Financing

| Newer Posts | Older Posts |

Ho, Ho, Ho, Is Santa Bringing Lower Mortgage Interest Rates For Christmas? |

|

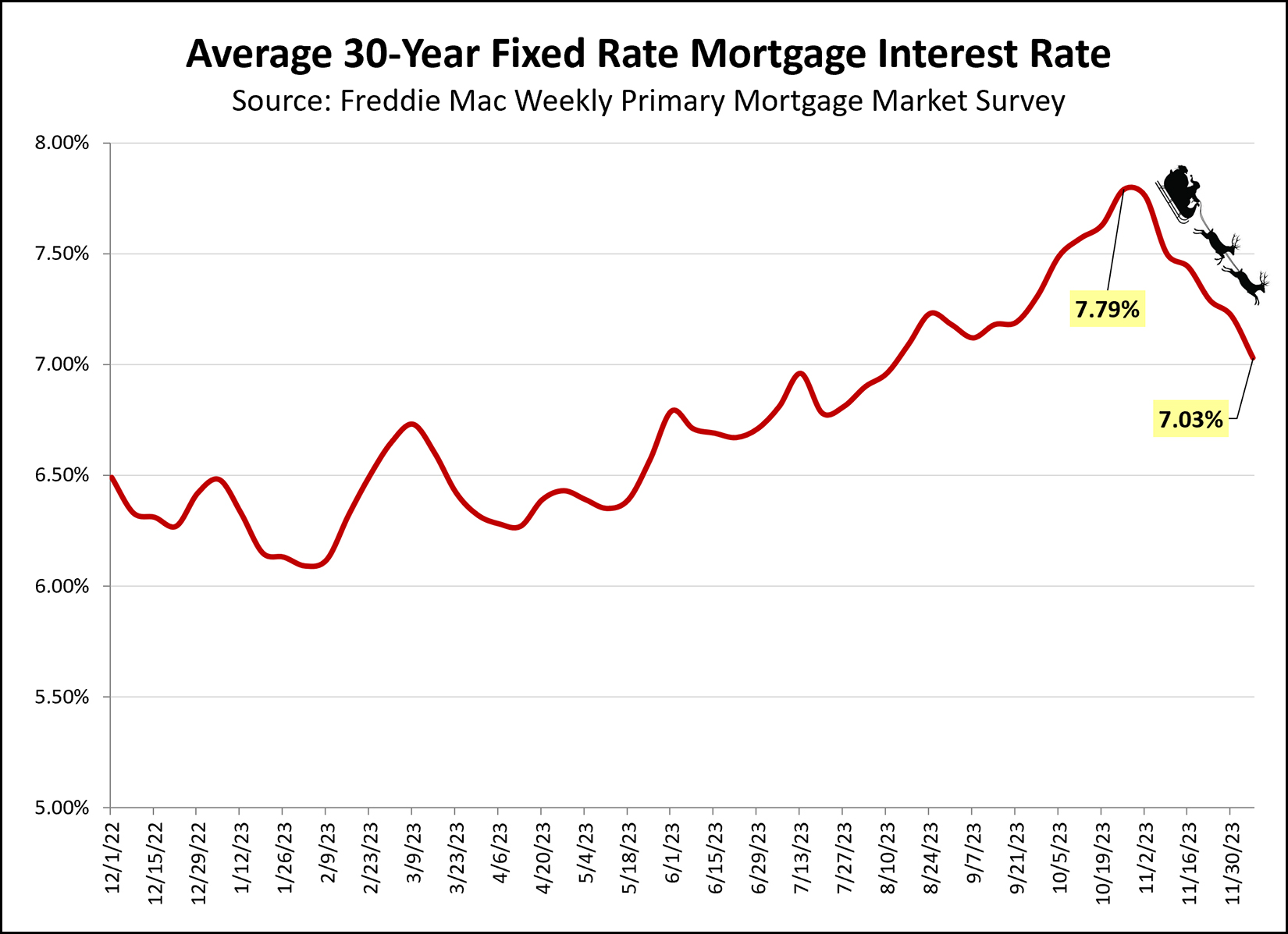

We'll see where the remainder of December takes things, but mortgage interest rates on 30 year fixed rate mortgages have been dropping steadily for the past four weeks. They were all the way up to a peak of 7.79% back in late October. This past week they were all the way back down to 7.03%. Will we see 6 point something before Christmas? | |

A Rough Two Years For Rising Mortgage Interest Rates |

|

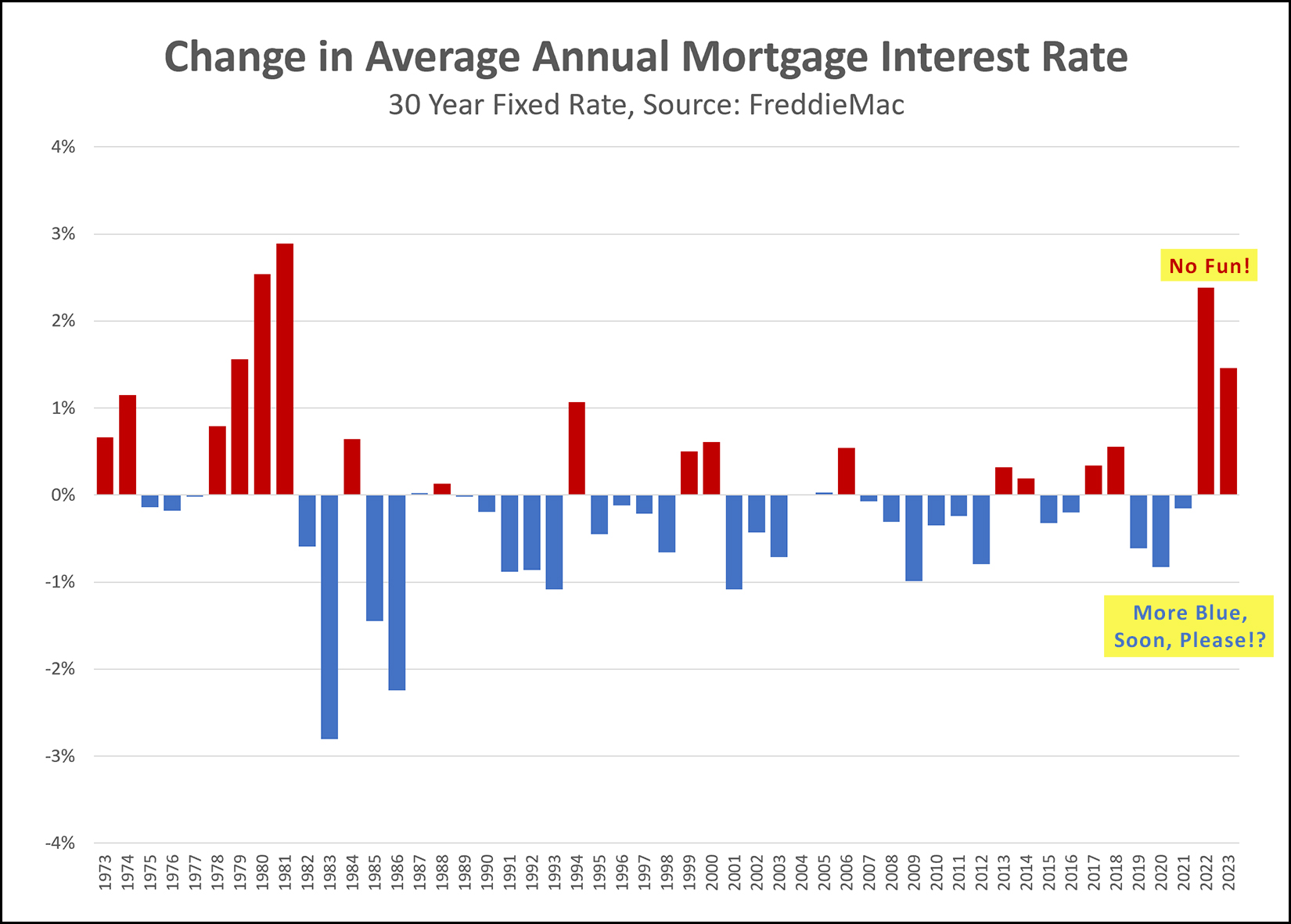

Mortgage interest rates have been declining on a weekly basis over the past month, but... let's not forget exactly where we are relative to the past 30, 40 and 50 years... The graph above shows the amount that the average 30 year mortgage interest rate changed from year to year. All of the red bars are showing years when the average mortgage interest rate increased as compared to the prior year. For example... Between 2003 and 2004 it didn't really change at all.. it increased by 0.01%. Between 2008 and 2009 it dropped 0.99%. But more recently... Between 2021 and 2022 it increased by 2.39%. Between 2022 and 2023 it has increased by 1.46%. So, it has been a rough two years of increasing mortgage interest rates... with the 2022 and 2023 increases being some of the largest increase in the annual average, ever, only surpassed by 1979, 1980 and 1981. Let's hope for a blue bar in 2024 with a decline in the average mortgage interest rate as compared to 2023. | |

Sometimes Upgrade Your Home (Selling And Buying) Results In An Even Larger Upgrade In Your Monthly Payment |

|

"Our house isn't working well for us anymore. We are thinking of selling it and buying a new house." Sounds good, but let's look at a few basic numbers first... You bought for $190K, put $20K down and have a mortgage payment of $955 per month thanks to a refinance a few years back at 3.5%. Your house is now worth $275K and you are thinking of selling it to move up to a house priced at $375K. When you sell your $275K house, you'll end up with about $90K in your pocket after closing costs and paying off the $170K balance on your mortgage. You'll spend about $10K of that $90K on closing costs for your purchase, so you'll put down $80K as a downpayment. You'll be borrowing $295K ($375K - $80K) and you'll be financing it at a current mortgage rate of about 7.25%. Your new monthly payment will be $2,392. Wait... what!? You're moving from a $275K house to a $375K house and your monthly mortgage payment is going to increase from $955/month to $2,392/month. Yikes! Why is this happening? [1] Your current mortgage payment is based on your initial purchase price of $190K... which is a good bit lower than your home's current value of $275K. [2] Your current mortgage payment is based on on a mortgage interest rate of 3.5%... which is a good bit lower than the current rate of 7.25%. [3] The costs of selling and cost of buying reduce the amount of equity that you can roll from one home into the next. So... before you dive right into upgrading your $275K house (with a $955/month payment) to a $375K house... let's run your version of the numbers above to help you determine your new potential monthly payment. | |

Checking In On Mortgage Interest Rates |

|

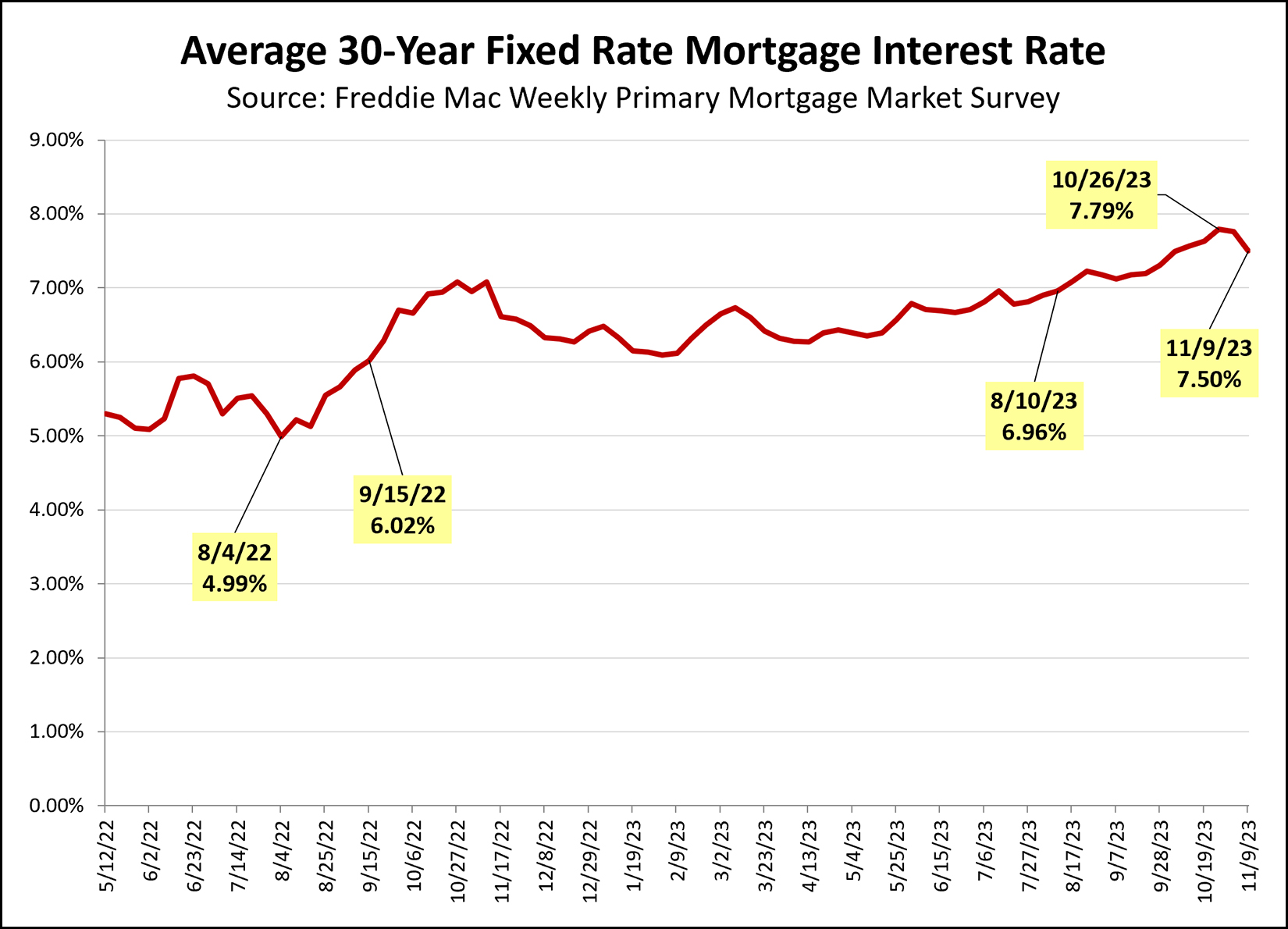

Mortgage interest rates have been declining for the past two weeks... or "plunging" as I saw it described in one news article. Let's put it all in a bit of a larger context. Mortgage interest rates rose above 7% in August... ...they peaked two weeks ago at 7.79%... ...and they have now dropped back down to 7.5% as of last week. Looking back further... ...rates rose above 5% in August 2022... ...and then very shortly thereafter rose above 6% in September 2022. I suspect we will see rates above 6% for at least the next year. I think it's possible that we'll see rates get down to 7% over the next few months, but if they stay above 7% I won't be completely surprised. If you are planning to buy a home, it will be important to check in with your mortgage lender for an updated payment projection. Here's a potential payment in Rockingham County for a $300K purchase with 90% financing... 7.79% mortgage interest rate = $2,175 / month 7.5% mortgage interest rate = $2,121 / month 7% mortgage interest rate = $2,029 / month 6.79% mortgage interest rate = $1,992 / month Lower or higher mortgage interest rates certainly affect a monthly payment pretty quickly. A full 1% drop from the peak of 7.79% down to 6.79% would reduce your mortgage payment by $184 / month. Let me know if you'd like some recommendations for qualified local lenders with whom you could talk through a variety of financing scenarios. | |

Monthly Housing Payments Are High But Seem Unlikely To Be Lower Over The Next Year |

|

Mortgage interest rates are higher they have been in over 20 years. Home prices are higher than they have ever been. Combine these two factors and you'll find monthly housing payments that are high. Quite high. Too high? Some would be home buyers are hesitating to move forward with a home purchase because of how high the monthly mortgage payment will be on their new home. This is understandable and quite reasonable. If your lender approves you for a mortgage payment of $2500 per month but you are only comfortable committing $2200 per month to a housing payment then perhaps you shouldn't buy that house that you love that would require a $2500 monthly housing payment. But... if you decide not to buy now (or soon) you probably shouldn't come to that decision within the context of waiting to buy in six to twelve months when you hope to have a lower housing payment. After all... what would we need to see in order to be experiencing lower housing payments? We'd need to see either... [1] Meaningfully lower mortgage interest rates -- which most economists don't seem to think will be showing up anytime in the next year. [2] Lower home prices -- which don't seem likely to exist anytime in the next year. Is it possible that mortgage rates will decline back to 5% or 6%? Sure, it's possible - but it doesn't seem likely, at all. Is it possible that home prices will decline over the next year? Sure, it's possible - but it doesn't seem likely, at all. So, a year from now, you'll likely have a very similar mortgage payment as you would have today -- or possibly even higher. Now, for all you contrarians out there -- tell me I'm wrong -- and tell me how. Will mortgage interest rates decline over the next year? Will home prices decline over the next year? | |

The Influence Of Mortgage Interest Rates On Who Will Buy Or Sell |

|

Mortgage interest rates -- and whether they are high, or low, or higher, or lower -- are not the only or even the primary factor affecting any given real estate market -- but they do play a role. Between May 2019 and March 2022, when 30 year fixed mortgage interest rates were below 4%, many (many!) buyers were pulled into the market. They were eager to buy a home while the cost of money so low. They were excited by how much house they could buy within their budget. They were delighted by how low of a mortgage payment they would have based on these low rates. Since September 2022, while 30 year fixed rate mortgage interest rates have been above 6%, many buyers are sitting on the sidelines, unable or unwilling to pay the mortgage payment that would be associated with purchasing a home and financing it at 6% or 7% or 8%. The pool of would-be home buyers has shrunk considerably AND the pool of would-be home sellers has shrunk as well. Homeowners who might sell are reconsidering selling as that would often involve paying off a mortgage with a rate below 4% and then financing a new purchase with a rate above 7%. But... looking ahead... will rates have to get all the way back down to 4% or below to spur a solid increase in the number of buyers in the market? Maybe not. Mortgage interest rates have now been above 7% for two months. It seems likely that they could stay above 7% well into 2024. But when rates do start declining -- at some point -- home buyers will likely start returning to the market in solid numbers as they decline. We were below 4% for three years... so 6% and 7% seem quite high. If stay above 7% for a year... then 6% won't seem bad at all! Whether mortgage interest rates are high or low seems to mostly be understood or felt within a recent context of where rates have been for the past year or two. Just as current (above 7%) mortgage interest rates are keeping some or many buyers out of the market -- I suspect once we get back down into the 6% range we will likewise start to see buyers pulled back into the market and sellers considering the sale of their home after all. | |

As Higher Mortgage Interest Rates Cause Some Home Buyers To Stretch Their Monthly Budget A Bit Further, It Is More Important Than Ever To Keep The Cost Of Future Home Maintenance In Mind! |

|

An important first step in considering your first or next home purchase... is talking to a qualified mortgage lender to better understand your potential monthly mortgage payment for the home you may decide to purchase. You'll be working with that mortgage lender to get a rough idea of two things... [1] The amount of money you'll need to have available at closing for your down payment and closing costs. ... and... [2] The amount of money you will be paying each month for your mortgage payment. But that's not all of the big picture calculations you should be doing. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $40K downpayment and your monthly mortgage payment will be $2,100 per month... great! That gives you a buffer in cash in hand for emergencies and you have extra room in your monthly budget. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $60K downpayment and your monthly mortgage payment will be $2,500 per month... maybe great, maybe not! Spending all of your available cash on the downpayment and closing costs... and spending the entirety of your monthly housing budget on your mortgage payment does not leave you with any room to deal with potential future home maintenance costs. What if you need to replace the heat pump in a few years? What if you need to replace the roof in five years? What if a kitchen appliance breaks? If you decide to stretch yourself monthly budget to make a house payment work -- make sure you have a game plan for those future home maintenance costs too! | |

Did The Federal Student Loan Payment Pause Spur On More Home Buying By Recent Grads Who Built Savings For A Downpayment And Closing Costs? |

|

Federal student loan payments were paused for three and a half years. For graduates who attended public schools, the average federal student loan debt at graduation seems to be around $25K... which worked out to be a student loan payment of $280 per month. 3.5 years = 42 months $280 x 42 = $11,760 Recent grads with average student loan debt, with average student loan payments, would have been able to save up about $12,000 over the past three and a half years when federal loan payments were paused. Did this pause in payments on student loans allow some would-be home buyers to build up savings to put towards a downpayment or closing costs for a home purchase? Quite possibly. There seem to be many reasons why we saw a surge in home buying activity over the past few years... 1. Covid-induced changes to work / life / home situations. 2. Super duper low mortgage interest rates. ...and maybe... 3. College graduates building up savings due to not needing to make student loan payments for a few years. But, back to reality, student loan payments have started back up again now. So if you were building up some savings with those (non)payments -- you'll now need to divert those monthly funds back towards paying off your student loans. | |

Anecdotally And Quite Reasonably, Many Buyers Seem To Be Making Larger Down Payments These Days |

|

Yes, I know, this is just based on transactions I am observing, and perhaps even just those that lodge themselves into my mind more than others, but... Home buyers seem to be making larger down payments these days -- and I can understand why. Before... with 3% - 4% mortgage interest rates... there wasn't much of a motivation to make much of a downpayment. Your mortgage payment would be so low, given low mortgage interest rates, that buyers would often finance as high of a percentage of the purchase price that their lender would allow. Now... with 7% mortgage interest rates... buyers are motivated to make as large of a down payment as possible, to make their loan amount as small as possible, given the (relatively) higher mortgage interest rates. This is not to say that all of a sudden all buyers are putting 20% down on their real estate purchases -- they aren't -- but the calculus of how much cash to put into a real estate purchase looks a bit different these days. Home buyers are certainly still keeping some cash on the side for emergencies, etc., but they are often making larger down payments (and financing less) now than they were a few years ago. | |

It May Be Time To Adjust To These Mortgage Interest Rates And Not Wait Around Thinking They Will Decline |

|

A year ago -- in October 2022 -- I commented on rapid changes in mortgage interest rates through the first ten months of 2022... January 2022 = 3.45% April 2022 = 5.00% October 2022 = 6.94% At that point, in October 2022, I reflected that... "I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months." I'm going to double down on that advice here in October 2023... The current average 30 year fixed rate mortgage interest rate is 7.31%. I don't think anyone should be waiting around thinking that we'll see 6.5% soon and then 6% after that... I think it is very likely that we will continue to see mortgage interest rates in the current range (6.75% - 7.50%) for the rest of 2023 and perhaps through the entirety of 2024. If mortgage interest rates decline, that will be fantastic, but I don't think we should expect it or count on it. | |

Our Local Real Estate Market Keeps Testing Basic Economic Theories |

|

Between 2019 and 2022 we saw an ever increasing number of buyers buying homes (or trying to do so) in Harrisonburg and Rockingham County. Demand for homes skyrocketed, mortgage interest rates fell to historic lows, supply increased a bit (new builds) but not a enough... and perhaps unsurprisingly, median home prices increased 10% per year for three years in a row. But then, 2023... Mortgage interest rates have increased 30% over the past year, and have increased 150% over the past two years, making mortgage payments higher than ever. But yet, the median sales price keeps rising. Demand seems to be falling, with 24% fewer home sales in the first eight months of 2023 as compared to the same timeframe last year. But yet, the median sales price keeps rising. Supply is now starting to increase, with 31% more active listings on the market now as compared to a year ago. But yet, the median sales price keeps rising. What comes next!? As I pointed out yesterday, the higher inventory levels are only higher than the Covid-era lows, and are in line with or lower than pre-Covid levels. And certainly, fewer home sales may be a result of fewer sellers selling just as much as it may be a result of fewer buyers trying to buy. So, over the next two years, will we potentially see slower home sales, higher mortgage interest rates, higher inventory levels -- and yet, still see stability and/or increases in the median sales price? Yes, it seems quite possible. Or, could slower home sales, mortgage interest rates and higher inventory levels lead to a decline in the median sales price? This seems more likely, in theory, but we're just not seeing it yet, and I don't know if we'll see it at all. | |

Sample Mortgage Payments In September 2023 |

|

Mortgage interest rates are on the rise... they were 3% two years ago, 6% a year ago, and just above 7% today. Let's see how those 7-ish percent mortgage rates translate into some mortgage payments these days. All of these illustrations are for homes in the City of Harrisonburg, and (since I'm not a lender) they are not offers for mortgages with specific terms... $250K purchase with 5% down = $1,833 / month $350K purchase with 10% down = $2,449 / month $450K purchase with 20% down = $2,850 / month $600K purchase with 30% down = $3,400 / month Working backwards for a moment, if you were trying to keep your mortgage payment under $1500 (for example) you'd be looking at a $205K purchase price with a 5% down payment. With current mortgage interest rates above 7%, it's more important than ever to talk to a lender sooner rather than later to determine how much you can afford in a mortgage payment -- and/or how much you want to spend each month on your mortgage payment. If you need a recommendation for a great local lender, just let me know. | |

Yes, Mortgage Interest Rates Are Still High. |

|

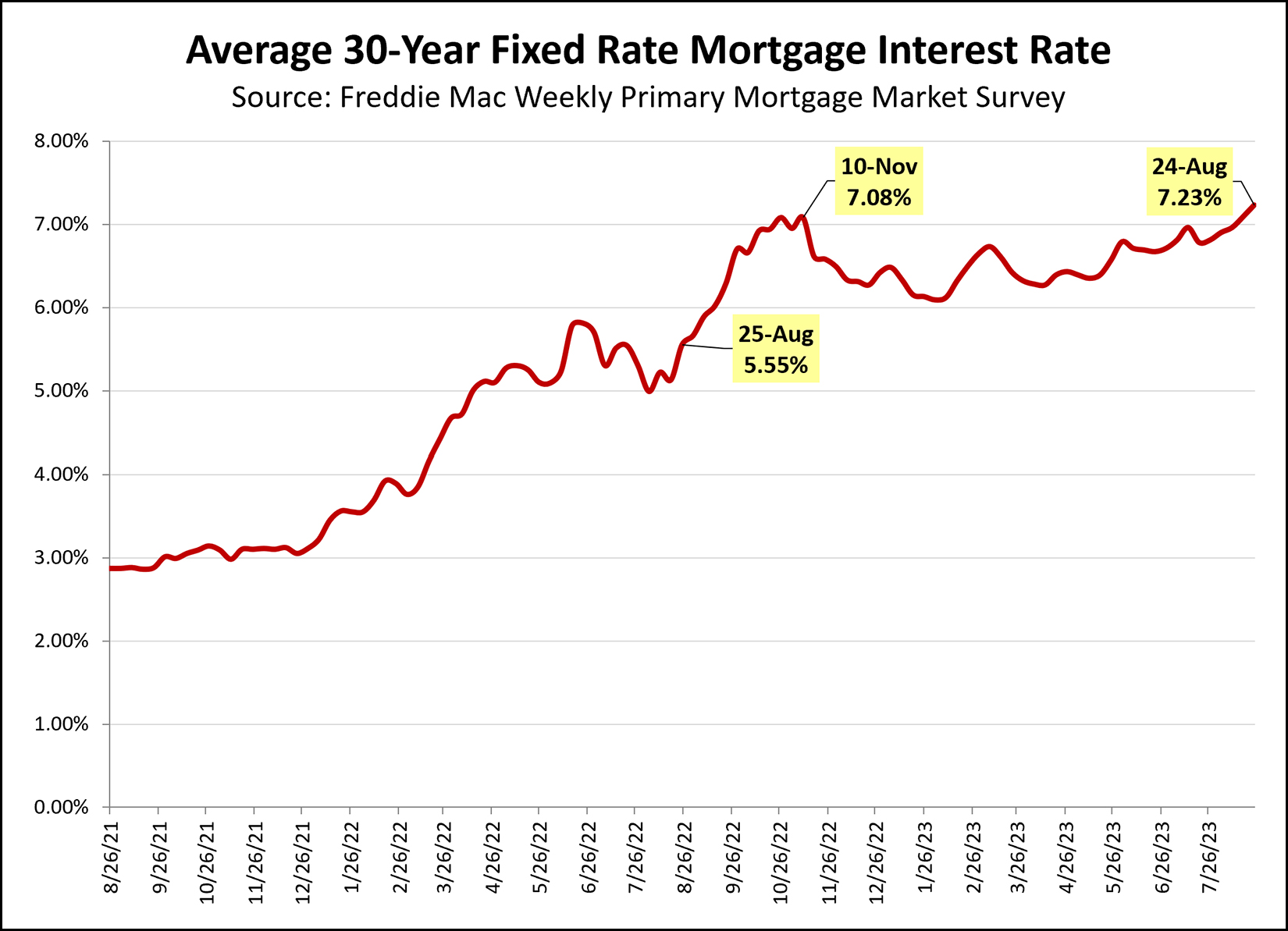

The current average 30 year fixed mortgage interest rate is 7.23%. That is the highest it has been in over 20 years. Actually... 22 years, it seems. The last time it was higher was back in June 2001 when it was 7.24%. What lies ahead? Per this NY Times article... "Economists predict that mortgage rates will remain elevated for at least a few more months. And even when they start to come down, they are expected to settle well above the 3 percent rates that home buyers enjoyed during the early stages of the pandemic." ...and... "The Mortgage Bankers Association, an industry group, recently forecast that the average 30-year mortgage rate would fall to 5 percent by the fourth quarter of next year." So... hopefully these historically high mortgage interest rates (that followed some historically low mortgage interest rates) will eventually start to decline again... but we're not seeing it yet. | |

Existing Home Sales Are Down 19% In 2023. Why? |

|

We've seen a 19% decline in existing home sales in 2023 - which includes all home sales in the HRAR MLS except new construction sales. In the first five months of last year there were 466 existing home sales - but there have only been 377 existing home sales in the first five months of 2023. Why are there fewer existing home sales taking place right now in Harrisonburg and Rockingham County? Theory 1 - Affordability Home prices have increased significantly (+32%) over the past three years and mortgage interest rates have as well (+108%) and these two trends have caused housing payments for most new buyers to increase significantly. So, one theory for why we are seeing fewer existing home sales is because homes are less and less affordable. But... if this theory were true... that higher home prices and higher mortgage interest rates were making housing too unaffordable... thus reducing buyer demand for existing homes for sale... then we would see inventory levels starting to climb as a result. But, we're not seeing inventory levels meaningfully rise -- which calls into question whether the reduction in existing home sales could really be related to affordability. Theory 2 - Homeowners Want To Hold Onto Their Low Mortgage Interest Rate Another potential theory for why we are seeing fewer existing home sales... is that perhaps we are not seeing a decline in the number of buyers who want to buy... but rather... a reduction in the number of sellers who are willing to sell. Take a look at the mortgage interest rates of current homeowners! 82% of homeowners have mortgage interest rates below 5%. 62% of homeowners have mortgage interest rates below 4%. If those homeowners sell their current homes (existing homes) they would be trading in their low mortgage interest rate for a new one around 6.5% or a touch higher. Thus, it is quite possible that we are seeing lower number of existing home sales because fewer homeowners are willing to sell... because they LOVE their low mortgage interest rates. Theory 3 - What Say You? Have any other theories? Email me! | |

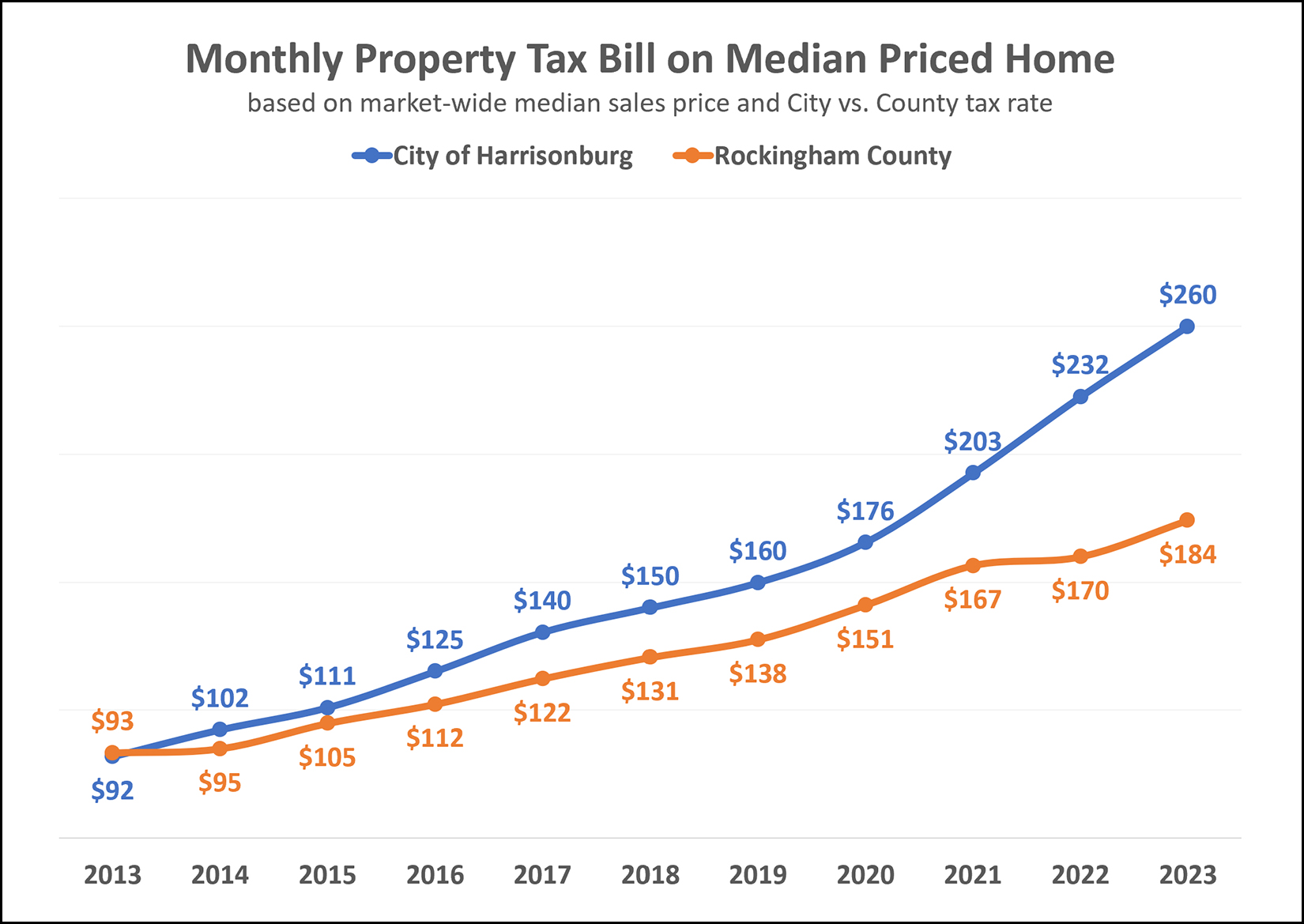

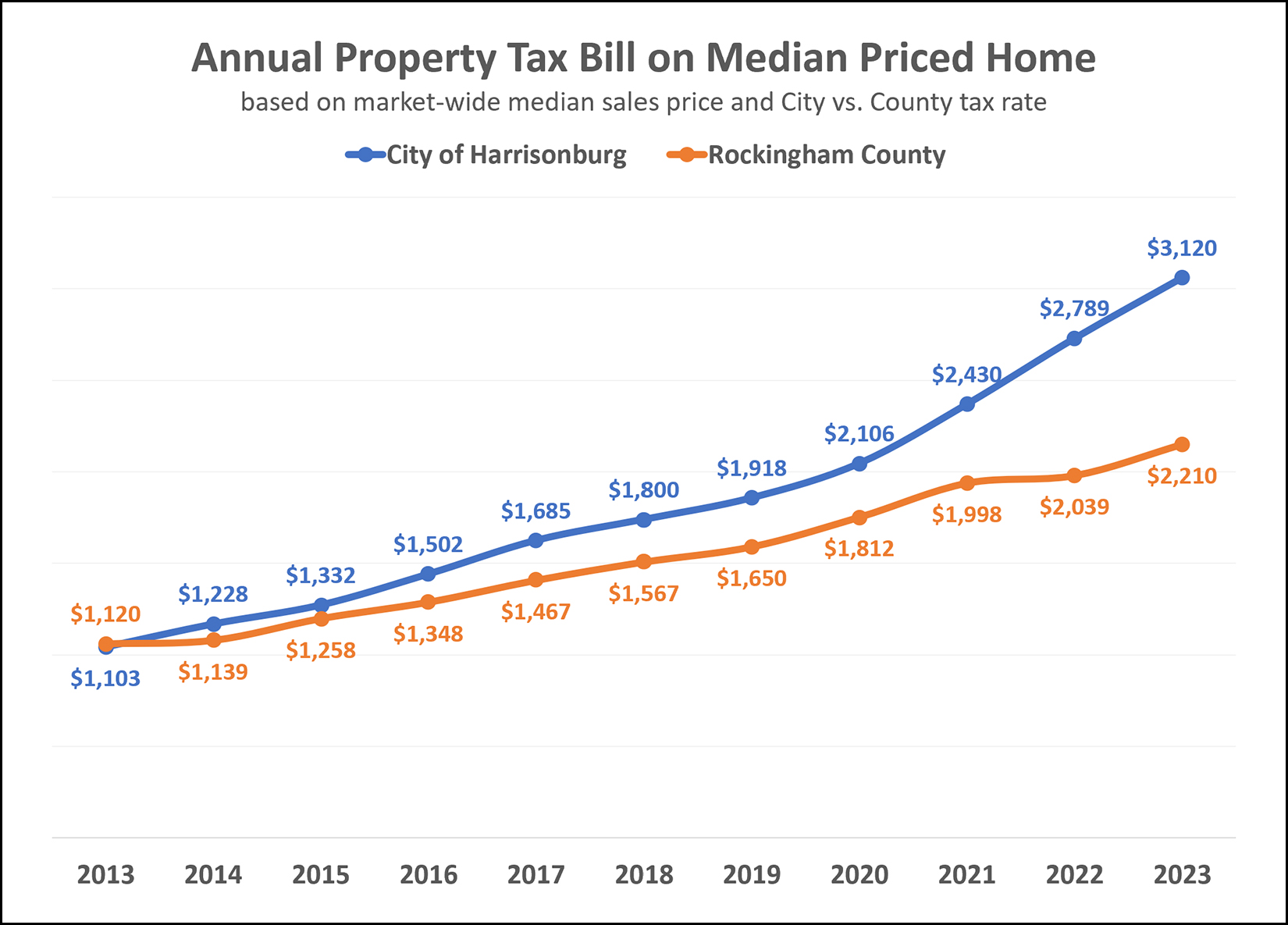

Monthly Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a median priced home in our market (Harrisonburg and Rockingham County) you would be spending $325,000. Will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

Also of note -- this analysis of monthly property tax bills over time does not adjust for inflation. A $260 monthly tax bill in the City of Harrisonburg in 2023 is not the same as a $260 monthly tax bill in 2013 as inflation has been running hot over the past few years. Certainly, one reason why the City tax bill has increased as much as it has over the past few years has been to fund the new high school currently under construction in the City. Will this difference in tax rates in the City and County result in some buyers deciding to buy homes in the County instead of the City? Maybe - but my experience has been that the tax rate is not what causes a home buyer to consider a home in one locality or the other. Multiplying by 12, here's a look at the annual tax bill in the City vs. County for a median priced (market wide) home in our area...  | |

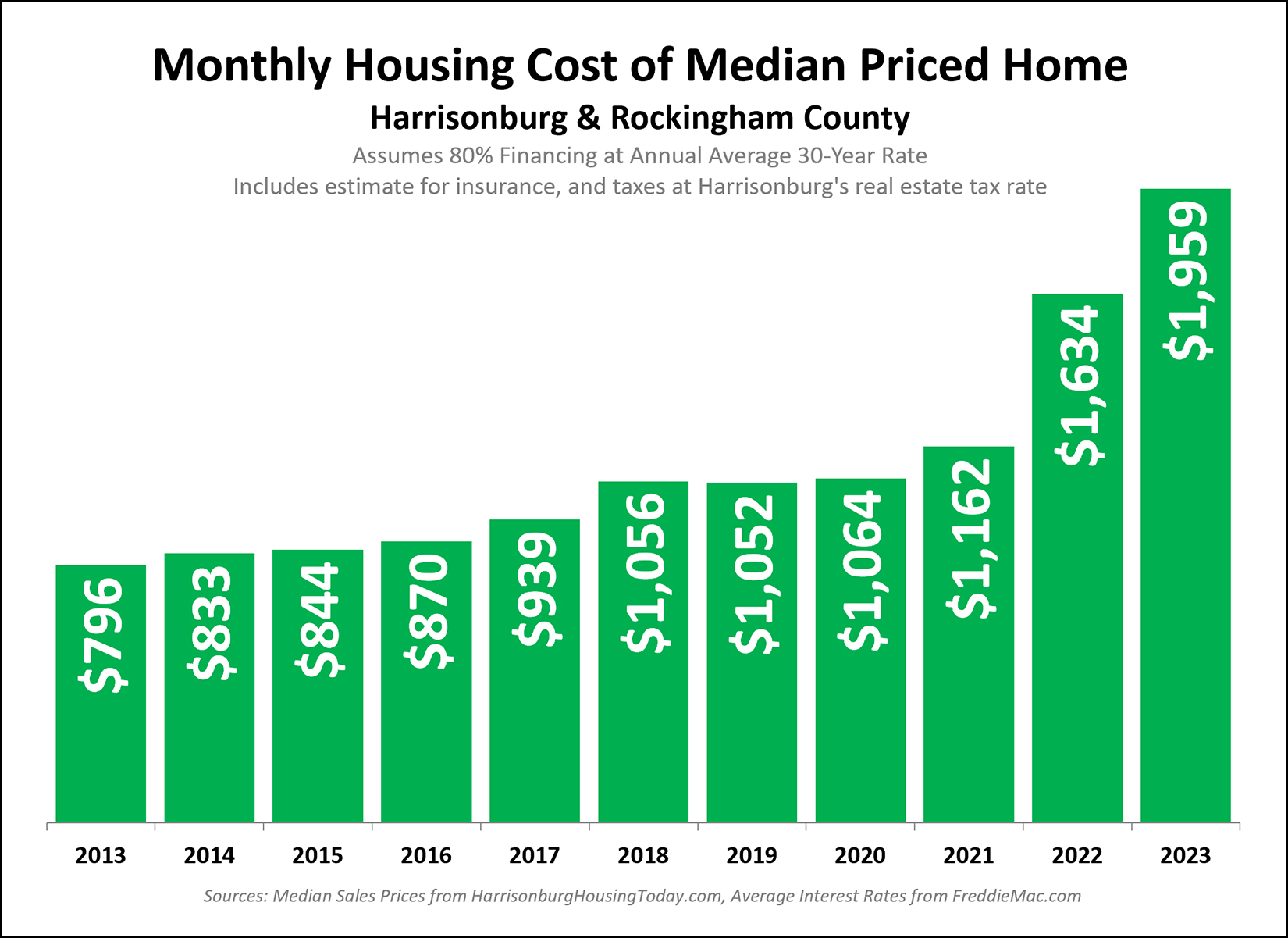

Monthly Housing Costs Up 84% In Three Years |

|

Over the past three years... [1] The median sales price has increased by about 10% each year. [2] The average mortgage interest rate has doubled. [3] The City real estate tax rate has increased by 12%. Given these three changes, and how each plays into housing costs, it shouldn't be much of a surprise that monthly housing costs have increased significantly over the past three years. Three years ago, if a home buyer financed 80% of their purchase of a median priced home, they would be paying about $1,064 per month. Now, if a home buyer finances 80% of their purchase of a median priced home, they will be paying $1,959 per month. Beyond the "wow, that's a crazy increase" here are a few of my other thoughts and observations... [1] Perhaps this is a statement of the obvious... but this "increase in monthly housing cost" only affects those who are buying homes now. Anyone who already owns a home is not seeing this type of an increase in their housing costs. They might have a minor increase in their monthly housing costs due to rising assessed values, rising real estate tax rates and/or rising homeowners insurance rates, but those will amount to a relatively small increase in their monthly housing costs compared to what is described above. [2] Yes, this is a big increase... but it's partially because monthly housing costs were abnormally low for quite a few years as a result of super low mortgage interest rates. We have now exited a prolonged period of tremendously low mortgage interest rates. This kept housing costs very low for anyone buying a home (or refinancing their mortgage) during that unique time of low mortgage interest rates. Thus, the increase in monthly housing costs seems huge -- but it's only partially because of how high mortgage rates are now, but also very much about how low those mortgage rates were very recently. [3] Just a note on methodology. The housing cost numbers above are calculated using the median sales price of homes sold in Harrisonburg and Rockingham County per the HRAR MLS, combined with the average mortgage interest rate for the duration of the year, combined with the real estate tax rate for the City of Harrisonburg, and assumes a 20% downpayment. Bottom line -- it is quite a bit more expensive for someone to buy a home now compared to just a few years ago. | |

Higher Mortgage Interest Rates Are Making Would Be Home Buyers More Thoughtful About Offers |

|

Back when mortgage interest rates were 3% - 3.5%... 10:00 AM - new listing hits the market 10:10 AM - drive by 10:11 AM - text Realtor to set up showing 1:30 PM - walk through the house 1:55 PM - get kicked out by the next buyer in line to see it 2:30 PM - make an offer on the house (90% chance you'll make one) Home buyers didn't have to think very hard at all about whether to make an offer on a house they liked because their mortgage payment would be pretty darn low given historically low mortgage interest rates at the time. Now a days, with mortgage interest rates of 6% - 6.5%... 10:00 AM - new listing hits the market 12:15 PM - drive by 12:30 PM - text Realtor to set up showing (next day) 10:00 AM - walk through the house 4:00 PM - talk through the mortgage payment details with lender (next day) 9:00 AM - make an offer on the house (33% chance you'll make one) Buying a $350K house (for example) is a big decision! Buying a $350K house can seem like a smaller decision with 3.5% mortgage interest rates. It's only a $1600/month mortgage payment given a 20% down payment. Buying a $350K house can seem like a really big decision with 6.5% mortgage interest rates. It's a $2,115/month mortgage payment given a 20% down payment. As noted in the comparison above, buyers are still making decisions relatively quickly -- but they're thinking things through a bit further -- and they're not always choosing to make an offer. These higher mortgage interest rates do impact the market, even though they haven't caused home prices to drop in Harrisonburg and Rockingham County. | |

The Amount You Are Comfortable Paying For Your Next Home Might Be Different Than The Amount Your Lender Would Let You Spend |

|

So, you took my advice and talked to a mortgage lender to get a sense of what you are qualified to spend and to get a feel for potential mortgage payments. Great! You had been hoping to spend up to $350K on a house. But your lender said you could spend up to $475K on a house! But... when you look at the monthly mortgage payment associated with a $450K home purchase... WOW!!! How does your lender expect you to pay this much per month, and still have money for other life expenses, travel, emergency savings, etc.?!? This is not an uncommon place to be. Plenty of well qualified buyers discover that their lender will qualify them for a home purchase price that would involve a monthly mortgage payment much higher than is comfortable. So... start with a conversation with your lender about how high you *could* go on price... but be prepared to possibly need to do a bit more work with your lender to dial back that potential purchase price until you get to a monthly mortgage payment that is comfortable for you! | |

Higher Mortgage Interest Rates Might Be Resulting In More Buyer Competition In Moderate Price Ranges |

|

Clearly, the Harrisonburg and Rockingham housing market is still quite competitive right now, especially for homes under $400K. One reason for this might be related to current mortgage interest rates! Higher mortgage interest rates result in higher monthly costs. If some home buyers were looking in the $400K - $500K range when mortgage interest rates were around 3%, they may very well now be looking in the $300K - $400K range now that mortgage interest rates are above 6%. After all, if you're financing 80%... $450K purchase at 3.25% mortgage interest rate = $2,011 per month $350K purchase at 6.25% mortgage interest rate = $2,070 per month Yikes! So, if $300K - $400K purchasers were previously only competing with eachother, they might now find themselves competing with buyers who were previously planning to spend up to $500K! That said, it is of course also true that some $300K - $400K purchasers might also have had to reduce the target price for their home purchase as well. | |

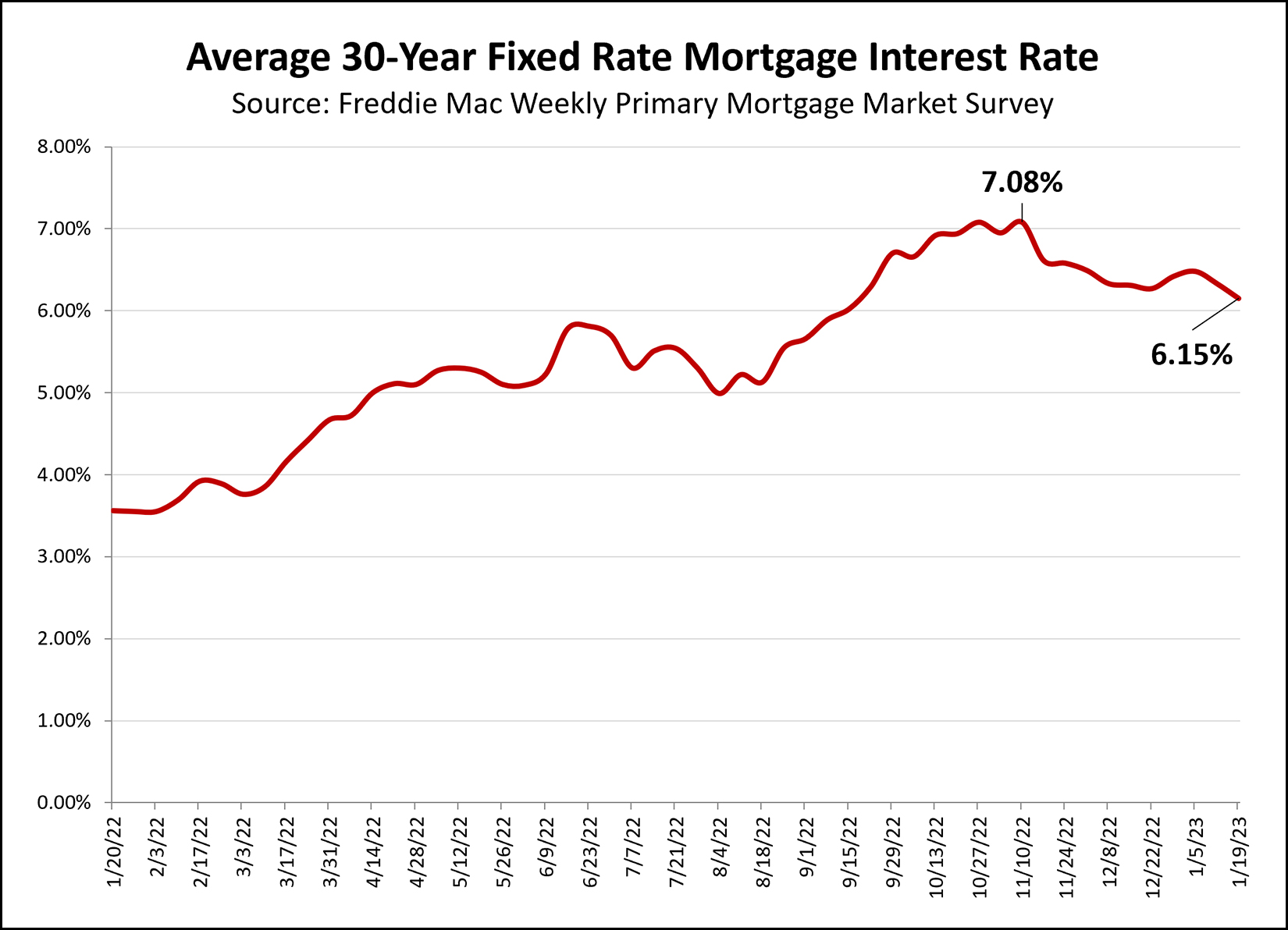

Home Buyers Happy To See Mortgage Interest Rates Continuing To Decline |

|

A year ago, the average 30-year fixed mortgage interest rate was 3.6%. Over the course of the past year that climbed... and climbed... and climbed... to a peak of 7.08% in October and November of 2022. As such, many buyers entered 2023 assuming we would likely see mortgage interest rates at or above 7% for much or most of 2023. Thankfully, that doesn't seem to be how 2023 is likely to unfold. After peaking at 7.08%, the average mortgage interest rate has been mostly declining... down to an average last week of 6.15%. I think it is extraordinarily unlikely that we would get back down to mortgage interest rates below 4% in 2023. It is also relatively unlikely that we'll see interest rates below 5%. But... I think it is now seeming unlikely that we'll see mortgage interest rates stick around above 7%. As such... we seem likely to see mortgage interest rates above 5% and below 7% in 2023... and if we give it a few more weeks we might conclude that rates might stay above 5% and below 6% for most of 2023. This is a trend that home buyers in 2023 are quite happy to see! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings