Financing

| Newer Posts | Older Posts |

Folks Who Bought Homes In 2020 or 2021 Might Stay In Their Homes Longer Than Expected |

|

Did you buy a home in 2020 or 2021? I'm betting you might stay in that home longer than we might otherwise expect. After all, who would want to give up that fixed mortgage interest rate that is SOOOO low! For nearly all of 2020 and 2021, the average mortgage interest rate on a 30 year fixed rate mortgage was below 3.5%. That is LOW. For some months during that two year period, the rate was lower than 3%! When home buyers from 2020 or 2021 think about selling five to seven years from now, I'm guessing a part of the though process of whether to sell will relate to whether they really want to give up that super, super, super low mortgage interest rate! Mortgage interest rates are currently hovering around 5%, and perhaps they'll stay there for much of the year, and beyond... If, seven years from now, you would potentially be selling and paying off a mortgage with a 2.75% interest rate... in order to take out a new mortgage with a 5.25% interest rate... will you really want to do it? Certainly, our needs for housing (location, size, configuration, etc.) change over time... and that might supersede a desire to hold onto that fantastically low mortgage interest rate. All that said, if you were fortunate enough to buy (or refinance) in 2020 or 2021, enjoy that super low interest rate, as it doesn't seem likely that we will see them anywhere near that low in the coming months and years. | |

If You Hope To Buy a Home and Have Not Talked To Your Lender Lately, Do So NOW! |

|

So, you've been planning to and trying to buy a home for the past four months... but despite having made multiple offers, nothing has worked out yet. This is not as uncommon as you might think -- there still seem to be many more buyers in the market as compared to sellers -- and thus, plenty of would be buyers haven't been able to convert themselves into actual real life buyers yet. As a conscientious and responsible buyer you likely talked to your lender before you started your home search -- four months ago -- and you became pre-approved for a loan. Good work! But... wait.... if you haven't talked to your lender since then... connect with them again ASAP! Why, you might ask? Because interest rates have increased quite a bit over the past four months! Buying a $400K house four months ago with 20% down...

Buying a $400K house today with 20% down...

As you can see, this fictional buyers would now be paying $381 a month more than anticipated because interest rates have risen quite a bit over the past four months. The buyer very likely can still afford the new mortgage payment and will still be pre-approved to buy the house of his or her dreams... but the payment will be higher than expected, and nobody likes surprises. So, if you are in the market to buy and haven't talked to your lender lately to get an updated estimate of your mortgage payment with today's rates... do so NOW! | |

Current Mortgage Interest Rates in the Context of the Past Decade |

|

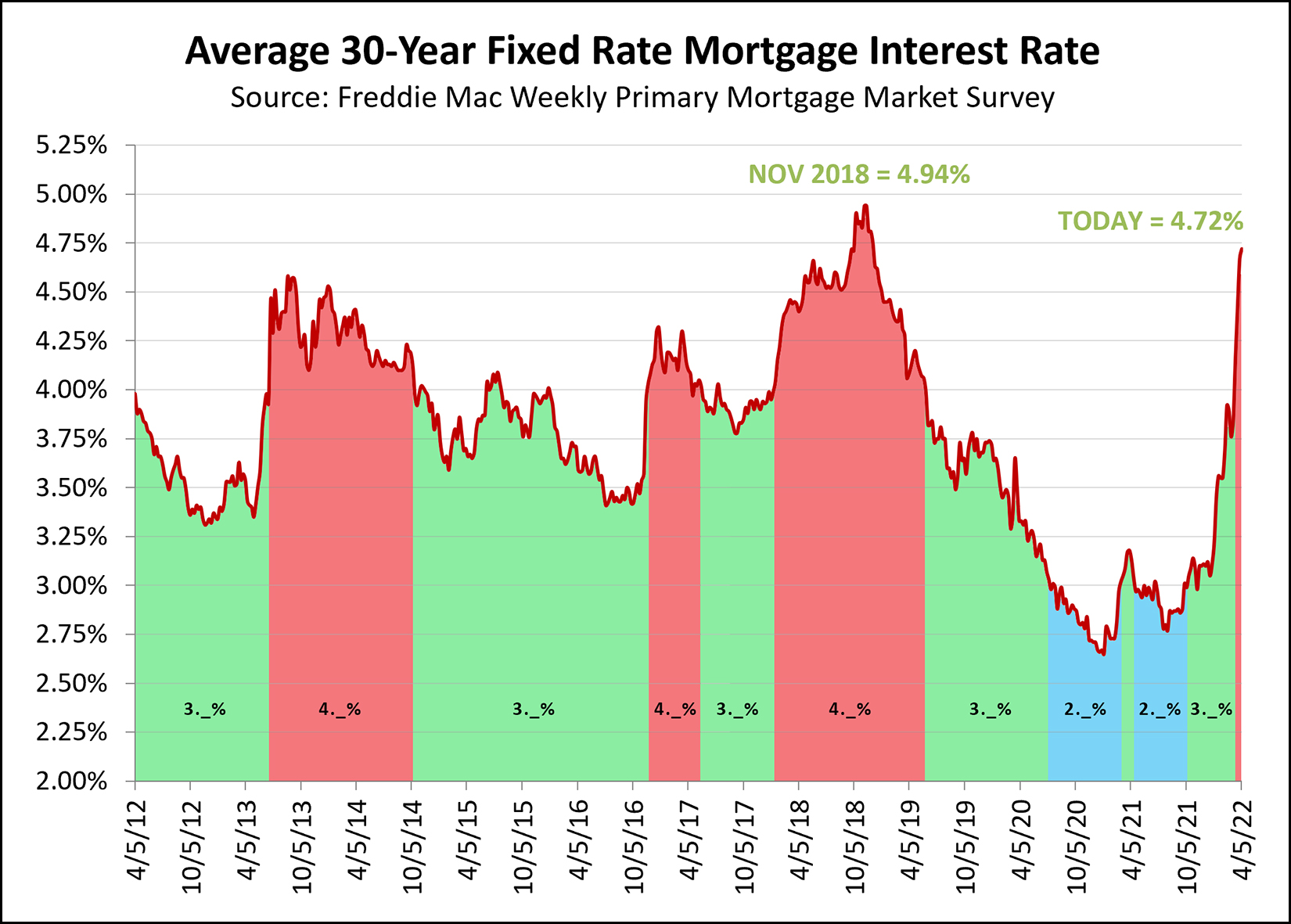

Mortgage interest rates keep on rising. The graph above shows the average mortgage interest rate over the past decade. Periods of Green = 3._% (somewhere between 3% and 4%) Periods of Red = 4._% (somewhere between 4% and 5%) Periods of Blue = 2._% (somewhere between 2% and 3%) A few resulting observations... [1] We're getting ready to pop over 4.75%, it seems, which we've seen once (for a few months) in late 2018. [2] We might be headed all the way up towards 5%, which we haven't seen at all in the past ten years. [3] While we've spent most of the past decade below 4% (green+blue) we have certainly also seen long spells above 4% (red) as well. [4] We moved pretty quickly from 2._% to 3._% to 4._% and it almost seems like 5._% could be knocking on the door. As mortgage interest rates rise, monthly mortgage payments (for new buyers) rise, which certainly creates the possibility that at some point rapidly rising home prices won't be rising quite as rapidly. | |

If Higher Mortgage Interest Rates Will Cause The Market To Shift, It Does Not Seem To Be Happening Yet |

|

In theory, as mortgage interest rates increase, some buyers will be priced out of considering some homes that they would like to purchase. If enough buyers are priced out of being able to afford their preferred home, maybe we will see fewer offers on homes listed for sale. If there are fewer offers on homes offered for sale, then perhaps buyers won't keep having to pay so much over the asking price. If buyers aren't paying so much over the asking price, maybe the 10% per year increase in median sales price in our area will start to move back to a more reasonable 3% to 4% per year. But, thus far, these are all just theories and possibilities, not actualities. Despite significant increases in mortgage interest rates over the past month (and 3 - 4 months) we don't yet seem to be seeing a decline in the amount of buyer interest in many or most new listings. I'll keep wondering if we will see that shift happening... and I'll keep crunching the numbers to see if there is evidence that it is happening... but if you are holding off on buying a home right now because you are absolutely certain that a shift is coming... it might be a long wait. | |

Rising Mortgage Interest Rates Are Causing Some Would Be Home Buyers To Adjust Their Target Purchase Price |

|

Have you heard? Interest rates are on the rise. In early January, the average mortgage interest rate was 3.22% on a 30 year fixed rate mortgage. Last week, the average mortgage interest rate was 4.67% on a 30 year fixed rate mortgage. That is quite an increase!!! Here are two examples of how that might -- and might not -- affect buyers. Buyer 1 - Buying Below Budget Our first set of fictional buyers was planning in January to buy a $450,000 home in Rockingham County while putting 20% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As you can see, these buyers will have to pay $300 more each month because of the increased mortgage interest rates -- but, they were originally qualified up to $600,000 so the $300/month increase is annoying and frustrating, but does not change their plans to buy a $450,000 home. Buyer 2 - Maxing Out The Budget Our first set of fictional buyers was planning in January to buy a $350,000 home in Harrisonburg while putting 10% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As such, here's how things really look for them if they are maxing out their $1,725 per month budget given these new mortgage interest rates...

As you can see, these buyers had to reduce their budget from looking at houses priced at $350,000 down to houses priced at $305,000. That's quite an adjustment, especially when home prices are currently increasing by 10% per year. So, what does this mean for our market? All this is to say that some buyers will *definitely* be affected by these rising interest rates -- finding themselves no longer able to buy the home they hoped to buy, or needing to lower the price point of houses they will be considering. At the same time, however, some buyers will still be able to afford to buy the same houses they had planned to buy -- though their monthly housing costs for having done so will certainly be increasing. If, in our local market, most buyers were maxing out their home buying budget, and thus now have to buy less expensive homes, that could cause values to stop increasing, or even to start decreasing. What is not clear is how many buyers in our local market were maxing out their home buying budget and how many had room to increase their monthly mortgage payment if needed. | |

As You Might Expect, Most Home Sellers Are Not Providing Closing Cost Credits These Days |

|

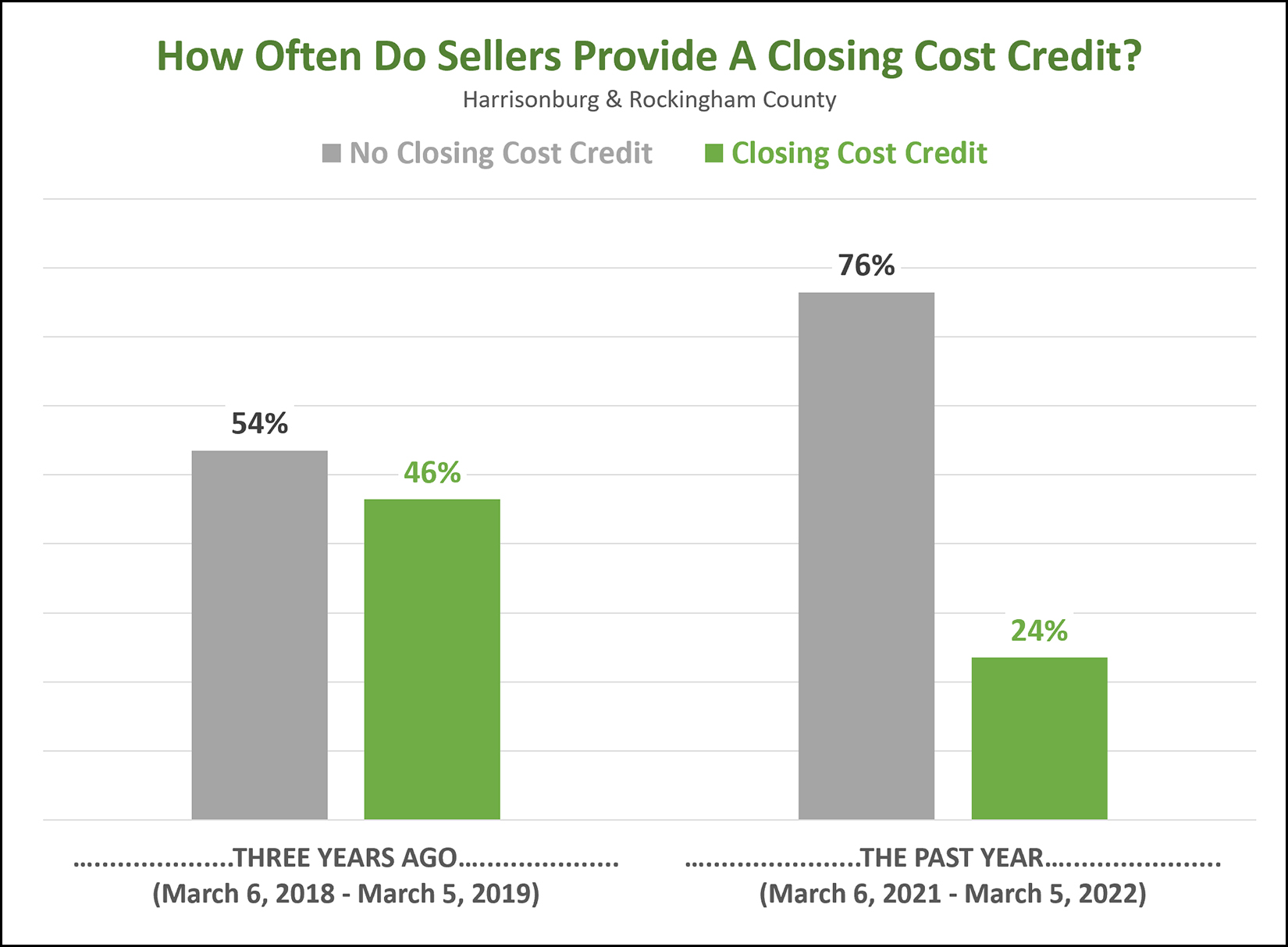

Sometimes a home buyers doesn't have all the cash on hand that they need for both a down payment and the closing costs. In that situation, sometimes a buyer might propose a higher sales price with the seller providing a closing cost credit at settlement. For example... instead of the buyer paying $240K for the house, they could pay $245K and the seller would give them a $5K credit back at closing. But... these days... that isn't happening as often. Three years ago sellers were giving closing cost credits to buyers in nearly half (46%) of all home sales in Harrisonburg and Rockingham County. These days, it is only happening about one in four times. Why might these types of transactions (with closing cost credits) not be happening as frequently right now? First, many or most sellers seem to gravitate towards buyers who have the strongest financial position (largest downpayment) as that is often an indication that they will be more likely to make it successfully through the contract contingencies (inspection, financing, appraisal) to settlement. Second, artificially increasing a contract price in order to have part of your closing costs included in that contract price will most often raise the bar as far as the the price for which the house will need to appraise. If presented with a $240K offer and a $245K less $5K offer, nearly all sellers will choose the $240K offer so that the house only has to appraise for $240K and not $245K. So... if you need a closing cost credit when buying a home... that's fine, it's still happening sometimes... but not nearly as frequently as it was in the recent past. | |

Average 30 Year Mortgage Interest Rate Rises Almost A Full Percentage Point In A Year |

|

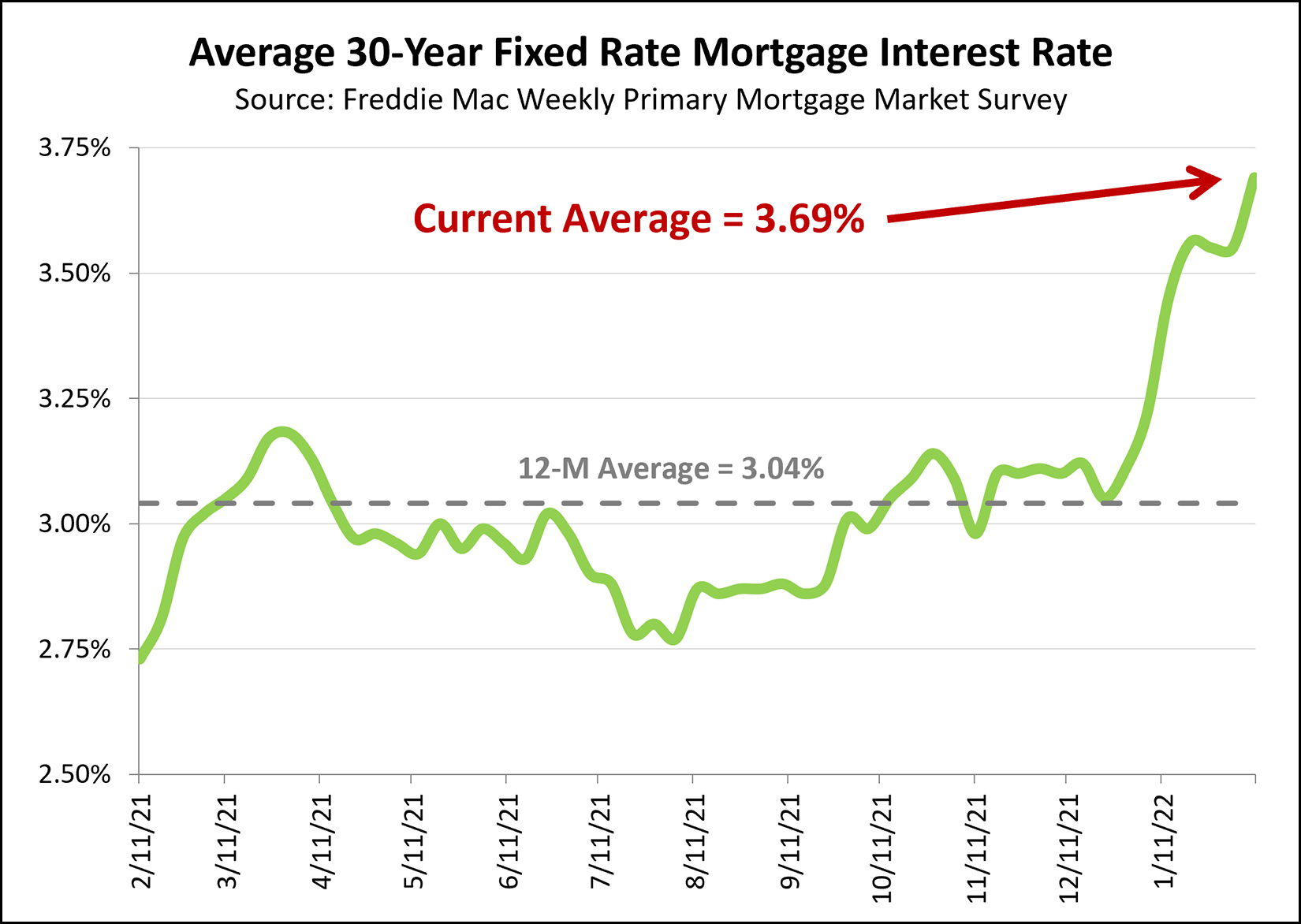

About a year ago, on February 11, 2021, the average 30 year fixed mortgage interest rate was 2.73%. A few days ago, on February 10, 2022, the average rate was 3.69%. So, yes, rates are rising, which means mortgage payments are rising for anyone who is not paying cash. In other words, for most home buyers. For example, if you were financing 90% of your $300K purchase...

But if you were buying a $300K home a year ago, given roughly the 10% increase in the median sales price over the past year it would be a $330K home today. So it's really more like...

The cost of housing is certainly increasing rather quickly right now given increasing prices and increasing mortgage interest rates! | |

Will Home Prices Drop As Mortgage Interest Rates Rise? |

|

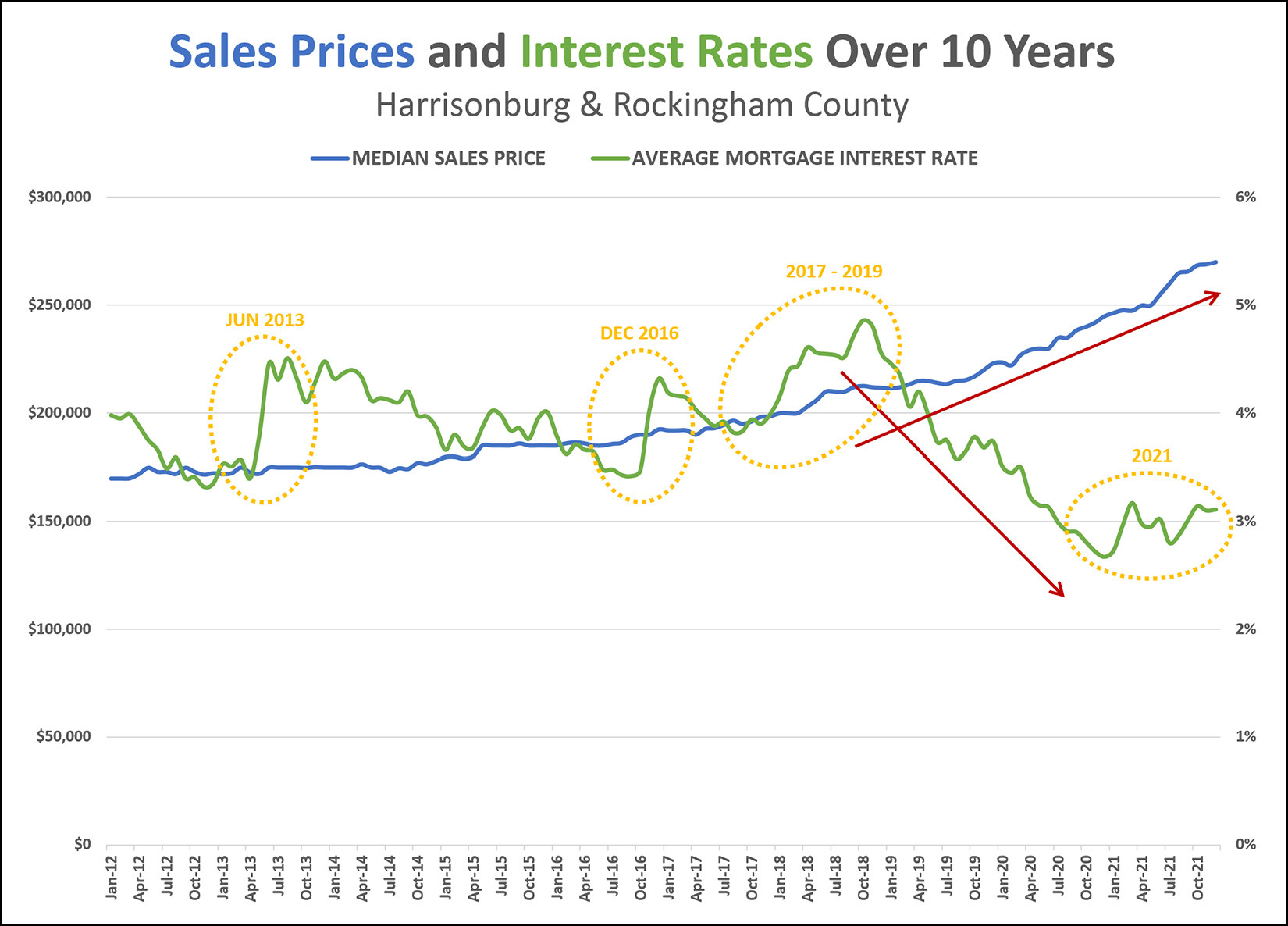

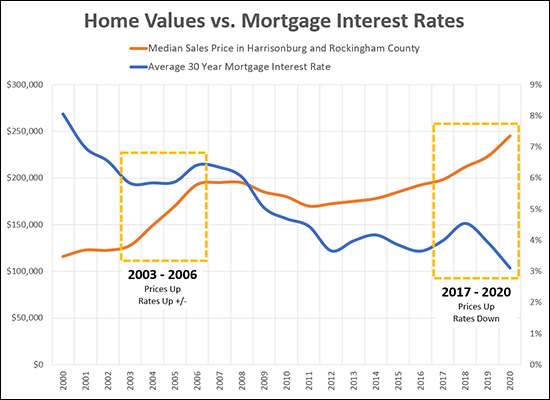

Question... Will Home Prices Drop As Mortgage Interest Rates Rise? Short Answer... I don't think so Long Answer... Above you'll find a graph showing the median sales price in Harrisonburg and Rockingham County over the past ten years, shown in blue, and the average mortgage interest rate during the same timeframe, shown in green. A few things to point out... [1] Yes, it is accurate to observe (see the red arrows) that while the median sales price was increasing rather quickly over the past four years, the the average mortgage interest rate was also dropping steadily. Did prices only rise because rates dropped? No, that does not seem likely at all. Did prices continue to rise as much as they did at least partially because rates were so low? Yes, that seems relatively likely. [2] Interest rates rose sharply in June 2013 and December 2016 (see the first two yellow circles) and sales prices did not start declining -- though, those increases in rates were followed by prolonged periods of declining interest rates. [3] Interest rates rose steadily (!) between mid-2017 and early 2019 (see the third yellow circle) and sales prices did not decline. [4] Interest rates started rising, and falling, and rising, and falling through pretty much all of 2021 (see the fourth yellow circle) and prices kept right on climbing. So... as we head into 2022 and as we start to see mortgage interest rates rising... will home prices decline? It seems unlikely that an increase in mortgage interest rates, alone, would cause home prices to decline. Yes, it is true that a buyer's potential mortgage payment will increase with higher interest rates, so that might reduce their buying capabilities - but plenty of home buyers, in this area, these days, seem to be buying below the top of what they could afford to buy -- so slightly higher mortgage payments may not affect them as much as we'd think. That was a lot of thoughts -- about a lot of numbers -- if you have thoughts of your own, feel free to email me as I welcome a variety of opinions and perspectives! | |

Will Mortgage Interest Rates Really Rise In 2022? |

|

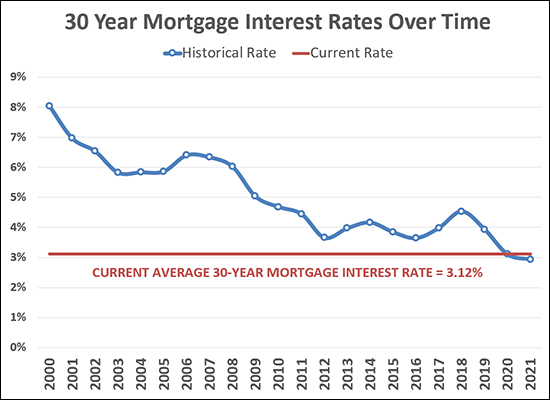

Will mortgage interest rates really rise in 2022? Yes, he said, knowing he has said "yes" for years and has been wrong over and over. ;-) To be fair, I guess interest rates did rise between 2012 and 2014 and again between 2016 and 2018. But, they've been below 5% for over a decade now -- and have been below 4% for eight of the past ten years. So, again, will interest rates really rise in 2022? After steadily declining since 2018, yes, it seems likely that interest rates will start rising again in 2022. But, it seems quite likely that I could be wrong, again. :-) | |

Mortgage Interest Rates Are Definitely Headed Up, For Sure, Oh Wait!? |

|

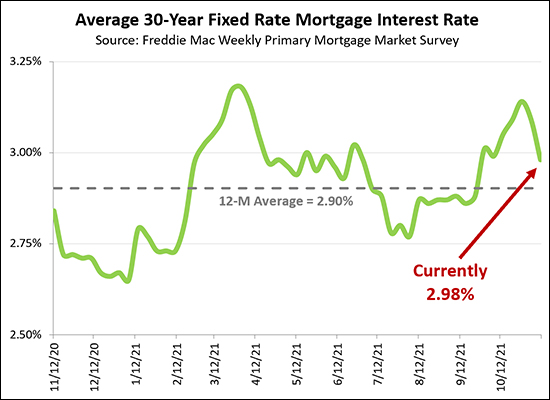

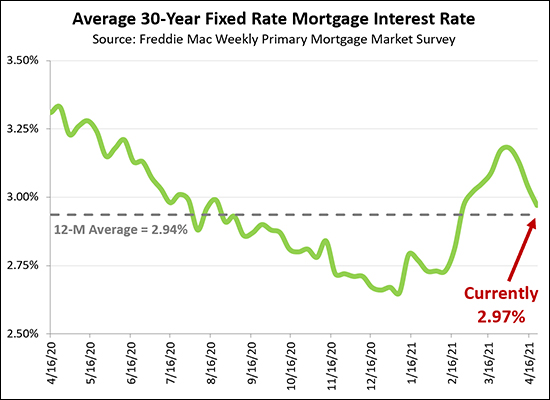

I can't even count how many times over the past five-ish years that I have said mortgage interest rates would certainly be rising again, soon, for sure. I have certainly been thinking that over the past few months, but... maybe they're not!? Consider these data points for the average 30 year fixed mortgage rate... One Year Ago = 2.84% April 2021 = 3.18% (a peak) August 2021 = 2.77% (a valley) October 28 = 3.14% (apparently, a peak) Today = 2.98% This is all show in the graph above, as well. After interest rates rather steadily rose between August and October, it seemed almost certain that they would continue to rise, staying above 3% for perhaps the indefinite future. But, then, for the past two weeks, mortgage interest rates have declined, now landing below 3%, again. So, yeah, mortgage interest rates are definitely going to go up now, soon, for sure. Just like I have been saying, inaccurately, for years now... | |

If You Are Buying A Home Soon, Consider Starting Your Loan Application Now |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

Buying A Home Before Selling Your Current Home |

|

If you plan to buy a home this fall -- but you already own a home, that you plan to sell -- then one of your first conversations should likely be with your favorite mortgage lender. It's a seller's market, after all, which means that... [1] When you are selling your home, you will likely find yourself able to negotiate favorable terms with most buyers making an offer on your home. ...but... [2] When you are making an offer to buy a home, the seller will likely have the upper hand in negotiations. As such, if you are planning to make an offer to buy a house with any of these scenarios, you are unlikely to be successful...

So, if you want to have a fighting chance at buying a home right now, you will likely want to explore what it would look like to buy before (or independent of) selling your home. Basically, will your lender allow you to buy a new home before selling your current home. If your lender says this is possible -- and if you are comfortable with it -- this will allow you to pursue houses that come on the market and make offers that are not contingent on the sale of your home. But again, all of this starts with a conversation with your lender. So, if you want to buy this fall, but will also need to sell, and you're not sure if you can buy before selling -- talk to a mortgage lender ASAP to find out! If you need recommendations on some great mortgage lenders in this area, feel free to email me. | |

Is A Cash Offer Really That Much Better Than One With Financing? |

|

Many sellers, when receiving a cash offer and one with financing, ask themselves (or their agent) whether a cash offer is really that much better than one with financing. As with many questions in real estate, it depends... First, a $400K cash offer and a $400K offer with financing will both (any other contingencies aside) result in the same amount money going to the seller -- $400K less mortgage payoffs and transaction costs. So, in that way, a cash offer and an offer with financing are pretty similar -- the seller gets the same amount of money. These two offers, though, start to feel pretty different...

In this case (above) the second buyer is likely is not very financially capable and that could mean there would be difficulties in the buyer obtaining financing to complete the home purchase. The fact that the lender is an unknown variable can also give a seller pause as they compare the two offers. These two offers, though, may very well seem pretty similar to a seller...

In this case (above) the second buyer would seem to be very financially capable, in that are putting a sizable deposit down and have a significant amount of funds to use as a down payment. The fact that the lender is a known variable (local, reliable) means that the offer is very likely to proceed quickly and smoothly to closing. So, in the end -- should a seller look at a cash offer as being undoubtedly better than any offer with financing? Not necessarily. An offer that is similar in offer price, with 80% financing, a sizable deposit, and where a buyer is working with a known local lender is just about as strong as a cash offer in almost all circumstances. | |

Home Prices Are Rising Quickly But Buyers Seem To Be Well Qualified To Buy What They Are Buying |

|

I started working in real estate way 18 years ago, way back in 2003. Between 2003 and 2006 home sales and prices shot up quickly -- and then sales slowed dramatically and prices declined slowly. Does it feel somewhat similar now? We're seeing significant increases in the number of homes that are selling -- and significant increases in our area's median sales price. But -- at least one thing is definitely different right now compared to that 2003-2006 timeframe... Today's home buyers seem to be very well qualified to buy. Back in the early 2000's when sales and prices were careening upward, some/many buyers were only marginally financially qualified to buy the homes they were buying...

These days, things are quite different...

So, yes, the market is heating up like it did in 2003-2006, but this go round, home buyers seem to be very well qualified to buy what they are buying. That would seem to be good news for the future stability of our local housing market. | |

I Do Not Think The Housing Market Would Collapse If Mortgage Interest Rates Rose A Bit |

|

Mortgage interest rates have been very low for quite a while now. The average 30 year fixed rate fell below 4% just over two years ago -- on May 30, 2019 and has never looked back. Furthermore, this average rate has been below 3% for 36 of the past 41 weeks. So, yes, mortgage interest rates are low. Super low. Eventually, they will start to rise -- maybe above 3%, maybe to stay above 3%, maybe above 3.5%, maybe even up to 4%! When mortgage interest rates start to rise, will the housing market collapse? Will prices fall? I am thinking not -- so long as interest rates move slowly and steadily and not quickly and erratically. Right now many houses are seeing 5+ (or 10+) offers within just a few days of being on the market. Not all houses, in all price ranges, in all locations -- but many houses! What will happen if interest rates start to rise? Perhaps if they rise far enough, some of those buyers will no longer be qualified to buy -- or will no longer comfortable buying based on their mortgage payment. But what will that actually mean? Maybe instead of 5 - 10 offers on a house there will be 4 - 8? Or 3 - 7? Demand exceeds supply by sooooo much right now that if mortgage interest rates rise a bit, unwinding some of that demand -- it will almost certainly still be a very strong seller's market -- just not a very, very, very strong seller's market. So, if you start to see mortgage interest rates rising, yes it is possible that it will eventually have an overall impact on our local housing market -- but I don't think it is likely to change the overall market fundamentals. | |

Monthly Housing Costs Remain Level Despite Rising Prices |

|

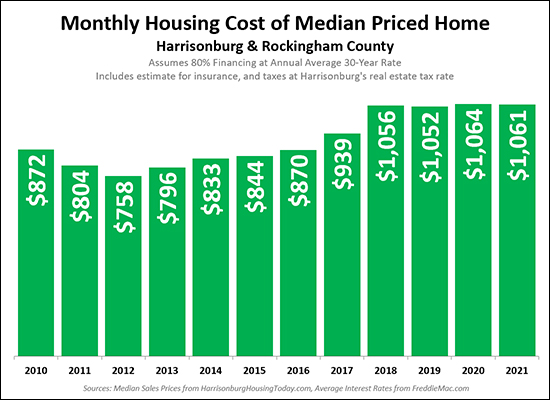

The median sales price in Harrisonburg and Rockingham County has increased 17% since 2018 -- rising from $211,750 up to $248,700. Yet, despite buyers paying higher sales prices for homes -- the monthly mortgage payment associated with that rising purchase price has barely risen at all. If a buyer financed 80% of $211,750 back in 2018 they would have had a mortgage payment of around $1,056. If a buyer finances 80% of $247,700 today, they are likely to have a mortgage payment of around $1,061. This has, of course, been possible because mortgage interest rates have generally declined over the past few years while home sales prices were rising. So, the good news is that even if you are paying a higher price for a house today then you would have over the past few years you likely will not see a corresponding comparative increase in the monthly housing cost associated with that higher purchase price.

This won’t necessarily last forever as interest rates will at some point start to drift upwards… or even if interest rates stay where they are now, if prices continue to climb over the next few years the corresponding monthly housing costs will start to increase as well. So everybody should just buy a house now, right? Easier said than done - as a result of a tremendous amount of competition in the market. Perhaps these steady monthly housing costs due to lower mortgage interest rates are what have drastically increased the amount of buyer demand in the market? | |

30 Year Mortgage Interest Rates Drop Below Three Percent Again |

|

Mortgage interest rates started out at 2.65% this January and kept on rising -- all the way up to 3.18% on April 1st. But, then, they started declining again. Interest rates are now averaging at 2.97% for a 30 year fixed rate mortgage. That is well below where we were...

Today's home buyers are certainly happy to be seeing interest rates declining again, as it helps to offset the rapidly increasing prices that they find themselves paying for houses in this quickly moving and highly competitive market. | |

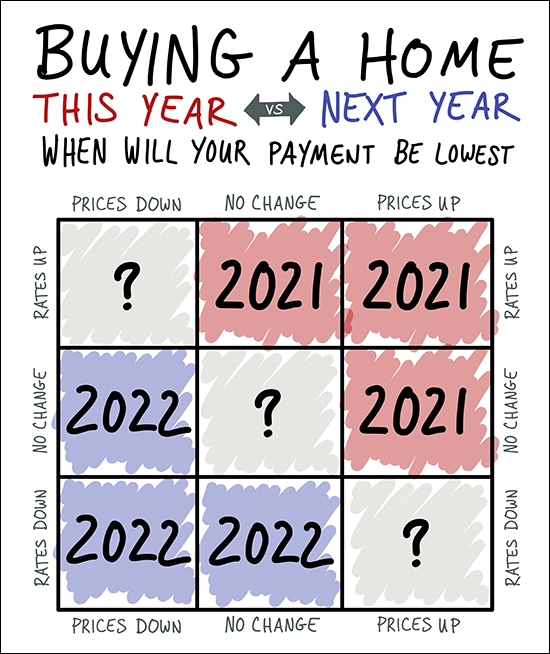

Will Buying A Home This Year Or Next Year Result In The Lowest Mortgage Payment? |

|

If you are hoping to minimize the amount of your monthly mortgage payment, should you buy a house this year? Or next year? Well, as shown above, it depends on whether you think home prices will be higher or lower (or the same) next year -- and whether you think mortgage interest rates will be higher or lower (or the same) next year. Most folks think mortgage interest rates will be higher next year than they are now. If so, it's most likely that you'd be better off buying this year rather than next to have a lower monthly payment. Even if rates continue to be this low, if prices continue to rise (as they seem likely to do) then again, you'll be better off buying this year than next. Since it seems relatively unlikely (highly unlikely?) that interest rates will go down over the next year, the only way you'd have a lower mortgage payment next year than you would now is if mortgage interest rates do NOT rise AND homes prices decline. So -- as to whether you should buy this year or next -- you tell me, based on your best guesses as to what interest rates and home prices will do over the next year. My best guess is that you'll pay more in a monthly payment for a house if you buy next year than you would if you buy this year. Now, all that said, we'll have to somehow secure you a home amidst a competitive market with lots of buyers -- but it's possible! | |

Are Home Prices Only Going Up Because Mortgage Interest Rates Are Going Down? |

|

Disclaimer: I am not an economist. I don't play an economist on TV. Or on this blog. Feedback from actual economists, or accountants, or financial analysts, or wise guys is welcome: scott@hhtdy.com So, are home prices going up because mortgage interest rates are going down? Maybe yes AND no? Yes...

No...

So What...

Why...

| |

It Is Hard For Home Buyers To Compete If They Have A Small Downpayment Or If They Need Closing Cost Assistance |

|

A few short years ago...

These days...

A few short years ago...

These days...

So, it's not that you can't buy a home with a small down payment or if you need a closing cost credit -- but it will be a lot harder to do so these days, largely because of other competing buyers who have a larger down payment and/or who do not need a closing cost credit. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings