| Newer Posts | Older Posts |

Median Sales Price Increases $23,000. Monthly Payment Increases $3. Wait! What?? |

|

Yes, you read that correctly. Over the past year...

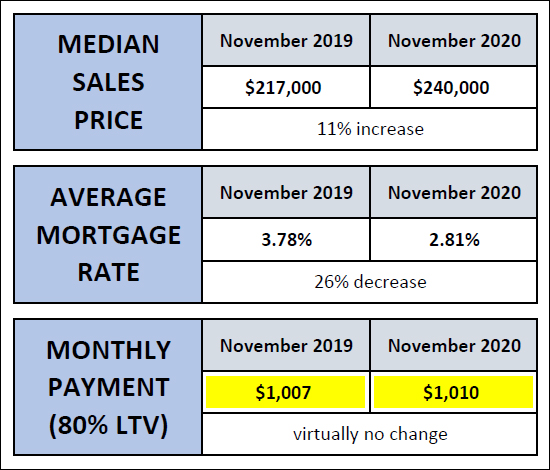

Oh, the magic and mystery of declining mortgage interest rates! :-) Over the past year we have seen a rather rapid increase in home prices. The median sales price in Harrisonburg and Rockingham County one year ago was $217,000. Today, it is $240,000. This is an 11% increase in the median sales price over the course of 12 months which is a much faster than normal increase. And yet, if a buyer finances 80% of the purchase price, their mortgage payment will only be $3 per month higher than it would have been a year ago. Wait! What?? That's all thanks to ridiculously low mortgage interest rates! One year ago the average mortgage interest rate was 3.78%. Today's average mortgage interest rate is 2.81% -- which is 26% lower than the rate from a year ago. So, if you're surprised that a buyer today is willing and able to pay 11% more for a house than they were a year ago -- don't be! Most buyers are financing their home purchases, and thanks to today's low mortgage interest rates, they are still paying basically the same amount as a monthly payment now as they would have been a year ago. Put slightly differently... A year ago, Fred was working in a job that paid him $X per year, which allowed him to afford a mortgage payment of around $1,000 per month, which allowed him to purchase a median priced home of $217,000. Today, Fred's cousin, Ted, is working in a job that pays him $X per year (the same amount as Fred), which allows him to afford a mortgage payment of around $1,000 per month, which allows him to purchase a median priced home of $240,000. Pretty wild. Now, if (when!) those mortgage interest rates start rising -- then the cost of housing will start to increase -- though that's what we generally expect it to do. | |

Mortgage Interest Rates Will Never Be This Low Again, I Said Countless Times In Recent Years |

|

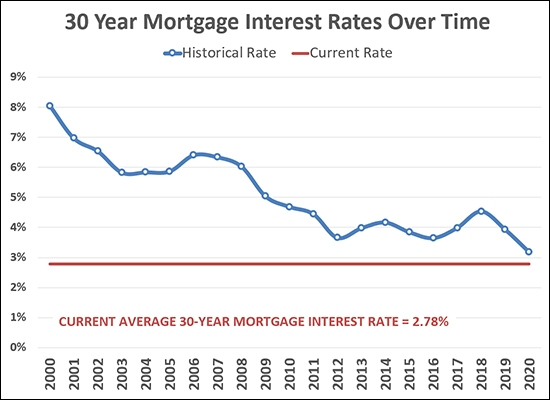

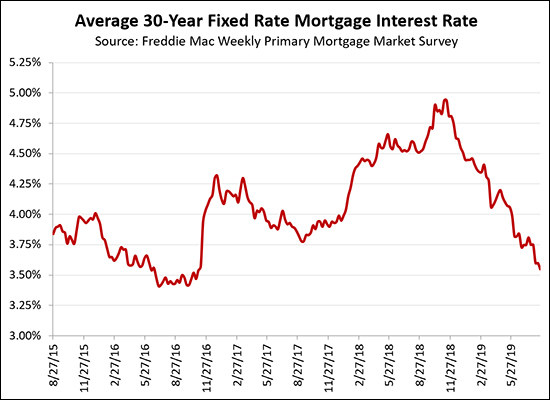

I've been in this business for 17 years now. When I started, mortgage interest rates were right around 6%, which was amazing, given that they had been up above 8% just three years prior. But then, after major housing market adjustments in 2007 and 2008, mortgage interest rates started dropping. They kept on going down until they were just below 4% in 2012. This was, again, amazing! We then actually saw some ups and downs between 2012 and 2018 -- though rates generally stayed between 3.5% and 4.5%. And where do we find ourselves now? Below 3%! Again, amazing! Current average interest rates are 2.78% -- and I have had clients buy homes this year with fixed rate mortgages as low as 2.5%. If you happen to be buying a home (or investment property) right now you are going to greatly enjoy the low rates that you will be able to lock in for years to come! | |

How Early Should You Make Loan Application? |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

If You Have Not Heard, Mortgage Interest Rates Are SUPER Low Right Now |

|

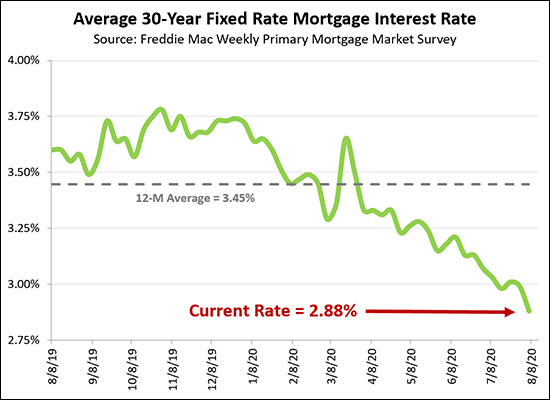

If you had asked me a year ago whether we'd see interest rates get as low as 3% - or lower than 3% - I would have said "no, definitely not, they couldn't get that low!" But, it seems I would have been wrong. The average mortgage interest rate (for a 30 year fixed rate mortgage) has continued to decline over the past four months from around 3.5% all the way down to the current rate of 2.88%. It seems likely that interest rates will continue to stay rather low in the coming weeks and months -- though I don't know if they will / can really stay below 3%. If you happen to be buying a home right now, PLEASE lock in your interest rate this week!! :-) | |

How To Run The Numbers On Upgrading To A New Home |

|

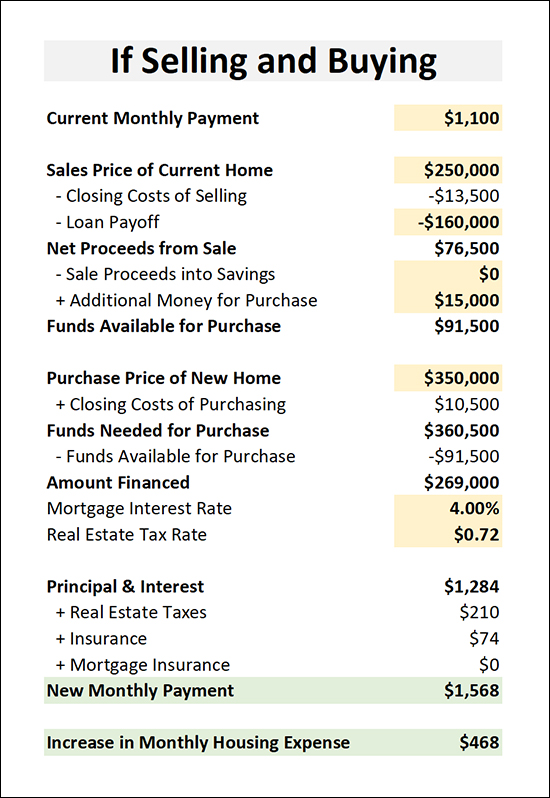

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

You Might Not Want To Spend As Much As You Are Qualified To Spend On A Home |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, shoot me an email (scott@hhtdy.com) and I can give you some recommendations. As you are navigating the home financing process, I am happy to help you understand the information you are receiving and the decisions you are being asked to make. There are a variety of loan programs that can likely work well for your situation, but we'll want to make sure you are aware of all of your options. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

How Often Do Home Sellers Provide A Closing Cost Credit? |

|

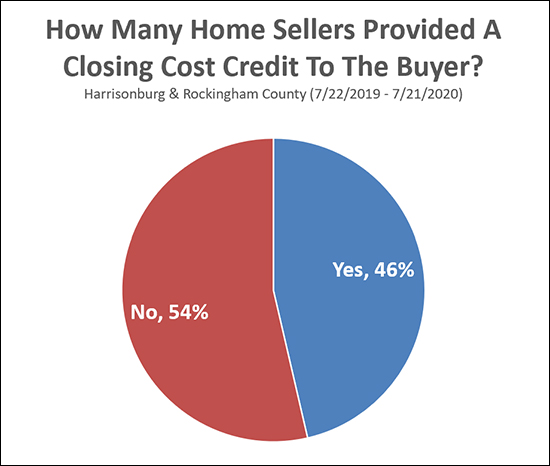

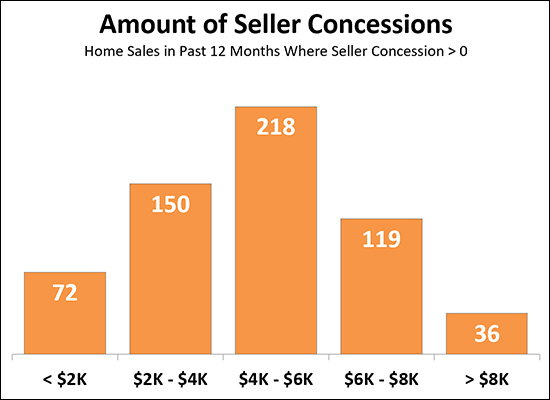

Looking back over the past year it seems that slightly fewer than half (46%) of home sellers provided a closing cost credit to the buyer for their home. It is not altogether surprising that many buyers ask for a seller paid closing cost credit. With interest rates so low, it is not a crazy idea to incorporate some of your closing costs into the mortgage by increasing the purchase price and mortgage amount by a few thousand dollars. Here, then, is how much sellers paid in buyer closing costs over the past year in the 46% of the cases where the seller did provide such a credit...  So, if, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 46% or so of sellers do so! | |

Home Buyers In 2020 Are Locking In Ridiculously Low Mortgage Interest Rates |

|

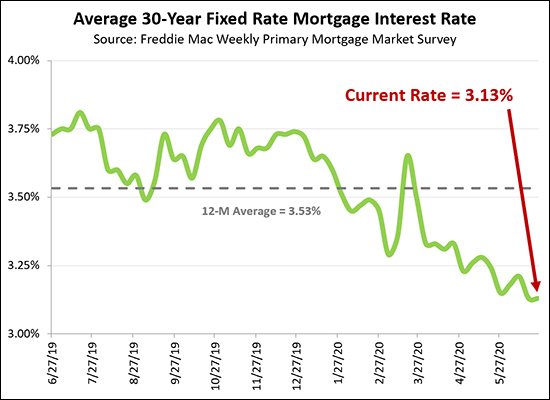

If there is one trend line that we like to see declining -- it's mortgage interest rates! :-) The interest rates at which buyers are financing their mortgages have been lower and lower and lower as we have progressed through 2020, and are now right around 3.13%. If you are thinking about buying a home in 2020 and IF you can secure a contract on a house despite LOTS of competition from other buyers, you are likely to be financing your mortgage at one of the lowest mortgage interest rates ever seen! Perhaps that is fueling some of surge of buyers currently in the market? | |

Renting or Buying A Home Within A 5 Year Time Horizon |

|

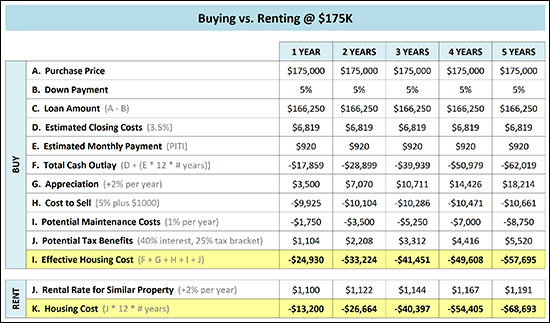

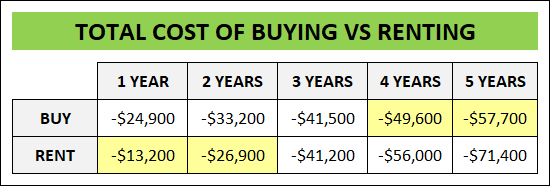

If you will only be in your next home for two (or 1, 3, 4 or 5) years -- should you buy that home? Or just rent a home instead? Let's take a look, assuming a price point in the current market of around $175K - which is likely to be a townhouse and might be what you are considering as a first time buyer...  As becomes pretty quickly, above, it doesn't necessarily make much sense to buy if you are only going to be in your home for 1 or 2 years -- and once you get to a time horizon of 4 or more years, it almost certainly makes sense to buy a home. For clarity, let's look at how I'm determining the cost of renting and buying this fictional house... The Total Cost of Renting Includes... Monthly rental rate x 12 x # years Yep, that's it The Total Cost of Buying Includes... Monthly mortgage payment x 12 x # years + closing closing costs when buying your home (3.5%) + cost of selling your home (5% + $1K) + potential maintenance costs (1% / y) - appreciation of your home's value (2% / y) - potential tax benefits of interest paid (int x 40% x 25%) Here's a visual (click for a closer look) as to how those numbers line up over a one through five year time horizon... I should also note that it is quite possible to be "just fine" from a financial perspective if you buy and only end up being in the home for a year or two if...

As you are thinking through whether you should buy or rent -- at a $175K price point or otherwise -- feel free to touch base with me and I can give you some feedback and advice based on your overall circumstances. | |

Monthly Housing Costs Decline A Bit In 2020 Thanks To Record Low Mortgage Interest Rates |

|

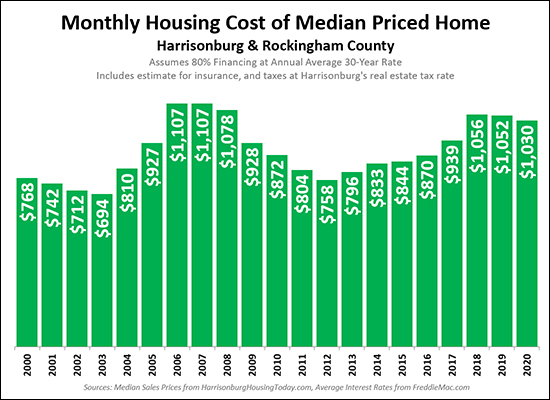

The monthly cost of a mortgage on a median priced house has actually declined a bit this year! For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Over the past year...

So, even though prices are higher now than over the past two years, the monthly housing cost for financing 80% of the purchase of a median priced home has actually declined. | |

Mortgage Interest Rates Are Absurdly Low |

|

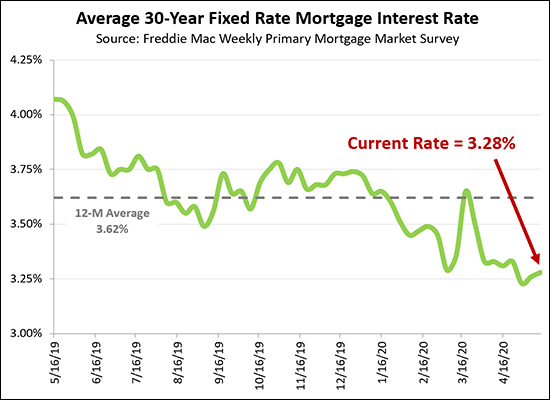

Fortunate are the home buyers who happen to be buying right now -- and locking in super low mortgage interest rates! Over the past year, interest rates have been at an average of 3.62% -- but that has varied widely from being over 4% a year ago, to now being right around 3.25%. Rates have never (ever, ever, ever) been this low! If you are buying right now, you are fortunate to be locking in a very low mortgage interest rate, and it will likely never make sense to refinance! | |

Mortgage Applications, Often A Good Leading Indicator Of Buyer Activity, Rising Quickly! |

|

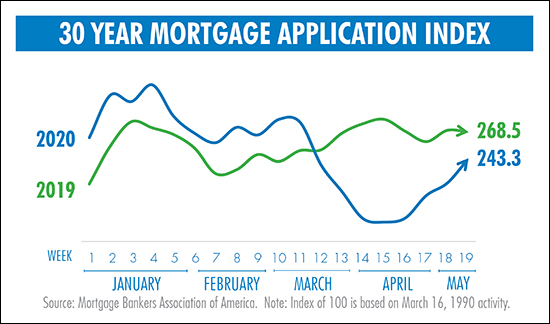

The number of people making applications for mortgages tends to be a good indicator of current and future buyer activity. The graph above shows that mortgage applications in 2020 were a good bit above 2019 through the middle of March and then they took a nose dive. That said, over the past two weeks, the rate of buyers making mortgage applications has started to rise quickly again -- and is nearing the same place it was a year ago at this time. Mortgage applications precede close sales by a month or two (or more) so this may be an early indicator that buyer activity is starting to stabilize and increase again. of note -- this is a national trend - locally, we did not see as much of a drop off in buyer activity in March and April as this graph would suggest. | |

Looking At The Big Picture, Financially, Of Both Selling AND Buying a House |

|

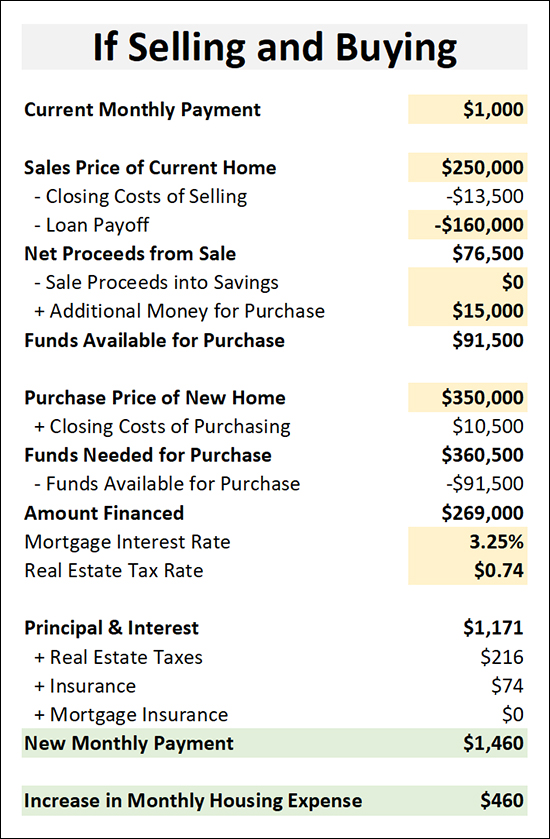

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

Refinancing Your Mortgage Might Make Sense |

|

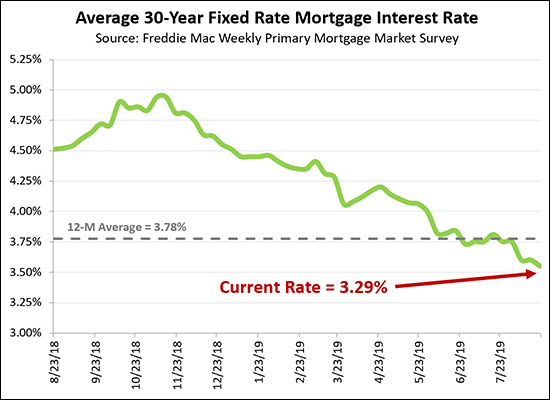

This is more of an alert to homeowners, not so much to buyers or sellers -- but if you haven't heard, re-financing your mortgage might make sense right now depending on your mortgage interest rate. The current average mortgage interest rate on a 30 year fixed rate mortgage is 3.29! This is the lowest we have ever seen, ever. If your current mortgage interest rate is higher than 4%, and you plan to stay in your home for the next few years, you should at least chat with a lender to see how these low interest rates could benefit you. You can likely either reduce your mortgage payment, or shorten the remaining life of your mortgage, or both! Feel free to touch base with me if you want some recommendation for local mortgage lenders. | |

Mortgage Interest Rates Hit All Time Low at 3.29% |

|

Mortgage interest rates have never been lower than right now. No, really! The current average 30-year fixed rate mortgage is 3.29% and that is the lowest level seen in the 50 years that this rate has been tracked! So, if you're buying a home in the near future, you will be locking in at historically low interest rates. And if your current mortgage is at an interest rate of perhaps 4.5% or higher, it might make sense to refinance! | |

Three Ways To Pay For Mortgage Insurance |

|

George Mason Mortgage has an excellent overview of the three main ways to pay for mortgage insurance. But before we go there, what is mortgage insurance? If your down payment is less than 20% of the purchase price, your lender may require that you pay for mortgage insurance to cover their greater risk because of your smaller down payment. Two quick points...

And now, the three main ways to pay for this mortgage insurance...

| |

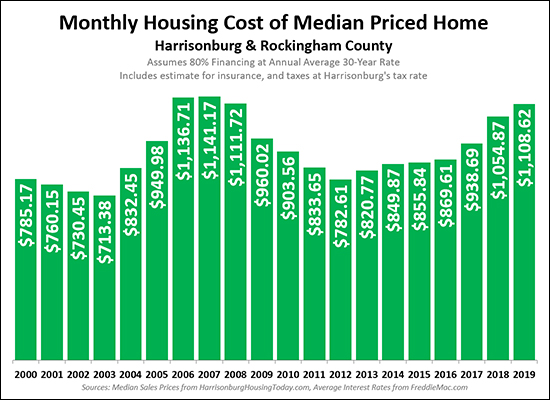

Monthly Housing Cost for Median Priced Home Climbs Further in 2019 |

|

As should come as no surprise, the monthly cost of housing is increasing -- and has been increasing more quickly over the past several years (2018, 2019) as compared to many prior years. The graph above devises a monthly cost of housing using the median sales price of homes sold in Harrisonburg and Rockingham County and the mortgage interest rate at the time. The payments above assume that a buyer finances 80% of the purchase price at the prevailing rate -- and these housing costs include an estimate of real estate taxes and homeowners insurance. Of interest -- this monthly cost...

Over the next few years, it seems likely we will see a continuation of this trend, as sales prices and mortgage interest rates are both likely to continue to increase. | |

Spend How Much You Want To Spend On A Home, Not Necessarily How Much You Can |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, shoot me an email (scott@hhtdy.com) and I can give you some recommendations. As you are navigating the home financing process, I am happy to help you understand the information you are receiving and the decisions you are being asked to make. There are a variety of loan programs that can likely work well for your situation, but we'll want to make sure you are aware of all of your options. Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

When To Actually Apply For A Mortgage When Buying A Home |

|

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

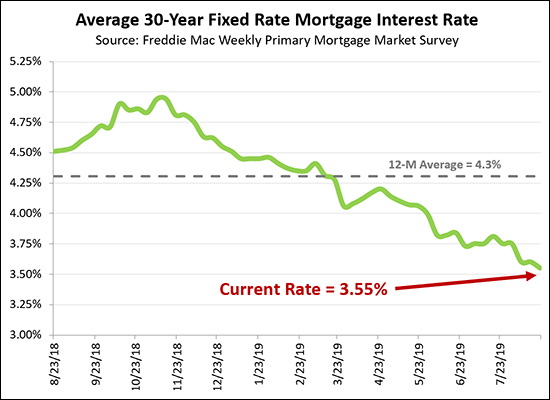

High Temps, But Low Mortgage Rates Throughout Summer 2019 |

|

Mortgage interest rates kept dropping lower - and lower - and lower all summer long! The current average rate for a 30 year fixed rate mortgage is only 3.55%, well below the 12 month average of 4.3%. If we look back even further, we're approaching the lows of mid-2016...  All of this adds up to VERY favorable times to be buying a house - in that you can lock in your monthly housing costs at some of the lowest long term interest rates ever seen. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings