Buying

| Older Posts |

You Will Want To Have A Lender Letter The Day BEFORE Your Ideal Home Is Listed For Sale |

|

We're headed towards the spring market soon. Yes, I know there is still plenty of snow piled up that has yet to melt -- but hey, this week we're going to see high temperatures in the 50's -- it will feel like springtime for sure! Back to real estate, though, many buyers have a casual conversation with a lender to make sure their overall financial picture looks OK, but never get to the point of obtaining a pre-approval letter. And then... the house that they have been waiting months and months to purchase finally comes on the market for sale. What is said buyer to do? They'll need to hope that they can get that pre-approval letter in time to make an offer on the house they really (really) want to buy. So, if you plan to (or hope to) buy a home this spring, please, please go ahead and get a pre-approval letter now or very, very soon. You'll be putting yourself in the best possible position for pursuing the house you hope to buy if you already have your pre-approval letter the day BEFORE that house comes on the market.

| |

Is This The One, Or Should I Wait For A Better House To Be Available? |

|

This is a common question at this time of year -- as new listings start to trickle onto the market -- but before the likely faster pace of new listings in March and April. As a buyer in a low inventory environment, you (hopefully) know that you may have to compromise on some of what you're hoping for in your next home. Otherwise, you may be sitting here a year from now, still not having moved forward with a home purchase. But how much (!!??!!) should you compromise -- that is the tough question at this time of year. Let's imagine you've been in the market since Halloween, and you haven't seen ANYTHING that would work for you in November, December or January... ...when a new listing pops on the market in February that *could* work -- sort of -- but would requirement some relatively major compromises in areas A, B and C -- what do you do?? Do you go ahead and move forward with the purchase because it is much better than anything we've seen in months? Do you commit to buy because you're just tired of waiting around and you want to get this home buying show on the road? Do you decide to wait and then kick yourself a few months from now when we haven't found anything better for you to buy? These are not easy questions to answer -- but we can and should and will talk it through on a house by house basis. We'll be evaluating how far off the mark the house really is -- and how likely we think it is that another, better, option will come on the market in the coming months. | |

As A Reminder, We Will Need To Sign A Buyer Brokerage Agreement Before We Go See Houses |

|

Since 2012, written buyer brokerage agreements have been required in Virginia. Since 2024, they must be signed prior to going to see a house together. So, even if we're just getting started in exploring your home buying options - before we go see a house, we'll need to review and sign a buyer brokerage agreement. What will that buyer brokerage agreement outline? 1. Our duties and obligations to each other as I represent you in pursuing the purchase of a home. 2. The specific house or types of houses I will be helping you explore. 3. The term (start and end date) of the agreement. 4. The compensation you will pay for my services. If you'll be buying a home soon, let's review a buyer brokerage agreement together sooner rather than later so that you'll know what I'll be asking you to review and sign before we go view our first house. | |

Who Is Winning In Our Local Real Estate Market In 2025 |

|

Who is winning in our local real estate market in 2025? SELLERS are enjoying life with plenty of buyer interest, ever higher sales prices, homes usually going under contract quickly when they hit the market, and relatively low levels of competition from other listings. The only downside of the current market for sellers are the (relatively) high mortgage interest rates that could hold back even further or stronger buyer interest. BUYERS aren't really loving any aspect of the local housing market right now. Lots of buyers are buying which means more competition, prices keep going up, home go under contract quickly, inventory levels are low reducing options at any given time, and mortgage rates continue to stay above 6% and close to 7%. HOMEOWNERS are able to largely ignore most of the factors affecting the local housing market - though they are almost certainly happy to see continued increases in median sales prices, which mean likely further increases in their home's value as well. Will you be a buyer or a seller in 2025? How are you feeling about the market? | |

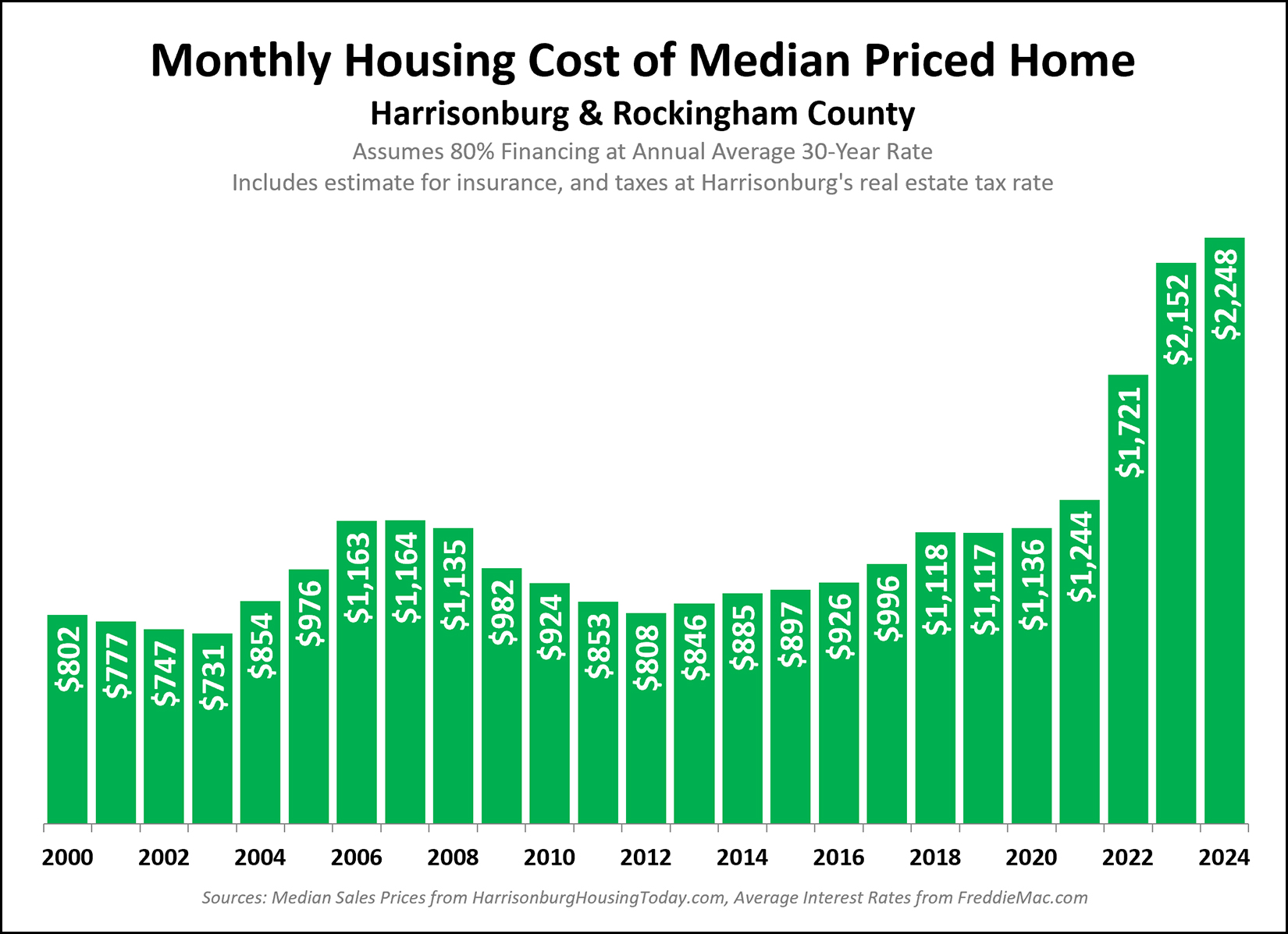

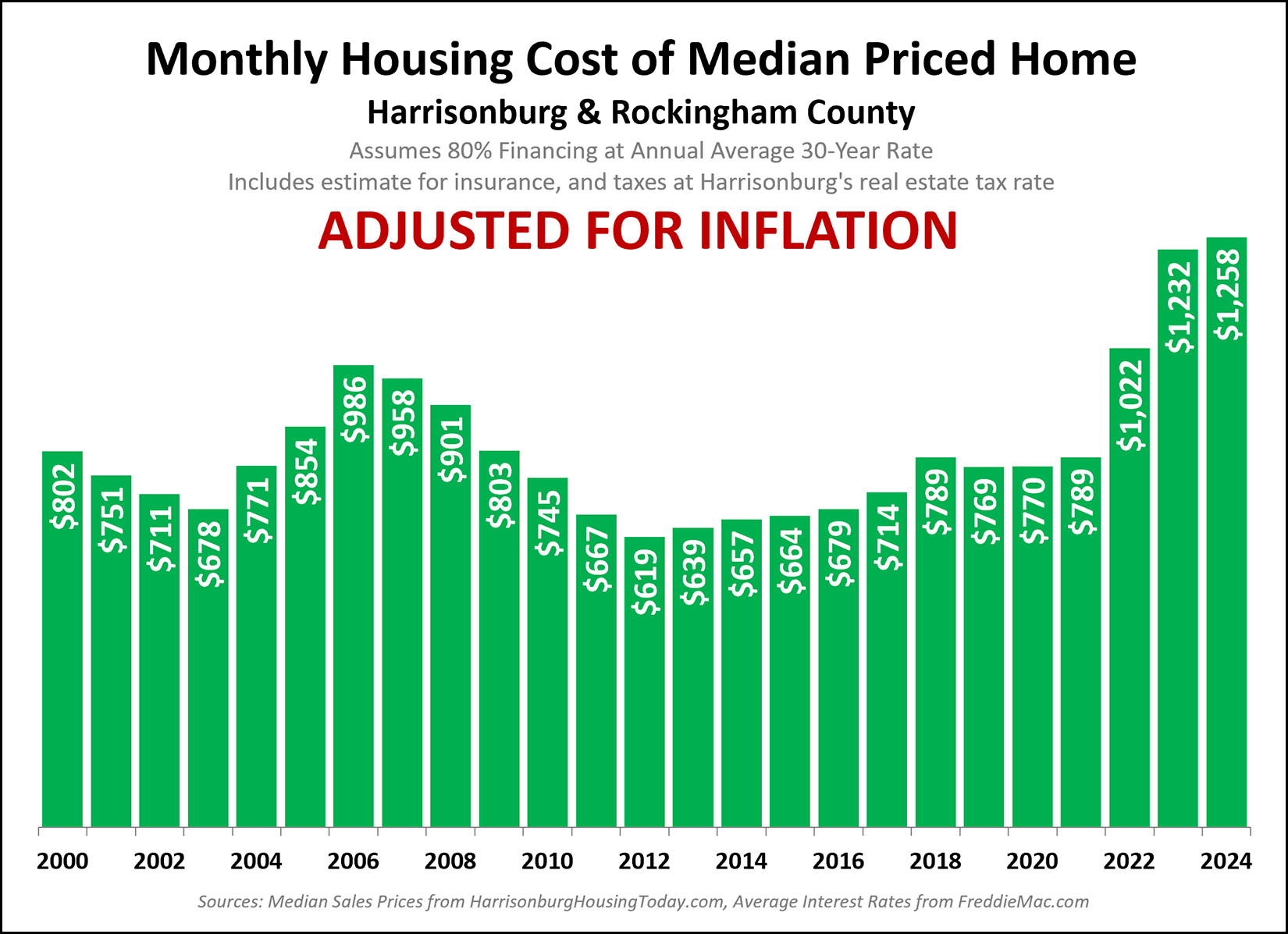

Monthly Housing Costs Over Time, Plus Adjusted For Inflation |

|

Above you can track average monthly housing costs in Harrisonburg and Rockingham County over time, with some pretty large caveats. This graph is based on the median sales price each year, assuming a buyer finances 80% of the purchase price with the average mortgage interest rate of that year, and the monthly costs include an estimate for insurance and property taxes. This chart is not showing the average housing cost of everyone in Harrisonburg and Rockingham County over time -- it is showing the monthly housing costs for buyers buying homes in each of the years in the graph. If you bought a home in 2014 with a fixed rate mortgage, your housing costs have likely stayed relatively level over the past decade other than adjustments for insurance costs and real estate taxes, both of which are a minority of the total housing cost. You might note that this graph shows monthly costs spiking significantly between 2021 and 2024. In fact... they nearly double between 2020 and 2024. Here's where we need to consider inflation. The inflation rate was quite higher in 2021 and 2022 which caused housing costs (and the cost of many other items) to increase significantly. Certainly mortgage interest rates were also rising during this time, but we can't ignore the impact of inflation alone. Here is the annual inflation rate during the same timeframe as in the graph above...  And now, let's adjust those housing costs for inflation, so that each year's housing cost is in 2020 dollars, to see how much housing costs have adjusted over time over and above how inflation has changed...  Here you can see that housing costs have still increased quite significantly over the past few years, but not quite as much as the non inflation adjusted data would have you believe. It seems unlikely that home prices are going to decline - so the best bet for housing costs leveling off would be lower mortgage interest rates. Most economists are not predicting significant downward adjustments in mortgage interest rates in 2025. | |

I Would Like To Buy A New (To Me) Home But Would Need To Sell My House In Order To Do So. Is This Possible? |

|

Ah yes - a good question - buying and selling - can it even be done in 2025? You own a home, but you want to buy a new one. You can't buy the new one until you sell the existing one. So, what are your options? This list doesn't include all the possible ways to do it... but it includes quite a few options to consider and explore... Buy First, Seller Later. If you are qualified for a mortgage to purchase the next home before you sell your current home, this may be the way to go. This will allow you to make an offer on a house you love without a home sale contingency, which often won't be be accepted by a seller. Certainly, there are some risks to this approach -- you won't know how quickly your home will sell or for what price -- but it will be a lot easier logistically. In addition to being able to make an offer without a home sale contingency, you will also be able to move into the new home before having to move out of your existing home. List Your Home For Sale After Having A Contract To Buy The Next Home. Shifting pretty far from the prior strategy - the concept here would be waiting to list your home until you have secured a contract to buy the home you want to buy. But... this isn't necessarily a realistic strategy in the current market. Most home sellers aren't going to be interested in your offer if it is contingent on you listing your home, getting it under contract, working through any contingencies and then getting to closing. So... it's fine to make offers with this contingency but it is not necessarily realistic to think that a seller will go along with your proposed plan. List Your Home For Sale After Seeing The Perfect House To Buy. This one is a bit tricky from a timing perspective, but it's trying to end up somewhere between the two strategies noted above. This game plan would involve waiting until a perfect house comes on the market for sale, and then listing your home for sale. The hope would be that you could get your current house under contract quickly enough to then make an offer contingent on your (under contract) home making it to closing -- instead of contingent on your (not yet listed) home being listed, going under contract and making it to closing. Most sellers will be more excited about your offer this time -- since your house is already under contract -- but your offer will still likely be seen as less favorable compared to an offer without a home sale contingency at all. List Your Home For Sale, Contingent On You Finding A House To Buy. If you have tried the above strategy (listing your home for sale as soon as a perfect house to buy comes on the market) a few times without success -- because another buyer jumped on that perfect house before your house was under contract -- then maybe this strategy is for you. We can list your home for sale without knowing what you will buy. When a buyer is ready to commit to buying your home, we can propose contract terms that make the sale of your home contingent on you securing a contract on a home you would like to purchase. Some buyers might go along with this, but some won't like the uncertainty of whether they are really buying your house. This strategy is asking the would-be buyer of your house to take on the risk of whether you will be able to find a house to buy and have your offer on that house accepted. List Your Home For Sale, Hope For The Best For A Next House. If you have tried the above strategy (listing your home for sale, contingent on you securing a contract on a house to buy) and it didn't work -- because buyers don't like that uncertainty -- then maybe this strategy is for you. We can list your home for sale, when a buyer comes along we can propose a slightly longer (60-75 day) closing timeframe, and then hope that a perfect house comes along in the next few weeks, allowing you to (hopefully) contract on the next house, with both closings to coincide. Certainly, if the right house doesn't come along, or if that seller doesn't like your contingent (on home settlement) offer then you might not be able to secure a contract to buy a home -- and you would still need to sell your current house (and move out of it) per the terms of your contract with a buyer. Eek. List Your Home For Sale, Hoping For A Flexible Buyer. We wouldn't want to bank on this being possible -- but if we list your home for sale, and a buyer comes along that is either an investor (planning to rent out your house) or is very flexible about when they would move in -- then you could contract with this flexible buyer knowing you wouldn't have to move out right away when the settlement date rolls along. This might buy you a few extra months to find the right home to contract to buy -- either making an offer contingent on your home getting to settlement (if closing hasn't happened yet) or not contingent on a home sale at all if the closing has taken place. Come To Terms With Moving Twice. This is perhaps the least exciting logistically. Nobody really likes moving. Moving twice is just about twice as bad as moving once. But... if the fact that you need to sell your home limits your ability to purchase the home (or homes) that you want to buy -- then you may need to sell your home, move into a rental, and then make offers without having a home sale contingency. | |

I Hope To Buy A Home Soon And Want To Better Understand The Process And The Market |

|

If you will be a first time home buyer, or if you are getting ready to buy a home for the fifth time in your lifetime, you may have questions about the home buying process and the market... 1. When should I get pre-approved for a mortgage? 2. I want to buy a house like ____, and I'm wondering if I will be able to do so in my budget of ____. 3. I'm worried about buying a home without doing a home inspection - is it possible to include an inspection contingency in an offer these days? 4. Do buyers or sellers pay for the services of a buyer's agent these days? 5. Is it OK for us to go look at some houses together even if they might not be a perfect fit for what I'm looking for? 6. How long does it usually take to get to closing and take occupancy of a house once I am under contract to purchase it? 7. What are home prices likely to do in our local market over the next few years? 8. What are mortgage interest rates likely to do over the next few months? 9. Should I plan to pay list price or higher on every house that is on the market this year? 10. What is the first step I need to take when a house of interest hits the market? I often meet with home buyers before we start to view houses to discuss these questions and more. If that type of a conversation would be helpful for you -- let's meet at my office, or meet up for coffee -- you can contact me most easily by phone/text at 540-578-0102 or by email here. | |

Inventory Levels Are Likely To Continue To Decline For The Next Few Months |

|

Inventory levels - the number of homes on the market for sale - are likely to continue to decline for the next few months. Above you can see the monthly inventory levels in Harrisonburg and Rockingham County over the past seven years. We typically see inventory levels declining at least through January or February. Of note -- this doesn't mean that new listings won't be hitting the market over the next few months -- they will. But there are likely to be fewer new listings and an equal or greater number of buyers, causing inventory levels to continue to decline. We should then start to see an uptick in overall inventory levels when we enter the spring market in March or April. If you are hoping to buy a home soon, you are likely to have fewer options than usual over the next few months. If you are hoping to sell a home soon, you are likely to have less competition from other sellers than usual over the next few months. | |

Mortgage Interest Rates Headed Down For Christmas? |

|

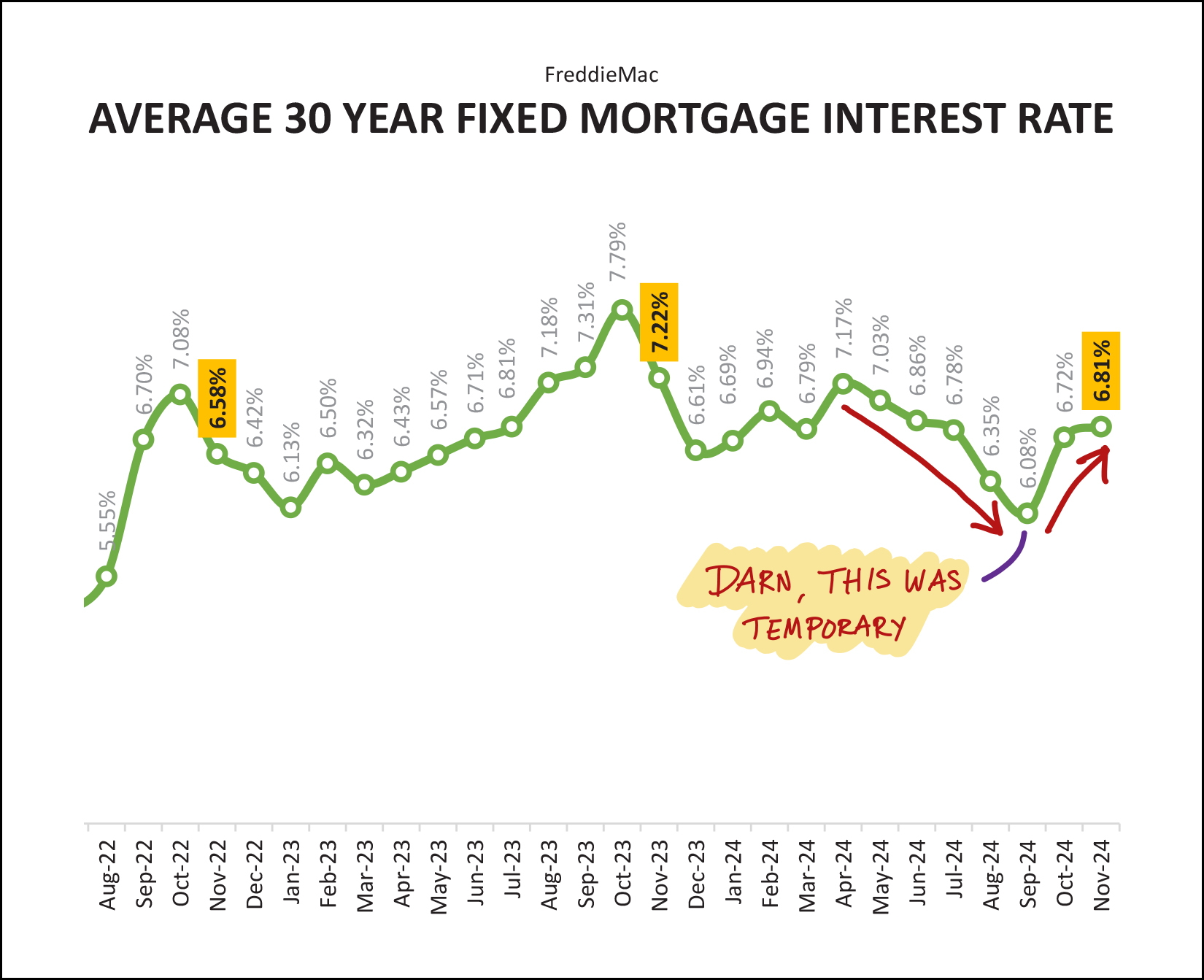

Christmas is one week away... and mortgage interest rates seem to be dropping in anticipation of the holiday. ;-) So... if you're looking for a last minute gift for a special someone... contract to buy them a house, lock in your mortgage interest rate, and my how appreciative they will be! No, but really, mortgage interest rates have been all over the place over the past year... as high as 7.22% and as low as 6.08%. They are currently on a downward trend back towards six and a half... though TBD if they'll stay there or keep dropping... for New Years!? | |

Buying A New Construction Townhouse Requires A Bit Of Planning |

|

Most new construction townhouses in the Harrisonburg area are going under contract months before construction is complete. Thus, would-be new construction townhouse buyers are finding they need to plan ahead... or they won't be buying a townhouse. Buyers often start looking for homes a month or two before they need a place to live... since it usually takes a month or two to get from contract to closing. But... not so on new construction. The townhouses currently offered for sale at Congers Creek (as pictured above) are currently slated to be complete in May or June of this coming year. So... if you are hoping to buy a new construction townhouse this coming spring or summer... you should be making those plans ASAP! | |

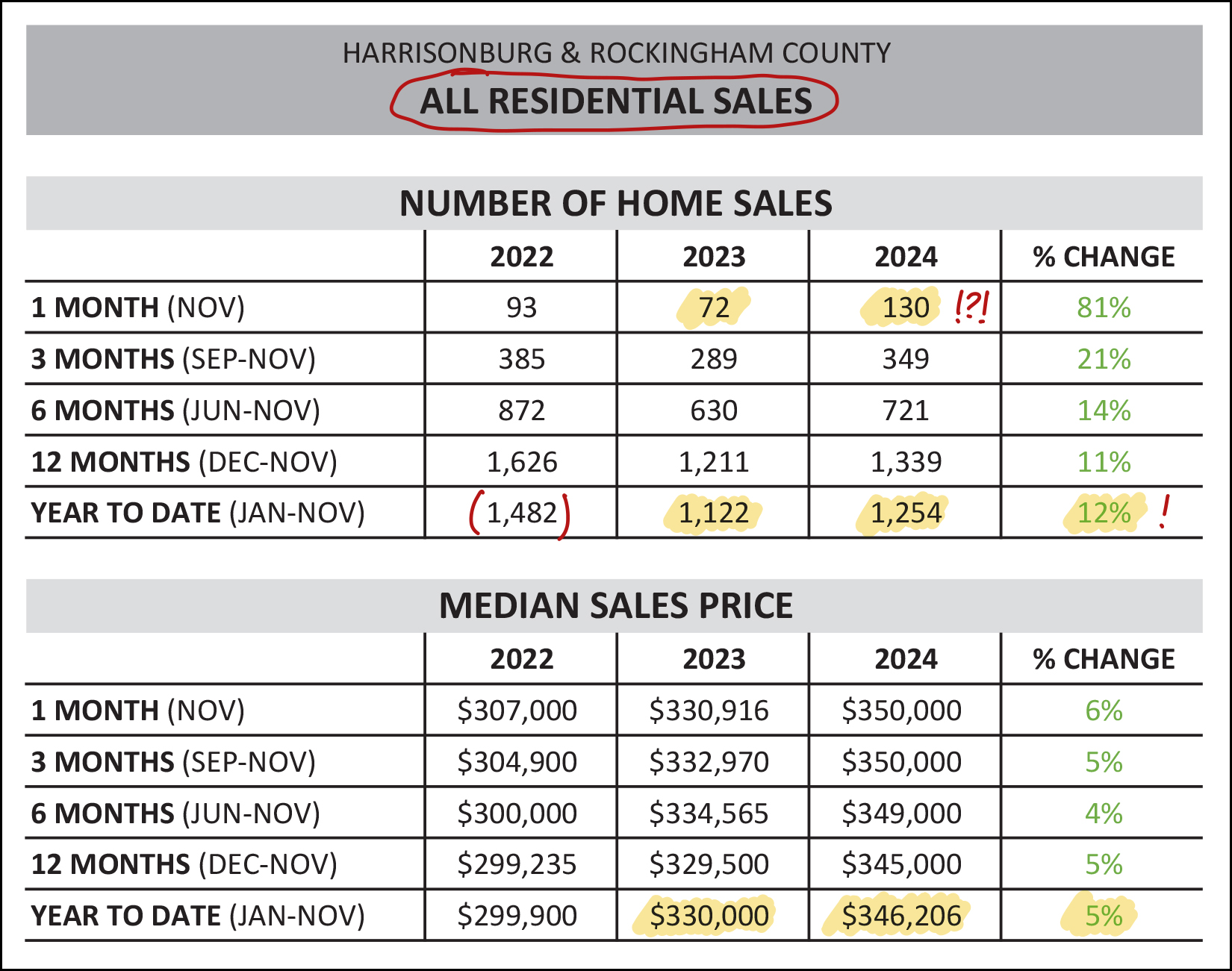

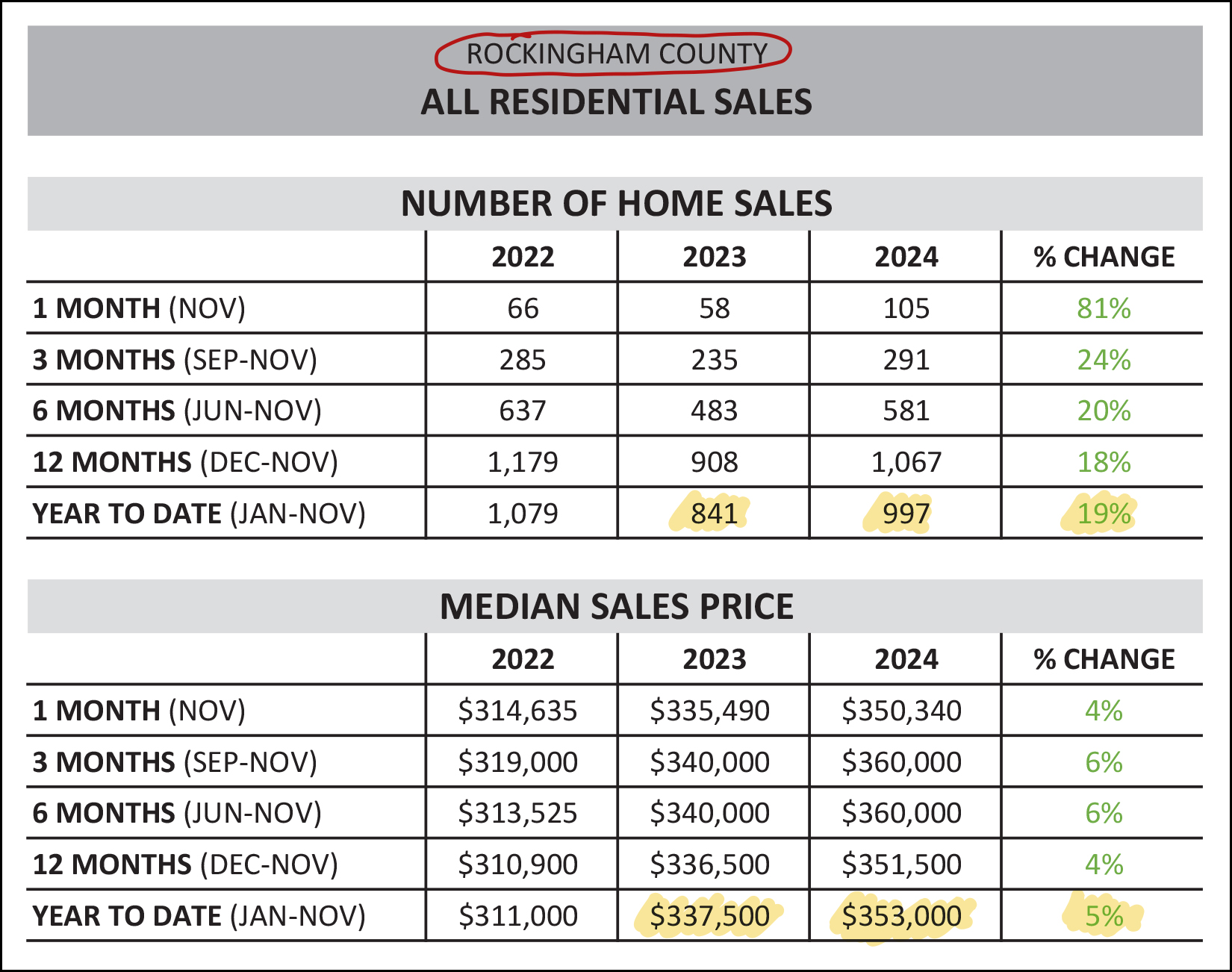

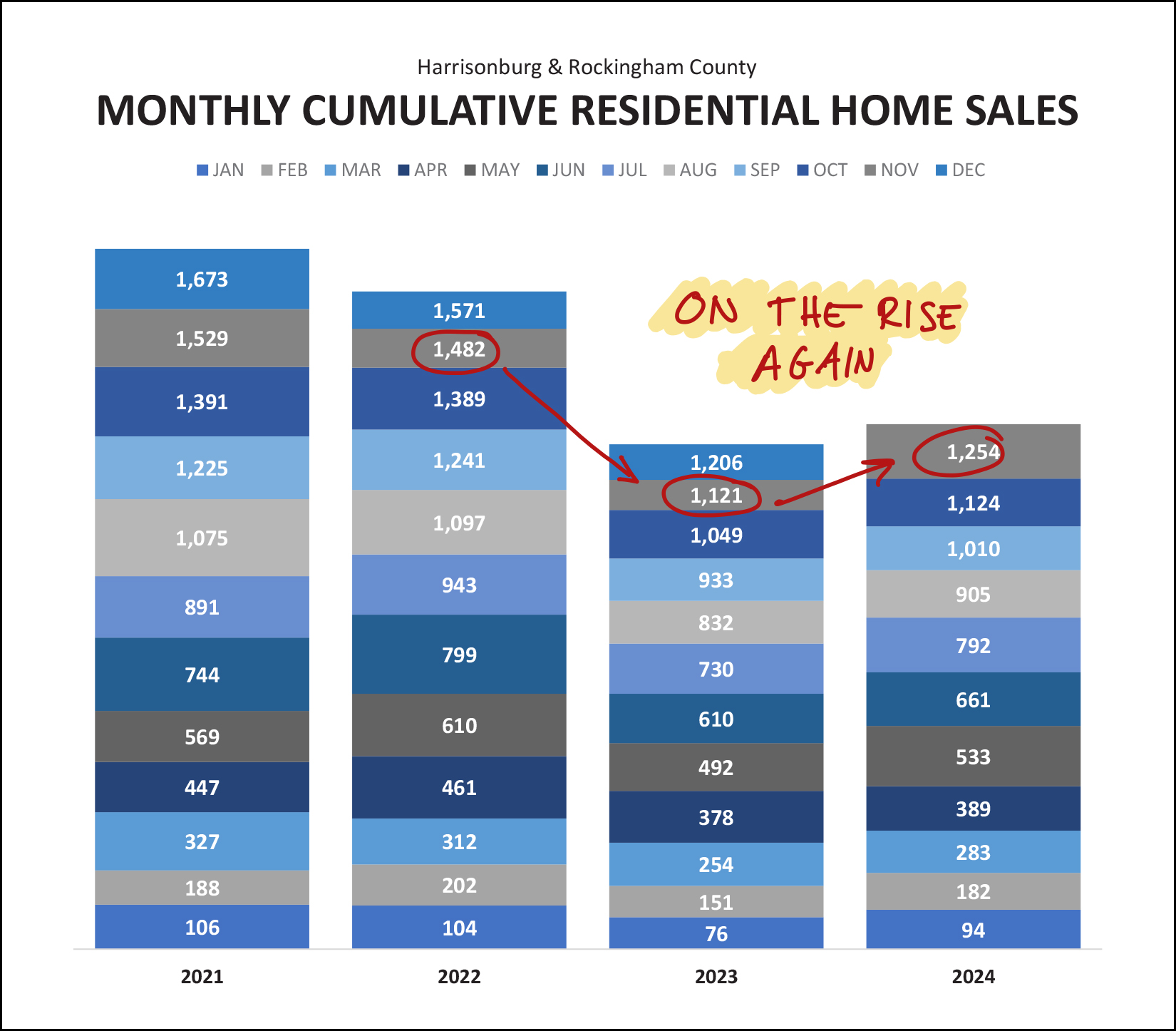

November Home Sales Surge with 12% Year Over Year Growth and 5% Increase in Median Price |

|

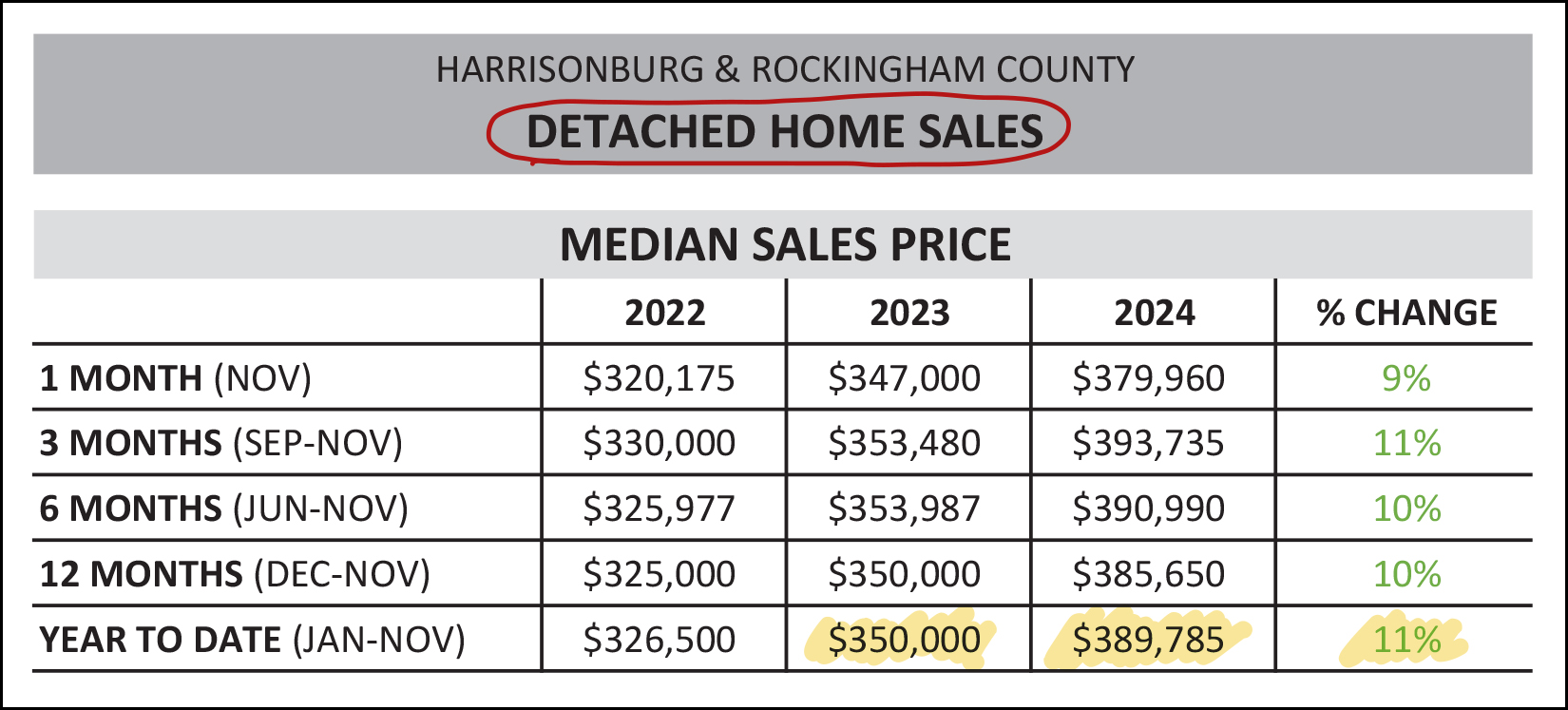

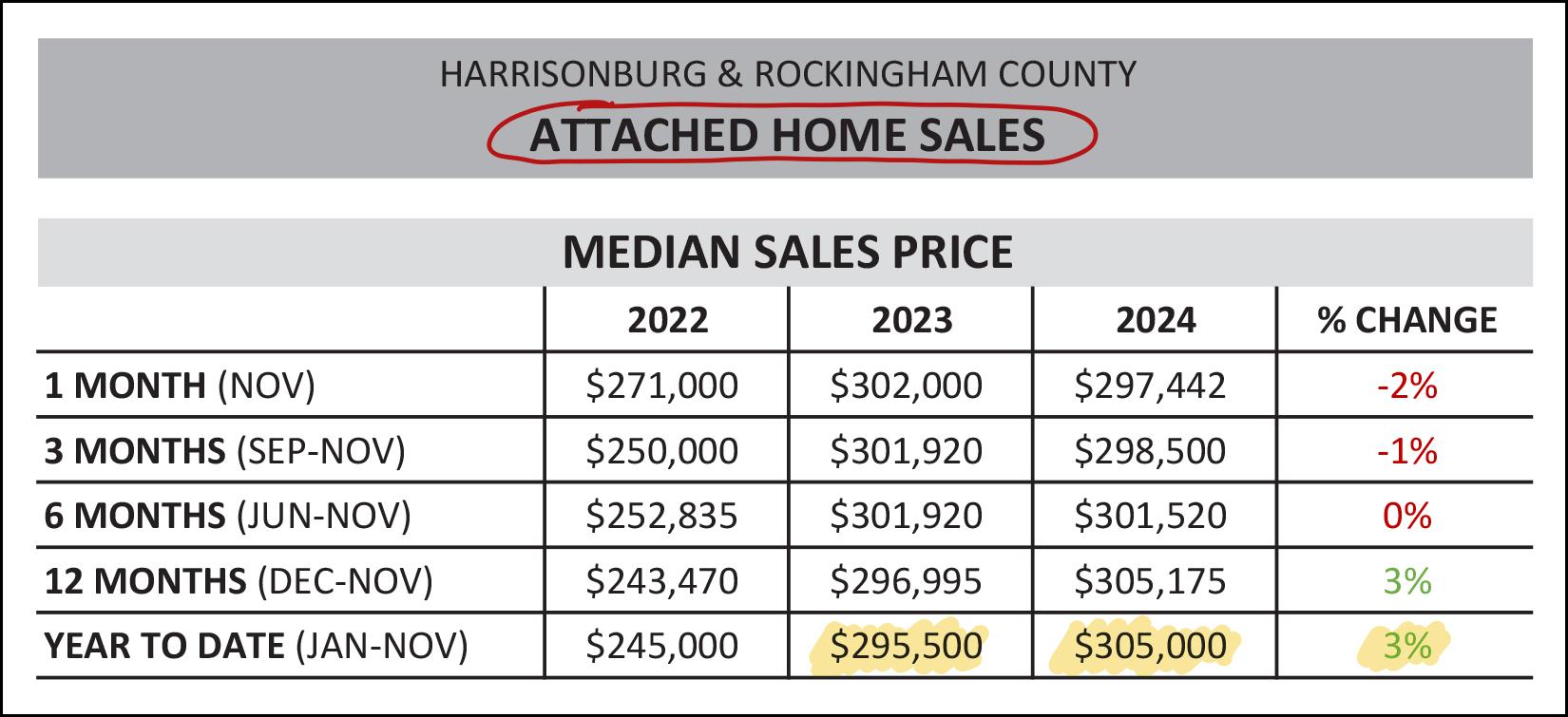

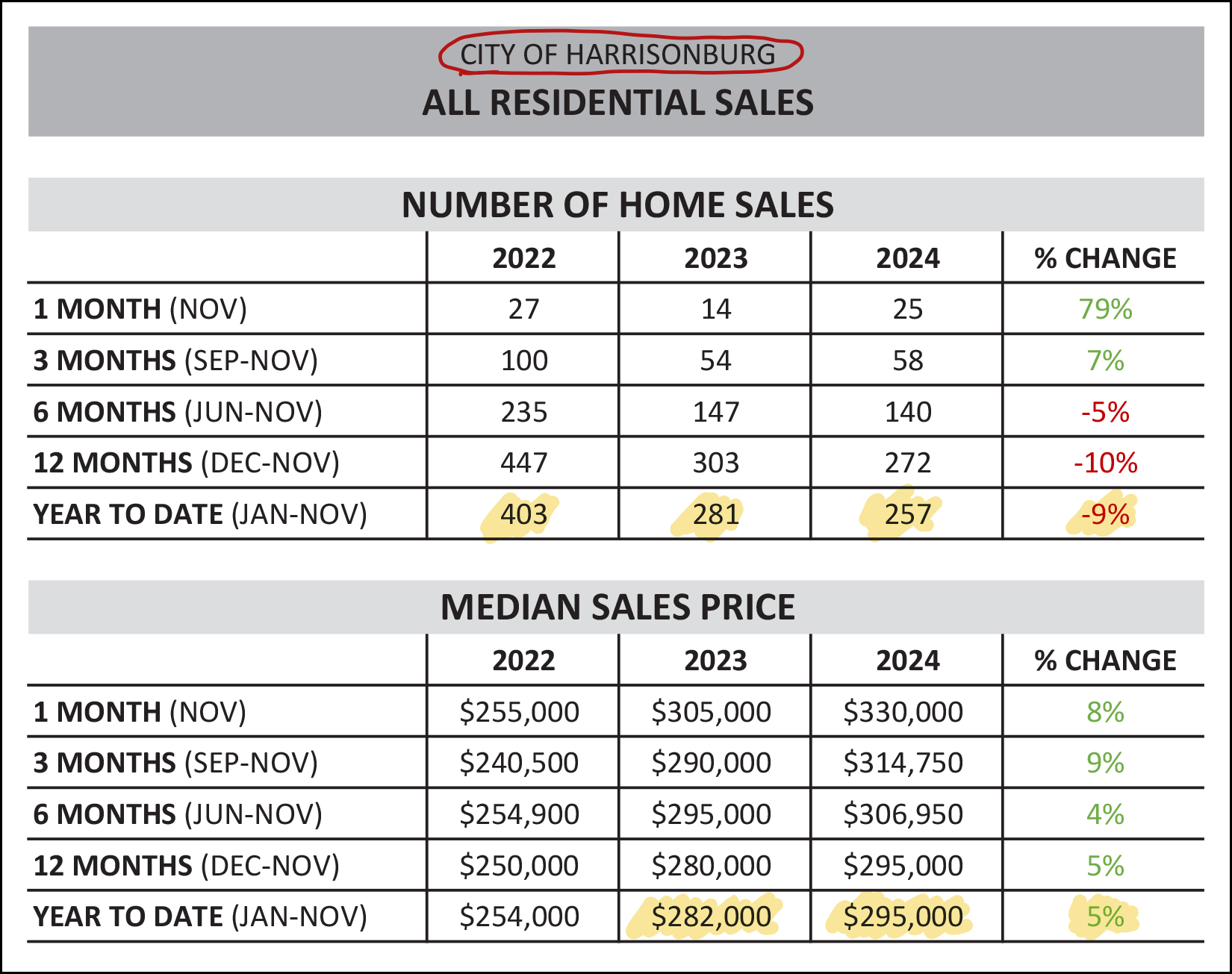

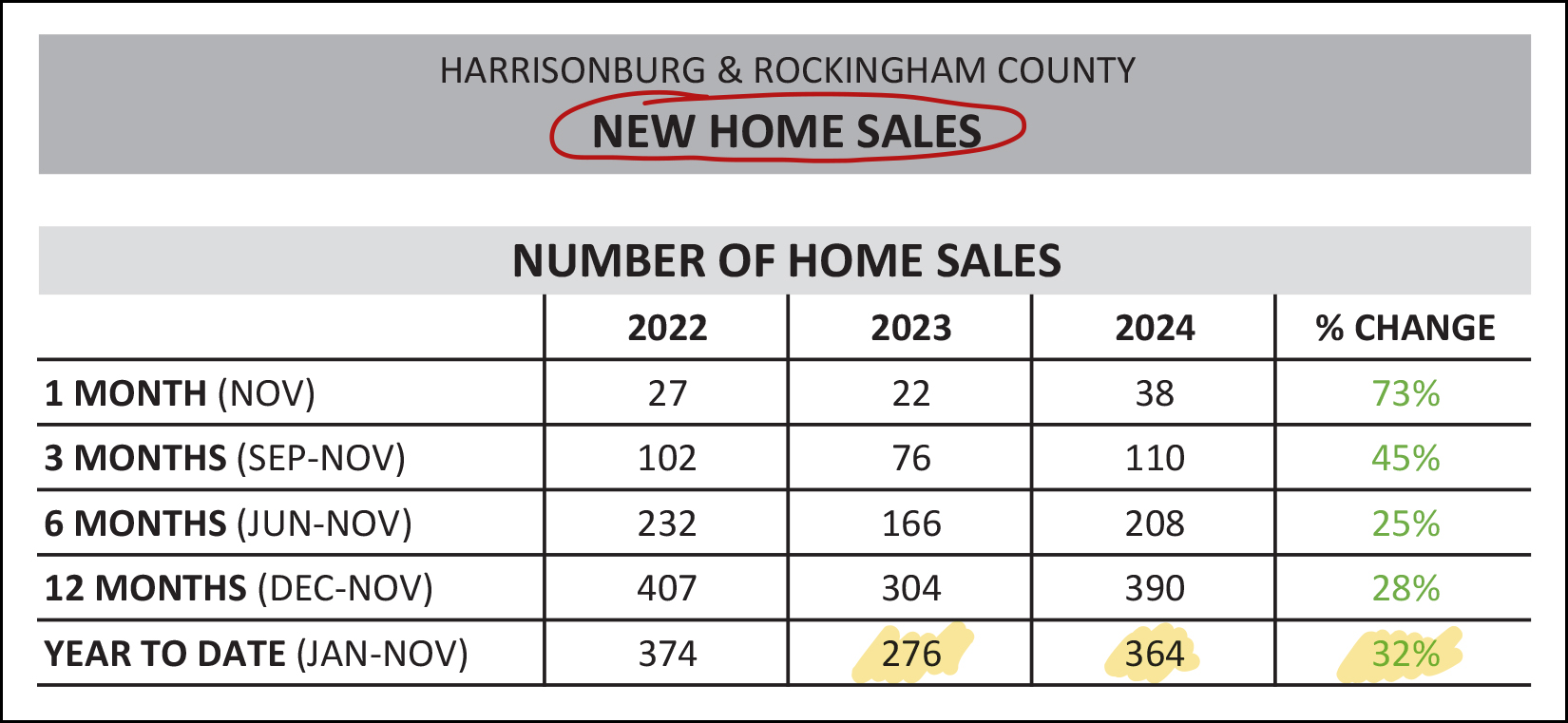

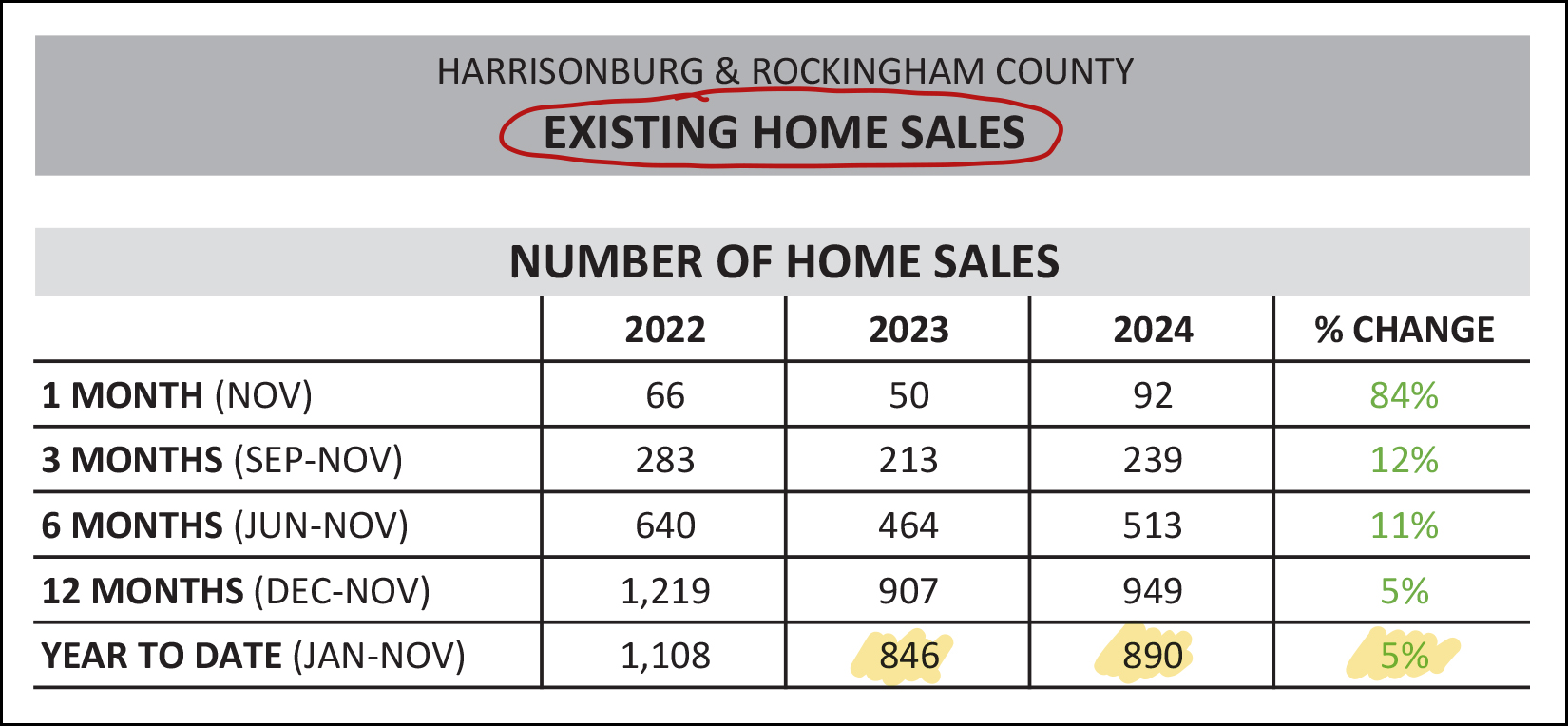

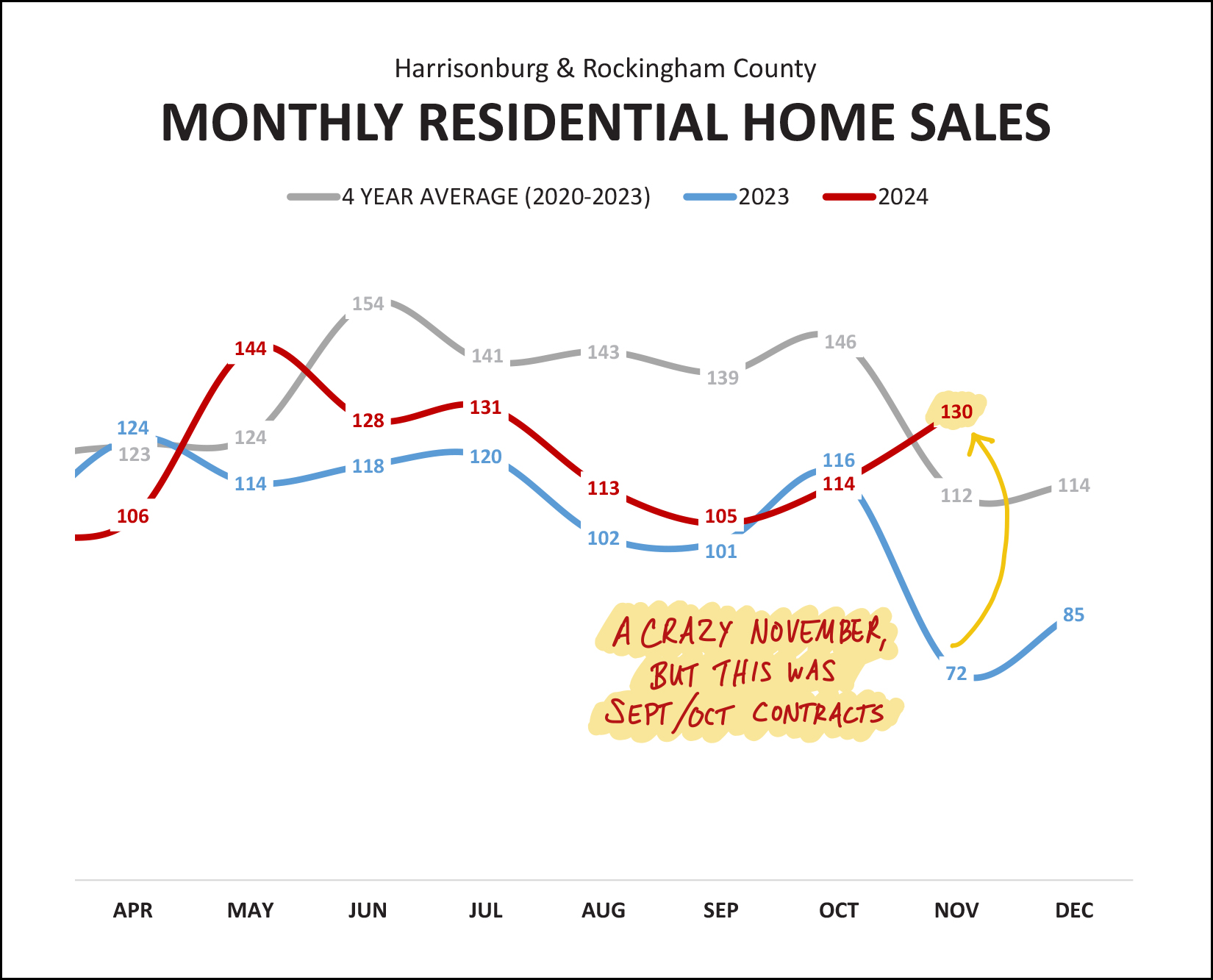

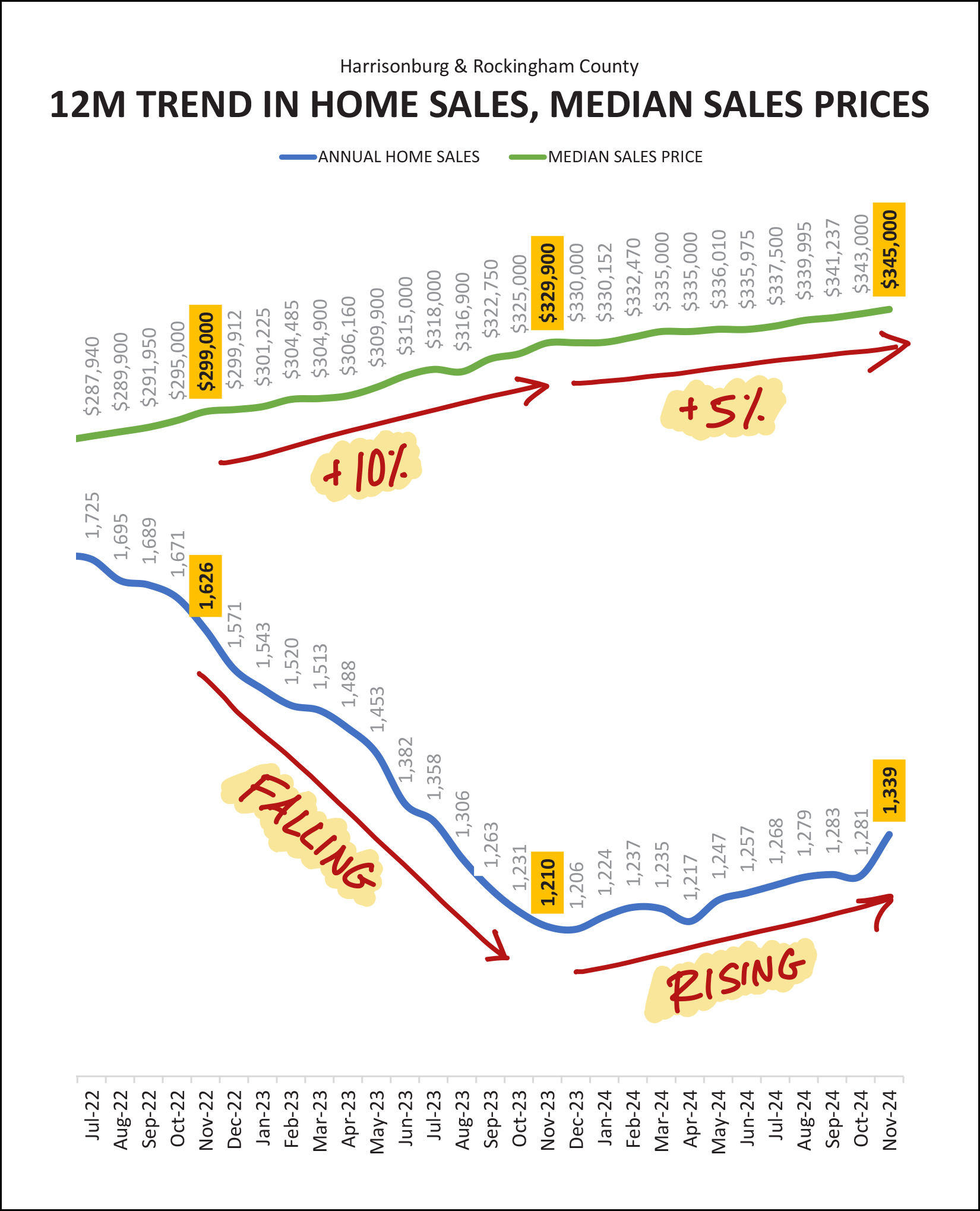

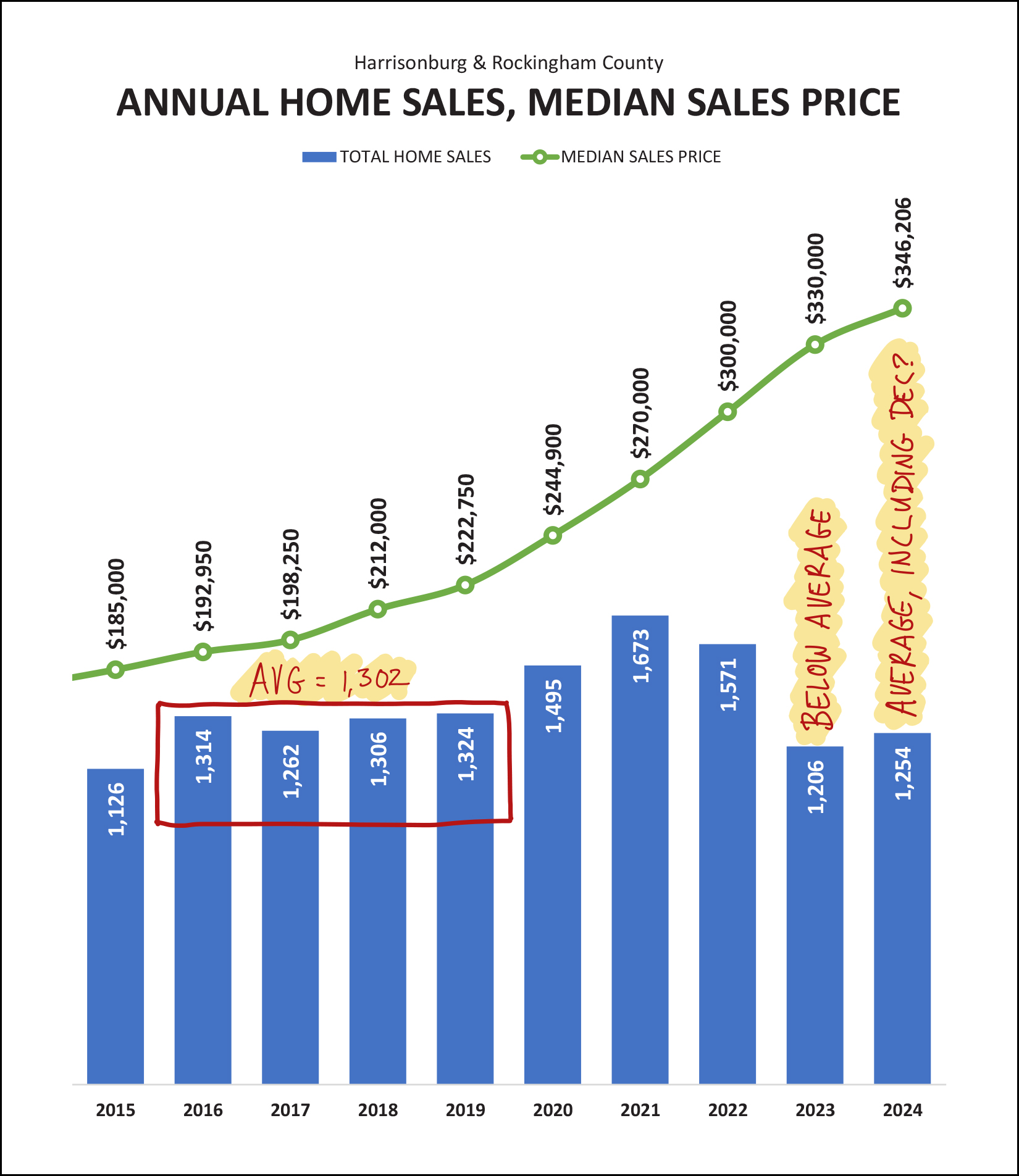

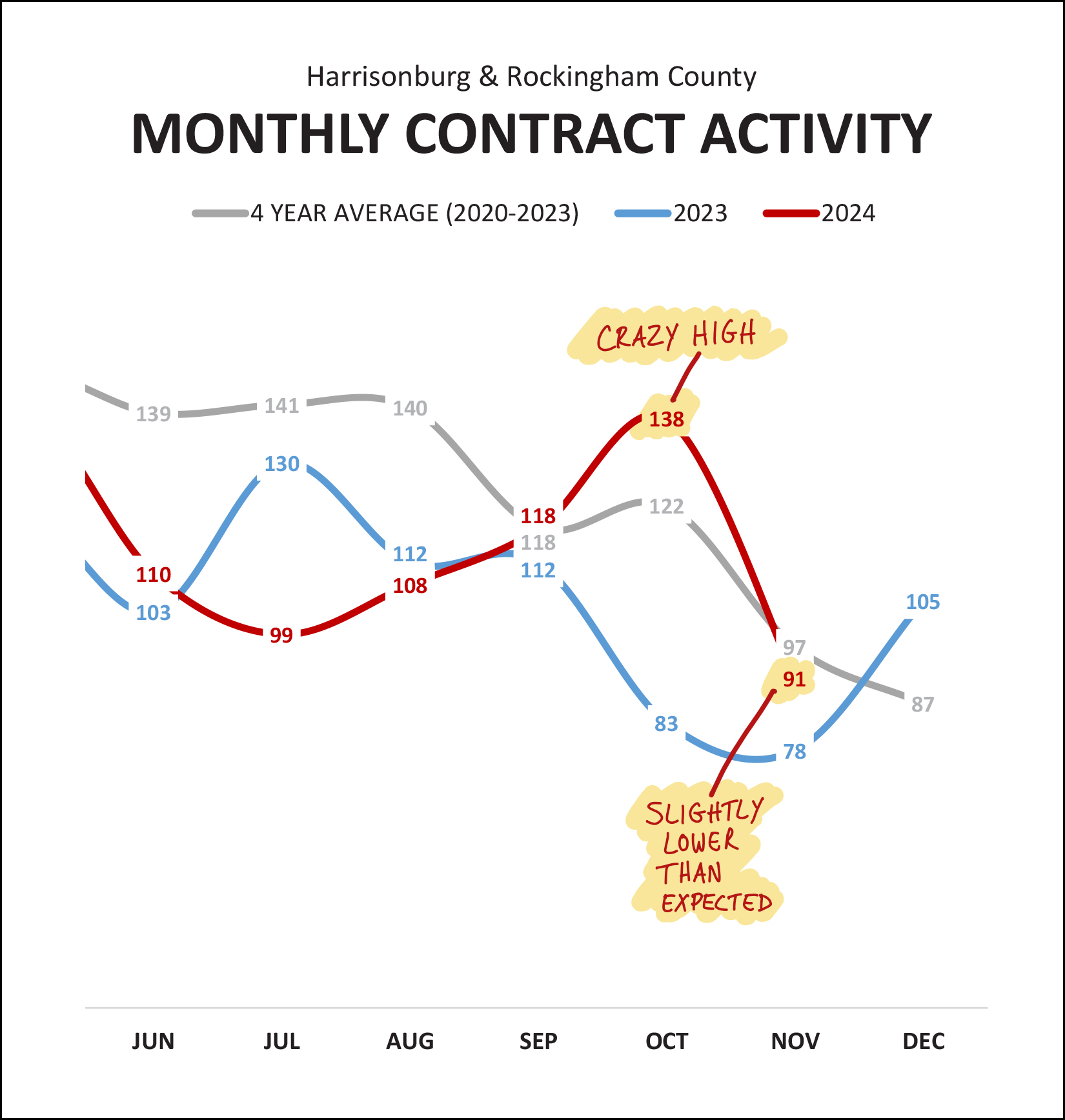

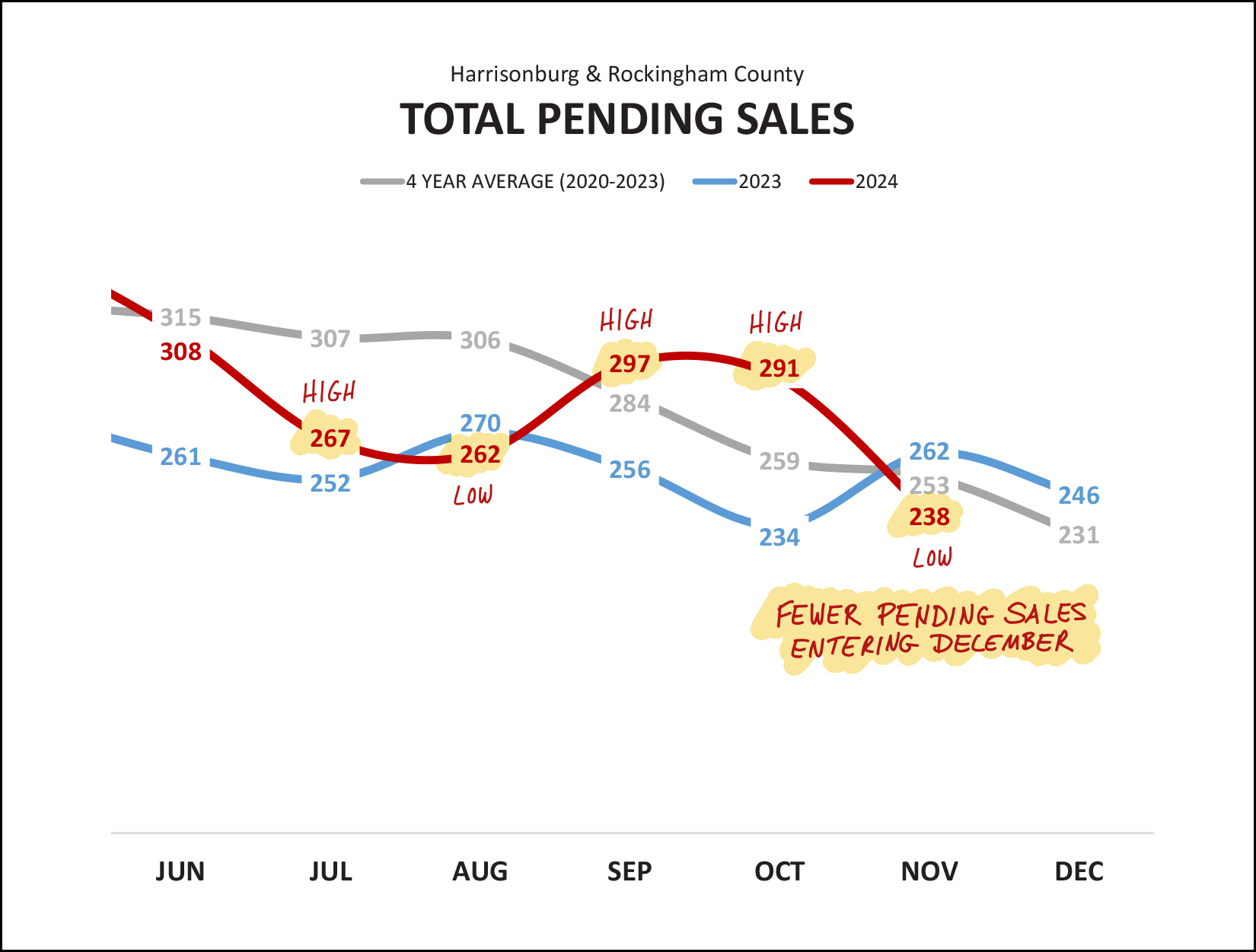

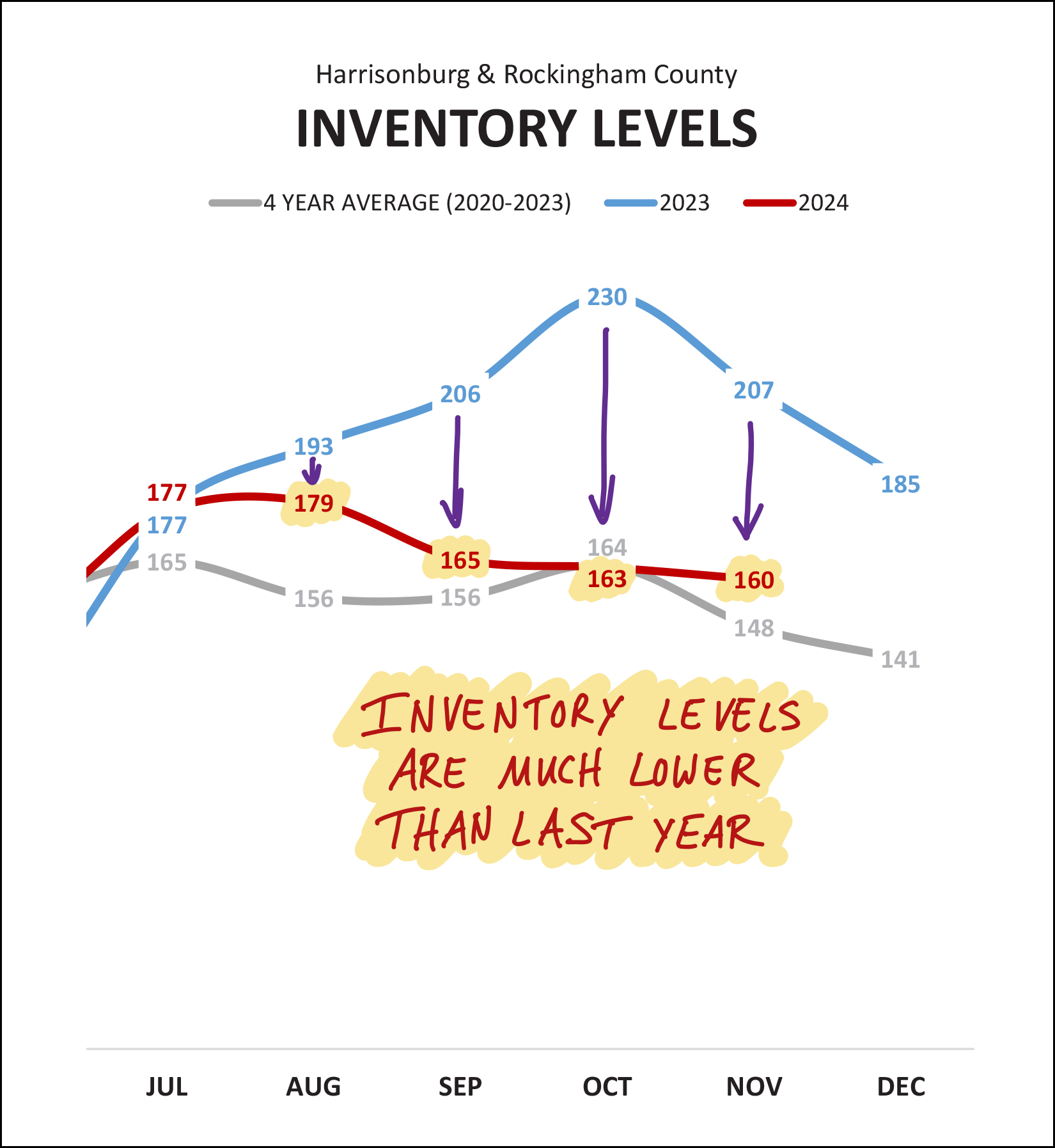

Happy Friday morning, friends! It's hard to believe there are only 19 days remaining in 2024! This year has flown by, and we'll soon be ringing in the New Year! Speaking of new beginnings, I'm excited to let you know about the latest news in our family - our son, Luke, is now also a Realtor! Luke looks forward to helping individuals and families navigate the real estate market in the Harrisonburg and Rockingham County area and is also continuing his studies at JMU, pursuing a dual degree in Independent Scholars and Communication Studies with minors in Entrepreneurship and Honors Interdisciplinary Studies. In some other fun news, The Steel Wheels are hosting another Winter Roots concert in February at JMU's Wilson Hall. You can find the details of the concert here, buy tickets here... and... enter to win a pair of free tickets here! And now... after all that... let's hit the real estate data...  First up... look at those November home sales!?! Last November there were only 72 home sales in Harrisonburg and Rockingham County... this November... 130 home sales!?! This took me by surprise. Even if we considered November 2023 to be a bit slower than normal, when we look back at November 2022 there were only 93 home sales... so this November was certainly a surprising surge of home sales for our market. This surge of home sales in November lead to -- no surprise here -- continued improvement in how this year's home sales compare to last year. We have now seen 12% more home sales this year than last in Harrisonburg and Rockingham County when looking at 11 months of data. Of note... the 1,254 home sales seen thus far in 2024 is still quite a bit lower than the 1,482 home sales seen in the first 11 months of 2022. And how about those prices? The median sales price for all homes sold in 2024 in Harrisonburg and Rockingham County is now approaching $350,000... which is a 5% increase compared to the median of $330,000 seen last year. Moving on to look at few sub-sections of the market, first let's see what's happening in the detached home market - which excludes townhouses, duplexes and condos...  The main metric I have highlighted above is the median sales price in 2024 compared to 2023. A year ago the median sales prices of detached homes was $350,000... and we are now quickly approaching a median sales price of $400,000 in Harrisonburg and Rockingham County! This marks an 11% increase in the median sales price in the course of a year. Meanwhile, in the "attached homes" market -- which mainly includes townhouses but also duplexes and condos...  The median sales price is not climbing quite as quickly for townhouses, duplexes and condos... but that median sales price has eclipsed $300,000 for the first time in 2024. We can also learn a bit more about the nuances of the local real estate market but breaking things down between the City of Harrisonburg and Rockingham County. Here are the numbers for the City...  As you will note in the top half of the chart above... we have seen 9% fewer home sales in the City of Harrisonburg this year compared to last year... but as shown in the bottom half of the chart above... the median sales price has risen 5% to $295,000. Let's compare these figures to Rockingham County... you'll find they are quite a bit different...  In contrast to the 9% decline in the number of City sales... we're seeing a 19% increase in the number of County sales -- though the median sales price in the County has increased by 5% over the past year, just as the City price has increased by 5%. Slicing and dicing the data one more time, let's look at new home sales compared to existing (resale) home sales. First up, new home sales...  My oh my how the new homes are being built, and are selling. We have seen a 32% increase in the number of new homes that have sold in Harrisonburg and Rockingham Count this year (364) compared to last year (276) though - interestingly - we're right back to about the level (374) where we were two years ago. The existence of newly built homes in our community continues to be a significant factor in our overall housing market. And the existing home sales... did they increase by 32% Nope...  We are seeing an increase in existing home sales (+5%) this year... but nowhere near the 32% increase seen in new homes. This is not too surprising, as many homeowners simply do not want to sell their homes right now given the super low mortgage interest rates that many homeowners still have on their current mortgages. Now, then, you made it past the charts... let's see what we can learn from some graphs showing the latest trends in our local market...  This graph (above) paints the picture more clearly than the chart of data earlier on -- the 130 home sales in November 2024 was unexpectedly high -- way higher than last November (72 sales) and also well above the average (112) of 2020 through 2023. But, remember, this high number of closed sales in November 2024 would have been the result of buyers (and sellers) signing contracts in September or October... since it takes some time to get from contract to closing. Thus, we'll look ahead a bit further on in this report to see what contract activity took place in November 2024 to better predict home sales activity in December 2024. But first, how is 2024 stacking up compared to prior years?  Home sales are on the rise again! After declining in 2022 and 2023, we are now seeing an increase in the number of home sales taking place in Harrisonburg and Rockingham County. The 1,254 home sales seen in the first 11 months of 2024 puts us 12% ahead of last year. Visualized differently, here's how the trajectory of home sales and home prices have changed over the past year...  After multiple years of 10% annual increases in the median sales price (only one year of that type of increase is pictured above) we are now seeing a more modest 5% increase in the median sales price over the past year in Harrisonburg and Rockingham County. I think this is more likely to be what we see moving forward as well -- a 5% (ish) increase in prices over the course of a year. Meanwhile, the number of homes selling has certainly rebounded over the past year... bottoming out around 1,206 annual home sales a year ago, and now back up to 1,339 annual home sales. How does the current number of home sales compare to some past years, particularly pre-Covid? Let's take a look...  Looking back to the pre-Covid days (2016-2019) we were seeing an average of about 1,300 home sales per year in Harrisonburg and Rockingham County. Then, Covid. During the pandemic and it's aftermath, which included super (super) low mortgage interest rates -- we saw the annual pace of home sales quickly climb above 1,400 then 1,500 then 1,600 to then crest at 1,673 in 2021. But then, as mortgage interest rates rose (and home prices rose) the number of home sales fell rather quickly - back down to 1,206 in 2023. This year, however, with 1,254 home sales in the first 11 months, it seems likely we will get back to that 1,300-ish level by December 31. So, maybe we are now back to the 1,300 home sales a year range, after having been quite far above it, and then a good bit below it. Stay tuned in 2025 to see how this plays out. Now, about that contract activity...  You can see it clearly here (above) that a crazy high number of contracts in October 2024 was what lead to the crazy high number of closed home sales in November 2024. So what shall we expect over the next few months? The 91 contracts signed in November 2024 was a normal-ish number of contracts for a November -- it was higher than the 78 we saw last year, but slightly lower than the 2020-2023 average of 97 contracts. Thus, we should likely see around 80 - 95 home sales close in December 2024. With all of those closings in November, are there still quite a few homes under contract right now? Sort of, kind of...  Pending sales were higher than expected at the end of September and end of October... but perhaps unsurprisingly because of all of the closed sales in November... the pending sales count is lower at the end of November than we might have otherwise expected. This is also an indicator that we'll see a bit of a slower month of closed sales in December and likely in January -- though this is somewhat to be expected in these winter months. And inventory levels -- how do they compare to last year?  There are significantly fewer homes on the market now as compared to a year ago. Last September through November we saw inventory levels of 206 to 230 homes for sale -- while we are seeing a more consistent 160 to 165 homes for sale during the same timeframe this year. Last year's higher inventory levels were mostly a result of rapidly increasing mortgage interest rates that slowed the market, causing inventory to start building. About those mortgage interest rates...  They've been up, they've been down, they've been all around!?! Mortgage interest rates were steadily declining for quite a few months in the middle of 2024 (May - Aug) but they have now increased again, getting closer to 7%. I think we will likely see mortgage interest rates continue to fluctuate between 6% and 7% over the course of the next year. If you're waiting to buy until rates get below 6%, it might be a long wait. Now, for a brief summary of the big picture and the latest trends in the Harrisonburg and Rockingham County real estate market... [1] We are seeing 12% more home sales this year than last. [2] The median sales price has increased by 5% over the past year. [3] Detached homes are increasing in value faster than attached homes. [4] We are seeing a decrease in City home sales and an increase in County home sales. [5] We are seeing a much larger year over year increase in new home sales than existing home sales. [6] Inventory levels remain relatively low. [7] Mortgage interest rates continue to stick between 6% and 7%. So, as we prepare for 2025... Home Buyers should connect with a great lender, get a preapproval letter in hand, and go see houses within the first few days that the hit the market. Home Sellers should be realistic in the pricing of their homes given that prices are not increasing as quickly and mortgage interest rates are remaining quite high. Homeowners who do not plan to sell should enjoy their home, their likely low mortgage interest rate, and enjoy not having to engage in what can be a hectic and/or stressful process of selling and buying a home. As you think about YOUR year ahead, if it might include a housing transition (buying, selling, both) feel free to reach out so that we can chat about the market, the process, your hopes and dreams and so that I can know how to best support you in that potential move. You can contact me most easily by phone/text at 540-578-0102 or by email here. Until next year (!) have a wonderful remainder of 2024 - and I hope that you have the opportunity to spend some quality time over the next few weeks hanging out with, laughing with, having fun with, the people in your life who bring you joy! | |

Interest Rates And Home Prices Affect Home Sales Trends, But Life Events Do As Well! |

|

It's easy to think, or say, that interest rates and home prices are the largest or main factors affecting whether sellers sell and buyers buy. But... sometimes life events or life changes eclipse the impact of interest rates and home prices. You are a new grandparent and you want to spend more time with your new grandbaby who lives eight hours away? I'm not at all surprised that you plan to sell your home and move. You have a new job opportunity with an exciting company in a city three hours away? I'm not at all surprised that you plan to sell your home and move. You are retiring in northern Virginia and your two kids both went to JMU and still live in Harrisonburg? I'm not at all surprised that you plan to sell your current home and move to Harrisonburg. There are lots and lots of life events or life changes that can cause a homeowner to all of a sudden be ready to sell... or can cause someone to all of a sudden be ready to buy. These buyers and sellers that became such because of life events will still stop and consider interest rates and home prices... but the life event is typically what will actually cause them to decide to make a move. | |

In Which Room Or Rooms Do You Spend Most Of Your Time? |

|

When you think about buying your next home, think about the room or rooms in which you spend most of your time. Some people spend most of their time in kitchen the kitchen or kitchen adjacent space. Some people spend most of their time in the family room. Some people spend most of their time in a sunroom. Some people spend most of their time in a finished basement. Some people spend most of their time in a home office. Some people spend most of their time on a back patio or in the backyard. Yes, and I know, most people spend time in lots of rooms... but which room is the primary room where you spend your time? Once you have determined that number one room (or numbers one and two if you must) consider prioritizing how that space lives, feels and works when you evaluate homes you might purchase. If you spend most of your time in the kitchen or kitchen spaces, then we shouldn't get too overly excited by the great home office and back patio that a home offers... as that is not where you spend most of your time. Certainly, the patterns of how and where you spend most of your time might change in a new home, but make sure that the spaces in which you currently spend most of your time are going to be just as nice or nicer in your next home. | |

All The Right Spaces In All The Wrong Places |

|

Sometimes a house will have all of the spaces you're looking for (number of bedrooms, living room, family room, dining room, sunroom, office, etc., etc.) but sometimes... they will be in all the wrong places. Yes, the home has a delightful primary bedroom suite... but it is on the upper level and you would really like for it to be on the main level. Yes, the home has a dining room... but it is on the entirely opposite side of the house from the kitchen, which is not ideal. Yes, the home has five bedrooms... but four of them are in the basement, and you want more main level bedrooms. Yes, the home has both a living room and family room... but they are right next to each other, which makes it more challenging to have to groups socializing in the two spaces. Yes, the home has a delightful office... but it is directly next to the playroom. Yes, the home has a wonderful and renovated laundry room... but it is in the otherwise unfinished basement. And on, and on, and on. When we see a new listing of a house for sale we'll likely be able to discern what spaces that house will offer... but we often won't be able to determine if they are in the right places until we visit the house. | |

How Many Homes Are Going Under Contract Within Three Days, These Days? |

|

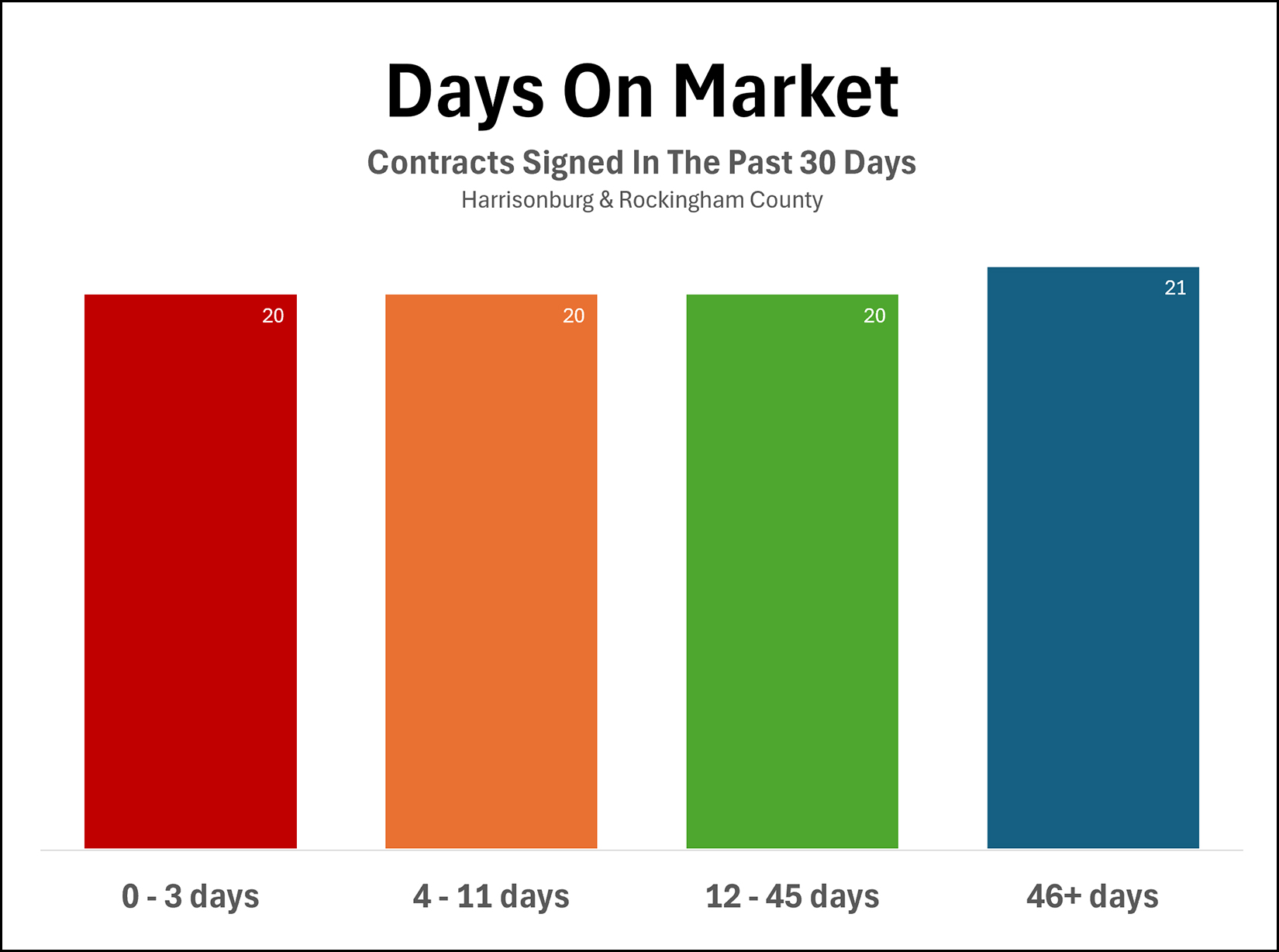

Only about a quarter of homes that are going under contract are doing so in three days or less. And actually, only about half are going under contract within a week and a half... 11 days. So, it's taking 12+ days for about half of homes to go under contract. And it's taking 46+ days for about a quarter of homes to go under contract. All that is to say, homes aren't going under contract quite as speedily as they were a year or two ago. So, with some new listings - yes - you will need to make a decision (and potentially make an offer) very quickly - but not necessarily on most homes any longer. | |

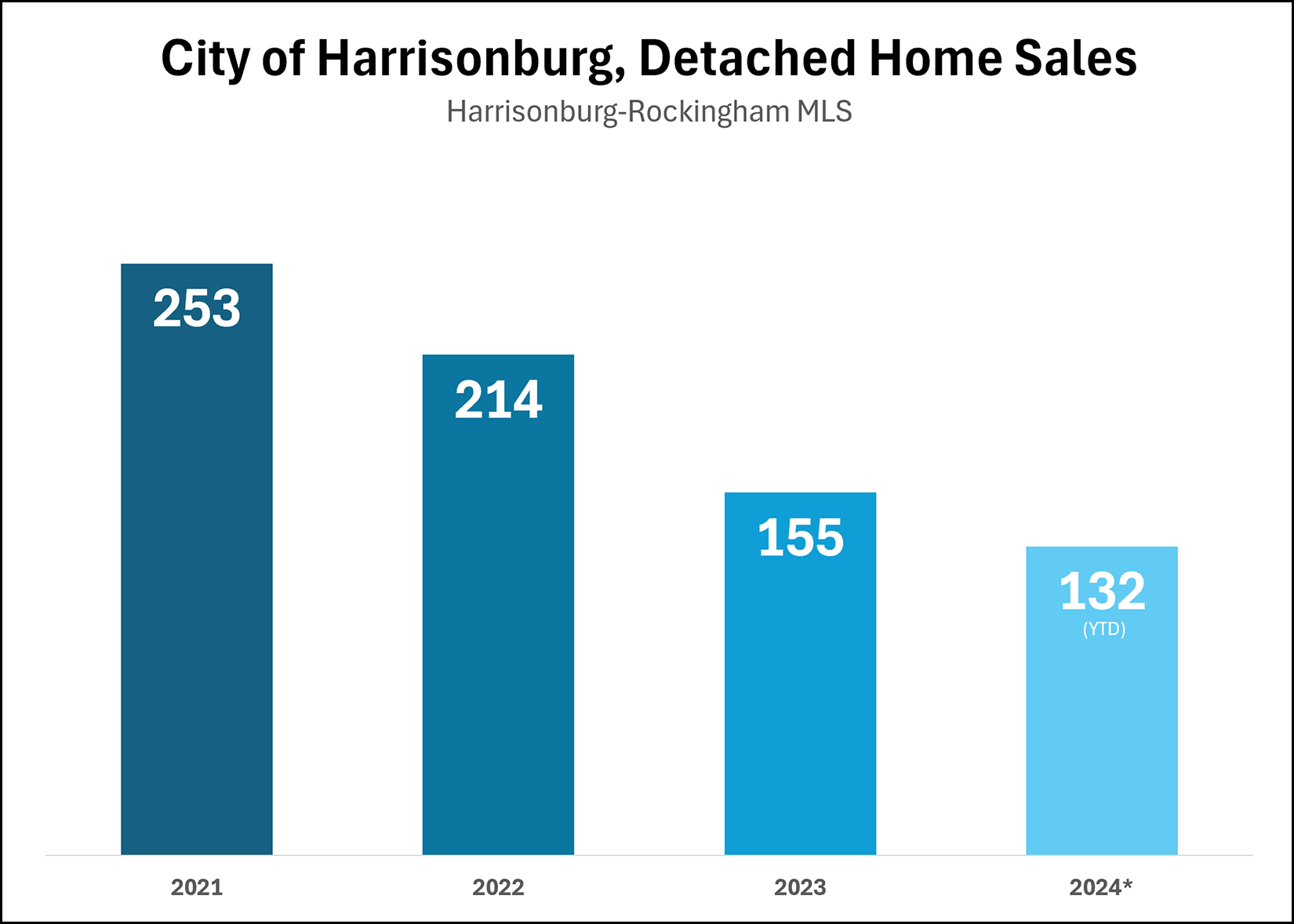

The Increasingly Difficult Challenge Of Purchasing A Detached City Home |

|

It has become increasingly difficult to purchase a detached home in the City of Harrisonburg... because there simply aren't as many sellers selling right now. Three years ago (2021) there were 253 detached homes sales in the City. In 2022 that dropped to 214 sales. In 2023 that dropped to 155 sales. Thus far in 2024, there have only been 132 detached home sales. Why aren't more City homeowners selling their homes? 1. Many have super low mortgage interest rates, and thus super low monthly housing costs, and wouldn't want to trade that in for much higher housing costs given current mortgage interest rates. 2. While many homeowners have plenty of equity and sell for a very delightful sales price... they would also have to pay a rather steep price for a replacement home if they want to stay in the City. 3. For anyone hoping to stay in the City, it's a vicious cycle... won't sell because what would I buy... which keeps my house off the market... which means there are fewer homes for anyone else to buy, etc., etc. So, if you hope to buy a detached home in the City of Harrisonburg, you may very well have a longer wait than you'd like, you may have more competition from other buyers than you'd like, and you will probably pay a higher price than you'd like to pay. | |

Is There A Price You WOULD Pay For This House? |

|

For quite a while now, we've been operating in a market where nearly everything sells at or over the asking price, sometimes with multiple offers. Thus, many buyers assume a seller will only sell for the asking price and it isn't worth making an offer below the asking price. Sometimes this is, indeed, the case -- especially in the first few weeks that a house is on the market. At this stage, home sellers are typically still rather confident and/or hopeful that their asking price is appropriate for the market. But after a house has been on the market for a few weeks, what's the downside of a buyer making an offer below the asking price? When a buyer views a house that has been on the market for a few weeks, and they don't like it enough to pay the list price... they often just move on and decide not to make an offer. I think many buyers should, instead, consider what price they WOULD pay for the house. If you like a house, but just not at the current offering price -- make an offer of the price you would be willing to pay for the house. Who knows, the seller might surprise you, and might be willing to negotiate to a price that would work for them and for you! | |

There Are Plenty Of Types Of Houses That Exist That Just Are Not Available To Purchase |

|

I'd like to buy that house, over there... Well, that's great, but... it's not for sale! :-) With some regularity, I'll be chatting with a buyer who describes what they want to buy... and we find that there is nothing on the market that matches their interests. Sometimes we will go a step further and look to see if something similar has sold in the past year... and sometimes we will again find that nothing has sold that matches their interests. But... this doesn't mean that the house they want to buy doesn't exist... it just means that it is not for sale and has not been for sale recently. As you might imagine, this can be frustrating for said buyer... who really wants to buy a house like ___ or in ___ neighborhood... but finds that nobody is selling such a house or a house in such a location. What, then, should you do if this describes your home search? Three main options exist... 1. Continue to patiently (?) wait for such a home to come on the market. 2. Compromise somewhat on the overall vision for your next home and buy something that is close to what you want, but not spot on. 3. Start knocking on doors of homes you think you'd like to buy to see if you can talk a homeowner into selling. | |

Are You Compromising On Aspects Of Your Next Home That You Can Or Cannot Change Later? |

|

Buying a home inevitably involves making some compromises. It is rare to find a home that fits you perfectly, that has everything that you want, and nothing that you don't. But... there are different types of compromises you might be considering making when viewing any particular home... 1. I like this home a lot, but I will probably want to update the flooring and do a lot of painting, and I might want to try to open up that wall between the kitchen and dining area. 2. I absolutely love this home, and wouldn't really change anything about it, other than that I wish it didn't back up to this busy road as all we hear is road noise when we're out on the back deck. The compromise on the first house is short term, and changeable -- you can (soon or eventually) replace flooring, paint walls, and possibly open up a wall between two rooms. The compromise on the second house is likely long term, and unchangeable -- busy roads almost always tend to remain busy roads or to become busier roads. So, as you are thinking about the compromises you are making in pursuing any given home, think about whether they are aspects of the property that you can or cannot change in the future. | |

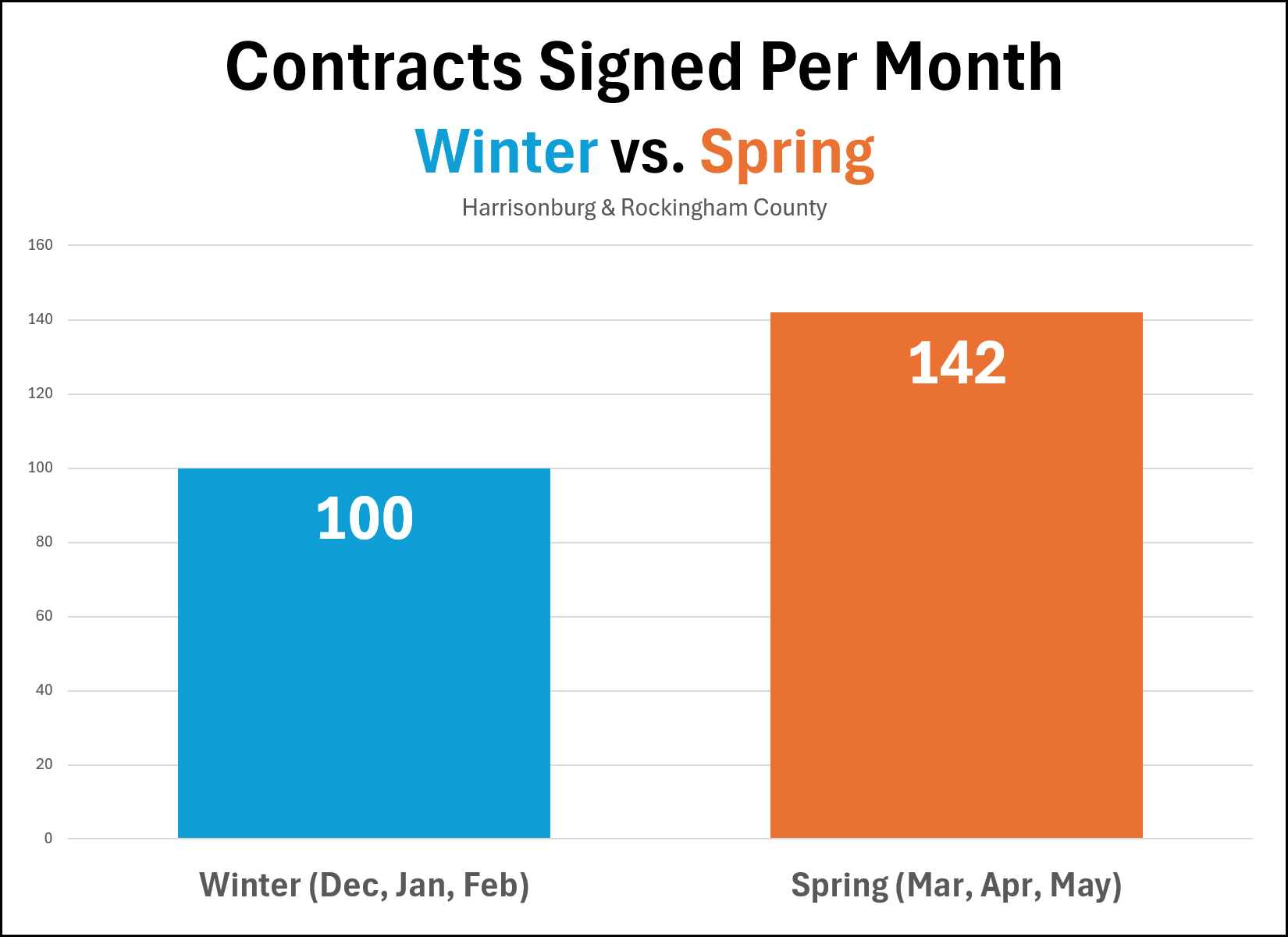

How Much Slower Are The Winter Months In Our Local Housing Market? |

|

It is common knowledge that the winter months are the slowest when it comes to home sales -- in our local market, and beyond. But just how much slower are they? The graph above shows the average number of *contracts signed* per month during the winter (Dec, Jan Feb) as compared to during the spring (Mar, Apr, May) based on the past three years of home sales in Harrisonburg and Rockingham County. So... Is 100 buyers buying a month a significantly slower pace of buyers committing to buy than 142 buyers buying a month? Yes. Is 100 buyers buying a month still a pretty solid amount of buyers buying per month in the context of the spring market only comprising of 142 buyers buying a month? Yes. Is it possible that the number of buyers buying per month during the winter is artificially constrained by a lower number of sellers being willing to sell per month? Yes. So... if you are thinking about selling your home in the next six months... should you wait until spring? You could, but I don't think you need to if you would rather sell and move sooner than springtime. There will still be plenty of buyers buying over the winter, even if it is not as many as will be buying in the spring. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings