| Newer Post | home | Older Post |

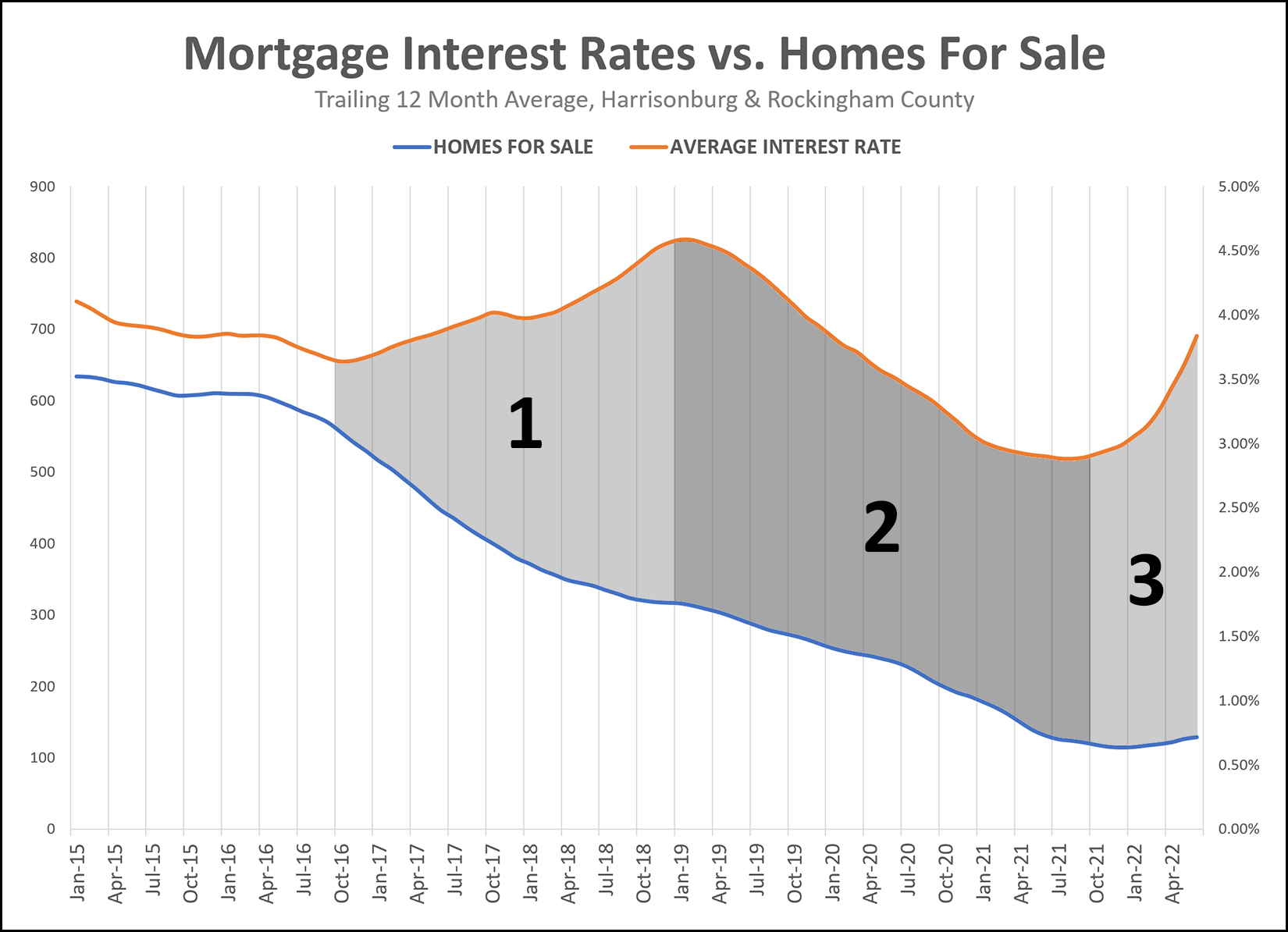

Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? |

|

Q: Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? A: Sometimes Interest rates are on the rise right now... and inventory levels are rising as well. Interest rates were falling for quite a few years just prior to 2021... and inventory levels also fell during that timeframe. So... do inventory levels just track right along with mortgage interest rates? Sometimes, but not always, it seems. Of note... The graph above shows a 12 month average of the number of homes for sale (blue line) and a 12 month average of a 30 year fixed rate mortgage interest rate (orange line). So, the last data point (June 2022) is showing the average number of homes for sale in the 12 months prior to and including June 2022... and the average mortgage interest rate in the 12 months prior to and including June 22. Looking back, then, to the beginning of 2015, we can see four general trends taking place, three of which I have labeled. [0] The unlabeled portion of the graph (2015-2016) showed very little upward or downward movement in inventory levels or interest rates. [1] Between 2016 and 2018 we saw interest rates rising, but inventory levels falling. This runs counter to the premise proposed above, that inventory levels rise and fall as interest rates do the same. [2] Between 2019 and 2021, indeed, interest rates declined, and inventory levels did as well. [3] Since late 2021 we have seen interest rates start to climb (and even faster and further in 2022) and inventory levels have started to climb as well. So... yes, there seems to be some connection between interest rates and inventory levels... at some times... but not always. The unspoken here, is the main connection between these two factors... which is home buyers. As interest rates decline, in theory there are more buyers, which would in theory, cause inventory levels to decline. As interest rates rise, in theory there are fewer buyers, which would in theory, cause inventory levels to rise. Beyond all of these theoretical connections and consequences, what does this mean for 2022 and 2023 in our local housing market? So long as interest rates are rising, there is a decent chance that inventory levels will rise somewhat as well, as some buyers won't be able to afford some houses any longer... or will choose to limit their home buying budget. The big question, of course, is whether it will be a four part chain reaction... [1] Interest Rates Rise [2] Fewer Buyers Buy Homes [3] Inventory Levels Rise [4] Prices Flatten Out or Fall Thus far in our local market, we are seeing... [1] Interest Rates Rising [2] More Buyers Buying (not fewer as predicted above) [3] Inventory Levels Rising (slightly, not significantly) [4] Prices Are Still Rising (not flattening out or falling as predicted above) Do keep in mind that every housing market trend you see in the national news may or may not actually be representative of what is happening in our local market. Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings