any of them want to buy another investment property. But... I think I'm rooting for the would-be owner occupants just a smidge more than the investors. Buying a home, moving in, investing in that home and in a neighborhood, having a sense of stability and permanence are all things that help build the Harrisonburg community that we know and love. If or as folks decide that they would like Harrisonburg to be their home for the long term, I'd be delighted for them to be able to *buy* a home and not just have to *rent* a home -- IF their financial situation points to that being a wise and sustainable decision. Anyhoo... only time will tell whether these (few) recent investor owned townhouses will be purchased by other investors or by owner occupants... but I'm a big fan of homeownership, so here's hoping that at least some of them will be purchased by those who plan to live in them and make Harrisonburg their home for years to come. | |

Would Be Home Buyers Are Finally Finding (Some) Relief In The Way Of Mortgage Rates |

|

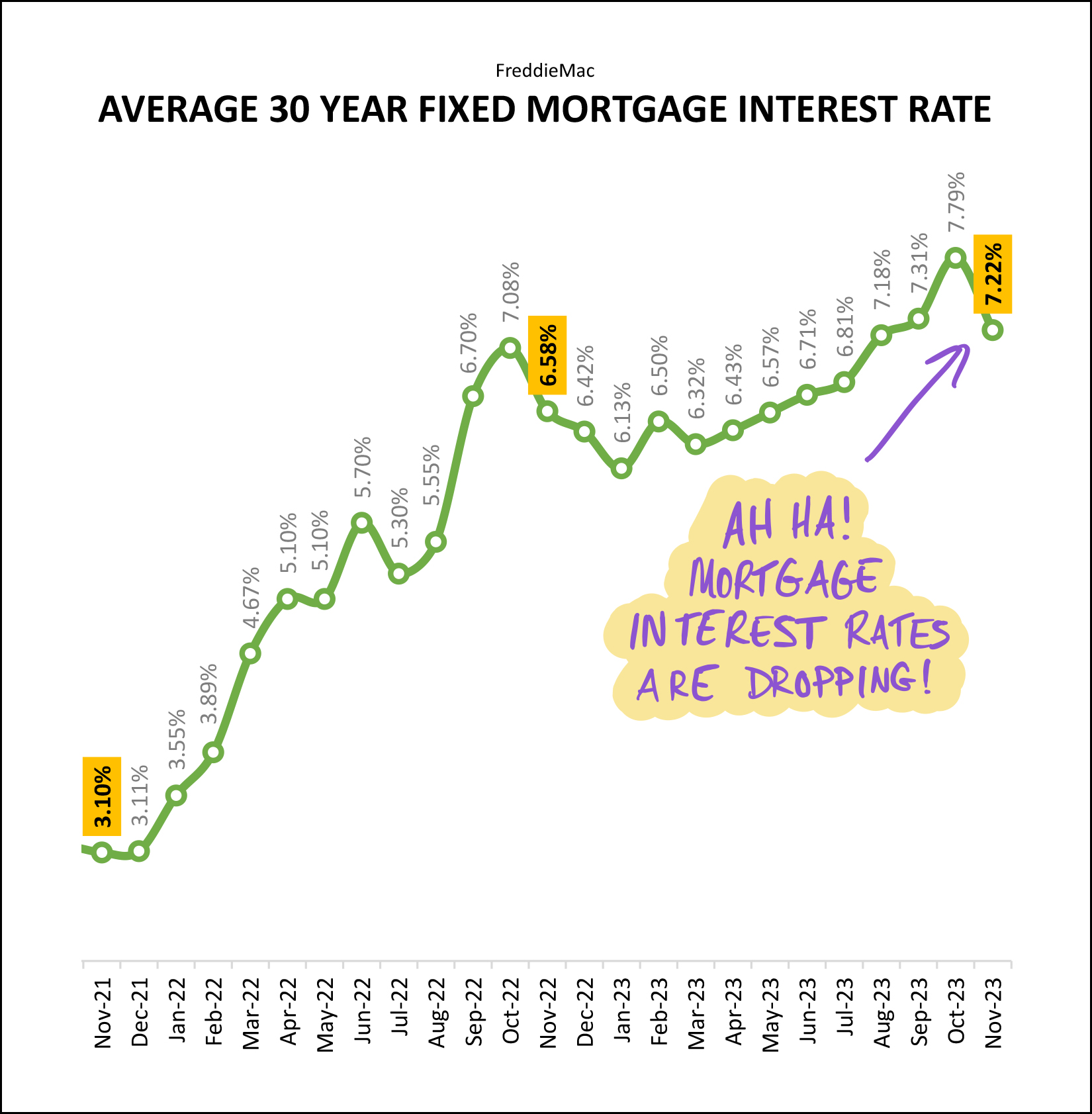

For over 10 years (Feb 2011 - Apr 2022) mortgage interest rates were below 5%. For about 3 years (May 2019 - Mar 2022) mortgage interest rate were below 4%. But since that time, they shot past 6%, past 7% and nearly hit 8%. Perhaps unsurprisingly, many buyers have found themselves priced out of the homes they want to buy over the past year. Not only were these buyers facing ever higher mortgage rates -- home prices were also continuing to climb, with the median sales price increasing 10% over the past year. But finally, some buyers are finding some relief in the way of lower mortgage interest rates. After peaking at 7.79% in October 2023 we have seen the average 30 year fixed rate mortgage drop steadily to it's current level at 6.60%. We're still not back down to 4% or 5% -- but a mortgage payment at 6.6% certainly makes many houses more affordable than they were at 7.79%. If you plan to buy a home in 2024 and you last talked to your lender in October or November of this past year, connect with them again soon -- you will likely be pleasantly surprised at how your projected monthly payment has adjusted given declining rates.

| |

So Many Different Ways To Consider Buying A Home If You Also Need To Sell A Home |

|

If you have own a home... but are ready to buy a new one... sometimes the biggest challenge is figuring out how to buy the next home while selling the current one. This list doesn't include all the possible ways to do it... but it includes quite a few options to consider and explore... Buy First, Seller Later. If you are qualified for a mortgage to purchase the next home before you sell your current home, this may be the way to go. This will allow you to make an offer on a house you love without a home sale contingency, which often won't be be accepted by a seller. Certainly, there are some risks to this approach -- you won't know how quickly your home will sell or for what price -- but it will be a lot easier logistically. In addition to being able to make an offer without a home sale contingency, you will also be able to move into the new home before having to move out of your existing home. List Your Home For Sale After Having A Contract To Buy The Next Home. Shifting pretty far from the prior strategy - the concept here would be waiting to list your home until you have secured a contract to buy the home you want to buy. But... this isn't necessarily a realistic strategy in the current market. Most home sellers aren't going to be interested in your offer if it is contingent on you listing your home, getting it under contract, working through any contingencies and then getting to closing. So... it's fine to make offers with this contingency but it is not necessarily realistic to think that a seller will go along with your proposed plan. List Your Home For Sale After Seeing The Perfect House To Buy. This one is a bit tricky from a timing perspective, but it's trying to end up somewhere between the two strategies noted above. This game plan would involve waiting until a perfect house comes on the market for sale, and then listing your home for sale. The hope would be that you could get your current house under contract quickly enough to then make an offer contingent on your (under contract) home making it to closing -- instead of contingent on your (not yet listed) home being listed, going under contract and making it to closing. Most sellers will be more excited about your offer this time -- since your house is already under contract -- but your offer will still likely be seen as less favorable compared to an offer without a home sale contingency at all. List Your Home For Sale, Contingent On You Finding A House To Buy. If you have tried the above strategy (listing your home for sale as soon as a perfect house to buy comes on the market) a few times without success -- because another buyer jumped on that perfect house before your house was under contract -- then maybe this strategy is for you. We can list your home for sale without knowing what you will buy. When a buyer is ready to commit to buying your home, we can propose contract terms that make the sale of your home contingent on you securing a contract on a home you would like to purchase. Some buyers might go along with this, but some won't like the uncertainty of whether they are really buying your house. This strategy is asking the would-be buyer of your house to take on the risk of whether you will be able to find a house to buy and have your offer on that house accepted. List Your Home For Sale, Hope For The Best For A Next House. If you have tried the above strategy (listing your home for sale, contingent on you securing a contract on a house to buy) and it didn't work -- because buyers don't like that uncertainty -- then maybe this strategy is for you. We can list your home for sale, when a buyer comes along we can propose a slightly longer (60-75 day) closing timeframe, and then hope that a perfect house comes along in the next few weeks, allowing you to (hopefully) contract on the next house, with both closings to coincide. Certainly, if the right house doesn't come along, or if that seller doesn't like your contingent (on home settlement) offer then you might not be able to secure a contract to buy a home -- and you would still need to sell your current house (and move out of it) per the terms of your contract with a buyer. Eek. List Your Home For Sale, Hoping For A Flexible Buyer. We wouldn't want to bank on this being possible -- but if we list your home for sale, and a buyer comes along that is either an investor (planning to rent out your house) or is very flexible about when they would move in -- then you could contract with this flexible buyer knowing you wouldn't have to move out right away when the settlement date rolls along. This might buy you a few extra months to find the right home to contract to buy -- either making an offer contingent on your home getting to settlement (if closing hasn't happened yet) or not contingent on a home sale at all if the closing has taken place. Come To Terms With Moving Twice. This is perhaps the least exciting logistically. Nobody really likes moving. Moving twice is just about twice as bad as moving once. But... if the fact that you need to sell your home limits your ability to purchase the home (or homes) that you want to buy -- then you may need to sell your home, move into a rental, and then make offers without having a home sale contingency. If you will be buying a home -- but you need to sell a home -- we'll talk through all of these options and more to figure out the best strategy for getting you to that next home. | |

Will Would Be Home Buyers Have More Competition Two Months From Now Than They Have Today? |

|

It seems likely that would-be home buyers will have more competition from other buyers two months from now compared to today. Here's why... [1] Mortgage interest rates have been trending steadily downward since late October. They seem likely to continue to trend downward over the next two months, even if not quite as quickly as they had been dropping. [2] Many more buyers seem to be looking buy homes in the spring than in the winter. [3] Many leases end in spring/summer - so any would-be buyers who are currently renting will be more seriously considering a purchase two months from now more so than they are today. [4] We will likely start to see more listings coming on the market in March and April, which seems to draw even more buyers out into the market. All that is to say that if you are thinking about buying a home sometime in the next six months -- you should carefully evaluate all current listings to see if there is a good fit that might be on the market right now for you to buy. Two months from now you will likely have more competition from other buyers. As an added bonus -- current home sellers who have had their home on the market for more than a few weeks may be more motivated to strike a deal with you than they (or other sellers) will be two months from now. | |

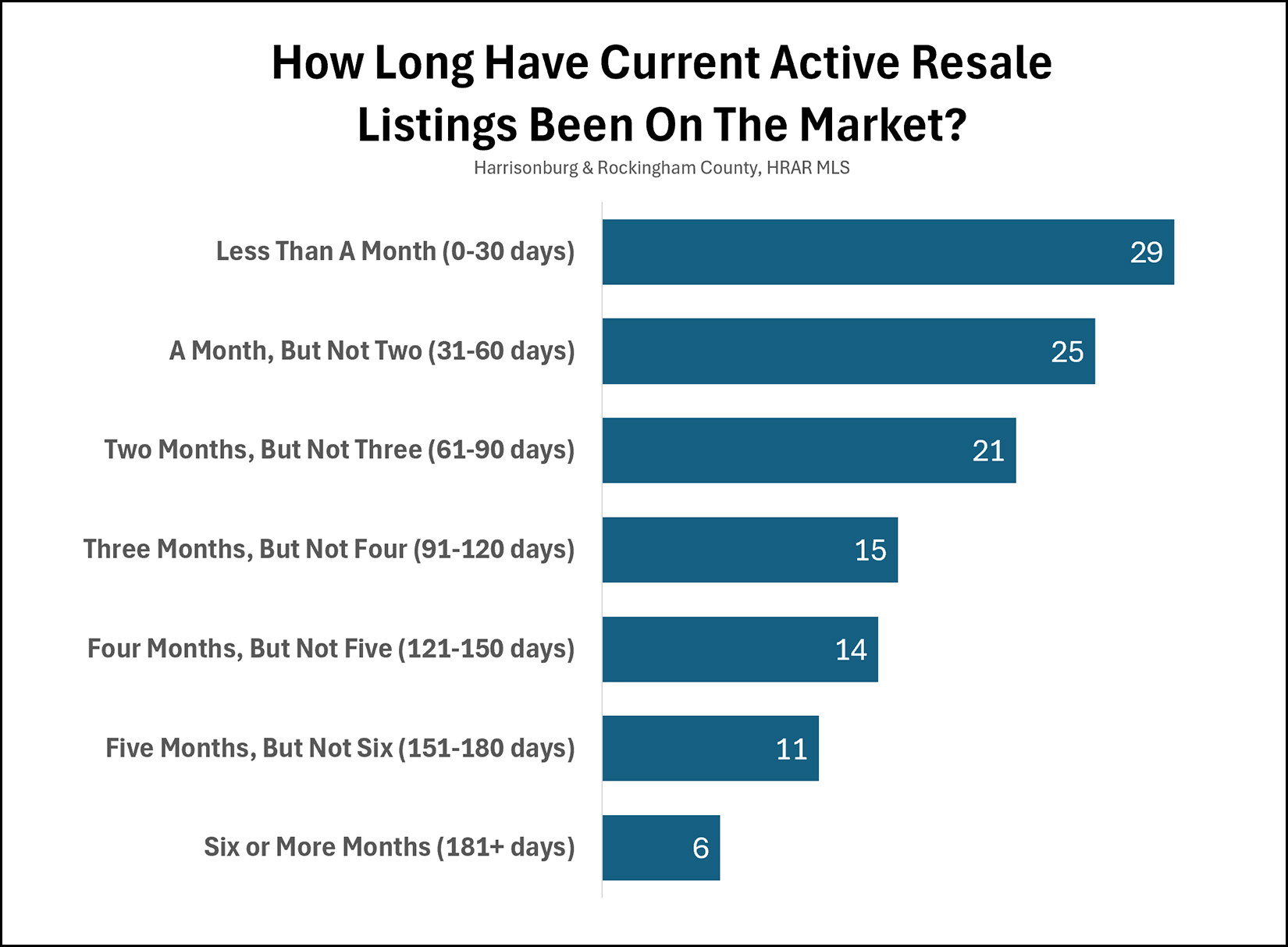

How Long Have Current Active Resale Listings Been On The Market? |

|

The graph above speaks for itself, but I'll point out a few more things that aren't explicitly referenced above... 76% of currently active resale listings (not new homes) have been on the market for more than a month. The median days on market of all 121 active listings is 65 days. That is to say that half of the current resale listings on the market have been on the market for 65 or fewer days... and half have been on the market for 65 or more days. The data above is relative to active listings. Let's contextualize this a bit further by looking at pending listings and then sold listings. Of the 87 resale homes currently under contract, the median days is 33 days. Of the 114 resale homes sold in the past 60 days, the median days on market was 17 days. Of the 894 resale homes that sold in the past 365 days, the median days on market was 7 days. So... Active listings = 65 days Pending listings = 33 days Sold in past 60 days = 17 days Sold over past year = 7 days Days on market -- the time it takes a home to sell -- seems to be drifting upward, at least recently, at least on resale homes. | |

Will Your New Years Resolution Be To Buy A House? |

|

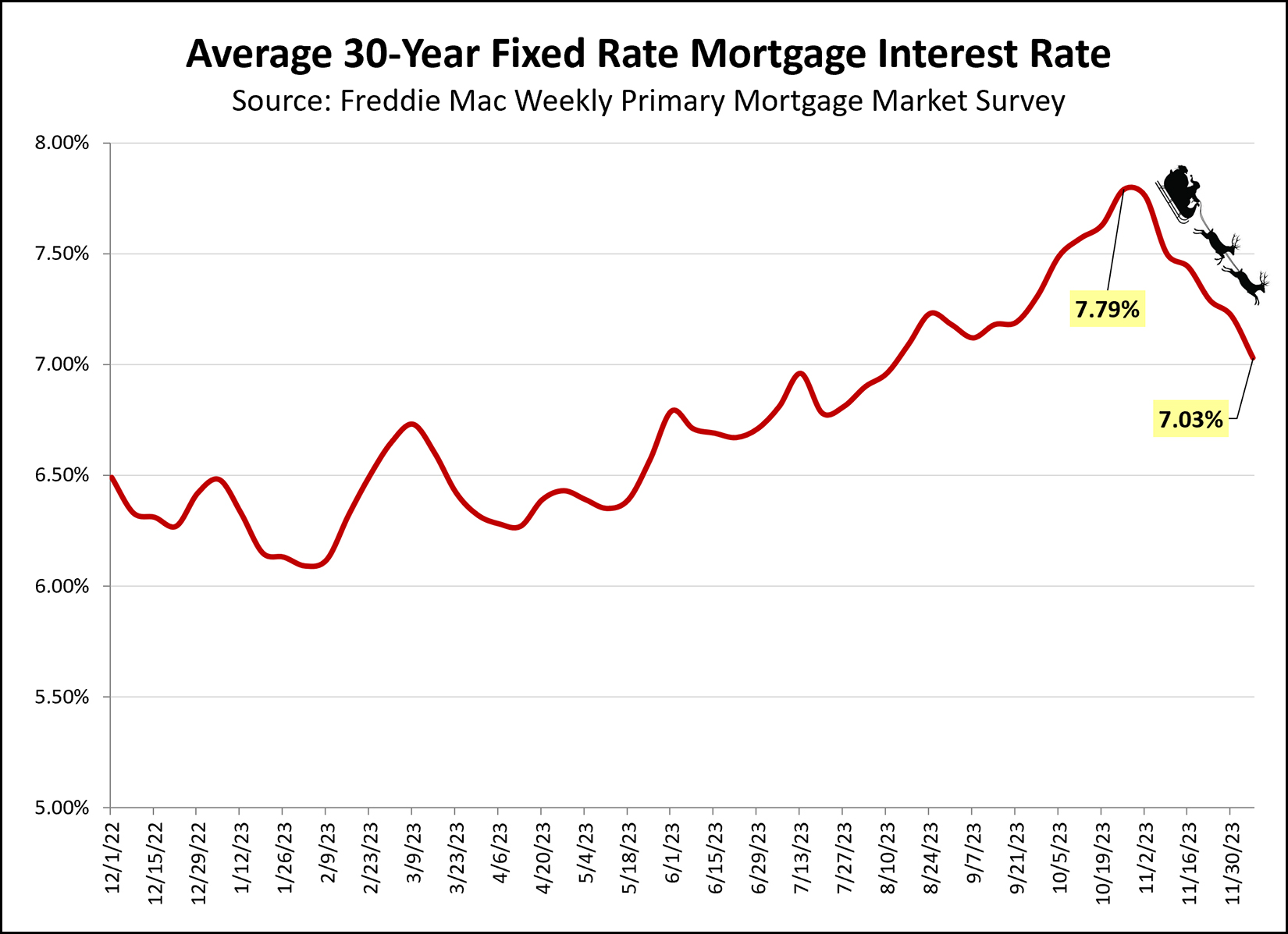

For whatever reason, the close of one year and the start of a new year cause many of us to pause and reflect on the big picture. What do we hope will remain the same in the new year? What do we hope to change in the new year? If you are considering a home purchase in the new year, here's one bit of welcome news... Mortgage interest rates have been falling steadily for the past eight weeks! In October, the average 30 year fixed mortgage interest rate peaked at 7.79%. Since that time, they have dropped all the way down to 6.67%. Rates actually started the year (Jan 2023) at 6.48% -- so we're closing out the year a touch higher than that, but things are headed in the right direction. It definitely seems possible that we'll see mortgage interest rates between 6% and 6.5% some time in the first few months of 2024. So, if your new years resolution is to buy a home, let's set up a time to meet to discuss the process and the market -- and you should talk to a lender sooner rather than later to get prequalified for a mortgage. | |

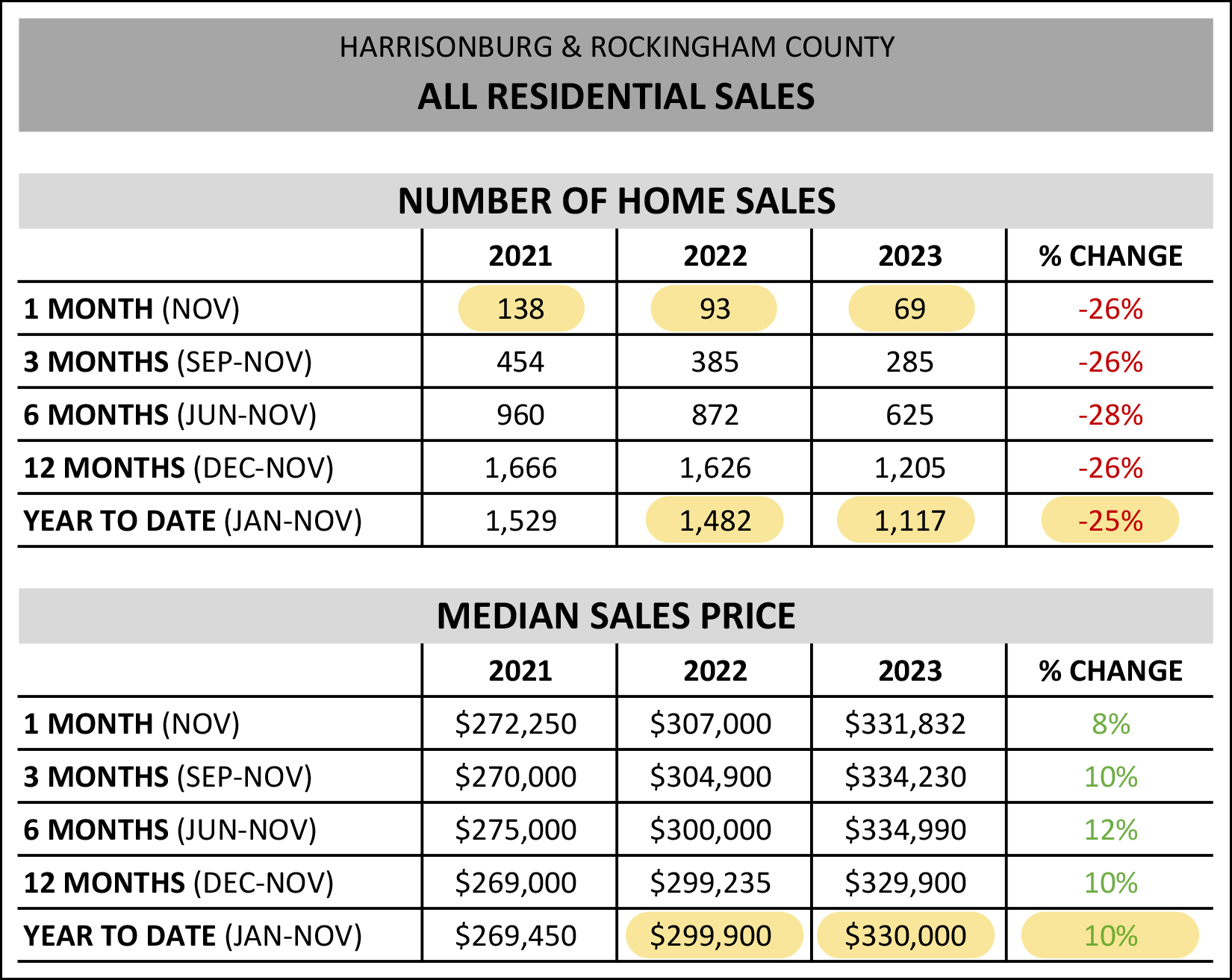

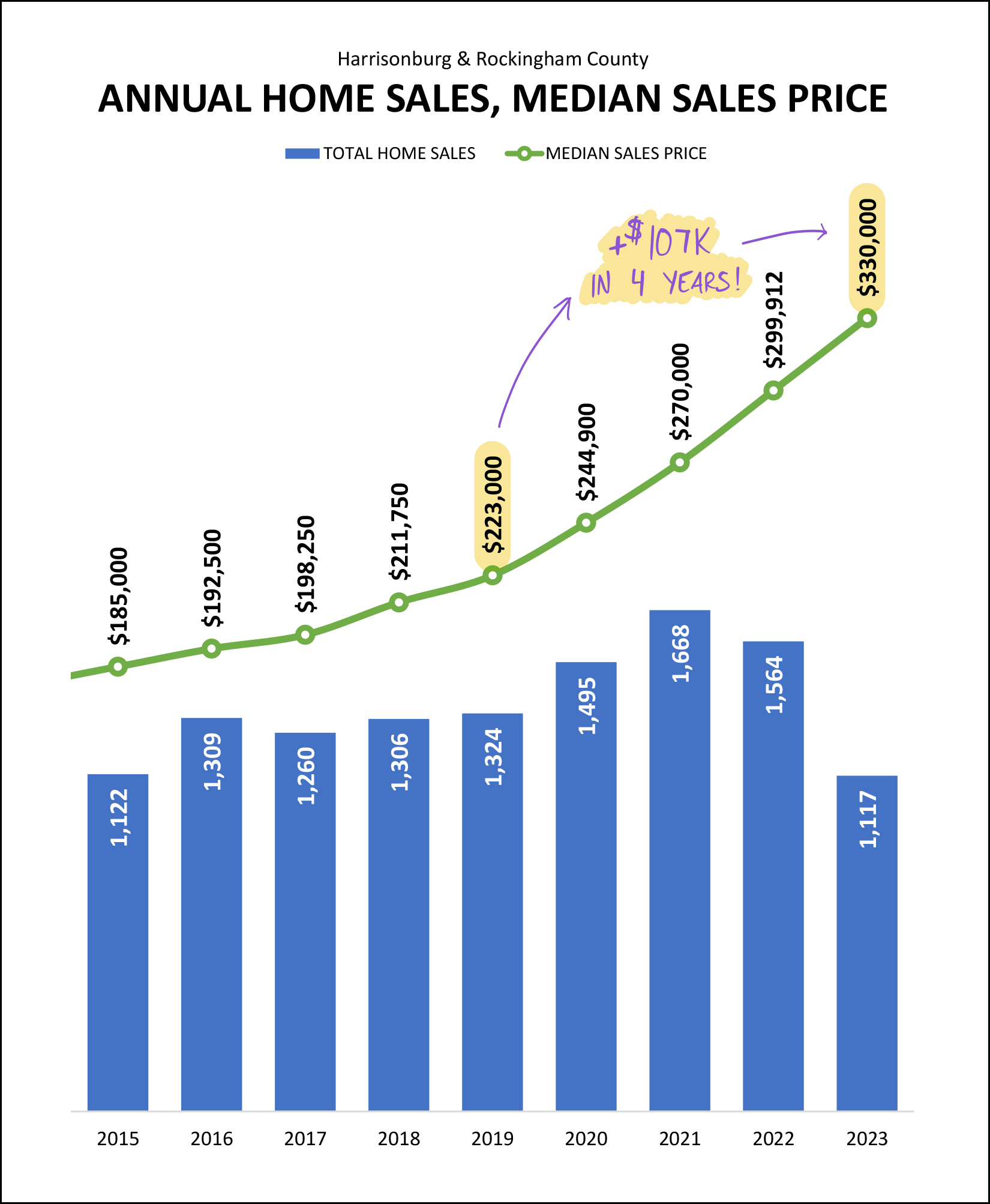

Despite Fewer Home Sales, We Are Seeing Higher Prices, And Recently, More Contracts And Lower Inventory Levels |

|

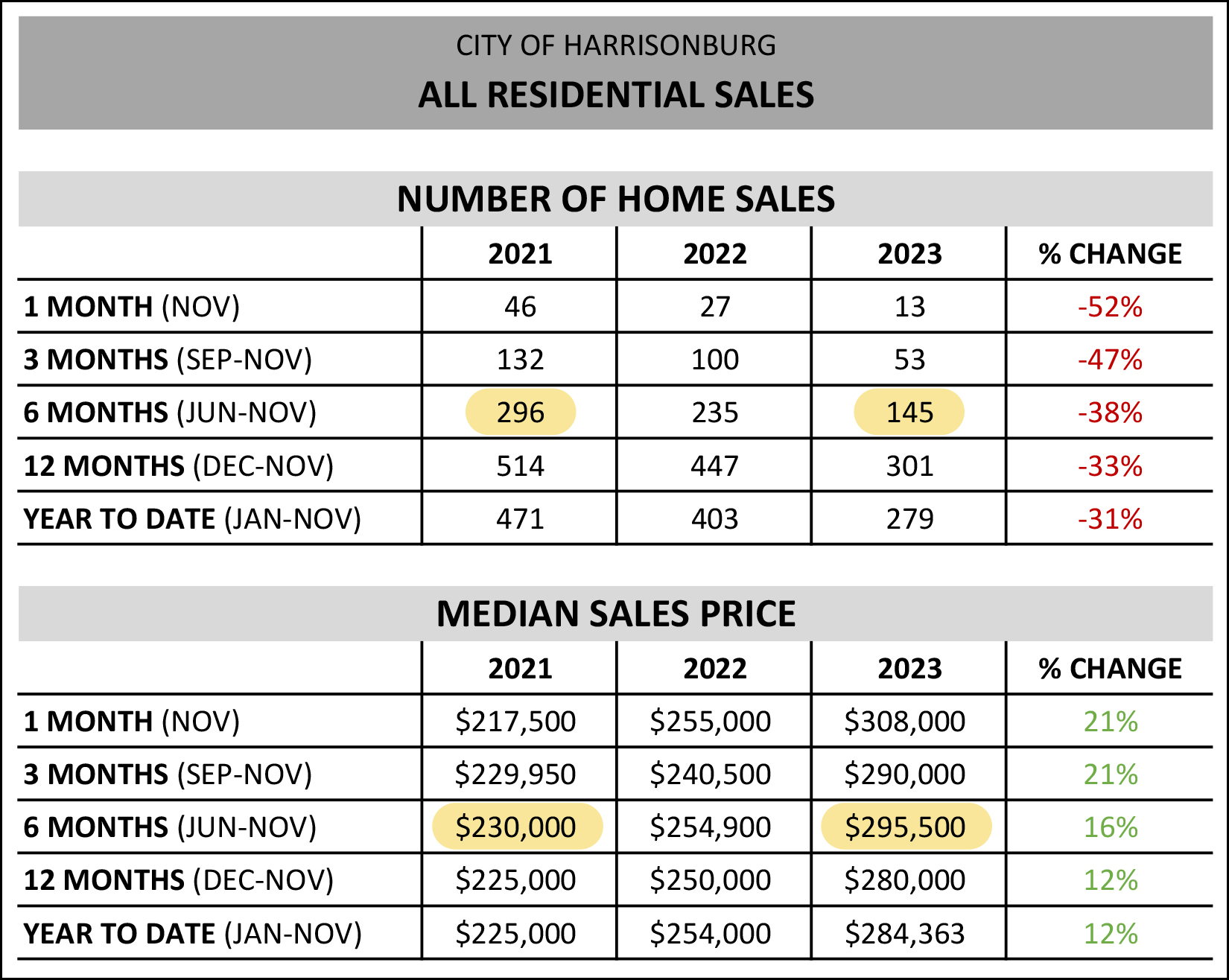

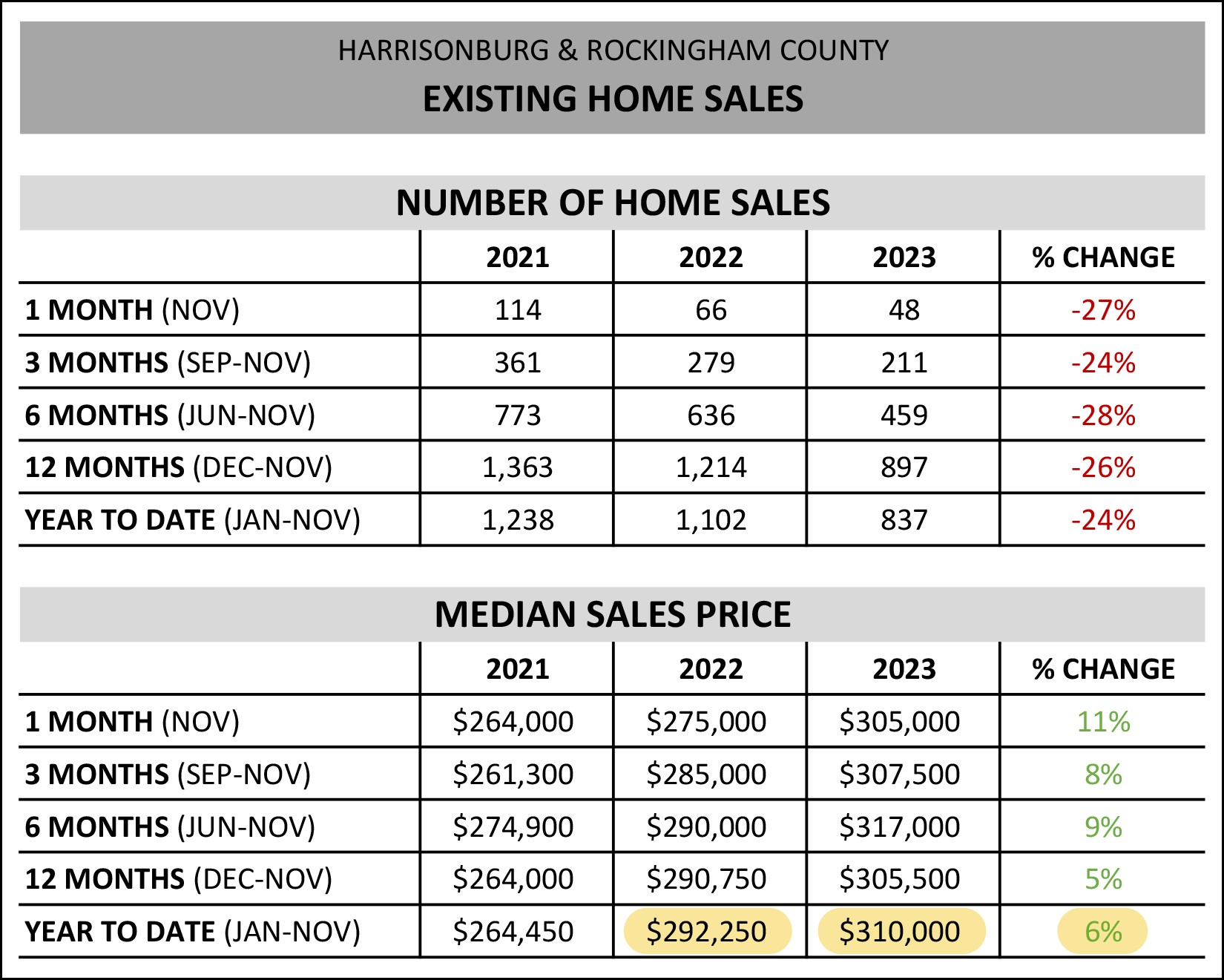

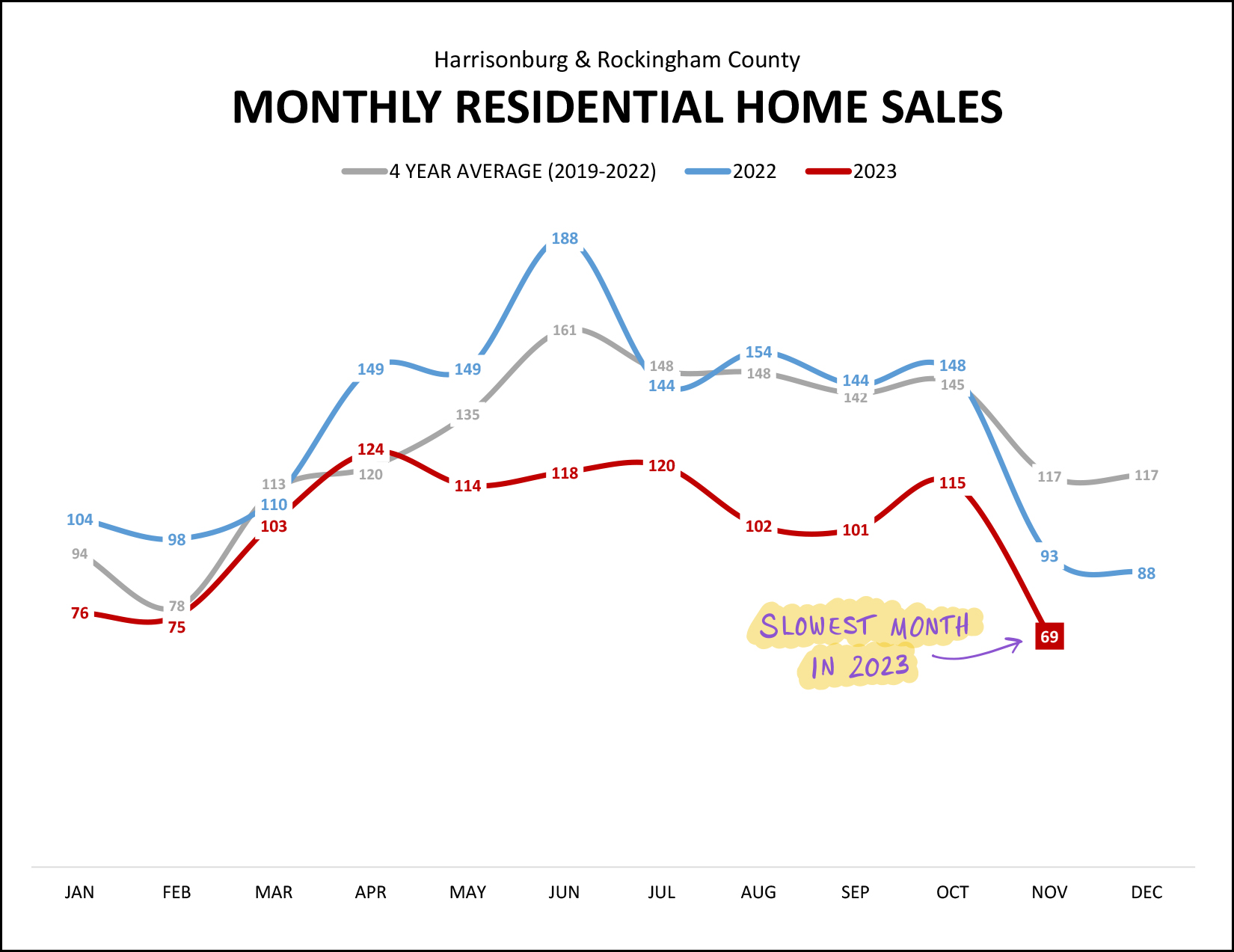

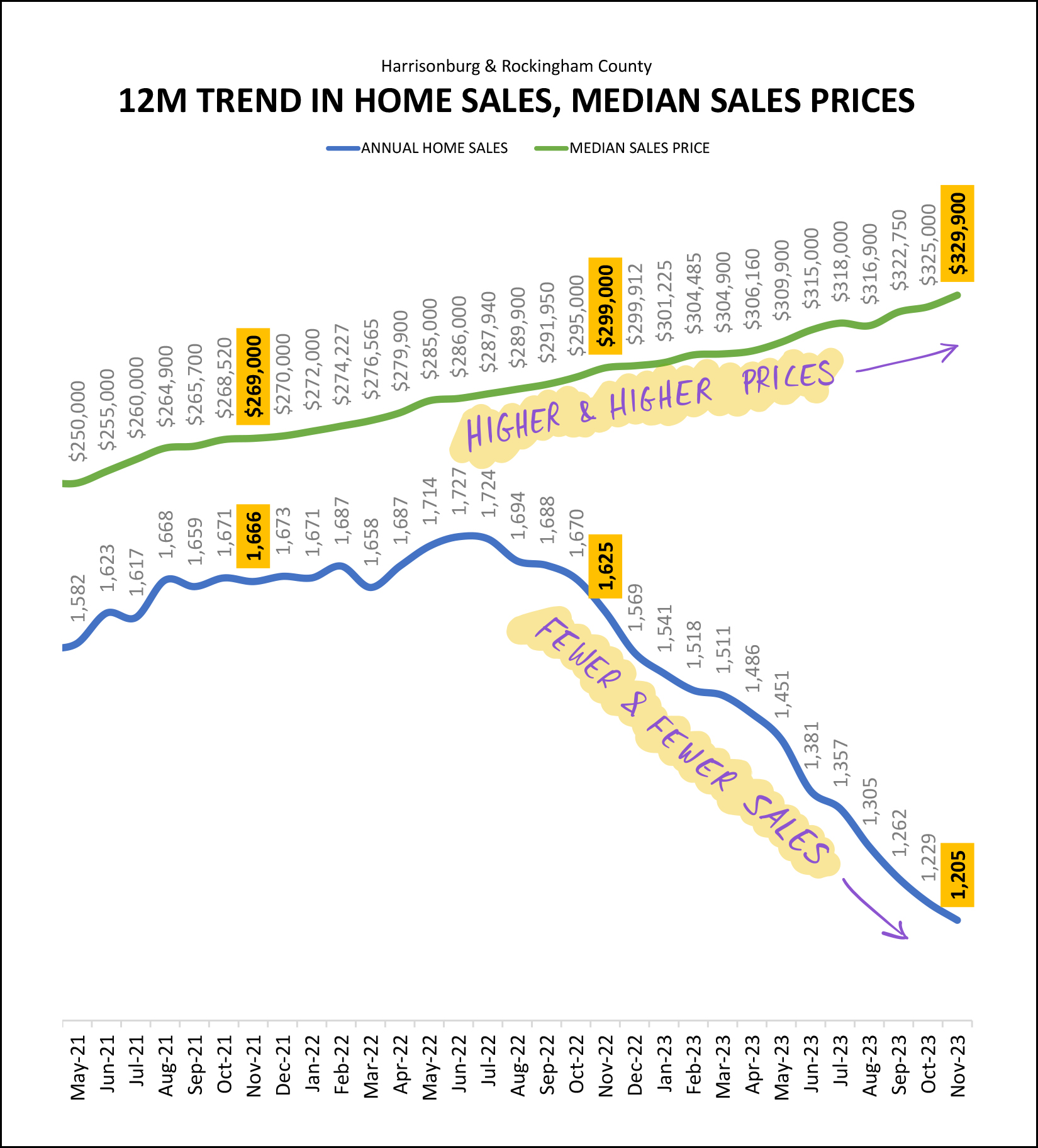

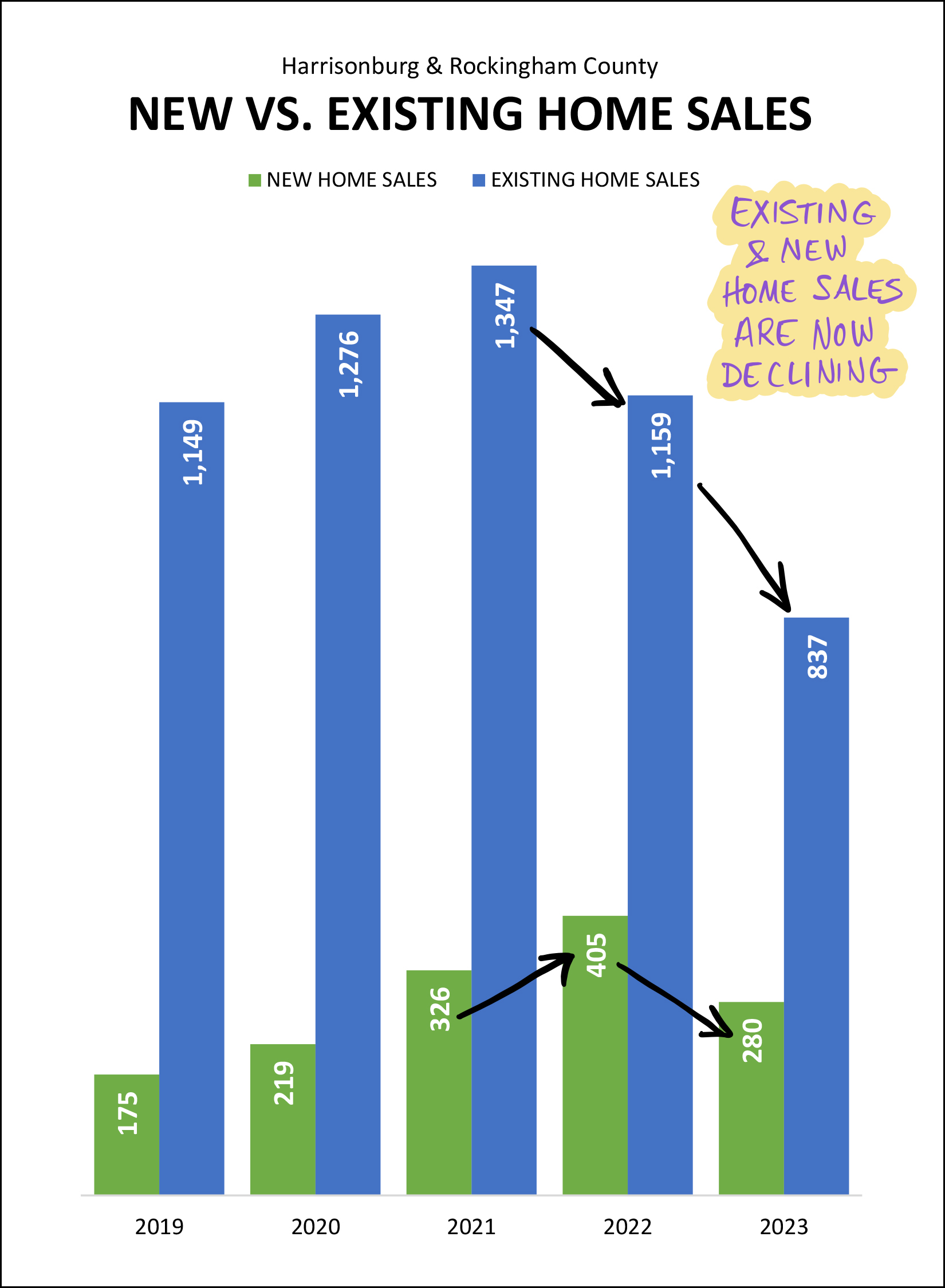

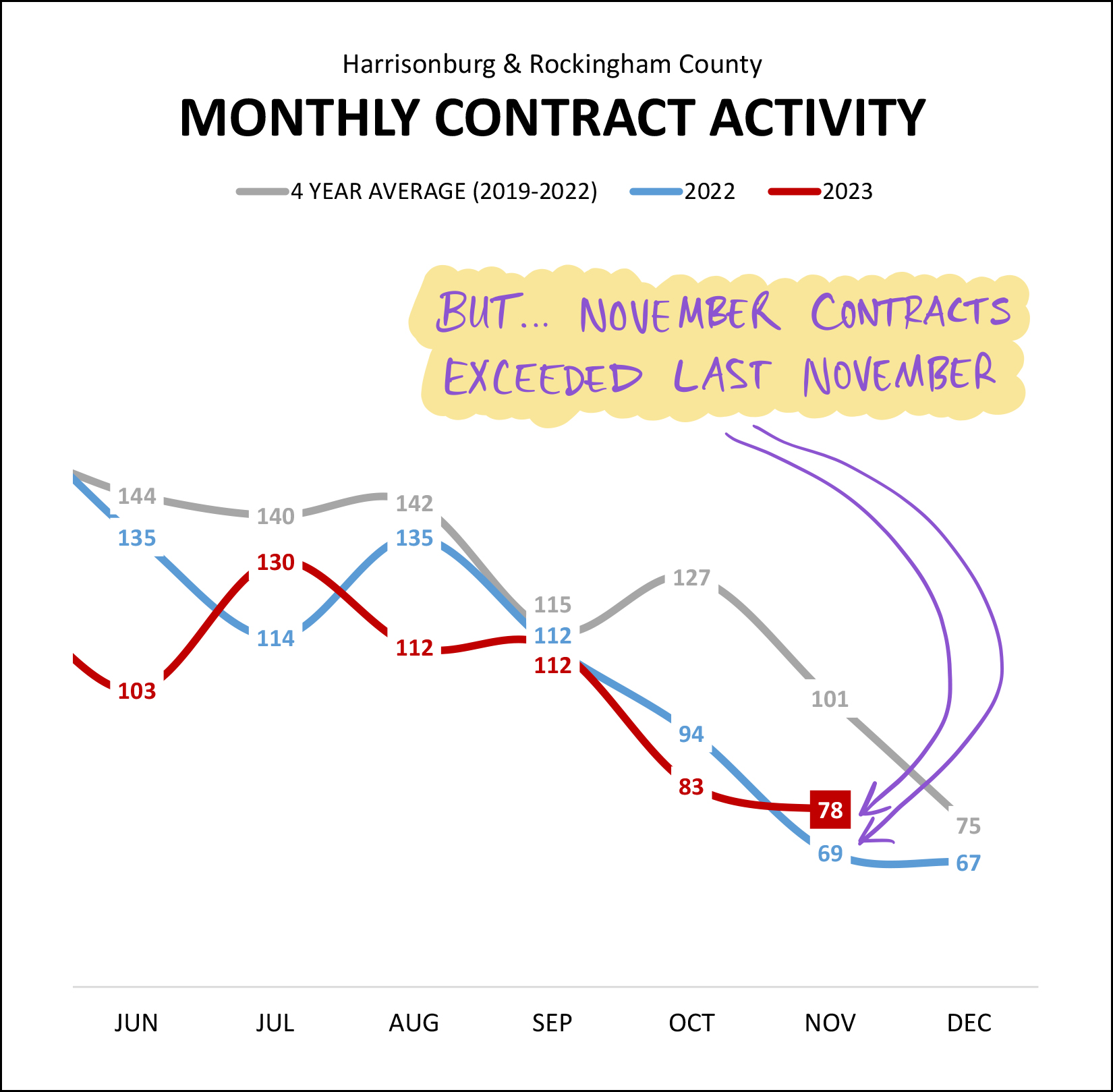

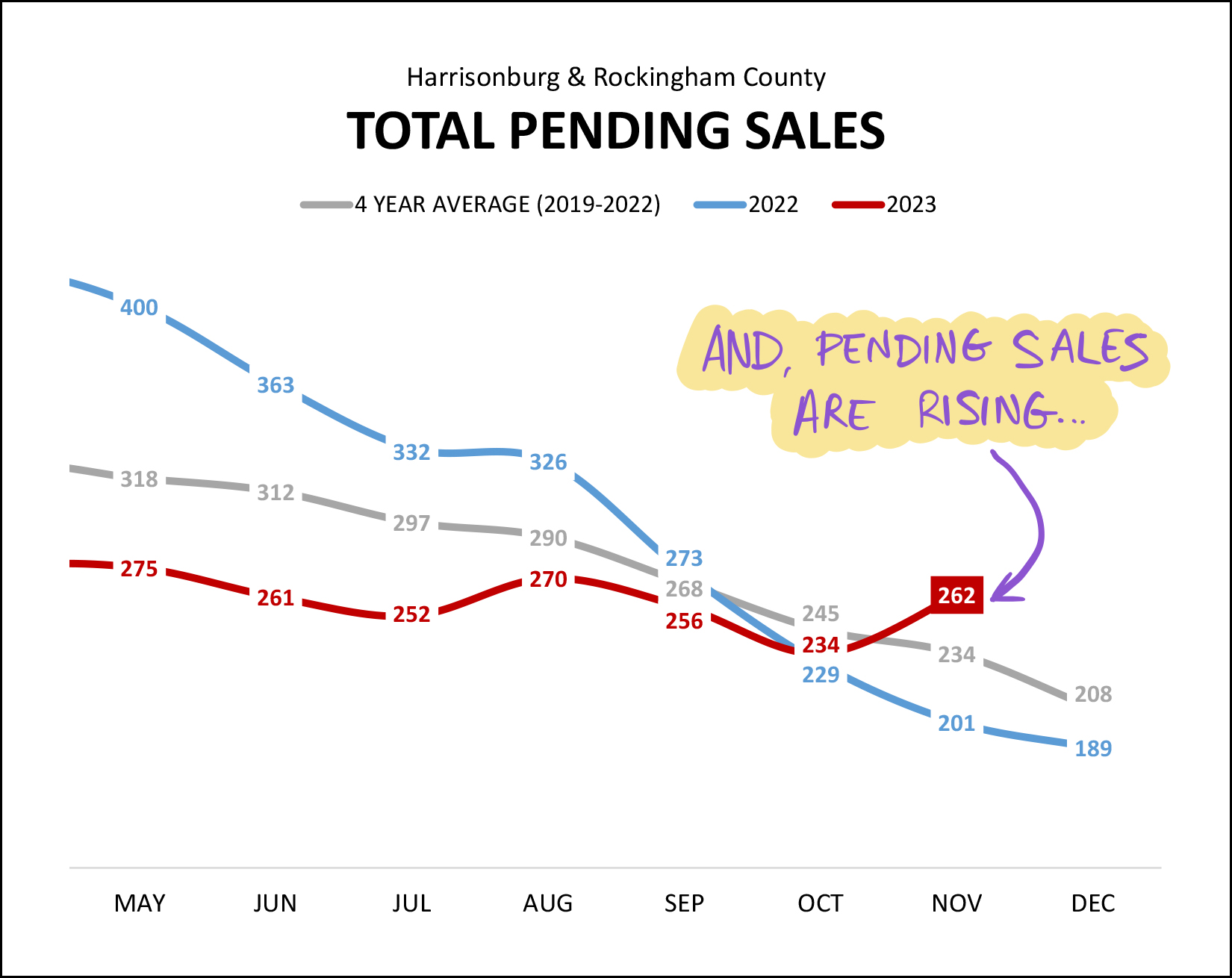

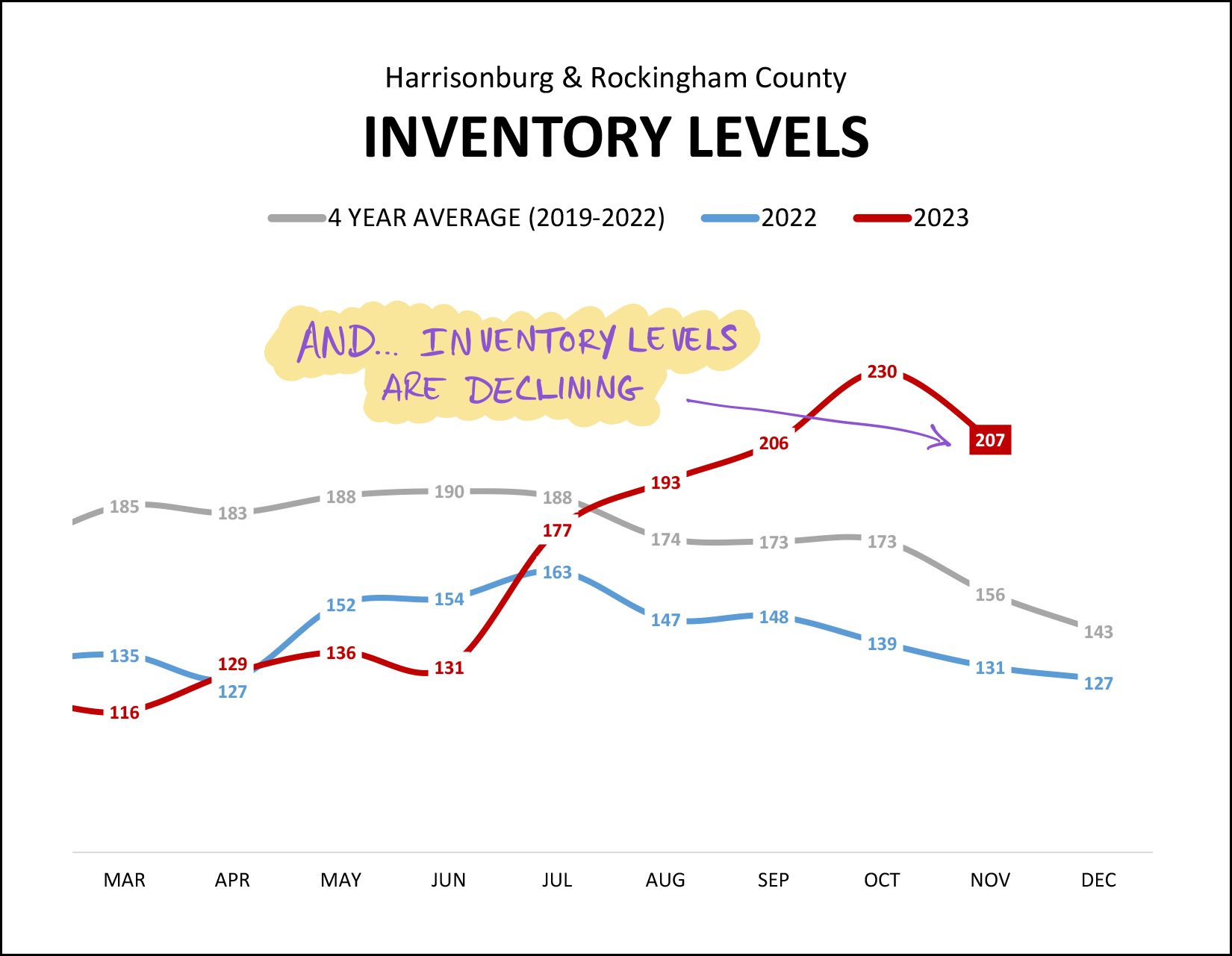

Happy Friday afternoon, Friends! I hope that your week has gone well and that you are looking forward to the next few weeks - presumably with some holiday celebrations, rest, relaxation and time with family and friends! Whether you are staying here or traveling afar, I hope it is a fulfilling and meaningful time for you and that you are able to spend some time with your loved ones! Before I dive into the housing data, I'd like to invite you to join me at a fun concert in January. The Steel Wheels are putting on an album release show with special guest Lindsay Lou on Saturday, January 20th at 7:00 PM in JMU's Wilson Hall. You can buy tickets online from JMU here, or... click here to enter to win the pair of free tickets I'm giving away! Regardless of whether you win the pair of free tickets, or buy your own tickets, I hope to see you in Wilson Hall in January to hear The Steel Wheels and Lindsay Lou! And now, on to the housing data and trends in our local market, starting with a few key indicators for our overall market...  A few observations related to the data above... [1] Looking just at November sales data, we see a striking year over decline from 2021 through 2022 to 2023 when examining the number of homes that are selling each November. Two years ago there were 138 November home sales... last year only 93... and this year just 69 home sales in November. While it's only one month of sales data, that is a 50% decline over the past two years. It was a particularly slow November. :-) [2] When looking at the first eleven months of the year (the year is almost over!?) we see that there have been 25% fewer home sales this year (1,117 in 2023) as compared to last year (1,482 in 2022) in Harrisonburg and Rockingham County. It was markedly slower year this year than last. [3] Despite fewer home sales taking place this year, home prices keep on rising. The median sales price of all homes sold in the first eleven months of last year was $299,900... and this year it was 10% higher at $330,000. So, fewer home sales, but higher prices. Next up, one particular segment of our local market that has seen a particularly striking change... the City of Harrisonburg...  I suppose I should have highlighted one other bit of data on data table above -- the first row. Pretend it is highlighted too... [1] With only 13 home sales in the City of Harrisonburg this November, we have seen a 52% decline compared to last year and a 72% decline as compared to two Novembers ago. Again, this is just one month, but still. If you want to buy a home in the City of Harrisonburg, it has been a tough time to try to do so. Very few homes are selling in the City. [2] A few lines down in the data table you'll see I have highlighted the data for the past six months. Over the past six months of this year we have seen 145 home sales in the City... compared to 296 in the same six months two years ago. Again, a rather striking decline... of 52% over two years. As I alluded to above, this is mainly a supply issue... there aren't enough sellers willing to sell this year to allow the same number of City home sales to take place. [3] In that same two year period I have referenced above, the median sales price of a home sold in the City has increased from $230,000 to $295,500! That is a 28% increase in the price of homes selling in the City... over a span of just two years. Now, let's look at existing home sales only (excluding new home sales) to contextualize the 10% increase in home sales prices in the overall market that I referenced earlier...  All the way at the bottom of the data table above you'll note that when we look at the median sales price of existing homes only, it has risen by only 6% over the past year, not 10%. What does this mean? [1] The value of existing homes has not necessarily risen 10% over the past year in Harrisonburg and Rockingham County as was suggested when looking at the entire market of existing and new home sales. Existing homes (resale homes) prices have only actually increased by 6% over the past year. [2] The increases in new home sales prices over the past year, and the number of new versus existing home sales, have combined to drive the overall median sales price of all homes (new and existing) up 10% over the past year. Let's simplify things... for all you homeowners out there... [1] Don't assume that your home has increased in value by 10% over the past year, because the existing home median sales price has only increased by 6% over the past year. [2] Don't assume that your home has increased in value by 6% over the past year. It might have. Or, that increase might be somewhat larger, or somewhat smaller. The change in the median sales price is a general indicator of changes in the overall market, not a specific indicator that each and every home in a market area has shared that same change in value. Now, let's reflect on a moment on what a slooooooowwww November it was as far as the number of homes selling in Harrisonburg and Rockingham County...  There were fewer home sales in Harrisonburg and Rockingham County in November 2023 than in any other month in 2023... and fewer than in any month in 2022... and fewer than in any month in 2021. But, keep on reading for some signs that perhaps we are seeing a slight reversal of this slow down. First, here's that downward ski slope (blue) of the number of homes are selling in a year's time in Harrisonburg and Rockingham County...  The annual pace of home sales in the City + County has now declined to 1,205 home sales... which is the slowest annual rate of home sales in over five years! But yet, as we have seen for quite some time now... fewer home sales is not causing home prices to also start declining... in fact, the further home sales have declined, the higher sales prices have increased! These two trends are an indicator that while there are certainly fewer buyers buying, it is likely at least partly a result of fewer sellers being willing to sell. If we were seeing a decline in buyer interest and we were seeing the same number of sellers wanting to sell, then we could more reasonably think home prices might start to decline -- but that's not where we are right now in the local housing market. Let's say you sold your house in 2019 and left town and decided to move back just four years later in 2023. Oof. Here's what you'd find...  When you (the imaginary you) left town in 2019 the median sales price of homes in Harrisonburg and Rockingham County was only $223,000. Now... just four years later, that median sales price has shot upwards to $330,000. That is a $107K increase in just four years. This is yet another view into some tricky timing aspects of when folks bought or didn't buy a home in this area... [1] If you bought your home in 2020 or prior, and still own it, you're in great shape. You likely paid much less for your home than it is worth now and you likely have a very low mortgage interest rate. [2] If you bought your home in 2021 or 2022, you're likely still in great shape as to how much your home value has increased, and you might have a great mortgage interest rate or not quite as great. [3] If you didn't buy a home and are working on buying one now, you are buying at the highest prices we have seen lately (until 2024 prices) and at higher mortgage interest rates than we've seen in over a decade. If you are thinking about buying a home right now, does #3 above make you want to pause and think twice before buying? If you don't buy in 2023 (yes, I know there are only 16 days left) you'll likely be paying an ever higher price in 2024 or 2025. This is not to say that everyone should buy a home right away, but many buyers who have been waiting to buy for the past few years because prices were increasing (and they hoped they would decline) likely wish they had gone ahead and bought last year, earlier this year, etc. One of the other metrics I follow is how many new versus existing homes are selling, and we have seen a bit of a shift in this break down in 2023...  Last year, in 2022, we saw a decline in existing home sales compared to 2021... but new home sales kept on rising. Not so in 2023. When comparing this year (2023) to last year (2022) we see that existing home sales have declined... and new home sales have declined as well. We have also seen *the highest* mortgage interest rates in many (many!) years in 2023, which is likely a major contributor to this slow down in both existing and new home sales. But... what follows are a few slight changes in direction in our local market as of the past month...  Monthly contract activity in 2023 (red line above) has been below 2022 (blue line) more often than not over the past six months, but in November... contract activity rose above where it was last November. Hmmm... why could that be... I wonder if mortgage interest rates started to decline from their 20+ year peak? And how about the number of homes that are under contract in total...  As shown above, we saw a big jump in the number of pending (under contract) homes through the month of November. There are 262 homes under contract right now, compared to only 201 a year ago. This is a significant improvement from last month when we were even with the prior year, and an even more significant improvement from the prior six (plus) months when pending home sales were lagging significantly behind last year. Hmmm... why could that be... I wonder if mortgage interest rates started to decline from their 20+ year peak? Next up (before we get to mortgage interest rates) let's look at inventory levels...  After four months of big increases in inventory levels in Harrisonburg and Rockingham County -- from 131 homes for sale up to 230 homes for sale -- we have now seen inventory levels start to decline again. Perhaps this is a result of more contract activity (causing inventory levels to drop as homes go under contract) or perhaps it is fewer sellers putting their home on the market during the holidays -- but regardless, November showed at least a temporary reversal in the trend of increasing inventory levels. Now, then, how about those mortgage interest rates...  Indeed, mortgage interest rates are dropping. At this point it seems rates peaked at 7.79% at the end of October. Since that time, as shown, they dropped to 7.22%. Since the end of November, not shown, they have dropped even further... to 6.95%. Certainly, the three years or so when rates stayed below 4% were *not* normal times... and rates below 4% were *not* normal -- but it's been tough for many would be home buyers to afford a home (or to rationalize paying the requisite mortgage payment) over the past year with mortgage interest rates above 6%, and for quite a few months over 7%. The pace of sales slowed the most in Harrisonburg and Rockingham County over the past few months with mortgage interest rates over 7%. The news that they have now broken back down through that barrier to six-point-something is welcome news for home buyers as we head towards 2024. I'll wrap things up there for now, though if you want even more charts and graphs you can review them all here. At this point in our local housing market, we're mostly looking ahead towards 2024, so here are a few thoughts for a variety of positions you might find yourself in... If your home is on the market now but not under contract... You may very well find renewed interest from buyers after the first of the year, especially with slightly lower mortgage interest rates -- but you should make sure your home is priced appropriately. If a price reduction is in order, it might make sense to wait until just after January 1 to make that change since there will be less buyer activity than normal over the next few weeks. If you plan to sell your home in 2024... Let's chat sooner rather than later about pricing, preparation and timing. It's not enough any longer to simply whisper "I'm selling" out your front door to bring on the throngs of eager buyers with 3% mortgage interest rates. We'll want to make sure to price your home appropriately, prepare it well to show best to buyers and market it thoroughly from day one but knowing that the marketing may need to continue on for a few weeks or more. If you plan to buy a home in 2024... It seems very likely that you'll be financing your purchase with a lower mortgage interest rate than would have been available to you over the past few months, which is good news. That said, with home prices continuing to climb, your projected monthly payment might still be higher than you prefer. It's important to talk to a lender early in the process to understand how much you could spend and to consider how much you want to spend on your next home. If you own a home and don't plan to sell it anytime soon... Enjoy your likely increasing home value and your likely low mortgage interest rate. It's been a great few years to own a home... a much better than average, much better than normal, few years! And for any and all of you... if I can be of help to you related to real estate, or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I hope you and your family have a wonderful holiday season and I look forward to connecting with you in 2024! | |

Ho, Ho, Ho, Is Santa Bringing Lower Mortgage Interest Rates For Christmas? |

|

We'll see where the remainder of December takes things, but mortgage interest rates on 30 year fixed rate mortgages have been dropping steadily for the past four weeks. They were all the way up to a peak of 7.79% back in late October. This past week they were all the way back down to 7.03%. Will we see 6 point something before Christmas? | |

Home Buying Activity Will Slow But Not Stop Over The Winter |

|

Generally speaking, folks don't use their outdoor hose spigots in the winter. I suppose you might use it from time to time, but it's just not as fun to wash your car in the driveway on most December days. Oh, and if you did use your hose spigot, and left the hose attached, you'd potentially have serious problems when the water in the hose freezes, backs up into the spigot, maybe into the pipe, and something splits, cracks or bursts. As such... Once we get into Winter, most folks are turning off their hose spigots for the last time until Spring. But... Not so with the local housing marketing. Looking back over the past five years... Between March and August (Spring and Summer, as we'll call it) an average of 140 buyers signed contracts to buy houses each month. A pretty rapid pace of buyer activity. So, this winter, what should we expect? Will that supply of buyers be turned off like a hose spigot, and will the buyers slowly drip out at a rate of (for example) 10 - 15 buyers per month? Nope! Looking at last Winter (December, January, February) there were an average of... 95 buyers signing contracts per month! Yes, you read that correctly, we only saw a 32% decline in buyer activity during the Winter months -- as compared to the Spring and Summer months. So, unlike your hose spigot, which will likely be barely used during the Winter -- the local housing market doesn't slow down, or cool down, or shut down, nearly as much. | |

Trying To Buy A Home... A Story Of Being All In, Then Bowing Out, And Now Being Ready To Jump In Again |

|

This seems to be the story of quite a few folks in Harrisonburg and the surrounding area. Some of these folks graduated from a local college or university in the past five years and have been working -- and renting -- since that time. Some of these folks moved into the area in the past five years and have been working -- and renting -- since that time. Many such local residents... ... were ALL IN during 2020 and 2021, trying to buy a house... but missed out on house house that had multiple offers. ... opted to BOW OUT in 2022 and 2023 as mortgage interest rates rose, which -- combined with rising home prices -- made potential mortgage payments seem unrealistically high. ... are now READY TO JUMP IN AGAIN in 2024. Here's why some of these local residents -- who are still renting -- seem ready to jump back in as a home buyer in 2024... 1. Waiting for home prices to correct or drop or decline even a little bit over the past two years has only resulted in two more years of increases in home prices. 2. Waiting for mortgage interest rates to drop back down to 3% or 4% is now broadly understood to be highly unlikely anytime soon. Though rates have been trending down (a bit) over the past few weeks. 3. Rental rates keep climbing in addition to home prices -- which means that the cost of not buying (renting) is also going up, rather quickly! It certainly isn't the right time for every renter to jump into buying a home, but plenty of folks who haven't bought over the past two years seem to be re-thinking that now. | |

Sometimes Upgrade Your Home (Selling And Buying) Results In An Even Larger Upgrade In Your Monthly Payment |

|

"Our house isn't working well for us anymore. We are thinking of selling it and buying a new house." Sounds good, but let's look at a few basic numbers first... You bought for $190K, put $20K down and have a mortgage payment of $955 per month thanks to a refinance a few years back at 3.5%. Your house is now worth $275K and you are thinking of selling it to move up to a house priced at $375K. When you sell your $275K house, you'll end up with about $90K in your pocket after closing costs and paying off the $170K balance on your mortgage. You'll spend about $10K of that $90K on closing costs for your purchase, so you'll put down $80K as a downpayment. You'll be borrowing $295K ($375K - $80K) and you'll be financing it at a current mortgage rate of about 7.25%. Your new monthly payment will be $2,392. Wait... what!? You're moving from a $275K house to a $375K house and your monthly mortgage payment is going to increase from $955/month to $2,392/month. Yikes! Why is this happening? [1] Your current mortgage payment is based on your initial purchase price of $190K... which is a good bit lower than your home's current value of $275K. [2] Your current mortgage payment is based on on a mortgage interest rate of 3.5%... which is a good bit lower than the current rate of 7.25%. [3] The costs of selling and cost of buying reduce the amount of equity that you can roll from one home into the next. So... before you dive right into upgrading your $275K house (with a $955/month payment) to a $375K house... let's run your version of the numbers above to help you determine your new potential monthly payment. | |

Despite Fewer And Fewer Home Sales, There Are Plenty Of Reasons Why Buyers Will Still Buy And Sellers Will Still Sell |

|

January 1, 2022 through November 20, 2022 = 1,445 home sales January 1, 2023 through November 20, 2023 = 1,082 home sales As of this week we have seen 25% fewer home sales this year than last! With fewer and fewer homes selling, sometimes it might feel like there aren't that many homes selling in our area. But yet, there are still plenty of reasons why buyers are still buying and sellers are still selling. Sellers are selling because:

Buyers are still buying because:

We are likely to close out 2023 with 25% fewer home sales than in 2022 -- and at this point it seems likely that we'll see even fewer in 2024 -- but there will always be some buyers buying and some sellers selling, even if not in as great of numbers as we have seen over the past few years. | |

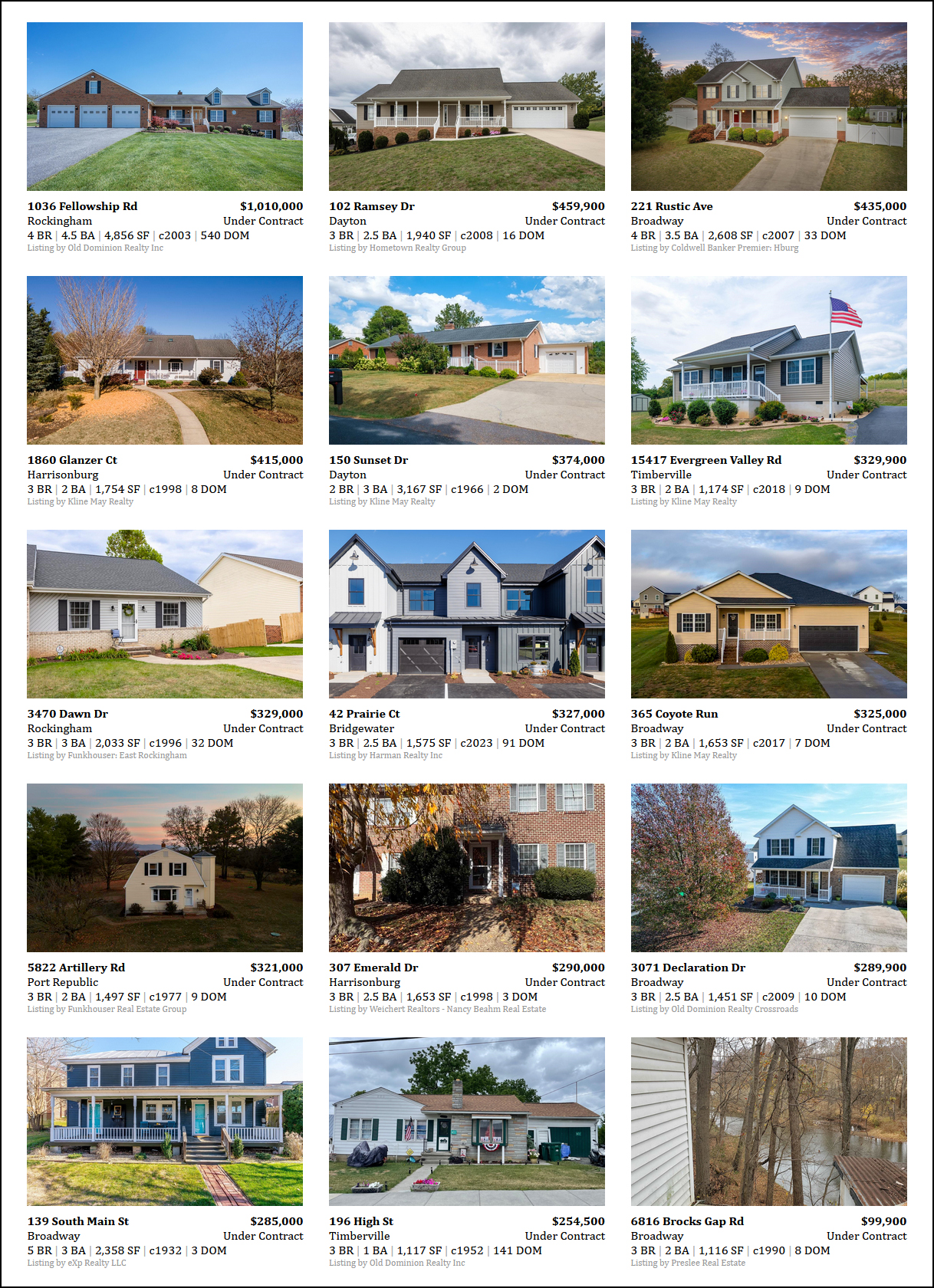

Home Buyers Signed Contracts On These 15 Homes Over The Past 7 Days |

|

Over the past week (15) home buyers in Harrisonburg and Rockingham County signed contracts to purchase (15) homes. A few observations...

What do you notice about these (15) homes that went under contract in the past week? What will go under contract over the next seven days? | |

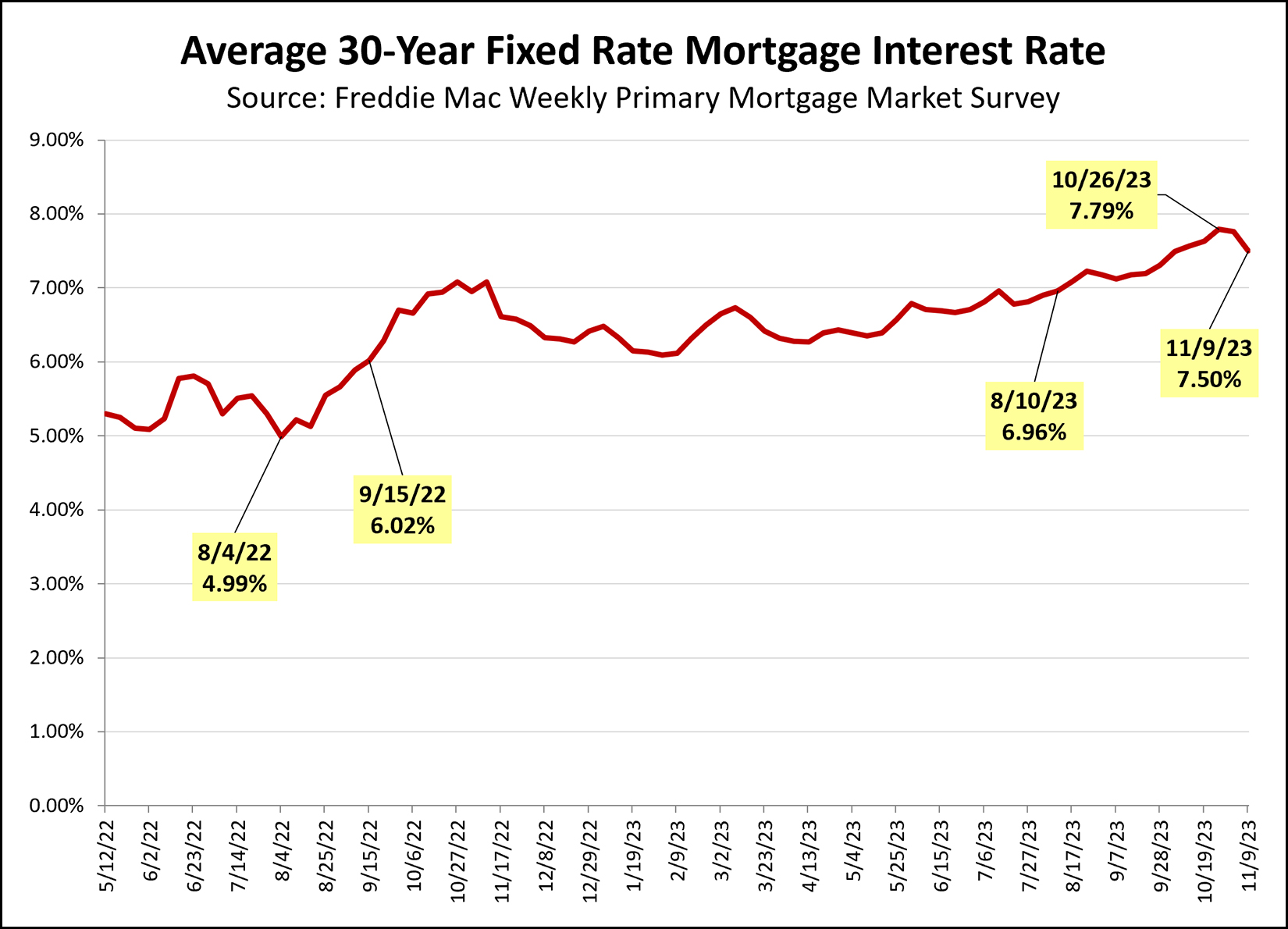

Checking In On Mortgage Interest Rates |

|

Mortgage interest rates have been declining for the past two weeks... or "plunging" as I saw it described in one news article. Let's put it all in a bit of a larger context. Mortgage interest rates rose above 7% in August... ...they peaked two weeks ago at 7.79%... ...and they have now dropped back down to 7.5% as of last week. Looking back further... ...rates rose above 5% in August 2022... ...and then very shortly thereafter rose above 6% in September 2022. I suspect we will see rates above 6% for at least the next year. I think it's possible that we'll see rates get down to 7% over the next few months, but if they stay above 7% I won't be completely surprised. If you are planning to buy a home, it will be important to check in with your mortgage lender for an updated payment projection. Here's a potential payment in Rockingham County for a $300K purchase with 90% financing... 7.79% mortgage interest rate = $2,175 / month 7.5% mortgage interest rate = $2,121 / month 7% mortgage interest rate = $2,029 / month 6.79% mortgage interest rate = $1,992 / month Lower or higher mortgage interest rates certainly affect a monthly payment pretty quickly. A full 1% drop from the peak of 7.79% down to 6.79% would reduce your mortgage payment by $184 / month. Let me know if you'd like some recommendations for qualified local lenders with whom you could talk through a variety of financing scenarios. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings