| Newer Posts | Older Posts |

Contracts do not always result in closings |

|

During 2010, buyers wrote 820 contracts --- and during the same year, only 758 closings took place. Why the difference? Technically, some of the 2010 closings are based on 2009 contracts....and some of the 2010 contracts will be 2011 closings. I don't suspect, however, that this timing issue significantly effected the relationship between the number of contracts and closings during 2010. Looking back, there were 47 closings during 2010 that were under contract at least twice. That closes the gap most of the way: 758 closings + 47 contracts that fell through (but then were contracted on again) = 805 closings. That leaves just 15 properties (with this rough math) that were under contract but never sold. Interestingly, 2011 was even more disproportionate....

Again, let's pretend ignore the overlap between years -- yes, I know that late 2011 contracts will close in 2012, but in theory almost all of those will be offset by late 2010 contracts that closed in 2011. So, the math gets interesting here..... There were 64 closings during 2011 that were under contract at least twice. 791 closings + 64 contracts that fell through (but then were contracted on again) = 855 closings. That leaves 100 properties (as compared to 15 in 2010) that were under contract but never sold. Again, it's rough math, here is the probability that a contract on your house would result in a closing during the past two years:

Don't get me wrong --- I like contracts, and houses going under contract -- however.....

| |

Local housing market stable in January 2012 |

|

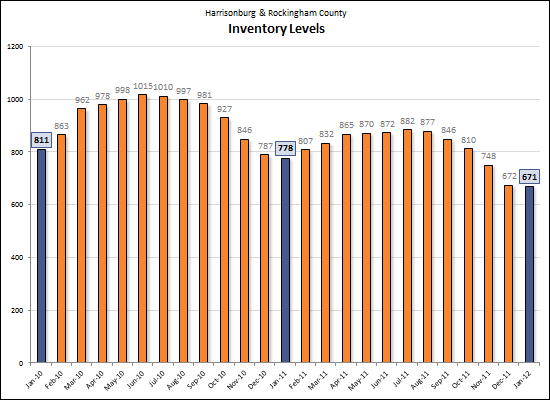

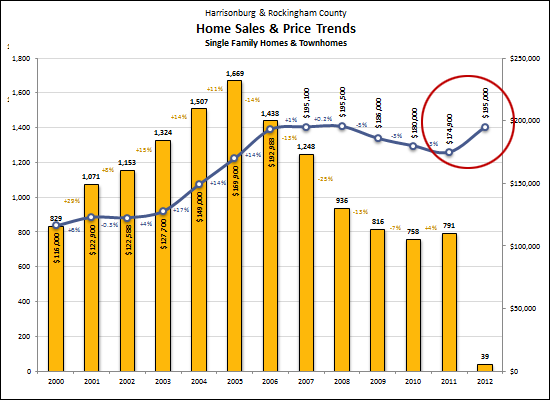

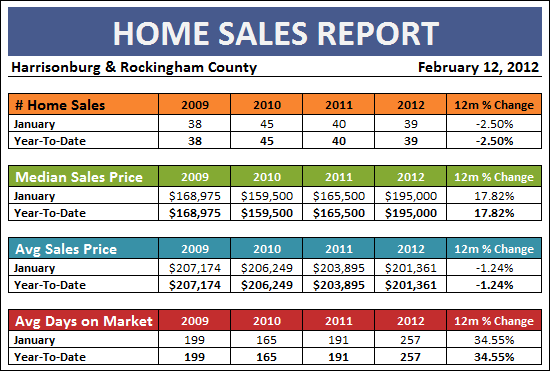

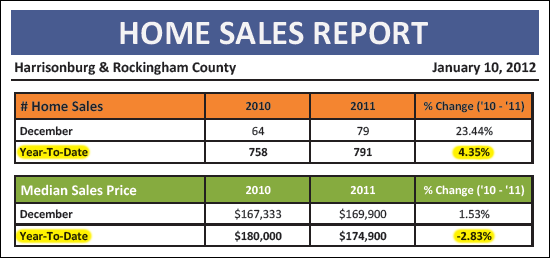

Our local housing market remained relatively stable in January 2012, showing some indicators that we will continue the new trend we saw in 2011. To remind you..... In 2011, after a five year slide (and a 55% drop) in the pace of home sales, our local real estate market showed a 4% improvement in the pace of home sales last year, even though the median sales price declined another 3%. Jump to the PDF of my monthly market report, or keep reading for an overview.  Important trends to note:

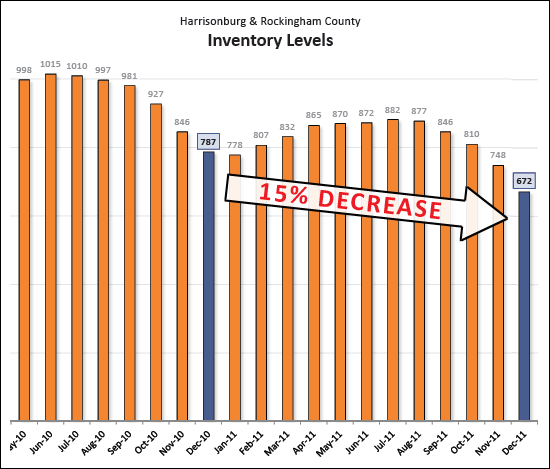

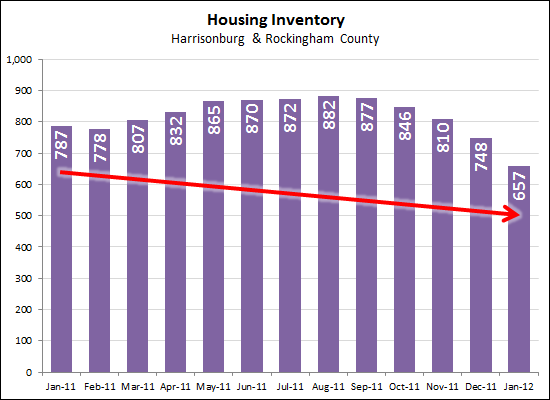

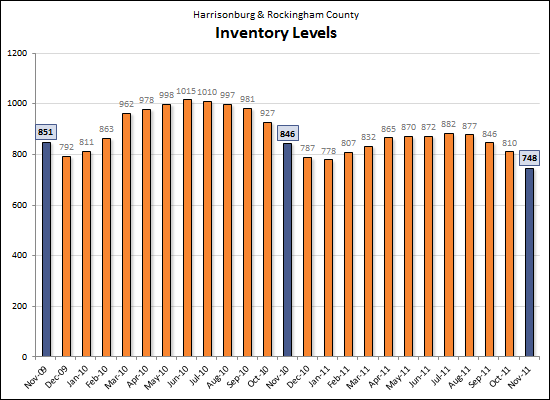

Inventory levels continue to decline (as shown above) with a 14% decline over the past year, and an overall 17% over the past two years.

Perhaps one month of data is too small of a data set to draw some conclusions --- otherwise we'd think our market has REALLY recovered, as the median sales price increased 11% when comparing 2011 to January 2012. For a more detailed look at the Harrisonburg and Rockingham County real estate market, download my full market report as a PDF. | |

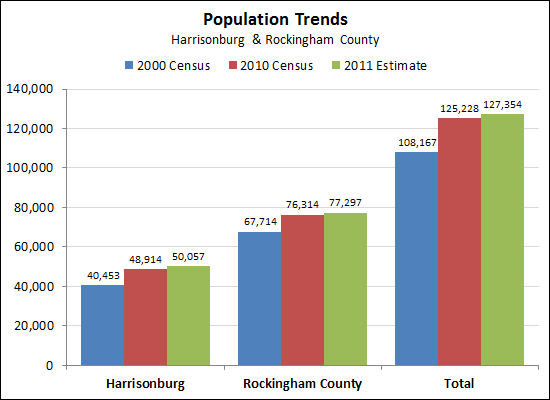

Harrisonburg Population Tops 50,000 |

|

As reported in the Daily News Record this week, the Weldon Cooper Center's population projections show that Harrisonburg has now surpassed a population of 50,000. There was a remarkable 2.3% population growth in the City over the past year -- certainly a good sign for the local economy and housing market. | |

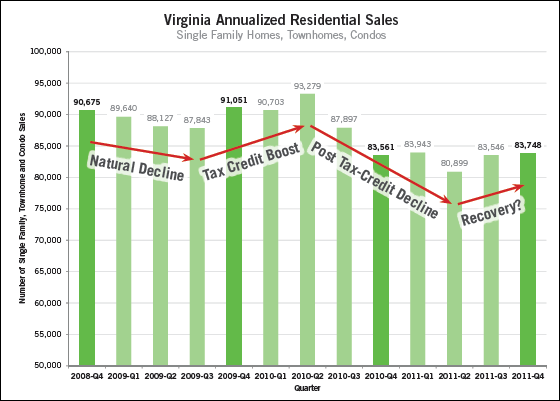

Virginia housing market shows signs of returning stability |

|

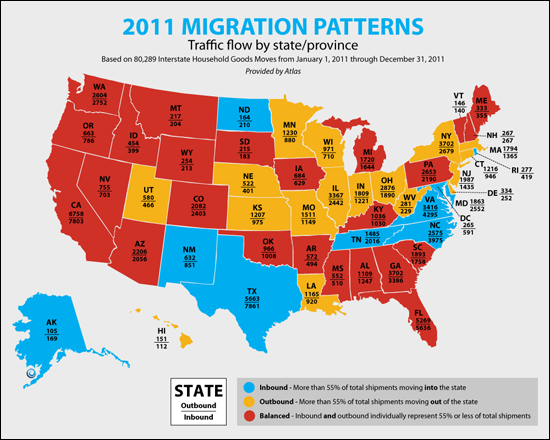

More people are moving into Virginia than out |

|

In another positive sign for Virginia's economy and thus housing market, there seem to be more people moving into Virgina than out of Virginia. Of note, Virginia is one of only 9 states where this is the case! Source: KCM Blog | |

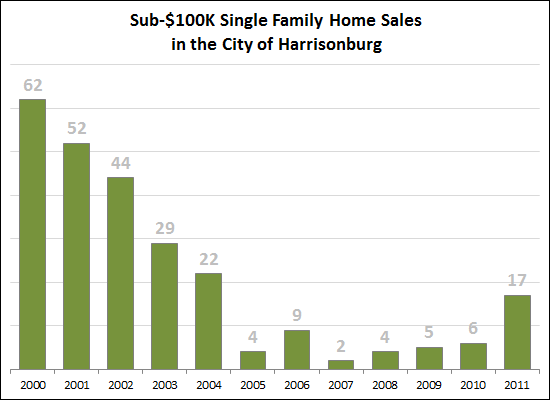

Harrisonburg Sub-$100K Single Family Homes: They're back, and more affordable than ever! |

|

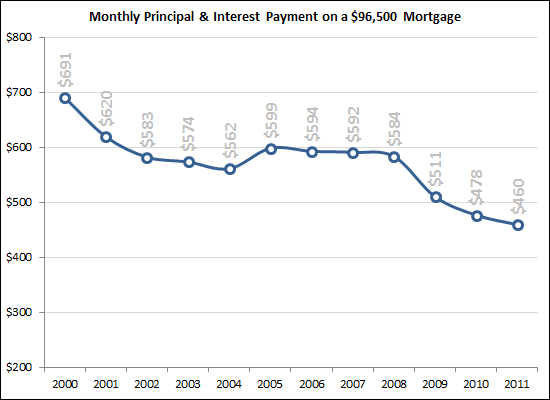

As the real estate market heated up, the opportunity to buy a single family home in the City of Harrisonburg for less than $100K cooled down. Now, however, there are more opportunities to buy such homes. The even better news is that it's more affordable than ever to buy such a property.  The chart above shows the principal and interest payment on a $96,500 loan (a 96.5% FHA loan on a $100K purchase) given the interest rates over the last 11 years. This does not include taxes, insurance, and PMI. If you are looking for an affordable house --- either from a sales price perspective, or a monthly payment perspective --- don't hesitate to contact me (scott@HarrisonburgHousingToday.com or 540-578-0102). I'd be happy to help you find a home to meet your needs. | |

How much are buyers (and sellers) negotiating on price? |

|

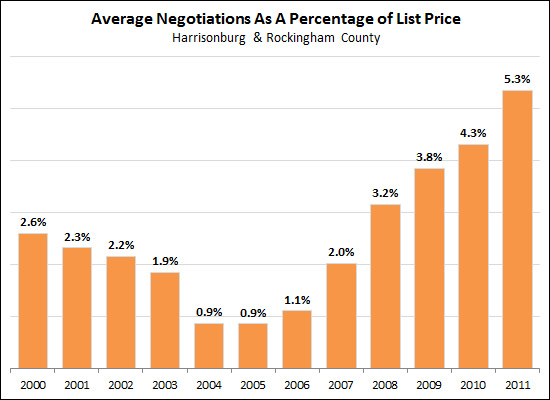

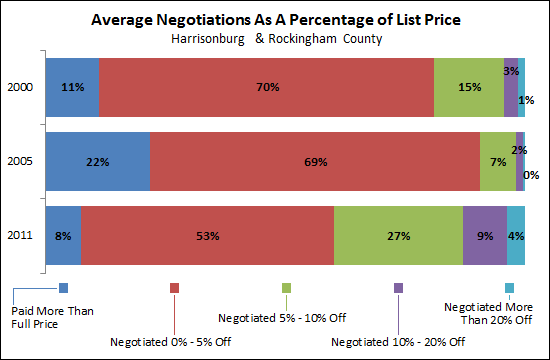

More than they ever have! Pre-boom, buyers (and thus sellers) were negotiating an average of 2.6% on price -- that is to say that homes were selling for 97.4% of the list price. That went as low as an average of only 0.9% of negotiating room in 2004-2005, before rising quickly to current market conditions where the average negotiations are 5.3% of the list price.  If we look closer at the data pre-boom (c2000), mid-boom (c2005) and post-boom (c2011) we find some interesting facts:

| |

Attached vs. detached homes over the past 11 years |

|

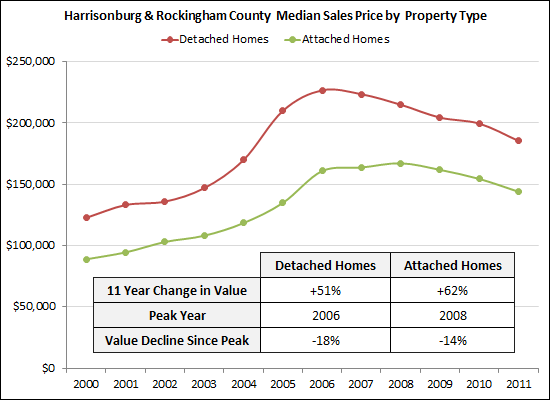

Detached home = single family home Attached home = duplex, townhouse, condominium So, which property type has shown a stronger performance over the past 11 years in Harrisonburg and Rockingham County?

But despite all of this, I believe the detached home market will be a stronger performer over the next five years, because:

| |

Was 2011 "the new normal" for the pace of home sales in Harrisonburg and Rockingham County? |

|

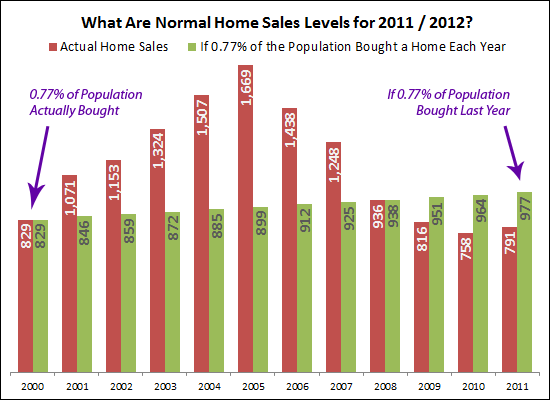

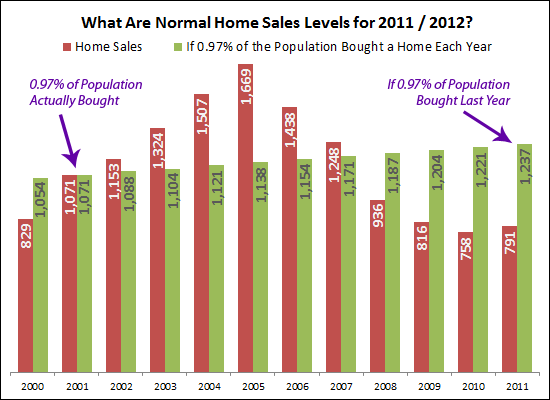

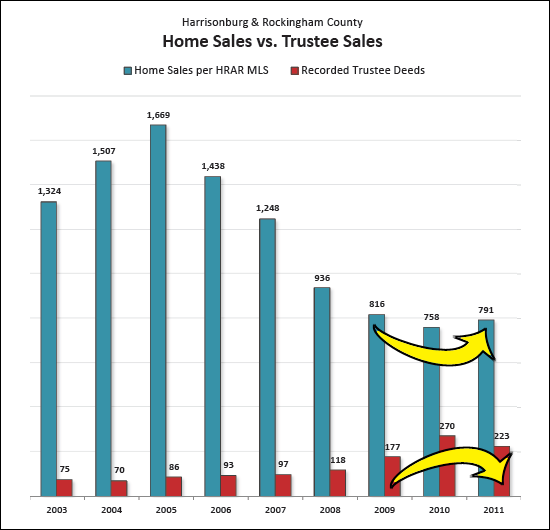

In 2000, there were 829 home sales. That zoomed up to 1,669 in 2005. This past year (2011) there were 791 home sales. Certainly, 1,669 home sales a year is not a normal pace of home sales, but is 791 home sales per year a reasonable assumption for the pace of our local housing market going forward? To explore this issue, I have created a model showing what home sales would have been if a constant percentage of our local population bought a home each year, and I have included population increases from the past decade.  Above you'll note that in 2000, a total of 0.77% of the population purchased a home (829). Then, for each following year, I have shown how many people would have bought a home if it continued to be 0.77% of the total population. Per these calculations, home sales in 2011 (though improved over 2010) are still well below where they (theoretically) should be. If 0.77% of the population bought in 2011, home sales would have been 23% higher than they were last year.  Above is a second illustration, assuming that 2011 was a normal year -- and that each year we should expect 0.97% of the population to buy a home. In this scenario, home sales should have been 56% higher last year to have 0.97% of the population buy a home. Regardless of the actual numbers, my conclusion based on the data above is that 791 home sales per year (as in 2011) is not the new normal for our market. I believe the market will improve further as to the annual pace of home sales -- at least to 1,000 sales per year. | |

Land sales increase, in pace AND price! |

|

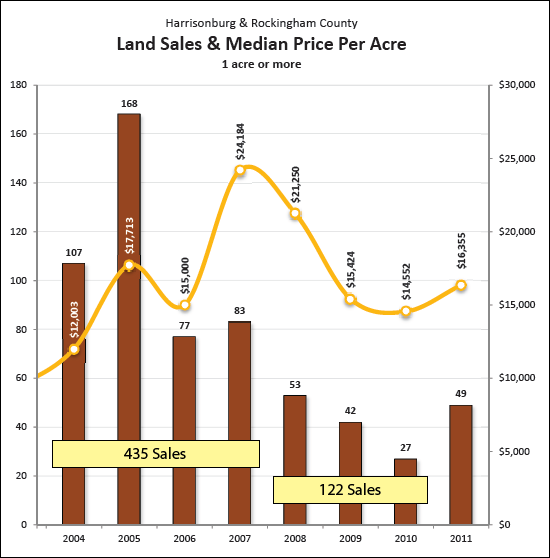

The housing market as a whole in Harrisonburg and Rockingham County seems to be stabilizing. As per my market report earlier this week, sales increased by 4% in 2011, even though prices declined by 3%. Land sales, however, are looking even better! There is quite a bit of information packed into the graph above, but here are the main things I think are important to note:

| |

2011 Summary: Stability is returning to the Harrisonburg, Rockingham County housing market |

|

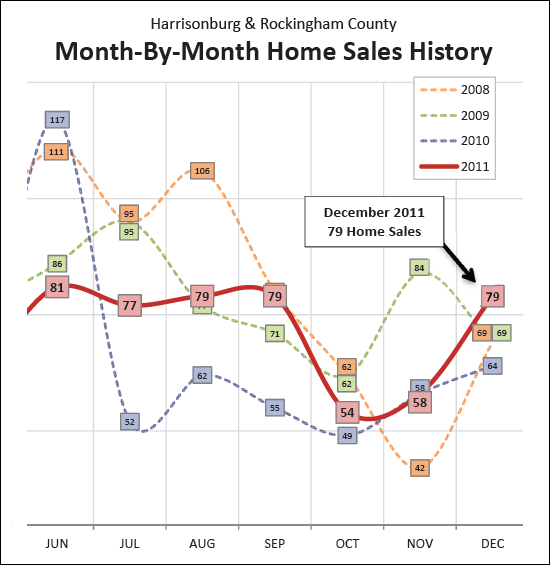

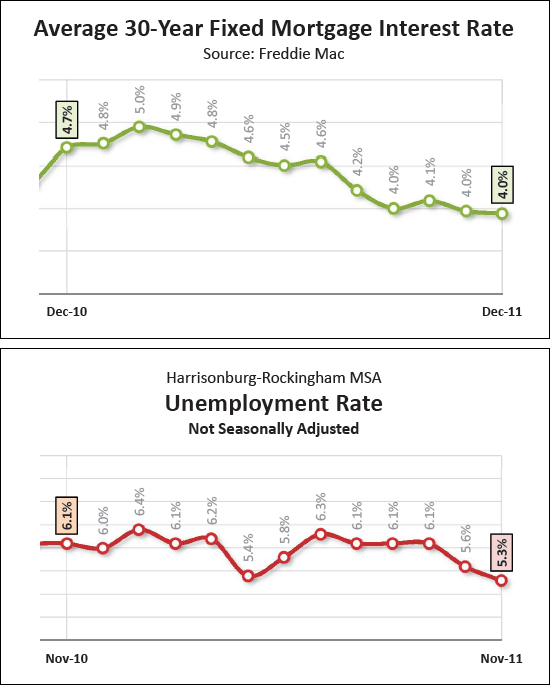

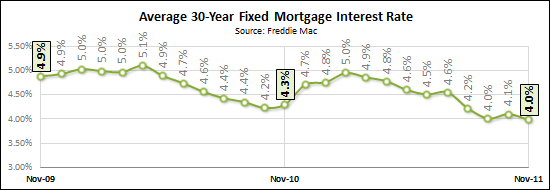

Friends and Colleagues --- Our local housing market has finally done it -- after a five year slide (and a 55% drop) in the pace of home sales, the tide has finally turned in 2011. Our local real estate market showed a 4% improvement in the pace of home sales last year, even though the median sales price declined another 3%. Jump to the PDF of my monthly market report, or keep reading for an overview. Speeding through the finish line....  The local housing market didn't slow down for the close of 2011 -- it poured on the gas to accelerate through the finish line with a strong month of 79 home sales in December. This was the strongest December in at least four years. October and November could have had us worried, with sales in the 50's, but apparently the market was holding back to create an exciting photo finish in December. The Great Reversal....  After five years of seeing fewer and fewer home sales in our local area (from 1669 in 2005 down to 758 in 2010) we finally experienced an increase in buyer activity during 2011 -- with 791 home sales. This marks a 4% improvement in the pace of home sales. The not-quite-as-exciting news, of course, is that the median sales price declined another 2.83% over the past year. But certainly, we needed to see this stability (and now growth) in sales pace before we could reasonably expect to see stability in sales prices. Hello Buyers, Good Bye Sellers....  For the past few years, there have been too many sellers in the market, and too few buyers. 2011, however, has told a different story -- one of returning stability. Not only did home sales increase 4% in 2011, but inventory levels declined 15%. While we still have a ways to go, both of these trends are headed in the direction of increased stability in our local real estate market. We Won't Miss You Mr. Foreclosure....  Foreclosures (and then bank owned homes) have dragged housing markets down across the country. Thankfully, not only did home sales increase this year in our local market (blue bars above), but foreclosures also declined (red bars above). This 17% decline in foreclosures during 2011 shows promise for fewer bank owned homes, and greater market stability in 2012. What else would help? Lower interest rates? Lower unemployment rates?  The stage is set for further stability in our local housing market during 2012 -- mortgage interest rates are at historic lows (below 4%) and our local unemployment rate is at its lowest level in over two years. Looking Forward After a 2005 peak, and a 2010 valley, 2011 brought a long awaited step towards stability in our local housing market as sales began to increase again. The pace of home sales is likely to increase even further in 2012, and we just might start to see some stability in median prices --- if not in 2012, then I would imagine we would certainly see that in 2013. For a more detailed look at the Harrisonburg and Rockingham County real estate market, download my full market report as a PDF. And -- if you have questions about the local housing market, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

The competition is stiff, oh wait, no it's not! |

|

In preparing to list a home for sale, I met with my clients and we examined the competition that their home would have given its characteristics (size, location, age, price). We were surprised that there were not too many comparable homes (at all) on the market right now. If someone wants to buy this home, they won't be comparing it side by side with others that are quite similar in size, location, age and price. One reason why some homes for sale don't have as much competition is because of the overall decline in the number of homes listed for sale. Inventory levels have dropped 16.5% over the past year, and there are now only 657 homes (single family, townhomes, condos) on the market in Harrisonburg and Rockingham County. This is good, folks, especially if you are ready to put your house on the market and it is in a decent neighborhood, has been well maintained, and you are able to price it reasonably given market conditions. If you'd like to examine your competition, just call (540-578-0102) or e-mail me (scott@HarrisonburgHousingToday.com) and we can set up a time to meet. | |

2011 Year in Review of the Harrisonburg and Rockingham County Housing Market |

|

Here is an overview of some of the more interesting, noteworthy, and/or popular stories of 2011 in the Harrisonburg and Rockingham County real estate market.... JANUARY - Has the real estate market finally hit bottom in Harrisonburg and Rockingham County? "After five years of a declining residential real estate market in Harrisonburg and Rockingham County, I think we might finally be poised to see an increase in sales activity." read more FEBRUARY - Preston Lake Foreclosure Auction Results In $3.5M Sale To Wells Fargo "The Preston Lake Trustee Sale took place today, February 3, at noon, and drew quite a crowd of Preston Lake homeowners, developers, attorneys, Realtors, and neighboring landowners. Here's an overview of where things stand." read more and more and more MARCH - Sale of North 38 Apartment Complex Sets New Valuation of Student Housing in Harrisonburg "An investor just bought a significant stake in the student housing market in Harrisonburg, which provides another data point upon which other student housing owners can value their investment." read more APRIL - How did Virginia fare in the housing bubble? "Virginia is one among a handful of states that experienced a net gain in housing prices between 2000 and 2010." read more MAY - Founders Way Condos are APPROVED for FHA financing! "As of this week, Founders Way Condos are approved for FHA financing. These spacious condos have wonderfully open floor plans with 2 or 3 bedrooms, and start at only $149K." read more JUNE - Downtown Harrisonburg has a grocery store! "The Friendly City Food Co-op opened this week, and it is a fantastic addition to Downtown Harrisonburg!" read more JULY - Are lower inventory levels leading to fewer home sales? "We wondered aloud as to why it might be that we can't find them a home right now --- yet at the same time, sellers are wondering why they can't find a buyer for their home right now." read more AUGUST - Did the federal home buyer tax credit impact the pace of home sales in Harrisonburg and Rockingham County? "The federal home buyer tax credit did not seem to have a lasting, positive impact on the local housing market." read more SEPTEMBER - Finding a rental property in or near Harrisonburg, VA "While you can find any property listed for sale (via the MLS) all in one place, it's not quite as easy to find rental properties." read more OCTOBER - Record low interest rates spur on buyer activity "Average 30-year fixed mortgage interest rates are now below 4.0%. Wow!" read more NOVEMBER - HarrisonburgREO.com, your source for bank owned -- REO -- properties in Harrisonburg and Rockingham County "If you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgREO.com." read more DECEMBER - Why am I cautiously optimistic about the future of our local housing market? "You don't need to tell me --- I know --- home prices are still on the decline. But here is the basis for my cautious optimism about our local housing market." read more | |

Should I list my home on Jan 1 or Mar 1? |

|

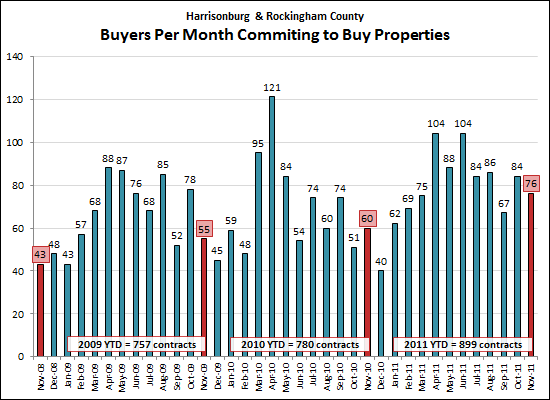

The annual question for those planning (or hoping) to sell their home in the spring or summer is whether to put your house on the market the first week of the year (we'll say Jan 1) or to wait until we're approaching spring (we'll say Mar 1). It's a double-edged sword --- while there will be more buyers several months from now.... there will also be more sellers, competing with you. Looking at this year (2011), between January and March:

So, while there is more competition with other sellers in March, the increase in buyers is even more significant. When comparing January to April, the change is even more extreme:

So, just when I (might) have you convinced to wait until April to put your house on the market, let me offer up this comparison:

Sure, 99 buyers per month makes your odds better than 69 buyers per month --- but it's not as if buyers are completely dormant over the next few months. Perhaps the best bet is to examine your house and your segment of the market more specifically. If you don't have much competition from other sellers right now based on the size, location, price range of your house, let's get your house on the market ASAP. If you have LOTS of competition right now with very comparable houses for sale, perhaps it makes more sense to wait for a few months. Feel free to call me (540-578-0102) or e-mail me to discuss whether it makes sense to get your house on the market now, or to wait until March or April. | |

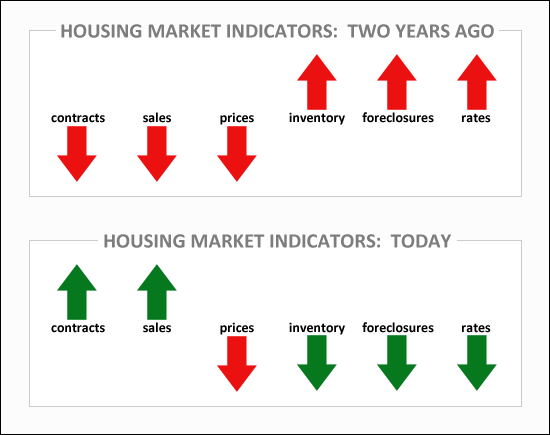

Why am I cautiously optimistic about the future of our local housing market? |

|

You don't need to tell me --- I know --- home prices are still on the decline. But here is the basis for my cautious optimism about our local housing market....  This illustrates the trends in general housing market indicators two years ago, as compared to the trends in general housing market indicators today. What do you think? Do I have some basis in reality for my cautious optimism? | |

Local housing market shows continued signs of gradual recovery |

|

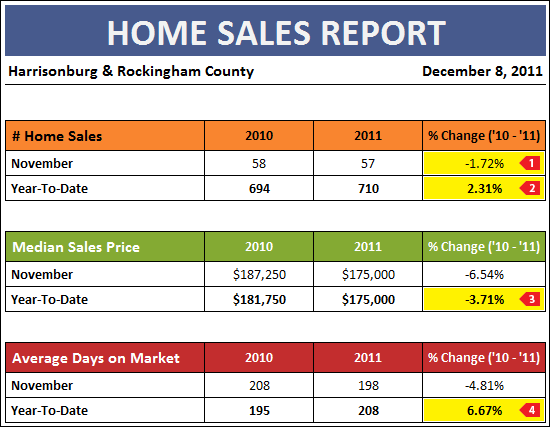

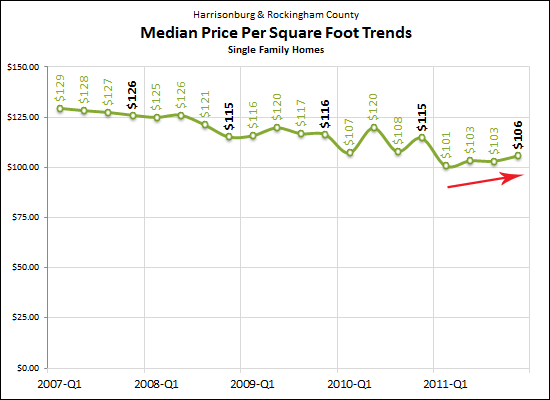

Click here to download my full market report (27 pages, 7 MB, PDF) or read on for highlights....  November was a relatively positive month for the local housing market:

A strong surge of buyers in 2011 is leading the charge towards more stability in the local housing market. As shown above, November 2011 was yet another strong month of contracts (76) showing a 27% increase over last November and a startling 77% increase over three Novembers ago.  Inventory levels continue to significantly decline, down 12% from a year ago. Lower inventory levels (fewer sellers) combined with an increase in contracts (more buyers) will eventually lead to greater balance in the local housing market.  Despite the fact that our local housing market's median price has not yet stabilized, it is interesting to note that we have seen a steady improvement in median price per square foot for single family homes over the past year. This is in sharp contrast to the steady decline seen in the four prior years.  The icing on the cake is that mortgage interest rates remain at historically low levels creating amazing opportunities for buyers. At the end of November, the average 30-Year fixed mortgage interest rate was 3.98%.  For an even more in-depth look at the Harrisonburg and Rockingham County real estate market, click the image above to download my full market report (27 pages, 7MB, PDF). If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

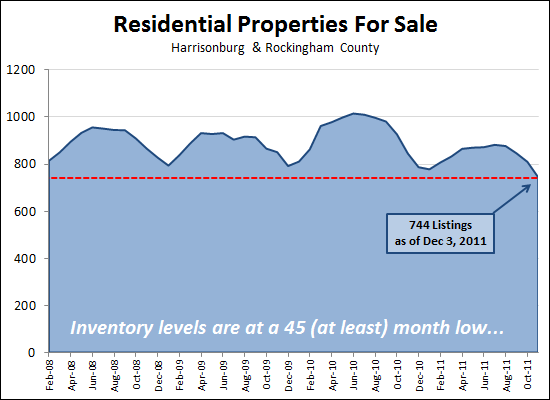

Inventory levels drop to 45 month low (at least) |

|

Each month inventory levels drop at the beginning of the month -- as quite a few listings expired on the last day of the prior month. So it's possible that today's incredibly low inventory levels (744 properties) will climb back up by a bit over the next few days. However, as things stand now, these are the lowest inventory levels we've seen in almost four years. It's actually probably quite a few more months than that, but I have only been tracking inventory levels for the past 45 months. What does this mean? Hope for further balance in the local housing market -- as the number of hopeful seller decreases, and the number of actual buyers increases, we'll return to a more balance market. | |

Budget 34% less for your housing costs at Taylor Spring |

|

Yesterday I pointed out that monthly housing costs have declined 28% since 2007 because of modest declines in median sales prices and significant declines in average mortgage interest rates. But let's make it a bit more specific.... The first townhouse pictured above was sold in 2007 for just $100 more than the median sales price at the time, and your monthly housing cost would have been $1,096 if you financed 80% of the purchase price at the average interest rate of 6.21%. The second townhouse pictured above is for sale now for only $159,200, and would require a monthly housing cost of only $719 -- again, assuming you financed 80% of the purchase price at today's average interest rate of 3.99%. This is quite a dramatic difference (-34%) in housings costs, and hopefully helps to illustrate the wonderful opportunities for buyers in today's market! | |

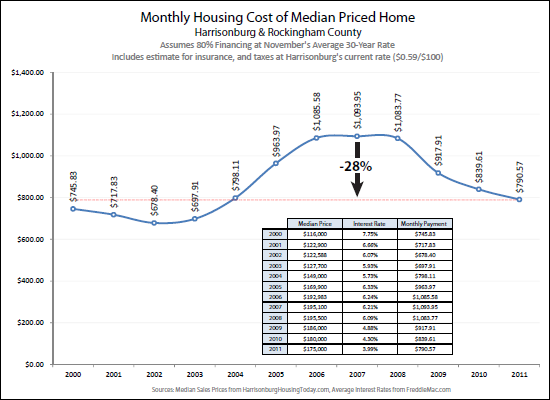

Monthly housing costs down 28% from 2007 peak |

|

How much does it cost on a monthly basis to buy the median price home in our area, assuming 80% financing? Today, that adds up to a $791 monthly payment. That marks a dramatic 28% decline since 2007 when the monthly payment would have been $1,094. The decline in median sales prices over the last few years (from $195K to $175K) combined with the decline in interest rates (from 6.2% to 3.9%) has brought average monthly housing payments down to very affordable levels. Again, the graph above (click here for a more legible PDF) shows the mortgage payment including principal, interest, taxes and insurance (PITI) assuming 80% financing at November's average 30-year interest rate, and assuming Harrisonburg's real estate tax rate ($0.59 per $100). | |

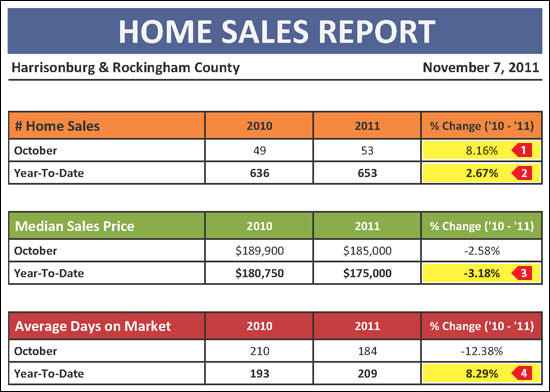

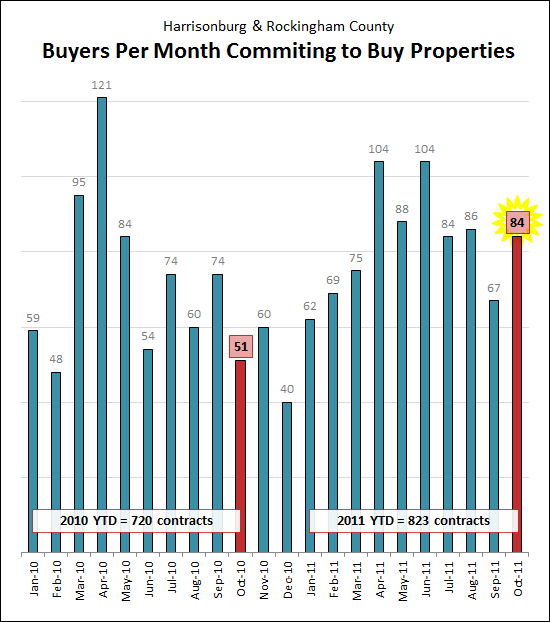

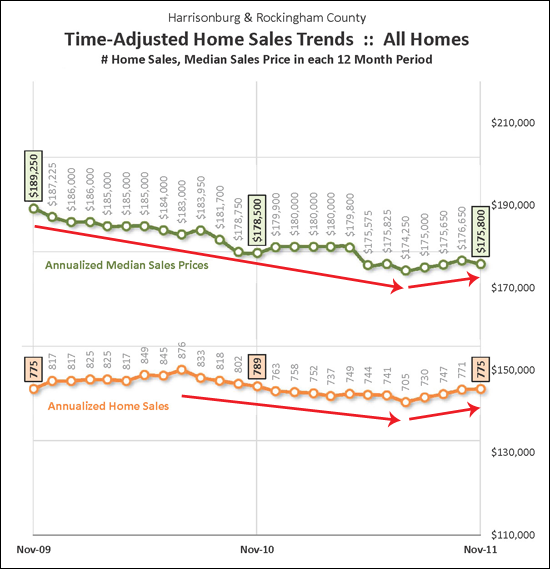

Home sales, contracts increase in October 2011, despite continued slow decline of home values |

|

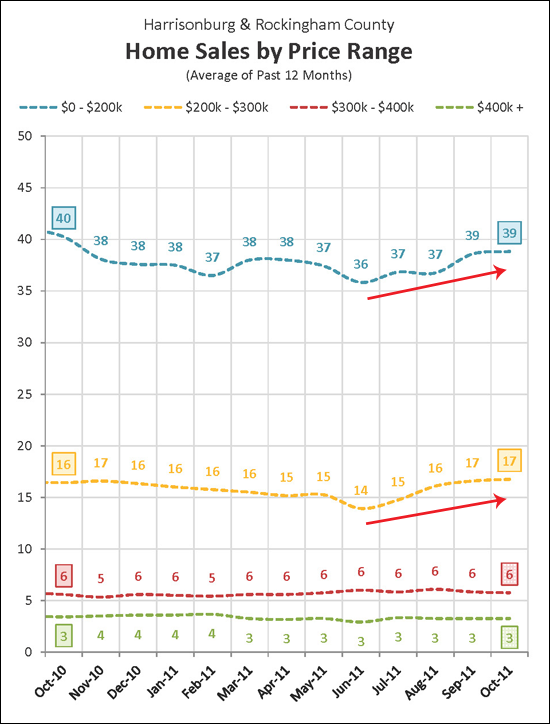

Click here to download my full market report (27 pages, 7 MB, PDF) or read on for highlights....  October was a relatively positive month for the local housing market:

A strong sign of strength to come in the local housing market, October 2011 was a great month of buying activity, with 84 buyers committing to buy homes in Harrisonburg or Rockingham County. This marks a 65% increase in buyer activity as compared to October 2010!  Trends are very slow to reveal themselves in annualized sales figures (shown above) because they are an indication of 12-month rolling averages. That said, it seems that it may be a safe bet that home sales and home prices are on the mend when examining the graph above, which has now been showing increases in these long-term indicators for four months.  Some price ranges are recovering more quickly than others. The graph above shows that the price ranges under $300K have been starting to see increases in sales over the past several months. This should eventually roll over into the higher price ranges as buyers move up the price spectrum.  For an even more in-depth look at the Harrisonburg and Rockingham County real estate market, click the image above to download my full market report (27 pages, 7MB, PDF). If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings