| Newer Posts | Older Posts |

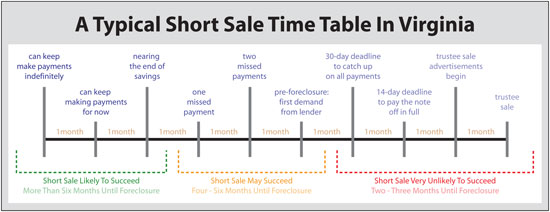

A Typical Short Sale Time Table In Virginia |

|

Earlier this week I attended an educational session put on by the Virginia Association of Realtors in regards to Short Sales which was very informative! I am currently representing a buyer who has a contract on a house that will be a short sale, and I am currently representing a seller whose listing will likely result in a short sale. Thus, in addition to being quite interesting, the top down overview prepared me to better represent my clients. First, my simplified definition of a short sale is any home sale where the proceeds will not provide the sellers with enough money to pay off the mortgage(s) in full, and where the sellers can't come up with the rest of the money themselves, and where the bank agrees to release the lien against the house anyhow, even though they aren't being paid in full. One very helpful part of our training session was an explanation of the typical foreclosure timeline (shown below) and how and when a short sale can fit in to prevent the foreclosure.  Click on the image above for a larger JPG version of the timeline, or click here for a PDF version. As you can see, above, when a homeowner knows they are headed towards foreclosure there is often still plenty of time to attempt to arrange a short sale rather than to simply wait for the foreclosure to transpire. Yet at the same time, as the foreclosure (trustee sale) looms nearer and nearer, the possibilitiy for a short sale diminishes. What else do you need to know about short sales and foreclosures? A LOT!

| |

A Casual Examination of Foreclosures in Harrisonburg and Rockingham County |

|

For almost a year now, I have been posting information about scheduled foreclosures (Trustee Sales) in Harrisonburg and Rockingham County to HarrisonburgForeclosures.com. In the more recent past I have been compiling some basic details on these scheduled foreclosures, an analysis of which is presented below, but first let me explain why this is only a "casual examination" of foreclosures. HarrisonburgForeclosures.com offers information on scheduled foreclosures, not just those that actually are foreclosed upon (some Trustee Sales never take place.) Thus, this analysis is based on properties that are headed towards foreclosure, but isn't just based on those that are actually foreclosed upon. Click here to view a larger version of this document As you may have imagined (above) most of the properties are in Harrisonburg (which includes Harrisonburg-addressed Rockingham County properties, and is the largest area in the County). Coming in behind Harrisonburg are Elkton, Broadway and McGaheysville. This next document examines when these homeowners purchased the home that is now being (possibly) foreclosed upon... As you can see, the vast majority of these homes were purchased in 2005, 2006 and 2007. This should serve as no significant surprise, as that was when loan requirements were being pared down and pared down, such that anyone with a pulse could obtain a mortgage. These lax guidelines resulted in some people owning homes that weren't really in a financial situation that would allow them to consistently pay their mortgage. I'll update this analysis from time to time, but one thing that you ought to be sure to remember is that (thankfully) Harrisonburg and Rockingham County have an extremely low rate of foreclosure as compared to other parts of the country. This is wonderful news, as it has not negatively skewed our home values as has happened in many larger metropolitan areas. For more details on upcoming foreclosures, visit HarrisonburgForeclosures.com. | |

Foreclosures in Harrisonburg and Rockingham County |

|

Thankfully, the foreclosure rate for Harrisonburg and Rockingham County is much lower than in other parts of the country. However, we do have foreclosures in this area, and it isn't always easy to keep track of them. Sites such as RealtyTrac.com and others invite you to subscribe to their services to access data on homes in the foreclosure process. Their records, however, are not always accurate, and are often difficult to put into context. The most complete source of foreclosure information I have found to date is the printed "Trustee Sale" notices in the Daily News Record. To make it a bit easier for those of you who like to keep up with properties in the foreclosure process, you can always check in over at HarrisonburgForeclosures.com where I post those notices. Also of interest - Types of Foreclosure Opportunities | |

Banks eager for short sales!? |

|

A short sale is one where the sales price was insufficient to pay the total of all liens and costs of sale; and where the seller did not bring sufficient liquid assets to the closing to cure all deficiencies. In other words, the seller had to sell at a price where they needed to bring money to closing, but they couldn't. A short sale almost always results in an incomplete payoff of one or more mortgage debts, so a lender has to agree to a short sale. Lenders are apt (in the current market) to consider a short sale because they are likely to recoup more of the money owed to them than if they are forced to foreclose on the property. I am listing a property this week that will almost certainly be a short sale, and I was surprised to learn from the owner that the bank had encouraged the short sale and was quite willing to go along with a short sale. This was somewhat of a surprise to me because over the last years I have heard countless stories of lenders who are hesitant to consider a short sale, and instead pursued foreclosure. If you are considering buying a property that will be a short sale, it will likely take a little bit longer for the transaction to take place, as the bank must approve of the deal that is worked out between buyer and seller --- but a short sale can be a great opportunity to buy at a good value. | |

Looking for foreclosures opportunities in Harrisonburg & Rockingham County? |

|

Over the past nine months I have posted quite a few foreclosures opportunities on this blog, HarrisonburgHousingToday.com. Yet during this time I have realized that not all of my blog readers are interested in hearing about houses that are coming up for foreclosure. Thus, I have created HarrisonburgForeclosures.com.  On HarrisonburgForeclosures.com you will find information and news about the foreclosure process, as well as updated information on properties that will be foreclosed upon in the near future. I will not be posting all foreclosure properties, but rather those where a reasonable opportunity exists for purchasing at a savings. If you are interested in knowing about foreclosures in the Harrisonburg area, you can subscribe to HarrisonburgForeclosures.com here. | |

Foreclosure Sale --- 101 years old --- $52k of possible equity! |

|

The property pictured to the right (506 Virginia Avenue) was purchased 18 months ago (January 2007) for $185,000. The first mortgage, with an original loan amount of $148,000 is scheduled to be foreclosed upon on Wednesday, July 30, 2008 at 11:00 a.m. The property pictured to the right (506 Virginia Avenue) was purchased 18 months ago (January 2007) for $185,000. The first mortgage, with an original loan amount of $148,000 is scheduled to be foreclosed upon on Wednesday, July 30, 2008 at 11:00 a.m.The house was built in 1907, and offers 2,514 finished square feet, 3 bedrooms, and 1 full bathroom. The property is currently assessed at $200,700 --- thus (potentially) offering a $52,700 equity opportunity. Do you have questions about this foreclosure sale, or about the foreclosure process in general? Feel free to ask (scott@cbfunkhouser.com, 540-578-0102). Or review the notice in the Daily News Record. | |

"Foreclosures are rising faster in Virginia than almost anywhere else" -- what does it mean for Harrisonburg and Rockingham County?? |

|

This morning the Richmond Times-Dispatch reported that Virginia is 11th in foreclosures. This new ranking was based on a report released yesterday by RealtyTrac Inc.

So....what does this mean for homes and homeowners in Harrisonburg and Rockingham County? It depends on when you ask....

So, here's my (elementary) executive summary for you:

| |

Looking to buy a Taylor Spring townhome? This foreclosure sale could afford you $62,900 of savings! |

|

2991 Taylor Spring Lane is a three-level townhome in Taylor Spring subdivision with three bedrooms, two full bathrooms, and a half bathroom. In addition to the 1400 finished square feet above ground, the home has a 700 square foot unfinished basement. Oh --- and as is evident from the photo on the right, this is an end unit with a brick facade! 2991 Taylor Spring Lane is a three-level townhome in Taylor Spring subdivision with three bedrooms, two full bathrooms, and a half bathroom. In addition to the 1400 finished square feet above ground, the home has a 700 square foot unfinished basement. Oh --- and as is evident from the photo on the right, this is an end unit with a brick facade!The property was originally purchased in March 2004 for $126,540. The deed of trust that may be foreclosed upon is dated August 30, 2004 and is in the amount of $135,000. Thus --- even if the principal balance had not been reduced at all by regular monthly payments --- a $62,900 opportunity may exist. This equity gap is based on the current assessed value of $197,900 and the original principal balance of $135,000. If you're interested, the trustee sale will take place on July 15, 2008 at 4:30 p.m. at the Rockingham County Circuit Court. A few other articles that might be helpful for understanding the foreclosure process include:

| |

Taylor Spring townhome foreclosure offers a possibility of $29,300 of equity |

|

The townhome located at 2979 Diamond Spring Lane (pictured to the right) may soon be sold at a trustee sale. The property was originally purchased for $200,345 on July 31, 2006. The mortgage that may be foreclosed on had an original principal amount of $160,000. The townhome located at 2979 Diamond Spring Lane (pictured to the right) may soon be sold at a trustee sale. The property was originally purchased for $200,345 on July 31, 2006. The mortgage that may be foreclosed on had an original principal amount of $160,000. This townhome (circa 2006) features three bedrooms, two full baths, a half bath, and over 1500 finished square feet. The current assessed value of the property is $189,300 --- thus, compared to the original principal amount of the deed of trust, an opportunity exists for at least $29,300 of equity. Click here to view other townhomes currently for sale in Taylor Spring. The trustee sale is scheduled for July 16, 2008 at 3:30 p.m. at the Rockingham County Circuit Court. A deposit of $15,000 (cash or certified check) will be required at the time of the sale. To learn more about foreclosures, you might consider reading these articles:

| |

112-acre Bridgewater farm --- foreclosure sale |

|

A credit line deed of trust with a maximum amount of $1,600,000 is being foreclosed on. The trustee sale will take place on July 9th at 2:00 p.m. on site (5639 Thomas Spring Road, Bridgewater, VA). The site looks pretty interesting --- a river runs through it! The current assessed value $413,980. A bidder's deposit of up to $25,000 in cash or certified funds may be required. Trustee: Doug Stark, 540-512-1800 Source: Daily News Record, June 23, 2008 | |

Harrisonburg (area) Foreclosure: 2979 Diamond Spring Ln ($29K) |

|||||||||||||||||||||||||||||||||

Click here to view a similar property.

Source: Daily News Record, June 5, 2008 Trustee: Samuel I. White, 757-457-1460 | |||||||||||||||||||||||||||||||||

Harrisonburg Foreclosure: 244 Commerce Drive ($22K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, June 5, 2008 Trustee: Bierman, Geesing & Ward, 301-961-6555, www.bgwsales.com | |||||||||||||||||||||||||||||||||

Buying A Foreclosure Property Before The Sale |

|

Can it be done? YES! Is it easy and fun? NO! Can it be done? YES! Is it easy and fun? NO!Properties in Harrisonburg and Rockingham County that are being foreclosed on are almost always advertised in the Daily News Record as an upcoming "Trustee Sale." When I see good opportunities in these notices, I post the trustee sale details on my blog. Oftentimes, information about these foreclosure sales is available several weeks before the actual sale, and thus interested buyers sometimes wonder if it is possible to short circuit the foreclosure proceedings, and buy the property before the sale. The simple answer --- yes, this is possible. However, there are typically a few obstacles: Owners in denial --- or seclusion --- or anger! Being in situation where you can't pay your mortgage any longer, and the bank is foreclosing on your home is not AT ALL a fun situation to be in. I don't at all intend to make light of the unfortunate light that some homeowners find themselves in. And thus, if you are hoping to purchased a foreclosure property prior to the trustee sale, it is important to consider the perspective of the homeowner. Many such homeowners are in denial --- thinking or hoping that they will catch up on their mortgage payments such that the sale will not take place. Others will be very difficult to reach, and it won't be possible to discuss a way to help them sell their home without being foreclosed upon. And some homeowners will be downright angry if someone contacts them about their home, and it's status as a pre-foreclosure property. The lender can't sell you the home before the trustee sale, so if you are to attempt to purchase it beforehand, you'll have to deal with the homeowner. Be careful how you broach the subject, and be sensitive to a time of difficult life circumstances! The timing will be tight! While there are often several weeks between the first notice of a foreclosure and the actual foreclosure sale, if you are financing the purchase, you will need every last day of it if you hope to purchase the property before the sale takes place. If you are purchasing the property with cash, or if you already have your financing lined up, you may not have as much of a time crunch. Sometimes the lender will postpone the foreclosure sale if they can be assured of a pending successful sale of the property that would pay off their loan. If they have doubts as to the buyer's performance, or doubts as to whether the purchase price will pay off the remaining balance of the loan, they may foreclose as planned. If you are going to attempt to buy a foreclosure property before the sale, be sure to have all of your financing details arranged ahead of time! Those second lenders don't like being in second place! Finally, it is important to recognize that there is sometimes a second mortgage or line of credit on the property being foreclosed upon. If a primary loan of $180,000 is being foreclosed on, it won't necessarily work for you to swoop in and offer the owner $181,000 because you know this will pay off their first mortgage and because you know the property is worth $200,000. If a second mortgage (of perhaps $10,000) is in place, the owner won't be able to sell the property to you unless they have other funds in place with which to satisfy the second loan. The potential existence of second mortgages doesn't mean you shouldn't pursue a foreclosure property prior to the sale, but it does mean that it will be worthwhile to do some preliminary research before making a proposal to the homeowner. It can be beneficial for multiple parties to purchase a home before it is foreclosed upon. You, the buyer, can get a good deal on the house. The seller can avoid a foreclosure scar on their credit history. The lender can avoid the hassle and cost of foreclosing on a property. But if you are going to attempt this feat of real estate acrobatics, be sure to review the factors above and consider how to adjust your proposal to make the scenario work best for all involved parties. Some additional light reading on foreclosures: - Types of Foreclosure Opportunities - How & Why To Buy Property At A Foreclosure Sale | |

Harrisonburg Foreclosure: 513 Broad Street ($104k) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 14, 2008 Trustee: Shapiro & Burson, LLP, 757-687-8822 | |||||||||||||||||||||||||||||||||

Harrisonburg Foreclosure: 1121 Rebecca Ridge Ct ($46K+) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 20, 2008 | |||||||||||||||||||||||||||||||||

Harrisonburg Foreclosure: 1161 Springfield Dr ($31K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 7, 2008 Trustee: Shapiro & Burson, LLP, 757-687-8822 | |||||||||||||||||||||||||||||||||

Harrisonburg Foreclosure: 1143 Sumter Ct ($36K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 6, 2008 Trustee: Samuel I White P.C., 757-457-1460 | |||||||||||||||||||||||||||||||||

Foreclosure: 304 Ridgewood Ave, Broadway ($42K) |

|||||||||||||||||||||||||||||||||||

Source: Daily News Record, May 1, 2008 Trustee: Shapiro & Burson, LLP, 757-687-8777 | |||||||||||||||||||||||||||||||||||

Foreclosure: 1775 Parklawn Drive, Harrisonburg ($79K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 1, 2008 Trustee: Bierman, Geesing & Ward, LLC, 301-961-6555, http://www.bgwsales.com/ | |||||||||||||||||||||||||||||||||

Foreclosure: 328 S Dogwood Dr, Harrisonburg - $120k opportunity |

|||||||||||||||||||||||||||||||||||

* based on actual rate of 6.375%, assuming fixed rate, 30-year ammortization Source: Daily News Record, April 9, 2008 | |||||||||||||||||||||||||||||||||||

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings