Analysis

| Newer Posts | Older Posts |

Is Harrisonburg Nearing Break Even Again On 80% LTV Investment Properties With Conservative Calculations? |

|

Many (many, many, many) townhouses were built in Harrisonburg between 2002 and 2007. They are still being built, but not at the same pace. The principal reason for this shift in building is that home values increased faster than rental rates. As such, a smaller and smaller pool of investors are considering purchasing townhomes as income generating properties --- though that may be changing again. Let's see how things compare when buying an income generating property in 2002 versus today. In 2002, a new two-story townhome in the City could be purchased for roughly $100,000, and rented for approximately $725/month. Here's how the annual cash flow looks: + $8,338 of rental income ($725 x 11.5 months) As you can see, this is a barely break even scenario using the conservative calculations above, though more positive cash flow was achieved by most investors by managing the properties by themselves, and because very few repairs were needed.- $5,916 for mortgage payments (80% LTV at 6.25%) - $750 for property management (9%) - optional - $590 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $252 for home owners insurance Cash Flow = $170 GAIN in the first year Fast forward to 2009, and here's how the cash flow might look on a new two-story townhome in the City that can be purchased for roughly $150,000, and rented for approximately $900/month: + $10,350 of rental income ($900 x 11.5 months) - $8,172 for mortgage payments (80% LTV at 5.5%) - $932 for property management (9%) - optional - $885 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $378 for home owners insurance Cash Flow = $677 LOSS in the first year As you can see, an investor would now have to bring more than 20% as a down payment to even break even in this townhome scenario. There are plenty of investors who do bring more than 20%, or who pursue other properties with better cash flow characteristics, but hopefully this is indicative of how the investment property landscape has changed over the past seven years. But --- perhaps some of those investors are, or should be, looking at the Harrisonburg market yet again. You see, there are quite a few townhouse owners who bought back in 2000, 2001, 2002, or 2003 who bought when townhouse prices were very low. If they haven't refinanced, or taken out a home equity line of credit (HELOC), they likely have a loan payoff significantly below what the market will bear for their townhouse. Thus --- there are deals to be found with investment properties right now in Harrisonburg. They won't always jump out at you, as they may be listed at reasonable "market price" --- but if the owner is motivated to sell, and they bought 7-10 years ago, they likely have quite a bit of equity with which they can negotiate. If you are looking for an income generating property, feel free to call me (540-578-0102) or e-mail me (scott@HarrisonburgHousingToday.com) and I can assist you in determining whether we can meet your investment goals given the opportunities in today's market. | |

Either The First Time Buyer Tax Credit Is Working, Or The Harrisonburg and Rockingham County Real Estate Market Is Improving, Or Both!??! |

|

For the past three years (2006, 2007, 2008) we have seen a decline in the number of home sales in the 3rd Quarter (July, August, September) as compared to the 2nd Quarter (April, May, June). These "seasonal" declines were 8%, 8% and 1% respectively. This year, we saw a 15% INCREASE in sales in the 3rd Quarter as compared to the 2nd Quarter. As stated, above, I have to conclude that either the First Time Buyer Tax Credit is working (creating more sales as we near the tax credit deadline), or our local real estate market is improving. Or, I suppose, both could be occuring --- either independently, or as cause and effect. If the tax credit is extended or expanded, I hypothesize that we'll continue to see an improving local market. If the tax credit is not extended nor expanded, we'll then perhaps be able to determine whether the 2009-Q3 home sale extravaganza was related to the tax credit, or an improving market. Stay tuned! | |

How Much Will I Pay In Capital Gains Taxes When I Sell My Investment Property? |

|

First, here's how to calculate your gain or loss on the sale of your investment property.... Selling Price - Purchase Price - Purchase Costs - Improvements - Selling Costs + Depreciation You may have heard of short-term and long-term capital gains --- the difference is in the timing.... If you sell an investment property within one year (including one year exactly) of purchasing it, your "short-term capital gain" will be taxed at the same level at which your ordinary income is taxed. This could be at a rate as high as 35%, but depends on your income level. If you sell an investment property after one year of owning it, your "long-term capital gain" will be taxed at either 0% or 15%. If you (as an investor) are in the 10% or 15% income tax bracket, you will pay 0% (yes, that's right, no taxes) on your long-term capital gains. If your income tax bracket is above 15%, you will still only pay 15% tax on your long-term capital gain. This is important to note, as an investor might pay a 25% tax on their ordinary income, but can pay significantly less (only 15%) on their income (long-term capital gains) on investment properties in that year. Of note, these tax rates (0%, 15%) only last through the end of 2010 given current legislation on the books. If they aren't extended, they will revert back to the previous tax rates of 10% and 20%. | |

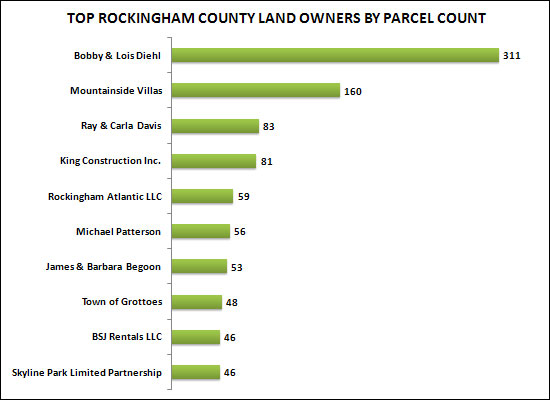

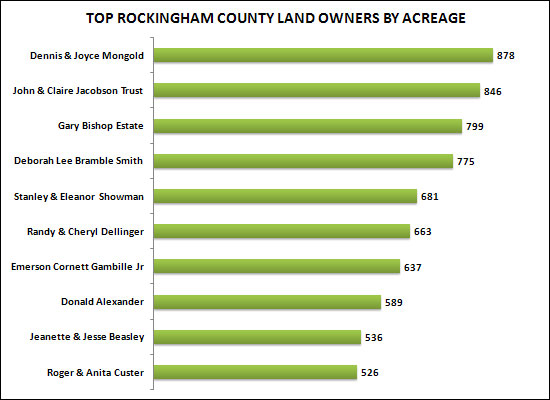

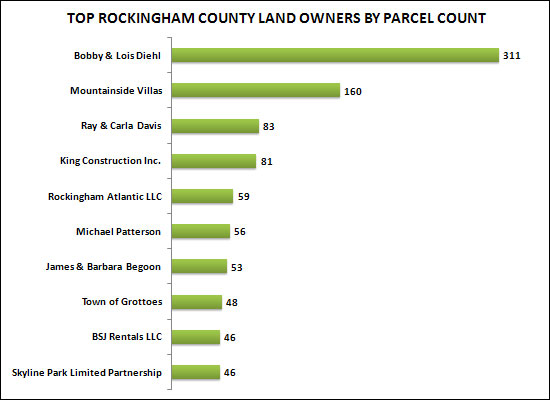

Top Rockingham County Property Owners |

|

A few days agoI provided information on the top 10 property owners in the City of Harrisonburg based on quantity of parcels owned, and total acreage owned. Today, let's take a look at the same breakdown for Rockingham County . . .    One significant note: This analysis does not account for the variety of property owners that own property in slightly different names or under entirely different entity names. | |

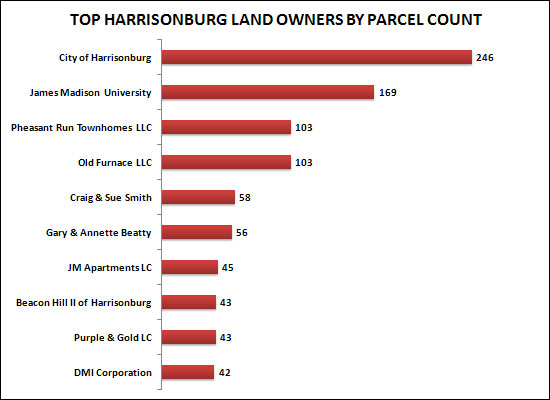

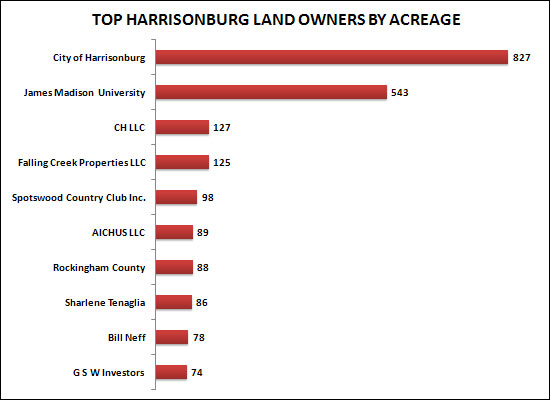

Top Harrisonburg Property Owners |

|

Last week we explored who owns Harrisonburg, based on where those property owners currently live. Below are two additional slices of this data set --- exploring the top real estate owners in the City of Harrisonburg based on the number of parcels that they own, as well as the total acreage of the parcels that they own. The top two in each category probably won't surprise you . . .   One significant note: I did some basic grouping for the City of Harrisonburg and JMU to combine the parcels owned by each in different variations of their names. This analysis does not, however, account for the variety of other property owners that own property in slightly different names or under entirely different entity names. | |

Is the Pace of Home Sales Finally Increasing In Harrisonburg and Rockingham County? |

|

There are some who are predicting that the coming months will be QUITE slow in terms of home sales. After all, the first time buyer tax credit is ending, and we're entering into winter -- a season that always brings slower sales. But looking at the trajectory of sales between the most recent two quarters (2009-Q2, 2009-Q3), I'm left starting to wonder whether things might be picking up in pace....  As you can see in the graph above, there were a roughly equivalent number of Q2 and Q3 homes sales last year. This year, however, despite both data points lying below the 2008 figures --- we saw a 15% increase in sales between Q2 and Q3. With last year's astonishingly slow fourth quarter, I think there is a good chance our local real estate market will finish out the year strong with lots of home sales in October, November and December. Why are home sales picking up in pace? One plausible reason is that lots of first time buyers are getting in the market who might not have otherwise, or might not have last year. Check out the graph below, showing the change in pace of home sales under $175k.  As you can see above, home sales in Q3 of this year surpassed (barely) last year's Q3 sales figure. It seems quite plausible that this trend will continue in Q4, and that it may be largely a result of the tax credit for first time buyers. Stay tuned as we move into and through October, November and December, but I don't believe real estate sales will be as slow as some predict. | |

What Are Your Home Buying Goals: A Place To Live, An Investment, Or Both? |

|

Why do people buy homes? In a context stretching prior to 2002, people bought homes mostly because they needed a place to live --- and buying a home provided stability (your landlord won't kick you out), and had some financial side benefits (gradual appreciation, tax deductions). However, the paradigm of the American dream of home ownership shifted in the beginning of the 21st century when home values started to inflate by 10% - 50% per year in many markets. All of a sudden people weren't just buying houses because they needed somewhere to live --- but also because it would be an incredible investment. This new paradigm can be paralyzing to buyers in today's market. Certainly, people still need a place to live --- but now some buyers become hesitant and unable to act absent confidence that they will also have a strong financial return. I don't fault any buyer for desiring a good return on a home buying investment --- but I don't believe that keeping this new expectation on the forefront of our decision making is sustainable. Let me be more precise:

| |

"Priced To Sell" -- Just Crazy Marketing Talk? |

|

Do you take special interest when you hear (or read) "Priced To Sell"? Should you? There are 20 homes on the market right now in Harrisonburg and Rockingham County described in the MLS as "Priced To Sell". Will they sell faster than the other 893 homes on the market that either aren't priced to sell, or at least aren't described that way? Let's see what history indicates.... In the past year 20 homes have sold that were described in the MLS as "Priced To Sell." They sold, on average, in 165 days. In the past year 756 homes homes sold that were not described as having been "Priced To Sell." They sold, on average, in 186 days. As it turns out, the "Priced To Sell" might have been a fair description --- these homes sold in about 10% less time than those that weren't described as "Priced To Sell." Actually, I was hoping we'd see a more convincing difference --- that perhaps homes that have been "priced to sell" would have sold in half the time of other homes. Aside: Maybe if we add "Priced To Sell" to the description of YOUR home it will shave 10% off the time it will take to sell it?? :) Inside Tip: You can search for "Priced To Sell" or other fun phrases in the MLS remarks of active listings via the "keywords" field on my Power Search. | |

Harrisonburg and Rockingham County Median and Average Sales Price Increase in September 2009, but . . . |

|

Perhaps as a result of the $8,000 tax credit, this month's home sales were not as low as could be expected given the year-to-date trends. During the first nine months of this year, we have seen an overall decline of 21% in home sales, yet September 2009 versus September 2008 only shows a 11% decline. Furthermore, both the median sales price and average sales price increased when comparing September 2009 sales to September 2008 sales. The year-to-date median and average sales prices are still showing declines (4%, 2%), so we won't call this a trend yet -- but hopefully a sign of positive changes to come. To learn more, review the entire September 2009 Harrisonburg & Rockingham County Real Estate Market Report: Read Report Online | Download PDF.  If you find the information in this report to be helpful....

| |

Who Owns Harrisonburg? |

|

Of the almost 15,000 pieces of real property in Harrisonburg --- who owns them? Mostly people who live in Harrisonburg? Or not? Mostly people living in Virginia? Or not? Record your guesses, and read on....  Per the data I'm working with (Sept '09), I find the following to be true, as pictured in the graphic above:

| |

Why Are Home Values Remaining Stable In Harrisonburg and Rockingham County? |

|

In most areas of Virginia and the United States, home values have fallen quite dramatically over the past two years. Why, in Harrisonburg and Rockingham County, haven't we seen a similar decline? This video explores the reasons why I believe we haven't seen a decline in home values, primarily because of stubborn sellers, the non-effect of foreclosures, and because home prices didn't increase as much here as they did in other areas. Click here to view the video. | |

The State of Our Local Housing Market |

|

Despite continued turbulence in many real estate markets across the country, the Harrisonburg and Rockingham County housing market continues to perform well, with stable values, despite a continued decline in sales pace. Many housing markets across the country have experienced net losses of 30% - 50% in housing values over the past three years. Harrisonburg and Rockingham have seen only a 2% downward shift in housing values over the past three years, as measured by the median price of sold residential properties per the Harrisonburg/Rockingham MLS. The Central Shenandoah's diverse economy has remained very stable in most sectors over the last several years, and our area's continued low unemployment rates have allowed our housing market to continue to perform well. While there are still those in our local community that are seeking employment, our local unemployment rate has been below the state and national rate for many years. This employment stability gives local home buyers confidence in moving forward with their housing purchases. While it hasn't created an enormous, market-altering boost in sales, the $8,000 credit to first time buyers has allowed many hopeful homeowners to buy over the past few months in Harrisonburg and Rockingham County. The $8,000 is returned to the home buyer when they file their 2009 taxes, but can also be used as a down payment or closing costs in some cases. Of note, time is now running short for those hoping to take advantage of this $8,000 first time buyer tax credit. The deadline for closing on a home under this government program is November 30, 2009, and the financing process generally takes 45 to 60 days to complete. In addition to low unemployment, and the $8,000 first time buyer tax credit, very low foreclosure rates in our local market have also contributed to stability in home values. Home values increased quite rapidly between 2003 and 2005 in Harrisonburg and Rockingham County, but did not increase fast enough and far enough to push large numbers of buyers into risky loan programs. In many other high priced areas of the country, buyers purchased homes using extremely risky loan programs during the market boom, which led to high foreclosure rates in those areas during 2007, 2008 and 2009. These foreclosed homes then re-entered the market and sold by the new owners (the banks) at values much lower than pre-existing market values. Since Harrisonburg and Rockingham County have such a low foreclosure rate, these few home sales have not significantly affected local housing values. Thus, it seems that our local housing market has experienced the lesser of two evils. Most local homeowners are glad that they have not seen 30% - 50% declines in the value of their home, yet the drastic decline in the number of homes that sell per year makes it difficult to sell a home in a timely fashion. Interestingly, many of the market that experienced huge drops in home values have now seen the pace of home sales increasing yet again. Prospective buyers in today's market ought to research home values carefully in the neighborhood(s) where they may buy, and shouldn't buy if they will need to sell again within a one to two year time period. Hopeful sellers in today's market should price and market their home aggressively to maximize the chances that it will sell amidst very high inventory levels. | |

City of Harrisonburg Land Use Analysis |

|

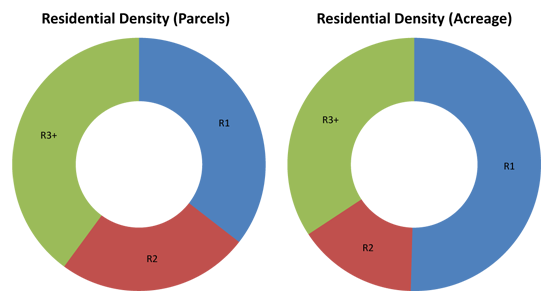

To better understand land use in our fine community, here is a basic breakdown of the 15,075 parcels of land in the City of Harrisonburg....  Zoning Distribution (Parcels)

Residential Density (Parcels)

| |

Size Distribution of Harrisonburg Land Parcels |

|

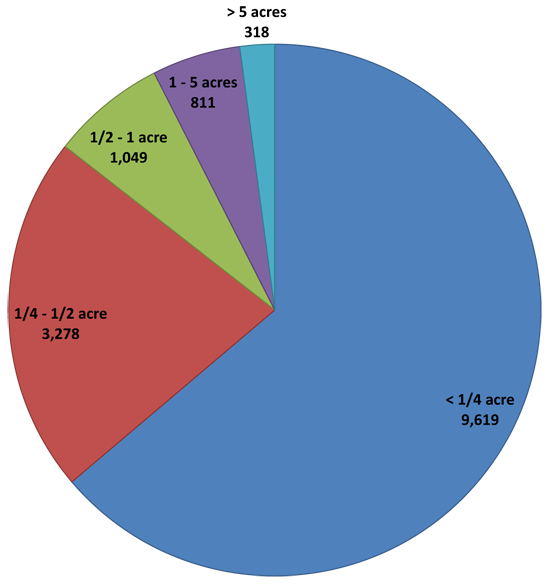

A few weeks ago I examined the size distribution of land parcels in Rockingham County, and was asked whether such data existed for the City of Harrisonburg. It does! As you'll see below, most (92.5%) land parcels in the City of Harrisonburg are less than an acre in size.  Here are a few other interesting tidbits about land parcels as a whole in the City of Harrisonburg:

| |

Rockingham County: Value Down but Assessments Up??? |

|

Rockingham County is currently in the process of reassessing all real estate in the County. When the new assessed values are sent to property owners, there is bound to be some distress and consternation, as assessed values will increase (in many cases), yet homeowners know that home values have been decreasing over the past few years. First, have home values decreased over the past few years?

So, why will many assessed values going up?

As a point of interest, property owners should actually be retroactively grateful that they are (only just) now seeing this increase in their assessed values. Here is the tax burden over five years for the median value of homes, given that reassessments only occur every four years:

| |

Everything You Need To Know About The Residential Real Estate Market In Harrisonburg & Rockingham County |

|

Below you will find an embedded version of my August 2009 report on the residential real estate market in Harrisonburg and Rockingham County. SUMMARY: The pace of home sales continues to slow, home values continue to stay relatively steady, and thus we haven't turned the corner yet to head back to more hopeful times. Click here to access a larger version, download a PDF, share it with a friend, etc. Do you have questions? Suggestions for other analysis? Do you disagree with the perspectives I offer? Feel free to leave a note in the comments section, or e-mail me at Scott@HarrisonburgHousingToday.com. Enjoy! | |

Measuring Asking Prices By Assessed Values In The City of Harrisonburg |

|

I showed four homes in the City of Harrisonburg this afternoon to one of my buyer clients, and as my clients and I viewed the homes we sensed a very strange relationship between asking prices and our perception of their value. That is to say that we didn't sense much of a correlation between what the owners were asking for the houses and what we thought they were worth. To explore the relationship (somewhat) objectively, I thought I'd compare the asking prices to assessed values. But first, here is how sale prices and assessed values compare for the last three sales in the City of Harrisonburg between $240k and $260k. Sold properties are selling for 97% of assessed value --- based on an unreasonably small sample size of three properties:

| |

A Casual Examination of Foreclosures in Harrisonburg and Rockingham County |

|

For almost a year now, I have been posting information about scheduled foreclosures (Trustee Sales) in Harrisonburg and Rockingham County to HarrisonburgForeclosures.com. In the more recent past I have been compiling some basic details on these scheduled foreclosures, an analysis of which is presented below, but first let me explain why this is only a "casual examination" of foreclosures. HarrisonburgForeclosures.com offers information on scheduled foreclosures, not just those that actually are foreclosed upon (some Trustee Sales never take place.) Thus, this analysis is based on properties that are headed towards foreclosure, but isn't just based on those that are actually foreclosed upon. Click here to view a larger version of this document As you may have imagined (above) most of the properties are in Harrisonburg (which includes Harrisonburg-addressed Rockingham County properties, and is the largest area in the County). Coming in behind Harrisonburg are Elkton, Broadway and McGaheysville. This next document examines when these homeowners purchased the home that is now being (possibly) foreclosed upon... As you can see, the vast majority of these homes were purchased in 2005, 2006 and 2007. This should serve as no significant surprise, as that was when loan requirements were being pared down and pared down, such that anyone with a pulse could obtain a mortgage. These lax guidelines resulted in some people owning homes that weren't really in a financial situation that would allow them to consistently pay their mortgage. I'll update this analysis from time to time, but one thing that you ought to be sure to remember is that (thankfully) Harrisonburg and Rockingham County have an extremely low rate of foreclosure as compared to other parts of the country. This is wonderful news, as it has not negatively skewed our home values as has happened in many larger metropolitan areas. For more details on upcoming foreclosures, visit HarrisonburgForeclosures.com. | |

Size Distribution of Rockingham County Land Parcels |

|

Rockingham County, Virginia (not including the City of Harrisonburg) is comprised of (approximately) 46,600 parcels of real estate. Some of these lots or tracts are very small, in towns such as Grottoes, Dayton or Elkton. Others are quite expansive and are in the far flung corners of the County. Below is a visual representation of the distribution of lot sizes of those 46,600 properties --- you might need to click on this link to view the full size document for easier reading. Here's the summary:

| |

If You're Buying A Big Or Expensive Home, Will It Be In The City of Harrisonburg, or Rockingham County? |

|

Every five years (or so) the Harrisonburg Redevelopment and Housing Authority conducts a detailed analysis of City housing. In 2005, S. Patz & Associates, Inc conducted the analysis, available here: Citywide Housing Analysis for Harrisonburg, Virginia. One interesting "housing issue" that is identified as affecting the City of Harrisonburg was identified in the 2000 analysis, and re-confirmed in the 2005 analysis: "The loss of new construction of higher price new homes to sites in Rockingham County, while the City continues to attract only more modest single family detached and attached homes." I had never considered that this might be occuring --- that most higher price new homes were being built in Rockingham County instead of in the City of Harrisonburg --- but it makes sense, because undeveloped land is generally quite scarce in the City of Harrisonburg. To confirm (or reject) this conclusion, let's take a look at the homes that have sold each year since 2000, that were built within 3 years of when they were sold (thus, new-ish homes).... First, here's the break down of where all of these homes sold.... You'll note that the majority of the new-ish homes that were sold (and thus purchased) where in Harrisonburg, as opposed to in Rockingham County with a Harrisonburg address. Now, let's look at "large" new-ish homes, those with 2500+ square feet.... Here we do indeed find the phenomenon that the report described --- almost all of the large (and thus expensive) homes were built just outside Harrisonburg, and not within the City limits. Of note --- the City of Harrisonburg identifies this phenomenon as an "issue" because.... "An objective for the City is to help support development of higher priced/higher rent housing to provide a better mix of housing types and income levels in the City." For even more reading, read the full housing analysis! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings