| Older Posts |

Harrisonburg Considers An Additional Increase In The Real Estate Tax Rate |

|

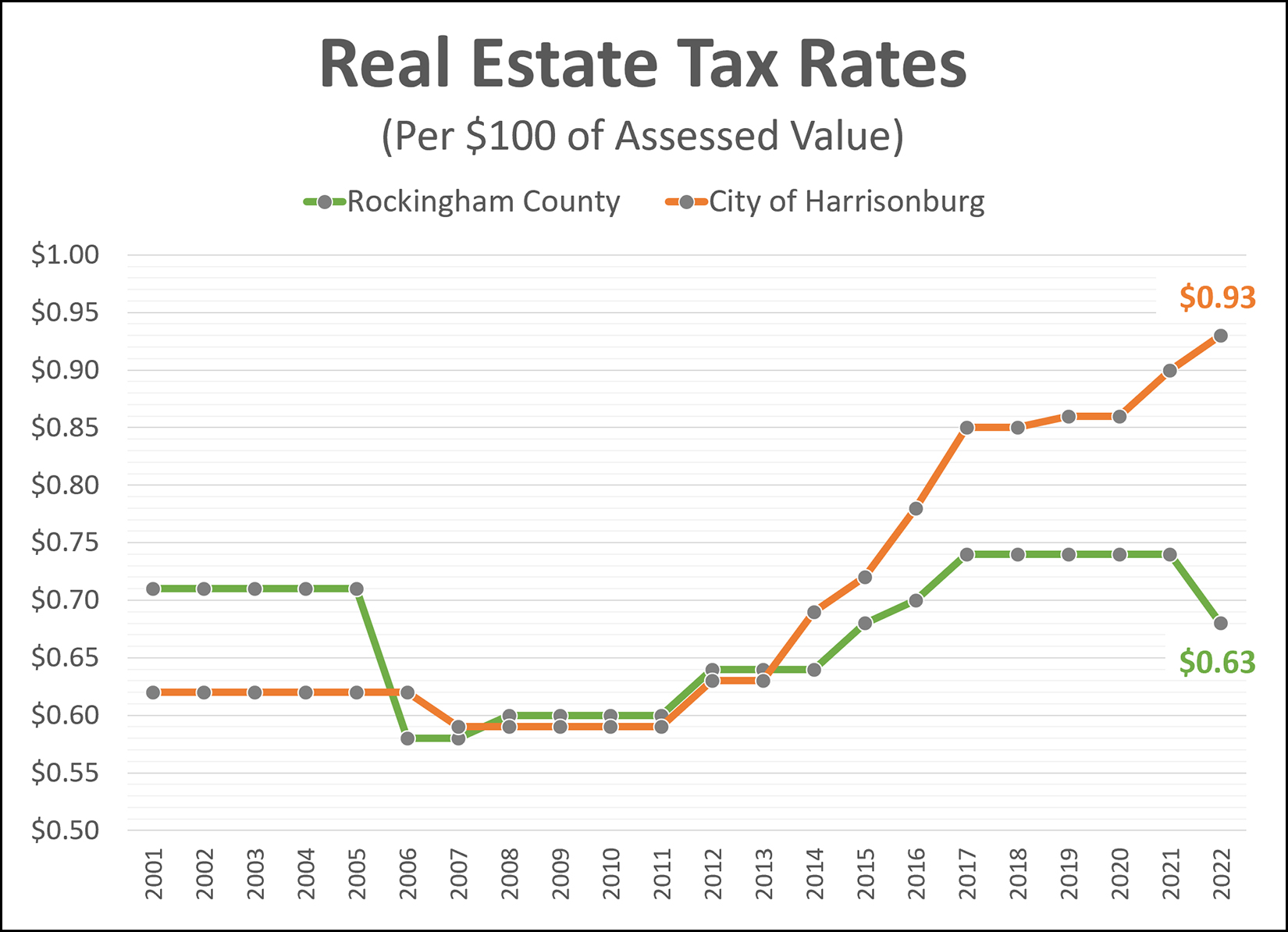

It's that time of year again... the City of Harrisonburg must decide how much money it can, will or must spend... and where that money will come from. City Council met last week and began to discuss a draft budget for Fiscal Year 2023-2024 presented by City staff. You can read more about the meeting and discussion here. You can view the draft budget here. In summary... the City is planning on a budget of around $362M in FY24, which is about a $27M increase from FY23. Where does all of that money come from? A variety of sources, including these top four funding sources... 34% from real estate taxes 11% from personal property taxes 11% from sales taxes 11% from restaurant food taxes The amount of real estate taxes collected (to fund the budget) depends on... [1] the value of real estate in the City [2] the real estate tax rate The planned budget includes (as shown on the graph above) a $0.03 increase in the real estate tax rate, from $0.93 to $0.96. What impact will this 3% increase in the real estate rate have on owners of real estate in the City of Harrisonburg? The median sales price of homes sold in the City of Harrisonburg over the past year was $255,000. Real estate taxes with a tax rate of $0.93 on this $255K home would cost a homeowner $2,371.50 per year. Real estate taxes with a tax rate of $0.96 on this $255K home would cost a homeowner $2,448.00 per year. So... a $76.50 increase per year... or about $6.38 per month. Two important notes related to these calculations... [1] The $255K figure of the median sales price is not necessarily perfectly aligned with the median tax assessed value of all residential properties in the City. The $255K figure is based on their sales prices... not the assessed values... and just of the homes that have sold... not all homes that exist. [2] The median sales price has increased 12% in the City of Harrisonburg over the past 12 months. This may mean that assessed values will rise when properties are next assessed by the City, which would result in a further actual increase in real estate taxes based on new assessed values. Finally, two other general notes... [1] For anyone wondering what the City spends $362M on in a year, the "Budget in Brief" document found on this page is a very helpful summary of the City budget. [2] From the article on The Citizen linked above (and here)... "This tax increase is a continuation of the city’s plan to raise that tax by 10 cents over three years to pay for the new Rocktown High School, which is expected to cost about $100 million." | |

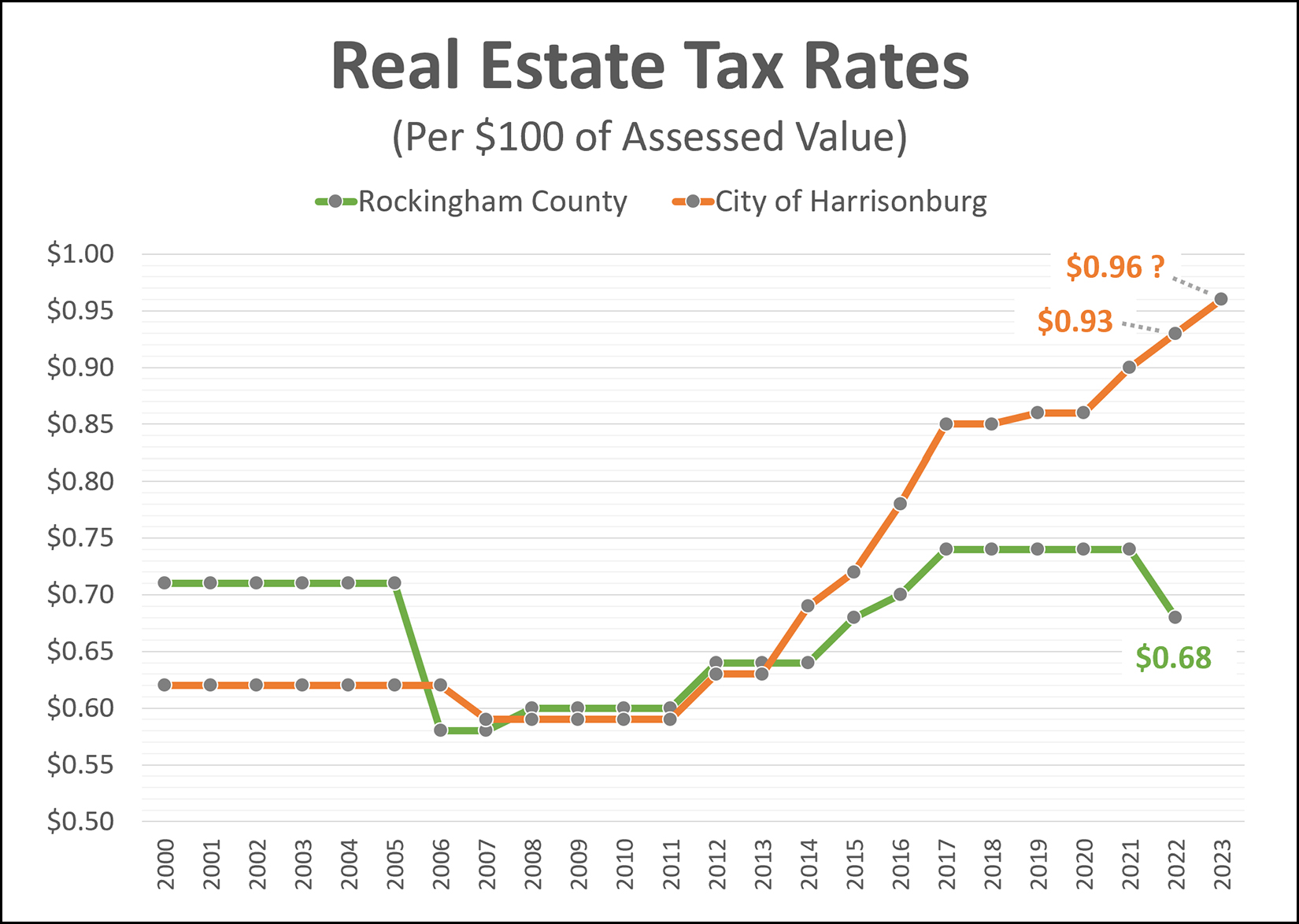

Comparing Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

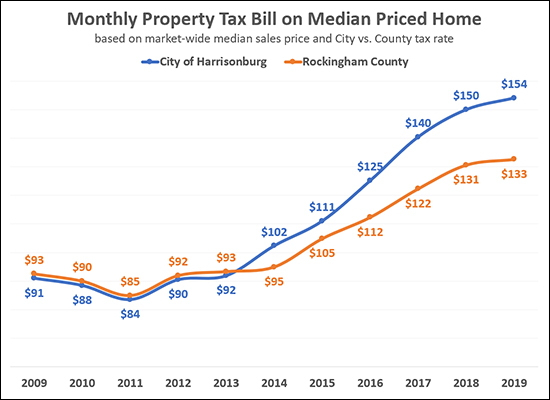

If you're buying a $300K house, will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, City property taxes have increased by 155% over the past decade while County property taxes have increased by 70% during the same timeframe. | |

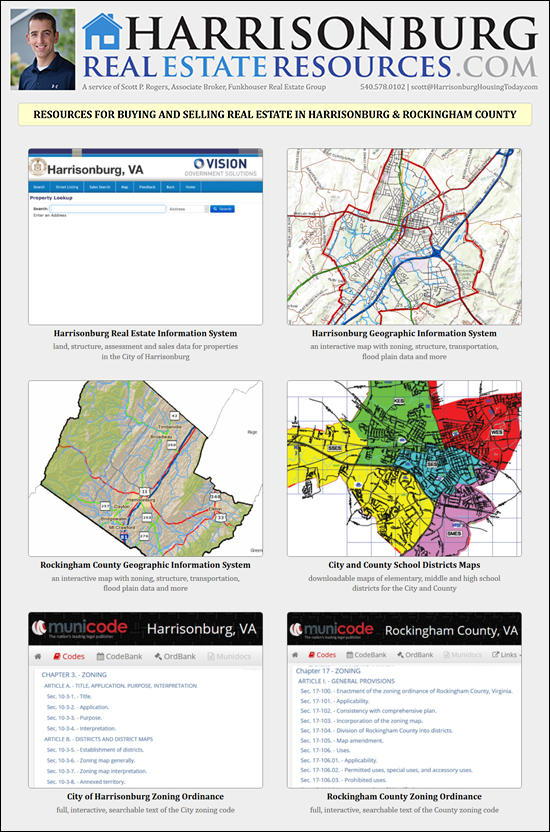

Real Estate Tax Rates Moving Up and Down |

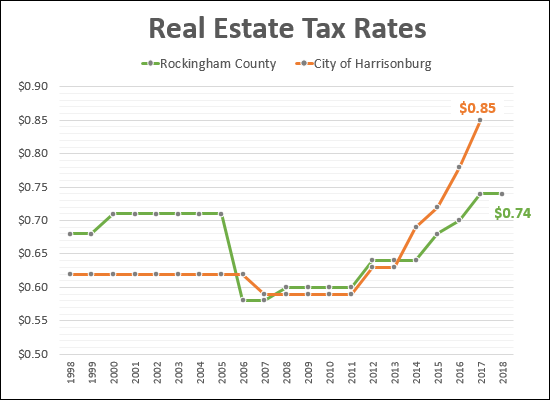

|

Rockingham County - tax rate down 8% The Rockingham County real estate tax rate is currently $0.74 per $100 of asssessed value, but the Board of Supervisors just approved a reduction in the tax rate to $0.68 per $100 of assessed value. But... that is in the context of recently updated tax assessed value for all properties in Rockingham County, most of which increased significantly because the last reassessment took place four years ago before significant shifts in market values in this area. As a result, most Rockingham County property owners will see an increase in their tax bill despite the reduction in the tax rate. City of Harrisonburg - tax rate up 3% (pending approval) The Harrisonburg City Council will soon consider increasing the tax rate from $0.90 per $100 of assessed value to $0.93 per $100 of assessed value. The City of Harrisonburg updates their assessed values every year, so while many or most property owners recently received notice of the updated assessed value of their property, those values likely did not increase as drastically as assessed values did in Rockingham County. As a result, almost all City of Harrisonburg property owners will see an increase in their tax bill because though small increases, their assessed value and tax rate are both likely to have gone up or to go up. | |

A Few More Ways To Think About Your New Rockingham County Property Assessment |

|

Ahhhh! The real estate assessment for my house just went up 30 percent! No way!? Mine went up 40 percent! I heard Bob's down the street went up 55 percent! What is happening!? Below are a few more nuggets to further expand on my relatively extensive overview of the changes in assessments last week, which you can read here. So, some new thoughts... [1] Low assessments four years ago might make the increase in assessed value seem more extreme. If your assessed value four years ago was 10 to 15 percent lower than market value at that time (many seemed to be at the time), and your assessment today is truer to market value, then the apparent increase from "lower than it should have been" to "just about right" will seem larger than life. For example, if your home was worth $250K four years ago, but was assessed for $220K, and today is worth 30% more than four years ago ($250K x 1.3) then it would be worth $325K today. If your house was then assessed (last week) for its actual value of $325K you would see a 48% increase in your assessment -- but a good chunk of that would be due to the artificially low assessment four years ago. [2] If you sold your house tomorrow, would you sell it for more or less than the new assessed value? Many homeowners who have seen a large increase in their assessed value and are getting (reasonably) anxious about the possibility of a significant increase in their real estate tax bill are focusing on the change -- not the actual numbers. If your assessed value was $300K four years ago and it went up 35% to $405K, would you sell your house for $405K? Many of the folks who I have talked with about this issue quickly realize that their new assessed value may very well be on point as it relates to the increases in home prices that we have seen over the past few years. So, if you would plan to sell your home (if you were selling now) for a price around (or above) your new assessed value, then don't worry about the new assessed value being too high -- it sounds like it's not. :-) If you look at the new assessed value of your home and think there is absolutely no way in Harrisonburg that someone would way that price for your home -- next, talk to me (or your Realtor, if it's not me) to make sure you are thinking about market value in the context of the recent sales trends. If I agree (or your Realtor agrees) that the new assessed value is way out of whack with recent sales trends, then, yes, it might be worthwhile talking further with the County about the basis for your house's new assessed value. [3] Congratulations and Condolences. ;-) Both, it seems, are in order. Congratulations -- the real estate that you own is worth a good bit more than it was four years ago. You might not have realized it, so this might be both a *CONGRATS* and a *SURPRISE* all in one. Condolences -- yes, because your property is worth more now, your real estate tax bill is going to increase. It probably won't increase by as much as is outlined on your notice of reassessment, but it will increase. My condolences as it relates to that increase in your monthly housing costs. That's all for now. Keep passing on your questions or thoughts about these new assessments as they come to you -- or call the Rockingham County Reassessment Office at 540-564-5079. :-) | |

Median Residential Harrisonburg Real Estate Assessment Increases 10.5% In 2022 |

|

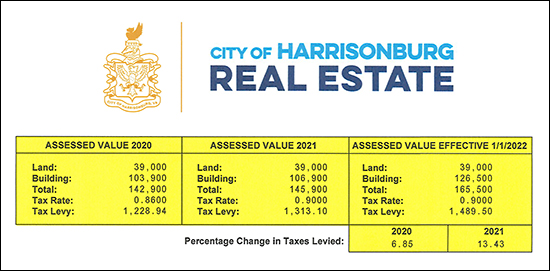

If you own a property in the City of Harrisonburg you likely recently received a "Change of Assessment Notice" in the mail. Harrisonburg updates the assessed value of every parcel of real estate every year... and some years (like this year) the assessed values increase quite a bit! The sample change in assessment notice above, for a townhouse in the City of Harrisonburg, shows the following assessed values...

You might also note that the tax rate changed a bit over time...

The increased assessed value, combined with the increase in tax rate results in the following increase in annual taxes...

In speaking with Lisa Neunlist, the real estate director for the City of Harrisonburg, she shared that there has been a 10.5% increase in the median assessed value of the approximately 9,600 residential properties (single family, townhomes, duplexes, condos that are not primarily students) in the City of Harrisonburg. Should this increase in assessed values surprise us? Probably not. The median sales price in our local area (City+County) has increased 12% over the past year. As such, a 10.5% increase in the median assessed value is not shocking. It will be interesting to see whether the tax rate is changed at all for 2022. The tax rate increased 4.6% (from $0.86 to $0.90) between 2020 and 2021 -- at least in part to help pay for building a second high school in the City of Harrisonburg -- though there was discussion of a possible need to increase that rate even further in 2022. Perhaps the increase in tax assessed values of properties in the City of Harrisonburg will provide enough additional tax revenue that the tax rate will not need to increase further at this time? Of note -- for the sample property I referenced above, if the tax rate remains at $0.90 in 2022 the annual taxes will increase by $176, which is a $15 per month increase. | |

The Tax Assessment Of A Property Is Most Useful For... Calculating The Real Estate Tax Bill For The Property |

|

Oh, I see that house down the street is for sale! What's the list price? They are asking $400,000 for the house. What is the tax assessment of the property? Why? --- If you want to know the tax assessed value of the house to understand how much an owner of the property pays in real estate taxes - great! Let's go take a look at the tax assessment. --- If you want to know the tax assessed value of the house to evaluate whether the seller's asking price for their home is reasonable -- you likely aren't looking in the right places for indicators of market value. --- Tax assessed values are actually intended to be a good indicator of market value, as the City and County want to be taxing you on the basis of the actual market value of your property... but... oftentimes, the tax assessed value of properties in this area range from low to very low. Part of that is due to timing. Today's tax assessed values may be based on sales data from 12 to 18 to 24 months ago due to the time intensive process of analyzing property values and updating tax assessed values. The median sales price is currently increasing quickly, at a rate of 10% to 12% per year. Thus, when market values are quickly increasing and tax assessed values are based on 12 to 24 month old data, you are likely to see a more significant difference between tax assessments and market values. So, it's fine to look at the tax assessment of a property, but I wouldn't put too much confidence in thinking that it is an indicator of the present market value of the property. | |

Does An Increase In The Real Estate Tax Rate Directly and Significantly Affect Housing Affordability? |

|

The City of Harrisonburg recently increased the real estate tax rate from $0.86 per $100 of assessed value to $0.90 per $100 of assessed value. Does this affect housing affordability for home buyers and homeowners? I tried to say "yes and no" for this question -- but it's somewhat difficult to say that the increase in the real estate tax rate (alone) has a meaningful increase on housing affordability. Technically, yes, the increased tax rate does increase the cost of owning a home -- but not by much... For a property assessed at $250,000...

So, for the house assessed for $250,000 -- the monthly payment would increase by $9 per month based on this change in tax rates. So, certainly an increase in monthly housing costs, but not much of one. To put this change in monthly housing cost in context... If a homeowner had financed 90% of their purchase price of $250K at 3.5%, their mortgage payment would likely be right around $1,243 before the change in tax rate -- and right around $1,251 after the increase in real estate taxes. So, this change in tax rates increases their monthly payment by less than 1%. Am I saying that the City of Harrisonburg can just keep on raising the real estate tax rate forever without any impact on housing affordability? No. But it's hard to argue that this increase in the real estate tax rate, on its own, dramatically changes the financial picture for many or most homeowners. Now, I'll pivot a bit to a few other common talking points related to real estate taxes... Increased Tax Rates + Increased Assessed Values If we look at both at the increase in property values AND the increase in the real estate tax rate, then yes, the change in one's real estate tax bill is more significant. That said, the assessed values of real estate do not (at least right now) seem to be increasing as quickly as sales prices are in the current real estate market. While the median sales price has increased by about 10% over the past year, this year's property value assessments increased a net of 2.9%. As such, we shouldn't hastily calculate the increase in a tax bill using the increase in our local median sales price to show a large increase in real estate taxes, because market values are currently escalating much more quickly than tax assessed values. Tax Rate Increases + Income Changes A somewhat common refrain is to say "real estate tax rates increased by __% over such and such timeframe -- but my income didn't increase by that much during that timeframe!" This argument doesn't make a lot of sense to me. Let's make it as extreme of a point to point comparison as possible. The real estate tax rate was $0.59 ten years ago and is now $0.90. That is a 53% increase over a ten year period. So, per the argument above, I'd need a 53% increase in my income during the same time period in order to afford those higher real estate taxes, right? Well, probably not. :-) I'm going to use very rough, inaccurate numbers here, but let's pretend Fred owned a home assessed for $150K ten years ago and today it is assessed at $250K. His annual tax bill would have been $885 a decade ago at that $0.59 tax rate and that would have increased to an annual tax bill of $2,250. That's quite an increase! In fact, it's a $1,400 increase in annual real estate taxes over ten years. So, per the prior argument, he probably needs to have seen a 53% increase in his income because the real estate tax rate increased 53% over a decade, right? Well, maybe not. If Fred was earning $35,000 a decade ago, a 53% increase over the past ten years would mean that he would be earning $53,000 today. If you made it through all of my ramblings, thanks for reading and engaging on this topic. Do I think higher taxes are OK or good or great? No. I would love for everybody to pay the same or lower taxes forever and ever. Do increases in the local real estate tax rate directly and significantly affect housing affordability? In the short term it's very hard to say "yes" to this ($9/year) based on the information above. Over the mid to long term, certainly, this does have a cumulative impact - but I believe we should be precise with our language. Do you agree or disagree or have another counterpoint? Email me at scott@hhtdy.com. | |

Comparing Monthly Property Tax Bills Between Harrisonburg and Rockingham County |

|

Getting a bit further into this topic -- yesterday I was looking only at the changes in the property tax rates in the City and County -- as shown here. Today (thanks for the idea, Mike) I looked at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, it has become more expensive (16%) to pay property taxes on a home in the City of Harrisonburg as compared to a similarly priced (assessed) home in Rockingham County. Now -- does this cause anyone to move from the City to the County? Or does it cause anyone new to the area to buy in the County instead of the City? Not necessarily - or at least that has not been my experience in working with buyers and sellers in the past ten (+) years. | |

New Harrisonburg Real Estate Information System |

|

There's an all new Real Estate Information System for the City of Harrisonburg, and you can use it to find the proposed 2019 assessed value of properties in the City of Harrisonburg. Check it out here... As a reminder, you can find a list of many resource websites to assist you in considering the purchase or sale of real estate in Harrisonburg and Rockingham County by visiting... | |

How To Appeal The Assessed Value of Your Home in Rockingham County |

|

Do you live in Rockingham County, and is your home's assessed value too high -- causing you to pay more real estate taxes than you think you should be paying? If so, now is the time to appeal that assessment. The Board of Equalization of Real Estate Assessments is meeting over the next month and you can make your case for having the assessed value of your home adjusted. Here are the dates of the hearings, each being from 9AM - 12PM:

Call 540-564-5079 to schedule a time and date for a hearing with the Board of Equalization. Of note -- in my experience, most assessed values in Rockingham County are not higher than market value. | |

2018-19 Rockingham County Budget Reflects No Change in Real Estate Tax Rate |

|

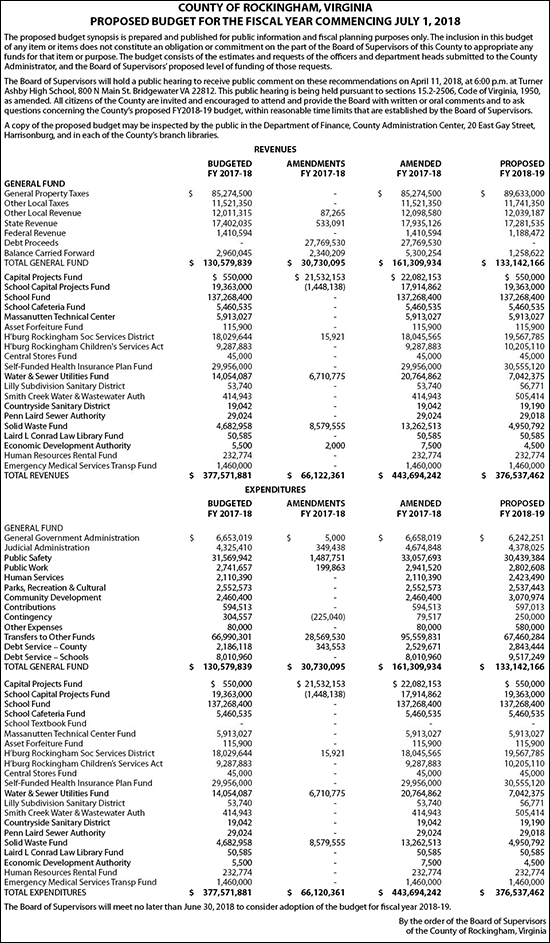

The budget shown above is the proposed budget for 2018-19 in Rockingham County, VA. This reflects no change in the real estate tax rate -- it would remain at $0.74 per $100 of assessed value -- though the tax revenue will increase due to increases in assessed values.  Interestingly (above) the real estate tax rate in the County has been above $0.70 before -- between 2000 and 2005 -- and at that time it was well above the City's real estate tax rate! Stay tuned for news of changes in the City real estate tax rate.... | |

Increasing Home Values Can Lead To Increased Real Estate Taxes |

|

It's exciting if your home value is increasing, right? Well -- mostly, it seems. Certainly, if you bought your home for $250K and it is now worth $260K or $270K or even $300K -- that can be a good thing. At some point in the future, you'll recoup that equity when you sell your home -- plus or minus any shifts in value between now and then. But in the near-term, increasing home values can actually hurt a bit. The amount of real estate taxes that a homeowner pays to their locality (city, county) are based on two factors -- the assessed value of the home, and the local real estate tax rate. In Rockingham County, the current real estate tax rate is $0.74 per $100 of assessed value....  Tomorrow, the Rockingham County Board of Supervisors will hold a public hearing to receive input before adopting a real estate tax rate for fiscal year 2019 -- which runs from July 1, 2018 through June 30, 2019. But here's the thing -- even if the tax rate remains the same (at $0.74) there are many homeowners who will see an increase in their real estate taxes -- because of increases in home values, and thus increases in assessed values. Rockingham County revises their property assessments once every four years -- and the most recent increase resulted in a 2% increase in the assessed value of an average home. This is good news for the County, as the increase in property values, even with no change in the real estate tax rate, will likely generate over $2 million in additional tax revenue. It is sort of good news for County property owners -- because it means your property value is (likely) increasing -- but it is also potentially bad news, as your tax bill will likely be increasing. To put some numbers to it:

And -- you can both celebrate and mourn the news that property values are increasing, and that your real estate tax bill likely will be as well. | |

Owners of median priced City homes might have to pay $26 more per month to fund new City high school |

|

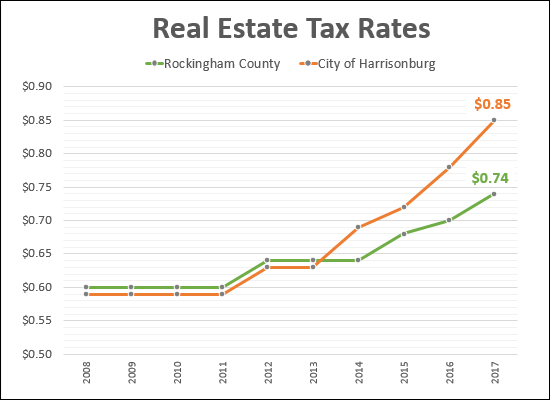

Numbers are funny. All of these statements are true based on current projections:

I'm guessing that if you ask most parents of school aged kids in the City if they'd be willing to pay $26 per month such that their child would not be in an overcrowded, not-so-ideal, learning environment for high school, they'd likely be quick to say yes. That said, this $26 per month increase would need to be paid for 25 years -- but for a parent of a child in the school system, I'm guessing that would still seem to be a reasonable cost. I'm also guessing that City property owners who do not have children in the local school system would LOVE for their property taxes to NOT increase. And I'll even go a step further -- I am guessing that they don't really want school aged children to have an overcrowded, not-so-ideal, learning environment -- it's probably just more about the increased tax burden. Anyhow. Numbers are funny. Read today's Daily News Record article, and feel free to form your own opinions. There seem to be plenty of them circulating through our community about this topic. :) | |

Single Family Housing Stock in the City of Harrisonburg |

|

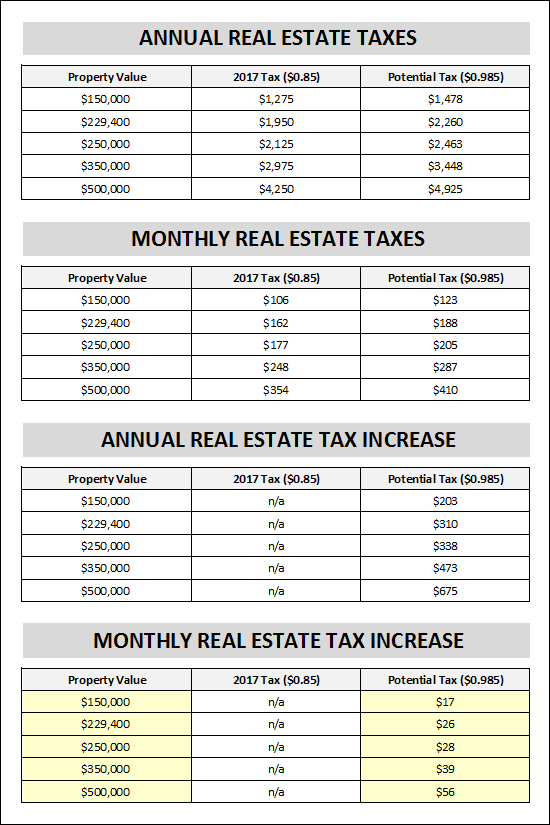

Forget about what actually SELLS in any given timeframe, or even what is available FOR SALE at any given point in time. Let's get down to what housing actually EXISTS in the City of Harrisonburg. The graph above shows the number of single family detached homes (Use Code 006 in the City's property database) that exist in the City of Harrisonburg in five different price ranges. The homes are sorted into these price categories based on their 2017 assessed values. So -- what surprises you? If more single family homes are to be built in the City, what price range should they fit into? | |

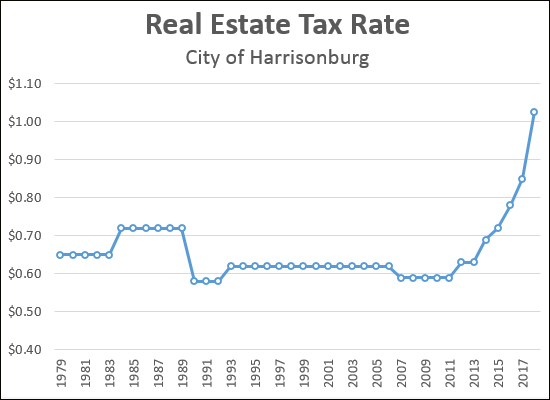

Harrisonburg Real Estate Tax Rates in a Historical Context |

|

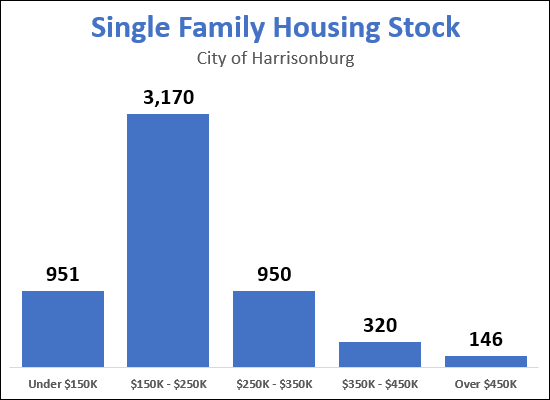

Per a reader's request, I have updated this super-long historical context of real estate tax rates in the City of Harrisonburg. This graph can be a bit deceiving in its attempts towards being legible -- the y-axis does not start at zero. As such, it makes some of the historical tax rates (around $0.60) seem closer to zero than they really are. That said, the trajectory of the real estate tax rate over the past five-ish years is quite striking in a historical context. OF NOTE -- the 2017 value ($1.025 per $100 of assessed value) is a proposed, not approved, tax rate. | |

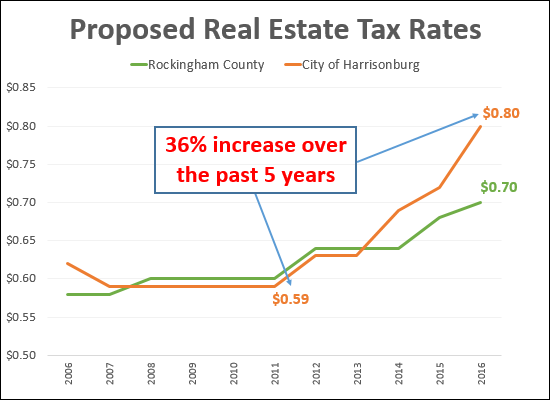

The proposed city real estate tax rate, contextualized |

|

The real estate tax rate in the City of Harrisonburg might increase to $0.80 per $100 of assessed value per the City's proposed 2016-17 budget. As shown above, this would be a 36% increase in the tax rate over a five year period. The context that might be missed by just looking at this increase includes....

Interested in knowing more? Read today's article in the Daily News Record (City Eyes Tax Hike In Budget Proposal) or attend the public hearing on the budget this evening at the City Council meeting at 7PM in City Hall Council Chambers. | |

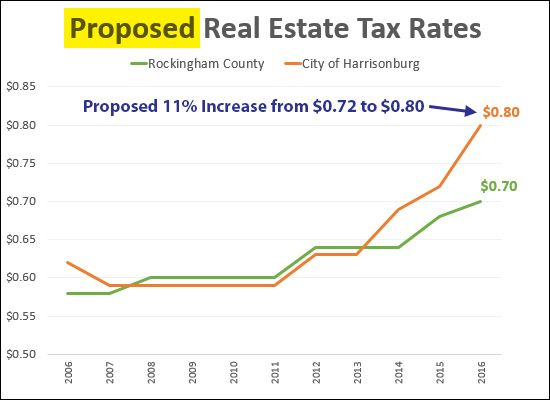

City of Harrisonburg Proposes 11% Increase in Real Estate Tax Rate |

|

The City of Harrisonburg has released its proposed budget for the 2016-2017 fiscal year, and it includes a proposed $0.08 increase in the tax rate from $0.72 per $100 of assessed value up to $0.80 per $100 of assessed value. A few excerpts of note from the City Manager's letter to City Council are included below. The bold sections are directly from the letter. City costs are increasing as population increase, even without increases in services.... As noted last year, the impact of a growing community continues to have a significant effect on our budget. That trend continues this year as we added another 1,263 new residents as of July 1, 2015 per the Weldon Cooper Center population estimates. I have stated in my budget transmittal letter for several years that even if we are not adding new services or programs, we have more people needing/consuming the services, programs, and facilities that we already provide, and we have added more infrastructure to be operated and maintained (streets, sidewalks, bike trails, emergency communications, juvenile and adult detention facilities, athletic fields, etc.) in support of our services and programs. Large new costs for 2016-17 include:

Natural revenue growth, while increasing, has not kept pace with the costs of all of the immediate needs. Lots of new costs without significant new revenue resulted in a recommendation for increasing the real estate tax rate.... As City staff developed the budget, they had a gap of about $7.5 million between revenues and expenditures. We began the development of the FY 16-17 general fund budget with a gap of about $7.5 million between anticipated revenues and expenditures. To varying degrees, all of the submitted requests had merit and were intended to address what department directors and management felt to be present or pending needs for providing services to our citizens. This budget does not include any increases to any of the "discretionary" outside agencies (listed as "Contributions – Community and Civic Organizations" in the budget) that receive City funding, nor does it propose adding any new agencies, programs or projects for funding. We attempted to build this budget based on available projected revenues and not expenditure requests, starting with a base revenue budget of just under $102 million (which included about $1.6 million in new revenue), less any use of fund balance. In spite of this effort, to meet the commitments we have in core service areas, a $3.15 million gap remains. As such, management believes an increase of approximately $0.08 in the real estate tax rate will be required to balance the FY 16-17 budget, pending Council direction as to other possible budget revisions or identification of reduction targets. The draft budget (and above-referenced letter, and supporting documentation) can be found here ("2017 Proposed Budget"). Next, the budget will be reviewed by City Council and opportunities will exist for public comment. | |

The 50 Most Valuable Properties in Harrisonburg |

|

The list above shows the 50 properties in Harrisonburg with the highest assessed values per the 2016 assessments. As you can see, JMU, apartment complexes and City schools are many of the most valuable properties. Let's take a closer look at the top 10....  017 B 1 900 S MAIN ST VISITORS JAMES MADISON UN $314,295,600  085 A 3 UNIVERSITY BLVD COMMONWEALTH OF VA VISITORS OF JMU $183,758,900  017 C 0-17 235 MARTIN LUTHER KING JR WAY VISITORS OF JAMES MADISON UNIVERSITY $72,134,500  081 A 17 250 CHESTNUT RIDGE DR COPPER BEECH TOWNHOME COMMUNITIES $49,952,800  018 D 2 3 5 VISITORS JAMES MADISON UN $47,061,600  086 D 1 UNIVERSITY BLVD VISITORS JAMES MADISON UNIVERSITY $45,777,400  117 A 2 935 GARBERS CHURCH RD HARRISONBURG CITY SCHOOL BOARD $44,560,100  078 C 3 1925 E MARKET ST SM VALLEY MALL LLC $41,596,500  051 A 1 1301 HILLCREST DR EASTERN MENNONITE COLLEGE & SEMINARY INC $34,447,800  072 A 16 LINDA LA SCHOOL BOARD OF THE CITY OF $33,905,400 | |

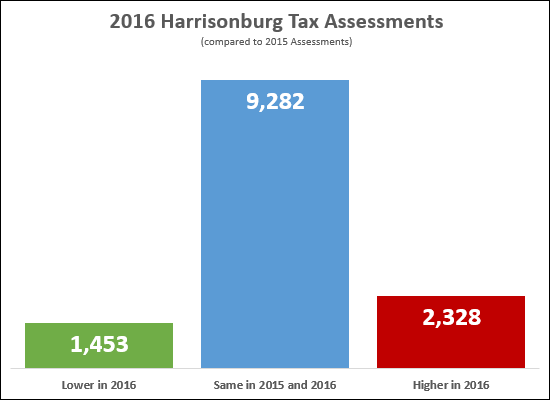

Did your Harrisonburg Tax Assessment Go Up or Down? |

|

Did your 2016 tax assessment go up or down? As shown above, most properties had the same tax assessed value in 2016 as compared to 2015....

Also of interest....

| |

Updated City Real Estate Assessments Released |

|

Updated assessed values were released earlier this month for all properties in the City of Harrisonburg, and they have now also been updated on HarrisonburgAssessments.com. As per the December 3, 2015 Daily News Record article....

Read more in the DNR article, or find the assessed value of any property in the City (or County) at HarrisonburgAssessments.com. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings