| Newer Posts | Older Posts |

If You Are Buying A Home Soon, Consider Starting Your Loan Application Now |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

Will This House Sell For More Than The Asking Price? |

|

The answer to this question - will a house sell for more than its asking price - does not just relate to how the asking price compares to the market value of the home.

Certainly, if a house is priced too low, or even priced fairly in a competitive market, that will increase the likelihood that it will sell above the asking price... [1] A house worth $350K, listed for $330K, will almost certainly sell for more than the asking price. [2] A house worth $350K, listed for $350K, is likely to sell for more than the asking price in the current market. ... but there are other factors that affect this as well. [1] How many buyers have viewed the home? As the number of showings increases, the likelihood of a house selling for more than the asking price also increases. [2] How many buyers have made an offer? As the number of offers increases, the likelihood of a house selling for more than the asking price also increases. All of this might seem pretty straightforward, but pause to reflect on these dynamics as you are considering an offer on a house recently listed for sale. Consider these two fictional houses that came on the market (not really) yesterday, that we’re walking through today... [1] House listed for $350K, with 18 showings and four offers thus far. This house is very, very likely to sell for more than the asking price. :-) [2] House listed for $350K, with eight showings and one offer thus far. This house might sell for more than the asking price - if another buyer jumps in and makes a second offer. [2] House listed for $350K, with 12 showings and no offers. This house could, possibly, sell for more than the asking price, but it is not seeming very likely given that lots of buyers have looked at it already and there aren’t any offers. [3] House listed for $350K, with one showing and no offers. This house is almost certainly not going to sell for more than the asking price - unless a bit more time passes and several buyers all of a sudden go see the house at the same time and make simultaneous offers and then have to compete with each other to buy the house. So, to answer the question of whether a house is likely to sell for more than its asking price, we really need to start by asking how many showings a house has had and how many offers exist. | |

We Will Not Know How Many Potential Buyers For Your Home Are Waiting In The Wings Until We List Your House For Sale |

|

How much interest will my house have once it is listed for sale?

The answer? Assume nothing! Just because you are in a low price range with very low inventory that does not mean you will have high buyer interest if there are other factors of the property (location, condition, age, finishes, systems) that make it less than appealing to most buyers. Just because you are in an extremely high price range that does not mean you will not have lots and lots of early buyer interest and lots of offers. Just because you are in a popular neighborhood that doesn’t mean that you can price your home higher than is justified based on comparable sales once adjusted for how they differ from your home based on layout, finishes and condition. In the end, we can make some educated guesses on how much buyer interest (showings, offers) will exist once your house is listed for sale - but we won’t REALLY know until we list it for sale. Ah, the suspense… | |

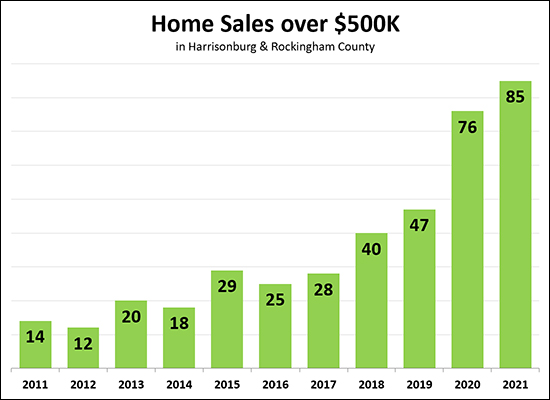

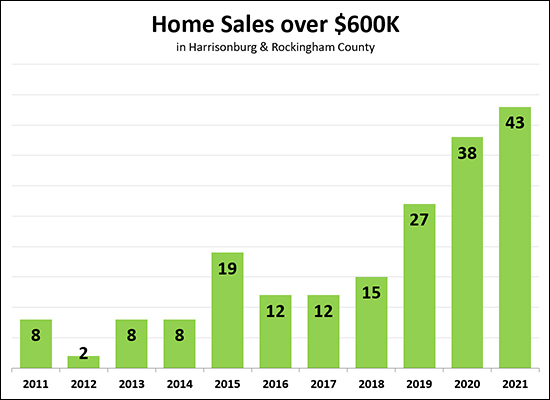

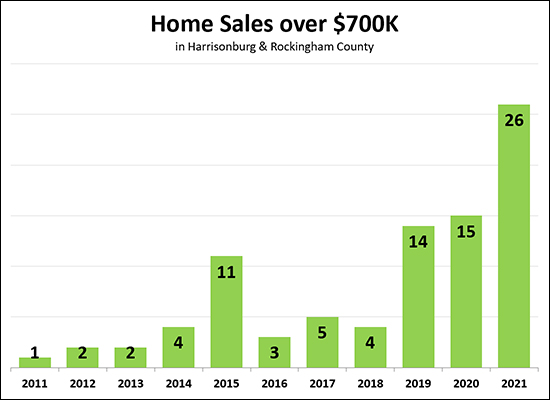

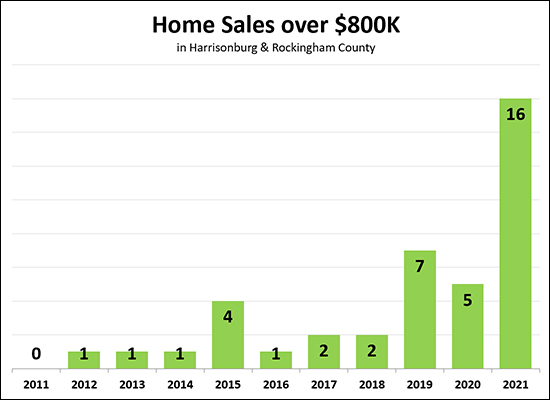

Harrisonburg Area High End Home Sales Booming In 2021 |

|

Only 7% of local home buyers spend $500K or more on their home purchase (per sales data over the past 12 months) but this segment of the local housing market has been strong over the past few years. As shown above, there were 76 home sales over $500K last year - which was wellmore than any time in the past decade. This year we have already exceeded that pace of $500K+ home sales even with just the first ninemonths of the year. There have already been 85 home sales over $500K up through October 4, 2020 and there is still time for a more before the end of the year.  We also saw a big jump in the number of home sales over $600K last year Last year was an extraordinarily strong year for home sales over $600K - with 38 such sales - well more than in any other year in the past decade. This year -- we're seeing even more $600K+ home sales, with 43 thus far and still three months to go! Let's keep narrowing our focus, now to sales over $700K...  The number of $700K home sales a year was averaging four sales per year between 2016 and 2018 and then more than tripled in 2019 to 14 sales, followed by another 15 sales in 2020. But this year -- wow! The number of home sales over $700K looks like it will likely double this year as we have already seen 26 such home sales in the first nine months of 2021! And... one more time... let's look at even more expensive homes...  This one surprised me. Well, most of the graphs did, but this one particularly. Before 2019 we were seeing around two sales a year over $800K. In 2019 and 2020 that jumped up to 7 (2019) and 5 (2020) -- but this year -- we have already seen 16 buyers pay over $800K for homes in Harrisonburg and Rockingham County! So -- overall, the high end home sales market is doing extremely well as compared to performance in past years! If you are thinking of selling your high end home (over $500K, $600K, $700K or even $800K) this might be the time to do so! | |

Moving Once Is Hard, But Moving Twice Is Harder |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

The Higher The Price Point Of The Home, The More Important The Layout Of The Home |

|

If a buyer is buying a home priced over $400K or $500K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

You Finally Found THE House, Now, How To Make An Offer |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Buying A Home Before Selling Your Current Home |

|

If you plan to buy a home this fall -- but you already own a home, that you plan to sell -- then one of your first conversations should likely be with your favorite mortgage lender. It's a seller's market, after all, which means that... [1] When you are selling your home, you will likely find yourself able to negotiate favorable terms with most buyers making an offer on your home. ...but... [2] When you are making an offer to buy a home, the seller will likely have the upper hand in negotiations. As such, if you are planning to make an offer to buy a house with any of these scenarios, you are unlikely to be successful...

So, if you want to have a fighting chance at buying a home right now, you will likely want to explore what it would look like to buy before (or independent of) selling your home. Basically, will your lender allow you to buy a new home before selling your current home. If your lender says this is possible -- and if you are comfortable with it -- this will allow you to pursue houses that come on the market and make offers that are not contingent on the sale of your home. But again, all of this starts with a conversation with your lender. So, if you want to buy this fall, but will also need to sell, and you're not sure if you can buy before selling -- talk to a mortgage lender ASAP to find out! If you need recommendations on some great mortgage lenders in this area, feel free to email me. | |

How Close Is Close Enough In A Limited Inventory Market? |

|

This house has soooo much of what I want in a new home... ...I mean -- it checks off almost all of the boxes... ...well, but, except for ___, and I did say that was pretty important... ...but there are so few options for buying right now... ...should I just go ahead and move forward with this mostly perfect house? This is the conversation I have had went LOTS of buyers lately -- they have decided to buy, have seen so few options on the market, finally see a house that is reasonably close to what they want -- and they then need to decide whether that house is close enough. It's a tough call with no one right answer! How close to perfect do you need to get when shopping for a home in a market where there are very few listings on the market at any given time, and when houses often go under contract in days rather than weeks or months? Will you be glad to finally have a contract on a house be done with the frantic search? Are the areas in which the house misses the market for you critical areas or "nice to have, but not essential" areas? Are the ways in which the house is not perfect changeable (condition, finishes) or unchangeable (location) in the future? There is no easy answer -- but I'm happy to talk it all through with you when we find that house that is pretty darn close to what you want to buy -- but not quite perfect. | |

Yes, It Is Possible To Overprice Your Home, Even In The Current Crazy Market |

|

Home prices are increasing quickly these days -- we've seen a 13% increase in the median sales price over the past 12 months! As such, it might seem nearly impossible to overprice your home when you are listing it for sale. But it's possible. :-) Let's say homes in your neighborhood were selling for $400K a year ago and are now selling for $440K. That sounds about in line with that 13% increase described above. Even though market data points to a value of $440K for your home, you decide to list it for sale for $475K. Why not, right? Buyers will pay nearly any price in the current market! Here's what is likely to happen... [1] You will still have showings. [2] Some (or even many) of the buyers who view your home will want to buy your house, but not for $475K, and they will hesitate to make an offer because they figure there is probably some buyer who will pay $475K because the market is so crazy. [3] You won't have any offers on the house. [4] You'll wait 2 or 3 or 4 weeks and then reduce the price to $460K. [5] You will won't have offers. [6] You'll wait another 2 or 3 or 4 weeks and then reduce the price to $449K. [7] You'll get an offer of $440K and settle on a price of $445K. The offer will include an inspection contingency and an appraisal contingency. Now -- wouldn't it have been easier to go this route instead? [1] Price your home at $445k or $449K. [2] Have lots of showings and multiple offers. [3] Sell your home for $445K or $449K without an inspection contingency or appraisal contingency. Even in a strong seller's market, it is important to price your home reasonably within the context of past sales data and competing listings. Overpricing your home is likely to slow down your home sale, possibly lower the price for which you'll sell, and possibly result in an offer with more contingencies than you would have had if you had priced your home reasonably from the beginning. | |

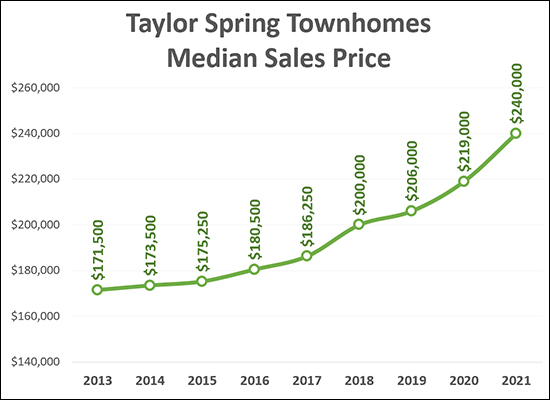

Perhaps This Would Be A Good Time To Sell Your Taylor Spring Townhome? |

|

If you own a townhome in the Taylor Spring neighborhood -- or actually, in most townhome neighborhoods -- this could be a fantastic time to sell it. You have likely seen a $21K increase in its value over the past year, and a $34K increase in value over the past two years and a $40K increase in value over the past three years! Wow! Buyers are paying more (and more and more) for townhomes these days -- which can make it an ideal time to sell such a property if you own one. With two important caveats, of course... [1] If you own a Taylor Spring townhome and live in it, we'll need to make sure we have a plan in place for where you will buy after you sell. [2] If you own a Taylor Spring townhome and are renting it out, you'll want to consider the tax consequences of selling the property and whether you would want to roll the proceeds into the purchase of a different property. Townhomes have seen steady increases in their market value over the past few years, so if you own one and are thinking of selling it, this could be an ideal time to move forward with that plan! You can explore Taylor Spring townhome value trends here and explore value trends in most of our area's townhome communities here. | |

It Is OK To Improve Your Home Beyond The Value Range Of Your Neighborhood, But Realize That You Are Doing So, And The Potential Consequences |

|

I've written about improving your home a few times this week... Thanks, to Frank, for spurring on many of these thoughts and topics. On to one more important concept to note... It is possible to over improve your home within the context of your neighborhood. A stark example...

As you can imagine, it might be hard to sell a $425K home amidst other homes that are selling for $300K to $350K. So, yes, it is quite possible to over improve your home compared to your neighborhood. It is OK to do so -- but you should just realize, going into the renovation project, that you are doing so -- and understand that it will likely mean you will see an even lower percentage of the cost of improvements contributing towards the post-improvement value of your home. Perhaps, though, I have oversimplified all of this. If you considering making some renovations to your home -- feel free to loop me into your thought process and I'm happy to provide you with some candid feedback to help you think things through. | |

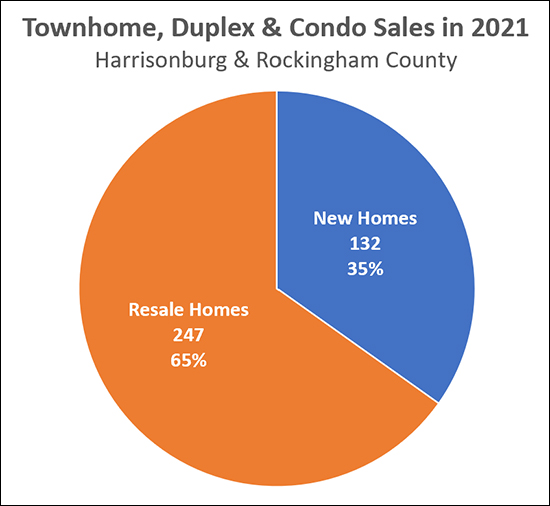

35% Of Townhome, Duplex and Condo Sales Are New Homes! |

|

This stat (illustrated above) might surprise you. It surprised me! Thus far in 2021 there have been 379 sales of townhomes, duplexes and condos in Harrisonburg and Rockingham County as recorded in the HRAR MLS. Of those 379 sales -- 35% of them have been new home sales! I know there have been plenty of new home sales (particular of attached properties) in 2021, but I didn't think it was more than a third of all attached homes that are selling. Here are some of the spots where we have seen the most sales of new townhomes, duplexes and condos thus far in 2021...

| |

While You Might Not Recoup The Cost Of Remodeling Your Current Home, Maybe You Should Do It Anyway! |

|

As I pointed out yesterday... But... that's not to say that you shouldn't consider remodeling your home... and it certainly doesn't mean that you should just trade up to a nicer home rather than making those improvements to your current home. Let's explore the numbers a bit using one of yesterday's example as a starting point...

Dialing in a bit, let's imagine this is your scenario...

So, given that of your $100K spend, you would not be recouping $40K of the money -- should you just trade up to a nicer home instead? Not so fast... Your costs of trading up to a new home might actually be more expensive than the money you "lost" in doing the renovations. Here are some approximate numbers, imagining an upgrade from a $400K home to a $460K home.

So, there with some very rough estimates, you can see that we made it up to a $44,000 cost to trade up from your current $400K home to a new $460K home. So, before you get overly depressed about spending more on your home renovation than you might see in an increased home value -- just keep in mind that it might be a very reasonable path forward as compared to selling your current house and buying a new one. | |

Basically, All Remodeling Projects Will Cost More Than They Will Add To Your Home Value |

|

Are you looking to renovate your living room, kitchen or bathroom... or replace your siding, roof, windows or deck? Are you curious about how each of these projects will affect your home value? Will spending the money on these major home renovations increase your home value by more than the cost of the renovations? Almost certainly, no. In almost all cases, you will spend more on these major home renovations than you will see in an increase in the value of your home after the renovations. According to the Remodeling 2020 Cost vs. Value Report the amount of your cost that will be recouped through an increase in value ranges from 50% to 70% for almost all of the home improvement projects they analyzed. So...

This lower than 100% return on investment on major home improvement projects often ends up being acceptable to many homeowners who are completing these home improvement projects -- because the balance of the return of the investment is their enjoyment of the utility or feel of the space that they have improved. Check out the actual numbers on each home improvement project by visiting CostVsValue.com. | |

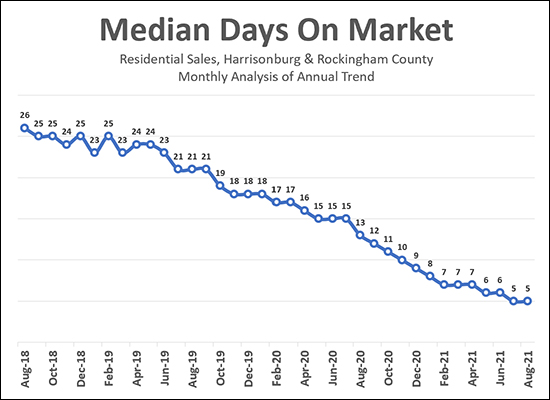

The Speed Of Home Sales (Days On Market) Is Likely The Best Indication Of The Mood Of The Market |

|

The number of homes that sell in a given timeframe is somewhat indicative of the strength of the local housing market - but not necessarily. The number of homes selling in a given timeframe is affected not only by how many buyers want to buy -- but also how many sellers are willing to sell. The median price of homes that sell in a given timeframe is a somewhat better indication of the strength of the local housing market - but it is somewhat slow to respond to changes in the market. Even if (when?) the market starts cooling off, we're not likely to see an immediate impact in the sales price of homes. But days on market -- how quickly homes are going under contract -- that can be an excellent indication of the mood of the local housing market. Independent of how many homes are selling and the prices at which they are selling -- if they are going under contract QUICKLY the market is strong and power is tipped towards sellers -- and if homes are taking a longer time to go under contract the market is not quite as strong and power is starting to balance out between sellers and buyers. The graph above shows the median days on market (the number of days it takes for a home to go under contract once it hits the market) measured each month by looking at the 12 months leading up to and including that month. So, for example...

Looking at the graph, we can notice a few things...

Some cynics might say -- but Scott, this is looking at a year's worth of data, so it will take months and months to see any changes that are actually happening in the here and now. This is a fair point -- if things are slowing down over the course of a month or two, it might take several more months after that for us to start to see this trend line change. I do, however, intentionally look at this data with a 12 month timeframe. Looking at it with a shorter timeframe makes the data jump up and down a bit more and makes it harder to recognize any trends that are likely to actually be sustained over time. But, for those who are curious about the most recent of recent data -- when I look at sales from the past two and a half months (7/1/2021-9/20/201) I find that the median days on market is... still five days. :-) So -- the market is strong, and buyers are moving quickly on new listings, and we're not really seeing that change yet -- but as you'd expect, I'll continue to monitor this trend over time. | |

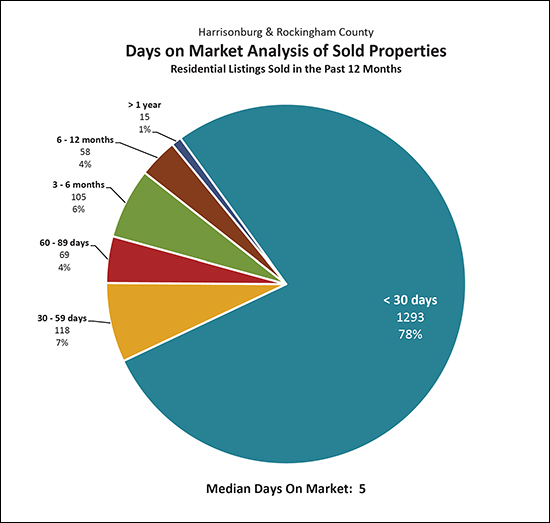

If Your House Is Going To Sell, There Is A Very Good Chance It Will Be Under Contract Within A Month |

|

So, you're thinking about putting your house on the market? And you're wondering how long it will take to go under contract? And how long it will take to get to closing? These days the chances are very high that your home will be under contract within 30 days and closed within 90 days -- and that's rounding up quite a bit. As shown above, 78% of homes that sold in the past year were under contract within 30 days. Technically, as per the stat at the bottom (median = five days) we can see that half of the homes that sold were under contract in five or fewer days! So, if you're wondering how the timing of your real estate transaction *might* play out, per the stats from the past year... Relatively (50%) Likely: under contract within 5 days, closed within 45 days. Very (78%) Likely: under contract within 30 days, closed within 90 days. One caveat, of course, is that your particular home, depending on it's location, price range, how well it is prepared, how well it is priced, how well it is marketed may over or under perform as compared to market norms. | |

Be Amazed By Your Home Value And Be Content To Stay |

|

It is so darn exciting for homeowners to see how much their home has increased in value over the past few years! As noted earlier this week in my monthly market report... Home prices have been rising very steadily over the past few years, but we have seen a 10% or higher increase in the median sales price in both 2020 and thus far in 2021. Of note, here are the annual increases in the median sales price per year for the past four years, including 2021...

So, if you have owned a median priced home for the past four years you may have very well seen a $70,000 increase in your home's value in the past four years! Wow! Having $70,000 more equity in your home based on increases in market values over the past four years is amazing! But, as the conversation has gone with soooo many folks lately.... "If I sold for that price, what would I buy!?" So, in the end, many homeowners find themselves wishing that they could do something about their newfound wealth via increased equity in their home - but not finding a home that they'd like to purchase - and not really wanting to move just to move. So, my encouragement to them (maybe to you?) is to... Be Amazed By Your Home Value And Be Content To Stay | |

Putting The Pace of August 2021 Home Sales In Context |

|

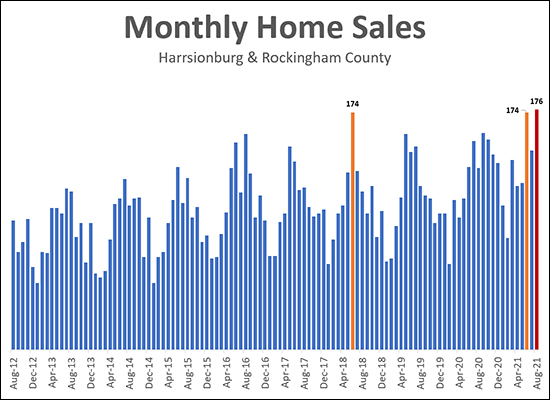

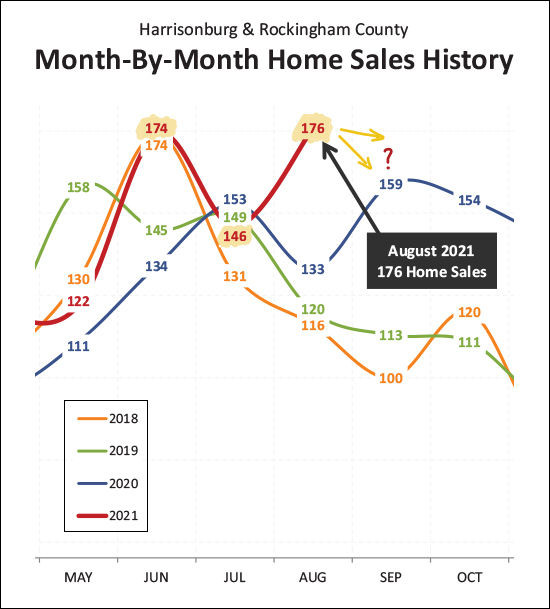

I knew August 2021 was a busy month of home sales in our local market -- Harrisonburg and Rockingham County. I didn't know HOW busy when put in the context of past years. Looking back a bit -- 10 years -- it seems that the 176 home sales that took place in August 2021 was the highest number of home sales seen in any month over the past 10 years! Runner Up = June 2021 with 174 home sales (yes, two months ago) Third Place = June 2018 with 174 home sales What, oh what, shall September... and October... bring in our local housing market!? | |

Harrisonburg Area Home Sales Spike Again In August 2021 |

|

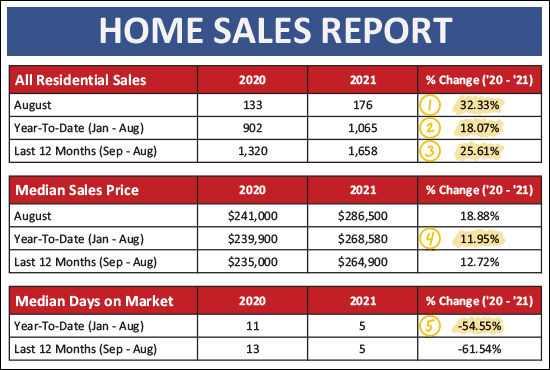

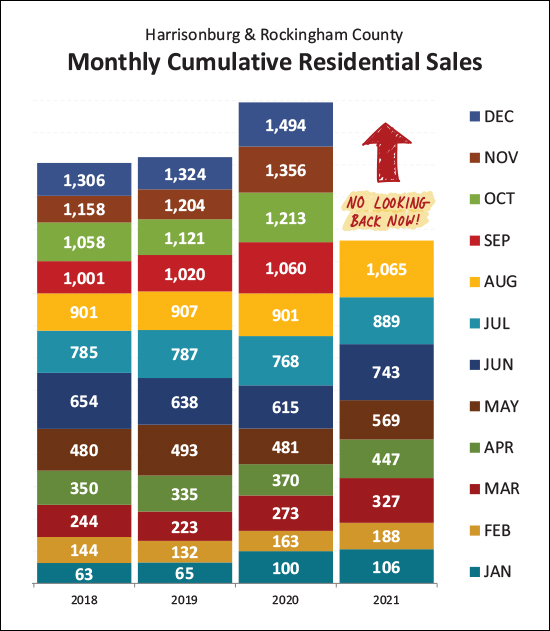

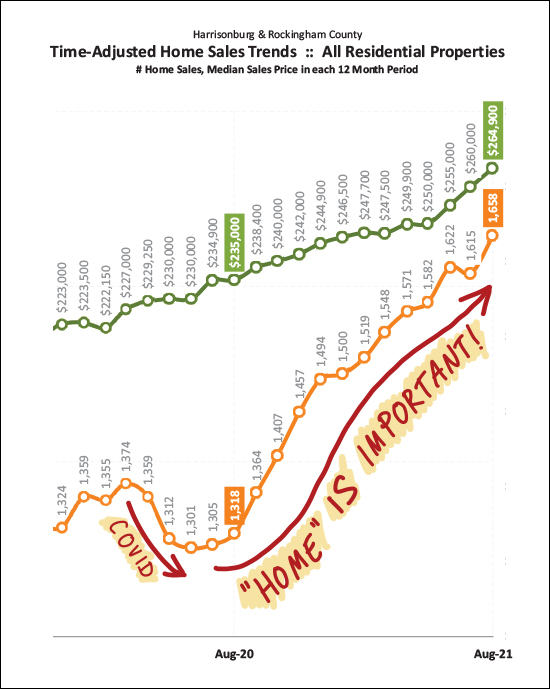

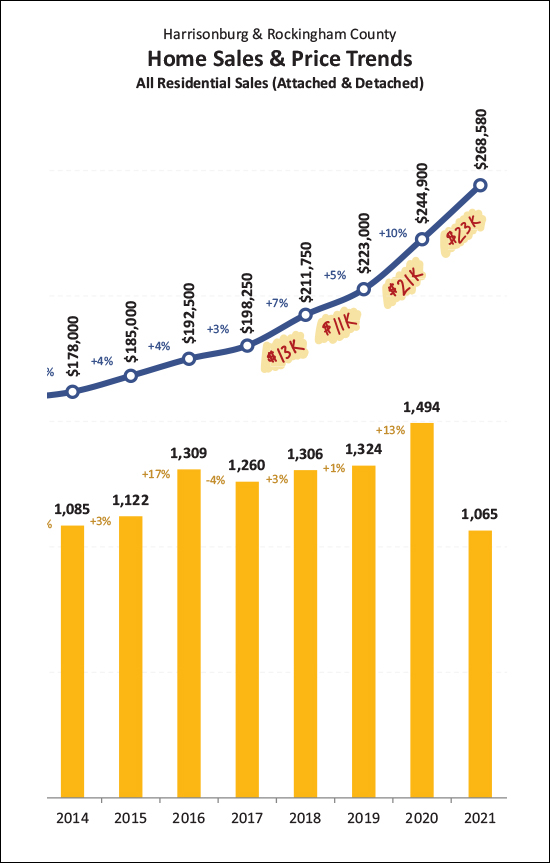

Happy Tuesday Morning, Friends! I hope you had a fun and relaxing weekend. My Sunday included an adventure with my daughter, about 24 of her classmates, and several other dads... hiking to Saint Mary's Falls... with many of them then jumping off a 15 foot high ledge down into a pool of water below!?! A bit nerve-wracking at first, but we didn't have any injuries, so we'll call it success. :-) You should definitely check out Saint Mary's Falls if you haven't been -- it's a 4.3 mile out and back hike only about 45 minutes from Harrisonburg!  But back to the business at hand - the very active Harrisonburg and Rockingham County real estate market! August 2021 was a busy month, and there is plenty to unpack in the latest data. Download a PDF of all of the charts and graphs here, check out this beautiful home on East Wolfe Street on the cover of this month's report, or keep reading for some insights into the latest news from our local housing market...  OK - so much to jump into (I guess I'm still thinking about the waterfall!?) right from the start... Referencing the data table above... [1] There were 176 home sales in August. 176! That's 32% more than last August. Admittedly, things slowed a bit in July -- but then sales spiked again in August! [2] We've now seen 1,065 home sales in 2021 which is 18% more than we saw last year during the same timeframe. It has been an active year! [3] Over the past 12 months we've seen 1,658 home sales recorded in Harrisonburg and Rockingham County via the MLS and that is 26% more than the prior 12 months! [4] The median sales price thus far in 2021 -- $268,580 -- is 12% higher than it was a year ago. That is a much larger than normal increase in the median sales price. [5] Homes are selling quite a bit faster this year (median of 5 days on the market) than last year (median of 11 days on the market).  Above you can take a closer look at the month by month trajectory of home sales this year. We saw 174 home sales in June -- which was well above 2020 (134) and tied with June 2018... but then home sales in July 2021 slowed to 146 sales, a small decline from the 153 sales seen in July 2020. But then, August!?! After only seeing 133 home sales last August, there were 176 this August! Where do we go from here? It's anyone's guess. September and October were extremely active for home sales last year -- could we match that pace this year? All these active months of home sales in 2021 have been piling up...  We're now more than a full month ahead of the pace of home sales last year. We've had more home sales (1,065) in the first eight months of 2021 than the number of sales (1,060) seen in the first nine months of 2020! Given the current trajectory, we are very likely to see more than 1,500 home sales in 2021 -- and it seems possible that we could get all the way up to 1,600 home sales! Here's the best "why" I can come up with at this point...  We saw a temporary decline in the pace of home sales when Covid started showing up in our lives -- in March/April of 2020. Then -- many of us started to work from home, learn from home, stay at home -- basically spending more and more time in our homes. This seems to have caused many folks to realize it was more important to have a home that worked well for them -- related to amount of space, types of spaces, etc. Home sales took off starting in late August 2020 and have been on a tear ever since. But it's not just the pace of home sales that has been increasing...  Home prices have been rising very steadily over the past few years, but we have seen a 10% or higher increase in the median sales price in both 2020 and thus far in 2021. Of note, here are the annual increases in the median sales price per year for the past four years, including 2021...

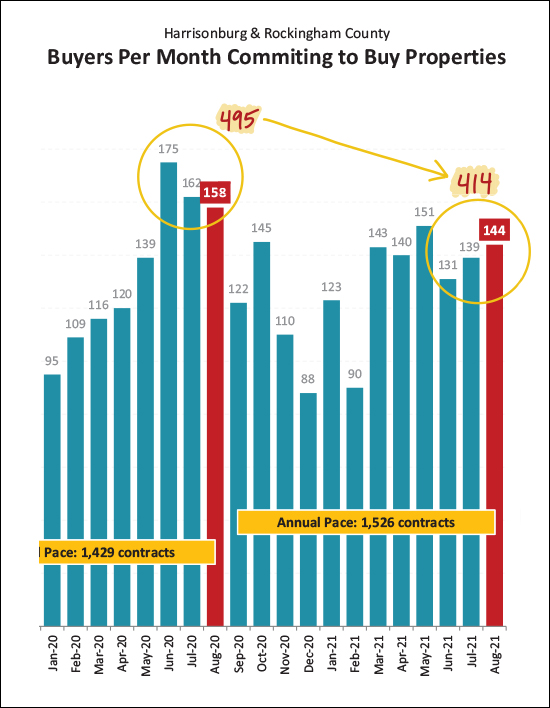

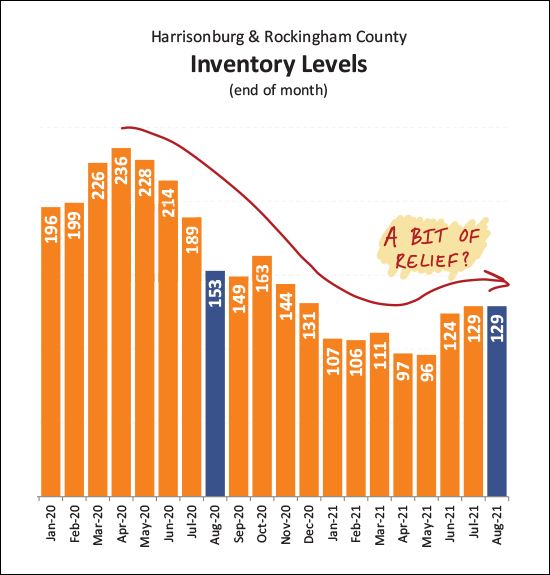

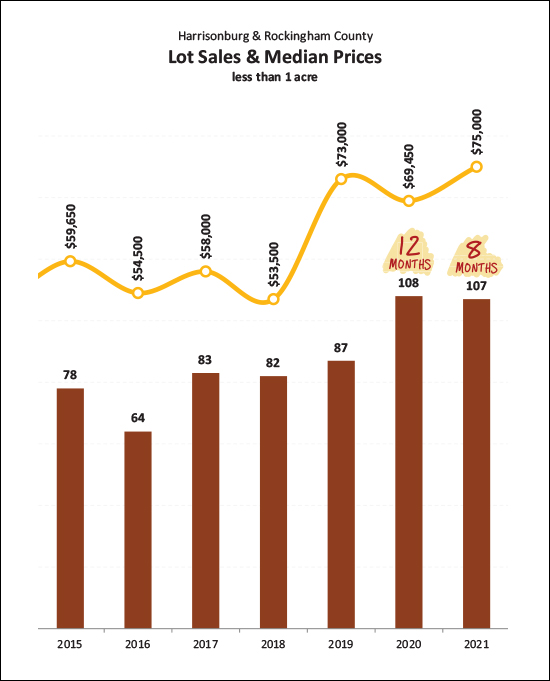

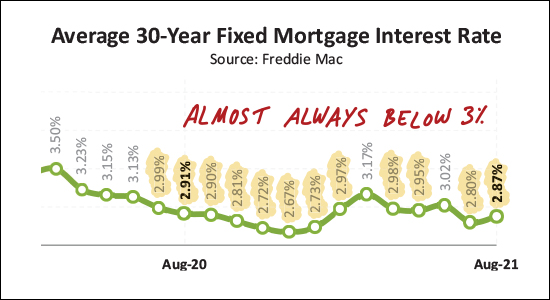

So, if you have owned a median priced home for the past four years you may have very well seen a $70,000 increase in your home's value in the past four years! What comes next?  Well, technically, things might eventually start slowing down? Last summer (June / July / August) there were 495 contracts signed for homes in Harrisonburg and Rockingham County -- compared to only 414 this summer. So, maybe we start to see a decline in closed sales in September and October? It's hard to say at this point. Clearly, the robust month of home sales in August is not an indication that things are slowing down or cooling off. :-) We are also seeing a marginal increase in available inventory...  The number of homes for sale at any given time has been declining for years -- but over the past few months the number of homes on the market at any given moment in time has increased slightly from "barely any" to "still very, very few" in Harrisonburg and Rockingham County. Keep in mind -- when 1,658 homes are selling in a year, an increase from 96 homes on the market to 129 homes on the market is not overly encouraging for new buyers. That means there is still less than a month of inventory on the market right now! Given than there aren't many homes on the market for sale -- some buyers are considering the purchase of a building lot to build a home...  Indeed, even at a time when the price of building materials is still quite high, we are seeing a lot of building lots selling. There were 108 lot sales (of less than an acre) all of last year -- and we've seen 107 such sales in the first eight months of 2021. It's not clear whether all of those buyers will really build -- or be able to build -- but low housing inventory has certainly contributed to more buyers considering building lots. And here's a big part of what has kept all of this home buying activity chugging along... cheap money...  The 30-year fixed mortgage interest rate has been below 3% for almost all of the past year. This has kept housing payments for buyers very low -- even amidst rising home prices. I've been saying for years that mortgage interest rates will certainly start rising soon. I think I have given up on that mantra now, after having been wrong year after year. Certainly, if or when rates do start to rise, that will affect monthly housing costs and housing affordability -- but higher interest rates don't necessarily seem to be on the horizon anytime soon. And now... we're already half way through September!?! We might be seeing high temperatures again this week, but hopefully it will start feeling like fall by the time we get to the first official day of fall, next week, on September 22nd. Meanwhile... If you are thinking of selling your house this fall, let's talk sooner rather than later about timing, pricing, preparations and more. If you're thinking of buying this fall, start looking now, because there aren't many houses on the market, so we'll likely need to patiently wait for the right opportunity to come along and then jump on it, quickly! If you have a question about the market, or your home, or your overall real estate plans -- don't hesitate to ask. Email me or call/text me at 540-578-0102. If you made it to the end, thanks for reading along. I hope you learned something -- and I hope you'll plan something exciting for this coming weekend -- as exciting as jumping off a 15 foot ledge into a pool of water! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings