Financing

| Newer Posts | Older Posts |

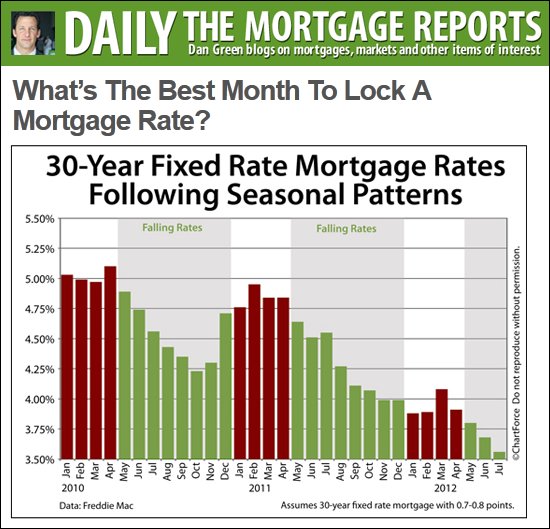

Summer, Fall best time to get low mortgage interest rate |

|

Check out this interesting analysis from Dan Green, showing that interest rates are typically lowest in the summer and fall. Talk to a lender now if you're thinking of buying this summer or fall! | |

Mortgage Interest Rates Drop Yet Again |

|

Yet another ALL TIME HISTORIC LOW. How low can they go? How about 3%? Can we get there?? | |

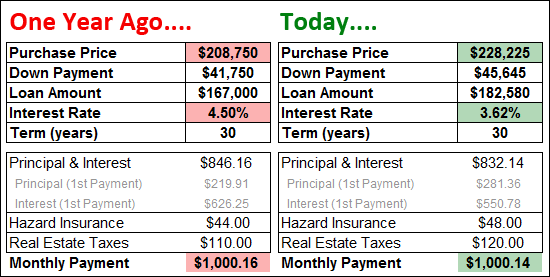

Your mortgage dollars are going further these days |

|

If you were qualified to buy a nice house a year ago, you can likely buy an even nicer house now! Lower interest rates will allow you to buy a more expensive house and keep the same mortgage payment. As shown above, a year ago you could have bought a $208,750 house for $1,000/month. Today, you could buy a $228,225 house. That is a an increase of almost $20,000 in purchasing power! Assumptions: 20% down payment, property located in the City of Harrisonburg | |

Consider a shorter loan term when refinancing |

|

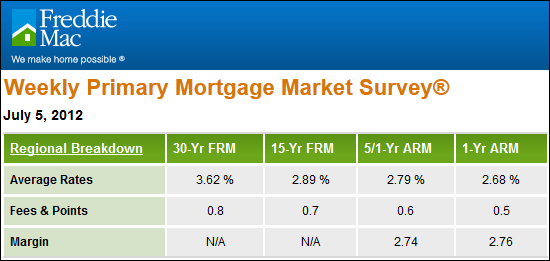

I bet you thought rates were low on 30 year mortgages at 3.62%. How about a 15-year fixed rate mortgage at 2.89% -- now that is low! If you are refinancing your mortgage because you have a high current interest rate --- be sure to check to see what would happen if you reduced the term of the mortgage. Let's consider the scenario of someone who bought a $250,000 house ten years ago with 80% of the purchase price financed at 6%. Somehow, this homeowner has still not refinanced (suspend your disbelief) but now is finally considering it. Current Mortgage Payment (principal and interest only) = $1200 Option 1: Refinancing balance of $167,371 at 3.62% over 30 years. New Mortgage Payment = $763 Option 2: Refinancing balance of $167,371 at 2.89% over 15 years. New Mortgage Payment = $1147 So.....after having paid for 10 years, this homeowner can take their remaining 20 years of intended mortgage payments ($1200/m) and lower that payment to $1147/m all while paying off the mortgage in 15 years instead of 20 years! Opportunities abound given today's low (low) mortgage interest rates. Whether refinancing or buying, now is a great time to consider taking out a new mortgage and locking in your interest costs at all-time record lows. | |

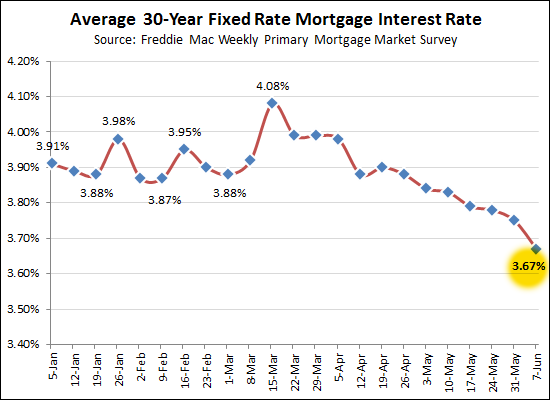

Perhaps we will be down to 3.5% on a 30-year fixed rate mortgage soon? |

|

If this trend continues....  A new record was set yesterday, with an average rate of 3.67% for a 30-year fixed rate mortgage. Wow! | |

Low mortgage interest rates offer unique opportunities |

|

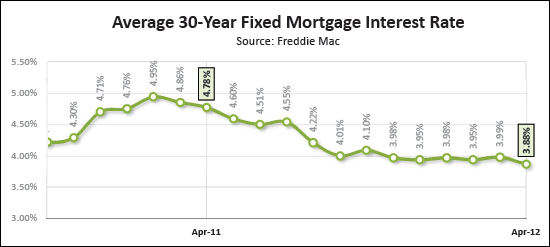

At some point, we will look back at early 2012 and marvel at how inexpensive money was at the time. After all, for over six months now, mortgage interest rates have stayed at phenomenally low levels – right around 4% for a 30-year fixed rate mortgage. While these interest rates won't necessarily disappear tomorrow, it is important for homeowners and would-be homeowners to consider whether current interest rates should prompt some action or decision today, rather than six months from now. Countless homeowners have found great benefit in refinancing their current mortgages, often against all odds. Today's low interest rates can make significantly lower your monthly housing costs depending on your mortgage's current interest rate. Many homeowners assume that they will not be able to refinancing their home if it has declined in value since they bought it, but this is not always the case. Several new programs, such as the Home Affordability Refinance Program (HARP) create provisions that may allow you to refinance your mortgage even if you owe somewhat more than the current value of your home. If your current mortgage interest rate is 5% or higher, I would recommend that you meet with a local lender to discuss your options in the current mortgage market. Beyond refinancing your current mortgage, today's interest rates offer a fantastic opportunity for would-be homeowners. As you may recall, some buyers felt priced out of the home of their dreams a few years ago during the real estate boom as home prices increased quickly. Those same buyers are now finding themselves priced back into the home of their dreams given both market adjustments (lower prices) and lower mortgage interest rates. After all, a $200,000 home five years ago with a 5.5% interest rate would have carried a cost of over $1,000 per month including taxes and insurance, and provided you were making a 20% down payment. That same house today, if purchasable at only $175,000, would have a monthly cost of less than $800 per month. Some home buyers are taking advantage of these low mortgage interest rates to get into a modest home, with a much lower monthly payment than they anticipated. Other buyers are taking the opportunity to buy a larger or nicer home than they anticipated being able to purchase – so that they will be able to stay in the home for a longer period of time. Whatever the decision as to how you make use of your broader financial capabilities, the key realization for today's home buyers is that a home purchase during 2012 allows you to lock in your housing costs for the future at what may be the lowest possible point we'll see anytime soon. Based on recent market analysis, home prices seem to be starting to steady themselves – thus, one year from now, you will likely not be able to buy a home at the same low prices as are found today. Combine this with somewhat higher interest rates that are bound to eventually materialize and it creates a unique window of opportunity for today's home buyers. | |

Why are we waiting so long to order appraisals?? |

|

I have had five transactions thus far this year where this dynamic seems to be at play....  The diagrams above are not showing the new reality for all lenders --- it is just a reflection of my experience with many lenders recently. For whatever reason, (many) lenders (on many transactions) seem to be waiting to order an appraisal until they have completely finalized the approval of the borrower. This is problematic for several reasons:

If you're buying a house, make sure your lender orders your appraisal as soon as you have made loan application --- especially since the fee that you pay at application is at least partially for the appraisal. If you're selling a house, don't assume that the appraisal has been ordered as soon as the buyer makes loan application. Follow up and make sure that the appraisal is ordered ASAP. If any lenders can explain why this is happening, or provide any good reasons for it happening this way, I'm all ears. | |

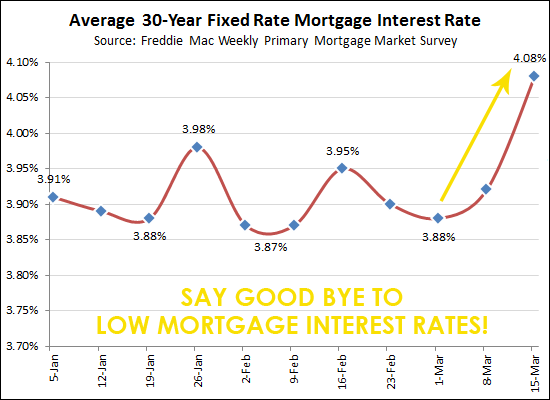

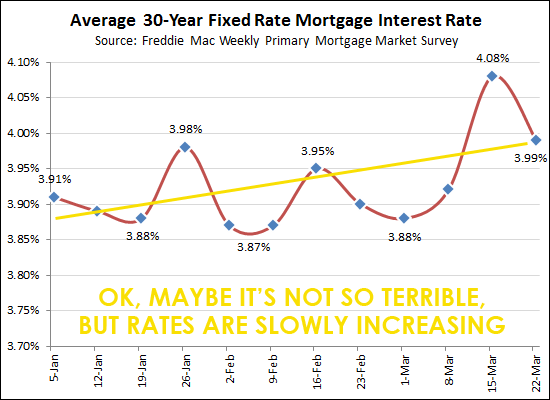

The perils of waiting to tell you that mortgage interest rates are headed back up |

|

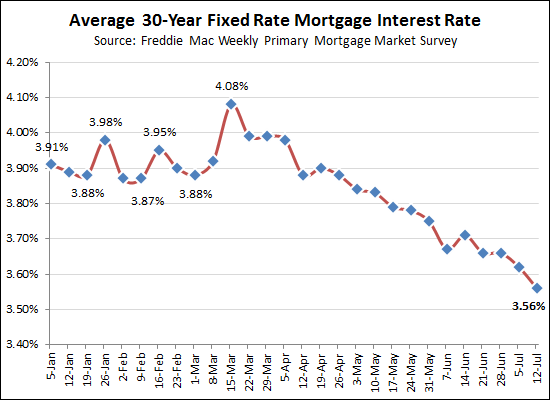

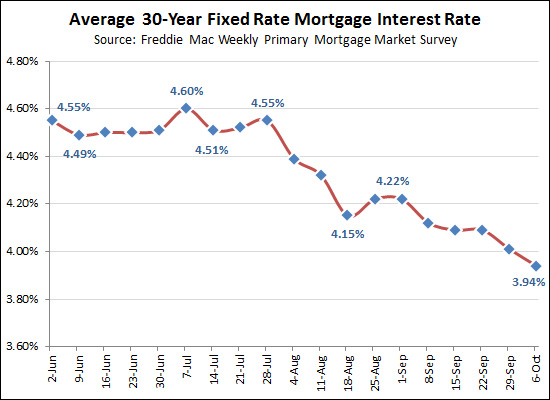

If I had been a bit more timely, and had broken this news about a week ago, I might have told you that THE SKY IS FALLING, LOCK IN AN INTEREST RATE NOW. Indeed, mortgage interest rates made a considerably two week jump from 3.88% to 4.08%. Many predicted that the end of low mortgage interest rates was nigh.  As is typical, one data point can distort one's perception of reality. So, let's take just one more data point and reassure ourselves about our previous perception of reality. :) As you'll see above, the jump to 4.08% may have been an anomaly, as average interest rates fell back below 4% the following week. The big picture is something we've known for a WHILE now -- these ridiculously low mortgage interest rates won't last forever -- though it could be quite a while before they may any meaningful increases (over 4.5% or 5.0%, for example). | |

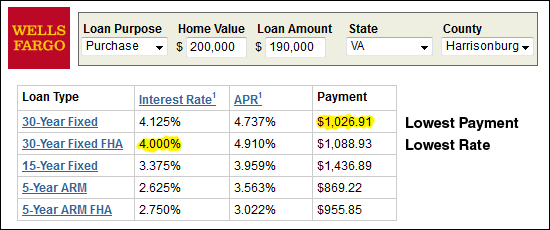

With a small down payment, check both FHA and conventional mortgage options! |

|

This was a great tip that Oguz Sengul (Wells Fargo Home Mortgage) shared with me yesterday....  As shown above, sometimes even with a lower rate (4.000% via the FHA loan program), sometimes you will have better financing terms with a higher rate (4.125% as a conventional loan). You need to be checking both the interest rate as well as the payment. Higher up front fees and higher monthly mortgage insurance costs can make the FHA loan program less affordable than a conventional loan if you have at least a 5% down payment. Disclaimer from Wells Fargo: Interest rates displayed above require that you pay 1% of your loan amount toward the loan origination charge. | |

Mortgage interest rates are on the rise....they are now at a sky high 3.95% |

|

Don't get too worried, interest rates are still incredibly low, and still below 4%. But after four weeks at record lows, the average 30-year mortgage interest rate increased from 3.87% to 3.95% "The rise in rates is a vote of confidence for the housing market, which continues to show signs of gradual improvement, said Frank Nothaft, Freddie Mac's chief economist." Other factors affecting more optimism in the housing market:

| |

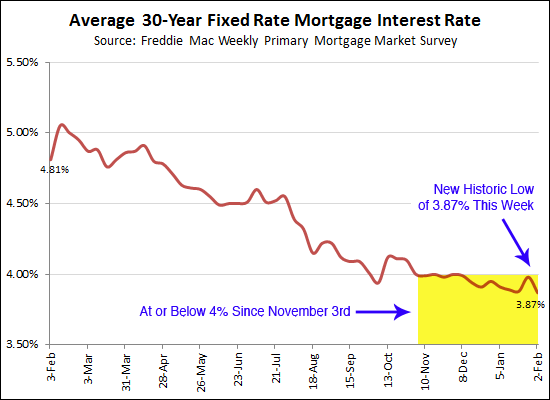

Average mortgage interest rates (3.87%) break historic low levels, again |

|

Not only have 30-year fixed mortgage interest rates been at or below 4% since November 3rd, they also hit an all-time low this past week at 3.87%. Buying a median priced home a year ago: Price: $180,000 Interest Rate: 4.81% Monthly Payment: $884 (assuming 80% LTV) Buying a median priced home now: Price: $174,900 Interest Rate: 3.87% Monthly Payment: $781 (assuming 80% LTV) | |

Yes, 100% financing does still exist. |

|

If you are looking to finance 100% of the purchase price of your new home, it may still be possible. Please note that each of the loan types below have limitations and requirements that may not make you or your property eligible -- but all of them deserve research if you are interested in a 100% loan. FHA Loan + 3.5% Gift If you have access to 3.5% of the purchase price as a gift, you may be able to combine that with a 96.5% FHA loan to acquire an effective 100% loan -- even though you won't be paying back the gift. BB&T's Community Homeownership Incentive Program (CHIP) These mortgages through BB&T do not require a downpayment nor a PMI payment. Veteran's Administration (VA) Loans These loans can be up to 100% of the purchase price and are available to qualified veterans, active duty, reserves and National Guard personnel. USDA Rural Development Loans The property you are purchasing must be eligible (based on location) and you must qualify (based on income) -- you can check both of those details here. Of note, the processing of these loans can be quite slow -- after your mortgage goes through underwriting with your lender, it then must be submitted to USDA for review and approval. I am not a lender, but I'm happy to answer any general questions you might have about the process of becoming pre-approved, some professional lenders in the Harrisonburg and Rockingham County area, etc. Feel free to call me (540-578-0102) or e-mail me to discuss your financing scenario. | |

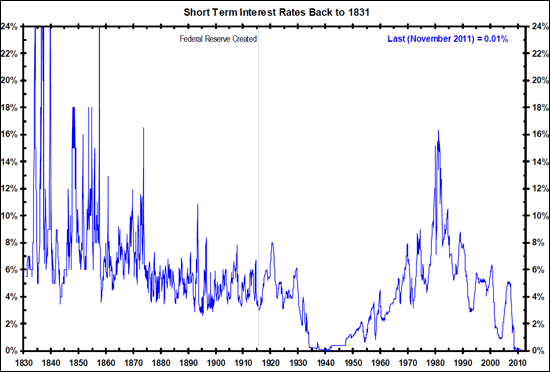

Here's one reason your mortgage interest rate is so low! |

|

Budget 34% less for your housing costs at Taylor Spring |

|

Yesterday I pointed out that monthly housing costs have declined 28% since 2007 because of modest declines in median sales prices and significant declines in average mortgage interest rates. But let's make it a bit more specific.... The first townhouse pictured above was sold in 2007 for just $100 more than the median sales price at the time, and your monthly housing cost would have been $1,096 if you financed 80% of the purchase price at the average interest rate of 6.21%. The second townhouse pictured above is for sale now for only $159,200, and would require a monthly housing cost of only $719 -- again, assuming you financed 80% of the purchase price at today's average interest rate of 3.99%. This is quite a dramatic difference (-34%) in housings costs, and hopefully helps to illustrate the wonderful opportunities for buyers in today's market! | |

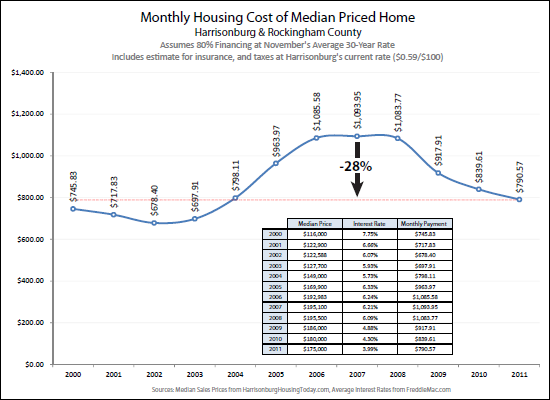

Monthly housing costs down 28% from 2007 peak |

|

How much does it cost on a monthly basis to buy the median price home in our area, assuming 80% financing? Today, that adds up to a $791 monthly payment. That marks a dramatic 28% decline since 2007 when the monthly payment would have been $1,094. The decline in median sales prices over the last few years (from $195K to $175K) combined with the decline in interest rates (from 6.2% to 3.9%) has brought average monthly housing payments down to very affordable levels. Again, the graph above (click here for a more legible PDF) shows the mortgage payment including principal, interest, taxes and insurance (PITI) assuming 80% financing at November's average 30-year interest rate, and assuming Harrisonburg's real estate tax rate ($0.59 per $100). | |

Should I buy or should I rent? |

|

Yesterday's Daily News Record had a thorough look at buying vs. renting from a variety of perspectives. Here are a few (long-ish) excerpts....  HARRISONBURG — Chris and Kate Kelty had no plans of jumping back into the housing market a year after selling their townhouse. The couple with three young children figured they'd remain renters for a few years while building back up money for a down payment. Then they watched mortgage rates start plummeting. After a bit of number-crunching, the Keltys switched gears. "We realized, oh, my Lord, it makes a lot more sense to start thinking about buying," Kate Kelty said. "It was kind of a no-brainer." In August, the Keltys closed on a 2,500-square-foot home west of Bridgewater for $230,900. Their mortgage is $1,300 a month through a USDA Rural Development loan. Kelty, 32, said that's about how much renting a similar-sized house in the area would cost.  A good deal on a home in the county near Rockingham Memorial Hospital enticed Chris Foster, 25, to buy his first house in early October for $220,000. His mortgage payments are about $200 more per month than what Foster shelled out as a renter, but he doubled his living space while adding a garage and a finished backyard. "I had a goal all along to purchase sooner rather than later," said Foster, a pharmaceutical representative. "This was kind of a perfect storm, so to say."  Record-low mortgage rates have made buying a more attractive option for some renters. Interest rates on the average 30-year loan are hovering around 4 percent. "It would be difficult for renters to not strongly consider buying a home," said William Haithcock, chief executive officer of the Harrisonburg-Rockingham Association of Realtors. Those were just some excerpts, so be sure to read the full article online if you have a subscription. Of course, as usual, buying doesn't make sense for everybody, but it is becoming a much more compelling option for many these days. | |

Record low interest rates spur on buyer activity |

|

Average 30-year fixed mortgage interest rates are now below 4.0%. Wow! I have shown houses to quite a few people over the past two weeks who are seriously considering a housing transition because of the extraordinary opportunity provided by these record low interest rates. Are you considering a move? Talk to a lender (ask me if you need references), and let's start exploring your opportunities. | |

Impact of October 1 reduction of FHA loan limits |

|

Come October 1, 2011 the loan limits for FHA mortgages will be reduced in many parts of the country. Some would have you believe this will be disastrous for the housing market....  But will there really be that much of an impact on the housing market because of these new loan limits? Alan Zibel at the Wall Street Journal explores this, wondering whether the changes really matter....  Beyond the possibility that these changes might not even matter much nationally, it's also important to note that....

| |

Mortgage interest rates drop...again...soon banks will be paying you to take their money! |

|

How low can they go? Mortgage interest rates (on 30-year fixed rate mortgages) dropped again yesterday per Freddie Mac's Primary Mortgage Market Survey. The national average for a 30-year fixed rate mortgage is now 4.12%. Wow! If you're planning to buy sometime in the next few months, now would be a GREAT time to lock in a mortgage interest rate! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings