Financing

| Newer Posts | Older Posts |

$8,000 downpayment assistance for first-time buyers |

|

We've all (hopefully) heard of the $8,000 tax credit for first time home buyers --- if you haven't owned a home in the past three years you can receive $8,000 if you buy one by November 30th of this year (6.5 months to go). But yesterday, the HUD Secretary announced that the Federal Housing Administration is going to permit buyers to use the $8,000 tax credit as a downpayment! More details will be forthcoming -- check with your lender in the coming weeks to see how this might work for your situation. | |

Current interest rates are incredibly low! |

|

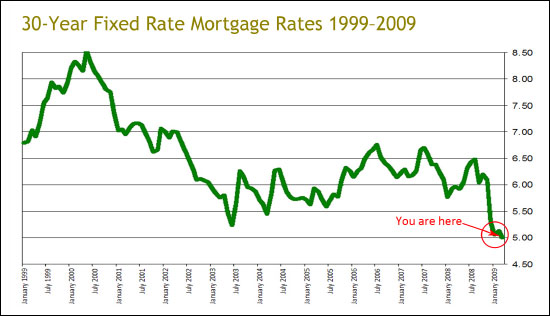

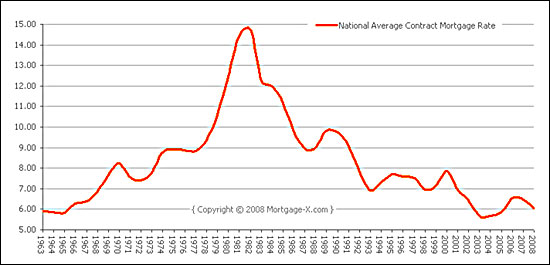

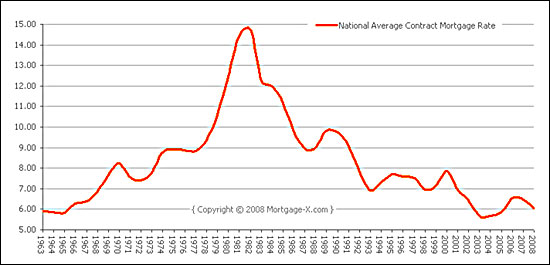

Interest rates for a typical 30-year loan have never been better --- since they started being recorded in 1970. They're hovering just below 5% right now --- could they go lower? Of note --- rates for the purchase of an investment property may be as low as 5.25% on a 30-year fixed rate mortgage. This was a quote from Debbie Huntley (540-568-1056) at SunTrust Mortgage yesterday (4/24/2009). | |

Benefits of $8,000 tax credit, record-low interest rates |

|

Let's assume for a moment that a first-time buyer decides to buy a $150,000 townhouse in Harrisonburg. With the appropriate income and credit scores, they may be able to obtain a rate as low as 4.625% on a 30 year fixed rate mortgage, with no downpayment. In the first year, this first-time buyer would likely have the following income and expenses:

Contrast this to a buyer who closes on December 1 of this year. At that point, the tax benefit will have ceased, and I predict that rates will be at least as high as 5.75% on a 30 year mortgage.

The combination of the tax credit, and the extremely low interest rates we are currently experiencing are likely to save you almost $9,000 in the first year of homeownership. As you can see, much of the above $9,000 of savings is in the $8,000 tax credit for first time buyers --- but the additional savings because of a low interest rate becomes quite dramatic over the course of the loan. Buying now at very low rates (4.625%) may save you as much as $37,000 over the next 30 years as compared to buying at 5.75%.

| |

Short-term home ownership doesn't always work well |

|

In days gone by (2002, 2003, 2004, 2005) you could buy a home in Harrisonburg or Rockingham County and sell it two years later for a tidy profit. Home values were escalating so rapidly that you no longer had to consider how long you would be in the home before needing to sell it. Today's recent home buyers, however, find themselves in a significantly different scenario. The graph below shows the progress made over time in paying down the principal balance of a 30-year mortgage of $225,000 at 5.5%.  As you can see, the majority of the principal is paid off in the tail end of the mortgage life cycle --- 53% of it is paid off in the last 10 years. But if we take an even closer look at the first five years, we can see what some recent home buyers would be facing if they needed to sell just two years later.  Consider these three factors:

What do you need to take away from this illustration?

| |

26.5-Year Mortgages for First Time Buyers |

|

First time buyers who purchase before December 1 of this year will be eligible for an $8,000 tax credit. While there are many things a first time buyer could do with that money, one idea might be to apply it directly to the principal balance of the mortgage! Assuming a $150,000 purchase price, this eliminates 3.5 years of mortgage payments off of the end of your loan! Even more exciting --- those 3.5 years of mortgage payments (that you won't pay) would have cost you a total of $33,000. There are many exciting aspects of this $8,000 tax credit to first-time buyers --- if you have any questions about it, feel free to call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com). This illustration assumes a $150,000 purchase price, with 97% financing at 5.25%. Contact a qualified lender for more details! | |

An $8,000 opportunity for first time home buyers! |

|

Just a few hours ago, the long-awaited (by some) stimulus package made its way through Congress, and it will likely be signed by President Obama by the end of the weekend. The stimulus plan affects many areas of our economy, as described in this AP press release, but one section in particular should stand out for first time home buyers. Potential first time home buyers will now have an $8,000 reason to buy a house in the next nine months! Here are a few of the fine details of this new (soon-to-be-finalized) legislation:

| |

Fannie Mae empowers real estate investors! |

|

Fannie Mae's current policies don't allow an investor to finance any more than four properties backed by Fannie Mae. Thus, if you own the home you live in, you could only purchase three additional properties as an investment. This has directly affected several of my clients who have had to stand on the sidelines, or seek a commercial loan as they considered recent investment purchases. THE GOOD NEWS --- effective March 1, 2009, an investor will now be able to finance up to 10 properties through Fannie Mae! Fannie Mae does, however, put some rather significant limitations on this new policy. This summary is my interpretation of the new policy, but I encourage you to talk to read the policy yourself as well:

Thanks to Jeremy Hart, a fantastic Realtor in Blacksburg, VA for bringing this to my attention! | |

What a difference a low interest rate can make! |

|

Some of the agents in my office remember when interest rates were as high as 15% for a 30 year fixed rate mortgage. Wow! Who could afford to buy at those rates!?  Today's rates, roughly 4.75% on a 30 year fixed rate mortgage, provide for great opportunities for those considering a home purchase. Here are a few examples of how this rate would affect a monthly payment, as compared to an interest rate of 6.5%, which we saw not too long ago! First time buyer of a city townhome at $155,900 (100% financing): Principal & Interest at 6.5% = $985 / month Principal & Interest at 4.75% = $813 / month Savings = $172 / month = $2,064 / year! Upper-end Barrington Home at $459,000 (80% financing): Principal & Interest at 6.5% = $2,261 / month Principal & Interest at 4.75% = $1,915 / month Savings = $346 / month = $4,152 / year! As you can see, these low interest rates can make a significant difference in a buyer's monthly budget! | |

National average rates at 5.17%, local rates at 4.875% |

|

As I mentioned a few days ago, low interest rates are helping people in this area cut down their monthly housing costs. And yet interest rates keep falling further --- according to MarketWatch: The benchmark 30-year fixed-rate mortgage tumbled to a national average 5.17% this week, the lowest level since Freddie Mac began its weekly rate survey in 1971. What is remarkable is that the national average rate is always somewhat higher than you can acquire from a lender locally. I reviewed a good faith estimate yesterday for a re-finance at 4.875% fixed for 30 years. If you'll definitely be buying in the next 3-6 months, now is a great time to consider doing so, given current rates. And if you aren't looking to buy / sell, but you have a rate higher than 6%, you should definitely investigate the cost savings of re-financing. | |

Current (Incredibly low) interest rates can make a significant difference in a monthly budget! |

|

Here's an insightful article from yesterday's Daily News Record that uses a local example to show what a significant impact current interest rates can have on a family. Grefe, a teacher and coach at Harrisonburg High School, currently has an adjustable-rate mortgage that has interest rates of both 7.5 percent and 11.5 percent - but he's refinancing to a rate nearer to 5.5 percent. Depending on your financial picture, some borrowers are currently obtaining fixed-rate mortgages at or below 5.0%, and some local lenders that I have talked to expect that rates should stay at (or just below) 5.0% into the near-term future."That should save me close to $200 to $250 a month," he said. "Monthly payment-wise this will work out pretty good." (source) Even if you aren't looking to buy a home right now, this can be a great time to examine potential savings from refinancing. | |

New rules limit real estate investors to four loans |

|

One of my clients forwarded me a story from the Atlanta Journal-Constitution, which discusses new Fannie Mae and Freddie Mac rules that states that Fannie and Freddie will only back up to four real estate loans by one person. This new four-loan rule apparently replaced a previous limit of 10 loans, and was is in place to keep inexperienced or start-up real estate investors from over-investing. The four-loan limit does not allow for any exceptions for income, assets or credit scores. In checking with a local lender, I was told that if a borrower has more than 4 non-owner-occupied homes and a primary residence, no one but a commercial lender can help them on their next investment purchase. So, what is the solution?? One option is to move several existing residential investment loans into a commercial "blanket loan" thus removing residential loans from their balance sheet. Commercial loans on residential properties don't count against the four loan limit if they are in an LLC. If any lenders or investors know of any other options with this new loan limit, please let me know! | |

Money is cheap! Interest rates keep heading down! |

|

Interest rates keep going down --- the Daily News Record reports today that they're down to around 5.375% for a conventional 30-year fixed rate mortgage. If you're considering a home purchase in the next month or two, it might be worthwhile to consider getting the ball rolling now, while interest rates are so favorable! Of note --- one statistic in the article is way off base... "In addition to lower mortgage rates, home prices also have reached extreme lows. Prices of single-family homes plunged a record 17.4 percent in September from a year earlier, according to the Standard & Poor's/Case-Shiller Home Price Indices." That may be the case nationally, but locally, we have seen home sales prices remain stable. | |

Banks eager for short sales!? |

|

A short sale is one where the sales price was insufficient to pay the total of all liens and costs of sale; and where the seller did not bring sufficient liquid assets to the closing to cure all deficiencies. In other words, the seller had to sell at a price where they needed to bring money to closing, but they couldn't. A short sale almost always results in an incomplete payoff of one or more mortgage debts, so a lender has to agree to a short sale. Lenders are apt (in the current market) to consider a short sale because they are likely to recoup more of the money owed to them than if they are forced to foreclose on the property. I am listing a property this week that will almost certainly be a short sale, and I was surprised to learn from the owner that the bank had encouraged the short sale and was quite willing to go along with a short sale. This was somewhat of a surprise to me because over the last years I have heard countless stories of lenders who are hesitant to consider a short sale, and instead pursued foreclosure. If you are considering buying a property that will be a short sale, it will likely take a little bit longer for the transaction to take place, as the bank must approve of the deal that is worked out between buyer and seller --- but a short sale can be a great opportunity to buy at a good value. | |

Web Site Enhancement - mortgage calculator |

|

I'm working on several exciting improvements to my web site, and this is the first. It's been a long time coming, as many of you have asked if there is any way to integrate an easy to use mortgage calculator along side the property listings. At last, the calculator is in place --- allowing you to quickly determine the principle and interest of your monthly mortgage payment. Enjoy, and let me know if you have any difficulties using it. | |

New loan guidelines - the underwriter must approve inspection results!? |

|

Here is some interesting news that Jon Ischinger (Wells Fargo, Harrisonburg) shared with me last week... If a sales contract is contingent upon a well inspection, septic inspection or termite inspection, the loan underwriter must be privy to any issues, and must approve how the buyer and seller choose to address those issues. And this is on all new FHA and conventional loans! It is my understanding from talking to Jon that this won't change the loan process drastically, but it will make things slower, and may make things more problematic if there are any issues with the termite, well or septic inspections. As Jon notes, "In the past you could have worked something out with the borrower/seller and it would happen very quickly, outside of the lender's scope - now, if there is any inspection mentioned in the purchase contract, we have to see it and send it to underwriting. If any maintenance is required, it will need to be addressed and re-inspected and then that documentation will have to be reviewed." I'm curious to see how this plays out in a real transaction --- but I'm not too surprised to see yet another tightening on the loan process as lenders become more conservative in their lending practices. | |

Affordable Housing with a LOW interest rate! |

|

The current VHDA interest rate is already low, at 5.875%. But for first time buyers looking for affordable housing, it can be tough to finance a purchase even at that low rate. So....how about 4.875%? If you're buying at Covenant Heights, a neighborhood being developed by Hope Community Builders (a non-profit group), depending on your income levels, you may be able to have the current VHDA rate lowered by an entire percentage point! And these are nice properties we're talking about here -- duplexes and townhomes with three bedrooms, all of which are pre-inspected and built to EarthCraft and EnergyStar standards. If you have a friend or co-worker who is seeking affordable housing, do them a favor and tell them about Covenant Heights! | |

How to decide whether to refinance |

|

Reproduced with the permission of Mortgage-X.com It's anyone's guess what interest rates might do in the next 3, 6 or 12 months, but rates continue to be historically low. Given these low rates, you may be considering whether it would be worthwhile to refinance. Here's a sample analysis of whether "Bob" should refinance, that might be helpful as you analyze your own scenario. Here's what you need to know about Bob....

One important note --- Bob lowered his payment by $167/month by refinancing not only because he lowered his rate, but also because he extended his remaining loan term from 25 years back up to 30 years. So, bottom line...

| |

When to buy a loan discount point... |

|

One option you have when obtaining a mortgage is to pay a loan discount point to lower the interest rate on your mortgage. In most cases, a loan discount point will cost 1% of the loan amount, and will lower the interest rate by 0.125% over the life of the loan. For example, on a 30 year, $200,000 loan at 6.5%, with no discount points, your principal and interest payment would be $1,264.14. If, however, you paid one point, the $200,000 loan at 6.375% would require a principal and interest payment of $1,247.74. The cost of the loan discount point would be $2,000, and it would save you $16.40 each month. Thus, it would take 122 months (10 years, 2 months) before you started to realize any savings. However, to take it one step further, we should include the tax benefits of having bought the loan discount point. The $2,000 is tax deductible, thus if you are in the 25% tax bracket, you would have a tax savings of $500, and only need to recoup $1,500 of savings. By including this tax perspective, it would only take 92 months (7 years, 8 months) for you to start seeing savings for having bought the discount point. Bottom line --- in the examples above, if you don't plan to own the house for more than 7-ish years (or 10-ish years), it is likely not worthwhile to buy the loan discount point. | |

Comparing Good Faith Estimates (GFE's) |

|

I always encourage my buyer clients to talk with at least two lenders. Different lenders offer different loan programs, closing costs, incentives, and more. Often, however, this leads to comparing what can be two very confusing documents --- the good faith estimates from each lender. The Good Faith Estimate is a document intended to outline all of your purchasing costs, and thus is a good document to use when deciding between your two favorite lenders. But it can often be quite difficult to make the comparison because costs can have so many different names on the GFE, and because there are non-lender fees included in these estimates. If you are deciding which lender to use based on closing costs, remember to subtract out all of these costs before you make the comparison:

I hope I haven't complicated things further --- just remember that you should not just look at the bottom line of the Good Faith Estimate when you are comparing lenders. | |

20% down required on investment properties? |

|

I have now heard from several lenders that they cannot lend more than 80% on investment properties. The main issue seems to be that mortgage insurance companies are not willing to issue policies on investment properties any longer. (Most loans with less than a 20% down payment require mortgage insurance.) | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings