| Newer Post | home | Older Post |

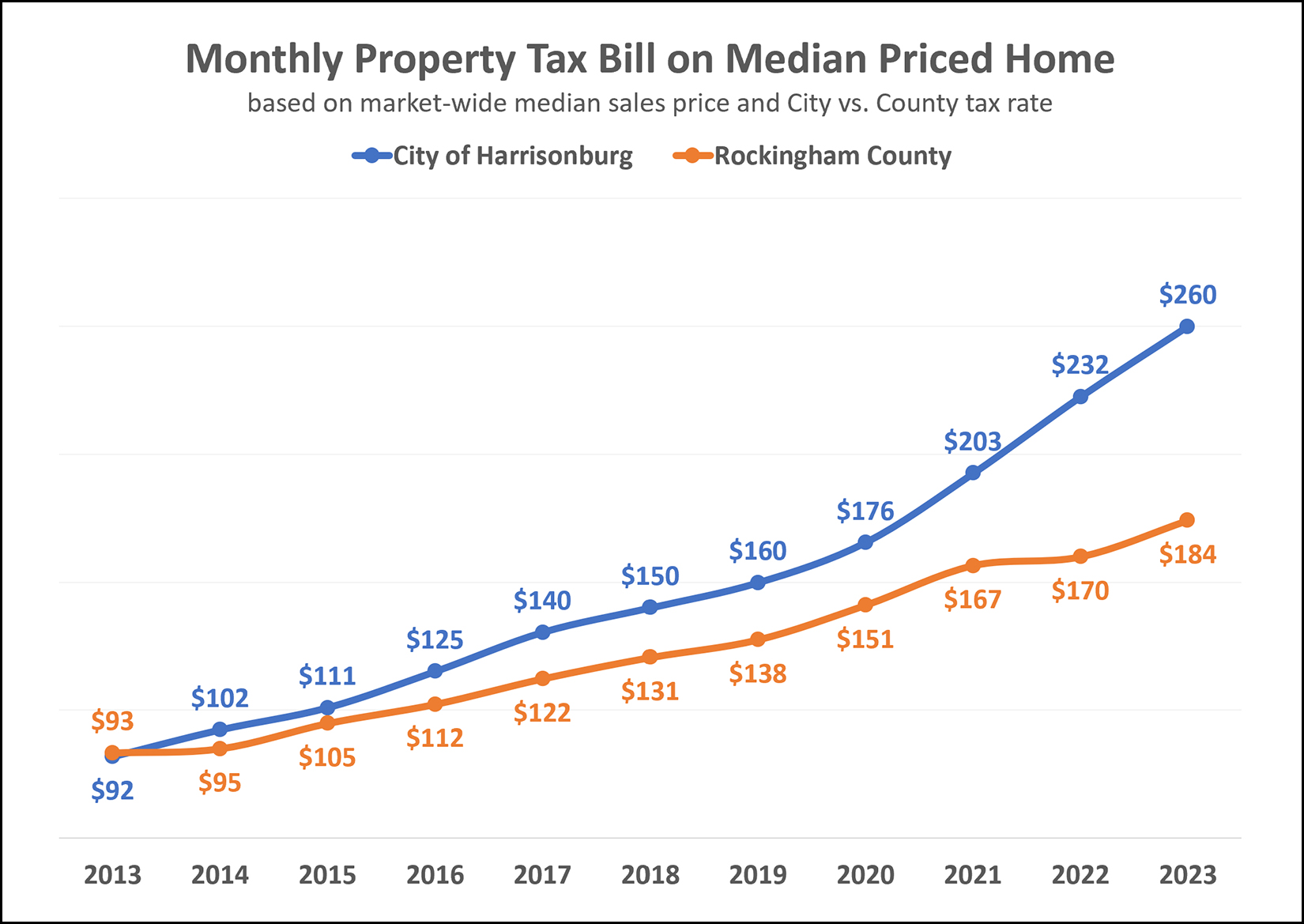

Monthly Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a median priced home in our market (Harrisonburg and Rockingham County) you would be spending $325,000. Will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

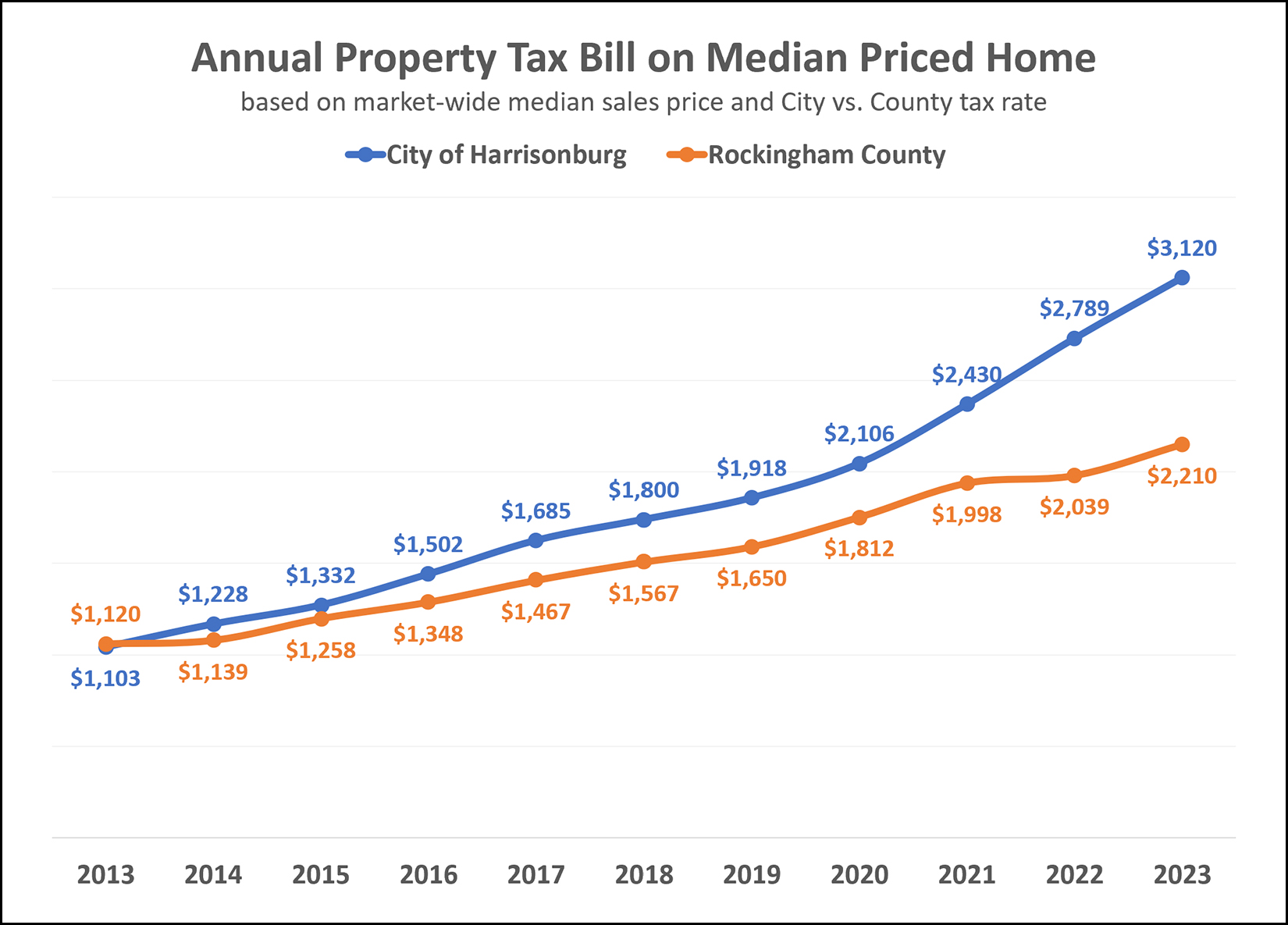

Also of note -- this analysis of monthly property tax bills over time does not adjust for inflation. A $260 monthly tax bill in the City of Harrisonburg in 2023 is not the same as a $260 monthly tax bill in 2013 as inflation has been running hot over the past few years. Certainly, one reason why the City tax bill has increased as much as it has over the past few years has been to fund the new high school currently under construction in the City. Will this difference in tax rates in the City and County result in some buyers deciding to buy homes in the County instead of the City? Maybe - but my experience has been that the tax rate is not what causes a home buyer to consider a home in one locality or the other. Multiplying by 12, here's a look at the annual tax bill in the City vs. County for a median priced (market wide) home in our area...  Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings