Financing

| Newer Posts | Older Posts |

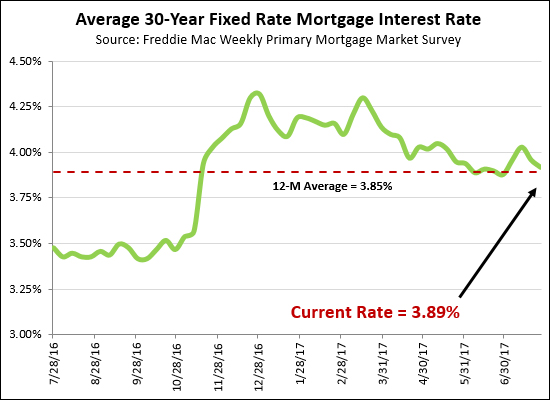

Fear Not, Mortgage Interest Rates Sticking Close to Four Percent |

|

Another month -- and still no meaningful changes in the 30 year mortgage interest rate. Since the beginning of the year, these rates have slowly edged downward, and have now been below four percent for most of the past three months. This continues to provide a great opportunity for home buyers -- likely spurring on continued buyer interest in our local market. As I commented to someone last week, I have been thinking mortgage interest rates were going to start increasing for at least five years now -- and I have been wrong for at least five years now. Will they ever increase? Possibly. When? How? By how much? It's anyone's guess at this point. I think there is probably a 75% chance (maybe a 90% chance?) we'll finish out this year at or below 4.5% -- which is hard to believe. | |

30 Year Mortgage Interest Rates Comfortably Below Four Percent |

|

Anyone who thought mortgage interest rates were above 4% for good -- and perhaps climbing up to 4.5% or 5% -- seems to have been WRONG! I certainly thought we were headed for 4.5% or 5% -- but over the past three months, 30 year mortgage interest rates have continued to slowly decline to their current level of 3.88%. Yet again, a great opportunity to lock in your monthly housing costs over the long term at one of the lowest possible monthly cost per dollar spent, given these tremendously low mortgage interest rates! | |

When to start working on securing your mortgage financing |

|

Here are the three sequences I see buyers follow most frequently.... As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

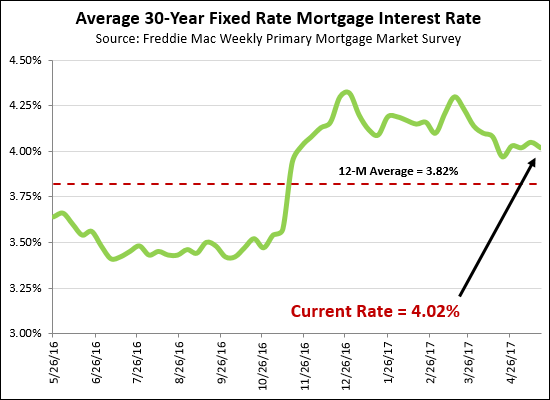

Mortgage Interest Rates Stay Reasonable at 4 Percent |

|

OK, so, admittedly, mortgage interest rates were compellingly low last year -- at around 3.5% for much of the year. However, at their current levels of 4%, that is still very (VERY) low historically speaking. Buyers still have a great opportunity to lock in their monthly housing costs for the long term at what will likely be some of the lowest interest rates we see over the next few (several? many?) years! If you're looking for a qualified, professional, responsive local lender, let me know. | |

Lock Your Mortgage Interest Rate NOW |

|

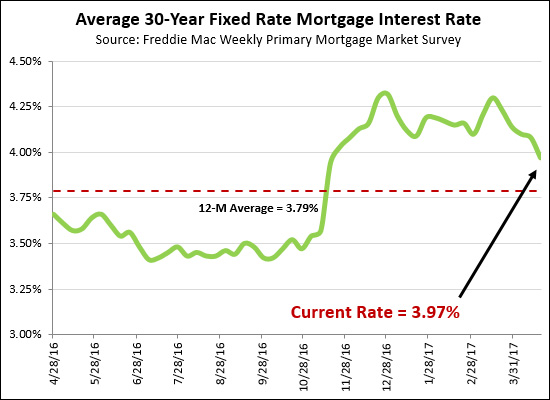

What??? Average mortgage interest rates (on a 30 year fixed rate mortgage) are back below 4% again. I truly did not think we'd see that this year -- or possibly ever. It seemed likely we'd stay between 4% and 4.5% or even up to 5% during 2017. Anyhow -- if you're in the market to buy, and have a contract signed on a house you are purchasing -- LOCK IN YOUR INTEREST RATE! Of note -- if you can swing it to finance your mortgage over 15 years instead of over 30 years, you'll be even happier at 3.23%! | |

Mortgage Interest Rates Drop (a bit) to Close Out March 2017 |

|

Mortgage interest rates ticked back downwards a bit yesterday to finish out the month of March at 4.14%. If we can keep going through 2017 between 4% and 4.25%, I'd be delighted -- though I suspect we'll end up in the 4.5% - 4.75% range. All that said, despite not being sub-4%, interest rates should not necessarily be drastically changing buying behavior. | |

Maybe interest rates will stay below 4.25% after all |

|

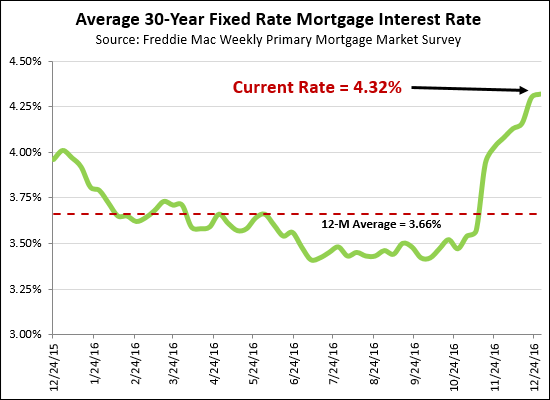

Well, things weren't looking so good for a while there. Just after the election interest rates shot up from 3.6% (+/-) all the way up to 4.3% (+/-). In that moment, it seemed that there wasn't any stopping rising interest rates, and we might see 4.5% followed by 4.75% before we knew it. Now, however, things seemed to have shaken out a bit differently than anticipated (or feared) with interest rates now hovering between 4% and 4.25%. Yes, it was fantastic to have interest rates under 4% for the past year (and more) but if we stay just over 4%, I don't think they higher rates will have a significant negative impact on the buying market in 2017. | |

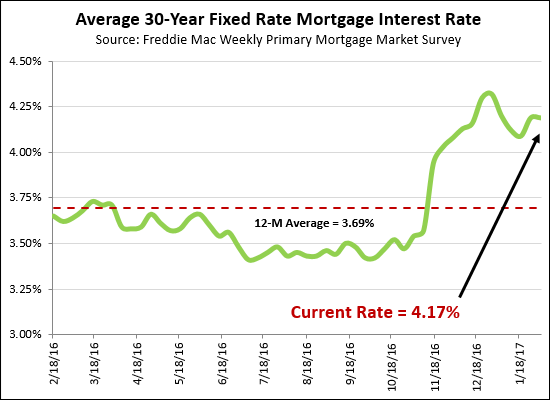

Mortgage Interest Rates On The Rise, Still, Further, Higher |

|

Well, it seems the mortgage interest rates might really, finally, be on the rise -- for good. Over the past several years there were several times when I thought they might be rising -- but then they'd fall again a few weeks later. We have seen a rather steady increase in mortgage rates since November 2016 -- and it is not yet clear when that increase will slow down or stabilize. Maybe around 4.25%? Hopefully? From June 2016 - October 2016 we saw average rates below 3.5%. We're now up to 4.3%. That types of a change in mortgage interest rates impacts payments for buyers and could affect the number of home sales we will see in 2017. While I don't think we'll see rates fall back below 4% in 2017 -- I am hopeful that they'll stay between 4.25% and 4.75%. Stay tuned for further updates. | |

How do higher mortgage interest rates affect monthly payments? |

|

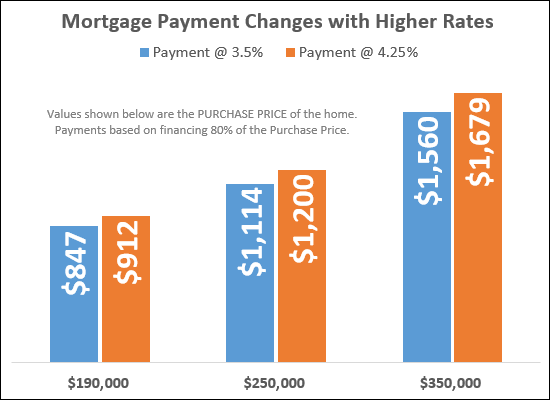

Just after the election, mortgage interest rates started rising. They started around 3.5%, and have since climbed to somewhere between 4.25% and 4.3%. It seems unlikely that they will come back own anytime soon -- if ever. So, what do these new mortgage interest rates mean for home buyers? Well, higher mortgage payments, naturally. The graph above shows the potential change in a monthly mortgage payment for a median priced home ($190K) as well as a home priced at $250K and $350K. The payment scenarios above assume that you are financing 80% of the purchase price -- and yes, I know, plenty of folks are really financing 90% or 95% of the purchase price. If you are financing a greater portion of the purchase price, the monthly payment will be higher, and the increase in the monthly payment will be greater. As you can see above.....

As always -- for actual payment scenarios, you'll need to consult a mortgage lender. Shoot me an email (scott@HarrisonburgHousingToday.com) and I can make some recommendations. | |

Recent Rise in Mortgage Rates is a Small Change in a Historical Context |

|

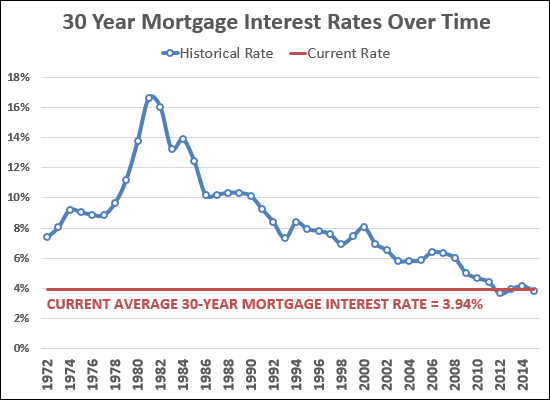

Mortgage interest rates jumped nearly 0.5% over the past week or two, but they are still below 4% given the current average of 3.94% -- and if we look at that rate of 3.94% in nearly any historical context, that is a TREMENDOUSLY LOW mortgage interest rate. As shown above, that is below the average annual mortgage interest rate for every year since 1972 with only two exceptions -- the average rate of 3.66% in 2012 and 3.85% in 2015. Interest rates could edge even higher after the first of the year, so if you like that first digit of your mortgage interest rate being a 3 instead of a 4, and if you'll be buying soon, you may want to start the buying process sooner rather than later. | |

Mortgage Interest Rates Jump Nearly 0.5% in a Week |

|

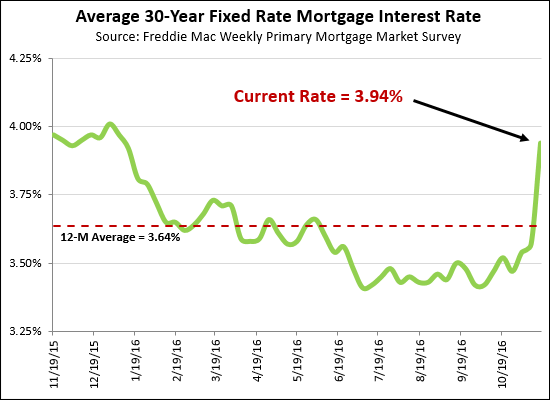

Stay tuned for where interest rates go next week -- but following the election, they jumped nearly 0.5% up to almost 4%. This takes us back to where we were nearly a year ago -- and is not a tremendously high level, but is much higher than where we were a week ago. Read more via Google News. | |

Mortgage Interest Rates Edge Up, Barely |

|

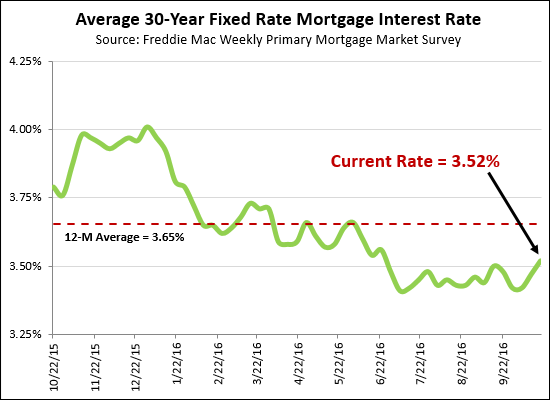

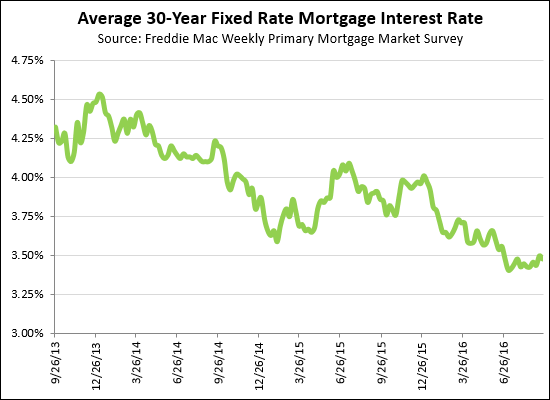

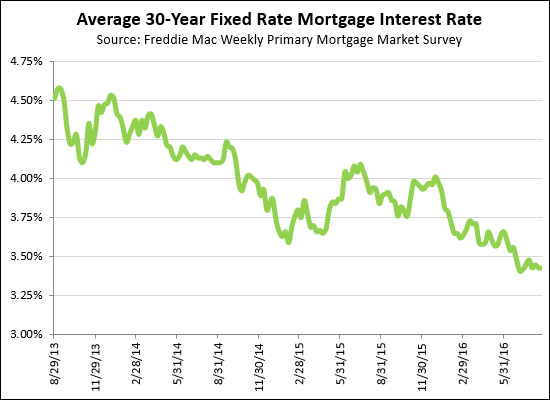

Mortgage interest rates edged up, barely, this week to an average of 3.52%. That pushes us above the 3.5% mark, after several months mostly below that mark. Let's look at a slightly longer (5 year) perspective....  As shown above, we are currently seeing some of the best interest rates in the past three years. The only time we have seen similar rates was in Fall 2012 through Spring 2013. Let me know if you need a recommendation for a mortgage lender for a purchase or refinance. | |

Mortgage Interest Rates Still Historically Low, For Now |

|

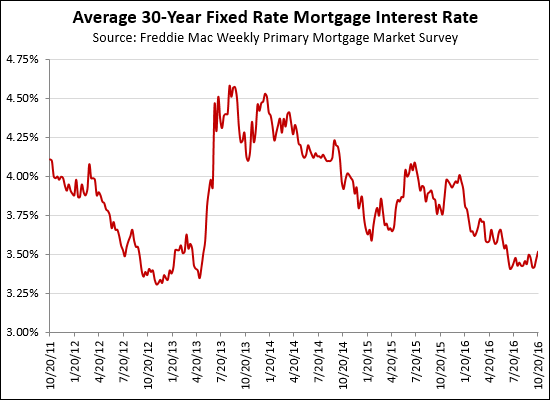

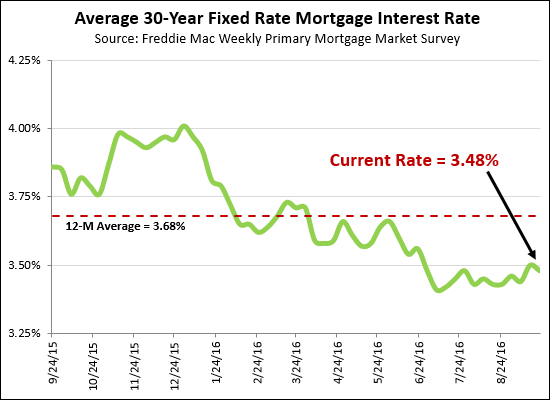

Mortgage interest rates were historically low a year ago, though they around 3.86%. Now, they are REALLY low, with the current average of 3.48%. But at the end of the day, they have been at or below (or just barely above) 4% for the past 12 months -- which means that it has been a fantastic year to lock in one's monthly housing costs. But, will the interest rate be rising in December or January? There is some talk that the Fed will increase the "Fed Funds Rate" in December, which could lead to an increase in mortgage interest rates. Oh, and just to put things in a slightly larger context, here is an illustration of average mortgage rates over the past three years....  | |

Mortgage Interest Rates Continue to Hover at Absurdly Low Levels |

|

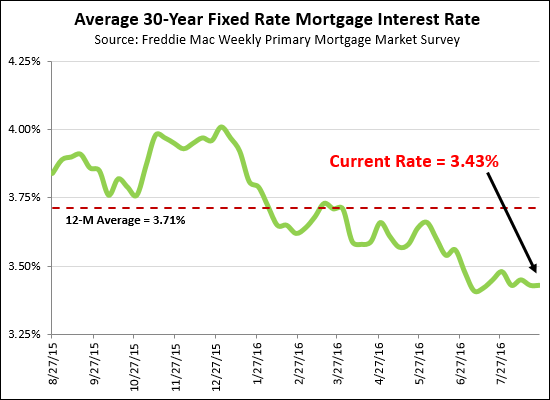

Maybe mortgage interest rates will never rise??? I have been thinking they would rise for quite a while now (years) but they just keep getting lower. Today's average rate of 3.43% is an absurdly wonderful opportunity to lock in your monthly housing costs at extremely low levels. Now, admittedly, Janet Yellen (US Federal Reserve Chair) has indicated that rates could go up soon. But until then, enjoy the low rates. If you're buying in the next 6 to 12 months, right now (or soon-ish) could be an especially opportune time to lock in your mortgage interest rates. Oh, and here are today's rates in a longer context, of the past three years....  | |

Housing costs stay relatively level despite increasing home values |

|

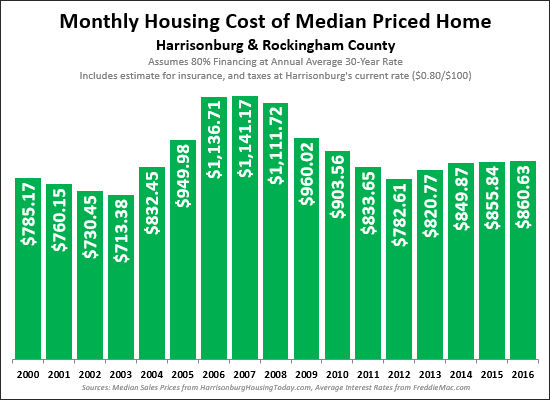

How much does it cost on a monthly basis to buy the median price home in our area, assuming 80% financing? Today, that adds up to an $681 monthly payment -- which is right in the same ballpark as what we've seen for the past two years ($850, $856). How can housing costs be staying relatively level if home values are increasing? Well, it's the declining mortgage interest rates, of course! The graph above shows how much you would pay in a monthly payment for each of the past 16 years if you financed 80% of the purchase price at the average interest rate for that year. These payments include an estimate for your insurance costs, and property taxes based on Harrisonburg's current rate of $0.80 per $100 of assessed value. Another pretty wild perspective -- over the past 16 years, housing costs (understood as outlined above) have only increased by 9.6%. | |

Diving Deep Into APPRAISAL DELAYS |

|

Silly me! Appraisal delays are NOT only related to increasing sales. Teri Robinson, of Vision Appraisal Services, kindly educated me on some of the other factors that are affecting appraisal delays. In summary....

So, it's not just more than just more sales, more fully, it is.... More Sales + More Paperwork + Fewer Appraisers = Appraisal Delays Still want to read more? Keep reading, from Teri....Since the 2008 downturn and subsequent housing collapse, the turmoil in the financial industry created many burdensome regulations on the only Licensed/Certified person in the financial process (prior to Loan Officers having to be Licensed/registered).So -- I stand corrected since yesterday -- yes, higher sales volume is contributing to slower appraisal timelines -- but there are other big picture factors at work here as well. | |

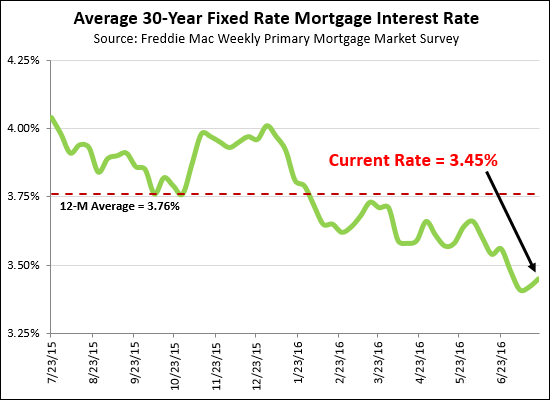

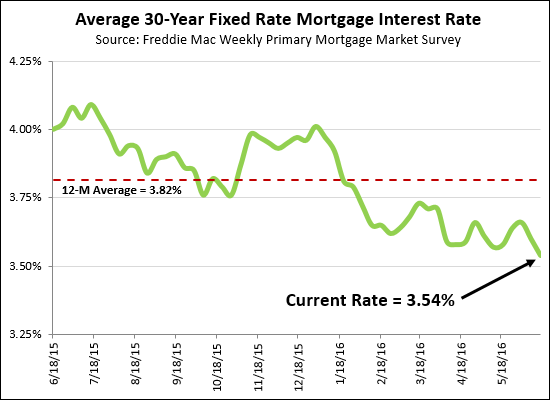

Current mortgage rates still WELL below 12 month average |

|

If I said, a year ago, that mortgage interest rates were going to rise soon --- I was WRONG!!! Current mortgage interest rates are just below 3.5%, and while I am still thinking that they could or will start to increase soon --- I would not be surprised if they are still below 4% a year from now. Buyer still have great buying power, and the opportunity to lock in super-low interest rates for the next 30 years. | |

Mortgage interest rates continue to fall, now almost to 3.5% |

|

Well -- there has never been a better time to lock in an interest rate this year than RIGHT NOW! The average 30-year fixed mortgage interest rate has continued to drop over the past month, to the current average rate of 3.54%. Perhaps it's silly, but I don't even have "rates will be going up soon" as a part of my vocabulary anymore. I said that for years (because that is what everyone assumed) and I was wrong, year after year. Sure, rates would go up a bit, but they'd then come right back down a few months later. So -- buyers, rejoice! If you are buying now/soon, you can lock in a super low mortgage interest rate on your mortgage! | |

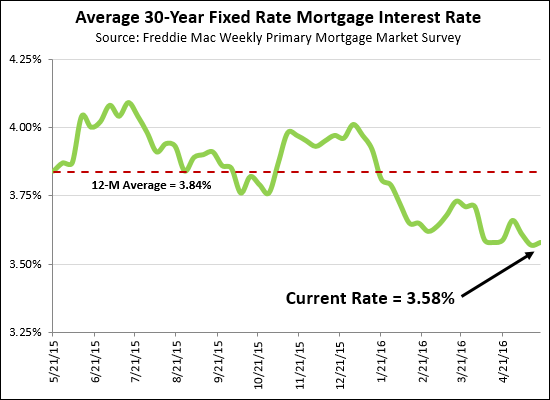

One month later, 30 year fixed mortgage interest rates still at 3.58% |

|

Fear not -- cheap money is still available. By that, I mean that the interest you will pay on a new mortgage still remains at record low levels. The current average mortgage rate for a 30-year fixed rate mortgage is still at 3.58%, the same spot it was one month ago. If I had to guess, I think we'll probably stay under 4% for the remainder of 2016. Crazy to imagine, I know, but that is my prediction. The low rates don't seem to be leaving very quickly. | |

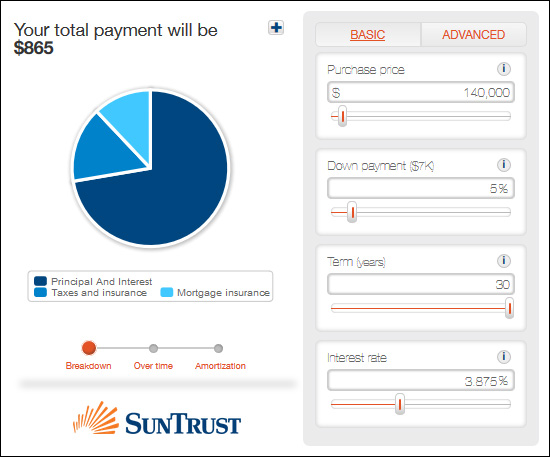

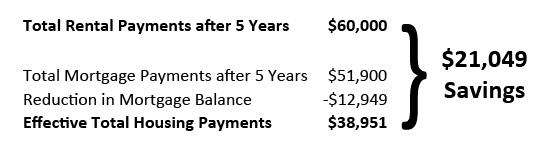

Should I rent or buy a townhouse in Harrisonburg? |

|

Given continued low interest rates and some increase in home values, let's take a new look at the opportunities of buying versus renting. RENT = $1000/m. There are regularly options for renting a two-story townhouse in Harrisonburg for approximately $1000 / month in Avalon Woods, Beacon Hill, Stonewall Heights, Liberty Square, etc. BUY = $865/m. With a 95% loan, buying such a townhouse apparently may cost as little as $865 per month assuming a $140K purchase price and 3.875% interest rate per SunTrust Mortgage's payment calculator....  This shows an $135/month cost savings of buying instead of renting. If we then look at the difference between renting and buying over a five year time period, the advantages start to pile up.  As you can see, this builds a rather compelling case for buying instead of renting if you are going to be living in this potential townhouse for the next five years. Two other factors to keep in mind....

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings