Foreclosure

| Newer Posts | Older Posts |

Foreclosures Decline in Harrisonburg, Rockingham County |

|

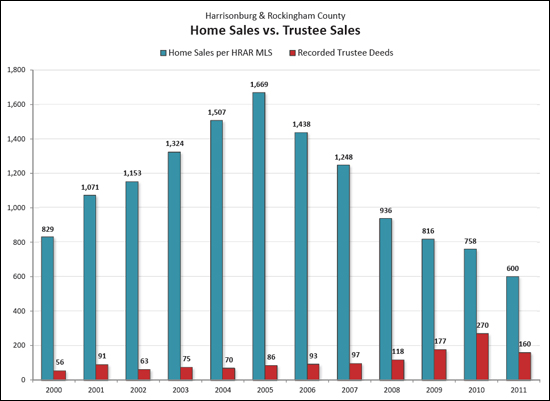

The most recent real estate news in Harrisonburg and Rockingham County isn't all good news, but there is plenty to be excited about, particularly related to foreclosures.  The numbers of foreclosures filed in Harrisonburg and Rockingham County steadily climbed between 2008 and 2010 -- but now it seems to be reversing course. In 2010, there were 270 foreclosure filings, and only 758 home sales. Thus far in 2010, there have only been 160 foreclosure filings and 600 home sales. This is a strong indicator that we'll finish out the year with fewer properties being foreclosed on, which should slowly strengthen the market. | |

I heard (insert this, that or the other) about foreclosures. Is that going to affect us here in Harrisonburg? |

|

If you hear something about the housing market on the news, it will likely mention the big (bad, scary) problem of foreclosures. Things you may have heard could include:

| |

Local foreclosures slow in 2011 |

|

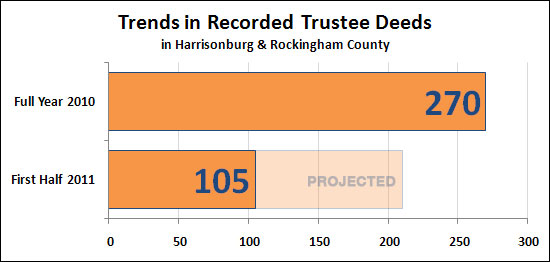

Great news -- the local foreclosure rate is on the decline! There were 270 recorded trustee deeds in Harrisonburg and Rockingham County during 2010. In the first half of 2011 there were only 105 recorded trustee deeds. Yet there are some interesting foreclosure sales currently scheduled:

Learn more about short sales, trustee sales and bank owned properties. | |

The current decline in median sales price is (partially) due to more frequent sales of bank owned properties |

|

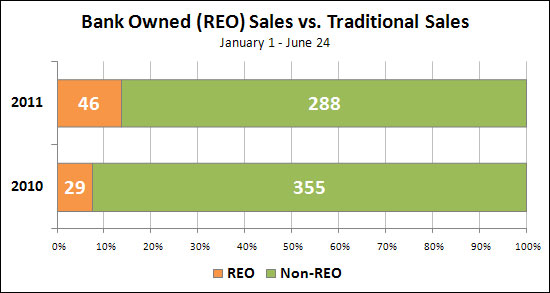

The median sales price in Harrisonburg and Rockingham County has declined by 11% over the past year from $180K to $160K. That's a rather significant decline. But looking closer, it seems that one reason why it has declined as much as it has is because there are more bank owned properties selling this year as compared to last year.  As you can see above, last year (YTD) REO sales only accounted for 8% of all home sales in Harrisonburg and Rockingham County. This year, however, REO sales account for 14% of all home sales. The median sales price of the non-REO properties this year is $170,056, whereas the median sales price of REO properties this year is only $129,250. There are certainly other factors that are causing a decline in median sales price, but the proportional increase in bank owned (REO) sales is certainly contributing to the situation. | |

How much do banks typically negotiate in selling a bank owned property? |

|

Buyers can often find great opportunities in bank owned properties, but they often wonder how much they should expect to be able to negotiate off of the list price of a bank owned property. Let's take a look.... For all residential sales in Harrisonburg and Rockingham County in the past year, we find:

I suppose the important thing to remember is that the list-to-sell ratio of any property is largely dependent on how realistic the asking price is. Both a homeowner and a bank can price a home too high when putting it on the market. Perhaps banks do that less often, and thus achieve a (slightly) higher list-to-sell ratio despite still offering great deals on properties? Additional Relevant Information:

| |

Foreclosure Rates in Harrisonburg, Rockingham County |

|

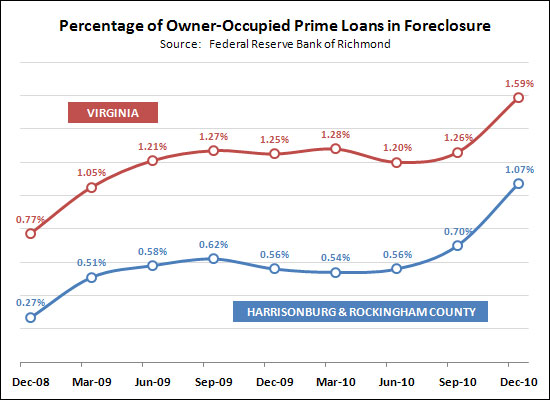

Inspired by a great article in yesterday's Daily News Record about foreclosure rates in the Harrisonburg and Rockingham County area, here is a comparison of foreclosure rates in Harrisonburg and Rockingham County as compared to Virginia.  A few other notable observations from the DNR article:

| |

Harrisonburg and Rockingham County Have Low Foreclosure Rates |

|

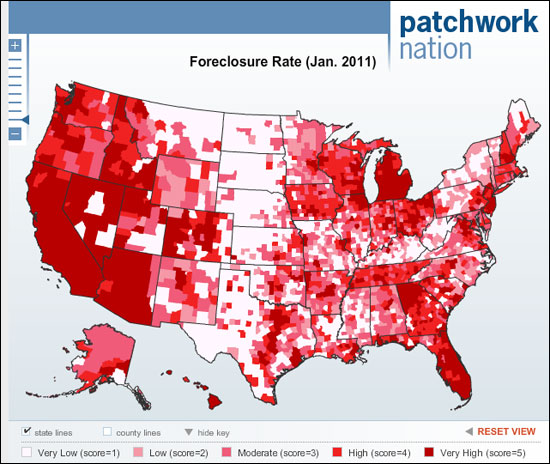

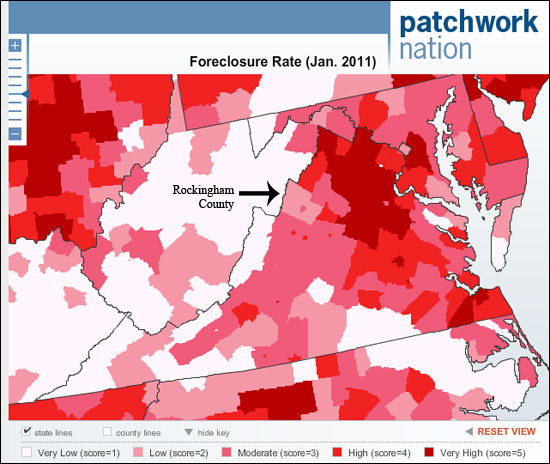

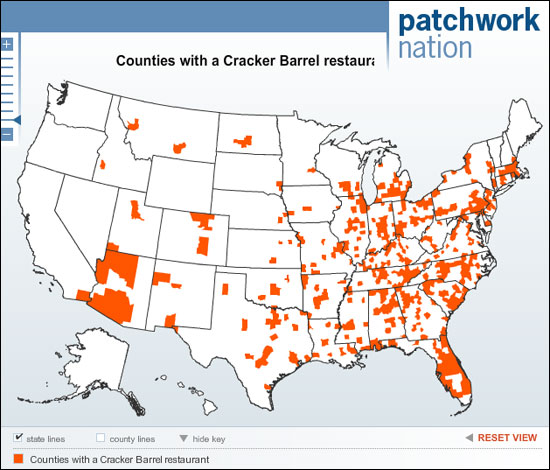

Over at Patchwork Nation, you can create maps to show all sorts of data, including these below that examine foreclosure rates as of January 2011....  The states that should stand out as having high foreclosure rates include California, Nevada, Arizona, Michigan and Florida.  Looking a bit closer (above) you'll see that Harrisonburg and Rockingham County are categorized as having low foreclosure rates. This has likely led to the relative stability in our housing market, whereas many Virginia markets north of us have seen significant price adjustments largely as a result of their high foreclosure rates. In case you're wondering, on Patchwork Nation you can also create fun maps such as the counties where Cracker Barrel restaurants exist....  | |

Updates on Preston Lake Subdivision |

|

If the development of Preston Lake had taken place just five years earlier, it might have been a much greater, faster, happier success story. Given its timing, however, Preston Lake was developed and constructed at a very slow rate, which recently reached a significant milestone when Wells Fargo foreclosed on the remaining developed lots at Preston Lake. Why did it happen? It could have been the decline in the housing market....or the decline in the national economy....or that the developer's bank (Wachovia) went out of business....or many other reasons. Regardless of the cause, the development and construction of Preston Lake was much slower than anticipated, and is now in a state of limbo. Here's a re-cap of where things are at Preston Lake, with a few bits of new information: Homeowners Association: The Preston Lake Homeowners Association is still controlled by the developer, which is now effectively Wells Fargo. For now, however, the on-the-ground association management is being handled by a Harrisonburg-based association management company, and thus far it does seem as if any services to residents will be interrupted, nor will dues increase. Ownership of the Land: The undeveloped residential lots all transferred to Wells Fargo (or REDUS VA HOUSING, LLC as it appears at the courthouse). Read more. Ownership of the 4 rowhouses: Most people attending the foreclosure auction were surprised to hear the announcement that morning that separate from the auction of all of the undeveloped lots, the bank would be auctioning off four rowhouses at various states of completion. Since potential bidders were not prepared to consider purchasing a rowhouse, all four of these properties were bought back by Wells Fargo. Further details follow....

Southern Classic, Inc: The company that purchased the three yet-to-be-finished rowhouses seems to be a company based out of Crozet/Charlottesville. Presumably, Southern Classic will be finishing the rowhouses and offering them for sale. Southern Classics is an Earthcraft certified builder, and is involved in developing several smaller communities including: Southern Classic, Inc: The company that purchased the three yet-to-be-finished rowhouses seems to be a company based out of Crozet/Charlottesville. Presumably, Southern Classic will be finishing the rowhouses and offering them for sale. Southern Classics is an Earthcraft certified builder, and is involved in developing several smaller communities including:

| |

Preston Lake Foreclosure Finalized: Land Transfers To Wells Fargo, Homeowners Association |

|

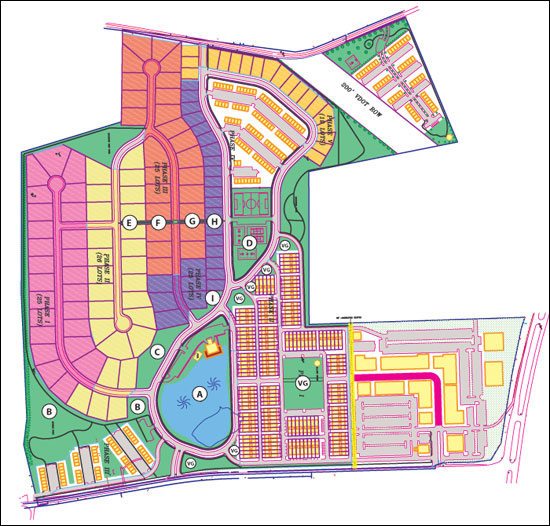

An early rendering of the intended Preston Lake community center A variety of documents were filed at the Rockingham County Circuit Court on Wednesday, February 23, 2011 finalizing the Trustee Sale of Preston Lake subdivision. In Summary: A trustee sale took place on February 3, 2011 on the steps of the Rockingham County Circuit Court, whereby Wells Fargo (as the only, and thus highest, bidder) contracted to buy back Preston Lake from its developer. Now, the deeds have been recorded transferring the bulk of the subdivision to Wells Fargo and the common areas to the Homeowners Association. The Value of 124+ Acres: The consideration paid by Wells Fargo for the 124+ acres was $3,500,000, but the trustee's deed also indicates that the appraised value is/was $4,530,000. Somewhat astonishingly, the two loans (notes) that were being foreclosed on appear to have been for a sum total of $20,500,000. The New Owner of Preston Lake: The grantee on the deed is listed as "REDUS VA HOUSING, LLC" -- an LLC registered in Deleware. The grantee's address, however, is Wells Fargo Bank out of Jacksonville, Florida. Value of the Common Areas: Per the deed transferring the common areas to the Homeowners Association, the common areas have an assessed value of $323,700.  What Conveyed To The Homeowners Association: The map above is based on an early engineering plan for Preston Lake. I have deciphered (to the best of my ability) the deed, and recorded plats for Preston Lake to mark on the map (letters in circles) the areas that conveyed the the Homeowners Association. Click on the map for a high resolution PDF, and scroll to the bottom of this post for the source files for the deed and plats. Management of the Homeowners Association: The Homeowners Association's mailing address is referenced in the deed as the same Jacksonville, Florida address for Wells Fargo. Homeowners at Preston Lake have been informed that Wells Fargo will be hiring an association management company in the very near future to handle the business of the association. What's Next: Now that the remaining land comprising Preston Lake is owned by Wells Fargo, my assumption is that:

| |

Preston Lake Foreclosure Auction Results In $3.5M Sale To Wells Fargo |

|

The Preston Lake Trustee Sale took place today (February 3, 2011) at noon, and drew quite a crowd of Preston Lake homeowners, developers, attorneys, Realtors, and neighboring landowners. Here's an overview of where things stand.... Local History in the Making: It's not necessarily the good type of history, but this was the first major subdivision --- and hopefully the last --- to be foreclosed on in the Harrisonburg area. Many other areas across the country have seen multiple large subdivisions be foreclosed on, but until today, Harrisonburg had been unscathed. The timing of the development of this subdivision is likely what led us to today's events, as the development began just as the housing market began to slow dramatically. Only One Registered Bidder: Only one individual registered as a potential bidder at the sale (by showing his deposit check to the Trustee, and providing his name), though he did bid during the auction, likely because of the opening bids from Wells Fargo. Only One Actual Bidder: There was only one actual bidder....Wells Fargo. Surprise Rowhouse Auctions: In addition to the 120+ acres of land at Preston Lake that were auctioned off today, four rowhouses were also auctioned separately. This was not specifically advertised -- if it had been, I think we would have seen some actual bidding take place. Each of these rowhouses are at a different stage of completion, but each at least has the shell completed. The opening bids from Wells Fargo were as follows, and these are the prices at which they are taking back the properties:

The Common Areas: The attorney representing Wells Fargo also indicated that the common areas would be deeded to the Property Owners Association. The Association will still exist, and owners will still make payments to it to support the maintenance of the common areas and other common amenities of the neighborhood. What Happens Next: In theory, within 30 days, Wells Fargo will close on their purchase of the four individual rowhouses, and the 120+ acres of Preston Lake. The attorney representing Wells Fargo commented to me afterward that he thinks there is a 90% chance that the sale will proceed to closing and that Wells Fargo will be the new owner. After Wells Fargo owns the property, he indicated that they would sell the four rowhouses individually, and seek to sell the remaining 120+ acres to a new developer. It is unclear what price they will ask for the remainder of the subdivision (likely lower than $3.5M), and it is unclear what price they will eventually take for the remainder of the subdivision (likely lower than $3.5M). Wells Fargo's attorney also indicated that while they will attempt to sell the entire undeveloped section of Preston Lake as a whole to one developer, it is also possible that they would sell the property as individual lots or sections of lots. Wells Fargo has done this with other subdivisions around the country that they have foreclosed on, though it is not their goal. Wells Fargo is interested in money: This should come as no surprise, but Wells Fargo's goal in being the new owner of the undeveloped areas of Preston Lake are to try to recoup as much as possible of the money that they have invested in the subdivision. They won't, thus, try to unload the property for development into a mobile home park -- they will be marketing it and working to sell it for its highest and best use. This does not mean that the development plan won't or can't change -- but they will be trying to recoup as much money as possible, and thus will be trying to sell it to a developer who has the a positive (and profitable) vision for it. Those Pesky Lawsuits: The developer of Preston Lake (Richard Hine) had filed a lawsuit against Wachovia (now Wells Fargo) --- and Wachovia had responded with a countersuit. Per the attorney representing Wells Fargo, both of those lawsuits will go away once the sale closes, and the property is taken back by Wells Fargo. A Community United: If anything, the turmoil and uncertainty over the future of Preston Lake seems to have drawn its residents closer together as a community. Most of the owners were in attendance at the sale, and then went as a group to Cally's afterward to have lunch. There seems to be solidarity and general optimism (as much as is possible) amongst most (or all) of the owners. They still seem to thoroughly enjoy their homes, and each other, which is a positive sign for the future of the community. Have Questions? If you have questions about Preston Lake or the foreclosure proceedings, I'm happy to try to answer them (540-578-0102, scott@HarrisonburgHousingToday.com), or you can contact Peter Barrett of Kutak Rock, LLP, who is the attorney representing Wells Fargo. You can reach Mr. Barrett at 804-343-5237 or peter.barrett@kutackrock.com. | |

Buying a Foreclosure |

|

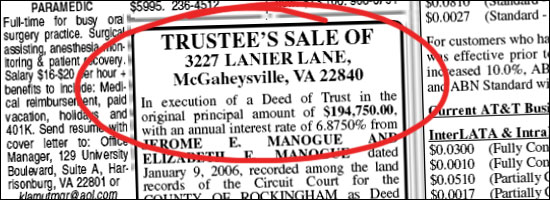

If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. Short Sales: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Trustee Sales: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Bank Owned Properties: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. For information about upcoming trustee sales, please refer to HarrisonburgForeclosures.com. For information about purchasing a property as a short sale, or purchasing a bank owned property, please e-mail me at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

Will Foreclosures Dominate 2011 Home Sales in Harrisonburg and Rockingham County? |

|

The Associate Press (AP) story below ran a few weeks ago in the Daily News Record. AP stories often don't reflect market realities here in Harrisonburg and Rockingham County, so I must admit I didn't really believe it to be true in our local area.  This headline came to mind again, however, when I was analyzing the 47 properties to go under contract in Harrisonburg and Rockingham County thus far in 2011. Each statistic below speaks to the types of properties that are actually selling these days, and the types of buyers that are actually buying. Of the 47 properties that have gone under contract thus far in 2011....    | |

Preston Lake Headed To Foreclosure? |

|

Per a Trustee Sale advertised in today's Daily News Record (view ad), the bulk of the Preston Lake subdivision may be headed to foreclosure. This doesn't necessarily mean that the foreclosure sale will take place, but this is a significant step in that direction. Preston Lake is Harrisonburg and Rockingham County's first master planned community, intended to include nearly 500 townhomes and single family homes, a large section of retail stores with a main street appearance, and many amenities such as a community center, soccer fields, swimming pool, and more.  The vision....  Main Street renderings  Amenities at Preston Lake Now, however, all of those plans may be coming to an end, at least for now. On February 3rd at 12:00 p.m., 124.693 acres of Preston Lake is scheduled to be auctioned at the Rockingham County Circuit Court. Please note that an advertised trustee sale (all that has happened thus far) does not necessarily mean that the foreclosure process will take place. This wasn't the first sign of trouble for Preston Lake, as the developer of Preston Lake and its lender (Wachovia) have been in the midst of legal proceedings for almost a year now, as described in the Mar 2, 2010 article from the Daily News Record: Preston Lake Homes and its developer, the Hine Group, filed claims against Wachovia in Rockingham County Circuit Court on Dec. 11 for breaking its loan contracts, according to the lawsuit. Preston Lake is seeking $32.4 million in damages for lost profit. Wachovia filed a counterclaim in U.S. District Court in Harrisonburg on Dec. 29. The Charlotte, N.C.-based bank is suing Preston Lake for $15.6 million in outstanding debt. While it was happening quite slowly, residential construction at Preston Lake had been continuing even over the past year. Since the first closing in 2008, there have been 37 sales at Preston Lake recorded in the HRAR MLS, ranging from $318k to $883k, with a median price of $421k. Three of these sales took place as recently as the fourth quarter of 2010. Today, only four properties are being marketed for sale at Preston Lake per the HRAR MLS -- three are resale properties, and one is being sold by the developer. (view active listings at Preston Lake) A few notes about the foreclosure sale:

| |

It is really hard (impossible?) to compete with bank owned properties |

|

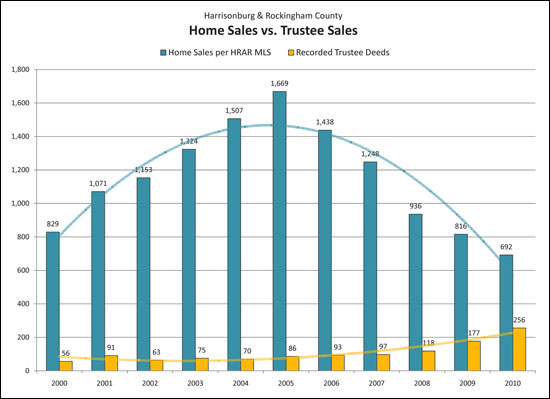

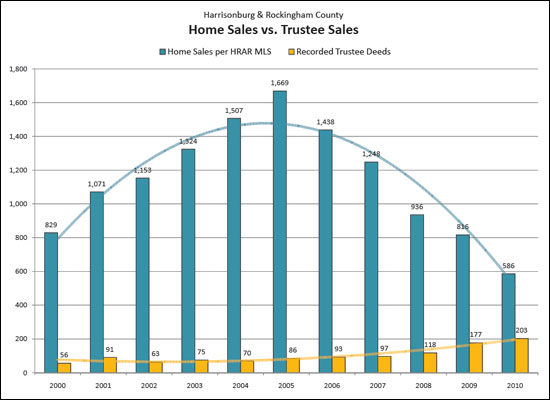

Harrisonburg and Rockingham County have seen an increasing number of trustee sales (foreclosures) over the past few years....  click the image above for a larger version of the graph The yellow bars above show the increasing number of trustee sales over the past decade, as compared to the number of sales recorded in the HRAR MLS (blue bars). I am quite thankful that we have not seen as much of a surge of foreclosures as many other areas in Virginia and across the country, but the presence of these foreclosure and then bank owned properties has had a very real impact on homeowners trying to sell in the same neighborhoods as some of these foreclosed properties. Let's take a look at an example to see the impact.... Stone Spring Village is a wonderful neighborhood of single family homes near the intersection of Port Republic Road and Peach Grove Road close to an elementary school, close to the new hospital, and close to JMU. Most homes in the neighborhood are 3 to 4 bedroom homes, most are 1,500 to 2,500 square feet, and many have basements. Until recently, home values in Stone Spring Village have been relatively stable. But three foreclosures in the past year have made the Stone Spring Village market a bit more turbulent....

Which house would you choose if the following were available?

| |

Harrisonburg Home Sales Decrease, Contracts Increase, in September 2010 |

|

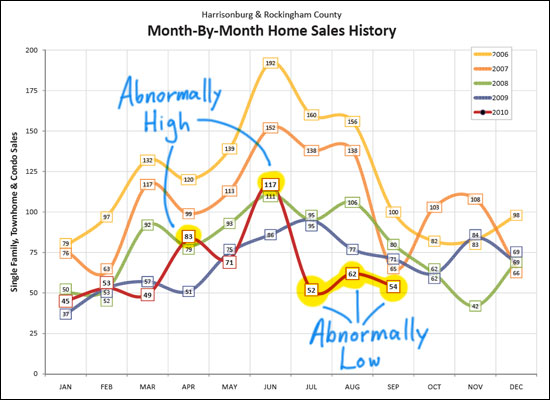

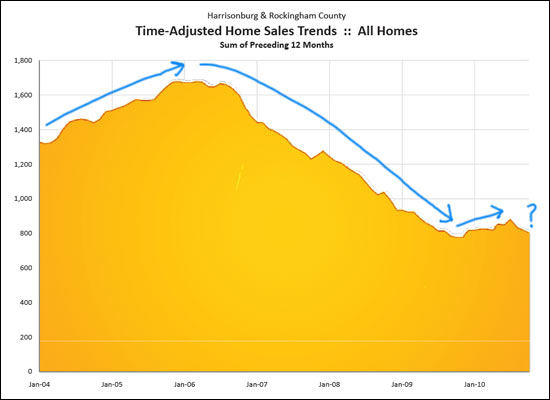

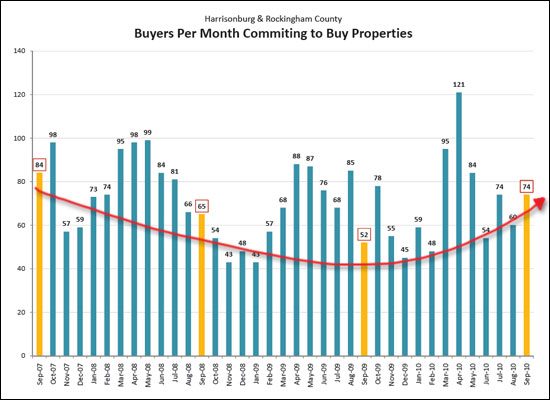

Below are several highlights from the October 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report.  As you'll note above, there were very few home sales in September 2010. In fact, there were very few home sales in in July, August and September! That was, however, after very high home sales in April and June. Thus, it would seem that the home buyer tax credit certainly rearranged the timing of 2010 home sales, regardless of whether it brought new buyers into the market nor not. The question now, of course, is how many of the October, November and December closings were borrowed by the first half of 2010.  After multiple years of a declining sales pace, the graph above shows that we were finally seeing a reversal for the first six months of this year. However, the past three months of slow sales has turned us back around into a declining market again. The fourth quarter of 2010 will be quite indicative as to a reasonable 2011 forecast.  Please note, above, the silver lining. Despite a lower than normal number of closings in September 2010 -- the buyers were out yet again, contracting to buy real estate. In fact, with 74 properties going under contract, buyers in our market outpaced the past two Septembers. This should be a good indicator for the coming months.  Above you'll see a decade-long comparison of two imprecise measures. The blue bars show the number of home sales recorded in the HRAR MLS -- this does not include private sales (sans Realtor), and some new home sales. The yellow bars show the number of Trustee Deeds recorded during each of the past 10+ years. Some of these foreclosed properties (203 in 2010) then show up in the blue bar when they are listed and then sold as bank owned properties. It would seem that foreclosures have increased nearly four-fold over the past ten years, and now make up somewhere between 15% and 26% of all home sales.  My full market report (click above -- or here -- for a 20 page PDF) includes LOTS more analysis to help you make informed real estate decisions. Read through it and let me know if you have any questions, or if any additional information would be helpful to you. You can contact me (nearly) anytime at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Will Home Values Fall in Harrisonburg and Rockingham County? |

|

An Associate Press story printed in the Daily News Record a few days ago....  The beginning of the article references an increase in prices in July as shown by the Case Schiller index. So, will home values fall here in Harrisonburg and Rockingham County as is suggested in the article might happen in many markets? Let's take a look at the support for their theory that values will fall.....

Stay tuned! | |

Home Sales versus Foreclosures |

|

Data Sources: Harrisonburg/Rockingham Association of Realtors MLS, Rockingham County Circuit Court Clerk's Office (Thanks Chaz & April!) Many have asked me how foreclosures are affecting our local real estate market. Absent hard data on the number of foreclosures in Harrisonburg and Rockingham County, I have always mentioned that there aren't an overwhelming number of foreclosures --- and certainly not enough to make a huge difference in home values. Now, I have the data, thanks Chaz & April at the Clerk's Office . . .  What can be seen here is that the percentage of the home sales that are foreclosures has certainly been on the rise over the past several years. However, despite this being based on hard data, there is still a bit of fuzzy math.... The "Sales" includes all home sales as recorded in the HRAR MLS. This includes most foreclosures, because most such properties end up being bank owned properties that are then listed (and sold) by Realtors via the MLS. However, if only 127 of the 177 foreclosures ended up in the MLS as sales, then the true number of total sales for 2009 would have been 866 sales, making foreclosures 20.4% of the market as opposed to 21.7% of the market. This year (2010) and next year will be important to watch as we see how many home sales we'll have, and how many foreclosures will exist in the market. I predict that home sales will level off this year (and thus, stop declining), but that foreclosures will increase over last year. | |

Are Foreclosure Rates Increasing In Harrisonburg and Rockingham County? |

|

Over at HarrisonburgForeclosures.com, I post notices of upcoming Trustee Sales (foreclosure auctions). The graph below shows how many trustee sale notices we've seen over the past 7 months.  As you can see, there has been a general increase over the past seven months, though it certainly could be a seasonal cycle since I don't have 12 months of data yet. Do remember that these numbers do not indicate how many properties are actually foreclosed on, but rather the number of properties for which a trustee sale is scheduled --- regardless of whether it ends up taking place. I'm working to get my hands on data about how many sales actually go through. Stay tuned! | |

What Happens If My Neighbor Is Foreclosed Upon? |

|

Thankfully, the Harrisonburg and Rockingham County real estate market is not greatly affected by foreclosures and short sales. Many people ask why we haven't seen an overwhelming number of foreclosures in this area -- to which I offer:

So, what is the impact? In our market, with a very low number of foreclosures, this sale will not have a tremendous impact, unless the particular neighborhood where it is situated happens to have an above average number of foreclosures. Let's see why . . . .  The table above demonstrates the impact of foreclosures on a given market when 8% of the sales are foreclosures, 50% and 75%. Of note, I have informally heard from several colleagues in Winchester that earlier this year 75% of active listings in their market were foreclosures, short sales or bank owned properties. The analysis above assumes that "normal sales" range from $250k to $300k, and that the foreclosure sales are all at $200k. As you can see, with a foreclosure rate of less than 10%, the impact on median sales price is marginal. However, the market value of homes really starts to shift as there are more and more foreclosures in a market. Interestingly, this is a bit of a snowball effect. More foreclosure sales bring home values down, which puts more homeowners under water, which causes more foreclosures, which brings home values down further, etc., etc., etc. Thankfully our local market has escaped this downward cycle to date! This is a broad topic, so feel free to ask some clarifying questions or raise other thoughts or perspectives, in the comments below, by e-mail (scott@cbfunkhouser.com) or by calling me at 540-578-0102. | |

Buying A Foreclosure: Before, At, After The Trustee Sale |

|

There is often confusion about what it means to "buy a foreclosure" -- and it really all revolves around whether your potential purchase is happening before, at, or after the Trustee Sale. The Trustee Sale is the sale of the property on the courthouse steps to the highest bidder as a result of the borrower's default on their loan. BEFORE THE TRUSTEE SALE If a property is headed towards foreclosure, you may be able to buy it before it is sold on the courthouse steps. Sometimes a property headed towards foreclosure is on the market during that pre-foreclosure time period, so you could go tour the home, make an offer, and follow a traditional path towards purchasing the property. It's important to realize, however, that if a homeowner is headed towards foreclosure they are likely to be in a "short sale" scenario. A short sale is one in which the proceeds from the sale won't be sufficient to pay off the money owed against the house. If you are considering a property that would be a short sale, you may want to brush up on the typical timing of a short sale in Virginia. It's also crucial to know that there will be lots of uncertainty in trying to buy a short sale property because you'll be waiting on approval from the owner's lender, which can take weeks or months. During that time, other offers can come in, the property can be foreclosed on, etc. You'd know about these properties by reviewing notices of future Trustee Sales, or by asking your Realtor to look for properties in the MLS where a short sale is noted. AT THE TRUSTEE SALE This is where all the action is --- or not! Most trustee sales that I have attended do not have any bidders who exceed the bank's minimum bid. That is to say that the lenders typically take the properties back at or close to the amount of the outstanding loan balance. If the loan balance is a decent amount below perceived market value, then there may be bidders, but this is usually not the case. The uncertainty in buying at the Trustee Sale is that you usually will not have viewed the property (so you won't know the condition), and you won't be able to make your offer/contract contingent upon a home inspection. Thus, you're buying sight unseen, and as is. Quite a dangerous combination, which makes most potential bidders hesitant to bid too high, as they don't know what types of repairs they may have to make to the property. You'll also need to be prepared at the Trustee Sale with a cashier's check in hand, and be ready to close within just a few weeks. AFTER THE TRUSTEE SALE If you're "buying a foreclosure" after the Trustee Sale, you're really buying a bank owned property. That is to say that the lender was not able to sell the property on the courthouse steps, and thus have it back on the market after having foreclosed on the original borrower. Oftentimes, the new owner will not be the actual lender, but an asset management company. Some asset management companies will price the house quite evenly with the market, and try to sell it in a reasonable, but not overly fast time period. These properties are much like other properties on the market, except that they are owned by a bank or asset management company. Other lenders or asset management companies will list the property at a price where it is sure to sell quickly, and likely with multiple offers. A property such as this came on the market in Bridgewater this past week, and there were three offers on the property within the first few days of having been listed. Buying a bank owned property is relatively straight forward, though you may be dealing with multiple competing offers, you will definitely be dealing with lots of extra paperwork and disclosures from the bank, and you may be dealing with a slower than normal process for negotiations and closing. IN SUMMARY If you have been encouraged to "look at some of those foreclosure properties" or think that your best opportunity might be a "a foreclosure" -- maybe you should, and maybe it is. But bear in mind that the process, the risks, and the certainty of the purchase will vary quite drastically based on whether you buy before, at or after the trustee sale! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings