| Newer Posts | Older Posts |

Every Home Seller Will Likely Prioritize Differently When Comparing Multiple Offers |

|

It's tough to be a would-be home buyer making an offer in a multiple offer scenario... [1] You don't know what offer terms other buyers are including in their offers. AND [2] You don't know how the seller will prioritize differing offer terms. For example... [1] Some sellers will focus mainly or only on price -- they will likely go with the offer with the highest offered price. [2] Some sellers will lean most heavily towards cash buyers, followed by buyers with the largest down payments, even if this is not the highest offer. [3] Some sellers will opt for an offer without a home inspection contingency, even if that is not the offer with the highest offer price or with the smallest loan [4] Some sellers will focus mainly on the timing of the closing and/or whether the buyer is offering to let them stay in the house after closing. AND [5] Almost all sellers will consider ALL of these factors but will consider some of the offer terms more heavily than others. | |

Slightly More Homes Are Selling This Year Than Last, At Significantly Higher Prices |

|

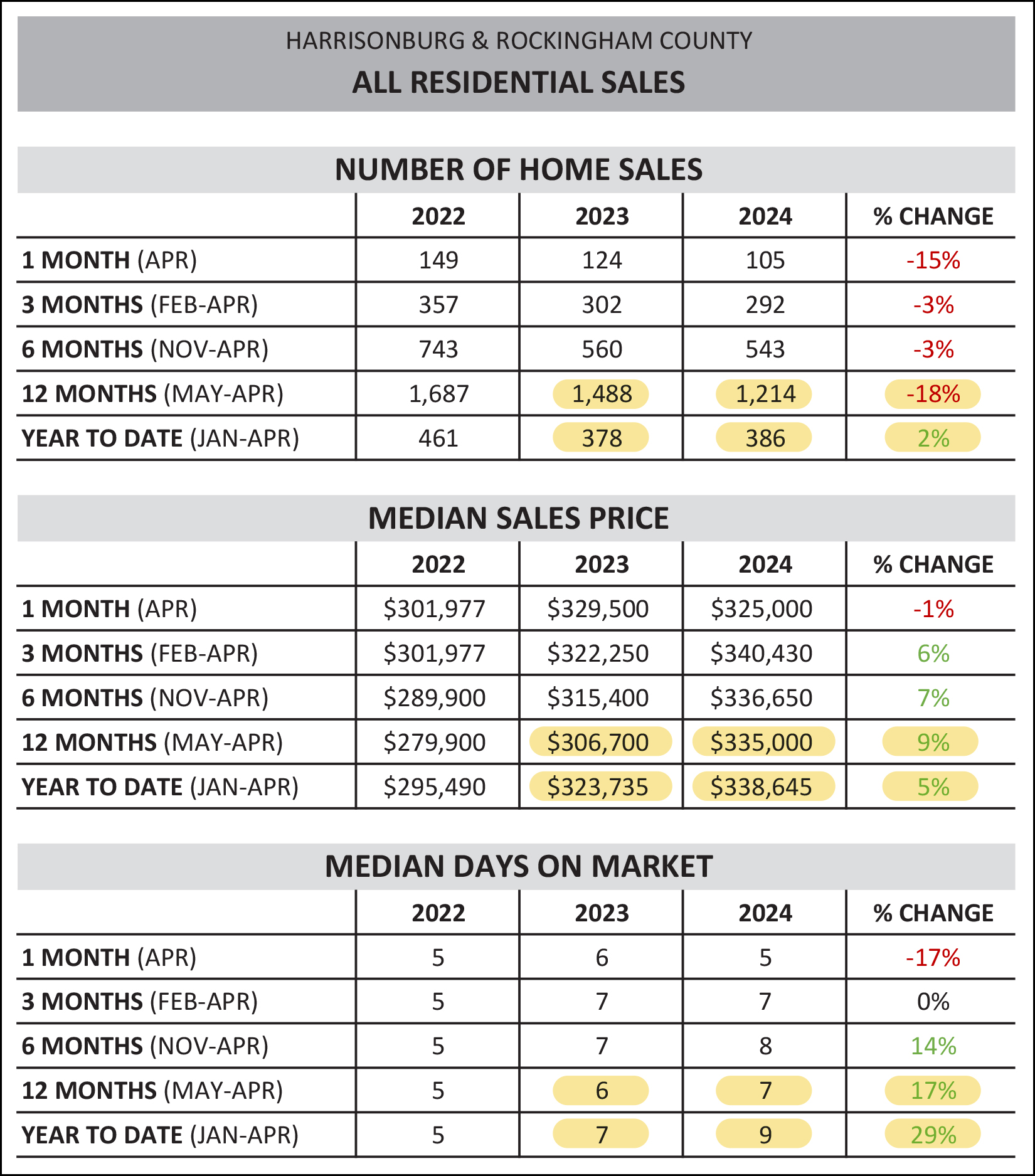

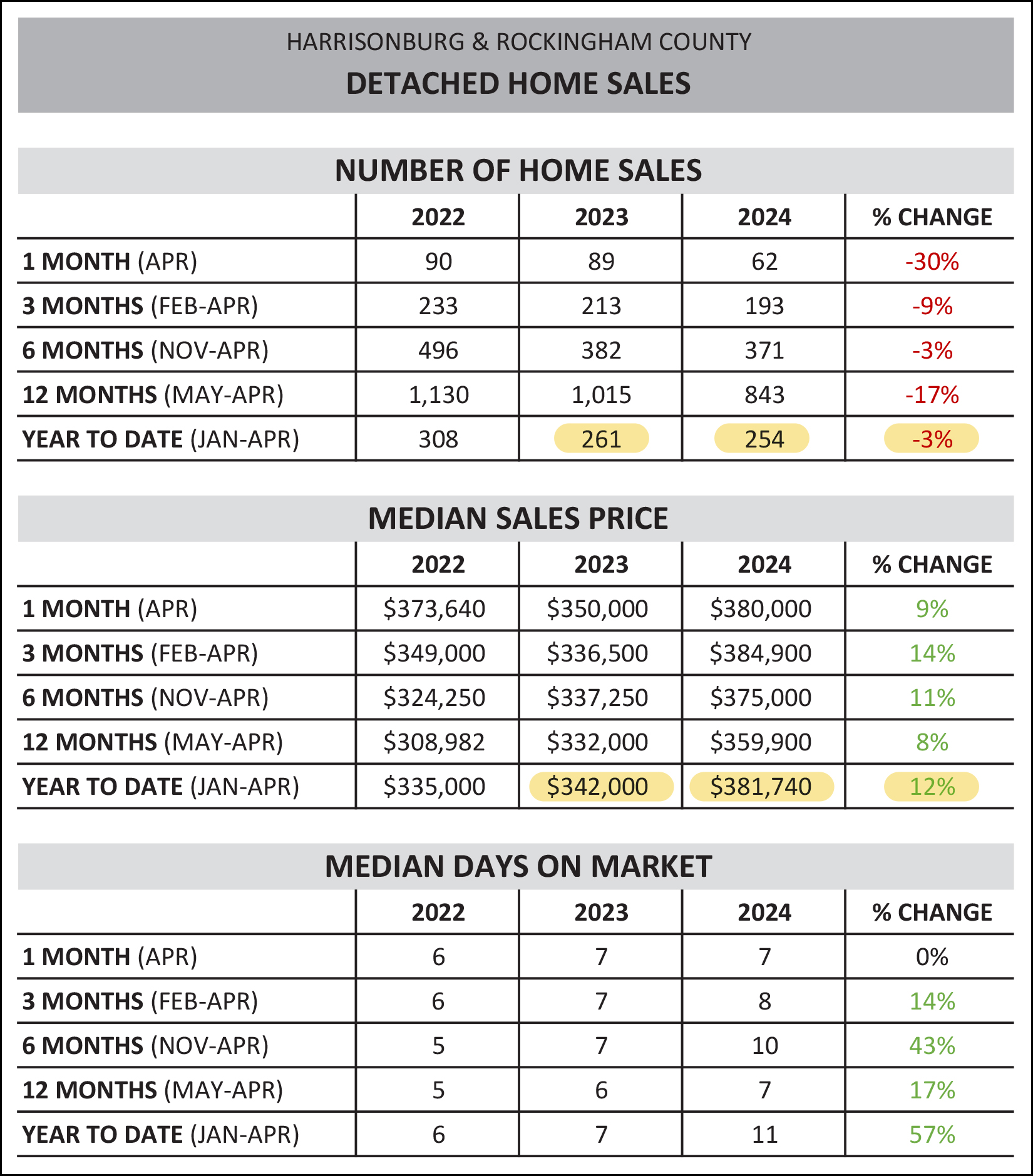

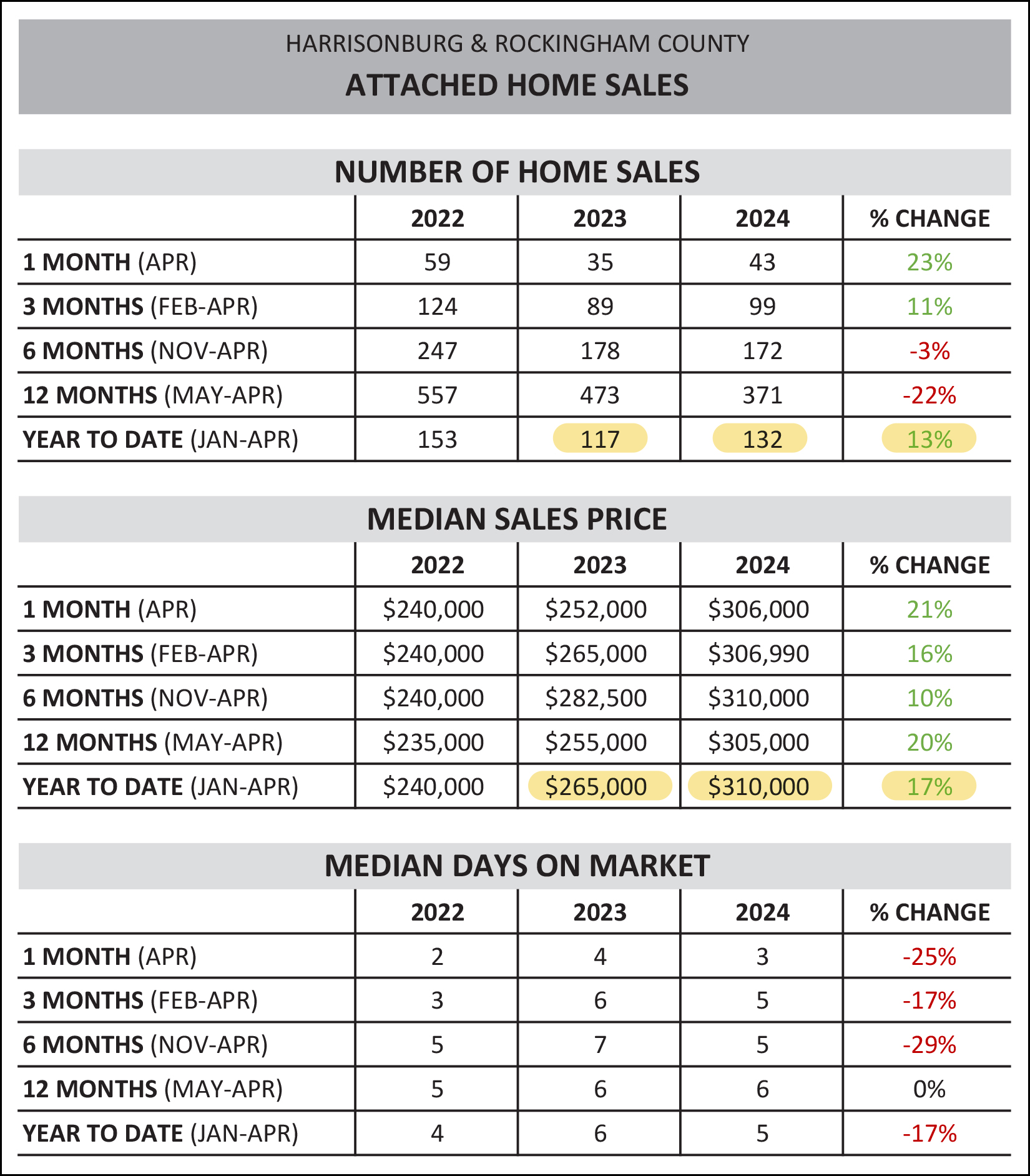

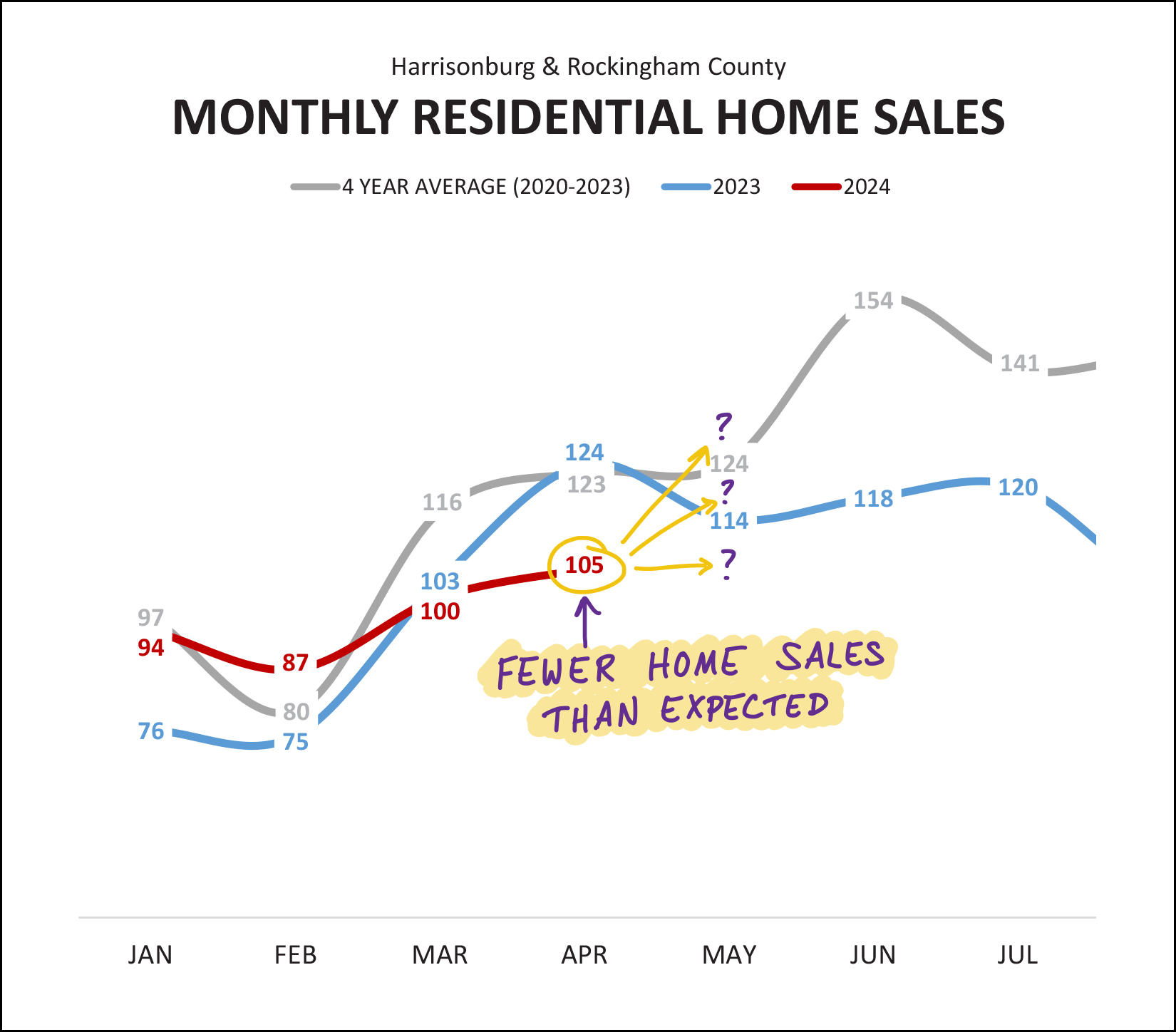

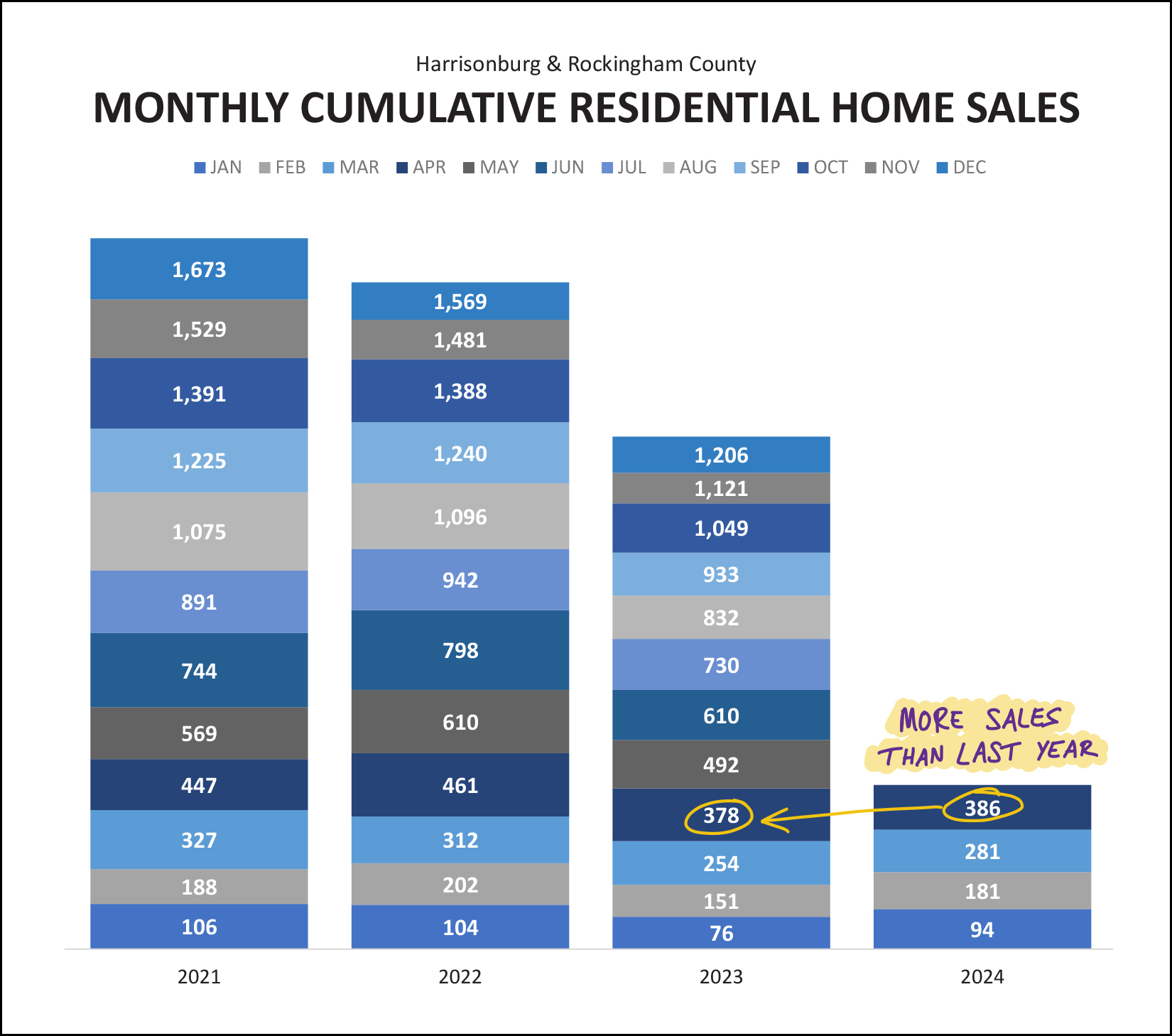

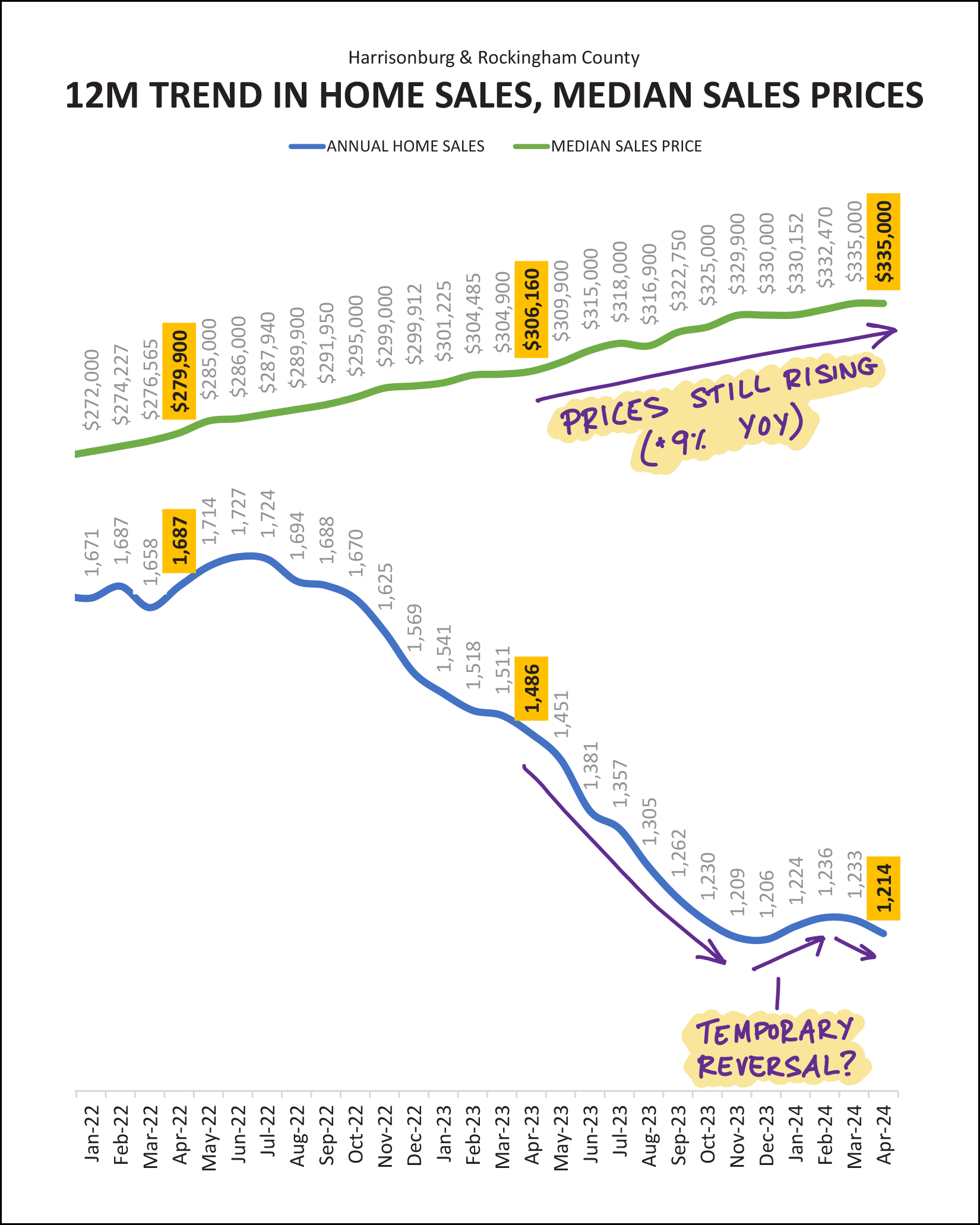

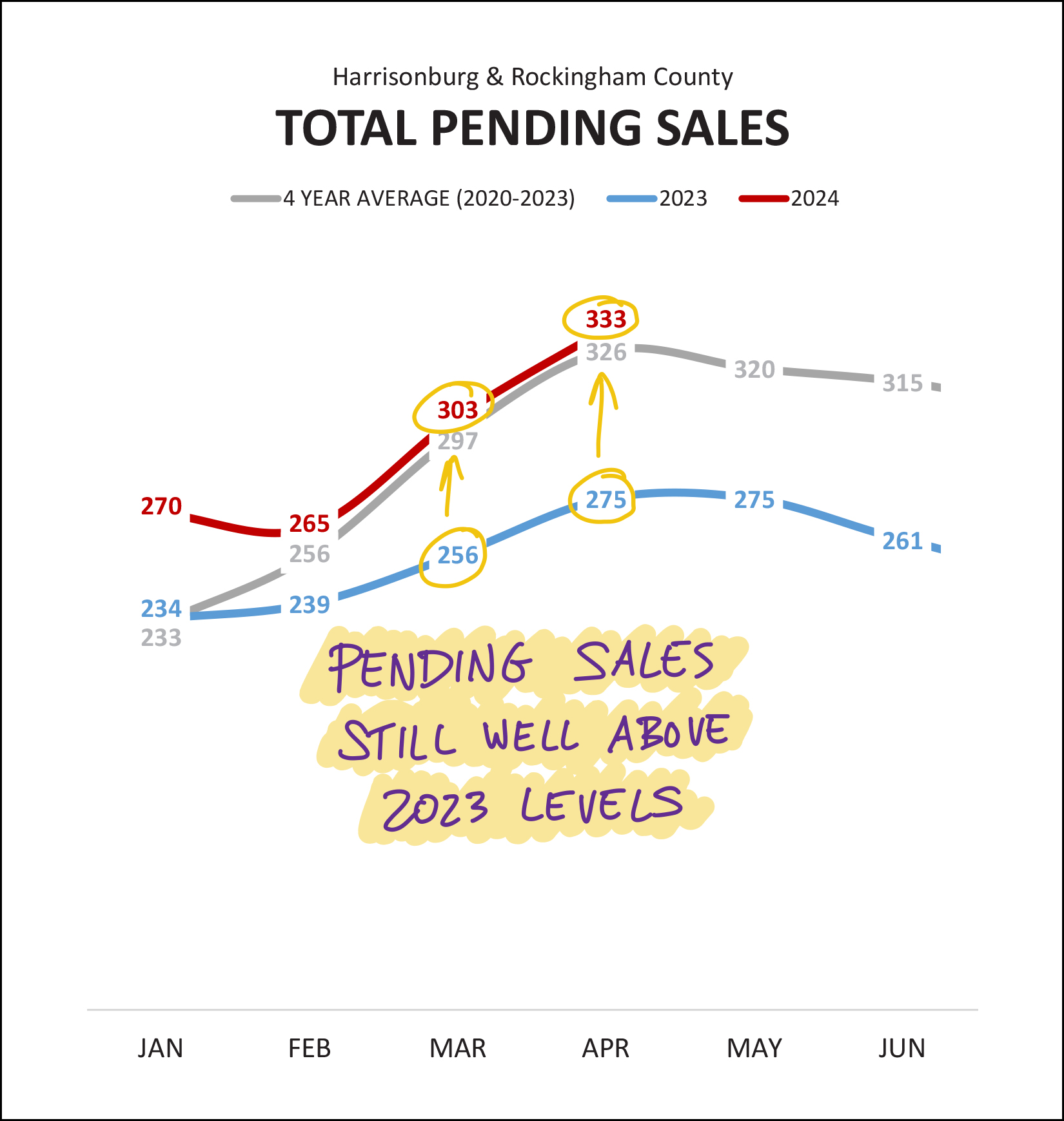

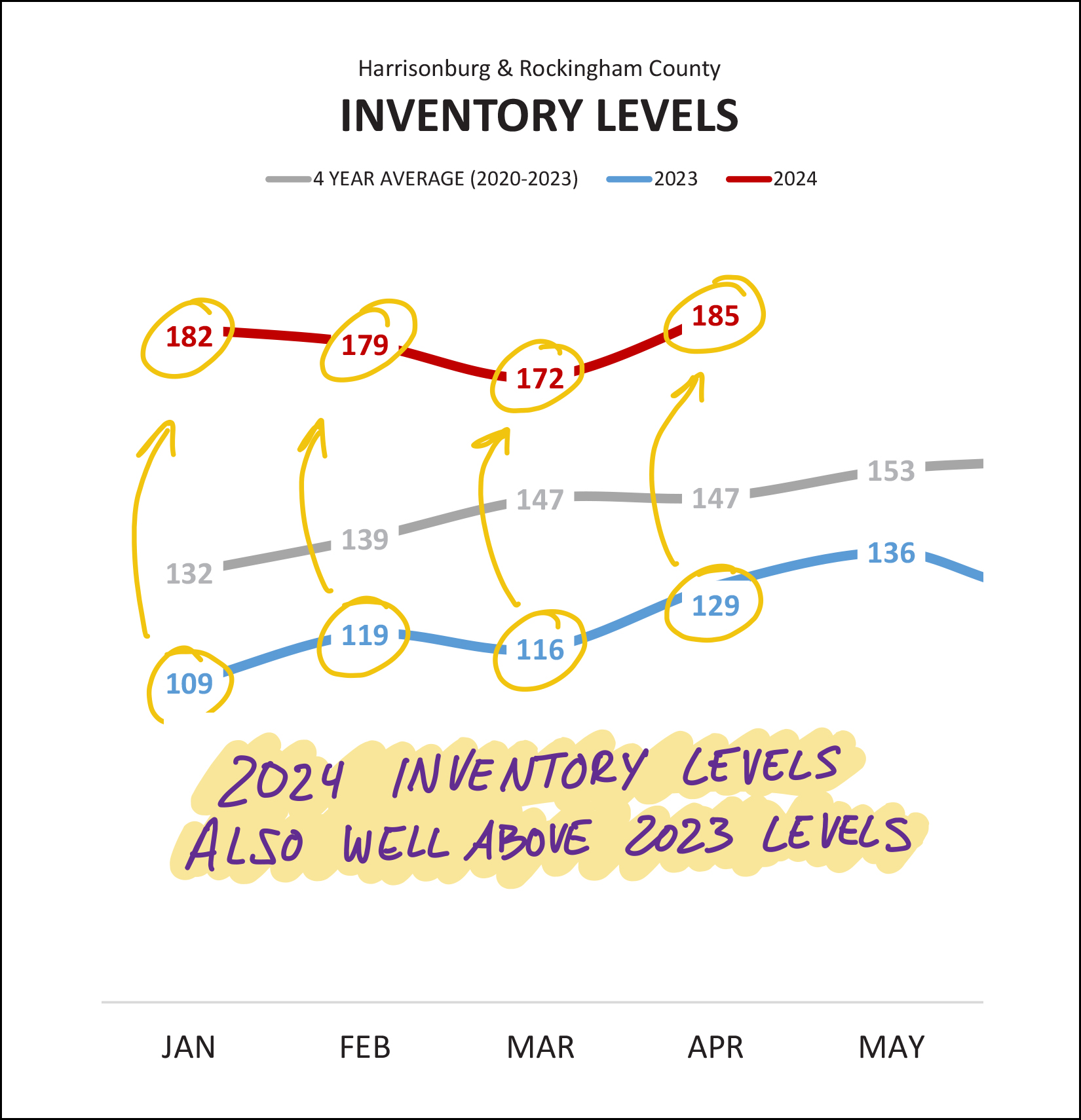

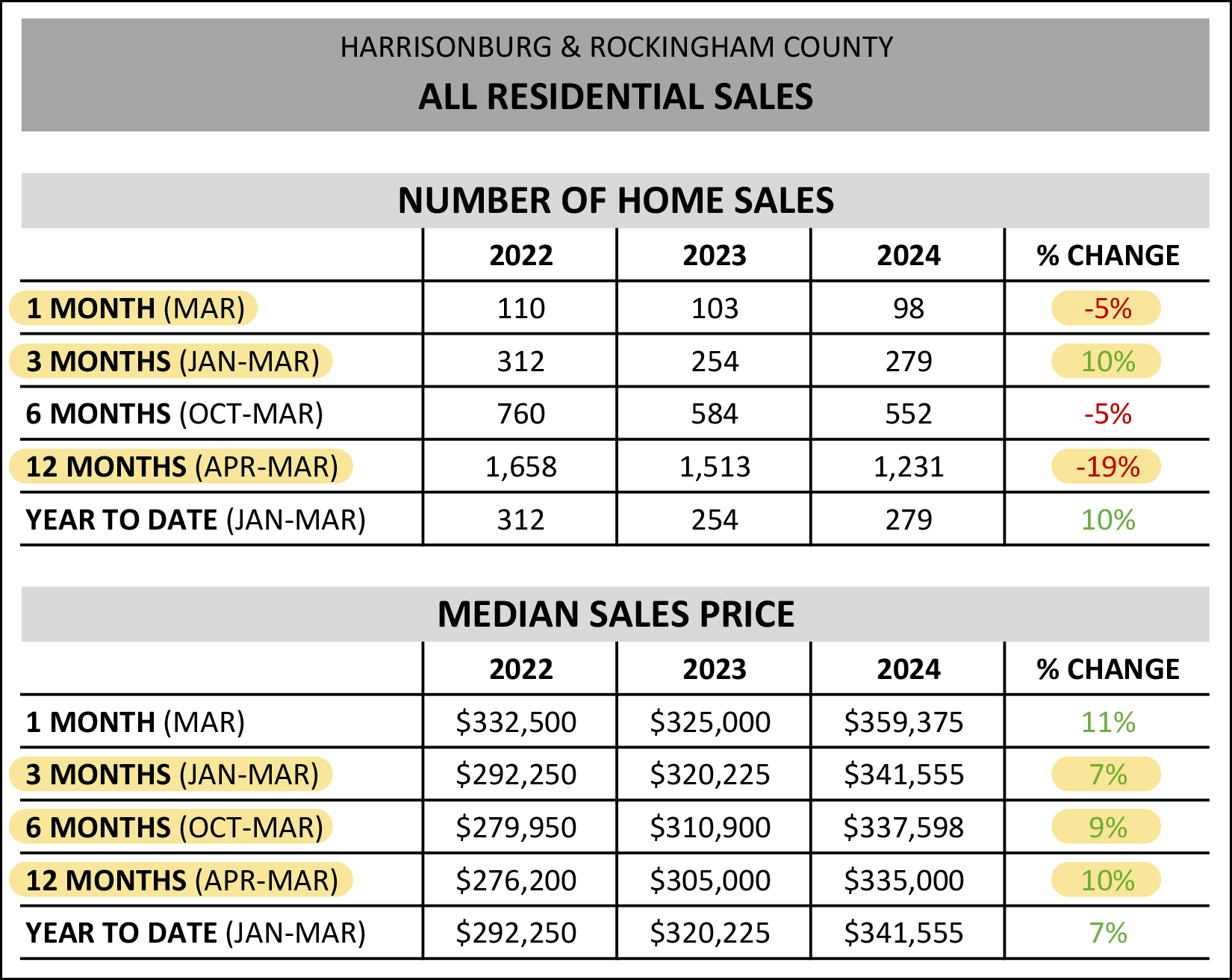

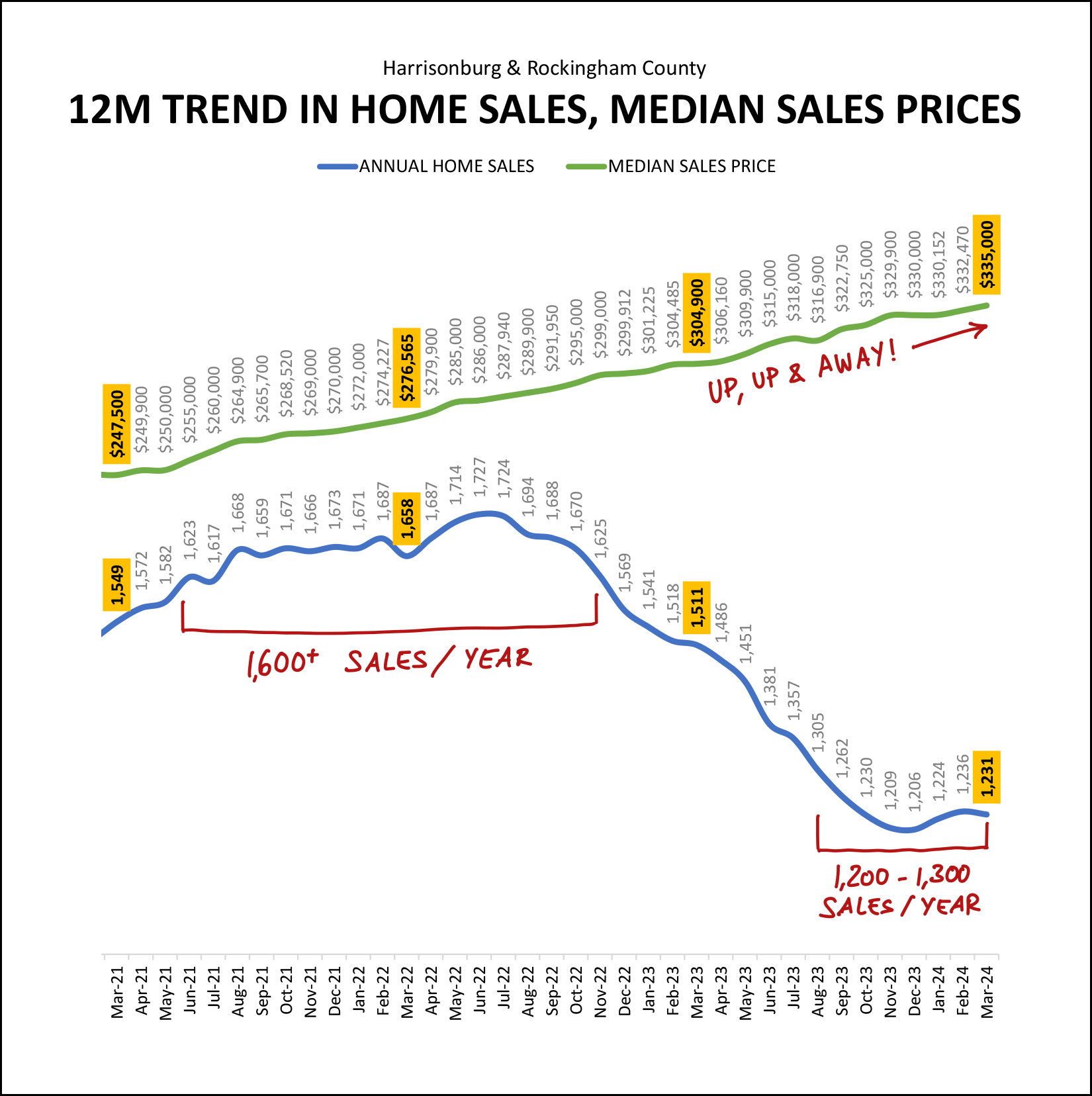

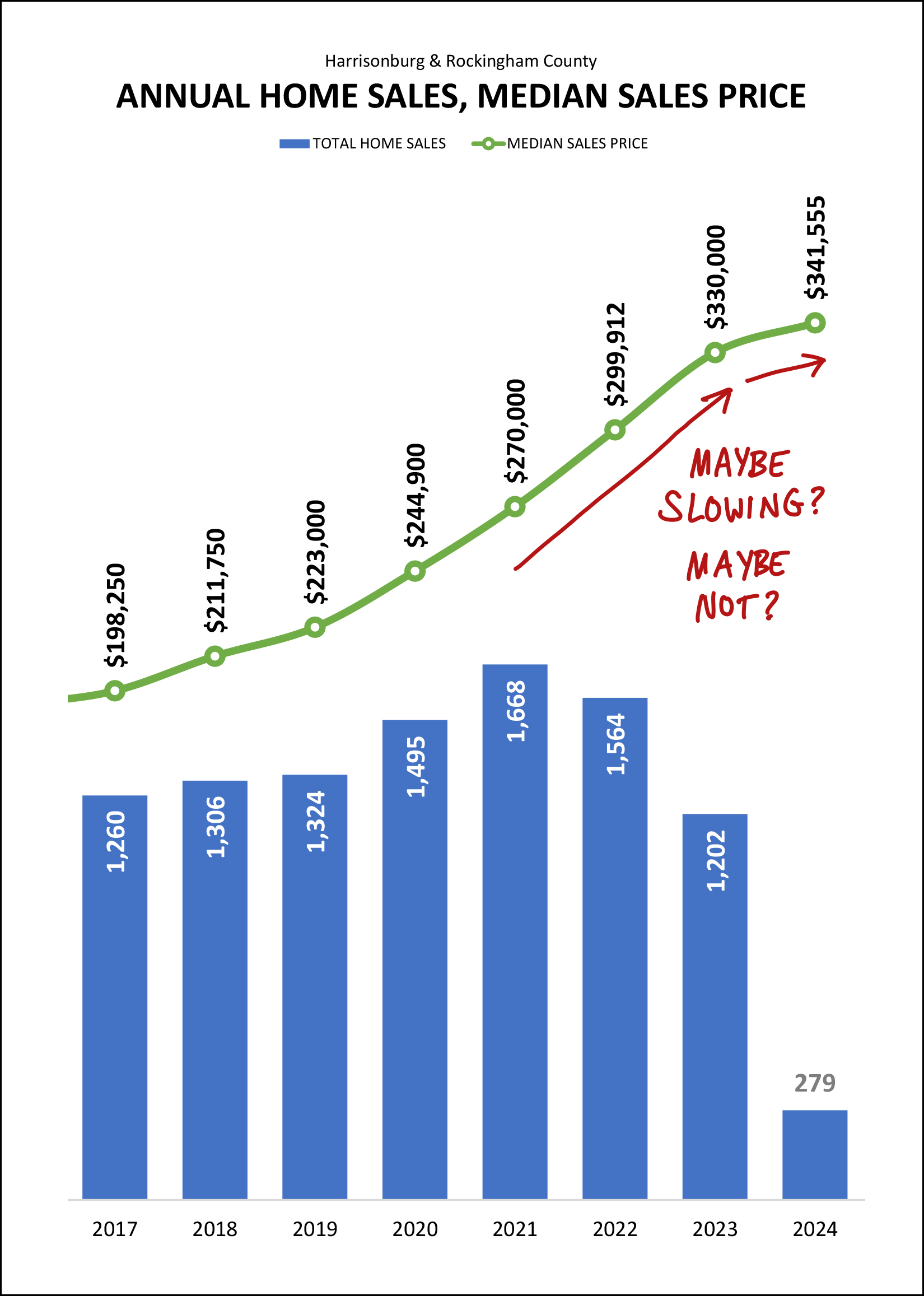

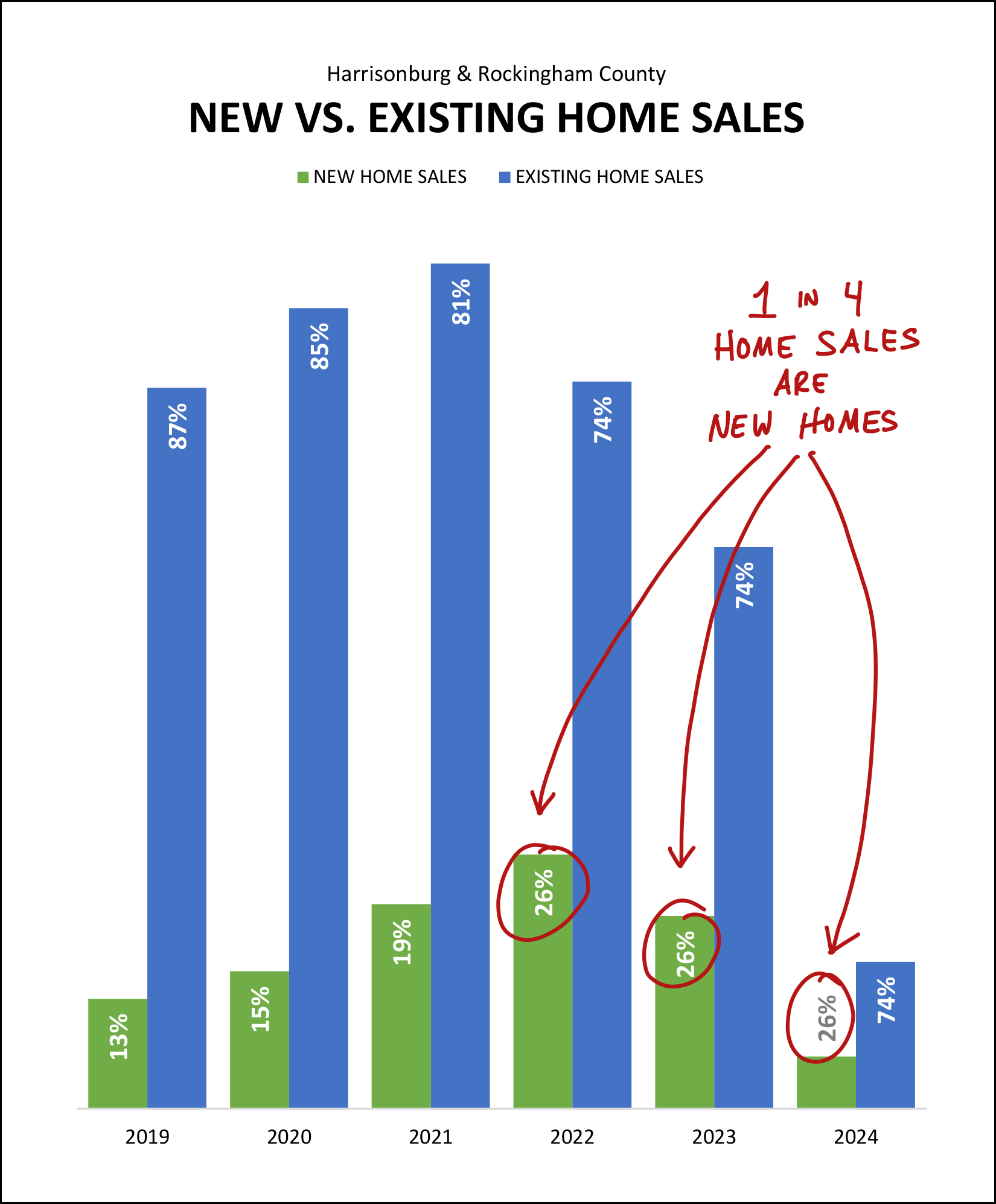

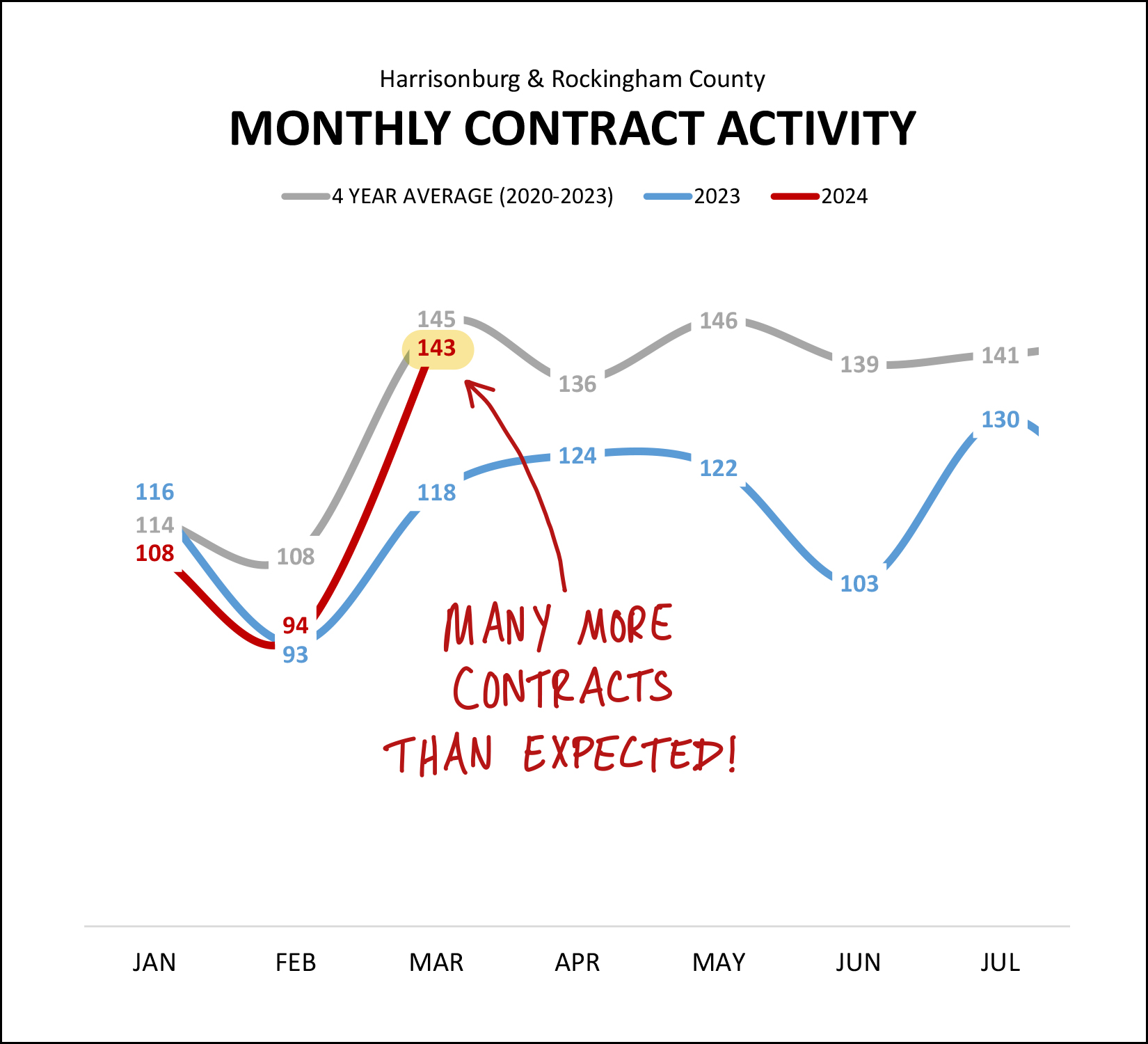

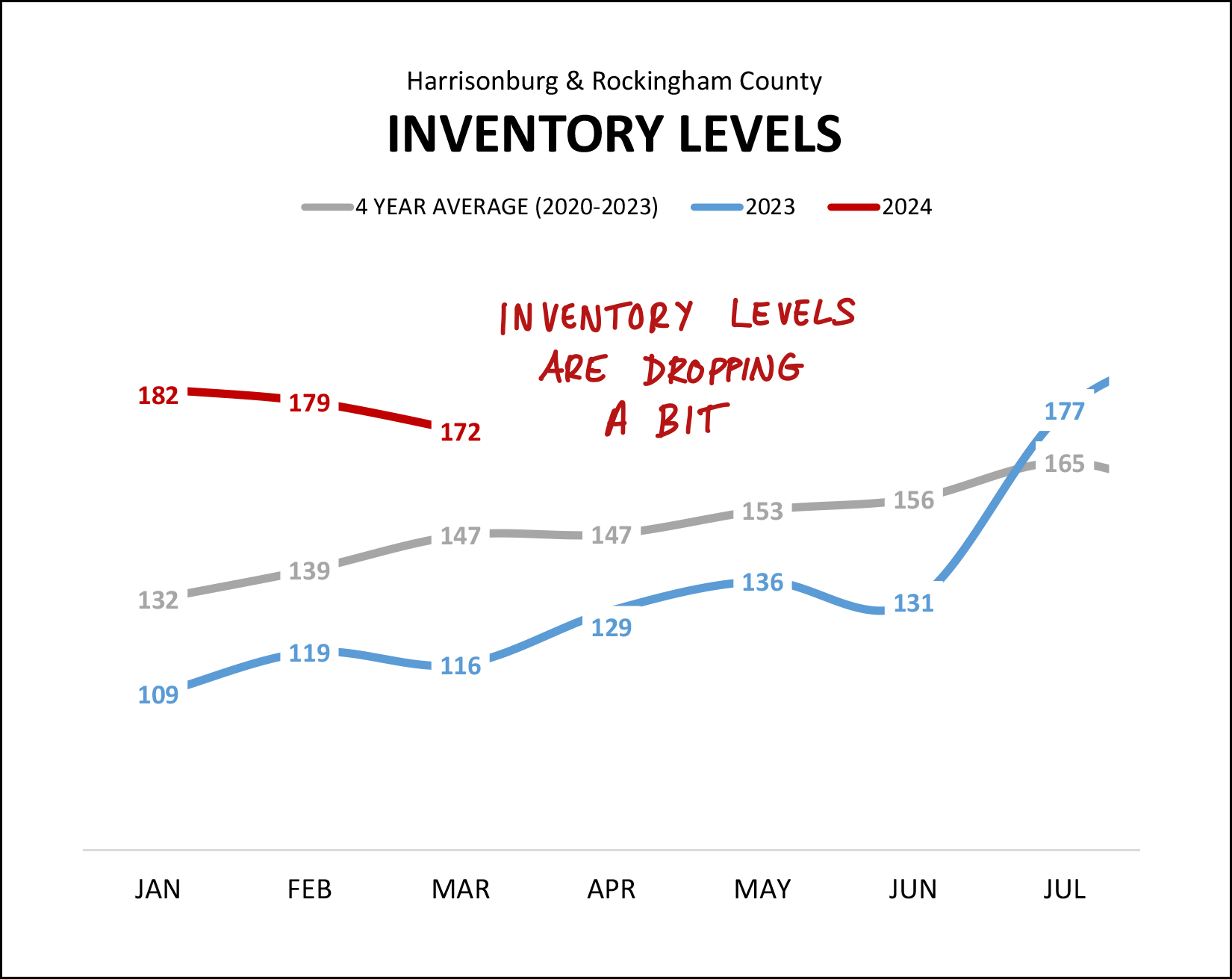

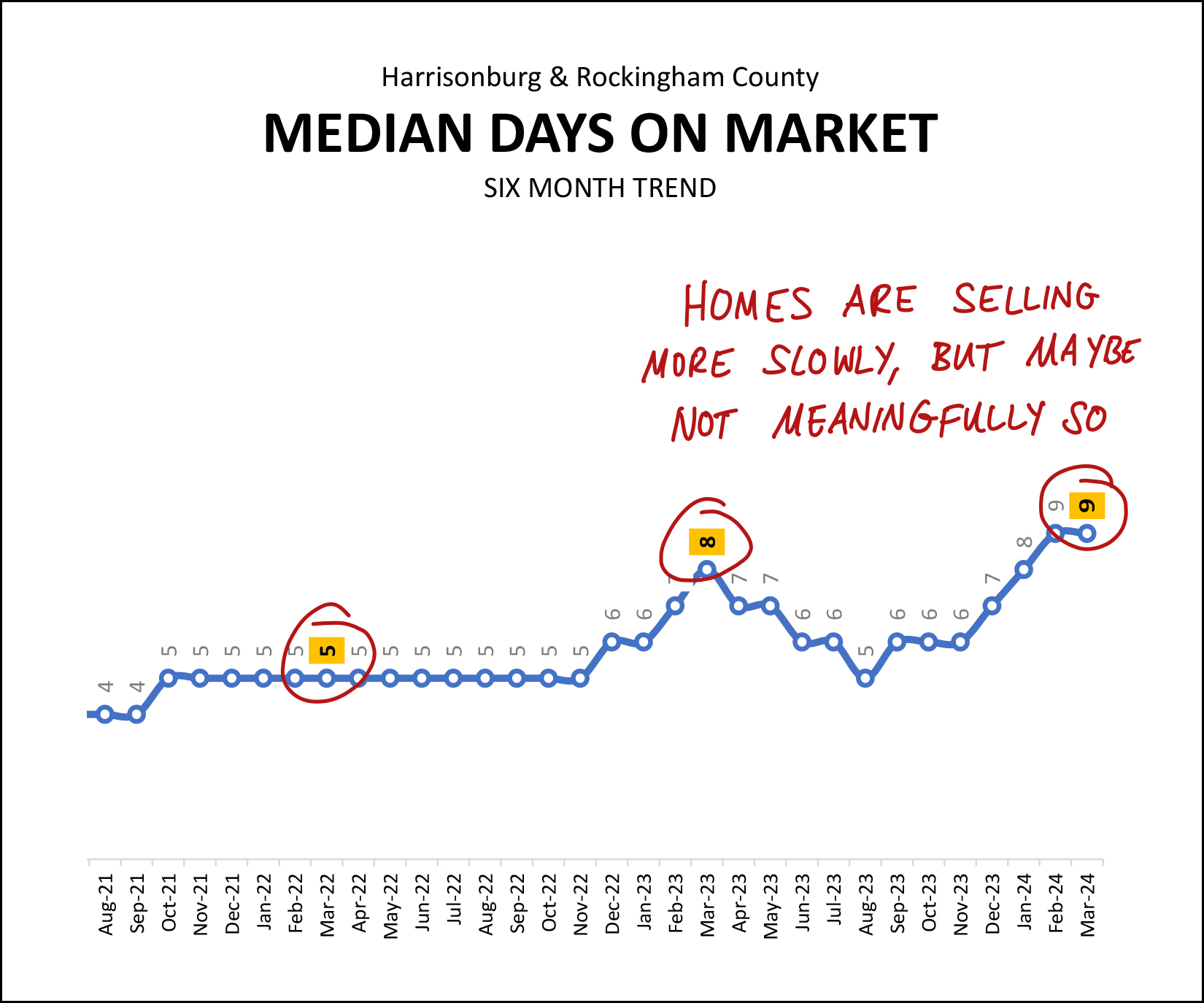

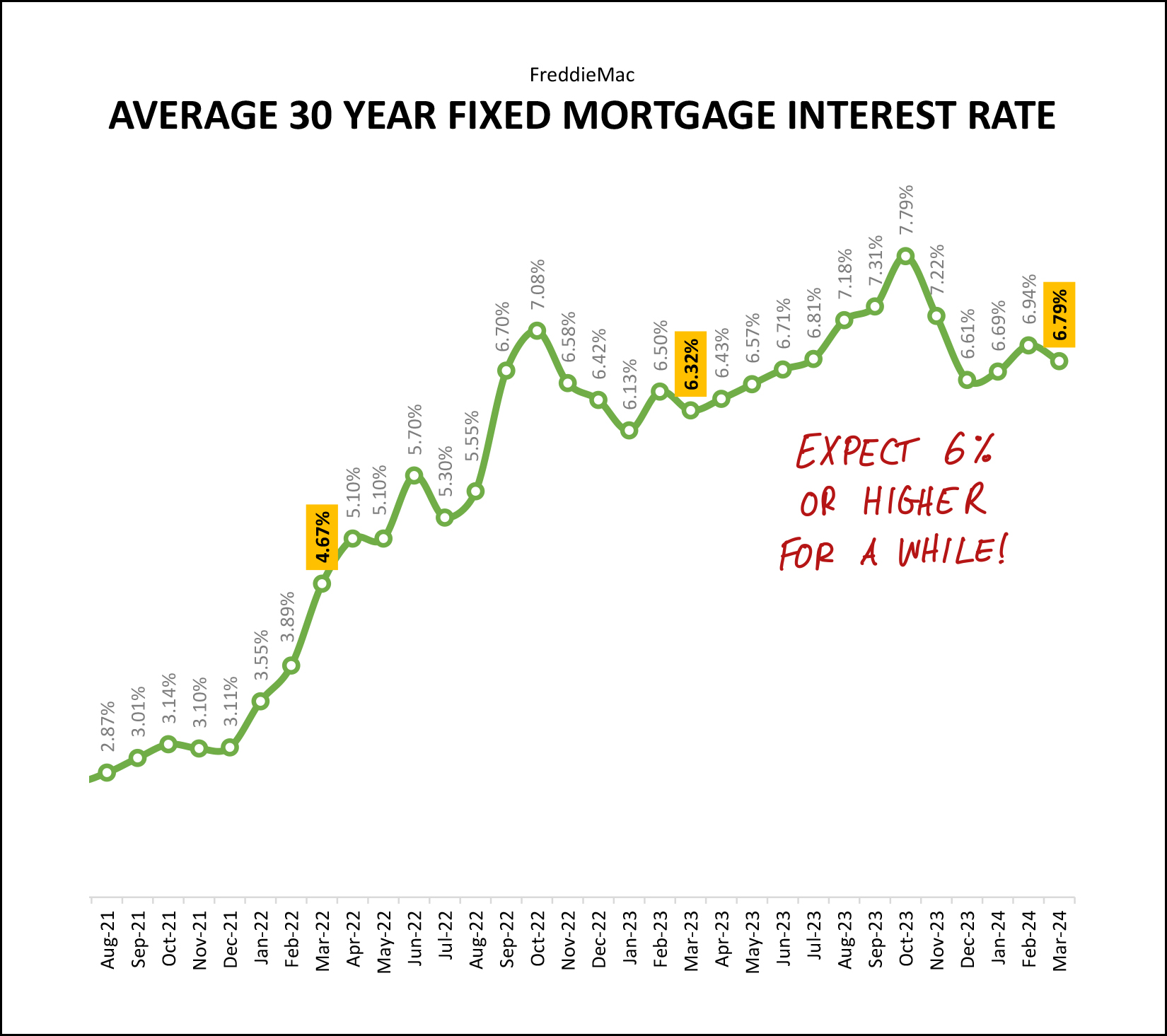

Happy Monday morning, friends! I hope you had an enjoyable weekend of seeing (or in my case, not seeing) the Northern Lights, celebrating the mothers in your life, and soaking in some delightful not-too-hot and not-too-cold spring weather here in the Shenandoah Valley! I was still at least partially in rest and recuperate mode this past weekend after running VA Momentum's Perfect Day 50K trail run the prior weekend with Luke. It was an amazing event with a community feel and great support from the family and friends as individuals and teams ran a 5K every hour on the hour for 10 hours straight, from 8AM until 5PM. It was definitely the longest Luke or I have run in a day!  Speaking of amazing events... each month I offer a giveaway for readers of this market report, and this month... I'm giving away a pair of 3-day tickets to one of my favorite events of the summer... the Red Wing Roots Music Festival!  This super-relaxing and family-friendly music festival from June 21 - 23 at Natural Chimneys Park in Mt Solon features wonderful music (on multiple stages throughout the weekend), great food, lots of activities (hiking, biking, running, yoga, kids events), and all around great fun with family and friends. Have you considered going to Red Wing but haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 21st through 23rd. And now, let's move on along to the latest numbers in our local housing market...  The chart above takes a look at our overall market during a variety of timeframes. Number of Home Sales -- As shown in the first set of highlighted numbers, over the past 12 months we have only seen 1,214 home sales in Harrisonburg and Rockingham County, compared to 1,488 during the 12 months before that. As such, we have seen an 18% decline in home sales when looking at a 12 month period -- but when looking just at this year, thus far, we are seeing a 2% increase in home sales, from 386 this January through April compared to 378 last January through April. Median Sales Price -- Over the past year we have seen a 9% increase in the median sales price in Harrisonburg and Rockingham County, which has now reached $335,000 (over the past 12 months) as compared to only $306,700 over the 12 months prior to that. Looking just at the first four months of this year we see a slightly smaller (5%) increase in the median sales price ($338,645) when comparing it to the first four months of last year ($323,735). Median Days On Market -- Homes are selling a bit more slowly this year than last. The median number of days it took for new listings to go under contract over the past 12 months has been nine days... which is an increase from the median of seven days during the 12 months prior to that. Now, looking at a subset of the market, for a moment, here are the same numbers when looking just at detached homes, and excluding townhomes, duplexes and condos...  Focusing just on the first four months of 2024 compared to the first four months of 2023, here are the differences we see between the detached home market and the overall market... There has been a 3% decline the number of detached homes that are selling... compared to the 2% increase in the overall number of homes selling. There has been a 12% increase in the median sales price of detached homes that are selling... compared to the 5% increase in the median sales price of all homes that have sold. So, when looking just at detached homes, slightly *fewer* are selling in 2024, and the increase in their median sales price is higher than that of the overall market. Meanwhile, in the attached home market...  When looking just at attached homes (townhomes, duplexes, condos) we have seen a 13% increase in the number of such homes selling in the first four months of 2024, compared to the first four months of 2023 -- and a 17% increase in their median sales price. As such, the attached home market is seeing a strong start to the year both in number of sales and the price of those homes. Now, let's switch gears learn about the latest trends via some graphs...  As you read above, we are seeing slightly more home sales in the first four months of 2024 compared to the first four months of 2023... but... April was not a contributor to that trend. Strong months of home sales in January and February were the biggest reason why we're seeing slightly more home sales in the first third of 2024 compared to the first third of 2023, as we saw fewer home sales this April (105) than we saw last April (124). Where do we go from here? We'll have to look at contract activity and pending sales (a bit further down this overview) to guess at whether home sales activity will rebound at all in May 2024. But first, let's see how the start of this year compares to the last few years...  The 386 home sales during the first four months of 2024 puts us slightly ahead of the 378 in the first four months of last year... though well below the 447 and 461 home sales levels reached during the first four months of 2021 and 2022. It seems reasonable to conclude we'll probably see around 1,200 home sales this year (similar to last year) and not 1,500 - 1,700 home sales such as were seen in 2021 and 2022. Now, then, looking at slow moving trends by examining rolling 12 months of data...  The top green line, above, shows the median sales price over a 12 month period, measured each month. Over the past year that median sales price has increased 9% from $306,160 to $335,000. Despite fewer home sales and higher mortgage interest rates, the median sales prices keeps... on... rising. The blue line, above, shows the number of homes selling in 12 months time, measured each month. Ever since the middle of 2022 we have seen this metric of annual home sales steadily falling... though in early 2024 that trend seemed to be reversing itself as the pace of annual home sales started to rise again. But... not so much in April 2024. Stay tuned to see if the annual pace of home sales levels out, declines even further, or starts rising again as we head through May, June and July. I haven't touched on it yet in this report, but a large portion of homes that are selling this year are new homes....  Thus far in 2024, 25% (1 in 4) home sales have been new home sales. This is a rather significant change from just a few years ago when only 13% (2019) and 15% (2020) of the homes that were selling were new homes. With soooo many current homeowners having rather low (to super low) interest rates on their current mortgages, we seem poised to have lower numbers of resale home sales for several years to come. As such, the new homes offered for sale (and being purchased) help to at least partially satisfy buyer demand for housing, and we are likely to continue to see around 25% (more or less) of buyers buying new homes over the next year or two. To get a sense of where the market might go next, let's look at contract activity...  Despite fewer home sales in March and April of 2024... the amount of homes going under contract was MUCH higher this March and April (red line) compared to last year (blue line). Given these higher months of contract activity, I believe we are likely to see higher numbers of home sales in May and June. This is reinforced when looking at the number of homes under contract at the end of March and at the end of April...  There are currently 333 homes under contract (waiting to go to closing) in Harrisonburg and Rockingham County... compared to only 275 homes being under contract at the same time last year. Higher numbers of homes going under contract in March and April of this year has resulted in this higher number of pending sales, which should (within the next month or two) translate into higher numbers of closed sales. And yet, just to throw one more metric into the mix to at least partially make you scratch your head and think on this Monday morning...  As shown above, inventory levels are tracking a good bit higher at the start of this year (172-185) than they were last year (109-129) and also well above the four year average (132-147). So, why are there more homes on the market (at any given point) this year than last? My two leading theories are... [1] Homes are going under contract (days on market) a bit more slowly this year than last, which could result in slightly higher inventory levels. [2] Quite a few (31%) of these active listings (58 of 185) are new homes... some of which have not yet been built or have not yet been finished, which might result in them remaining as active listings and not going under contract. Think on that mystery... home sales rising, contract activity rising, prices rising, but inventory... also rising... and let me know if you have any other theories. While you think on that, here's one more thing that is rising...  Mortgage interest rates have been above 6.5% for the entirety of the past year, and the sub-5% rates are now a distant (two years ago) memory. After steady declines in rates between October 2023 (7.79%) and December 2023 (6.61) we have seen rates trend back up over the past four months. Anyone who is waiting to buy a home until mortgage interest rates get back down to 5% -- or even 6% -- will probably have a long wait. So, what does all of this mean for you? Home Sellers - As has been the case for quite a few years now, you're in a great position. You will likely be selling your home at a higher price than would have been possible over the past few years. Remember, though, that mortgage interest are high, which make mortgage payments for buyers quite high, so make sure your list price is in line with recent sales so that you have enough buyer interest to hopefully see your home quickly go under contract. Home Buyers - Depending on your price range and the type of property you hope to buy, you may or may not have LOTS of competition. I am currently seeing some properties linger on the market for a week or more without any offers... and some going under contract within days with multiple offers. Talk to a lender to get a sense of where you can be and where you want to be with your mortgage payment and purchase price, and then let's start getting out there to see some homes and get a feel for the market so that you're ready to confidently move forward when the right house hits the market. Home Owners - If your current home works well (or well enough) for you - enjoy your likely low housing payment (depending on when you bought or refinanced) and enjoy the increasing equity you likely have in your home. As much as excited would-be home buyers might wish you would sell your home so they have more options for buying... I can't blame you for staying put and enjoying where you are. Renters - Plenty of folks are not homeowners and are not planning to buy anytime soon, or do not see themselves being able to buy anytime soon. This is completely understandable given the significant increases in sales prices and mortgage interest rates over the past five years. If you are on the edge of being able to or interested in buying, don't hesitate to have a preliminary conversation with a lender and/or with me to get a sense of what it would look like to buy a home... especially given how rental rates keep on increasing. And... that's a wrap, folks. You are about as well informed as is possible on the overall Harrisonburg and Rockingham County real estate market on this Monday morning. But if you have questions about a specific segment of the housing market, or about your neighborhood, or about your home... feel free to ask! Until next month... [1] Check out the complete set of May 2024 charts and graphs here. [2] If you're getting ready to buy, let's chat about the process, the market and what you hope to buy. You'll also want to talk to a lender sooner rather than later. [3] If you're getting ready to sell, let's meet soon to talk about the market, the process, your house, your timing and your goals. To touch base with me about any of the above, call/text me at 540-578-0102 or email me here. Enjoy your Monday! | |

Some Buyers Are Starting To Be Able To Compare And Contrast Multiple Similar Listings At The Same Time Now |

|

For the past few years, inventory levels were so low and homes were going under contract so quickly that a buyer's process looked like this... Home #1 is listed for sale, we go see it, you make a decision about whether to make an offer, it is under contract within 48 hours. Three days later, Home #2 is listed for sale, we go see it, you make a decision about whether to make an offer, it is under contract within 48 hours.

Etc., etc. There would rarely be two similar houses on the same time for you to be able to consider both at the same time and decide which to pursue. You'd have to decide if you wanted to pursue House #1 before knowing that House #2 would be coming on the market. If you didn't like House #2 as much as House #1, it was too late, as House #1 would already be under contract. But... we're starting to see (some!) listings linger on the market for a bit longer these days... Some buyers are able to go see multiple houses on one day and compare and contrast them before deciding which one to pursue. Or, some buyers are able to go see multiple houses over the course of a few days and compare and contrast them before deciding which one to pursue. What a novel concept... being able to consider multiple options at once, rather than only being able to consider one option at a time, over and over. | |

No Need To Get Overly Competitive As A Home Buyer... Unless You Have Competition |

|

Many sellers of homes newly listed for sale are still receiving multiple offers from eager buyers within the first few days on the market... but that is not universally happening on all new listings. As such... if you're the first one to the party... the first buyer to make an offer, you likely do not need to... [1] included an escalation clause [2] waive a home inspection [3] offer to pay your offered price regardless of the appraised value But... if you submit an offer without an escalation clause, with a home inspection contingency and with an appraisal contingency... and then receive notice that another offer has been received... you might pause to reconsider your offer terms. If you are competing against another buyer, you may very well want to... [1] included an escalation clause and/or [2] waive a home inspection and/or [3] offer to pay your offered price regardless of the appraised value The competition that you do or do not have when making an offer should guide and direct your offer terms. | |

Buying A Great House Is Likely Better Than Eternally Searching For A Perfect House |

|

You may have heard of the expression - "Don't let the perfect be the enemy of the good" - and here are a few other similar phrases from philosophers over the ages...

So, how does this all apply to house hunting and home buying? When in the midst of a home search process, when a buyer finds a house that seems like it could work well -- they might get stuck in trying to determine conclusively whether good is good enough... or whether great is perfect enough. It's understandable... Buying a house is an expensive and lasting decision. You'll likely live in the home for many years to come, and the various aspects of the house will shape some of the patterns of your life, relationships and more. So, it's important to get the right house -- a great house -- a perfect house -- right? Yes, 100%. That said, oftentimes a house is great, but is not 100% perfect, and this can leave a buyer wondering whether to go ahead and jump on the pretty-amazing-but-not-perfect house, or to keep looking for something that is an even better fit for their needs or desires. There's no magical answer here -- it's not that you should always decide to buy a great-but-not-perfect house -- and it's not that you should always eternally wait for the perfect house. | |

Local Real Estate App Now Available For Download |

|

Funkhouser Real Estate Group has recently launched a real estate app that will make your home search easier than ever. Download it today by clicking here, or read on for some highlights. Enjoy an easy and intuitive map based search when you first launch the app, based on your current location...  View full property details for any home on the market with the ability to easily ask a question or schedule a showing...  Create a search area by drawing any shape you'd like, and save that search for notifications when a listing hits the market in your areas of interest...  Refine your search parameters with a variety of filters allowing you to find just the houses best suited for you...  Take this new local real estate app for a spin today by downloading it here. Let me know if you have questions or feedback! | |

It Is Prime Time For Getting Your House On The Market If You Want To Sell This Summer |

|

Lots of home buyers try to, prefer to, want to move into their next home during the summer months... which typically means contracting on that home in May or June. As such... sellers who are hoping to sell in the next six months should consider getting their home on the market now or soon. Just to spell out a bit of the potential timing for listing your home in May... May 15 - home listed for sale May 20 - home under contract (not always this fast, but often so) June 30 - closing on sale of home (typically 30 - 45 days after contract) Or, a bit later... June 1 - home listed for sale June 5 - home under contract July 15 - closing on sale of home A touch later... June 15 - home listed for sale June 20 - home under contract July 31 - closing on sale of home Many home buyers hoping to transition over the summer will want to close on their purchase by the end of July -- which means sellers will be an ideal position to sell to those buyers if they have their home listed for sale by June 15. Again, there are plenty of assumptions in the timelines above, such as the home going under contract in four days (when it might take 10 or 14 or 21) and a closing happening in about 40 days (when it might take 60). If you hope to sell this summer, we should chat sooner rather than later about a potential timeline for preparing your house for the market and getting it on the market. | |

It Can Be Hard To Justify Purchasing A Well Maintained Home With Finishes You Do Not Like |

|

Sometimes we'll go in a house that has finishes you don't like... but the house hasn't had very many updates in 20 - 30 years, and is priced appropriately given those needed updates. Many buyers can get excited about buying such a home... you can make the updates over time and make selections to make the updated finishes and features match your tastes. But sometimes... we'll go in a house that has finishes you don't like... and that house will have been meticulously updated over time. The expansive kitchen with two year old cabinetry -- of a color or style you just don't like. The flooring throughout the main level that was replaced a year ago -- and is not at all what you would have selected. The challenge in purchasing a well maintained home with finishes that you don't like is that you often feel you have two less than desirable options... 1. Buy the house, don't make further changes, live with finishes you don't love. 2. Buy the house, make further improvements, replacing finishes you don't like with those that you do, taking out reasonably nice finishes and fixtures that just weren't your style. As you can see, neither of these options is particularly compelling... which causes many such would-be buyers to just not buy the house at all. | |

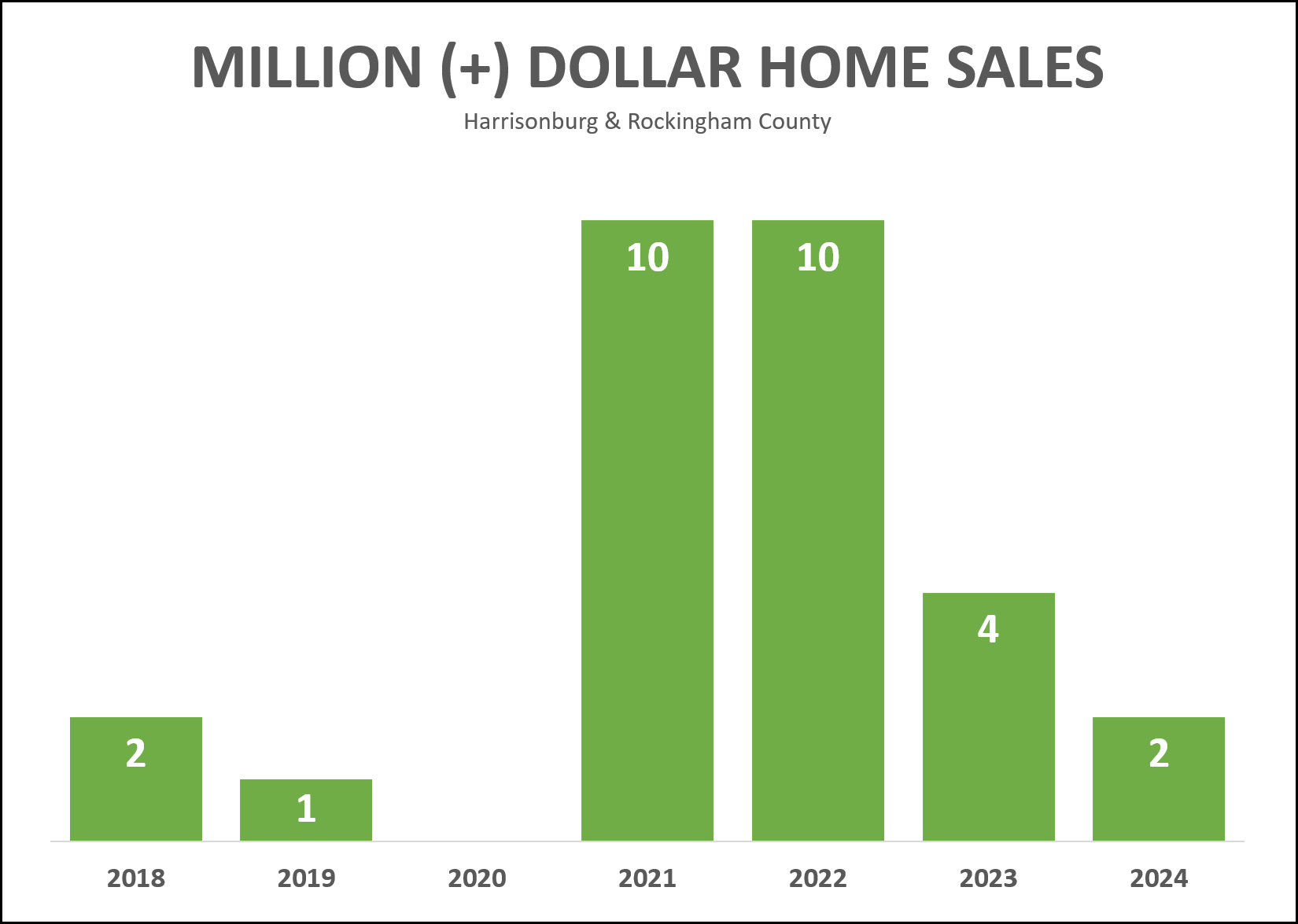

Million Dollar Home Sales Peaked In 2021, 2022 |

|

Between 2018 and 2020 there were only three million dollar home sales in Harrisonburg and Rockingham County area as recorded in the HRAR MLS. Then, in 2021, we saw (10) million dollar (+) home sales, and then (10) more such sales in 2022! Home prices were certainly increasing between 2018 and 2021, so one of the reasons we saw more million dollar home sales was certainly because of increases in those home values. But then -- we only saw (4) such sales in 2023. One theory here is that the increase in mortgage interest rates in 2022 and then 2023 resulted in fewer buyers being willing to pay a million bucks (or more) for a home. Thus far in 2024, we have seen two of these million dollar (+) home sales in the first four(ish) months of the year -- though there are four other million (+) dollar listings that are under contract and waiting to make it to closing. If you're eager to purchase a million dollar home in Harrisonburg or Rockingham County, these are your (14) current options. | |

What Would You Buy If EVERY Existing House Were Offered For Sale? |

|

What Would You Buy If EVERY Existing House Were Offered For Sale? This can be a helpful question -- though often not specifically productive. Sometimes it can be worthwhile in a home search to take a step back and think about what home (or type of home) you would buy if EVERY existing home were offered for sale. In the current local housing market, with a limited number of homes for sale at any given point, it can be easy to get stuck within the confines of thinking about only the homes that are for sale yesterday, today and tomorrow. But ignore those confines for a moment... what if EVERY existing home in Harrisonburg and Rockingham County were currently offered for sale?!? What would you buy?? This can be a helpful question for broadly exploring what you like, hope for, strive for, and more. It's worth taking the time to work through this exercise. We will then, of course, have to dial it back into the confines of reality... and how often such a home might come on the market for sale and how long you are willing to wait for that ideal vision. So, it's not always a specifically productive question -- but it can be helpful in exploring what you really want in your next house. | |

How Much Can You, And Should You, Spend On Your Next Home? |

|

There are LOTS of ways to answer this question, usually within the context of a monthly payment...

The other question (how much should you spend) could be discussed with your spouse, your family, your loan officer, your peers, me, etc. The most important part -- is to have these conversations. We need to know how much money you can spend and how much you are willing to spend on your new home, so that we can be looking for the right houses for you! | |

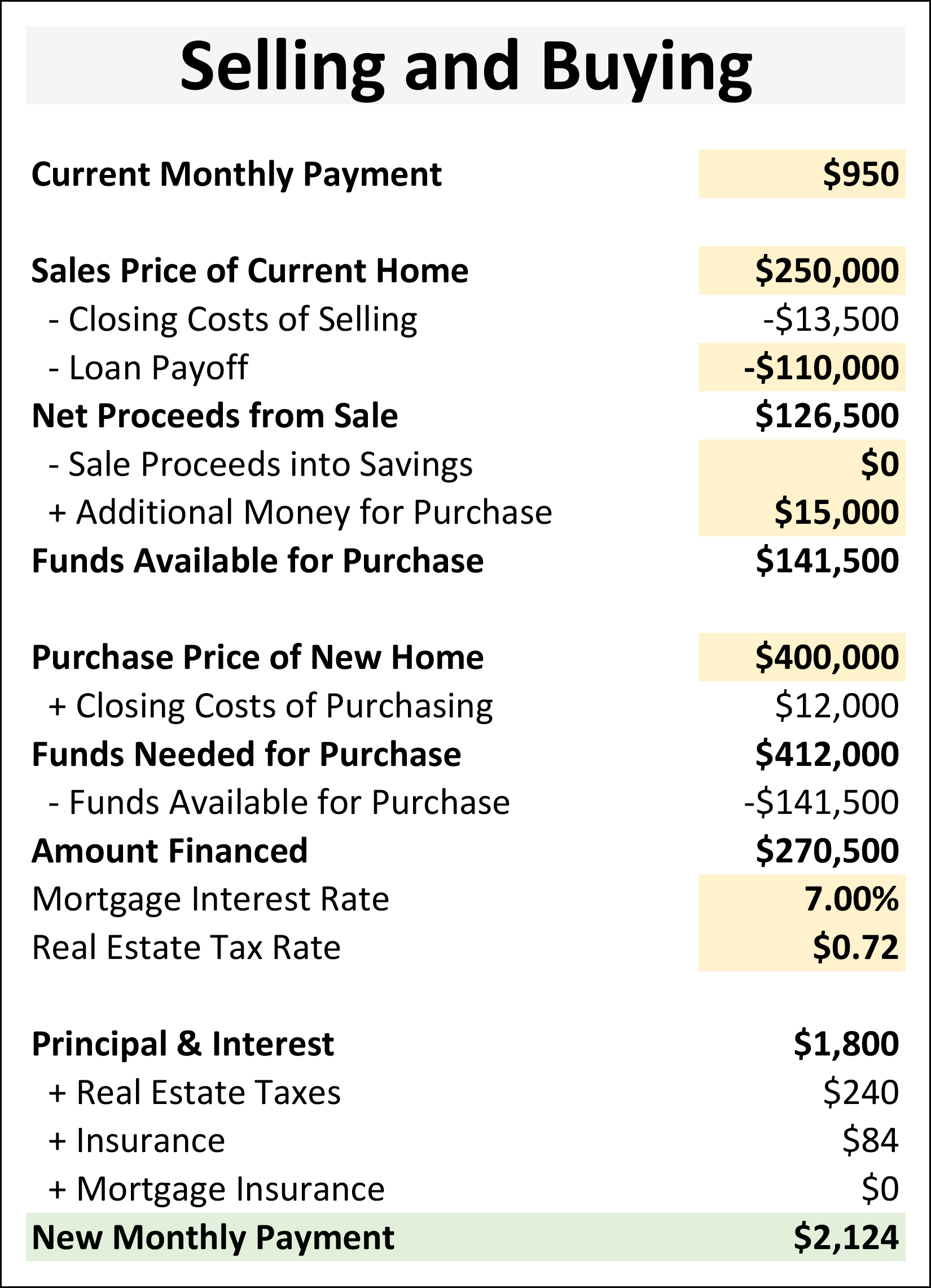

How Much Will Your Mortgage Payment Change If You Sell Your Home And Buy A New One? |

|

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

Many (Or Most?) Home Sellers Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

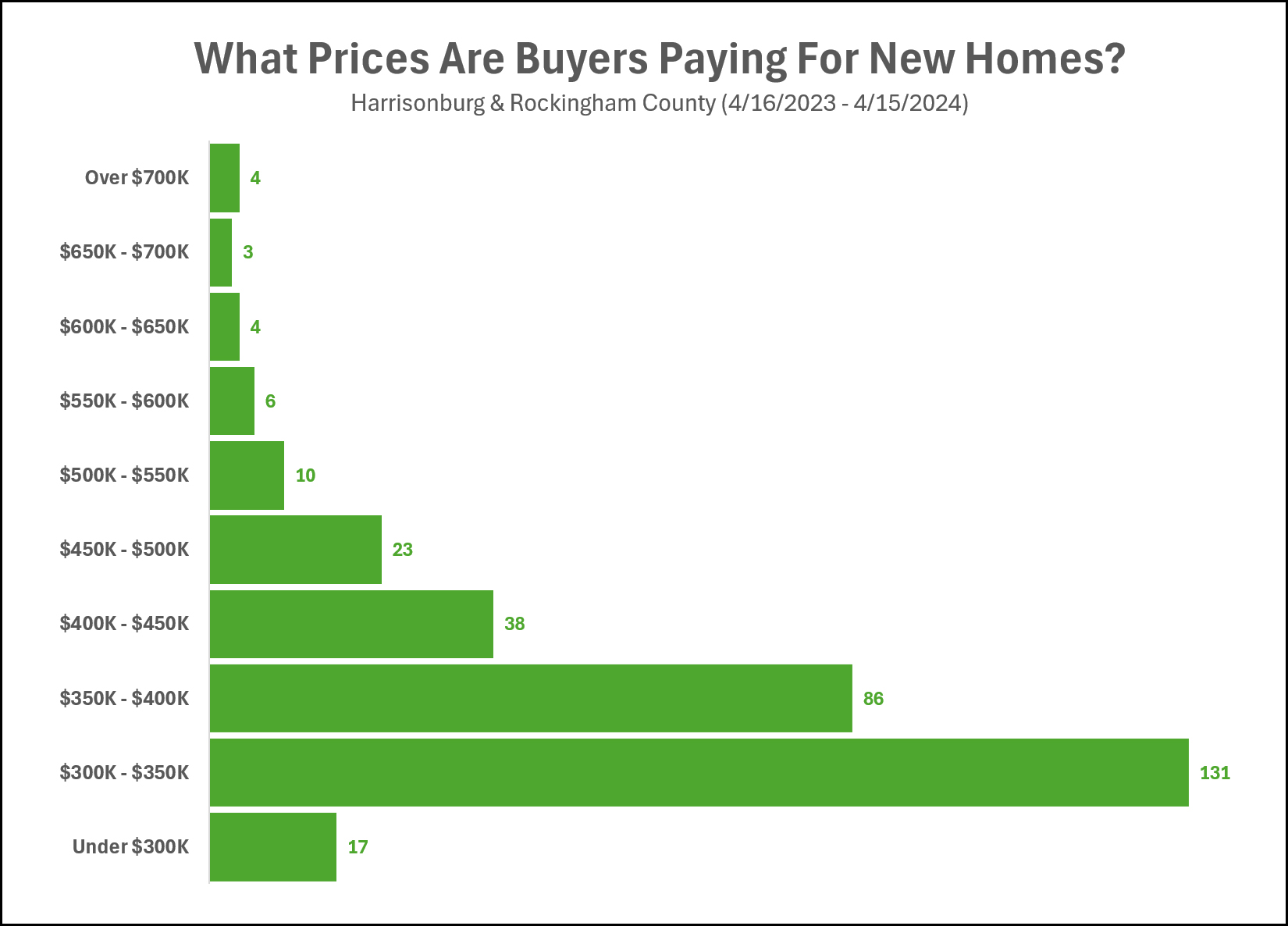

What Prices Did Buyers Pay For New Homes Over The Past Year? |

|

Over the past year, 322 new home sales have been recorded in the HRAR MLS. The full breakdown is above, but here are a few highlights of what buyers paid for new homes in Harrisonburg and Rockingham County over the past 12 months...

A few more details not shown in the data above...

| |

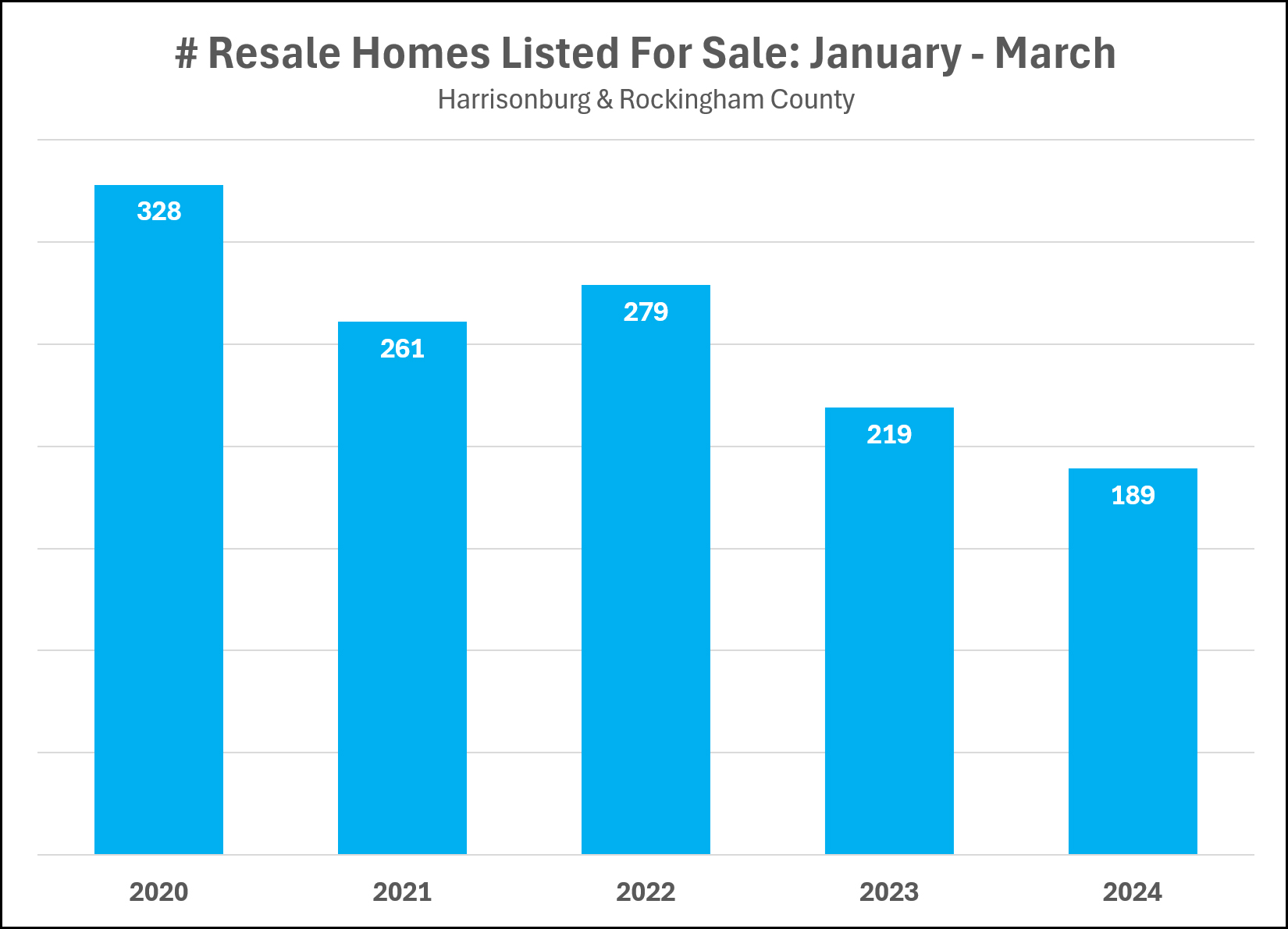

It Is Not Your Imagination. There Have Been Fewer Resale Homes Listed For Sale This Year |

|

Quite a few home buyers (or would-be home buyers) have asked me lately about whether we are seeing fewer resale homes (not new construction) being listed for sale in Harrisonburg and Rockingham County. Indeed, as shown above, we have seen fewer resale homes listed for sale in the first quarter of this year than in any other recent year. So, it's not just your imagination -- if you're looking to buy a resale home, you have had fewer choices thus far in 2024. But... we're in the thick of the spring market now... with 75 homes listed for sale thus far in April... so the spring and summer market of 2024 will be kinder to would-be buyers than the first three months have. | |

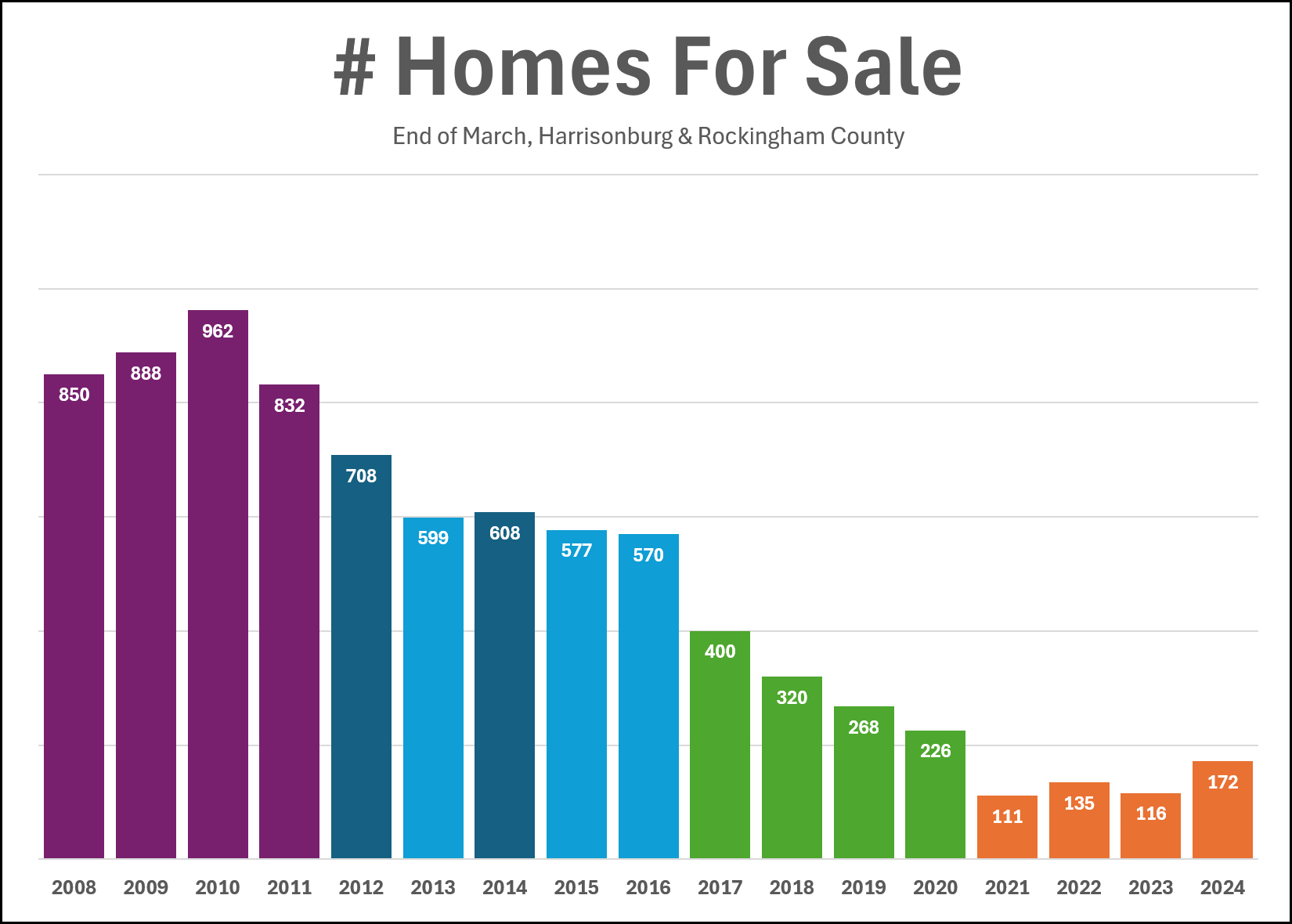

Inventory Levels Are Rising, But Consider The Larger Context |

|

Inventory levels are rising. That much is true. At the end of last month there were 172 homes for sale in Harrisonburg and Rockingham County... well more than the 111 to 135 at the end of March each of the past three years. But... if you consider a context of any length of time longer than four years, you start to see a pretty different story. It's hard to believe, but back in 2008 - 2011 there were over 800 homes for sale at the end of March!?! All the way through 2016 we were generally around or above 600 homes for sale. We did see large year over year declines between 2016 and 2017 (570 down to 400) and between 2020 and 2021 (226 down to 111). So, while we're now seeing "the highest inventory levels we have seen in four years" = it's important to consider the larger context of where we have been over the past 15+ years. | |

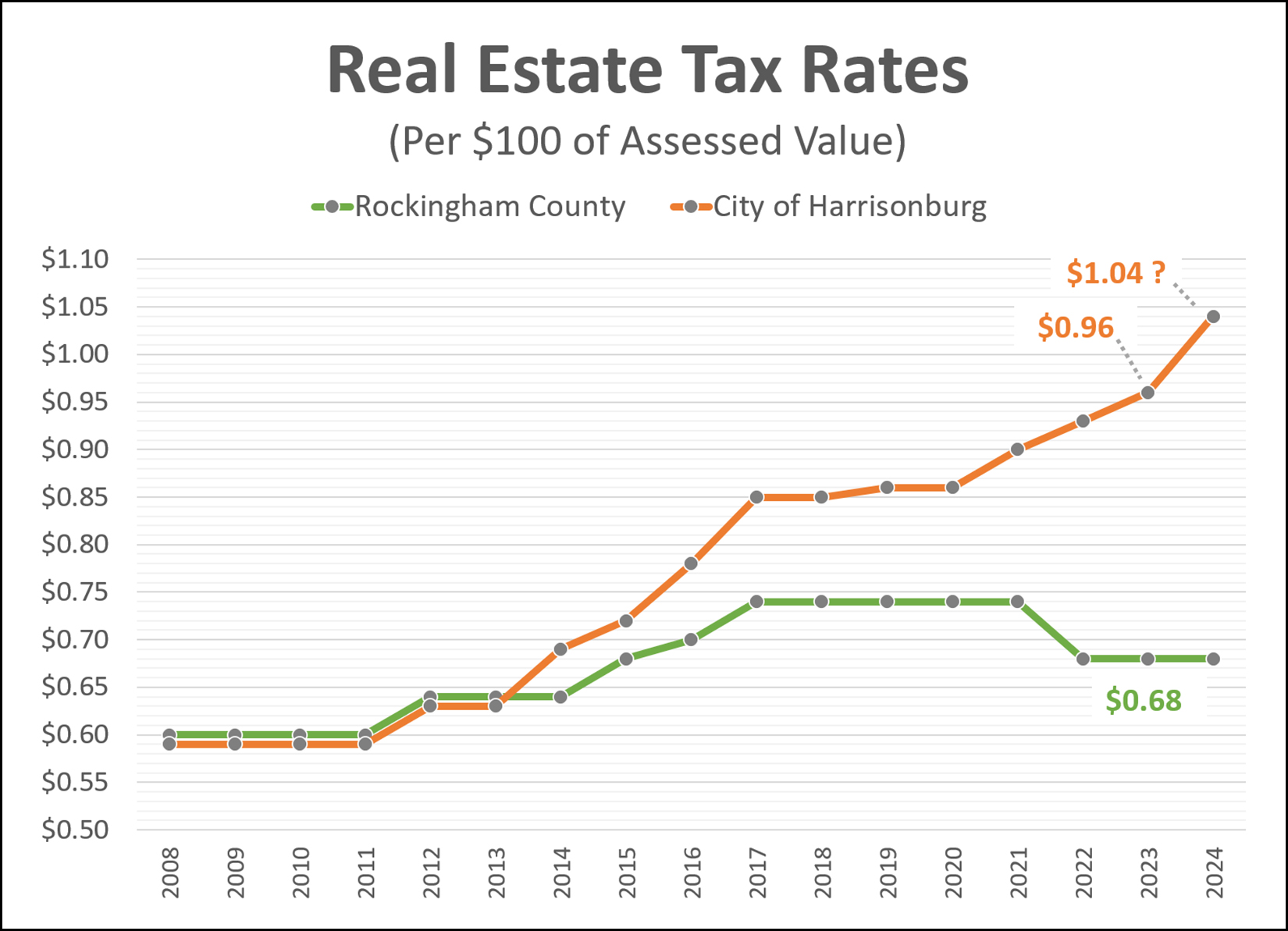

City Of Harrisonburg Considers 8% ($0.08) Increase In Real Estate Tax Rate |

|

The current real estate tax rate in the City of Harrisonburg is $0.96 per $100 of assessed value. That means that if you owned a home assessed at $280,000 (median City sales price over the past 12 months) you would pay $2,688 of real estate taxes each year... or $224 per month. City Council is considering an increase of the real estate tax rate to $1.04 per $100 of assessed value. If this change is approved, your real estate tax bill on your $280,000 home would increase to $2,912 pear year... or $243 per month. Looking at the details and the big picture, both of these statements seem to be true... [1] This $19 increase in monthly real estate taxes is not a huge change. [2] Home values have increased significantly over the past four years and so has the city real estate tax rate. Four years ago the median sales price was $200,000 and the real estate tax rate was $0.86. This cumulative twofold increase has resulted in a significant increase in city real estate taxes. Four years ago ($200K, $0.86) the tax bill would been $1,720/year or $143/month compared to today's tax bill ($280K, $1.04) of $2,912 or $243/month. In whole, over four years, a monthly real estate tax bill may have increased by $100/month. The potential increase in the city tax rate seems to be primary due to the opening of Rocktown High School. From the City's "budget in brief" (link below) we read... "For some time, we have known that the 2024-2025 budget would need to accommodate staffing the soon-to-open Rocktown High School. That effort, in addition to other needs within Harrisonburg City Public Schools, resulted in the school system's ask for an additional budget transfer of $6.6 million, equating to the 8-cent tax increase you will see in this year's budget proposal. Of the $6.6 million increase, $4.2 million is requested specifically for Rocktown High." Read more about the potential upcoming changes in the City real estate tax rate here... Daily News Record: City Council Hears Budget Proposal The Citizen: City leaders mull 8-cent property tax increase to pay for new school's opening, other services | |

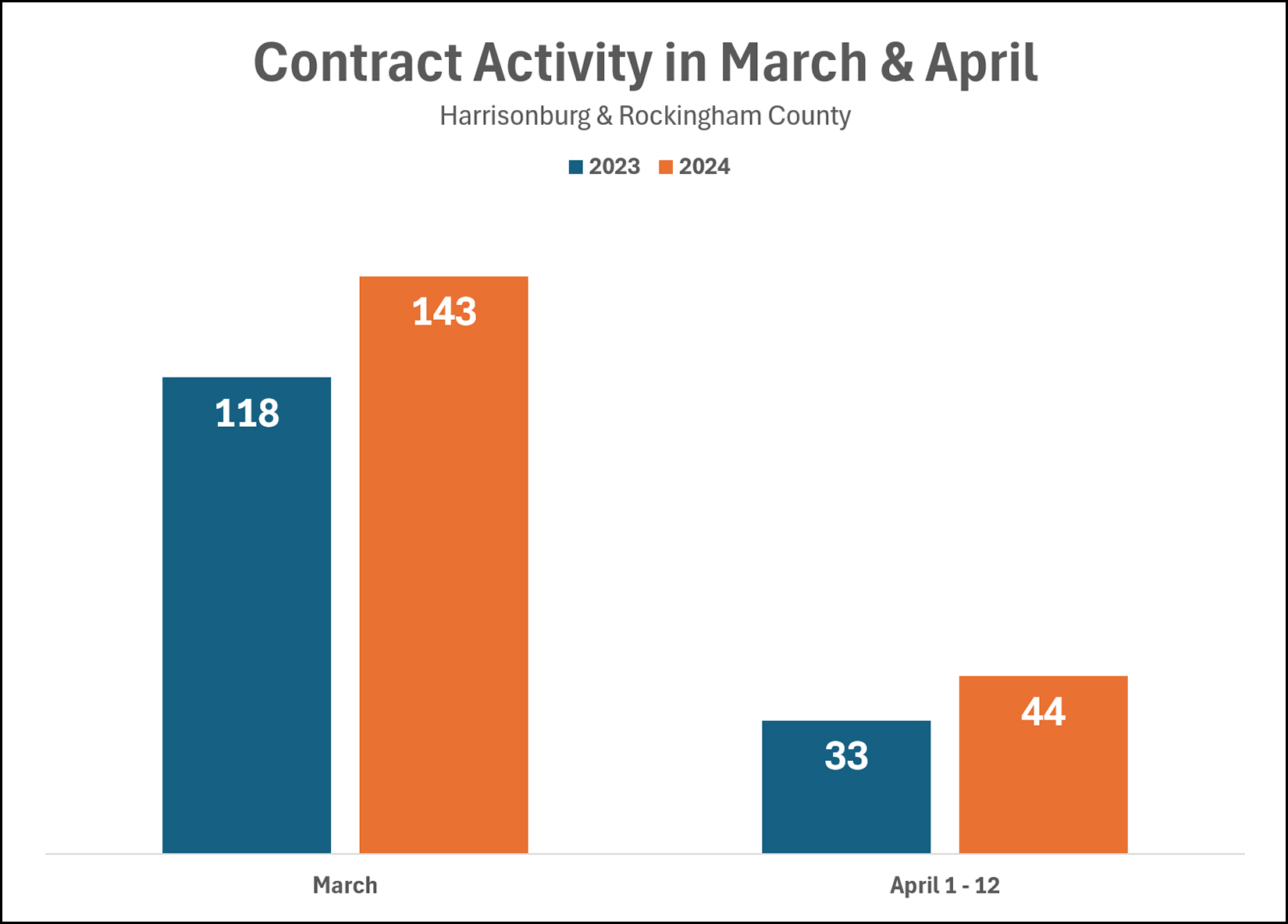

Strong Contract Activity Continues Into April |

|

We saw a surprisingly high number of homes go under contract in March this year... 143 of them, compared to only 118 last March. And... this April is also starting off strong compared to last April. In the first 12 days of this month (through this past Friday) we saw 44 houses go under contract in Harrisonburg and Rockingham County compared to only 33 last April. It is turning into a busy spring in the local housing market! | |

Home Sales Are On The Rise Again In 2024 With Slightly Smaller Increases In Home Prices |

|

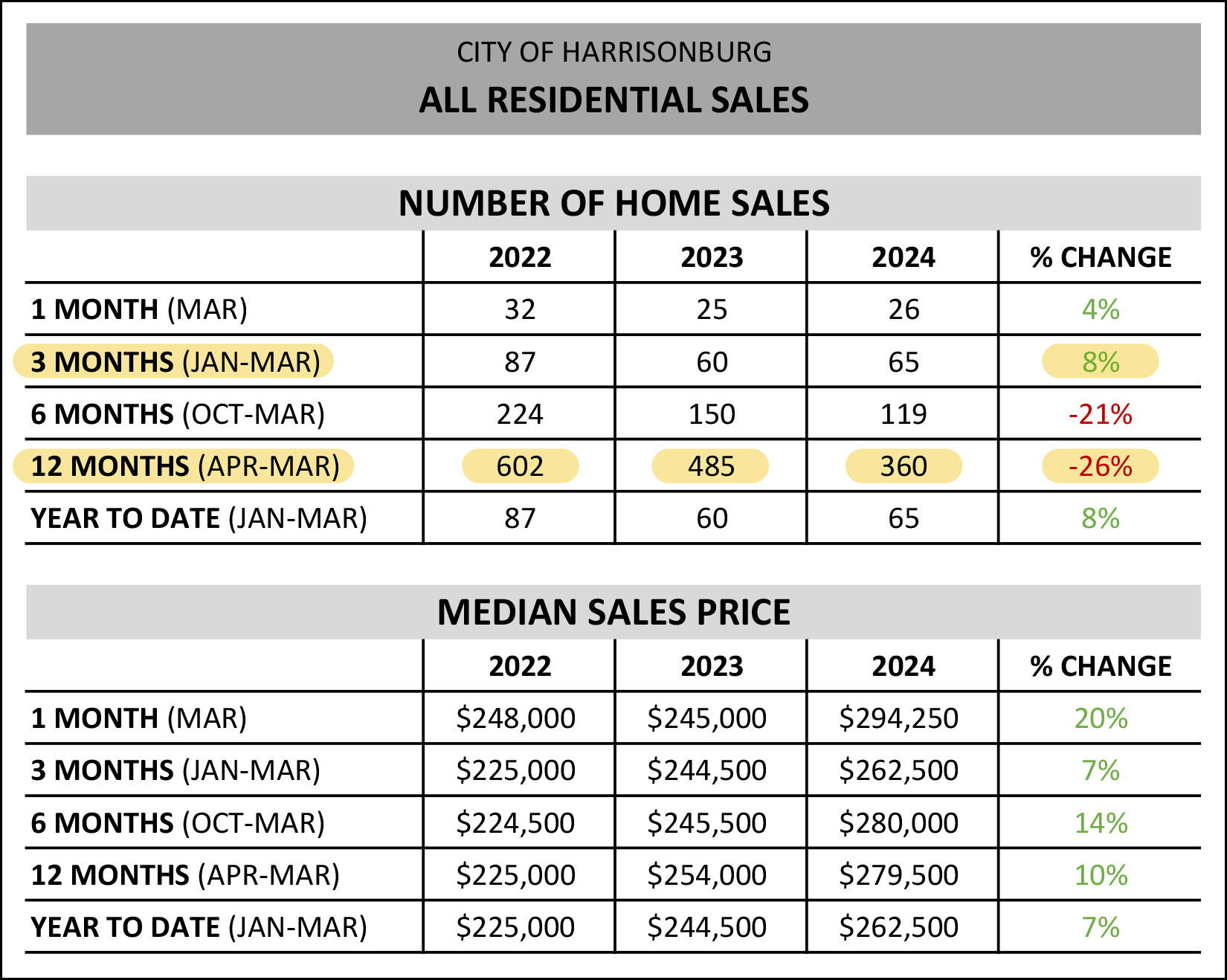

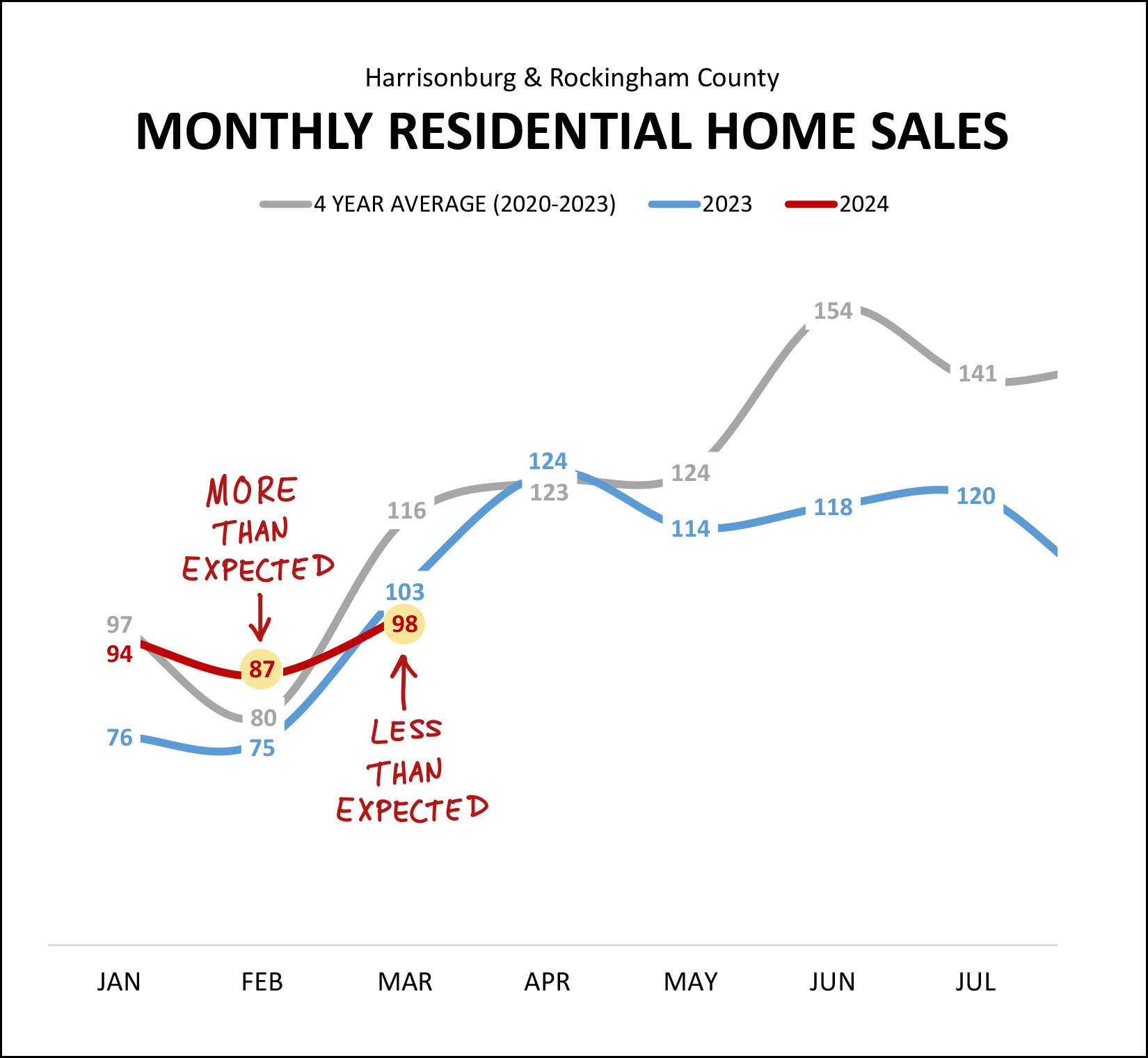

Happy Friday morning, friends! We're having some warmer (and mostly sunny) days this week in the Shenandoah Valley. We probably needed yesterday's rain, though unfortunately it didn't result in another rainbow like the incredible double rainbow that showed up last week...  Warmer weather finds me running outside more these days, preparing for a few races over the next few months... which leads me to my monthly giveaway for readers of my monthly market report. This month you have a chance to win a $50 gift certificate to Sole Focus Running, a new running shop in downtown Harrisonburg. Click here to enter for a chance to win a $50 gift certificate to Sole Focus Running! Now, let's dive right into the latest data from our local real estate market...  A few items to call out from the data table above... [1] Home sales in March were actually slightly slower this year (98) than last year (103) but not by much. [2] When we look at the first three months of 2024 we'll note a 10% increase in home sales this year (279) compared to last year (254) - which is a reversal of the downward trend seen between the first quarter of 2022 and 2023. [3] When looking at a full year of data, we're still seeing a 19% decline in home sales in the city and county, but again, it seems that trend may be reversing itself in 2024... at least thus far. [4] The median sales price is undoubtedly still increasing in Harrisonburg and Rockingham County... but maybe not as quickly as over the past few years. When looking a year of data we see a 10% increase in the median sales price. When we look just at the most recent six months, it's a 9% increase. When we look just at the most recent three months, it's a 7% increase. So, prices are still rising, but the pace at which they are rising might be declining. Say that five times fast. One particularly squeezed portion of the local housing market is the City of Harrisonburg. It's a tough time to try to buy a home in the City of Harrisonburg because of how few homes are available to purchase...  As shown above, yes, we're seeing a slight (8%) increase in home sales in the first quarter of 2024 in the City of Harrisonburg -- but that is against a backdrop of a 26% decline over the past year (from 485 to 360) and a 40% decline over the past two years (from 602 to 360). Far fewer sellers are selling, resulting in far fewer buyers being able to buy. The bottom half of the data tables above show that prices keep on increasing in the City of Harrisonburg, in some instances at faster rates than in the overall market. Now, then, let's get to some pretty graphs to help us further understand the market...  As shown above, home sales in February were a bit higher than expected and March were a bit lower than expected. Home sales popped up from 75 to 87 in February... and then dropped from 103 to 98 in March. Looking ahead, it seems likely that we will continue to see stronger months of home sales as we move through April and May... which will become even more evident when you read a bit further on in this report and see the amount of contract activity in March. :-) But, before we get there, let's look at the first quarter of 2024 compared to the past few years in our local market...  As 2024 began, I wasn't sure what to expect as to how many homes would sell this year in Harrisonburg and Rockingham County. The number of annual sales peaked at 1,673 homes sold in 2021 -- before falling in 2022 and 2023 down to only 1,206 homes sold last year. How, then, would 2024 shape up in our local housing market? Now three months into the year, we can start to have a sense of what we might expect this year. We have seen more home sales in the first quarter of this year (279) than we saw in the first quarter last year (254) and more than in the first quarter of 2020 (273) -- but we have certainly seen fewer than in the first quarter of 2021 (327) and 2022 (312). As such, perhaps we'll see a slight uptick in home sales in 2024? It's probably still too early to tell, but maybe we'll see more than 1,206 home sales this year in Harrisonburg and Rockingham County. Now, let's look at that annual pace of home sales in a slightly different way...  As shown above, for a year and a half we were consistently seeing 1,600+ home sales in a 12 month period... largely due to super low (historically low) mortgage interest rates during the Covid pandemic and our recovery from it. We have definitely shifted out of that high gear now and have been in the 1,200 - 1,300 home sales per year range over the past six months. As mentioned above, while it is possible that we will see further declines in the number of homes selling in our market, it is starting to seem more likely that things are stabilizing in that 1,200 to 1,300 range. Stay tuned through the remainder of 2024 to see if we continue to see a leveling out or increase in the number of homes that are selling. In addition to the likely conclusion that we are seeing a rise in home sales, it also seems quite possible that we are seeing a slowing in the pace at which home prices are increasing...  We have been seeing steady 10% per year increase in the median sales price in Harrisonburg and Rockingham County over the past four years -- but maybe this year we will see a slightly smaller increase in the median sales price? The median sales price in Harrisonburg and Rockingham County is definitely still rising... but maybe not as quickly as it has been over the past few years. Or, maybe it is still rising just as quickly, and we're just not seeing it yet with only three months of data. Given that mortgage interest rates have been much higher (sub-3% to over-6%) for over a year now, I don't think we need to think that the higher mortgage interest rates are going to cause home prices to fall. Next up, new home sales... if you bought a home last year, there is a 1 in 4 chance that you bought a new home...  Back in 2019 only about 1 in 7 home sales was a new home... but for the past three years we have consistently seen 1 in 4 home sales being a new home. This is not likely to change much moving forward as many homeowners are choosing not to sell because they love their low mortgage interest rate. I suppose, then, we need to be thankful for so many new homes being built -- as without them, home buyers would have had even fewer options from which to choose last year when buying a home in Harrisonburg and Rockingham County. Next up, contract activity, where we'll see a bit of a surprise...  Woah! After rather typical months of contract activity in January and February (compared to previous months of January and February) we saw a sharp uptick in contract activity in March 2024. Last March we only saw buyers (and sellers) sign 118 contracts... but that figured jumped up to 143 contracts in March 2024! It will be interesting to note over the next month or two whether we continue to see elevated levels of contract activity (compared to last year) or if this was a one month phenomenon. All that contract activity may have been a part of what caused inventory levels to inch down a bit over the past month...  Usually (see the grey line above) we see inventory levels rise between the end of February and the end of March -- but this year that number fell between the end of February and the end of March. For as many sellers as put their homes on the market, buyers kept showing up, causing inventory levels to decline slightly over the past month. That said, inventory levels this year (172) are still well above where they were a year ago (116) so buyers do have more options now than they did a year ago. And how about how quickly homes are (or are not) selling these days...  Over the past six months, homes have been going under contract with a median of nine days on the market. That is to say that half of homes that went under contract did so in nine or fewer days and half in nine or more days. This time on the market is certainly higher than it was back in 2021 when it was a median of five days... and higher than the four days back in early 2021... but it's not meaningfully or drastically higher. Many homes in many price ranges are still going under contract very quickly - often with more than one offer. Finally, those silly mortgage interest rates... silly high mortgage interest rates, that is...  Mortgage interest rates were below 3% just three years ago... and below 5% just two years ago... but they have been above 6% for the entirety of the past year... and I expect them to stay there. While it's tempting to say that mortgage interest rates *might* decline below 6% soon, it just doesn't seem likely. I believe we'll likely see mortgage interest rates above 6% for the remainder of 2024. So, where then does this leave us? First -- If you're interested in even more charts and graphs, I create many more each month than I highlight here. Check them all out here. Next -- If you're planning to buy a house this year, talk to a lender sooner rather than later to become preapproved and to understand your potential monthly housing costs. If you need some lender recommendations, just let me know. Also -- If you're considering selling your home this year, feel free to reach out to me to set up a time to meet at your house to discuss the market, the process, your house, your timing and your goals. Finally -- If you have questions about anything I've mentioned above, or other real estate questions in general, feel free to be in touch anytime. You can contact me most easily at 540-578-0102 (call/text) or by email here. | |

A Year From Now, Mortgage Interest Rates Seem Unlikely To Be Much Below Six Percent |

|

The current average 30 year fixed mortgage interest rate is 6.82%. If you are waiting to buy a home until mortgage interest rates fall below 6% you might be waiting a while. A compilation of mortgage interest rate projections by Fast Company (here) show the following projected mortgage interest rates for the first and second quarter of 2025... Mortgage Bankers Association: 5.9% in 2025-Q1 5.8% in 2025-Q2 Fannie Mae: 6.3% in 2025-Q1 6.2% in 2025-Q2 Wells Fargo: 6.0% in 2025-Q1 5.9% in 2025-Q2 It seems that mortgage interest rates may very well stay near, at or above 6% for at least the next year. Read more here. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings