Archive for July 2023

Home Buyers In Some Price Ranges Are Likely Competing With Would Be Buyers From A Year Ago |

|

Let's focus in on one particular segment of the home buying public... ...those relocating to the Harrisonburg area for employment. Plenty of folks relocated to our area in 2022 for a job and plenty are doing so in 2023. A year ago, in summer 2022, inventory levels were extremely low. Some or perhaps many of those buyers relocating to our area for work were not able to find a home to buy given those low inventory levels. What did they do as a result? They rented a home for a year to pursue buying a home from Harrisonburg now that they are living here. So now, those relocating to Harrisonburg this year for work are not only competing with other would be home buyers also relocating here for work this year but ALSO those would be home buyers that relocate here for work a year ago and have been renting ever since that time. And, perhaps this dynamic has been happening for a few years now, building up an ever larger critical mass of buyers competing for housing. Let's translate it into fictional numbers... 2020 100 would-be buyers relocate to Harrisonburg for work. 100 homes are available for purchase. 100 would-be buyers buy a home. Yay! 2021 100 would-be buyers relocate to Harrisonburg for work. 90 homes are listed for sale and 100 buyers fight over them. 90 buyers buy, 10 would-be buyers rent. Yay-ish 2022 100 would-be buyers relocate to Harrisonburg for work. 10 would-be buyers from 2021 still want to buy a home. 80 homes are listed for sale and 110 buyers fight over them. 80 buyers buy, 30 would-be buyers rent. 2023 100 would-be buyers relocate to Harrisonburg for work. 30 would-be buyers from 2021 and 2022 still want to buy a home. 70 homes are listed for sale and 130 buyers fight over them. 70 buyers buy, 60 would-be buyers rent. This one won't be pleasant... 2024 100 would-be buyers relocate to Harrisonburg for work. 60 would-be buyers from 2021-2023 still want to buy a home. 70 homes are listed for sale and 160 buyers fight over them. 70 buyers buy, 90 would-be buyers rent. I think you get the picture. If buyers keep relocating to the area for work (they will) but inventory levels (sellers willing to sell) continue to remain low -- only so many of those relocating buyers will be able to buy a home. Then, the next year's relocating buyers will be competing with an even larger pool of would-be buyers the following year. So, if you're relocating to the Harrisonburg area for work, great, welcome! If it feels like the competition for homes is rather fierce, you are not wrong... and it seems to be a problem a few years in the making. | |

Why Some Buyers Are Comfortable Paying More Than You Would Expect On Their Home |

|

"Did you see that new listing? It was just listed for $425,000. Looks like a great place. I'm sure there will be tons of interest and probably multiple offers. I can see someone paying up to $440,000 for that house!" "Wait... what!? That house just went to closing, and the buyer paid $465,000 for it. I mean... it was a great house, but $465,000? For that house?" Some buyers are comfortable paying more for their house than you might expect. Why!? [1] Real estate is, often or even most of the time, an appreciating asset. You're not paying more than anyone might expect on a depreciating asset, like a car. Even if you paid more than market value for your home, over time, that market value is likely to catch up to and surpass the price you paid. [2] Their home is not just a financial asset... it's a place that they live, spend time with their family and friends, often providing a sense of community with neighbors, and so much more. Paying more than one might expect for a financial asset alone is different than paying more than one might expect for a place to live and potentially spend most of your waking hours. [3] Especially over a longer time horizon, the purchase price becomes much less consequential. Let's say the house was really worth $440K and the homeowner stays in it for 15 years and prices increase a meager 2% per year. After those 15 years, the house is worth $592K. At that point, I don't think the homeowner (today's buyer) is overly worried about having paid $465K instead of $440K. Now, to be clear, I'm not saying that you should be willing to pay any price for any house, and that it is totally normal, fine, cool, acceptable or hip to pay more than market value. What I am saying is that some buyers are deciding they are willing to pay more than market value for a house in the current market - and I can understand some of the reasons why they choose to do so. | |

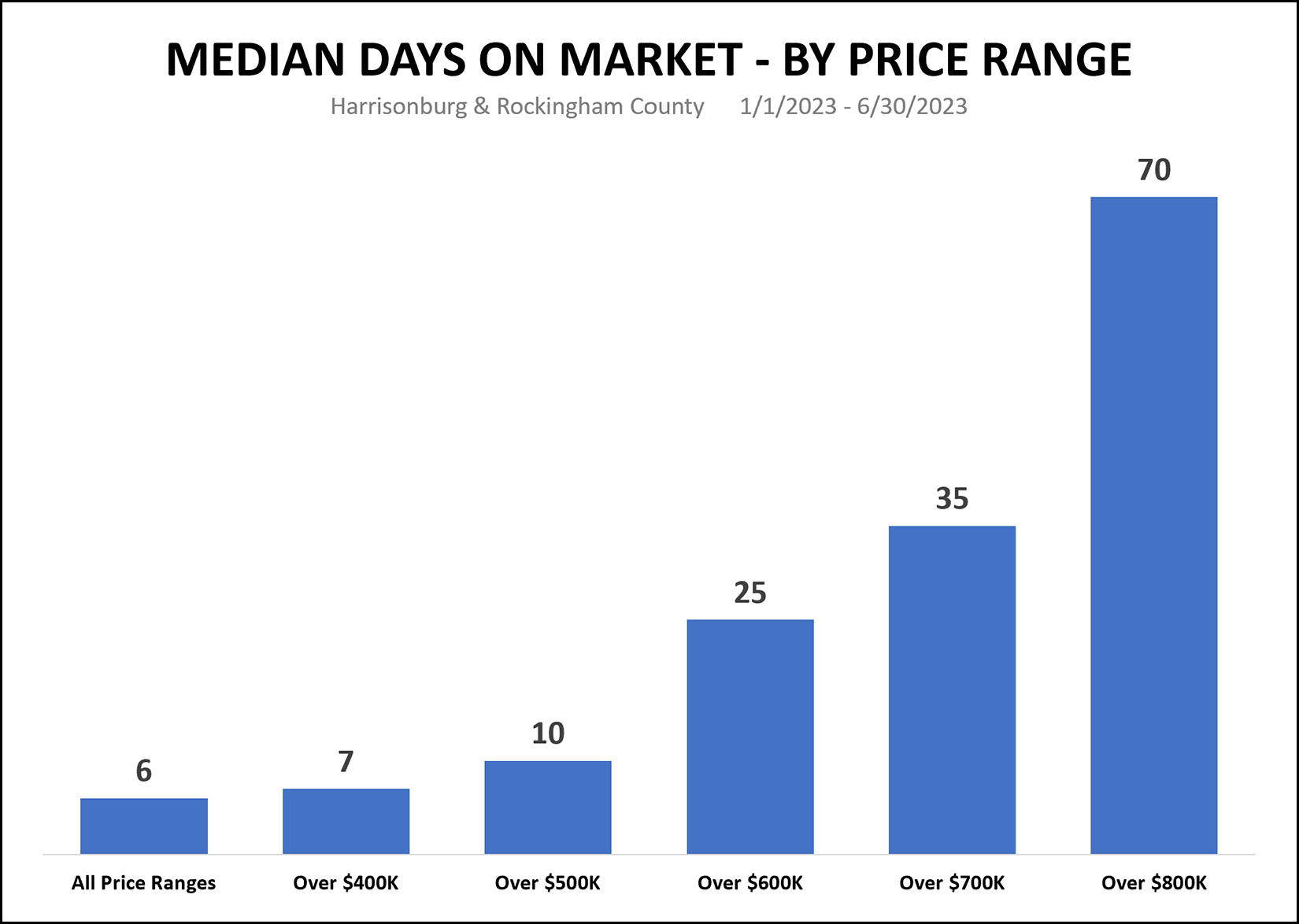

How Quickly Your Home Will Sell Might Depend On The Price Range |

|

The "Median Days On Market" in Harrisonburg and Rockingham County is six days... that is to say that half of homes go under contract in six or fewer days and half go under contract in six or more days. That is based on home sales in the first half of 2023. But... when we zoom into some different price ranges we start to see a slightly different story. The median Days On Market for homes over $500K is 10 days... ...for homes over $600K is 25 days... ...for homes over $700K is 35 days... ...and for homes over $800K is 70 days. So, yes, market-wide, the median Days on Market is six days... but that doesn't necessarily mean your home will go under contract in about six days... especially if it is in one of the upper price ranges for our area. | |

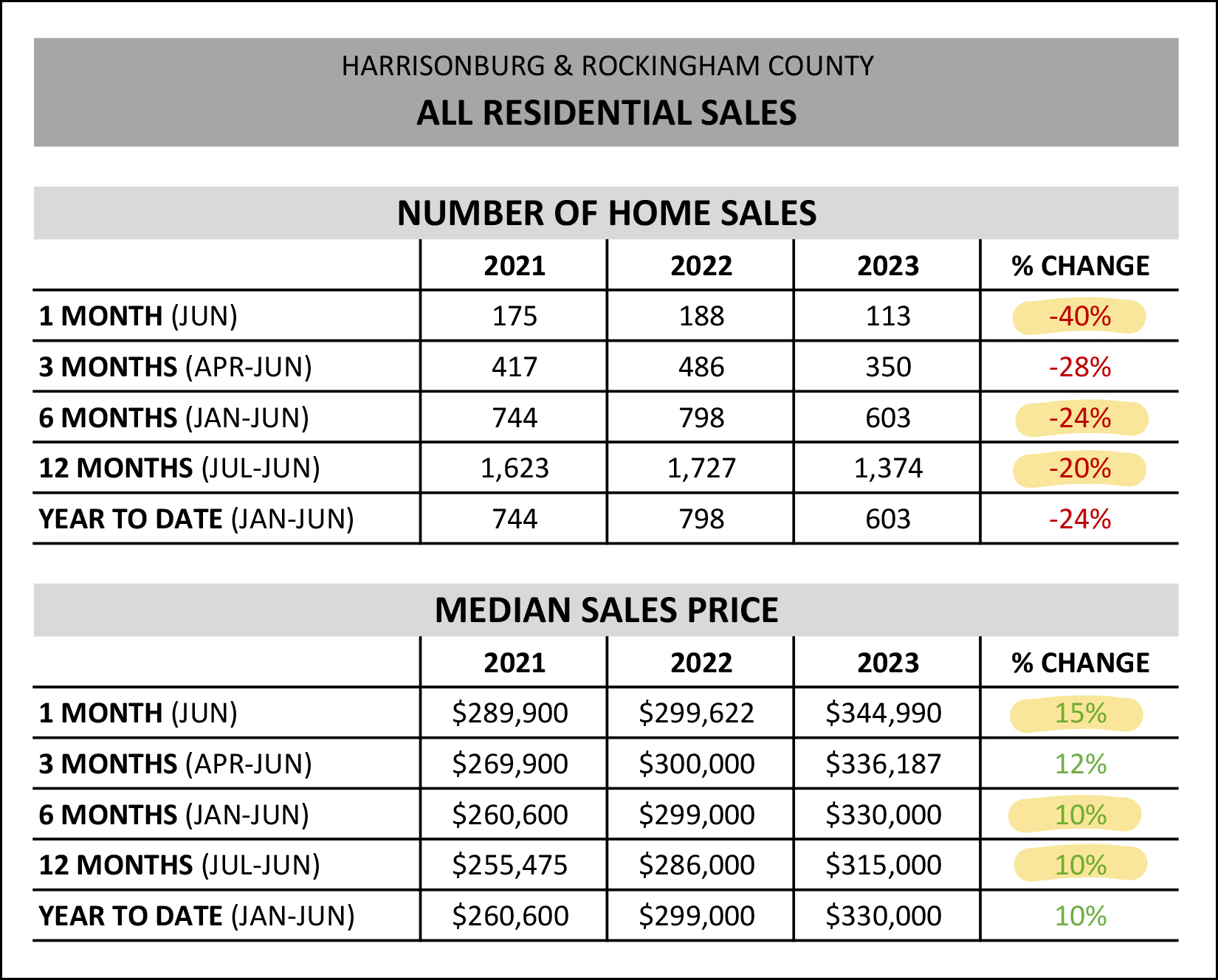

Far Fewer Homes Are Selling, But Sales Prices Keep Rising |

|

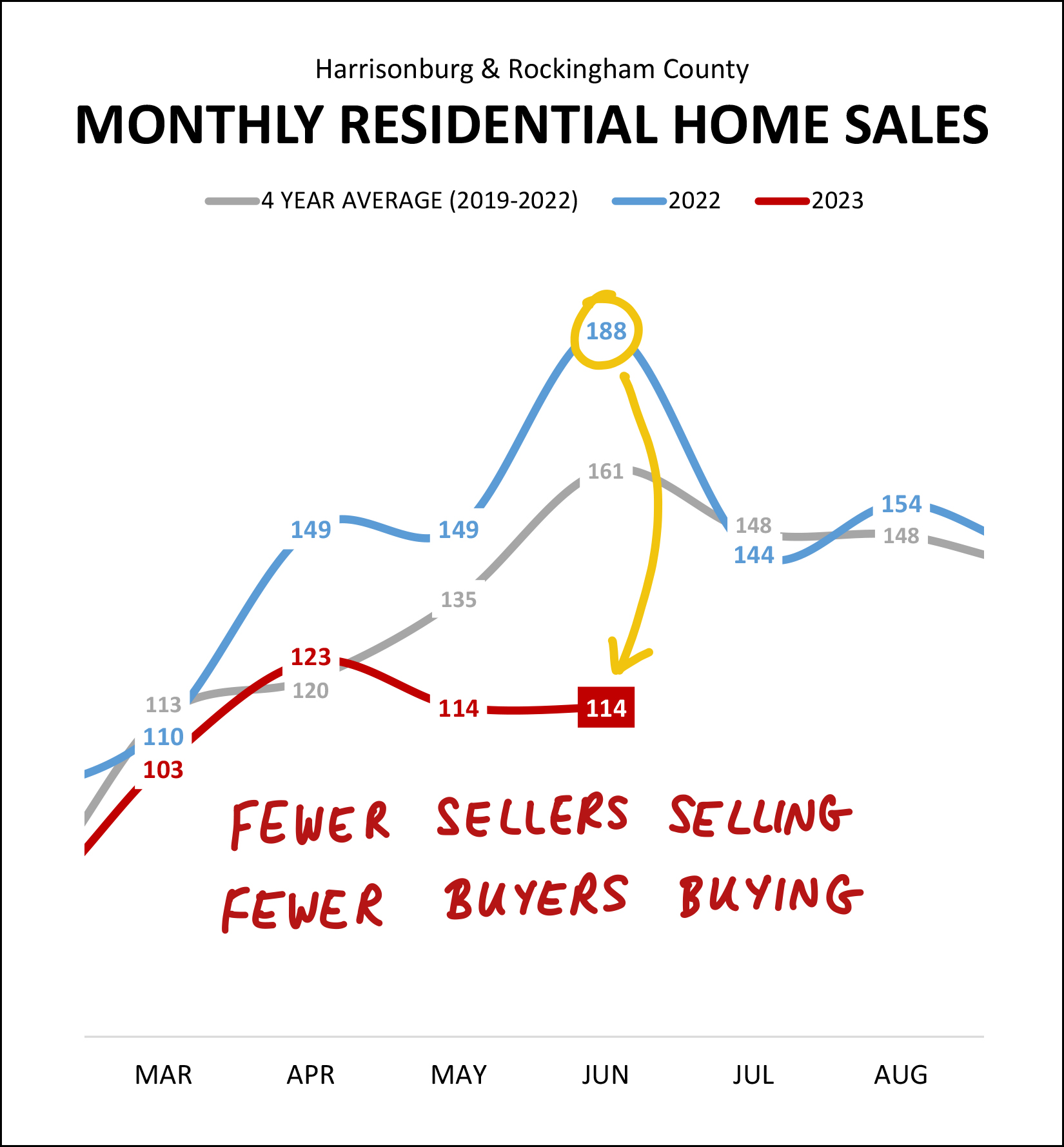

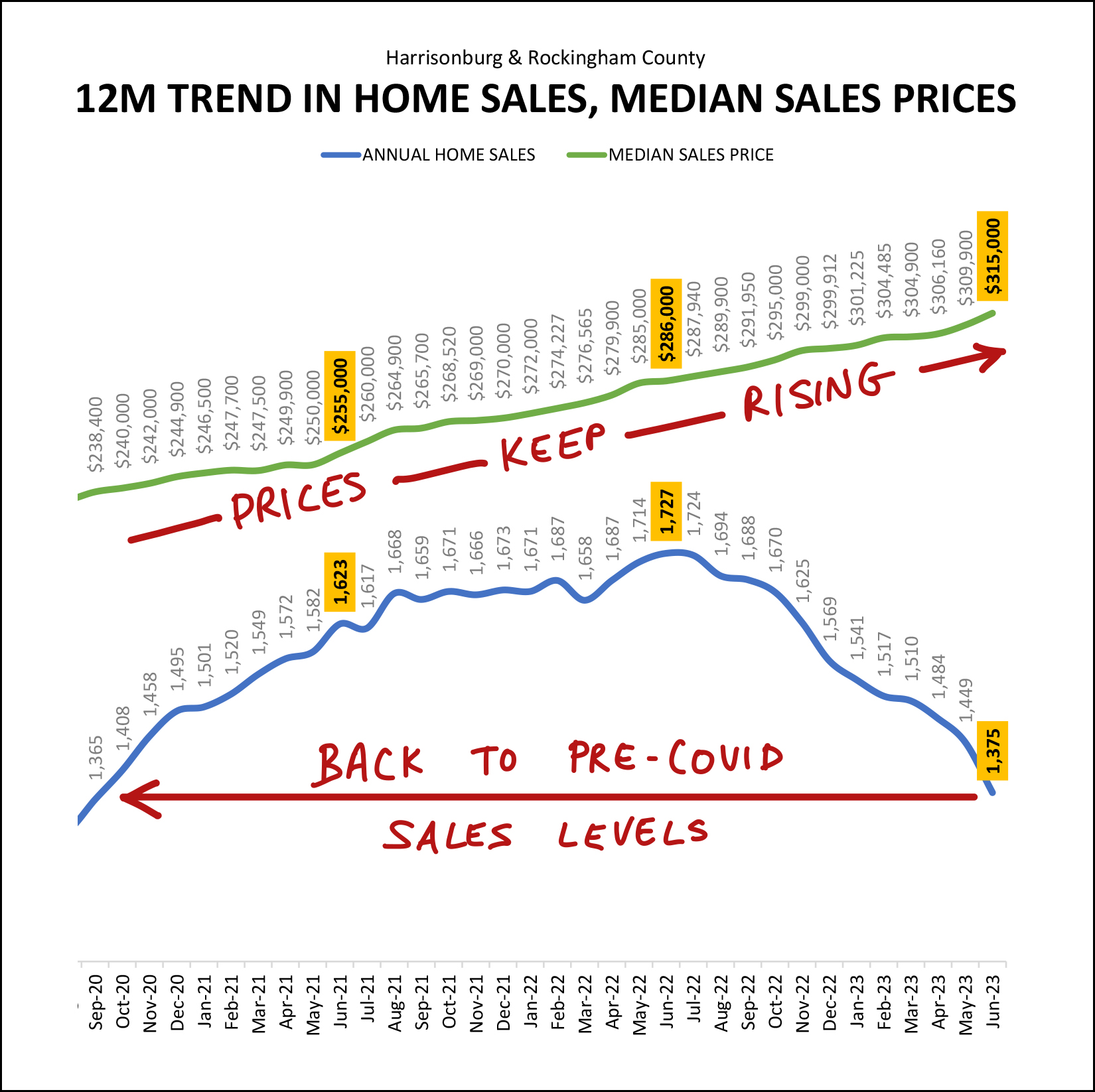

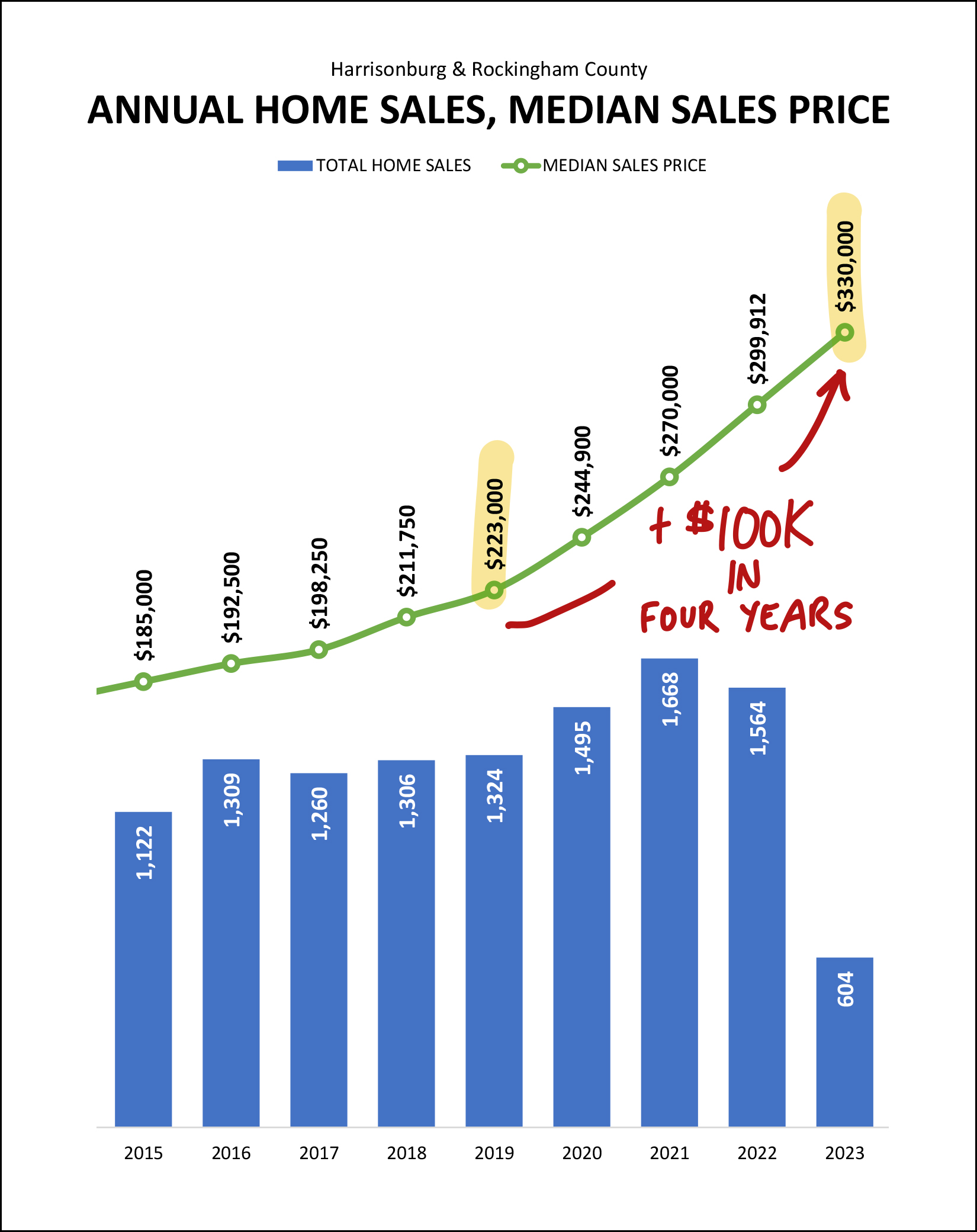

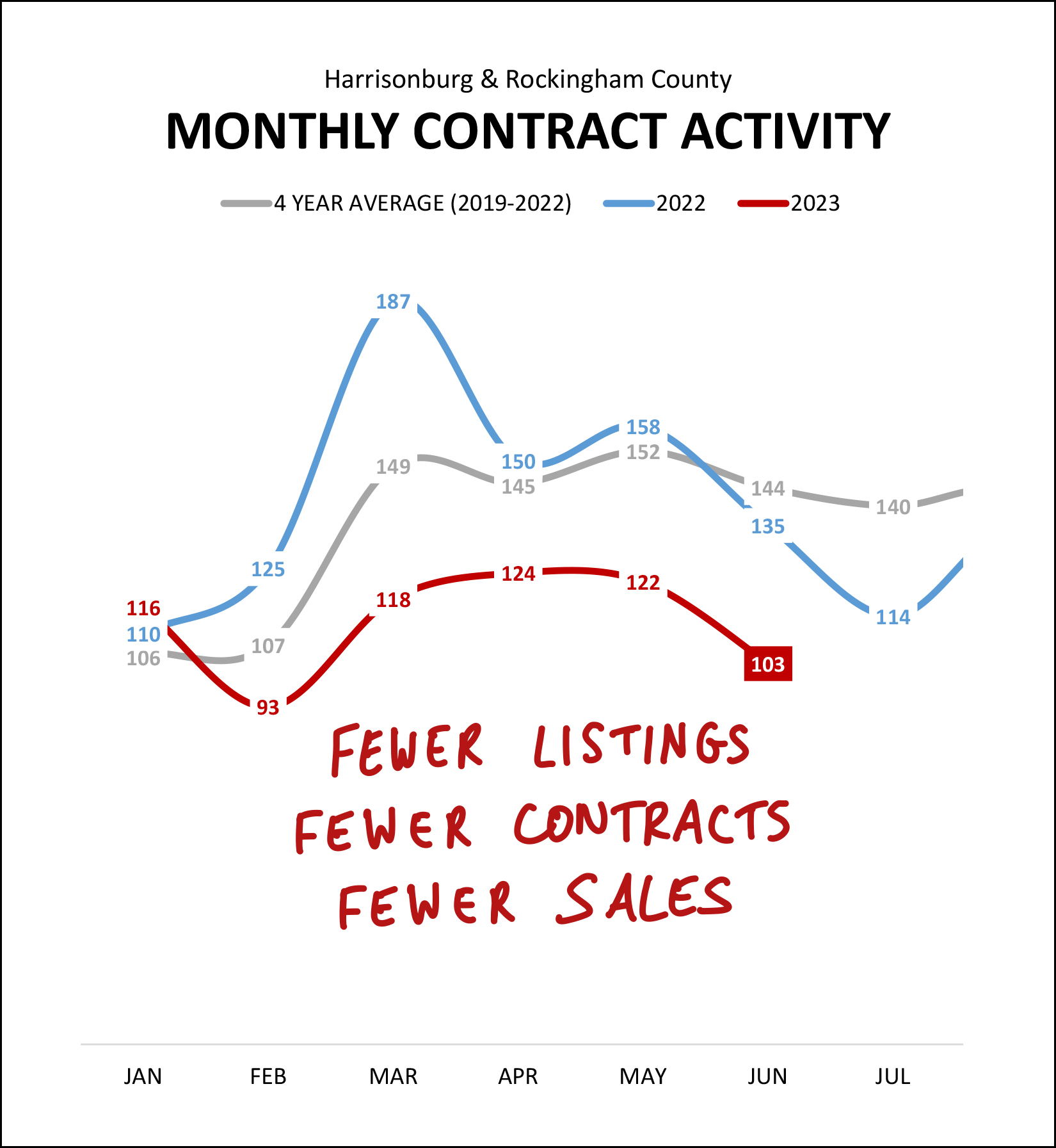

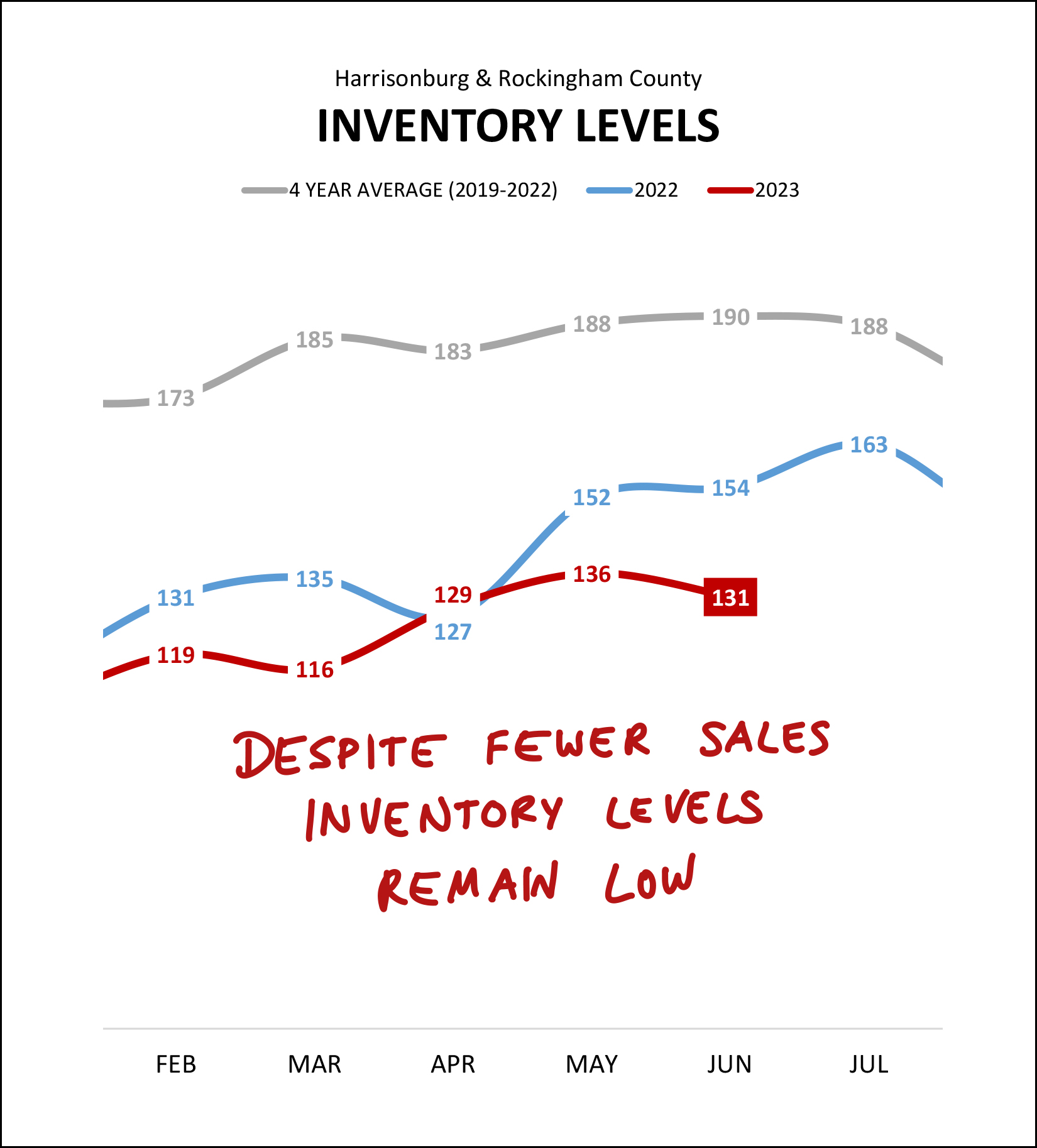

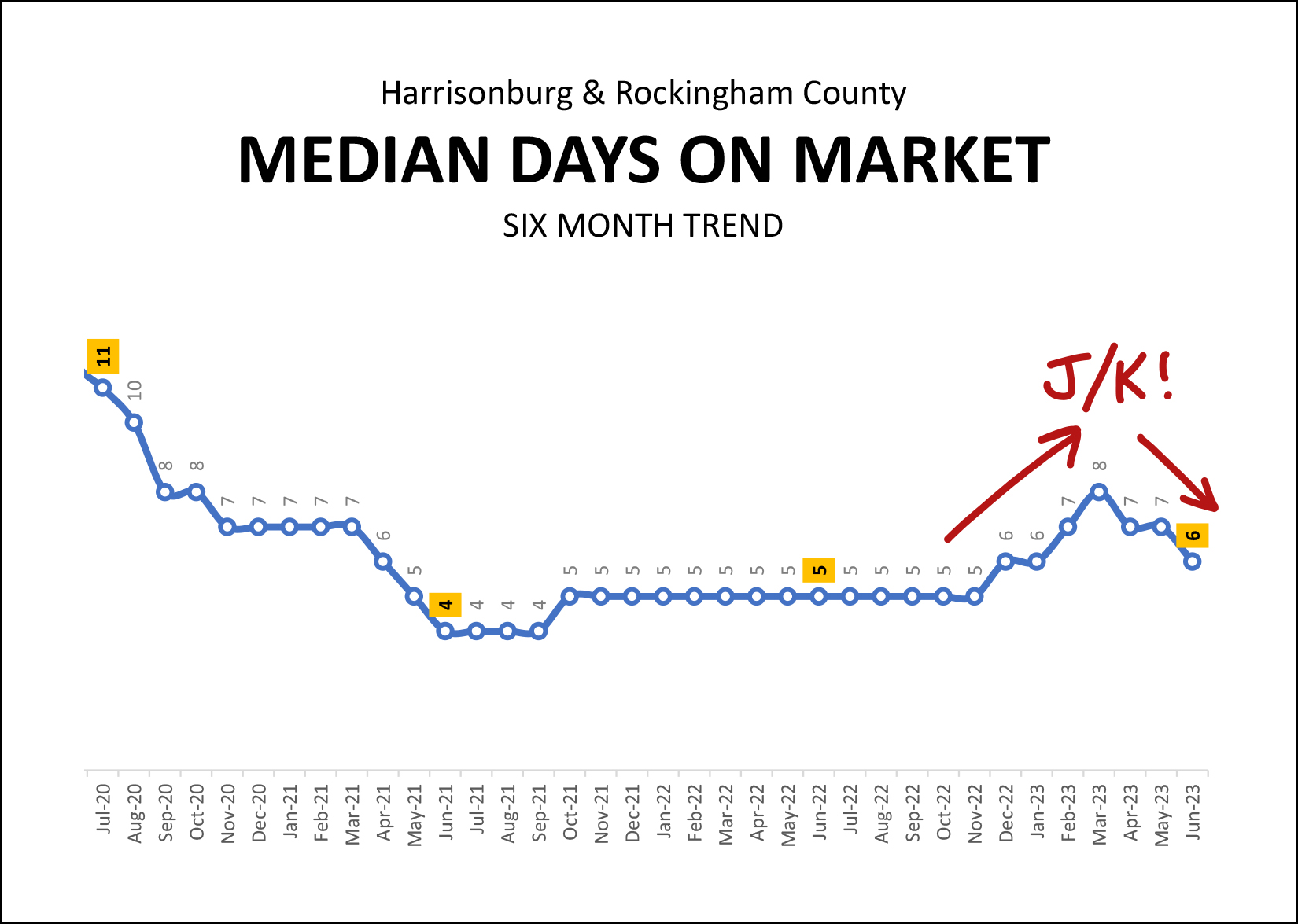

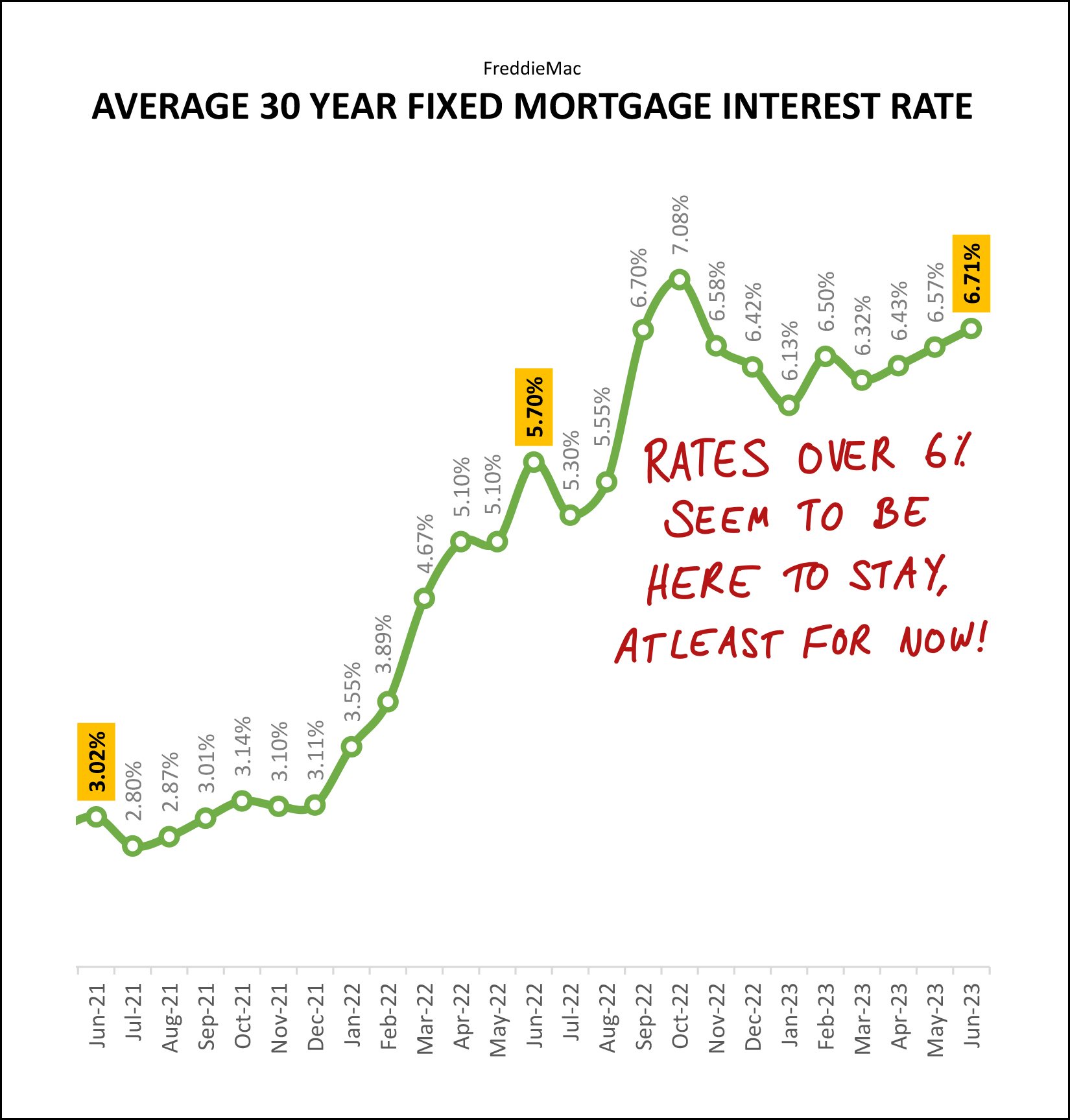

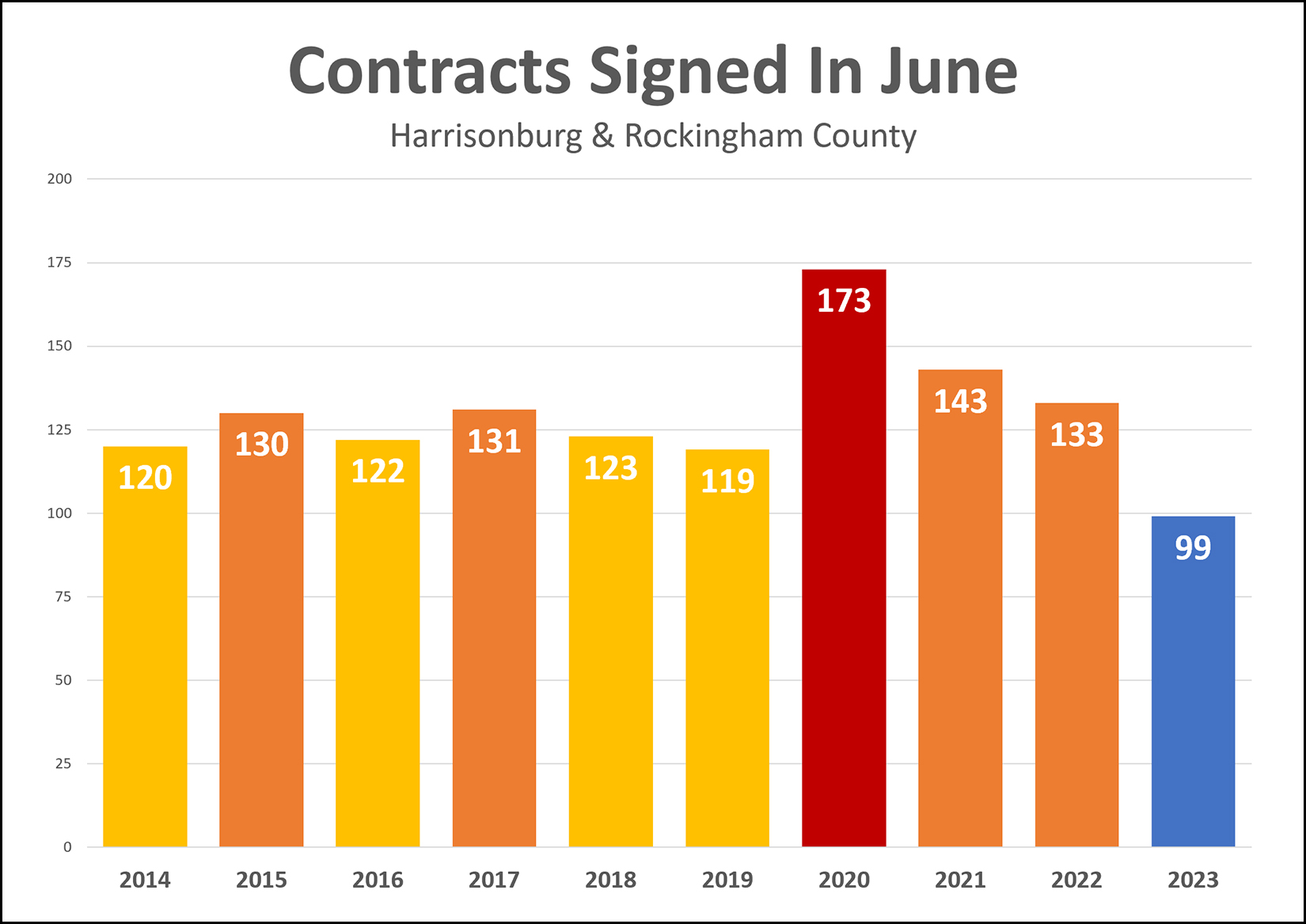

Happy Friday Morning, Friends! As per the headline above, far fewer homes are selling this year, but sales prices keep rising. But before we dive into it... First, if you're looking for a spacious four bedroom home in a neighborhood in the Spotswood High School district, be sure to check out 350 Confederacy Drive... This beautiful, well maintained house in Battlefield Estates has had many updates over the past few years and is currently listed for sale. Find out more at 350ConfederacyDrive.com. Second, I hope you have had a fun first half to your summer. The weeks are flying by and before you know it, we'll be thinking about and planning for the coming school year. I was out of town for a few days last week for some fun on the water...  I have always loved water skiing but in recent years I have become the boat driver so it was great to have Luke drive this year so I could ski again. It was a fun and relaxing time away with family, and I hope you find time to have fun this summer as well... whether at the lake, at the beach, or right here in the beautiful Shenandoah Valley. Third, and finally before we get to the market data, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Red Wing Roots tickets, The Little Grill, and Cuban Burger. This month I am giving away a $50 gift certificate to Jimmy Madison's... located in downtown Harrisonburg. If you find me at Jimmy Madison's, I'll be enjoying one of many favorite items from their fantastic menu... but always with a side of their delicious Jimmy Sprouts -- Caramelized Brussels Sprouts with sweet pecans, candied bacon and honey thyme vinaigrette. I'm getting hungry just talking about them! Click here to enter to win the $50 gift certificate to Jimmy Madison's. Now, on to the data...  As shown above... [1] There were only 113 home sales in June 2023, which was a 40% decline from last June. We'll see this visually in a graph in a bit. [2] We've seen 603 home sales in the first half of the year which is a 24% decline from the first half of last year. This is the "far fewer homes are selling" part of my market report. [3] If we stretch back a full year (12 months) we will find 1,374 home sales -- a 20% decline from the 1,727 home sales seen in the 12 months before that. So, regardless of how you slice or dice the data, fewer homes are selling in Harrisonburg and Rockingham County this year than last. But... [4] The median sales price in June 2023 ($344,990) was 15% higher than last year when it was $299,622. [5] The median sales price in the first half of 2023 ($330,000) was 10% higher than the first half of 2022 when it was $299,000. [6] The median sales price over the past 12 months ($315,000) was 10% higher than in the in the 12 months before that when it was $286,000. As such, regardless of how you look at it, the median sales price is still on the rise in Harrisonburg and Rockingham County, despite far fewer homes selling. Here's a visual of the drop off in the number of homes selling...  The blue line above shows the number of homes selling per month last year -- compared to the red line which shows this year's home sales. As is quite evident, the number of homes selling has been far lower this year than last, particularly over the past few months -- April, May and June. The grey line above shows the average number of home sales per month based on the past four years (2019-2022) of data. When looking at all three lines together it becomes clear that home sales last year were significantly above historical averages and home sales this year are now (particularly in May and June) significantly below historical averages. As I'll continue to discuss throughout this report... this decline in the number of homes selling is (perhaps obviously) both a result of fewer sellers selling and fewer buyers buying. We need both a seller and a buyer for a home sale to take place. As we'll see in later graphs, inventory levels remain low -- so it seems likely that the main constraint on home sales is the number of sellers selling... not a limit on the number of buyers who would like to buy. But before we get to inventory levels, let's look at a slightly longer historical perspective...  The blue line above shows the number of home sales per year, updated each month. This snapshot looks back to late 2020 (in the thick of Covid) when home sales were surging upwards, from 1,365 annual sales all the way up to 1,727 annual sales. But over the past year we have seen annual sales steadily drop... all the way back down to 1,375 sales per year... about the same place as where we were in the early months of the pandemic. If the pandemic (and low mortgage interest rates, and lots of people working from home) drove the number of annual home sales up over the course of two years... it was immediately followed by much higher mortgage interest rates driving the number of annual home sales down over the course of the most recent year. When the number of home sales in our market was surging in 2020, 2021 and 2022 it certainly made sense that home prices were rising steadily, as shown in the green line above. But over the past year, even as the number of homes selling has declined, and even with higher mortgage interest rates, we have continued to see home prices keep on rising. This (ever higher prices) is an indication (along with continued low inventory levels) that the limitation of the number of homes selling is almost certainly primarily a supply side issue -- not enough sellers being willing to sell. To put rising home prices in context... take a look at this change in the median sales price in our local market over the past four years...  The median sales price in Harrisonburg and Rockingham County has increased by more than $100,000 over the past four years. Wow! Four years ago your purchase of a median priced home would have had you spending $223,000 -- and today you'd be spending $330,000. This is certainly wonderful news if you have owned a home over the past four years -- or if you bought a home four years ago -- and less exciting news if you do not own a home and/or have been trying to buy a home for any or all of the past four years. It is important to note that these figures are not adjusted for inflation. I'll take a look at that separately, hopefully soon, as we have seen significant changes in what a dollar buys you over the past few years -- not just with houses, but across the majority of the economy. As should come as no surprise, the precursor to fewer home sales is... fewer contracts being signed...  As to the point I made earlier, the blue line above (last year's monthly contracts) was certainly above the historical average (grey line) but this year's trajectory of monthly contracts (red line) is well (well!) below historical averages. Looking ahead to home sales for the rest of the summer and into fall, we are likely to see continued to declines in home sales based on continued low levels of contracts being signed. As mentioned previously, one of the main reasons why we are seeing fewer home selling... is because there are fewer sellers selling...  Over the past four years (grey line above) we have seen an average of 180 to 190 homes for sale as we have rolled through March, April, May and June. This year (red line above) we have seen between 116 and 136 homes for sale during those same months. Inventory levels are remaining low despite far fewer home sales. This is the data point (alongside continued increases in the median sales price) that seems to rather clearly confirm that the decline in home sales is almost entirely related to fewer sellers selling -- and not fewer buyers wanting to buy. Across many (though not all) price ranges and property types, home buyers keep snatching up most new listings that come on the market -- which is keeping inventory levels quite low. How quickly are those new listings getting snatched up, you might ask? That is most readily measured via the "days on market" metric...  The graph above tracks the median "days on market" metric -- looking at six months of data at a time. As such, the most recent data point of a median of six days on the market is based on January 2023 through June 2023 home sales. After dropping, dropping, dropping to a median of only four days on the market in mid-2021, we saw a steady report of a median of five days on the market all the way through the end of 2022. But then, it seemed that things might be changing as the median days on market crept up to eight days on the market in early 2023. But... maybe not, after all... as median days on market has shifted back down to only six days over the past few months. If we ever see a significant shift in market balance -- with more sellers trying to sell than there are buyers to buy -- we are likely see that reflected in this median days on market metric. As is likely evident from the graph above, we're not seeing that type of market shift right now, despite far fewer homes selling this year than last. Finally, how about those mortgage interest rates. :-/  Please only looking briefly (and wistfully) at that 3.02% rate from two years ago... and then focus more on the past year. We have seen relatively volatile mortgage interest rates over the past year -- starting at 5.7%, ending at 6.7%, drifting as high as 7.1% and as low as 6.1%. It seems likely that we will continue to see mortgage interest rates over 6% for the balance of 2023... though home buyers would certainly love to see that be closer to the 6.31% seen in January rather than the 6.7% at the end of June or the 6.96% seen this week. Having sifted through all of the data above, what does it all mean for current home sellers and would be home buyers? Home sellers are likely to still do quite well in the current market, as the median sales price keeps rising and inventory levels (your competition) remain quite low. Home buyers are likely to continue to have difficulty securing a contract on a home as we move through 2023 due to fewer sellers selling, homes still going under contract very quickly, and likely competition from other buyers for many new listings. If you are planning to sell your home, or buy a home, in the coming months I would be happy to chat with you about how your segment of the local housing market (based on location property type and/or price) is performing as it compares to the overall market. Feel free to reach out to me if I can be of any assistance to you as you make plans to buy or sell. You can reach me most easily at 540-578-0102 (call/text) or by email here. Until next month, I hope you find some time to disconnect and enjoy the summer season with your family, friends and loved ones... and if you need me to drive the boat while you water ski... just let me know... ;-) | |

Do We Care How Many Homes Are Selling, Or More About Their Sales Prices? |

|

Each month I publish a comprehensive report on our local housing market. A few years back, after I published a report showing that sales had risen by _% and prices had risen by _%, one of my past clients shared an interesting perspective. He said, I don't care if there are 20% more home sales, or 20% fewer home sales this year... what I care about is the prices that were paid for those homes! I get his point. If home values rose 3% per year over a 10 year period, would you, as an individual homeowner, care if the number of homes selling for year bounced back and forth from 500 to 700 to 400 to 800? Probably not. You might find it interesting to see so much variation in the number of homes selling per year - but you'd mainly be focused on how the prices of those homes changed over time. I'll publish my latest market report later this week if all goes well, and it will likely include statistics somewhere along the lines of... Home Sales Decline 15% - 20% Median Sales Prices Rise 10% So, far fewer homes selling... but at much higher prices. Circling back around to my client's point... will we care? Should we care? If continue to see fewer and fewer home sales per year over the next two to three years... do we care about that decline, if home prices keep on rising? Existing homeowners probably wouldn't care. The number of homes selling per year wouldn't seem to impact them much. Home sellers would likely be glad. Fewer homes selling means less competition -- so long as inventory levels stay relatively low. But (wannabe) home buyers, yeah, they won't be thrilled to see a decline in the number of homes selling. That decline means there are fewer homes that they can attempt to buy - assuming that inventory levels stay relatively low. So, if the number of homes that sell continues to decline, but prices continue to rise, will we care? It depends on who the "we" is. | |

How Could Housing Market Affordability Be Restored? |

|

Here's an interesting article for your perusal... If you can't access the entire article, here's the gist of it... There are three levers that can ease housing affordability:

As per this article... "A new housing report put out by Morningstar expects mortgage rates will indeed be the primary lever that helps to ease housing affordability." "As of Friday, the average 30-year fixed mortgage rate tracked by Mortgage News Daily stands at 7.14%. Morningstar expects that’ll trend down in the second half of the year, and we’ll average 6.25% for 2023. Morningstar’s forecast model then expects mortgage rates will average 5.00% in 2024 followed by 4.00% in 2025." The entire article is worth a read. Other groups putting out predictions for future mortgage interest rates aren't thinking they'll get as low as Morningstar predicts, but they do think they will decline over the next few years. The last paragraph of the article holds a key reminder... "When it comes to mortgage rate and home price forecasts, it might be best to take them with a grain of salt. Uncertainty in the economy makes it hard to predict both mortgage rates and house prices." So... you certainly shouldn't count on lower mortgage rates in the future (relative to either waiting to buy until rates drop, or buying now with a plan/need to refinance to a lower rate later) but it is interesting to see multiple groups now predicting lower mortgage interest rates over the next few years. That change would be welcomed by home buyers! | |

Contract Activity In June 2023 Was The Slowest It Has Been In A Decade, Much To The Dismay Of Would Be Home Buyers |

|

It remains a tough time to buy a home in many or most price ranges and locations -- with limited resale inventory leading to continued low levels of contract activity. As shown above, the 99 contracts that were signed in Harrisonburg and Rockingham County in June 2023 was the lowest number of contracts signed in a month of June for the past decade. At first glance some might assume that the low number of signed contracts is an indication that fewer buyers want to buy homes right now -- but with inventory levels starting the month low and ending the month low -- the bottleneck seems to be almost entirely on the supply side of the equation. There aren't enough sellers willing to sell their homes. Getting into the details of new homes versus resale homes for a moment, let's take a look at the highest and lowest data points... June 2020 = 124 resale homes + 49 new homes = 173 total contracts June 2023 = 73 resale homes + 26 new homes = 99 contracts So, if we take out new homes, not only did only 73 buyers sign contracts to buy home in June 2023 compared to 124 in June 2020... only 73 sellers were willing to sell their homes in June 2023 as compared to 124 in June 2020. I don't expect we'll see much of an increase in resale homes being listed for sale as we continue through 2023, so any upside potential for increased contract activity likely lies on the new home side of the equation. If you were one of the 99 buyers to secure a contract to buy a home in June 2023... congrats! | |

It Is The Beginning Of The End Of Summer When It Comes To Real Estate |

|

Yes, yes, I know... the official first day of summer was June 21st, which was only two weeks ago. But, when it comes to real estate, we're just about at the beginning of the end of summer. Here's the math, working backwards for anyone hoping to be settled into a new home before the start of next school year... August 23 - first day of school in Rockingham County August 22 - first day of school in the City of Harrisonburg August 18 - latest closing date to have a full weekend to move into a new home before school starts July 18 - a month prior to that August 18 closing date So... if you're hoping to close on the purchase of a home before the upcoming school year begins, you have a bit less than two weeks to do so. And... if you're hoping to sell your home to someone that wants to close on their home purchase before the upcoming school year begins, you should probably have your house on the market in the next two weeks. Happy Summer! ;-) | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings