Trends

| Newer Posts | Older Posts |

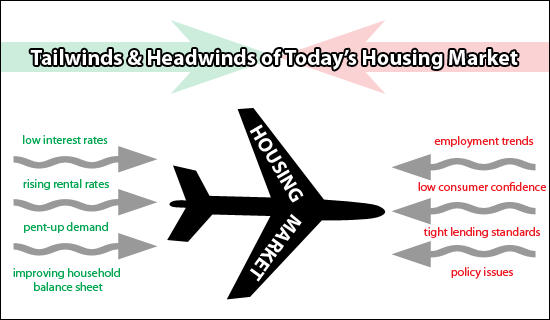

Tailwinds and Headwinds of Today's Housing Market |

|

As we conclude 2011 and head into 2012, Virginia's housing market will likely be strengthened by low interest rates, rising residential rental rates, pent-up demand, and an improving household balance sheet based on increases in household saving habits. Despite these tailwinds, however, a return to stability in the housing market may be slowed by employment trends, low consumer confidence, tight lending and underwriting standards and significant policy issues. Recent policy decisions or discussions that could impact Virginia's housing market include a possible elimination of the mortgage interest deduction, GSE reform, changes in FHA loan limits and a new QRM proposal (Qualified Residential Mortgage) that would require lenders to retain 5 percent of the value of the loans they originate (excluding Fannie and Freddie) unless the borrowers have a 20% down payment | |

Why it's important to focus on utility costs |

|

Let's start here, with a passionate narrative from a friend and blog reader (thanks Tony!) who recently bought a home here in Harrisonburg.... Boy do I regret not asking for utility data for the house we bought last year near Memorial Hall--ugh! What a leaky old house we bought, totally unawares. $750 for oil for just the month of January alone. Alert! Alert! Depending on the age of the home you are buying, it can be very important to ask for utility data. But it's a bigger issue, as Tony reveals.... We all are flying on the same plane at some level. We start in January and end in December. But everyone on this plane called Harrisonburg housing is paying a different utility fare. That's not too surprising -- some of us are frugal, some are not; some of us are in smaller houses, others in mansions; etc. Tony raises a great perspective for us to keep in mind -- we can think (as a home buyer) that we have all of the costs nailed down and entered into our monthly budget -- but if we forget the variability of utilities, we're in trouble. Perhaps you live in a home now that averages $150/month for heating, cooling and electricity costs. What if you purchase a new home and that jumps up to an average of $350/month. Perhaps you made your new budget based on $150/month?But I think this cost of utilities -- not just for 30 years, but forever -- is really a sleeper issue when it comes to buying a house; particularly when your utilities are based on fossil fuels. Think the price of coal-fired electricity is going to go down? I don't. Think the cost of heating oil is going to go down? I don't. Natural gas? Etc. So at first glance, it's important to ask the sellers of a house you are considering for some utility history. But wait -- that's not even entirely helpful because they might keep the house tremendously colder or warmer than you would prefer. Thus their heating, cooling and electricity costs could be much lower than you would experience once you move in. So what is the answer? Well, Tony goes even further, with a hope and goal of putting large amounts of data to work for us.... Wouldn't you like to know who got the best "fare" in your neighborhood--and how, and at what investment price? Indeed it would be nice to have this type of data. Imagine being able to take the utility costs for the home you own OR the home you might buy and compare them to other similar houses in terms of age and square footage. All of a sudden you'd be able to not only estimate your own costs, but you'd also be able to know whether the home was more efficient than most, or had significant energy efficiency challenges. Here's to hoping for a future where information about utility use is more easily available and more widely analyzed. | |

Will homes prices decline another 10% locally? |

|

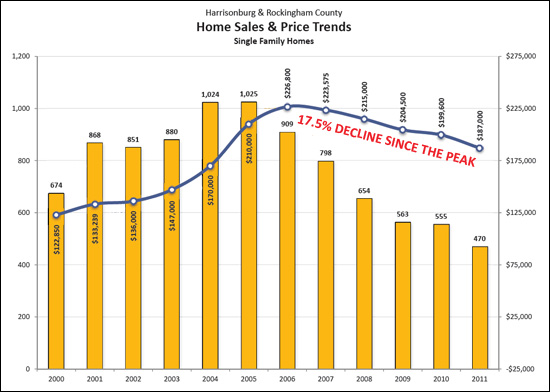

Someone mentioned last week that they expect local home prices to drop another 10% or so before they stabilize. I don't think that I agree, but let's try to put it in context:  The graph above (click here for a larger version) shows the median prices for single family homes in Harrisonburg and Rockingham County since 2000. You'll note that the median sales price has fallen 17.5% from $226,800 in 2006 to the current value (in 2011) of $187,000. Will home values really drop by another 10%, down to $168,300? I don't expect that they will -- I think that as the pace of home sales stabilizes (which started in 2010) that we will see prices gradually start to stabilize. Certainly, though, if prices were to drop another 10% locally (or even 5%) that would be instructive for sellers who are holding out with aggressive list prices. | |

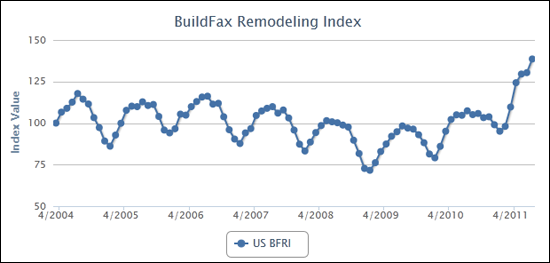

Honey, given the less than ideal housing market, perhaps we should renovate instead of selling! |

|

It seems this conversation has likely been happening quite a bit, as home improvements are on the rise!  Beyond people deciding to renovate instead of selling, it is also quite likely (as the news release points out) that homeowners are refinancing because of the current (ridiculously) low interest rates and then using equity or monthly costs savings to do home improvement projects. | |

September home sales continue recent positive trends |

|

Thus far, September is looking good, with 38% more home sales than last year!  Re-read last month's report if you missed it, and know that we have more positive data in September to continue what appears to be a stabilization of the market. | |

Motivated, eh? Really? |

|

Please bear in mind, this is not related to the price of any homes currently on the market. It is, however, a reminder that if you are motivated as a seller that it is important that such a motivation carry over into your pricing as well. | |

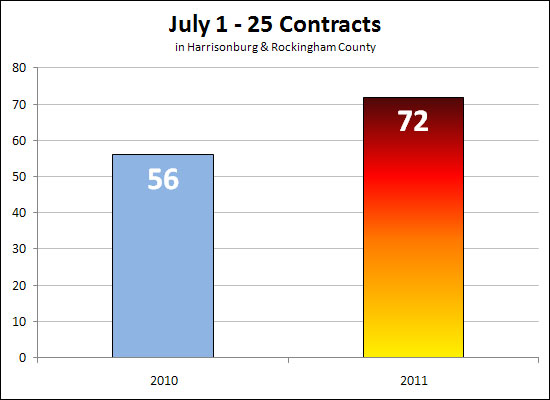

With contracts still on the rise, the local housing market is showing continued signs of stabilization |

|

August was another strong month of contracts....  Contracts year-to-date are also still quite strong!  Stay tuned for my full market report next week --- could this finally be the year when home sales stop declining in Harrisonburg and Rockingham County? | |

Unwillingly keeping your townhouse might be your best (unintentional) financial move yet! |

|

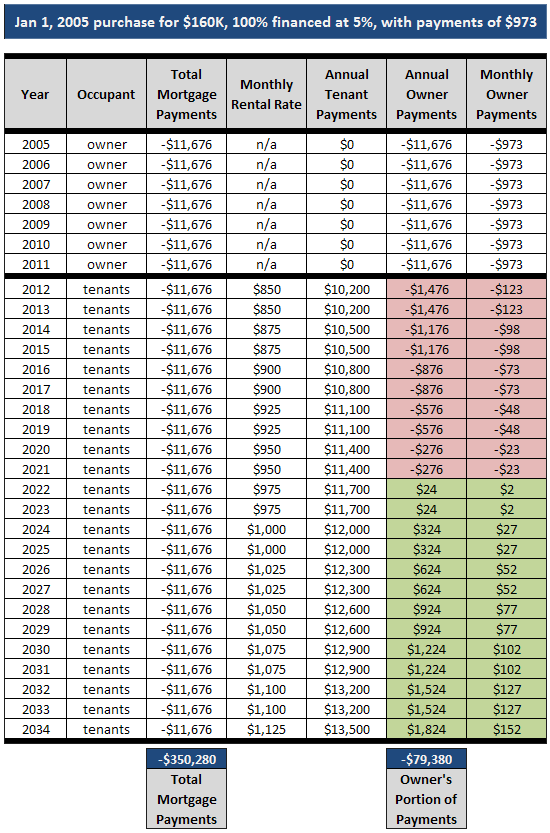

As I pointed out a few days ago, if you bought a townhouse a few years ago, you might be in a position where you can't sell it -- and thus end up being an accidental landlord. But there may be some unintended very positive consequences for keeping that townhouse. Let's examine what might happen if you kept your townhouse for the remainder of the term of your mortgage.  In the illustration above, let's imagine you bought your townhouse for $160K in January 2005 and financed 100% of the purchase price. You stay in the townhouse for seven years, and then move out of the area for a new job. Faced with a tough townhouse sales market, you feel forced to keep the townhouse. What happens next.....

As you can see, after investing $0.00 on Day 1, you end up having a cumulative $230,352 benefit after 30 years. Wow! So, can this make you a bit more optimistic about being (or feeling) forced to keep your townhouse? | |

Sellers are now landlords, and buyers are now tenants |

|

Five (or so) years ago, there were LOTS of first time buyers purchasing $150K new/newish townhomes in the City of Harrisonburg. Many of these buyers were young professionals or newly married couples. At the time, 100% mortgages were readily available, and sellers frequently paid closing costs, so a buyer could get into a house with just about no money at all. Buying a house was the cool and hip thing to do, so young people were buying houses/townhouses let and right. Fast forward to today, and we find that things are a bit different. People who would have bought five years ago are now renting because they would now need at least 3.5% of the purchase price as a down payment, and may have to pay their own closing costs. They also aren't buying because home values aren't increasing at a pace that would allow them to sell the house in the next few years without taking a loss. Thus, lots of the buyers of yesteryear are now not buyers at all --- they are deciding to rent a townhouse instead. But wait......so if there are lots of townhouse sellers, and fewer and fewer townhouse buyers, what is happening, or what will happen? In large part, many of today's would-be sellers are turning into landlords. After not being able to sell their townhouse that they bought five years ago, they decide to try to rent the property instead. This entire shift in who is (not) buying and who is (not) selling will likely take several years to sort itself out. One interest side effect is that there will be lots of 30-somethings who will unintentionally end up owning an investment property when they hadn't been aiming to do so. | |

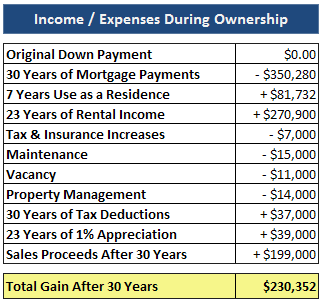

Did the federal home buyer tax credit impact the pace of home sales in Harrisonburg and Rockingham County? |

|

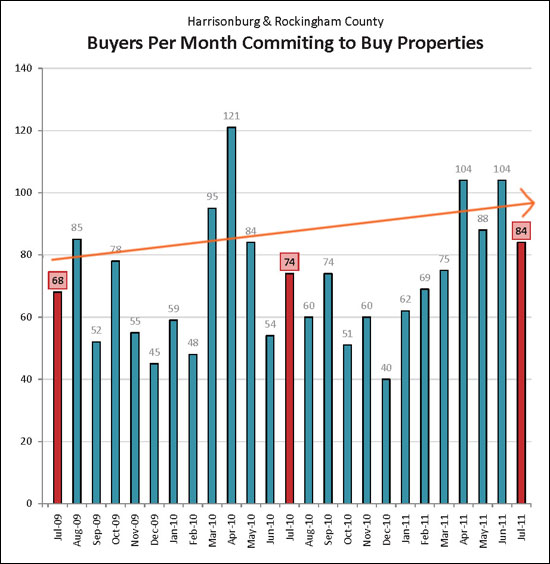

The federal home buyer tax credit did not seem to have a lasting, positive impact on the local housing market. While the federal home buyer tax credit (timeframe shown in green above) did cause the pace of home sales to increase, it was not lasting -- sales declined again after the tax credit expired. We're now roughly a year out from the expiration of the tax credit, so we are now getting close to being able to analyze the local housing market without a backwards reference to the (long) period of time with government intervention as an influencing external variable. It's great, thus, that the real estate market seems to finally be improving as of mid-August. | |

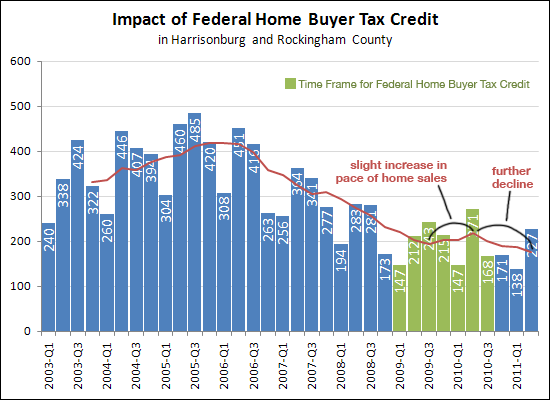

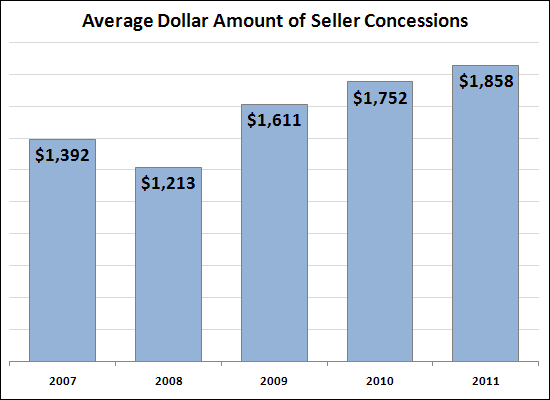

Seller concessions increase as market activity decreases |

|

Thank you, Michael, for suggesting that I analyze this....  As seen above, more sellers are giving concessions these days to close the deal. These concessions are most often a credit towards closing costs -- and thus far in 2011, 41.2% of sellers have provided such concessions at closing in Harrisonburg and Rockingham County home sales. This is a 30% increase over just three years ago.  Not only are more sellers making concessions, the average concessions are also on the rise --- from $1,213 three years ago to $1,858 thus far in 2011. This shows 53% increase, though the current average of $1,858 is less than 1% of the current average sales price of $201,364. | |

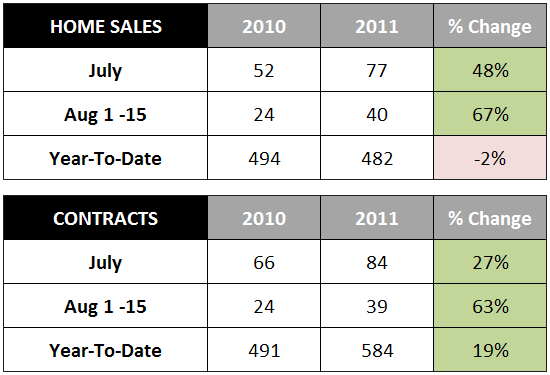

Halfway through August, and the real estate market still seems to be performing well in Harrisonburg and Rockingham County |

|

For the past five years, I've had to answer the question of "so, how's the real estate market" with responses such as "well, not so great" or "well, it could be worse." Now, the answer is a bit different, more along the lines of.... While we're not out of the wood yet, there are many positive indicators in our local housing market that seem to show a modest and slow start to market recovery. As shown above, above:

| |

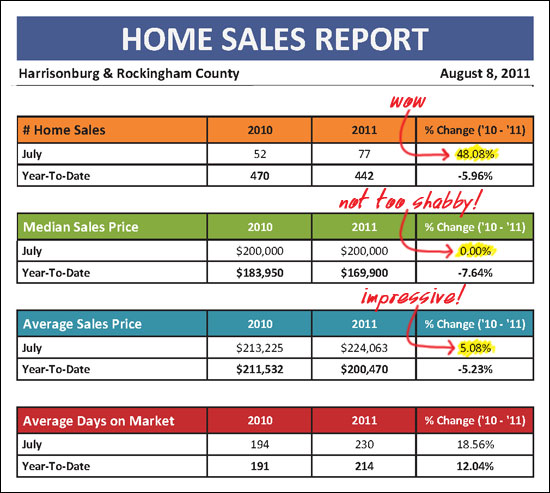

Home Sales Increase, Prices Increase, Contracts Increase! |

|

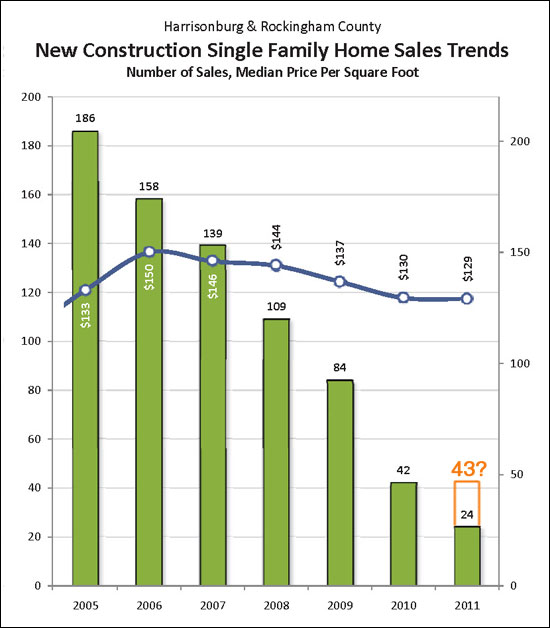

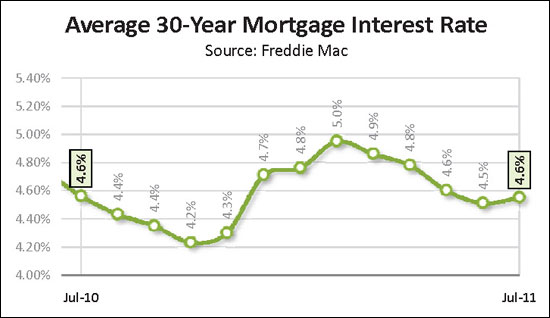

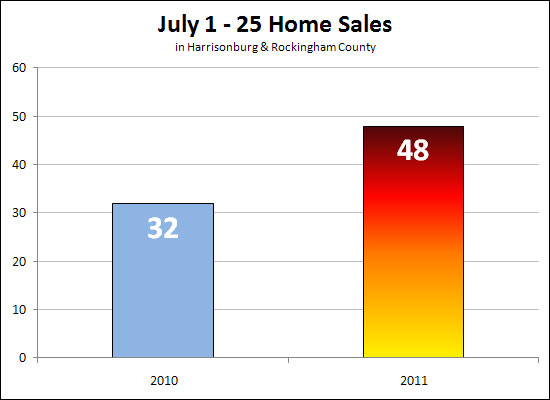

Finally, some signs of hope for the local housing market! I just completed my monthly analysis of the Harrisonburg and Rockingham County real estate market, and there are plenty of reasons to be excited. Download the full market report (PDF, 7MB) or read on for some highlights.  As seen above, July 2011 home sales shot past July 2010 by 48% --- which helped the year-to-date sales pace to come within 6% of last year's pace. Furthermore, we did not see a decline in median sales prices when comparing this July and last July....and....the average sales price INCREASED by 5% comparing July to July.  But it gets better --- the next few months should be rather exciting as well, since July 2011 buyer activity (shown above) exceeded both July 2009 and July 2010 contract levels.  Finally, some good news for local home builders, new home sales may finally be stabilizing, with both the pace and price of new homes looking to stay relatively consistent between 2010 and 2011 (as shown above).  One of the reasons (among many) that we are continuing to see improvement in the local housing market is because mortgage interest rates continue to stay below 5%. As shown above, they have started to increase a bit, but are still at an average of 4.6%.  Click on the image above to download my full Harrisonburg & Rockingham County Real Estate Market Report for further analysis of our local housing market. As always, I have included both the good news and the bad news -- my hope is that my analysis will empower you to make the best real estate decisions possible. If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

New study finds correlation between local real estate market and weather conditions! |

|

OK, so admittedly it is a bit cooler this week --- but last week was HOT, with temperatures soaring up to (and over) 100 degrees! Likewise, the local real estate market has been HOT this month....  Yes, that is a 50% increase in home sales between last July and this July!  Contracts are also up, 29% as compared to last July! My hope is that the weather cools off, but the real estate market continues to heat up! | |

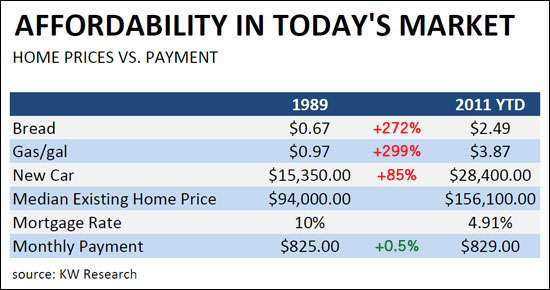

The costs of bread, gas and cars have increased, but not homeownership! |

|

The price of bread has increased 272% over the past 22 years. Likewise, the price of gas has increased dramatically (299%) -- and even the cost of cars has increased 85%. But the cost of owning a home has not increased at all --- when it comes to monthly payment. The table above shows how each item has increased in cost over time. The mere 0.5% increase in the cost of owning a home is derived using the median home price (nationally) and the average interest rate at the time. Perhaps if bread, gas and cars didn't cost so much, more people would be able to afford homes? ;) | |

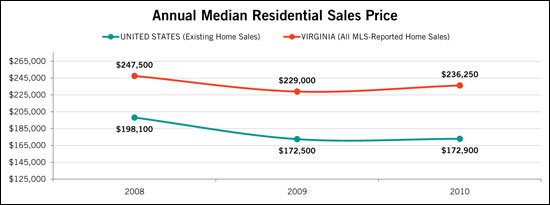

Virginia home values recovering more quickly than U.S. |

|

The Virginia Association of Realtors has released their 2nd Quarter report providing a great overview of the housing market in Virginia, including (amongst lots of other analysis) the following good news....  While median home prices have declined in both Virginia and the United States over the past two years (comparing 2010 to 2008), it seems that home values may be recovering in Virginia more quickly than in the United States as a whole. The United States median sales price stayed relatively level between 2009 and 2010 (less than 1% change) while the median sales price in Virginia increased by 3% during the same time period. Click here to read the press release from VAR, or click the image below to download the PDF of the 2011-Q2 Virginia Quarterly Home Sales Report.  | |

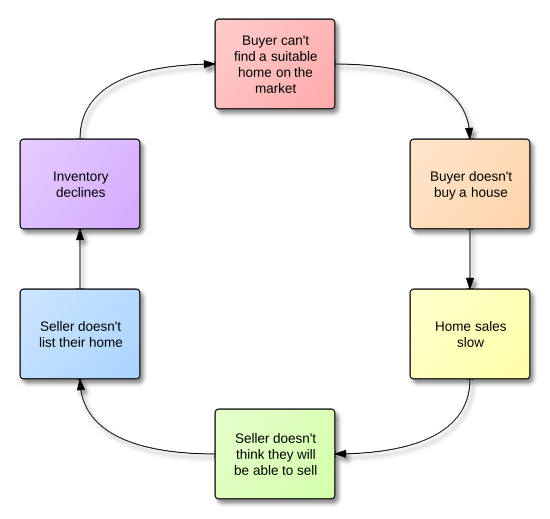

Are lower inventory levels leading to fewer home sales? |

|

After showing a house to some buyer clients yesterday, we were reflecting on the fact that there don't seem to be too many options on the market in the price range that they are considering with the characteristics that they are seeking in a home. We wondered aloud as to why it might be that we can't find them a home right now --- yet at the same time, sellers are wondering why they can't find a buyer for their home right now. Here's what I think is going on.....  If this is what is occurring (generally speaking), it begs the question of how we break out of this cycle. One suggestion is that perhaps more potential sellers ought to consider putting their homes on the market if they can offer a product and price combination that would be compelling in the current market. What are your thoughts? Does this accurately portray one dynamic of the current local real estate market? | |

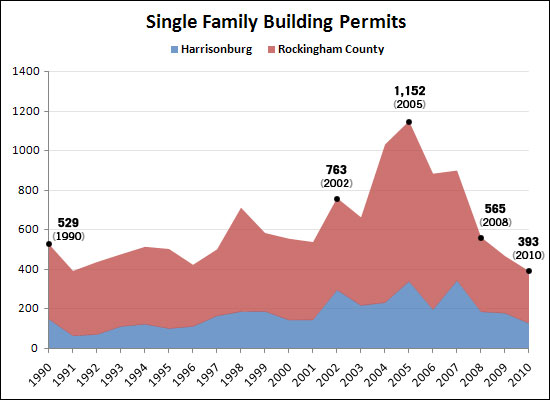

Historical Building Permit Trends in Harrisonburg and Rockingham County |

|

A 20 year history of single family home building permits in Harrisonburg and Rockingham County (shown above) reveals that much of the new home construction is market driven. The past twenty years can be summarized in four main stages:

Data Source: Weldon Cooper Center | |

Per The Atlantic: Is Now the Right Time to Buy a Home? |

|

For your daily real estate reading, consider perusing this article from The Atlantic a few weeks ago entitled "Is Now the Right Time to Buy a Home?" The author considers factors such as:

Again, enjoy the read of "Is Now the Right Time to Buy a Home?" | |

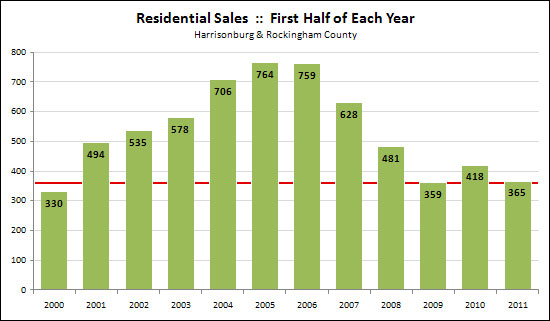

How did the first half of 2011 compare to previous years? |

|

Last year (2010) was assisted by the federal home buyer tax credit. Thus, even though 2011 shows a decline compared to 2010, it's important to note the (slight) increase as compared to 2009. The second half of the year, however, will be key. Last year's 3rd and 4th quarter were rather slow, as many (many!) buyers were enticed towards the first half of the year before the tax credit expired. Thus, this year still has plenty of opportunity to outperform last year since we don't have a tax credit affecting the timing of the market. Stay tuned! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings