| Newer Posts | Older Posts |

Home Sales Strong Despite (or because of) Price Declines |

|

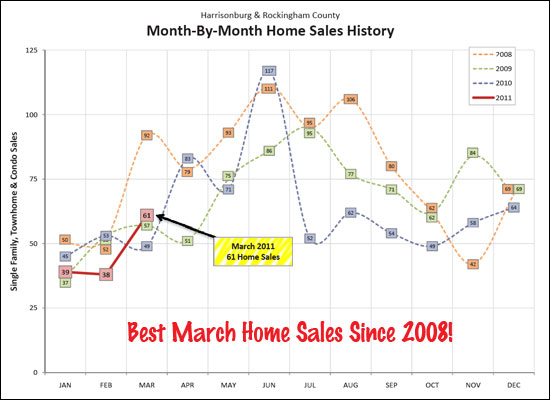

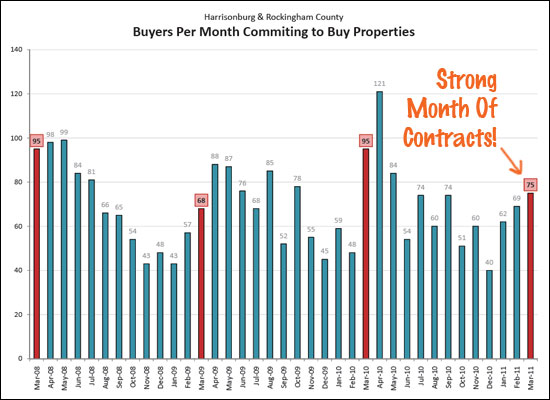

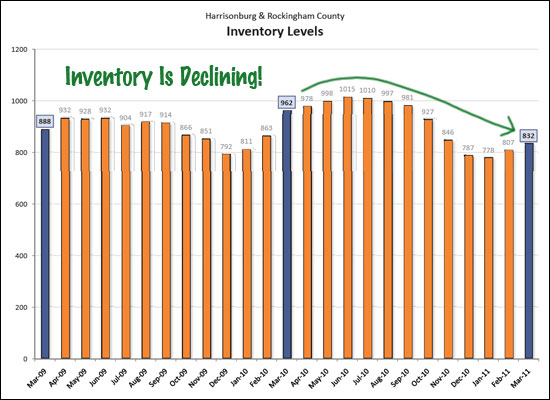

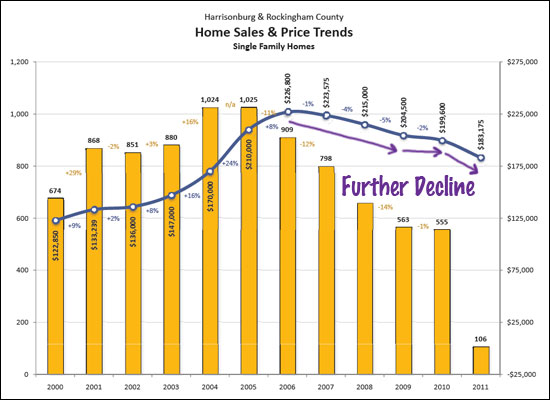

March 2011 home sales show plenty of positive indicators, though the local market is still a ways off from a full recovery.  After mediocre performance in January and February, the Harrisonburg and Rockingham County housing market finally witnessed some growth in March 2011. March's 61 home sales exceeded March 2010 (49 sales) and March 2009 (57 sales), and contributed to an overall decline in home sales of only 6% between 2010 (YTD) and 2011 (YTD).  Not only did buyers close on properties in March, they also contracted on properties --- though probably not the same buyers. March 2011 showed another strong month of contracts (75), exceeding March 2009 figures (68). Last March's contract figures (95) were significantly affected by the home buyer tax credit.  Despite increases in inventory over the past two months, it appears that 2010's peak of over 1,000 properties for sale will not be met this year. We have seen an overall decline of 13.5% over the past year in the number of residential properties for sale, which can help restore balance to the market.  Despite the strong indicators noted above, we do see that the median sales price of single family homes has started to decline again more sharply after a relatively steady year last year. We may not be totally out of the woods yet.  There's plenty more news in my monthly housing market report -- click on the image above (or here) to download and view the full PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Fortune Magazine: It Is Time To Buy Real Estate Again |

|

Fortune Magazine makes some bold predictions after LOTS of detailed analysis....  Click on the image above (or here) for a PDF of the entire article, which deserves a careful read. To entice you to read the entire article, consider the following excerpts....

| |

Is It Easy To Get A Mortgage? |

|

Three times in the past three weeks I have been in real estate related meetings when someone asked "So, how much do you have to put down on a mortgage these days, twenty percent?" Each time my jaw dropped, and I explained that the down payment on a purchase can be as little as 3.5%....and sometimes as little as no down payment at all. Their jaws then dropped, as they asked questions along the lines of "but, I thought it was nearly impossible to get a mortgage these days" and "but, what about reforming the mortgage market after all the crazy loans that were issued?" These are reasonable questions and objections, which I then discussed with them, but what I hoped stuck with them is that you don't need to wait to buy until you have 20% of the purchase price as a down payment. At this point it is important to note that having 20% as a down payment is not at all a bad idea –it is certainly something to be strived for – but it shouldn't necessarily limit your purchasing decision. If home prices declined over the next few years, a larger down payment (for example, 20%) would help you to avoid getting stuck in a house with a mortgage you could not pay off in order to sell. A 20% down payment can also lower your mortgage payment, as you will be financing a smaller amount, and you should not have to pay mortgage insurance in addition to the principal, interest, taxes and insurance. Despite these benefits, however, waiting to purchase until you have a 20% down payment can significantly change when you are able to buy a house, particularly if you are a first time buyer. Are there really loan programs that only require a 3.5% down payment? The most frequently utilized loan program these days is the FHA loan program, which is underwritten by the federal government and only requires a 3.5% down payment. The federal guarantee of the loan allows lenders to offer you lower interest rates, which makes the monthly payment more affordable to you. Many (or most) first time buyers utilize the FHA loan program, however it can be used for mortgages up to $277,150 in Harrisonburg or Rockingham County. Isn't it difficult to get a mortgage these days? A few years ago, it was said that if you had a pulse, you could get a mortgage. Indeed, there were mortgage programs where your lender did not need to verify your income, nor your assets, nor your employment, etc. It is certainly more difficult to get a loan now if that is our basis of comparison, however new mortgage guidelines are not absurdly strict. Most people with reasonably good credit and with steady, predictable income can obtain a mortgage with reasonable terms. One of my clients recently asked me whether a significant portion of contracts fall through these days as a result of buyer not being able to obtain financing – thankfully, this is not seen too often in our area. If you are wondering whether you can obtain a mortgage, talk to a bank or mortgage company to quickly and easily be pre-qualified. If you're not sure who to talk to, start by speaking with a Realtor, who can certainly give you some recommendations on reliable, professional lenders in the area. What about mortgage reform? It is true – there were some wild and crazy things happening in the mortgage market over the past several years, and new guidelines are now in place (and being put in place) to attempt to ensure that we will not travel down those roads again. Despite these new guidelines, however, it is still possible for hopeful buyers with a reasonable amount of income to obtain a mortgage without too much of a hassle, without too much cost, and with very favorable terms. What is next in the mortgage market? Interest rates are still phenomenally low compared to the past several decades, so opportunities abound to buy and obtain a fantastically low fixed interest rate on your mortgage. Many people predict that interest rates will rise as we continue through 2011, though many people have predicted that for the past several years without any great supporting evidence after the fact. It is important to note, however, that changes to the mortgage market may be coming down from the administration. Current plans are in the works to re-vamp how the mortgage market works, which some argue will increase mortgage costs to consumers. Each of the three people who presumed that a 20% down payment was required these days is a very smart person – but each of them had an incorrect assumption about the current state of the mortgage market. If you are considering buying, or refinancing, don't make a decision based on your assumptions, or based on what your neighbor or friend tells you. Talk to a mortgage professional who can accurately explain your options and help you find the best path for your future. | |

Sale of North 38 Apartment Complex Sets New Valuation of Student Housing in Harrisonburg |

|

Did you know Facebook is now estimated by some to be valued at $65,000,000,000? Yes, that's $65 BILLION dollars. How do analysts come to that number? The valuation is based on the percentage stake that is given to a new investor as compared to the dollar value of the investment that they make in the company. Just two months ago, a Goldman Sachs investment in Facebook put the value at $50 BILLION.  How does this relate to real estate in Harrisonburg, VA? An investor just bought a significant stake in the student housing market in Harrisonburg, which provides another data point upon which other student housing owners can value their investment. How does this relate to real estate in Harrisonburg, VA? An investor just bought a significant stake in the student housing market in Harrisonburg, which provides another data point upon which other student housing owners can value their investment.The big news --- 38 North has been sold for $32.8 million. The specs of this recently built (2008) student housing complex include:

| |

Preston Lake Foreclosure Finalized: Land Transfers To Wells Fargo, Homeowners Association |

|

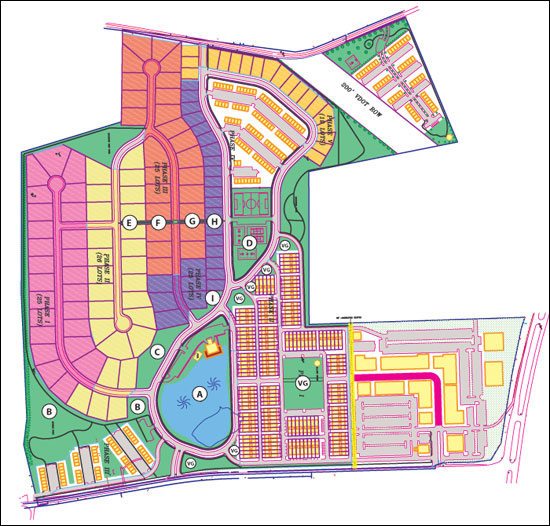

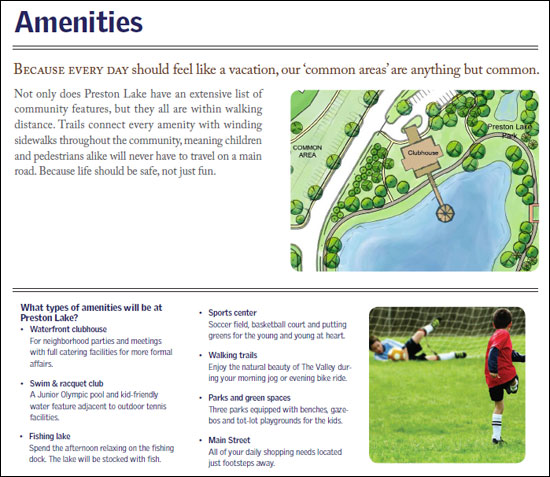

An early rendering of the intended Preston Lake community center A variety of documents were filed at the Rockingham County Circuit Court on Wednesday, February 23, 2011 finalizing the Trustee Sale of Preston Lake subdivision. In Summary: A trustee sale took place on February 3, 2011 on the steps of the Rockingham County Circuit Court, whereby Wells Fargo (as the only, and thus highest, bidder) contracted to buy back Preston Lake from its developer. Now, the deeds have been recorded transferring the bulk of the subdivision to Wells Fargo and the common areas to the Homeowners Association. The Value of 124+ Acres: The consideration paid by Wells Fargo for the 124+ acres was $3,500,000, but the trustee's deed also indicates that the appraised value is/was $4,530,000. Somewhat astonishingly, the two loans (notes) that were being foreclosed on appear to have been for a sum total of $20,500,000. The New Owner of Preston Lake: The grantee on the deed is listed as "REDUS VA HOUSING, LLC" -- an LLC registered in Deleware. The grantee's address, however, is Wells Fargo Bank out of Jacksonville, Florida. Value of the Common Areas: Per the deed transferring the common areas to the Homeowners Association, the common areas have an assessed value of $323,700.  What Conveyed To The Homeowners Association: The map above is based on an early engineering plan for Preston Lake. I have deciphered (to the best of my ability) the deed, and recorded plats for Preston Lake to mark on the map (letters in circles) the areas that conveyed the the Homeowners Association. Click on the map for a high resolution PDF, and scroll to the bottom of this post for the source files for the deed and plats. Management of the Homeowners Association: The Homeowners Association's mailing address is referenced in the deed as the same Jacksonville, Florida address for Wells Fargo. Homeowners at Preston Lake have been informed that Wells Fargo will be hiring an association management company in the very near future to handle the business of the association. What's Next: Now that the remaining land comprising Preston Lake is owned by Wells Fargo, my assumption is that:

| |

Mixed Signals From January Housing Market Activity in Harrisonburg and Rockingham County |

|

My most recent market report (excerpts below, full report here) shows a variety of mixed market indicators when examining market data through January 31, 2011:

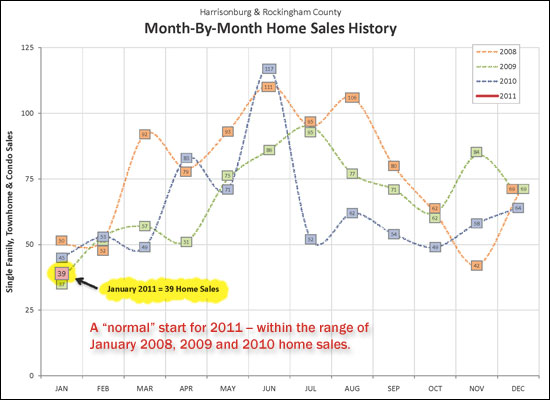

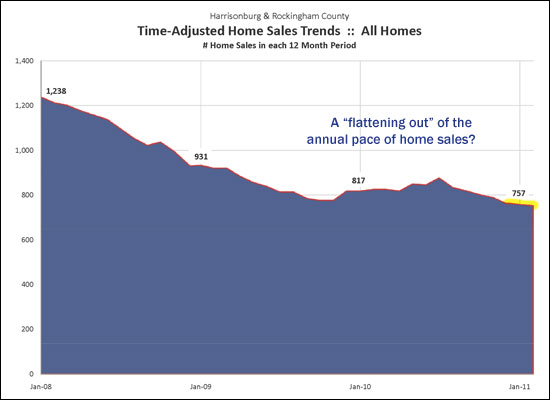

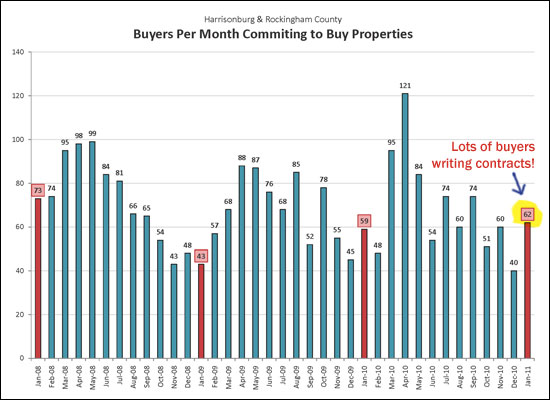

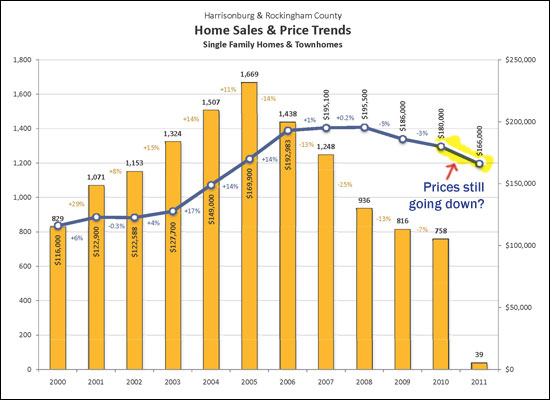

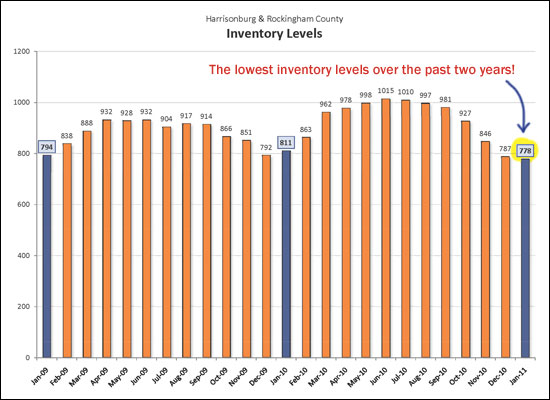

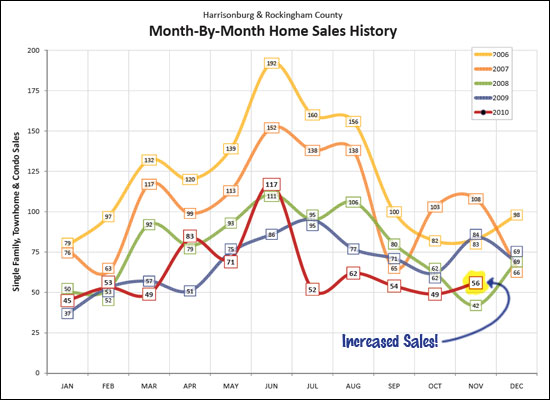

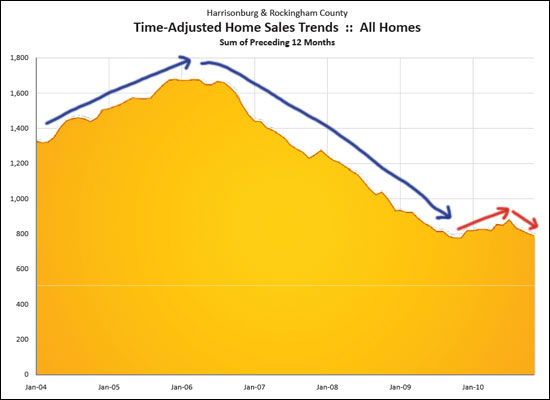

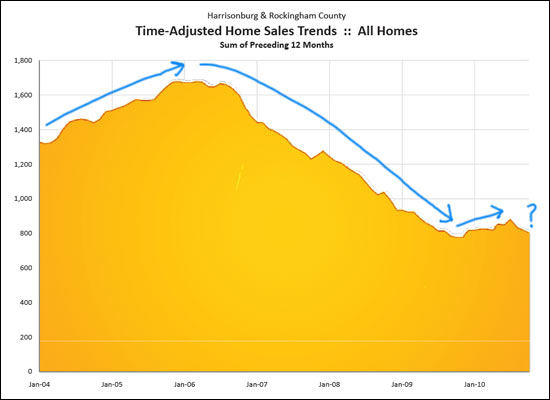

Home sales in January 2011 (39 sales) were down compared to the 45 sales in January 2010 -- but up compared to the 37 sales in January 2009. This is a relatively even start for 2011, and if the past three years are any indicator, we'll have around 50 home sales in February.  This graph shows a rolling 12 months of home sales -- and you can see that the annual pace of home sales has been declining for several years other than the temporary respite offered by the home buyer tax credit last year. The last several months, however, seem to be offering some leveling out of this indicator.  Buyers were out in full force in January 2011 -- 62 properties went under contract. This is an increase over January 2010 (59 contracts), an increase over January 2009 (43 contracts) and an increase over last month (40 contracts). This could be a strong spring market.  Perhaps due to a small sample size, the median sales price continues to decline in January 2011.  We are currently seeing the lowest inventory levels that we have seen over the past two years. This can help the market to stabilize, unless the market is flooded with listings in March and April.  Click the image above (or here) to read the full report. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Preston Lake Foreclosure Auction Results In $3.5M Sale To Wells Fargo |

|

The Preston Lake Trustee Sale took place today (February 3, 2011) at noon, and drew quite a crowd of Preston Lake homeowners, developers, attorneys, Realtors, and neighboring landowners. Here's an overview of where things stand.... Local History in the Making: It's not necessarily the good type of history, but this was the first major subdivision --- and hopefully the last --- to be foreclosed on in the Harrisonburg area. Many other areas across the country have seen multiple large subdivisions be foreclosed on, but until today, Harrisonburg had been unscathed. The timing of the development of this subdivision is likely what led us to today's events, as the development began just as the housing market began to slow dramatically. Only One Registered Bidder: Only one individual registered as a potential bidder at the sale (by showing his deposit check to the Trustee, and providing his name), though he did bid during the auction, likely because of the opening bids from Wells Fargo. Only One Actual Bidder: There was only one actual bidder....Wells Fargo. Surprise Rowhouse Auctions: In addition to the 120+ acres of land at Preston Lake that were auctioned off today, four rowhouses were also auctioned separately. This was not specifically advertised -- if it had been, I think we would have seen some actual bidding take place. Each of these rowhouses are at a different stage of completion, but each at least has the shell completed. The opening bids from Wells Fargo were as follows, and these are the prices at which they are taking back the properties:

The Common Areas: The attorney representing Wells Fargo also indicated that the common areas would be deeded to the Property Owners Association. The Association will still exist, and owners will still make payments to it to support the maintenance of the common areas and other common amenities of the neighborhood. What Happens Next: In theory, within 30 days, Wells Fargo will close on their purchase of the four individual rowhouses, and the 120+ acres of Preston Lake. The attorney representing Wells Fargo commented to me afterward that he thinks there is a 90% chance that the sale will proceed to closing and that Wells Fargo will be the new owner. After Wells Fargo owns the property, he indicated that they would sell the four rowhouses individually, and seek to sell the remaining 120+ acres to a new developer. It is unclear what price they will ask for the remainder of the subdivision (likely lower than $3.5M), and it is unclear what price they will eventually take for the remainder of the subdivision (likely lower than $3.5M). Wells Fargo's attorney also indicated that while they will attempt to sell the entire undeveloped section of Preston Lake as a whole to one developer, it is also possible that they would sell the property as individual lots or sections of lots. Wells Fargo has done this with other subdivisions around the country that they have foreclosed on, though it is not their goal. Wells Fargo is interested in money: This should come as no surprise, but Wells Fargo's goal in being the new owner of the undeveloped areas of Preston Lake are to try to recoup as much as possible of the money that they have invested in the subdivision. They won't, thus, try to unload the property for development into a mobile home park -- they will be marketing it and working to sell it for its highest and best use. This does not mean that the development plan won't or can't change -- but they will be trying to recoup as much money as possible, and thus will be trying to sell it to a developer who has the a positive (and profitable) vision for it. Those Pesky Lawsuits: The developer of Preston Lake (Richard Hine) had filed a lawsuit against Wachovia (now Wells Fargo) --- and Wachovia had responded with a countersuit. Per the attorney representing Wells Fargo, both of those lawsuits will go away once the sale closes, and the property is taken back by Wells Fargo. A Community United: If anything, the turmoil and uncertainty over the future of Preston Lake seems to have drawn its residents closer together as a community. Most of the owners were in attendance at the sale, and then went as a group to Cally's afterward to have lunch. There seems to be solidarity and general optimism (as much as is possible) amongst most (or all) of the owners. They still seem to thoroughly enjoy their homes, and each other, which is a positive sign for the future of the community. Have Questions? If you have questions about Preston Lake or the foreclosure proceedings, I'm happy to try to answer them (540-578-0102, scott@HarrisonburgHousingToday.com), or you can contact Peter Barrett of Kutak Rock, LLP, who is the attorney representing Wells Fargo. You can reach Mr. Barrett at 804-343-5237 or peter.barrett@kutackrock.com. | |

Real Estate: Finally a Good Investment? |

|

One of my clients forwarded me a great article from the Wall Street Journal that you might have interest in reading.... Real Estate: Finally a Good Investment? (Smart Money / The Wall Street Journal) The article has four premises for concluding that real estate might finally be a good investment, all of which seem reasonable to me:

Click here to take a quick read --- and let me know what you think. | |

Preston Lake Headed To Foreclosure? |

|

Per a Trustee Sale advertised in today's Daily News Record (view ad), the bulk of the Preston Lake subdivision may be headed to foreclosure. This doesn't necessarily mean that the foreclosure sale will take place, but this is a significant step in that direction. Preston Lake is Harrisonburg and Rockingham County's first master planned community, intended to include nearly 500 townhomes and single family homes, a large section of retail stores with a main street appearance, and many amenities such as a community center, soccer fields, swimming pool, and more.  The vision....  Main Street renderings  Amenities at Preston Lake Now, however, all of those plans may be coming to an end, at least for now. On February 3rd at 12:00 p.m., 124.693 acres of Preston Lake is scheduled to be auctioned at the Rockingham County Circuit Court. Please note that an advertised trustee sale (all that has happened thus far) does not necessarily mean that the foreclosure process will take place. This wasn't the first sign of trouble for Preston Lake, as the developer of Preston Lake and its lender (Wachovia) have been in the midst of legal proceedings for almost a year now, as described in the Mar 2, 2010 article from the Daily News Record: Preston Lake Homes and its developer, the Hine Group, filed claims against Wachovia in Rockingham County Circuit Court on Dec. 11 for breaking its loan contracts, according to the lawsuit. Preston Lake is seeking $32.4 million in damages for lost profit. Wachovia filed a counterclaim in U.S. District Court in Harrisonburg on Dec. 29. The Charlotte, N.C.-based bank is suing Preston Lake for $15.6 million in outstanding debt. While it was happening quite slowly, residential construction at Preston Lake had been continuing even over the past year. Since the first closing in 2008, there have been 37 sales at Preston Lake recorded in the HRAR MLS, ranging from $318k to $883k, with a median price of $421k. Three of these sales took place as recently as the fourth quarter of 2010. Today, only four properties are being marketed for sale at Preston Lake per the HRAR MLS -- three are resale properties, and one is being sold by the developer. (view active listings at Preston Lake) A few notes about the foreclosure sale:

| |

What you found to be most interesting in 2010... |

|

As we finish up the last day of 2010, I though I'd take a look back at some of the most frequently viewed posts here on HarrisonburgHousingToday.com from 2010....

Happy New Year! | |

Housing Market Report: Sales Increase, Prices Increase, Contracts Increase in Harrisonburg, Rockingham County |

|

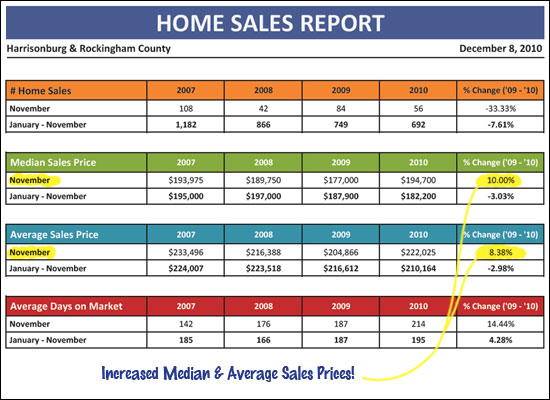

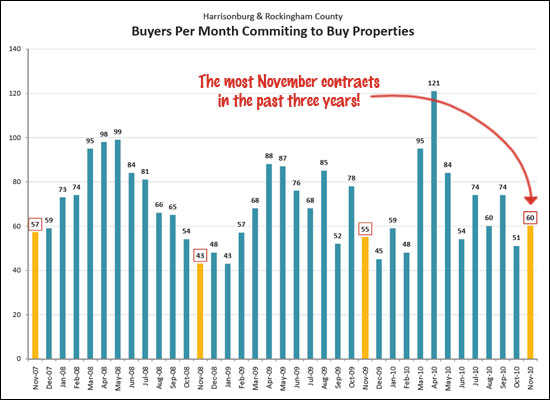

Below you will find several highlights from my December 2010 Harrisonburg and Rockingham County Real Estate Market Report, available as a PDF by clicking here. Our local real estate market still has a ways to go before recovering, but there are some positive signs this month.  First, you'll note (above) that home sales increased in November 2010 as compared to the previous month (October 2010). Sales in November were lower than in November 2009, but last November had the benefit of being the intended deadline for the home buyer tax credit -- thus lots of extra buyers closed in November.  Median sales prices and average sales prices both increased in November (10%, 8%). This, however, is likely because the median and average sales prices were much lower than normal last November as a result of so many first time buyers closing (on properties with low purchase prices) during November. Year to date figures still show a 3% year over year decline in prices.  More buyers committed to buy properties in November 2010 than we have seen in the past three Novembers! Hopefully we'll see a strong December as well.  Click the image above (or here) to review the entire December 2010 Harrisonburg and Rockingham County Real Estate Market Report. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Despite Slow Sales, Home Values Remain Relatively Stable in Harrisonburg and Rockingham County |

|

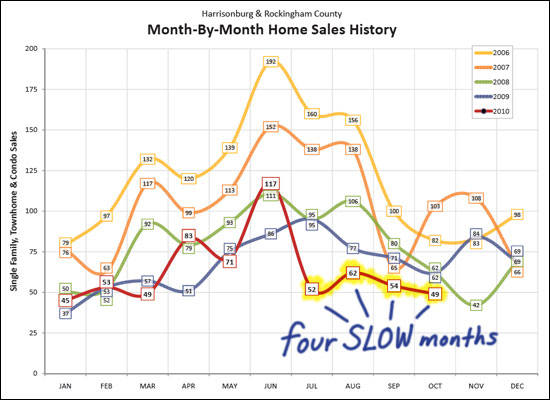

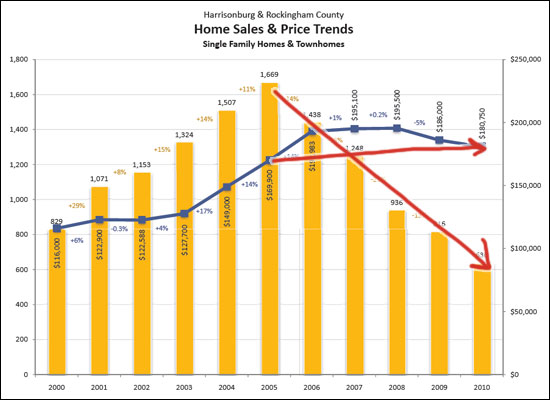

Read on for several highlights of the November 2010 Harrisonburg and Rockingham County Real Estate Market Report. Or click here to view the PDF.  Despite early gains in 2010 (particularly in April and June) home sales have stagnated over the past several months. July, August, September and October of 2010 have been the slowest such months during the past five years. Despite these low sales figures, however, year-to-date sales are only 4% below last year's sales.  Late 2009 through mid 2010 showed some promise. After several years of declining home sales (pace, not values) it seemed that our local market had finally turned around. Now looking back, that increase in sales pace may have been largely related to the home buyer tax credit, as the pace of sales is now on the decline yet again. What surprises lie in store for us in 2011?  As demand falls, prices should fall --- isn't that what I learned back in my economics class at JMU? Not so in the Harrisonburg and Rockingham housing market!?! Fewer and fewer buyers have been present in the market over the past six years (demand fell) but prices have not fallen in the way that that shift in demand would suggest. Calling all economists....how can we explain this?  Click the image above (or here) to review the entire November 2010 Harrisonburg and Rockingham County Real Estate Market Report, complete with an all new Executive Summary this month. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Founders Way, New Condo Community in Harrisonburg, Wins Parade of Homes Awards |

|

If you haven't stopped by Founders Way yet to see these newly finished condominiums, you might want to considering doing so this coming weekend during the SVBA Parade of Homes. Founders Way won several awards including Realtors Choice, Best Interior, Best Exterior and Best Overall. But let's give Founders Way some context.... There are lots of townhouses for sale in Harrisonburg priced around $160k, with 1300-1400 square feet. The condos at Founders Way are similar ($160k, 1300-1400 SF) but they have some significant differences.

For more information, visit FoundersWay.com or call me at 540-578-0102 to schedule a time to look at this very new and very exciting product in our market. | |

Harrisonburg Home Sales Decrease, Contracts Increase, in September 2010 |

|

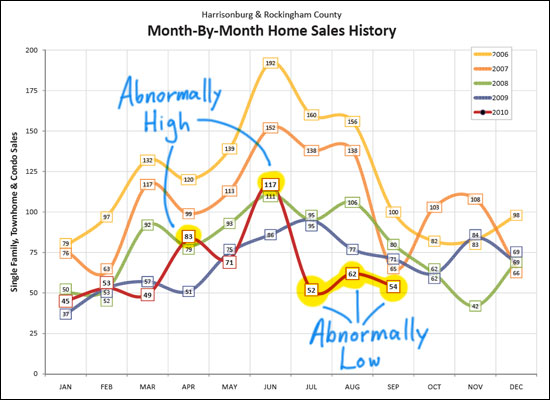

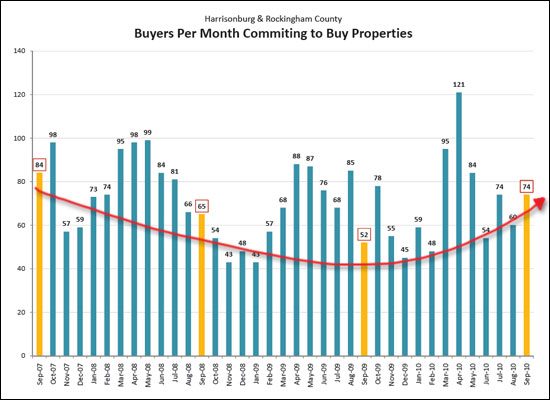

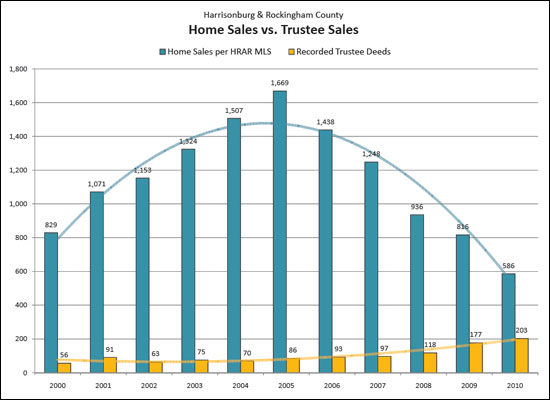

Below are several highlights from the October 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report.  As you'll note above, there were very few home sales in September 2010. In fact, there were very few home sales in in July, August and September! That was, however, after very high home sales in April and June. Thus, it would seem that the home buyer tax credit certainly rearranged the timing of 2010 home sales, regardless of whether it brought new buyers into the market nor not. The question now, of course, is how many of the October, November and December closings were borrowed by the first half of 2010.  After multiple years of a declining sales pace, the graph above shows that we were finally seeing a reversal for the first six months of this year. However, the past three months of slow sales has turned us back around into a declining market again. The fourth quarter of 2010 will be quite indicative as to a reasonable 2011 forecast.  Please note, above, the silver lining. Despite a lower than normal number of closings in September 2010 -- the buyers were out yet again, contracting to buy real estate. In fact, with 74 properties going under contract, buyers in our market outpaced the past two Septembers. This should be a good indicator for the coming months.  Above you'll see a decade-long comparison of two imprecise measures. The blue bars show the number of home sales recorded in the HRAR MLS -- this does not include private sales (sans Realtor), and some new home sales. The yellow bars show the number of Trustee Deeds recorded during each of the past 10+ years. Some of these foreclosed properties (203 in 2010) then show up in the blue bar when they are listed and then sold as bank owned properties. It would seem that foreclosures have increased nearly four-fold over the past ten years, and now make up somewhere between 15% and 26% of all home sales.  My full market report (click above -- or here -- for a 20 page PDF) includes LOTS more analysis to help you make informed real estate decisions. Read through it and let me know if you have any questions, or if any additional information would be helpful to you. You can contact me (nearly) anytime at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

We are clueless on how to save energy (just ask NPR), but this Saturday you can learn how! |

|

As reported by NPR, Columbia University recently conducted a study where they asked people about the most effective ways were to save energy --- and as a general public, we're well off the mark! From NPR.... CHIOTAKIS: So what the study found is when it comes to energy savings, we're all idiots? HILL: Yeah, pretty much. Basically researchers asked people what one thing they could do that would be the most effective thing to save energy and people said turning off the lights. CHIOTAKIS: Well that makes sense, what's wrong with that? HILL: Well, turning off the lights and other curtailment activities, as researchers like to call them, may not save as much energy as we think. A better choice might be making efficiency improvements, like installing energy-efficient light bulbs or driving non-gas guzzlers. CHIOTAKIS: So what are the things, Adriene, we do that we think save more energy than they actually save? HILL: Well, so there's turning off the lights. There's driving slower on the highway -- maybe stepping it down to 55, people think that saves more energy than it actually does. Unplugging your phone charger -- again, these things do save energy, but not as much as people guess. CHIOTAKIS: And what do we under-rate? What saves more than most people think they save? HILL: Driving cars that get better mileage, using room air conditioners instead of central air, and running more efficient appliances. BUT WAIT! THERE'S GOOD NEWS . . . This Saturday (September 25) from 9am to 4pm you can learn all about saving energy, and living sustainably at Harrisonburg's First Annual Green Expo. Don't waste the next few months doing web searches and making phone calls to try to learn about improvements you could make to your home, or technologies or products you could use in a new home. This Saturday you can spend an hour or two going from booth to booth speaking directly to the experts! Take a look at the long list of companies that will be present! Plus, you can learn a lot about these four notable speakers!

| |

Harrisonburg Is One Of The Ten Best Places To Launch Your Second Career! |

|

Retirement doesn't come at age 55 for everyone -- and an increasing number of people are continuing to work past that age given the current economy and financial markets. Even after retirement, many people are looking for second careers, and U.S. News & Word Report recently (yesterday) ranked Harrisonburg as one of the ten best places to launch your second career. Click here to read the article. Here's what they have to say about our area.... The centerpiece of this rural town is James Madison University and its 17,000 undergrads. It's hard to miss the purple-and-gold-clad students around town. Eastern Mennonite University is here as well. Agriculture and JMU fuel the economy. Healthcare provider Centra Healthcare Solutions is also one of the region's major employers. Getting to Washington will take a two-hour drive, but Charlottesville (home of the University of Virginia) is just an hour away by car. It's the area that surrounds Harrisonburg that often clinches the deal. The Blue Ridge Mountains, Skyline Drive, and the Shenandoah Valley, along with its namesake river, are a magnet for outdoor enthusiasts from skiers and spelunkers to hikers and kayakers. And the 1.8 million-acre George Washington and Jefferson National Forests extend along virtually the entire western edge of Virginia; Crabtree Falls Trail features one of the most impressive vertical-drop waterfalls east of the Mississippi River. Toss in the wineries and apple orchards tucked away on winding back-country roads, and it's an appealingly bucolic picture. Meanwhile, the downtown area is showing signs of new life, with an active farmers' market and a handful of hip coffee shops and ethnic restaurants. A few observations....

| |

Could September be showing signs of an improved real estate market in Harrisonburg and Rockingham County? |

|

Last year, 816 homes sold in Harrisonburg and Rockingham County. Per my most recent market report, it seems probably that we'll be at the same pace in home sales for 2010. But follow me for a minute....

One last exciting statistic for your Monday --- last September, only 52 homes went under contract in the entire month. In the first half (less than half, really) of this September, 36 homes have already gone under contract! Thanks Kemper, for pointing out last week's astounding buying pace! | |

Local Home Sales Slow in August, Still Strong YTD |

|

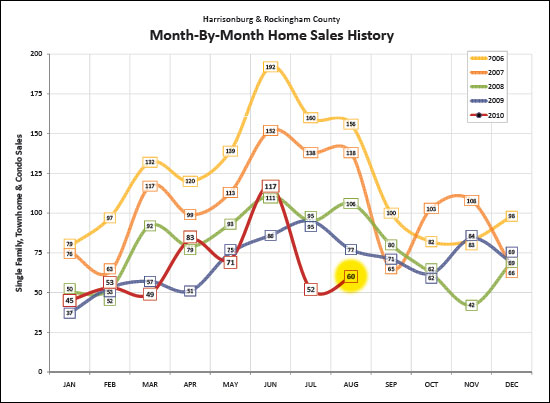

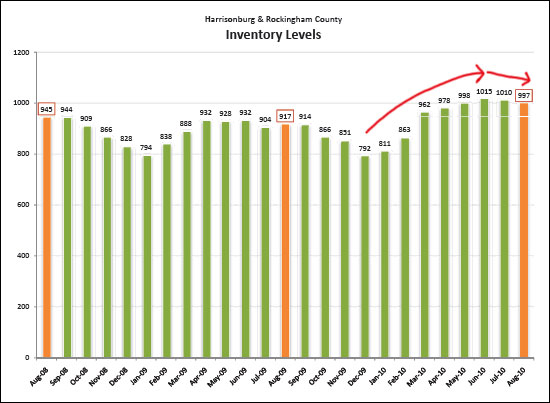

Below are several highlights from the September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report. Home sales in Harrisonburg and Rockingham County... Are they up? Down? Stable?  In fact, they are up, down AND stable! A mix of indicators this month:

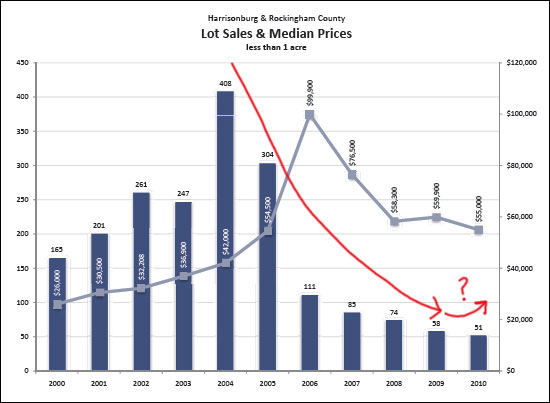

Another good indicator, as shown above, is that the local housing inventory has peaked --- at least for now. A few months ago the number of homes for sale in Harrisonburg and Rockingham County broke 1,000 for the first time -- but it has now started to decline again, as is typical for this season of the year.  Lot sales (less than an acre) have been very, very slow over the past several years, falling from a peak in 2004 of 408 lot sales to only 58 lot sales last year. As shown above, lot sales might actually rebound this year! There is even more in the 19-page September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Download the entire report by clicking on the image below.  Thanks for reading, and if you have any questions, or if I can assist you with buying or selling real estate in Harrisonburg or Rockingham County, please contact me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

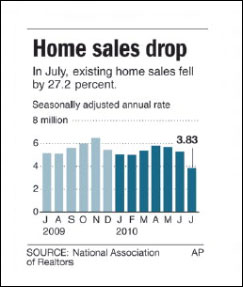

Local Home Sales Versus National Home Sales |

|

You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! But wait -- those are national numbers, and may not have much to do with what's going on in Harrisonburg and Rockingham County. The chart to the right is from the DNR, showing the 27% decline in July. The chart below shows essentially the same data for Harrisonburg and Rockingham County. The only difference is that the national figures only include existing home sales (it excludes new homes) and the local numbers are both new and existing homes. Here is the local data:  Despite a 27% decline nationally, local home sales only showed a 5% annualized decline! | |

Housing Market Enjoys Boomlet But Area's Sales Surge Likely To Be Short-Lived |

|

It's always good to get a different take on the data and situation in our market. Feel free to share your own comments on the state of our market in the comment section below.  [From the Daily News Record, July 16, 2010] Housing Market Enjoys Boomlet But Area's Sales Surge Likely To Be Short-Lived By Doug Manners HARRISONBURG - Buoyed by the expected expiration of federal tax credits, home sales in Harrisonburg and Rockingham County climbed in June to the highest monthly total in nearly three years. However, sales are likely to drop during the second half of the year, due in part to the expiration of the tax credit program. According to a report released by Scott Rogers, associate broker at Coldwell Banker Funkhouser Realtors, 116 homes were sold last month, the most since August 2007, when 138 homes sold. It also marks a 35 percent increase over sales from June 2009. To be eligible for the credits - up to $8,000 for first-time homebuyers and $6,500 for existing homeowners - buyers originally had until June 30 to close sales, but Congress extended the deadline to Sept. 30. Buyers still must have entered into a binding contract by April 30 to qualify. ‘Buffer' Needed Local sales in 2010 are 16 percent higher than those from the first six months of last year, and Rogers said he believes that the area will reverse a four-year downturn in annual home sales. "I think the 16 percent is enough of a buffer" to beat last year's numbers, Rogers said. That buffer is key because sales are now expected to fall, with most tax-credit seekers having already made their home purchases (Congress didn't approve the extension until late June). Furthermore, Rogers wrote in his report, "for most of the past four years, there is a steady decline in sales between June and December, so we will likewise probably see a decline month after month." Contracts Plummet In April, 121 properties went under contract, the most since March 2007. After the April 30 deadline expired, that number dropped to 84 in May and plummeted to 54 in June. "This June's buyer commitment rate is notably lower than any of the past three Junes," Rogers wrote, "which is not a good indicator for July and August sales figures." Rogers said it's too soon to say conclusively whether the tax credits provided a real boost to the housing market or simply shifted sales toward the first half of the year. "Perhaps it's a wash other than the timing," Rogers said, "except that timing might have helped create some momentum in getting people feeling more positive and hopeful about the economy." Values Continue To Drop Despite the increased market activity, home values continue to decline, according to Rogers' report. The average median sales price is $186,450, down 8 percent from a year earlier. Rogers said median prices are not likely to start increasing until the year-over-year sales pace rises. The average time a home stays on the market is holding steady at about six months. Contact Doug Manners at 574-6293 or dmanners@dnronline.com | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings