Archive for March 2020

Careful What You Say While Touring A House For Sale |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening! These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. And, these cameras (or other listening devices) are less and less obvious and less and less expensive! So..... 1. Don't insult their house. It won't help during negotiations.One way around this is to pretend (as a buyer) that the seller is walking through the house with you. By the way, sellers, it may not be legal for you to record conversations in your home while you are gone. You should likely either NOT record conversations, or disclose that it is taking place. P.S. I am not an attorney. Consult one if you want an actual legal opinion. Ask me if you need a recommendation. | |

Is Social Distancing Keeping Buyers From Buying Houses In Harrisonburg? |

|

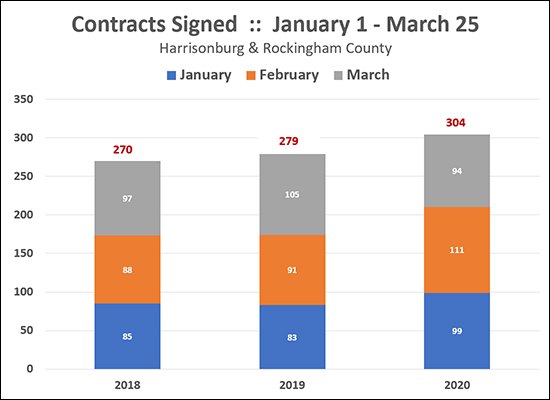

I don't think I had ever heard of the concept of social distancing prior to March 2020. Maybe it was a thing, but just not a part of our common vernacular? Anyhow -- it's here now, and real -- but the question that many of you have asked me is whether social distancing is affecting market activity in our area. Above is a first look at that -- and I'm coming to a conclusion of "maybe, maybe not, maybe not yet, who knows" -- so, you're welcome in advance for the great clarity I will be providing here. ;-) The graph above shows the number of contracts that were signed (by buyers and sellers) for houses in Harrisonburg and Rockingham County between January 1 and March 25 of each of the past two years, as well as this year. A few observations...

So, now you see why I concluded what I did...

Anyhoo - we'll just have to continue to monitor the impact of social distancing on our local housing market - but thus far, we have not seen a drastic decline in the amount of buyer activity. | |

Should I Buy A Home Now? |

|

School is cancelled and/or happening at home for the rest of the year. Businesses are closing. Folks are encouraged to stay at home and certainly not spend time in groups any larger than 10 people What does this mean for someone thinking about buying a home? If you were planning to find a home to buy this Spring, should you keep searching for that home and get ready to move forward with a home purchase, given the current state of affairs? As usual, it depends... Yes, you should buy a home now...

No, you should not buy a home now...

So, plenty of reasons to buy a home right now, and plenty of reasons to wait for a bit. As usual, the right answers for you depends on your specific situation as it pertains to where you are living now, why you want to buy, your plans for the near-term and long-term future, your budget, your overall finances, your current job, your future work prospects, etc. So, if you were planning to buy a home this Spring, let's talk things through and make sure we're thinking about it all from all angles and ensure that you are making the best real estate decision for you given your circumstances and goals. | |

Should I List My House For Sale Now? |

|

School is cancelled and/or happening at home for the rest of the year. Businesses are closing. Folks are encouraged to stay at home and certainly not spend time in groups any larger than 10 people What does this mean for someone thinking about selling their home? If you were planning to sell your home this Spring, should you list it for sale now, given the current state of affairs? As usual, it depends... Yes, you should list your house for sale now...

No, you should not list your house for sale now...

So, plenty of reasons to list your home for sale, and plenty of reasons to hold off on doing so. All that said, this gets slightly more nuanced once we consider your reasons for selling...

So - yes - it depends. If you were planning to list your house for sale this Spring, the decision to do so is at least a bit more complex than it was previously. Let's talk sooner rather than later (and then on an ongoing basis) to figure out what makes the most sense for you given your circumstances and goals. | |

It Is A Great Time To Virtually Walk Through A Home |

|

It's a great time to virtually walk through a home - given social distancing, and everything going on right now. Here are a few homes where you can do just that...  This beautiful, well maintained, contemporary home in Kentshire Estates with an open floor plan, a stone and brick exterior, an expansive garage, and a finished basement is located in close proximity to Sentara RMH Medical Center. Enjoy upscale finishes throughout, such as hardwood floors, crown moulding, custom cabinetry, granite countertops and much more. The two story great room with a gas fireplace is open to the kitchen and the main level also features the master suite, a home office and formal dining room. Upstairs you'll find three additional bedrooms - one being an enormous bonus room - and the lower level features an open rec room or family room, plus an additional office option, a full bathroom, and storage space.  16 LOUISE DRIVE: Walk Through | More Details This immaculate brick contemporary home in Windsor West is just a short walk away from Turner Ashby High School! Enjoy a grand two-story living room with hardwood floors and a gas fireplace, an upscale kitchen with granite countertops, a pantry and breakfast nook, an enormous family room just off the kitchen, with lots of natural light, a home office at the front of the house and a master suite with a walk-in closet. Don't miss the large laundry room with plenty of cabinetry, three upstairs bedrooms, plus a rec room, bedroom and bathroom on the lower level! Recent updates include a new back patio, new exterior doors and lighting, new carpet, fresh paint, and much more! This home offers lots of storage in the basement!  285 CALLAWAY CIRCLE: Walk Through | More Details This upscale paired home in The Glen at Cross Keys offers low maintenance living with a HardiePlank and stone exterior and a fenced backyard. Enjoy an open floor plan with a two-story living room, gourmet kitchen with plenty of cabinetry, granite countertops, stainless steel appliances and an eat-up breakfast bar, hardwood floors on the main level and a large dining room easily converted to a guest bedroom. The master suite features a separate sitting room or home office, a master bathroom with ceramic tile floors, a double vanity, a shower and a soaking tub. Don't miss the second bedroom suite upstairs, the full bathroom on the main level and the two-car garage! All this in a beautiful, well-maintained community with mountain views! | |

Buying When Needing To Sell But Only If You Can Buy But After You Sell |

|

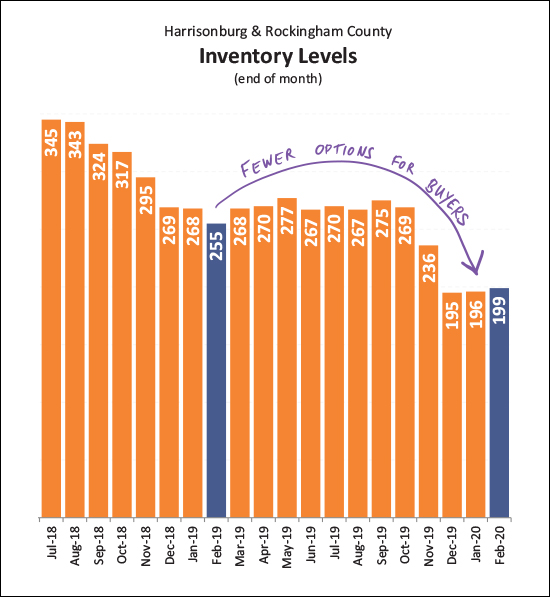

If you're looking to buy a house this Spring or Summer -- but -- you own your current home -- this morning's ramblings are for you... Selling (for some houses, in some price ranges, in some locations) can seem like a breeze -- inventory is low, buyer interest is high, homes are going under contract quickly -- all good news for sellers. And buying (for some houses, in some price ranges, in some locations) can be quite difficult these days -- inventory is low, interest from competing buyers is high, homes you might want to buy are going under contract quickly -- all less than exciting news for buyers. And when you wrap those two realities together -- buying and selling at the same time -- things can get tricky. Because it can be hard to find something to buy, many would-be seller-buyers aren't listing their home despite their desire to make a move. After all, they don't want to find someone to buy their home when they don't have somewhere to go. But then, the perfect house comes on the market! So, now what!? Do we quickly (quickly!!) list your home for sale and try to secure a buyer in time to make an offer on your dream house that is contingent on the settlement on the sale of your current home that is under contract? Hoping some other eager buyer has not already secured a contract on your dream house by the time we have your current house under contract? OR -- do we make an offer on your dream home, contingent on the sale of your current home, even though your current home is either not yet on the market or not yet under contract? (Hint, hint - the seller of your dream home probably won't be be interested in this proposal.) OR -- do we make an offer on your dream home WITHOUT a home sale contingency. That was a lot of build up to get here -- but this is the central item you may want to think about as you consider a sale and purchase this Spring or Summer. First - Do you NEED a home sale contingency... This can be pretty quickly determined in a conversation with a lender. Let me know if you need some recommendations of who to call for your next mortgage. They will essentially be asking you questions about your income, recurring monthly debt (house, car, student loans, etc.), and assets (cash) on hand. They'll be trying to determine whether your income (and offsetting expenses) qualify you to get a mortgage to purchase the new home while still owning the current home. Again - this is rather cut and dry from a lender's perspective, so if you're thinking (even a little bit) about whether you could / should / would buy without having first sold, then start with a conversation with your lender. If they can qualify you for a mortgage to purchase your dream home without having first sold your existing home, you will then move on to the next question... Second - Do you WANT a home sale contingency... Perhaps you own a $250K house and you're thinking about buying a $350K house. And perhaps your lender says it is no problem at all - they'll give you a mortgage to buy the $350K house even if you still own the $250K house. And perhaps you are quite certain we'll be able to speedily sell the $250K house. But yet, still, you might decide that you don't WANT a home sale contingency. Maybe you don't want the risk associated with having to pay both mortgage payments until the $250K house sells. Perhaps you don't like the loan terms that will be required on the $350K purchase without having freed up some equity from the $250K sale. Whatever the reason, there may in fact be a reason why you WANT a home sale contingency. Alright - the ramblings will stop for now. As you may have figured out if you made it this far -- selling and buying at the same-ish time can be relatively complex -- and we can't always figure it all out by thinking through a formula or checklist. As such -- if you're thinking about selling and buying this summer, let me know if you'd like to chat more about all of these topics, in person, as it relates to your own particular scenario.

| |

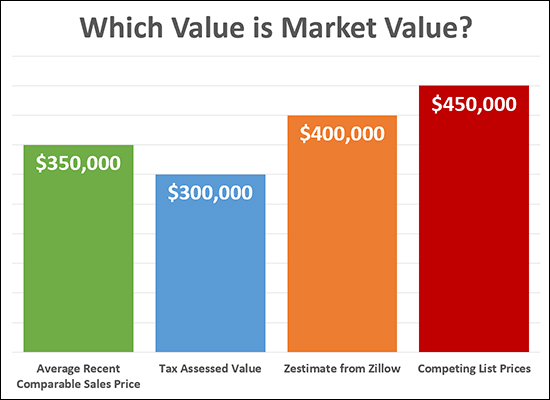

Sorting Through Multiple Perspectives On Home Value |

|

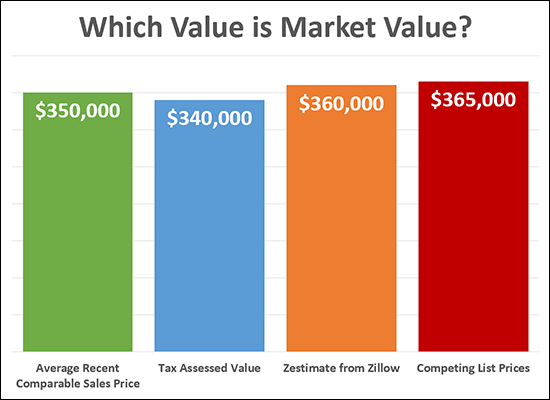

Which one of the values above is the "market value" of the imaginary home in question? The answer is -- the GREEN bar -- a home's value is most often determined by how much other buyers have recently paid for similar properties. A would-be buyer might WANT the home's value to be the "tax assessed value" -- but that might be quite a bit lower than the recent sales prices -- so a home's tax assessed value is not necessarily the home's market value. A would-be seller might WANT the home's value to be the "Zestimate" from Zillow -- but that might (often, usually) vary quite a bit from a home's market value -- so a home's Zestimate is not necessarily the home's market value. A would-be seller might REALLY WANT the home's value to be the same as the list price on competing properties currently for sale -- but those listings might sit on the market forever with unreasonably high list prices -- so the list price of competing listings is not necessarily the home's market value. Now, this scenario would be much easier...  As you can see here, there isn't too much of a difference between the different values -- so it matters a bit less which of the value perspectives we use when estimating a likely sales price and planning for a potential list price. But in the case where there is quite a bit of separation in these different value perspectives -- stay focused on what other buyers have recently paid for similar properties -- this alone is your best guide as to what you can/should expect the next buyer to be willing to pay for your house. | |

Is COVID-19 Impacting Our Local Real Estate Market? |

|

Public Service Announcement: Wash Your Hands! :-) Now, back to COVID-19, several folks have asked me if it is impacting our local real estate market. So far, it seems maybe not, for most folks?

So, amidst some rapidly changing times, with many folks working from home and with schools, movie theaters and many businesses closed, it seems that many sellers are still willing to sell and many buyers still want to buy. A few notes, though...

One last note -- all I'm pointing out above is that so far, things seem to be continuing on at a relatively normal clip in the local real estate market. That said, I do recognize that many folks may be seeing significant changes in their lives, their work, their small businesses, their income, etc. So -- two things I'm not saying...

If you have further questions about all of this -- or thoughts, comments or suggestions -- drop me a line at scott@hhtdy.com. | |

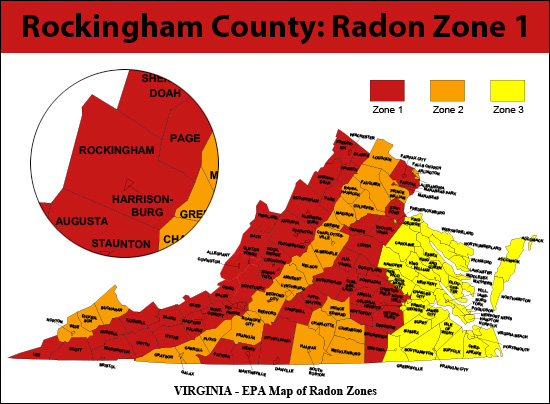

Test For Radon When Buying A Home With A Basement |

|

Radon is a colorless, odorless gas that can cause cancer -- in fact, it is the second leading cause of lung cancer after cigarette smoking! Radon quickly disperses in air, reducing its danger, but if it accumulates in a basement or other living space, it can be quite problematic. As you'll see below, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels...  Here's some further info from the EPA about radon... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside. Learn more about radon and real estate here. And here's the bottom line... 1. If you are buying a house with a basement, I recommend that you conduct a radon test 2. If you are selling a house and the buyer discovers radon levels above the EPA's recommended limit, I recommend that you agree to install a radon mitigation system for the buyer at your cost. | |

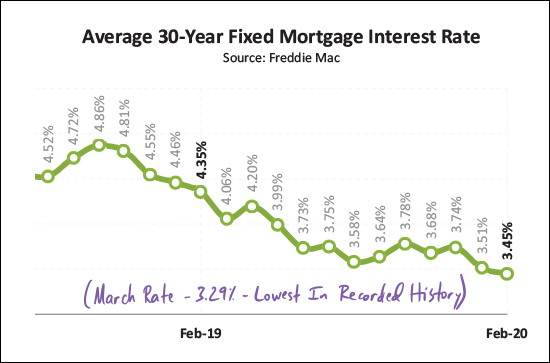

Refinancing Your Mortgage Might Make Sense |

|

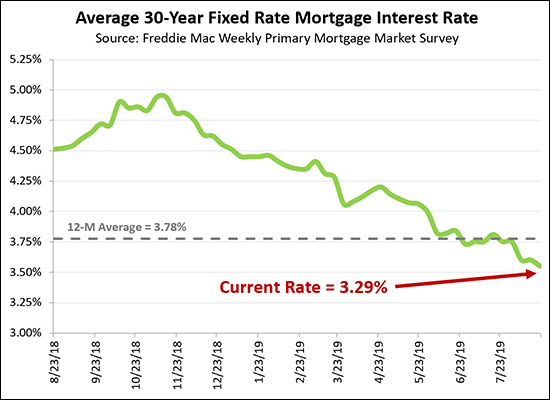

This is more of an alert to homeowners, not so much to buyers or sellers -- but if you haven't heard, re-financing your mortgage might make sense right now depending on your mortgage interest rate. The current average mortgage interest rate on a 30 year fixed rate mortgage is 3.29! This is the lowest we have ever seen, ever. If your current mortgage interest rate is higher than 4%, and you plan to stay in your home for the next few years, you should at least chat with a lender to see how these low interest rates could benefit you. You can likely either reduce your mortgage payment, or shorten the remaining life of your mortgage, or both! Feel free to touch base with me if you want some recommendation for local mortgage lenders. | |

Harrisonburg Area Home Sales Remain Strong in 2020 Despite Slower February |

|

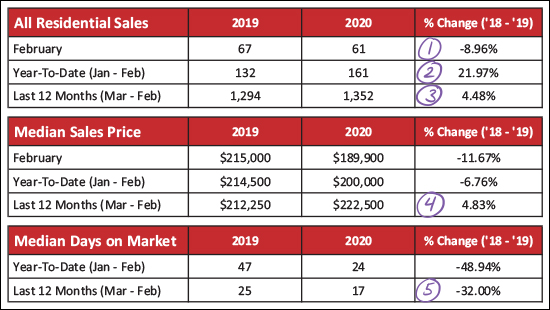

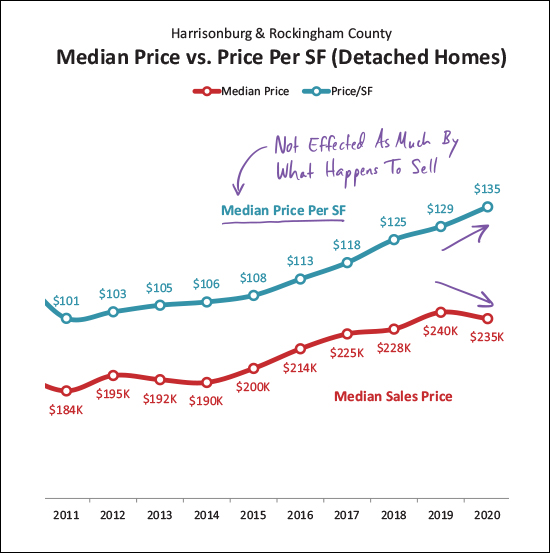

This month's featured home (shown above) is located in Kentshire Estates and you can find out much more about it out by visiting 3241DanburyCourt.com. OK. Now. Let's set the stage... Home sales slowed and prices fell in February 2020. Ahhh! Is the sky falling? Before you lump this news in with the rise of the coronavirus and the decline of the stock market -- remember two things...

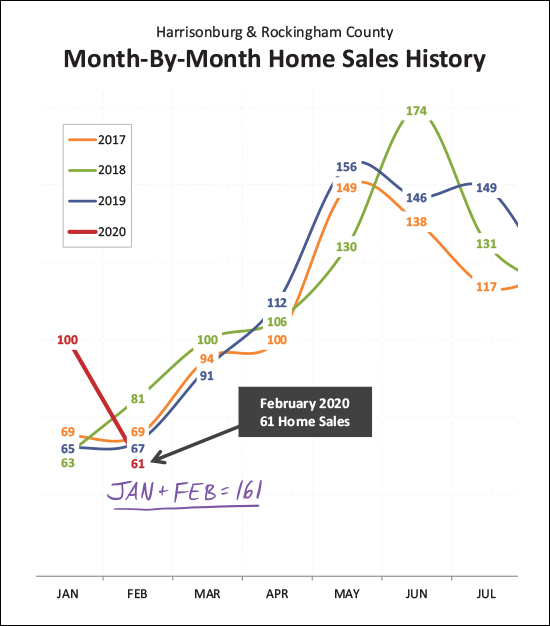

So, there we go. Read on to better understand both short and long term trends in our local housing market -- but don't let a few less-than-exciting short term trends make you think our local housing market is (necessarily) experiencing anything as dramatic as what you're hearing about in the (health and economic) news of the week. Moving out from my drawn out intro -- here's the PDF of the entire report -- and let's dive in...  Lots to see and think about above...

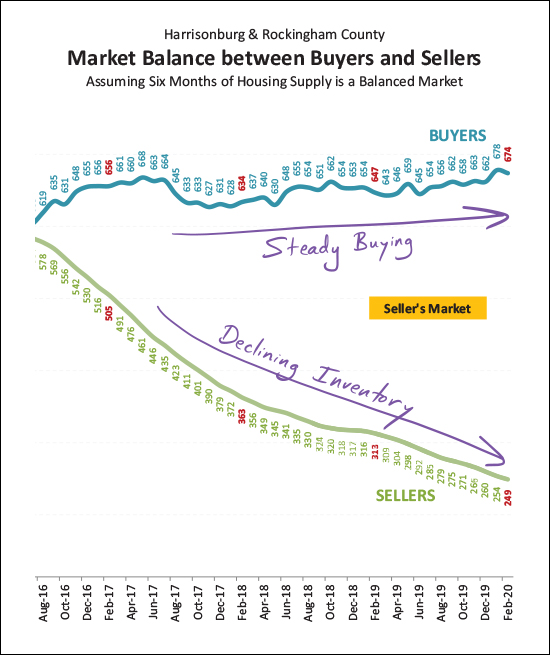

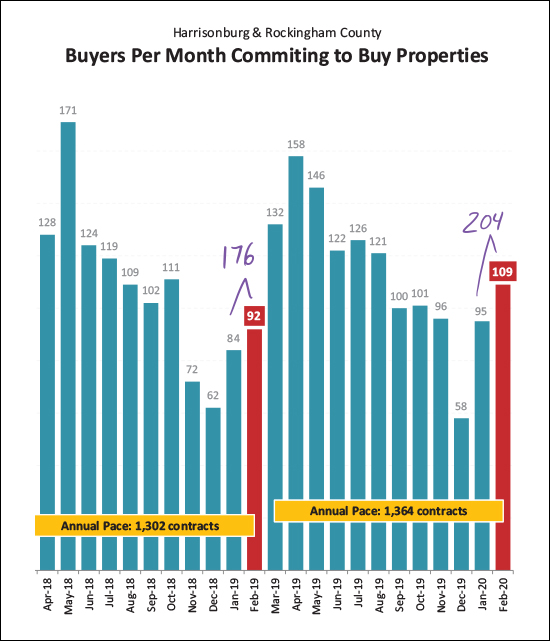

This next graph could - again - scare you, given the sort of crazy news we're hearing about all day long this week...  January 2020 was the strongest January we've ever seen -- and it was followed by one of the slower months of February in recent years. Again, should we panic? That red line is going nearly straight down! Here's my take on it -- any given month can be abnormally strong and any given month can be abnormally weak -- perhaps January was overly strong and February was overly weak. I come to this conclusion by looking at January and February sales combined, and am noting that the 161 sales in these two combined months is much higher than the same two months during the previous three years. So -- this isn't a message of "don't worry about that slow, slow February - everything is going to be just fine - trust me" -- it's more of a message of "the market still seems to be quite strong despite a slightly odd (slow) February." And now, we might be done with the nail biting portions of this monthly update on our local housing market, because most of the remainder of these graphs focus on the big picture and the long term trends...  As shown above, buyers have been steadily buying homes at a slightly (just slightly) faster pace for each of the past few years -- but they have been choosing from a smaller and smaller pool of homes for sale at any given time. This has created a strong "seller's market" where many homes are seeing a flurry of showings when they first come on the market and sometimes are seeing multiple offers.  I don't usually include the graph above in this monthly re-cap, but I thought it was helpful this month. The median sales price has declined slightly between 2019 and 2020 (looking only at January and February 2020, of course) but you will note that the median price per square foot has increased during that same timeframe. This is a good indicator that the downward shift in sales prices is likely a change in what is happening to sell, more so than a change in home values. If more smaller homes are selling thus far in 2020 (as compared to all of 2019) then the median sales price would decline while the median price per square foot increases.  Another important distinction to make when thinking about short term market trends -- changes in the pace of closed sales are not a good measure of current buyer behavior, they just show how many buyers were (or were not) signing contracts 30 to 60 days ago. So, the fact that there have been 204 contracts signed this January and February -- compared to only 176 last January and February -- is likely a good indicator that we will see (closed) home sales bounce back up again in March and April.  One of the main story lines of the past few years has been fewer and fewer choices for buyers in the market -- and this has continued into 2020. The number of homes on the market at any given time continues to fall -- and has now been (slightly) below 200 for three months in a row. This makes it a thrilling time to sell (many showings, sometimes multiple offers) but makes it a nerve-racking, frustrating time to (try to) buy a home.  OK -- if there is one trend in this report that is definitely and 100%, completely, and fully related to the coronavirus, this (above) is the one. The Federal Reserve cut its benchmark interest rate by half a percentage on March 3 to try to combat any adverse economic effects of the coronavirus. That March 3rd rate cut isn't shown above, since my graph only goes through the end of February, but it caused the already low average rate of 3.45% to dip even lower, down to the current level of 3.29%, which is the lowest average mortgage rate that we have ever seen for a 30 year fixed rate mortgage. OK, alright, we made our way through the data for the month. There is much more, of course, in the full PDF of my market report. As we continue to learn more about the coronavirus I hope that you and your family and friends remain well. I don't expect that we'll see drastic ramifications of the coronavirus on our local real estate market because I believe people will still need housing, and people will still have jobs - but we will all have to closely monitor how things develop from here. My advice from last month still applies... If you're planning to sell your home in 2020 -- let's chat SOON about the best timing for doing so, what you should do to prepare your home for the market, and of course, we'll want to start by analyzing your segment of the market. As always -- shoot me an email if you have follow up questions or if you want to chat about your plans to buy or sell. | |

Mortgage Interest Rates Hit All Time Low at 3.29% |

|

Mortgage interest rates have never been lower than right now. No, really! The current average 30-year fixed rate mortgage is 3.29% and that is the lowest level seen in the 50 years that this rate has been tracked! So, if you're buying a home in the near future, you will be locking in at historically low interest rates. And if your current mortgage is at an interest rate of perhaps 4.5% or higher, it might make sense to refinance! | |

Is The Perfect The Enemy Of The Good In House Hunting? |

|

You may have heard of the expression - "Don't let the perfect be the enemy of the good" - and here are a few other similar phrases from philosophers over the ages...

So, how does this all apply to house hunting and home buying? Especially after a long home search process, when a buyer finally finds a house that could actually work -- they might get stuck in trying to determine conclusively whether good is good enough. It's understandable... Buying a house is an expensive and lasting decision. You'll likely live in the home for many years to come, and the various aspects of the house will shape some of the patterns of your life, relationships and more. So, it's important to get the right house -- and a great house -- right? Yes, 100%. That said, sometimes a house is great, but is not 100% perfect, and this can leave a buyer wondering whether to go ahead and jump on the pretty-amazing-but-not-perfect house, or to keep looking for something that is an even better fit for their needs or desires. There's no magical answer here -- it's not that you should always decide to buy a great-but-not-perfect house -- and it's not that you should always eternally wait for the perfect house. But as you mull over that pretty great house, make sure that you are not letting your (perhaps solely theoretical) ideas of a perfect house get in the way of you buying a house that would be a great home for you. | |

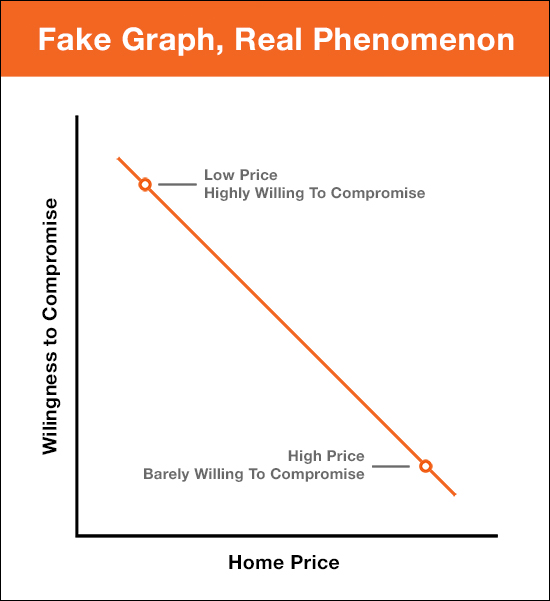

Buyers Of Expensive Homes Are Often Less Willing To Negotiate On Other Home Criteria |

|

Sometimes, if you can't find data to analyze to demonstrate a market dynamic, you should just make up the data or chart. Right? ;-) Well, not necessarily, but maybe just this once? Here's something I observe time and time again...

And it sort of makes sense when you think of it from a price perspective...

And it sort of makes sense when you think of it from a timeline perspective...

As a side note -- this is one of the main frustrations for sellers of "more expensive" homes -- why do all the buyers have to be SOOOO picky? Why aren't they willing to compromise even just a little bit!? Again -- a real phenomenon, but definitely a fake graph. :-) | |

Typical Obstacles Between Contract and Closing |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. BUT WAIT -- THERE'S MORE.... Would you rather have three main hurdles to clear, or six? Let's imagine that you receive two offers on your house, which is listed for $250K....

So -- a slightly higher sales price, with a home sale contingency, is not always more valuable to a seller than a slightly lower sales price without a home sale contingency. | |

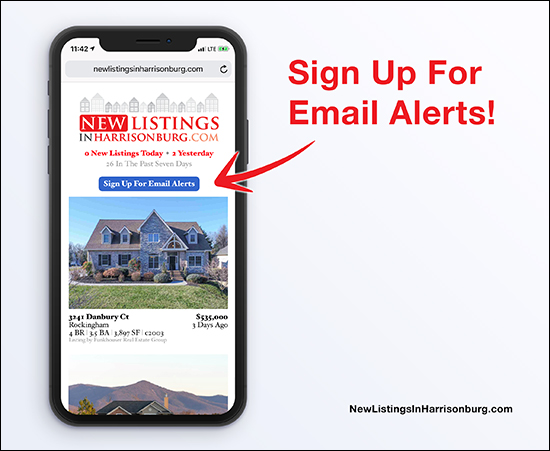

March Is Here, New Listings Will Be Coming, Get Ready To Pounce |

|

The market is moving QUICKLY -- homes are often going under contract in a matter of days instead of weeks -- so it is essential that you know about new listings immediately when they hit the market. Most of my clients use NewListingsInHarrisonburg.com to keep track of new properties coming on the market in Harrisonburg and Rockingham County. You can quickly and easily scroll through the most recent residential listings in Harrisonburg and Rockingham County, view the pertinent details, all of the photographs of the home, an area map, and then quickly and easily share that new listing with a friend, your spouse, your Realtor, etc. You can also sign up to receive an email alert every time there is a new listing....  Check it out, at NewListingsInHarrisonburg.com. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings