| Newer Posts | Older Posts |

As Higher Mortgage Interest Rates Cause Some Home Buyers To Stretch Their Monthly Budget A Bit Further, It Is More Important Than Ever To Keep The Cost Of Future Home Maintenance In Mind! |

|

An important first step in considering your first or next home purchase... is talking to a qualified mortgage lender to better understand your potential monthly mortgage payment for the home you may decide to purchase. You'll be working with that mortgage lender to get a rough idea of two things... [1] The amount of money you'll need to have available at closing for your down payment and closing costs. ... and... [2] The amount of money you will be paying each month for your mortgage payment. But that's not all of the big picture calculations you should be doing. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $40K downpayment and your monthly mortgage payment will be $2,100 per month... great! That gives you a buffer in cash in hand for emergencies and you have extra room in your monthly budget. If you have $60K of cash available for a downpayment and $2,500 you could spend on housing...and you work things through with your lender and discover you need a $60K downpayment and your monthly mortgage payment will be $2,500 per month... maybe great, maybe not! Spending all of your available cash on the downpayment and closing costs... and spending the entirety of your monthly housing budget on your mortgage payment does not leave you with any room to deal with potential future home maintenance costs. What if you need to replace the heat pump in a few years? What if you need to replace the roof in five years? What if a kitchen appliance breaks? If you decide to stretch yourself monthly budget to make a house payment work -- make sure you have a game plan for those future home maintenance costs too! | |

Buyer Demand Still Exceeds Housing Supply, But Not For All Properties |

|

In 2020, 2021 and 2022, almost every new listing had LOTS of interest and likely had multiple offers. There was some variation by price range and property type, but they were all quite favorable scenarios for sellers and quite frustrating scenarios for would be buyers. For example, with three fictional properties at different price points or in different locations or of different property types, etc., here's how the first week might look... First Property = 30 showings, 10 offers Second Property = 20 showings, 5 offers Third Property = 10 showings, 2 offers Again, great fun for sellers, no fun for buyers... mostly brought on by super low mortgage interest rates and Covid-induced changes in how people thought about the space they needed or wanted in their homes. Today, things are a bit different... mortgage interest rates are much higher (twice as high as their recent low point) and a global pandemic is no longer stretching our use of our homes in quite the same ways. This is resulting in a slightly different market response to those same fictional properties in week one of being on the market... First Property = 10 showings, 4 offers Second Property = 3 showings, 1 offer Third Property = 1 showing, no offers As represented above, we're seeing several dynamics here... [1] Some properties are still seeing lots of buyer interest and are having multiple offers the first week they are on the market. [2] Some properties are seeing a few showings in the first week, one of which results in an offer from a buyer who is happy to go ahead and move forward with purchasing the home. [3] Some properties are having very few showings the first week, and no offers. Seller #1 is still delighted. Seller #2 is quite satisfied and decides they are OK not having had multiple offers because they just needed one buyer. Seller #3 might think their house will never sell, might wish they sold their house a year ago, might be discouraged, might be frustrated, might be surprised. My general advice for Seller #3 is to remember the market before 2020... it often took a few weeks or a few months for many properties to sell. That's OK. Be patient. Collect feedback from buyers who are coming to look at your home. Make adjustments to your home's condition, marketing and/or price to best appeal to prospective buyers. But again, be patient. We're not in 2020-2022 any longer. | |

Did The Federal Student Loan Payment Pause Spur On More Home Buying By Recent Grads Who Built Savings For A Downpayment And Closing Costs? |

|

Federal student loan payments were paused for three and a half years. For graduates who attended public schools, the average federal student loan debt at graduation seems to be around $25K... which worked out to be a student loan payment of $280 per month. 3.5 years = 42 months $280 x 42 = $11,760 Recent grads with average student loan debt, with average student loan payments, would have been able to save up about $12,000 over the past three and a half years when federal loan payments were paused. Did this pause in payments on student loans allow some would-be home buyers to build up savings to put towards a downpayment or closing costs for a home purchase? Quite possibly. There seem to be many reasons why we saw a surge in home buying activity over the past few years... 1. Covid-induced changes to work / life / home situations. 2. Super duper low mortgage interest rates. ...and maybe... 3. College graduates building up savings due to not needing to make student loan payments for a few years. But, back to reality, student loan payments have started back up again now. So if you were building up some savings with those (non)payments -- you'll now need to divert those monthly funds back towards paying off your student loans. | |

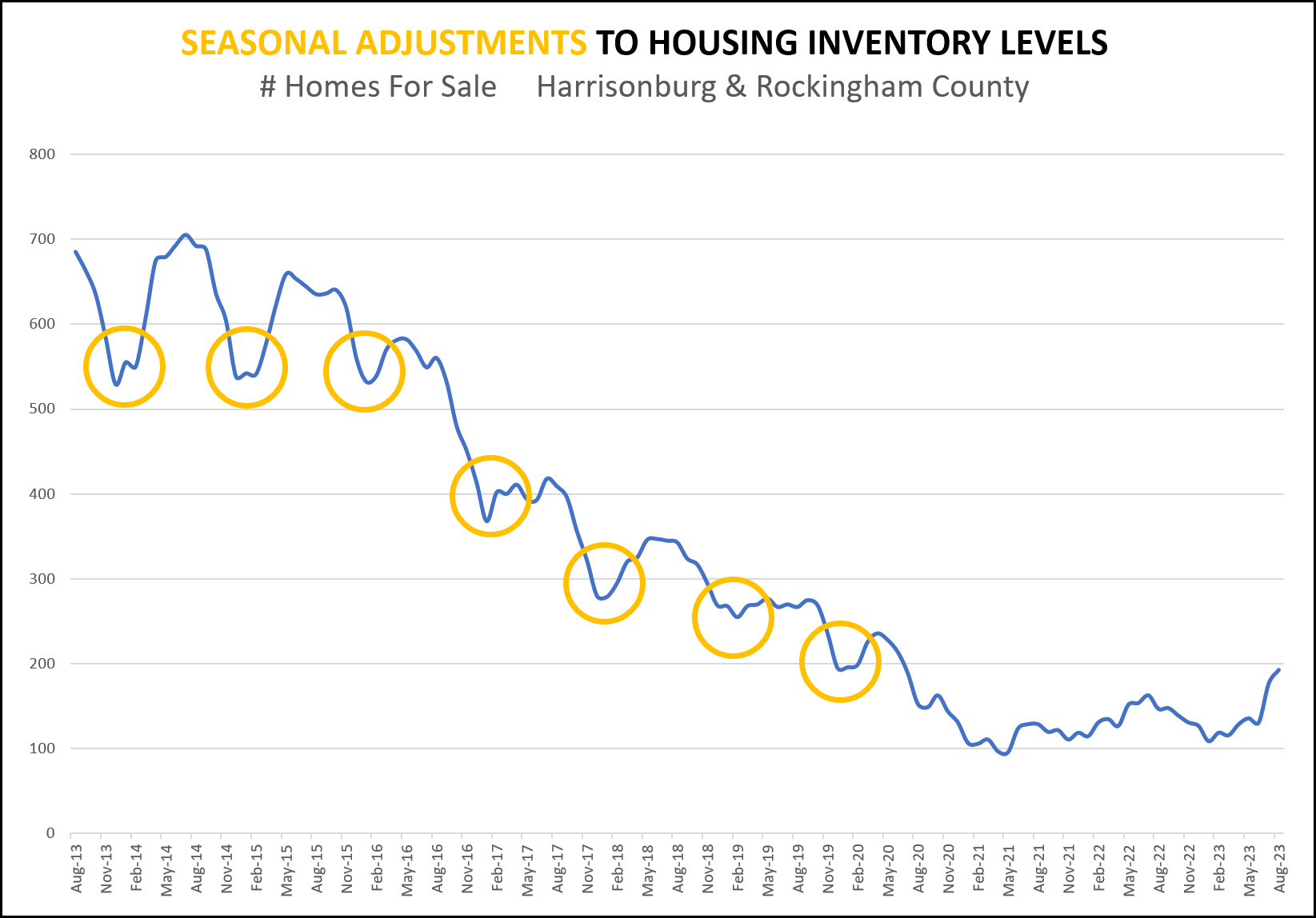

Maybe We Will See Seasonal Declines In Housing Inventory Levels Again This Year? |

|

All the way through 2019, we would see a seasonal decline in housing inventory levels each winter. Inventory levels would typically be the lowest between November and February as some sellers took their homes off the market for a few months -- and as some sellers decided to wait until spring to sell their homes. But then between 2020 and 2022, that all changed. The real estate market was on FIRE as Covid-induced work/life/home changes and super low mortgage interest rates pushed more buyers than ever into the housing market. Inventory levels that had been dropping for several years (2016 - 2019) dropped even further. All of a sudden, inventory levels were ALWAYS low. Spring and summer inventory levels - low. Fall and winter inventory levels - low. We stopped seeing seasonal shifts in housing inventory levels. But over the past few months inventory levels have been drifting back upwards a bit. So, as we (eventually?) start to see cooler temperatures, will we start to see seasonal declines in housing inventory levels again? | |

Anecdotally And Quite Reasonably, Many Buyers Seem To Be Making Larger Down Payments These Days |

|

Yes, I know, this is just based on transactions I am observing, and perhaps even just those that lodge themselves into my mind more than others, but... Home buyers seem to be making larger down payments these days -- and I can understand why. Before... with 3% - 4% mortgage interest rates... there wasn't much of a motivation to make much of a downpayment. Your mortgage payment would be so low, given low mortgage interest rates, that buyers would often finance as high of a percentage of the purchase price that their lender would allow. Now... with 7% mortgage interest rates... buyers are motivated to make as large of a down payment as possible, to make their loan amount as small as possible, given the (relatively) higher mortgage interest rates. This is not to say that all of a sudden all buyers are putting 20% down on their real estate purchases -- they aren't -- but the calculus of how much cash to put into a real estate purchase looks a bit different these days. Home buyers are certainly still keeping some cash on the side for emergencies, etc., but they are often making larger down payments (and financing less) now than they were a few years ago. | |

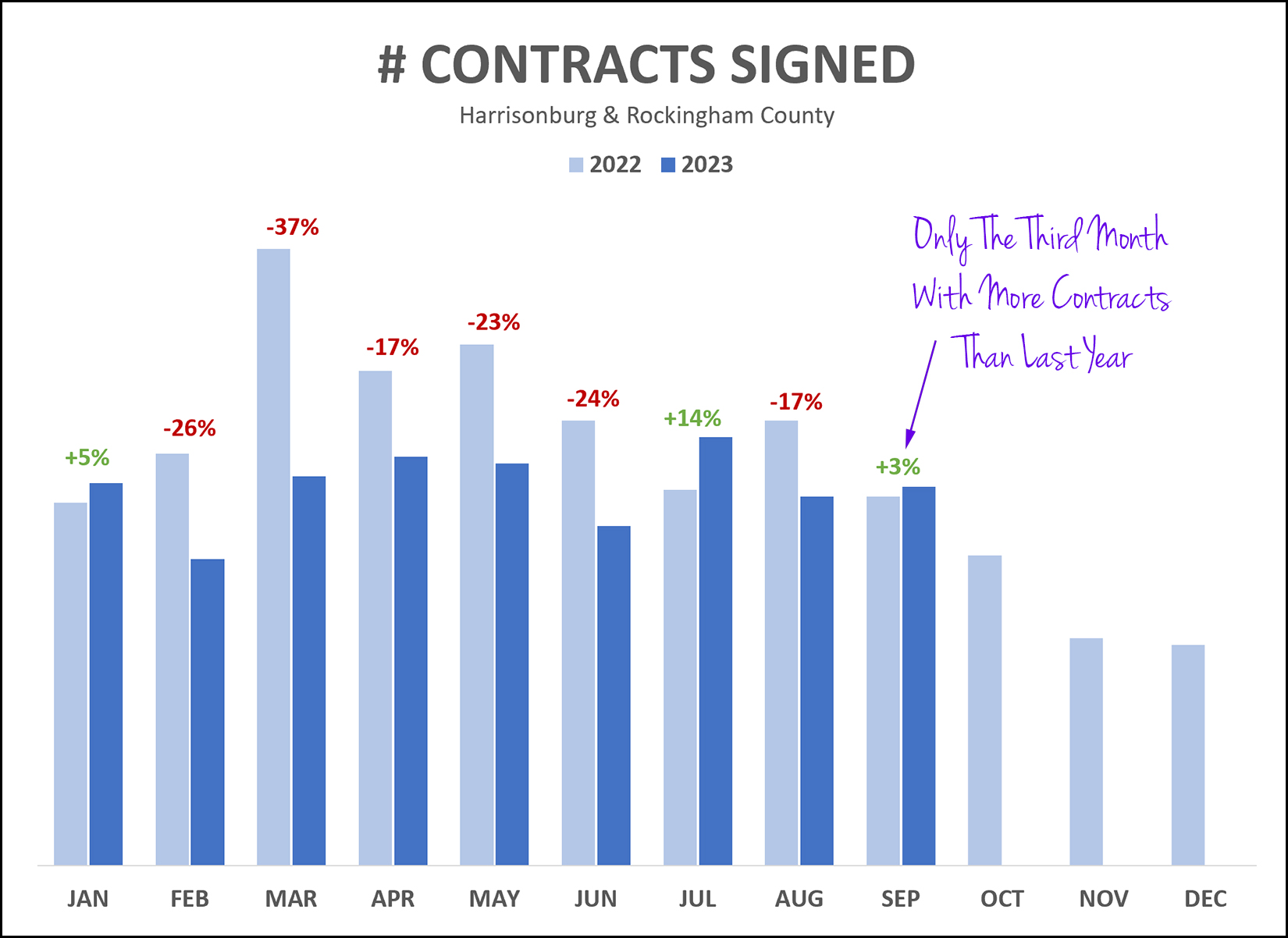

Slight Bump In Contract Activity In September 2023 |

|

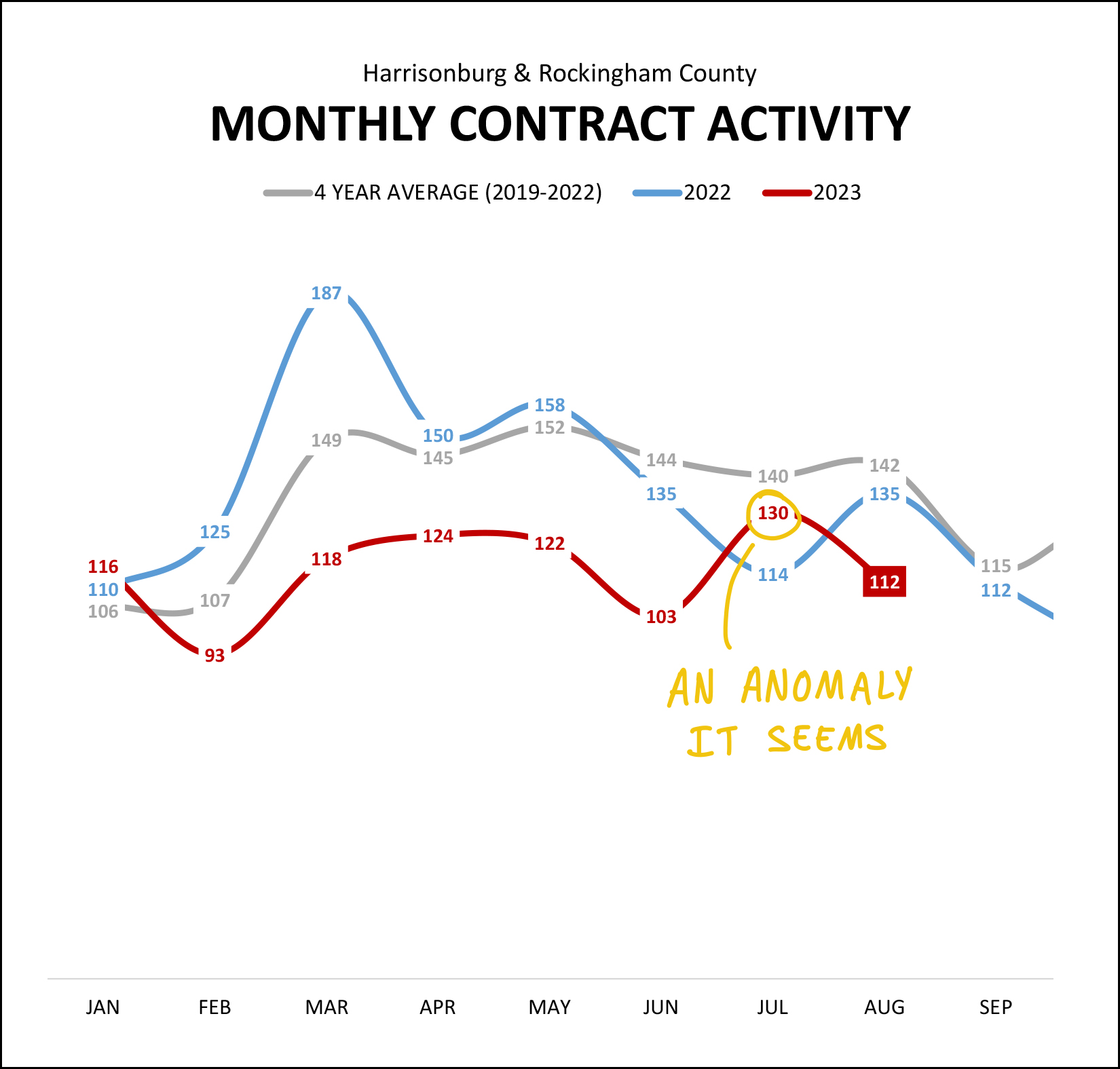

We saw a slight increase in contract activity this September as compared to last September... with 3% more contracts signed this year than last... 115 contracts were signed in September 2023 112 contracts were signed in September 2022 As you'd like imagine given the graph above, the total pace of contract signing this year is a good bit below last year... 1,226 contracts signed January - September 2023 1,033 contracts signed January - September 2022 So, we're seeing 16% fewer contracts signed this year than last -- though we had a few more than expected in September 2023. It will be interesting to see how October through December finish out in 2023. Stay tuned for a fuller market analysis in the next week or so. | |

It May Be Time To Adjust To These Mortgage Interest Rates And Not Wait Around Thinking They Will Decline |

|

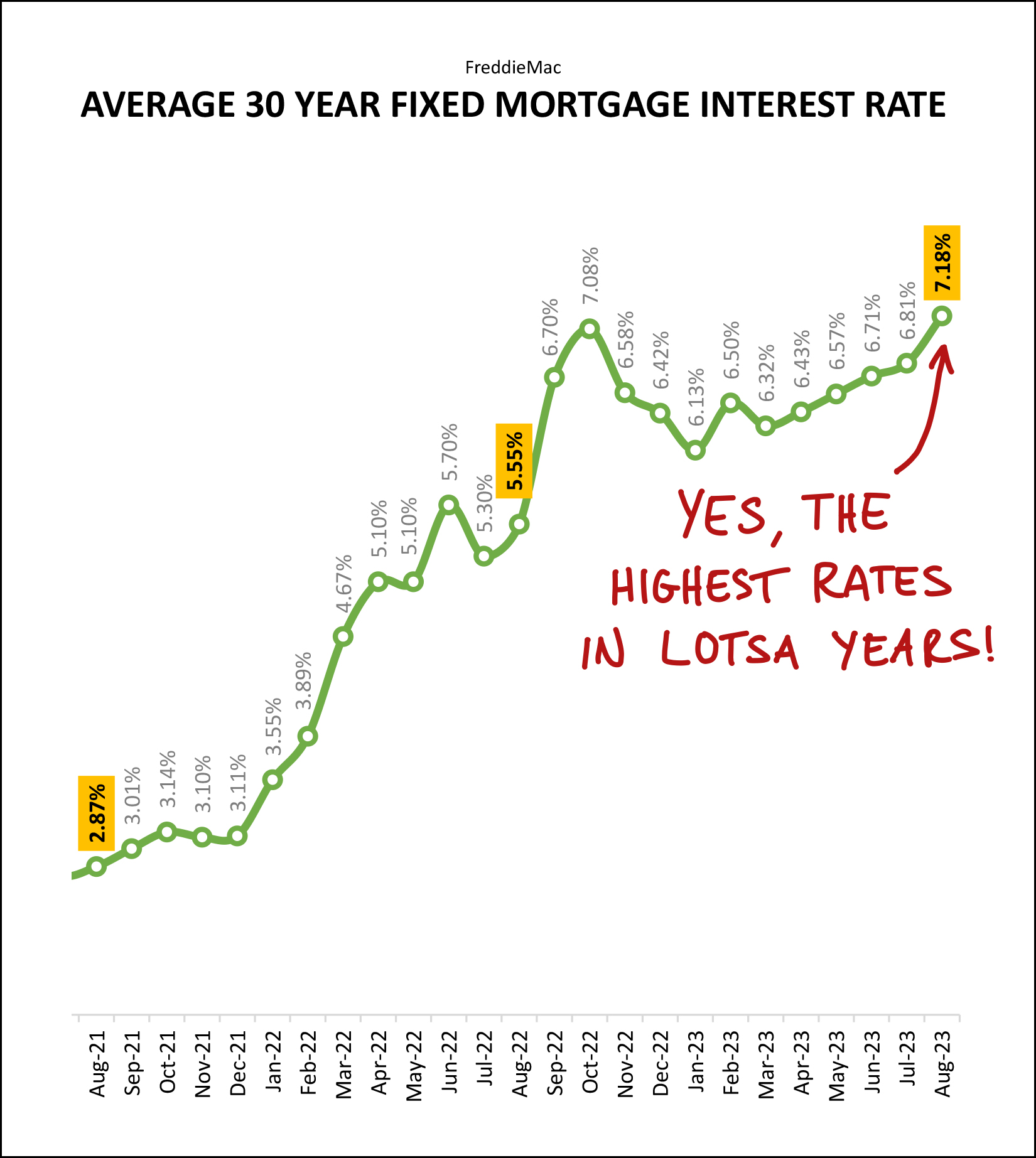

A year ago -- in October 2022 -- I commented on rapid changes in mortgage interest rates through the first ten months of 2022... January 2022 = 3.45% April 2022 = 5.00% October 2022 = 6.94% At that point, in October 2022, I reflected that... "I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months." I'm going to double down on that advice here in October 2023... The current average 30 year fixed rate mortgage interest rate is 7.31%. I don't think anyone should be waiting around thinking that we'll see 6.5% soon and then 6% after that... I think it is very likely that we will continue to see mortgage interest rates in the current range (6.75% - 7.50%) for the rest of 2023 and perhaps through the entirety of 2024. If mortgage interest rates decline, that will be fantastic, but I don't think we should expect it or count on it. | |

Many (Most) Home Sellers Are Adjusting Their List Price If Their Home Is Not Under Contract Within 30 Days |

|

Here's how I get to the conclusion above... Today, there are... 200 homes for sale in Harrisonburg and Rockingham County per the HRAR MLS. Of those 200 active listings... 116 homes have been on the market for 30+ days. Of those 116 listings that have been on the market for a month or more... 65 homes have seen a price reduction in the past 30 days. So, yes, it would seem that many (most -- 56%) home sellers are adjusting their list price if their home is not under contract within 30 days. It makes sense... If a buyer hasn't made an offer, a price reduction may... 1. Cause existing buyers to reconsider your home. 2. Cause a new buyer consider your home for the first time. 3. Cause a buyer who has viewed your home to make an offer. Should all home sellers reduce their list price after 30 days on the market? Not necessarily. Should it be a discussion about the merits of making such a price change? Absolutely! | |

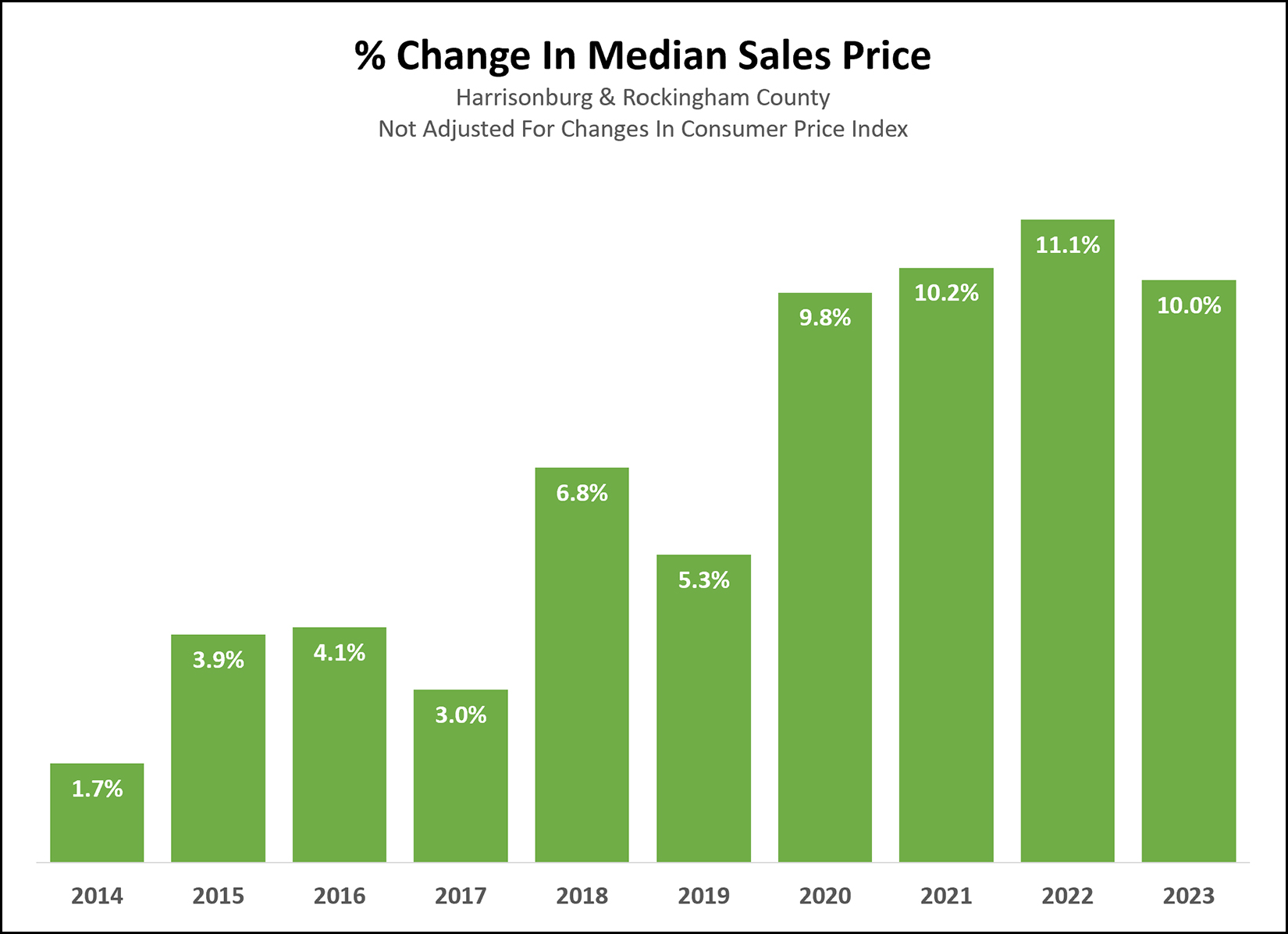

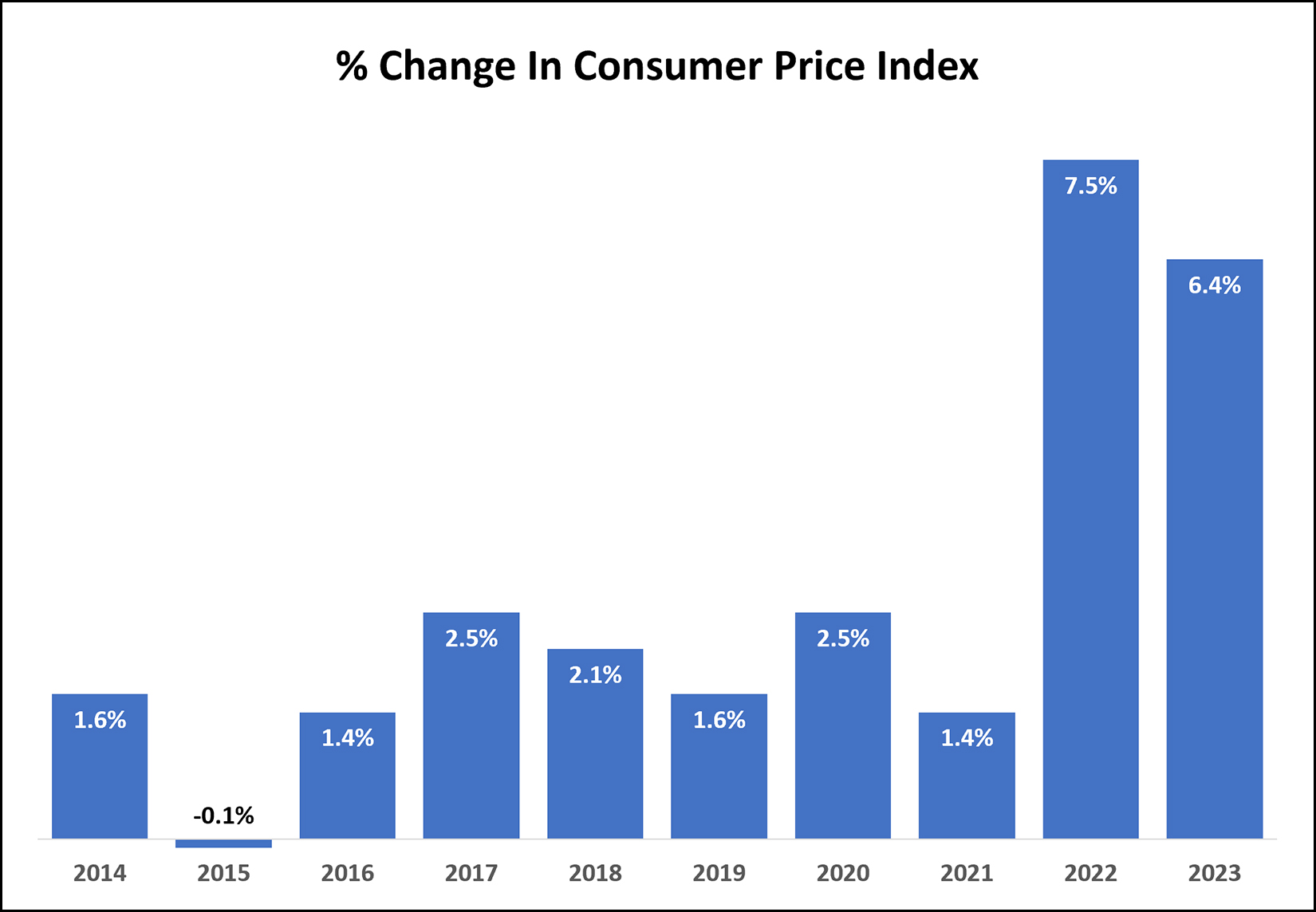

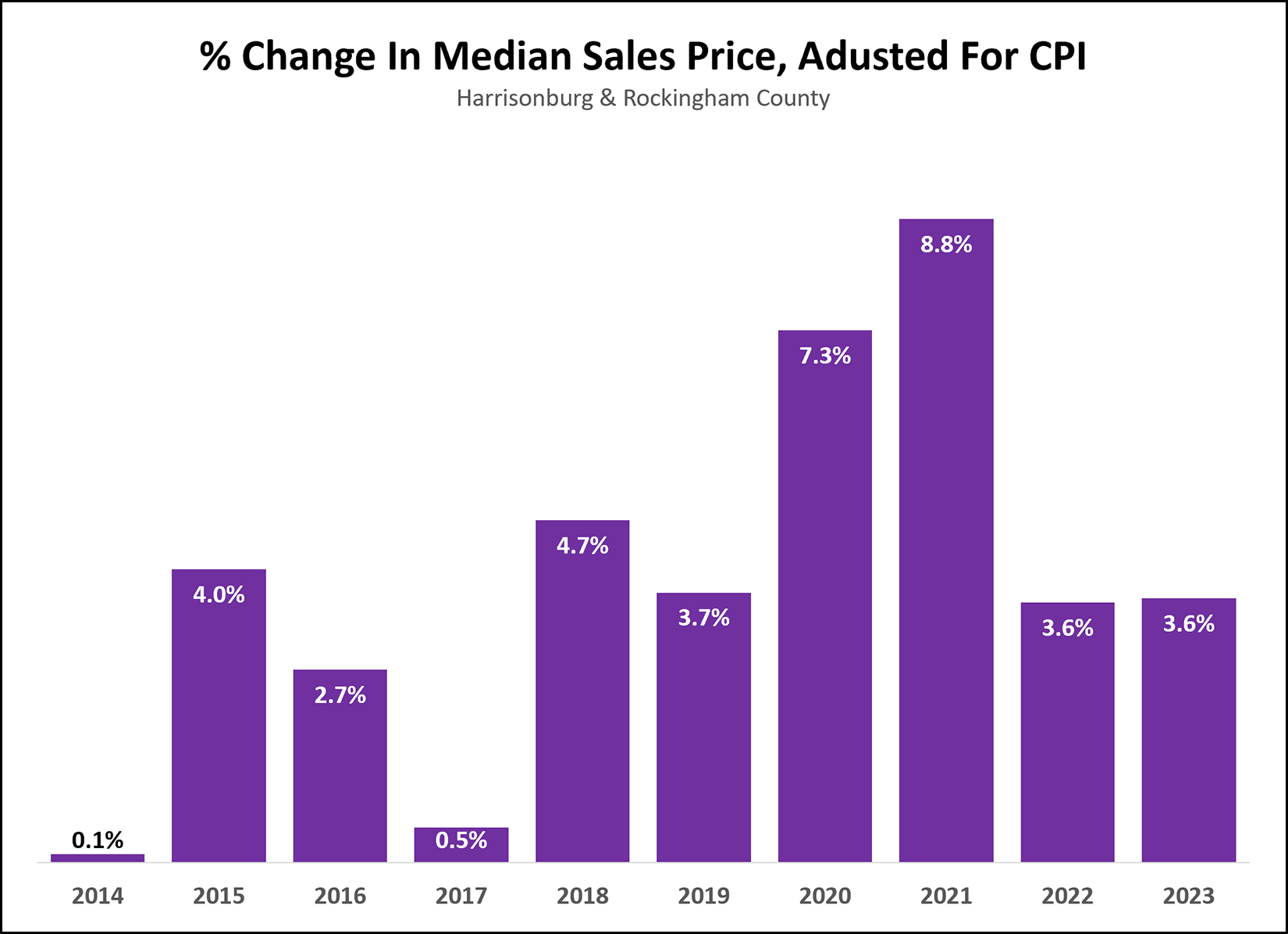

How Much Have Home Prices Increased, Locally, When Adjusted For Inflation? |

|

At first glance (above) the changes in the median sales price in Harrisonburg and Rockingham County have been CRAZY... with around 10% (or higher) increases in the median sales price every year since 2020. Wow! But... what if we adjust for inflation? The Consumer Price Index is the most widely used measure of inflation, and you'll see what the prices of most things have been increasing significantly over the past few years. Here's the change in CPI during the same timeframe as on the graph above...  As you can see, there were some rather large increases in the Consumer Price Index during 2022 and 2023. Inflation, if you haven't heard, is real and larger than life. So, what happens when we subtract out the changes in CPI from the changes in the median sales price? Let's take a look...  This graph starts to put the most recent price increases in a slightly different context. Yes, there were massive increases in the median sales price (when adjusted for inflation) during 2020 and 2021 -- which was in the midst of the Covid-19 pandemic. But when we adjust the median sales price (locally) for inflation (nationally) we see that the inflation-adjusted change in the median sales price over the past two years has been staying at 3.6%, not the 10% (+) increase we've seen in real dollars. But, yes, I know... you have to pay for a house with real dollars... and those real -- non inflation adjusted -- prices have been rising quickly. | |

Our Local Real Estate Market Keeps Testing Basic Economic Theories |

|

Between 2019 and 2022 we saw an ever increasing number of buyers buying homes (or trying to do so) in Harrisonburg and Rockingham County. Demand for homes skyrocketed, mortgage interest rates fell to historic lows, supply increased a bit (new builds) but not a enough... and perhaps unsurprisingly, median home prices increased 10% per year for three years in a row. But then, 2023... Mortgage interest rates have increased 30% over the past year, and have increased 150% over the past two years, making mortgage payments higher than ever. But yet, the median sales price keeps rising. Demand seems to be falling, with 24% fewer home sales in the first eight months of 2023 as compared to the same timeframe last year. But yet, the median sales price keeps rising. Supply is now starting to increase, with 31% more active listings on the market now as compared to a year ago. But yet, the median sales price keeps rising. What comes next!? As I pointed out yesterday, the higher inventory levels are only higher than the Covid-era lows, and are in line with or lower than pre-Covid levels. And certainly, fewer home sales may be a result of fewer sellers selling just as much as it may be a result of fewer buyers trying to buy. So, over the next two years, will we potentially see slower home sales, higher mortgage interest rates, higher inventory levels -- and yet, still see stability and/or increases in the median sales price? Yes, it seems quite possible. Or, could slower home sales, mortgage interest rates and higher inventory levels lead to a decline in the median sales price? This seems more likely, in theory, but we're just not seeing it yet, and I don't know if we'll see it at all. | |

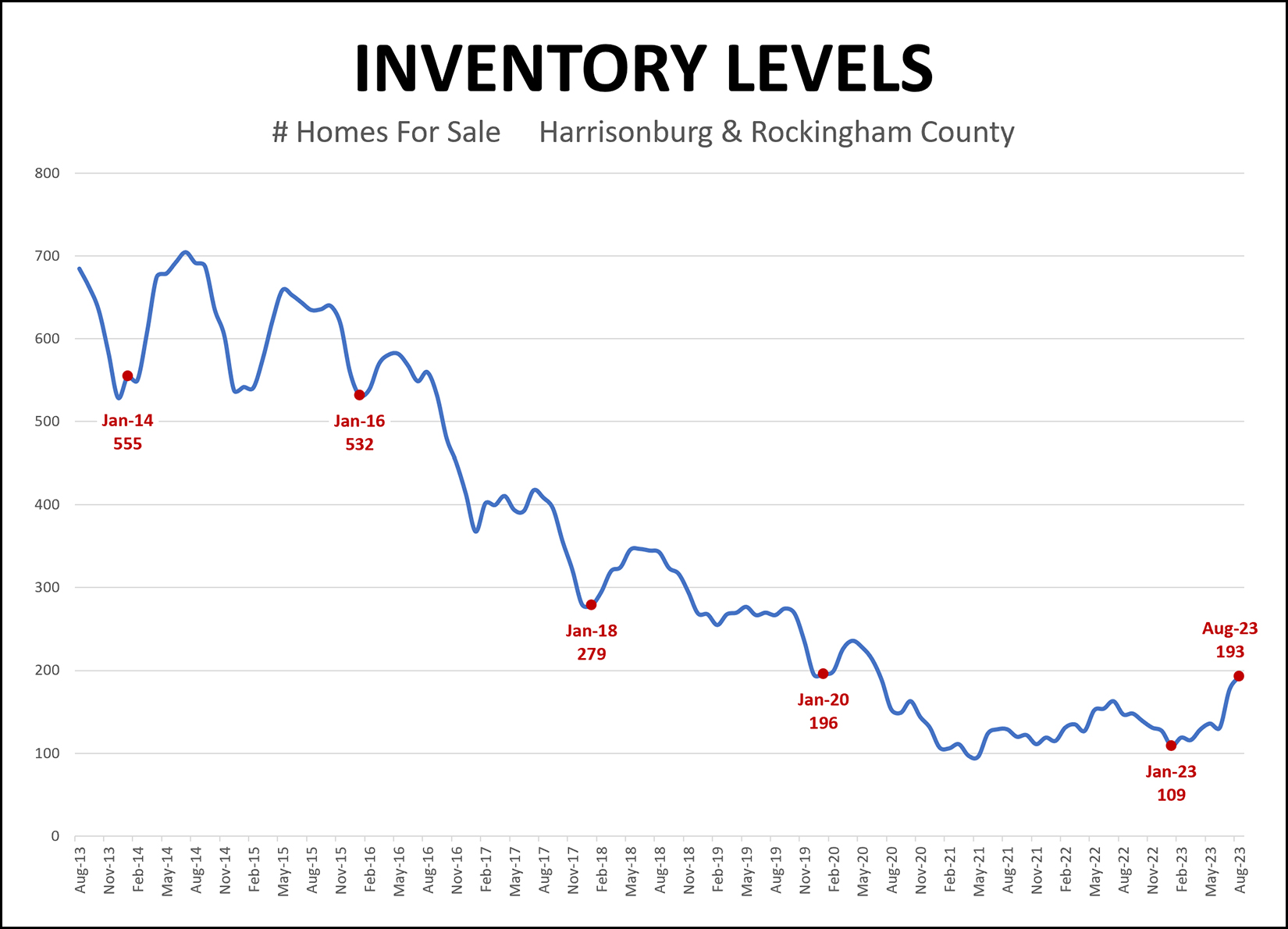

Recent Rises In Inventory Levels In Context |

|

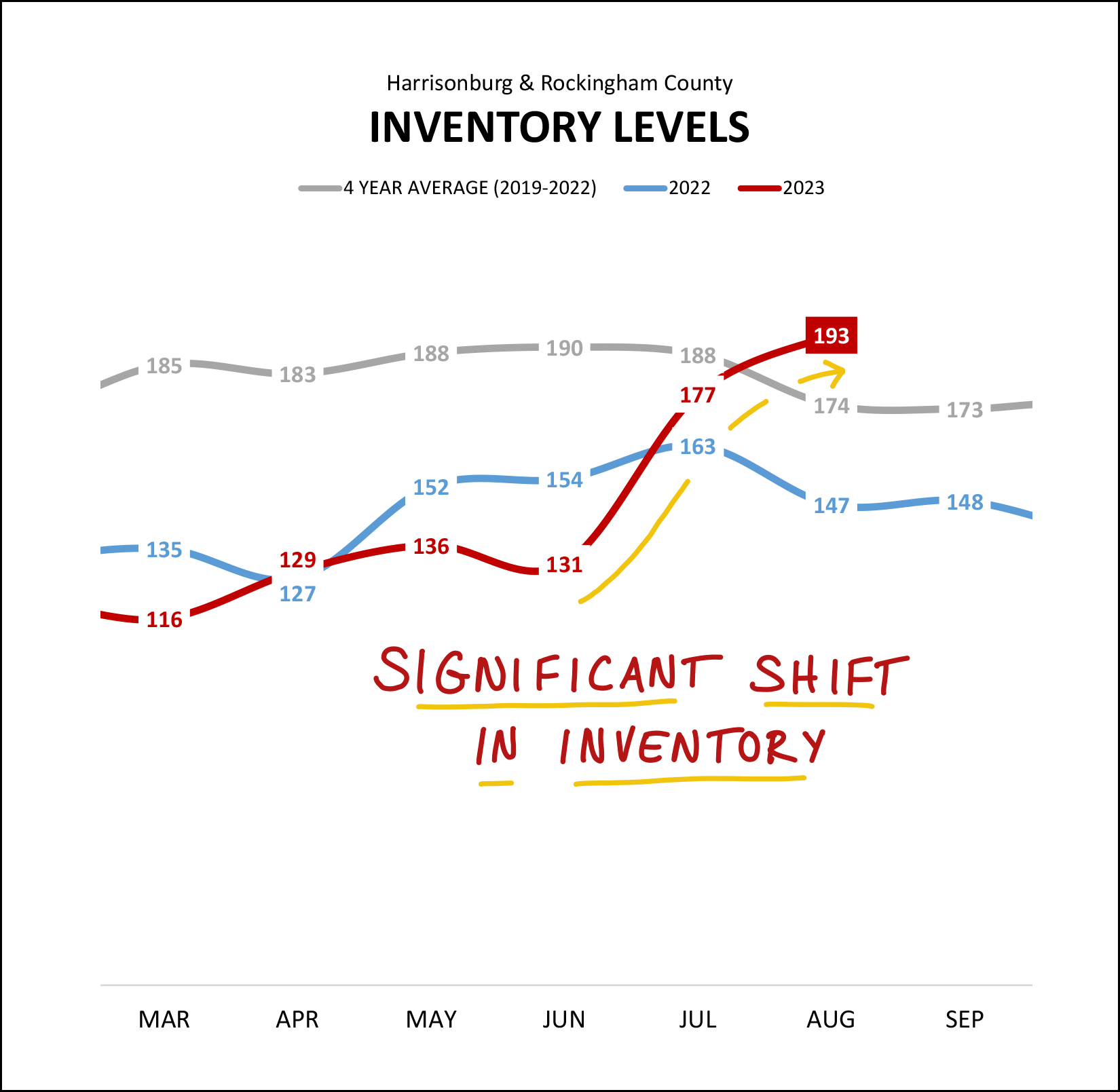

Inventory levels are on the rise in Harrisonburg and Rockingham County. January 2023 = 109 homes for sale August 2023 = 193 homes for sale That's a 77% increase in inventory levels! But... let's put it into a bit larger of a context... Just before Covid began (January 2020) there were 196 homes for sale. So, as shown above, other than during the weird years since the Covid pandemic began (2020-2023) inventory levels have always been above 200 homes for sale in Harrisonburg and Rockingham County... and sometimes well above that mark. So, higher inventory levels today do not necessarily mean we will see a marked change in home prices (for example) in our local market, but we'll have to continue to monitor changes in inventory levels over the next few months to see where they go from here. | |

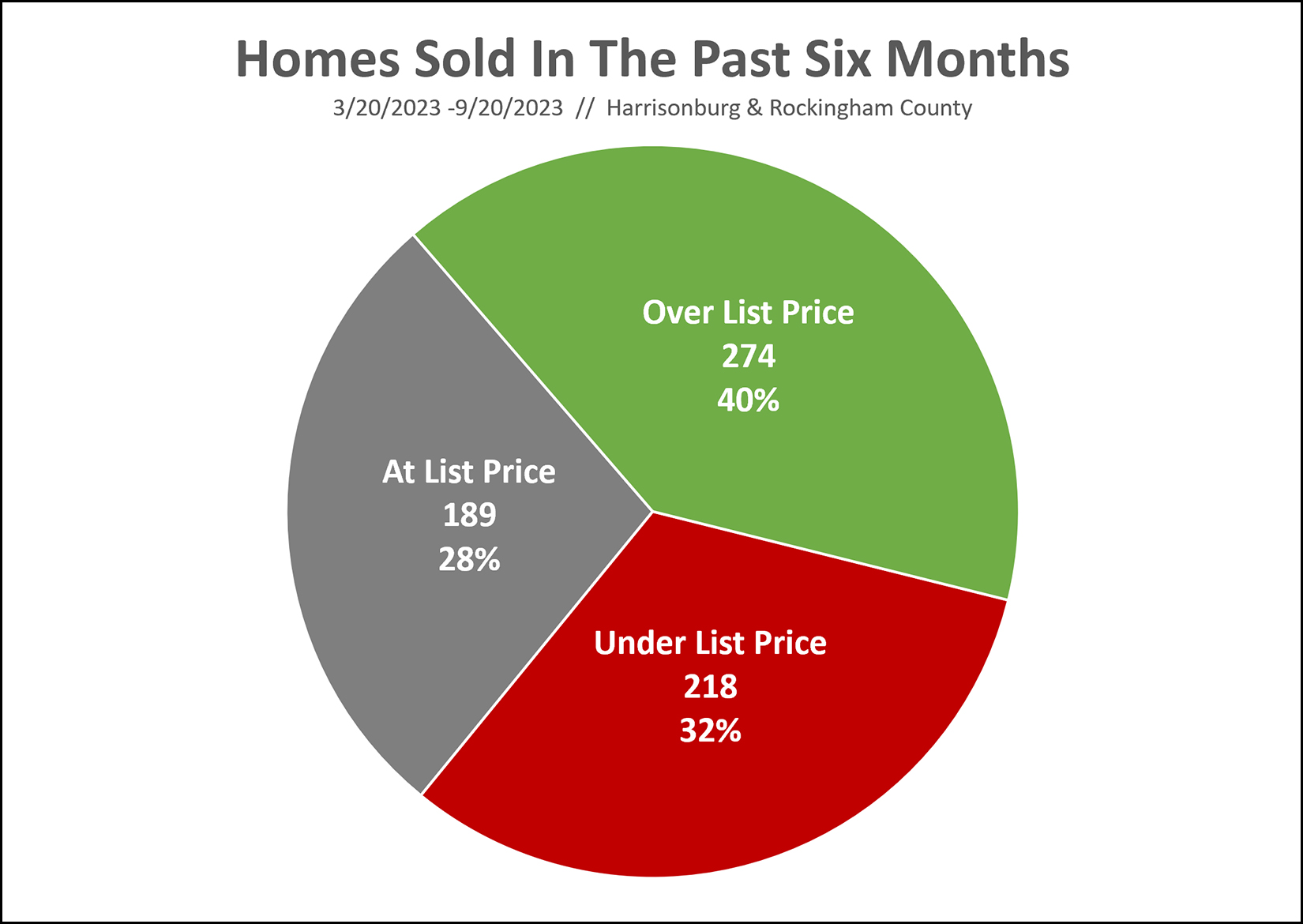

How Many Homes Are Selling For Less Than The List Price? |

|

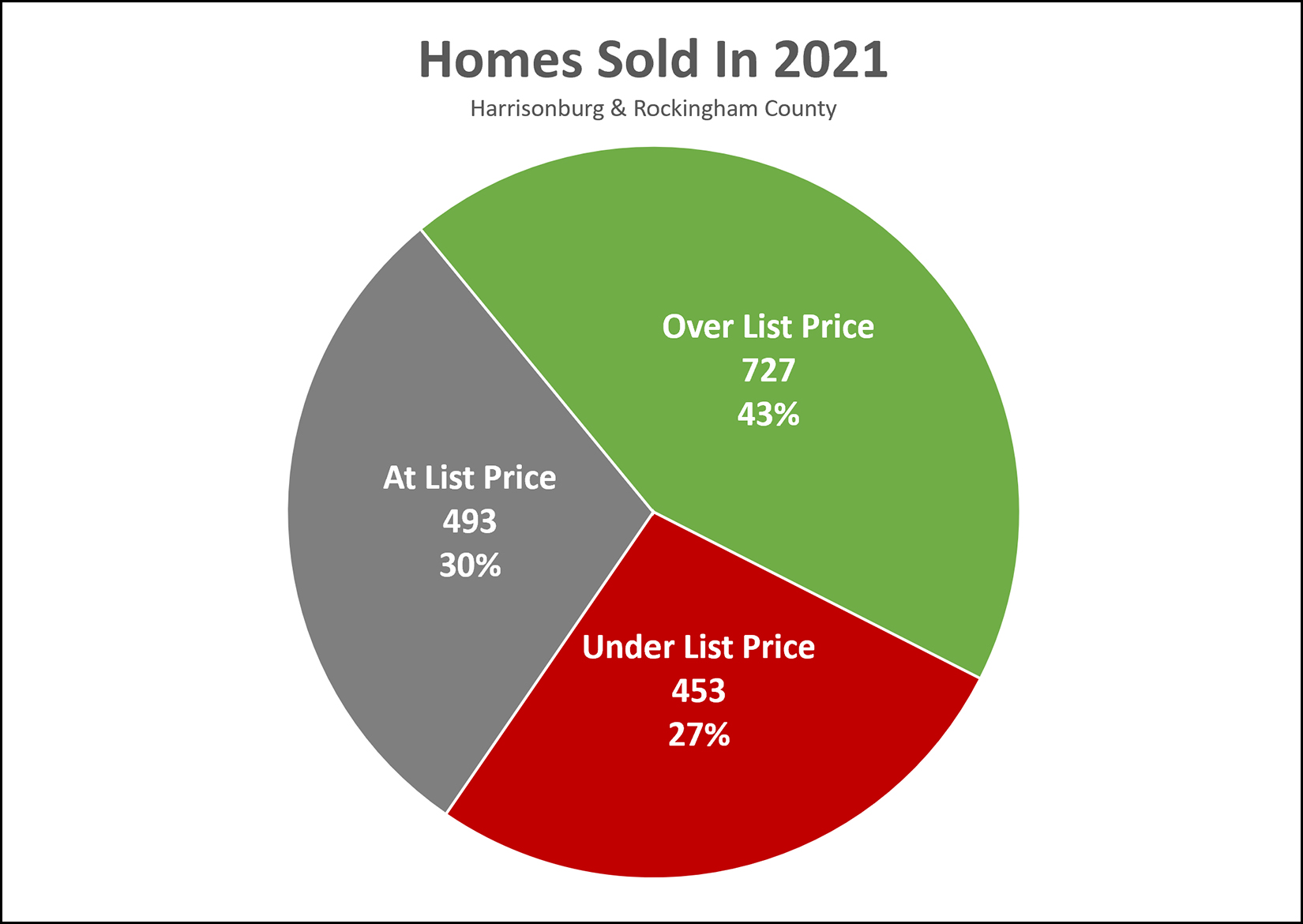

If we look at homes that have sold in the past six months... [1] 68% have sold for the list price or higher. [2] 32% have sold for less than the list price. [3] 40% have sold for over list price. Maybe several of these stats surprise you. Maybe none of them do. I think the most surprising to me is that 32% of homes sold for less than the list price. If often feels like buyers are barely ever able to negotiate on price -- and sellers are barely ever willing to negotiate on price. Interestingly, let's look back a year and a half (ish) to 2021 when mortgage interest rates were in the 3.something range...  The numbers here are certainly different, though not quite as different as you might imagine. For all the homes that sold in 2021... [1] 73% sold for the list price or higher. [2] 27% sold for less than the list price. [3] 43% sold for over list price. So... is every home selling over asking price? Nope. Back in the crazy times of 2021, was every home selling over asking price? Nope. | |

Interstate 81 Through Harrisonburg Will Be Expanded Soon, But Will It Have Sound Barriers? |

|

A nearly six mile stretch of Interstate 81 (from mile marker 242 to 248.8) will soon be expanded to have three lanes of traffic in each direction!

The noise barrier balloting is set to take place in October 2023. In 2024, VDOT will work on acquiring right of ways and will work on relocating utilities. In 2025, VDOT will advertise for construction. The widening of Interstate 81 is anticipated to be substantially complete by December 2029... in about six years. Read all about this I-81 Harrisonburg Widening Project here. | |

Sample Mortgage Payments In September 2023 |

|

Mortgage interest rates are on the rise... they were 3% two years ago, 6% a year ago, and just above 7% today. Let's see how those 7-ish percent mortgage rates translate into some mortgage payments these days. All of these illustrations are for homes in the City of Harrisonburg, and (since I'm not a lender) they are not offers for mortgages with specific terms... $250K purchase with 5% down = $1,833 / month $350K purchase with 10% down = $2,449 / month $450K purchase with 20% down = $2,850 / month $600K purchase with 30% down = $3,400 / month Working backwards for a moment, if you were trying to keep your mortgage payment under $1500 (for example) you'd be looking at a $205K purchase price with a 5% down payment. With current mortgage interest rates above 7%, it's more important than ever to talk to a lender sooner rather than later to determine how much you can afford in a mortgage payment -- and/or how much you want to spend each month on your mortgage payment. If you need a recommendation for a great local lender, just let me know. | |

Fewer Homes Are Selling, Though Prices Keep Rising, And Now Inventory Levels Are Rising Too!? |

|

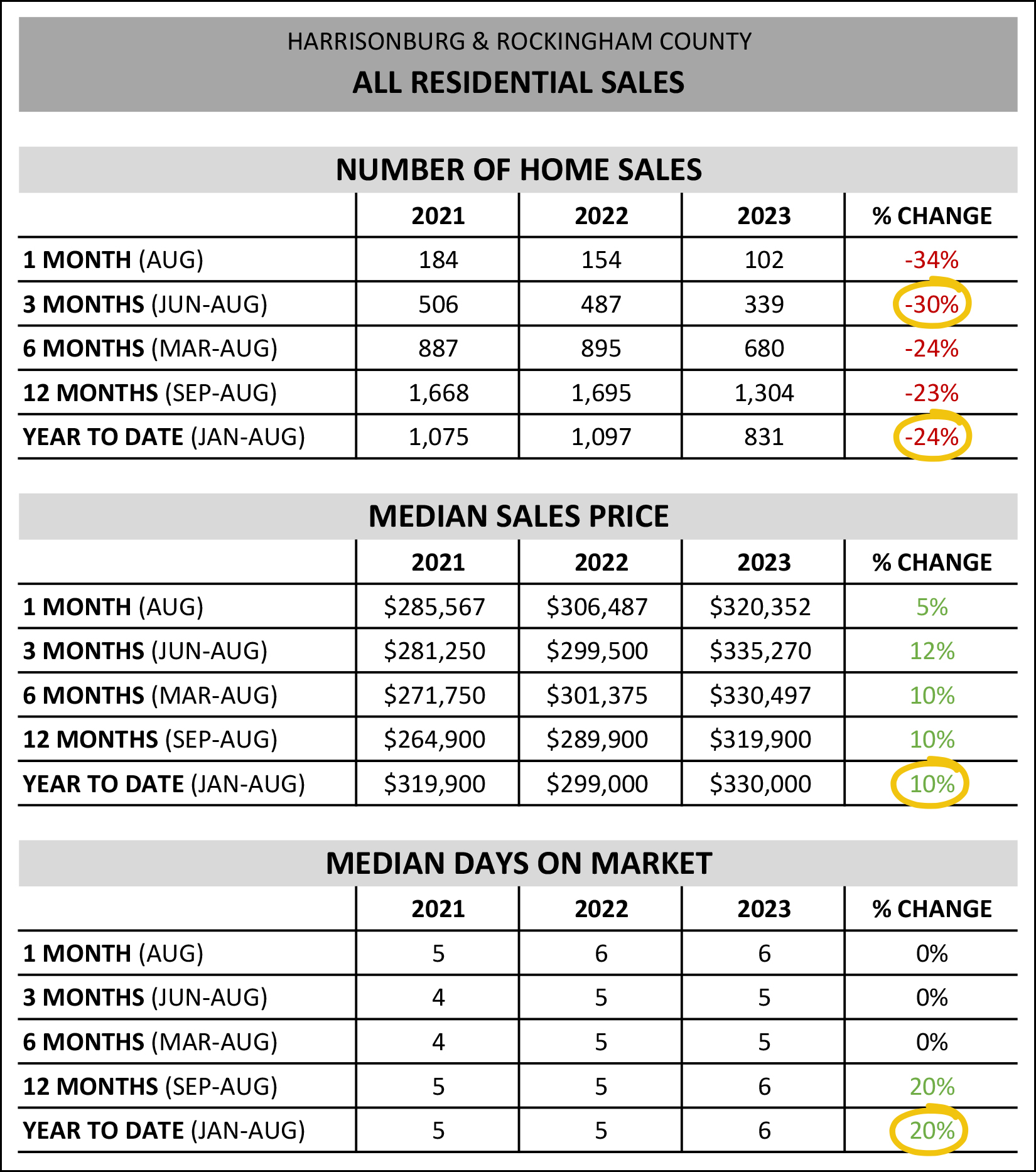

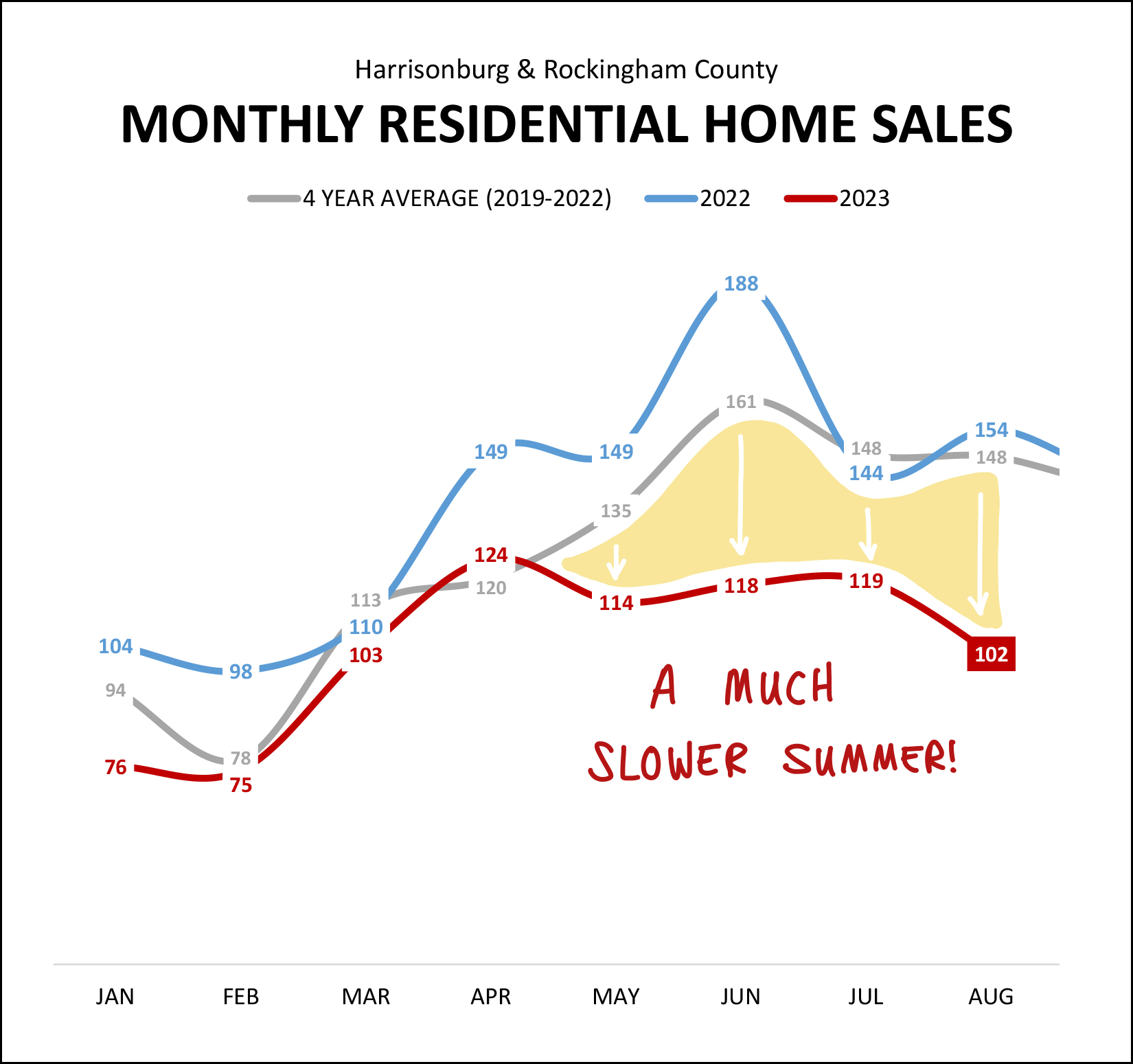

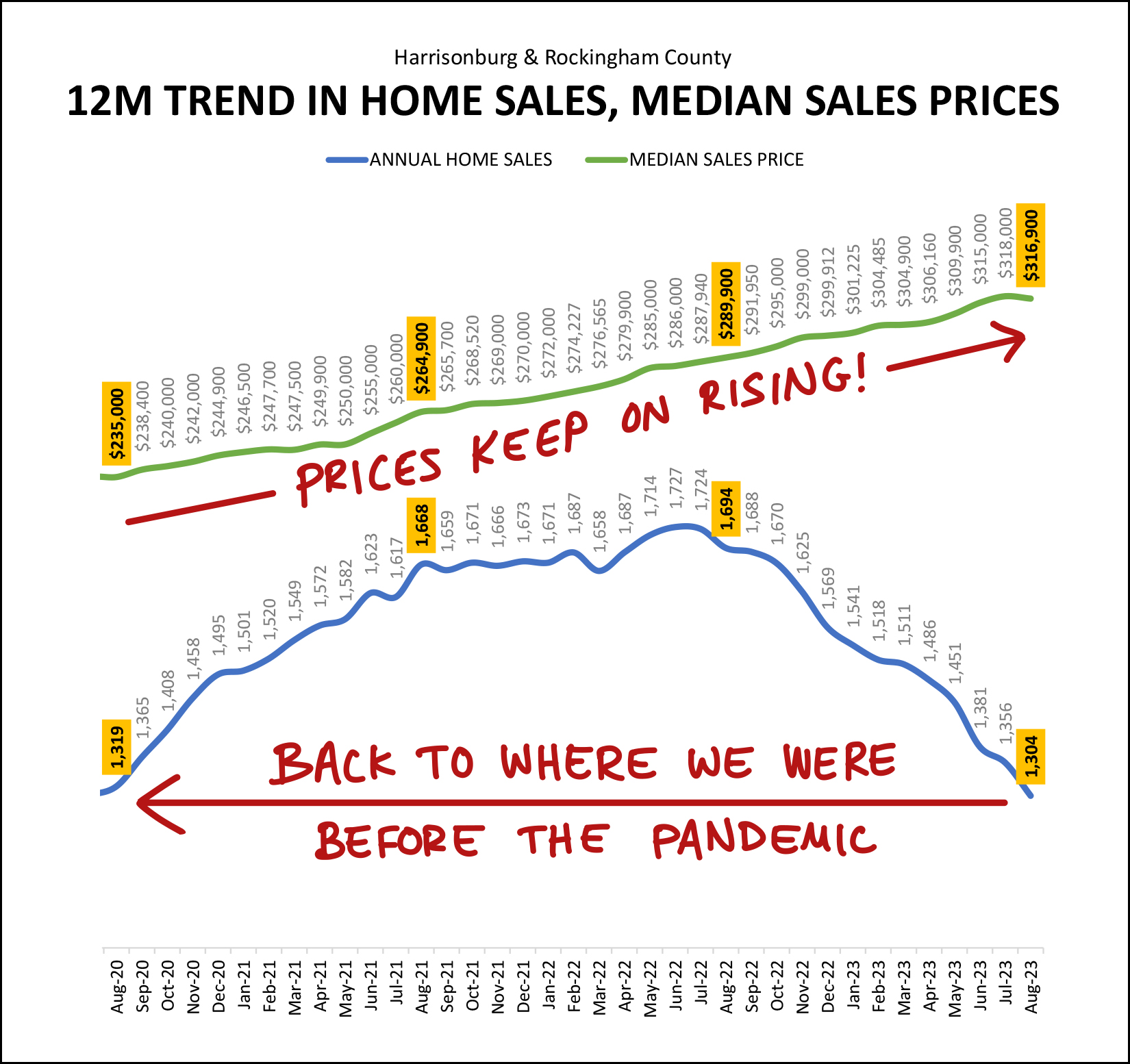

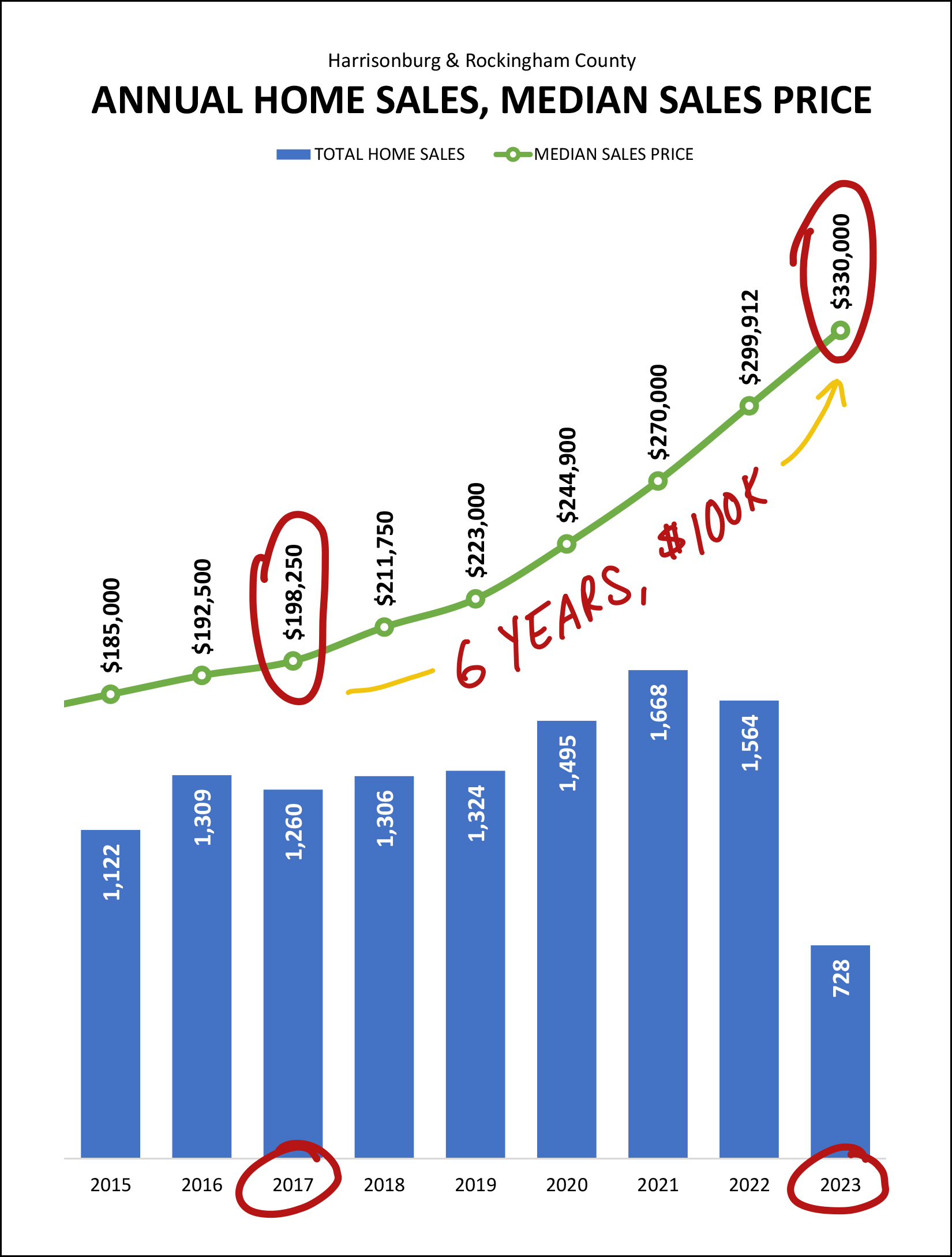

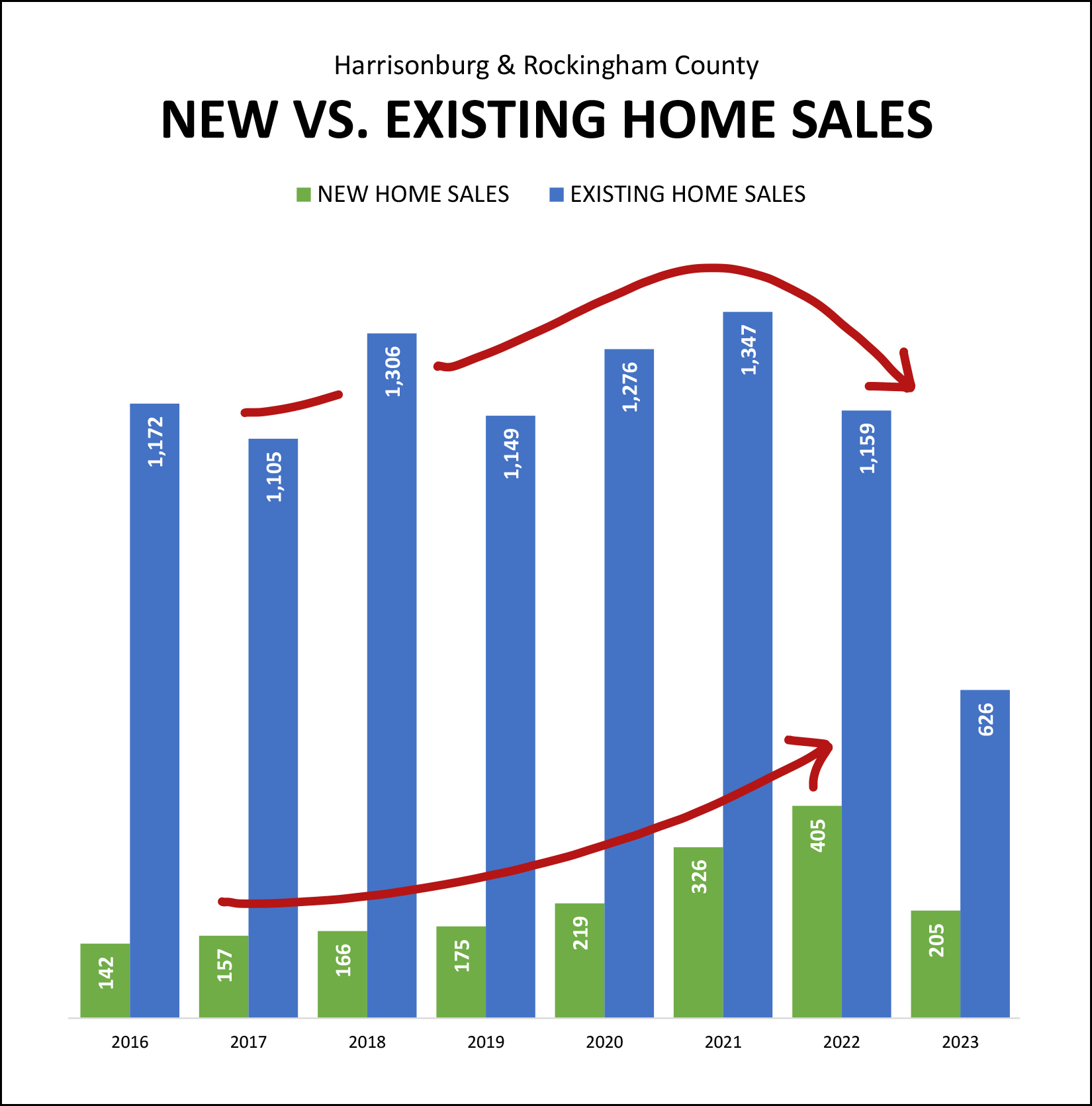

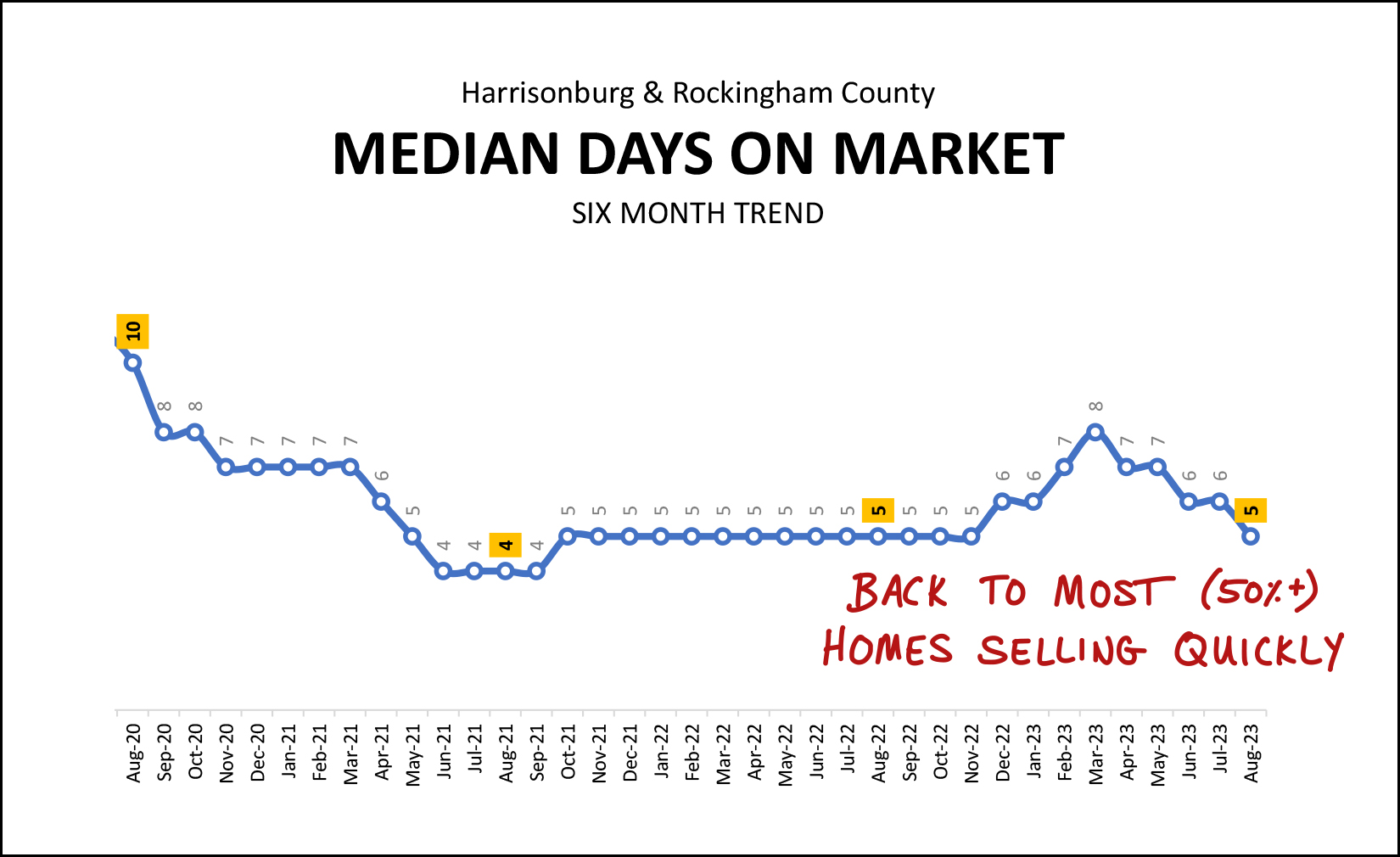

Happy Thursday morning, friends in and around Harrisonburg and beyond! After I process all the data... and create all of the charts and graphs... and doodle on them to notate trends... I then go back and review it all again in order to write the headline of my monthly market report. As it turns out, this month's headline ended up being pretty similar to last month. Fewer home sales... higher sales prices... but also... higher inventory levels. We are definitely seeing some shifts in our local market, though it is not yet clear how significant of an impact those changes will have. But we'll get to all of that real estate data... First, whether you are a teacher, a student, a professor, a school administrator, a staff member at a local college, or a parent, I hope your school year has had a great start. On our end, Luke has started his first semester of classes at Wake Forest and Emily is a few weeks into 10th grade. It has been a fun but busy start to the year, and we're looking forward to visiting with Luke at WFU Family Weekend soon! Secondly, a few listings of potential interest to you... 9926 Goods Mill Road - A modern farmette on 3.3 acres with awesome mountain views in the Spotswood High School district for $575,000. 3986 Dixie Ridge Road - A spacious four (or five) bedroom home with the primary bedroom suite on the main level for $475,000. 3211 Charleston Boulevard - A like-new, upscale townhouse in Preston Lake with a two-car garage with access to many community amenities for $375,000 Congers Creek Townhomes - Three-level, new construction townhomes across Boyers Road from Sentara RMH Medical Center for $306,900 and up. And thirdly, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Merge Coffee, Jimmy Madison's and Red Wing Roots tickets. This month I am giving away a $50 gift certificate to a delicious local restaurant, Taste of Thai. I'm writing this report on Wednesday evening... you'll get it Thursday morning... and my writing this evening is powered by one of my go to dishes at Taste of Thai... Massaman Curry. Are you a fan of Taste of Thai as well? Click here to enter to win a $50 gift certificate! And now... on to the data, and charts and graphs...  This first data table above shows much of what we've seen for the past year or so now... [1] We're seeing fewer home sales now than we were a year ago. In the first eight months of this year (Jan-Aug) we've seen 24% fewer home sales than in 2022. If we look only at the summer months (Jun-Aug) we see a slightly larger 30% drop in the number of homes selling. [2] The median sales price continues to rise... it's up 10% in the first eight months of this year (Jan-Aug) as compared to the same timeframe in 2022. [3] Homes are still going under contract rather quickly with a median days on market of six days, which is just a smidge ahead of last year's median of five days. As alluded to above, the summer months were a good bit slower this year than last...  The three lines shown above are as follows... Red = This Year Blue = Last Year Grey = Average of Past Four Years As such, home sales in the summer (+/-) of 2023 were well below the average of the past few years, and even farther below last summer. We saw 102 home sales in August 2023... which is slightly less than we saw in... January 2022. That's actually sort of surprising... a summer month that we would expect to be rather active was slower than a winter month that we would expect to be rather slow. High mortgage interest rates -- we'll get to those below -- likely play a significant role in slowing down the number of homes that are being sold and purchased these days. Now, putting the lower and lower number of home sales in context...  We have seen the number of home sales in a 12 month period drop from about 1700 home sales (summer 2021 through summer 2022) down to only 1300 home sales. But... looking back a bit further, this just takes us back to... where things were at the start of or just before the pandemic. So... yes, we're seeing significantly fewer home sales right now... compared to the significantly higher number of home sales seen in 2020, 2021 and 2022... which were likely high points fueled by low mortgage interest rates and lots of buyers rethinking what they needed in a home during the pandemic and thereafter. And yes, despite the rapid increase (1300 to 1700) and then rapid decrease (1700 to 1300) in home sales, we've seen home prices steadily march on along, upward, during the entirety of the past three years. Looking back a bit further than three years puts the change in median sales price in an even wilder context...  Not too long ago (2017) the median sales price in Harrisonburg Rockingham County was just below $200K. This year (2023) that median sales price is now above $300K. That $100K(+) jump over the course of six years has significantly changed what it looks like to be a first time buyer (or a move up buyer) in our local market. Certainly, the higher mortgage interest rates we have seen in 2023 (and 2022) haven't helped either. The combination of higher sales prices and much higher mortgage interest rates have resulted in much, much higher housing payments for buyers in today's market. Looking for a trend that is heading in two different directions at once? Here's one...  We are currently seeing a downturn (blue bars) in the number of existing homes selling in Harrisonburg and Rockingham County... while at the same time seeing an increase (green bars) in the number of new homes selling in our market. Higher mortgage interest rates are causing many homeowners to have no interest in selling... which is resulting in fewer existing homes being on the market for sale. Thankfully, there are builders helping to add housing stock in our area, resulting in more new homes selling over the past few years. Shifting gears a bit to the here and now... the freshest data to watch for the most recent trends is contract activity...  Last month we saw an increase in contract activity... with 130 homes going under contract, compared to only 114 in the same month last year. It seemed that maybe we would see a sustained surge of buyer activity. But... maybe not. With only 112 contracts signed in August 2023, it seems that the surge of contract activity in July 2023 was an anomaly, and we will still see smaller numbers of contracts being signed in 2023. Darn. And here's the most interesting graph of them all, in my opinion...  Over the past two months we have seen a significant shift in inventory levels -- the number of homes available for sale in Harrisonburg and Rockingham County. For most of this year (red line) we have seen even fewer homes for sale than last year (blue line) but that all changed in July 2023. Over the past two months we have seen inventory levels build up beyond (above) where they have been for the past several years. These higher inventory levels are resulting in... [1] Buyers have slightly more choices of homes to go view. [2] Homes sometimes staying on the market a bit longer than before. [3] Many sellers seeing fewer showings than they expected. [4] Plenty of homes not going under contract in the first few weeks. Will higher inventory levels eventually translate into a higher number of home sales, bringing inventory levels back down? Maybe. Will higher inventory levels eventually lead to some sellers being more flexible on price, and a leveling out of the median sales price, or even a decline in the median sales price? Maybe. I'll continue to monitor inventory levels with interest as higher inventory levels can start to make it a slightly more favorable market for buyers than it has been for the past few years. As already mentioned in this report, despite higher inventory levels, we're still seeing prices rise... and most (50%+) homes are still going under contract quite quickly...  Just to translate the graph above into words... over the past six months the median "days on market" of homes that have sold was five days. Of note... that only measures the median days on market for sold homes... not those that are still on the market for sale. Furthermore, this is just a median -- it's not saying that all homes are going under contract in five or less days. As per how a "median" calculation works... 50% of homes are going under contract in five or fewer days... and 50% are going under contract in five or more days. And finally... I have mentioned higher mortgage interest rates so many times in this market report that you're probably wondering how high they are...  They are QUITE high... higher than they have been in many years... higher than they have been in several decades. It seems quite possible that mortgage interest rates will edge back down below 7% in the coming months... but I'm guessing we'll see mortgage interest rates above 6% for the next year or two. These higher mortgage interest rates significantly affect housing costs for buyers making a decision to buy in today's market. If mortgage interest rates were lower, we would likely see more sellers being willing to sell, and more buyers able to and interested in buying. And just like that, we've breezed our way through all of the charts and graphs I have for you today. My advice to buyers and sellers is relatively similar to recent months gone by, but I'll reiterate it here... Home Buyers -- You might be able to wait a day (or even two) to go see a new listing now, but don't assume that many or most will be there three or four days after they hit the market. Plenty of homes are still going under contract very quickly, particularly those in more desirable price ranges, locations, etc. Talk to a mortgage lender to understand your potential housing costs and get going to see some new listings as they hit the market. Home Sellers -- All homes won't go under contract within five days. Your home might be on the market for a few weeks or even a few months depending on it's condition, location, price range and other attributes that are appealing to either a wide or narrow pool of buyers. Price your home competitively, prepare it well for the market and market it thoroughly and professionally and you should still have success in securing a contract with a buyer -- but it won't necessarily happen overnight like it seemingly always was over the past few years. If you have a real estate question... reach out anytime. It's never too early to have an initial chat about your possible plans to buy, sell or move. I'm happy to provide feedback and input to help you think some things through and make a plan for your housing transition when you're ready to do so. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

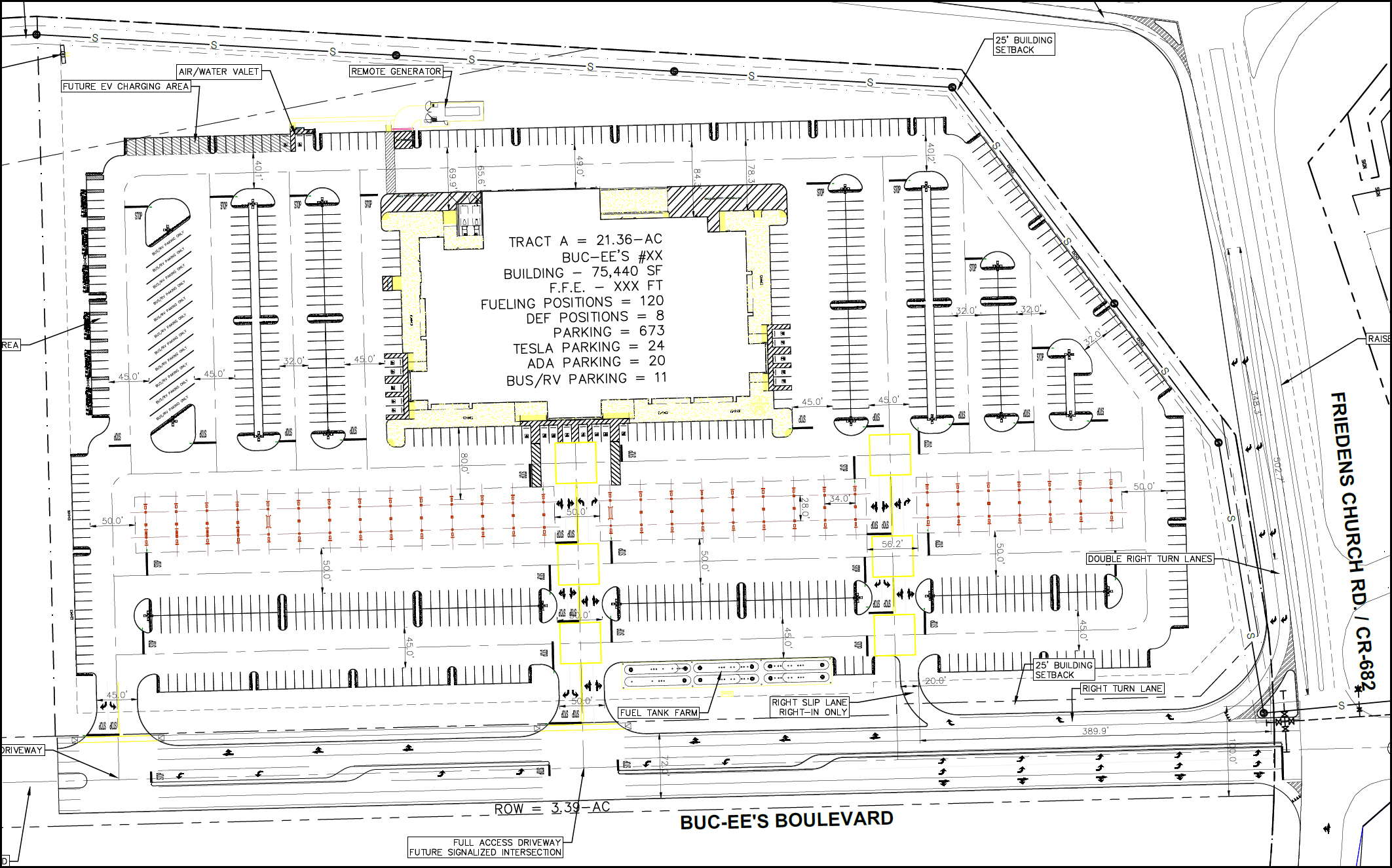

Major Travel Center Proposed To Include 75,000 SF Building, 673 Parking Spots, 120 Gas Pumps, 24 Tesla Chargers Just Outside Mount Crawford |

|

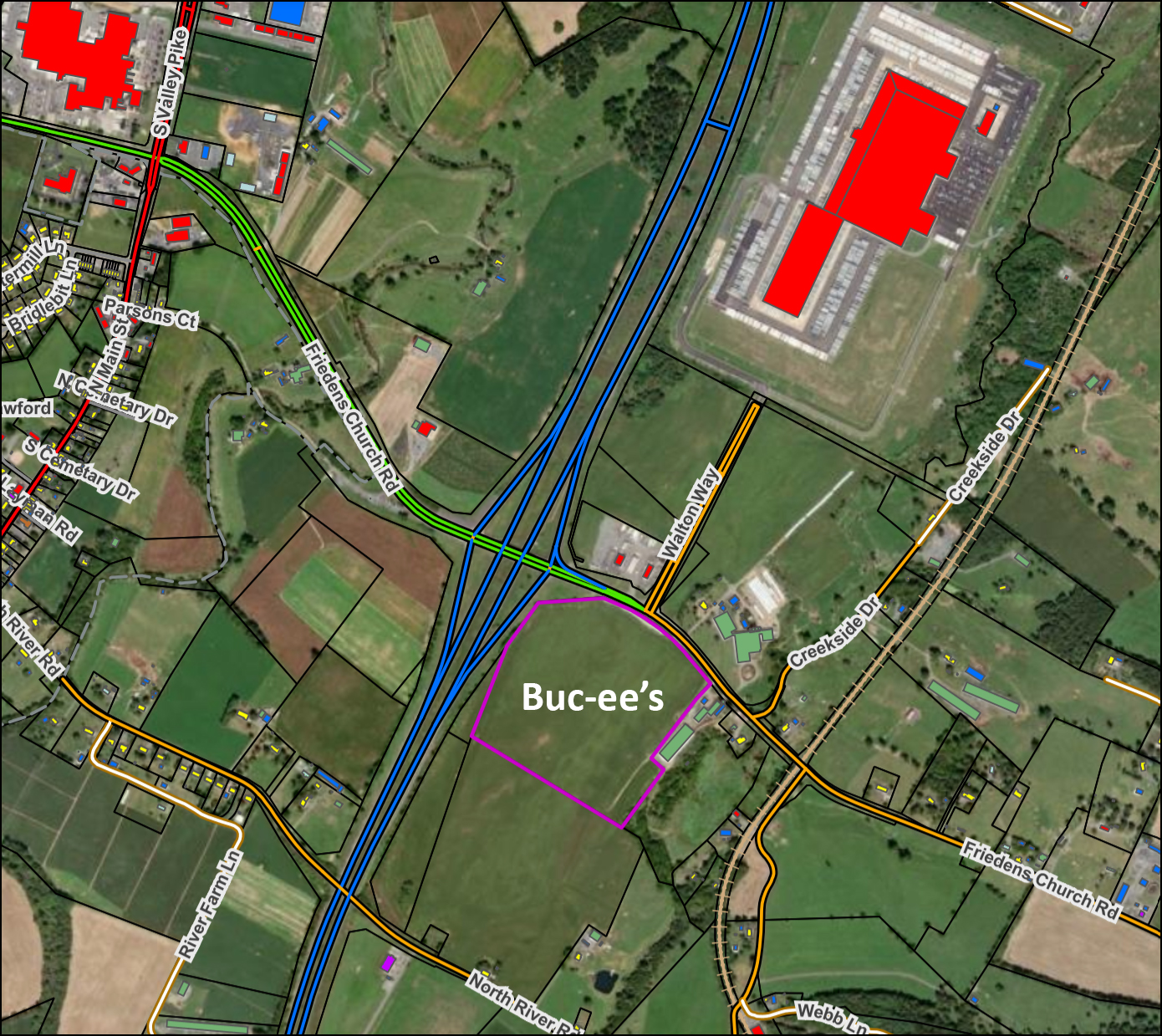

(The Buc-ee's shown above is a photo of a similar travel center - not a rendering of the proposed travel center.) This is old-ish news now, but I have still been getting questions about where the Buc-ee's will be located, so here's a bit of context for those who are interested... A major travel center is proposed to be built just outside Mount Crawford, on Friedens Church Road, along Interstate 81, across from the entrance to the Walmart Distribution Center...  Here's the potential layout of the site...  Download an info packet from the County related to the special use permit for the Buc-ee's sign here. | |

If Your Home Has Not Sold We Should Look At What Buyers Are Actually Buying |

|

As an aside... the market is definitely shifting in some ways... as we are no longer seeing every house go under contract in hours or days with multiple offers. We're still not seeing prices adjust, overall, but some homes are sitting on the market longer than they would have over the past few years. That nuance aside... let's say your house is listed for sale, and it just hasn't sold after 30, 60 or 90 days. How should we think about that? What information would be helpful in understanding why your house has not sold? I believe context is key here... [1] How many buyers have contracted to buy homes that are similar to your house since your house has been on the market. If you are selling a 3 bedroom, 2 bathroom, 2000 SF home -- let's look at how many buyers have contracted to buy 3 - 4 bedroom, 2 - 3 bathroom, 1800 - 2500 SF homes in the same timeframe that you have been trying to sell your home. Have lots of buyers contracted to buy similar homes? Or just a few? How have the prices of those other homes compared to your list price? [2] How many other sellers of similar homes are trying to sell their homes right now? If you are selling a 3 bedroom, 2 bathroom, 2000 SF home -- let's look at how many other sellers are trying to sell a 3 - 4 bedroom, 2 - 3 bathroom, 1800 - 2500 SF home right now. Do you have lots of competition? Or not very much? How do the list prices of those competing homes compare to your list price? -- As the local housing market continues to shift over the coming months it will be important to understand the context in which you are selling your home and making sure you are pricing and marketing your home in a way that will give it the best chance to sell relative to what buyers are buying and what other sellers are trying to sell. | |

Home Buyers Might Not Request Showings Of Your Home With Minutes. Gasp! |

|

Looking back, one of the humorous things about the (crazy) real estate market in 2020, 2021 and 2022 was how quickly buyers would jump on every new listing when it hit the market. When I would launch a new listing for sale via the MLS, Realtor.com, Zillow, local and national websites, Facebook, etc. -- I would invariably start getting showing requests within the first 15 minutes. It was surreal how quickly home buyers were responding to new listings, running out to go see them that very first day that they were listed for sale. After all... there would often be 20 - 30 showings within the first three days, and 5 to 15 offers within the first three days... so it's not surprising that the showing requests would roll in so quickly. But now, it's back to pre-Covid normals, at least in this regard. When a new listing is launched, I will often have a showing request or two within the first few hours or on that day -- but my phone doesn't immediately blow up with texts from buyer agents in that first 15 minutes any longer. Certainly, the speed at which showings are requested, and the number of showings that are requested varies by price range, location and more -- but the requests aren't starting off quite as quickly as they were during the Covid era. | |

Going, Going, Gone. Make An Offer Before That House Is Under Contract. |

|

Home buyers aren't making decisions quite as quickly these days. That doesn't mean that homes aren't going under contract as quickly -- they often are -- but individual buyers aren't making decisions about whether to make an offer on a house quite as quickly as they have over the past few years. As a result, sometimes buyers are missing out on buying houses for new reasons. Over the past few years buyers often missed out on houses because there were multiple offers on most new listings and they were always competing with other buyers. What I am finding in the current market is that some buyers are missing out on houses because they are waiting a bit too long to make a decision to make an offer. How could this be? Aren't sellers waiting days and days for offers to roll in before they consider moving forward with one? Sometimes. But not as often as in 2021 and 2022. If a seller has 10 showings and four days later they receive their first offer -- they might decide to wait a few days to see what other offers might roll in -- or they might just sign the contract and move forward with the buyer who went ahead and made the offer. So... if you go to see a house that you like, and you're thinking about making an offer but you haven't done so yet... realize that it could very quickly become unavailable if a seller receives a reasonable offer. I don't think all buyers need to universally speed up their decision making process... but they should realize that many sellers are currently more likely to move forward with a favorable offer rather than let it sit for a few days in hopes of receiving additional offers. | |

Price Changes, Even If Small, Can Remind Buyers That You Really Do Want To Sell Your Home |

|

Consider these two listings that a buyer might be considering in today's market... Home #1 A home priced at $435K that has been on the market for 75 days without a price change. Home #2 A home priced at $425K that has been on the market for 75 days and... [1] was initially listed for $439,000 [2] was reduced to $435,000 after being on the market for 30 days [3] was reduced to $429,000 after being on the market for 45 days [4] was reduced to $425,000 after being on the market for 60 days Certainly, buyers are going to see a $10K difference between the two homes ($435K vs. $425K) but they are also likely going to believe that the sellers of the second home are more motivated to sell. A seller who has priced their home at $435K and who hasn't budged at all is likely more motivated to sell for a particular price than they are motivated to make sure that their home sells. A seller who has made several price adjustments to their home over time is signaling to potential home buyers that they are definitely motivated to sell and want to be sure that their home will sell. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings