| Newer Posts | Older Posts |

Is $250K The Sweet Spot of our Local Housing Market? |

|

As Hannah observed out this morning (thanks Hannah!) the $250K price point seems to be the sweet spot for our market. As a random aside, while I use the expression "sweet spot" with some regularity, I had forgotten its primary meaning, which Google informs me is... "the point or area on a bat, club, or racket at which it makes most effective contact with the ball" As a further aside, I have no idea if the tennis player pictured above is about to hit the tennis ball at the sweet spot of the racket!? But I digress. The second definition of "sweet spot" per Google is... "an optimum point or combination of factors or qualities" And that, I believe, sums up Hannah's point about the $250K price point... 1. There are LOTS of buyers who would like to buy $250K-ish homes. 2. Inventory is extremely low around the $250K-ish price point. 3. Builders aren't really hitting that $250K price point with many new homes being built. So - if you own one of these homes already - congrats, and know that you could likely sell it if you need to do so. And if you want to buy one of these homes, consider my usual advise for buyers in this fast paced market -- know the market, know the process, know your buying power, and closely monitor new listings! | |

Hey Builders, Harrisonburg is an Increasingly Popular Place to Live, Keep Up, Please! |

|

OK -- no numbers today. Just a few thoughts that have been coming up in conversation after conversation over the past year. Inventory levels (the number of houses for sale at any given time) have been quite low when looking at the City of Harrisonburg and immediately surrounding areas. Many buyers are having a tough time finding a home to buy. Many houses are selling quickly because there are many buyers who want to buy them when they hit the market. I believe a significant reason why housing inventory levels are so low is because people are deciding they want to live in (or stay in or move to) Harrisonburg faster than builders are building new homes for them to purchase. Sometimes it is young adults who just graduated from JMU, EMU, or Bridgewater College and who want to stay in the area. Sometimes it is a local college grad moving back after having had a taste of life in the big City. Sometimes it is parents of these college grads turned Harrisonburg residents who are moving to Harrisonburg to be close to the grand kids. Whomever it happens to be -- more and more people are deciding they want Harrisonburg (or close to it) to be their home. And I believe they are deciding this at a faster rate than new homes are being built. Side note -- lots of rental housing is being built right now. This sort of helps -- people can rent if they can't find something to buy -- but it is not a viable long-term solution. So -- builders -- let's get to building some new homes, why don't we? It is time -- the home buying population is growing, and needing housing.... | |

Approaching March, A Different Look For Our Local Housing Market |

|

This is a bit of a different look for our local housing market. Ignoring last year, there have always been between 500 and 900 homes for sale in Harrisonburg and Rockingham County when entering into March -- the very early edge of the Spring real estate market. Last year -- that number felt low -- only 402 homes on the market in early March. This year -- low doesn't even describe it -- there are only 279 homes on the market right now. There is bound to be a surge of buyers hoping to contract on homes this March, April, May and June. What will they find as they enter into our local housing market? Very few houses for sale. And lots of competition from other buyers!!! | |

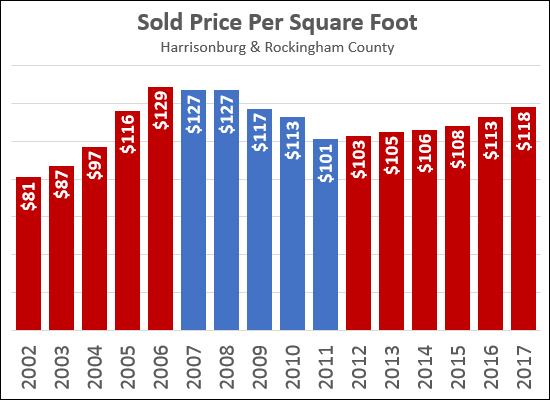

Median Price Per Square Foot Keeps On Rising |

|

In addition to watching how the median sales price changes over time, it can be quite insightful to see how the median price per square foot of sold homes changes over time. The graph above tracks the median price per square foot of single family homes (not townhouses, duplexes or condos) in Harrisonburg and Rockingham County over the past 15 years. Price per square foot increased 59% between 2002 and 2006 during the housing boom, but then fell 22% between 2006 and 2011 as the market cooled back off. Since that time, however, we have seen a slow and steady increase in this metric -- from $101/SF in 2011 to $118/SF last year -- which marks a 17% increase over the past six years. I do not expect that we will see any drastic increases in this metric in the next few years, though an increasing number of buyers (more demand) and significantly fewer sellers (less supply) does make you wonder if we will start to see more rapid increases in sales prices, and thus in price per square foot. ALSO OF NOTE -- this metric is most helpful in understanding value trends over time -- not in calculating the value of one particular property. This median price per square foot is the mid point of many very different homes -- new homes, old homes, homes with garages, homes without garages, homes with basements, homes without basements, homes with acreage, homes on small lots, etc. A median price per square foot can be more helpful in understanding the potential value (or value range) of a single property if we pull that median value based on a smaller data set of more properties more similar to the single property. | |

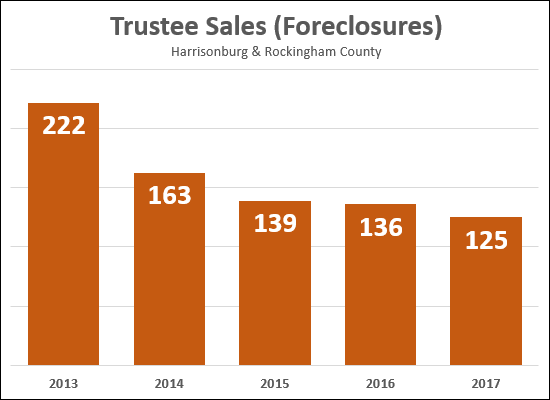

Fewer and Fewer Foreclosures |

|

Well, here's a good indicator that our local housing market continues to become healthier over time -- as shown above, the number of foreclosure sales per year has continued to decline over the past several years. To put these into an even larger context:

All in all, it is a good sign for our local housing market when the number of foreclosures per year declines. It means more homeowners are able to stay in their homes, and make their mortgage payments, which is a general sign of a stronger local economy. | |

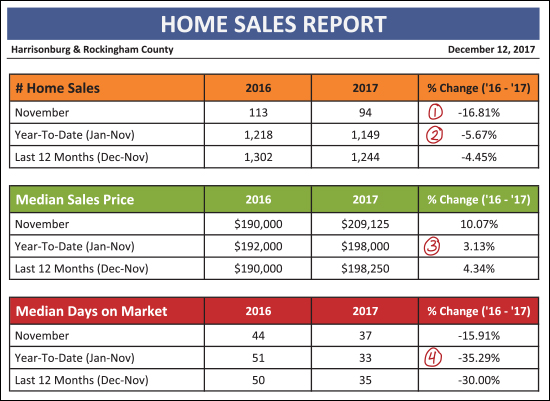

Local Home Sales Slow, As Inventory Declines, But Prices Are Rising! |

|

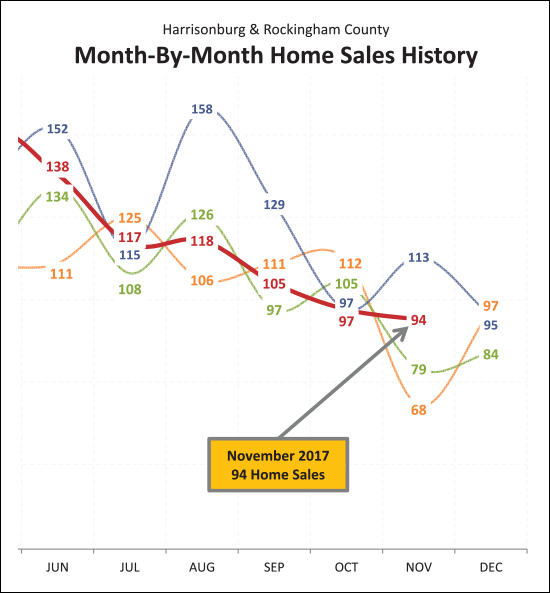

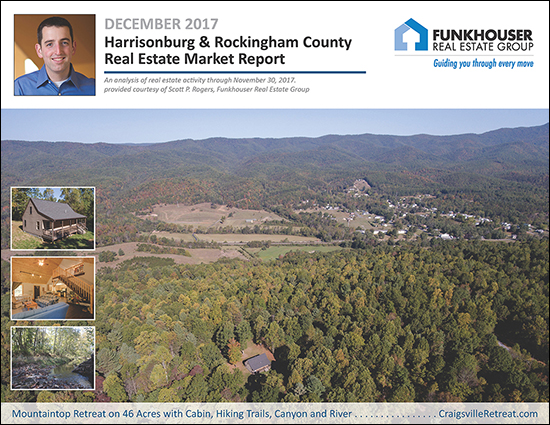

Find out more about this Mountaintop Retreat on 46 acres with a cabin, hiking trails, canyon and river here. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  Now, let's take a closer look at some of this month's data....  As can be seen above....

Last year certainly was interesting!?! Or odd!?! Last August, September and November were OFF THE CHARTS as far as a record number of home sales for those months -- which then makes this year's sales trajectory seem as slow as mud in August, September and November. This November's sales were a good bit higher than in 2014 and 2015 -- but were solidly below November 2016.

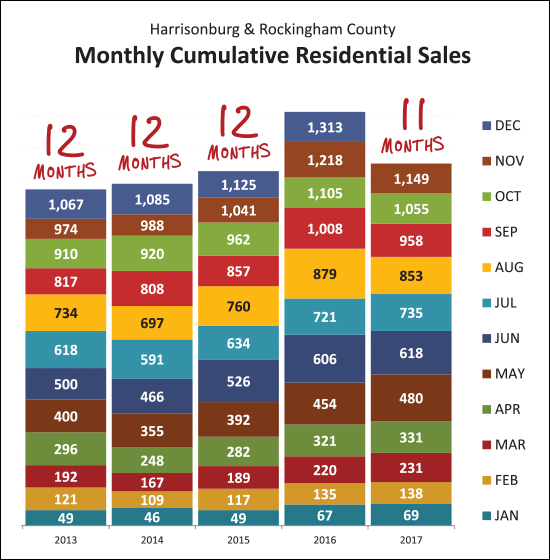

So -- despite the fact that 2017 is hiding in the shadows of a towering year of sales in 2016 -- it is interesting to note that the 11 months of home sales thus far in 2017 (all 1,149 of them) has already surpassed the full 12 months of sales seen in 2013 (1067 sales), 2014 (1085 sales) and 2015 (1125 sales). As such -- while total home sales will likely be 5% to 6% lower this year than last -- that will still mark a solid improvement as compared to any other recent year.

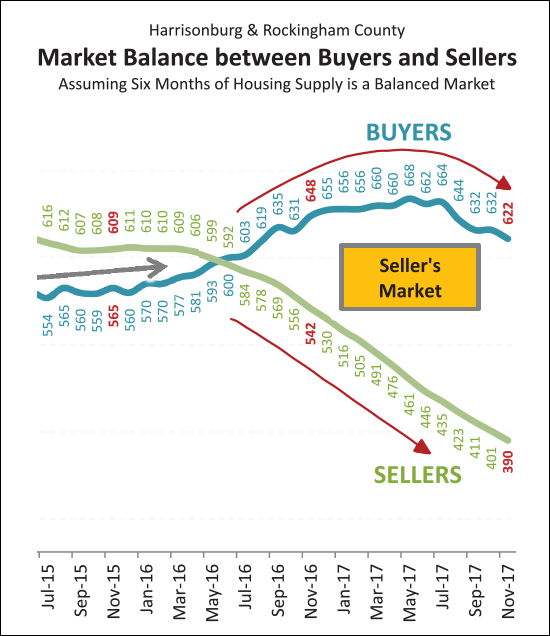

After quite a few years of steady increases in buyer activity -- we are starting to see a decline. Over the past six months we have seen buyer activity taper off and start to decline. I believe this is a direct result of the drastic reductions in the availability of homes for those buyers to buy. As the number of sellers in the market at any given time has declined, eventually that also resulted in a reduction in the pace of buying activity.

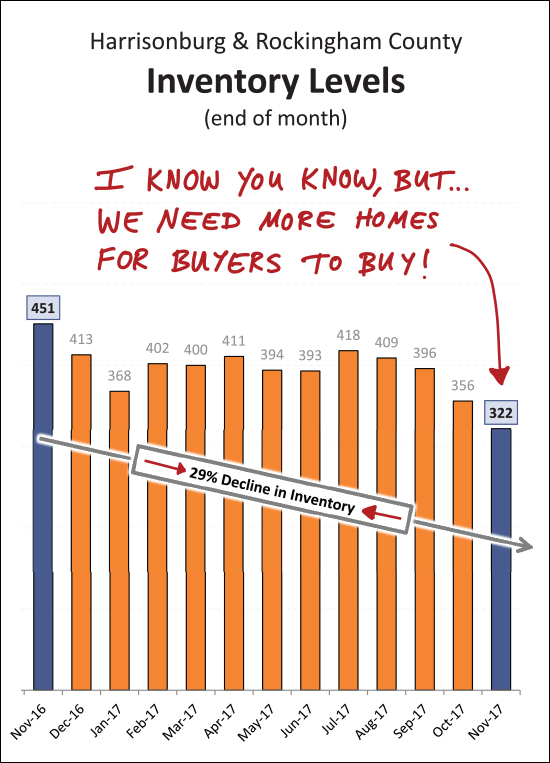

Yeah, so, about those inventory levels. They are low and getting lower!?! And, realistically, when and how do we think that would or could change? In theory, inventory levels will rise this coming Spring -- except they didn't during 2017. Looking back, the end of last November was the highest inventory level we saw for the following 12 months!?! So -- hmmm -- absent any outside factors (new home construction, anyone?) it is possible that the current inventory level (322 homes for sale) could be the highest inventory level we will see for the next 12 months!?! Stop and think about that for a moment....

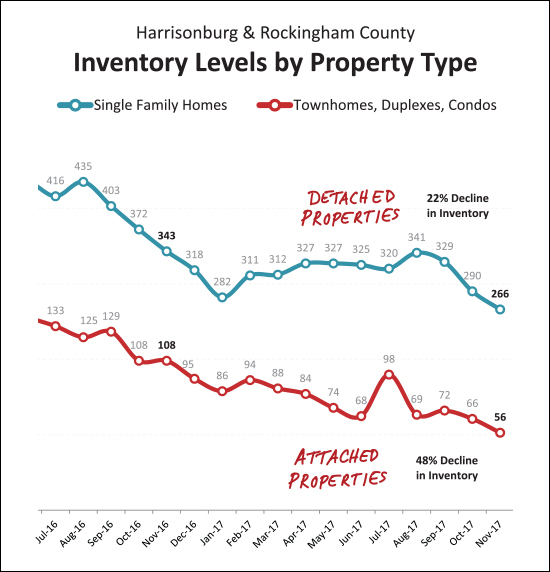

Somewhat interestingly, as shown above, there has been a larger (proportional) decline in inventory levels for attached properties (townhouses, duplexes, condos) than for single family detached properties. There are now only 56 townhouse/duplex/condo properties available for sale in all of Harrisonburg and Rockingham County! And finally -- one last look at some interesting trends....

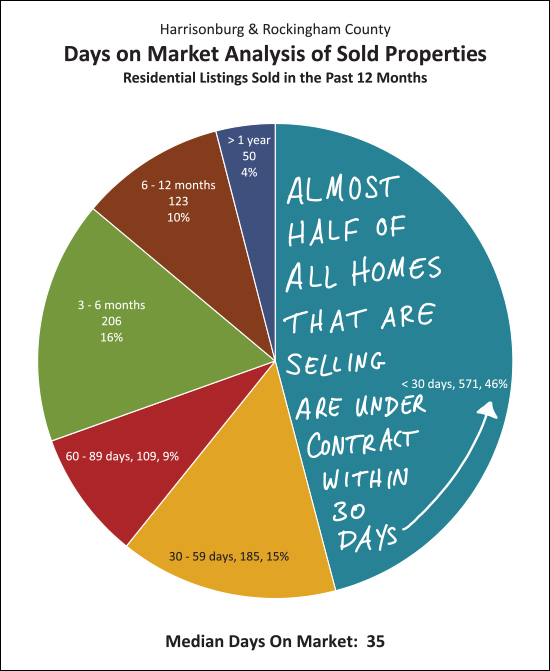

As shown above, nearly half (46%) of homes that are selling (not of all that are listed) are selling (going under contract) within 30 days of hitting the market. So -- yes -- the market is moving pretty quickly in many locations and price ranges! OK -- I'll stop there for now. There is plenty more in my full market report, so feel free to download it as a PDF, read the entire report online, or watch/listen to a video overview of this month's report. And, my reminders for buyers and sellers last month still apply.... SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Local Home Prices Rise Despite Slightly Slower Sales Pace |

|

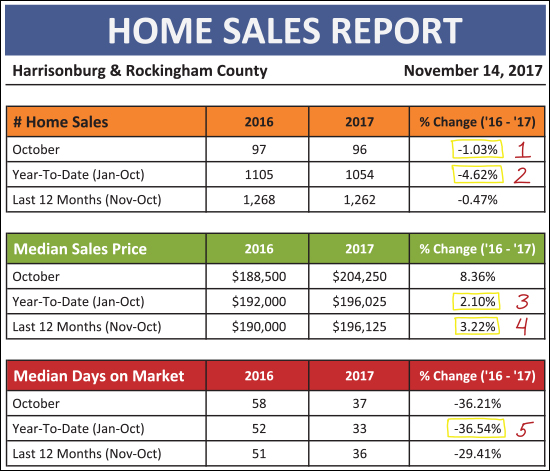

Find out more about this new listing in Lakewood Estates shown above by clicking here. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF or read the entire report with commentary online. Taking a look, first, at a high level overview of the market thus far in 2017....  As shown above....

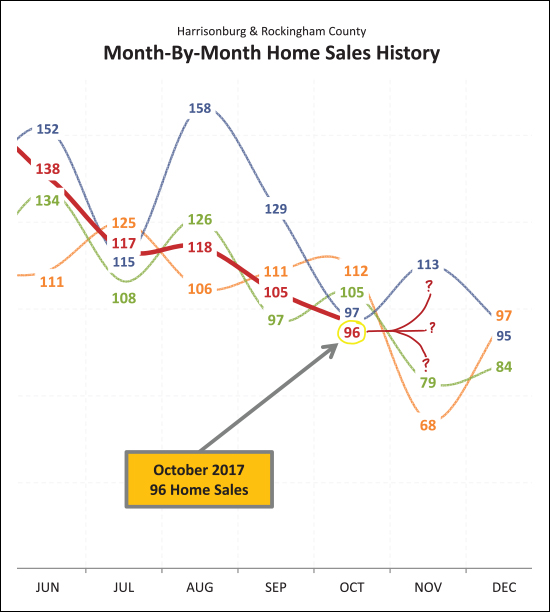

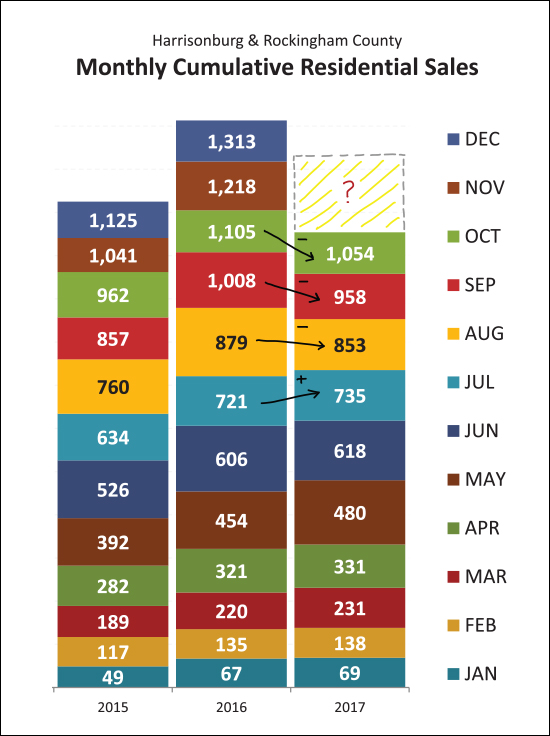

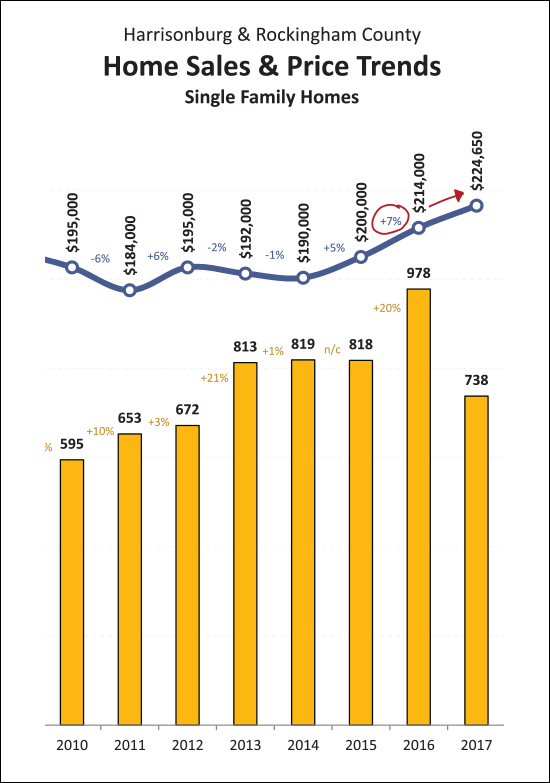

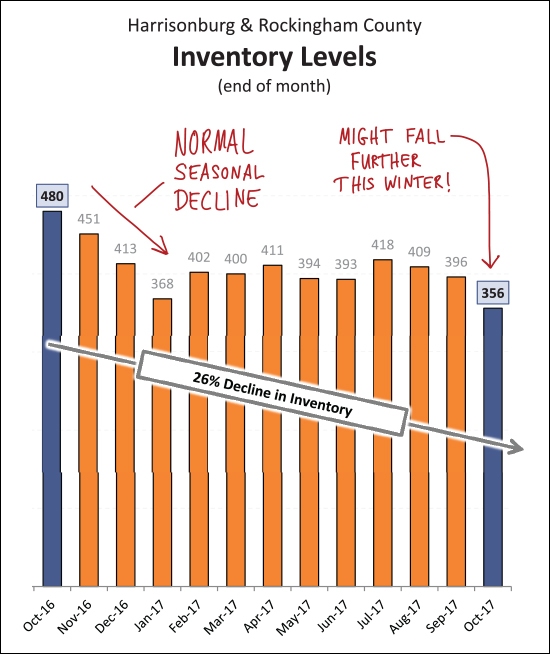

So -- while slightly fewer (-5%) homes are selling this year, they are selling at higher (+2%) prices, and are selling much (+37%) more quickly!  As shown above, this year lost its momentum in August and September -- where monthly home sales (118, 105) were no match for last year (158, 129). Things leveled out, a bit, in October -- with just about the same number of home sales (96 vs. 97) this year as last year. Where things will go next month is anyone's guess -- looking at the past three years, November home sales have ranged from 68 all the way up to 113!  Above, visualized slightly differently, you can see that 2017 home sales were on par with (actually exceeding) last year up and through July before we then fell behind in August, September and now October. It seems certain that we'll finish out the year with fewer home sales this year than last, but more than in 2015. All that said -- as one of my clients pointed out -- maybe we shouldn't care if home sales slow down?  Indeed -- a slightly slower pace (-5%) of home sales might not be an negative indicator of market health -- that decline could be a result of declining inventory levels. Perhaps a better sign of a robust and improving local real estate market is the 7% increase in the median sales price of single family homes between 2015 and 2016, and the apparent 5% increase we seem likely to end up with in 2017.  Speaking of slowing sales possibly being a result of lower inventory levels -- yes -- inventory levels are still way (-26%) below where they were last year at this time. And -- no good news here -- it would seem that we will likely see a further seasonal decline in the number of homes on the market as we continue through November, December and January!? Home buyers will likely have a tough time finding options over the next few months -- depending on their price range, where they want to (or are willing to) buy, etc. Let's pause there for now -- though I will continue to explore the latest trend in our local housing market in the coming days on my blog. Until then -- feel free to download and read my full market report as a PDF, or read the entire report online. And if you will be preparing to sell your home soon, you might find these websites helpful.... | |

Average 30 Year Mortgage Interest Rates Still Below Four Percent |

|

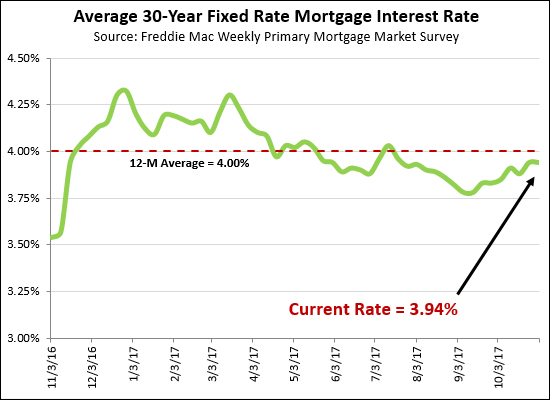

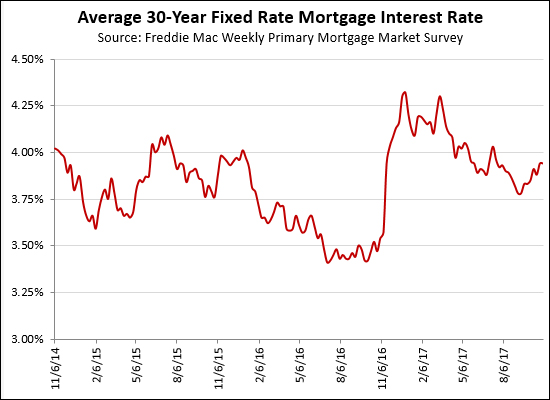

Mortgage interest rates are still below 4% -- after having spent November 2016 through May 2017 between 4% and 4.5%. Today's buyers are enjoying the opportunity to lock in their monthly housing costs at historically low rates. And -- let's look a bit further back -- at the past three years....  As you can see, above, mortgage interest rates have fluctuated between 3.5% (+/-) and 4.25% (+/-) over the past three years. If you were prequalified for a loan nine months ago (when rates were at 4.3%) you might want to request some updated potential payment scenarios from your lender with the current mortgage rates. | |

Low Inventory Levels Spur On Home Renovations |

|

Homeowners are staying in their homes longer than ever before, according to date from the National Association of Realtors (NAR). The median number of years that a hmeowner has lived in their home is up to 10 years in 2017, which matched 2016 and 2014 as the highest level seen since NAR started tracking the data in 1985. It would seem that low inventory levels, plus a lower than normal pace of new home construction, are causing many homeowners to stay and renovate their homes, rather than try to sell their home and buy a new home. Sometimes this works, and sometimes it doesn't. It is certainly harder to stay in a townhouse and renovate it to allow it to work for your family for longer into the future -- and much more possible to do so with a detached home. I expect we will continue to see this trend locally (more people staying put, more people renovating) until and unless we start to see more new homes being built. | |

Can New Homes Be Built That Buyers Will Want and Can Afford? |

|

OK -- lots of great thoughts from folks over on Facebook yesterday, and in person as I talked to people around town yesterday, after I suggested that our market needs lots of mid size detached homes to be built. I'm going to think aloud about all of that by capturing a bit of that conversation here.... --- WHAT TYPES OF HOUSES? I had suggested that homes along these lines were needed for current townhouse owners that want to buy their first detached home....

These types of homes have not been built in large quantity over the past ten years, and I believe there are plenty of buyers who would love to buy this type/size of home. --- COSTS ARE HIGH BEFORE THE ACTUAL CONSTRUCTIONAs Jim, Jerry and Keith pointed out, It is expensive (!!!) to create a developed lot. The cost of building roads, installing water an sewer lines, utility hook up fees, etc. all add up to make the costs quite high even before construction (pouring the foundation, framing the home) begins. And as Nate points out -- if the land cannot be purchased by a builder at an affordable price, the rest of the equation downstream won't work out. High costs for land, plus development costs, plus building costs, will result in unrealistically high prices for homes, that then won't be affordable (or desirable at that price point) to buyers. Nate then ponders whether larger, regional builders can do better than local builders in this regard based on economies of scale. I'm not sure if the savings would be in buying a larger tract of land, lower development (infrastructure costs), or lower building costs -- but I wonder the same. Gary and Renee also point out that some of these "costs before you even start building" are high because of utility connection fees, requirements for stormwater management, proffers, etc., that are coming from government regulations and development requirements. Ginny points out that the final cost of a house is largely dependent on the initial land and development costs. Thus, to have smaller single family homes built, we may need to see smaller lots, to keep those initial costs down. --- DEMAND NEEDS TO DISCUSSED WITHIN THE CONTEXT OF PRICE As Jim succinctly puts it, "If I want something I can't afford then it isn't really demand." An excellent point -- which means that we need to think about (and talk about) the demand for the homes I outlined above (for example) within the context of the price for bringing such a home to market. If the houses I described (1750 / 1950 / 2150 square feet) were able to be sold for $150K, $175K and $200K (obviously not realistic) then clearly, there would be a ridiculously high demand for them. I believe that if the houses I described could be sold for $250K, $275K and $300K there would still be a strong demand for them. But, clearly, if the homes could not be sold for any less than (I'm exaggerating again) $400K, $425K and $450K then likely NOBODY would want want to buy them. So, yes, when we talk about demand for a particular type of housing, it likely should be -- as best as possible -- set within a context of price. That price-based demand can then be compared to development and building costs to see if developer and builders can bring such a product to market at a price that it will sell. --- WHAT SHOULD WE BE ADDING TO OUR HOUSING STOCK? As Jim also points out, the high demand and low supply environment we're in right now COULD cause a large quantity of under-qualified builders to start building homes. This doesn't help, in the long-term, as it is adding lower quality homes to our housing stock, which I do not believe helps our community in the long-term. Jim goes on to suggest that we should be ensuring that we are adding quality homes to our housing stock. I agree -- though I do think that we need to find a balance. If the quality of materials and finishes is too high, we're pricing ourselves out of the ability to meet the demand we're discussing. Michael takes us in a different direction when considering what should be built. He points out that even beyond building for all of those townhouse buyers (the original reason for my suggestion that we need to build mid sized detached homes) that he believes there is also a significant demand for affordable housing for the elderly in our community. He points out that retirement communities are not affordable for everyone, and plenty of older adults in our community would love to move into an affordable, (one-level), wheelchair accessible home. Again -- another market segment where we are not seeing much new construction. --- WHAT ARE PEOPLE GOING TO DO IF WE DON'T BUILD THESE HOMES? Ginny suggests that homeownership may be delayed for some families. A good point -- if the homes they want aren't available at the prices they can afford, perhaps they'll keep renting or keep living in the townhome they purchased. Ginny also suggests that we'll see more remodeling or upgrading of current homes to accommodate growing families, which also makes sense. Keith suggests that people will just have to move to some of the more affordable towns surrounding Harrisonburg. There are more affordable detached housing options when you look to Broadway, Timberville, Elkton and Grottoes. So, perhaps the townhome owners will just have to settle for a bit of a commute in order to buy a mid sized detached home that fits their budget. Jim suggests that maybe higher costs for new homes means that it will take much longer for families to be able to buy a home -- and perhaps they will have to stay in one home for a lifetime, instead of moving every 5 - 7 years. Gary concludes that many in our community may simply have to rent, or keep living in a townhouse, because of the cost of building new homes. --- CONCLUSIONS There were many other great points made, and discussions beginning, so thanks to all who engaged in this topic. A few big picture thoughts that come to mind for me....

Keep the conversations going, folks, on Facebook, with me, with each other. As Jim points out, "we're going to have to do housing differently than it has been built in the past 30 years if we are going to provide sustainable, affordable housing." | |

We need mid sized detached homes, and lots of them, soon! |

|

Between 2000 and 2012, three centrally located townhouse developments were built in Harrisonburg:

Some of these townhomes were purchased by investors. Some were purchased by folks who have since sold and left the area. Some were purchased by folks who have since sold and bought a new, larger home, in or near Harrisonburg But I believe a lot of the original (or second) owners of these 614 townhouses are now looking around Harrisonburg wondering where they will, where they can go next. I believe our market desperately needs mid sized detached homes to be built, as these many townhouse owners are now older, often have started a family, and are looking for more space -- but can't jump up to buying a $350K to $400K home. What might these mid sized detached homes look like? Perhaps....

So -- who is going to build them? And where can the be built? In many conversations I have had lately, one of the main challenges is finding land that can be purchased at a price that will allow for the development and construction of this type of housing without making them $350K homes. | |

Housing Inventory Shortages in City of Harrisonburg Should Not Be Surprising |

|

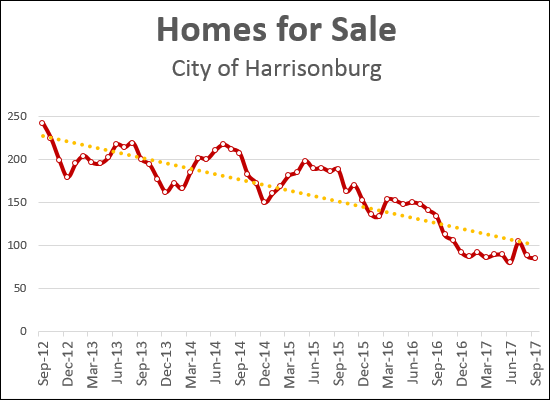

If only we could have seen this coming. :-) Just kidding -- we have seen it coming. Knowing it was coming, though, didn't seem to inspire any actions to change the trajectory. As shown above, inventory levels have been steadily dropping in the City of Harrisonburg over the past five years -- or perhaps even longer -- I only have a record of the past five years. There have now been fewer than 100 homes for sale in the City of Harrisonburg for most of the past six months. How is this cured?

There is no easy way to turn this trend around -- and to have more options for City home buyers -- and until this does change, it can be quite challenging for buyers to find a home they want to purchase in the City. | |

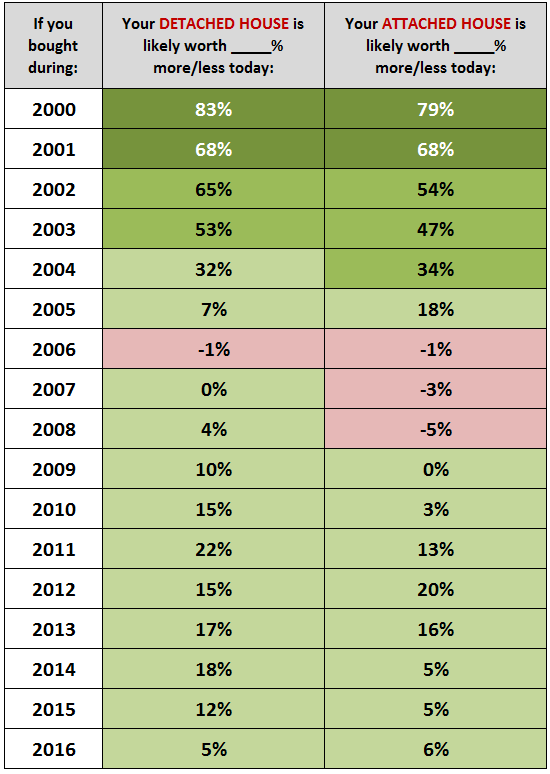

The Value of Your Home Based On When You Bought It |

|

Can historical median sales prices give you some sense of your home's current market value? Perhaps so! The chart above is calculated based on comparing the 2017 median sales price to the median sales price in each of the past 16 years. Do remember, of course, that while this might provide a general guide to what has happened with home values over the 17 years, every home and neighborhood is unique. Let's chat about your specific house if you want to know what it is worth in today's market. Also, if you bought your home in one of the (now few) red years (2006, 2007, 2008), while your home might still be worth less today than when you bought it, you may have paid down your mortgage to the point that you could sell your without bringing money to closing. | |

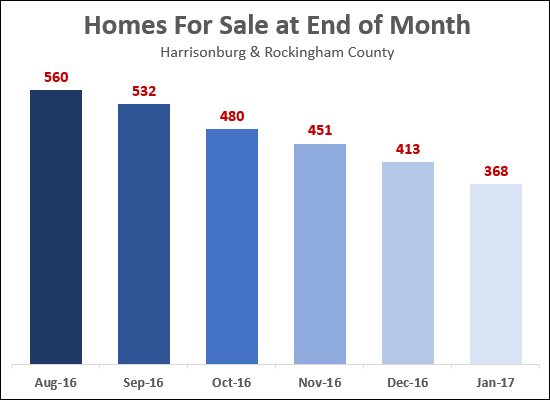

If you think housing inventory levels are low now.... |

|

If last year is any indication, get ready to see inventory levels falling over the next few months almost as fast as the leaves are falling off the trees. In all seriousness, though, many buyers these days are having a difficult time finding a home they are excited to purchase -- which is not surprising, as inventory levels have declined 27% over the past year. But it is likely to get (temporarily) worse for buyers. As shown above, inventory levels fell 34% last year between the end of August and the end of January. As such -- look at the meager supply of homes currently on the market -- and then eliminate 1 out of every 3 of those homes. That's likely where we're headed over the next few months. But here's the good news (sorta, kinda, with limitations) -- if you are thinking of selling your home in the next few months, you may have quite a few buyers angling to purchase it if it aligns well with what they are looking for in a home. The sorta/kinda part is that you'll only be good shape if you don't have to buy as well. After all, if we quickly sell your home (because of low inventory levels), but can't find something for you to buy (because of low inventory levels), then we still have problems. Who is the indisputable winner in today's local housing market? The home seller who does not have to buy a home as well. :-) | |

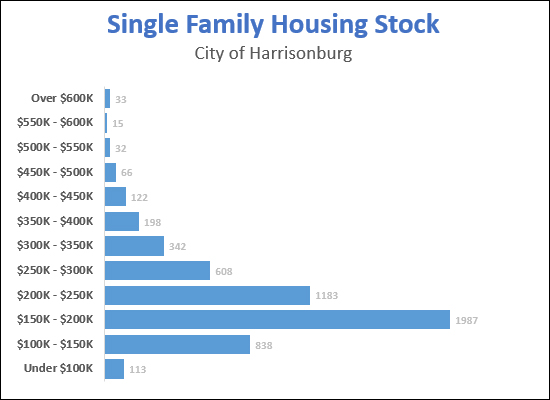

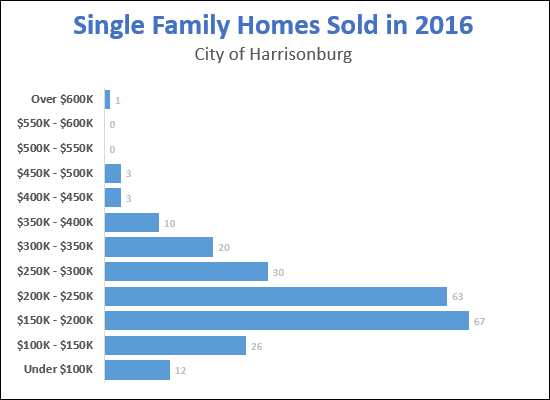

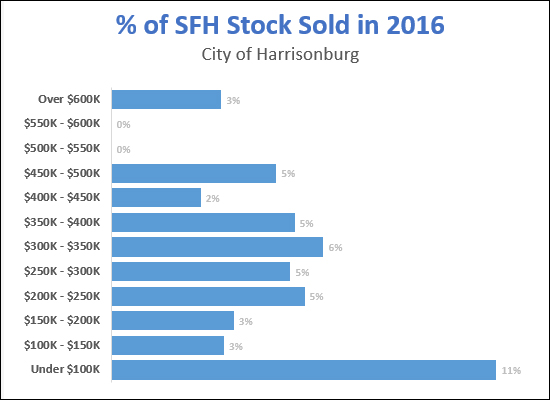

How much of the City of Harrisonburg single family housing stock sells in any given year? |

|

OK -- I'll point out, from the start, that I'm making things a bit more complicated here. I'll partially blame Derik, as he asked the question. OK - the graph above, is the same one I posted yesterday -- a look at how many single family homes exist in the City of Harrisonburg in a variety of price ranges, based on their assessed values. But -- if that's how many actually exist -- it is probably reasonable to wonder how many homes actually sell in each of those price ranges in each year. So, here are the City single family home sales in the same price ranges for all of 2016....  You'll notice that the two graphs above don't look altogether that different. Then, to combine these two, rather than just put really little numbers (how many sell) next to really big numbers (how many physically exist) I thought I"d look at what percentage of each price segment of the City housing stock sells in a given year....  I think this makes it more helpful, though slightly less specifically meaningful absent scrolling back up and also remembering how many houses we're talking about in each given price range. For example, the chart directly above shows that:

OK -- next, a few flaws and disclaimers:

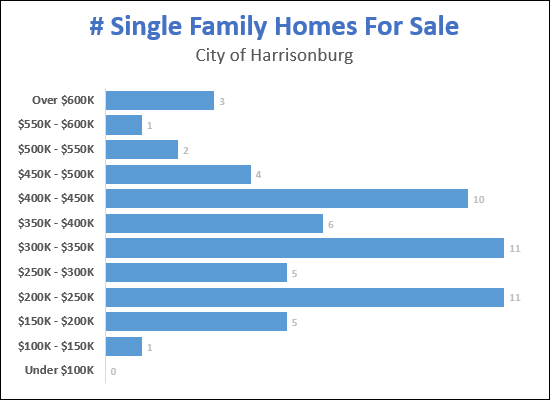

OK -- it continues -- I think it is probably necessary to try to contextualize this with "active listing" data -- to see how some of these numbers compare to what is available today for a buyer to purchase. Here is a breakdown of single family homes currently for sale....

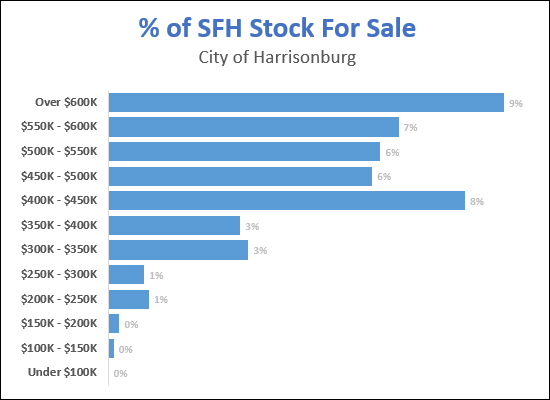

As you can see, above, there are NOT a lot of homes for sale in the City of Harrisonburg right now. And let's see if we can flesh anything out if we break it down by how many homes are available to be purchased as compared to the overall number of homes that actually exist....

This graph might have been the one I was looking for -- at least to support my understanding of the world.... Right now -- almost 9% of the homes over $600K are listed for sale -- and 6% to 8% of homes over $400K are listed for sale in the City of Harrisonburg. On the other hand, only 3% of homes between $300K and $400K are listed for sale, only 1% of homes between $200K and $300K and less than 1% of homes under $200K are listed for sale. This would seem to be about as clear of an indicator as one could find that homes under $300K (or even better, under $200K) are in short supply and in high demand in the City of Harrisonburg. Finally, lastly, ultimately, some "overall market" stats....

Questions? Thoughts? Observations? Insights? Suggestions? Email me: scott@HarrisonburgHousingToday.com | |

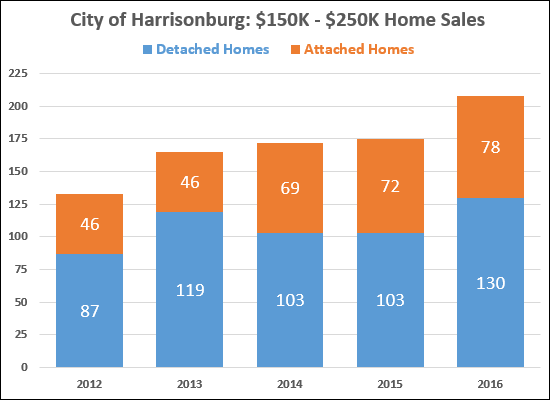

Are $150K - $250K Detached Homes Available in the City of Harrisonburg? |

|

HINT -- this is a bit of a trick question. Again.... Are $150K - $250K Detached Homes Available in the City of Harrisonburg? Ignore the graph above for a moment -- and let's see what we find.... There are only 15 detached homes currently on the market in the City of Harrisonburg priced between $150K and $250K. Wow! At first blush, this is (or seems to be) very significant. One might conclude that we are seeing a significant under supply of these "mid-priced" homes in the City of Harrisonburg, and assume that this under supply is causing very few of these homes to actually sell. But wait -- looking further (now you may refer to the graph above, thank you for your patience) it seems that plenty of these homes are actually selling. In fact, 130 detached homes between $150K and $250K sold in the City of Harrisonburg last year. The tricky part is this -- if 130 buyers are buying per year, that's an average of 10.83 buyers per month. And thus, if there are only 15 such homes on the market, that is a 1.4 month (42 day) supply of homes for sale. Which is -- rather absurdly low. Most folks consider a six month supply to provide a balanced market between buyers and sellers. So -- yes, homes are SELLING between $150K and $250K -- but they aren't widely AVAILABLE at any given point. When they come on the market, they sell quickly! A few other observations....

| |

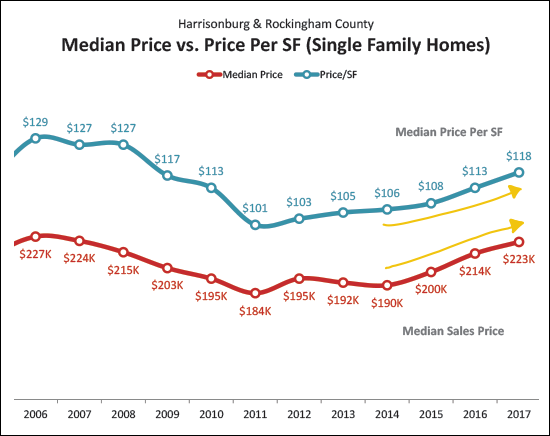

Price Per Square Foot Steadily Rising |

|

The price per square foot of homes in Harrisonburg and Rockingham County has been steadily increasing over the past six years....

That said -- while the median sales price ($223K) has nearly climbed backup to the high we saw in 2006 ($227K) -- the median price per square foot ($118) has actually not come anywhere closer to that 2006 high ($129). Which would seem to mean that you're getting slightly more house for your money now (as compared to 10-11 years ago) even if you're paying a similar price. | |

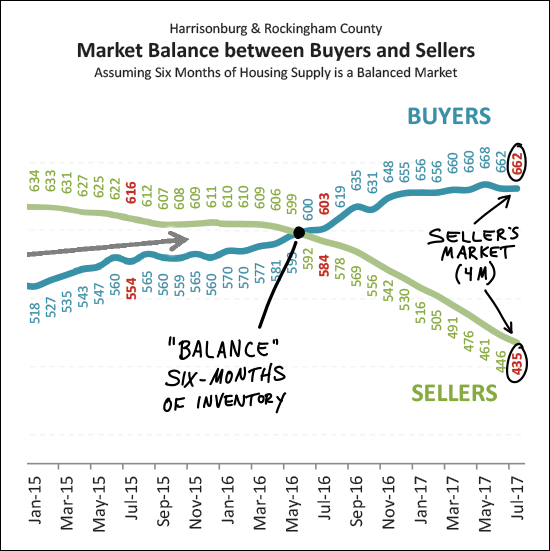

This is not a balanced real estate market |

|

Most housing market analysts consider six months of inventory (active listings) to be an indicator of a balanced market (between buyers and sellers). The "BUYERS" trend line above is illustrating how many buyers are buying in a six month period. The "SELLERS" trend line above is illustrating how many sellers are in the market (active listings) at any given time. Over the past four years we have seen a steady increase in buyers and a declining number of sellers. In June 2016, these two trajectories crossed, and there was no turning back. There are now many more buyers buying in a six month period than there are homes for sale -- creating a seller's market. Instead of having a six month supply of homes for sale, we now have a four (3.95) month supply. Of note -- it is not a seller's market in every price range, in every location, for every property type -- but overall, we are definitely seeing a seller's market. Find out more about our local housing market by clicking below for my monthly market report.  | |

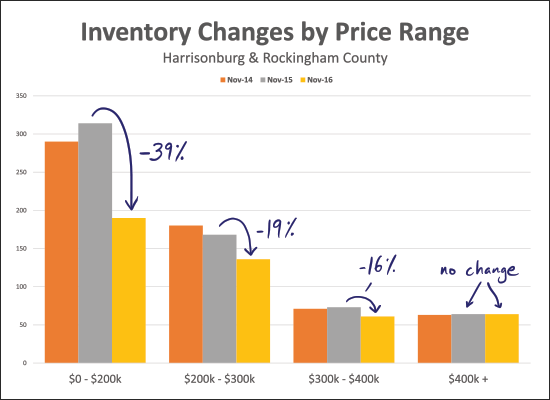

Have all price ranges seen equivalent changes in inventory levels? |

|

Indeed -- inventory levels are falling -- there aren't nearly as many homes on the market now as there were a year ago. In fact, over the past year, we have seen a 27% decline in the number of homes for sale in Harrisonburg and Rockingham County. However -- not all price ranges are created equal. As shown above, the most significant declines in inventory levels has been in the "under $200K" market, where there has been a 39% decline over the past year. The "over $400K" market, in contrast, has seen no change in the past year in the number of homes for sale. You can find out more about the Harrisonburg and Rockingham County real estate market by visiting....  | |

Sellers Selling for 98% of (Last) List Price |

|

This graph shows the average list price to sales price ratio (red line) in recent years as compared to the overall pace of home sales. Over the past several years, the amount that buyers have been able to negotiate sellers down on price has diminished significantly. Between 2010 and 2012, sellers were negotiating down to a median of 4% off of their (last) list price. Now, sellers are only negotiating down 2%. Of note --- 1. This is a median calculation -- so half of sellers are negotiating more than 2%, and half are negotiating even less than 2%. 2. This is a comparison of the sales price to the LAST list price. If a home is worth $200K and is listed for $300K, it is not likely to sell for 2% less than $300K. The seller is likely to have to continue to reduce the price until it is at a reasonable place -- perhaps 2% or 5% above $200K, and then they will likely negotiate somewhere around 2% to their final sales price. Find out more about the Harrisonburg and Rockingham County real estate market by visiting....  | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings