Financing

| Newer Posts | Older Posts |

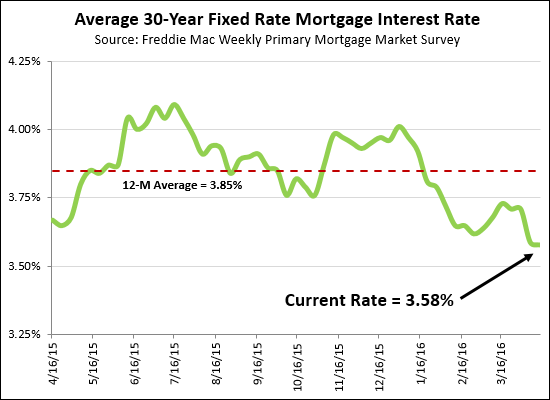

Mortgage Interest Rates Lower Than Low |

|

Mortgage interest rates have been at an average of 3.85 over the past 12 months. Fantastic, right? But wait, they are currently hovering at 3.58%! Wow! Perhaps this has been part of what has inspired so many buyers to sign contracts in recent months. | |

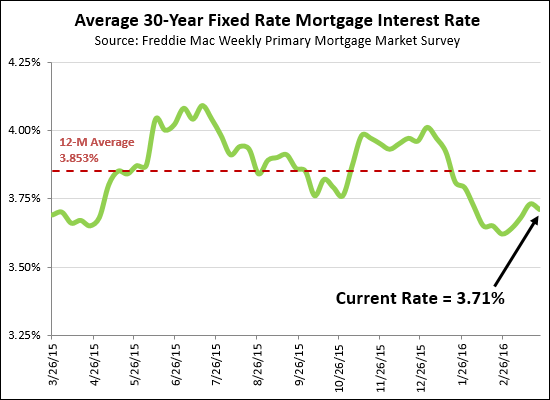

Mortgage Interest Rates Fall (Slightly) Again |

|

Money continues to be cheap. Mortgage money, that is. The average mortgage interest rate fell again (slightly) to 3.71%, after having risen for a few weeks. This is a good bit below the 12 month average of 3.853%. And, notably, interest rates continue to be below 4%, as they have been for most of the past year. This is still a great time to lock in your long-term housing costs! | |

Leap Day Special on Mortgage Interest Rates |

|

There seems to be a LEAP DAY SPECIAL on mortgage interest rates -- though the rates are diving down low, as opposed to leaping up high. The current average mortgage interest rate (on a 30 year fixed rate mortgage) is an astonishing 3.62%. This is well below the average over the past year (3.86%) and in fact, is the lowest rate we have seen anytime in the past year! Lock in your interest rate today -- and Happy Leap Year and Leap Day! | |

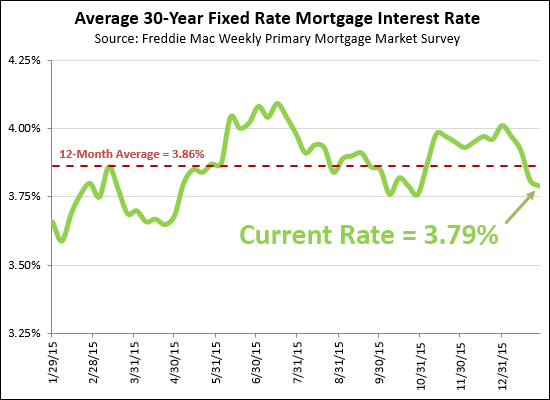

Now wait a minute, I thought interest rates were rising? |

|

Fear not, interest rate watchers, while mortgage interest rates were on the rise -- climbing up above 4% at the end of December, they have now tumbled back down to 3.79%. When the Fed raised its key interest rates, it seemed that mortgage interest rates might finally be leaving the sub-4% range for good. Not so much. It's anyone's guess where mortgage interest rates will end up in December 2016 -- but their recent trajectory (down, down, down) no longer has me worrying (as much) that we will see a steady increase through the year up to and beyond 5%. | |

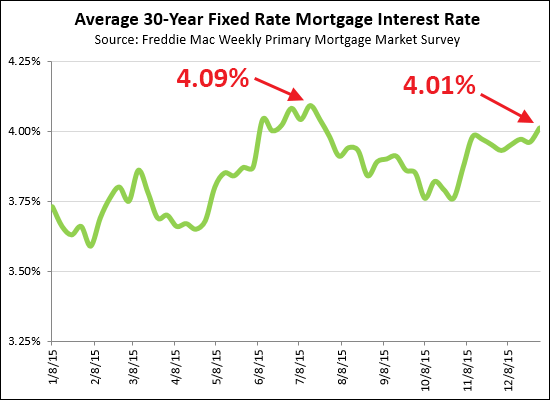

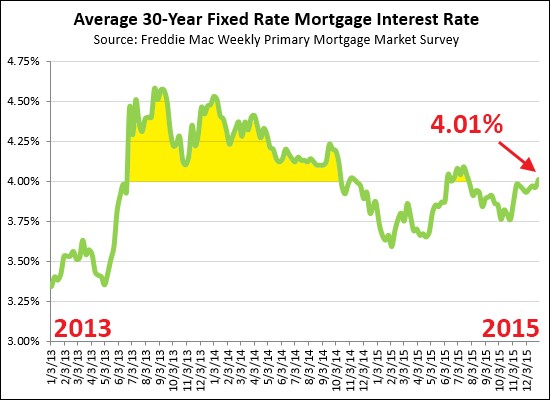

After almost ten years, the Fed raised rates, and wait until you see what happened to mortgage interest rates |

|

So, after almost a decade, the Fed raised rates. What happened to mortgage interest rates? Per the graph above, not much has happened thus far. Rates have edged up a bit over the past few weeks, and have headed back into the 4-point-something territory, but we were there (and a bit higher) as recently as this past summer, so that's not necessarily new territory. Maybe if we look back a bit further, we'll see that this rise to 4.01% is really disastrous?  Nope! If we look back over the past three years (2013-2015) we'll notice that there as a long time frame during those years (shaded in yellow) when the rates were above 4 percent. So, we'll see where things go from here, but thus far, the Fed's actions do not seem to have resulted in an end to super low mortgage interest rates. | |

Will mortgage interest rates shoot skyward? |

|

The Federal Reserve announced on Wednesday that it will raise its key interest rate for the first time in almost a decade. This is expected to lead to gradual increases in mortgage interest rates. WASHINGTON - The Federal Reserve said on Wednesday that it would raise short-term interest rates for the first time since the financial crisis, a decision it described as a vote of confidence in the American economy even as much of the rest of the world struggles.Read more in this NY Times article. | |

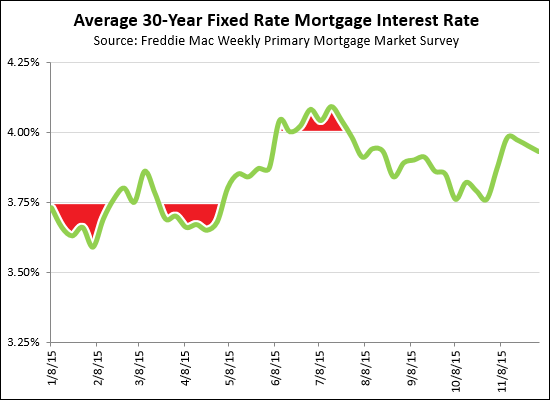

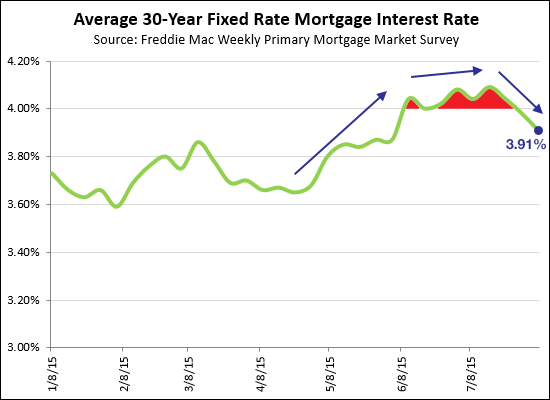

30 Year Fixed Mortgage Interest Rates Stay Put Between 3.75% and 4% for nearly all of 2015 |

|

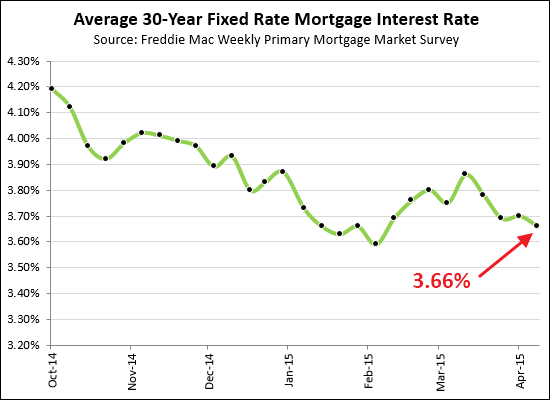

Who would have thunk it? Seriously!?! When interest rates started rising from 3.65% in April up to 4.04% in June, it seemed that maybe, just maybe, interest rates were headed back up for good. But no -- rates then generally declined, again, between June and November. As shown above, for nearly all of 2015, interest rates have been between 3.75% and 4%. These rates are the average rate on a 30 year fixed rate mortgage. Opportunities to finance your home purchase with a historically low (fixed!) mortgage interest rate continue -- perhaps on into 2016! | |

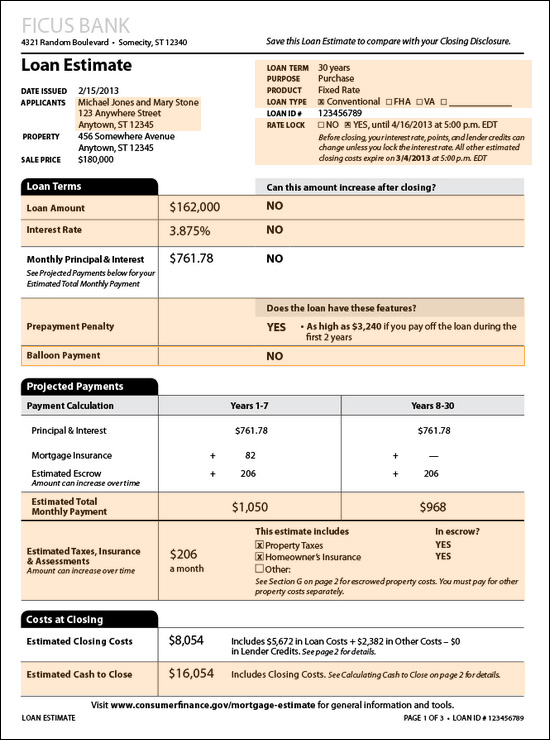

Understanding your mortgage quote (Loan Estimate) |

|

If you are talking to a lender about a potential mortgage on a home you might purchase, you are likely to receive a "Loan Estimate", the first page of which is shown above. This document will walk you through all of the basic terms of the proposed mortgage, and can help you easily compare two loan offers. For a full interactive explanation of this document, go check out the Loan Estimate Explorer at the Consumer Financial Protection Bureau website. | |

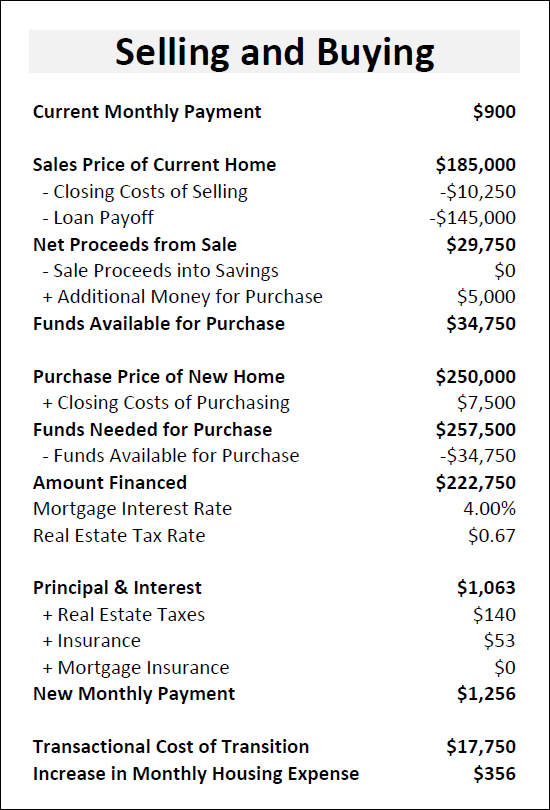

Running the numbers of selling and buying |

|

If you're selling your current home to buy a new one, you may be wondering....

So many questions -- all very helpful to think through, calculate and discuss. The worksheet above can help you think through those numbers -- and it is available here as an editable Excel file. Enjoy! | |

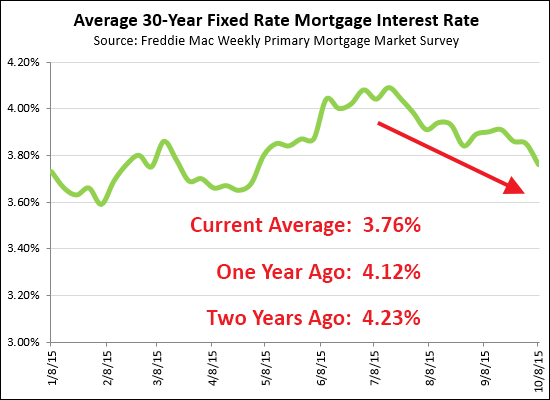

Mortgage Interest Rates Remain Low |

|

For years now I have been thinking (and sometimes saying) that mortgage interest rates were certain to rose. From time to time they would rise, a bit, and then drop back down again. As you can see from the graph above, the current average rate of 3.76% is a good bit lower than where we were one year and two years ago. These low interest rates continue to make it a very compelling time for buyers to buy -- they can lock in tremendously low housing costs at historically low rates. Mortgage interest rates are sure to rise soon -- or wait, maybe they won't! | |

How much can you spend versus how much you want to spend |

|

Most folks who buy a home this year will not be paying cash. An important early stage of the home buying process is to talk to a lender to become pre-approved for a mortgage. As you meet with a lender, remember that there is often a difference between:

If you are looking for a qualified mortgage professional, I would recommend that you contact one of the individuals listed below. Most of my buyer clients work with one of these lenders:

Learn more about the home buying process at BuyingAHomeInHarrisonburg.com. | |

Fear not, folks, mortgage interest rates are still below four percent |

|

For the past few years everyone has been thinking, saying, predicting that interest rates would rise. We're going to get back to 6% -- maybe higher. Or, maybe not. Taking a look at average mortgage interest rates, as I do around the middle of each month, we find that we're still below four percent. Thus, great opportunities still exist to lock in your housing costs at historically low levels relative to the interest rate on your fixed rate mortgage. Let me know if you'd like a recommendation of a lender to speak with if you are considering a purchase or a refinance. Here's to more low, low, super low interest rates!!! | |

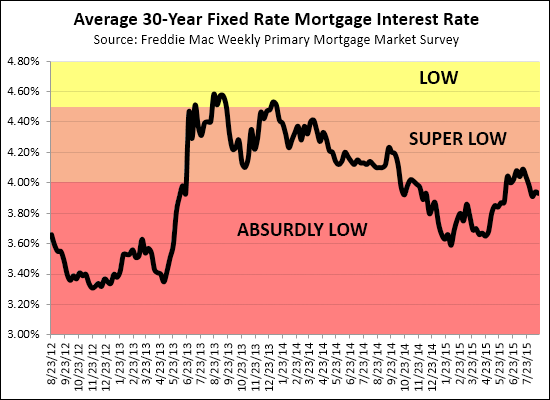

Mortgage interest rates are likely to increase soon, but not now, per minutes of Federal Reserve meeting |

|

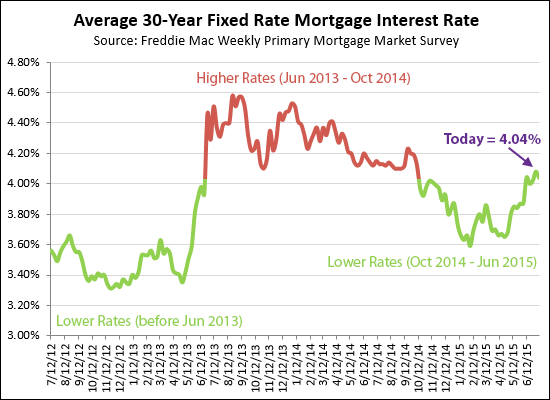

Over the past three years (shown above) interest rates have fallen into three categories....

As you can see above, interest rates have spent the most time in the ABSURDLY LOW category over the past years -- and apparently interest rates will be going up "soon, but not now" per a Washington Post article about the recent Federal Reserve meeting.... The Federal Reserve made few waves when its top brass met in Washington last month for their regular policy-setting meeting. Its target interest rate — pegged at zero since the financial crisis — remained unchanged, and the central bank's official statement offered few clues of when it might rise.Read more in the full Washington Post article, This is how the Federal Reserve is preparing to raise interest rates. | |

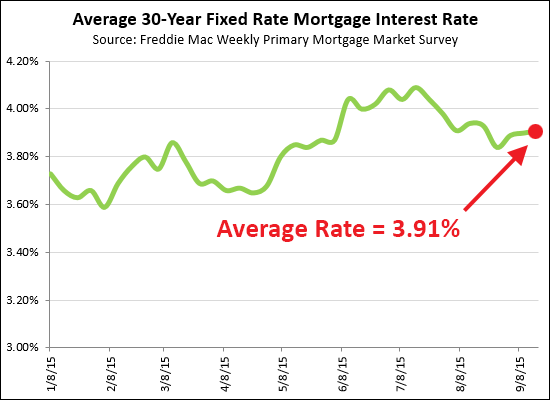

30 Year Mortgage Interest Rates Dip Below 4%, Again |

|

Home buyers enjoyed mortgage interest rates below 4% for the first five months of this year -- and they even dropped as low as 3.6% in February. But after rates started rising in mid-April, they did not stop at 4% -- they kept on rising, and stayed largely above 4% for much of June and July. But no longer! Just when you thought mortgage interest rates were going to keep on climbing, to 4.5%, 5%, 5.5%, 6% and beyond -- they dropped again! The average mortgage interest rate for a 30 year fixed rate mortgage has again been below 4% for the past two weeks. Despite numerous false alarms of interest rates getting ready to go up, up, up over the past few years -- it still has not happened. I'm sure the rates will eventually go up, and yes, that will affect your monthly payment relative to your home's purchase price -- but for now, we can continue to enjoy these super (super) low interest rates below 4% -- yet again. | |

Mortgage interest rates have been better (3.3%) and worse (4.6%) in the past three years |

|

Mortgage interest rates (for a 30 year fixed rate mortgage) have varied from as low as 3.3% to as high as 4.6% over the past three years. Current rates are hovering right around 4% -- which is higher than they have been recently, but is still absurdly low within a longer-term context, providing buyers with a great opportunity to lock in their housing costs for the long-term. | |

Balancing what you can afford with what you want to pay |

|

An important part of getting ready to buy a home is to talk to a mortgage lender (ask if you need recommendations) to find out how much money they will lend you to purchase a home. Lenders have a variety of calculations that they perform to determine how much money they will lend you -- most related to the highest percentage of your income that they are comfortable with having you spend on housing. However -- this does not always mean that you should borrow as much as you possibly can. Spending the most on a house that your lender would be comfortable with may not make you comfortable -- as it would then reduce the amount of money in your monthly budget that you could use for vacations, retirement savings, college savings, and so much more. Check with your lender to find out how much of a home you CAN afford to buy -- but then decide how much you WANT to buy. | |

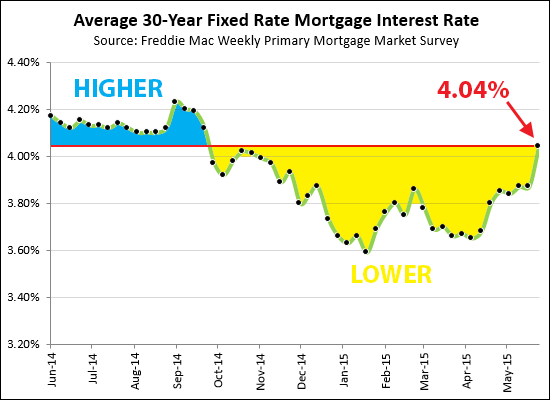

Mortgage Interest Rates Edge Up Past 4% |

|

Average interest rates on a 30-year fixed rate mortgage have edged up past 4%. Above you will note that interest rates have been lower than current levels (yellow area) during most of the past year, though we were seeing rates higher than 4% once we look back about seven months. | |

Mortgage Interest Rates Edge Up Slightly |

|

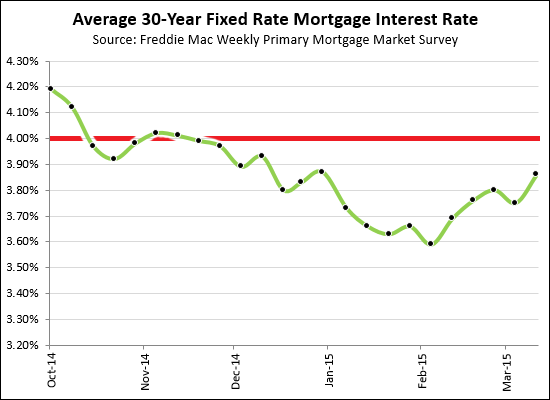

30-Year Fixed Mortgage Interest Rates have edged up slightly over the past few weeks, to a national average of 3.84%. That means that there have certainly been lower rates in the past five months (shown above in yellow) but the current rates are better today than they were for the last seven months of 2014 (shown above in blue). If you're buying soon, talk to a lender ASAP so that you are ready to lock in a rate once you have a contract on a home to purchase. | |

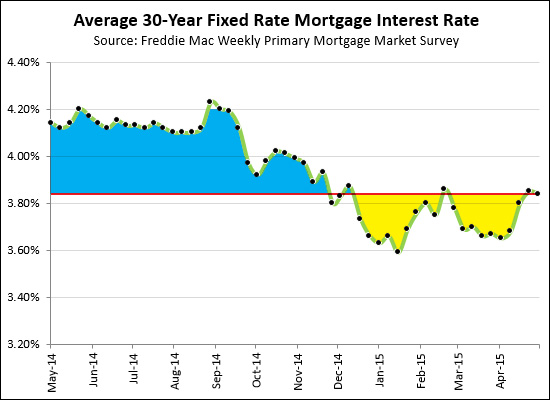

And... mortgage interest rates go back down, again! |

|

Well....after having edged up a bit a month ago, mortgage interest rates have headed back down, AGAIN. If you're buying a home this Spring, it's an exciting time to lock in an interest rate. Imagine -- a 3.66% interest rate, available to you for the next 30 years. We are still in historic times as to the (LOW) cost of money -- which provides LOTS of purchasing power for buyers in today's market. Let me know if you are looking for some lender recommendations. | |

Mortgage Interest Rates Edge Up, A Bit |

|

Fear not, you will still (likely) be able to obtain an interest rate below 4%. That said, rates have ended up a bit over the past month -- now close to 3.9%. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings