| Newer Posts | Older Posts |

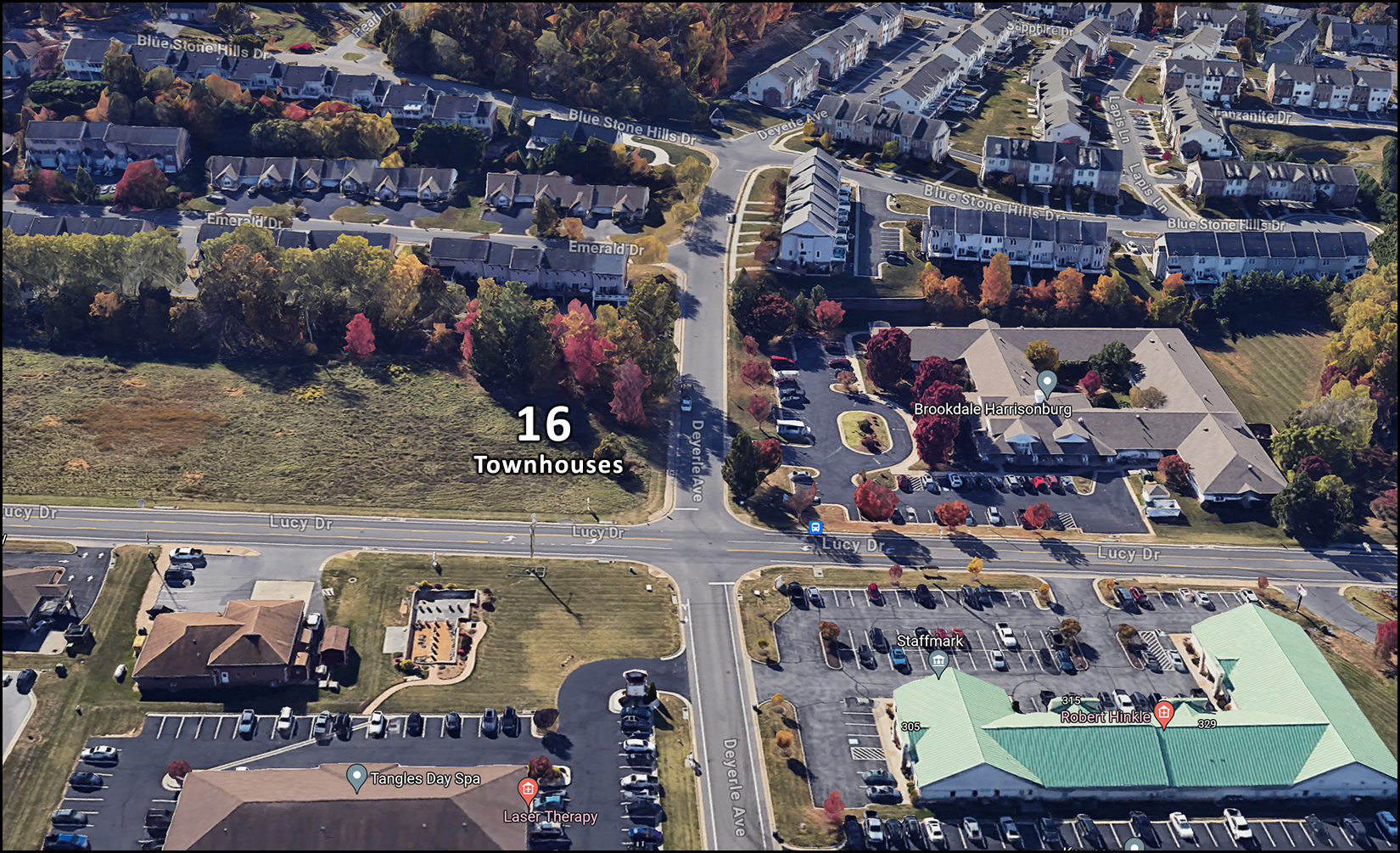

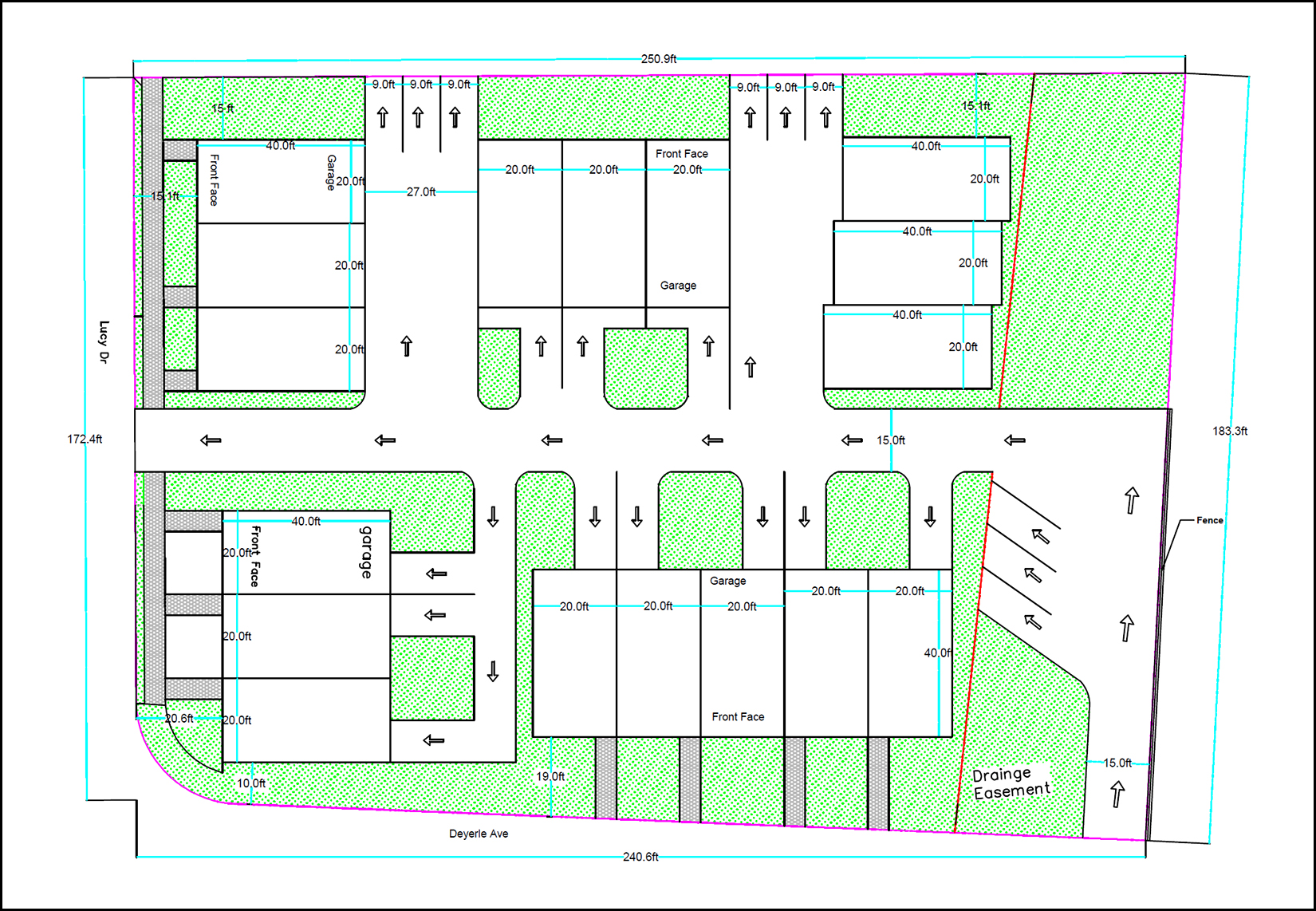

16 Townhouses Planned For Corner Of Deyerle Avenue And Lucy Drive |

|

City Council recently approved the rezoning (from R3 to R8) of a one acre parcel at the corner of Deyerle Avenue and Lucy Drive to allow for the development of 16 townhouses. Here's the potential site plan...  Learn (a bit) more via the application packet here. | |

Three Story Apartment Building With 15 to 20 Apartments Planned On West Elizabeth Street |

|

The owners of a 0.24 acre lot on West Elizabeth Street, between North High Street and North Liberty Street, plan to build a three story apartment building with 15 to 20 apartments. The owners have received approval from the City for the rezoning required for this development to move forward. City staff, planning commission, city council and the developers all seem excited at the prospect of bringing more living opportunities to the downtown area. Interestingly...

I'm just realizing that the site will potentially be transformed from only being used by cars (a parking lot) to a use that does not allow for cars (apartment building with no on-site parking). :-) | |

Listings Hitting The Market On Fridays Make It Important For Buyers To Have A Lender Letter Ready To Go |

|

A buyers says... I plan to buy a home as soon as "the right one" comes on the market. I talked to a lender six months ago and they didn't have any concerns with being able to approve me for a mortgage. I'll just wait until the right house hits the market and then I'll get a prequalification letter from my lender. This works out OK some of the time to most of the time - but not all of the time. Sometimes a new listing hits the market on a Friday. We might go see it on Saturday afternoon. By the time we are looking at the house there are already two offers in hand and a few more might be received at any moment. If you love the house, and want to make an offer, we might be in a tight spot, because... 1. An offer without a lender letter won't typically go anywhere. 2. An offer with a promise to deliver a lender letter on Monday won't typically go anywhere. Certainly, sometimes a seller won't be making a decision until Monday or Tuesday and sometimes offers don't materialize that quickly. But... if you want to be ready to make an offer on a house that you love when it hits the market, you should already have a lender letter ready to go. | |

How To Best Understand How Home Values Are Changing |

|

Full Disclosure: I have more questions than answers today. In the first five months of this year versus last year...

Wait, what!? The detached homes that sold in the first five months of this year sold at prices that were 13% higher than last year... and attached homes sold at prices that were 15% higher than last year... but when you combine the two data sets the median sales price is only 5% higher? Yes, that is correct. My first theory to try to explain this was that maybe more detached or attached homes sold in one year versus the other. But, it seems not... 2023: 68% detached, 32% attached 2024: 67% detached, 33% attached Next up I looked at what happens when we take new construction homes out of the mix. When looking at home sales in the first five months of this year versus last year, and when only looking at resale homes, not new homes...

That is certainly much less confusing than the first set of numbers. Where do we go from here? 1. I want to see how some of these numbers change as we have more months of 2024 data to work with. 2. I will be thinking further about how to best understand changes in home values in this area... perhaps it is best to only look at resale home sales, or just look at resale detached home sales? 3. I will welcome the thoughts, theories, guesses and questions from my readers. :-) Yes, that's you. | |

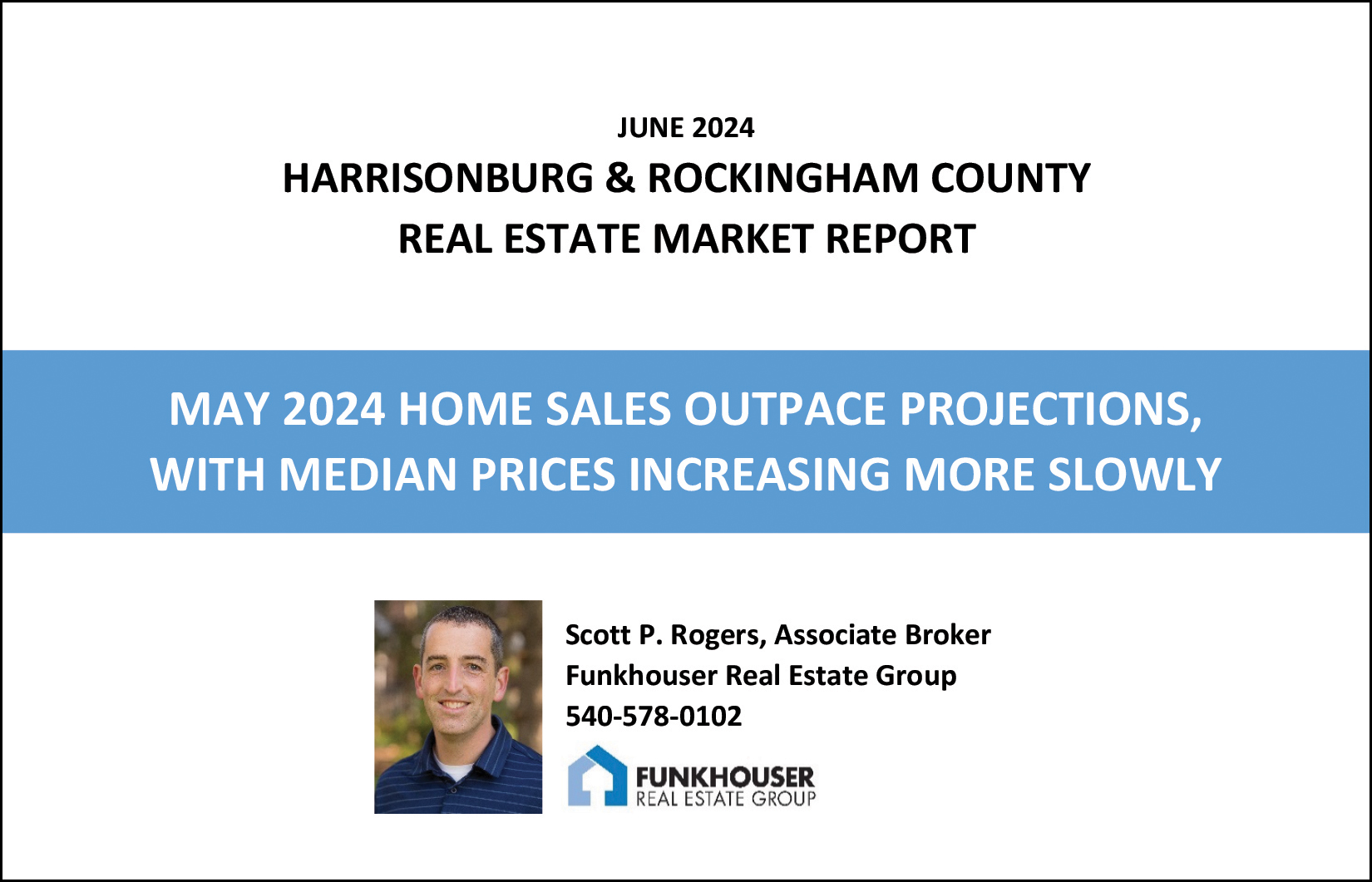

May 2024 Home Sales Outpace Projections, With Median Prices Increasing More Slowly |

|

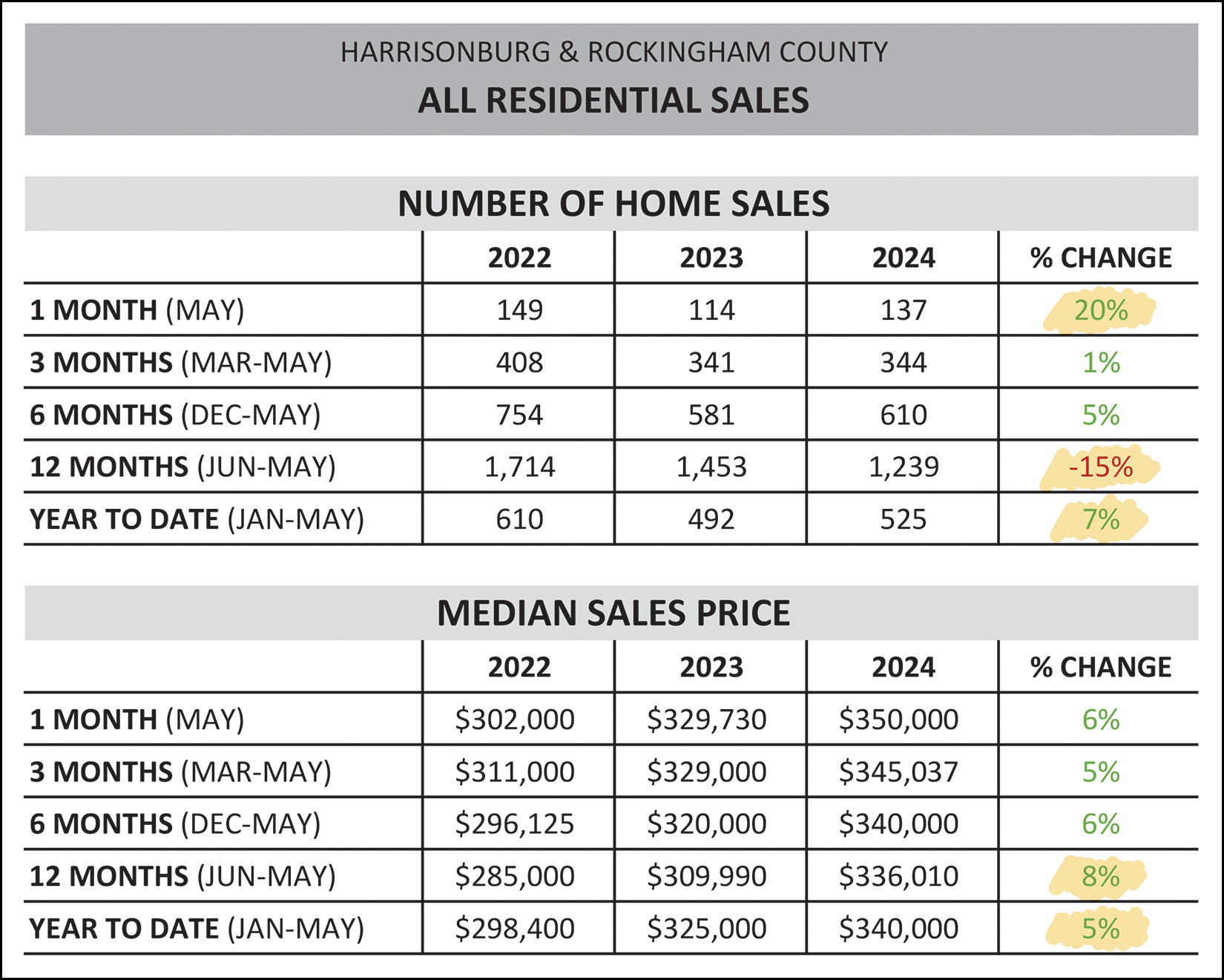

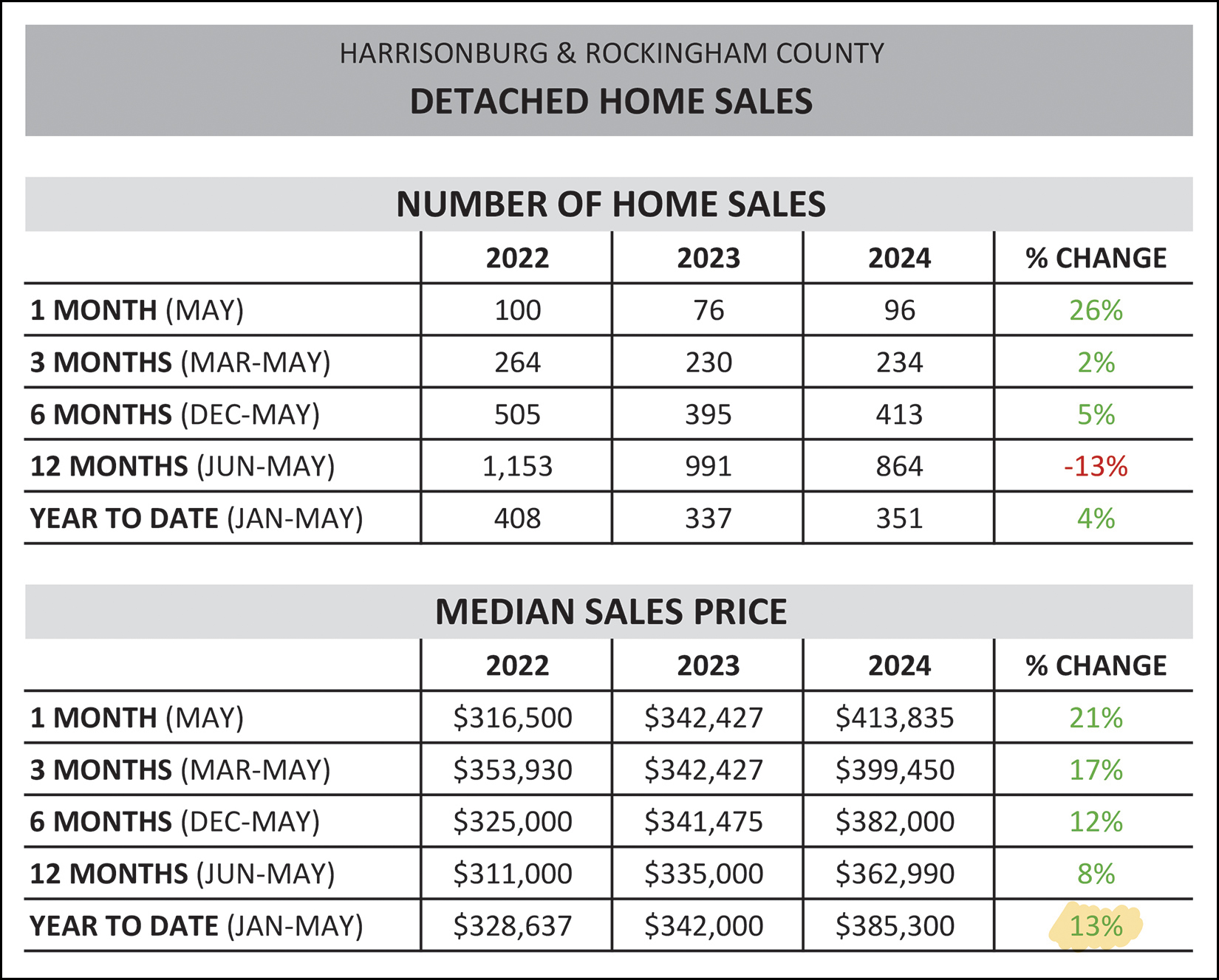

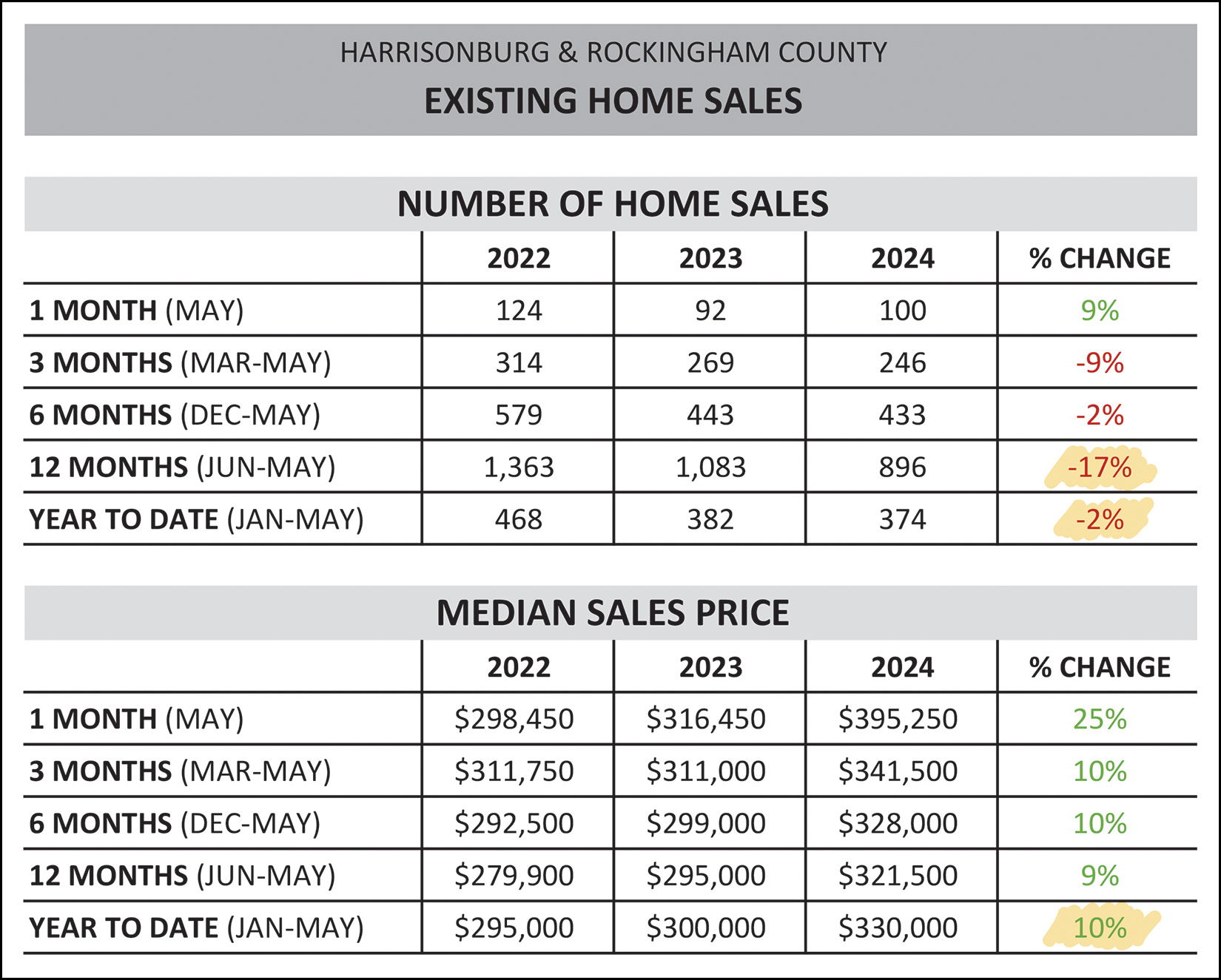

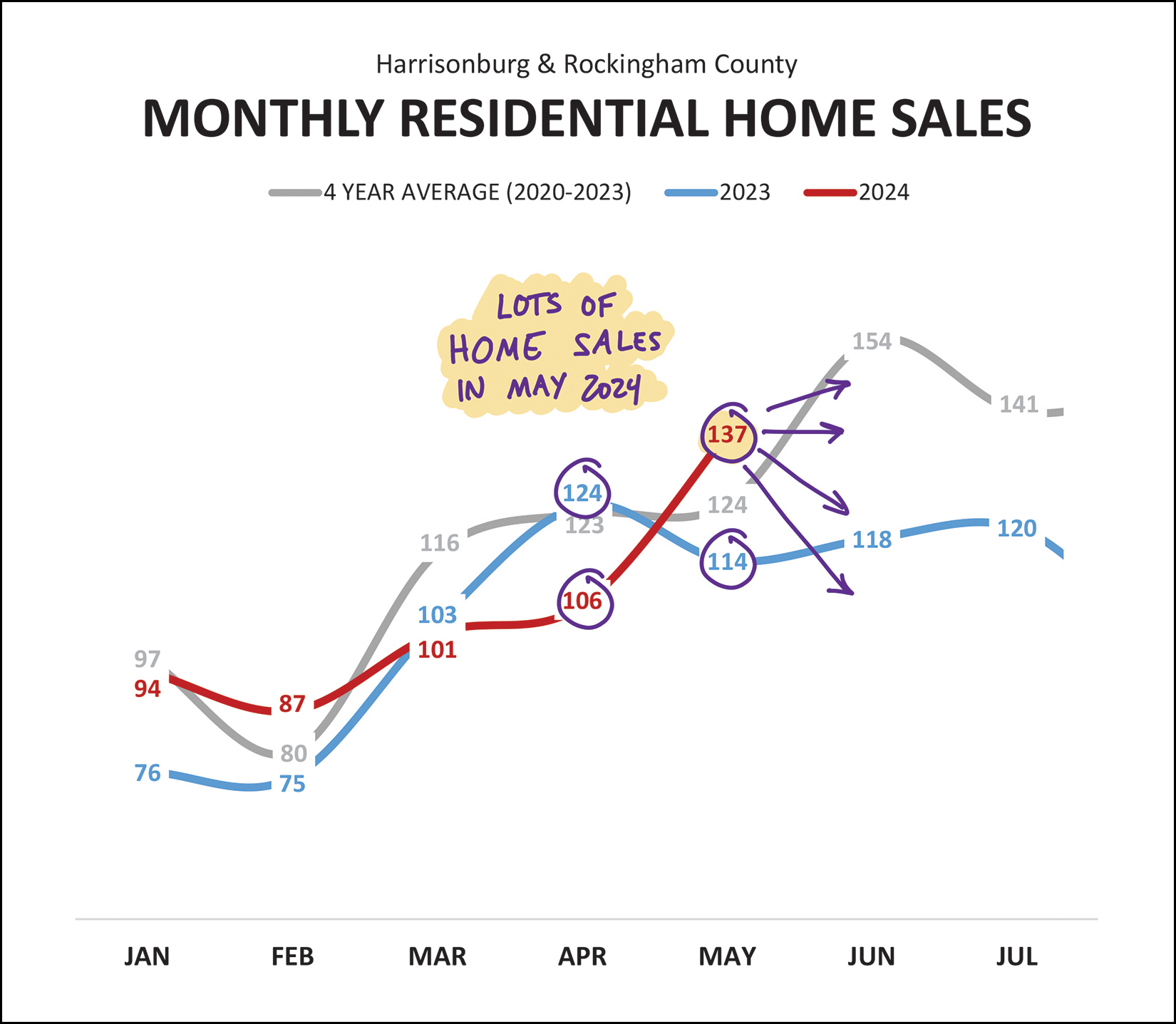

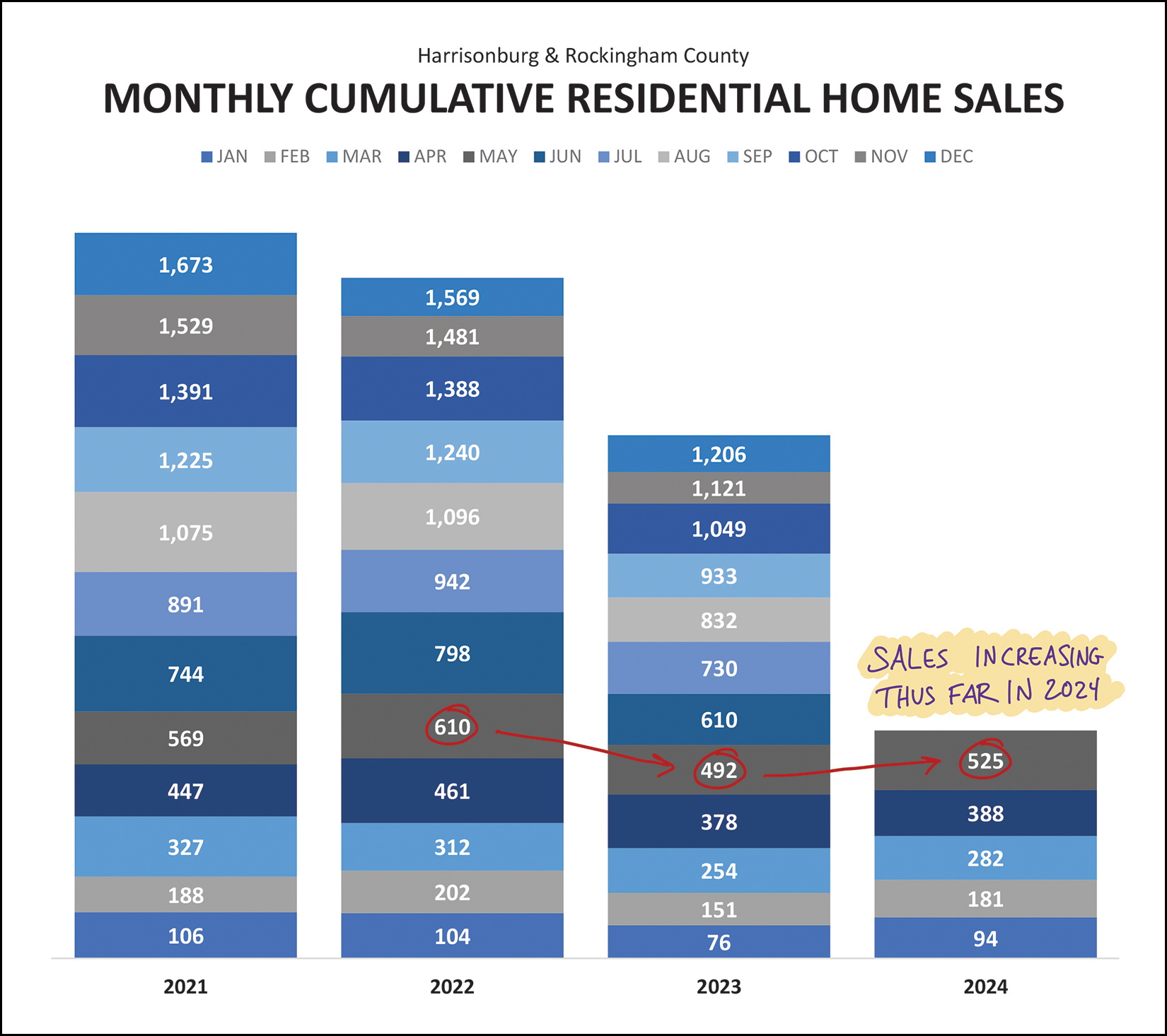

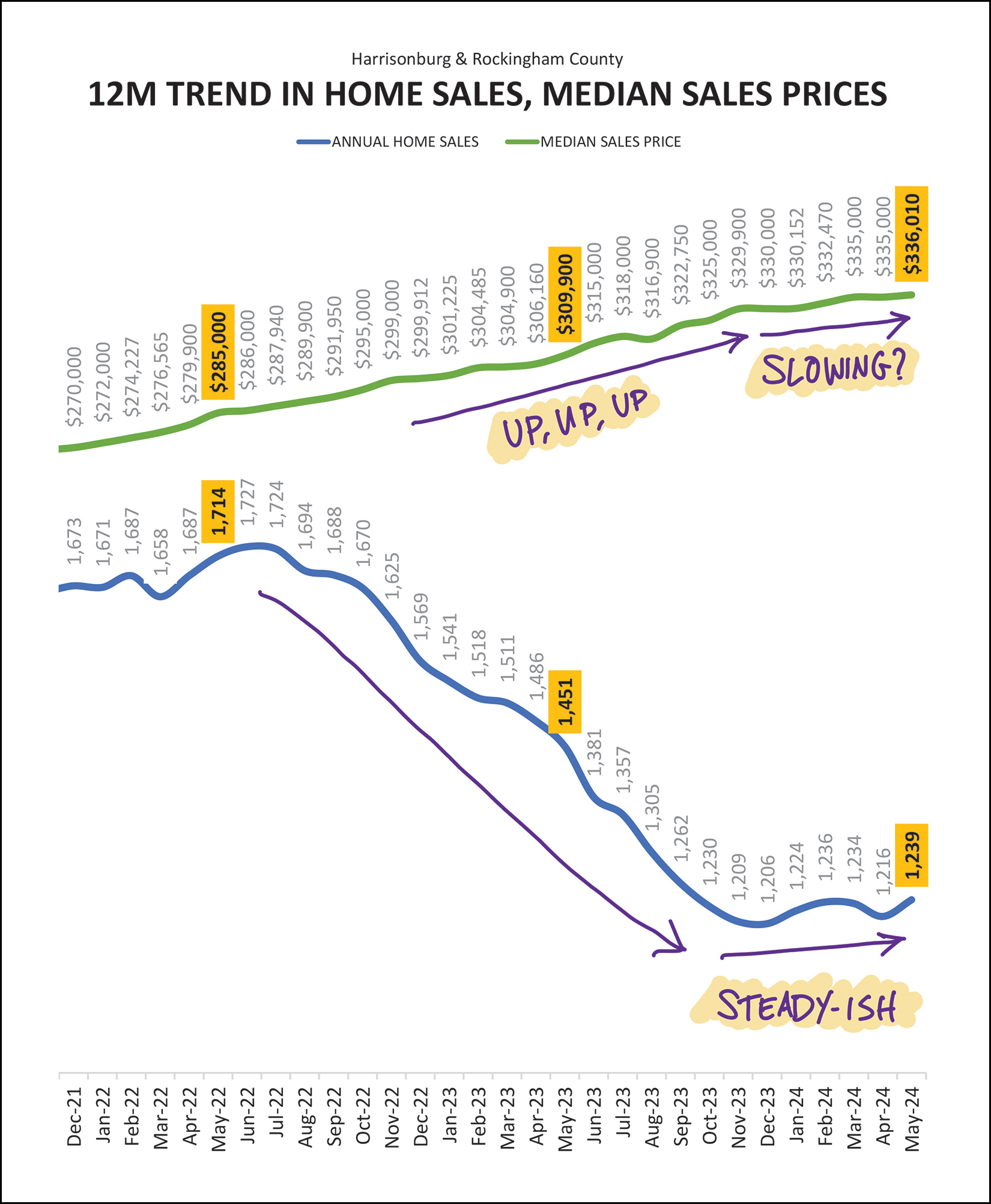

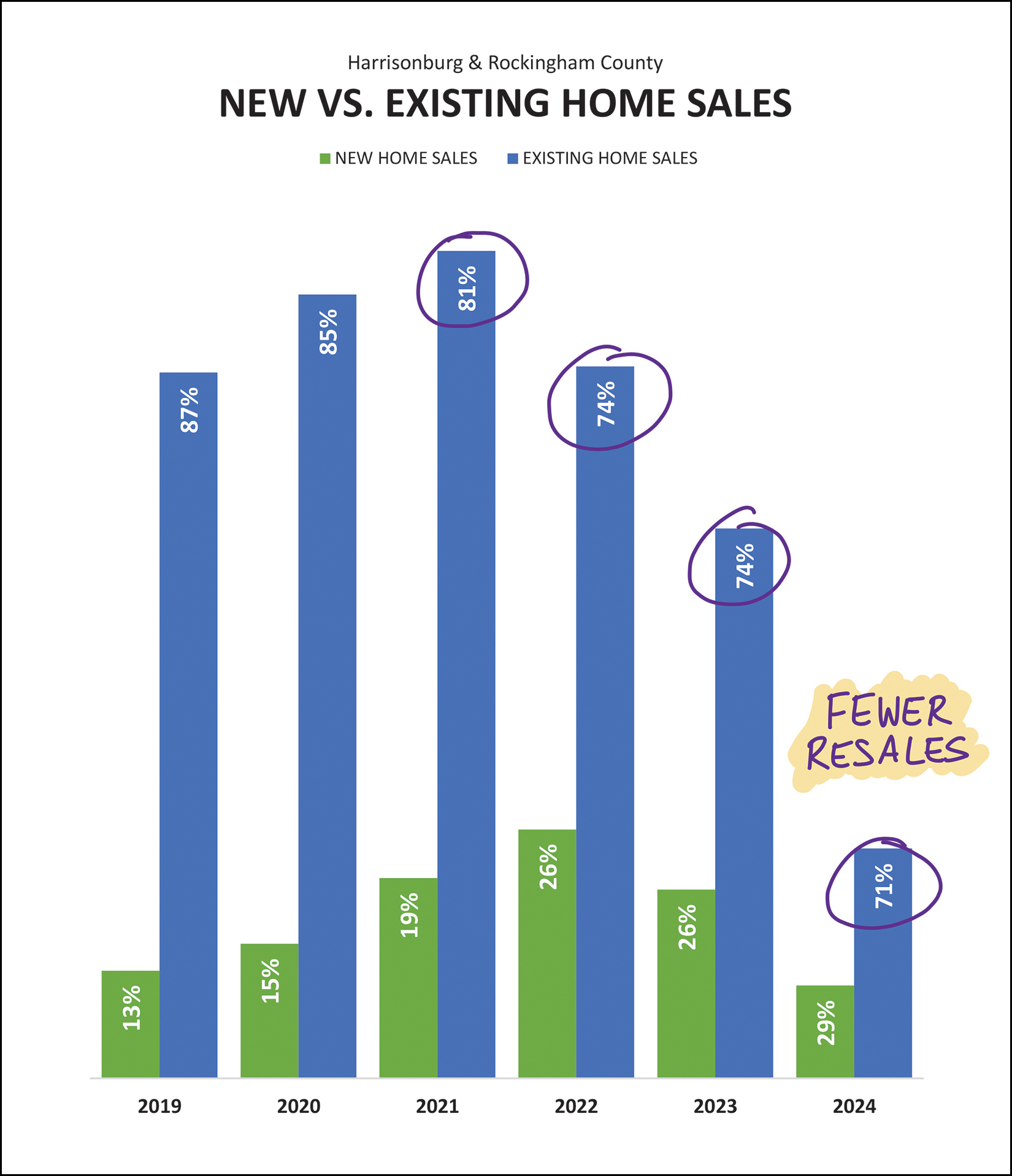

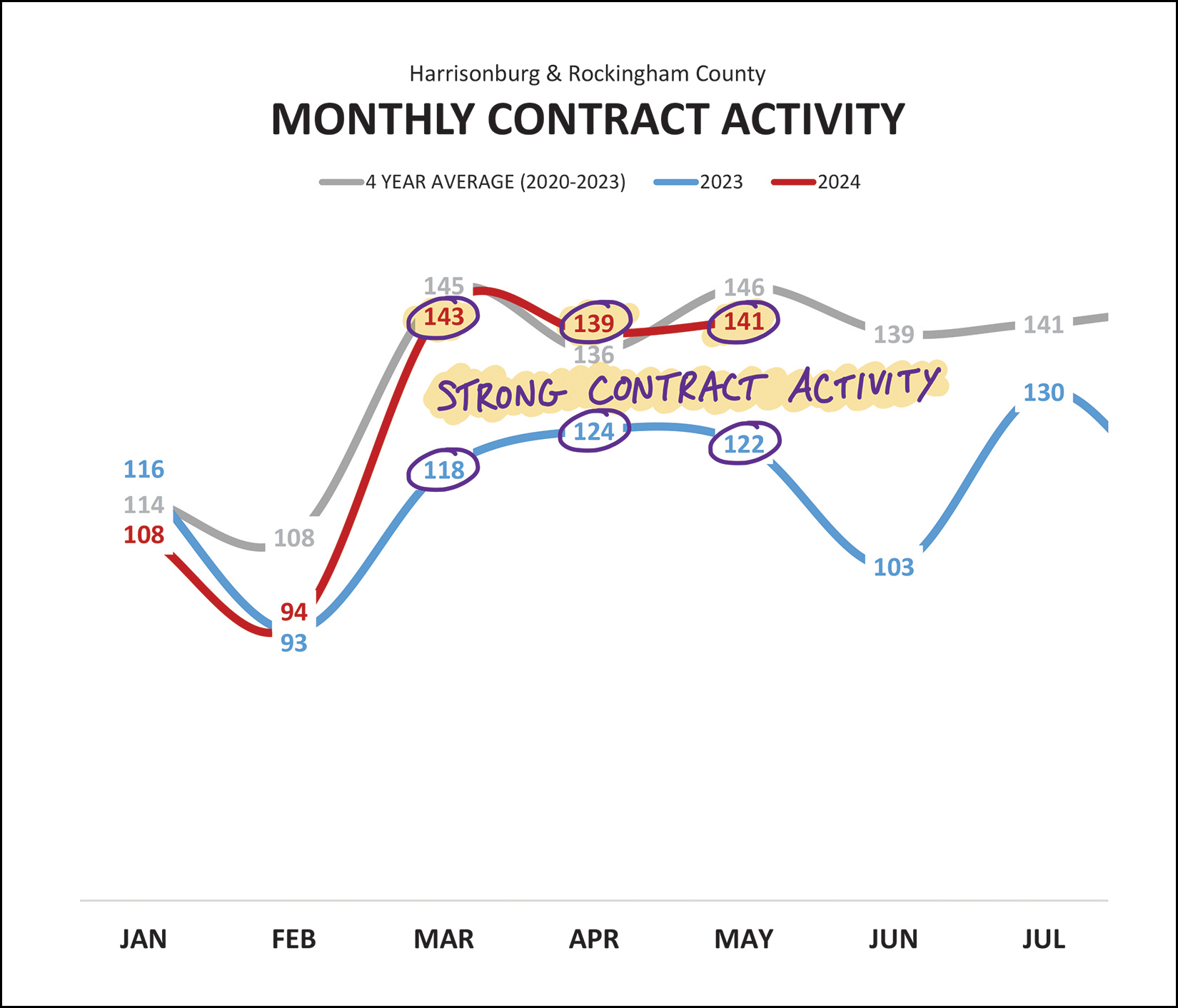

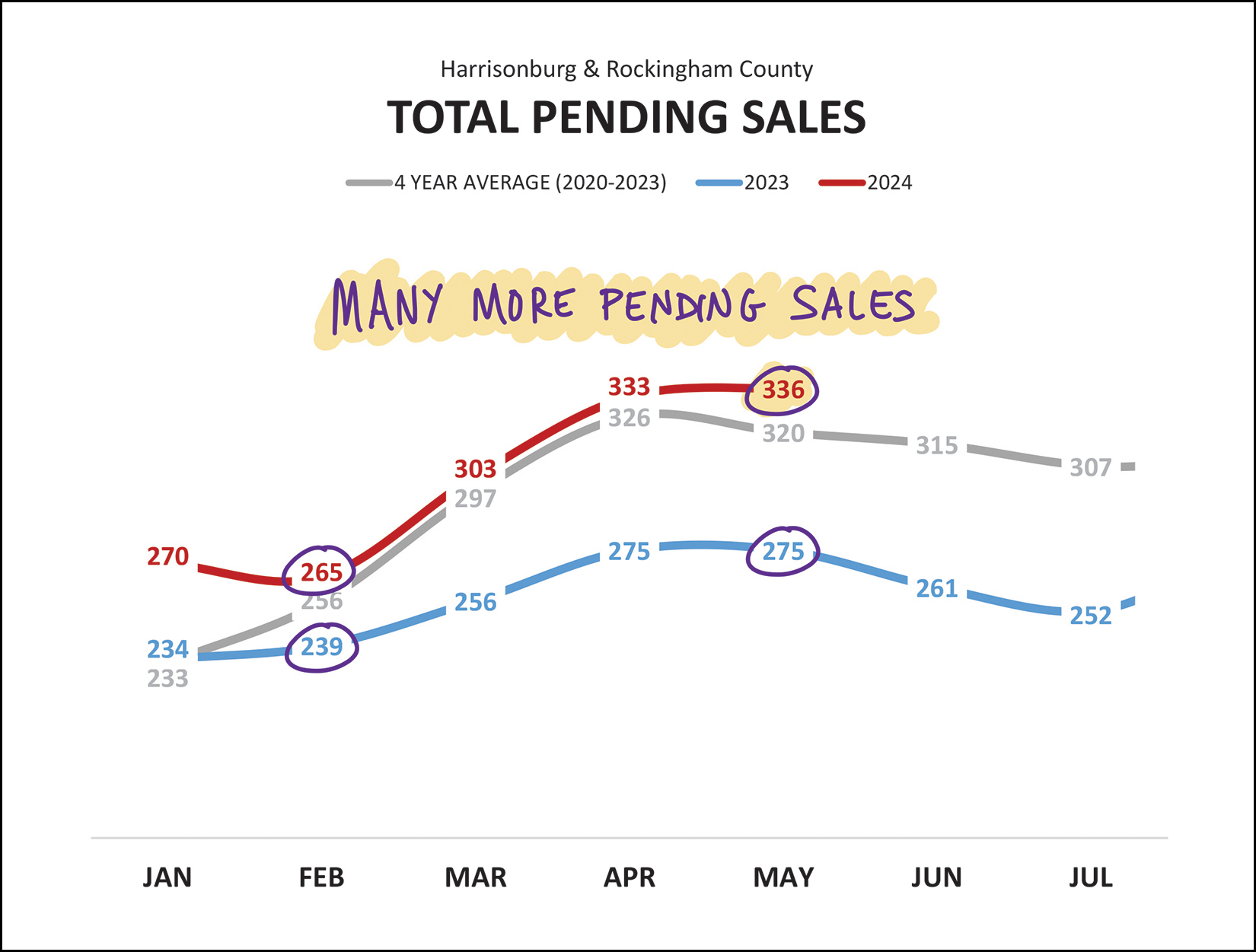

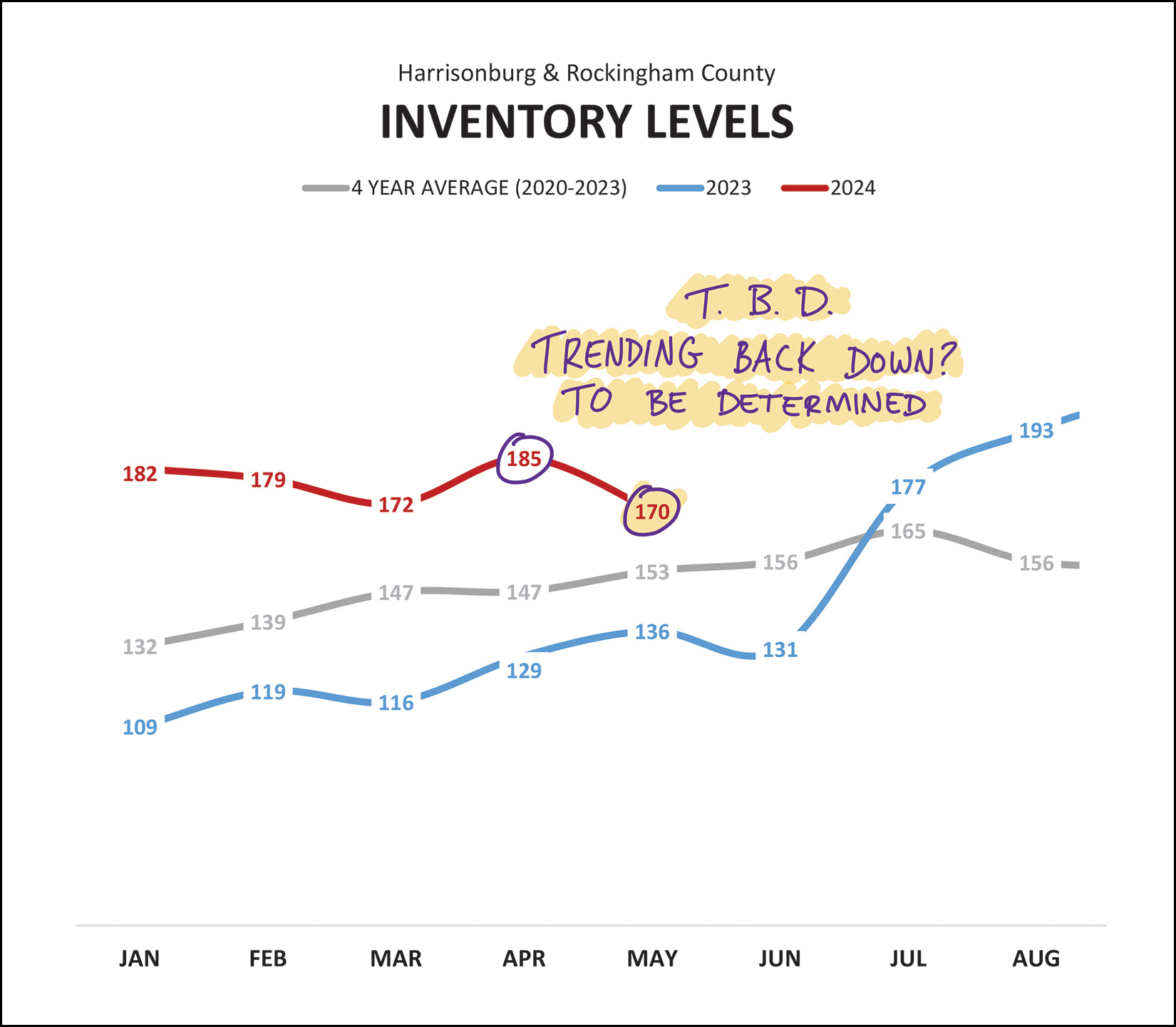

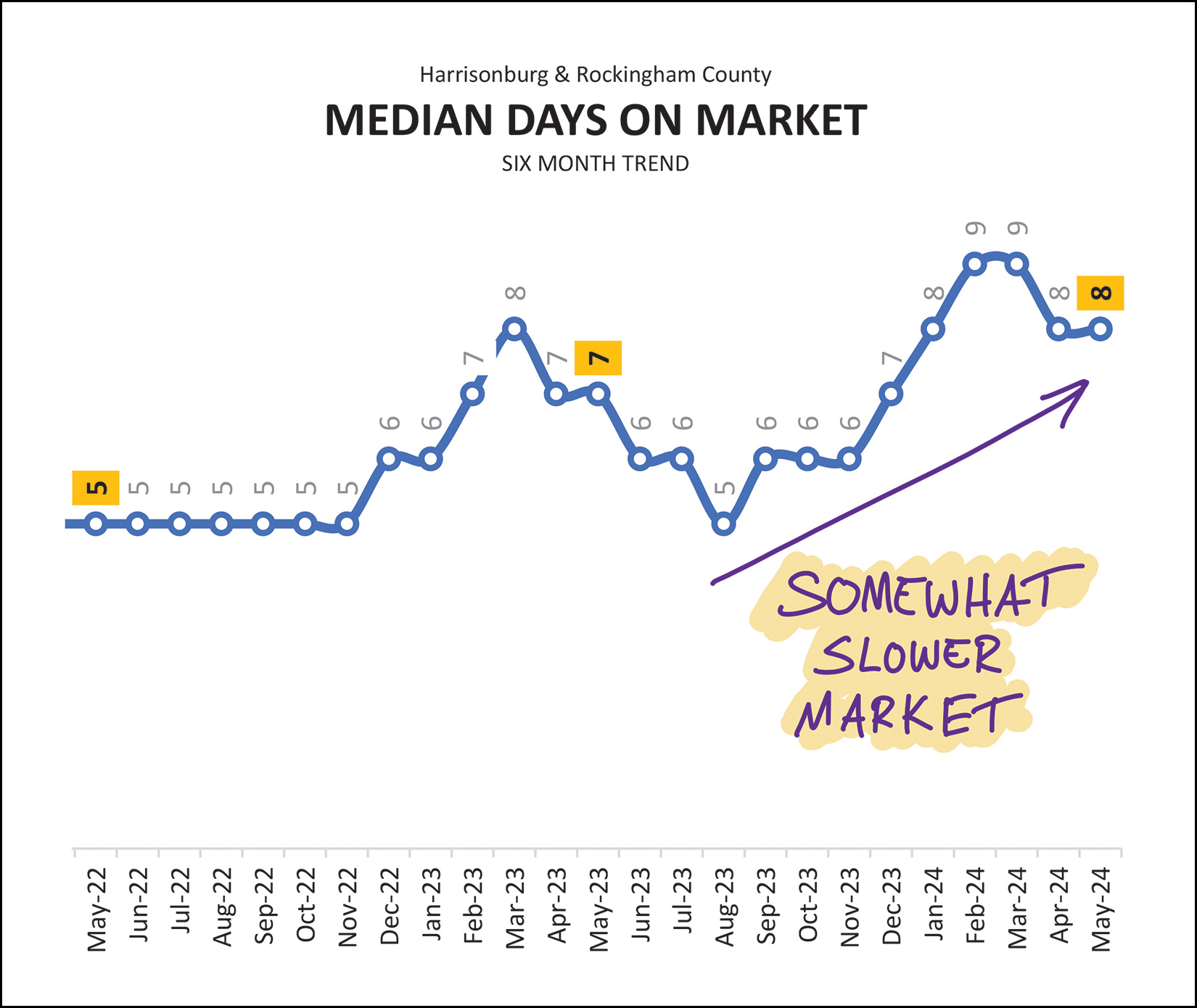

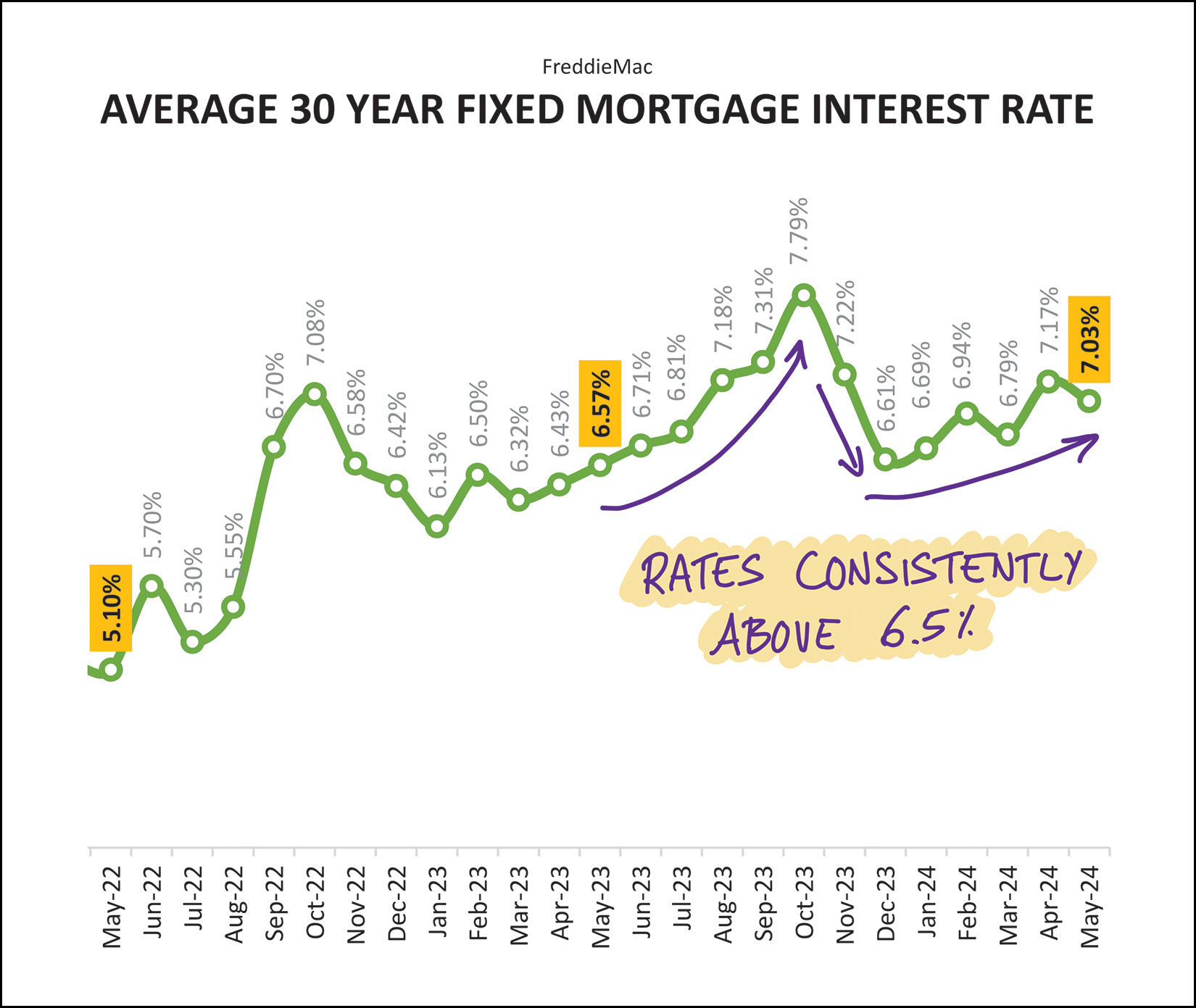

Happy Monday, friends, and Happy Summer! Summer is well underway over here at the Rogers household, with Luke having finished his first year of college and Emily wrapping up 10th grade. The start of our summer has included getting away for a few days to the lake for some water skiing and tubing, celebrating my niece's graduation (congrats Sofia!) and looking forward to Red Wing Roots Music Festival in less than two weeks! I hope your summer is off to a great start and that you'll find some time to relax or get away for a few days at some point this summer.  Before we dive into the lake, or rather, the real estate data... each month I offer a giveaway for readers of my market report. This month I'm giving away a $50 gift card to Bruster's. Yes, I realize that is a lot of ice cream... but they have SO many delicious flavors! Click here to enter to win the gift card. Now, on to the latest happenings in our local housing market...  Above you'll find the basic numbers related to how many homes are selling in Harrisonburg and Rockingham County and the prices at which those homes are selling. Here are a few things that stand out to me... [1] Home sales this May (last month) were much higher than expected... with 20% more sales than last May. [2] Despite seeing a 15% decline in the number of home sales in the past 12 months compared to the 12 months before that, we are now seeing a 7% increase in year to date home sales, thanks in part to the strong month of sales in May. [3] You might recall that for the past few years we have been seeing a (surprising) 10% increase in the median sales price each year. The median sales price over the past 12 months ($336,010) is now 8% higher than in the 12 months before that -- and the year to date median sales price is only 5% higher than in 2023 year to date. Thus, it seems that the median sales price may be increasing a bit more slowly this year than in recent years. Looking for a moment just at detached single family homes...  Sometimes it can be helpful to look only at detached home sales to see how they are comparing compared to the overall market. This month I am noting that the median sales price of all homes sold has only increased by 5% year to date (from $325K to $340K) but the median sales price of detached homes has increased by 13% year to date (from $342K to $385K). If you're trying to buy a home, you are likely paying a higher price now than you would have a year ago. If you are trying to buy a detached single family home, you are likely paying a much higher price now than you would have a year ago. As one final subset of the overall market data, here's a look at only existing homes... excluding new construction homes...  If you don't happen to want to buy a new home (based on their size, location, price, etc.) then you'll be focusing just on resale homes -- and there have been far fewer of those home sales over the past 12 months. We have seen 17% fewer resale home sales over the past 12 months (compared to the 12 months before that) mostly due to sellers not selling - rather than buyers not buying. In slightly better news, we have only seen a 2% decline in existing home sales year to date, so as to say that the decline is slowing in the number of existing homes that are selling. Perhaps it is unsurprising then that the median sales price of existing homes is 10% higher this year to date compared to last year to date, which shows a higher rate of increasing prices for existing homes as compared to the overall market. Now, I started off by mentioning that May home sales exceeded expectations... and you can see that more clearly here...  April home sales (106) were much (!) lower than last April (124) but May did not follow that pattern. After only seeing 114 home sales last May... there were 137 this May! Adding up those two months to see how April+May is tracking year over year, we find 243 home sales this year compared to 238 home sales last year. As you can see from my abundance of purple arrows above, it's hard to say where things will head in June... will home sales drop below 2023 again, or match 2023, or exceed 2023? It's hard to know for sure, but keep reading for the latest on contract activity and pending sales, both of which should give us somewhat of a hint of what is ahead. But first, let's see how this year stacks up compared to prior years...  We have been seeing a decline in the number of home sales over the past few years (2021 to 2022 as well as 2022 to 2023) but that might be reversing itself in 2024. The 525 home sales we have seen in the first five months of 2024 puts us ahead of 2023, though certainly still behind 2022 and 2021. Stay tuned to see if we can come out ahead of the 1,206 home sales we saw last year. Next up is a monthly look at rolling 12 month trends...  The top (green) line shows (barely, if you squint) what I have already mentioned in this month's report... median sales prices are increasing, but maybe not quite as quickly over the past six months as compared to their trajectory over the past few years. But, we'll need to continue to watch this metric to see if price increases are indeed settling down a bit. The bottom (blue) line shows that after almost two years of a downward trend in the number of homes selling in Harrisonburg and Rockingham County... we might finally be seeing things level out and increase a bit. We peaked above 1,700 home sales a year... and over about two years then saw things bottom out at just over 1,200 home sales a year. Will this trend slowly make its way back up to 1,300 home sales a year? If so, how soon? I mentioned new vs. existing home sales a bit earlier, but here's how the breakdown looks over the past few years...  We have seen a steady decline in the number of existing homes selling in our market... and in the percentage of home sales that are existing homes. Three years ago 81% of home sales were existing homes and only 19% were new homes. This year only 71% of homes that are selling are existing homes and 29% are new homes. Many homeowners have low mortgage interest rates on their existing mortgages and thus do not want to sell their homes -- which is contributing to lower numbers of existing home sales. We are also seeing many more new home communities in our area -- from local builders, but mostly from regional builders. I suspect we will continue to see new homes making up 25% or more of all home sales over the coming years. Now, for predicting the future...  After a strong month of sales activity in May, one might wonder what the next few months will hold. As shown above, we have now had three straight months of solid contract activity (red line) compared to those same months last year (blue line). Over the past three months, 423 buyers (and sellers) have signed contracts compared to only 364 in the same three months last year. These strong levels of contract activity suggest that we will continue to see at least several more months of strong home sales. Trends in pending home sales also supports that theory...  A year ago (blue line) there were only 275 homes under contract (pending) in Harrisonburg and Rockingham County. Today, that has risen to 336 homes under contract in our market. The overall declines in the number of homes selling may be behind us at this point given recent months of strong contract activity and the current trends in pending home sales. Perhaps unsurprisingly, inventory levels are also declining a bit...  Back in July 2023 we saw inventory levels start to rise... and they have stayed higher than expected since that time. But... at least as of today, inventory levels are trending back down a bit. Will this trend continue? Or is it a one month blip? Stay tuned. Keep in mind that even as inventory levels rose from the 100-130 range to the 180-200 range, all of those levels are well below pre-COVID inventory levels. Days on market -- how quickly homes go under contract -- is also keeping things interesting lately...  After several years of a median days on market of four or five days, we started to see this metric drift upward in late 2022, corresponding in large part to increases in mortgage interest rates. Last summer we saw days on market start to decline again (back down to five days in August 2023) but then it rose through early 2024. Has the market slowed back down since that time -- or are we starting to see a seasonality to this metric? We'll need to see how things develop as we progress through the remainder of the summer months. And, finally, those mortgage interest rates...  Two years ago the average rate was just above 5%, and rates peaked last Fall just under 8%, but the average 30 year fixed mortgage interest rate has been consistently above 6.5% for a year now... and there are not any indications that we'll see anything below 6.5% anytime soon. Most home buyers (or would be home buyers) have now adjusted to this new interest rate environment, and hopefully nobody is planning to wait to buy until rates get below 5%. There is talk of mortgage interest rates potentially coming down some over the remainder of the year, but we've heard that talk quite a few times over the past six (+) months and it hasn't measurably happened yet. As I bring this monthly market recap to a close, I'll point out that I post even more charts and graphs for your perusal each month over here. And finally, as we look ahead through the summer and towards the fall... If you plan to sell your home in the next six months, let's chat sooner rather than later about market conditions, your home preparations, your timing objectives and more. If you are considering a home purchase in the next six months, I'd be happy to chat with you about the buying process, the market and introduce you to some mortgage lenders who can help you consider your financing options. Reach out to me anytime via phone/text at 540-578-0102, or by email here. | |

Do Not Assume A Seller Will Say No To An Offer You Have Not Made |

|

It often goes something like this... "That house was listed for a sale a few days ago for $435K and I could probably only afford to pay $425K. I'm sure the seller would not accept my $425K offer, so I just won't make the offer." "I know that house has been on the market for two months priced at $650K without a price adjustment, but I'm sure the seller would not be willing to sell for $625K, so I won't even make the offer." "Even though that house has been on the market for a few months, they probably still wouldn't accept a full price offer because I would need to include a home sale contingency, so I probably shouldn't make an offer." In almost all cases, I recommend that all three of the fictional buyers above go ahead and make the offers that they chose not to make because they assumed a seller would say no to their offer. Certainly, a seller might really say no to your offer, but that's OK. If you never actually make the offer, you'll never have a chance to find out if the seller will say "no" -- or whether they would say "yes" or "no, but how about..." | |

If You Are Selling A Rental Property It May Be Best To Sell Just Before Or Just After Your Tenants Move Out |

|

Property values are high and they seem to keep getting higher. That statement is not true for all locations, price ranges and property types -- but overall, the local median sales price keeps increasing. This dynamic has resulted in some owners of rental properties deciding to go ahead and sell those rental properties... which is a welcome turn of events for first time home buyers who are often looking to buy the same properties that may currently be rental properties owned by investors. So... if you are planning to sell your rental property... when should you do so? Your best bet will be to list your rental property for sale either just before or just after your tenants move out. If you list within this timeframe, your property will be able to be considered by owner occupant purchasers as well as other investor purchasers. In contrast... if you list your rental property for sale while the current tenant still has six more months on their lease... the lease will convey to and be binding on the new owner... which means owner occupant purchasers won't be able to consider the purchase of your property... and your property will solely be appealing to investors who would take over the lease. So... if you want to expose your rental property to the widest pool of potential home buyers... we should wait until you have about 60 days (or less) remaining on the lease... or wait until just after your tenants move out. | |

When Will Construction Begin At Bluestone Town Center? |

|

A major housing development is planned on Garbers Church Road (and Erickson Avenue) and here's an overview of the timing, looking back and looking forward... June 2022 - Details first merge on the proposed housing development January 2023 - Planning Commission considers rezoning request February 2023 - City Council approves rezoning request May 2023 - Developer purchases the land for the development January 2024 - Plat for Phase One proposed And the latest... Mid/Late 2025 - Construction anticipated to begin From the article above...

Find out more about Bluestone Town Center here. | |

International Companies Seem To Like Opening Facilities In Harrisonburg, Virginia |

|

The latest news... Virginia Business: Specialty gift manufacturer establishes $1.4M Harrisonburg operation

But don't forget the other international company that recently moved their operations to Harrisonburg, VA...

Learn more about these companies now with Harrisonburg-based operations... What other international company will show up next in Harrisonburg? | |

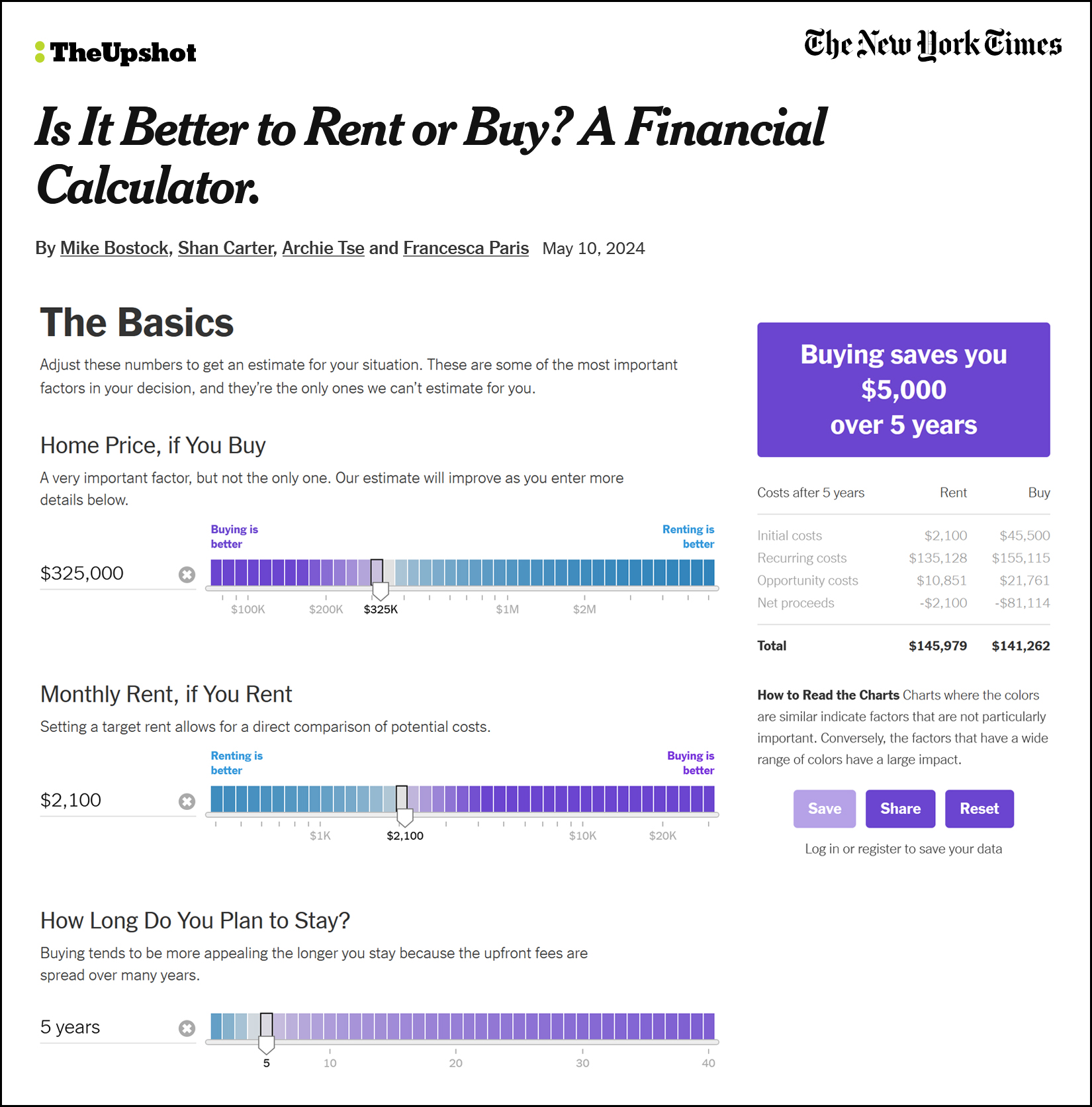

How To Determine Whether To Rent Or Buy A Home (via NYT) |

|

Buying a home is expensive these days, given high sales prices and high more interest rates -- but renting a home can be quite expensive as well! How can you best compare the financial impact of buying vs. renting? The New York Times has created a very helpful, interactive calculator that lets you dive into the details to better understand whether it will make sense for you to buy or rent based on the particular details of your situation. You'll start with some basic inputs including:

It is important to then adjust a few additional assumptions they have built into their calculator to match your scenario. The main sliders that seem important to adjust are...

The calculator will then show you your total costs of renting vs. buying over the timeframe you chose. In the fictional scenario I have illustrated above, it made more sense (barely) to buy over five years when comparing a $325K purchase to a $2100 rental rate. One final (important) note... the calculator assumes 3% growth in home prices. I don't necessarily recommend adjusting that to a higher percentage... BUT... over the past four years we have been seeing 10% growth in home prices each year. If we continue to see that type of home price growth it will almost always make sense to buy, regardless of your timeline. In summary... $325K purchase vs. $2100 rental rate over a 5 year horizon with 3% annual growth in home prices... it's better to buy, but barely. (If we see 5% growth in home prices per year for the next three years, it would be better to buy, even over that short three year timeframe) Explore the calculator and all of your possible scenarios here. | |

Harrisonburg City Council Approves Increase In Real Estate Tax Rate |

|

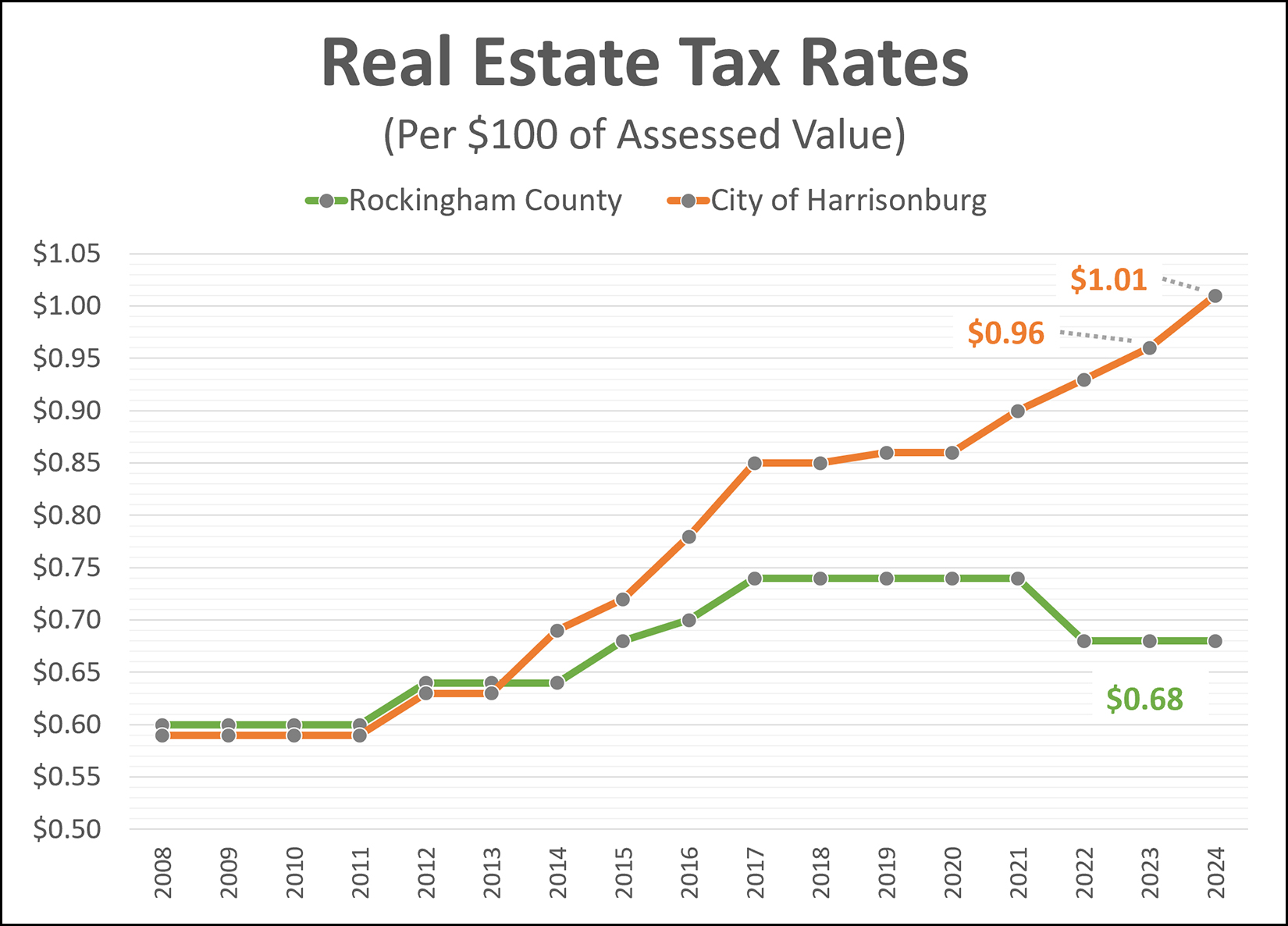

The real estate tax rate in the City of Harrisonburg will be increasing again for the 2024-25 fiscal year... rising $0.05 to $1.01 per $100 of assessed value. This is the fourth year in a row that the City of Harrisonburg has increased the real estate tax rate...

You can read a good bit more about the decision, rationale and citizen comments over at The Citizen... As you likely realize, we have also seen a rather significant increase in home values during the five year period referenced above, which further increases the property tax bill for city property owners. | |

Almost All Houses Look Better Online Than In Person |

|

This isn't a secret to anyone who has bought a home in the past 10+ years... Almost All Houses Look Better Online Than In Person Real estate photographers do an EXCELLENT job at making each home look absolutely fantastic! Some of it is in the lighting, some in the angles, some in the cropping, some in the post production... but real estate photographers can make almost any house look better online than in person. That's not a criticism of real estate photographers (certainly!) and it is not a criticism of all those houses that in reality don't look quite as pristine as they did in the photos online. It is just a reality that home buyers should be aware of when clicking through photos of new listings, imagining that the house is 110% as wonderful as the amazing photos make it appear. I am merely pointing out the importance of seeing a house in person to be able to take in... [1] the condition of the walls and floors that photos don't show in great detail [2] the parts of the house that weren't as prominently displayed in the photos [3] the lot characteristics or surrounding properties that weren't highlighted Don't get me wrong... I want you to LOVE each house in person just as much as you did when you viewed it online... but once we start looking at a few you may notice that the photos REALLY made it shine, perhaps a bit more than it does in reality. And, just to flip things completely upside down for a moment... every once in a while I do still come across a house that looks much better in person than in the photos... which makes me wonder why the photos look as they do. Photos matter in real estate marketing... a lot... but buyers will almost always be making their decision when walking through the house and experiencing it in person. | |

Make The Strongest Offer You Are Comfortable Making And Acknowledge All The Possible Outcomes |

|

The market is still moving along pretty quickly in many price ranges. This often results in multiple offer scenarios, where you are making an offer and will be competing against one or more other buyers who are also making offers. You won't know how much the other buyers are offering... or if they are including escalation clauses... or if they are including inspection contingencies... or if they are including appraisal contingencies... or if they are offering cash. So, what then, are you to do as a buyer? I recommend that you make the strongest offer that you are comfortable making and acknowledge all the possible outcomes. Your offer might not be high enough to compete against other offers and the seller might select another offer. You might have included more contingencies than another buyer and the seller might select another offer. You might have the fewest contingencies and the seller might select your offer. You might have the highest offer and the seller might select your offer. Home inspection contingencies make sense to include as a buyer... as do appraisal contingencies... but both can limit your ability to win in a multiple offer scenario. So, make the strongest offer you are comfortable making and acknowledge all the possible outcomes. | |

Different Local Real Estate Markets Are Performing, Unsurprisingly, Differently |

|

If you are relocating from a small rural area (or from a much larger city) to Harrisonburg, you are likely to experience different market dynamics in the two local markets. If you are relocating from Harrisonburg to a much larger city (or to a much more rural area) you are likely to experience different market dynamics in the two local markets. In conversations with folks moving to or from larger markets, I have heard anecdotes of...

Those sort of (extreme!) market dynamics are not currently being seen very frequently in Harrisonburg... but every local market is different. Consult an active, professional, local Realtor in the area where you are relocating to or from in order to understand current market dynamics in that market. Knowing how the market is performing will help you set proper expectations relative to potential offer terms and contingencies. | |

You Will Be Well Served To See Multiple Homes You Do Not Love Before You See The One You Do Love |

|

Sometimes home buyers think they should only take the time to go see homes that are almost certainly the PERFECT home that they will almost certainly LOVE. I disagree -- I think you should take the time to see some homes that you will probably LIKE but not LOVE. By doing so... 1. You will start to clarify what you like, love, must have, must not have in a home. 2. You will start to very clearly understand what types of homes are selling for what types of prices. 3. You will be much more confident in moving forward with a home that you LOVE because you have explored multiple homes that you liked but did not love. So... if you want to pore over the photos of new listings and potentially disqualify them based on the photos, that's fine... and if you want to drive by new listings and potentially disqualify them based on the lot topography or surrounding homes, that's fine... but you will likely be a more prepared and confident home buyers if you look at some homes that are close to what you want, but not exactly on the mark. | |

Bedroom And Bathroom Location Is Often Just As Important As Bedroom And Bathroom Count |

|

A four bedroom, two bathroom home might work wonderfully for you... unless all four bedrooms and one bathroom are on the second level... and the second bathroom is all the way down in the basement. A four bedroom, three bathroom home might be a great fit for you... unless all three of the bathrooms are accessed from inside bedrooms... leaving the person living in the fourth bedroom traversing through someone else's bedroom to get to the bathroom. A five bedroom house might work great for you, unless only one of the bedrooms is above grade and all four of the others are in the basement. A three bedroom, two bathroom house might seem like it is just the right size... unless the first bathroom is a common bathroom on the second level, for all of the bedrooms, and the second bathroom is tiny, in the basement, and two floors away from all of the bedrooms. There are countless other examples I could provide... of imaginary homes and/or homes I have explored with buyers over the past year... where the location of the bedrooms and bathrooms is just as important as how many bedrooms and bathrooms exist. We can sometimes piece together the bedroom and bathroom locations by poring over photos of a new listing... or if a floor plan is available... but oftentimes the quickest way to determine if the bedroom and bathroom layout will work for you is to go walk through the house together. | |

How Does Your Childhood Home Impact What Home You Want To Buy Today? |

|

What type of home did you live in when you were growing up? A townhouse? A single family home? A one-story home? A two-story home? A home with (or without) a basement? The home you lived in as a child might be subconsciously impacting how you think about and feel about homes you might buy as an adult. If you grew up in a single level home you might be most comfortable buying a single level home -- and bedrooms might seem *SO* far away in a two level home. If you grew up in a two level home you might be most comfortable buying a two level home -- and it might feel odd to have *EVERYTHING* on the main level in a one-level home. If you grew up with a basement it might feel like something is missing in a home without a basement. Certainly, if you grew up in multiple homes of multiple styles and sizes when you were growing up, the impact of those childhood homes might be more diluted. | |

All Contingencies Involve Uncertainty. As A Seller You Can Pick Which Uncertainty Worries You The Least. |

|

If you are selling your home and you have a few offers from which to choose, you'll have some decisions to make. Which contingencies are you most and least comfortable with? Certainly, ever seller would love to have a cash offer (no financing contingency and thus typically an appraisal contingency), without a home inspection contingency, and certainly without a home sale contingency -- but those offers don't come along that frequently. So, if you have to pick an offer that has some contingencies, which are you most and least comfortable with? Nobody's Favorite: Home Sale Contingency Only Slight Better: Home Settlement Contingency (home already under contract) Comfort Levels Vary: Inspection Contingency Financing Contingency Appraisal Contingency How a particular seller will feel about an inspection contingency, financing contingency and appraisal contingency will vary from seller to seller, house to house and buyer to buyer. Some sellers are quite comfortable with an inspection contingency because they have always been proactive with their home's maintenance over the years. Some sellers are quite comfortable with a financing contingency because the buyer has a significant down payment and/or the buyer is working with a familiar local lender. Some sellers are quite comfortable with an appraisal contingency because they are confident that there are multiple comparable sales that support the sales price. Given that offer terms almost always differ between multiple offers, it is important to discuss and decide which contingencies you are most comfortable with as a seller. | |

Sellers Are Often Making Price Reductions In A Matter Of Weeks Not Months |

|

Most segments of the local housing market are moving very quickly these days. Many homes are going under contract in a matter of days and not weeks. As such, the market is essentially giving feedback to home sellers very quickly as well. If your home goes under contract in the first week -- success -- you likely prepared it well, priced it appropriately, marketed it thoroughly and likely negotiated a favorable contract. If your home is not under contract after two or three weeks, any number of things could be going on... 1. You might not have prepared the property well enough. 2. You might not have priced the property appropriately. 3. You might not have marked the property thoroughly. 4. You might be selling a property for which there is a very small pool of likely buyers. Because the market is giving feedback to sellers so quickly (Did your house go under contract? Or not?) many home sellers are thus making adjustments very quickly as well - and if the home preparation is solid and if the marketing is thorough, then many home sellers find themselves considering a price adjustment. These days, it is best to price your home perfectly from the beginning (if that is even possible) but if it is not under contract within a few weeks it is better to go ahead and make a price adjustment now rather than waiting a few months. | |

Mortgage Interest Rate Fluctuations Do And Do Not Seem Likely To Impact Local Housing Market Activity |

|

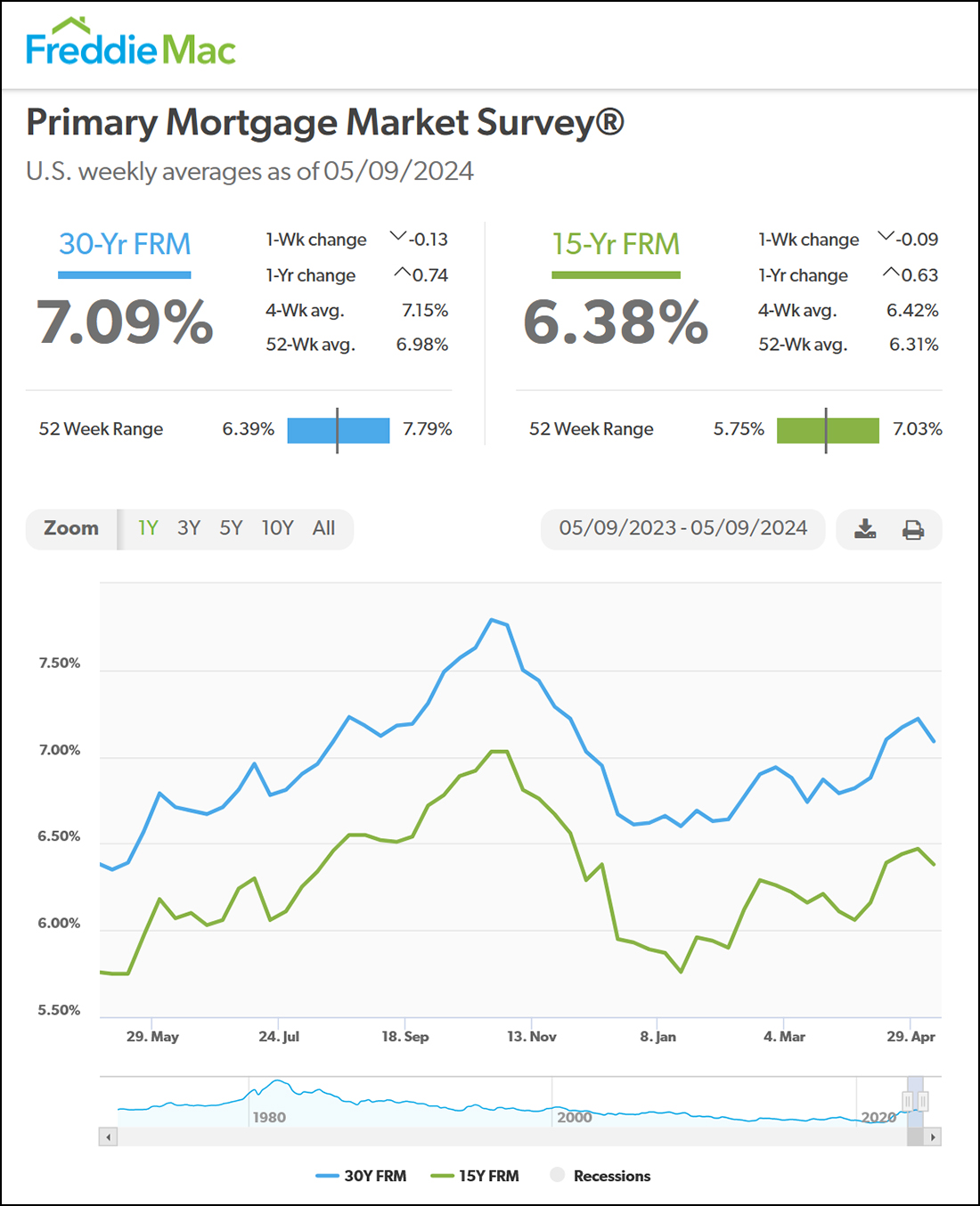

Will mortgage interest rate fluctuations impact market activity in the local housing market? Yes and no. For context, first... Over the past year, rates have fluctuated between 5.75% and 7.75%. That's a pretty broad swing over just a single year. The current average rate of 7.09% is lower than the 7.5% rate we saw six months ago. Rates have been mostly rising over the past four months from 6.6% to 7.1%. So, will rates impact market activity? Yes... if/as rates get back below 7% or closer to 6.5%, more buyers are likely to more seriously consider more offers on more properties. Likewise, if/as rates rise further and if they approach 7.5%, fewer buyers are likely to consider offers. But, no... rate swings between 6% and 7% (for the most part) seem unlikely to drastically change the number of buyers who will choose to buy a home this year. So, if you will be selling a home, you likely don't need to try to time your listing with when mortgage interest rates are lowest. And if you will be buying a home, it will be convenient if the home you like the most hits the market when mortgage interest rates are the lowest... but you'll probably still pursue it if rates are a bit higher when that perfect house hits the market. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings