Investing

| Newer Posts | Older Posts |

Leasing instead of selling your townhouse |

|

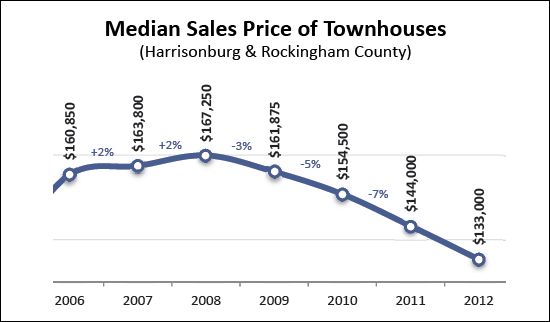

Plenty of townhouse buyers from the past five years would now like to sell their townhouse and move up to a single family home. But it has been difficult to do so recently because of adjustments in townhouse values.  Thus, I have counseled many townhouse owners that if they really want to move up to a single family home, that they ought to seriously consider leasing their townhouse instead of selling it. This doesn't work for everyone (especially if you need to free up some equity in your townhouse) but it can be a great long-term decision. Read about how unwillingly keeping your townhouse might be your best (unintentional) financial move yet to see how the owner of such a townhouse could potentially experience $230,000 of gain over 30 years of owning the townhouse. If you can't sell, you should seriously consider leasing your townhouse, and I'd be happy to help you analyze the opportunity to see what would make the most sense for your situation. | |

Gold, Real Estate, Stocks, Savings |

|

photo by digitalmoneyworld According to a recent survey by Gallup, Americans value gold as the best long-term investment, with real estate coming in second place, followed by stocks.  Read the entire story here. | |

Everything you need to know about buying an investment property in Harrisonburg, Virginia |

|

Types of Investment Properties in Harrisonburg Overview of Real Estate Investing in Harrisonburg Reasonable Goals for Buying an Investment Property in Harrisonburg Everything You Need To Know About Buying An Investment Property in Harrisonburg, Virginia Buying real estate for your son or daughter to live in while they attend JMU Analyzing Investment Properties Three ways to buy a foreclosure in Harrisonburg or Rockingham County, and how to find such opportunities OK, that's probably not EVERYTHING you need to know, but I hope it is a good start towards it. If you are ready to consider buying an investment property, please e-mail me (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) to discuss your investment goals. | |

Finding a deal on a townhouse in Harrisonburg |

|

There are some deals to be had on townhouses in Harrisonburg, based on:

Some of these are bank owned properties (post-foreclosure) and some are homeowners who are just ready to move on. I have had investors take advantage of some of these great opportunities, and I have had some first time buyers take advantage of them. Send me an e-mail (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) if you are looking for a great deal on a townhouse and I'll fill you in on the details. Also, don't forget that you can find out a lot of information about townhouses communities in/around Harrisonburg by visiting HarrisonburgTownhouses.com. | |

First Time Buyers Beware! You might accidentally set yourself up for long term financial success!?! |

|

Frank is renting a townhome in Avalon Woods, and is paying $875 per month for the privilege to do so. He has thought about buying a home, but assumes he'd have to pay quite a bit more per month. Well, maybe not! If Frank were to buy a townhome in Avalon Woods (or Liberty Square, Beacon Hill, Harmony Heights, etc) he might pay around $140,000 for the townhouse --- or even less! Assuming $140,000, here is an illustration of what Frank's mortgage payment might look like, with a ridiculously low rate of 3.875% (which one of my clients was quoted yesterday)....  Frank will still have to pay $40/month for the Property Owners Association on top of this mortgage payment, but his monthly housing cost is now going to be $775. Wait a minute.......Frank is going to move from paying $875 in rent to paying $775 for a mortgage payment? How could this be?

What are you waiting for? If you're a potential first time buyer, let's talk through your situation to see if a home purchase might fit into your short term (housing) and long term (investment) plans. | |

Unwillingly keeping your townhouse might be your best (unintentional) financial move yet! |

|

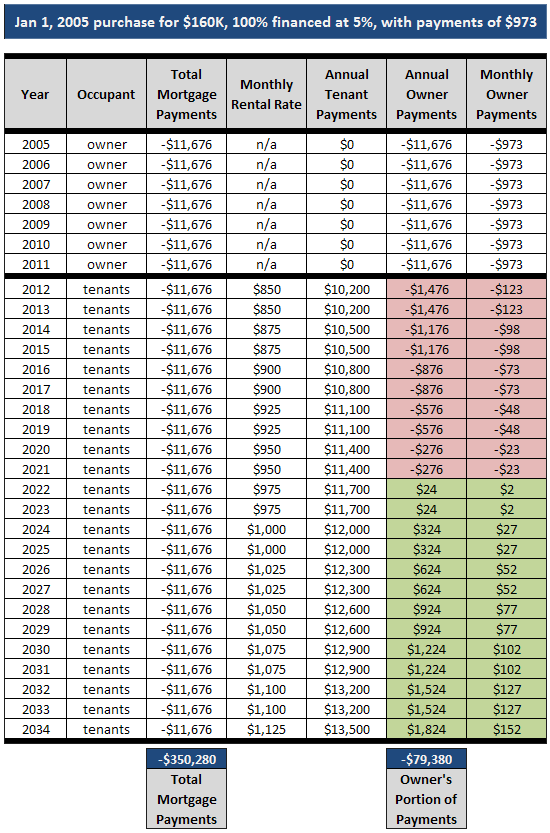

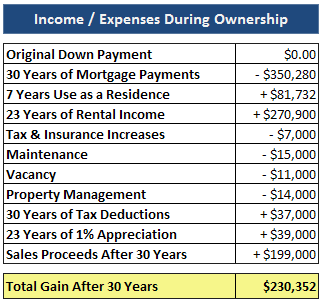

As I pointed out a few days ago, if you bought a townhouse a few years ago, you might be in a position where you can't sell it -- and thus end up being an accidental landlord. But there may be some unintended very positive consequences for keeping that townhouse. Let's examine what might happen if you kept your townhouse for the remainder of the term of your mortgage.  In the illustration above, let's imagine you bought your townhouse for $160K in January 2005 and financed 100% of the purchase price. You stay in the townhouse for seven years, and then move out of the area for a new job. Faced with a tough townhouse sales market, you feel forced to keep the townhouse. What happens next.....

As you can see, after investing $0.00 on Day 1, you end up having a cumulative $230,352 benefit after 30 years. Wow! So, can this make you a bit more optimistic about being (or feeling) forced to keep your townhouse? | |

Do you own (and live in) a townhouse in the City of Harrisonburg? |

|

Do you like playing Monopoly? If you bought a townhouse between 2000 and 2005 in the City of Harrisonburg (perhaps in Liberty Square, Beacon Hill, Avalon Woods or Harmony Heights) I would encourage you to check with a lender to see if you can buy a second townhouse. I have many clients who bought two-level townhomes between 2000 and 2005 and bought them for anywhere between $100K and $125K. As a result, their mortgage payments are somewhere in the neighborhood of $700/month including principal, interest, taxes, insurance, and homeowners association dues. ($115K purchase price, 100% financing at 4.5% over 30 years) That townhouse can very likely be rented in the current market for $850/month to $900/month. There continue to be isolated opportunities to buy re-sale townhouses in these same neighborhoods for around $125K to $140K. The new mortgage payment could thus be around $800/month including principal, interest, taxes, insurance, and homeowners association dues. ($135K purchase price, 96.5% financing at 4.75% over 30 years) Monthly cash flow now: Mortgage payment (etc) = -$700 Total cost = $700/month Monthly cash flow after acquiring a second townhouse: Mortgage payment (etc) on 1st townhouse = -$700 Rental income from 1st townhouse = +$850 Mortgage payment (etc) on 2nd townhouse = -$800 Total cost = $650/month You'll actually lower your monthly costs by $50 by acquiring a second townhouse. Furthermore your tenant will be paying off your first mortgage for you, and you will own approximately $270K of real estate instead of only $135K. So, what do you say? Are you ready to invest? | |

Did Your Property Lose Value? Buy Another! |

|

In a recent real estate conversation, I was presented with what seemed at first to be a very bold real estate investment strategy. If you bought high, and now the value of your home is lower, buy another home! This CERTAINLY doesn't work in all cases, but it is very interesting to think about how it can work well in some situations. For example, Hunters Ridge.... If you bought a townhouse for $140k a few years ago --- and now realize that it is worth around $70k --- might you improve your situation ($70k underwater) by trying to negotiate a deal to purchase a second townhouse for $60k? You would then have paid $200k for $140k of property, making each property only $30k underwater. To the extent that you are looking at your losses over a long term period, you'll be better off trying to recoup a $30k loss on each property instead of trying to recoup a $70k loss on one property. What do you think? Smart? Bold? Strategic? Foolish? | |

Owners of Rental Property in Harrisonburg: Get ready for more IRS paperwork! |

|

Thanks to one of my clients, who pointed this new regulation out to me.... If you own rental property, you must now submit a 1099 form to the IRS and to service providers if you pay $600 or more for the provided service -- such as to a plumber, carpenter, painter, landscaper, etc. Apparently, the basis for this requirement is to make sure that contractors are not hiding their income. Requiring that this information from rental property owners will (potentially) reveal more income that should be taxed. This goes into effect for 2011 rental property income and expenses, so start keeping detailed records, if you're not already. Do you love legislation and taxation? Read more about the Small Business Jobs Act of 2010, which enacts this new requirement. | |

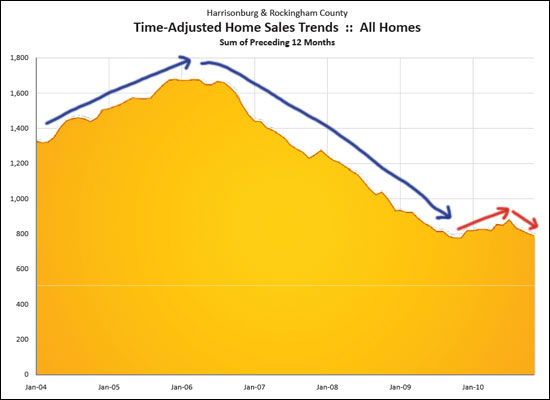

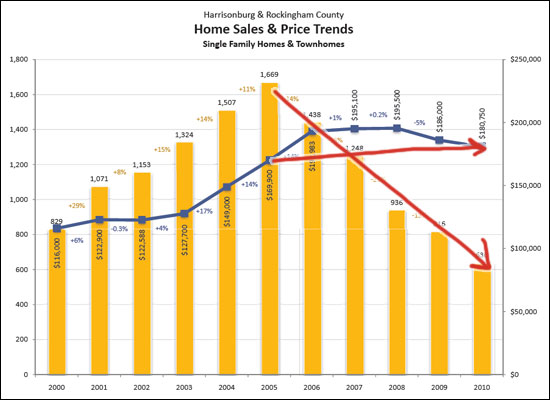

Despite Slow Sales, Home Values Remain Relatively Stable in Harrisonburg and Rockingham County |

|

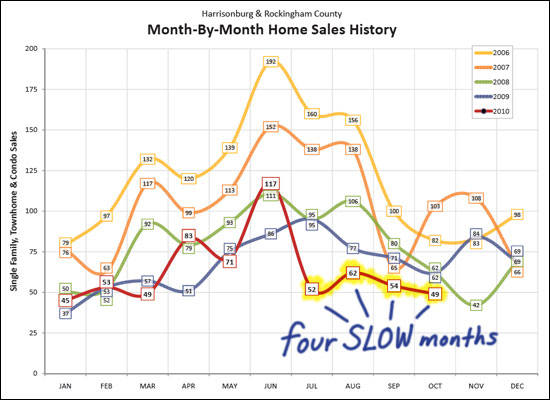

Read on for several highlights of the November 2010 Harrisonburg and Rockingham County Real Estate Market Report. Or click here to view the PDF.  Despite early gains in 2010 (particularly in April and June) home sales have stagnated over the past several months. July, August, September and October of 2010 have been the slowest such months during the past five years. Despite these low sales figures, however, year-to-date sales are only 4% below last year's sales.  Late 2009 through mid 2010 showed some promise. After several years of declining home sales (pace, not values) it seemed that our local market had finally turned around. Now looking back, that increase in sales pace may have been largely related to the home buyer tax credit, as the pace of sales is now on the decline yet again. What surprises lie in store for us in 2011?  As demand falls, prices should fall --- isn't that what I learned back in my economics class at JMU? Not so in the Harrisonburg and Rockingham housing market!?! Fewer and fewer buyers have been present in the market over the past six years (demand fell) but prices have not fallen in the way that that shift in demand would suggest. Calling all economists....how can we explain this?  Click the image above (or here) to review the entire November 2010 Harrisonburg and Rockingham County Real Estate Market Report, complete with an all new Executive Summary this month. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Types of Investment Properties In Harrisonburg |

|

Below are several general categories of investment properties in Harrisonburg that you might consider purchasing. Each has its own pros and cons. College Rentals - There are many more bedrooms than college students in Harrisonburg right now, so this is not necessarily a great choice, but it can work well given the current pricing of these properties. Hunters Ridge Condos, Hunters Ridge Townhomes and Madison Manor are your main choices in this area, and with a decent down payment, the cash flow can actually work well now that prices have dropped considerably over the past few months. New-ish Townhomes - Here you'll be aiming for graduate students or young professionals as tenants. I suggest buying a townhouse with two full bathrooms, and either two bedrooms or three bedrooms can work well. Your main choices are: Liberty Square, Liberty Square II, Beacon Hill, Avalon Woods, Harmony Heights, Wellington Park and Blakely Park, though there are some other areas to consider as well. Being new or new-ish townhomes, these are usually in good condition and relatively easy to rent. Old-ish Single-Family / Multi-Family Homes - If you don't mind tackling some maintenance on a home that is 40 to 70 years old, you might find some good opportunities in and around the downtown area where you can buy a home that could be fixed up and rented to college students, graduate students, young professionals or a family. These properties range from 2 bedroom homes that may currently be owner occupied to 5+ bedroom homes that have been rented to college students for years. Depending on your goals as an investor, each of these categories of investment properties can make more or less sense. Feel free to call (540-578-0102) or e-mail (scott@HarrisonburgHousingToday.com) if you'd like to discuss your goals, and which properties would work best for you. Read more about the numbers of investing here. | |

Investing in Harrisonburg Real Estate |

|

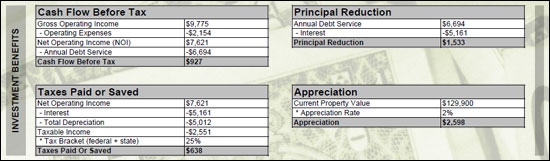

Investing in real estate isn't for everyone --- and it isn't without its risks. But if you have some money to put into an investment as a down payment, and if you have financial reserves with which to cover maintenance costs and months without rental income, you might be interested in learning more. The easiest case study of real estate investing in Harrisonburg is to consider the purchase of a two-story townhome built in the last ten years. There are quite a few neighborhoods where these townhomes can be purchased, somewhere between $130k and $160k: These two-story townhouses in these neighborhoods will likely rent for between $850 to $950 depending on the age and condition. View them on a map here. Next, let's assume a great deal on the purchase (we'll shop until we find that deal) with a purchase price of $129,900. However, we'll make lots of conservative assumptions as we continue. For the time being, assume:

This might not seem like much, but when combined with a few other investment benefits, it starts to add up, even in the first year. Year 1 Investment Benefits

There are plenty of variables to consider when buying an investment property, but the basics of the cash flow are the first to thoroughly understand. For a head start on everything else you need to learn, review this detailed investment analysis. | |

Reasonable Goals For Buying An Investment Property In Harrisonburg |

|

Every investor (or potential investor) comes to the table with different expectations for an investment property that they may choose to purchase. A few examples of this broad spectrum include: Having One's Cake And Eating It Too!

Put more specifically in today's context, most rental properties that an investor could purchase in Harrisonburg today will offer (how exciting!) negative cash flow --- even given a 20% down payment, self-management and self-maintenance. This leads me to two questions every potential investor should be asking.... 1. Should I be investing in real estate in Harrisonburg? If you are seriously considering investing in real estate, Harrisonburg is a great place to buy. While there are still some who believe our home values will eventually, somehow, start falling rapidly, we have seen relatively stable home values over the past several years despite the majority of the country seeing sharp declines. This is likely attributable to our low unemployment, a diverse economy, multiple local colleges/universities, and our proximity to D.C. --- all of which are great economic stabilizers that benefit real estate investors in this area. 2. What should I be buying as an investment property in Harrisonburg? And how should I be buying it? First, you'll need to be patient. As stated above, most properties currently for sale won't be very exciting, even given reasonable investment goals. However, there are, and there will continue to be some properties that can work well --- providing positive cash flow, likely appreciation, a stable tenant base, etc. To properly evaluate such opportunities, however, you'll want to (in my opinion) become comfortable with analyzing the properties and their potential financial benefits through several different lenses (cash flow, tax benefits, principal reduction, appreciation). Read up here for more details. If you are considering purchasing an investment property in Harrisonburg, I'd be delighted to assist you in that process. Get in touch (540-578-0102 or scott@HarrisonburgHousingToday.com) and we can start to discuss your situation and goals. | |

Don't Sell! If You Can Keep Your First Home As A Rental Property, Do It! |

|

If you own your first home now, and are looking to move up to your next home --- I urge you to carefully examine the potential benefits (and risks) of keeping your current home instead of selling it. Your first home is likely an ideal rental property, and you can see enormous returns if you are able to keep your current home as a rental property when you purchase your next home. That being said, I know that many people need to sell their current home to use the proceeds of that sale to use as a down payment for their purchase. Scenario #1 -- Sell After Five Years We'll imagine that your home was a townhouse bought five years ago for $110k, which is now worth $155k. In selling the property, you will clear about $42k after closing costs. (Assumptions: 100% financing at 7% fixed, five years of principal reduction, 6% gross closing costs) Net Gain After 5 Years Of Residency = $42,000 As you can see, this is a hefty payoff after just five years. Certainly, even if you didn't need the funds to roll into your next purchase, it would be tempting to "cash out" by selling your first home. Scenario #2 -- Sell After Ten Years (total) We'll again imagine that your home was a townhouse bought five years ago for $110k, which is now worth $155k. However, instead of selling the property, you rent it for $875/month, with a super conservative 1% per year increase in rental rate. We'll also assume that your insurance, property taxes, and property value go up 3% per year. If you keep the property for another five years after moving into your new home, and then you sell it, in addition to getting the roughly $42k out that you would have netted after five years, you'll also likely experience:

Scenario #3 -- Sell After Thirty Years (total) But what if you kept it all the way until the end of the 30 year fixed rate mortgage? Then things would be looking excellent! In addition to getting the roughly $42k out that you would have netted after five years, you'll also likely experience:

The Risks Certainly, as in any investment scenario, there are risks. Here are a few:

The Benefits I believe the benefits CAN outweigh the risks, depending on your own personal financial scenario. Instead of cashing out after 5 years for $42k, you can have tenants pay off the remainder of your mortgage, while you get to enjoy the monthly excesses as rental rates go up, and you eventually get to realize the appreciation of the property. After 30 years, you are likely to have received a net of $353k instead of just $42k. Wow! | |

Do Townhomes in Harrisonburg Hold Their Value? |

|

This is a fascinating question, asked by a potential townhouse buyer who is concerned that townhouse values might be more volatile than single family homes because there have been so many townhouses built in the Harrisonburg area over the past several years. Here is my best attempt at evaluating how townhouses in Harrisonburg hold their value compared to single family home . . . Most of the new townhome communities in and around Harrisonburg have been built during the past six years, so I began by comparing how the median price of townhomes changed over the past six years (2003-2009) as compared to the median price of single family homes. I found that townhomes increased in value by 51% during this time period, while single family homes only increased in value by 42%.  Next, I thought it might be interesting to see how each property type has fared in the most recent three years (2006-2009) in a tough market with very little price appreciation. Comparing median price changes between 2006 and 2009, I found that townhomes increased in value by 1% during this time period, while single family homes LOST 8% in value.  Finally, just for good measure, I thought I'd stretch back even further and look at how the median prices of townhomes have changed over the past nine years (2000-2009) as compared to single family homes. I found that townhomes increased in value by 83% during this time period, while single family homes only increased in value by 70%.  Having examined value trends in a 3-year, 6-year and 9-year window, I'm quite comfortable asserting that townhomes grow in value, and maintain their value better than single family homes. Or, at least, they have in Harrisonburg and Rockingham County for the first nine years of this decade! Median price data source: October 2009 Harrisonburg & Rockingham County Real Estate Market Report | |

Is Harrisonburg Nearing Break Even Again On 80% LTV Investment Properties With Conservative Calculations? |

|

Many (many, many, many) townhouses were built in Harrisonburg between 2002 and 2007. They are still being built, but not at the same pace. The principal reason for this shift in building is that home values increased faster than rental rates. As such, a smaller and smaller pool of investors are considering purchasing townhomes as income generating properties --- though that may be changing again. Let's see how things compare when buying an income generating property in 2002 versus today. In 2002, a new two-story townhome in the City could be purchased for roughly $100,000, and rented for approximately $725/month. Here's how the annual cash flow looks: + $8,338 of rental income ($725 x 11.5 months) As you can see, this is a barely break even scenario using the conservative calculations above, though more positive cash flow was achieved by most investors by managing the properties by themselves, and because very few repairs were needed.- $5,916 for mortgage payments (80% LTV at 6.25%) - $750 for property management (9%) - optional - $590 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $252 for home owners insurance Cash Flow = $170 GAIN in the first year Fast forward to 2009, and here's how the cash flow might look on a new two-story townhome in the City that can be purchased for roughly $150,000, and rented for approximately $900/month: + $10,350 of rental income ($900 x 11.5 months) - $8,172 for mortgage payments (80% LTV at 5.5%) - $932 for property management (9%) - optional - $885 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $378 for home owners insurance Cash Flow = $677 LOSS in the first year As you can see, an investor would now have to bring more than 20% as a down payment to even break even in this townhome scenario. There are plenty of investors who do bring more than 20%, or who pursue other properties with better cash flow characteristics, but hopefully this is indicative of how the investment property landscape has changed over the past seven years. But --- perhaps some of those investors are, or should be, looking at the Harrisonburg market yet again. You see, there are quite a few townhouse owners who bought back in 2000, 2001, 2002, or 2003 who bought when townhouse prices were very low. If they haven't refinanced, or taken out a home equity line of credit (HELOC), they likely have a loan payoff significantly below what the market will bear for their townhouse. Thus --- there are deals to be found with investment properties right now in Harrisonburg. They won't always jump out at you, as they may be listed at reasonable "market price" --- but if the owner is motivated to sell, and they bought 7-10 years ago, they likely have quite a bit of equity with which they can negotiate. If you are looking for an income generating property, feel free to call me (540-578-0102) or e-mail me (scott@HarrisonburgHousingToday.com) and I can assist you in determining whether we can meet your investment goals given the opportunities in today's market. | |

How Much Will I Pay In Capital Gains Taxes When I Sell My Investment Property? |

|

First, here's how to calculate your gain or loss on the sale of your investment property.... Selling Price - Purchase Price - Purchase Costs - Improvements - Selling Costs + Depreciation You may have heard of short-term and long-term capital gains --- the difference is in the timing.... If you sell an investment property within one year (including one year exactly) of purchasing it, your "short-term capital gain" will be taxed at the same level at which your ordinary income is taxed. This could be at a rate as high as 35%, but depends on your income level. If you sell an investment property after one year of owning it, your "long-term capital gain" will be taxed at either 0% or 15%. If you (as an investor) are in the 10% or 15% income tax bracket, you will pay 0% (yes, that's right, no taxes) on your long-term capital gains. If your income tax bracket is above 15%, you will still only pay 15% tax on your long-term capital gain. This is important to note, as an investor might pay a 25% tax on their ordinary income, but can pay significantly less (only 15%) on their income (long-term capital gains) on investment properties in that year. Of note, these tax rates (0%, 15%) only last through the end of 2010 given current legislation on the books. If they aren't extended, they will revert back to the previous tax rates of 10% and 20%. | |

Everything You Need To Know About Buying An Investment Property in Harrisonburg, Virginia |

|

This won't actually cover absolutely everything you need to know, but I believe it will give you a good overview. These questions were posed by a reporter from the Shenandoah Valley Business Journal, and my responses (below) were in print a month or so ago. If you missed the newsprint version, keep reading... 1. Is real estate still a good investment? What should investors know about this market? Real estate is still a good investment over the mid to long term time horizon. The days, however, of buying an investment property and selling it for a profit one year later are likely gone for good. Our local market experienced record price increases between 2003 and 2006 --- which brought a lot of new investors into our market. The perfect storm included a combination of low prices as compared to rental rates, low interest rates on investment loans, and lenders willing to finance 95% - 100% of an investment loan. In 2003 a brand new two story townhouse would sell for $100k and rent for $750/month. Three years later, in 2006, the same townhouse would sell for $160k and rent for $900/month. The 60% increase in value was accompanied by just a 29% increase in rental income. As becomes evident, the investment opportunities are not as exciting now as they were in 2003. 2. What's the difference between residential and commercial investing? Is one better than the other? A "residential investment property" is typically a single family home, townhouse or condo that will be rented to a tenant with the rental income being used to pay the monthly mortgage payment. A loan on a residential investment property will often be amortized and paid off over 30 years, similar to loan on a home being purchased as a residence. A "commercial investment property" might be a duplex building, a small or large apartment building or complex an office space, a shopping center, a farm, undeveloped land, or factory space. A loan on a commercial investment property may be amortized over 20 (or possibly 30) years, but it often will have a balloon payment after 3, 5 or 7 years --- requiring the borrower to pay off the loan or refinance it. Commercial investing is much more complex, with many factors to analyze to understand the value of any given investment opportunity. Residential investing is a much more straight forward analysis with fewer variables. Given this basic difference, those considering investing in real estate for the first time should like start with residential investing to familiarize themselves with the concept before considering the purchase of a commercial property. 3. What should potential investors look for in an investment property? Most investors start by examining cash flow --- how much cash the property will generate each month compared to the expenses that must be paid. The expenses may include: a loan payment, taxes, insurance, repairs, association dues, management expenses, utilities, advertising and supplies. Just a few years ago, positive cash flow (more income than expenses) could be achieved with 80% of even 90% financing. Today, there are many available investment properties that barely (if at all) provide positive cash flow when financed at 80%. This change is a result of property values increasing more rapidly than rental rates. After understanding the cash flow of a property, an investor should also analyze their potential one-time maintenance costs upon purchasing, or within the first few years. If a property has wonderful cash flow, but needs new flooring, paint, appliances, windows and a roof, then it is not as exciting of an opportunity as it may have first appeared. Additionally, an investor should examine other investment properties in the same neighborhood or area to evaluate whether property values and rental rates are stable, increasing, or decreasing. There are a variety of other aspects of an investment property that should be evaluated as well, including the tax consequences of buying and the potential benefit from principal reduction, tax savings and appreciation. 4. How long should investors plan to commit to their property? There are a limited number of opportunities for flipping a property in our current market. There are still, occasionally, properties that can be purchased, fixed up, and re-sold for a profit. Most investment properties, however, will need to be held/owned by the investor for at least 4 to 5 years. Residential properties in Harrisonburg and Rockingham County increased in value by an average of 15% per year between 2003 and 2006. In contrast, they decreased in value by an average of 0.67% per year between 2006 and 2009. An investor could have bought and sold in a 1 year time horizon in 2003, 2004 or 2005, but since then the time horizon would need to be much longer. While an investor won't necessarily see quick gains in appreciation if they buy an investment property now, they will have the potential for lots of negotiating room on price depending on the property being considered. That opportunity to buy below the value of other comparable properties, combined with record low interest rates, makes it a valid time for an investor to consider a purchase. 5. What tax and legal issues should investors consider before making their purchase? Consult a tax accountant and an attorney! Some of the issues that deserve consideration include: increased tax liability based on investment property income, the short and long term impact of reported property depreciation, methods for limiting legal liability, the best type of ownership structure for investment properties (personally owned, LLC, corporation, etc) 6. How does the Valley compare to the rest of the state/country in terms of investment potential? The Shenandoah Valley has not seen dramatic drops in property values that have occurred in other parts of the state and country. As a result, we may not have as many great investment opportunities in the short term, but the investor is also likely more protected from value drops in the long term. Our real estate market, and local economy have proven to be much more stable than other economies, which provides value to the investor because of a lower likelihood of losing tenants, or having difficulty leasing a property. 7. There are lots of programs designed to help first-time home buyers enter the market. Are there any incentives for investors? The government has created many incentives for first-time buyers, but there are very few incentives for investors. Investors, in fact, were a large part of the turmoil seen in real estate markets across the country. In many larger markets, investors were speculating on new construction --- signing contracts to buy 10 or more condos or other residential properties, and then selling them by the time the construction was complete to the eventual end user for 20% (plus) more than their contract price. Large scale investor speculation on new construction led to higher prices than would have been experienced otherwise, as well as a false sense of demand that led to some of the overbuilding in those markets 8. What are the best resources for potential investors? There are many concepts, calculations, measures and benefits that an investor must understand as they are considering an investment property purchase. Perhaps the most important is to understand the nature of and changes in the local real estate market -- for this, I recommend that investors review the market reports on HarrisonburgHousingToday.com. Investors interested in foreclosures can either review the printed "Trustee Sale" notices in the Daily News Record, or browse recent foreclosure notices on HarrisonburgForeclosures.com. Perhaps the most important is finding a Realtor who can assist you in evaluating individual investment properties, and comparing several investment opportunities side by side. | |

Buying real estate for your son or daughter to live in while they attend JMU |

|

Many parents of JMU students consider buying a property in Harrisonburg for their son or daughter to live in while attending college. This can be a great financial alternative to paying several years of rent, especially if there is, or may be more than one student in a family attending JMU. But you can't just come to Harrisonburg, buy any property, and put your students and all of their friends into it. Here's what you need to know about buying houisng for your JMU student to live in with friends:

| |

Examples of Great Deals in Harrisonburg |

|

Yesterday, I mentioned that there are good deals available on investment properties in Harrisonburg, with the key to finding them being: Seek properties listed at prices under market value in neighborhoods (subdivisions) where it is easy to understand market value. To continue that theme, here are a few examples of what I'm referring to: 1296 Victorian Village Drive (Beacon Hill) Asking price: $139,900 Average recent sale price: $155,633 Average current list price: $152,720 view details 1043 Meadowlark Drive (Reherd Acres) Asking price: $136,100 Average recent sale price: ~ $150,000 Average current list price: ~$150,000 view details There are other possibilities on the market right now, and these opportunities will continue to present themselves over time. If you have funds available (10% - 20% of the purchase price) to buy an investment property in Harrisonburg, I'd be more than happy to help you sort through the available properties to find some of your best options. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings