Financing

| Newer Posts | Older Posts |

The government shut down did not seem to affect mortgage interest rates |

|

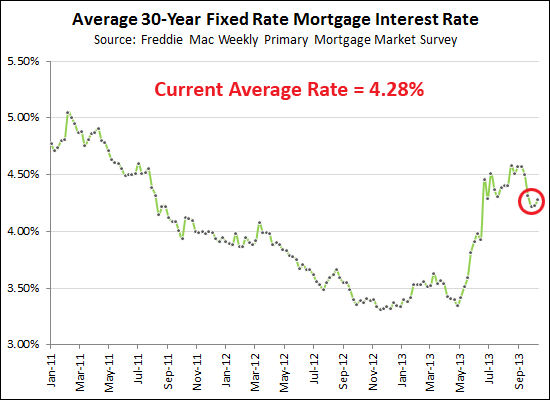

Mortgage interest rates have stayed relatively stable over the past few weeks, despite the shenanigans going on in Washington. The current average rate for a 30-year fixed rate mortgage is 4.28%. | |

Government shutdown may affect your financing |

|

If you haven't heard, a partial government shutdown happened earlier today (midnight) and it may affect your financing if you are in the process of buying a home. Here is an overview from the Virginia Association of Realtors. CNN has the answers, but here's the gist: | |

30 Year Fixed Mortgage Interest Rates Steady Around 4.5% |

|

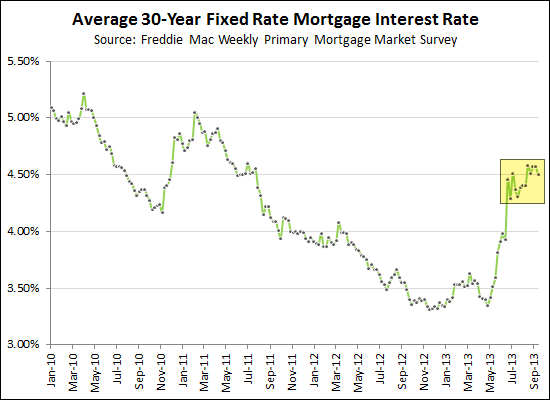

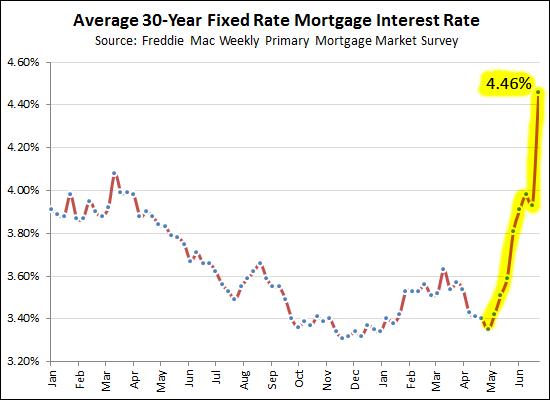

At least for now, 30 year fixed mortgage interest rates seem content to hover around 4.5%. After having stayed below 4% for a year and a half (Nov 23, 2011 - June 20, 2013) mortgage interest rates jumped up rather quickly this past June. Since that time, however, rates have stayed between 4.3% and 4.6% without too much variation from week to week. | |

30-Year Fixed Mortgage Interest Rates Stabilizing Around 4.4%? |

|

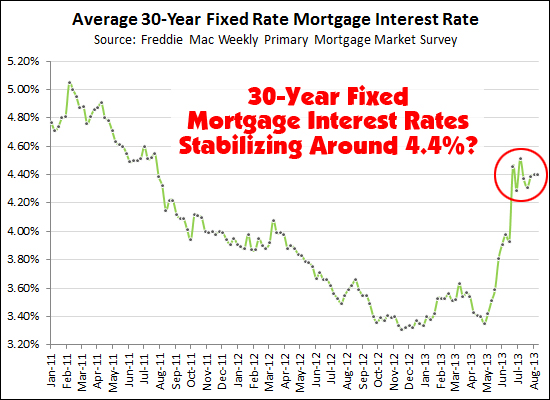

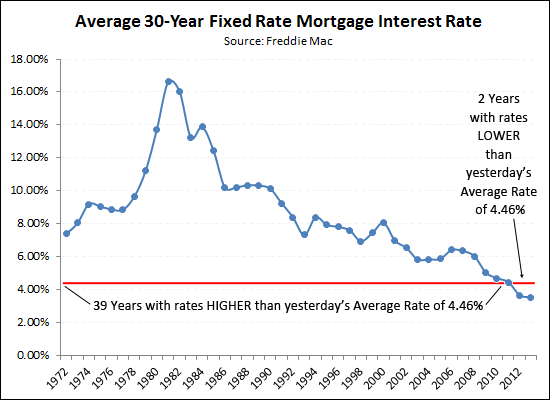

At least for now, mortgage interest rates seem to be stabilizing around 4.4%. These rates are an entire point higher than the all-time lows seen in late 2012 and in May 2013......however, they are still lower than than any mortgage interest rates seen anytime other than in the past two-ish years. | |

Mortgage Interest Rates Continue to Fluctuate |

|

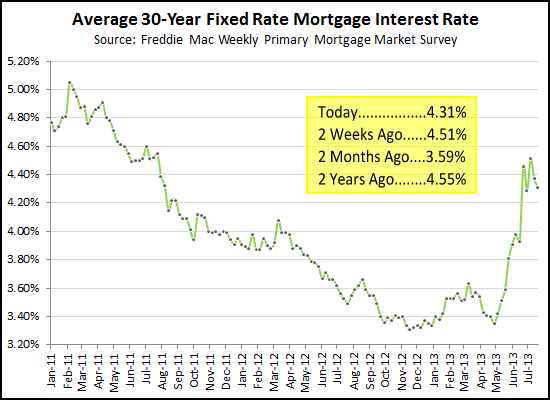

Rates are down (4.31%) as compared to a few weeks ago (4.51%), even though they have climbed quite a bit from two months ago (3.59%). Bear in mind, that these sub-4.5% rates have only existed for the past two years. Thus, we are still in a period of amazing opportunity for fixing in a low monthly housing cost given these historically low rates. | |

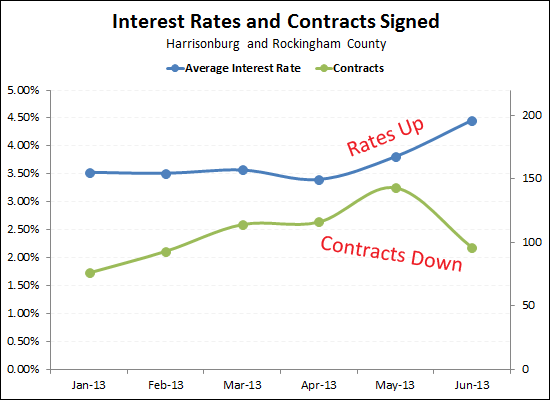

Are rising interest rates slowing down buyer activity? |

|

It seems quite possible --- see above. But remember folks, these are still ridiculously low interest rates from a historical perspective. | |

Putting rising interest rates in context |

|

Several of you asked me to put yesterday's news (average rates increased by 0.5% in a week) in perspective. As you can see above, we are still working with ridiculously low mortgage interest rates (4.46%) from a historical perspective. | |

Lock in your interest rate! |

|

These are still amazingly low interest rates (4.46%) compared to what we've seen in past years, but the rates are certainly starting to rise. If you're buying soon, you may want to act soon to lock in before rates go up further. | |

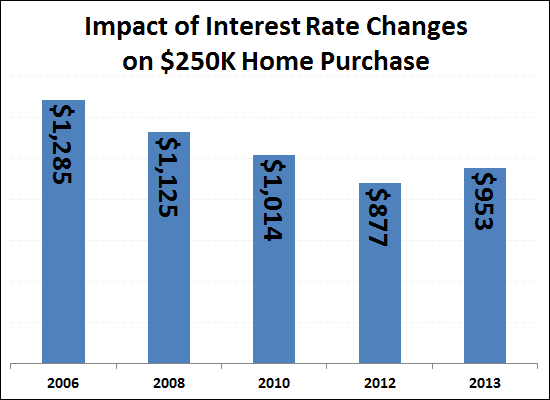

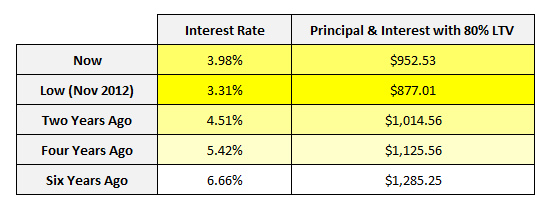

Impact of Interest Rate Changes on a $250K Home Purchase |

|

Interest rates are increasing. It's not the end of the world, but buying soon will likely be more affordable than buying later.....  The payments shown above only reflect principal and interest, not taxes and insurance.  | |

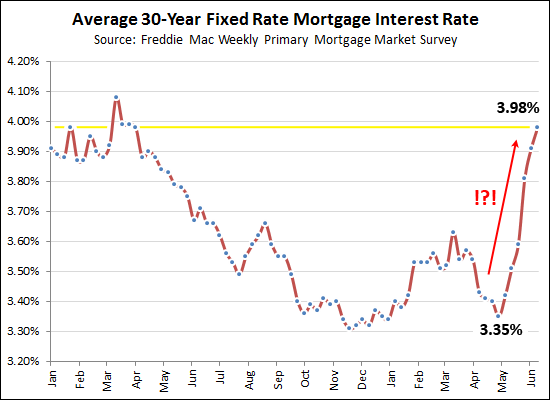

Mortgage interest rates just barely under 4% |

|

Interest rates have increased from 3.35% to 3.98% over the past six weeks. A 30 year fixed mortgage interest rate below 4% is still fantastic (even below 5% is great) but if you're buying soon, you should consider finalizing those details ASAP to try to get a 3.something% interest rate if you can. | |

Low Mortgage Interest Rates Create Unprecedented Opportunity for Home Buyers |

|

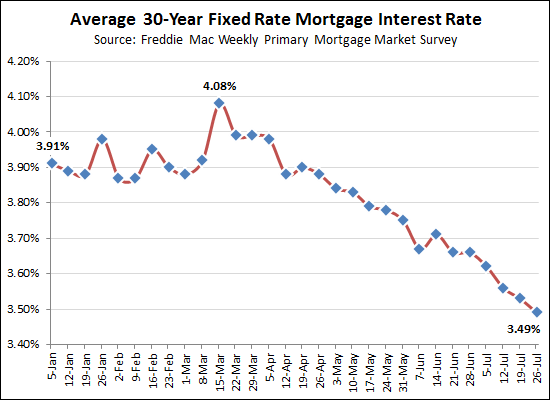

Never before have home buyers been able to lock in such low mortgage interest rates, which sets up 2012/2013 home buyers to have ultra-low housing costs on into the future. For the past six months, most home buyers have been able to lock in 30-year fixed mortgage interest rates between 3.3% and 3.6%. Over the past four decades (since Freddie Mac started tracking this data) the average U.S. interest has never been this low --- in fact, this average mortgage interest rate had never dipped below 4.0% until October 2012. To put today's low mortgage interest rates in perspective, a home buyer financing 80% of their purchase at the most recent average rate (3.41%) would have a monthly payment (principal and interest only) of $622. Just one year ago, the average rate was 3.90%, which would have resulted in a monthly payment of $660, and two years ago the average rate was 4.91%, which equates to a $744 payment each month. As can be seen, locking in a mortgage interest rate today can create tremendous monthly savings for years into the future. Not only do today's home buyers have the unique opportunity to lock in a low interest rate, they are also potentially buying at the lowest housing prices that we will see for many years to come. Local home values increased quickly between 2003 and 2006, with a 51% increase in median price over a three year period. Since that time, home values have been slowly declining, showing an overall 9% decline between 2006 and 2012. Home values now appear to have stabilized, with annualized median sales prices steady for the past 23 months. We are likely to see home prices slowly start to improve again over the coming years. The lowest mortgage interest rates ever combined with the lowest home prices that we are likely to see over the next 5-10 years create a unique opportunity for buyers who are willing and able to act now to buy a home. The first steps in taking advantage of this opportunity should include talking to a local mortgage lender to become preapproved for a mortgage, and talking to a Realtor about what you are looking for in a new home. | |

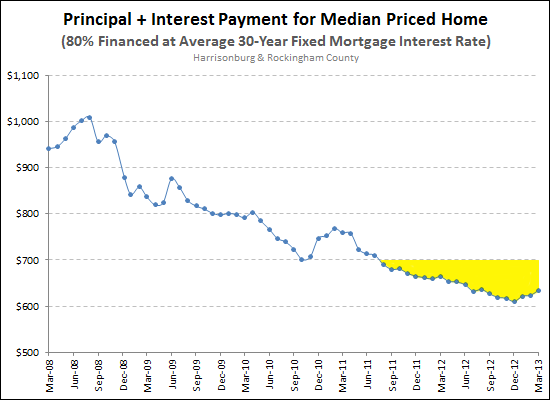

Low Home Prices + Really Low Mortgage Interest Rates = Fantastic Monthly Payments |

|

March 2008 Annualized Median Sales Price = $197,000 March 2013 Annualized Median Sales Price = $175,000 March 2008 Average 30-Year Fixed Mortgage Interest Rate = 5.97% March 2013 Average 30-Year Fixed Mortgage Interest Rate = 3.57% The graph above shows the impact of combining low home prices and ultra low mortgage interest rates by analyzing the monthly payment (principal + interest) assuming 80% financing of the median sales price at the average mortgage interest rate. As you can see, this monthly payment would have been $942 back in March 2008, and is only $634 today. Today's low housing prices and historically low mortgage interest rates provide unique opportunities for home buyers! | |

30 Year Fixed Mortgage Interest Rates Drop....Again! |

|

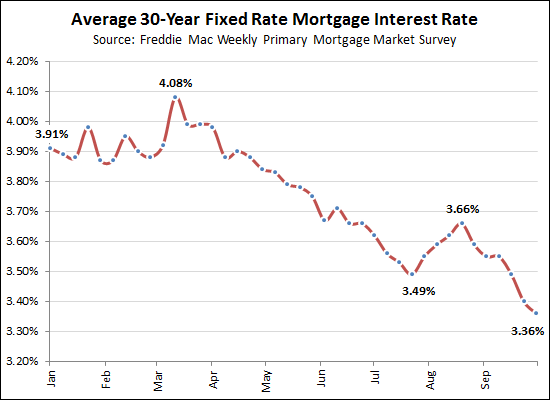

Today's rates are not the lowest ever (see Oct 2012 - Jan 2013, in yellow) but they are still amazing rates --- at an average of 3.41% per Freddie Mac's weekly survey. Just one month ago, the average rate was 3.63%, and we're now back down to an average rate of 3.43%. If you're buying, this week would be a great time to lock in your mortgage interest rate! | |

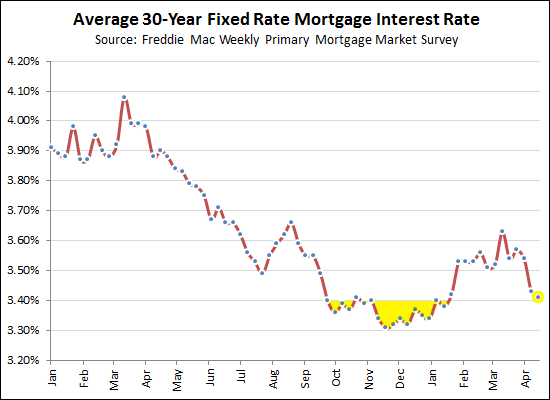

Will 30-year fixed mortgage interest rates fall below 3.5% again? |

|

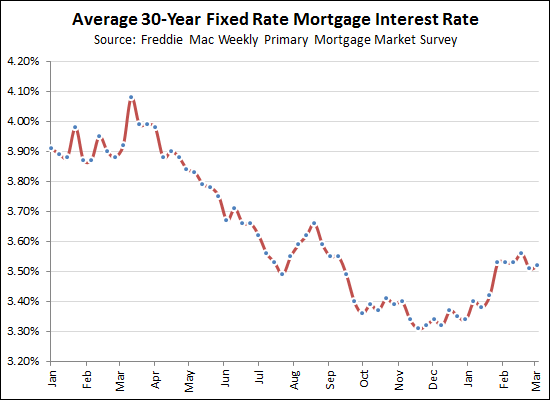

Lest I be accused of only talking about mortgage interest rates when they are falling.... As you'll see above, interest rates have generally been on the rise since the beginning of the year. After staying below 3.5% between September 2012 and January 2013, they have now edged back up. These mortgage interest rates are, of course, still unbelievably low -- both over the long-term (the past year's rates are the lowest ever) --- as well as in the short term (rates are 0.5% lower than a year ago). If you are considering a home purchase this spring or summer, now might be an excellent time to become pre-approved, find a house and lock in an ultra-low mortgage interest rate! | |

The annual cost to own a $250K home has dropped $780 since January thanks to low interest rates. |

|

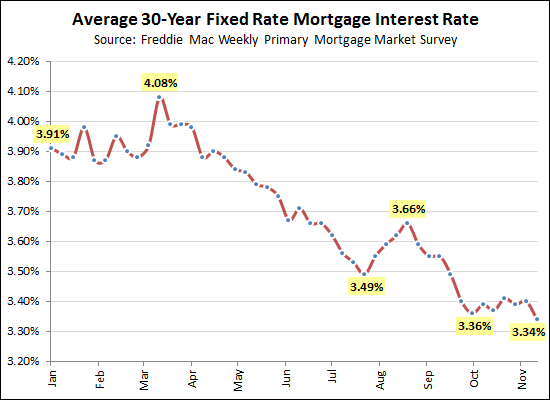

Another new record low -- average 30-year fixed mortgage interest rates are now hovering at 3.34%, a level never seen before! If you bought a $250K house in the first week of January with 80% financing with the interest rate at the time (3.91%) you would be paying $945/month in principal and interest. Buying a $250K house today with 80% financing with the current interest rate (3.34%) will result in a payment of $880/month in principal and interest. That means that since the first of the year, the cost to own a $250K house has decreased by $65/month --- which is an annual savings of $780. Wow! It has been very rewarding to see many of my clients closing on home purchases this year and locking in their housing costs at such historically low levels. Will you be next? | |

You had better lock in that mortgage interest rate, because they are headed up, oh wait, nevermind! |

|

After some increase in the average mortgage interest rate between late July and late August, it looked like we were finally going to see mortgage interest rates start to climb. But now, they have achieved yet another historic low this week, with an average 30-year fixed rate mortgage at 3.36%. Wow! If you bought a $300K house with 20% down, your payment would be another $74/month less expensive because of the decline in interest rates that we have seen since the beginning of the year. If you're buying soon, buy now. Lock in a 30-year mortgage interest rate at these ridiculously low rates, and brag about it for years to come! | |

Should I buy a home if I am only going to be there for two years? |

|

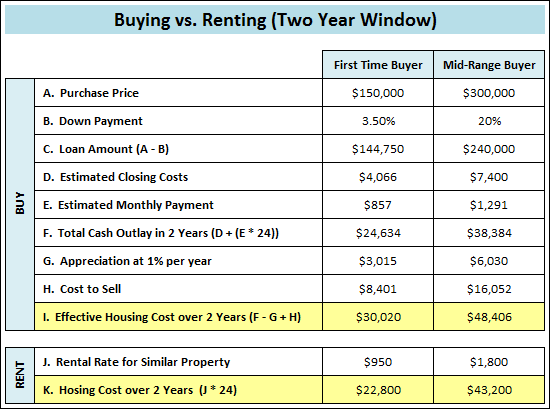

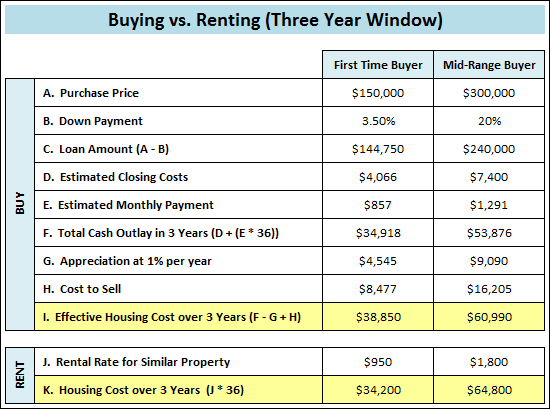

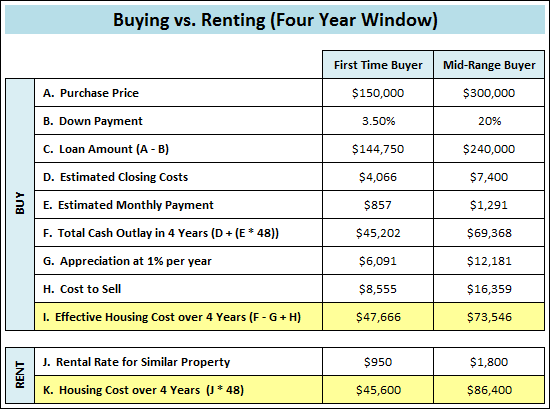

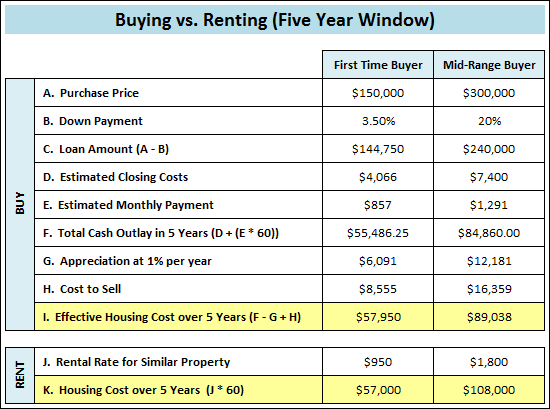

It depends on the price range, how much of a down payment you are making, whether you are willing to keep the property as a rental property after you move out, and many other factors. However, below is a 2-year, 3-year, 4-year and 5-year analysis of buying versus renting a property valued at $150K compared to $300K, which shows that....

There are, of course, plenty of extenuating circumstances. Many people might buy a $150K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits (not shown below). Every buyer's situation is different, and I'd be happy to help you run an analysis similar to those shown below if you're interested in analyzing your best housing move.

| |

Estimating your housing payment as a first time buyer |

|

I often have conversations with people considering their first home purchase who want to first get an idea of how much they would have to pay for housing on a monthly basis. I have devised an Excel mortgage calculator that I can use to give them a rough idea, or I recommend that they call a lender to get pre-approved. But --- for those of you looking to get just a rough idea, at a few price points, here are some examples of monthly housing costs... The condo or least-expensive townhomes in Harrisonburg ($125K) There are not very many options for housing below $110K in Harrisonburg, but there are some between $120K and $130K. We'll assume a price in between of $125K. 96.5% financing = $652/month ($4K down payment) 90% financing = $614/month ($13K down payment) 80% financing = $556/month ($25K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. The new-ish, starter Harrisonburg townhome ($150K) There are quite a few two-story townhomes on the market right now built in the last 5-10 years, priced between $145K and $155K, located in the City of Harrisonburg. We'll assume a price somewhere in between, of $150K. 96.5% financing = $782/month ($5K down payment) 90% financing = $737/month ($15K down payment) 80% financing = $668/month ($30K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. The entry-level Harrisonburg single-family home ($200K) While there are some single family homes priced below $175K, there are quite a few more options between $180K and $220K, again located in the City of Harrisonburg. 96.5% financing = $1,042/month ($7K down payment) 90% financing = $982/month ($20K down payment) 80% financing = $890/month ($40K down payment) All of these estimates include taxes and insurance, and are based on a 30-year mortgage with a 3.75% interest rate. BUT....DON'T FORGET ABOUT THE TAX SAVINGS! If you're renting now, you should also consider the tax savings of buying a home. All of the interest you pay on your mortgage can be deducted from your income for tax purposes. $125K @ 96.5% financing = $1,131 tax savings in the first year $150K @ 90% financing = $1,265 tax savings in the first year $200K @ 80% financing = $1,500 tax savings in the first year The tax savings above assume a 25% tax rate and aren't realized until the end of the year, but if you factor in these monthly savings, the effective monthly housing costs (including property taxes, home owners insurance and the tax savings) would be... $125K @ 96.5% financing = $558/month $150K @ 90% financing = $632/month $200K @ 80% financing = $765/month And...one final disclaimer...I am not a lender, nor do I offer any type of financing. E-mail or call me and I'd be happy to recommend a few lenders to you. | |

What will I need to provide when applying for a mortgage? |

|

Here is a comprehensive list from Jon Ischinger at Wells Fargo Home Mortgage of the items you'll need to provide when applying for a mortgage.

Ready to get pre-approved for a loan? Start gathering the items, and click here to start the loan pre-approval process. | |

Mortgage interest rates continue to do the limbo . . . how low CAN they go? |

|

The average 30 year fixed mortgage interest rate is now below 3.5% -- and for that matter, has only been above 4% for one week this year. If you're buying, talk to your lender today (OK, or the next business day) and lock in your interest rate! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings