Market

| Newer Posts | Older Posts |

Comparing Home Pricing Strategies |

|

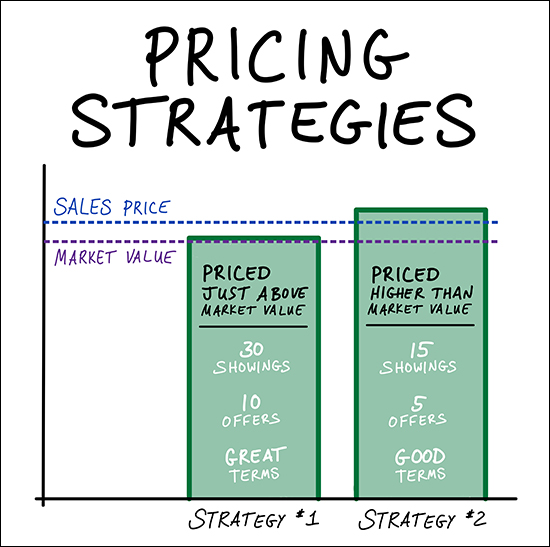

Above I have included an overly complicated illustration of an overly simplified comparison of two pricing strategies. A few key points for understanding the graphic above...

So... the two strategies... STRATEGY #1 In this scenario, the seller decides to price their home just barely above market value. If most would agree that a house is worth $315K, then maybe that is pricing it at $319K. Pricing a home so close to (but just above) what you believe to be its market value is likely to (in this market, now) generate a LOT of showings. A fairly priced house in a market with extraordinarily low inventory levels results in a lot of early showing activity. Houses listed for sale with prices very close to their market value also typically see quite a few offers, which leads to the most important differentiation between these two pricing strategies... With so many offers, you are bound to have a buyer or buyers who are willing to go above the asking price, maybe with an escalation clause, maybe with an escalation clause that goes up to a silly/high number, maybe without a home inspection contingency, maybe without an appraisal contingency, maybe cash, etc. You see where I'm going here. The more offers you have, the more likely you are to have an offer (amongst the many) with terms that will be very favorable to you. STRATEGY #2 In this scenario, the seller decides to price the house a good bit above the assumed market value, you know, because the market is strong! If most would agree that a house is worth $315K, then maybe that is pricing it at $329 or $335K. Even if most buyers (and buyer agents) suspect the price is a bit too high, you are likely still to have a good number of showings, though definitely not as many as if you had priced the home closer to its market value. Of the smaller group of buyers who looked at the home, you are likely to have a smaller number who make an offer. You'll have fewer offers because the price is not quite as realistic, and because some buyers will assume you won't come down much on your price since you just listed your home, which leads to that key difference again... Having priced your home a good bit above its market value, you are less likely to have full price offers, less likely to have escalation clauses, less likely to have buyers waive an inspection contingency or appraisal, etc. You will likely still have very good terms as far as price, but not great terms. Again -- this is an oversimplification of how to best price your home -- and every house and segment of the market is different -- but at some point you will need to decide what type of a strategy you will take in pricing your home, as to what results you are hoping to see. | |

Low Inventory Levels AND Lots Of Listings |

|

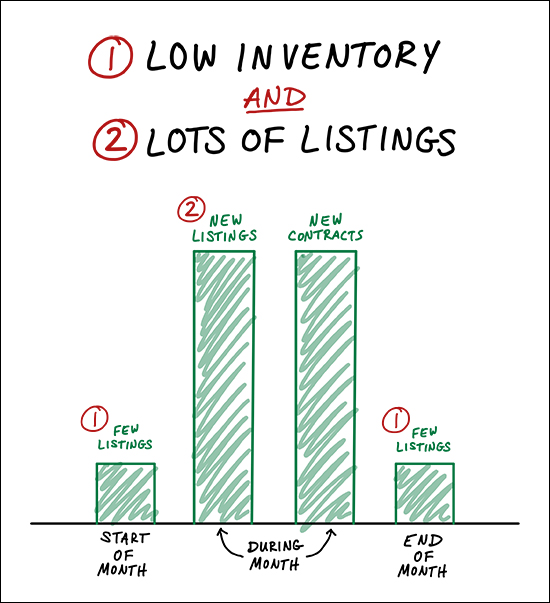

It's an interesting conundrum. Inventory levels are really (really!) low right now, but there are plenty of new listings that will come on the market this month and next month and nearly every month this year. So, how and why does this happen? Well, if there aren't many listings... ...and then a bunch of houses are listed for sale... ...but there are plenty of buyers in the market so that those new listings all go under contract quickly... ...we'll be left with... not many listings. The key factor keeping inventory levels so low right now are an abundant number of buyers in the market -- or trying to get into the market -- to buy a home. So long as that supply of buyers stayed steady and strong, we are likely to continue to see low inventory levels. So, if you are a buyer and are feeling glum about the very few choices you have today... ...be encouraged -- plenty of houses will be listed for sale in the next month or so... ...but maybe (sorry!) also be discouraged -- you will likely be competing with quite a few other buyers for each new listing. | |

Will Buying A Home This Year Or Next Year Result In The Lowest Mortgage Payment? |

|

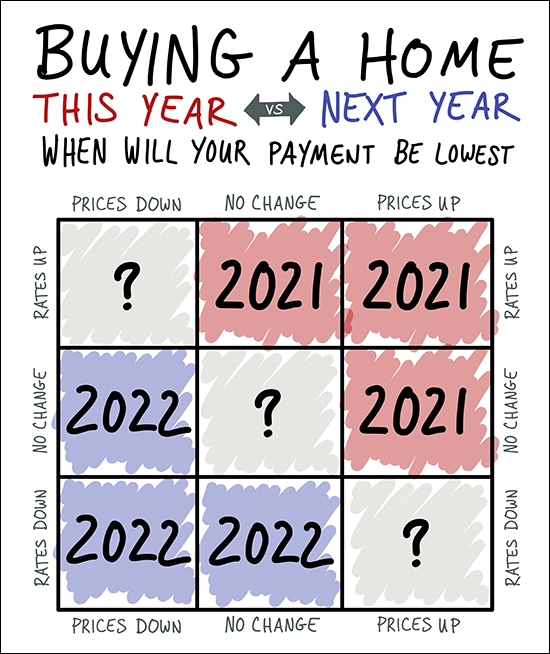

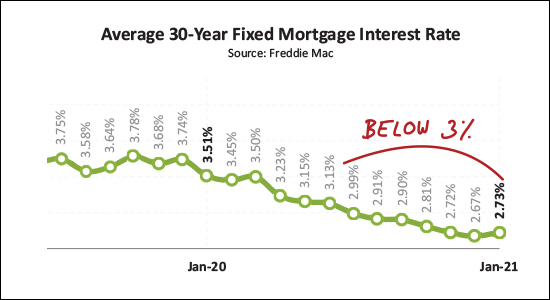

If you are hoping to minimize the amount of your monthly mortgage payment, should you buy a house this year? Or next year? Well, as shown above, it depends on whether you think home prices will be higher or lower (or the same) next year -- and whether you think mortgage interest rates will be higher or lower (or the same) next year. Most folks think mortgage interest rates will be higher next year than they are now. If so, it's most likely that you'd be better off buying this year rather than next to have a lower monthly payment. Even if rates continue to be this low, if prices continue to rise (as they seem likely to do) then again, you'll be better off buying this year than next. Since it seems relatively unlikely (highly unlikely?) that interest rates will go down over the next year, the only way you'd have a lower mortgage payment next year than you would now is if mortgage interest rates do NOT rise AND homes prices decline. So -- as to whether you should buy this year or next -- you tell me, based on your best guesses as to what interest rates and home prices will do over the next year. My best guess is that you'll pay more in a monthly payment for a house if you buy next year than you would if you buy this year. Now, all that said, we'll have to somehow secure you a home amidst a competitive market with lots of buyers -- but it's possible! | |

Are Home Prices Only Going Up Because Mortgage Interest Rates Are Going Down? |

|

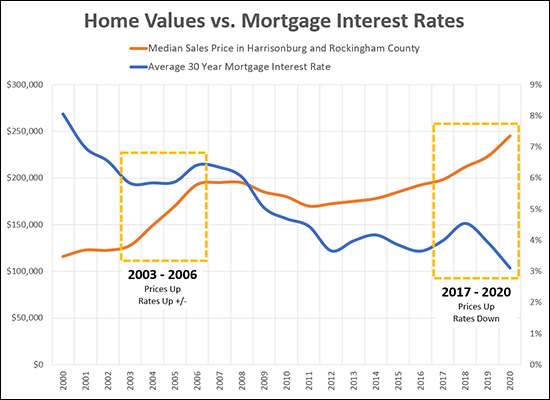

Disclaimer: I am not an economist. I don't play an economist on TV. Or on this blog. Feedback from actual economists, or accountants, or financial analysts, or wise guys is welcome: scott@hhtdy.com So, are home prices going up because mortgage interest rates are going down? Maybe yes AND no? Yes...

No...

So What...

Why...

| |

Who Is Winning In The Local Real Estate Market? |

|

Sellers are winning - rather universally. Every market metric works in their favor, making it a rather enjoyable time to sell.

Buyers are losing - in most categories. Buyers are happy about low rates and low unemployment, but otherwise, all market metrics are working against them. Homeowners are winning - they are indifferent to most market fluctuations - but are glad that home values are increasing. | |

Why Did So Many Homes Sell In Our Area In 2020? |

|

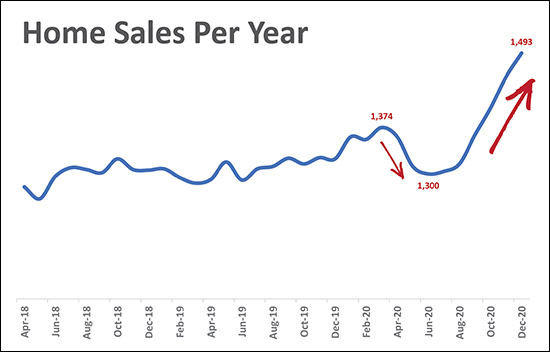

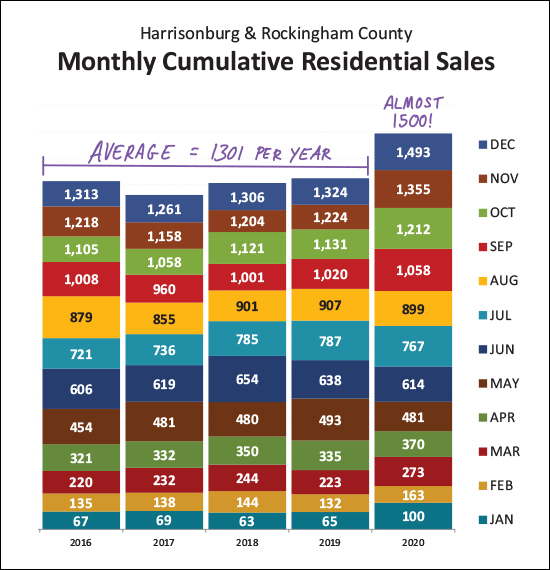

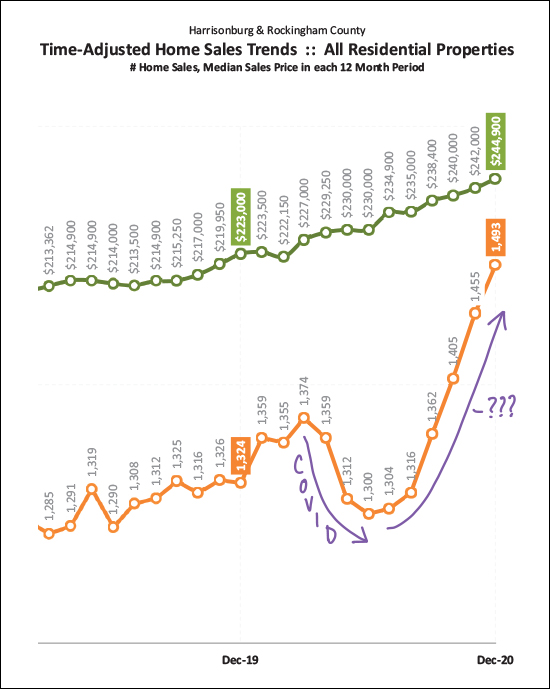

As shown above, the annual pace of home sales took a nose dive in April 2020 related to COVID, but has taken off since August 2020 and quickly accelerated the market to a pace of almost 1,500 home sales per year. Why is this happening? Here are some of my best guesses... Pre-COVID, most of us likely spent the minority of our waking hours in our homes. We would be at work much of the time. During COVID, many folks find themselves spending 90% or more of their waking hours in their homes. For many people, this made them quickly realize that their home was no longer working for their needs or those of their family. If you're working from home and your kids are learning from home, you suddenly have higher expectations for the space and spaces that your home offers. I suspect this "being at home much more than normal" dynamic caused more people to decide to sell their home and buy a new home during 2020. Mortgage interest rates have been dropping throughout most of 2020, making it an excellent time to buy a home from a monthly mortgage payment perspective. These lower rates likely made it pretty easy for the "my home doesn't work during COVID" buyers to consider upgrading to a new home. There is an extraordinary amount of pent up buyer demand in our area. Perhaps more sellers than usual listed their homes in the second half of the year, most of which were scarfed right up by eager buyers, thus leading to higher than normal home sales. This also seems to have lead to higher sales prices! What do they say? The whole is greater than the sum of its parts? It seems that... more buyers wanting to upgrade to a new home + super low interest rates + pent up buyer demand + quickly rising home prices = a red hot real estate market in 2020! As one other aside, it is also possible that we may have seen more second home purchases in 2020 than in other comparable years. More and more people found they could work from home, or from out of town, and this likely drove at least some number of new buyers of second homes into our market. | |

Home Sales Up, Prices Up, Inventory Down in January 2021 |

|

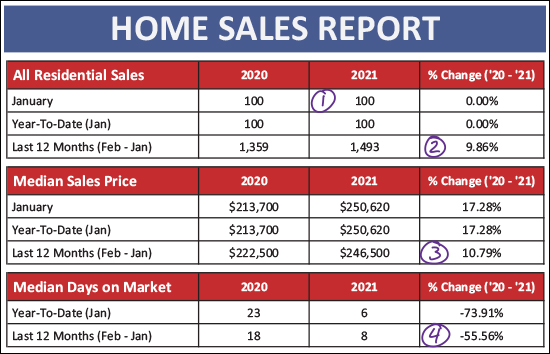

Happy Wintry Monday Morning, friends! It looks like it might be a touch above freezing temperatures today, so perhaps some of the lingering snow and ice and will start to melt today. This has been one of the coldest and snowiest and iciest months of January / February that I can remember anytime recently in the Harrisonburg area! As a preview of where we're headed in this overview of the local real estate market:

So, no huge surprises. It seems the 2021 housing market is trying to keep the momentum going from 2020. Read on for a recap of what is happening in our local housing market or:

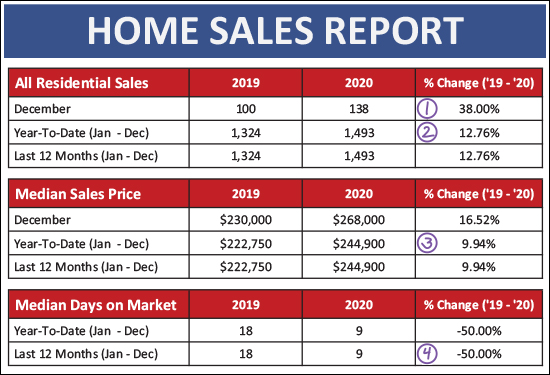

Now, onto the data and some pretty charts and graphs...  A few observations from the overview data presented above...

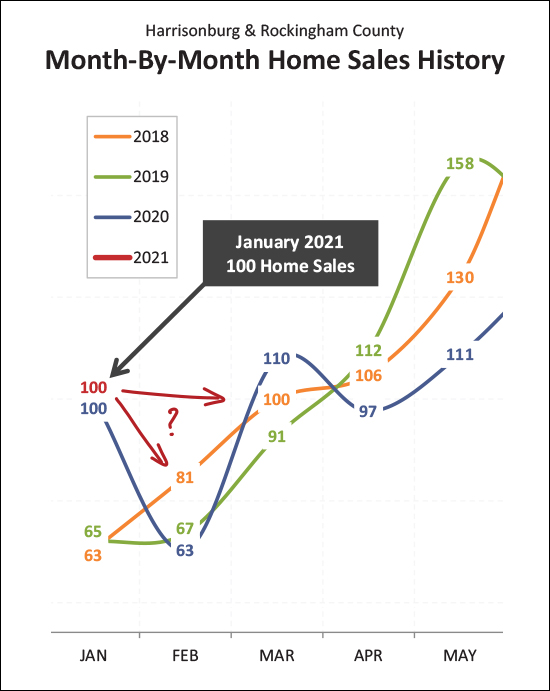

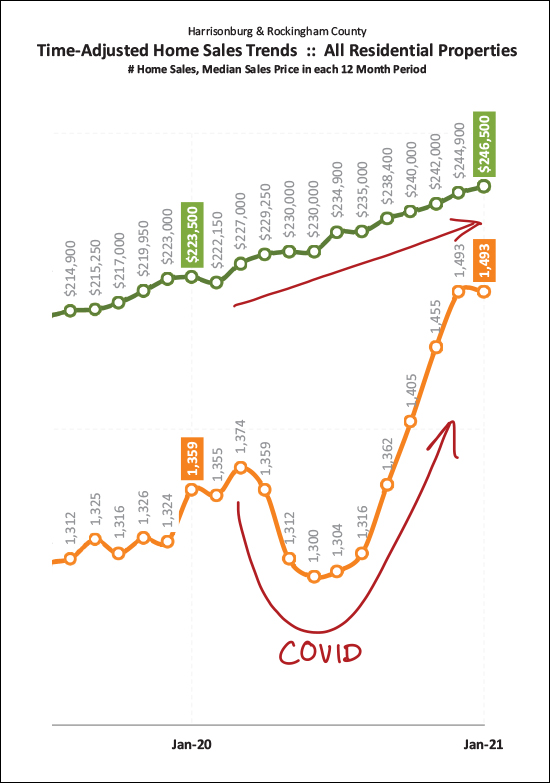

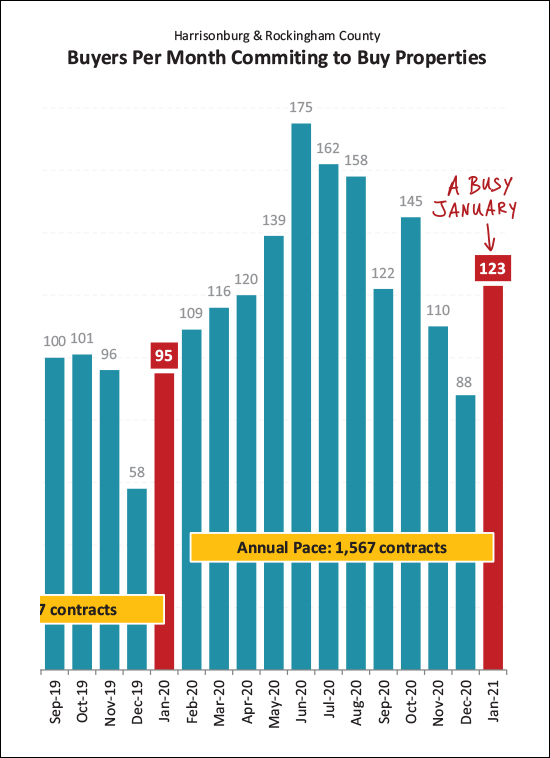

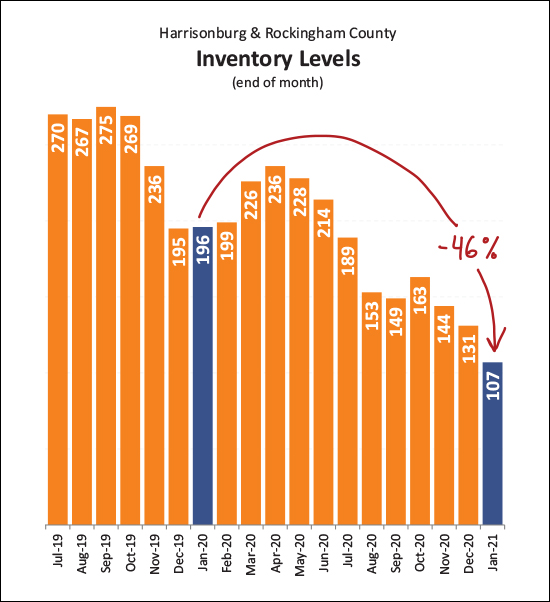

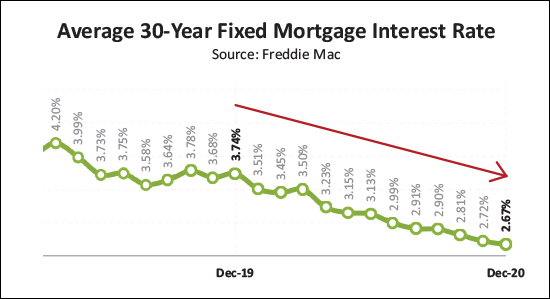

Now, I was telling you that January was a bit unusual, even though it was a repeat of last January, right? Let's take a look...  Indeed, the 100 home sales we saw in January 2021 was merely a repeat of January 2020 -- boring! ;-) -- but that is many more home sales than we typically see in January. We usually see 60 to 70 home sales in the month of January. Last year's super strong month of 100 home sales was followed by a super slow month of only 63 home sales in February. Stay tuned to find out whether home sales will again quickly slide downward in February, or will remain strong. Keep reading to see how many people signed contracts in January, which might be at least some indication of what we'll see as far as February sales. Looking for a big picture graph that summarizes what has been happening in our local housing market over the past year? It's this funny looking one...  Starting with the bottom, orange, line -- this is showing the number of home sales per year for each of the past 12+ months. You'll note that the annual pace of home sales took a nose dive last year between April and August, which are usually the strongest months of the year for home sales. But then, home sales took off quickly in the fall and continued to accelerate into winter, leading to huge rebound in the pace of home sales in our area. This seems to mostly be able to be attributed to COVID. There was a lot of uncertainty in the market in March, April, May, etc. which slowed down home sales, but then as people realized that the housing market wasn't falling apart AND they realized that their homes weren't working as well for them when they were in them 95% of the time (thanks, COVID) AND they realized that super low interest rates made it a compelling time to upgrade their home, we saw home sales take off quickly! The top, green line, then is the median sales price. We have been seeing steadily increasing sales prices in our local area for the past few years and those prices kept marching upward quickly in 2020. The annualized median sales price at the end of January 2021 was $246,500 -- a significant increase above a year ago when it was $223,500. So, remember that I mentioned that January contracts might give us an idea of what to expect for February sales? Let's take a look...  It seems January wasn't just a busy month of closings - it was also a busy month for buyers (and sellers) signing contracts to buy (and sell) homes. There were 95 contracts signed in January 2020, and 123 in January 2021! As such, it seems likely that February (and March) will be busy months for closed home sales. What's it like buying a home these days? It can be a bit challenging, and stressful, mostly because of the very (very, very) low inventory levels at any given point...  A year ago, a buyer would have been choosing from 196 homes on the market in Harrisonburg and Rockingham County. Today, there are only 107 homes on the market for sale!?! This huge (46%) decline in inventory levels means that a buyer doesn't have a whole lot of options at any given moment in time. Now, that's not to say that they don't have options at all -- they do. If we see 1400 home sales over the next 12 months it will be because around 1400 homes will be listed for sale. So, there will be plenty of options of what a buyer might buy -- but if recent market dynamics continue through 2021, most of those new listings will go under contract quickly (median of eight days on the market) which will keep the inventory levels quite low! Finally, those interest rates. Yes, they are still low...  Some part of what fueled the wild real estate market in 2020 was super low mortgage interest rates. As shown above, the average 30 year fixed mortgage interest rate has been below 3% for over six months now. This has kept monthly housing prices affordable for buyers amidst rising prices and has also allowed plenty of folks to refinance and see cost savings on a monthly basis. So there we have it. We're a month (ok, really a month and a half) into 2021 and thus far we're seeing a continuation of the strong local housing market that we saw in 2020. Generally speaking that means it will be pretty fun to be a seller, pretty challenging to be a buyer, and you'll get to experience the full range of emotions of you are selling AND buying! If you are making plans for selling or buying in spring 2021... Sellers - Even though the market is hot, you still need to prepare your home well, price it appropriately based on historical sales data and market it thoroughly and professionally. Buyers - Get prequalified for a mortgage, start stalking new listings, go see them on the first day they hit the market, and get ready to compete in a multiple offer situation. Seller / Buyers - If you need to (or want to) sell in order to buy, this will require a bit more strategery :-) than normal. It can be done, but we need a solid plan in place from the start. If I can be of help to you as you start to think about the possibility of making a move, selling your home, buying a new one, etc. -- just let me know. I'd be happy to meet with you in person, via Zoom, or to chat by phone to help you think and talk through the possibilities. You can reach me at scott@hhtdy.com or via phone/text at 540-578-0102. Enjoy the second half of February, and we'll check in again in early March! | |

What Could Cause Our Imbalanced Housing Market To Balance Out? |

|

Several of my clients have recently commented on how our local real estate market seems out of balance - with so many more active buyers in the market than there are sellers willing to sell their homes. This dynamic often leads to many buyers making offers on well priced, well prepared, well marketed listings to hit the market in and around Harrisonburg. Sometimes it even leads to buyers offering above (or waaaay above) the list price for homes that they don't want to let slip away. So -- if the market is imbalanced, with sellers having the upper hand, what could help our local market come back into more of a balance? In some ways, it's hard to imagine how we work ourselves out of this imbalance, but here are a few real, imagined or fantastical thoughts...

In the end, there don't seem to be many certain paths forward that would allow for our local housing market to balance out in any significant way. As such, it seems relatively likely that our local housing market will remain strong and at an imbalance that heavily favors sellers. If you're seeing something I'm not - and have predictions for how our local market might balance itself out in the coming year - let me know! | |

There Seems To Be A Backlog of Home Buyers |

|

If you're a buyer, it's hard to secure a contract on a house these days -- especially under $250K, even under $300K, especially in the City of Harrisonburg. It almost seems like there is a backlog of home buyers all frustrated from not having found something this past fall, or past summer, or past spring -- because homes under $250K or $300K are often seeing 10+ showings and multiple offers in the first two or three days on the market. What is this backlog of buyers causing?

It's a wild and crazy time right now to try to buy a home, at least partly because there is a larger than normal number of buyers frustrated that they haven't been able to buy in the past 6 to 12 months. Perhaps when spring arrives we'll see a rush of newly listed homes which will start to cut into this excess buyer demand? Or perhaps not. Stay tuned! | |

Why Is Unmet Home Buyer Demand So High In Harrisonburg? |

|

Earlier this week I was chatting with some friends and clients who relocated out of Harrisonburg (out of state) nearly a decade ago. They are now looking to move back to Harrisonburg and are accurately observing that our local housing market is at a drastically different point now than it was a decade (+/-) ago when they left. The most pressing issue at hand for them, as soon-to-be buyers in this market, is the extraordinary high level of unmet home buyer demand. And so we pondered aloud why in the world buyer demand is so high in Harrisonburg. Here's my overly condensed thesis...

Put differently, with some make believe numbers, to illustrate the point... 2010 = population of 50,000 2020 = population of 55,000 Increased population = 5,000 5000 newly built housing options between 2010 and 2020:

The problem, then, is that many more than 500 (10%) of the new population want to buy single family detached homes -- but that is not what has been built over the past decade. Further exacerbating the problem is that plenty of the already existing 50,000 population also wants to move up to a single family detached home, putting more and more pressure on that segment of the market. So - the population is increasing and housing options are increasing, but the housing that is being created is not matching what the expanding population desires. Why!? Basically, it's all about profitability as a developer. For all the ways to develop a 10 acre parcel of land, this is a rough approximation of the ranking of their potential profitability...

At this point, most land being developed is not being developed for single family homes because that is not the most profitable way to develop the land. So long as student housing keeps being rented as soon as it is built, and non-student apartments keep being rented as soon as they are built, and townhouses keep being rented as soon as they are built, and townhouses for sale keep being bought before they are built -- it remains relatively unlikely that land in or close to Harrisonburg will be developed for single family homes. I am now accepting recommendations for more cheery perspectives to write about next week. Call. Text. Email. Help! ;-) | |

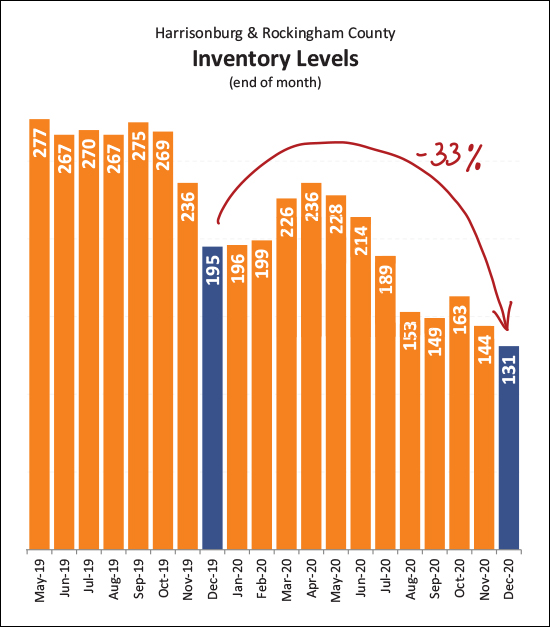

January Housing Inventory Levels Sink To New Lows |

|

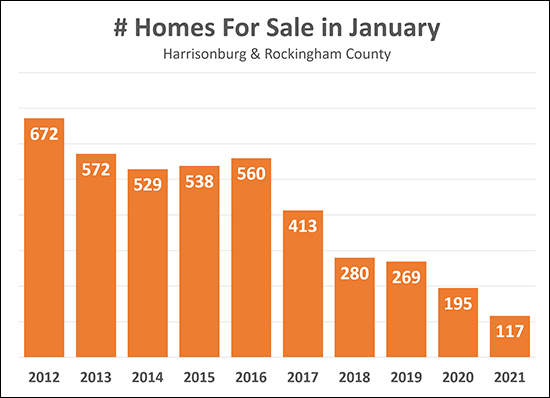

We like somethings to be low - like mortgage interest rates. But inventory levels - it really isn't ideal for them to be this low - except for sellers, I suppose. For each of the past five years, home buyers in our local market have found themselves worse off as far as having options for houses to buy in Harrisonburg and Rockingham County. Today, buyers are choosing from 117 homes for sale in the entire City and County. Ouch! Just a year ago, that was 195 homes, two years ago 269 homes, oh -- and can you imagine having 500+ homes to choose from such as back in 2016!? Here's hoping for a flurry of homes coming on the market in February and March to help meet the apparently never ending surge of buyer demand! | |

Will Buyer Activity Continue Full Strength In January? |

|

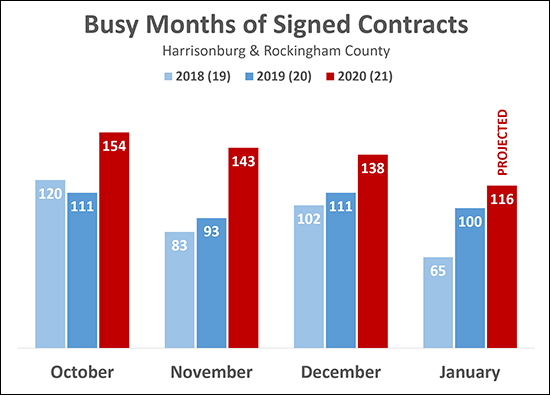

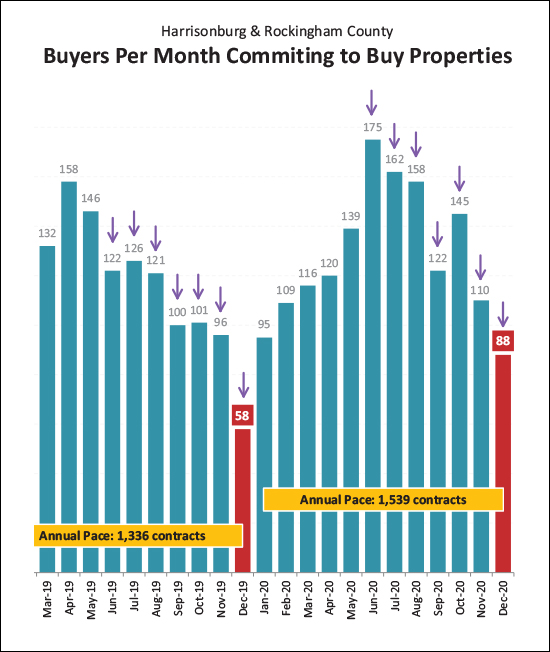

As shown above, the past three months (October, November and December) were absolutely bonkers as far as contract activity in Harrisonburg and Rockingham County. We saw far more contracts being signed than is typical for those months of the year. If we average the number of contracts seen in the fourth quarter of 2018 and 2019 we might have thought we would have seen 310 contracts signed in the fourth quarter of 2020. Instead, there were 435 contracts signed! So, how will things turn out in January? So far -- it seems buyer activity will continue to be strong in January 2021. There were 75 contracts signed between January 1 and January 20 which points to a projected total of 116 contracts potentially being signed during the full month of January, which would -- again -- surpass normal market activity for the month of January. Stay tuned to see how long this strong wave of buyer activity will continue... | |

Most Homes Sold Quickly In 2020! |

|

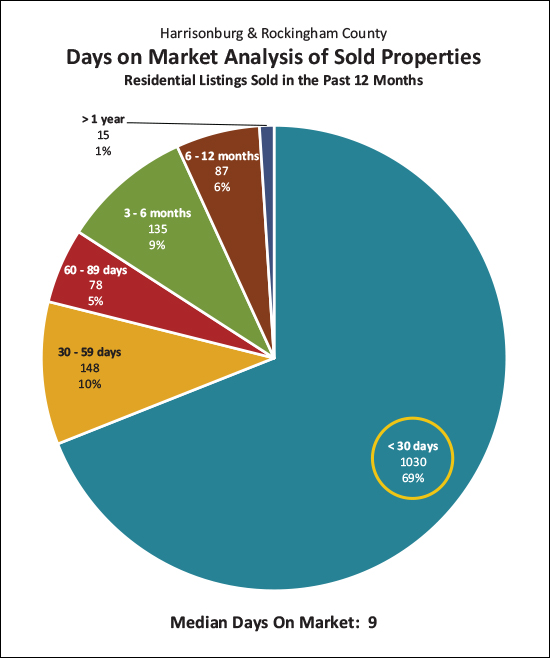

The graph above is an analysis of all of the homes that sold during 2020 in Harrisonburg and Rockingham County. You'll note that 69% of those homes sold (went under contract) within 30 days of being listed for sale! I expect that we will continue to see this dynamic in 2021. There are still plenty of buyers looking to buy homes, and very low inventory levels. As such, many homes are being scooped up by buyers within days (or weeks) of first hitting the market for sale. Home buyers in 2021 will need to be ready to act QUICKLY to secure a contract to purchase a home! | |

Not Much Negotiability In Home Prices In 2020 |

|

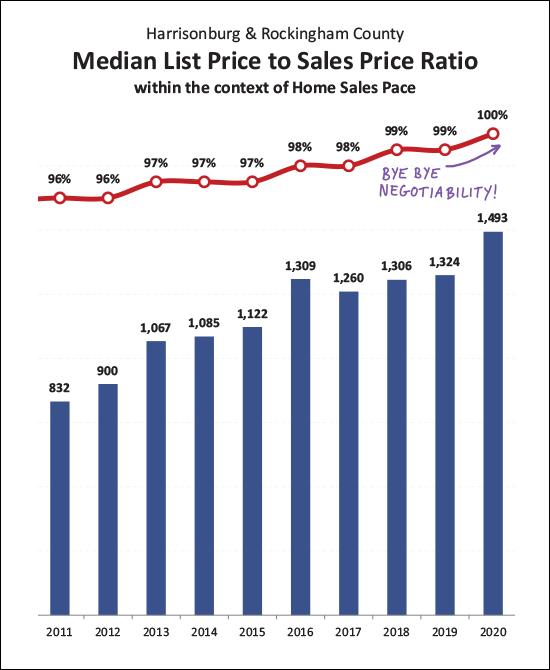

Looking back at a full year of data now for 2020, it is impressive to note that the median "list price to sales price ratio" was 100% for the year. This means that at least half of sellers sold at or above their list price! Home buyers likely aren't surprised by this revelation as they have experienced it first hand if they bought - or tried to buy - in 2020. New listings that are prepared well, priced well and marketed well are receiving multiple offers within days of hitting the market. Oftentimes, buyers are not discussing whether to make a full price offer - they are discussing how far above list price to go with their offer. Home sellers must still remember that this is not a blank check. Just because buyers are so eager to buy that they are often going above list price does not mean that you can list your home for any price you'd like. If your home is potentially worth $300K in the market right now, you ought not list it for $350K and then be surprised when you don't have a rush or showings and don't have any offers. You still need to price your home based on recent sales, though you might be able to round up a bit more than you had in the past when pricing your home. I expect this dynamic (most homes selling for the list price or higher) to continue as we move through 2021. | |

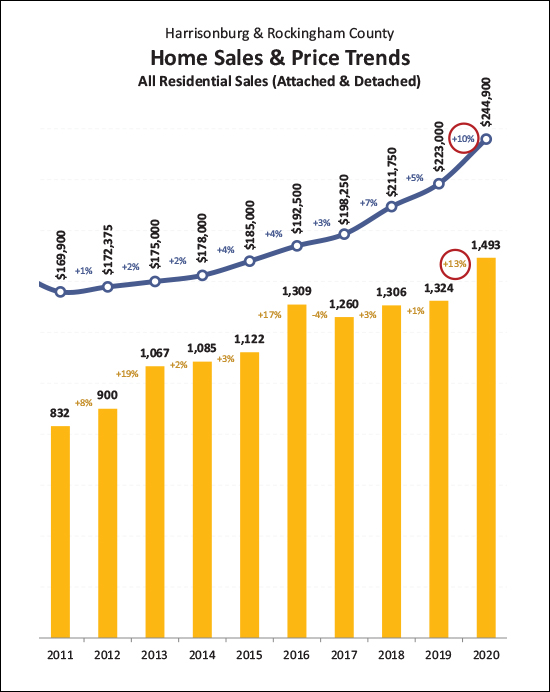

At Year End, Home Sales Up 13%, Prices Up 10% in 2020 in Harrisonburg, Rockingham County |

|

Happy New Year, friends! 2020 was a year like no other - in our local housing market - and in many (many!) other ways. I hope you and your family are doing well, staying healthy, and are full of hope looking forward to the year ahead! Below, I'll walk you through some of the overall trends we are seeing in our local housing market when reflecting back on a full year of 2020 home sales data. Before we get started, though, check out the featured home above here and feel free to download the full PDF of my market report here. Now, to the data...  What a wild finish to the year! A few things to note when looking at this overall data...

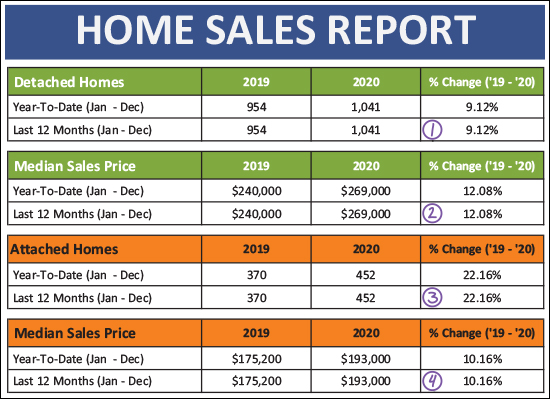

Looking a bit further, let's break down the detached homes as compared to attached homes. Attached homes are duplexes, townhomes and condominiums.  As you can see above...

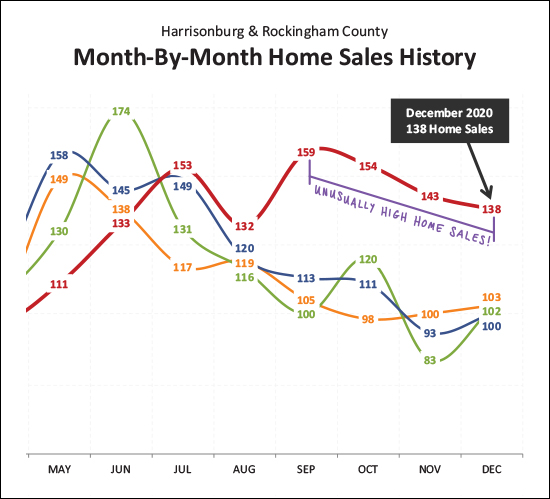

It's hard to think of the best metaphor for the monthly pace of home sales in 2020. Perhaps someone running a race that tripped and fell and slowed down considerably a third of the way into the race, but who slowly picked up speed over the next third of the race and who absolutely SPRINTED through the final third of the race?  Take a look at September through December of 2020 above, marked with a red line. This is not normal / typical / expected. We expect to see an average of about 100 home sales per month for the last four months of the year. In 2020, it was an average of 149 home sales per month! This, clearly, makes me hesitant to guess about what we'll see in January and February. These winter months are typically the slowest months of the year for home sales -- but not in 2020. I expect we'll continue to see stronger than usual home sales for at least the first few months of 2021. And, looking at those sales on an annual basis...  If you track along any particular color band in the graph above you can see where we were at that point of the year for each of the past five years. In August (yellow) of 2020 we were tracking right around where we would expect to be based on 2019 sales. But then those last four months of the year happened, catapulting us waaaaay ahead of where we have been for any recent year in Harrisonburg and Rockingham County! Here's an even crazier look at what has been happening for the past four months...  The more interesting (confusing!?) line above is the orange one. That is showing the number of home sales we're seeing per year in our area. That trajectory took a nose dive in early 2020 thanks to COVID but has been absolutely skyrocketing over the past four months. Why, why, why? Here are some guesses...

OK, I went on a bit more than I expected there, let's look one more time at the annual trends before we move on...  Two main things to note above...

Now, looking briefly at what is to come...  After I meticulously drew all of those purple arrows to point something out (see below) I realized it might seem like I was saying those numbers were decreasing. They're not. I didn't re-draw the arrows. You'll forgive me? OK - now to the point -- if you look at the seven purple arrows on the left you'll see that I'm pointing out the contracts signed between June and December of 2019 -- a total of 724 contracts. The seven purple arrows on the right are pointing out the contracts signed between June and December of 2020 -- a total of 960 contracts. So -- here's that evidence of a big increase in contract activity in the second half of the year. We saw that bear itself out in lots of closed sales between September and December, and I think that is going to keep on rolling into January and February. I expect we will see stronger than normal months of home sales for the first few months of 2021 if not longer. As I've alluded to a few times thus far, there is a lot of competition amongst buyers as each new listing hits the market. This abundance of buyers in the market, and scarcity of sellers, has caused continued downward shifts in inventory levels...  As you can see above, end-of-year inventory levels fell 33% over the past year. The important detail to note here is that these are just "moment in time" inventory levels. How many homes are on the market, actively listed for sale, on a particular day. Clearly, the 33% decline in inventory levels did not result in a decline in home sales in 2020. Perhaps it's actually the other way around -- the 13% increase in home sales in 2020 caused inventory levels to drop another 33% OK, one last graph to illustrate something I've referenced above...  I told you mortgage interest rates had fallen - but look at how far they have fallen! Less than two years ago, the average 30 year mortgage interest rate was above 4%. Only a year ago it was 3.74%. Now, it's 2.67%. That marks a 29% decline in interest rates over the past year. This makes mortgage money cheap -- and monthly payments low -- and is part of what allowed median sales prices to rise 10% over the past year. Buyers were willing to pay higher prices for homes at least partly because their monthly costs keep declining. OK, I'll wrap it up there for now. Again, 2020 was a wild year and not at all what I expected it to be in March and April when things started slowing down. I did make a few predictions for 2021, but given how many surprises 2020 threw at us, it's certainly hard to imagine where exactly things might go in 2021. If you're thinking about buying a home in 2021, let's chat sooner rather than later if I can be of help to you in that process. You'll want to get pre-approved for a mortgage right away and then we'll want to start stalking the new listings as they hit the market. If you're thinking about selling your home in 2021, it is likely going to be a lot of fun to do so -- even if still a bit stressful. You will still need to prepare your house well, price it according to pertinent market data, and we'll need to market it thoroughly, but many sellers in most price ranges and locations are finding it to be a very favorable time to sell. If/when you're ready to connect to talk about buying or selling, feel free to email me (scott@hhtdy.com) or call/text me at 540-578-0102. Happy New Year! | |

Largest Inventory Declines In Lowest Price Ranges |

|

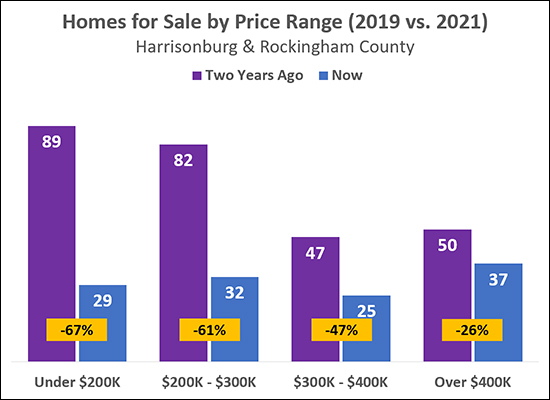

As will come as absolutely no surprise to anyone looking to buy a home under $200K, or even under $300K, there are far fewer options of houses on the market now as compared to two years ago. The graph above compares "beginning of the year" inventory levels today (blue bars) to two years ago (purple bars) to see how the market has shifted. As noted in gold, the lowest price ranges (under $200K, $200K - $300K) have seen over 60% declines in the number of homes on the market. It is a lot tougher to find a house to buy these days if you are hoping to buy for less than $200K, or even less than $300K. If you are planning to buy in that price range, get pre-approved, plan to see new listings the first day they come on the market, plan to make an offer immediately if it is of interest, and consider including an escalation clause to compete on price! | |

Local Home Prices Increase 32% In Five Years |

|

The median sales price five years ago (2015) was $185,000 in Harrisonburg and Rockingham County. Last year, five years later, it was $244,900. That's a 32% increase in the median sales price over five years! A variety of thoughts come to mind...

That's all from me, for now. If this 32% increase in prices over five years seems shocking, or depressing, or awesome to you -- drop me a line (scott@hhtdy.com) and let me know what you're thinking or how you're feeling about these changes in home values in our area. | |

So, Will My House Sell For 10% More This Year Than Last? |

|

It's a reasonable question. The median sales price increased from $223,000 to $244,900 between 2019 and 2020 -- which is a 10% increase. So, would your house sell for 10% more this year than last? Maybe. A good, solid, maybe. Whether your home would sell for 10% more than a year ago largely depends on its location and the buyer demand for homes like your home. If you live in a popular neighborhood where lots of buyers want to buy homes -- and few sellers are selling homes -- it is much more likely that your home would now sell for 10% more than it would have last year. In analyzing the market value of a property to prepare to list it for sale, we aren't going to look for comparable sales from 12 to 18 months ago and then add 10% to those sales prices. We will look for comparable sales from 6 to 12 months ago and then also examine current listings that are either actively for sale or are under contract. When prices are increasing quickly (10% over a year puts us in that zone) it is even more important to be precise and intentional with the pricing of your home. Pricing your home for sale won't always be a super straight forward decision but usually there are enough data points of recent sales and pending listings to give us enough guidance to make a good decision to maximize both the price for which you sell your home and the speed at which you sell your home. If you're getting ready to list your home this spring, it is definitely worthwhile to start looking at market value now. We can then continue to monitor listings and sales between now and when you list your home for sale to affirm our decision on pricing. | |

My Predictions for the 2021 Real Estate Market |

|

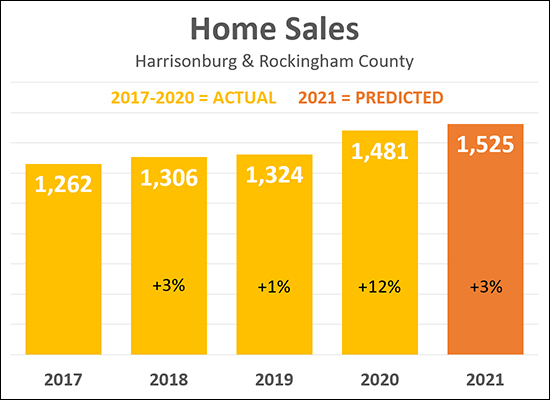

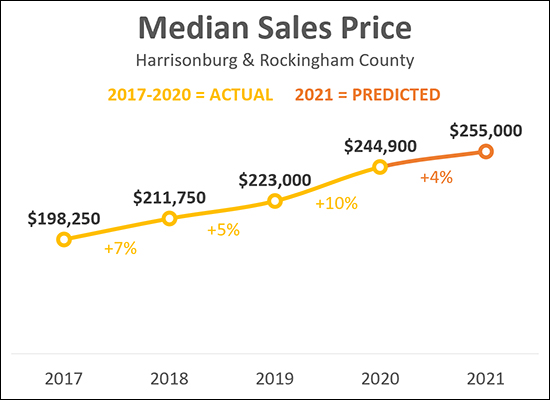

As I mentioned yesterday, my 2020 predictions for our local housing market were WAY off base. :-) I did not see such a strong market coming, and if I had known about COVID my predictions for 2020 would have been even more dire. But yet, despite COVID, 2020 was a robust year in our local housing market with 12% more sales and a 10% increase in the median sales price. So - knowing that my 2020 predictions were quite wrong - will I still take the time to make some predictions for the 2021 market? Sure! Why not!? :-) As shown above, I am anticipating a 3% increase in the number of homes selling in Harrisonburg and Rockingham County in 2021 as compared to 2020. Here's why...

So, given that I am anticipating an increase in home sales, albeit smaller than last year, what am I predicting on sales prices?  After as 7% increase in the median sales price in 2018 and a 5% increase in 2019, we saw a much higher, double digit, increase in 2020. The median sales price increased 10% from $233,000 up to $244,900. Again, I did not see this coming. I think this increase in the median sales price was largely the result of lots of buyers wanting to buy, low interest rates keeping mortgage payments affordable despite higher sales prices, and a limited inventory of homes for sale. So, where are we headed in 2021? I am predicting a 4% increase in the median sales price in 2021 in Harrisonburg and Rockingham County, which would get us up to $255,000. Here's why...

OK - enough about my predictions --what about for you? Email me (scott@HarrisonburgHousingToday.com) and let me know where you think our local market will go in 2021. And keep up with all the market data between now and next January by signing up to receive my monthly housing market report by email if you are not already receiving it. | |

Comparing My 2020 Housing Market Predictions To Reality |

|

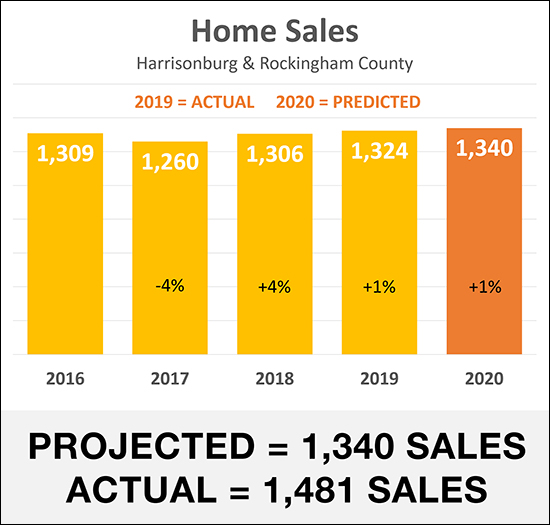

As shown above, I was terribly (!!!) inaccurate in predicting how many home sales would take place in Harrisonburg and Rockingham County in 2020. We saw a 1% increase in home sales between 2018 and 2019 and so I made the rather unexciting prediction that we'd see another 1% increase in 2020 to a total of 1,340 home sales. Wow, was I wrong! Home sales actually increased almost 12% to 1,481 home sales in 2020. This double digit increase in the pace of home sales is surprising because we were in the middle of a global pandemic for much of 2020 - but perhaps this is a part of why the increase happened. Here are some ways that the global pandemic (Covid) could have contributed to a significant increase in local home sales in 2020...

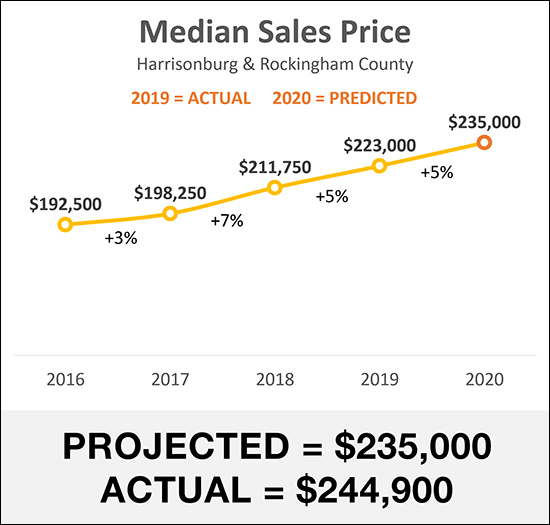

These (above) are some but certainly not all of the reasons why we saw an increase in home buying activity in 2020. In March and April of this past year as many aspects of our lives slowed to a stop, I certainly would not have predicted we see such a large increase in home sales locally -- but once we hit July, there seemed to be no stopping this quickly moving local housing market. So, given that I was wildly wrong on the number of home sales we would see in 2020, is it safe to assume I also erred on predicting the change in median sales price? Let's see...  ...and, yes, I was also quite off the mark when it came to predicting the median sales price for 2020! After a 5% increase in the median sales price in 2019, I predicted that we would see another 5% increase to a median sales price of $235,000. When the year closed out, we actually saw a 10% increase in the median sales price -- from $223,000 in 2019 up to $244,900 in 2020. Wow! So, what could have caused this significant increase in the median sales price?

So -- given how inaccurate my 2020 predictions were you must, certainly, be looking forward to my predictions for 2021, right? :-) Stay tuned for my best guesses on what we'll see in our local market in the year ahead! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings