Selling

| Newer Posts | Older Posts |

Can Your Current Home Grow With You? |

|

I'd love for mortgage interest rates to not be the sub-text for most real estate conversations, but it's the world we live in right now. 30 year fixed mortgage interest rates were below 4% from May 2019 through March 2022. During that time, lots of folks bought homes, and lots of folks refinanced their mortgages to get to pretty low mortgage interest rates. Thus, many homeowners (with low mortgage interest rates) find themselves considering whether their current home can grow with them as their needs change. If you need another bedroom in your home (as your family grows, or as you start working from home) you could either... 1. Sell your home and buy a new, larger home. 2. Reconfigure our renovate your current home to get the extra space that you need. Given that most homeowners have super low mortgage interest rates, many such homeowners are leaning heavily into the second option -- staying and trying to allow your home to grow with your needs. But... it isn't always possible. Some homes just don't have the right amount of space, or the right space in the right space, to allow them to grow to fit your growing needs. And thus, some homeowners find themselves concluding that as much as they would like to stay in their home and keep their mortgage interest rate - they need to get to a new house to have a space that works for them for years to come. | |

Lower Mortgage Interest Rates Will Likely Bring More Buyers Into The Market But Maybe Not More Sellers |

|

As noted yesterday... August 2023 & 2024 = higher mortgage interest rates, fewer contracts signed August 2022 = lower mortgage interest rates, higher contracts signed What's the connection? The higher the mortgage interest rates... 1. The fewer buyers who can and are willing to buy. ...but also... 2. The fewer sellers who are willing to sell and give up their (likely) low mortgage interest rate on their current home. So... if or when or as mortgage interest rates decline... will we see higher levels of contract activity? Maybe. Maybe not. As mortgage interest rates decline... 1. More buyers will be able and willing to buy. ...but... 2. Sellers might still be reluctant to sell, as lower mortgage interest rates won't necessarily be lower than their locked in mortgage interest rates. Thus, I suspect as mortgage interest rates decline, we'll see the pool of would be buyers expanding more quickly than the pool of would be sellers. | |

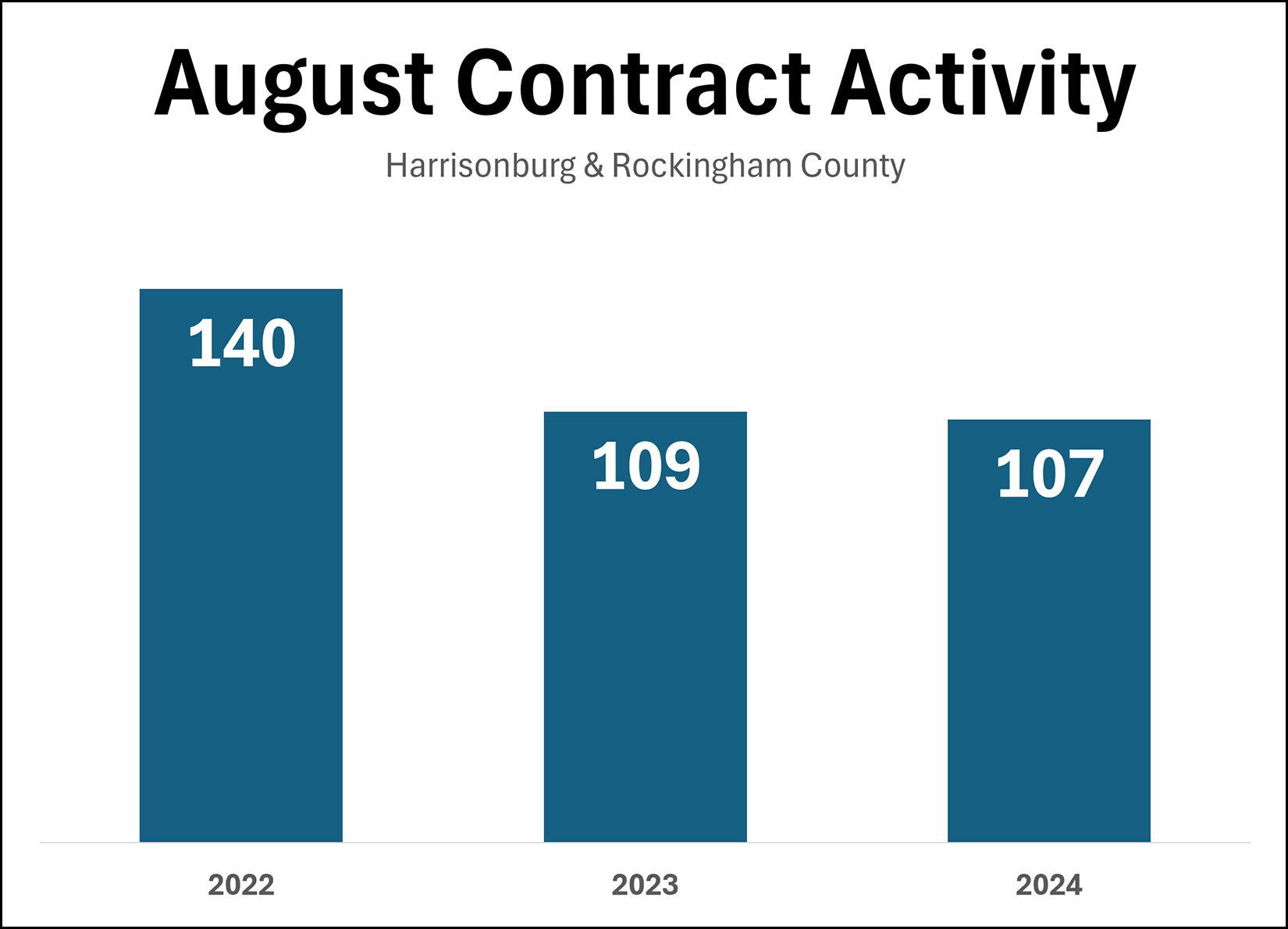

An Early Look At August Contract Activity |

|

August 2024 was another busy month of buyers and sellers signing contracts to buy and sell homes. While 109 buyers and sellers signed contracts last August (2023) we saw about the same number (107) sign contracts this August (2024). Looking in a slightly longer context, both of these months of August are a good bit below the 140 contracts signed in August 2022. For a bit more context, here is the average 30 year fixed mortgage interest rate at the start of August for each of the past three years... August 2024 = 6.73% August 2023 = 6.90% August 2022 = 4.99% I think it is very reasonable to conclude that the lower numbers of sellers being willing to sell and buyers being willing to buy in August 2023 and 2024 are related to the higher mortgage interest rate during those years. | |

If I Am Selling My House Do I Have To Pay A Commission For The Buyer Agent? |

|

If I Am Selling My House Do I Have To Pay A Commission For The Buyer Agent? Short answer - no. Longer answer - keep reading. For most of the transactions I have been involved with for the past 21 years... The sellers of most homes agreed in a listing agreement to pay a brokerage fee (commission) that would end up (in most transactions) being paid in part to the company and agent representing the seller and in part to the company and agent representing the buyer. But with home buyers now needing to sign buyer brokerage agreements before touring even a single house... ...and thus having more upfront conversations with their agent about compensation... ...some sellers might be wondering... If the buyer for my home is signing a buyer brokerage agreement to pay their agent for their services, do I have to offer to pay a commission to the buyer agent? Sellers are not required to offer to pay a commission to a buyer agent... though this is not actually new. You didn't have to offer to pay a commission to a buyer agent last year, nor do you this year. Given you don't have to offer to pay a commission to the buyer agent, what should you do, or what will most sellers likely do? WILL PAY - I imagine plenty of sellers will likely still plan to offer to pay the buyer agent's commission. In this scenario, the buyer will pay the seller X for the house and the seller will pay their agent's commission and the buyer's agent's commission out of the sales price. WON'T PAY - There will likely be some sellers who will not plan to offer to pay a buyer's agent's commission. In this scenario, assuming the buyer is represented by an agent, the buyer will pay the seller X for the house and the seller will ONLY pay their agent's commission out of the sales price. The buyer will then pay Y to their agent as a commission, resulting in the buyer paying X (sales price) plus Y (buyer agent commission) to purchase the home. What you as a seller might choose to do could be related to the balance of the market in your particular price range, or could be related to whether your target buyers are likely to have extra funds available to pay the buyer agent commission in addition to the sales price, or could be related to your overall pricing and marketing strategy. We will want to talk through all of these scenarios to determine your best course of action as to whether to offer to pay a buyer agent commission when you are selling your home. | |

How Much More Will A Home Buyer Pay For THAT Feature? |

|

A common line of thinking among home sellers can be... I know that the last three buyers in my neighborhood paid $X for their homes... but those homes didn't have ___ feature that my home does offer... so certainly, a buyer will pay $X + Y for my house. Pardon my overly algebraic explanation. Put another way... if your home has a particularly unique feature... that will be seen as desirable by many, most or all buyers... we'll need to think about how much more a buyer will be willing to pay for your house based on that feature. This can be a rather mundane unique feature, such as a brand new roof compared to all of your neighbor's 25 year old roofs... or it can be a rather exciting feature, such as a freshly renovated primary bathroom compared to all of your neighbor's bathrooms that haven't been updated since the 1980's. Regardless of what the main point of differentiation that sets your home above and beyond nearby competing homes... we'll eventually have to translate that feature into a value difference. How much more will a buyer be willing to pay for THAT feature in your house compared to what another buyer paid for a similar home WITHOUT that feature? We can think about that question in a variety of ways...

In the end, though, we'll need to attach some dollar amount to the feature and decide if we are confident enough that a buyer will pay $20K for that feature (for example) such that we will price your home $20K higher than we would have otherwise. | |

Home Purchase Price In The Context Of Needed Or Wanted Further Improvements |

|

Many houses are still selling (going under contract) very quickly, sometimes with multiple offers. Some houses are not. Frequent feedback on houses that do not quickly go under contract is something along the lines of... We like the house... and the purchase price could work for us... but it's at the top of our price range... and we would want to (or need to) make a variety of further updates or improvements after closing. And so... these would be buyers of the could be home... don't make an offer. If you are in the process of selling your home, and you are getting this feedback (like the house, price is OK, but would want to make updates) this can almost always be translated into or better understood as... your list price is too high. Oversimplifying a bit... If a 2400 SF home is listed for sale for $500K and a buyer is comfortable paying $500K for a 2400 SF home... but they would want to (or need to) make $20K - $30K of improvements after purchasing the home... ...then they are not going to be willing to pay $500K for the house. If your house does not go under contract quickly once it is listed for sale, patiently sort through the feedback... but understand that much of the feedback (particularly the feedback described above) can be translated into feedback on your list price. | |

Sometimes Buyer And Seller Price Expectations Conflict On New Listings |

|

Some home sellers decide they ought to round up their list price a bit because surely buyers will expect them to negotiate. This might result in a house worth $400K being listed for $410K. Some home buyers expect all listings to go under contract quickly at or above the list price. This might result in them assuming that house listed for $410K will really sell for $420K or $425K. In such an instance -- a home buyer deciding whether they are willing to pay $420K or $425K for a house they believe is worth $400K -- likely results in the buyer not making an offer at all. So... Sellers - Price your homes reasonably - don't round up too much, or any at all, above the market value of the house. Buyers - Consider the list price as the list price - don't assume every house will sell for $10K or $15K or $25K more than the list price. Some will, but not all, and probably not most. | |

After X Days On The Market Without An Offer, You Should Consider Adjusting Your List Price |

|

Solve for X... After X Days On The Market Without An Offer, You Should Consider Adjusting Your List Price Arguably, X varies based on the property location, property type, price range and much more. But regardless, the point remains the same, if some amount of time has passed (X) without an offer on your house, you should probably consider lowering the list price. For sellers in a particularly active price range, that might be as little as 14 days. For sellers in much of the market, that might be 30 days. For sellers with a particularly unique property that might only appeal to a small portion of buyers, that might be 60 or 90 days. The same logic also applies after a price reduction... If another X days passes, without an offer, you might want to consider a price adjustment again. | |

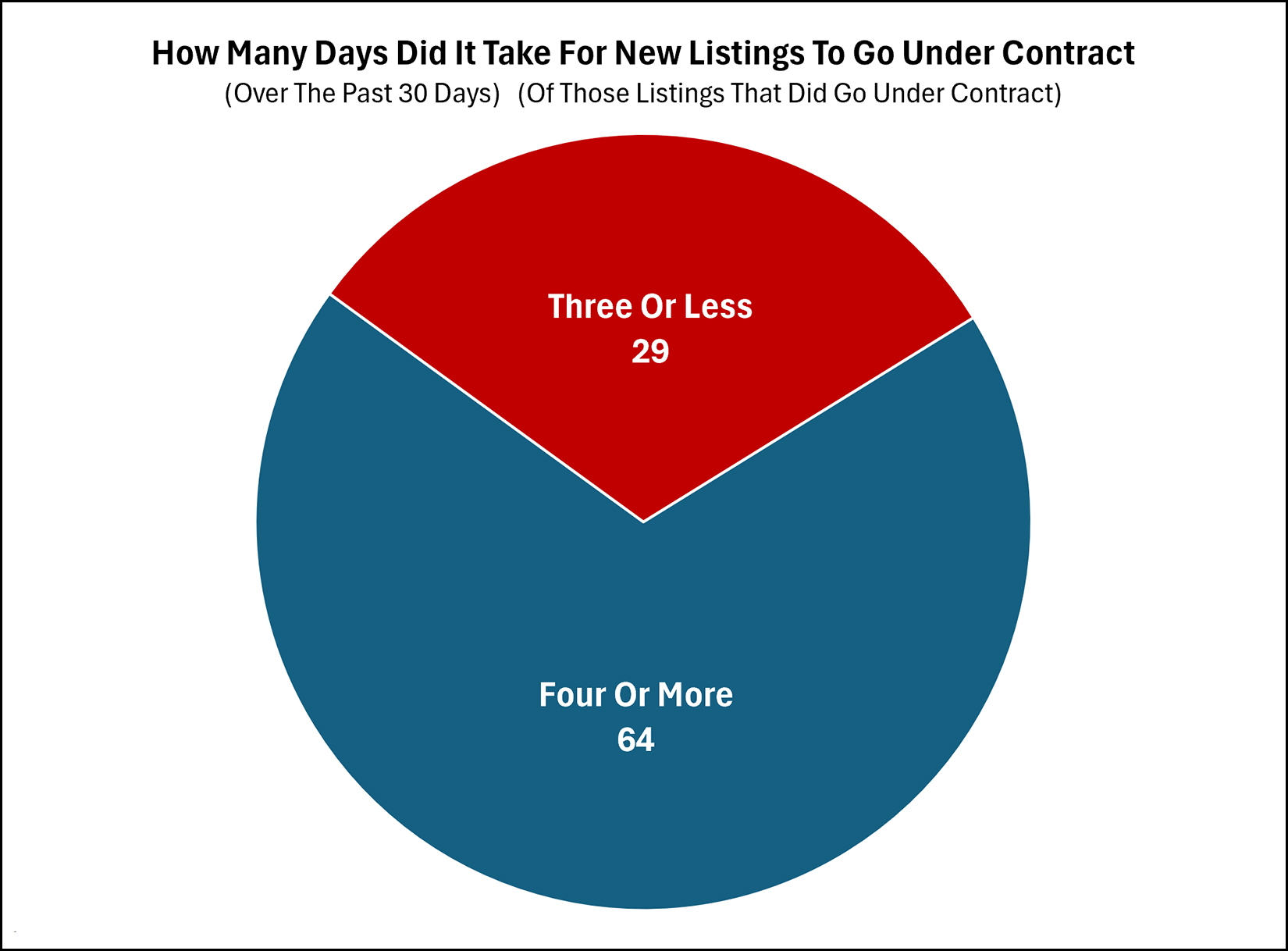

How Many Days Did It Take For New Listings To Go Under Contract |

|

All new listings are not receiving multiple offers. All new listings are not under contract in a matter of days. But plenty of new listings are going under contract plenty quickly! Of the homes that have gone under contract over the past 30 days... approximately a third of them have been under contract within three days! Thus, if you are looking to buy in the near future... go see homes within a day of when they come on the market (whenever possible) and make sure you have a lender letter ready to go if you want to make an offer! | |

With Home Inspections Back In Play Again, Do Not Assume Your Contract Price Will Definitely Be Your Sales Price |

|

Plenty of buyers are making offers that include home inspection contingencies these days - and reasonably so. A home purchase is a large purchase and a major decision and it makes sense to engage a professional to help you understand the condition of the house. As such, home sellers should not assume that their contract price will definitely be their sales price, because... 1. Your home inspection might reveal property condition issues that you did not know existed, resulting in negotiations on repairs or pricing. 2. The buyer for your home might be more concerned about some known needed repair items than you might expect, resulting in negotiations on repairs or pricing. So, when your home goes under contract, great! But wait until you get past the home inspection contingency to consider your contract price to (likely) be your sales price. All that said, as with most things, how true the above will be for you and your home will vary based on the price range of the home, it's condition, the age of the major systems, and based on how much other buyer interest existed when your current buyer made their offer. | |

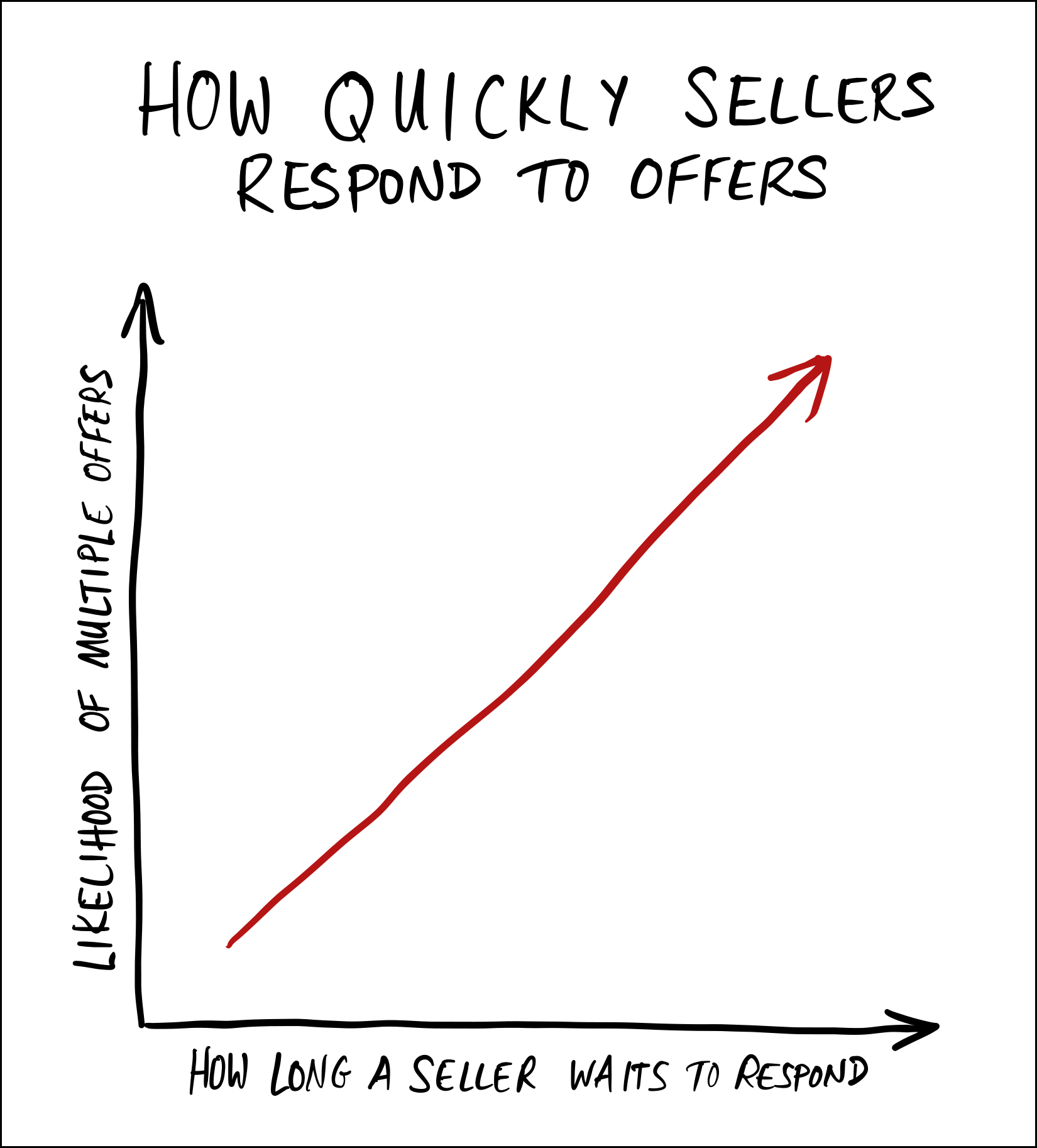

How Quickly A Home Seller Responds To An Offer Is Often Related To How Likely It Is They Will Receive Multiple Offers |

|

Nearly all home buyers would like home sellers to respond right away to their offer... but sellers don't always respond to offers in a timely fashion. One dynamic that is often (but not always) at play is whether a seller believes they will be receiving other offers. A few examples... 1. If a house was listed for sale on Monday, followed by 12 showings on Monday and Tuesday and an offer on Tuesday evening, a seller might wait a day or two to respond to the offer, believing that they might receive additional offers given the flurry of showings after having listed their home for sale. 2. If a house was listed for sale a month ago and a favorable offer is received on day 31, a seller might respond rather quickly, even if there is another showing scheduled for the following day. 3. If a house was listed 10 days ago and there have been 15 showings, but it wasn't until that 15th buyer viewed the home that they decided to make an offer, a seller might respond rather quickly, even if there are three or four more showings scheduled in the coming days. There are certainly usually other dynamics at play as well that affect how quickly a seller responds to an offer - but the likelihood of receiving other offers usually plays a part in the speed of their decision making. | |

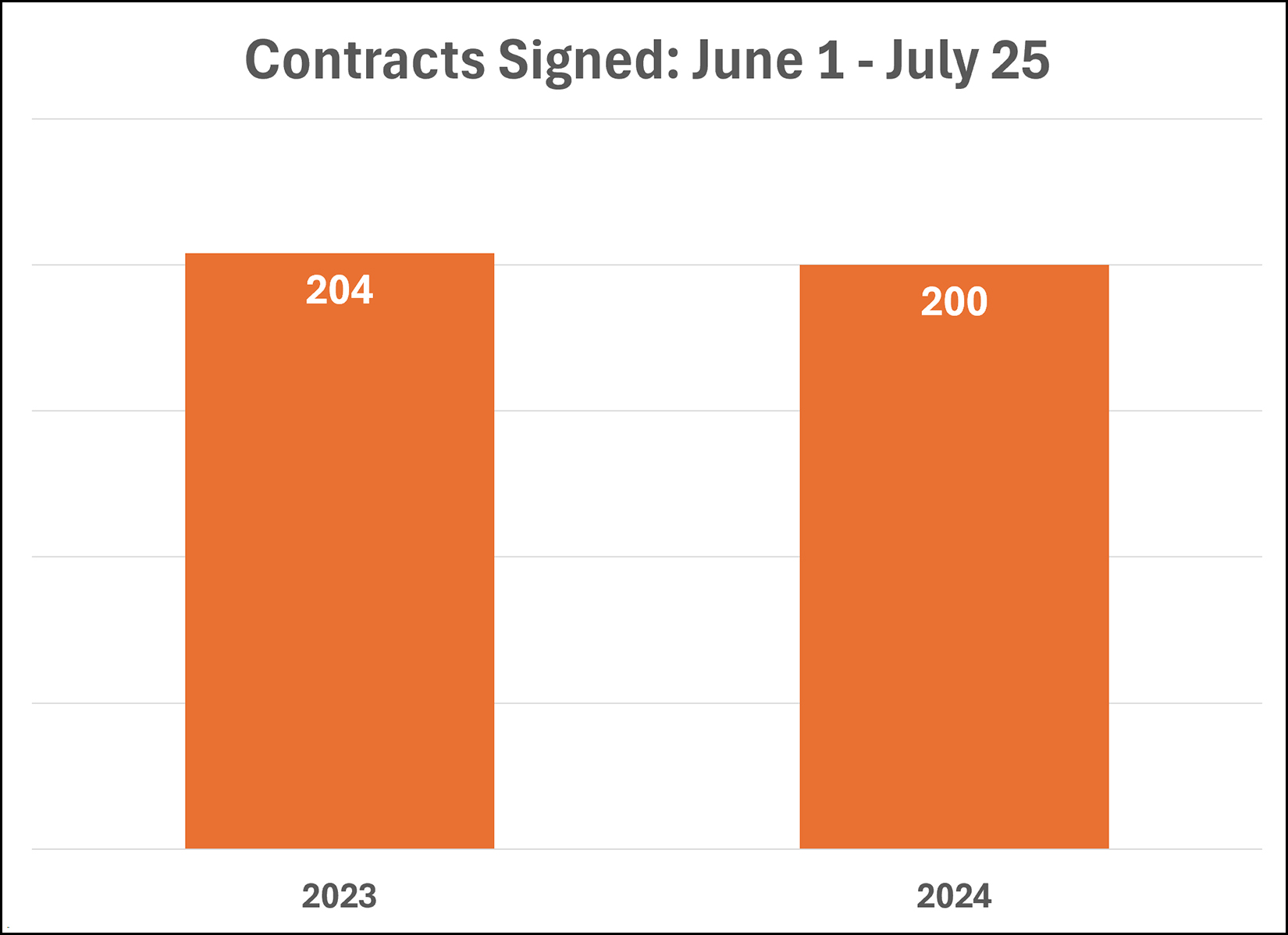

Another Busy Summer For Home Buyers (And Sellers) |

|

It has been another busy summer for home buyers and home sellers thus far this year. As shown above, 200 buyers (and thus, sellers) have signed contracts on homes in Harrisonburg and Rockingham County between June 1 and July 25... as compared to 204 last year during the same timeframe. We will likely continue to see relatively strong contract activity as we move into and through August - though things get a bit irregular in the second half of August as many folks are preparing for the start of the school year... either with kids who are students... or as teachers. | |

All Homes Are Not Appealing To An Equal Number Of Home Buyers |

|

There are many more home buyers in our market who can buy a $300K home than there are that can buy a $500K or home or a $800K home. But... we can't over generalize and assume that there will be tons of buyers for every $300K home, many buyers for every $500K home and just a few buyers for every $800K home. After all, all homes are not appealing to an equal number of home buyers. Some homes are broadly appealing to many buyers, independent of their price, perhaps because of their floor plan, features and finishes. Some homes are quite narrowly appealing to just a few buyers, independent of their price, perhaps because of their floor plan, features and finishes. Before we list your home for sale... and before we finalize a pricing strategy for your home... we'll need to evaluate how broadly appealing we believe your home will be to buyers in the current market. | |

Most Home Buyers Prefer To Close Within About 30 To 45 Days |

|

How early should you put your home on the market? Maybe three or four months before you want to move out? Maybe not. Most home buyers these days want to be able to close on their home purchase within about 30 to 45 days of signing a contract - and they would like to have possession of the house at closing. As we talk about the timing of when we will list your home for sale we can work things forwards or backwards... Forwards... July 15 - list home for sale July 22 - home under contract (maybe, though could be later) August 31 - buyer wants to close and move in July 15 - list home for sale August 1 - home under contract (slower than expected) September 15 - buyer wants to close and move in Does it work to move out of your home by August 15 or September 15? If so, great. If not, maybe let's work backwards. Backwards... October 31 - earliest date you'd like to move out September 30 - buyer contracts and asks to close in 30-ish days September 22 - list home for sale expecting a short time on the market October 31 - earliest date you'd like to move out September 15 - buyer contracts and we tell them we need 45-ish days September 7 - list home for sale expecting a short time on the market Certainly, there are variables for which we cannot completely control... 1. How quickly will your home go under contract? 2. How quickly will a buyer want to close on the home? 3. Will a buyer be willing to let you stay in the home for a few days or weeks after closing? We can take our best guess at the answers to these questions and then work the timeline forward or backward to identify the best date for getting your house on the market for sale. | |

What Is Median Days On Market Hiding These Days? |

|

At first glance, homes are going under contract just as quickly this year as last year, as shown by looking the first six months of each of those years... First Half of 2023 Median Days On Market = 6 Days First Half of 2024 Median Days On Market = 7 Days But... # Homes Taking More Than A Month To Go Under Contract... First Half of 2023 = 157 of 610 (26%) First Half of 2024 = 209 of 658 (32%) # Homes Taking More Than Three Months To Go Under Contract... First Half of 2023 = 67 of 610 (11%) First Half of 2024 = 85 of 610 (14%) So... yes, the median days on market statistic is remaining relatively unchanged, but there are certainly more homes this year than last that are taking a big longer to go under contract than sellers might have otherwise thought or hoped. | |

Some Home Sellers Will Need To Be A Bit More Patient Now |

|

For several years (most particularly 2020-2022) homes of every size, price and in every location would just FLY off the shelves. Ready to sell? No problem. There would be an abundance of buyers ready to pounce on your home within days if not hours of your house being listed for sale. That is still the case for some price ranges, locations and for some property types -- but it is not the case for all homes. Thus, some home sellers will still (excitedly) see their homes go under contract within a few days or a week of being listed for sale -- but some will not. If your home is still on the market for sale, and is not yet under contract, a few weeks after being on the market -- don't despair. There are no longer 10 would be buyers for every house at any given point that a house is listed for sale. You might need to wait for a few weeks or - (gasp) a month or more - for a buyer to come along that would like to buy your home. It was certainly a delightful time to be a home sellers when homes went under contract so quickly and so certainly -- but just because your house does not go under contract that quickly now does not mean that it won't sell at all. | |

Are Homes Staying On The Market Longer These Days? |

|

Some homes certainly are staying on the market longer these days than they have been over the past few years. We haven't seen a noticeable shift in the "median days on market" statistic that I track on a monthly basis, but it is no longer the case that nearly all homes that are listed for sale go under contract within a week. For example... 1. There are (22) resale homes currently on the market with a "Harrisonburg" or "Rockingham" mailing address (ignoring towns or far flung properties) that are priced under $400K and have been on the market for at least a week. 2. Of those (22) homes, there are (18) that have been on the market for at least two weeks. 3. Of the (133) resales homes that have sold in that same geographic area over the past three months, only (76) had a "days on market" of a week or less, and (44) of them took longer than two weeks to go under contract. So, when we list your home for sale, will it be "off to the races" with an offer being received (and a contract signed) within days? Maybe -- but maybe not. Plenty of homes are taking longer than a week to sell -- and no, that does not necessarily mean that nobody will ever want to buy your house. :-) | |

Home Sellers AND Buyers Are Both Trying To Get Used To Home Inspection Contingencies Again |

|

For much of the past five years, in many price ranges, in many locations, we were seeing multiple offers, escalation clauses, and buyers willing to remove any and all contingencies. Home inspections were a thing of the past -- for a few years. But now, with somewhat fewer buyers in the market to buy (given higher mortgage interest rates) we are often just seeing a single offer, or only a few, rather than 5 to 10 offers on a popular new listing. As a result, home inspections are often taking place on transactions in Harrisonburg and Rockingham County. Since home inspections haven't been top of mind lately (given the heated market) here are a few reminders to home sellers and buyers related to home inspections... Sellers - Certainly, it would be ideal if the one offer you received did not have an inspection contingency, but you only have one offer, so it is probably reasonable to go along with the home inspection. Buyers - Try to focus on major issues in the home inspection report. It is not necessarily realistic to think a seller is going to address every minor issue identified in the inspection report. Sellers - Your buyer is (probably) not just trying to use the inspection report and contingency to renegotiate the deal. Assume the best about your buyer, that they are attempting to renegotiate the deal given the new information they discovered during the inspection process. Buyers - I do not recommend asking sellers to make elective upgrades to the home. Your home inspector might have pointed out items that would be done differently if the home was built today, but was normal at the time the house was built -- or they might point out areas where you could make improvements to improve energy efficiency, etc. These sorts of items are not typically repairs (or upgrades) that you should request from a seller. Sellers - If the unknown of what might be discovered during a home inspection worries you, it could be a good idea to have an inspection completed before listing your home to identify and resolve any significant issues. Buyers - Given how difficult it can be to line up a contractor or handyman these days, consider being willing to discuss a credit with the seller instead of requiring that repairs be completed. I suspect home inspections will continue to be (will return to being) a normal part of the home purchasing and selling process over the next few years. | |

If You Are Selling A Rental Property It May Be Best To Sell Just Before Or Just After Your Tenants Move Out |

|

Property values are high and they seem to keep getting higher. That statement is not true for all locations, price ranges and property types -- but overall, the local median sales price keeps increasing. This dynamic has resulted in some owners of rental properties deciding to go ahead and sell those rental properties... which is a welcome turn of events for first time home buyers who are often looking to buy the same properties that may currently be rental properties owned by investors. So... if you are planning to sell your rental property... when should you do so? Your best bet will be to list your rental property for sale either just before or just after your tenants move out. If you list within this timeframe, your property will be able to be considered by owner occupant purchasers as well as other investor purchasers. In contrast... if you list your rental property for sale while the current tenant still has six more months on their lease... the lease will convey to and be binding on the new owner... which means owner occupant purchasers won't be able to consider the purchase of your property... and your property will solely be appealing to investors who would take over the lease. So... if you want to expose your rental property to the widest pool of potential home buyers... we should wait until you have about 60 days (or less) remaining on the lease... or wait until just after your tenants move out. | |

Different Local Real Estate Markets Are Performing, Unsurprisingly, Differently |

|

If you are relocating from a small rural area (or from a much larger city) to Harrisonburg, you are likely to experience different market dynamics in the two local markets. If you are relocating from Harrisonburg to a much larger city (or to a much more rural area) you are likely to experience different market dynamics in the two local markets. In conversations with folks moving to or from larger markets, I have heard anecdotes of...

Those sort of (extreme!) market dynamics are not currently being seen very frequently in Harrisonburg... but every local market is different. Consult an active, professional, local Realtor in the area where you are relocating to or from in order to understand current market dynamics in that market. Knowing how the market is performing will help you set proper expectations relative to potential offer terms and contingencies. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings