Buying

| Newer Posts | Older Posts |

Inspecting the Home Inspection Process |

|

The first thing to know about the home inspection process is that it is a process for the benefit of the buyer. However, the standard contingency form and negotiation document typically used in our market are balanced documents that respect the needs and priorities of both the buyer and seller. The first thing to know about the home inspection process is that it is a process for the benefit of the buyer. However, the standard contingency form and negotiation document typically used in our market are balanced documents that respect the needs and priorities of both the buyer and seller.The Context When making an offer on a property, a buyer negotiates the price and other terms based on their understanding of the property at the time of the offer. However, often buyers will include a home inspection contingency to allow themselves an opportunity to learn more about the property with the help of a professional home inspector. Thus, if a buyer negotiates a contract on a house that has two broken windows, it would not be reasonable to try to negotiate for the repair of the windows during the home inspection process, since that fact was already known about the house --- but if a leaky sink is discovered, it would be perfectly reasonable to request that repair. The Substance The standard inspection contingency references a long list of areas for inspection, including: geotechnical inspections, inspections of the structure, foundations, roof, flooring, HVAC systems, electrical system, plumbing system, appliances, exterior insulation finishing systems, drainage, windows, well and septic systems, and lead-based paint and radon. Yet at the same time, the inspection contingency specifies that the buyer may only request the repair of "material defects" which is described as "those items that could affect the decision of a reasonable person to purchase the Property" and would not include "cosmetic items, matters of preference, or grandfathered systems or features that are properly functioning but would not comply with current building codes if constructed or installed today." The Flow Post-inspection, a buyer may provide the seller with a list of requested repairs. The seller would then respond by offering any of the following:

The Problems Potential pitfalls during the inspection and re-negotiation process include:

| |

Preparing for the 2008 Real Estate Market |

|

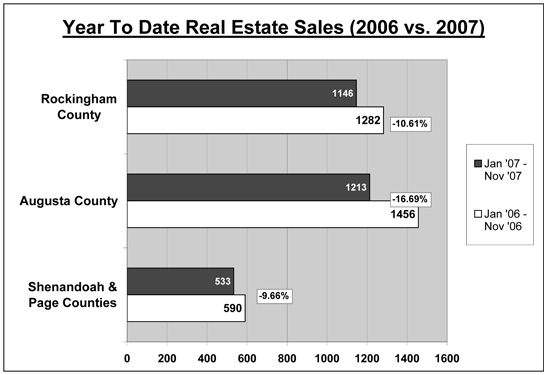

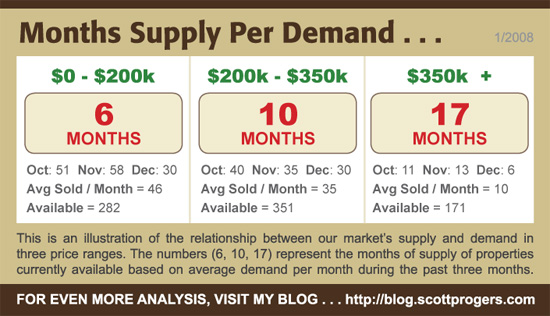

In any market, it's important for both buyers and sellers to understand the market dynamics specific to his or her location. With declining sales, but better performance in the Valley than the state as a whole, there is a lot of information to consume. Here's where to start: Sales Trends Each month the Virginia Association of Realtors releases home sales data about each locality around the state of Virginia. The most recent release compares January through November of 2006 and 2007. This information is visually reflected in the graph to show the difference between the two years.  Despite a decrease in sales in all four counties – Rockingham, Augusta, Shenandoah, and Page – all of the counties except Augusta outperformed the state as a whole. Overall, Virginia showed a 14.64% decrease in sales during this same time frame. Supply & Demand In Harrisonburg and Rockingham County, the relationship between supply and demand differs significantly based on the price range. Generally, as the price goes up, the market is increasingly over-supplied. Of homes priced under $200,000, there is a six month supply available. This is to say that in all of Harrisonburg and Rockingham County, approximately 46 residences are selling each month (10/07 = 51, 11/07 = 58, 12/07 = 30). Thus, with 282 homes currently for sale, there are 6 months (282 / 46) of supply available. In the $350,000 and up price range, however, there are 18 months of homes available. In all of Harrisonburg and Rockingham County, approximately 10 residences are selling each month (10/07 = 11, 11/07 = 13, 12/07 = 6). Thus, with 171 homes currently for sale, there are 17 months (171 / 10) of supply available. Six months of supply is considered by many to be an indicator of a healthy balance between buyers and sellers. The Implications As has always been the case, all real estate is local. Sales trends, supply and demand all affect every buyer and every seller – but these market factors are different in almost every situation, based on location, property type, price range, and much more. As a seller, before pricing your home, take a careful look at similar recent sales. How long did it take for these homes to sell? Did they sell close to asking price, or did the sellers concede on purchase price? Were any additional buyer incentives offered, such as closing cost assistance? In addition to looking at recently sold comparable properties, sellers must examine their competition – similar properties in their neighborhood, or of a similar property type and price range. Today more than ever, having a firm grasp on your segment of the real estate market is essential for making wise real estate decisions as a seller. Buyers are having a bit more fun than sellers these days. In almost all cases, they have lots of homes to choose from, in many price ranges they have the upper hand in negotiations, and they can finance their purchase with a historically low fixed interest rate. Yet despite all of these exciting factors for a buyer, it is still important to analyze the market in which a home is being purchased. Buyers should look at recently sold properties to better understand the value of the property being considered, as well as to understand the seller's context. Looking Forward As 2007 progressed, sales increased, and inventory levels decreased. In most price ranges, there is still somewhat of an oversupply of housing – but this will likely continue to correct itself in 2008. As we move through the first quarter of 2008, expect to see a continued gradual increase in the number of sales, and a continued gradual decrease in the inventory of available homes. The continuation of both of these trends will restore a healthy balance between buyers and sellers in our market. | |

Foreclosure: 2410 Reservoir Street, Harrisonburg |

|

Date/Time of Sale: Monday, February 4, 2008 at 10:00 a.m. Original Principal Amount of Deed of Trust: $93,800 Assessed Value: $152,800 Terms of Sale: A bidder's deposit of $9,300.00 or 10% of the sale price, whichever is lower, will be required in cash, certified or cashier's check. Settlement within fifteen (15) days of sale, otherwise Trustees may forfeit deposit. For Information Contact: Professional Foreclosure Corporation of America C/O Shapiro & Burson, LLP 236 Clearfield Avenue, Ste 215 VIrginia Beach, VA 23462 757-687-8777 Per the Daily News Record, January 21, 2008 | |

Foreclosure: 153 Bellevue Street, Timberville |

|

Property To Be Sold: 153 Bellevue Street, Timberville Property To Be Sold: 153 Bellevue Street, TimbervilleDate/Time of Sale: Wednesday, February 13, 2008 at 9:00 a.m. Original Principal Amount of Deed of Trust: $161,209.46 Most Recent Property Transfer: $137,000 (July 19, 2005) Assessed Value: $94,600 Terms of Sale: A deposit in the form of certified funds in the amount of $15,000.00 or 10% of the successful bid, whichever is lower, is required of any bidder at the time of sale. Closing within fifteen (15) days of sale. For Information Contact: Stephen B. Wood Friedman & MacFadyen, P.A. 1601 Rolling Hills Drive, Ste. 125 Richmond, VA 23229 (804) 288-0088 Ref# 213052 Per the Daily News Record, January 18, 2008 | |

Supply and Demand By Price Range - January 2008 |

|

The latest housing market stats, from the Harrisonburg-Rockingham Association of Realtors, MLS data:  | |

Single Family Homes Priced Under $200,000 |

|

Is it still possible to buy a home under $200,000 in Harrisonburg or Rockingham County? Many people think it's not possible, and talk about it within the context of how much home prices have increased over the past few years. First, a disclaimer --- there are lots and lots of townhouses or duplexes priced under $200,000. There are 97 currently available in the City of Harrisonburg, and 71 more in Rockingham County. However, there are even some single family homes in that price range as well. 23 homes in the City of Harrisonburg are priced under $200k, and 107 more in Rockingham County. Here are a few selected listings in Harrisonburg:  1463 Bluestone Street 1,100 square feet 2 BR, 1 BA $174,900  541 Lee Avenue 1,404 square feet 4 BR, 2 BA $199,500 And in Rockingham County:  301 3rd Street, Grottoes 1,889 square feet 3 BR, 2 BA $169,900  TBD Declaration Drive, Broadway 1,535 square feet 4 BR, 2.5 BA $199,900 | |

Single Family vs. Duplex --- Where Did the Price Difference Go? |

|||||

One of my readers asked a great question --- essentially, why do some city duplexes seem to be selling for just about as much as similar single family homes. Let's take a look, starting with a few examples of somewhat pricey duplexes . . .

These are just a few examples, but one thing that becomes clear is that there are quite a few city duplexes (many one-story, with only 2 bedrooms, without significant square footage) that are selling for similar prices to relatively new single family homes. What is the explanation? Here are some of the likely contributing factors:

Of note, here are several newer duplex developments fitting the profile mentioned above: Cullison Creek | Emerald Drive Estates | Meadow Pointe Village | Southside Heights | Spring Oaks | The Glen At Cross Keys | |||||

Condos Are Coming To Downtown Harrisonburg! |

|

Urban Exchange, an exciting new mixed-use development, will be built with frontage on East Market Street and Mason Street --- within walking distance to downtown Harrisonburg and JMU campus.  The six-story structure will be comprised of (196) 1, 2 and 3 bedroom condos / apartments, as well as approximately 12,000 s.f. of retail space -- to house tenants such as a coffee shop, restaurant, and other retail operations. These brand new, upscale units will be available both for sale or for lease. Amenities will include on-site parking, free internet and phone service, a state-of the-art fitness center, public space and an outdoor courtyard. Demolition on the existing structures will begin this month, and the entire project will be complete by Summer 2009. For more information about Urban Exchange, visit http://www.ueharrisonburg.com. | |

Foreclosure: 332 Chestnut Oak Lane, Penn Laird |

|

Property To Be Sold: 332 Chestnut Oak Lane, Penn Laird Date/Time of Sale: Wednesday, January 23, 2008 at 11:30 a.m. Original Principal Amount of Deed of Trust: $625,000 Assessed Value: $825,600 Terms of Sale: A deposit of $62,500.00 or 10% of the sales price, whichever is lower, (in certified funds or cash of not more than $10,000.00) will be required of the successful bidder at time of sale. Settlement is to be made within 15 days. For Information Contact: Glasser and Glasser, P.L.C. and/or Atlantic Trust Services, L.L.C., Substitute Trustees, Crown Center Building, Suite 600, 580 East Main Street Norfolk, VA 23510, File No. 61185 (757) 321-6465 Call between 10:00 a.m. and 12:00 p.m. Per the Daily News Record, January 11, 2008 | |

Eastern Rockingham County Lot Sales - The Ups and Downs |

|||||||||||||||||||||||||||||||

Over the past several years, prices of lots in eastern Rockingham County, particularly in the Peak View school district have increased dramatically. However, in 2007, the average sales price dropped below the 2006 average sales price. Over the past several years, prices of lots in eastern Rockingham County, particularly in the Peak View school district have increased dramatically. However, in 2007, the average sales price dropped below the 2006 average sales price. 2003: $47,546 (81 sales) 2004: $55,354 (112 sales) 2005: $89,112 (98 sales) 2006: $118,075 (51 sales) 2007: $110,875 (35 sales) As you can above, during this same time, demand for lots decreased rather significantly. This was compounded by the fact that the inventory of available lots increased during the same time --- there are currently 109 lots available in the Peak View school district, as follows:

| |||||||||||||||||||||||||||||||

A Wider View On The Harrisonburg Real Estate Market |

|

Some people don't like month-by-month analysis, as monthly figures in a market of our size can be deceiving. Every so often, I also look at quarterly figures to look for larger trends. Here's the latest, with a bit of commentary below the graph . . .  The main observation I would make is that though December 2007 sales figures were quite low, the fourth quarter of 2007 finished out stronger than the four quarter of 2006. This is, perhaps, a change in momentum, as Q1, Q2 and Q3 in 2007 were all lower than in 2006. The graph above shows the number of sales per month as reported by the Harrisonburg/Rockingham MLS in all of Harrisonburg and Rockingham County | |

Virginia Association of Realtors - November 2007 Sales Figures |

|

On Friday, January 4, 2008 the Virginia Association of Realtors released November 2007 sales data (report, stats) for the various parts of Virginia, separated by local Realtor association. Before getting to the numbers, and some observations, please bear in mind that these are measuring things slightly differently than how I pull my monthly sales stats. According to VAR figures, sales in November '07 (94) were up 6.82% from November '06 (88). Year-to-date sales for 2007, however, are still down 10.61% compared to 2006. When looking at pricing trends, median and average calculations contradict each other. The median sales price for November '07 ($196,500) was down 1.75% from November '06 ($200,000). However, the averages sales price for November '07 ($225,744) was up 1.24% from November '06 ($222,970). Interestingly, buyers are almost as active as they were last year --- as measured by the number of contracts written. In November '07, 89 contracts were ratified, whereas in November '06, 92 were ratified (a decline of 3.26%). Year-to-date '07 shows 1,152 ratified contracts, which is a 4.48% decline as compared to 1,206 ratified contracts for year-to-date '06. Finally, we're doing a little better than average as compared to the other parts of the state --- as measured by the number of sales year-to-date, as compared to last year (to-date). Our market (Harrisonburg/Rockingham) shows a decline in number of sales of 10.61%, making us the 10th best market in a field of 23 markets that have a combined decline of 14.64. The best markets right now are Southwest Virginia (+3.00%) and the Dan River Region (-4.71%). The worst markets are the Northern Neck (-75.31%) and the Eastern Shore (-48.06%). Source: Virginia Association of Realtors | |

December 2007 - Slower Sales After Two Strong Months |

|

As seen below, the Harrisonburg and Rockingham County real estate market experienced a change in direction this month. October and November of 2007 showed sales quite a bit stronger than 2006. However, December 2007 numbers fell quite a bit below October '07, November '07, as well as December '06.  January sales figures should be interesting, as they have been very consistent for the past several years. The Details: The graph above shows the number of sales per month as reported by the Harrisonburg/Rockingham MLS in all of Harrisonburg and Rockingham County | |

Foreclosure: 9075 Centreville Road, Bridgewater |

|

Property To Be Sold: 9075 Centreville Road, Bridgewater Date/Time of Sale: Tuesday, January 22, 2008 at 4:00 p.m. Terms of Sale: A deposit of $20,000.00, cash or certified check, will be required at the time of sale with settlement within fifteen (15) days from the date of sale. For Information Contact: ReConstruct Company 209 Business Park Drive Virginia Beach, VA 23462 (800) 281-8219 Call between 10:00 a.m. and 5:00 p.m. (CST) Original Principal Amount of Deed of Trust: $274,400 Assessed Value: $260,600 Per the Daily News Record, January 4, 2008 | |

Foreclosure: 2998 Earmans Loop, Harrisonburg |

|

Property To Be Sold: 2998 Earmans Loop, Harrisonburg Date/Time of Sale: Wednesday, January 23, 2008 at 11:00 a.m. Terms of Sale: A deposit of $15,000.00, cash or certified check, will be required at the time of sale with settlement within fifteen (15) days from the date of sale. For Information Contact: ReConstruct Company 209 Business Park Drive Virginia Beach, VA 23462 (800) 281-8219 Call between 10:00 a.m. and 5:00 p.m. (CST) Original Principal Amount of Deed of Trust: $199,500 (12/28/06) Assessed Value: $102,600 Per the Daily News Record, January 4, 2008 | |

Foreclosure: 2991 Taylor Spring Lane, Harrisonburg |

|

Property To Be Sold: 2991 Taylor Spring Lane, Harrisonburg Property To Be Sold: 2991 Taylor Spring Lane, HarrisonburgDate/Time of Sale: January 15, 2008 at 11:00 a.m. Terms of Sale: A bidder's deposit of $13,200.00, cash or certified check, will be required at the time of sale with the settlement and full payment of the purchase price within (15) fifteen days from the date of the sale. For Information Contact: Nectar Projects, Inc 104 N. Bailey Ln. Purcellville, VA 20132 540-751-1267 Call between 8:00 a.m. and 11:00 a.m. http://www.nectarp.com Original Principal Amount of Deed of Trust: $135,000 Assessed Value: $197,900 Comparable Properties For Sale: http://taylor_springs.scottprogers.com Per the Daily News Record, January 2, 2008 | |

Local Housing Inventory Drops 4% Overnight |

|

As we all flipped our calendars to the new year, 29 homes in Harrisonburg and Rockingham County came off the market. This reduced the inventory of homes for sale from 807 to 778, in other words, a 4% drop. It is possible that it was an arbitrary drop. There were likely many listing agreements with expiration dates of 12/30/2007. It will be interesting to observe whether there is a corresponding surge of new or renewed listings in the coming days. | |

Harrisonburg Homes - True List to Sell Ratios |

|

A statistic that can be very helpful in understanding the state of the real estate market is the ratio between the list price and sale price of a home. For example, 216 single family homes sold thus far in 2007 (1/1/2007 - 12/30/2007), with an average list to sell ratio of 97.81%. This means that Sellers are getting, on average, 97.81% of their asking price - - - or are they?? When I (or any other Realtor) runs these calculations in the MLS, the statistical analysis compares the sale price to the final list price, not the original list price. Unfortunately, comparing the sale price to the original list price is a manual process. But let's see what it would show us . . . Because of the tedious nature of this research, I have limited this to Harrisonburg single family homes that sold in the 4th quarter (9/1/2007 - 12/30/2007). There were 39 homes, that sold at 97.24% of the final list price. When looking at the sale price compared to the original list price, the ratio drops to . . . . . . . . . . 94.20%. Interestingly, of the 39 homes, 8 of them sold for less than 90% of the original list price. Let's put a few of these numbers in perspective, with the lowest ratios in the set . . . 977 Summit Avenue Original List Price = $498,000 Final List Price = $424,900 Sale Price = $375,000 (75% of original list price) 740 Collicello Street Original List Price = $150,000 Final List Price = $145,000 Sale Price = $125,000 (83% of original list price) 60 Shenandoah Avenue Original List Price = $182,500 Final List Price = $169,900 Sale Price = $156,000 (85% of original list price) A few interesting take away points:

| |

Harrisonburg High-End Real Estate Market |

|||||||||||||||||||||||||||||

Each month I run the same series of calculations to determine how supply and demand relate in several price ranges --- less than $200k, $200k - $350k, and $350k and up. At the start of December, there were 20 months of supply of homes priced $350,000 and up. One of my readers posed the question of whether there might be more of a story to tell in what could be a very large price range --- $350k and up encompasses many hundreds of thousands of dollars. So, let's take a look --- please note, I updated the "Available" numbers to reflect current availability.

So --- it is somewhat interesting --- there are only 17 months of homes priced between $350k and $600k --- and a whopping 61 months of homes available priced above $600k. But to give the $600k+ homes a fair shake, let's make sure September, October and November weren't unusually low sales months. From January 2007 through November 2007 (inclusive), there were 16 sales of homes above $600k. This is 1.45 sales per month --- which would make the current inventory (43 homes) equivalent to 30 months of supply. Better than 61 months --- but this is still the most oversupplied price range by far! | |||||||||||||||||||||||||||||

Negotiations: Speed vs. Enforceability |

|

Negotiating a contract can take place verbally, or in writing -- there are advantages and disadvantages of each strategy. Negotiating a contract can take place verbally, or in writing -- there are advantages and disadvantages of each strategy. Almost always, the (prospective) buyer makes the first move in negotiations -- I suggest that it takes place in written form. A buyer can certainly make a verbal offer on a property, but putting the offer in writing has several benefits:

When it comes to further negotiating the terms of a contract -- after the offer has been made -- oftentimes it can be more helpful to do so verbally. A few things to consider:

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings