Financing

| Newer Posts | Older Posts |

I heard (insert this, that or the other) about foreclosures. Is that going to affect us here in Harrisonburg? |

|

If you hear something about the housing market on the news, it will likely mention the big (bad, scary) problem of foreclosures. Things you may have heard could include:

| |

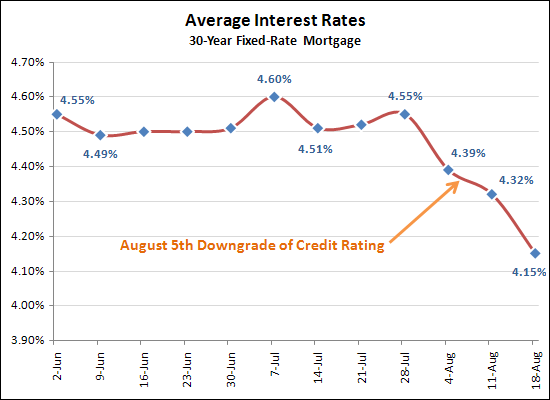

Great news for buyers! Average 30-year fixed rate mortgages at only 4.15% per Freddie Mac. |

|

The downgrade of the United States' credit rating sure helped mortgage interest rates! Wow! The average rate on a 30 year fixed rate mortgage is now 4.15%. This is certainly a great time to lock in a rate and buy a house. You will likely be locking in your housing costs to the lowest possible point they could be for the near-term future given both low interest rates and low median home values. | |

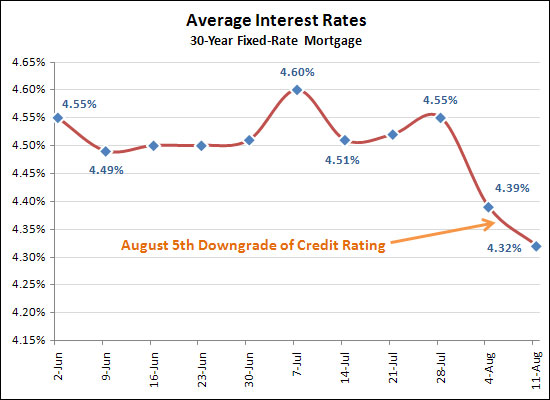

So, the downgrade of the U.S. credit rating will definitely lead to an increase in interest rates, right? |

|

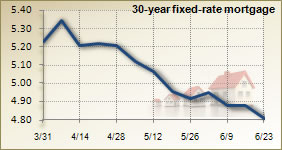

While rates could still swing back upward, thus far rates have just continued to decline after the downgrade of the United States' credit rating.  Source: Freddie Mac | |

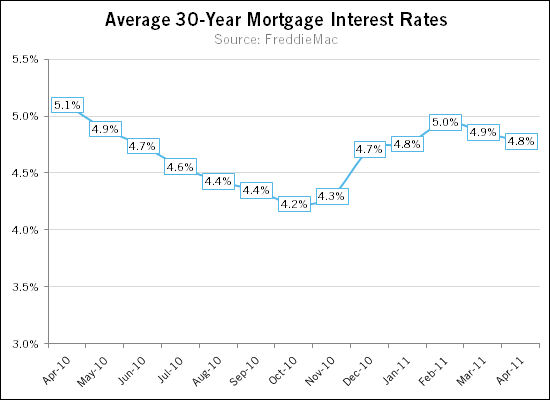

Mortgage interest rates continue to decline in April 2011 |

|

After interest rates climbed nearly a full percentage point (4.2% to 5.0%) between October 2010 and February 2011, they have started to decline again over the past several months. April 2011 marks the second straight decline down to the current average of 4.8%. Please note that you may be able to obtain an even lower interest rate than the average rates shown above depending on your credit score and other details of your finances and home purchase. Current rates offered via WellsFargo.com include:

| |

Founders Way Condos are APPROVED for FHA financing! |

|

Buying a condo at Founders Way couldn't be any easier!  As of this week, Founders Way Condos are approved for FHA financing. These spacious condos have wonderfully open floor plans with 2 or 3 bedrooms, and start at only $149K. Buyers at Founders Way are often attracted to:

Find out more about Founders Way:

| |

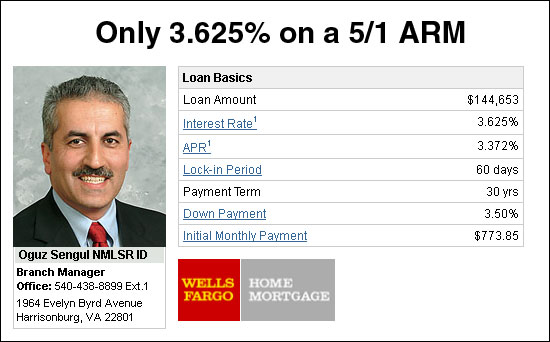

FHA Adjustable Rate Mortgages For Only 3.625% |

|

As of today, you can obtain an amazing 3.625% interest rate on a 5/1 adjustable rate mortgage through FHA. Until recently, I had thought that 30 year fixed rate mortgages were the only product offered through FHA, but Oguz Sengul pointed out that FHA also offers a 5/1 ARM. A "5/1 ARM" is a mortgage that has a fixed rate (3.625%) for five years, and then can adjust once every year. If you anticipate only being in your home for 3, 4, 5 or 6 years, this can be a fantastic loan program to consider! | |

Is It Easy To Get A Mortgage? |

|

Three times in the past three weeks I have been in real estate related meetings when someone asked "So, how much do you have to put down on a mortgage these days, twenty percent?" Each time my jaw dropped, and I explained that the down payment on a purchase can be as little as 3.5%....and sometimes as little as no down payment at all. Their jaws then dropped, as they asked questions along the lines of "but, I thought it was nearly impossible to get a mortgage these days" and "but, what about reforming the mortgage market after all the crazy loans that were issued?" These are reasonable questions and objections, which I then discussed with them, but what I hoped stuck with them is that you don't need to wait to buy until you have 20% of the purchase price as a down payment. At this point it is important to note that having 20% as a down payment is not at all a bad idea –it is certainly something to be strived for – but it shouldn't necessarily limit your purchasing decision. If home prices declined over the next few years, a larger down payment (for example, 20%) would help you to avoid getting stuck in a house with a mortgage you could not pay off in order to sell. A 20% down payment can also lower your mortgage payment, as you will be financing a smaller amount, and you should not have to pay mortgage insurance in addition to the principal, interest, taxes and insurance. Despite these benefits, however, waiting to purchase until you have a 20% down payment can significantly change when you are able to buy a house, particularly if you are a first time buyer. Are there really loan programs that only require a 3.5% down payment? The most frequently utilized loan program these days is the FHA loan program, which is underwritten by the federal government and only requires a 3.5% down payment. The federal guarantee of the loan allows lenders to offer you lower interest rates, which makes the monthly payment more affordable to you. Many (or most) first time buyers utilize the FHA loan program, however it can be used for mortgages up to $277,150 in Harrisonburg or Rockingham County. Isn't it difficult to get a mortgage these days? A few years ago, it was said that if you had a pulse, you could get a mortgage. Indeed, there were mortgage programs where your lender did not need to verify your income, nor your assets, nor your employment, etc. It is certainly more difficult to get a loan now if that is our basis of comparison, however new mortgage guidelines are not absurdly strict. Most people with reasonably good credit and with steady, predictable income can obtain a mortgage with reasonable terms. One of my clients recently asked me whether a significant portion of contracts fall through these days as a result of buyer not being able to obtain financing – thankfully, this is not seen too often in our area. If you are wondering whether you can obtain a mortgage, talk to a bank or mortgage company to quickly and easily be pre-qualified. If you're not sure who to talk to, start by speaking with a Realtor, who can certainly give you some recommendations on reliable, professional lenders in the area. What about mortgage reform? It is true – there were some wild and crazy things happening in the mortgage market over the past several years, and new guidelines are now in place (and being put in place) to attempt to ensure that we will not travel down those roads again. Despite these new guidelines, however, it is still possible for hopeful buyers with a reasonable amount of income to obtain a mortgage without too much of a hassle, without too much cost, and with very favorable terms. What is next in the mortgage market? Interest rates are still phenomenally low compared to the past several decades, so opportunities abound to buy and obtain a fantastically low fixed interest rate on your mortgage. Many people predict that interest rates will rise as we continue through 2011, though many people have predicted that for the past several years without any great supporting evidence after the fact. It is important to note, however, that changes to the mortgage market may be coming down from the administration. Current plans are in the works to re-vamp how the mortgage market works, which some argue will increase mortgage costs to consumers. Each of the three people who presumed that a 20% down payment was required these days is a very smart person – but each of them had an incorrect assumption about the current state of the mortgage market. If you are considering buying, or refinancing, don't make a decision based on your assumptions, or based on what your neighbor or friend tells you. Talk to a mortgage professional who can accurately explain your options and help you find the best path for your future. | |

What if I don’t have enough for a 20% down payment? |

|

Good news -- it won't be a problem if you don't have a 20% down payment. Some people think that you need a 20% down payment these days, since financing guidelines have become so much more restrictive over the past year or two. That's simply not the case. The FHA loan program is an excellent example of a low down payment loan option that many buyers are using these days. You can purchase a home with as little as 3.5% of the purchase price as a down payment. Furthermore, your closing costs and/or your down payment can be a gift. The VA loan program (available to qualified veterans, reservists, and active-duty service members) requires no down payment and your closing costs can be a gift. For more information about FHA loans or VA loans, read more on the Government Loans section of Wells Fargo's web site. Again -- remember -- you don't need a 20% down payment to buy a house these days. If you'd like to talk more about your buying situation, feel free to contact me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

It’s Amazing How "Dumb" Smart People Can Be |

|

First --- let's be clear --- I'm not accusing smart people of sometimes being dumb. The title of this post is actually a quote from a smart person last week. She said something along the lines of "Wow, it's amazing how dumb smart people can be sometimes". I quickly translated "dumb" into "uninformed about specific topic areas" --- which she thought was a gesture of politeness, but I really think it is a fair judgment of what she was describing. Again, she's quite a bright person, but....

Bottom line -- if you only participate in something every 5 to 8 years, it's probably not reasonable to think you'll know and retain the intricacies (or even the basics) of that content area during the 5 to 8 (or more) years in between such events. If you bought a house today, you'd likely have learned during the process of doing so that you could have as little as 3.5% of the purchase price to use as a downpayment. Will you retain that information for the next 5, 8, 12 years until you buy your next home? You might, but you might also hear lots of news reports over the next three years about changing (tightening) lending requirements and then start to assume that these low downpayment programs no longer exist. If you bought a house 12 years ago and were told that you had a credit score of 800, and that it was excellent, would you remember that today (12 years later)? Or might you forget that the range is between 300 and 850? Now realizing that smart people can be dumb (uninformed) about specific topic areas, what can we conclude? Consumers should remember to not make any assumptions, and to ask questions even if they seem like they are dumb questions. Professionals (Realtors, lenders, etc.) should remember that consumers might not necessarily know the basics of what is required for a mortgage, or what good credit looks like. Have questions yourself? Don't worry, I won't think you're dumb -- I'll happily help inform you about an area of information that you probably had no need to be aware of until recently. Call anytime (540-578-0102), or send me an e-mail: scott@HarrisonburgHousingToday.com. | |

Preston Lake Foreclosure Auction Results In $3.5M Sale To Wells Fargo |

|

The Preston Lake Trustee Sale took place today (February 3, 2011) at noon, and drew quite a crowd of Preston Lake homeowners, developers, attorneys, Realtors, and neighboring landowners. Here's an overview of where things stand.... Local History in the Making: It's not necessarily the good type of history, but this was the first major subdivision --- and hopefully the last --- to be foreclosed on in the Harrisonburg area. Many other areas across the country have seen multiple large subdivisions be foreclosed on, but until today, Harrisonburg had been unscathed. The timing of the development of this subdivision is likely what led us to today's events, as the development began just as the housing market began to slow dramatically. Only One Registered Bidder: Only one individual registered as a potential bidder at the sale (by showing his deposit check to the Trustee, and providing his name), though he did bid during the auction, likely because of the opening bids from Wells Fargo. Only One Actual Bidder: There was only one actual bidder....Wells Fargo. Surprise Rowhouse Auctions: In addition to the 120+ acres of land at Preston Lake that were auctioned off today, four rowhouses were also auctioned separately. This was not specifically advertised -- if it had been, I think we would have seen some actual bidding take place. Each of these rowhouses are at a different stage of completion, but each at least has the shell completed. The opening bids from Wells Fargo were as follows, and these are the prices at which they are taking back the properties:

The Common Areas: The attorney representing Wells Fargo also indicated that the common areas would be deeded to the Property Owners Association. The Association will still exist, and owners will still make payments to it to support the maintenance of the common areas and other common amenities of the neighborhood. What Happens Next: In theory, within 30 days, Wells Fargo will close on their purchase of the four individual rowhouses, and the 120+ acres of Preston Lake. The attorney representing Wells Fargo commented to me afterward that he thinks there is a 90% chance that the sale will proceed to closing and that Wells Fargo will be the new owner. After Wells Fargo owns the property, he indicated that they would sell the four rowhouses individually, and seek to sell the remaining 120+ acres to a new developer. It is unclear what price they will ask for the remainder of the subdivision (likely lower than $3.5M), and it is unclear what price they will eventually take for the remainder of the subdivision (likely lower than $3.5M). Wells Fargo's attorney also indicated that while they will attempt to sell the entire undeveloped section of Preston Lake as a whole to one developer, it is also possible that they would sell the property as individual lots or sections of lots. Wells Fargo has done this with other subdivisions around the country that they have foreclosed on, though it is not their goal. Wells Fargo is interested in money: This should come as no surprise, but Wells Fargo's goal in being the new owner of the undeveloped areas of Preston Lake are to try to recoup as much as possible of the money that they have invested in the subdivision. They won't, thus, try to unload the property for development into a mobile home park -- they will be marketing it and working to sell it for its highest and best use. This does not mean that the development plan won't or can't change -- but they will be trying to recoup as much money as possible, and thus will be trying to sell it to a developer who has the a positive (and profitable) vision for it. Those Pesky Lawsuits: The developer of Preston Lake (Richard Hine) had filed a lawsuit against Wachovia (now Wells Fargo) --- and Wachovia had responded with a countersuit. Per the attorney representing Wells Fargo, both of those lawsuits will go away once the sale closes, and the property is taken back by Wells Fargo. A Community United: If anything, the turmoil and uncertainty over the future of Preston Lake seems to have drawn its residents closer together as a community. Most of the owners were in attendance at the sale, and then went as a group to Cally's afterward to have lunch. There seems to be solidarity and general optimism (as much as is possible) amongst most (or all) of the owners. They still seem to thoroughly enjoy their homes, and each other, which is a positive sign for the future of the community. Have Questions? If you have questions about Preston Lake or the foreclosure proceedings, I'm happy to try to answer them (540-578-0102, scott@HarrisonburgHousingToday.com), or you can contact Peter Barrett of Kutak Rock, LLP, who is the attorney representing Wells Fargo. You can reach Mr. Barrett at 804-343-5237 or peter.barrett@kutackrock.com. | |

What do we do if the real estate market stalls out? |

|

I'm not suggesting that the real estate market has stalled out in Harrisonburg and Rockingham County, but in talking to someone in another part of the country (thanks for the insight, Laura!) we came to a realization that some markets have stalled out -- and it's not clear what will get them started again. Laura and I realized that some markets are stuck in an endless loop: Buyers can't buy because comps aren't available to support appraisals......because buyers haven't bought......but buyers can't buy because comps aren't available to support appraisals............ Some would be quick to blame lenders --- why are they holding back the market? Buyer X wants to buy a house from Seller Y, and has written a contract to do so at a particular price. Why then, is the lender denying the loan on the basis of the appraisal? Well, it's actually quite reasonable for the bank to want and need to protect their interest. If they are going to invest $250k in a mortgage on a $300k purchase, they'd want to know if the house was only worth $200k. If that were the case, they would have made a poor investment, and their collateral (the house) would not sufficiently cover their investment should the borrower stop making payments. But you can likely see why this is frustrating for buyers and sellers alike. Even though it is reasonable for a lender to want to know (via an appraisal) that a house has a particular value --- if a buyer and seller have agreed to terms, and the buyer is not overpaying for the house, why must the entire process be stopped in its tracks simply because there aren't any comps available to support an appraisal. Here is a specific (though fictional) example of what this might look like, in a subdivision in Anytown, USA: 2008 sales prices: $250k, $255k, $260k, $255k, $250k, $255k, $255k, $255k 2009 sales prices: $250k, $245k, $245k, $245k 2010 sales prices: no sales! Then, when a buyer and seller agree on a sales price of $225k in early 2011, they certainly think that everything should go quite smoothly with the transaction. But if the lender can't find any comparable sold properties in the past 6 to 12 months that support , they will likely deny the loan on the basis of the appraisal. What are the buyer and seller to do? How does a market get started again after a very slow spell, given that appraisals are required for loans to move forward, and that comparable sales are required for appraisals??? | |

Per CNNMoney.com, "Buying a home now is a no-brainer" |

|

The market is slow, prices have slowly declined for the past few years, and likely will for the next year --- could this still be a good time to buy? Ali Velshi from CNNMoney.com says yes. (Thanks for the tip, Sue!) Velshi's logic is that even if prices fall a bit more, that today's super low interest rates make it a terrific time to buy: "Buying a fairly priced home at today's rates may be the best deal you will ever get." I tend to agree with his logic. You see, if you're going to be in a house for the next five years, and are considering the purchase of a $250k home, you're better off to buy it today at 4.25% than to buy it a year from now at $240k with a 4.75% interest rate. Assuming a 20% down payment....

| |

Everything is worth what its purchaser will pay for it |

|

Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!): Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!):

While this may have been a prevailing theory at the time, modern day appraisal practice takes a bit of a different stance, more along the lines of "Everything is worth what someone else recently paid for something similar." For example.... if three fine homes have recently sold for $325k, $330k and $335k, we'd probably all agree that a fourth similar home is probably worth around $330k. But what if it a buyer and seller agree to a sales price of $345k? The appraisal is likely going to come back low, closer to $330k. But despite Past Buyers #1, #2 and #3 paying around $330k, if Current Buyer #4 wants to pay $345k, doesn't that mean that it some ways the house is indeed worth $345k?? | |

What Do You Mean I Did Well? I Brought Thousands Of Dollars To Closing! |

|

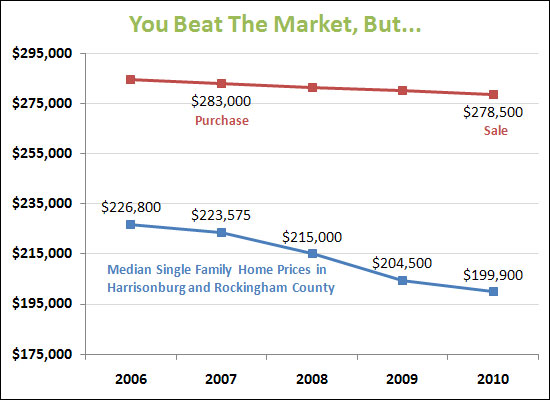

In these crazy times, it's possible to "beat the market" and yet still be hurting financially...  The blue line above shows the trend in single family home prices over the past five years in Harrisonburg and Rockingham County. As you can see, prices have declined, though only a total of 12% over the past five years. The red line shows the purchase and sale of a single home in Harrisonburg, as experienced by some of my clients. You'll note that while the red line declines, it's not by anywhere near as much as the blue line. Thus, my client's home outperformed the market --- they beat the market, and experienced a smaller decline that perhaps they should have. How exciting, right?? But no, actually, it wasn't too exciting. The heroic act of selling the house at a higher price than the market suggested would be possible was still painful. My clients had financed most of their home purchase in 2007, so they actually had to bring thousands of dollars to closing in 2010 in order for the sale to proceed. You see, it's not as simple as the purchase price minus the sales price --- you also have to factor in the closing costs on the buying side (2007) and the closing costs on the selling side (2010). So....when the market is declining, even if it is declining slowly, it can be difficult to purchase and then sell within a short time period. Thus, buyers and sellers should note that:

| |

Owner Financing In Harrisonburg & Rockingham County |

|

Can't obtain traditional financing? Perhaps the owner of the house you are purchasing can finance the purchase for you! Actually...there don't seem to be too many owner financing opportunities available. Searching our local MLS, I'm finding five properties in Harrisonburg and Rockingham County that are advertised as having owner financing opportunities....   (1) 3318 Friedens Church Road - 3 BR, 3 BA, 2700 SF, $326k (2) 216 Emerald Drive - 3 BR, 3.5 BA, 2581 SF, $199k (3) 150 Inglewood Court - 3 BR, 2 BA, 1408 SF, $178k (4) 1380 J Hunters Road - 2 BR, 2 BA, 953 SF, $57k (5) 1372 J Hunters Road - 2 BR, 1 BA, 837 SF, $47k In many (not all) cases, an owner that can provide owner financing either owns the property outright (no mortgage remains), or has a low balance on their mortgage that they can pay it off entirely. Then, with no mortgage in place, they'll expect some portion of the purchase price from you as a down payment, and the rest will be repaid over a term and on a schedule negotiated between you and the owner. Most owner financing scenarios are not 30 year arrangements, but may involve owner financing for 5 or 7 years, with a balloon payment at the end. To be more specific --- a $200k purchase might involve a $20k down payment, and then the $180k balance amortized over 30 years at 6% interest, but with a 5 year balloon. This would mean that you'd pay a monthly payment of principal and interest as if the $180k loan were stretched out over 30 years, but after 5 years you would have to pay off the entire remaining balance of the loan. Typically the balloon payoff is accomplished by refinancing the property with a traditional lender at some point prior to when the balloon payment is due. If you own a property, and are trying to sell it, and could offer owner financing --- do it! There aren't too many properties with this option readily available, so you might entice additional buyers if you can offer to finance their purchase. If you're a buyer looking for owner financing, you'll probably need to approach owners (in addition to the five above) who aren't offering owner financing, to see if they can or would consider it. | |

Mortgage Interest Rates Have Never Been Lower -- Get Out Your Calculator! |

|

I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. Of note, I two of my clients locked in this week at 4.375% and 4.5% --- wow! How do these incredibly low interest rates affect you?

Put another way --- if you were buying a new townhome this week, could it be helpful to have an extra $1,600 in your pocket? Or an extra $2,700 in your pocket? Buying now, with low rates, can save you that much (annually) as compared to your costs if rates start to increase. | |

Why Have Home Values Remained Stable in the Central Shenandoah Valley? |

|

Some reports indicate that Americans lost over $1,000,000,000,000 (one trillion dollars) in home values in the last three months of 2009. When looking at the sum of the last several years, the figures are even more staggering – declining home values across the United States have resulted in trillions of dollars of losses for American homeowners. Yet during this same time period, homes values in Harrisonburg and Rockingham County have only been marginally affected. In fact, it wasn't until 2009 that this area saw any significant decline in median sales price, and then it was only a 5% decline. So why and how, in this time of rapidly declining home values, have homes in the central Shenandoah Valley held their value? First, while Harrisonburg and Rockingham County did see a sharp increase in home prices (51% increase in median home value between 2003 and 2006), our median sales price started out quite low ($127,700 in 2003) and only increased to $192,983 in 2006. Median sales prices in many other metropolitan areas increased to much higher levels leading to borrowers stretching pursuing riskier mortgages for their purchases. In such areas with significant increases in home values, many homeowners took on risky mortgage programs such as variable rate mortgages, interest only mortgages, or mortgages with a teaser rate. Those with 30-year fixed rate mortgages knew what to expect of their housing payment and likely were able to continue to pay their mortgages after buying several years ago, but those with these higher risk mortgages often had trouble keeping up with their mortgages and were foreclosed upon. Variable rate mortgages have been somewhat problematic, but not to a great degree because interest rates have remained relatively low for the last several years. Interest only mortgages have proven to be quite dangerous, because the homeowners has not been paying down any principal on their mortgage, and thus does not build up an equity in their home absent any appreciation in the market. Mortgages with teaser rates provided for a very low rate (1%, 2%) for a short time period in order to qualify a home purchaser. These teaser rate mortgages would then reset to a much higher rate after several years, then putting the homeowner in financial duress, unable to make their mortgage programs Since home values didn't go too drastically in this area, home buyers did not (in large number) feel pressured to obtain risky mortgages with variable or escalating future housing payments. As a result, we have seen a very low number of foreclosures in the central Shenandoah Valley. I have heard, anecdotally that earlier in 2009 over half of the homes on the market in the Winchester area were "bank owned" homes --- homes that had been foreclosed upon. This high, high number of foreclosures lead to rapid decreases in home values, as banks quickly reduced the prices at which they would sell their inventory in order to get these homes off their books. Thus while high foreclosure rates in other metropolitan areas lead to declining home values, the very low foreclosure rate in Harrisonburg and Rockingham County has lead to relatively stable home values. The Harrisonburg and Rockingham County market has also been greatly protected by its diverse and stable local economy. We have not seen significant losses of jobs over the past five years, which could have put large numbers of homeowners in a position where they had to sell their homes rapidly because they were unemployed, or because they were moving to another area to find work. Our economy includes jobs from many sectors, and is largely supported by the colleges in universities in our midst. It also helps that we have always had very low unemployment rates as compared to most every other metropolitan area in the country. Since 2005, the pace of home sales has declined drastically, with only 813 home sales in 2009 compared to 1,669 home sales in 2005. The law of supply and demand would suggest that such a large reduction in demand (a 51% decrease) would certainly lead to a drastic decrease in home values. Yet, in the same time frame (2005-2009), the median home price has shown a net increase from $169,900 to $186,300 (a 10% increase). While we have seen a 5% decrease in home values between 2008 and 2009, our local housing market continues to be amazingly resilient, without any significant shift in home values. While we can't point one particular factor that has protected home values in the central Shenandoah Valley, it is highly related to the relatively slow and small increase in home values, the conservative mortgage programs used by home buyers, our low foreclosure rate, and our stable local economy. | |

How To Close On Your Home Purchase ON TIME! |

|

It is a challenge! It seems that these days over half of home purchases don't close on time, and it is often because of delays in the financing process. Financing guidelines are much more stringent, requiring more documentation than ever before. So how CAN you close on time? Wells Fargo is confident that they can make it happen. They are so confident that they're putting their money on the line in promising to close your loan on time. The program is called the "Wells Fargo Closing Guarantee" and states that if Wells Fargo doesn't close your loan on or before the date in your sales contract, they'll pay your first month's principal and interest! Wells Fargo typically has great programs and rates, so this closing guarantee certainly boosts them up on my list of top lenders that I'd recommend that you speak with in determining where you'll obtain your financing. For financing via Wells Fargo in Harrisonburg, contact Jon Ischinger at 540-478-5223 or jonathan.ischinger@wellsfargo.com. | |

Brand New Good Faith Estimate AND Settlement Statement (HUD-1) Coming in 2010! |

|

The U.S. Department of Housing & Urban Development approved (some time ago) two updated forms that are CENTRAL to the real estate transaction. These two new forms will go into effect on January 1, 2010:

The new Good Faith Estimate (GFE) is now a standard form across all lenders. In the past a borrower would receive a GFE with a different format from each lender that they visited --- each having a slightly different set of disclosed loan terms, or vocabulary for referencing such terms. Now, a buyer can compare two proposed mortgage scenarios from two different lenders and be able to quickly and easily compare the exact same terms from each. I see this as a huge improvement for the financing process (for buyers), as in the past there has often been much confusion about how to determine which proposed loan program is better than the other. Here is an excerpt from Page 1 of the new Good Faith Estimate, which (surprisingly?) is quite intelligible!  But there's more! Beyond a buyer's (borrower's) loan terms and closing costs being easier to comparison shop, and easier to understand . . . there is also more accountability on the lender to make sure that those terms and costs stay intact through to closing. Some of the costs CANNOT change from the Good Faith Estimate, others can only change by a certain percentage, and others that can change without limit. This is a big improvement from current HUD guidelines whereby there was no guarantee that any of the closing costs or loan terms from a Good Faith Estimate would be carried through to closing. If you're buying in 2010, or beyond, you'll have the benefit of these new lending guidelines. Feel free to ask questions as you go through the process (of me, or of your lender) -- but hopefully the process will be much clearer and easy for you to navigate! | |

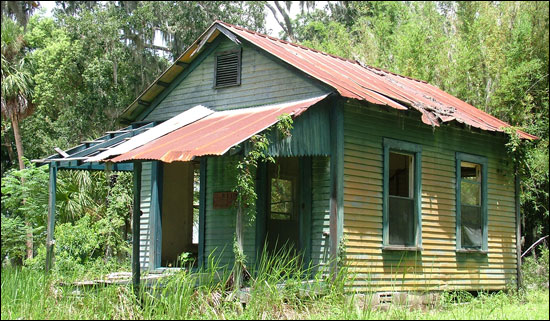

Buying a Fixer Upper in Harrisonburg? Check Out The FHA Section 203(k) Loan Program! |

|

If you're buying a fixer upper that you'll live in, you might want to consider the FHA Section 203(k) loan program! This program allows a buyer to finance their purchase and subsequent repairs into one loan. The alternative is for a fixer-upper buyer to obtain a secondary or short-term loan to finance the repairs or improvements that they will make after settlement. You can finance significantly more than the purchase price of the property in order to have cash on hand for repairs. The funds for improvements are placed into an escrow account, and the buyer (now owner) can draw on them through the rehabilitation process to pay for the repairs and improvements. There are a few basic guidelines that can quickly tell you whether this might work for your situation:

I have had clients consider this program, who didn't end up buying a fixer upper. Have you purchased a house in Harrisonburg (and surrounding) using this loan program? Or do you know someone who has? Please share! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings