Buying

| Newer Posts | Older Posts |

It Seems Likely That Home Buyers Will Have Fewer (Resale) Options In The Next 12 Months Compared To The Past 12 Months |

|

Not be Debbie Downer here but it seems likely that home buyers in Harrisonburg and Rockingham County are likely to have fewer options of homes to purchase in the next 12 months compared to the past 12 months. Why, might you ask? Roughly 80% of homeowners have mortgage interest rates below 5%. Mortgage interest rates are currently above 7%. Raise you hand if you'd sell your home with a mortgage interest rate below 5% and purchase a replacement home with a mortgage interest rate above 7%. <nobody raises their hand> So... as long as mortgage interest rates stay above 7% we're likely to see a lower than historically normal number of homeowners willing to sell their homes. So, if you're hoping to buy a home in the next 12 months, you should realize that you will likely have fewer options than in the recent past, and you might need to compromise a bit on what you are looking for in a home. Even though it seems unlikely that you actually will compromise... because of, again, the current high(er) mortgage interest rates. :-)

| |

The Higher The Mortgage Interest Rates, The More Perfect A House Must Be For A Buyer |

|

This is a totally made up graph. I don't know how I would actually measure "how perfect a house must be" to a buyer. But I will point out that... 1. When mortgage interest rates were super low, there were so many buyers competing over every new listing that home buyers were willing to compromise - often a lot - in how perfect a house had to be for them. They just wanted to secure a contract on a house. 2. Now, with mortgage interest rates a good bit higher (double) and with mortgage payments quite high as a result, buyers seem to have much more of a desire for a house to fit them well. If they're going to pay *that much* on a monthly housing payment, the house better fit them pretty well! | |

Monthly Housing Payments Are High But Seem Unlikely To Be Lower Over The Next Year |

|

Mortgage interest rates are higher they have been in over 20 years. Home prices are higher than they have ever been. Combine these two factors and you'll find monthly housing payments that are high. Quite high. Too high? Some would be home buyers are hesitating to move forward with a home purchase because of how high the monthly mortgage payment will be on their new home. This is understandable and quite reasonable. If your lender approves you for a mortgage payment of $2500 per month but you are only comfortable committing $2200 per month to a housing payment then perhaps you shouldn't buy that house that you love that would require a $2500 monthly housing payment. But... if you decide not to buy now (or soon) you probably shouldn't come to that decision within the context of waiting to buy in six to twelve months when you hope to have a lower housing payment. After all... what would we need to see in order to be experiencing lower housing payments? We'd need to see either... [1] Meaningfully lower mortgage interest rates -- which most economists don't seem to think will be showing up anytime in the next year. [2] Lower home prices -- which don't seem likely to exist anytime in the next year. Is it possible that mortgage rates will decline back to 5% or 6%? Sure, it's possible - but it doesn't seem likely, at all. Is it possible that home prices will decline over the next year? Sure, it's possible - but it doesn't seem likely, at all. So, a year from now, you'll likely have a very similar mortgage payment as you would have today -- or possibly even higher. Now, for all you contrarians out there -- tell me I'm wrong -- and tell me how. Will mortgage interest rates decline over the next year? Will home prices decline over the next year? | |

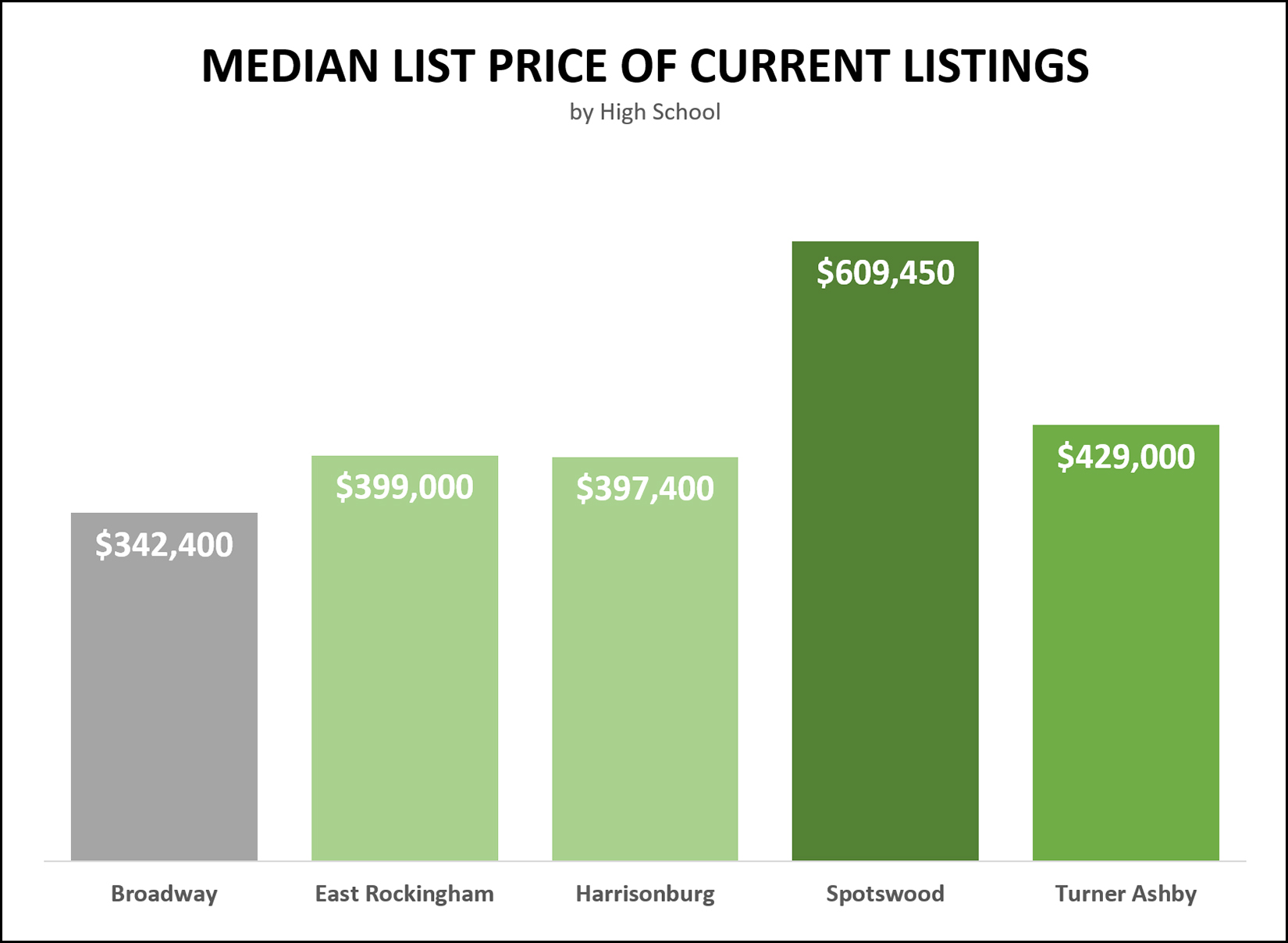

The Spotswood High School District Has The Highest Priced Current Listings |

|

The graph above takes a look at the list prices of current listings of resale (not new) homes for sale in Harrisonburg and Rockingham County. The price shown is the median list price, so as to say that... In the Broadway High School district, half of the current listings are priced at or above $342,400 and half are priced at or below $342,400. Likewise... In the Spotswood High School district, half of the current listings are priced at or above $609,450 (!) and half are priced at or below $609,450. | |

The Influence Of Mortgage Interest Rates On Who Will Buy Or Sell |

|

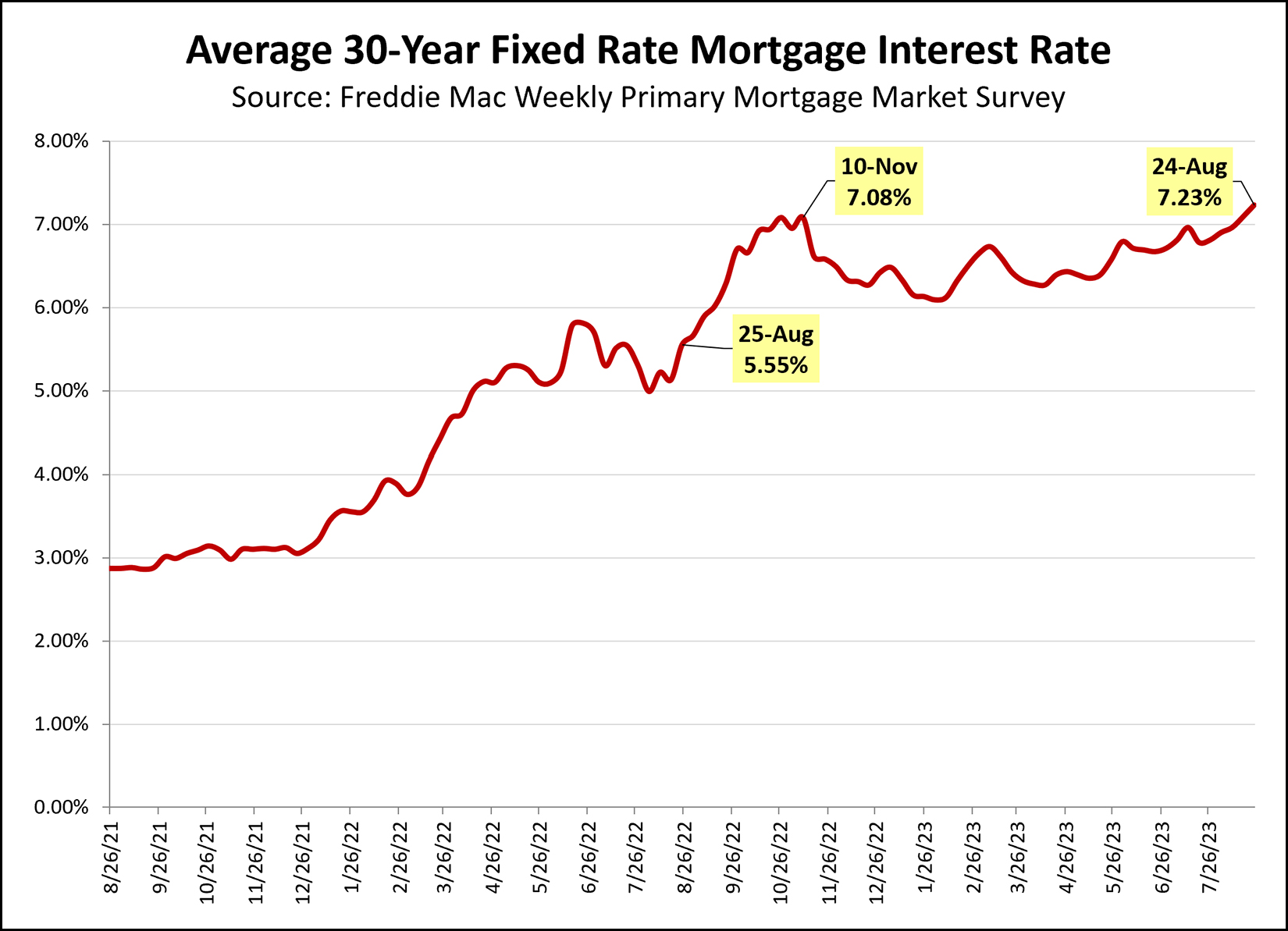

Mortgage interest rates -- and whether they are high, or low, or higher, or lower -- are not the only or even the primary factor affecting any given real estate market -- but they do play a role. Between May 2019 and March 2022, when 30 year fixed mortgage interest rates were below 4%, many (many!) buyers were pulled into the market. They were eager to buy a home while the cost of money so low. They were excited by how much house they could buy within their budget. They were delighted by how low of a mortgage payment they would have based on these low rates. Since September 2022, while 30 year fixed rate mortgage interest rates have been above 6%, many buyers are sitting on the sidelines, unable or unwilling to pay the mortgage payment that would be associated with purchasing a home and financing it at 6% or 7% or 8%. The pool of would-be home buyers has shrunk considerably AND the pool of would-be home sellers has shrunk as well. Homeowners who might sell are reconsidering selling as that would often involve paying off a mortgage with a rate below 4% and then financing a new purchase with a rate above 7%. But... looking ahead... will rates have to get all the way back down to 4% or below to spur a solid increase in the number of buyers in the market? Maybe not. Mortgage interest rates have now been above 7% for two months. It seems likely that they could stay above 7% well into 2024. But when rates do start declining -- at some point -- home buyers will likely start returning to the market in solid numbers as they decline. We were below 4% for three years... so 6% and 7% seem quite high. If stay above 7% for a year... then 6% won't seem bad at all! Whether mortgage interest rates are high or low seems to mostly be understood or felt within a recent context of where rates have been for the past year or two. Just as current (above 7%) mortgage interest rates are keeping some or many buyers out of the market -- I suspect once we get back down into the 6% range we will likewise start to see buyers pulled back into the market and sellers considering the sale of their home after all. | |

As Higher Mortgage Interest Rates Cause Some Home Buyers To Stretch Their Monthly Budget A Bit Further, It Is More Important Than Ever To Keep The Cost Of Future Home Maintenance In Mind! |

|

An important first step in considering your first or next home purchase... is talking to a qualified mortgage lender to better understand your potential monthly mortgage payment for the home you may decide to purchase. You'll be working with that mortgage lender to get a rough idea of two things... [1] The amount of money you'll need to have available at closing for your down payment and closing costs. ... and... [2] The amount of money you will be paying each month for your mortgage payment. But that's not all of the big picture calculations you should be doing. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $40K downpayment and your monthly mortgage payment will be $2,100 per month... great! That gives you a buffer in cash in hand for emergencies and you have extra room in your monthly budget. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $60K downpayment and your monthly mortgage payment will be $2,500 per month... maybe great, maybe not! Spending all of your available cash on the downpayment and closing costs... and spending the entirety of your monthly housing budget on your mortgage payment does not leave you with any room to deal with potential future home maintenance costs. What if you need to replace the heat pump in a few years? What if you need to replace the roof in five years? What if a kitchen appliance breaks? If you decide to stretch yourself monthly budget to make a house payment work -- make sure you have a game plan for those future home maintenance costs too! | |

Did The Federal Student Loan Payment Pause Spur On More Home Buying By Recent Grads Who Built Savings For A Downpayment And Closing Costs? |

|

Federal student loan payments were paused for three and a half years. For graduates who attended public schools, the average federal student loan debt at graduation seems to be around $25K... which worked out to be a student loan payment of $280 per month. 3.5 years = 42 months $280 x 42 = $11,760 Recent grads with average student loan debt, with average student loan payments, would have been able to save up about $12,000 over the past three and a half years when federal loan payments were paused. Did this pause in payments on student loans allow some would-be home buyers to build up savings to put towards a downpayment or closing costs for a home purchase? Quite possibly. There seem to be many reasons why we saw a surge in home buying activity over the past few years... 1. Covid-induced changes to work / life / home situations. 2. Super duper low mortgage interest rates. ...and maybe... 3. College graduates building up savings due to not needing to make student loan payments for a few years. But, back to reality, student loan payments have started back up again now. So if you were building up some savings with those (non)payments -- you'll now need to divert those monthly funds back towards paying off your student loans. | |

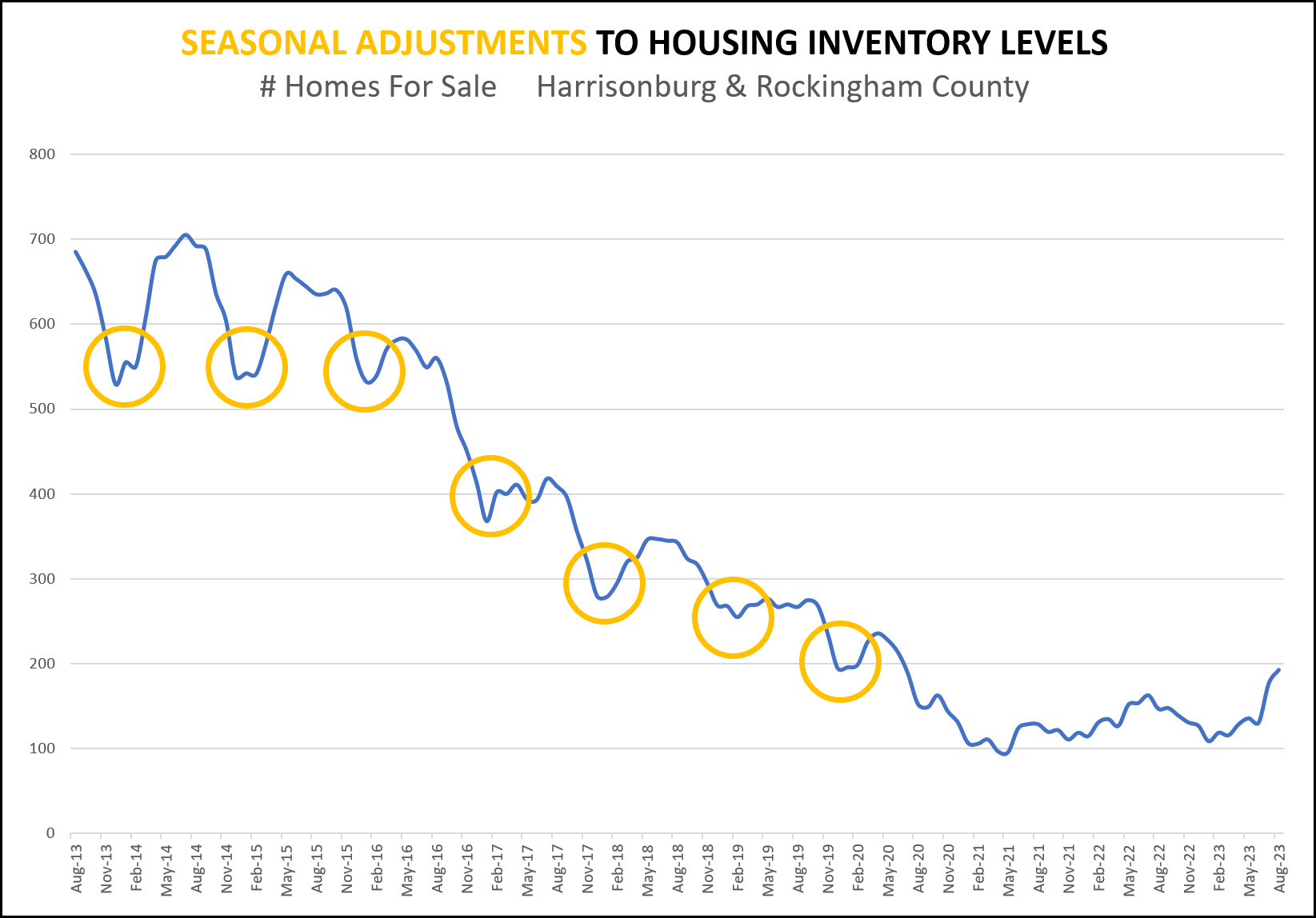

Maybe We Will See Seasonal Declines In Housing Inventory Levels Again This Year? |

|

All the way through 2019, we would see a seasonal decline in housing inventory levels each winter. Inventory levels would typically be the lowest between November and February as some sellers took their homes off the market for a few months -- and as some sellers decided to wait until spring to sell their homes. But then between 2020 and 2022, that all changed. The real estate market was on FIRE as Covid-induced work/life/home changes and super low mortgage interest rates pushed more buyers than ever into the housing market. Inventory levels that had been dropping for several years (2016 - 2019) dropped even further. All of a sudden, inventory levels were ALWAYS low. Spring and summer inventory levels - low. Fall and winter inventory levels - low. We stopped seeing seasonal shifts in housing inventory levels. But over the past few months inventory levels have been drifting back upwards a bit. So, as we (eventually?) start to see cooler temperatures, will we start to see seasonal declines in housing inventory levels again? | |

Anecdotally And Quite Reasonably, Many Buyers Seem To Be Making Larger Down Payments These Days |

|

Yes, I know, this is just based on transactions I am observing, and perhaps even just those that lodge themselves into my mind more than others, but... Home buyers seem to be making larger down payments these days -- and I can understand why. Before... with 3% - 4% mortgage interest rates... there wasn't much of a motivation to make much of a downpayment. Your mortgage payment would be so low, given low mortgage interest rates, that buyers would often finance as high of a percentage of the purchase price that their lender would allow. Now... with 7% mortgage interest rates... buyers are motivated to make as large of a down payment as possible, to make their loan amount as small as possible, given the (relatively) higher mortgage interest rates. This is not to say that all of a sudden all buyers are putting 20% down on their real estate purchases -- they aren't -- but the calculus of how much cash to put into a real estate purchase looks a bit different these days. Home buyers are certainly still keeping some cash on the side for emergencies, etc., but they are often making larger down payments (and financing less) now than they were a few years ago. | |

It May Be Time To Adjust To These Mortgage Interest Rates And Not Wait Around Thinking They Will Decline |

|

A year ago -- in October 2022 -- I commented on rapid changes in mortgage interest rates through the first ten months of 2022... January 2022 = 3.45% April 2022 = 5.00% October 2022 = 6.94% At that point, in October 2022, I reflected that... "I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months." I'm going to double down on that advice here in October 2023... The current average 30 year fixed rate mortgage interest rate is 7.31%. I don't think anyone should be waiting around thinking that we'll see 6.5% soon and then 6% after that... I think it is very likely that we will continue to see mortgage interest rates in the current range (6.75% - 7.50%) for the rest of 2023 and perhaps through the entirety of 2024. If mortgage interest rates decline, that will be fantastic, but I don't think we should expect it or count on it. | |

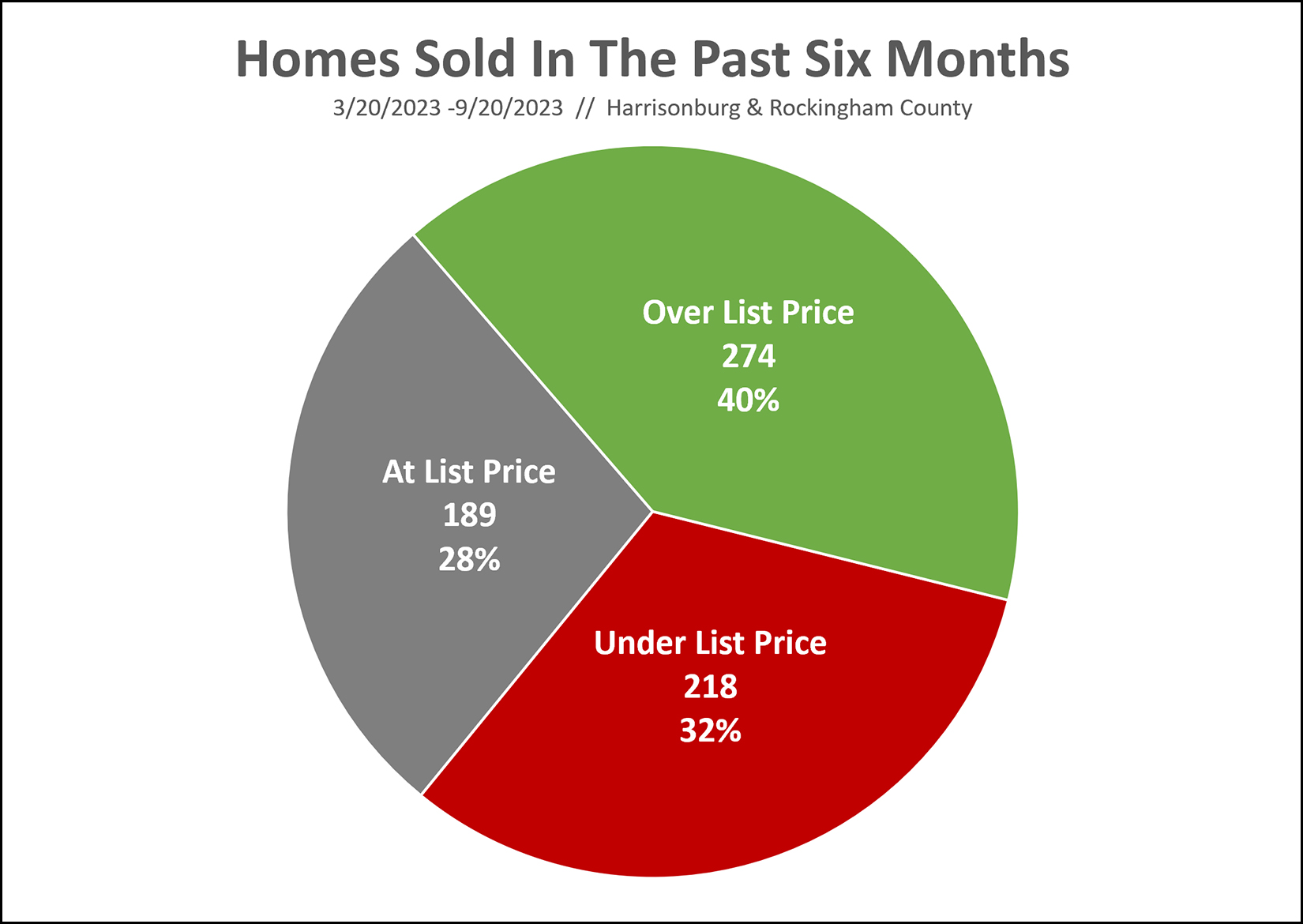

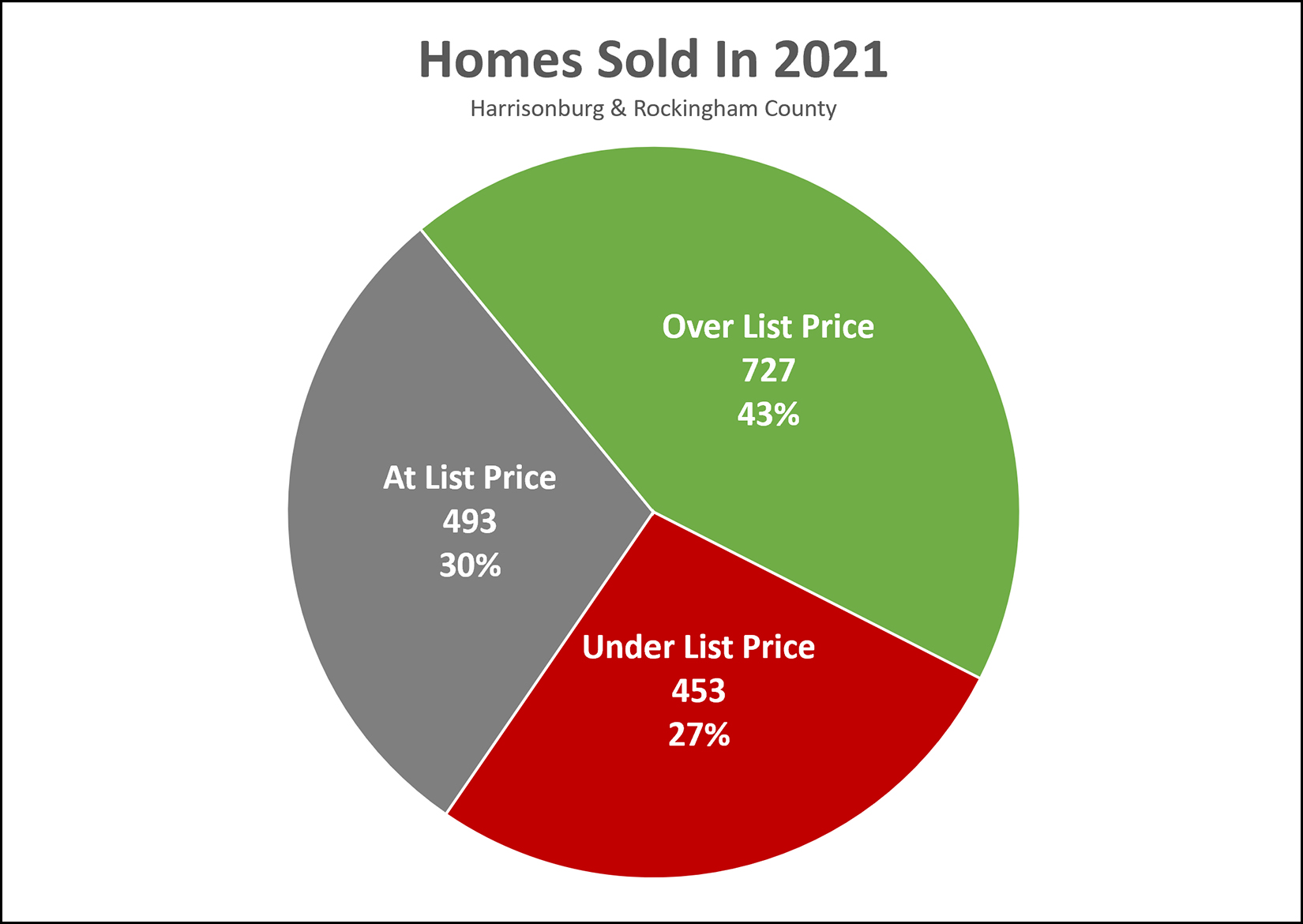

How Many Homes Are Selling For Less Than The List Price? |

|

If we look at homes that have sold in the past six months... [1] 68% have sold for the list price or higher. [2] 32% have sold for less than the list price. [3] 40% have sold for over list price. Maybe several of these stats surprise you. Maybe none of them do. I think the most surprising to me is that 32% of homes sold for less than the list price. If often feels like buyers are barely ever able to negotiate on price -- and sellers are barely ever willing to negotiate on price. Interestingly, let's look back a year and a half (ish) to 2021 when mortgage interest rates were in the 3.something range...  The numbers here are certainly different, though not quite as different as you might imagine. For all the homes that sold in 2021... [1] 73% sold for the list price or higher. [2] 27% sold for less than the list price. [3] 43% sold for over list price. So... is every home selling over asking price? Nope. Back in the crazy times of 2021, was every home selling over asking price? Nope. | |

Sample Mortgage Payments In September 2023 |

|

Mortgage interest rates are on the rise... they were 3% two years ago, 6% a year ago, and just above 7% today. Let's see how those 7-ish percent mortgage rates translate into some mortgage payments these days. All of these illustrations are for homes in the City of Harrisonburg, and (since I'm not a lender) they are not offers for mortgages with specific terms... $250K purchase with 5% down = $1,833 / month $350K purchase with 10% down = $2,449 / month $450K purchase with 20% down = $2,850 / month $600K purchase with 30% down = $3,400 / month Working backwards for a moment, if you were trying to keep your mortgage payment under $1500 (for example) you'd be looking at a $205K purchase price with a 5% down payment. With current mortgage interest rates above 7%, it's more important than ever to talk to a lender sooner rather than later to determine how much you can afford in a mortgage payment -- and/or how much you want to spend each month on your mortgage payment. If you need a recommendation for a great local lender, just let me know. | |

Going, Going, Gone. Make An Offer Before That House Is Under Contract. |

|

Home buyers aren't making decisions quite as quickly these days. That doesn't mean that homes aren't going under contract as quickly -- they often are -- but individual buyers aren't making decisions about whether to make an offer on a house quite as quickly as they have over the past few years. As a result, sometimes buyers are missing out on buying houses for new reasons. Over the past few years buyers often missed out on houses because there were multiple offers on most new listings and they were always competing with other buyers. What I am finding in the current market is that some buyers are missing out on houses because they are waiting a bit too long to make a decision to make an offer. How could this be? Aren't sellers waiting days and days for offers to roll in before they consider moving forward with one? Sometimes. But not as often as in 2021 and 2022. If a seller has 10 showings and four days later they receive their first offer -- they might decide to wait a few days to see what other offers might roll in -- or they might just sign the contract and move forward with the buyer who went ahead and made the offer. So... if you go to see a house that you like, and you're thinking about making an offer but you haven't done so yet... realize that it could very quickly become unavailable if a seller receives a reasonable offer. I don't think all buyers need to universally speed up their decision making process... but they should realize that many sellers are currently more likely to move forward with a favorable offer rather than let it sit for a few days in hopes of receiving additional offers. | |

Does It Make Sense To Wait To Buy A Home? |

|

Given high home prices and high mortgage interest rates, does it make sense to wait to buy a home? As usual, maybe yes and maybe no. Let's start with maybe no, you shouldn't wait to buy a home... [1] If you are waiting to buy a home because you want to wait until home prices come down, that might be a long wait. I can't guarantee that home prices will be stable or will increase forever, but there aren't any current signs that we should expect to see home prices declining in the next year or two so that it would make sense to wait until that time to buy. [2] If you are waiting to buy a home because you want to wait until mortgage interest rates get back down to 4% or 5%, that might be a long wait. With current mortgage interest rates at 7%, I understand the sentiment of wanting to wait until they drop back down somewhat -- but I wouldn't recommend waiting for them to get all the way down to 4% or 5% -- or even 6% for that matter. Mortgage interest rates may very well stay at or above 6.5% for the next year. But... maybe you should wait to buy a home... [1] If you are waiting to buy a home because you aren't comfortable with the mortgage payment on the home you'd like to buy -- that makes a LOT of sense. You need to be comfortable with the long-term financial commitment of buying a home. While home prices and mortgage interest rates might not decline over the next few years -- your income and savings might go up -- getting you to a place where you are more comfortable with a home purchase. So... should you wait to buy a home? Maybe. It depends on your overall financial picture and your plans and goals for the next few years. If you'd like to talk any or all of that through as you contemplate a possible home purchase, just let me know. | |

Yes, Mortgage Interest Rates Are Still High. |

|

The current average 30 year fixed mortgage interest rate is 7.23%. That is the highest it has been in over 20 years. Actually... 22 years, it seems. The last time it was higher was back in June 2001 when it was 7.24%. What lies ahead? Per this NY Times article... "Economists predict that mortgage rates will remain elevated for at least a few more months. And even when they start to come down, they are expected to settle well above the 3 percent rates that home buyers enjoyed during the early stages of the pandemic." ...and... "The Mortgage Bankers Association, an industry group, recently forecast that the average 30-year mortgage rate would fall to 5 percent by the fourth quarter of next year." So... hopefully these historically high mortgage interest rates (that followed some historically low mortgage interest rates) will eventually start to decline again... but we're not seeing it yet. | |

Yes, We Seem To Be Back In A Time When Some Offers Might Be Under The Asking Price |

|

Many homes are still going under contract quickly, often with multiple offers. But not all homes. I know it's hard to believe after the past few years of craziness in our local real estate market -- but some homes are actually going under contract below the list price. Between 2020 and 2022: You want to pay less than list price!? Ha ha ha ha ha ha. You're so silly. Now: Let's see whether they have had many showings and if they have any offers. If a few days or a few weeks have passed and the house is still available, yes, we may very well be successful with making an offer under the list price. That's all on the buyer side. On the seller side... it's more important than ever to price your property appropriately for the market. | |

How Often Are We Seeing Multiple Offer Scenarios These Days? |

|

Pre-COVID, multiple offer scenarios were the exception not the rule -- we would see them from time to time, but not often. During most of 2020, all of 2021 and much of 2022, multiple offer scenarios were the norm. Nearly any property being listed for sale would have multiple offers within just a few days. Buyers were desperate to secure a contract on a house and were including escalation clauses, waiving contingencies, and more, just to try to be the winning buyer. Now, mid-way (a bit more) through 2023, we are still sometimes seeing multiple offer scenarios, but not on all listings, and perhaps not on most new listings. So... BUYERS - You may very well have fallen in love with a house that is going to have multiple offers, so prepare for that and be ready to act quickly - but ask about other interest (and offers) before automatically including an escalation clause and/or dropping contingencies. SELLERS - You may very well be listing a home that buyers will fall in love with and that will have multiple offers, but that also might not happen. You should be super realistic (instead of super optimistic) when it comes to the pricing of your home, and then wait to see what the market response is once your house is listed for sale. I'm sure we'll still see a significant number of multiple offer scenarios moving through the remainder of 2023, but I don't think we'll see it on most/all listings any longer. | |

Home Buyers In Some Price Ranges Are Likely Competing With Would Be Buyers From A Year Ago |

|

Let's focus in on one particular segment of the home buying public... ...those relocating to the Harrisonburg area for employment. Plenty of folks relocated to our area in 2022 for a job and plenty are doing so in 2023. A year ago, in summer 2022, inventory levels were extremely low. Some or perhaps many of those buyers relocating to our area for work were not able to find a home to buy given those low inventory levels. What did they do as a result? They rented a home for a year to pursue buying a home from Harrisonburg now that they are living here. So now, those relocating to Harrisonburg this year for work are not only competing with other would be home buyers also relocating here for work this year but ALSO those would be home buyers that relocate here for work a year ago and have been renting ever since that time. And, perhaps this dynamic has been happening for a few years now, building up an ever larger critical mass of buyers competing for housing. Let's translate it into fictional numbers... 2020 100 would-be buyers relocate to Harrisonburg for work. 100 homes are available for purchase. 100 would-be buyers buy a home. Yay! 2021 100 would-be buyers relocate to Harrisonburg for work. 90 homes are listed for sale and 100 buyers fight over them. 90 buyers buy, 10 would-be buyers rent. Yay-ish 2022 100 would-be buyers relocate to Harrisonburg for work. 10 would-be buyers from 2021 still want to buy a home. 80 homes are listed for sale and 110 buyers fight over them. 80 buyers buy, 30 would-be buyers rent. 2023 100 would-be buyers relocate to Harrisonburg for work. 30 would-be buyers from 2021 and 2022 still want to buy a home. 70 homes are listed for sale and 130 buyers fight over them. 70 buyers buy, 60 would-be buyers rent. This one won't be pleasant... 2024 100 would-be buyers relocate to Harrisonburg for work. 60 would-be buyers from 2021-2023 still want to buy a home. 70 homes are listed for sale and 160 buyers fight over them. 70 buyers buy, 90 would-be buyers rent. I think you get the picture. If buyers keep relocating to the area for work (they will) but inventory levels (sellers willing to sell) continue to remain low -- only so many of those relocating buyers will be able to buy a home. Then, the next year's relocating buyers will be competing with an even larger pool of would-be buyers the following year. So, if you're relocating to the Harrisonburg area for work, great, welcome! If it feels like the competition for homes is rather fierce, you are not wrong... and it seems to be a problem a few years in the making. | |

Why Some Buyers Are Comfortable Paying More Than You Would Expect On Their Home |

|

"Did you see that new listing? It was just listed for $425,000. Looks like a great place. I'm sure there will be tons of interest and probably multiple offers. I can see someone paying up to $440,000 for that house!" "Wait... what!? That house just went to closing, and the buyer paid $465,000 for it. I mean... it was a great house, but $465,000? For that house?" Some buyers are comfortable paying more for their house than you might expect. Why!? [1] Real estate is, often or even most of the time, an appreciating asset. You're not paying more than anyone might expect on a depreciating asset, like a car. Even if you paid more than market value for your home, over time, that market value is likely to catch up to and surpass the price you paid. [2] Their home is not just a financial asset... it's a place that they live, spend time with their family and friends, often providing a sense of community with neighbors, and so much more. Paying more than one might expect for a financial asset alone is different than paying more than one might expect for a place to live and potentially spend most of your waking hours. [3] Especially over a longer time horizon, the purchase price becomes much less consequential. Let's say the house was really worth $440K and the homeowner stays in it for 15 years and prices increase a meager 2% per year. After those 15 years, the house is worth $592K. At that point, I don't think the homeowner (today's buyer) is overly worried about having paid $465K instead of $440K. Now, to be clear, I'm not saying that you should be willing to pay any price for any house, and that it is totally normal, fine, cool, acceptable or hip to pay more than market value. What I am saying is that some buyers are deciding they are willing to pay more than market value for a house in the current market - and I can understand some of the reasons why they choose to do so. | |

How Could Housing Market Affordability Be Restored? |

|

Here's an interesting article for your perusal... If you can't access the entire article, here's the gist of it... There are three levers that can ease housing affordability:

As per this article... "A new housing report put out by Morningstar expects mortgage rates will indeed be the primary lever that helps to ease housing affordability." "As of Friday, the average 30-year fixed mortgage rate tracked by Mortgage News Daily stands at 7.14%. Morningstar expects that’ll trend down in the second half of the year, and we’ll average 6.25% for 2023. Morningstar’s forecast model then expects mortgage rates will average 5.00% in 2024 followed by 4.00% in 2025." The entire article is worth a read. Other groups putting out predictions for future mortgage interest rates aren't thinking they'll get as low as Morningstar predicts, but they do think they will decline over the next few years. The last paragraph of the article holds a key reminder... "When it comes to mortgage rate and home price forecasts, it might be best to take them with a grain of salt. Uncertainty in the economy makes it hard to predict both mortgage rates and house prices." So... you certainly shouldn't count on lower mortgage rates in the future (relative to either waiting to buy until rates drop, or buying now with a plan/need to refinance to a lower rate later) but it is interesting to see multiple groups now predicting lower mortgage interest rates over the next few years. That change would be welcomed by home buyers! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings