Financing

| Newer Posts | Older Posts |

Trading Up For A New House Will Likely Also Mean Trading Up Your Interest Rate |

|

For about three years (2019-2021) the average mortgage interest rate for a 30 year fixed rate mortgage was less than 4%. It even dropped below 3% at times. As such, anyone who bought a home during that timeframe likely has a mortgage interest rate below 4%... and many (many) other homeowners refinanced during that timeframe to lower their rate and their mortgage payment. So now we find ourselves in a situation where many mortgage holders have a mortgage interest rate below 4% or even below 3%. Thus, when any such holder of a low mortgage interest rates considers selling their home to trade up for a new house... they will also be trading up their mortgage interest rate. It was often an easy decision to sell a $300K home and buy a $400K home when you were paying off a 5% mortgage and taking out a new 3.5% mortgage. Now, if you're selling a $300K home with a 3.5% mortgage and are considering the purchase of a $400K home with a 6.5% mortgage... the math is going to work out a BIT differently. I suspect there will still be plenty of people selling and buying homes in 2023, even with these higher mortgage interest rates, but I think there will be fewer people swapping one house for another unless it is a significant upgrade in the house... because it will more than likely be a significant upgrade in the mortgage interest rate. :-/ | |

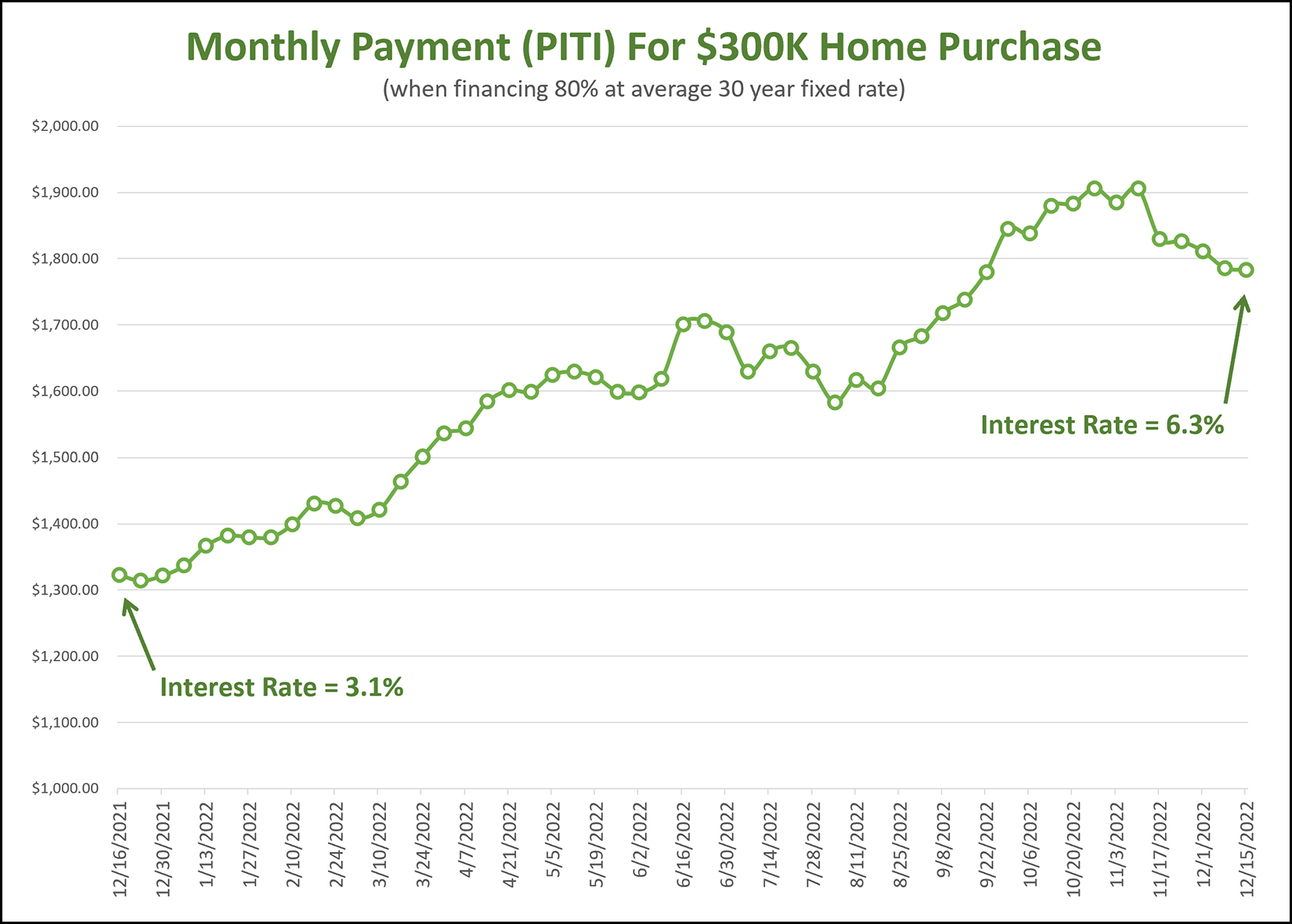

Monthly Housing Payments Have Changed A LOT In The Span Of A Single Year! |

|

With some regularity I take a look at trends in mortgage interest rates... but nobody really specifically cares about their mortgage interest rate... they really care about their monthly housing payment. The graph above shows how much monthly housing costs have changed over the past year. A year ago, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just over $1300 per month. Today, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just under $1800 per month. The slight bit of good news, I suppose, is that this potential monthly housing cost has been edging down over the past month-ish from over $1900 to under $1800 as mortgage interest rates have started to decline a bit. I don't think we're going to get back down anywhere close to the 3% ($1300) range in 2023 or 2024, but perhaps the monthly housing cost for a $300K home can work its way back down to $1700 (5.75%) or even $1600 (5.15%) over the next few years? | |

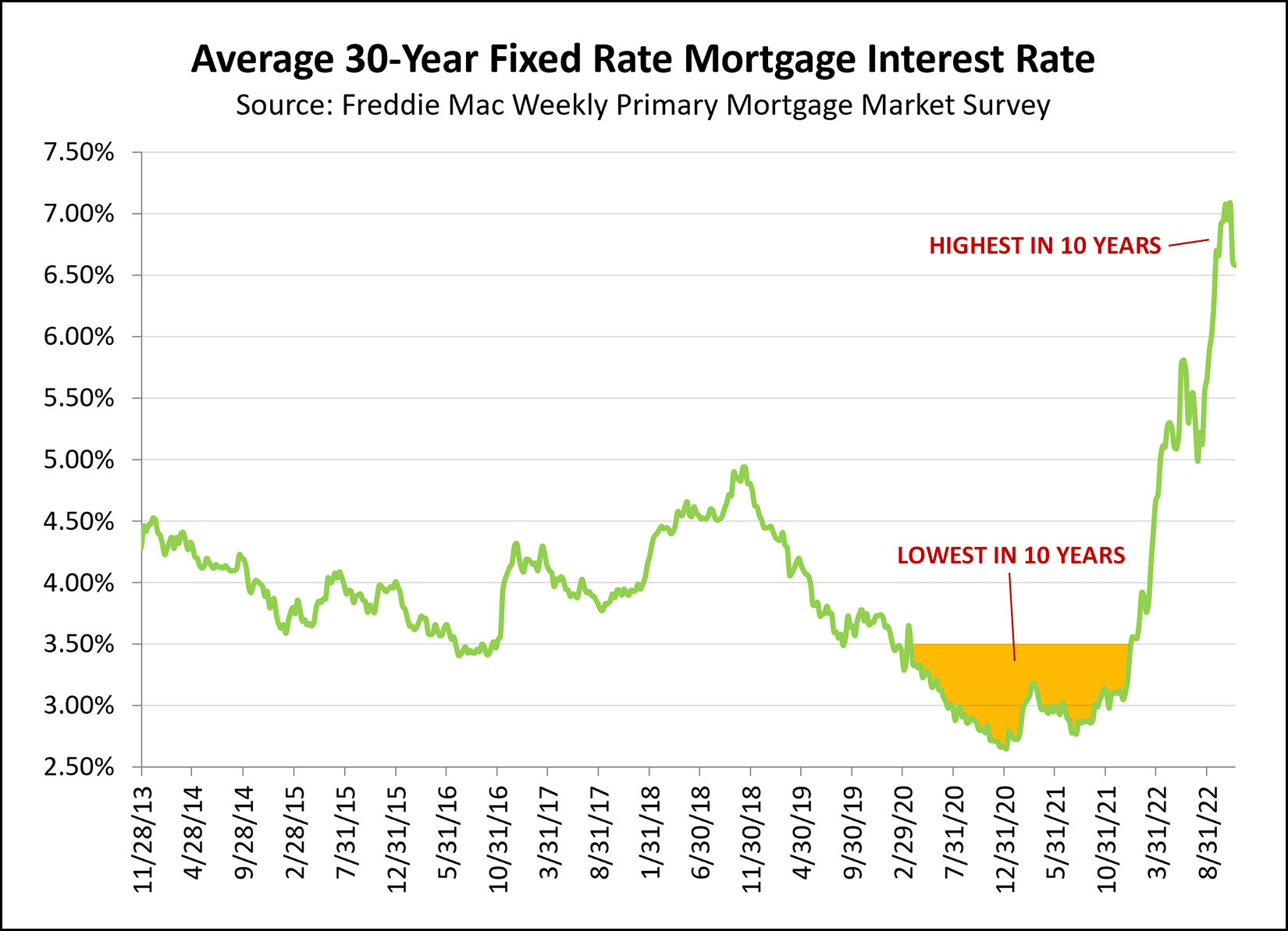

If You Bought A Home In 2020 Or 2021 You Should Be Retroactively Thrilled About Your Mortgage Interest Rate |

|

Did you buy a home in 2020 or 2021? If so, you likely locked in a mortgage interest rate that was the lowest we've seen in the past 10 years... and actually... the lowest we've seen... ever! So, for all of the buyers from the past two years, please look back and be thrilled that you were able to take advantage of that unique opportunity to lock in a very low interest rate on what is likely to be one of the largest purchases of your lifetime. Hopefully your home will work for you for many years to come and you will continue to enjoy the benefits of that super low interest rate. And... for would-be home buyers of 2022... yes, current mortgage interest rates are the highest we have seen in the past 10 years. In fact, we have to go all the way back to 2000 to find an interest rate above 7%. But... mortgage interest rates are starting to trend back down over the past month. They have dropped from about 7% to about 6.5%... and I have seen some recent prequalification letters much closer to 6%. Just as those record low mortgage interest rates didn't stick around forever, it seems unlikely that these record high mortgage interest rates will stick around forever... and they might pass more quickly than we realize. | |

Talking Things Through With Multiple Lenders Makes Sense Again |

|

Over the past three or four years mortgage interest rates were sooooo low that there often wasn't too much of a difference in the interest rate quoted by one lender vs. another. Furthermore, buyers didn't have to think too creatively about different loan programs as far as fixed rate vs. adjustable rate, etc. The thirty year fixed mortgage rate was so exceptionally low that almost all buyers were purchasing with that program. But, now things have changed... Mortgage interest rates are quite a bit higher now... at or above 7% for a 30 year fixed mortgage rate! As such, savvy home buyers are... [1] Talking to more than one lender to see how interest rates and closing costs compare. [2] Considering fixed rate mortgages alongside adjustable rate mortgages that start out fixed for (usually) five or seven years. If you are buying a home in late 2022 or early 2023 it will matter now more now than ever that you talk to an experienced, professional, responsive, creative mortgage lender to make sure you are finding the financing program that is the best fit for your financial scenario and your plans for the coming years in your new home. | |

Engaging With A Lender Continues To Be Essential For Buyers And It Does Not Have To Be Scary |

|

The local real estate market might be slowing down, a touch. For the past year the median "days on market" has been five days... which means that half (or more) homes that sold were under contract within five days of hitting the market. That is fast! Perhaps we'll eventually get to a time where homes are taking a full week or two (gasp!) to go under contract. In this very recent speedy market it was absolutely imperative that you had talked to a lender before you went to see a house for sale. You would likely need to make an offer within 24 hours of seeing a home, so having a lender letter in hand was a must. But even if or as the market is slowing a bit it is and will continue to be very important to have a lender letter in hand when going to see a house... though for slightly different reasons this time. Before... you needed a lender letter in hand to accompany the offer that you might make hours after viewing a house. Now... you need a lender letter to accompany an offer as well as to make sure you know what your mortgage payment will be within the context of recent rapid increases in mortgage interest rates. So, if you're in the market to buy a home now, but it's been a while (six months, a year, etc.) since you have talked to a lender... you should do so now. Talking to a lender doesn't have to be scary. They'll need some basic financial information from you in order to help you understand the type of mortgage you will qualify for and thus the price range in which you should be searching for homes. If you need a recommendation or recommendations for a great local lender, let me know! Call/text me at 540-578-0102 or email me here. | |

Home Buyers Who Want To Buy A Home In The Next Year Likely Should Not Wait For Mortgage Interest Rates To Come Back Down |

|

If you are looking to buy a home right now you might be surprised by higher mortgage interest rates than we have seen for much of the past year... January = 3.45% February = 3.92% March = 4.16% April = 5.00% May = 5.30% June = 5.78% July = 5.51% August = 5.13% September = 6.02% Now = 6.94% How could mortgage interest rates be close to 7% after having started the year at 3.45%? Surely mortgage interest rates will start coming back down again soon, to 4% or 5%, right? Or even 6%? I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months. As such, if you are thinking about buying a home right now, you should see what your payments will look like at current mortgage interest rates and decide if that is a monthly payment that will work for you. If so, it may be worth going ahead and moving forward with a purchase rather than holding off in hopes of lower mortgage interest rates. While it is certainly possible that mortgage interest rates will start declining again, I don't think we can assume that is what will happen next. | |

If You Will Be Buying A Home In The Next Year, Sooner Might Be Better Than Later |

|

Home prices have increased quite a bit over the past few years. Clearly, that's a bit of an understatement. ;-) Mortgage interest rates have increased drastically (doubled+) over the past year. As such, some would be home buyers might be wondering whether they should go ahead and buy a home now, or wait until next year. Waiting would make sense... if you thought home prices were going to decline and/or if you thought mortgage interest rates were going to decline. I think there is a relatively low possibility that we will see a significant decrease in home prices and/or mortgage interest rates over the next six to twelve months. Buying sooner rather than later would make sense... if you think home prices will either stay at about the same level or they might increase... and if you think mortgage interest rates will either stay at about the same level or they might increase. I think there is a relatively high possibility that home prices and mortgage interest rates will either stay at the same level or increase over the next six to twelve months. So, if you are almost certainly going to buy a home in the next 12 months, then the chances are sooner will probably be better than later. Clearly, this guidance is based on my best guesses (or your best guesses) about future trends in home prices and mortgage interest rates... so we're all just guessing. Only waiting and watching will show us what really will happen. Let me know if you want to chat further about this topic as it relates to your particular portion of the local housing market. | |

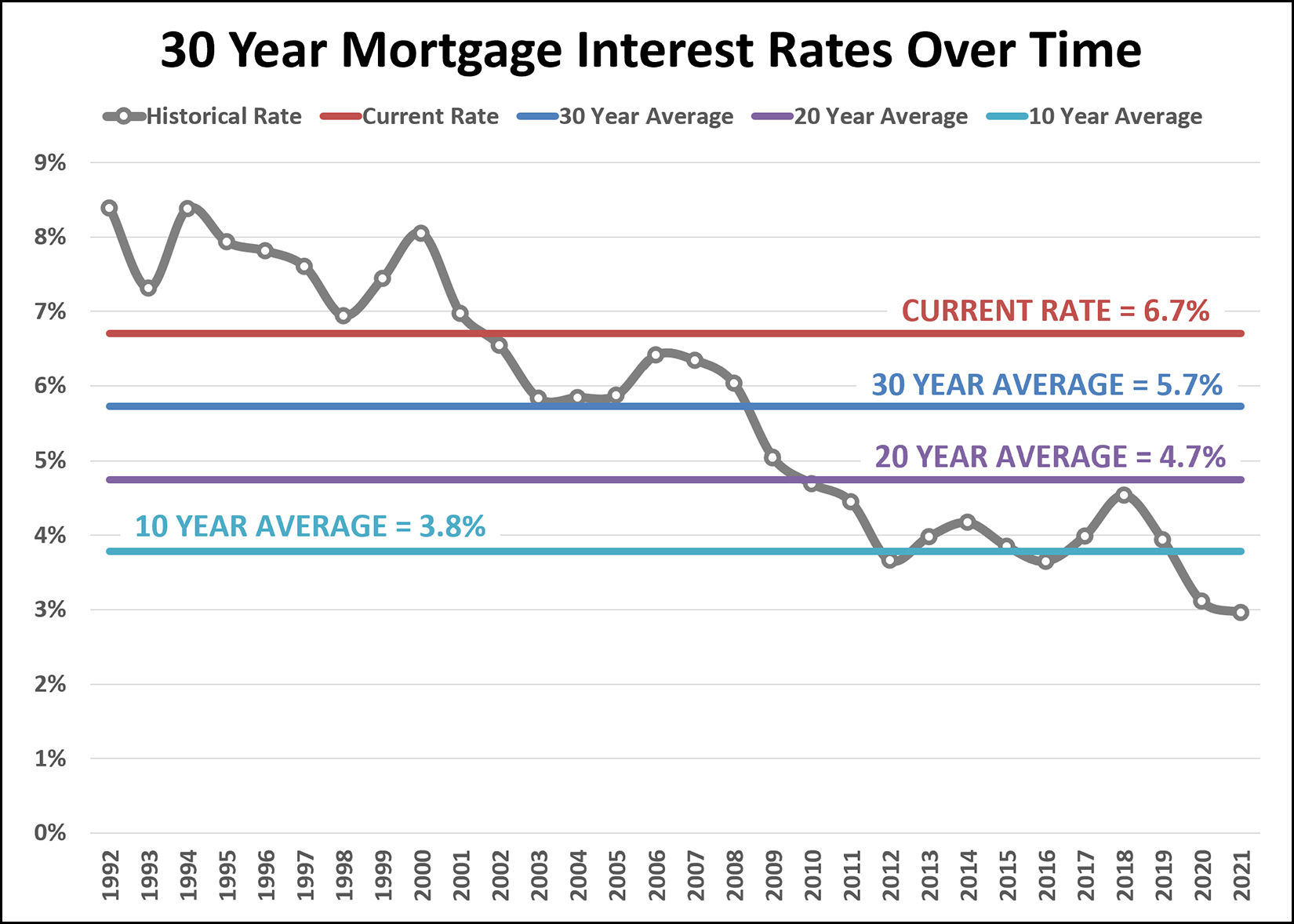

Where Might Mortgage Interest Rates Go From Here? |

|

30 year fixed mortgage interest rates were around 3% a year ago... and now they are up to 6.7%. Ahhhh! Some home buyers today, taking out mortgages at today's rates, are wondering whether it is likely that they will be able to refinance their mortgage anytime soon to get a mortgage rate lower than 6.7%. It's very difficult to know whether that would be likely... but a lot of that would have to do with what historical norm we may or may not gravitate back towards within the next few years. Are mortgage interest rates going to settle back down to 3%? That seems extraordinarily unlikely. Might they drop back down to the average rate over the past 10 years, of 3.8%? That seems somewhat possible, but still not necessarily likely. Might mortgage interest rates drop down to the average rate over the past 20 years, which was 4.7%? That seems quite possible, which would result in a 2% drop from today's 6.7% to the average over the past 20 years of 4.7%. Or, if you want to be even more conservative, we could look at the average mortgage rate over the past 30 years... which was 5.7%, still a full percentage point below the current rates. Another way to look at this is to note that mortgage interest rates were above the current 6.7% rate between 1992 and 2001... and below the current 6.7% rate between 2001 and 2021. Are we headed back towards mortgage interest rates we saw in the 90's? Or the early 2000's? As you might have gathered, I have no actual answers here other than to point to this historical data as a greater context for current mortgage interest rates. :-) | |

Well, I Suppose This Was One Way To Revive The Market For Future Mortgage Refinances? |

|

Sorry. Bad joke. Probably too soon. Mortgage interest rates have risen even further this week... with the current average rate on a 30 year mortgage now at 6.7%. One year ago it was 3.01%. Also one year ago, some said that every last person who could ever possibly think about refinancing their mortgage certainly must have done so. But now it seems some buyers are likely entering into fixed rate mortgages at rates that are high enough that they will be planning to refinance sometime in the next few years with the assumption that at some point we won't be looking at 6.7% interest rates any longer. I suppose it is also important to note that a 5/1 ARM is currently at 5.3%, which might be a MUCH better option for some home buyers. This mortgage interest rate would stay level at 5.3% for five years, and then have the potential to adjust once a year each year thereafter. It's a topsy-turvy time in the mortgage world right now, which can impact the home buying world, which can impact the home selling world. The steady increase in mortgage interest rates has certainly affected housing affordability, especially when piled on top of higher home prices. | |

Will A 6% Mortgage Interest Rate Seem High After A Year Of 6% Rates? |

|

Many (though not all) home buyers in the market today have been shopping for homes for the past three, six or 12 months. As such, when they encounter today's mortgage interest rate of around 6.25% they find it to be high. Quite high! After all, six months ago, the average 30 year fixed rate mortgage interest rate was 4.25%... and a year ago, the average rate was a touch below 3%. So, of course, a 6.25% mortgage rate seems high compared to 4.25% or 3%. But... fast forward a year... if mortgage interest rates have remained around 6% for a full year, will they then stop seeming and feeling high? Clearly, a 6.25% mortgage interest rate a year from now will still result in the same mortgage payment as a 6.25% mortgage interest rate does today... but perhaps that payment (and that interest rate) will no longer be viewed in the context of what could have recently been... at 4.25% or 3%. Of course, I'm hoping mortgage interest rates don't really stay this high (around 6%) for a full year, but if they do, maybe they won't seem quite as high to home buyers a year from now. | |

I Was Going To Upgrade To A Larger Home Until I Saw That Larger Mortgage Payment!?! |

|

In more than a few conversations over the past week I have been chatting with friends and past clients who have shared that they had been recently toying with the idea of upgrading to a larger home. In each of these instances, they bought their home three to eight years ago and are now finding it to be a bit tight in various areas. A new kid (or two) stretching the bedroom usage... working from home part of the time with limited space in which to do so... older kids with friends coming over to hang out and wanting room to lounge, etc., etc. These various "life is changing and house needs are changing" situations prompted each of these homeowners to think about whether they ought to upgrade to a larger home. But... then they started running the numbers. At first, things look good... They bought their current home for $300K, have a mortgage payment of around $1600/month, they still owe $250K and could sell for $415K. Thus, they could walk away with about $140K after settlement. But then, things turn a bit... The larger home would cost them around $540K. They'd put $140K down, so they'd be financing about $400K. At current mortgage rates of around 6%, their monthly payment would be... $2900/month. As you can see from this rough math for this one homeowner's situation, even though their $300K home is now worth $415K, and even though they would be walking away with $140K after selling, and even though they'd only be upgrading from a $415K home to a $540K home... their mortgage payment would be jumping up from $1600/month to $2900/month. The big change here is, of course, the mortgage interest rate. Paying off that 3.25% mortgage and taking out a new 6% mortgage is going to cost ya! What does this mean for homeowners and our local market? I suspect there will be fewer elective home upgrades over the next few years if interest rates remain this high... which has the potential to further limit resale inventory of homes for sale. This story is not everyone's story... so if you're considering an upgrade (or a downgrade) let me know if you'd like to do some rough math together to evaluate the overall financial impact of making the change. | |

Mortgage Interest Rates Double Within A Single Year |

|

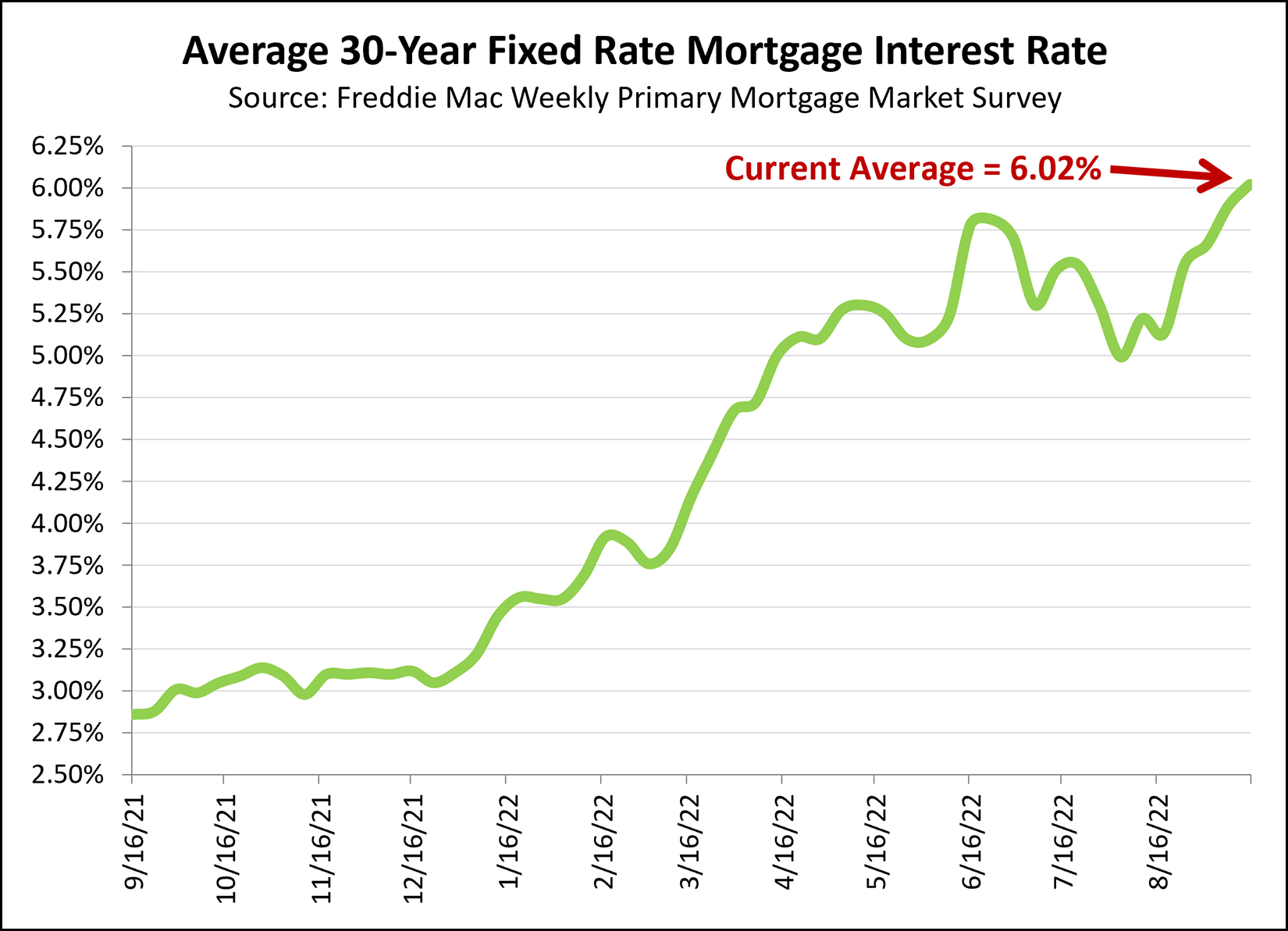

Well, then. A year ago, the average 30 year fixed rate mortgage interest rate was under 3%. Today, the average 30 year fixed rate mortgage interest rate is 6.02%. Yikes. Clearly, this affects mortgage payments rather significantly. Now, to create at least a bit of context... [1] Nobody really thought 3% mortgage interest rates were normal or sustainable. They were great, of course, for home buyers... but I don't think anyone really thought they'd stick around for as long as they did. [2] In some ways a buyer's monthly housing costs were held abnormally low by those abnormally low mortgage interest rates. So, while monthly housing costs have increased significantly over the past year given this shift in interest rates... it wasn't really from "normal" to "high" - it was more of from "low" speedily through "normal" and then to "high" today. [3] The last time this average 30 year fixed rate mortgage rate was above six percent was back in 2008. It's been a bit. Will mortgage interest rates continue to rise? Will they hover around six percent? Will they drop back into the five point something range? Stay tuned to find out. In the meantime, some home buyers today are opting for an adjustable rate mortgage instead of a fixed rate mortgage. The average rate for a 5/1 ARM is currently 4.93%. This type of mortgage product will keep that 4.93% rate for five years and then can adjust once per year thereafter. | |

Do Home Prices Rise As Interest Rates Fall, And Fall As Interest Rates Rise? |

|

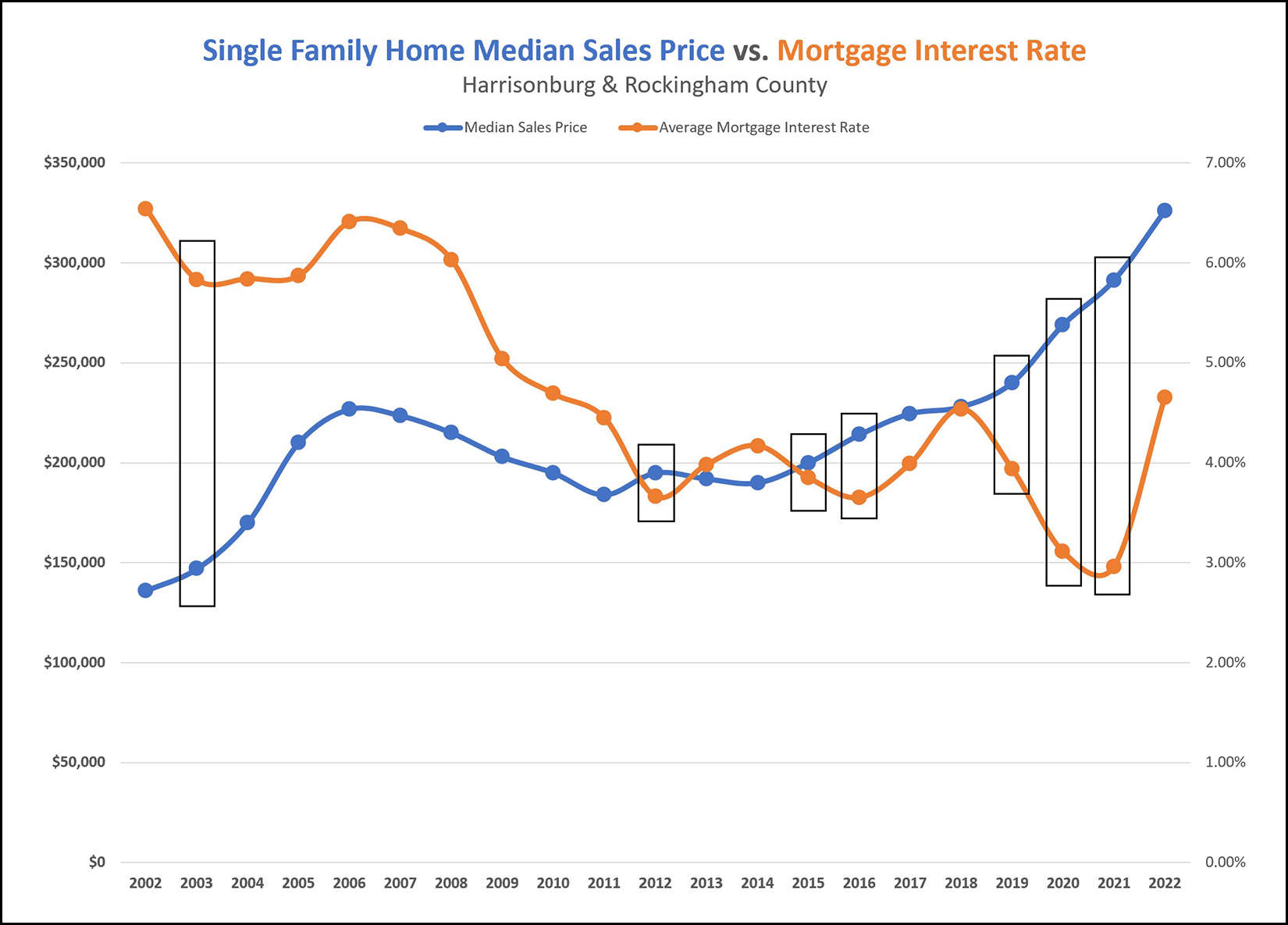

Q: Do Home Prices Rise As Interest Rates Fall, And Fall As Interest Rates Rise? A: Sometimes In the graph above I tracked the median sales price of single family homes sold in Harrisonburg and Rockingham County over the past 20 years (blue line) as compared to the average mortgage interest rate (orange line) to try to answer the question above. I then looked for years where there was a significant increase (or decrease) in the median sales price paired with a significant decrease (or increase) in the mortgage interest rate. I found 7 years where this happened... out of 20 years. There were also plenty of years where the two metrics tracked alongside each other in the same direction... prices fell while rates fell... or prices rose while rates rose. So... it does not seem that a decline in rates is likely to necessarily result in higher prices... or that an increase in rates is likely to necessarily result in lower prices. Though, of course, sometimes (not usually) that does happen. The question is asked, of course, in the context of rapidly rising mortgage interest rates. The answer we are all seeking, of course, is whether these higher rates will result in lower sales prices. History does not indicate that will definitely happen, but it is certainly possible given how higher mortgage interest rates affect how much a buyer can pay for a house and how many buyers can qualify to buy any given house. | |

Happy Mortgage Interest Rate News As Average Rate Falls Below 5% Again |

|

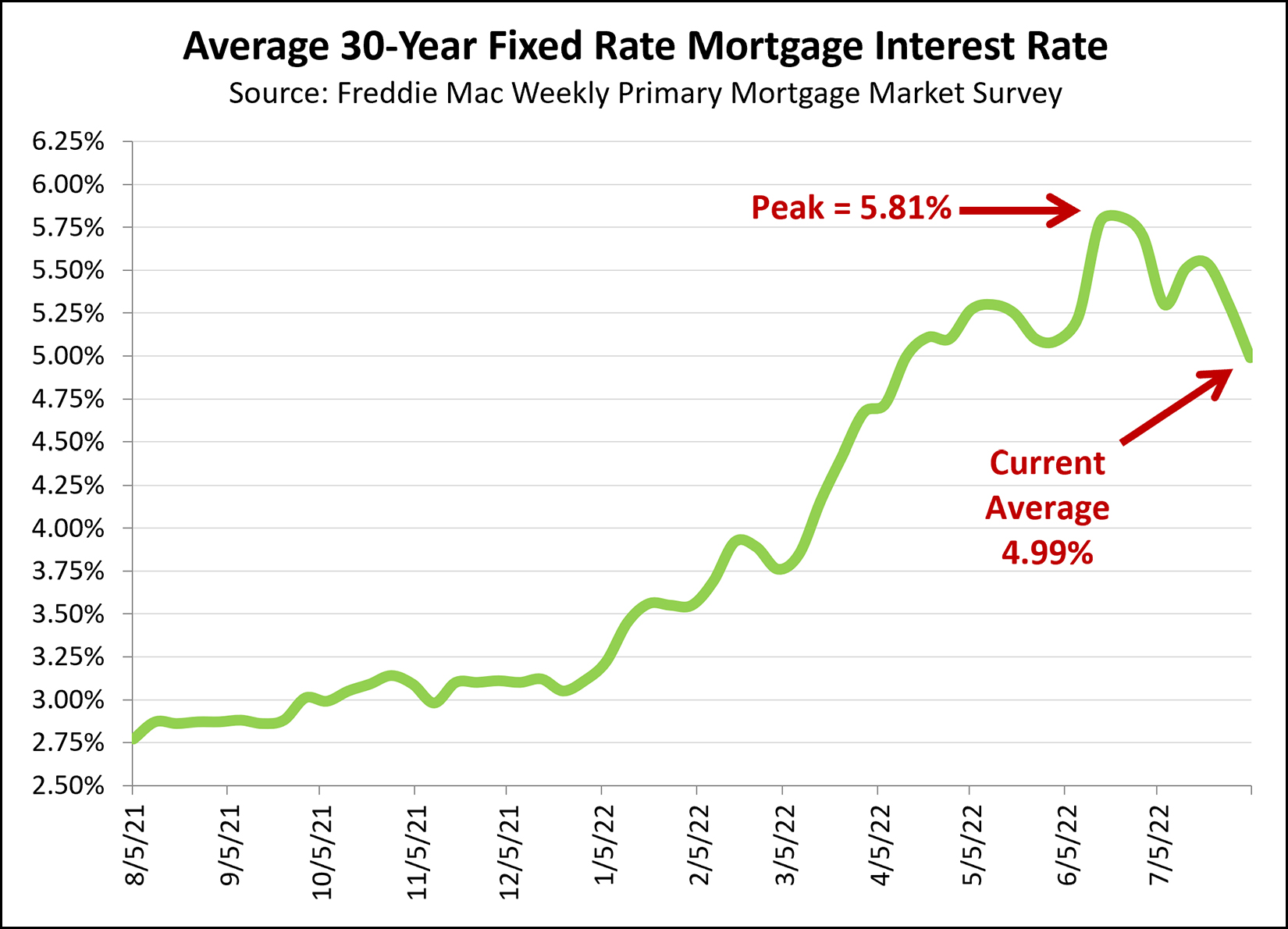

Mortgage interest rates have been steadily climbing for most of the past six months -- peaking at 5.81%. But... in a bit of good news for buyers in today's housing market... the average mortgage interest rate (for a 30 year fixed rate mortgage) has fallen below 5% again... barely... to 4.99%. Just over a month ago with rates nearing 6%, some were thinking we were going to see them continue to rise to 6%, 7% or beyond. This moderation in rates is certainly helpful for home buyers looking to buy a home right now! | |

Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? |

|

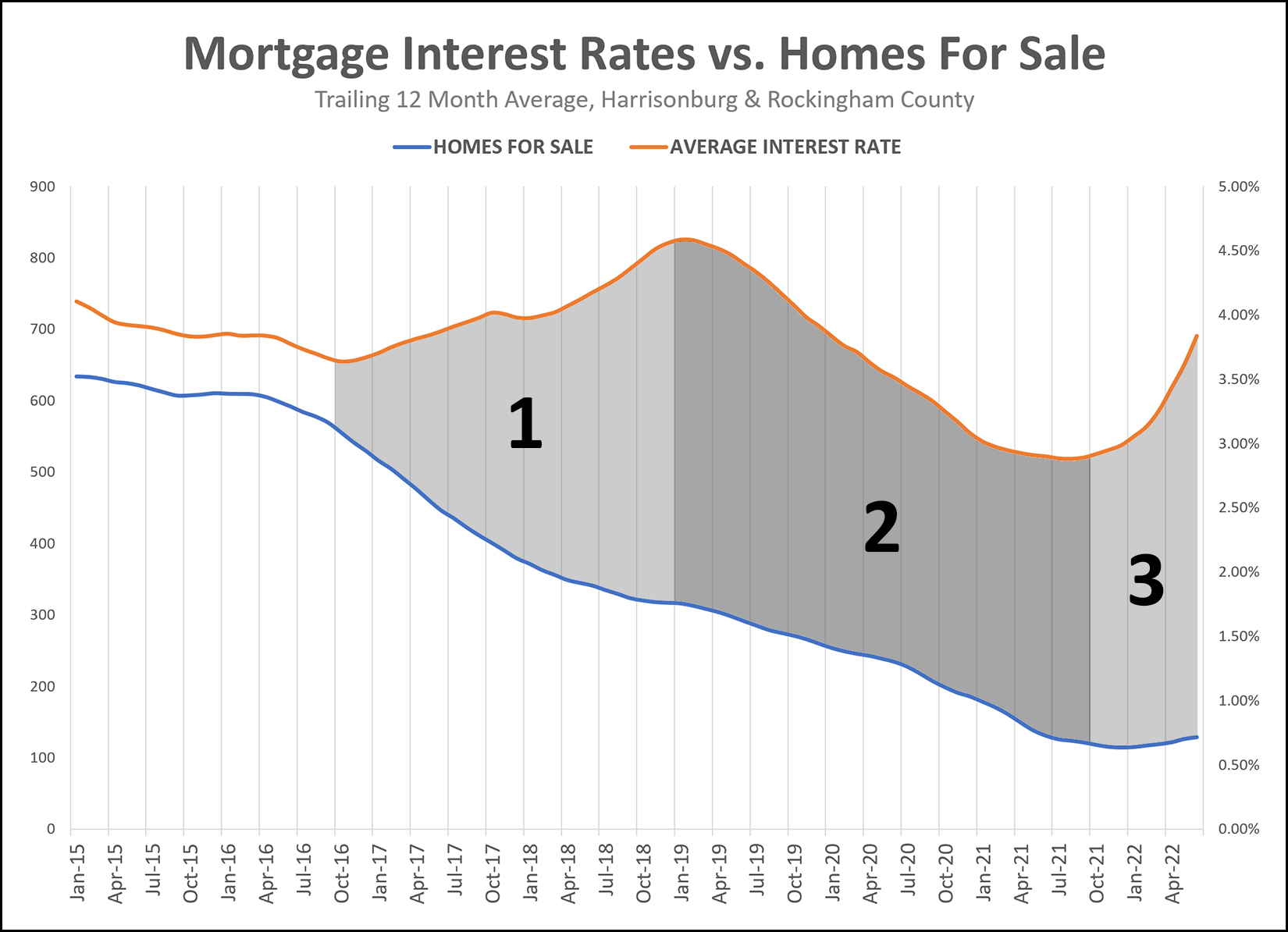

Q: Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? A: Sometimes Interest rates are on the rise right now... and inventory levels are rising as well. Interest rates were falling for quite a few years just prior to 2021... and inventory levels also fell during that timeframe. So... do inventory levels just track right along with mortgage interest rates? Sometimes, but not always, it seems. Of note... The graph above shows a 12 month average of the number of homes for sale (blue line) and a 12 month average of a 30 year fixed rate mortgage interest rate (orange line). So, the last data point (June 2022) is showing the average number of homes for sale in the 12 months prior to and including June 2022... and the average mortgage interest rate in the 12 months prior to and including June 22. Looking back, then, to the beginning of 2015, we can see four general trends taking place, three of which I have labeled. [0] The unlabeled portion of the graph (2015-2016) showed very little upward or downward movement in inventory levels or interest rates. [1] Between 2016 and 2018 we saw interest rates rising, but inventory levels falling. This runs counter to the premise proposed above, that inventory levels rise and fall as interest rates do the same. [2] Between 2019 and 2021, indeed, interest rates declined, and inventory levels did as well. [3] Since late 2021 we have seen interest rates start to climb (and even faster and further in 2022) and inventory levels have started to climb as well. So... yes, there seems to be some connection between interest rates and inventory levels... at some times... but not always. The unspoken here, is the main connection between these two factors... which is home buyers. As interest rates decline, in theory there are more buyers, which would in theory, cause inventory levels to decline. As interest rates rise, in theory there are fewer buyers, which would in theory, cause inventory levels to rise. Beyond all of these theoretical connections and consequences, what does this mean for 2022 and 2023 in our local housing market? So long as interest rates are rising, there is a decent chance that inventory levels will rise somewhat as well, as some buyers won't be able to afford some houses any longer... or will choose to limit their home buying budget. The big question, of course, is whether it will be a four part chain reaction... [1] Interest Rates Rise [2] Fewer Buyers Buy Homes [3] Inventory Levels Rise [4] Prices Flatten Out or Fall Thus far in our local market, we are seeing... [1] Interest Rates Rising [2] More Buyers Buying (not fewer as predicted above) [3] Inventory Levels Rising (slightly, not significantly) [4] Prices Are Still Rising (not flattening out or falling as predicted above) Do keep in mind that every housing market trend you see in the national news may or may not actually be representative of what is happening in our local market. | |

Increased Mortgage Interest Rates Can Significantly Decrease Your Home Purchasing Power |

|

If you have $2,000 per month in your budget for your mortgage payment, that budget won't allow you to buy quite the same house now as compared to six months ago. Six Months Ago = 3.22% Mortgage Interest Rate = $451,000 house Six months ago, you could purchase a $451,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 3.22%, pay your tax bill and homeowners insurance all for a smidge less than $2,000. Today = 5.81% Mortgage Interest Rate = $353,000 house Today, you can purchase a $353,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 5.81%, pay your tax bill and homeowners insurance all for slightly less than $2,000. $98,000 of Purchasing Power... Gone! As such, if you have a fixed budget for your housing costs, you have lost $98,000 of purchasing power over the past six months given the increased interest rates. But Remember... Six months ago, plenty of buyers with a $2,000 budget may have been buying $353K houses... not $451K houses... so for some buyers the increased monthly costs are likely painful, but may not change their purchasing decisions. -- This article was inspired by an even more thorough analysis of this dynamic over here. | |

Will Mortgage Interest Rates Decrease Again, Somewhat, In The Next Few Years, Allowing 2022 Home Buyers To Refinance? |

|

It's an interesting question that I have discussed with several home buyers lately. The economy is on a tear... inflation is rampant... housing markets (including our own) are seeing double digit per year increases in sales prices. One action that the Federal Reserve is taking to combat these factors is to raise interest rates. Mortgage interest rates are now approaching 6% -- after having started the year just over 3%. Wow! But... if the rates have risen this high to get things (the economy, inflation, housing markets) to cool off a bit... if/when they do, will interest rates eventually decline again? I don't know that they'll ever go back down towards 3%, and maybe not 4%... but is it possible within the next few years that we will see mortgage interest rates of 4.5% or 5%? It seems possible? I certainly won't say that it is likely, but it is certainly possible. This possible future reality is providing some residual comfort to home buyers who are going ahead and buying in 2022. They can afford the mortgage payments at the current rates of close to or at 6%, but they'd love to be paying a lower mortgage payment for their home at some point in the future. If their theory holds true... perhaps we will see interest rates eventually decline, somewhat, allowing 2022 home buyers to refinance to take advantage of future lower rates. Clearly, there is no guarantee that this will happen... but it does seem possible. | |

Mortgage Interest Rates Have Been Trending Back Down A Bit |

|

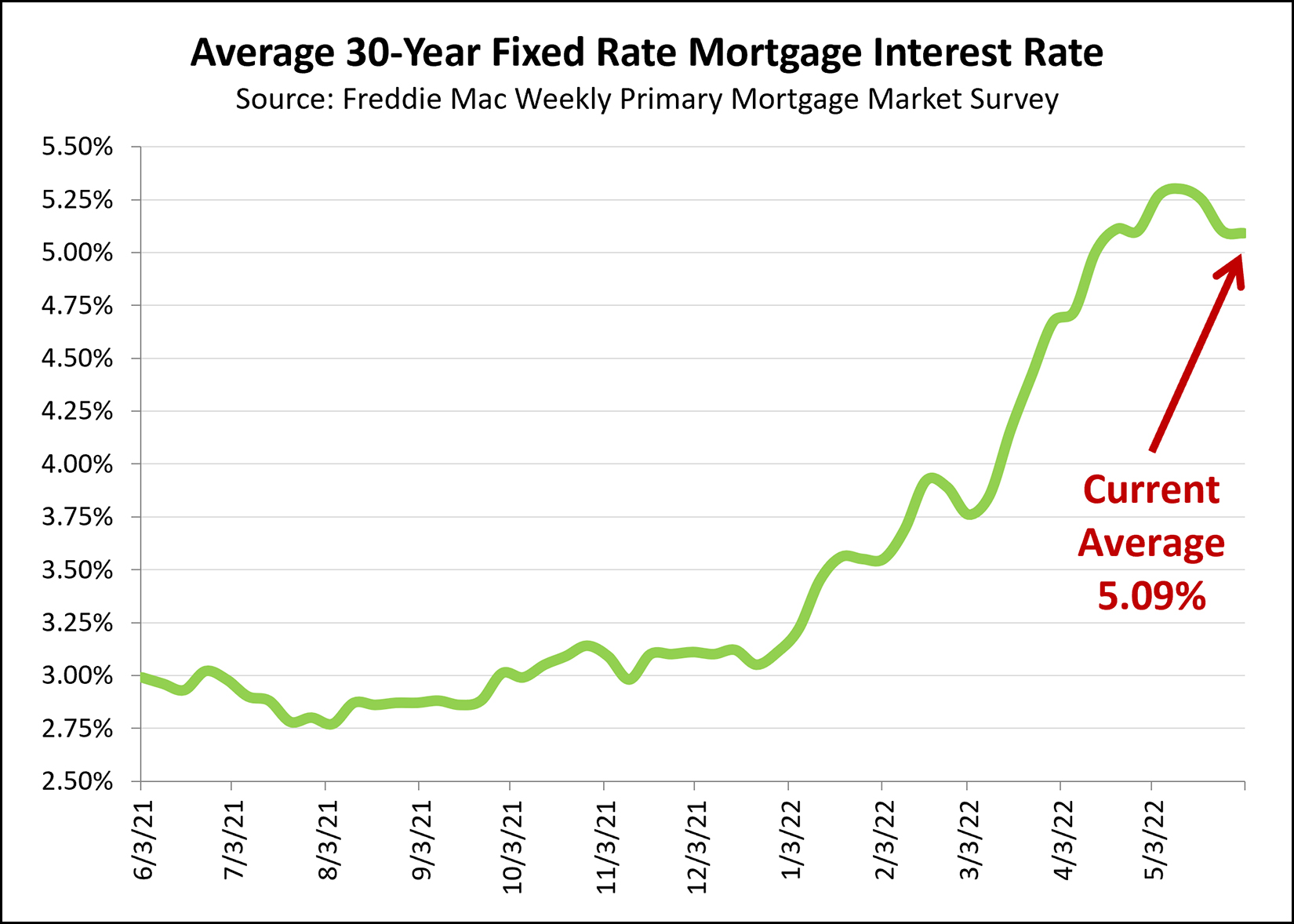

After soaring from 3.2% in January 2022 to 5.3% in May 2022, mortgage interest rates have actually started to level off and even decline in recent weeks. The graph above shows the average 30-year fixed rate mortgage interest rate each week for the past year. Clearly, rates have been rising quickly for the past four to five months... but if you look at the past four weeks, you'll see a different trend. May 12 = 5.30% May 19 = 5.25% May 26 = 5.10% June 2 = 5.09% It is certainly encouraging to see mortgage interest rates leveling out a bit with the potential for sticking right around 5% in coming weeks and months. Certainly, I'd rather today's buyers were able to obtain a 3.5% or 4% mortgage interest rate if possible... but given the possibility of 5%, 5.5%, 6% or even higher, something right around 5% sounds just fine! | |

Monthly Cost Of Median Priced Home Jumps Much Higher In 2022! |

|

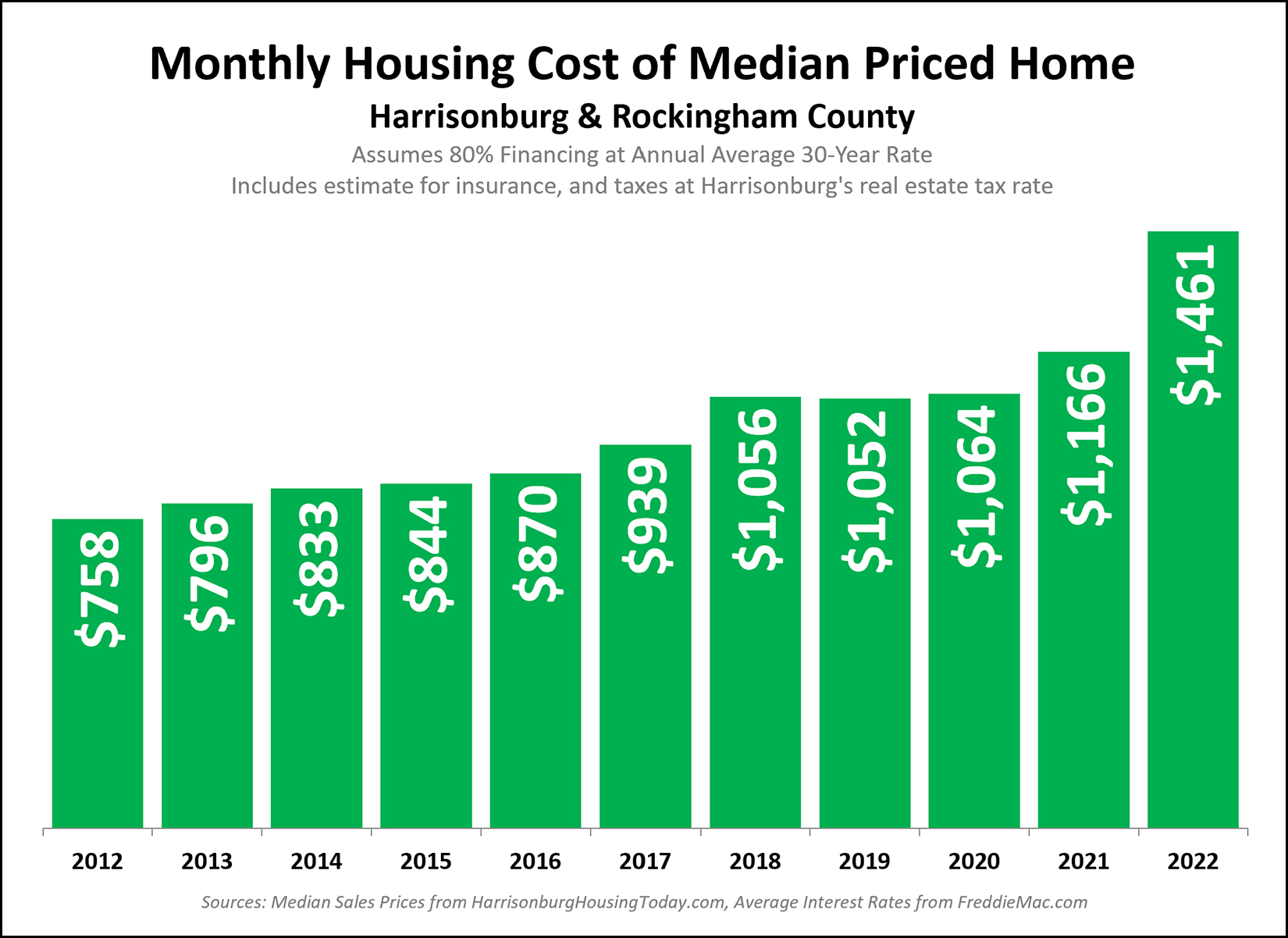

Wow. The monthly cost of a median priced home has jumped quite a bit in 2022! This is related to a variety of changes between 2021 and 2022... [1] The median sales price increased from $270,000 to $296,500. [2] The average mortgage interest rate increased from 2.96% to 4.27%. [3] The City real estate tax rate increased from $0.90 to $0.93. All of these factors, combined, resulted in a rather significant increase in the monthly cost of a median priced home in our local market. | |

Reflecting On Large, Fast Changes In Mortgage Interest Rates |

|

For at least the past five years, I have remained convinced that mortgage interest rates would start rising... anytime. But month after month, year after year, interest rates did not rise... instead, they fell. But 2022 has been a bit different. If you had asked me anytime in the past five or ten years what would happen if mortgage interest rates increased from 3% to 5% in the course of just four months, I likely would have told you that the market would likely immediately and significantly slow down... not to a screeching halt... but certainly to a slower pace than before that enormous increase in mortgage interest rates. But, here we are, on the other side of rapidly increasing mortgage interest rates for the past four months, and the market seems to still be, doing pretty similar things to what it was doing before mortgage interest rates started rapidly climbing. Homes are still going under contract very quickly. Buyers are still often competing with multiple offers, including escalation clauses and waiving contingencies. Prices keep climbing. So, have the rising mortgage interest rates had any impact at all on our local housing market? I'd say yes. 1. Some would-be home buyers are no longer able to afford the homes they would like to buy. 2. I think some homes might be receiving two or three offers now instead of six or eight that they might have received before. 3. Some would-be sellers might not be selling after all as they see how their buying budget will be affected by higher mortgage interest rates. So, there have been changes in our local market as a result of these rapidly rising interest rates, they the higher rates have had a much narrower impact than I would have assumed in years gone by. One other point of trivia... the last time the average mortgage interest rate was 5.25% (or higher) was... way back in August 2009... almost 13 years ago! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings