Archive for June 2023

How Quickly Can You Sell A Second Cup Of Lemonade, Or Your House? |

|

Let's say you set up a lemonade stand early on a Saturday morning around 8:00 AM. Before you can even put the last sign up, you have your first customer at 8:04 AM. After you sell them that cup of lemonade, you are excited for the rest of the day and you start squeezing lemons for a second batch of lemonade because you just know that you'll have a strong day of lemonade sales, probably with a new thirsty customer every few minutes. Four hours later you sell your second cup of lemonade of the day. As those four hours passed by, without a second customer, you start to realize that... Just because the first lemonade customer showed up quickly, that did not necessarily mean that there would be lots and lots of lemonade customers that day. Maybe there is only one person in the market for lemonade in your area right now!?! I'm glad you asked... When you are getting ready to sell your home you might look around at recent sales and find that one of your neighbors recently sold their home -- and that it went under contract very quickly, and sold at or above list price. That would likely cause you to conclude that when you list your home for sale you will also find a buyer very quickly and sell at a great price. That may very well be the case! They might have had 10 showings and 3 offers, and you might have 9 showings and 2 offers. Great news for you if that is the case! Or... maybe there was only one buyer in the market (right now) for a house like your neighbor was selling and that you are selling... maybe they had 3 showings and 1 offer, and you might have 2 showings and no offers. Not quite as exciting for you. So just as we concluded with lemonade... Just because the first lemonade customer showed up quickly, that did not necessarily mean that there would be lots and lots of lemonade customers that day. Maybe there is only one person in the market for lemonade in your area right now!?! ...so it goes with any particular house given its price, location or property type... Just because a house sold recently, very quickly, at a great price, that does not necessarily mean that there are lots and lots of other buyers currently in the market for your very similar house. Maybe there is (was) only one person in the market (at least for now) for that particular type of house given its price, location and property type. So, how do you know what situation you'll be in as a lemonade or house seller? When selling lemonade, you won't know how quickly you will (or will not) sell that second cup of lemonade until the minutes or hours start going by with or without any lemonade sales. When selling a house, you won't know how quickly you will (or will not) sell your house until you have your house on the market and you can start seeing how quickly showings are (or are not) being scheduled. | |

Existing Home Sales Are Down 19% In 2023. Why? |

|

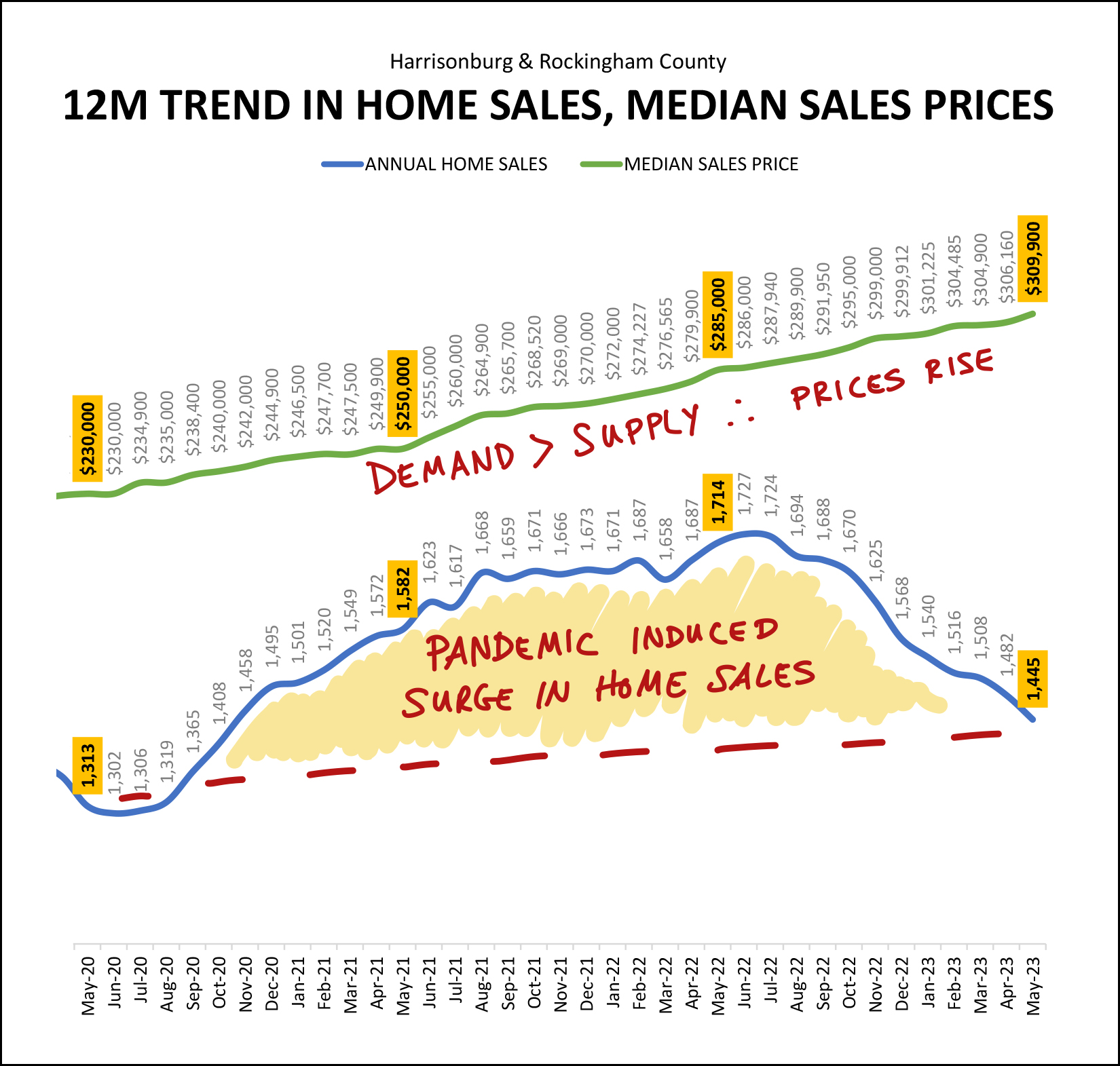

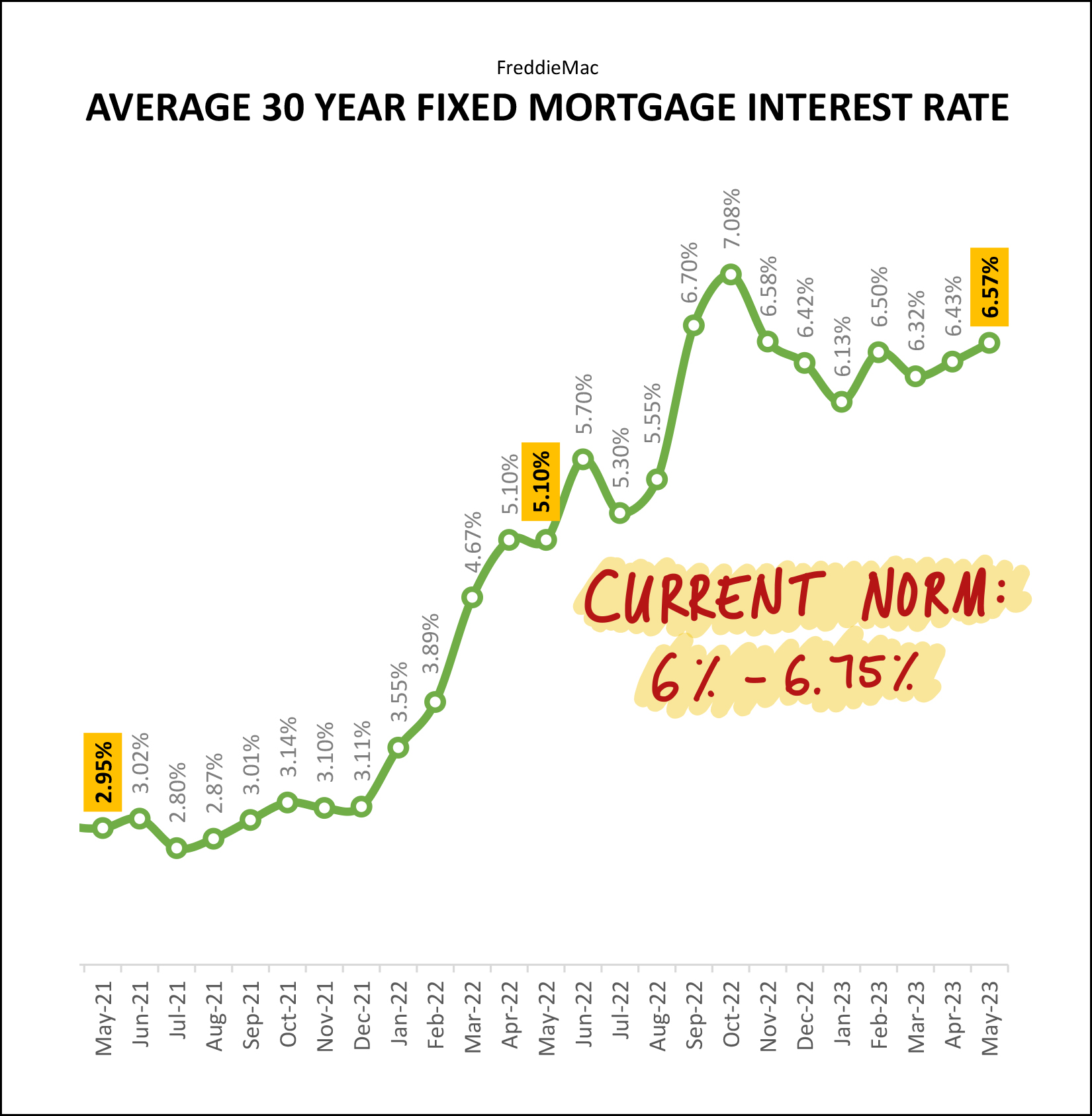

We've seen a 19% decline in existing home sales in 2023 - which includes all home sales in the HRAR MLS except new construction sales. In the first five months of last year there were 466 existing home sales - but there have only been 377 existing home sales in the first five months of 2023. Why are there fewer existing home sales taking place right now in Harrisonburg and Rockingham County? Theory 1 - Affordability Home prices have increased significantly (+32%) over the past three years and mortgage interest rates have as well (+108%) and these two trends have caused housing payments for most new buyers to increase significantly. So, one theory for why we are seeing fewer existing home sales is because homes are less and less affordable. But... if this theory were true... that higher home prices and higher mortgage interest rates were making housing too unaffordable... thus reducing buyer demand for existing homes for sale... then we would see inventory levels starting to climb as a result. But, we're not seeing inventory levels meaningfully rise -- which calls into question whether the reduction in existing home sales could really be related to affordability. Theory 2 - Homeowners Want To Hold Onto Their Low Mortgage Interest Rate Another potential theory for why we are seeing fewer existing home sales... is that perhaps we are not seeing a decline in the number of buyers who want to buy... but rather... a reduction in the number of sellers who are willing to sell. Take a look at the mortgage interest rates of current homeowners! 82% of homeowners have mortgage interest rates below 5%. 62% of homeowners have mortgage interest rates below 4%. If those homeowners sell their current homes (existing homes) they would be trading in their low mortgage interest rate for a new one around 6.5% or a touch higher. Thus, it is quite possible that we are seeing lower number of existing home sales because fewer homeowners are willing to sell... because they LOVE their low mortgage interest rates. Theory 3 - What Say You? Have any other theories? Email me! | |

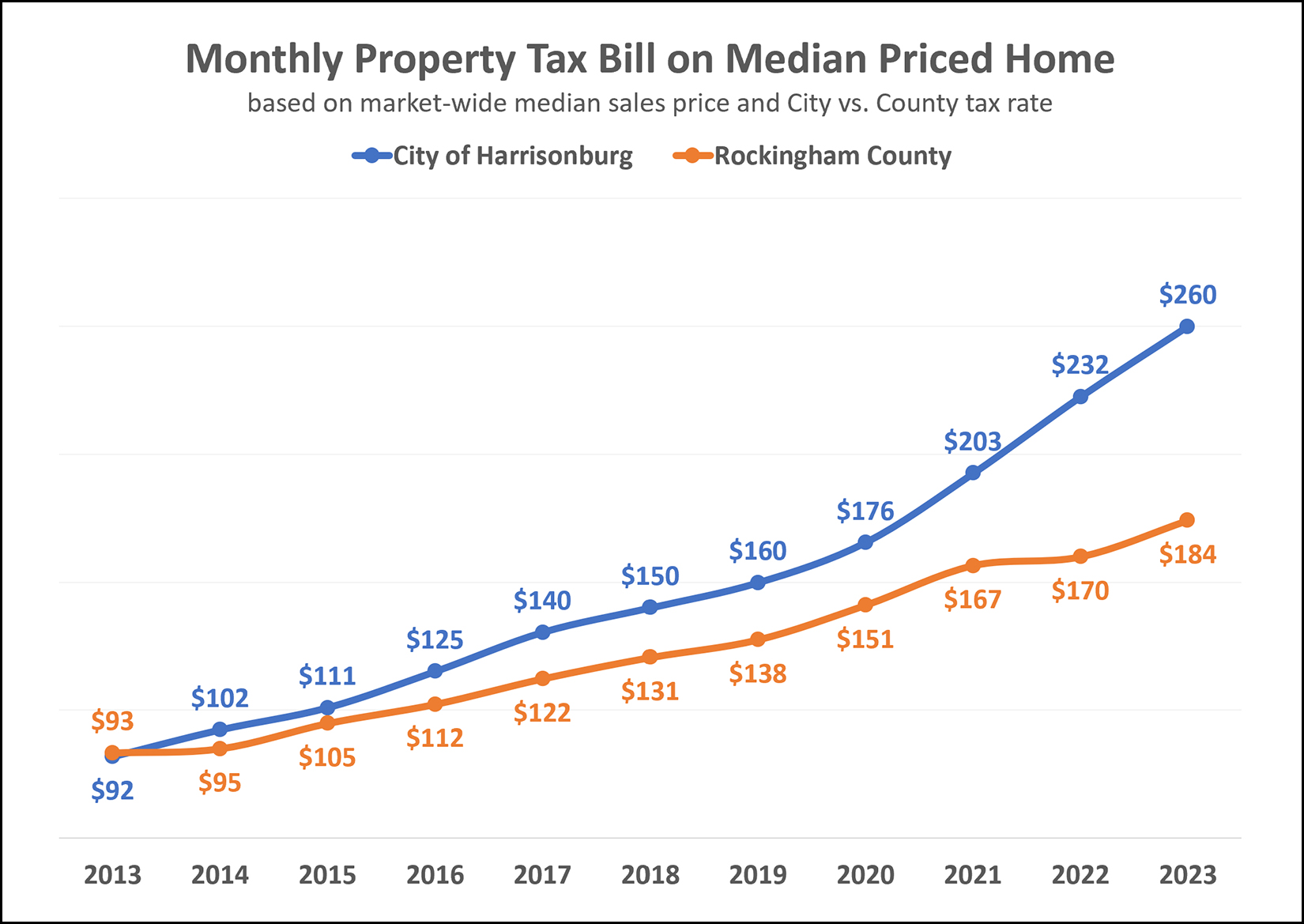

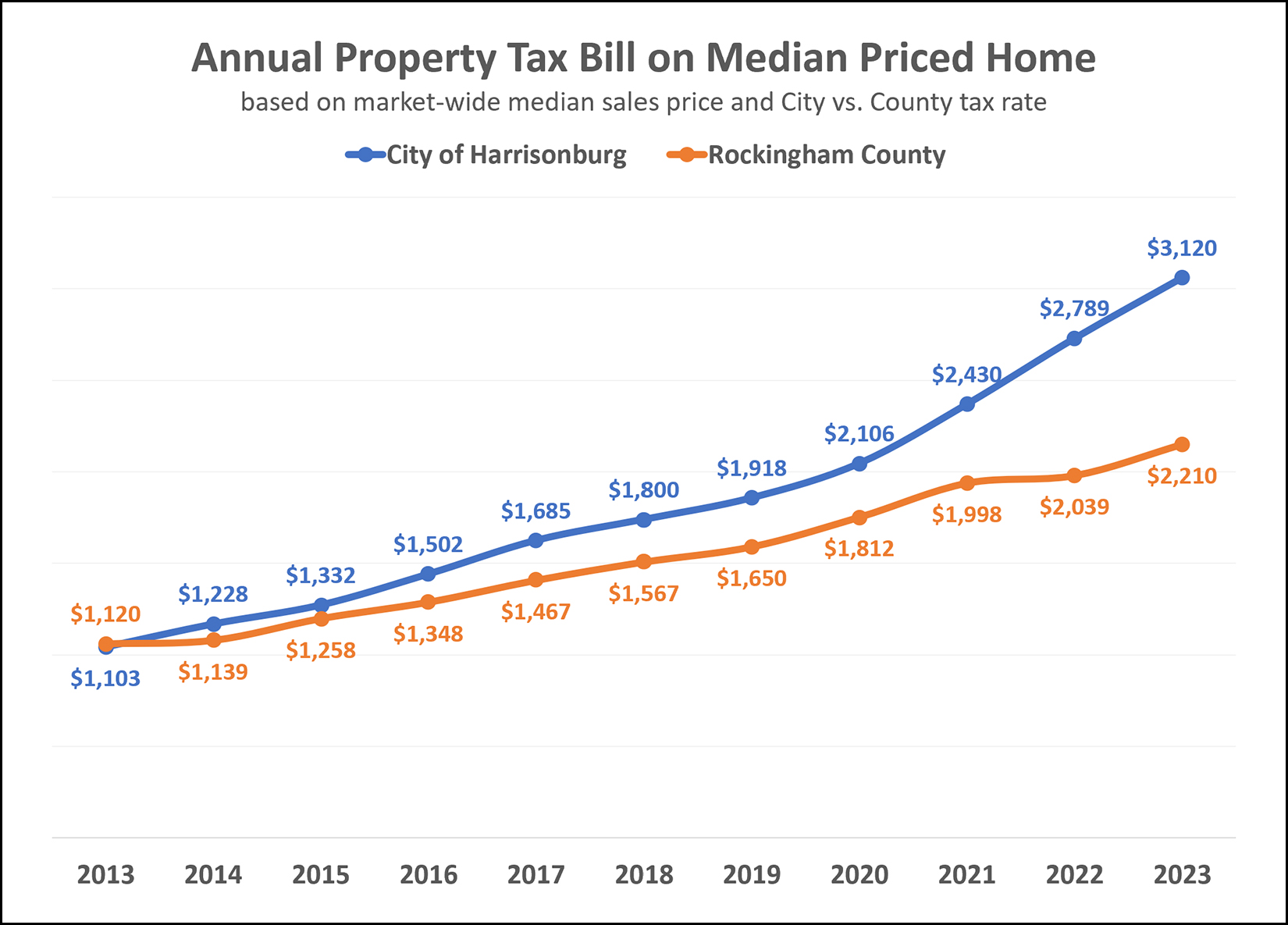

Monthly Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a median priced home in our market (Harrisonburg and Rockingham County) you would be spending $325,000. Will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

Also of note -- this analysis of monthly property tax bills over time does not adjust for inflation. A $260 monthly tax bill in the City of Harrisonburg in 2023 is not the same as a $260 monthly tax bill in 2013 as inflation has been running hot over the past few years. Certainly, one reason why the City tax bill has increased as much as it has over the past few years has been to fund the new high school currently under construction in the City. Will this difference in tax rates in the City and County result in some buyers deciding to buy homes in the County instead of the City? Maybe - but my experience has been that the tax rate is not what causes a home buyer to consider a home in one locality or the other. Multiplying by 12, here's a look at the annual tax bill in the City vs. County for a median priced (market wide) home in our area...  | |

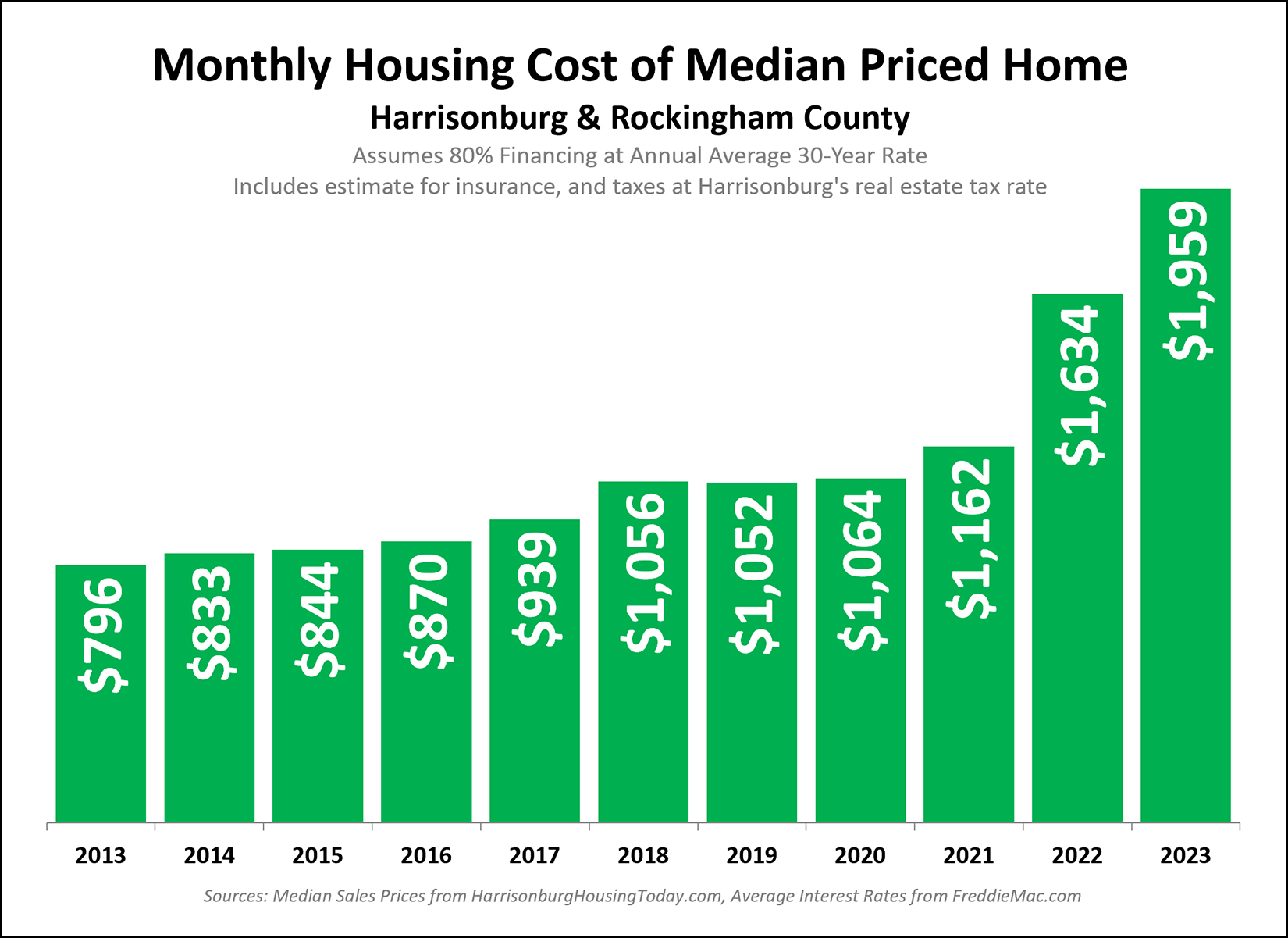

Monthly Housing Costs Up 84% In Three Years |

|

Over the past three years... [1] The median sales price has increased by about 10% each year. [2] The average mortgage interest rate has doubled. [3] The City real estate tax rate has increased by 12%. Given these three changes, and how each plays into housing costs, it shouldn't be much of a surprise that monthly housing costs have increased significantly over the past three years. Three years ago, if a home buyer financed 80% of their purchase of a median priced home, they would be paying about $1,064 per month. Now, if a home buyer finances 80% of their purchase of a median priced home, they will be paying $1,959 per month. Beyond the "wow, that's a crazy increase" here are a few of my other thoughts and observations... [1] Perhaps this is a statement of the obvious... but this "increase in monthly housing cost" only affects those who are buying homes now. Anyone who already owns a home is not seeing this type of an increase in their housing costs. They might have a minor increase in their monthly housing costs due to rising assessed values, rising real estate tax rates and/or rising homeowners insurance rates, but those will amount to a relatively small increase in their monthly housing costs compared to what is described above. [2] Yes, this is a big increase... but it's partially because monthly housing costs were abnormally low for quite a few years as a result of super low mortgage interest rates. We have now exited a prolonged period of tremendously low mortgage interest rates. This kept housing costs very low for anyone buying a home (or refinancing their mortgage) during that unique time of low mortgage interest rates. Thus, the increase in monthly housing costs seems huge -- but it's only partially because of how high mortgage rates are now, but also very much about how low those mortgage rates were very recently. [3] Just a note on methodology. The housing cost numbers above are calculated using the median sales price of homes sold in Harrisonburg and Rockingham County per the HRAR MLS, combined with the average mortgage interest rate for the duration of the year, combined with the real estate tax rate for the City of Harrisonburg, and assumes a 20% downpayment. Bottom line -- it is quite a bit more expensive for someone to buy a home now compared to just a few years ago. | |

If Your Offer Is Competing With Other Offers, You Should Max Out Your Preapproval Letter |

|

A few (4+) years ago, most offers were made without having to compete with another offer. In such as a circumstance, it often made sense to tailor your preapproval letter to match the price you were offering. For example... $275,000 = List Price $350,000 = Your Max Preapproval Amount $265,000 = Your Offer $265,000 = The Preapproval Letter You Include After all, why let the seller know that you could pay $350K when you're trying to negotiate them down from $275K to $265K. :-) These days, however, things work a bit differently. You should consider maximizing the amount of your preapproval letter to show your financial strength. $350,000 = List Price $475,000 = Your Max Preapproval Amount $375,000 = Your Offer (after escalating) $475,000 = The Preapproval Letter You Include Yes, you could certainly include a preapproval letter from your lender showing you are qualified to pay $375K for the house -- but the strength of your finances will be much more evident to the sellers if you include the maximum preapproval letter of $475,000. So... in a competitive offer scenario, don't hide the top price you can afford, as it might sway the seller in your favor as they are considering multiple offers. Most sellers, if presented with these three offers would choose the third offer... [1] Offer of $375,000 with pre-approval letter of $375K [2] Offer of $375,000 with pre-approval letter of $395K [3] Offer of $375,000 with pre-approval letter of $475K As a side note -- even if you don't want to spend $475K, and you won't spend $475K, if you qualify for $475K it can still be helpful to have that letter from your lender for the reasons outlined above. | |

Think About These Questions Before You Go See A House You Want To Buy |

|

The market is still moving quickly in Harrisonburg and Rockingham County. As such, once we walk inside of a house, and you decide you like it enough to make an offer, the clock will start ticking. We'll have a limited amount of time for you to make a few big decisions... [1] What price do you want to offer? [2] Do you want to include an escalation clause? [3] How high will that escalation clause go? [4] Do you want to include a home inspection contingency? [5] Do you want to include an appraisal contingency? Some of these questions are certainly property specific -- and your answer will be different when asked about different properties. But some questions can be made somewhat more generic... [1] Will there ever be a time when you are comfortable making an offer without an inspection contingency? [2] Are you comfortable paying more than the appraised value for a house? Including a home inspection or appraisal contingency (or both) will definitely make your offer less competitive if there are multiple offers and if one (or more) of the other offers does not include either or both of those contingencies. So... before you go see a house that you then might discover that you love... think about... [1] Would you be comfortable buying a home that you love without doing an inspection? [2] Would you be comfortable paying more than the appraised value for a house that you love? Thinking about these questions generically will prepare you for when I ask you to think about your answer to that question when we're inside of one specific home. | |

Homes Still Selling Quickly, At Record High Prices, Despite Decline In Total Home Sales |

|

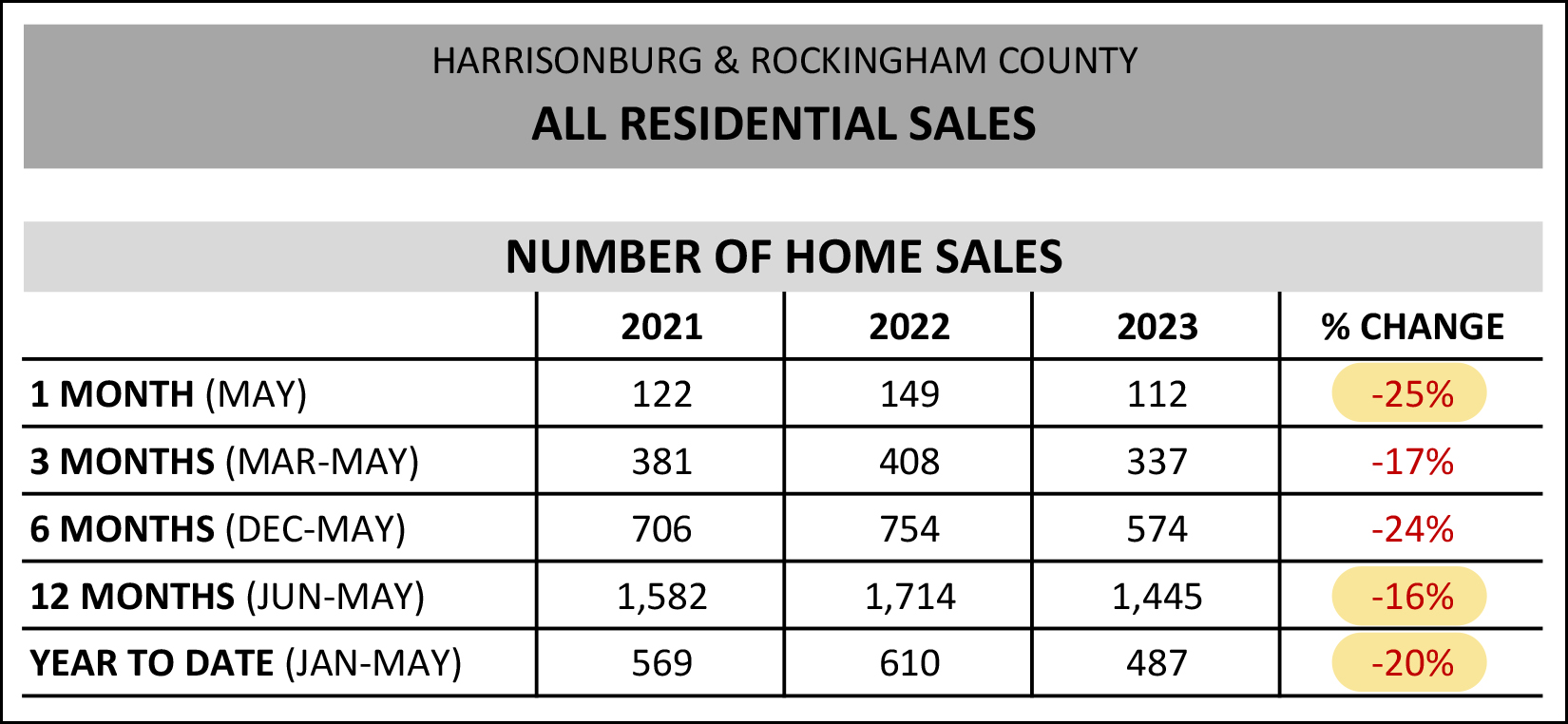

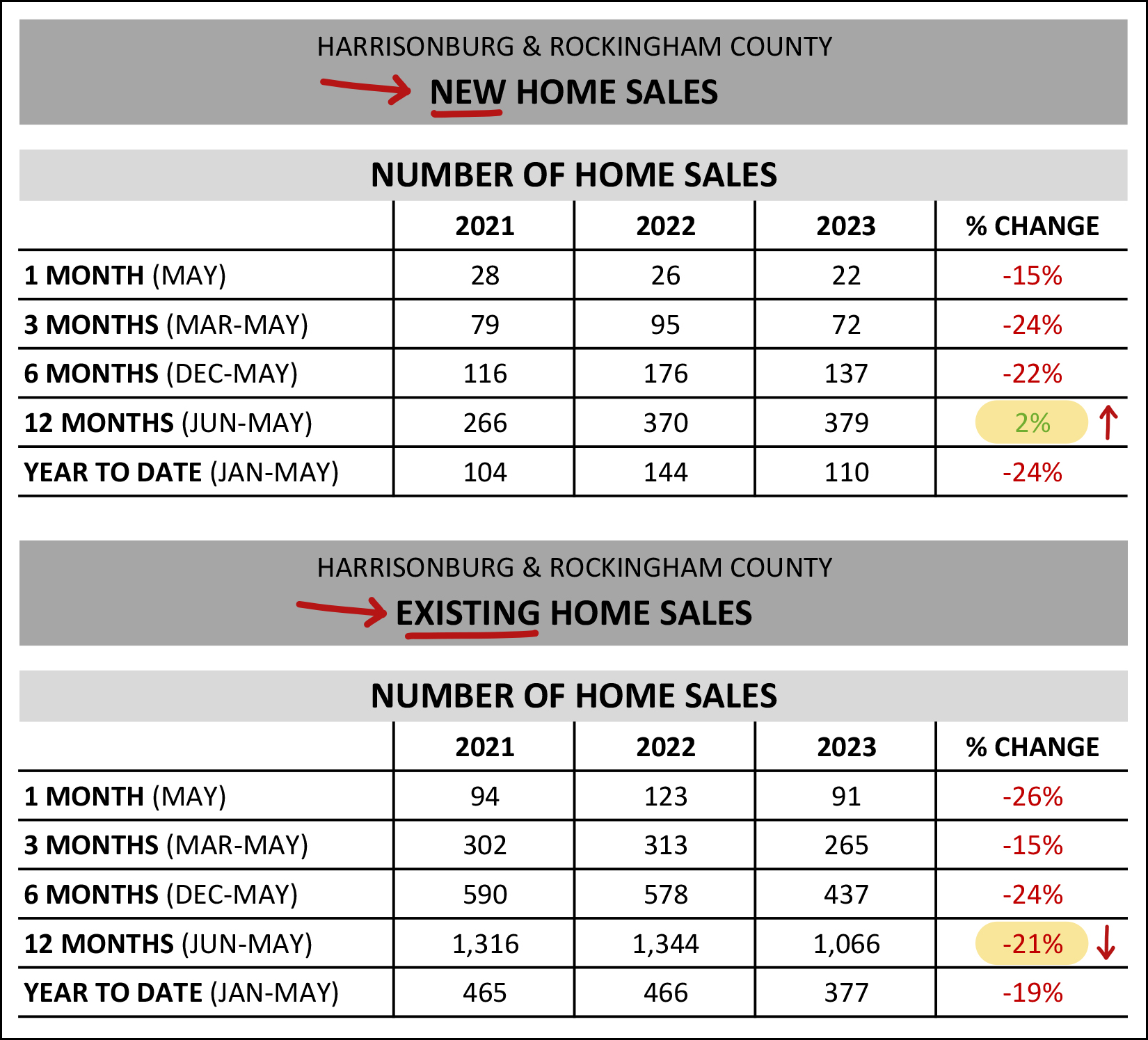

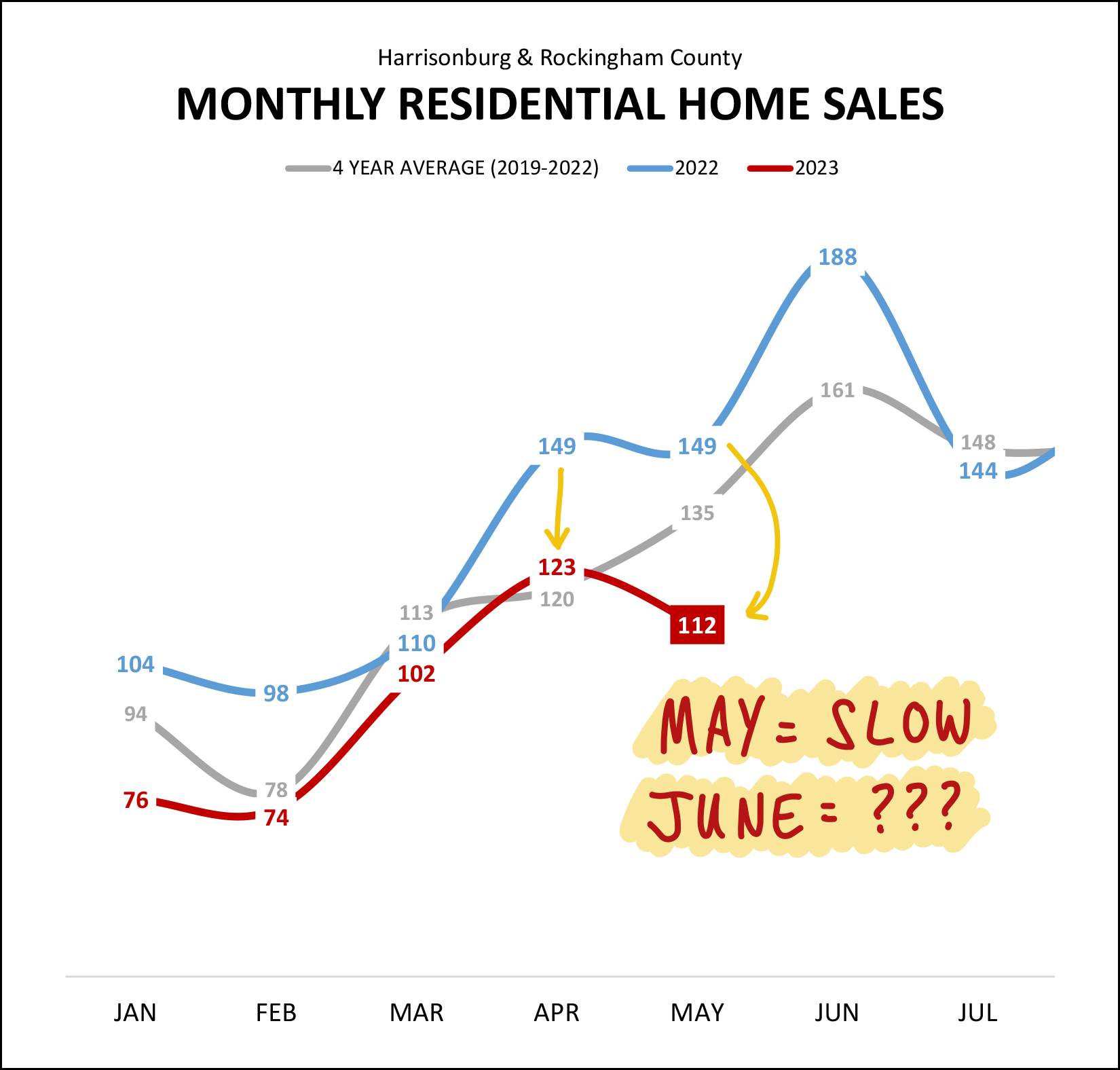

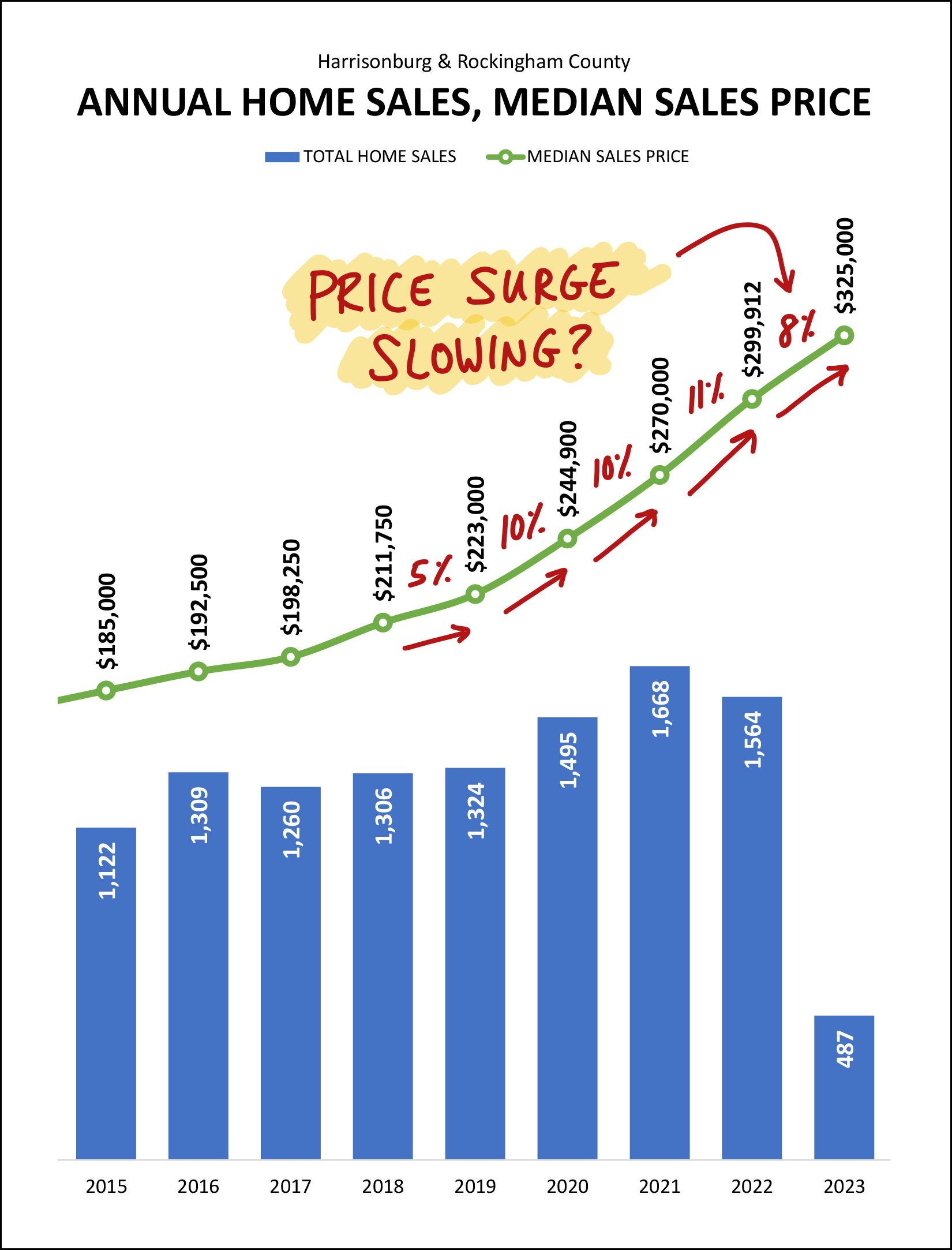

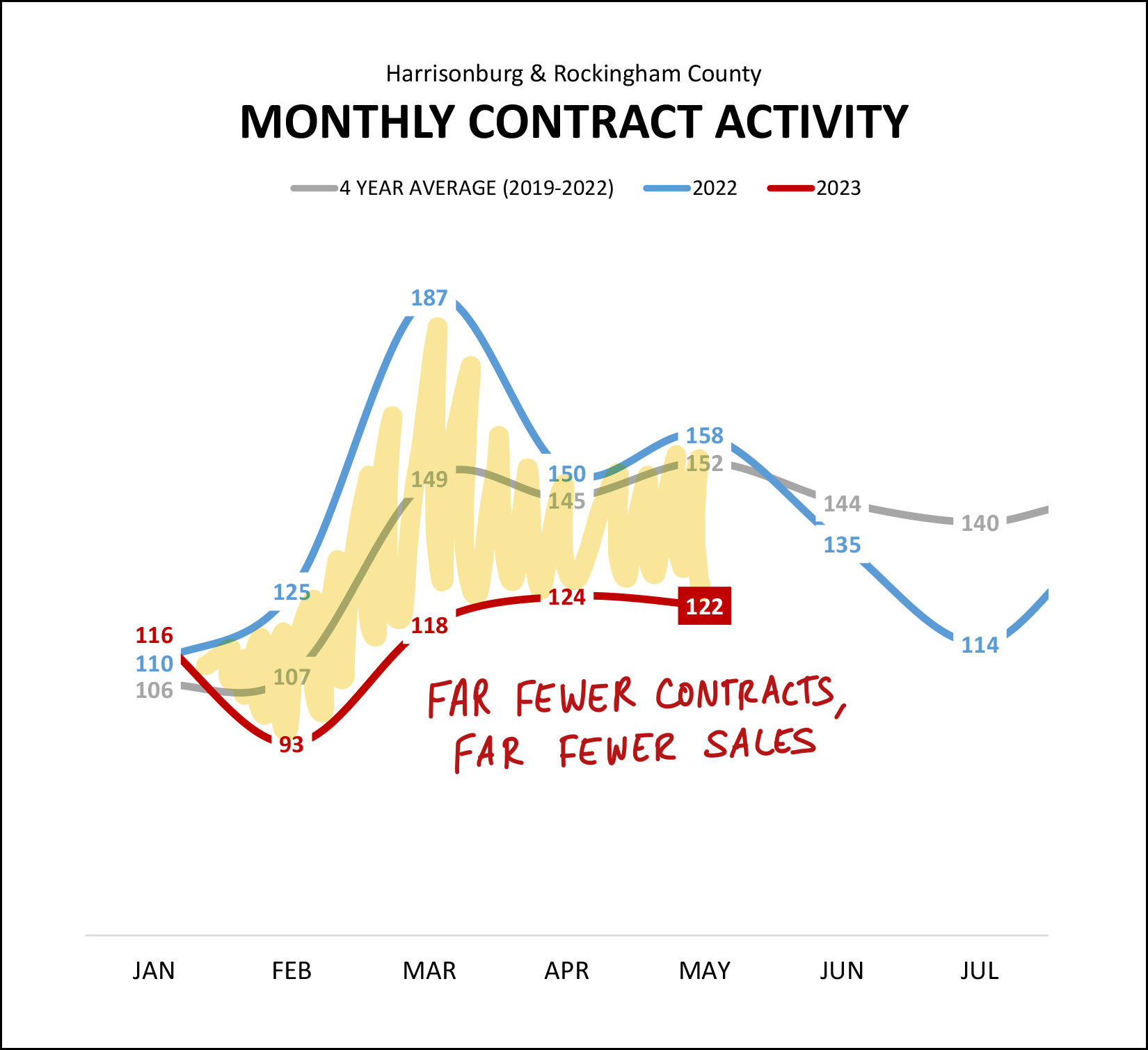

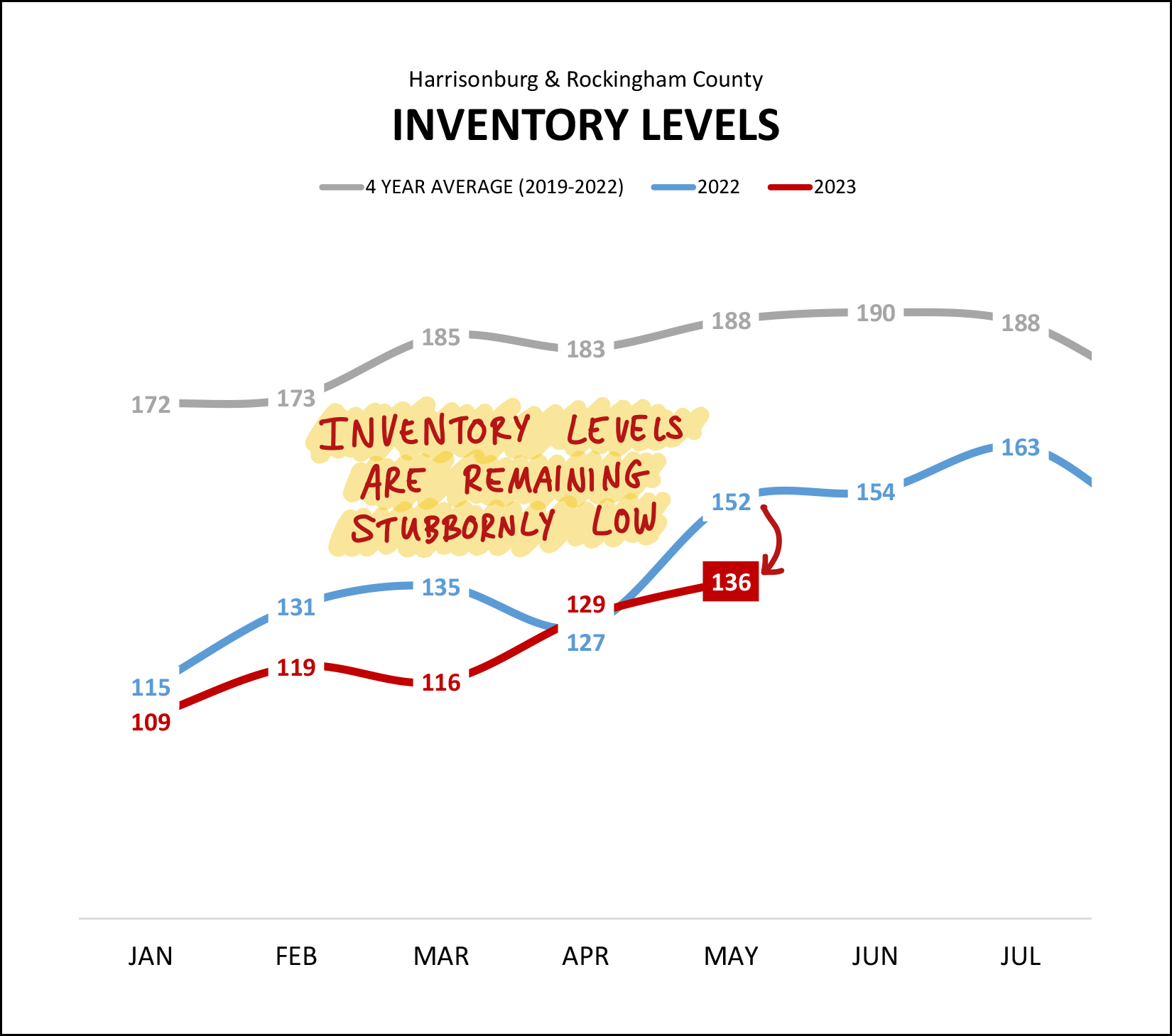

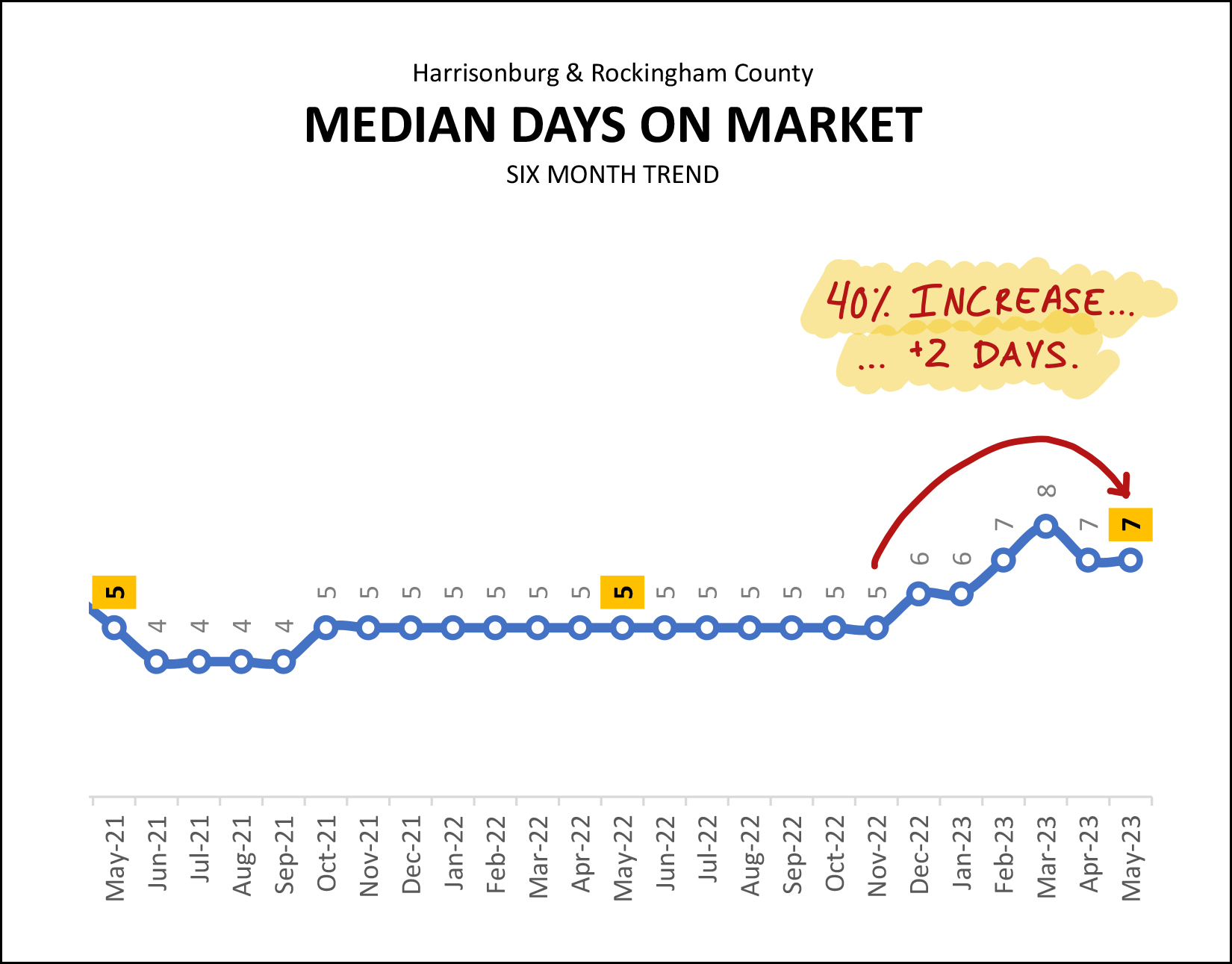

Happy Monday morning, friends! They say summer doesn't start until June 21st, but the 85 degree temps yesterday certainly felt like summer. Regardless of the formal start of the season of summer, most students have finished out their school year now, which also certainly makes it feel like summer. One such student who finished up his school year is this guy, below. Luke has now officially graduated from high school! :-) We are delighted for his accomplishment of this major milestone, and are excited for all that lies ahead. And yes, Emily also finished up 9th grade! These kids they sure do grow up quickly!  Looking for a new (to you) house this summer? Look no further than this brand new listing (just listed this morning) in the City of Harrisonburg... Find out more about this spacious four bedroom City home on a large lot by visiting 3121HorseshoeLane.com. And finally, one last item of business before we get into the real estate data. Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included The Little Grill, Cuban Burger and Taste of India. This super relaxing and family friendly music festival from June 23 - 25 at Natural Chimneys Park in Mt Solon features wonderful music (on multiple stages throughout the weekend), great food, lots of activities (hiking, biking, running, yoga, kids events), and all around great fun with family and friends. Have you considered going to Red Wing but haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 23rd through 25th. If you're interested in going to Red Wing but don't have tickets... I'm giving away a pair of three-day general admission tickets. Click here to enter to win the tickets... I'll pick a winner later this week. Now, on to the real estate data...  As mentioned in the headline, and as shown above, we're seeing far fewer home sales this year than last... [1] This past May (last month) we saw 112 home sales in Harrisonburg and Rockingham County, which marks a 25% decline from last May. [2] When looking at the first five months of this year, there has been a 20% decline in home sales compared to last year during the same (Jan-May) timeframe. [3] When looking at a full year of data (June - May) the number of homes selling in our area has declined 16%. A year ago we were seeing an annual pace of 1,714 home sales... and that metric has now declined to an annual pace of 1,445 home sales! But... fewer home sales has not resulted in lower sales prices...  As home sales have started to decline, some folks speculated that prices would also start to decline. That hasn't been the case, and I believe it's because the decline in sales is a supply side issue, not a demand side issue. There seem to be plenty of buyers still wanting to buy... but fewer sellers willing to sell. We need both a buyer and seller in order for a home sale to happen... so fewer sellers results in fewer home sales... but the continued ready supply of buyers is keeping competition fierce for most new listings, which is causing home prices to keep on rising. As shown above, the median sales price thus far in 2023 ($325,000) is 9% higher than it was a year ago ($298,400) and when we look at 12 months of data (June - May) we also see a 9% increase in the median sales price over the past year. I should point out that each month I prepare many more charges and graphs than make it into this report. You can also view those over at HarrisonburgHousingMarket.com including this month's charts and graphs here. One of the data subsets I dive into in the extra charts and graphs at the link above is the breakdown of new home sales vs. existing home sales...  As shown above, when we look at the past 12 months we see slightly different trajectories when it comes to new vs. resale homes... [1] There have been 2% more new home sales over the past 12 months as compared to the previous 12 months. [2] There have been 21% fewer existing home sales over the past 12 months as compared to the previous 12 months. Certainly, when we look at other timeframes above, we see declines in sales activity of both new and existing home sales, but it's worth nothing that a significant cause of fewer home sales in our market... is a lower number of homeowners who are willing to sell their existing (resale) homes. Why, might you ask? Mortgage interest rates are likely a key piece of the puzzle. Most homeowners have current mortgage interest rates under 5%, and many under 4%... compared to current mortgage interest rates that are above 6%. As such, the difference in mortgage payments is quite significant for a homeowner who would sell their home and pay off a mortgage with an interest rate under 4% (for example) to then take out a mortgage with an interest rate above 6%. I expect we will continue to see lower numbers of homeowners willing to sell their homes throughout the remainder of 2023. Getting into some visuals now, here's how slow May was...  After a 17% decline in April home sales (149 to 123) we then saw a 25% decline in May sales (149 to 112) which is almost certainly going to result in an even larger decline in June home sales... since there were a LOT of sales in June last year. As I have already mentioned, sales prices keep on climbing, so a decline in the number of homes selling isn't really a concern for home sellers, or homeowners, but it is not as exciting of news for would-be home buyers. We are likely to continue to see fewer home sales throughout the remainder of 2023 in Harrisonburg and Rockingham County... and it will be a result of fewer homeowners being willing to sell... not a result of fewer would be home buyers being interested in buying. Here's another visual of the general trends we're seeing in our local housing market right now...  We're still seeing a general increase in the number of homes selling per year if we compared pre-pandemic (early 2020 and prior) and post-pandemic (2023) but we've seen a steady decline in annual home sales over the past year, from 1,714 sales/year to 1,445 sales/year. So, after a steady increase in home sales during the pandemic (largely brought on by the pandemic - with super low mortgage interest rates and everybody needing their home to serve more functions than before) we have now seen a steady decrease in home sales as the pandemic has come to a close. We're returning to where we were pre-pandemic as far as how many homes are selling a year... with the home sales trendline being dragged down by a limited number of home sellers being willing to sell. There seem to still be plenty of buyers ready and willing and able to buy. With continued high levels of demand, but lower levels of supply, we have continued to see steady increases in sales prices as shown by the top line. That trendline (rising prices) seems unlikely to change course significantly anytime in the near future. But even if we aren't likely to see home prices stop rising, or to see them decline, perhaps we'll see a slight tapering off of the surge in sales prices?  In the last full year before the pandemic (2019) we saw a 5% increase in the median sales price in Harrisonburg and Rockingham County. Then, we saw three years of double digit increases in the median sales price with a 10%, 10% and 11% increase in 2020, 2021 and 2022. Thus far in 2023, we are seeing a slightly smaller increase in that median sales price, with an 8% increase through the end of May. Of note... sales prices are not declining... they are just increasing slightly more slowly than they have over the past three years. Stay tuned to see how this metric does or does not continue to change as we move through the next few months. Looking ahead, though, contract activity is our best indication of what we are likely to see in the way of closed home sales over the next few months...  As you can see, we have now closed out the fourth month in a row of significantly lower levels of contract activity in Harrisonburg and Rockingham County. The red line is measuring contracts signed per month this year, and the blue line shows the same months last year. As such, we are likely to continue to see lower levels of closed sales over the next few months, given lower numbers of contracts being signed. And finally, here's a visual of the supply side of the market...  Despite 20% fewer home sales this year... inventory levels are lower than they were a year ago. The red line above shows inventory levels this year, compared to last year in blue. If we were seeing a shift in the market, with demand softening, we would start to see inventory levels increasing. We're just not seeing that. As such, the 20% decline in home sales seems almost certainly to be a result of an insufficient number of homes being available for buyers to buy. Now, for all the stats folks out there, here's the statistic that could be the most misleading...  We have seen a 40% increase in the time it takes for a house to go under contract in Harrisonburg and Rockingham County! Gasp! Oh my! But wait... that just means that it is taking seven days for a house to go under contract... instead of five days? Yes, that is correct. The 40% increase in the median days on market is an increase from five to seven days. Ask just about any would-be buyer and they will report that this doesn't measurably change how quickly they need to act on seeing and pursuing new listings. And another interesting phenomenon in our current market, mortgage interest rates...  Despite fewer homes selling... sales prices keep rising. Despite higher mortgage interest rates... sales prices keep rising. Two years ago the average mortgage interest rate was around 3%. A year ago that had risen to 5%. Now, it is bouncing around between 6% and 7%. And yet, buyers keep buying, and they are paying ever higher prices for the homes they are purchasing. As you can imagine, that means that mortgage payments are higher than ever for today's home buyers -- as a result of both higher sales prices and higher mortgage interest rates -- but these higher rates haven't seemed to have impacted buyer interest enough to then impact sales prices. So, given all of the data above, what does this mean for you? If you are planning to sell... you'll likely still have plenty of interest from buyers, you're likely to sell at a very favorable price, and your home is still likely to be under contract within a week. If you are hoping to buy... you'll need to see homes quickly when they come on the market, you will still have stiff competition from other buyers, and you should talk to a lender to understand mortgage payments based on current mortgage interest rates. If you own a home and aren't planning to sell... lucky you. Home values keep on increasing, and you likely have a low or low-ish mortgage interest rate. I hope this overview of the latest trends in our local housing market has been informative and helpful, especially if you are gearing up to buy or sell soon. Feel free to reach out to me if I can be of any assistance to you as you make those plans. You can reach me most easily at 540-578-0102 (call/text) or by email here. Until next month, I hope you enjoy the start to summer, and perhaps I'll see you at Red Wing! | |

It Can Be Frustrating To Try To Buy A Home Right Now, But Keep At It! |

|

Surely, homeownership isn't for everyone... [1] You might only know that you'll be living in the Harrisonburg area for a year or two, and thus it might not make sense to buy. [2] Your overall financial picture might not be stable enough right now, or yet, for it to make sense to buy a home. [3] You might not be ready to take on the long term commitment to the ongoing costs of homeownership such as replacing a heat pump, a roof, etc. But... there are seem to be plenty of people locally who are not currently homeowners, but who are ready to own a home... [1] They know (or are very confident) that they'll be in this area for 5+ or 7+ years. [2] Their finances are stable and they have funds saved up for a downpayment and closing costs. [3] They understand and are prepared for the ongoing costs of homeownership such as improving or replacing the systems or building components of a home over time. Plenty of these well prepared, would-be, homeowners have not been able to successfully secure a contract to buy a home over the past few years because of extremely high levels of buyer interest in buying in our local market - which often results in multiple buyers making offers on the same house within the first day or two that it is on the market. So, yes, it can be quite frustrating to try to buy a house right now. You might make offers on 2, 3, 4 or more houses and still not have a contract to buy a home. What should you do? Should you give up? Rent forever? If you match the description above (staying here, financially stable, prepared for home maintenance costs) I would encourage you to keep trying to buy a home. Eventually it will work out, and you will successful contract to buy a home and then you'll be able to start enjoying the many benefits of homeownership, including... [1] Mostly stable housing costs - with the principal and interest portion of your mortgage payment staying level, even if there are some increases in taxes and insurance over time. [2] An increase in the value of your home over time - maybe not every year, but certainly over the long-term. [3] The ability to make a house/property your own, improving or upgrading it to fit your specific needs and wants. [4] The tax benefit of paying mortgage interest. [5] Often longer-term relationships with neighbors which doesn't happen if you're bouncing around from one rental to the next. The list could go on, but I think you get it -- there are plenty of great reasons for many (but certainly not all) folks in our area to buy a home -- so even if you miss out on an offer or two, don't give up the hope yet! | |

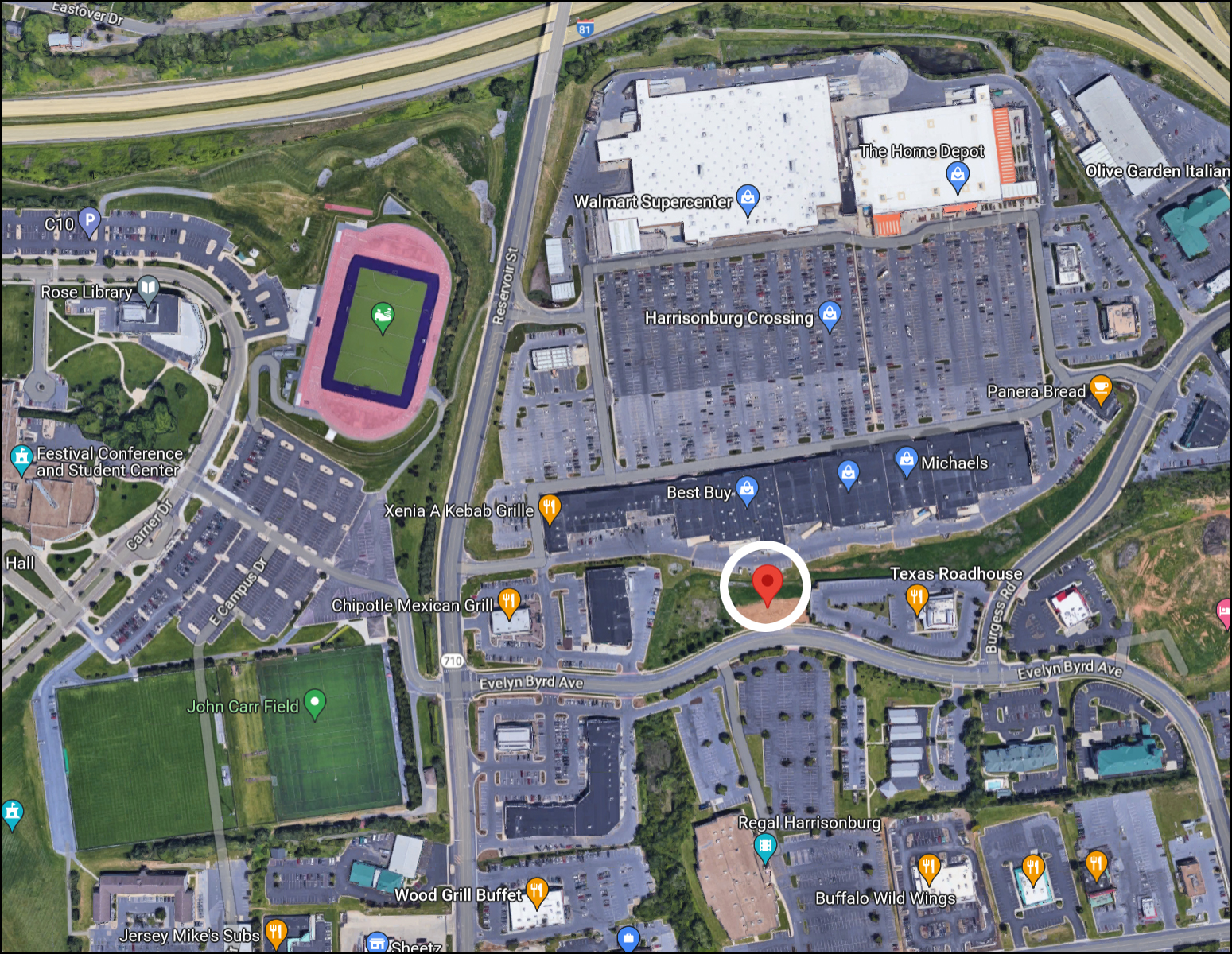

NERD Apartments LLC Proposes 20 Apartments In Five Story Building On Evelyn Byrd Avenue |

|

We may soon see the development of 20 apartments on Evelyn Byrd Avenue between Harrisonburg Crossing, Texas Roadhouse, Regal Cinema and Forbes Crossing. The developer is requesting a special use permit to allow multi-family dwellings and/or mixed use buildings in the B-2 district. A few details from the proposal include...

Read more in the proposal documents here. | |

An Early Look At May 2023 Home Sales In Harrisonburg And Rockingham County |

|

May is over! Gasp! It's June. Already! Here's a quick look at a few early indicators of trends in our local housing market in May 2023... May 2020 = 112 home sales May 2021 = 122 home sales May 2022 = 149 home sales May 2023 = 106 home sales So... unless quite a few more (6+) home sales are reported over the next few days as having been sold in May via the HRAR MLS, it seems May 2023 may have been the slowest (number of sales, not speed of sale) month of May in several years. Mortgage interest rates were also a bit higher this May than last, and much higher than two years ago... Early May 2021 = 2.96% Early May 2022 = 5.27% Early May 2023 = 6.39% And yet, despite fewer home sales and higher mortgage interest rates, home prices seem to keep on rising... Median Sales Price, Jan 2022 - May 2022 = $298,400 Median Sales Price, Jan 2023 - May 2023 = $325,000 Stay tuned for a fuller analysis of local market trends in about a week. | |

What Might The Rest Of 2023 Look Like In The Local Housing Market? |

|

Let's take some wild guesses here. Between June and December of 2023, what trends do I expect to see in the following areas... [1] Home Sales = no change (similar pace as early 2023) [2] Home Prices = increase [3] Mortgage Interest Rates = decrease (though likely not by much) [4] Inventory of Resale Homes = no change / decrease [5] Inventory of New Construction Homes = increase What about you? Would you predict anything wildly different? [1] Will mortgage rates drop significantly? [2] Will home prices stop rising? [3] Will inventory levels rise? | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings