| Newer Post | home | Older Post |

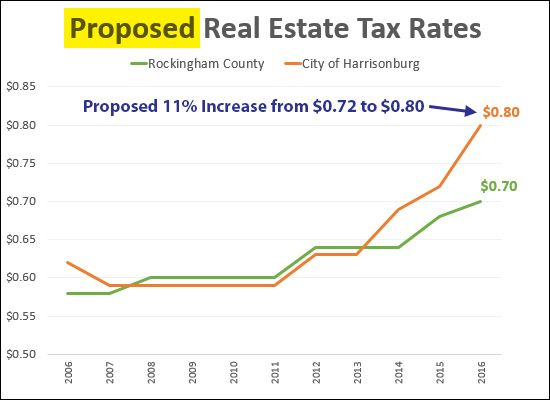

City of Harrisonburg Proposes 11% Increase in Real Estate Tax Rate |

|

The City of Harrisonburg has released its proposed budget for the 2016-2017 fiscal year, and it includes a proposed $0.08 increase in the tax rate from $0.72 per $100 of assessed value up to $0.80 per $100 of assessed value. A few excerpts of note from the City Manager's letter to City Council are included below. The bold sections are directly from the letter. City costs are increasing as population increase, even without increases in services.... As noted last year, the impact of a growing community continues to have a significant effect on our budget. That trend continues this year as we added another 1,263 new residents as of July 1, 2015 per the Weldon Cooper Center population estimates. I have stated in my budget transmittal letter for several years that even if we are not adding new services or programs, we have more people needing/consuming the services, programs, and facilities that we already provide, and we have added more infrastructure to be operated and maintained (streets, sidewalks, bike trails, emergency communications, juvenile and adult detention facilities, athletic fields, etc.) in support of our services and programs. Large new costs for 2016-17 include:

Natural revenue growth, while increasing, has not kept pace with the costs of all of the immediate needs. Lots of new costs without significant new revenue resulted in a recommendation for increasing the real estate tax rate.... As City staff developed the budget, they had a gap of about $7.5 million between revenues and expenditures. We began the development of the FY 16-17 general fund budget with a gap of about $7.5 million between anticipated revenues and expenditures. To varying degrees, all of the submitted requests had merit and were intended to address what department directors and management felt to be present or pending needs for providing services to our citizens. This budget does not include any increases to any of the "discretionary" outside agencies (listed as "Contributions – Community and Civic Organizations" in the budget) that receive City funding, nor does it propose adding any new agencies, programs or projects for funding. We attempted to build this budget based on available projected revenues and not expenditure requests, starting with a base revenue budget of just under $102 million (which included about $1.6 million in new revenue), less any use of fund balance. In spite of this effort, to meet the commitments we have in core service areas, a $3.15 million gap remains. As such, management believes an increase of approximately $0.08 in the real estate tax rate will be required to balance the FY 16-17 budget, pending Council direction as to other possible budget revisions or identification of reduction targets. The draft budget (and above-referenced letter, and supporting documentation) can be found here ("2017 Proposed Budget"). Next, the budget will be reviewed by City Council and opportunities will exist for public comment. Recent Articles:

| |

| Newer Post | home | Older Post |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings