| Newer Posts | Older Posts |

Where to start when considering the purchase of an investment property |

|

If you are considering the purchase of an investment property, I believe the first things you need to think about are.... BUDGET How much are you able or willing to spend on an investment property? This can be determined by your financing ability, or by the amount of cash you have to put into the purchase (for the down payment or closing costs), or simply by how much of an investment in a rental property you want to make at this time. INVESTMENT GOALS Are you planning to purchase and hold this property indefinitely? Or are you looking at a five year time horizon? Based on the amount of money you are putting into the transaction (compared to how much you are financing) are you hoping to break even on a monthly basis? Are you hoping to clear $X / month in positive cash flow? What are you hoping to get in return for your investment in the short term and long term? RISK TOLERANCE Relatively early on, you will need to decide how comfortable you are with risk, particularly because the more risk you take on, the more potential reward you have for taking that risk. The easiest way to think about this (in our local investment property market) is whether you are comfortable with buying student housing -- which comes with high rental income, but also the potential for more property damage and vacancy. If we gain some clarity on your budget, your investment goals and your risk tolerance, we can then narrow the scope on which properties it will make sense for you to consider as a potential investment property purchase. | |

Where to find the best deals on houses in Harrisonburg |

|

One way for investors to identify the best deals in Harrisonburg is to compare the list price of each active listing to its assessed values. To make it super easy for you (and any other aspiring investors) I have created BestDealsInHarrisonburg.com which features properties that are being offered at a low list price compared to their assessed value. This is likely to mean that they are a "good deal" -- though if their assessed value happens to be high (relative to their market value) then the deal won't be as sweet. As always, consult a Realtor (such as myself) for expert advice on whether any particular property really is a great deal. BestDealsInHarrisonburg.com is simply shuffling some good prospects to the top of the pile for your consideration. What are you waiting for? Go check it out at BestDealsInHarrisonburg.com. | |

Winter can be the best time to purchase an investment property |

|

Many of my savvy investor clients wait for the winter months to acquire additional rental properties. Their reasons are pretty logical....

Of note -- this advice is most applicable to townhouse properties that might be purchased by investors or owner occupants. This does not necessarily apply to multi-family properties or student housing properties. If you are looking for some advice on how to get started with real estate investing, check out HarrisonburgInvestmentProperties.com. | |

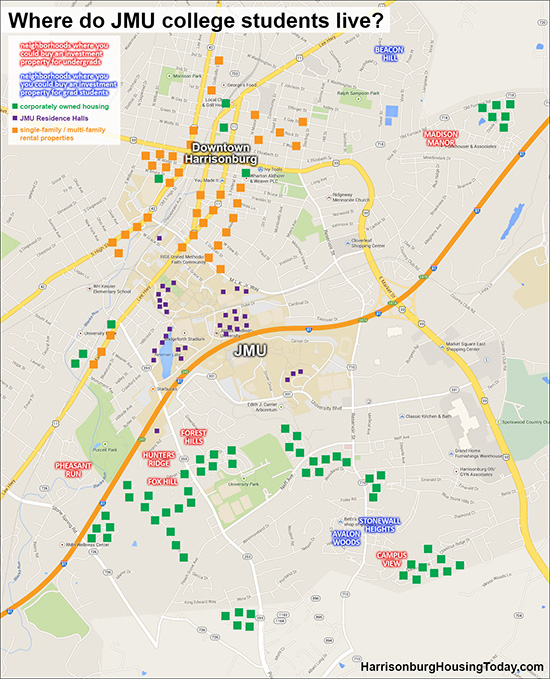

Where to buy an investment property to be rented to JMU college students |

|

click here for a larger version of the map or here for a PDF The map above shows where JMU college students live, in a few categories of housing....

If you are interested in purchasing an investment property in Harrisonburg, you may want to check out HarrisonburgInvestmentProperties.com -- or, feel free to drop me an email (scott@HarrisonburgHousingToday.com) and we can discuss the best opportunities for you. | |

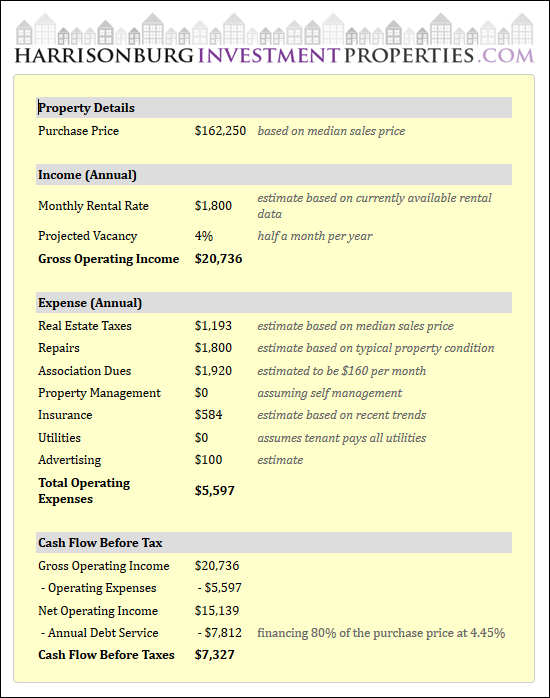

Invest $32K and make $7K back per year? |

|

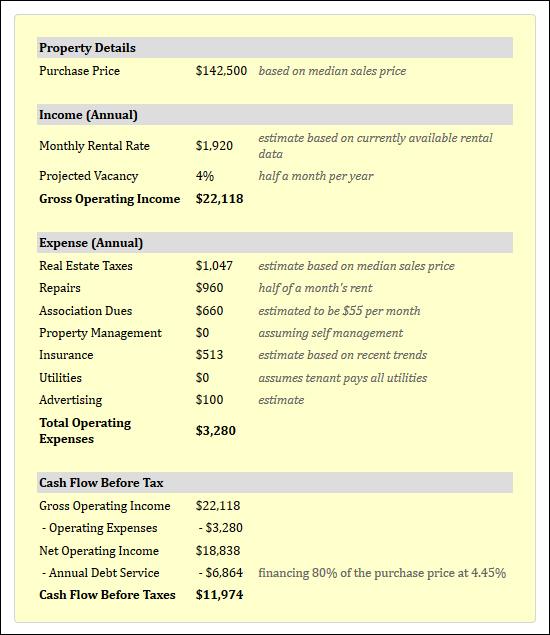

As shown per the above analysis, found on HarrisonbugInvestmentProperties.com, the purchaser of a condo at Campus View could potentially invest $32K (20% of the purchase price as a down payment) and be making $7K(+) per year in positive cash flow before taxes. Not bad, not bad, not bad at all! Despite the abundance of caveats (some listed below) this is a great investment opportunity to explore depending upon your tolerance for risk....

| |

Multi Family Properties in Harrisonburg VA |

|

As I was developing HarrisonburgInvestmentProperties.com, one of my editors commented -- "Multi Family Properties? We don't have have Multi Family Properties in Harrisonburg, do we?" In fact, we do. Sometimes it is a duplex (the whole thing, both sides), or a triplex, a quad, or a small apartment building. They do exist in Harrisonburg, and there are always a few for sale to consider. Check them out on HarrisonburgInvestmentProperties.com. | |

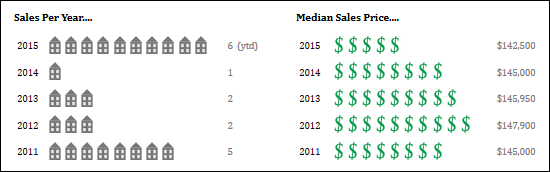

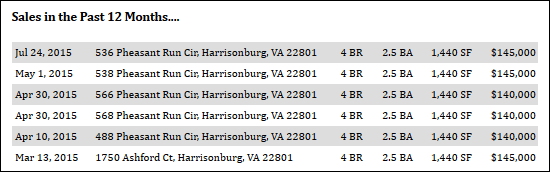

Introducing HarrisonburgInvestmentProperties.com |

|

Many of my past clients have considered, or are considering, the purchase of an investment property in Harrisonburg as a means for diversifying their investments. Today, I launched a new website, HarrisonburgInvestmentProperties.com to provide an overview of your options if you are considering the purchase of an investment property in Harrisonburg, Virginia. This new website features investment properties in a number of categories, including....  On this new website you can explore a variety of communities where you might consider the purchase of an investment property, and explore useful information such as the pace and price of sales in the community....  ....a concise investment analysis of a sample property in the community....  ....specific details of recent sales in the community....  ....and much more, including properties currently for sale, and a neighborhood map. But that's not all! I am also releasing several tools I have built in Microsoft Excel to aid in your analysis of potential rental properties, including a mortgage calculator and two different investment analysis worksheets. Check out these analysis tools here. Whether you are preparing to buy your first rental property, or your 10th, I hope that this new website will serve as a helpful resource to you. If you have suggestions for further additions to the site please let me, and if you would like my assistance in evaluating and purchasing investment properties in Harrisonburg, please email me (scott@HarrisonburgHousingToday.com) to set up a time for a preliminary consultation. | |

Finding Bank Owned Homes (for sale) in Harrisonburg |

|

If you are looking for bank owned properties (for sale) in Harrisonburg or Rockingham County, I would recommend starting at HarrisonburgREO.com. This provides a listing of all listings in the local MLS that are identiifed as bank owned (REO) properties. | |

The Financial Benefits of Keeping Your First Home |

|

Many people who bought their first home when home prices peaked between 2005 and 2008 have had difficulty selling their homes without taking a financial hit. It was, after all, during those same years that 100% financing was all the range – and some lenders were even making loans for more than the purchase price at the time. Understandably, when home values declined in the years that followed, many of those first time buyers with high loan-to-value mortgages did not have enough equity to sell when they were otherwise ready to move on to a second home. Some of these first time buyers opted to keep their first home as a rental property to avoid the pain of the financial hit of selling when they were under water. For many such people, keeping their first home will be a decision they will cherish in years to come. Let's imagine for a moment that you purchased a $160,000 townhouse in the City of Harrisonburg on January 1, 2005 and financed 100% of the purchase price – that results in a $973 monthly mortgage payment. You stayed in the townhouse for seven years, and then (in 2012) either had to move out of the area for a new job, or needed to purchase a new home for your growing family. Facing a tough townhouse sales market, you felt forced to keep the townhouse. You start off, in 2012, renting your townhouse for $850 per month, leaving you still footing a part of the monthly payment ($123/month) but as the years progress, your mortgage payment stays constant, and your rental income grows as rental rates slowly increase. Life is busy, and before you know it, the kids have grown up and headed off to college, and in 2034 you send in your last mortgage payment on that first home you ever purchased. You pause, looking back, to reflect on the 30 years that you have owned that townhouse, and decide to check to see how much you contributed towards paying down that mortgage, and how much help you received from your tenants. Shockingly, in that 30 year period, a total of $350,280 was paid to your mortgage company – but you only had to pay $79,380 --- your tenants over the years paid 77% of the total mortgage costs over the 30 year period. Never have you been so grateful for your tenants. There are, of course, some extra expenses over the years, and to be fair we must consider those. Increases in taxes and insurance will likely cost you around $7K (+1% per year), we'll estimate maintenance costs a $15K, vacancy (1 month / 2 years) would cost you $11K, and hiring a property manager (after you are 15 years in) would cost around $14K. Despite the $47K of extra expenses above, there are also some fantastic upsides to this accidental ownership of an investment property. The $149K of interest that you (and your tenants) paid during the life of the loan is tax deductible, thus $149K of your income has been sheltered, which (with a 25% tax bracket) provides $37K of extra income. Eventually, property values will start increasing again. If your property increases an average of 1% per year since the time that you became a landlord for the property (quite a conservative estimate!), the appreciation would add up to $39K of extra income. While your head is starting to hurt from all of these calculations, you are determined to come to a final conclusion about whether it was a wonderful or terrible decision to keep that first home. Delightfully, you will discover that after investing $0 in 2005 to purchase your townhouse, you have had a cumulative $230,000 gain over those 30 years, thanks to your simple decision to keep your first home. For all the details of this fictional scenario, click here. | |

Buying an Investment Property in Harrisonburg, VA |

|

Here are some good primers to what you'll need to know if you are considering purchasing an investment property in Harrisonburg.... Types of Investment Properties In HarrisonburgIf you're thinking of buying an investment property in Harrisonburg, let's set up a meeting to discuss your goals and review some of the basics. | |

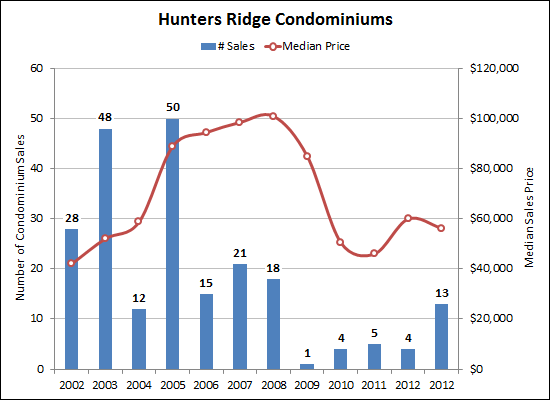

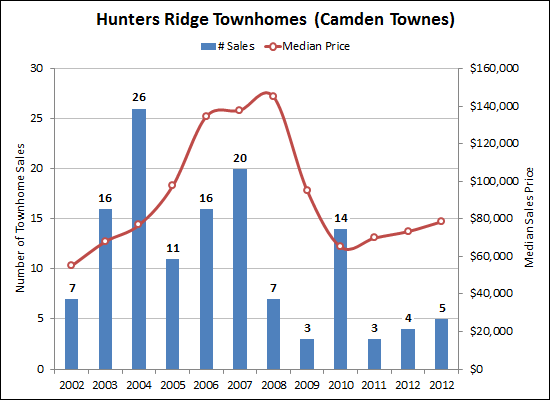

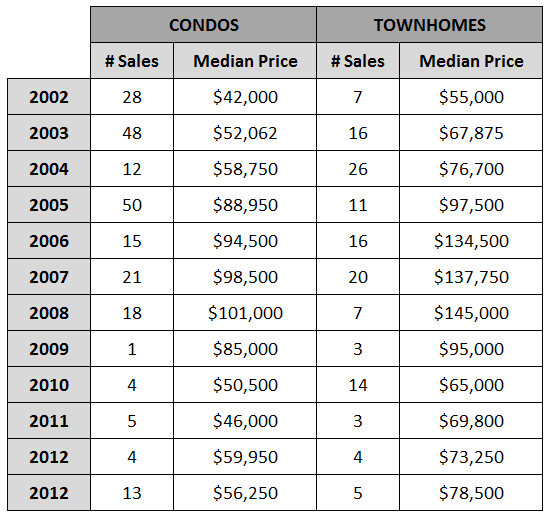

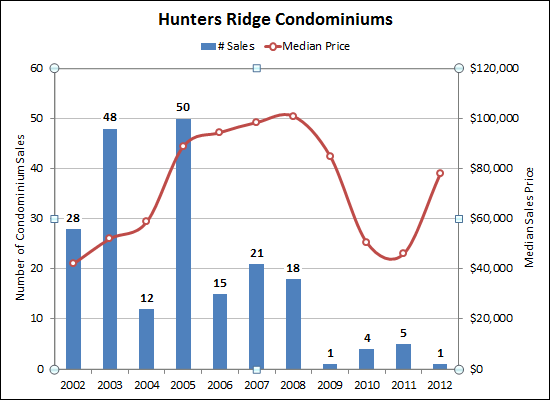

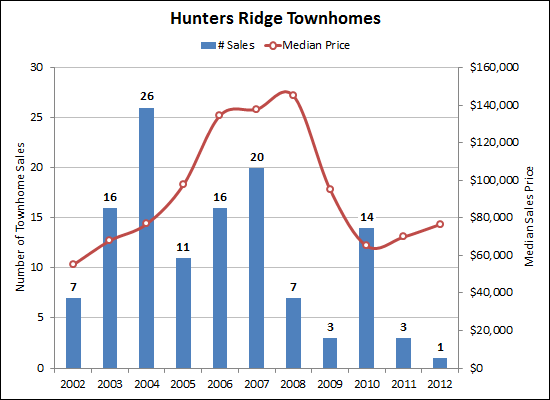

Sales Boom at Hunters Ridge (and Camden Townes) |

|

After several (very!) slow years of condo sales at Hunters Ridge, there has been a rush of sales this year --- 13 as of 11/13/2013. Prices have come down a bit further this year, to a median of $56,250.  Sales have also increased (slightly) at Camden Townes (Hunters Ridge Townhomes) -- and prices have started to tick upwards a bit to a median of $78,500. Here is all of the data....  Search for properties for sale in... Hunters Ridge or Camden Townes. | |

When flipping a property, wait at least 90 days to put it back on the market |

|

If you are purchasing a property to renovate and the list for sale again, you should wait at least 90 days (from the date you closed on the purchase) to put the property back on the market. If you only waited 30 days to put the property back on the market (kudos to you for a speedy renovation job) and if a buyer then comes along and writes a contract on the property before 90 days have passed, then the transaction will be flagged as a flip via the appraisal property. Once flagged as a flip, by Fannie Mae / Freddie Mac guidelines, there will be a variety of implications for the transaction:

The third item above (20% down payment requirement) is what can quickly make a deal backfire, especially if you have purchased and renovated a home that will be appealing to first time buyers.....many of whom will not have a 20% down payment available. So, as an investor, or someone considering purchasing a property to renovate and then list for sale, it is highly advisable that you wait to list the renovated property for sale until at least 90 days after you closed on the purchase of the property. | |

Plan for Retirement by Purchasing an Rental Property |

|

Purchasing a rental property can be an excellent way to plan for retirement, providing you with tax benefits in the short term and an income stream in the long term. Your best bet is to purchase an investment property when you are in your 30's, but a purchase later on in life can still be of great benefit to you as well. Today's low mortgage interest rates will allow you to purchase many types of properties and immediately have positive cash flow, or at least be breaking even on a monthly basis. Financing 80% of a $150,000 townhouse purchase will require a total monthly payment of around $800 including the principal, interest, taxes, insurance and home owner's association dues. Most such townhouses will then easily be leased for $900 to $950 depending on the age, condition and location. Thus, there is a cost for getting started with this type of a retirement strategy – the 20% down payment plus closing costs – but then there will not be many costs as you move forward. Many owners of rental properties will save up their excess monthly cash flow ($100 - $150 per month) to save for any need repairs and maintenance. As you move past the first three to five years of owning your rental property you will start to see an increasing monthly financial benefit. The largest portions of your monthly costs of the rental property – principal and interest – will stay fixed over time thanks to 30-year fixed mortgage interest rates. You will eventually start to see small increases in taxes, insurance rates and home owner's association dues, but in most cases those will surpassed by increases in rental rates over time. Thus, as time marches on, your monthly positive cash flow will increase. Five to ten years in, you may be seeing a rental rate of $1,000 to $1,050 compared to a monthly cost of $850. With positive monthly cash flow from the first day you owned the rental property, you have effectively only had to pay 20% of the market value of a townhouse, and put yourself in a situation where your tenants will be paying the other 80% for you as they pay off your mortgage with their rental payments. Thus, over 30 years, you can thank your tenants for helping your mortgage loan balance decline down to zero. In addition, if we assume an average of 2% appreciation per year over 30 years, when your tenants have finished paying off your mortgage in 30 years, your $150,000 townhouse would be worth as much as $270,000. Purchasing a rental property allows you to create a "retirement account" into which you made the initial deposit (the down payment) and into which other people (your tenants) will make all of the subsequent deposits. This financial transaction can provide positive cash flow from the first day of your ownership of the property, and will also provide tax benefits based on the interest that is being paid on your mortgage payments. In the mid to long term, you will have a regular source of monthly income when either the increased rental rate exceeds your monthly costs or once the mortgage is paid off. Then, after 30 (or 20 or 40) years, you can sell your rental property and cash in on your retirement savings. | |

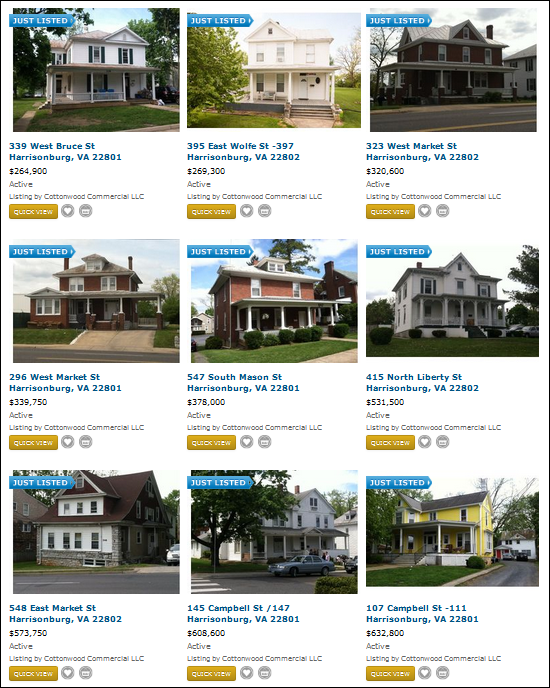

Looking to purchase a large investment property rented to lots of JMU (or EMU) students? Now might be your opportunity. |

|

I have come to know these two things to be true....

That changed earlier this week, when nine such properties were listed for sale. Click here to review the details of these investment properties -- they house lots of students, paying healthy amounts of rent, and thus they carry a high price tag. | |

You can use money in your IRA to invest in real estate! |

|

I have several clients who have purchased real estate using a Self-Directed IRA. While there are certainly some risks, and it can seem like a complex process at first, there are some distinct advantages of considering this strategy....

Here are several articles that will help you better understand the concept....

| |

How to find a great deal on an investment property |

|

During the real estate boom, many people were trying to "get rich quick" by investing in real estate – and many people succeeded. Now that the market has cooled back down, there are still great investment opportunities, but you have to know where to look. Foreclosure Auctions offer a unique opportunity to buy a property at a price that could be much lower than market value. A lender will open up the bidding at such a Trustee Sale with a price typically dictated by the remaining balance on the owner's mortgage plus the Trustee's fees. In many cases, this opening bid is higher than market value --- but occasionally, there will be great opportunities to buy a property at the courthouse steps and then keep it as a rental property, or fix it up and sell it. The caveat to this, of course, is that you will usually not have the opportunity to view the interior of these properties before the auction. You can review upcoming Trustee Sales online at HarrisonburgForeclosures.com. Bank Owned Properties are those that do not sell at the courthouse steps and thus come to be owned by the bank that foreclosed on them. These properties typically offer better than average buying opportunities – but they are not amazing deals – the bank wants to recoup as much of their loss as possible. Buying a bank owned property is relatively straightforward, though it requires wading through the lengthy additional contract documents provided by the lender. You can review upcoming Trustee Sales online at HarrisonburgREO.com. Under-Priced Homes don't come around too often, but occasionally you (or I) will spot a property on the market that is priced lower than it should be. Typically this happens as the result of an above-average motivation to sell – perhaps an owner needs to leave the area for a new job, or there might be bigger picture financial issues, or a divorce, etc. Whatever the reason, there are usually a few properties on the market with better-than-they-should-be asking prices, providing unique buying opportunities for the alert investor. Buying in bulk can offer you a discount, just as when you shop at Costco. If you are in a position to acquire several properties at once, from the same owner, you will typically have much more negotiating ability than you would otherwise. This could include multiple investment properties owned by one individual or entity, or perhaps new construction properties. If you are interested in investing in real estate in Harrisonburg or Rockingham County, there are opportunities to be tracked down, at the sources above and using a few other research strategies depending on your specific goals . Don't forget, of course, to also consider how you will finance the purchase, whether you will rent or flip the property, and the tax implications of investing. It can still be an exciting time to invest in real estate, though you must be more strategic now than was required during the real estate boom. | |

Things that make you say "WOW" (pending sale of 22 condos at University Place) |

|

Every once in a while, something unexpected happens in the local real estate market --- say, for example, the bulk sale of 22 condos at University Place! This morning, 22 listings were entered into the HRAR MLS in University Place (South Ave) and then marked under contract --- each priced at $41,000 --- so apparently a $902,000 bulk sale. Each of the properties, as you might imagine, has a common owner. Let's contextualize it.... University Place sales during 2010 = NONE University Place sales during 2011 = 2 sales (med price = $42,600) University Place sales during 2012 (YTD) = 2 sales (med price = $39,500) Active Listings: 10 listings, priced at $59,900 each So what is the "wow"? The sale of quite a few of these condos all at once after very slow sales in the complex over the past few years. And at an apparent price that doesn't seem fantastic relative to recent sales --- unless the actual sales price will end up being lower than $41,000. | |

Tenants can make or break an investment property |

|

Especially when it comes to student housing, it can be quite helpful to view an investment property once the tenants are in place. I took the above photo when showing an investment property last week -- as you can tell, the tenants moved the most important items in first.... | |

Map of Hunters Ridge Condos and Townhouses in Harrisonburg, VA |

|

Out of town investors often wonder where a particular property is located at Hunters Ridge --- now they need wonder no longer. Click the map above for a printable version (4.8M) of this map of Hunters Ridge. I have labeled each condo building and group of townhouses by its address. View properties for sale in: Hunters Ridge Condos, Hunters Ridge Townhouses | |

Property values increasing in Hunters Ridge? |

|

Is it possible that values at Hunters Ridge have bottomed out and are on the rise? Don't read into the upswing too much, as there is only one data point for each property type so far this year --- but this will be a trend to continue to monitor.   View currently available condos and townhouses in Hunters Ridge. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings