| Newer Posts | Older Posts |

The Challenge Of Suggesting You Stay In Your Home And Improve It Instead Of Selling It And Buying A New One |

|

Plenty of homeowners are *delighted* to see the price for which they could likely sell their home in this fast moving local housing market. :-) Most of those homeowners are then at least slightly *dismayed* when they see what they'd have to pay to buy their next home. :-/ As such, I have suggested to plenty of homeowners lately that they consider staying in their home - and improving it - rather than selling their home and buying a new one. But... that advice is easier to give and receive than it is to implement. Contractors and any such professionals that would make such improvements to your home are in short supply and high demand! Over the past three to six months in conversations with homeowners contemplating staying in their homes -- and making improvements to them -- I have heard over and over again that they are having an extremely difficult time lining up contractors (or other professionals) to do the work they'd like to have done on their house. What then is a homeowner to do? 1. Get in line and patiently wait for the contractors (and the applicable materials) to be available to accomplish your home renovations. 2. Just go ahead and sell your home and buy a new one. There is no easy answer to this conundrum, but I have realized more and more in recent months that suggesting that a homeowner "just stay in their home and renovate it instead of selling it and buying again" might not be the right solution for all homeowners. If you are weighing your options of renovating or selling and buying, let me know if you'd like to think it through and talk it through together. | |

Is The Local Housing Market Starting To Cool Off? |

|

Several local agents have recently said, conversationally, that they think the local housing market is starting to cool off. Is it? Maybe yes and no, depending on what you mean, and how you measure it? ;-) No - After only seeing 148 home sales in September 2021, there were even more (158) in October 2021! No - After seeing only 125 contracts signed in September 2021, there were 156 contracts signed in October 2021! Yes - It took a median of five days for homes to go under contract in September 2021 and a median of six days in October 2021. Slower. Much slower. By a day. Gasp! Maybe - Six to twelve months ago it was not uncommon to have 2, 5 or 10 offers on a house within 48 hours of the property hitting the market. Now, I'm often, but not always, seeing fewer offers within the first few days. This is definitely anecdotal, not based on data. So, is the market cooling?

| |

The Tax Assessment Of A Property Is Most Useful For... Calculating The Real Estate Tax Bill For The Property |

|

Oh, I see that house down the street is for sale! What's the list price? They are asking $400,000 for the house. What is the tax assessment of the property? Why? --- If you want to know the tax assessed value of the house to understand how much an owner of the property pays in real estate taxes - great! Let's go take a look at the tax assessment. --- If you want to know the tax assessed value of the house to evaluate whether the seller's asking price for their home is reasonable -- you likely aren't looking in the right places for indicators of market value. --- Tax assessed values are actually intended to be a good indicator of market value, as the City and County want to be taxing you on the basis of the actual market value of your property... but... oftentimes, the tax assessed value of properties in this area range from low to very low. Part of that is due to timing. Today's tax assessed values may be based on sales data from 12 to 18 to 24 months ago due to the time intensive process of analyzing property values and updating tax assessed values. The median sales price is currently increasing quickly, at a rate of 10% to 12% per year. Thus, when market values are quickly increasing and tax assessed values are based on 12 to 24 month old data, you are likely to see a more significant difference between tax assessments and market values. So, it's fine to look at the tax assessment of a property, but I wouldn't put too much confidence in thinking that it is an indicator of the present market value of the property. | |

Recent Similar Home Sales In The Same Neighborhood Are Often The Best Indicator Of Home Value |

|

What are the top three factors affecting home value? "Location, Location, Location" Or so the saying goes. But, really, the location of a property is key in understanding its value. A home with 1500 SF in one neighborhood in Harrisonburg will not necessarily sell for the same price as a home with 1500 SF in another neighborhood on the other side of town. A townhome built 20 years ago in one neighborhood will not necessarily sell for the same price as a townhome in another neighborhood that was built 20 years ago. As such... Don't be too hasty in drawing conclusions about the value of a house based on the sales price of houses in a completely different location or neighborhood. It is usually best to seek to understand the value of a home by first examining recent sales in the same neighborhood or location of the home in question. | |

Most, But Not All, Home Sellers Optimize For Price |

|

What are you optimizing for?

As a home seller, you are always optimizing for something. PRICE - Maybe you are willing to wait as long as it takes to get the price that you want for your house. Even if it takes months longer than you had hoped and even if it means that you aren't able to continue on with other life transitions that you had planned, at least you go the price you wanted. TIME - Maybe it's important to you that you wrap up your home sale (have the house under contract) within a few weeks or within a month. If so, you might be willing to price your home a bit lower to maximize the possibility that you accomplish your timing goals. CONVENIENCE - Maybe your strategy for when you list your home and your pricing strategy all revolve around making it a seamless transition to your next home. You're willing to be flexible on timing and on pricing so long as it lets you accomplish your goals of buying that perfect next home. | |

The Three Main (Usual) Hurdles To Getting To Closing |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So if you are selling your house -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. NOW, TECHNICALLY, 2021 IS A BIT DIFFERENT... Some buyers in today's market are skipping a home inspection -- so you might be dealing with two hurdles instead of three... ...and some buyers in today's market are not making their contract contingent on an appraisal -- so you might be dealing with just one hurdle instead of two or three. BUT YOU MIGHT ALSO BE DEALING WITH SIX HURDLES!

Would you rather have three main hurdles to clear, or six? Let's imagine that you receive two offers on your house, which is listed for $250K....

So -- a slightly higher sales price, with a home sale contingency, is not always more valuable to a seller than a slightly lower sales price without a home sale contingency. Selling your home can be quite straight forward and a very smooth process -- but we typically have one, two, three or even six significant hurdles to clear before we successfully make it to closing. | |

Is That Bedroom Really A Bedroom? |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

How Much Will Your Housing Costs Increase When You Sell Your Home And Buy A New One? |

|

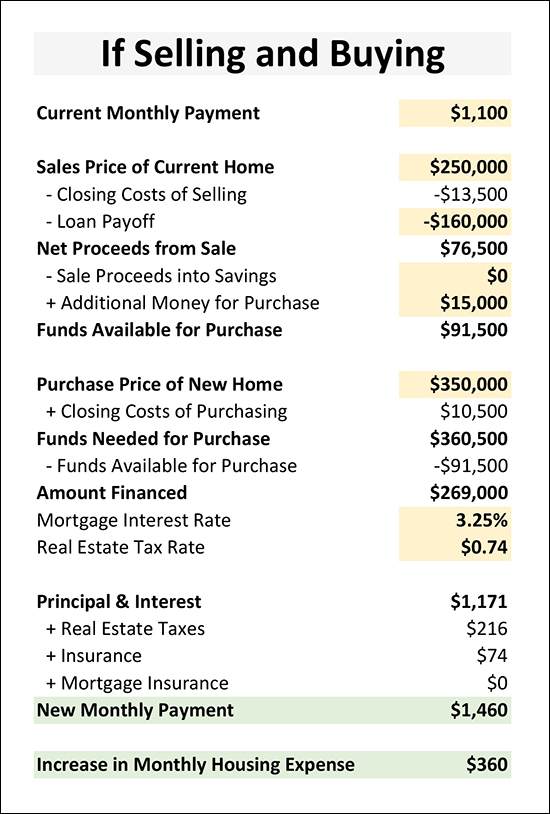

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

What If The Right Buyer For Your Home Is NOT Out There Right Now? |

|

If you are preparing your house well for the market - and pricing it appropriately, according to what other buyers have recently paid for similar houses - and the house is marketed fully and professionally...it should be under contract relatively quickly, and certainly within the first 30 days, right? Well... maybe... Sometimes, it just takes time. In the end, if the right buyer is not in the market right now, then it might not sell until the right buyer is ready to buy - and we shouldn't necessarily expect that the wrong buyer will buy your house just because it is prepared well, priced well and marketed well. Understanding how these dynamics will affect you and your listing is highly related to how many buyers are in your price range -- and in that pool of buyers in your price range, is your house likely to meet the needs of only a few, many or most of the buyers. So, if your home has been on the market for 30 days, or 60 or 90 or 120 or more days -- we should be thinking about...

If the answer is yes, yes and yes -- then we'll be left with two options...

| |

Discover That Your Water Heater Is Leaking BEFORE It Causes Major Damage |

|

Who has had a water heater leak before? (raising my hand) Who has had major damage as a result of a water heater leaking? (thankfully, not raising my hand) Most of us have water heaters tucked away in a closet or the corner of the basement. As a result, if they start to leak (they often will as they get older) it could be hours or days before you realize you have a problem. In that time, the leak may have caused water damage to your floors or personal belongings. Do you have a sump pump in your basement? What would get wet if it stopped working? How often do you check to see if your sump pump is working properly? There are all sorts of reasons why it would be helpful to know about a water leak early - and with Resideo's Wifi Water Leak and Freeze Detector you can know about it early! This handy device...

Consider purchasing a water leak detector to give you a bit more piece of mind that you will know about a potential water leak early and before it causes damage to your home. | |

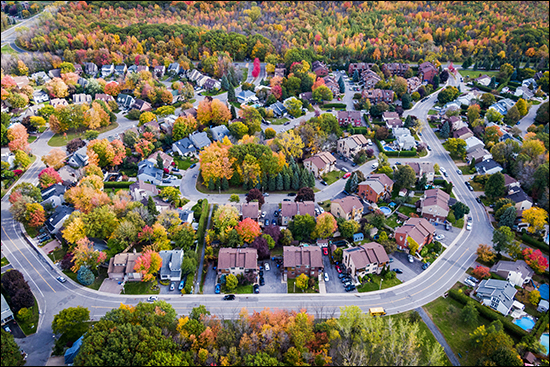

The Only Way I Can Try To Get You To Be More Excited About Raking All Of Those Leaves |

|

Are you raking a lot of leaves lately? Or trying to blow them in one direction or another with a leaf blower? Sounds like you have a lot of trees on your property -- and perhaps -- quite a few in front of your house. Here's the one upside to all of those leaves falling down onto your lawn -- we're finally entering the time of year when we can finally see the front of your house! :-) Many sellers list their homes in the spring or summer, which is often ideal for the timing of their move, and aligns well with when most buyers are in the market. However -- some houses are very difficult to be seen (and photographed) in the spring and summer because of large trees in the front yard. So -- while you're raking or blowing leaves this fall -- think about whether you are going to be selling your house this coming spring or summer. If you are, and if you have trees obscuring the front of your house, we should discuss taking some exterior photos SOON rather than waiting until later when we can't see your house at all. | |

Yes, A Realtor Can Represent You As A Buyer |

|

Home buyers are well served to have a Realtor represent them in their home purchase. So, before you call the listing agent to see a home listed for sale, you should understand a bit more about buyer representation.

In representing you in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) -- or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more by visiting BuyingAHomeInHarrisonburg.com.  | |

How Much Are You Really Paying For That House? |

|

A first time buyer looking to buy a detached home (not a townhouse or duplex) under $275K might find themselves considering mostly homes that are at least 50 years old. Said buyer might find the **perfect** home built in 1945 that is "move-in ready" with pretty paint on the walls, and beautiful furnishings, and a well-kept garden, and a quaint covered front porch, and on and on. This buyer is likely head-over-heels excited about the house at this point, as it is priced at $280K, just barely above their target maximum of $275K. But before the buyer signs that contract to make an offer on the house they should probably pause at least for a moment to ask some questions and to consider...

There are plenty of other items that might need updates or replacements in the next three years, but they are all either of a lower cost or elective - though these costs could also add up:

But circling back to the first two items - the roof and heating system - these are pretty much non-negotiable. If either quits working as it should, you'll need to replace it. And if you're maxing out your housing budget with a $275K-$280K home purchase, and then within a year or two you need to spend $8K - $15K on a roof and $8K - $15K on a heating system, that will likely create some financial stress for you. | |

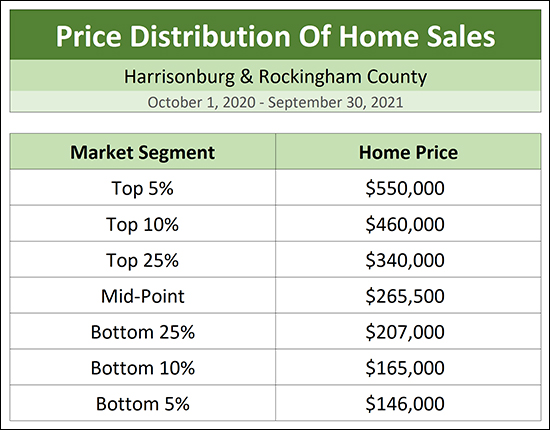

Only The Top 5% Of Home Buyers In Our Market Pay Over $550,000 |

|

If you are selling a home over $550,000 -- you are only appealing to about 5% of the buying public as per the price distribution of the 1,654 home sales that were recorded in the HRAR MLS in Harrisonburg and Rockingham County over the past year. Looking to sell something over $460,000? That will appeal to about 10% of the buying public. You can slice and dice the data above however you'd like...

I think you get the point. :-) If you have ever wondered where your home falls into the overall distribution of home sales prices in this area -- now you know! Thanks, Tom, for the question that lead to this analysis! :-) | |

If Your Home Is Not Under Contract After 30 Days, And You Have Not Received Any Offers, Should You Consider Adjusting The Price? |

|

The answer to this question is not timeless -- it depends on the market dynamics -- so we should answer it differently now as compared to in five years ago as compared to in five years. But here's the question, again... If Your Home Is Not Under Contract After 30 Days, And You Have Not Received Any Offers, Should You Consider Adjusting The Price? Right now, in the current 2021 market, I'd say the answer is usually (but not always) yes. If your home has been on the market for 30 days and it is still available for sale (not under contract), without having received any offers, then you should likely consider adjusting the asking price of your home. After all, within that first 30 days you have likely had a good number of buyers consider your home -- either by viewing it online, driving by or walking through it. If none of these buyers have been inspired to make an offer, it is likely a good time to consider adjusting your asking price. With... a few exceptions... [1] If your home is priced in the top 10% (or 5%) of our market, you are appealing to a much smaller portion of the buyers in our market, and it might take longer for a buyer to be in the market to buy your home and you might not want to or need to adjust your asking price yet. [2] If your home is in a bit of an "out of the way" location that will only appeal to a small subset of buyers in the market, it might take longer for a buyer to be in the market to buy your home and you might not want to or need to adjust your asking price yet. You get the point... If there are plenty of potential buyers in the market to buy houses like what you are trying to sell -- and nobody has made an offer -- you should likely reconsider your pricing strategy. Again, though, this is market specific and property specific. The same advice might not apply a year or two from now -- and the same advice does not necessarily apply to every property on the market today. If we're listing your house for sale, while we'll be in constant communication in the first 30 days and thereafter, let's also plan to pause 30 days in to reconsider our pricing strategy if we haven't received any offers. | |

Do Some Of The Attributes Of Your Home Disqualify Some Buyers? |

|

There are plenty of ways in which attributes of your home may cause some buyers to not even consider it. When you are analyzing the market value of your home, it is important to understand whether a few, many, or most buyers will be disqualified based on those attributes of your home. Some examples...

We'll spend much of our time focusing on the positive attributes of your home and how they will appeal to buyers -- but we can't ignore the attributes of your house that will cause some buyers to disqualify themselves from considering your home. If a combination of the disqualifying attributes of your home cause only 10% of buyers in your price range to consider buying your home -- then we need to account for that in our pricing strategy. Your home likely won't sell for as much as we might have hoped, given that we will effectively be appealing to a much narrower segment of buyers. | |

Some Sellers Will Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

102 Apartments Proposed On Apple Valley Road |

|

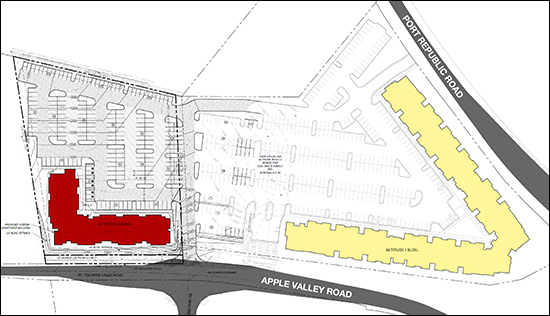

Driving down Port Republic Road, from the County towards the City, you'll spot a tall apartment building on the left side of the road where you'd turn to go to Moe's Southwest Grill. This apartment complex -- Altitude Apartments -- opened in 2019 and features 140 apartments and a clubhouse. The current owner of Altitude Apartments is asking the County to rezone 2.7 acres of adjacent land to allow for an additional apartment building with 102 apartments on five levels. This new apartment building is planned to include:

The complex will be marketed towards undergraduate students, graduate students and young professionals. Below you'll see the existing building in yellow and the proposed new building in red... Finally, here's a rendering of what it will look like if you're standing next to the first building, looking down the road towards the new building... Find out more about this proposed development in the County's full rezoning packet here. | |

95 New Townhouses Proposed At Massanutten Resort |

|

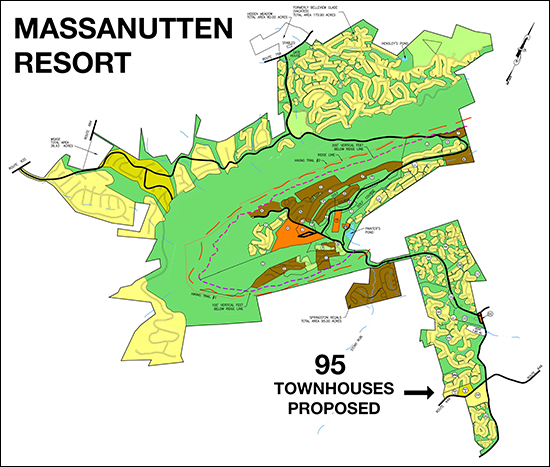

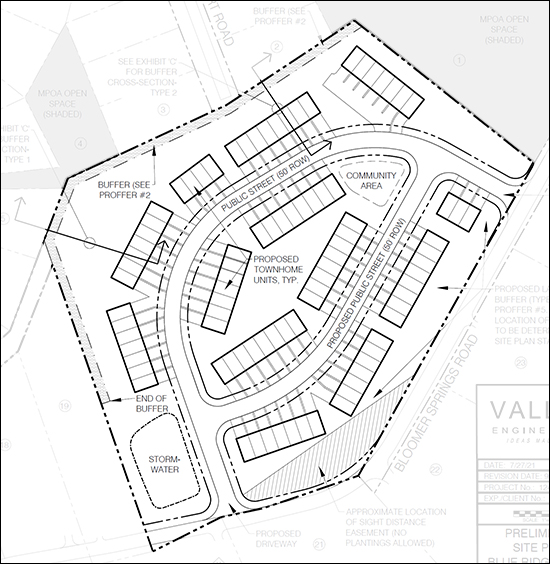

view a larger image here Great Easter Resort Corporation, the developer at Massanutten Resort, has requested a rezoning of a parcel of land just under 10 acres to allow for 95 townhouses to be built near the intersection of Bloomer Springs Road and Resort Drive. Here's the proposed site layout... view a larger image here Find out more about this proposal by downloading the full rezoning request packet here. | |

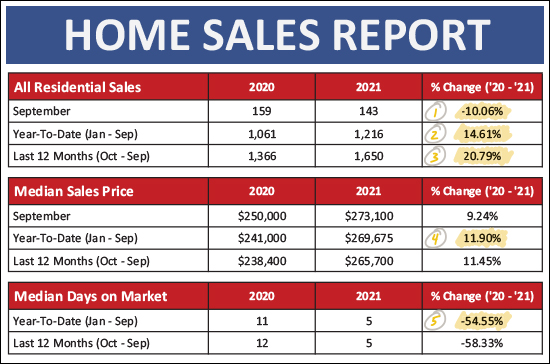

Home Sales Up 15%, Prices Up 12% In 2021 Despite Slightly Slower September Sales |

|

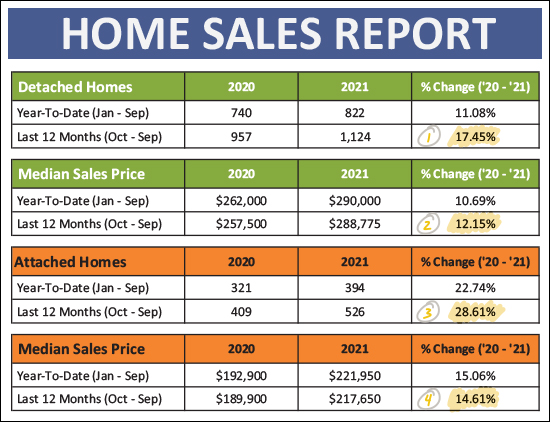

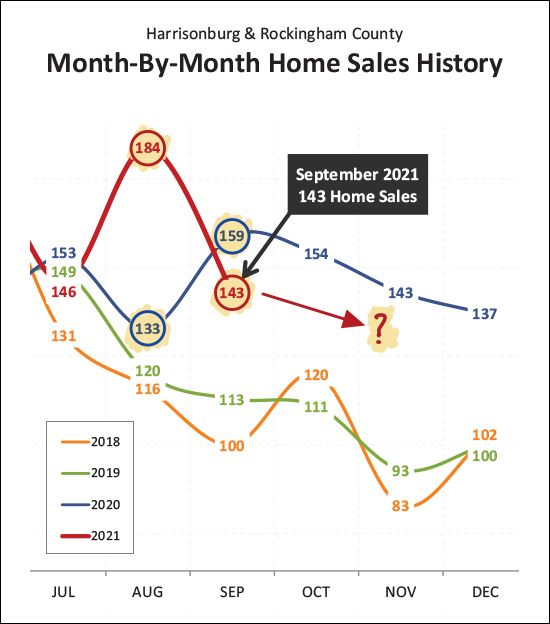

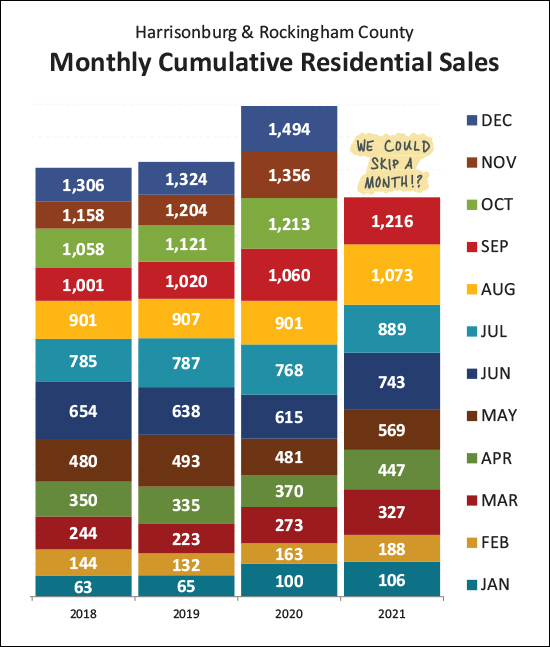

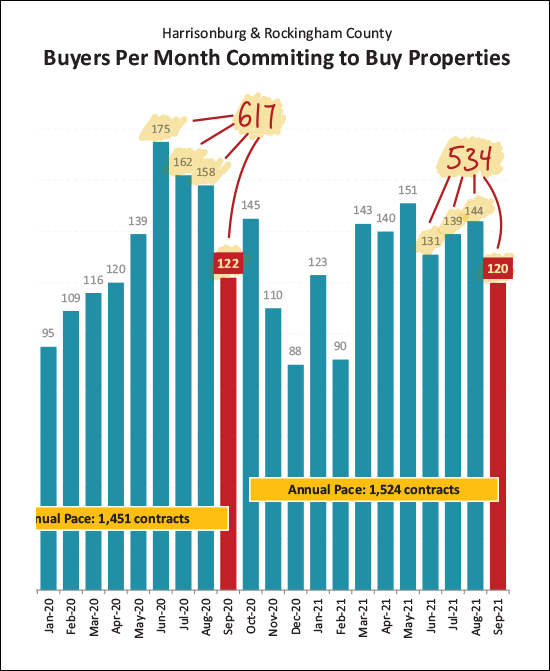

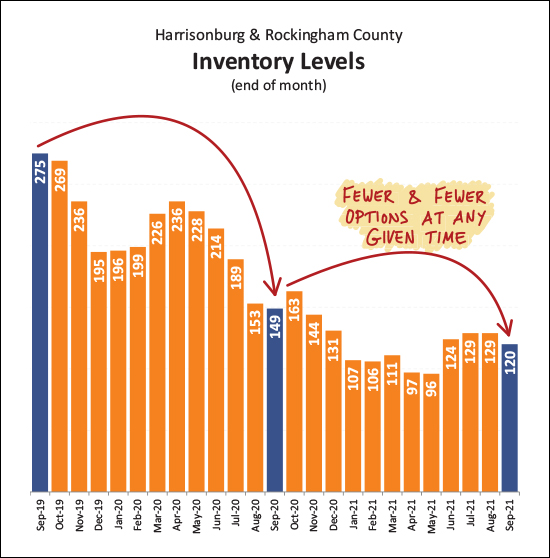

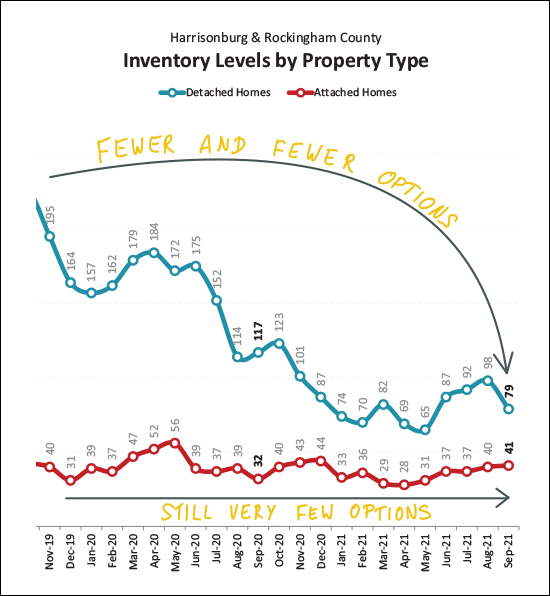

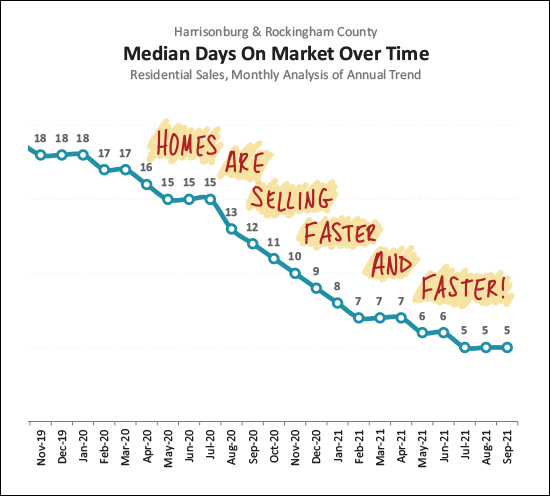

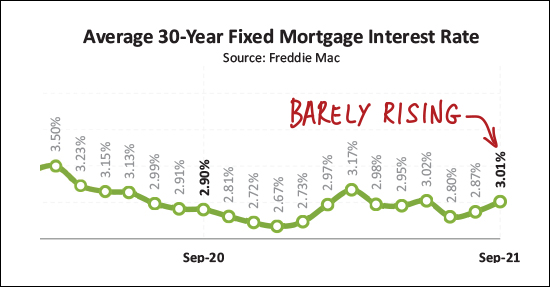

Happy Tuesday Morning, Friends! I hope October is treating you well and that you are enjoying the cooler temperatures as much as I am. Earlier this month I had a great time picking apples at Showalter's Orchard in Timberville for the very first time. I brought home plenty of apples and some of their delicious apple cider. I had high hopes of baking some of those apples into a crisp... probably to be enjoyed with some vanilla ice cream and caramel sauce... Delicious! Alas, thus far those delicious, crisp, apples have only been enjoyed with a side of peanut butter -- but maybe I'll break out the apple crisp recipe yet this week. I hope you are enjoying some delicious flavors of fall yourself, and perhaps you'll consider a visit to Showalter's Orchard... But moving past delicious, freshly grown, hand picked apples... and the desserts they might produce... let's explore the latest numbers from our local housing market for a bit. As always, you download a PDF of all of the charts and graphs here or, if you are intrigued by the beautiful house in Fairway Hills that graces the cover of my market report this month, check it out here. Now, let's break down the stats...  From a big picture perspective, here's what jumps out to me above... [1] Home sales were a bit slower this September (143) than last September (159). [2] Despite a slightly slower September, we've seen 15% more home sales thus far in 2021 than during the same time period in 2020! [3] When looking at a full year (12 months) of data there has been a 21% increase in the number of homes selling, annually, in Harrisonburg and Rockingham County. That is a significant surge! [4] The median sales price thus far in 2021 is $269,675 which is 12% higher than it was a year ago when it was only $241,000. This is a large increase in median sales prices in just a year. [5] Homes were selling fast a year ago. They are selling faster now. Median days on market has dropped 55% from 11 days to five days over the past year. When we break things down between detached homes and attached homes we can learn a bit more about what is happening in our local market. An attached home is a duplex, townhouse or condo...  The green sections above are tracking the sales of detached homes where we find... [1] There have been 17% more detached home sales (1,124) in the past 12 months as compared to the prior 12 months (957). [2] The median sales price of detached homes has increased 12% over the past year, from $257,500 to $288,775. That is an increase of more than $30,000 in a single year. The orange sections above are tracking the sales of attached homes where we find... [3] There was a much larger, 29%, increase in the sales of detached homes over the past year. The annual pace of these detached home sales increased from 409/year up to 526/year. [4] The median sales price of these detached homes has increased 15%, from $189,900 up to $217,650. I mentioned earlier that home sales slowed down in September -- but maybe partially because August was bonkers?  As shown above, September 2021 fell short (143 sales) of September 2020... but... [1] Don't forget about August! There were an astonishingly high number of home sales (184) in August 2021, and if we combine August and September we find that there were 292 home sales during those two months last year, compared to 327 this year. [2] The last four months of 2020 were abnormally active because many home sales that would have likely taken place in the first half of 2020 were pushed into the second half of 2020 because of Covid. As such, looking towards the remainder of the year, I would not be surprised if 2021 continues to under perform as compared to 2020. Now, let's stack all of those months up to see how 2021 compares to past years...  Remarkably, the home sales in the first nine months of 2021 was more than in the first ten months of 2020 and more than the first eleven months of 2018 and 2019! So, we can take a month off, right? We could have no home sales in October and we'd still be outperforming last year! Alas, it doesn't seem like home sales will be taking a break in October. But as for predicting future sales activity, the best bet is to look at recent contract activity...  The most recent four months of contract activity (Jun-Sep) have definitely been slower than the contract activity we saw a year ago. There have been a total of 534 contracts signed between June 1 and September 30 this year -- as compared to 617 contracts signed during the same timeframe last year. This likely means we'll see somewhat fewer home sales over the next few months. This next graph won't surprise you as you've likely heard about the extremely low inventory of available homes in this area...  As I have mentioned before, this graph can be a bit misleading. Some might understand it to mean that there are fewer and fewer homes for sale and thus fewer and fewer homes are selling. But, in fact, we have seen 21% more home sales in the past 12 months as compared to the prior 12 months -- so what's the story? The second half of my comment above "at any given time" is the key to unlocking this mystery. Homes are selling (going under contract) quickly, and thus the number of homes on the market at any given time is continuing to stay low. That doesn't mean that there aren't homes on the market to buy -- there are, or were -- but most will go under contract and not be available for any more than a few days. So, as a buyer, be prepared to act quickly, likely compete with other buyers, and possibly have to wait a bit to find the right opportunity. Interestingly, the changes in inventory levels haven't affected all property types in the same way...  The blue line above is showing changes in the number of detached homes on the market at any given time. You'll note that these inventory levels have dropped quite a bit over the past two years. The red line, showing attached homes) has been very low and remained very low for quite some time now. Neither property type is likely to meaningfully increase until and unless we see a significant amount of new construction to help offset high buyer demand.  This graph is a new one, but I think an important one for keeping an eye on the mood of the market. Days on market, as shown above, measures how quickly homes are going under contract. Independent of how many homes are selling and the prices at which they are selling -- if they are going under contract quickly then the market is strong and power is tipped towards sellers -- and if homes are taking a longer time to go under contract the market is not quite as strong and power is starting to balance out between sellers and buyers. Over the past three years we have seen a steady decline in how long it takes homes to go under contract, with a current median of five days on the market. I'll continue to monitor this "days on the market" metric over time to see if things are cooling off at all in our local market. That doesn't seem to be happening yet. :-) You might have heard that mortgage interest rates are increasing, but...  I have read quite a few headlines lately about how rising interest rates are certain to dampen home buyer enthusiasm. If I had a dollar for every time someone told me (or I told you) that interest rates were going to rise over the past seven (+) years... Mortgage interest rates were around 3.5% a year and a half ago, and around 3% a year ago, and are around 3% now. So, are interest rates rising? Sure, a bit, depending on when you pick as the "then" to compare to the "now" but they are still very (very!) low. Alrighty then! That brings my monthly deep dive into our housing market statistics to a close, for now. As usual... If you are thinking of selling your house this fall or winter, let's talk sooner rather than later about timing, pricing, preparations and more. If you're thinking of buying this fall or winter, start looking now, because there aren't many houses on the market, so we'll likely need to patiently wait for the right opportunity to come along and then jump on it, quickly! Have a great remainder of the week, and if you visit Showalter's Orchard and subsequently make apple crisp, text me a photo to make me jealous... or invite me over to sample it... I'll bring the ice cream and caramel sauce! ;-) | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings