Financing

| Newer Posts | Older Posts |

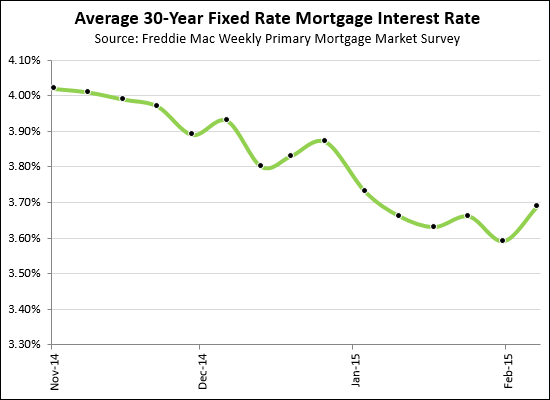

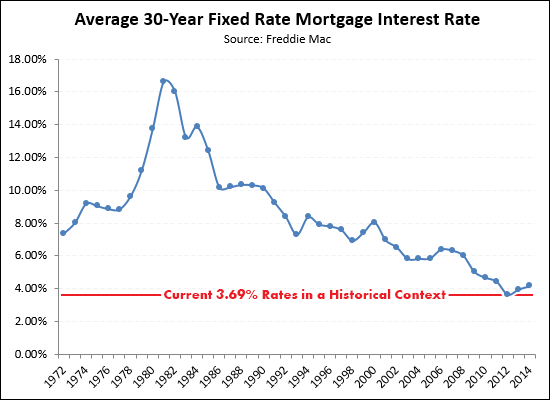

Current Mortgage Interest Rates Are Ridiculously, Historically Low |

|

Average interest rates edged up last week (from 3.59% to 3.69%) but from a historical perspective, they are still ridiculously low....  Thus, the opportunity persists to lock in your housing costs at very, very low levels. Looking for a referral for a great local lender? Email me at scott@HarrisonburgHousingToday.com for several recommendations. | |

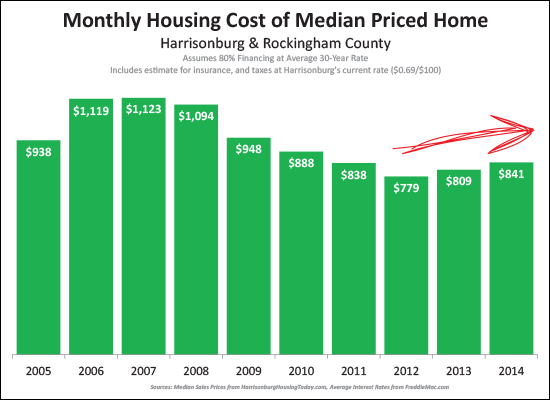

Monthly housing costs on the rise |

|

It had to happen eventually. The analysis above shows the monthly cost of financing 80% of the purchase price for a median priced home over the past ten years. A few observations....

The increases in monthly housing costs over the past two years are not surprising, because....

As a buyer, you still have a great opportunity to lock in some relatively low monthly costs of homeownership -- and there is some value in acting sooner rather than later, as these costs are likely to continue to increase over the next few years. Here's the data behind the graph....

A few notes....

| |

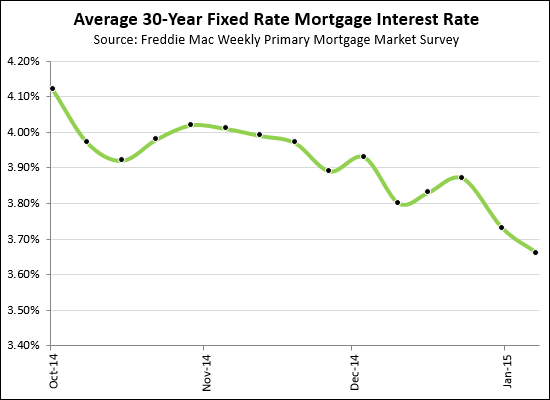

Mortgage Interest Rates Get Lower, and Lower, and Lower |

|

Here's my monthly updates on long-term mortgage interest rates and they (AGAIN!) have dropped over the past month. The average rate is now 3.66%. It is a great time to lock in your interest rate if you are buying a home! | |

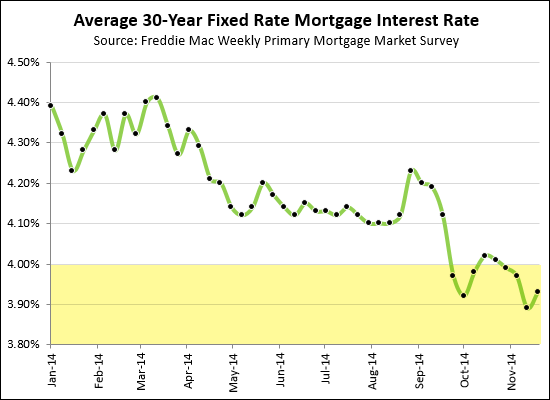

Mortgage Interest Rates Still Below 4 Percent |

|

If you're thinking of buying your significant other a house for Christmas (mostly a joke) you might want to lock in your mortgage interest rate NOW. 30 year fixed mortgage interest rates continue to linger below 4%, which will provide you with an excellent opportunity to have low monthly payments on that exciting Christmas gift. :) | |

Mortgage interest rates edge up.... to ridiculously low levels |

|

It's compelling to get a long term fixed interest rate that starts with a 3.....and it might still be possible, but the national average is now 4.01%. Let me know if you're looking for recommendations for lenders.... | |

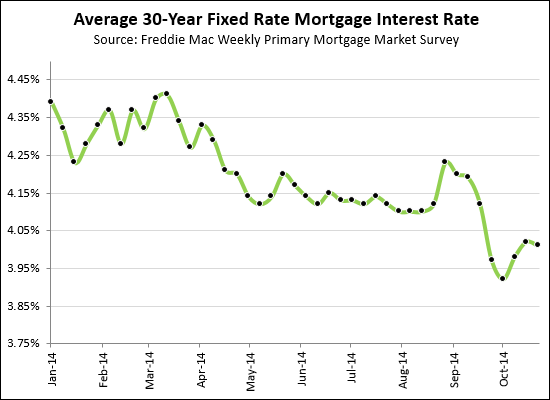

Mortgage Rates Continue To Fall |

|

I promise I won't play-by-play this, but interest rates fell again this week, to an average of 3.92% for a 30-year fixed rate mortgage. Wow! If you're getting ready to buy, there is a compelling reason to do it now / soon to take advantage of these great rates. | |

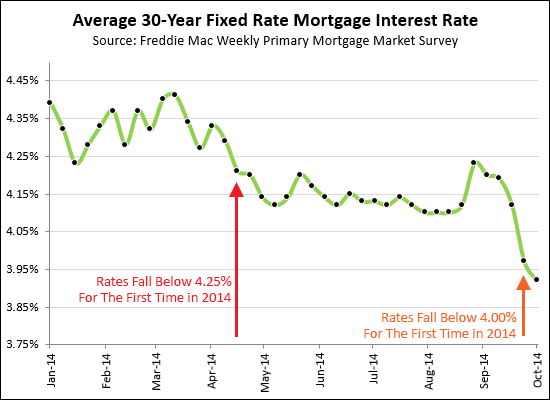

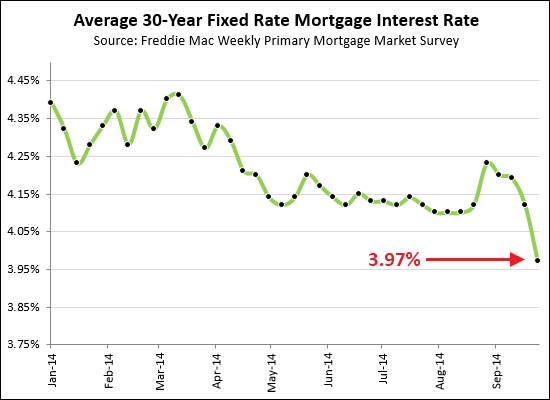

Mortgage interest rates below 4% for the first time in 2014 |

|

For the very first time in 2014, the average mortgage interest rate is below 4% for a 30 year fixed rate mortgage. The national average as of yesterday was 3.97%. The last time we saw interest rates in the 3%'s was in June 2013. | |

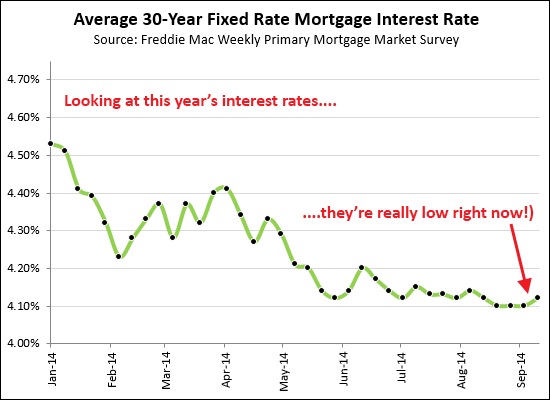

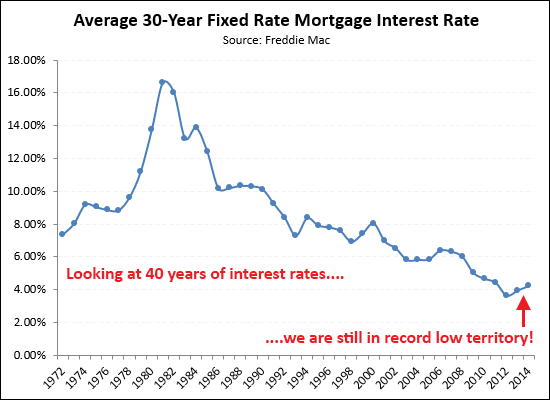

Mortgage rates hold relatively steady just above 4 percent |

|

Average mortgage interest rates (for a 30 year fixed rate mortgage) are hovering around 4.1% -- the lowest we have seen this year.  And looking back even further, we can be even more grateful for this low cost of mortgage money. | |

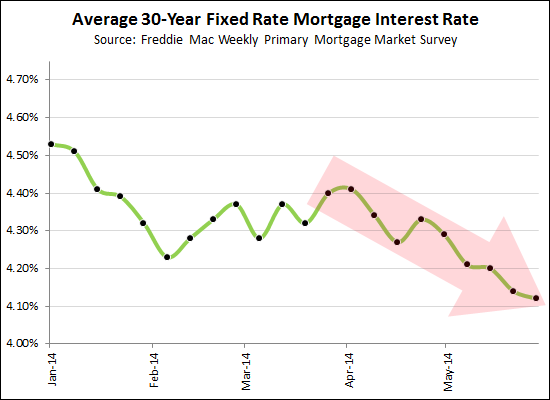

Mortgage interest rates dip to lowest level of 2014 |

|

Fixed mortgage interest rates keep declining....now to their lowest level thus far in 2014. The average rate for a 30-year fixed rate mortgage is now 4.1%. If you are under contract to buy a home, it may be wise to lock in your rate now! | |

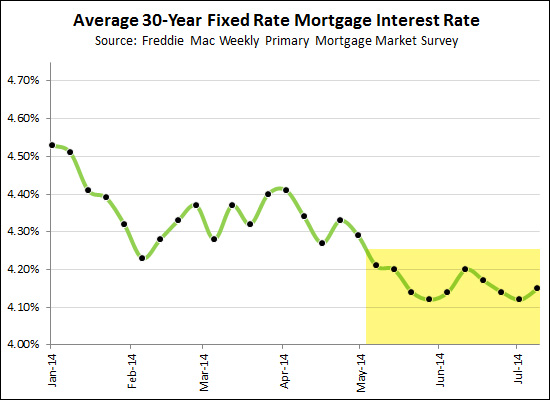

Mortgage Rates Remain Below 4.25% |

|

Rates continue to stay quite low this summer -- hovering between 4% and 4.25%. Whether you are buying a re-sale or new construction home, this is a great time to lock in your housing costs with these tremendously, historically low rates. | |

Are low interest rates (several years ago) making some owners less likely to sell? |

|

Are low mortgage interest rates from 2012-2013 keeping today's inventory levels down? Sound confusing? Read the excerpt above, or the entire article on the Matrix Blog.... New Angle: Blame Low Mortgage Rates Here in Harrisonburg, I don't talk to many homeowners who are hesitant to sell because of the low interest rate they obtained in 2012-13. In fact, I don't see many homeowners who bought in 2012-13 even considering selling at all. If you bought a home in 2012-13, likely you were and are planning to be in it for quite a few more years. And today's higher mortgage interest rates? They aren't really that high! | |

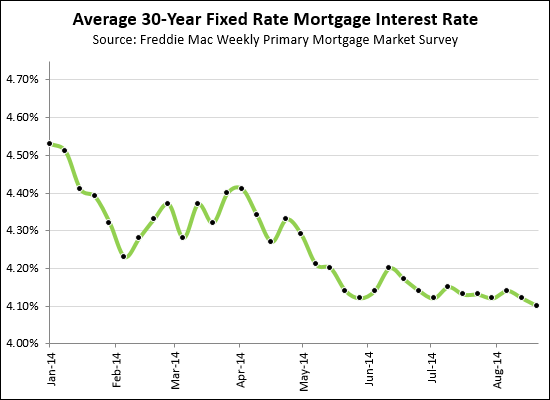

Enjoy the LOWEST mortgage interest rates thus far in 2014 |

|

Fixed mortgage interest rates (30 year) continue their downward trend towards 4%. The average rate right now is an astonishingly low 4.12%. If you're buying now, or soon, today would seem to be a GREAT day to lock in your interest rate! | |

Temperatures Rising, Mortgage Interest Rates Falling |

|

This is a great time to lock in your interest rate if you haven't already done so! Mortgage interest rates have fallen over the past several weeks, and are now approaching 4%. | |

Long Term Mortgage Interest Rates Seem QUITE Stable |

|

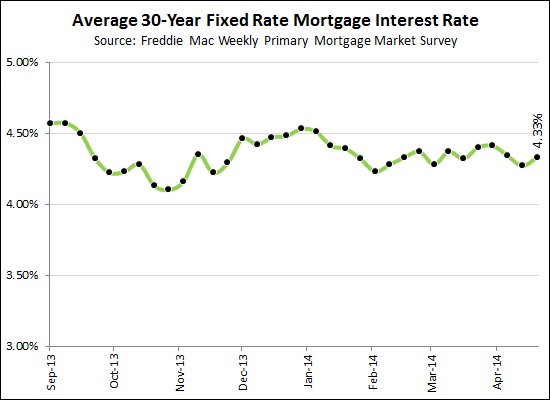

Mortgage interest rates seem to be QUITE stable between 4% and 4.5%. Let's keep them there! This continues to be a great time to buy relative to locking in your housing costs at historically low levels. That said, you do need to think about how much you should spend on your next home. Talk to me, or talk to a mortgage lender, to get that conversation started. | |

30 Year Fixed Mortgage Interest Rates Staying Below 4.5% |

|

A quick update on mortgage interest rates.... So far, mortgage interest rates are staying below 4.5%, other than for two weeks at the very start of this year. These current rates (4.3% - 4.4%) are still WONDERFUL from absolutely ANY long term perspective. Money is cheap --- if you're buying a home now, you'll be locking in your housing costs at historically low levels. | |

Long Term Mortgage Interest Rates Trending Down Again |

|

Will they keep going down? Lock in now....or soon! | |

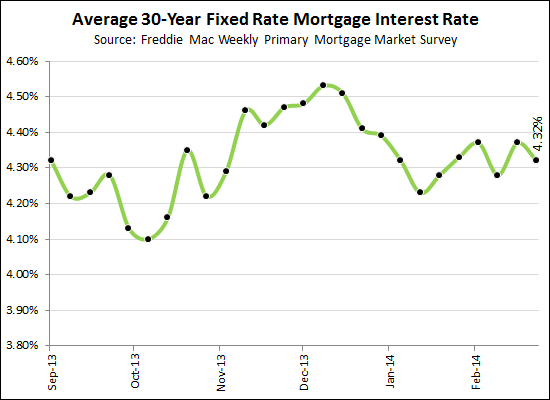

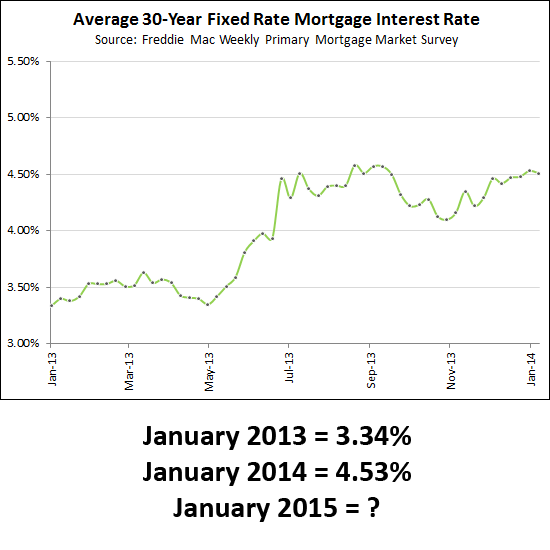

Where will interest rates go in 2014? |

|

Where will interest rates go in 2014? My guess is that we'll end this year somewhere between 4.25% and 5%. What is your forecast? | |

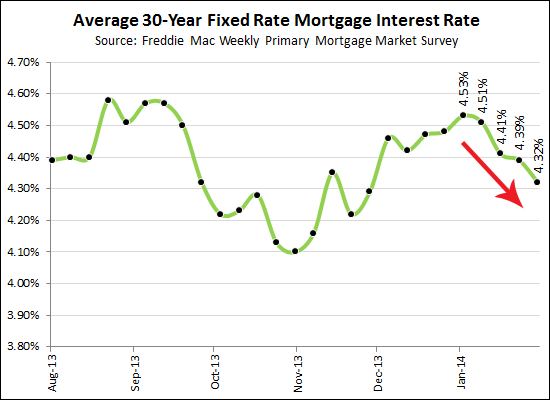

30 Year Fixed Mortgage Interest Rates Close Out 2013 around 4.5% |

|

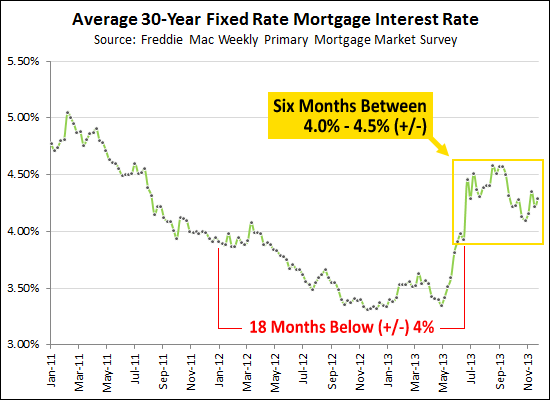

Late 2012 through early 2013 provided the lowest mortgage interest rates ever -- as low as 3.3%. While mortgage interest rates have now risen from those low levels, they have remained between 4.1% and 4.6% over the past six months. These are still wonderfully low interest rates from any sort of a long term perspective, providing buyers with the opportunity to lock in their housing costs at historically low levels. | |

Fixed Mortgage Interest Rates Remain Relatively Steady |

|

Fixed mortgage interest rates continue to hover between 4% and 4.5% --- for six months now. This continues to provide buyers with a great opportunity to lock in their housing costs at historically low levels. Over the next 3 - 5 years we are likely to see increases in both home sales prices as well as mortgage interest rates. Source: Freddie Mac | |

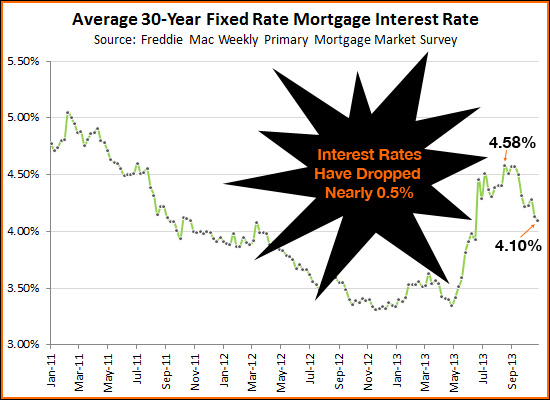

Halloween Surprise, Mortgage Interest Rates Drop Nearly 0.5% |

|

This is certainly a TREAT, not a TRICK. Perhaps we'll see 3.something% interest rates again soon??? | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings