| Newer Posts | Older Posts |

Will 30-year fixed mortgage interest rates fall below 3.5% again? |

|

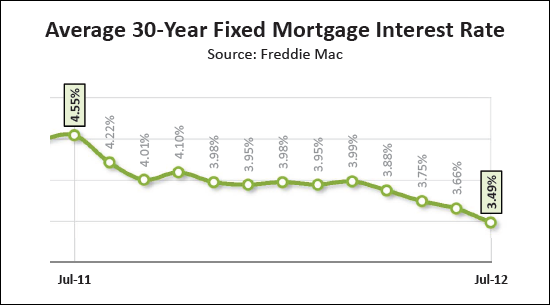

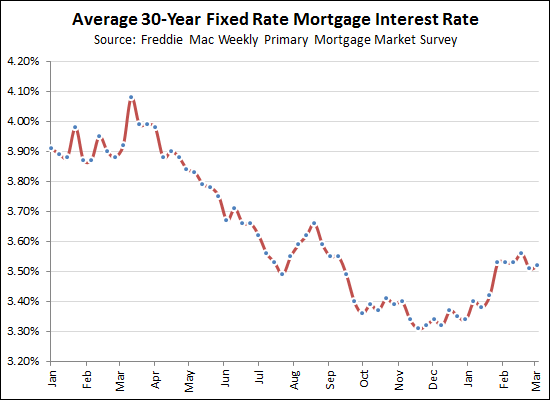

Lest I be accused of only talking about mortgage interest rates when they are falling.... As you'll see above, interest rates have generally been on the rise since the beginning of the year. After staying below 3.5% between September 2012 and January 2013, they have now edged back up. These mortgage interest rates are, of course, still unbelievably low -- both over the long-term (the past year's rates are the lowest ever) --- as well as in the short term (rates are 0.5% lower than a year ago). If you are considering a home purchase this spring or summer, now might be an excellent time to become pre-approved, find a house and lock in an ultra-low mortgage interest rate! | |

If you were waiting for the bottom of the market, this is it. |

|

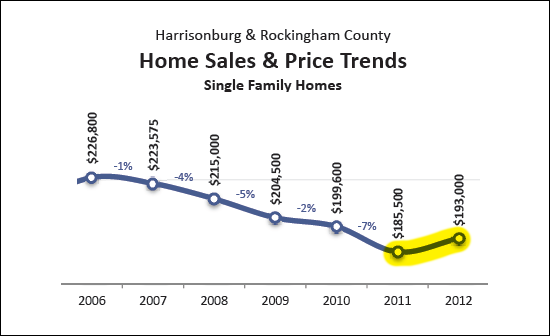

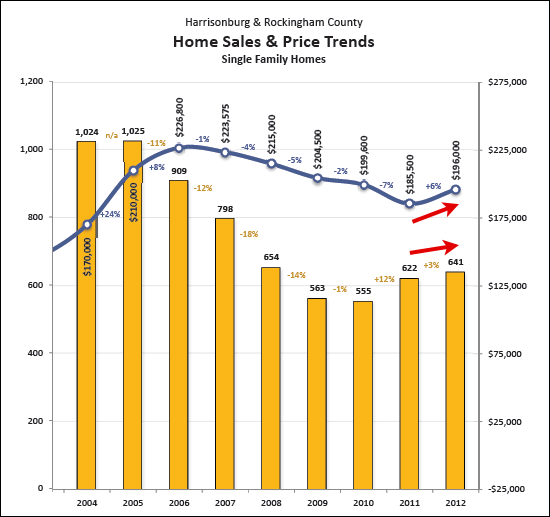

After five years of declining sales (2005-2010) the pace of single family home sales finally increased in 2011. After five years of declining sales prices (2006-2011) the median price of single family homes (sold) finally increased in 2012. At this point, I'm not expecting either of those to start declining again over the next few years (even if they don't increase exponentially either) -- so, if you were waiting for the bottom of the market, this is (or was) it. Buyers -- act early in 2013 before prices continue to increase through 2013. Sellers -- be realistic about pricing, to best present your house to potential buyers. I'm expecting to see further recovery in both pace of sales and price of sales during 2013. | |

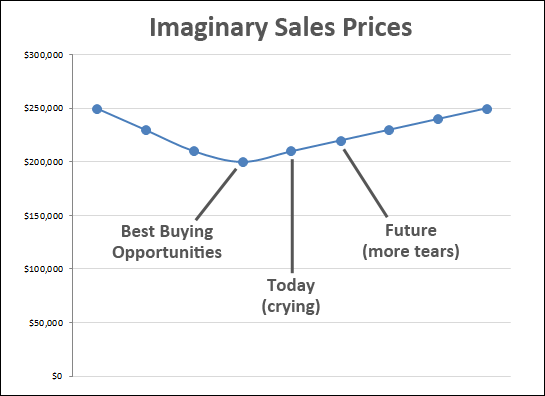

In a market upswing, crying over missed past buying opportunities can lead to even more tears |

|

In the fictitious value trend graph above, the best opportunities were yesterday (or some time before now). As a housing market starts to improve, some buyers have a tendency to get stuck on the fact that they just missed out on the lowest prices seen during a market downturn. It is important for those tearful buyers to remember, however, that there will likely be more tears and larger tears tomorrow (or some amount of time into the future) when prices have recovered even further. For example....

A few notes and disclaimers....

| |

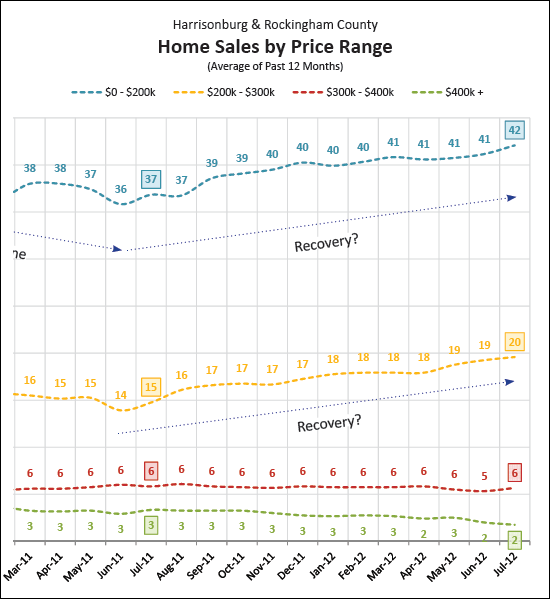

Has the local housing market started stabilizing and/or recovering in all price ranges equally? |

|

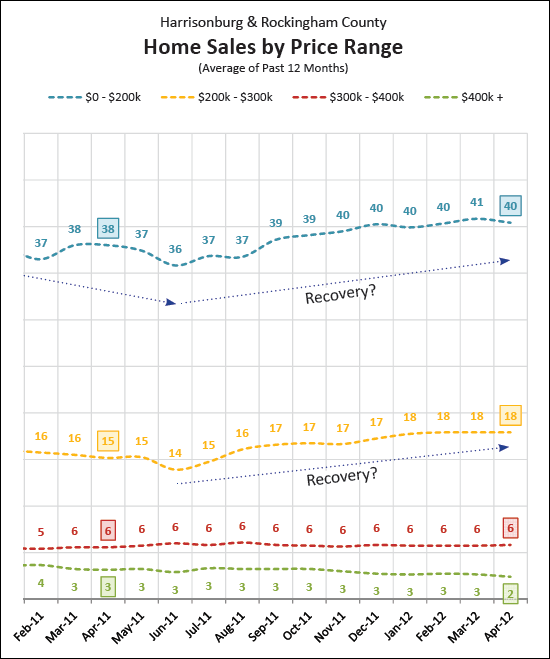

Yesterday, I was chatting with two different people about the housing market and both were wondering how the potential local recovery (or at least stabilization) impacted different price ranges. The increased pace of home sales over the past year has not affected all price ranges equally, as shown in the graph above:

The winner, it seems, is the $200K - $300K price range, though the lowest price range (under $200K) is also doing quite well. | |

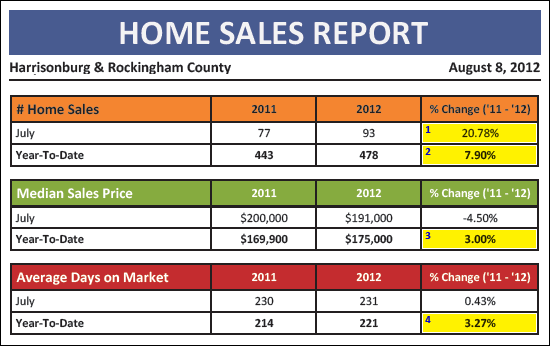

Home Sales Up 8%, Prices Up 3% in Harrisonburg, Rockingham County |

|

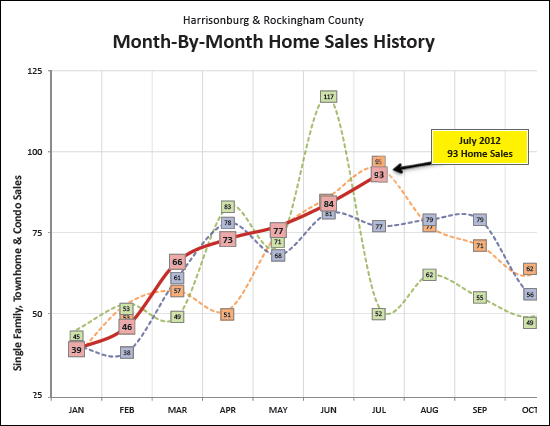

Seven months into 2012, the Harrisonburg and Rockingham County housing market is showing signs of steady improvement in the pace and price of home sales. Click here to download the PDF of my full market report, or read on for highlights.  Most indicators above show signs of a stabilizing local housing market:

July 2012 was quite a month for home sales --- and this year has shown a strong upward May-June-July sales trajectory, not unlike the 2009 sales trajectory.

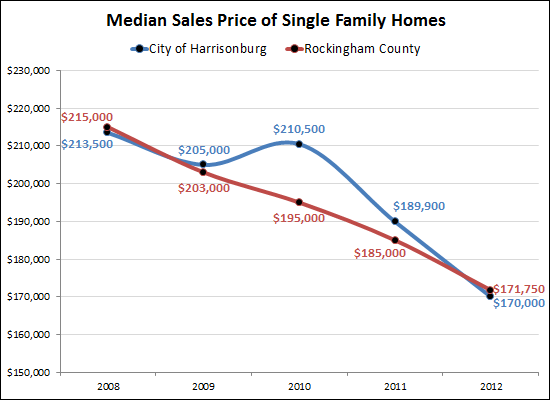

While the graph above only shows price trends for single family homes (not the overall market) it is encouraging (for sellers, at least) to see a halt to the multi-year decline in home prices in the area.

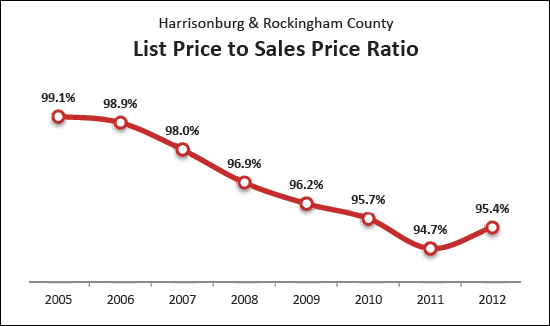

Among other market trends to improve, the list price to sales price ratio has also started to improve in Harrisonburg and Rockingham County. This means that sellers are (on average) negotiating less off of their asking prices when selling their homes. This is more welcome news for sellers --- and buyers should take note that their window of maximum negotiating ability might be starting to close.

Record low mortgage interest rates have certainly helped to spur on the local housing market as buyers continue to take advantage of their opportunity to lock in their housing costs for now and the future. For much more insight and analysis, click on the image above to download my full market report specifically focused on Harrisonburg and Rockingham County. | |

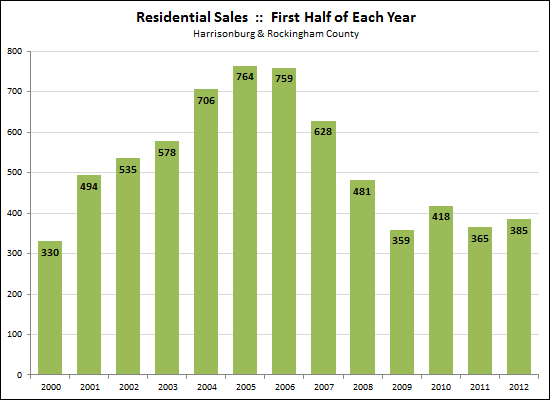

How did the first half of 2012 compare to previous years? |

|

Things to note....

What this means for you....

| |

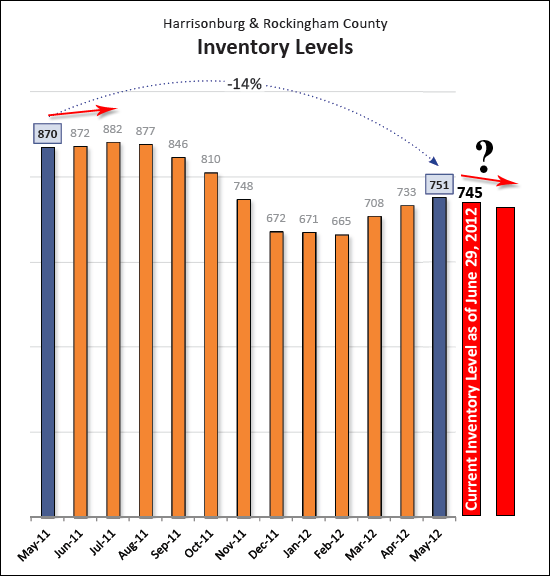

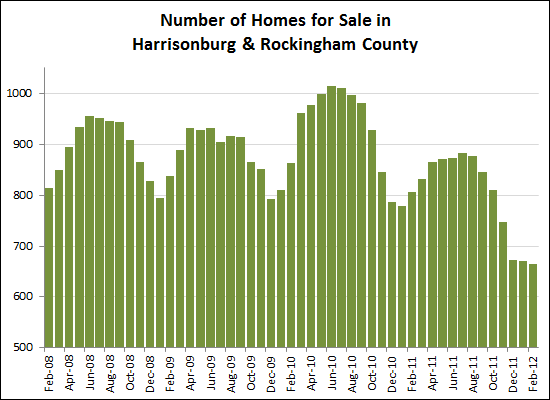

Local housing inventory bucks historical trend |

|

Summer is not quite over yet (100 degrees today, I hear) --- but the local housing market is already showing some signs of fall --- and that's a good thing! Typically our local housing inventory continues to increase through July before starting to decline heading into the fall. This year, however, we're seeing a decline in local housing inventory earlier than we typically do. Perhaps it is the result of more buyers making buying decisions. Perhaps fewer sellers are trying to sell. Whatever the reason, it is helping to (slowly but surely) bring more balance back to our local housing market. | |

Are sellers accepting home sale contingencies? |

|

Plenty of houses are going under contract, but are sellers accepting home sale contingencies?  Based on the analysis above, it would seem that they are not (in almost all cases) accepting home sale contingencies. Here's the logic....

I must say, I was quite surprised to find this to be the case --- I thought perhaps 10% - 20% of contracts might have kickout clauses (and thus home sale contingencies) because plenty of buyers have to sell before buying. It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyers' houses are already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

Understanding Real Estate Assessments |

|

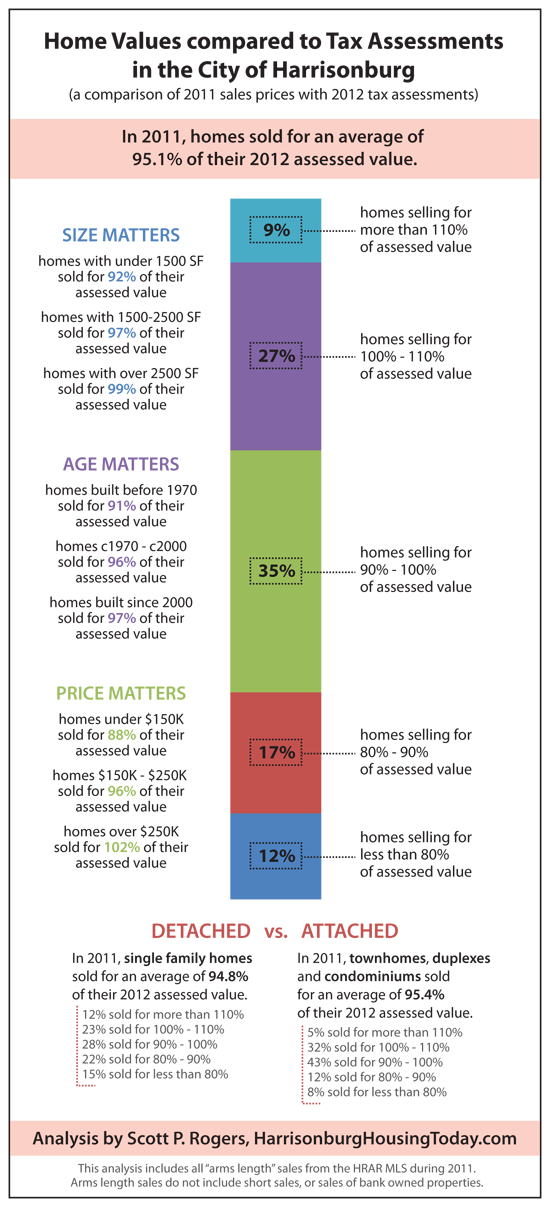

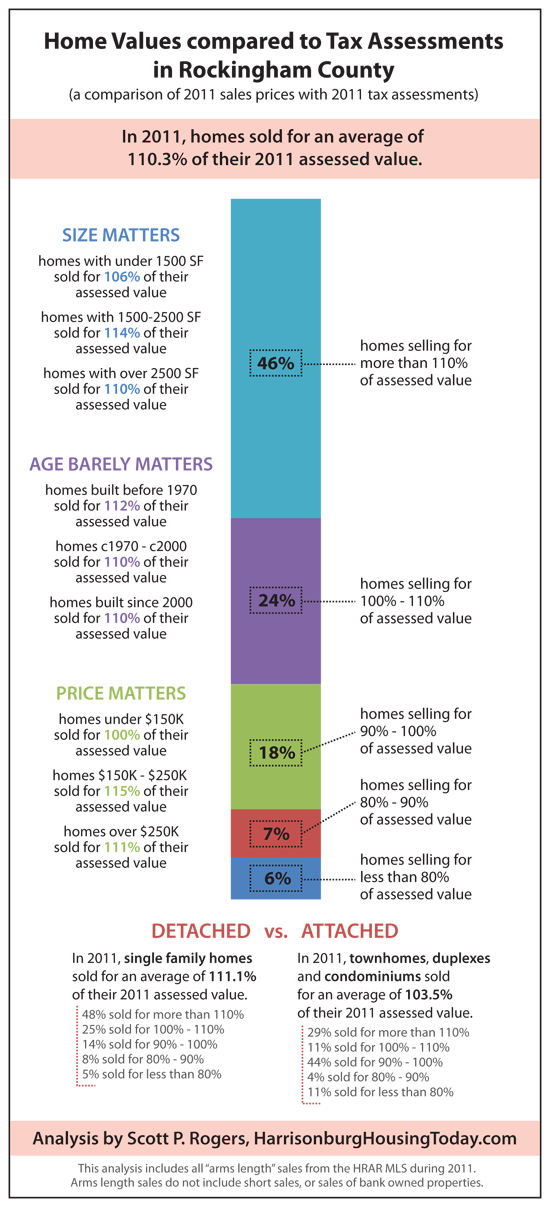

As published yesterday in the Shenandoah Valley Business Journal. Many people believe the assessment of their property istheir home's value. In actuality, theassessed value of a property is the value assigned to the property by the localassessor's office, for the purpose of determining how much you will pay intaxes. Certainly, the assessed value is intended to be the precise valueof your home – but quite frequently there is a disparity in this assessed valueand market value. The market value ofyour home is the price at which it would sell in the current market. Of interest, the City of Harrisonburg real estateassessments are currently a bit more accurate than those in RockinghamCounty. As can be seen in theinfographic, homes sold during 2011 in the City of Harrisonburg sold for 95.1%of their current assessed value. Breaking it down further, 64% of the homes that sold during 2011 in theCity of Harrisonburg sold at a lower price point than their assessed value. This is an indication that many City propertyassessments are likely a bit too high. In Rockingham County, most property assessments are too low –as 70% of properties that sold in 2011 sold for more than their assessed value– and on average, properties sold for 110% of their assessed value. Of note, homes in the City of Harrisonburgare re-assessed every year, while homes in Rockingham County are onlyre-assessed every four years. In thepast, this has resulted in lower than expected assessments in Rockingham Countydue to the infrequent updates to their assessed values. Given the great variation in assessed values and marketvalues, homeowners should not rely on their tax assessment for an understandingof their property's value. Furthermore,home buyers should not rely on assessed values to guide them in understandingthe market value of a home that they might purchase. Both buyers and sellers should strive tounderstand the market value of a particular piece of real estate my analyzingsimilar homes that have recently sold and those currently on the market in agiven neighborhood or price point. Click on either image below for a printable PDF.... | |

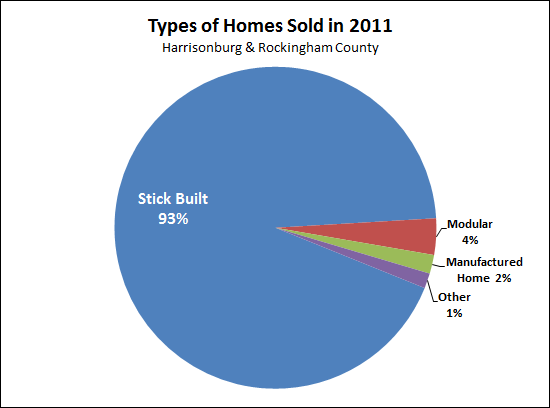

Are modular homes common in our local market? |

|

Before we get to the presence of modular homes in our local market, let's review some terminology.... According to Wikipedia, a stick-built structure is "one constructed entirely or largely on-site," as opposed to a modular home that is "divided into multiple modules or sections which are manufactured in aremote facility and then delivered to their intended site of use." And here is a breakdown of the types of homes sold via the HRAR MLS last year....  Click here to read about some opinions of stick built homes versus modular homes. | |

Oops, sorry, that's already under contract |

|

I've been hearing that a lot lately.....  Contracts are on the rise --- and more and more of the competitively priced listings are selling, and selling relatively quickly. In the first 25 days of May there have been 81 contracts --- that is compared to only 60 in the same time period last year! Buckle up, it looks like we might have a strong summer sales market on the way! | |

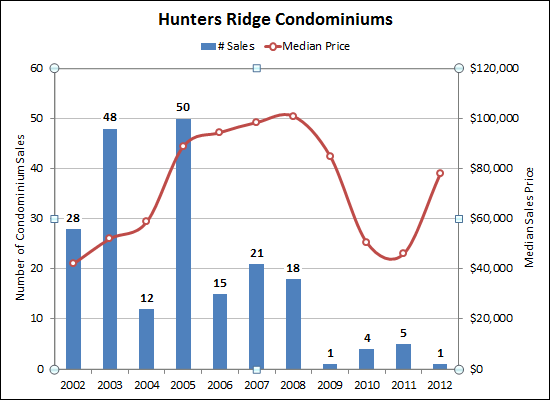

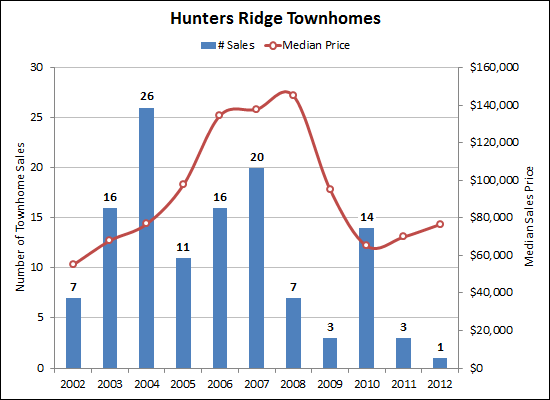

Property values increasing in Hunters Ridge? |

|

Is it possible that values at Hunters Ridge have bottomed out and are on the rise? Don't read into the upswing too much, as there is only one data point for each property type so far this year --- but this will be a trend to continue to monitor.   View currently available condos and townhouses in Hunters Ridge. | |

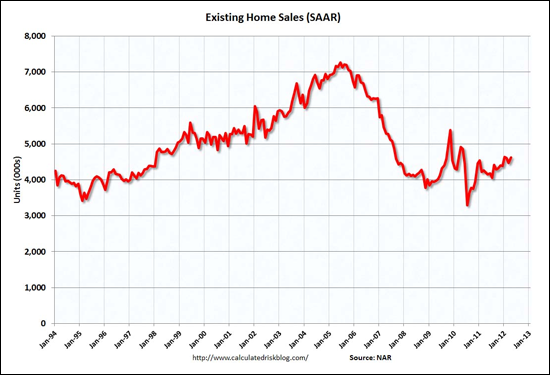

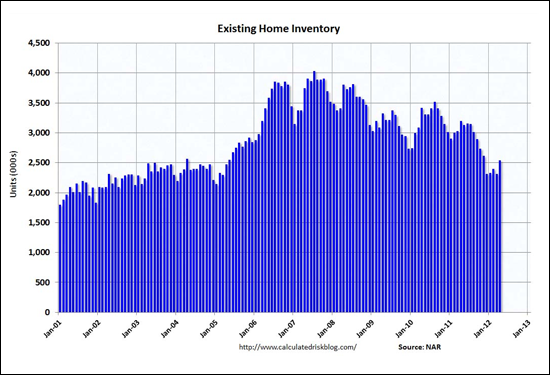

Nationally, sales are up, inventory down per NAR, Calculated Risk |

|

Just as we have seen over the past 6 to 12 months in Harrisonburg and Rockingham County as well as in Virginia, home sales are increasing and inventory levels are dropping on a national level as well.   Read more from NAR and Calculated Risk. | |

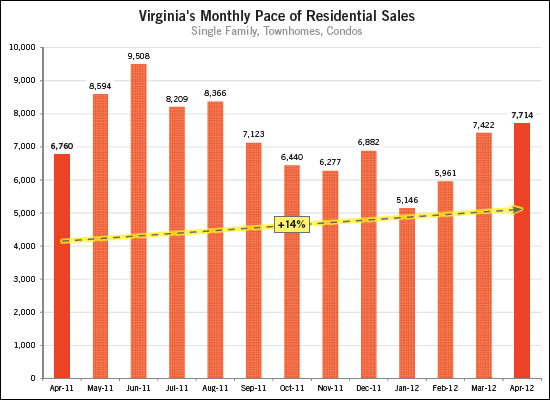

Overall Virginia housing market continues to gain strength |

|

From the Virginia Association of Realtors this morning....  Home sales (# of sales) and median prices are both up across Virginia! Click the image below to download the full Virginia Home Sales Report.  | |

Demand grows for new homes |

|

A new foundation (pictured above) is going in at The Glen at Cross Keys as a result of growing local demand for new homes. Photo by Carey Keyes. Along with Carey Keyes and Suzanne Trow, I represent several of the main builders in the Harrisonburg area. In the past 30 days the model home at each of these communities was sold....

| |

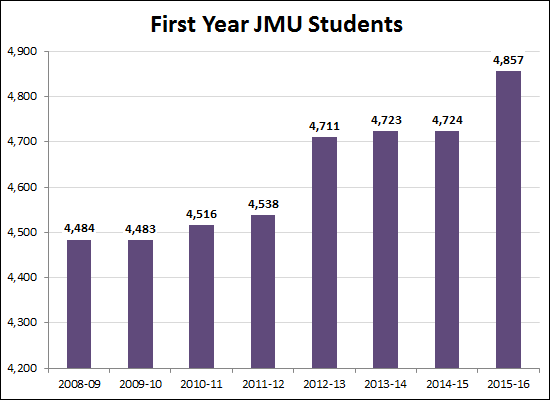

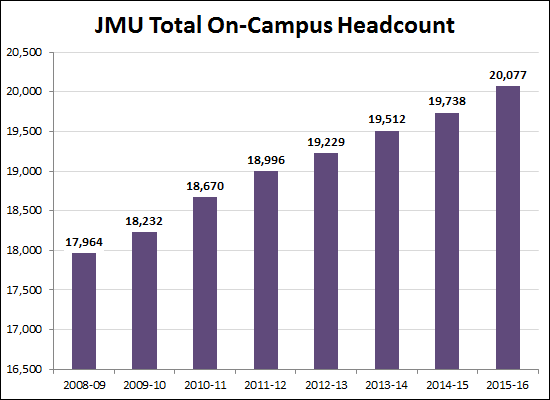

JMU (slightly) boosts first year student count, continuing steady growth trajectory |

|

After several years in a row of relatively similar sized classes of first year students at JMU, the first year headcount will jump up a bit this coming year, as shown above.  Despite this jump in first year students, the overall growth trajectory will stay relatively similar to what JMU has experienced over the past several years. These increases in enrollment will (gradually) help the over-supplied student housing market in Harrisonburg. If you haven't heard, there are many more places for students to live than there are students. (read up here) These increases are also (continued) great news for the local economy, as JMU is a major economic engine for the local economy -- as both students and faculty/staff live here, work here, spend here, etc. This is not, of course, to ignore the significant contributions made to our local economy by Bridgewater College, Eastern Mennonite University and Blue Ridge Community College. The data for the graphs above is based on JMU's enrollment projections. "Total On-Campus Headcount" is the number of students who are taking classes on the JMU campus. | |

Housing recovery more evident in lower price ranges |

|

The graph above shows the average number of home sales per month (in each of four price ranges) when evaluating a 12-month time period. For example, the last data point shows the average number of home sales per month for May 2011 - April 2012. As is quite evident, the recovery (in the pace of home sales) is more pronounced in the lower price ranges. | |

Explain this to win a $10 Starbucks gift card: Why did single family home values diverge in Harrisonburg, Rockingham County between 2009 and 2012? |

|

I'll give a $10 Starbucks gift card to the person who can provide the correct explanation of the graph below. OK, I'll be fair, I don't know what the correct answer is. :) So, I'll give the gift card to the most believable answer. Leave your answer as a comment below, or e-mail me (scott@HarrisonburgHousingToday.com).  | |

Local housing inventory hits four year low |

|

Yes, you heard me correctly -- there are fewer homes on the market than we have seen anytime in the past four years.  The inventory data above is current as of a few days ago when I published my monthly market report. At that time there were 665 homes on the market --- fewer than anytime in the last four years, including any of the winter months over the past few years. Inventory is starting to pick up a bit (678 as of this morning) but there are still fewer homes on the market than we've seen in a while. This certainly helps sellers, as there is less competition -- though it is certainly still a buyer's market. | |

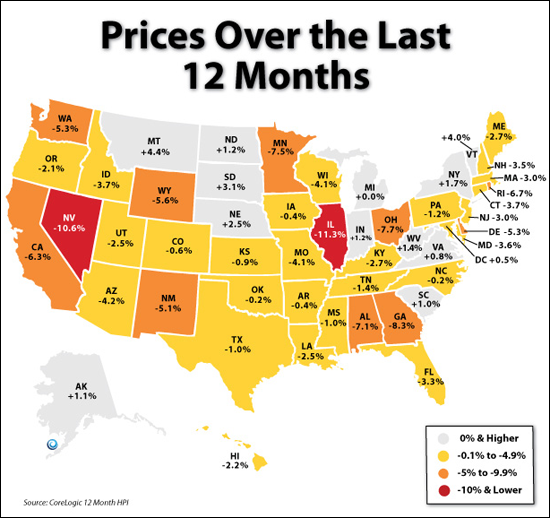

Virginia home prices continue to fare well, comparatively |

|

Source: KCM Above you will see the state-by-state change in home prices over the past 12 months. The majority of states (yellow, orange, red) have seen a decline in prices over the past 12 months --- but not Virginia. Stability in the overall housing market in Virginia is a result of overall stability in Virginia's economy and job market -- both of which positively influence our local economy and housing market as well. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings