| Newer Posts | Older Posts |

Building A Budget When Buying A Home |

|

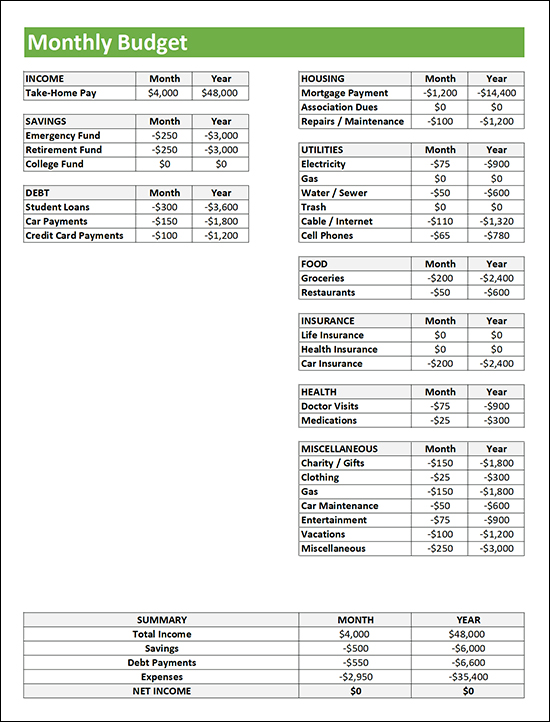

Several buyers have recently asked me about how to determine how much they can and should spend on a home purchase. Those are actually answered differently... CAN -- How much you *can* spend will best be determined through a conversation with a mortgage lender. They will evaluate your income, existing required recurring debt payments, credit score, etc., to tell you the maximum that you can spend on a home. SHOULD -- How much you *should* spend is best determined by calculating what portion of your income you are comfortable spending on housing while still having enough left over for all of your other life expenses. In other words, a budget! I created the budget spreadsheet shown above (download it here) as a starting point for thinking this through. Let me know if you have questions about how to use this spreadsheet. And let me know if you'd like a recommendation on a local mortgage lender. | |

Crunching the Numbers on Both Selling AND Buying a House |

|

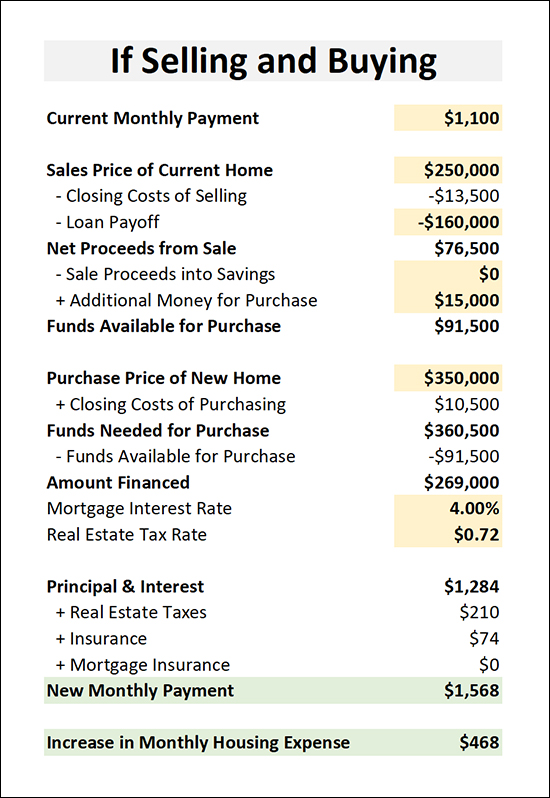

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

Summer Home Buyers Will Love These Low Mortgage Interest Rates |

|

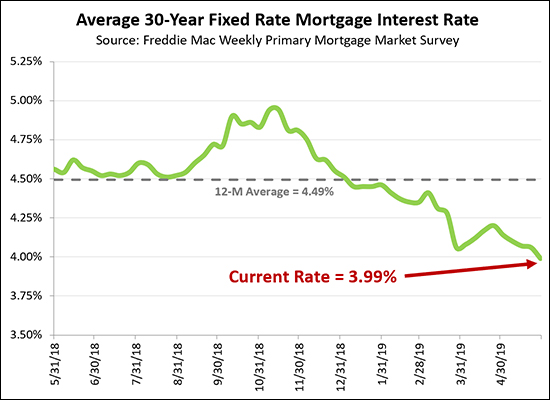

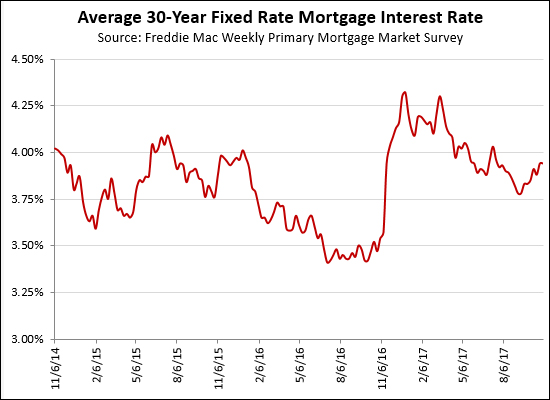

Interest rates climbed nearly all the way to 5% this past Fall -- and over the past year have been at an average of 4.5%. But since the first of the year, mortgage interest rates have been falling, falling, falling, further and further! They are now, unbelievably at 3.99% for a 30 year mortgage. So - if you're contracting to buy a house in the near future you may want to lock your interest rate in sooner rather than later. It's hard to imagine we'll stay under 4% for long. | |

Monthly Housing Costs Actually Decline, A Bit |

|

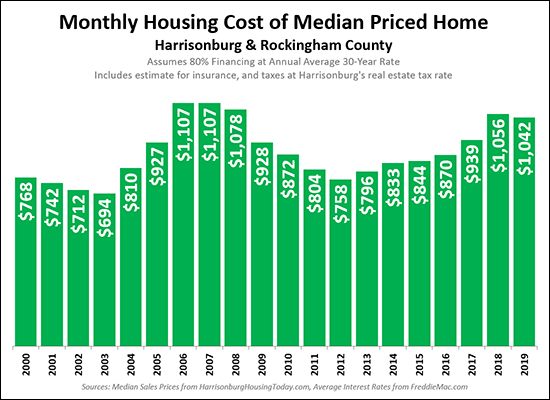

The monthly cost of a mortgage on a median priced house has actually declined a bit this year! For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Over the past year, the median sales price has only increased 1%, and the average mortgage rate has declined 6%, which results in a slight decline in the median housing cost -- if you are buying your home, and you have a 20% downpayment. So - monthly housing costs are still relatively high from a historical perspective, but we're not seeing a 12% increase in that monthly cost like we did between 2017 and 2018! | |

Mortgage Interest Rates Are Falling, Falling, Falling |

|

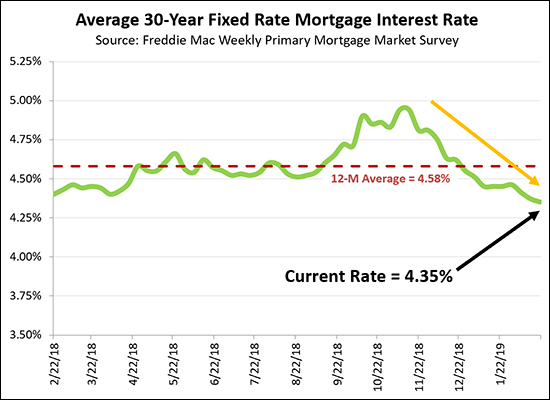

In what can only be described as good news for home buyers -- mortgage interest rates keep declining! In November 2017 interest rates had climbed to 4.94% and it seemed we'd soon be seeing 5.something% rates. But then they started to decline again, now all the way back down to 4.35%. If you're planning a home purchase this Spring, this is an extremely enticing time to lock in your interest rate! | |

30 Year Fixed Mortgage Rates Dropped Half Percentage Over Past Two Months |

|

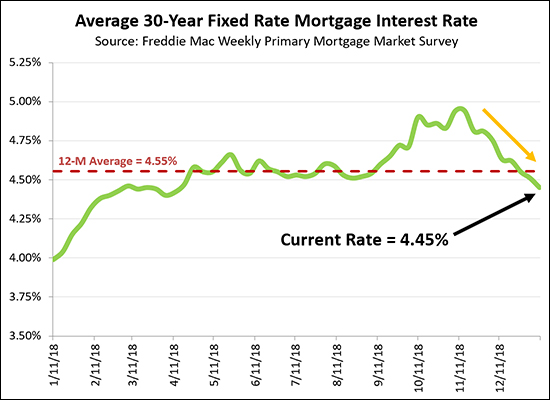

Mortgage interest rates have, indeed, steadily declined over the past two months -- from 4.94% down to 4.45%. That is a half of a percentage point, which is a large decline given the range of mortgage rates we're seeing today. So -- now we're back to where we were for much of 2018 -- or at least April through September. Today's buyers will luck out with a low housing payment compared to what they would have expected two months ago -- IF (this is a big if) they can actually find something to buy in this low inventory environment. Where do rates go from here? It's anyone's guess. This recent drop gives me hope that we could spend all of 2019 under 5%. We shall see! | |

Some Perspective on Changes in Mortgage Interest Rates |

|

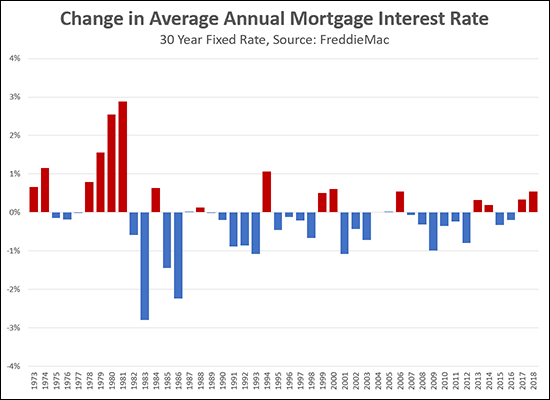

In some ways, my alarm bells are going off!

But yet -- it looks like the average rate for 2018 will only be 0.54% higher than in 2017 -- and the graph above puts that in what might be a somewhat more helpful context. The last red bar (all the way to the right) is an indication of how much the annual average rate will have increased between 2017 and 2018. Any red bar is an increase in the average annual rate. Any blue bar is a decrease in the average annual rate. As such -- the increases we have seen in 2017 and in 2018 are a far cry from the crazy increases seen in 1978, 1979, 1980 and 1981. And there have been several times in the past thirty years when there has been a year or two of increases of less than 1% in a year, that were then followed by decreases in subsequent years. So -- back to real rates -- you could get a mortgage with a rate less than 4% a year ago, and now it would be just under 5%. And it's possible that the rates will keep rising in 2019. But in the big picture:

| |

The Impact Of Higher Mortgage Interest Rates |

|

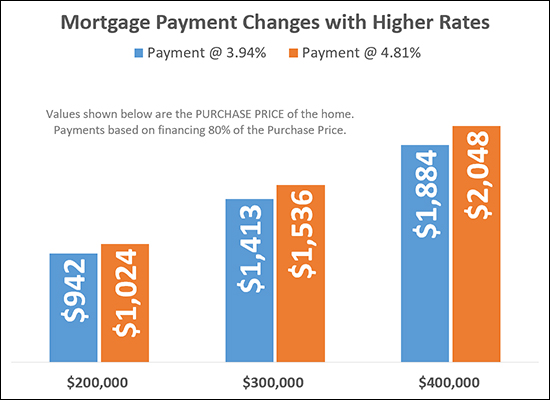

One year ago, the average 30-year fixed mortgage interest rate was 3.94%. Today, that same average rate is 4.81%. Does this rise in mortgage interest rates impact buyers? It sure does! A buyer purchasing a $200K home would pay $82/month more for their mortgage payment -- with the increased interest rate causing it to increase from $942/month to $1,024/month. A buyer purchasing a $300K home would pay $123/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,413/month to $1,536/month. A buyer purchasing a $400K home would pay $164/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,884/month to $2,048/month. Of note -- the estimated mortgage payments above include principal, interest, taxes and insurance -- and assume that the buyer is financing 80% of the purchase price. So.....

| |

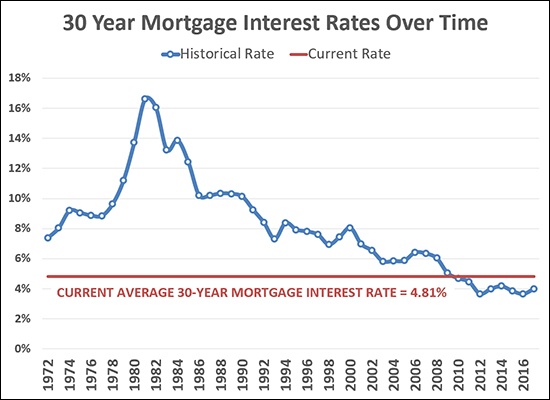

Mortgage Interest Rates At Highest Point in Eight Years |

|

Mortgage interest rates keep on rising. The current average rate for a 30 year mortgage is 4.81%. These two statement are equally true... 1. Current mortgage interest rates are now higher than they have been for the past eight years. 2. Current mortgage interest rates have been higher than the current rate for 38 out of the past 46 years. The lingering question over the past few years has been whether rising interest rates, which pushes monthly housing costs higher, will eventually slow down buyer ability and buyer interest. We don't seem to be seeing that as a current widespread effect, but the more the rates increase the more likely that becomes. | |

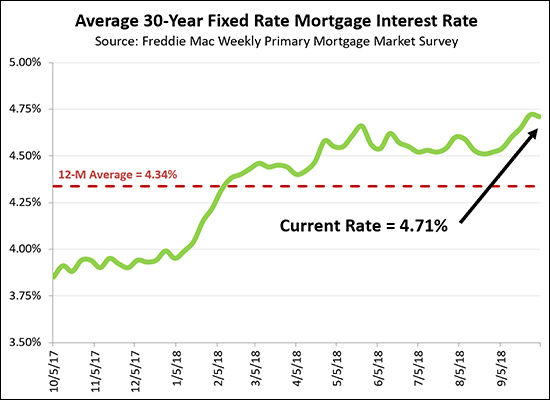

30 Year Fixed Mortgage Interest Rates Keep Rising |

|

Mortgage interest rates keep on rising. The question now seems to be whether the higher rates will take anyone out of the market to buy -- or will put a damper on rising home values / sales prices. Thus far, buyer activity has continued to be quite strong in 2018 despite these modest increases in interest rates. Interest rates have not quite risen a full percentage point over the past year.... 3.85% back in October 2017 4.71% today | |

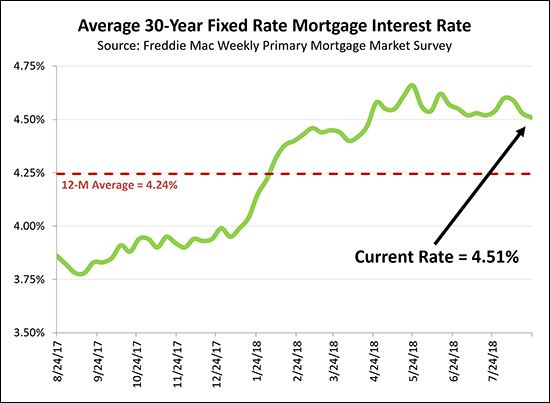

30 Year Fixed Rate Mortgage Interest Rates Seeming Stable Around (Just Above) 4.5% |

|

Despite the fact that interest rates have climbed almost three quarters of a percentage in the past year -- they are now seeming relatively stable, around 4.5%. Over the past three months we have seen interest rates mostly between 4.5% and 4.6%. These interest rates, being higher than the sub-4% rates seen last year, do not seem to be hindering buyer interest and activity -- as we have seen a record year of home sales (thus far) in 2018. If you will be buying a home soon, I would recommend talking to a lender early in the process to get a sense of your buying power and to understand your potential monthly mortgage payments. | |

When To Get Serious About A Mortgage For Your Home Purchase |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

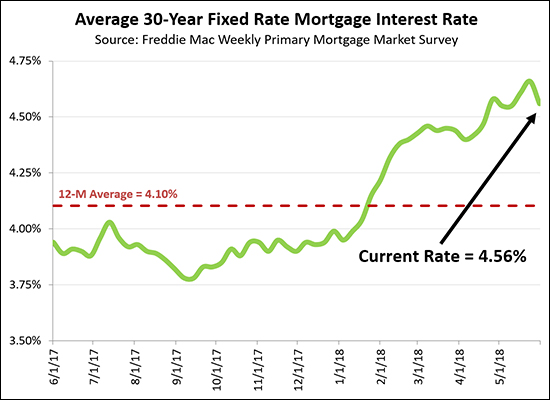

Mortgage Interest Rates Edge Back Down, A Bit |

|

Mortgage interest rates have steadily climbed over the past nine months -- from 3.78% last September to 4.66% about two weeks ago. Now, however, they have drifted back down a bit to 4.56%. Will this be a trend? Are we headed back below 4.5%? Not necessarily. But -- it might be an indication that we're not going to keep on rolling all the way up to 5% anytime soon. If you are buying a home and are under contract to buyer a particular property and have not yet locked in your mortgage interest rate, this week would seem to be a particularly good time to do so. Explore historical interest rates here. | |

Why Is Shopping Around For Mortgage Interest Rates Important? |

|

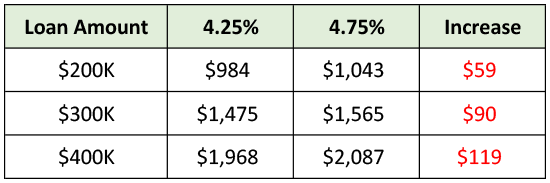

As mortgage interest rates rise, we are likely to see a bit more variation in interest rates between lenders. As such, it is important to check with at least two lenders to make sure you are getting the best possible interest rate on your new mortgage. As shown above, a half of a percentage point shift in the interest rate can make a big difference in the monthly payment. Oh, and if we stretch out that difference over 10 years, assuming you stay in your home that long, here's how much extra you would pay with that higher mortgage interest rate....

Feel free to email me (scott@HarrisonburgHousingToday.com) if you would like recommendations of lenders in this area. | |

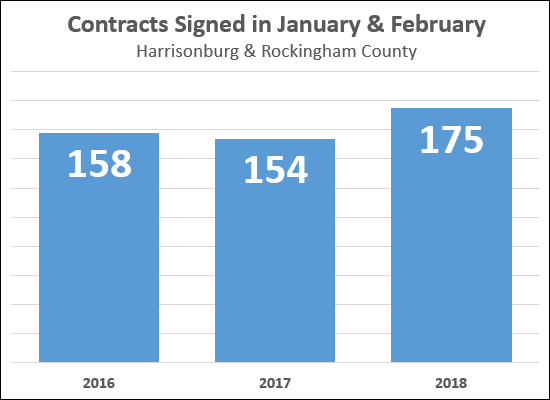

14% Increase in Home Buyers Signing Contracts in January and February |

|

Mortgage interest rates are edging up again, as you may have heard. The average 30 year fixed rate at the end of February was 4.4% -- up from 3.9% just three months prior. Could this (slight) rise in the cost of financing your home be affecting the pace at which buyers are signing contracts? Possibly. It seems that 14% more buyers signed contracts this January and February as compared to last year during the same timeframe. This is a likely indicator that we'll see stronger months of closed sales in March and April. Then, the questions will be....

Let's hope for yes and no, in that order. | |

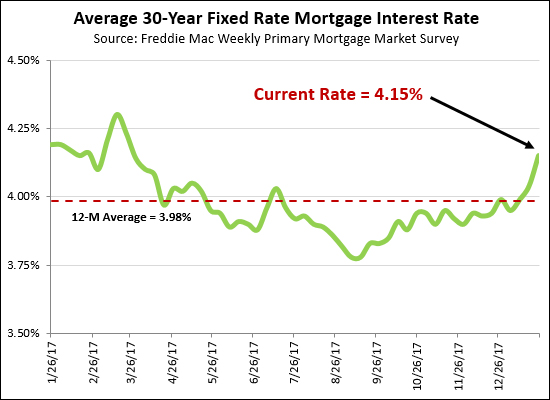

30 Year Mortgage Interest Rates Starting To Rise |

|

While we ended the year just below 4%, the average 30-year fixed mortgage interest rate has now risen to 4.15%. This is a good bit above the 12-month average of 3.98%, though still historically low in any longer term context. It seems possible that we'll see some further increases in coming months, though I don't think rates will get up to 4.5% in 2018. And....it's possible they will drop back down closer to 4% within the next few weeks or months. | |

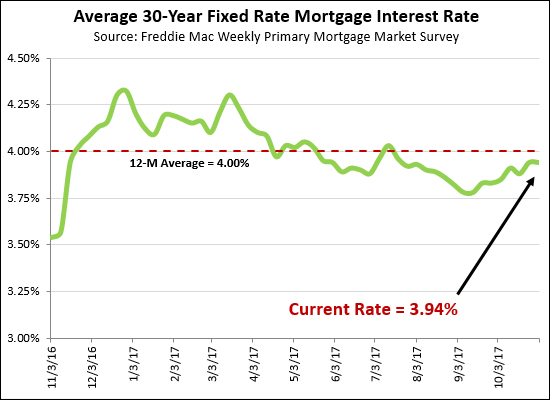

Average 30 Year Mortgage Interest Rates Still Below Four Percent |

|

Mortgage interest rates are still below 4% -- after having spent November 2016 through May 2017 between 4% and 4.5%. Today's buyers are enjoying the opportunity to lock in their monthly housing costs at historically low rates. And -- let's look a bit further back -- at the past three years....  As you can see, above, mortgage interest rates have fluctuated between 3.5% (+/-) and 4.25% (+/-) over the past three years. If you were prequalified for a loan nine months ago (when rates were at 4.3%) you might want to request some updated potential payment scenarios from your lender with the current mortgage rates. | |

A Ruff Breakdown of Why Millennials Are Buying Homes |

|

I'll say no real surprises here, on this analysis put together by SunTrust Mortgage of why millennials are buying homes....

Knowing why you are buying a home, and how long you think you will be in that home, are important things to be thinking about as you are preparing to embark upon the home buying process. Thanks to JoDee Lambert at SunTrust Mortgage for this fun infographic. | |

Sellers Paying More and More of Buyer Closing Costs |

|

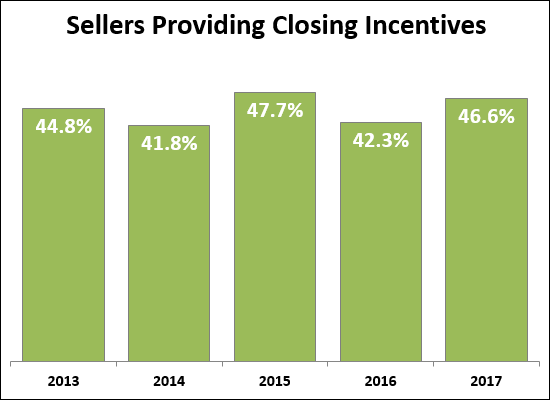

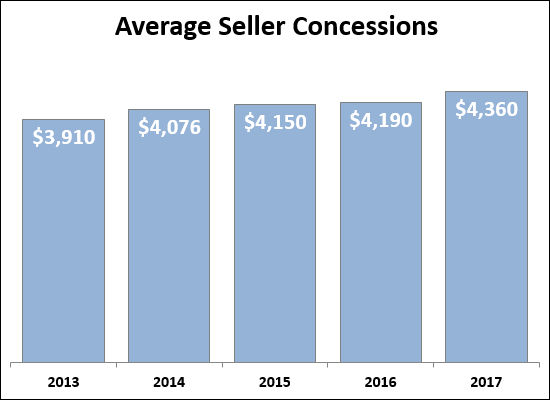

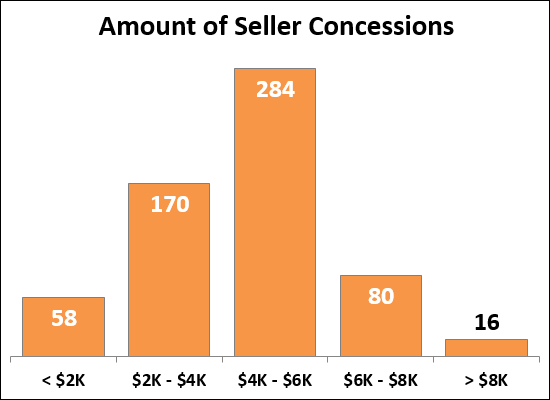

Nearly half of sellers (46.6%) pay some portion of a buyer's closing costs in the form of a credit at closing. Over the past five years, the number of sellers providing a "concession" of this sort to buyers have stayed between 40% and 50%.  Here's the interesting one -- sellers have paid more and more of a buyer's closing costs over time. The average amount of seller concessions has increased steadily over the past five years. But why, you might ask? It's hard to say exactly -- buyers might be asking for more money, sellers might be agreeing to provide a larger credit, or perhaps the total amount of closing costs that a buyer has to pay is increasing as well?  If, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 45% or so of sellers do so! | |

Should you buy or rent a townhouse in Harrisonburg? |

|

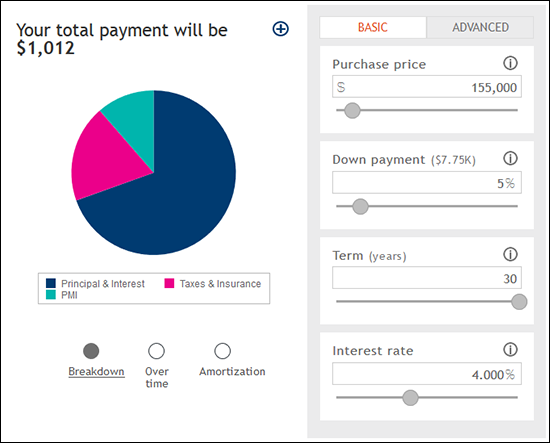

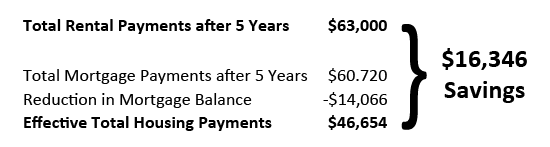

Given continued low interest rates and some increase in home values, let's take a new look at the opportunities of buying versus renting. RENT = $1050/m. There are regularly options for renting a two-story townhouse in Harrisonburg for approximately $1050 / month in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $1012/m. With a 95% loan, buying such a townhouse apparently may cost as little as $1,012 per month assuming a $155K purchase price and a 4% interest rate per SunTrust Mortgage's payment calculator....  This shows a rather small, $38/month, cost savings of buying instead of renting. If we then look at the difference between renting and buying over a five year time period, the advantages start to pile up.  As you can see, this builds a rather compelling case for buying instead of renting if you are going to be living in this potential townhouse for the next five years. Two other factors to keep in mind....

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings