| Newer Posts | Older Posts |

"Good Deals" on Investment Properties in Harrisonburg |

|

I met with a client earlier this week who has funds available to purchase an investment property, and we were contemplating what might make the most sense in the Harrisonburg. Here's what we came up with... Seek properties listed at prices under market value in neighborhoods (subdivisions) where it is easy to understand market value. If we consider, for a moment, townhouses and duplexes in the City of Harrisonburg --- we find that most of these properties are barely viable investment properties given their current market value and the rental income that they can generate. Most new-ish two-story townhomes in the City are selling between $155k and $165k, and might generate $850-$950 per month in rental income. When you consider 80% financing, insurance, taxes, association fees, you'll likely have (on average) $900 of rental income to offset (roughly) $900 of monthly expense. This "barely break even" scenario can make sense to some investors --- they are not only in it for the monthly cash flow, but also for the tax savings, principal reduction and appreciation. But consider this --- if you can purchase a townhome in one of these communities between $135k and $145k, the scenario can be quite different. Dropping the purchase price by $20k reduces your monthly obligations by approximately $110, which creates a nice buffer between income and expenses. Furthermore, you will likely be picking up some "instant equity" because you are buying below market value. A few important notes:

Feel free to call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com) to get started. | |

Analyzing Investment Properties |

|

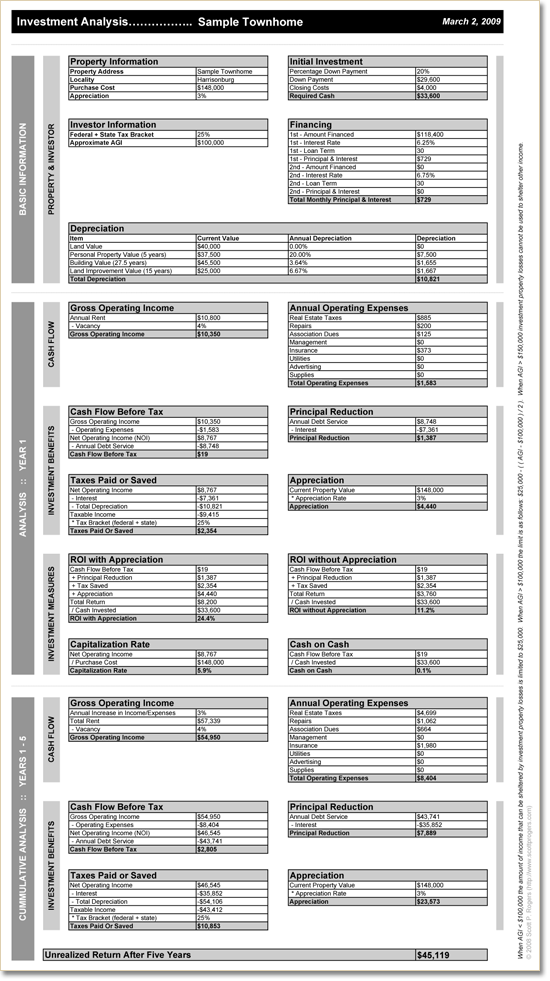

When considering the purchase of an investment property, you ought to account for the following investment benefits:

Click on the image for more detail.  | |

Fannie Mae empowers real estate investors! |

|

Fannie Mae's current policies don't allow an investor to finance any more than four properties backed by Fannie Mae. Thus, if you own the home you live in, you could only purchase three additional properties as an investment. This has directly affected several of my clients who have had to stand on the sidelines, or seek a commercial loan as they considered recent investment purchases. THE GOOD NEWS --- effective March 1, 2009, an investor will now be able to finance up to 10 properties through Fannie Mae! Fannie Mae does, however, put some rather significant limitations on this new policy. This summary is my interpretation of the new policy, but I encourage you to talk to read the policy yourself as well:

Thanks to Jeremy Hart, a fantastic Realtor in Blacksburg, VA for bringing this to my attention! | |

New rules limit real estate investors to four loans |

|

One of my clients forwarded me a story from the Atlanta Journal-Constitution, which discusses new Fannie Mae and Freddie Mac rules that states that Fannie and Freddie will only back up to four real estate loans by one person. This new four-loan rule apparently replaced a previous limit of 10 loans, and was is in place to keep inexperienced or start-up real estate investors from over-investing. The four-loan limit does not allow for any exceptions for income, assets or credit scores. In checking with a local lender, I was told that if a borrower has more than 4 non-owner-occupied homes and a primary residence, no one but a commercial lender can help them on their next investment purchase. So, what is the solution?? One option is to move several existing residential investment loans into a commercial "blanket loan" thus removing residential loans from their balance sheet. Commercial loans on residential properties don't count against the four loan limit if they are in an LLC. If any lenders or investors know of any other options with this new loan limit, please let me know! | |

Looking for investment properties in Harrisonburg? |

|

Some investors wonder whether there are any good opportunities anymore in buying investment properties. You will find good investment opportunities if...

If you're interested in seeing either of these properties, or having an investment analysis for these or other properties, feel free to call (540-578-0102) or e-mail me (scott@cbfunkhouser.com). | |

Buying A Foreclosure Property Before The Sale |

|

Can it be done? YES! Is it easy and fun? NO! Can it be done? YES! Is it easy and fun? NO!Properties in Harrisonburg and Rockingham County that are being foreclosed on are almost always advertised in the Daily News Record as an upcoming "Trustee Sale." When I see good opportunities in these notices, I post the trustee sale details on my blog. Oftentimes, information about these foreclosure sales is available several weeks before the actual sale, and thus interested buyers sometimes wonder if it is possible to short circuit the foreclosure proceedings, and buy the property before the sale. The simple answer --- yes, this is possible. However, there are typically a few obstacles: Owners in denial --- or seclusion --- or anger! Being in situation where you can't pay your mortgage any longer, and the bank is foreclosing on your home is not AT ALL a fun situation to be in. I don't at all intend to make light of the unfortunate light that some homeowners find themselves in. And thus, if you are hoping to purchased a foreclosure property prior to the trustee sale, it is important to consider the perspective of the homeowner. Many such homeowners are in denial --- thinking or hoping that they will catch up on their mortgage payments such that the sale will not take place. Others will be very difficult to reach, and it won't be possible to discuss a way to help them sell their home without being foreclosed upon. And some homeowners will be downright angry if someone contacts them about their home, and it's status as a pre-foreclosure property. The lender can't sell you the home before the trustee sale, so if you are to attempt to purchase it beforehand, you'll have to deal with the homeowner. Be careful how you broach the subject, and be sensitive to a time of difficult life circumstances! The timing will be tight! While there are often several weeks between the first notice of a foreclosure and the actual foreclosure sale, if you are financing the purchase, you will need every last day of it if you hope to purchase the property before the sale takes place. If you are purchasing the property with cash, or if you already have your financing lined up, you may not have as much of a time crunch. Sometimes the lender will postpone the foreclosure sale if they can be assured of a pending successful sale of the property that would pay off their loan. If they have doubts as to the buyer's performance, or doubts as to whether the purchase price will pay off the remaining balance of the loan, they may foreclose as planned. If you are going to attempt to buy a foreclosure property before the sale, be sure to have all of your financing details arranged ahead of time! Those second lenders don't like being in second place! Finally, it is important to recognize that there is sometimes a second mortgage or line of credit on the property being foreclosed upon. If a primary loan of $180,000 is being foreclosed on, it won't necessarily work for you to swoop in and offer the owner $181,000 because you know this will pay off their first mortgage and because you know the property is worth $200,000. If a second mortgage (of perhaps $10,000) is in place, the owner won't be able to sell the property to you unless they have other funds in place with which to satisfy the second loan. The potential existence of second mortgages doesn't mean you shouldn't pursue a foreclosure property prior to the sale, but it does mean that it will be worthwhile to do some preliminary research before making a proposal to the homeowner. It can be beneficial for multiple parties to purchase a home before it is foreclosed upon. You, the buyer, can get a good deal on the house. The seller can avoid a foreclosure scar on their credit history. The lender can avoid the hassle and cost of foreclosing on a property. But if you are going to attempt this feat of real estate acrobatics, be sure to review the factors above and consider how to adjust your proposal to make the scenario work best for all involved parties. Some additional light reading on foreclosures: - Types of Foreclosure Opportunities - How & Why To Buy Property At A Foreclosure Sale | |

What on earth is this "cap rate" you keep talking about? |

|

No --- that's not a cap rate!! Simply put, a "cap rate" is a measure of how quickly your investment is being returned to you. By your "investment" I mean the value of property that you have purchased. by "returned to you" I mean the amount of money that a property generates in a year. The cap rate formula is . . . Net Operating Income / Purchase Price So if you buy a property for $160k, rent it for $975 per month, and have $1,500 of annual expenses, you have a cap rate of 6.375%. ( ( 975 * 12 ) - 1500 ) / 160,000 = 6.375% Care to know more? Read these . . . What Is A "Cap Rate"? Harrisonburg Single-Property Cap Rates Harrisonburg Multi-Family Cap Rates Would you like help calculating the cap rate on a property you own, or are considering purchasing? Call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com). | |

Harrisonburg Single-Property Cap Rates |

|

Cap rates vary over time, as market conditions change. Here is a brief analysis of current cap rates for single properties in the Harrisonburg area as of May 2008. | |

What Is A "Cap Rate"? |

|

The "cap rate" or capitalization rate of a property is what I call an an "investment measure." It is a value that compares the income generated with the acquisition cost of an investment.

| |

Harrisonburg & Rockingham County Foreclosures |

|

For some time now, I have been posting the details of foreclosures on my blog. I began to post all Harrisonburg and Rockingham County foreclosures because I have had clients interested in buying foreclosed properties. I'm making a change starting today, that I believe will still well serve my clients, and those interested in foreclosure properties. First, let me explain that I categorize foreclosures into three areas:

As I move forward, I will only be posting the foreclosure properties that I would categorize as a "good" or "great" opportunity. | |

Foreclosure: 730 Virginia Avenue, Harrisonburg |

|||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

Foreclosure: 1121 Rebecca Ridge Court, Harrisonburg |

|||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||

Foreclosure: 292 E. Riverside Drive, Timberville |

|

| |

Foreclosure: 97 Blue Stone Hills Drive, Harrisonburg |

|||||||||||||||||||||||||||||||||||||||||||

Per the Daily News Record, February 27, 2008 | |||||||||||||||||||||||||||||||||||||||||||

Foreclosure: 12173 Port Republic Road, Grottoes |

|||||||||||||||||||||||||||||||||||||

Per the Daily News Record, February 27, 2008 | |||||||||||||||||||||||||||||||||||||

Foreclosure: 1182 Portland Drive, Harrisonburg |

|

Date/Time of Sale: Friday, March 5, 2008 at 3:15 p.m. Original Principal Amount of Deed of Trust: $177,882 Assessed Value: $193,000 Deposit: $15,000 or 10% of the sales price, whichever is lower For Information Contact: Samuel I. White, P.C. 5040 Corporate Woods Drive, Suite 120 Virginia Beach, VA 23462 757-457-1460 (call between 9:00am and 11:30am) ASAP# 993440 Per the Daily News Record, February 21, 2008 | |

Foreclosure: 111 Middlebrook Street, Harrisonburg |

|

Property To Be Sold: 111 Middlebrook Street, Harrisonburg Property To Be Sold: 111 Middlebrook Street, HarrisonburgDate/Time of Sale: Friday, February 29, 2008 at 9:30 a.m. Original Principal Amount of Deed of Trust: $260,775 Assessed Value: $260,400 Last Sale: $274,500 (April 3, 2006) Deposit: $26,000 or 10% of sales price, whichever is lower For Information Contact: Glasser and Glasser, P.L.C. Crown Center Building, Suite 600 580 East Main Street Norfolk, VA 23510 File No. 61895 757-321-6465 Per the Daily News Record, February 18, 2008 | |

Foreclosure: 80 Shotgun Spring Road, New Market |

|

Property To Be Sold: 80 Shotgun Spring Road, New Market Property To Be Sold: 80 Shotgun Spring Road, New MarketDate/Time of Sale: Friday, February 29, 2008 at 8:00 a.m. Original Principal Amount of Deed of Trust: $90,000 Assessed Value: $130,300 Last Sale: $66,500 (November 30, 2000) Deposit: 10% of sale price For Information Contact: Bierman, Geesing & Ward, LLC, attorneys for Equity Trustees, LLC 4520 East West Highway, Suite 200 Bethesda, MD 20814 (301) 961-6555 www.bgwsales.com Per the Daily News Record, February 12, 2008 | |

Foreclosure: 7110 Rocky Bar Road, Elkton |

|

Property To Be Sold: 7110 Rocky Bar Road, Elkton Date/Time of Sale: Friday, February 22, 2008 at 9:00 a.m. Original Principal Amount of Deed of Trust: $92,800 Assessed Value: $155,700 Deposit: $5,000 or 10% of sale price, whichever is lower For Information Contact: Stephen B. Wood Friedman & MacFadyen, P.A. 1601 Rolling Hills Drive, Ste. 125 Richmond, VA 23229 804-288-0088 Ref# 213234 Per the Daily News Record, February 6, 2008 | |

Foreclosure: 7415 Lilly Square, Dayton |

|

Property To Be Sold: 7415 Lilly Square, Dayton Date/Time of Sale: Wednesday, February 27, 2008 at 9:40 a.m. Original Principal Amount of Deed of Trust: $35,000 & $61,000 Assessed Value: $155,700 Deposit: $10% of sale price. For Information Contact: Hill & Rainey Attorneys 2425 Boulevard, Suite 9 Colonial Heights, Virginia 23834 (804) 526-8300, Ext. 124 Per the Daily News Record, February 6, 2008 | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings