Foreclosure

| Newer Posts | Older Posts |

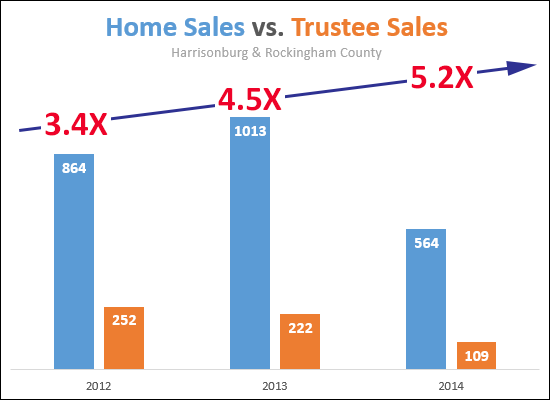

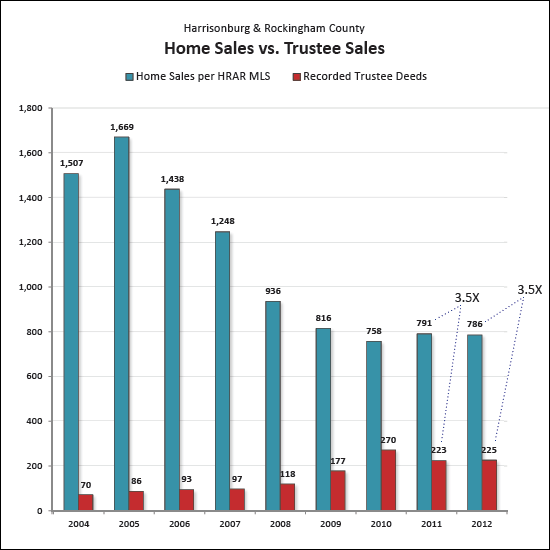

Rising Number of Home Sales Per Trustee Sale |

|

Not only are there fewer foreclosures happening (252 in 2012 declined to 222 in 2013) there are also fewer foreclosure when compared to the number of home sales. As shown above....

| |

Foreclosures slowing down in Harrisonburg, Rockingham County? |

|

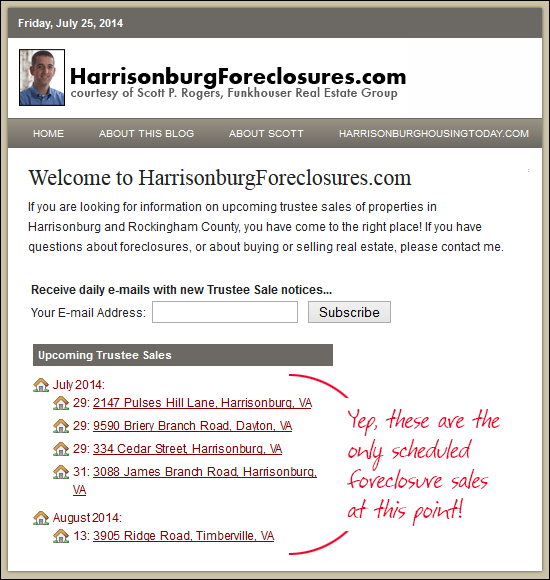

There are only five foreclosure sales scheduled in the future at this point. This is a much lower level than I've observed in many years. This could be an abnormal lull -- perhaps we'll start to see more sales scheduled in the near future, but at this point, nearly everybody in Harrisonburg and Rockingham County seems to be keeping up with their mortgage payments. View upcoming foreclosure sales at HarrisonburgForeclosures.com. | |

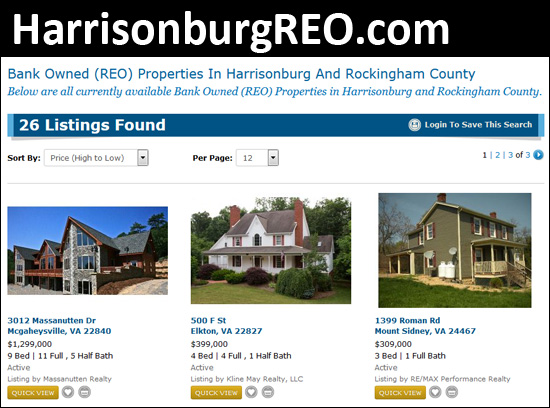

Finding Bank Owned Homes in Harrisonburg and Rockingham County |

|

Looking for bank owned homes in Harrisonburg and Rockingham County? You can find all active listings at HarrisonburgREO.com. If you're interested in receiving email updates of new listings of bank owned homes, just drop me a line at scott@HarrisonburgHousingToday.com and I will set that up for you. Also, you can find out about upcoming foreclosure sales at HarrisonburgForeclosures.com. | |

How to buy a foreclosure in Harrisonburg or Rockingham County |

|

As shown above, we are starting to see fewer foreclosures in Harrisonburg and Rockingham County. With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Visit HarrisonburgShortSales.com for a list of potential short sale properties currently on the market. TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

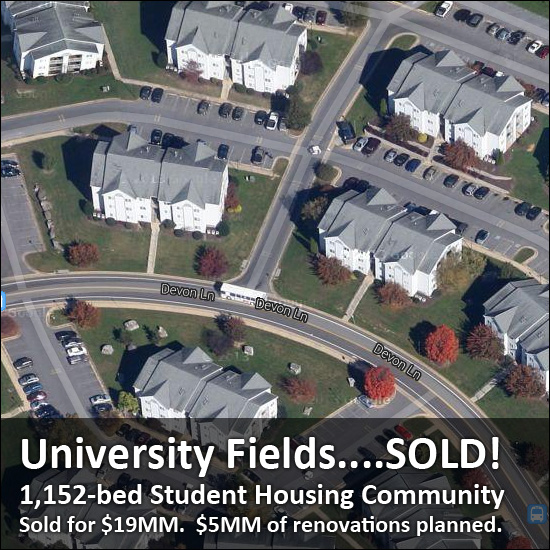

University Fields (1,152 bed student housing community in Harrisonburg, VA) purchased by NY investment firm for $19MM |

|

An auction was scheduled for University Fields back in September -- and now we know who purchased the property. Vesper Holdings, a real estate investment firm in New York City, purchased University Fields for $19 million on October 28th. Five million dollars of capital expenditures are planned including renovating the interiors of the apartments, clubhouse and amenities as well as enhancements to the exteriors of each building and technology upgrades. Pertinent details about University Fields....

Read the entire press release here. Read today's Daily News Record article here. | |

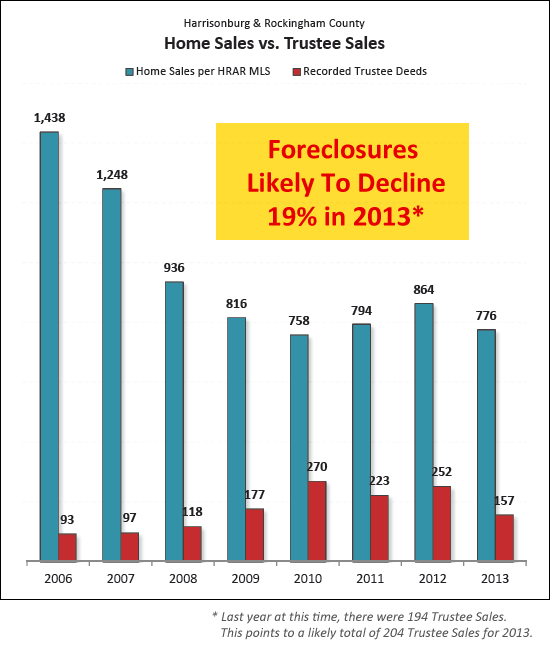

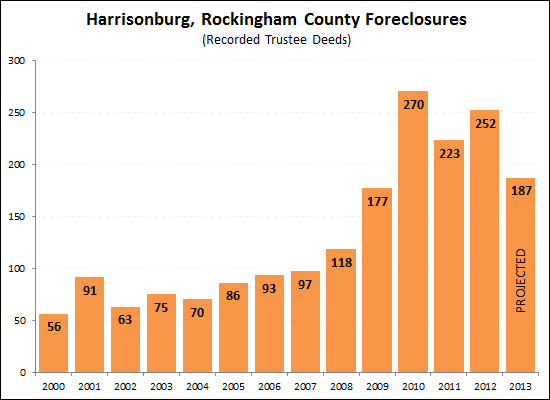

Local Foreclosures Likely to Decline 19% in 2013 |

|

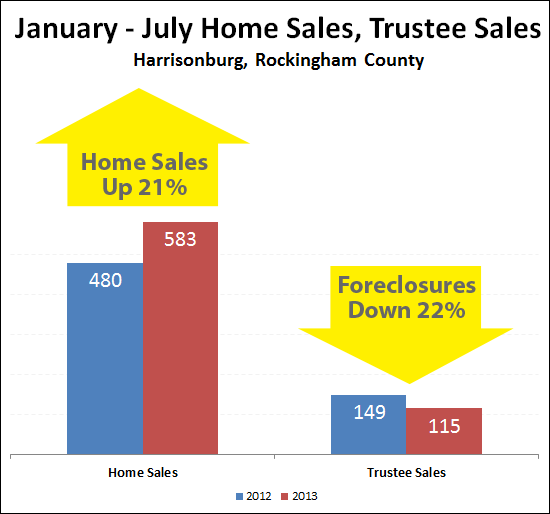

Foreclosures down 22% YTD in Harrisonburg, Rockingham County |

|

| |

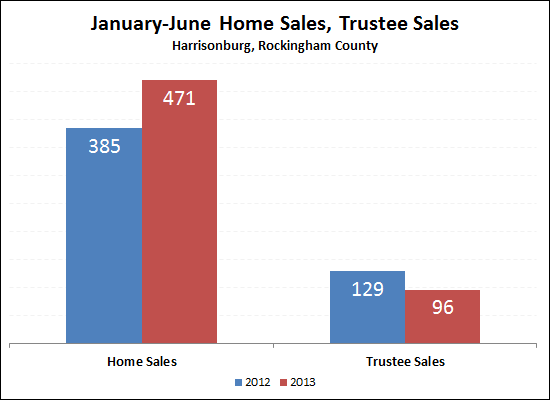

Home Sales Up 22%, Foreclosures Down 26% |

|

These are both great indicators for our local housing market --- home sales are up (22%) and foreclosures are down (26%) in the first six months of the year, as compared to the first six months of last year. | |

Foreclosures slowing in Harrisonburg, Rockingham County |

|

Based on Jan 1 - May 31 data (78 recorded Trustee Sales) the foreclosure rate seems to be slowing in Harrisonburg and Rockingham County. This is good news for the local housing market, as foreclosures (and bank owned properties) can have a negative impact on home values. | |

How negotiable are bank owned (REO) list prices? |

|

As you'll note, above, banks aren't that much more flexible on price than the average seller on the market. That said, their list prices are oftentimes more compelling than typical listings, which makes the "normal" amount of negotiating room less of a concern for most buyers. View upcoming Trustee Sales View current bank owned listings | |

Impact of local foreclosures is low compared to many other parts of the country, but still higher than historical norms |

|

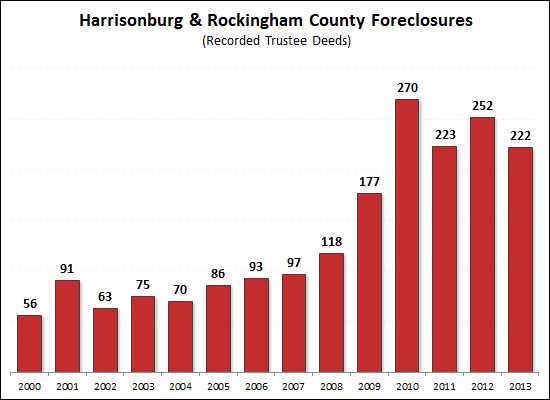

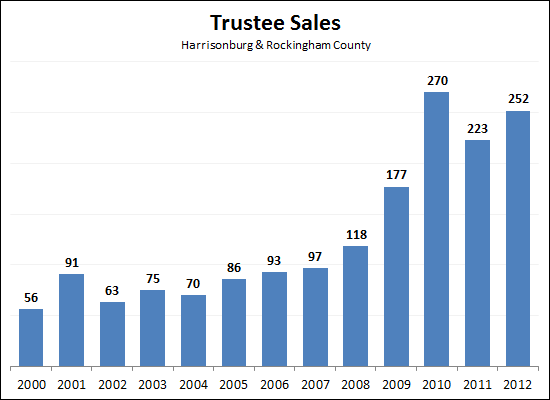

The Harrisonburg and Rockingham County area sees fewer foreclosures than many other areas of the country, but we too saw an increase in completed foreclosures over the past several years. After staying between 50 and 120 Trustee Sales per year (between 2000 and 2008) we have seen elevated numbers of foreclosures over the past several years as shown in the graph above. After declining between 2010 and 2011 (-17%), the number of foreclosures increased again in 2012 -- though not to as high of a level as seen in 2010. Expect to see more bank owned listings coming on the market in 2013. And hopefully we will see the number of foreclosures decline again in 2013. | |

Foreclosures up a bit in Harrisonburg, Rockingham County |

|

Foreclosures in the Harrisonburg and Rockingham County (shown in red above) are actually up a bit this year after having declined in 2011. In the first 11 months of this year there have been 225 completed Trustee Sales, whereas there were only 223 in all of 2011. Thus, look for more bank owned properties to be coming on the market in the coming months and likely well into 2013. While foreclosures have increased over the past few years (compared to historical norms) we still have far fewer foreclosures than many other parts of the country. Learn more about our local real estate market at HarrisonburgHousingMarket.com. View upcoming Trustee Sales at HarrisonburgForeclosures.com. | |

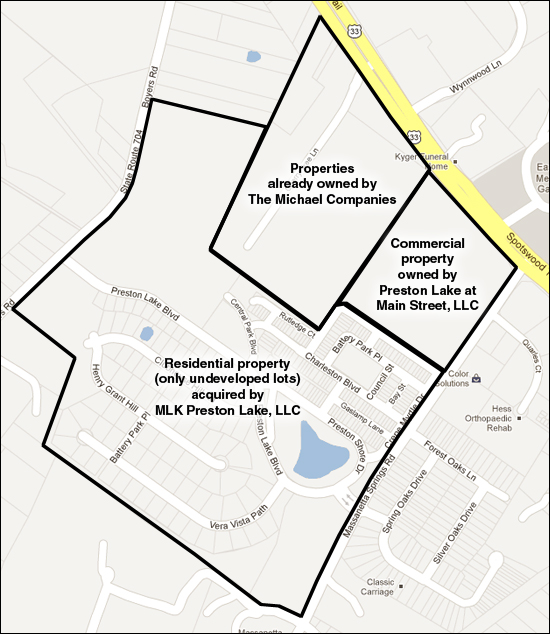

Preston Lake Acquired By Neighboring Property Owner (Development Company from Maryland) |

|

According to a letter from Brian D. Goldstein, Vice President if Development for NAI The Michael Companies, the residential property at Preston Lake has been sold by Wells Fargo to a new entity known as MLK Preston Lake, LLC. A letter, excerpted below, was sent to current Preston Lake homeowners yesterday.... It is with great pleasure that I am writing this letter on behalf of MLK Preston Lake, LLC, the new owner of the Preston Lake Residential property. Being already invested in and committed to the success and vitality of the area through ownership of a portion of the adjacent commercial property, we look forward to reinvigorating the Preston Lake Residential development with this acquisition. We are confident that the existing homeowners in the neighborhood, Rockingham County officials, and the entire surrounding community will be very pleased with the quality and expertise that we will bring to Preston Lake.This excerpt from their web site speaks to the development background of the NAI Michael Companies, based in Lanham, MD.... Kenneth H. Michael, founder and Chairman of the Board of NAI Michael, created a Development Consulting Division to assist landowners and developers through the then increasingly complicated permit approval process. Over the years, as the approval process has become even more complex, time consuming, and technically demanding, NAI Michael's Development Consulting Division continues to stay abreast of the changes and requirements associated with the development process.The Michael Companies also seems to be amidst the development of a $900 million, 382-acre, upscale mixed-use community in Prince George's County. While The Michael Companies might be an out of town (out of state!) development company, they are no stranger to the Harrisonburg and Rockingham County area -- nor the general vicinity of Preston Lake. Over the past several years they have purchased a variety properties surrounding Preston Lake including (but not limited to) those outlined on the map at the top of this post. For a bit more context (and history) of Preston Lake, consider reading....

And, if you're excited about the reinvigoration of Preston Lake, you might want to buy my parents' house in Preston Lake.... | |

Where have all the foreclosures gone? |

|

I keep HarrisonburgForeclosures.com updated with scheduled Trustee Sales....and usually there are 15-20 scheduled in the future at any given point in time. Currently, however, there are only six scheduled!?! Don't get me wrong, I'm excited that almost all homeowners are staying current on their mortgage payments and are not in jeopardy of foreclosure --- but I'm surprised at this significant swing in scheduled foreclosures. Find out more at HarrisonburgForeclosures.com or search for bank owned homes at HarrisonburgREO.com. | |

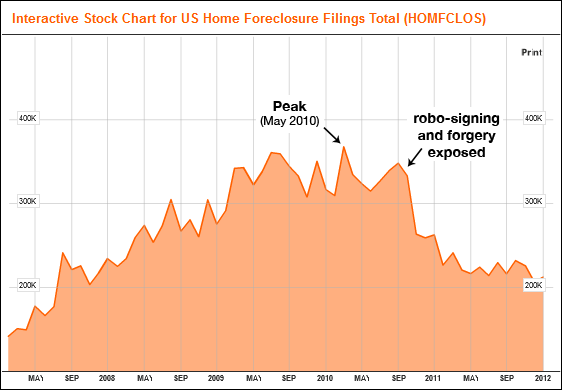

The past five years of foreclosures |

|

Bloomberg has an interactive tool that explores the number of foreclosure filings in the United States over the past five years. | |

Three ways to buy a foreclosure in Harrisonburg or Rockingham County, and how to find such opportunities |

|

If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Research potential short sales in Harrisonburg and Rockingham County online via www.HarrisonburgShortSales.com  TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Research upcoming trustee sales in Harrisonburg and Rockingham County online via www.HarrisonburgForeclosures.com  BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Research currently available bank owned properties in Harrisonburg and Rockingham County online via www.HarrisonburgREO.com  When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. For information about purchasing a property as a short sale, or purchasing a bank owned property, please e-mail me at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

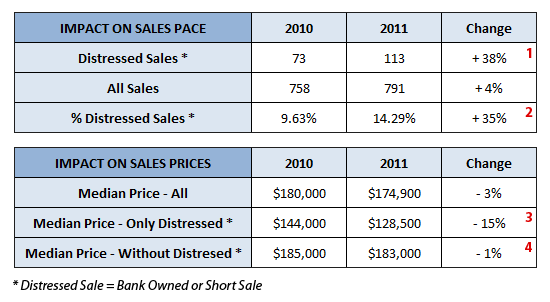

The impact of distressed sales (bank owned, short sales) on the Harrisonburg, Rockingham County housing market |

|

Housing markets across the country have been affected by an increase in distressed sales over the past few years -- both bank owned homes (that were foreclosed on) and short sales (where the sales price didn't pay off the mortgage). So, what was the impact in our local area?  A few observations based on the data above....

Again, given the decline in foreclosures in 2011, I am hopeful that we'll see a smaller number of distressed sales in 2012, leading to greater stability in our local housing market. | |

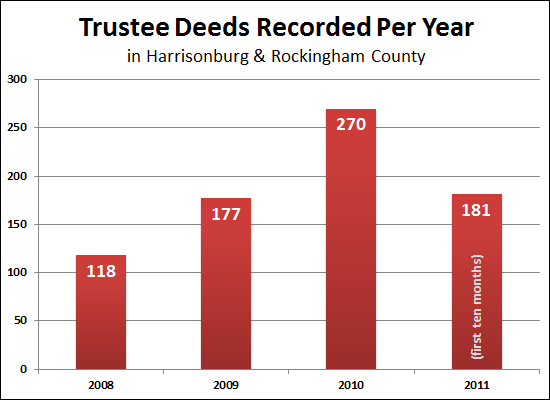

Foreclosures decline in Harrisonburg, Rockingham County |

|

In very good news for the local housing market, foreclosures are declining in Harrisonburg and Rockingham County. The graph above shows the number of Trustee Deeds recorded at the courthouse per year for 2008-2010 and the number recorded in the first ten months of 2011. It is clear that 2011 has marked a sharp turning point in the foreclosure rate in our local area. While we are not yet back to historically normal rates (70-100 per year), we have turned the corner from the peak of 270 in 2010. | |

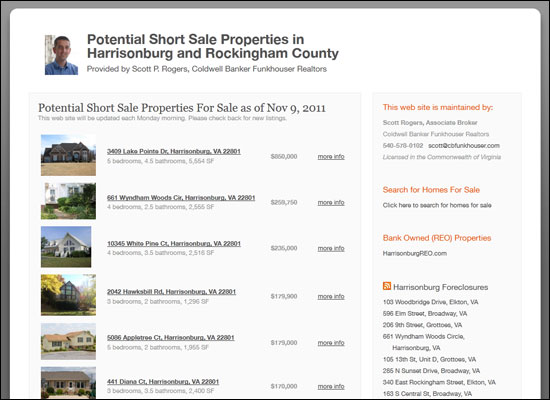

HarrisonburgShortSales.com, your source for potential short sales in Harrisonburg and Rockingham County |

|

If you are looking for potential short sales in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgShortSales.com. Also, don't forget, if you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can find them on www.HarrisonburgREO.com. | |

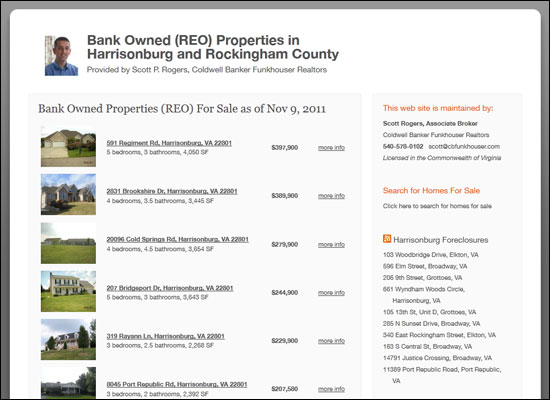

HarrisonburgREO.com, your source for bank owned (REO) properties in Harrisonburg and Rockingham County |

|

If you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgREO.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings