Financing

| Older Posts |

Monthly Housing Costs Over Time, Plus Adjusted For Inflation |

|

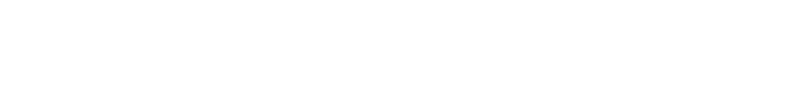

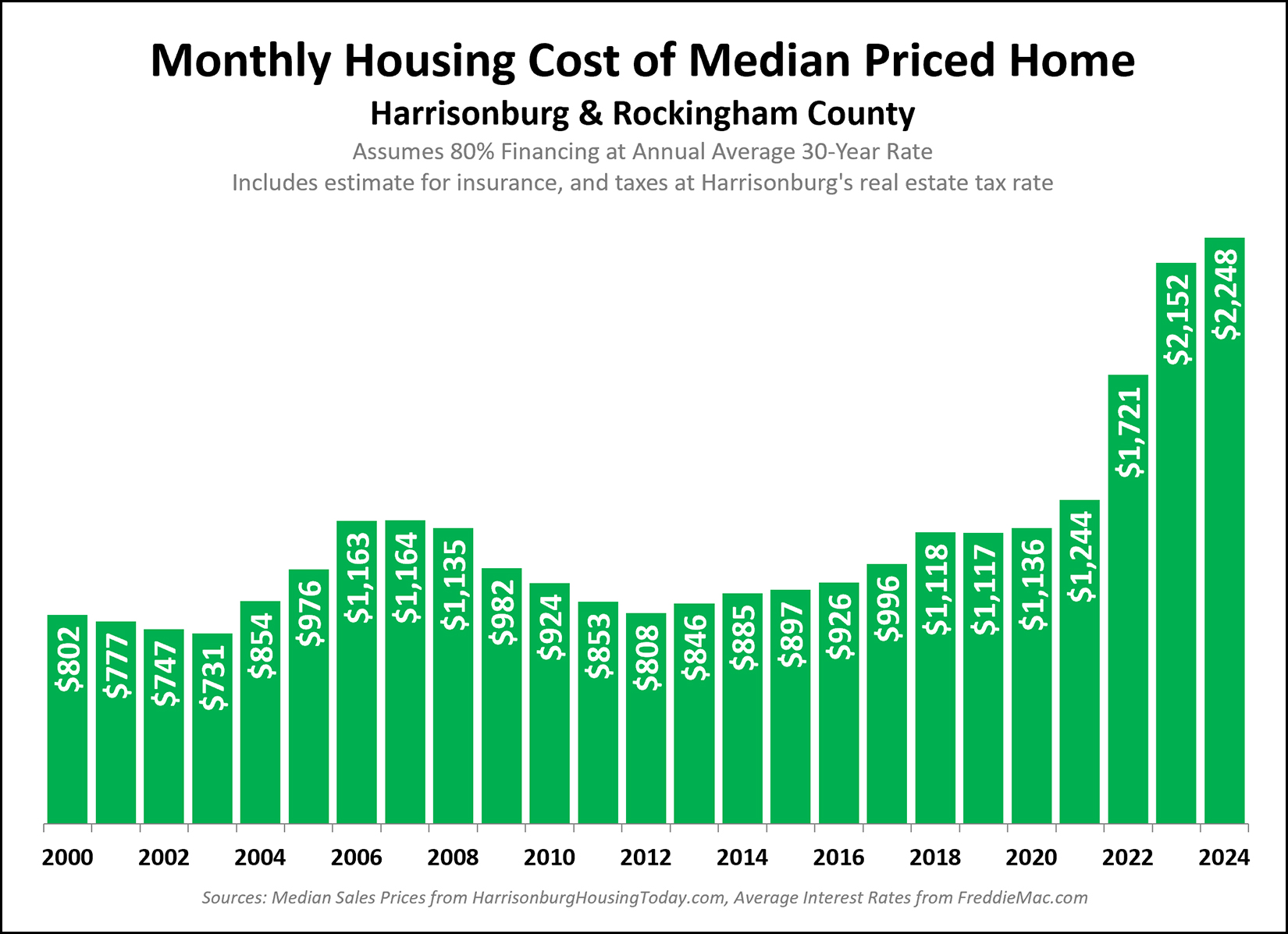

Above you can track average monthly housing costs in Harrisonburg and Rockingham County over time, with some pretty large caveats. This graph is based on the median sales price each year, assuming a buyer finances 80% of the purchase price with the average mortgage interest rate of that year, and the monthly costs include an estimate for insurance and property taxes. This chart is not showing the average housing cost of everyone in Harrisonburg and Rockingham County over time -- it is showing the monthly housing costs for buyers buying homes in each of the years in the graph. If you bought a home in 2014 with a fixed rate mortgage, your housing costs have likely stayed relatively level over the past decade other than adjustments for insurance costs and real estate taxes, both of which are a minority of the total housing cost. You might note that this graph shows monthly costs spiking significantly between 2021 and 2024. In fact... they nearly double between 2020 and 2024. Here's where we need to consider inflation. The inflation rate was quite higher in 2021 and 2022 which caused housing costs (and the cost of many other items) to increase significantly. Certainly mortgage interest rates were also rising during this time, but we can't ignore the impact of inflation alone. Here is the annual inflation rate during the same timeframe as in the graph above...  And now, let's adjust those housing costs for inflation, so that each year's housing cost is in 2020 dollars, to see how much housing costs have adjusted over time over and above how inflation has changed...  Here you can see that housing costs have still increased quite significantly over the past few years, but not quite as much as the non inflation adjusted data would have you believe. It seems unlikely that home prices are going to decline - so the best bet for housing costs leveling off would be lower mortgage interest rates. Most economists are not predicting significant downward adjustments in mortgage interest rates in 2025. | |

Mortgage Interest Rates Headed Down For Christmas? |

|

Christmas is one week away... and mortgage interest rates seem to be dropping in anticipation of the holiday. ;-) So... if you're looking for a last minute gift for a special someone... contract to buy them a house, lock in your mortgage interest rate, and my how appreciative they will be! No, but really, mortgage interest rates have been all over the place over the past year... as high as 7.22% and as low as 6.08%. They are currently on a downward trend back towards six and a half... though TBD if they'll stay there or keep dropping... for New Years!? | |

Indeed, As Mortgage Interest Rates Decline, More Buyers Will Be Able To Afford To Buy Your Home |

|

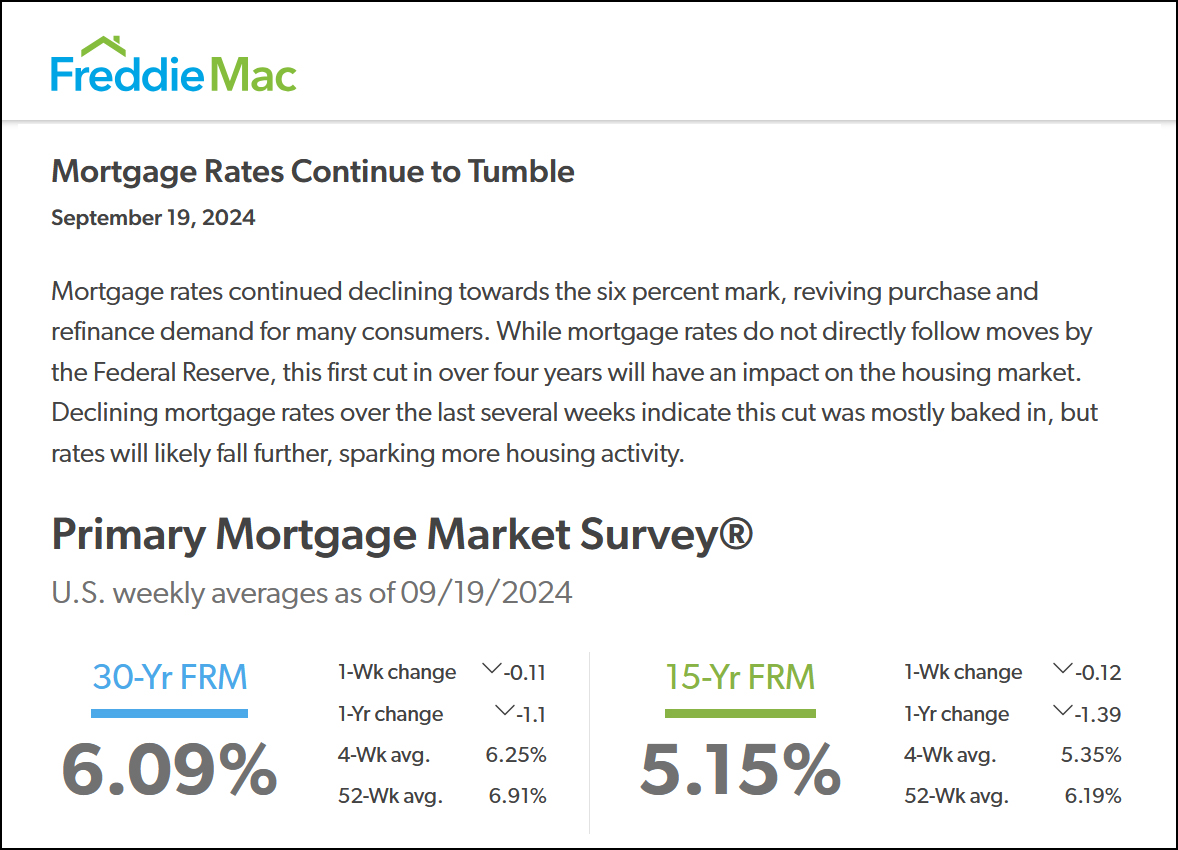

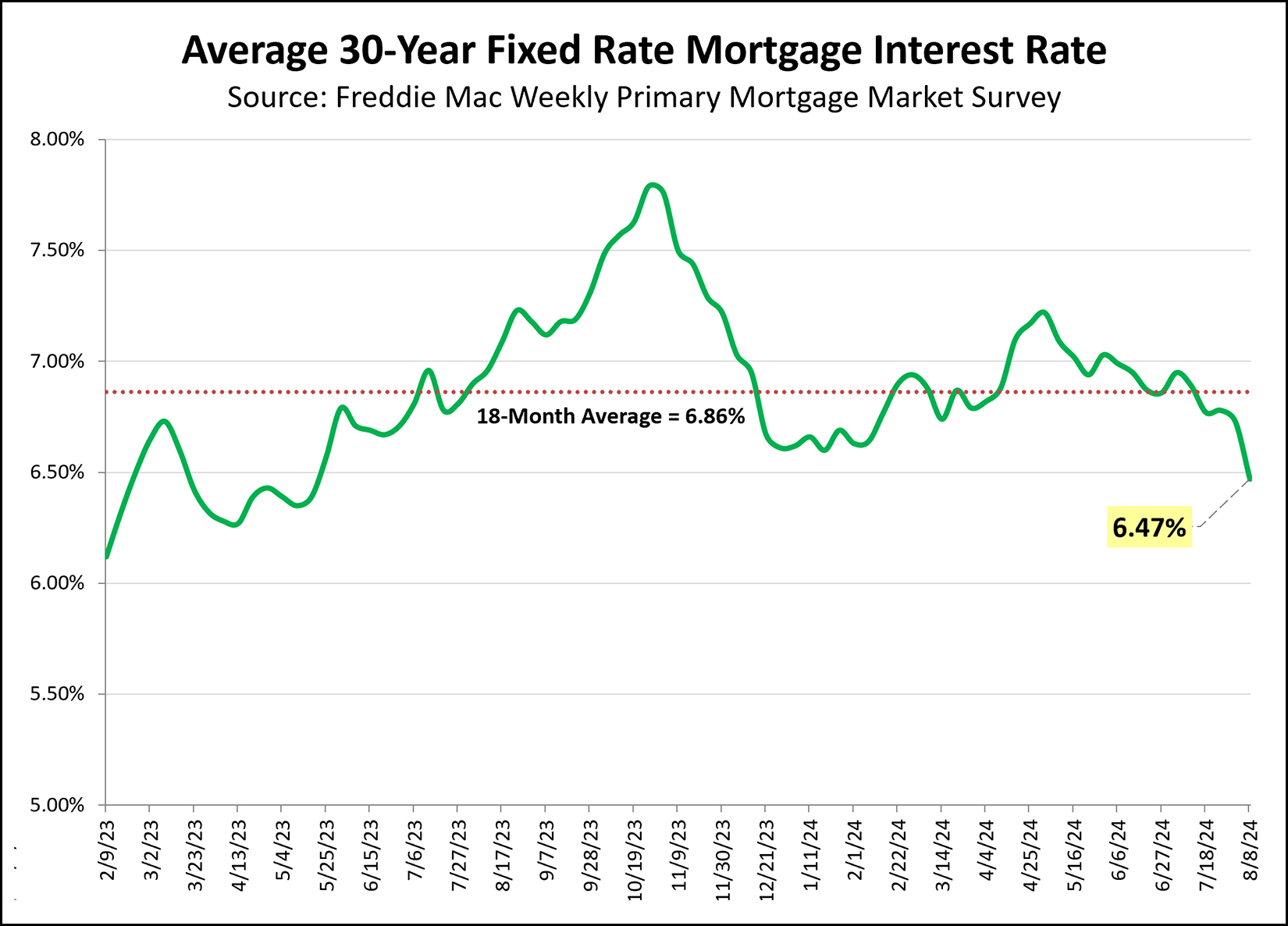

Mortgage interest rates have been declining for about five months now... Early May = 7.22% Early August = 6.47% Mid September = 6.09% Will we even see a FIVE-point-something mortgage interest rate soon? Quite possibly. As any home buyer will tell you, these lower mortgage interest rates are GREAT... they are lowering mortgage payments for buyers getting ready to buy a home. And... for the home sellers... these interest rates are also GREAT... they allow more buyers to afford to buy your home! If you're getting ready to buy a home, but haven't talked to your mortgage lender in a few months, you should reconnect with them and ask for an updated estimate of your mortgage payment given these newer, lower mortgage interest rates. | |

Lower Mortgage Interest Rates Will Likely Bring More Buyers Into The Market But Maybe Not More Sellers |

|

As noted yesterday... August 2023 & 2024 = higher mortgage interest rates, fewer contracts signed August 2022 = lower mortgage interest rates, higher contracts signed What's the connection? The higher the mortgage interest rates... 1. The fewer buyers who can and are willing to buy. ...but also... 2. The fewer sellers who are willing to sell and give up their (likely) low mortgage interest rate on their current home. So... if or when or as mortgage interest rates decline... will we see higher levels of contract activity? Maybe. Maybe not. As mortgage interest rates decline... 1. More buyers will be able and willing to buy. ...but... 2. Sellers might still be reluctant to sell, as lower mortgage interest rates won't necessarily be lower than their locked in mortgage interest rates. Thus, I suspect as mortgage interest rates decline, we'll see the pool of would be buyers expanding more quickly than the pool of would be sellers. | |

Average Mortgage Interest Rates Are Just That, Average Mortgage Interest Rates |

|

The average (30 year fixed) mortgage interest rate peaked at 7.8% last October. Now, the average rate is right around 6.5%. But... take that with a grain of salt... or however the expression goes... Home buyers that lock in their mortgage interest rate over the next week are likely to see rates anywhere from 6% to 7%, depending on...

So, yes, if you buy a home this week, you might have a rate of 6.5%... or it could be a decent bit lower... or higher. That average rate is just an average of the rates offered by lenders for 30-year fixed rate, conventional financing with an 80% loan-to-value ratio. So, don't ask your lender for that average rate... ask what rates are possible for you based on your credit, downpayment, loan program and points. | |

Mortgage Interest Rates Fall, Again, To Lowest Levels In Over A Year |

|

I suppose this might become an ongoing theme over the next few months but mortgage interest rates have fallen, again. The average 30 year fixed rate mortgage interest rate is now 6.47%... which is the lowest average rate we have seen since May 2023. These lower mortgage interest rates are likely to spur on more home buying activity as each time the rates drop it makes a home buyer's dollars go a bit further. If you plan to buy a home this coming fall, talk to a mortgage lender sooner rather than later to understand what your mortgage payment would look like given current rates... and perhaps you'll be able to keep requesting updated payment information if rates continue to fall. :-) | |

Mortgage Payments Drift Downward As Mortgage Interest Rates Slowly Decline |

|

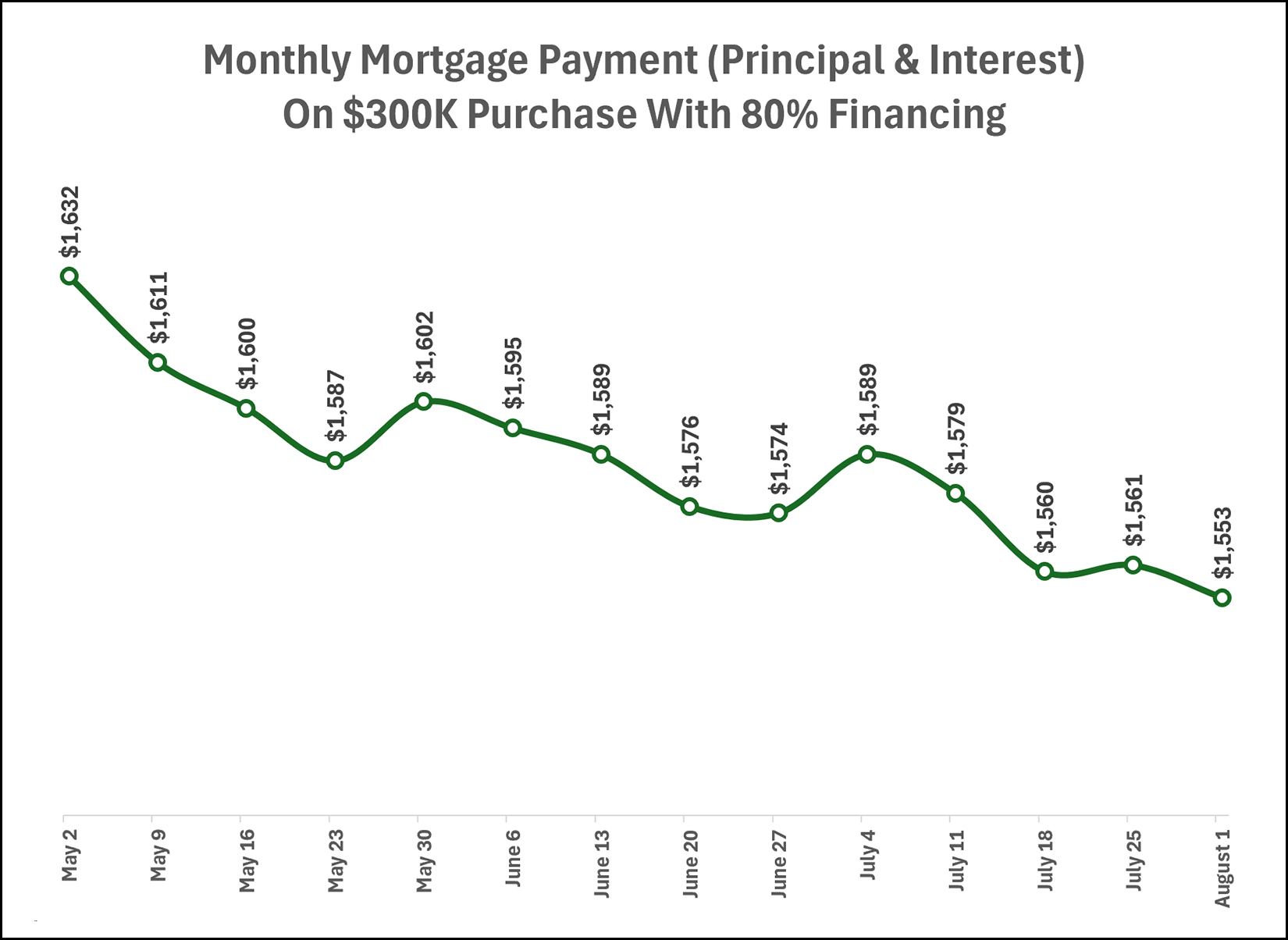

The average mortgage interest rate on a 30 year fixed rate mortgage has been slowly declining over the past three months, from 7.22% on May 2nd to 6.73% on August 1. Thus, as you would expect, monthly mortgage payments are trending downward as well. The graph above shows the principal and interest portion of the mortgage payment for a $300K purchase with 80% financing given the average mortgage interest rates each week for the past three months. As you can see, this theoretical mortgage payment has declined by about $80 over the past three months... which provides almost $1,000 per year of savings to a buyer given the lower mortgage interest rates. | |

Mortgage Interest Rates Declining Steadily Through Start Of Summer |

|

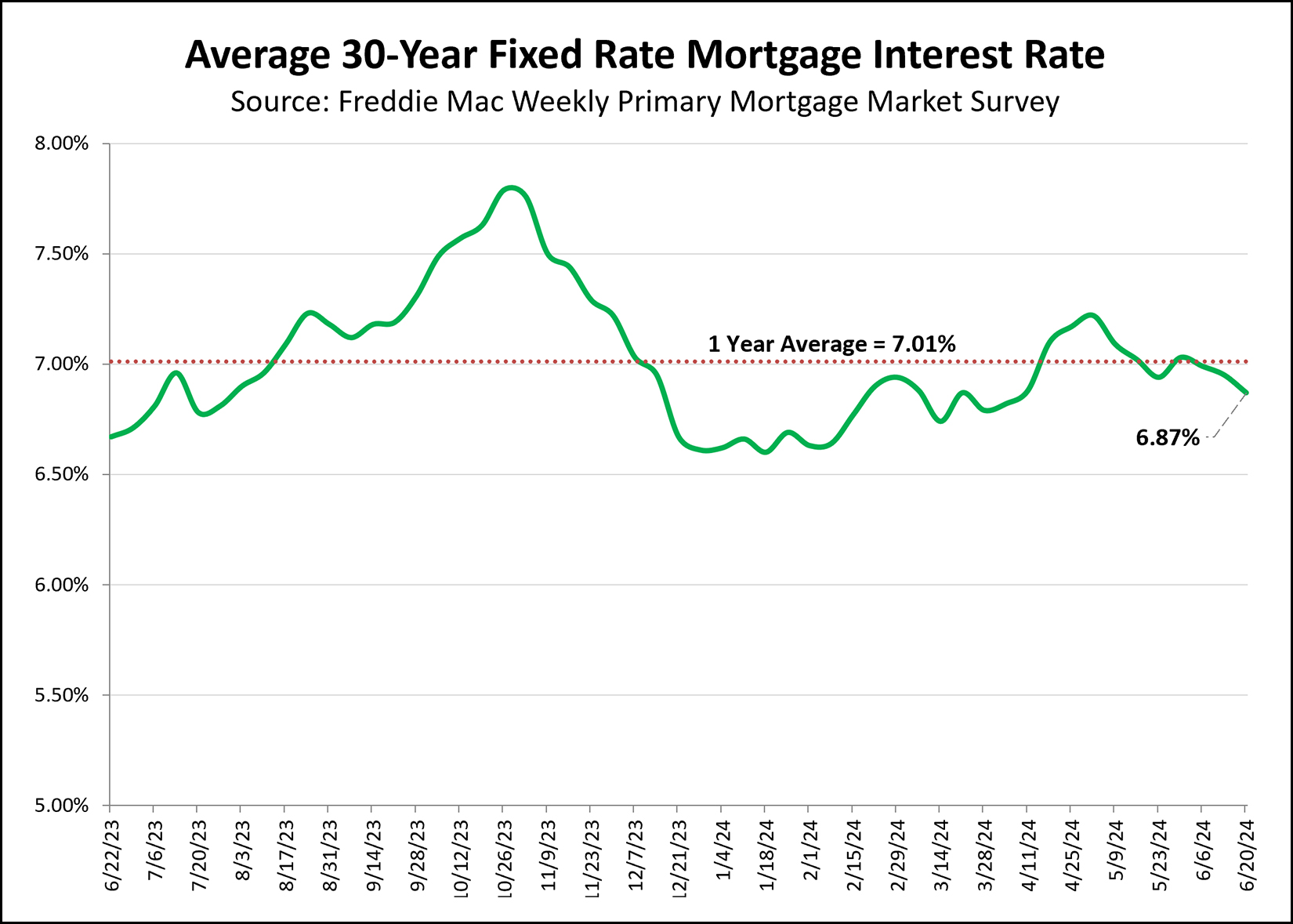

Outdoor temperatures may have been HIGH during the first few weeks of summer... but mortgage interest rates have been falling! Over the past years, the average 30 year fixed mortgage interest rate has been 7.01%. The average rate peaked last October at 7.79% and then fell relatively steadily through December... but then (mostly) climbed again all the way through May when it hit 7.22%. Since that time we have seen a decline almost every week, and the average rate is now 6.87%. That is nearly a full percentage point lower than the high of 7.79% this past October. Home buyers are certainly enjoying these lower mortgage interest rates though they hope they will continue to decline. | |

Listings Hitting The Market On Fridays Make It Important For Buyers To Have A Lender Letter Ready To Go |

|

A buyers says... I plan to buy a home as soon as "the right one" comes on the market. I talked to a lender six months ago and they didn't have any concerns with being able to approve me for a mortgage. I'll just wait until the right house hits the market and then I'll get a prequalification letter from my lender. This works out OK some of the time to most of the time - but not all of the time. Sometimes a new listing hits the market on a Friday. We might go see it on Saturday afternoon. By the time we are looking at the house there are already two offers in hand and a few more might be received at any moment. If you love the house, and want to make an offer, we might be in a tight spot, because... 1. An offer without a lender letter won't typically go anywhere. 2. An offer with a promise to deliver a lender letter on Monday won't typically go anywhere. Certainly, sometimes a seller won't be making a decision until Monday or Tuesday and sometimes offers don't materialize that quickly. But... if you want to be ready to make an offer on a house that you love when it hits the market, you should already have a lender letter ready to go. | |

Mortgage Interest Rate Fluctuations Do And Do Not Seem Likely To Impact Local Housing Market Activity |

|

Will mortgage interest rate fluctuations impact market activity in the local housing market? Yes and no. For context, first... Over the past year, rates have fluctuated between 5.75% and 7.75%. That's a pretty broad swing over just a single year. The current average rate of 7.09% is lower than the 7.5% rate we saw six months ago. Rates have been mostly rising over the past four months from 6.6% to 7.1%. So, will rates impact market activity? Yes... if/as rates get back below 7% or closer to 6.5%, more buyers are likely to more seriously consider more offers on more properties. Likewise, if/as rates rise further and if they approach 7.5%, fewer buyers are likely to consider offers. But, no... rate swings between 6% and 7% (for the most part) seem unlikely to drastically change the number of buyers who will choose to buy a home this year. So, if you will be selling a home, you likely don't need to try to time your listing with when mortgage interest rates are lowest. And if you will be buying a home, it will be convenient if the home you like the most hits the market when mortgage interest rates are the lowest... but you'll probably still pursue it if rates are a bit higher when that perfect house hits the market. | |

How Much Can You, And Should You, Spend On Your Next Home? |

|

There are LOTS of ways to answer this question, usually within the context of a monthly payment...

The other question (how much should you spend) could be discussed with your spouse, your family, your loan officer, your peers, me, etc. The most important part -- is to have these conversations. We need to know how much money you can spend and how much you are willing to spend on your new home, so that we can be looking for the right houses for you! | |

A Year From Now, Mortgage Interest Rates Seem Unlikely To Be Much Below Six Percent |

|

The current average 30 year fixed mortgage interest rate is 6.82%. If you are waiting to buy a home until mortgage interest rates fall below 6% you might be waiting a while. A compilation of mortgage interest rate projections by Fast Company (here) show the following projected mortgage interest rates for the first and second quarter of 2025... Mortgage Bankers Association: 5.9% in 2025-Q1 5.8% in 2025-Q2 Fannie Mae: 6.3% in 2025-Q1 6.2% in 2025-Q2 Wells Fargo: 6.0% in 2025-Q1 5.9% in 2025-Q2 It seems that mortgage interest rates may very well stay near, at or above 6% for at least the next year. Read more here. | |

Monetary Policy Enacted By The Fed Contributed To Current Housing Affordability Challenges But Monetary Policy Does Not Seem Likely To Fix The Problem In The Near Future |

|

If you're hoping to understand the current housing affordability challenges (in many or most markets across the US) and how we came to be in the current situation, this article is a good one to read... The Fed won't fix the housing market (Yahoo Finance) Below are a few pertinent excerpts...

Indeed, the drastic rate cuts by the Fed at the start of the pandemic resulted in pandemonium in the housing market with an abnormally high number of buyers seeking to buy a home.

Indeed, both here in the Shenandoah Valley and in many other markets across the country, there is a shortage of housing. And so, what will get us out of this challenging time for housing affordability? It does not seem that the Fed plans to make any rapid or significant monetary policy changes that would impact housing affordability... and, since the Fed doesn't build houses, they won't be creating any further housing inventory. We can likely expect slow interest rate cuts over the next year or two and hopefully we will see continued construction of new residences to house those who already live in the Shenandoah Valley and those who wish to make it their home now or in the future. | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

If Or As Mortgage Interest Rates Decline, Buyers Will Likely Jump Back In Sooner Than Sellers |

|

Mortgage interest rates peaked this past Fall at 7.79% and have been mostly declining since that time, to current levels of 6.74%. But, 6.74% can still feel high after interest rates were below 5% for 13 years... and below 4% for three years. As mortgage interest rates potentially continue to decline, perhaps back down to 6%, what will we see happening in the market? Will the lower mortgage interest rates spur on more home sales activity? Maybe, but perhaps not as much as you would likely expect. If / when / as mortgage interest rates move back down towards 6% -- or the low 6%'s or the high 5%'s we are likely to see more would be home buyers interested in buying. They will be able to afford higher sales prices and/or their monthly mortgage payment will be lower. But... in order for a home sale to take place... we need both a buyer AND a seller. Many homeowners (would be sellers) have mortgage interest rates below 4%. Quite a few have interest rates below 3%. Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 6% mortgage interest rate? Somewhere between no and probably not? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 5.5% mortgage interest rate? Somewhere between probably not and maybe? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 4.99% mortgage interest rate? Maybe? I expect that as we move through 2024 and 2025, and as mortgage interest rates (likely?) continue to decline (at least somewhat) we are likely to see more buyers jumping back into the market before sellers are doing the same. Which means... that we are likely to still see a competitive market... if buyer demand rises more quickly than seller supply. | |

Planning To Buy A Home? Yes, Talk To Me, But Talk To A Lender Too! |

|

If you are getting ready to buy a home -- whether your first or your last -- you will probably have plenty of questions.

If you're new to home buying, or new to the area, you'll probably have more questions than some other buyers, and that is OK! If you're getting ready to buy your fourth home and have lived in Harrisonburg for decades you might have fewer questions than some other buyers, and that is OK too! I am happy to meet with you to talk through all of this, and much more. We can do that in person, by phone, by Zoom, etc. But another important conversation to be having in parallel is with a mortgage lender. Unless you will be paying cash for your home, you'll need a loan to make your home purchase, and having a conversation with a lender sooner rather than later will serve you well. When meeting with a lender you will be...

So, if you're planning to buy a home this spring... Yes, talk to me... but talk to a lender too! Call/text me at 540-578-0102 or email me here. We can set up a time to meet and I can send you contact information for several qualified, professional and responsive local lenders. | |

A Slightly Smaller Downpayment Allows You To Hold Onto Reserve Funds But Does Not Keep You From Paying Ahead On Your Slightly Larger Mortgage |

|

So... you're getting ready to buy a house... but you don't know how much of a downpayment you should plan to make. You have enough savings on hand to pay for your closing costs and have up to a 15% downpayment based on your purchase price. This would leave you with a bit of remaining savings, but not much. Should you... [1] Go for the 15% downpayment, financing 85% of the purchase price, and leaving you with minimal remaining savings? [2] Reduce your downpayment to 10%, financing 90% of the purchase price, and leave a bit more in savings. [3] Reduce your downpayment to 5%, financing 95% of the purchase price, and leaving a solid amount in savings. In most cases, I would recommend scenario #2 or #3. Reducing your downpayment *will* increase your monthly mortgage cost, but it will allow you to have savings on hand in the event that you need to pay some unexpected medical bills, make a major repair on your home, replace a vehicle, etc. And... you will still have the flexibility to pay more on your mortgage payment if you continue to have savings accrue and you want to pay down your mortgage more quickly. So, as you meet with a mortgage lender, don't assume that you will or you should put every last dollar of your savings into your downpayment and closing costs. Explore other possibilities that will result in a slightly larger mortgage but will allow you to still have some savings on hand in case you need them. | |

Lenders Will Likely Want To Compete For Your Mortgage Business Right Now |

|

Mortgage interest rates have been dropping for the past three months -- BUT -- they are still much higher now than where they have been for most of the past 10+years. As a result, we are seeing lower levels of home buying activity, which means fewer mortgages -- and there are definitely far fewer refinances happening right now. All of this means that lenders will very likely want to compete for your business. If you are buying a home, have good credit and maybe even a downpayment -- there will likely be many lenders who would love to finance your home purchase for you. Some general recommendations are... [1] Start by talking to one lender to get a pre-approval letter prior to making an offer. [2] Once you are under contract to buy a home, knowing the specific property and specific price, go back to that first lender as well as several others to compare rates and terms. [3] Try to get each lender to simplify things down as much as possible related to closing costs and monthly payments so you can compare apples to apples. [4] Don't hesitate to take one lender's quote to the other to ask them if they can match or beat it. [5] If two lenders are pretty close in the terms they can offer you, give some preference to a local lender (who you can meet with in person if things go awry) and to a lender that is prompt, professional and detail oriented in their communication. Happy mortgage shopping! | |

Depending On How Long You Plan To Be In Your Home, A Rate Buy Down May Make Lots Of Sense! |

|

One option you will have when finalizing your loan terms with your lender will be buying down your mortgage interest rate. Current mortgage interest rates are right around 6.7% -- but you very likely will have the option to pay some extra closing costs to buy down that mortgage interest rate. The more you pay, the lower that rate will go - and the that lower rate will last for the life of your loan. Of note, if you think you might be selling your home within two to three years, it might not make sense to pay thousands of dollars up front to secure a lower than market interest rate -- but your lender can help you determine the length of time you would need to be in your home to make the cost of the rate buy down make sense. If you know (or believe) you will be in your home for many (many!) years to come, you may very well want to go ahead and buy down that interest rate. There are lots of options to consider when securing a mortgage, and if you have questions about the many different options, feel free to run them by me. | |

Would Be Home Buyers Are Finally Finding (Some) Relief In The Way Of Mortgage Rates |

|

For over 10 years (Feb 2011 - Apr 2022) mortgage interest rates were below 5%. For about 3 years (May 2019 - Mar 2022) mortgage interest rate were below 4%. But since that time, they shot past 6%, past 7% and nearly hit 8%. Perhaps unsurprisingly, many buyers have found themselves priced out of the homes they want to buy over the past year. Not only were these buyers facing ever higher mortgage rates -- home prices were also continuing to climb, with the median sales price increasing 10% over the past year. But finally, some buyers are finding some relief in the way of lower mortgage interest rates. After peaking at 7.79% in October 2023 we have seen the average 30 year fixed rate mortgage drop steadily to it's current level at 6.60%. We're still not back down to 4% or 5% -- but a mortgage payment at 6.6% certainly makes many houses more affordable than they were at 7.79%. If you plan to buy a home in 2024 and you last talked to your lender in October or November of this past year, connect with them again soon -- you will likely be pleasantly surprised at how your projected monthly payment has adjusted given declining rates.

| |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings