Buying

| Newer Posts | Older Posts |

Indeed, As Mortgage Interest Rates Decline, More Buyers Will Be Able To Afford To Buy Your Home |

|

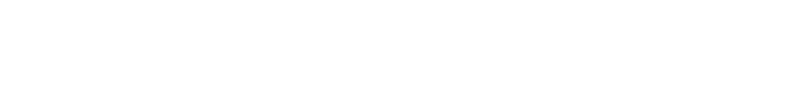

Mortgage interest rates have been declining for about five months now... Early May = 7.22% Early August = 6.47% Mid September = 6.09% Will we even see a FIVE-point-something mortgage interest rate soon? Quite possibly. As any home buyer will tell you, these lower mortgage interest rates are GREAT... they are lowering mortgage payments for buyers getting ready to buy a home. And... for the home sellers... these interest rates are also GREAT... they allow more buyers to afford to buy your home! If you're getting ready to buy a home, but haven't talked to your mortgage lender in a few months, you should reconnect with them and ask for an updated estimate of your mortgage payment given these newer, lower mortgage interest rates. | |

I Just Decided I Want To Buy A Home. How Quickly Do I Need To Go See That House Over There? |

|

So, you just decided you are going to buy a house. Excellent. The Harrisonburg and Rockingham County area are a pretty great place to live - and if you're buying a house it likely means you plan to stick around for a while. So, back to your question -- how quickly do you need to go see that house over there? Well, it depends, on how long it has been on the market. A popular new listing towards the end of last week had eight (+) offers within just a few days of being listed for sale. So, if the house of interest is a new listing, you might need to go see it immediately to have a chance at pursuing it. But some houses currently listed for sale have been on the market for 30 to 60 days or longer. You should go ahead and schedule a time to go see these houses - but it could probably wait a day or two - you probably don't need to drop everything and go at this very moment to see the house. So, as a new buyer... 1. While not mentioned above, get preapproved with a lender ASAP. 2. Hurry out to see the brand new listings of interest. 3. See slightly older listings (on the market for two or more weeks) with some haste, but it doesn't necessarily need to be with quite as much urgency. | |

Contract Activity Cools Slightly After Strong Summer Surge in Home Sales in Harrisonburg and Rockingham County |

|

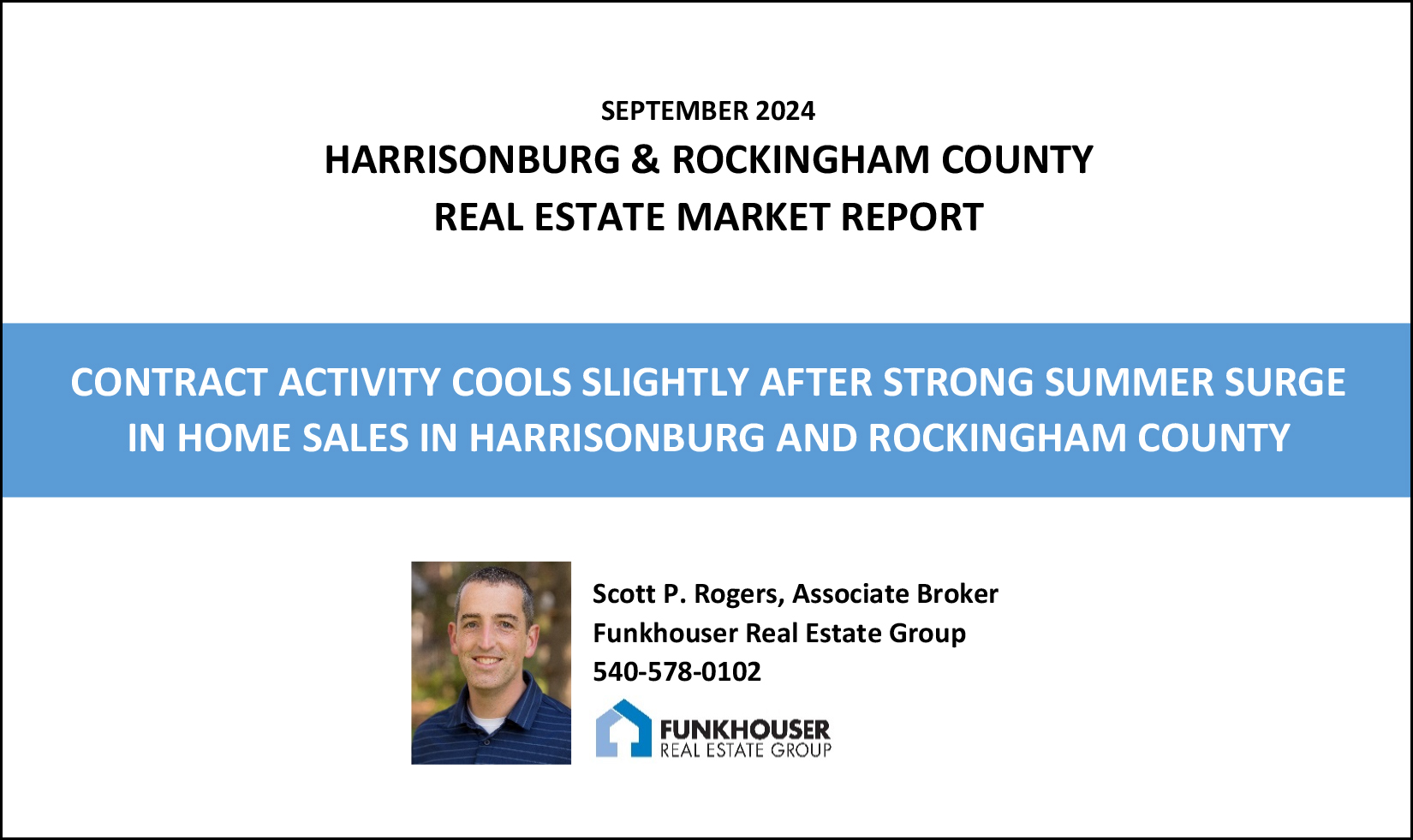

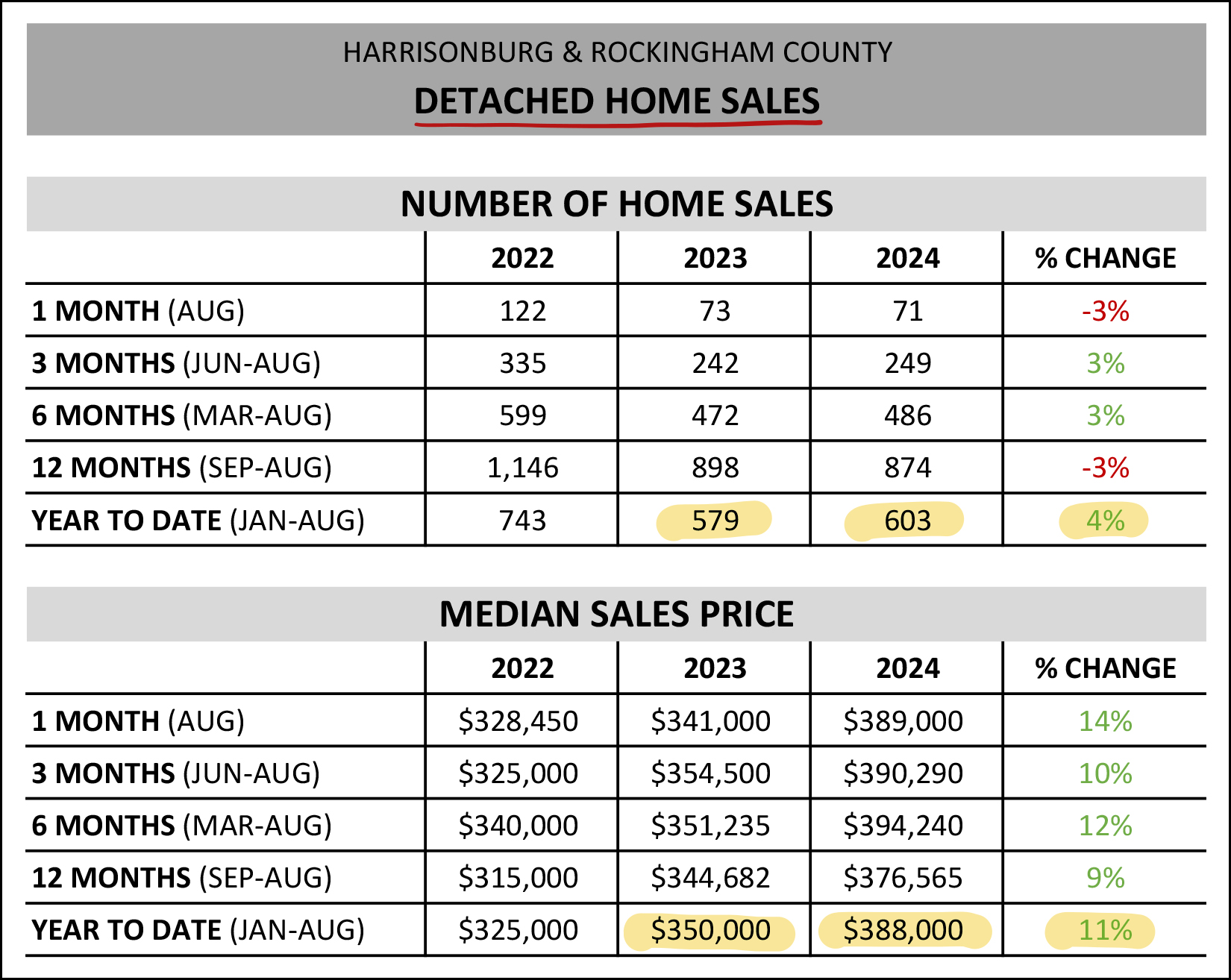

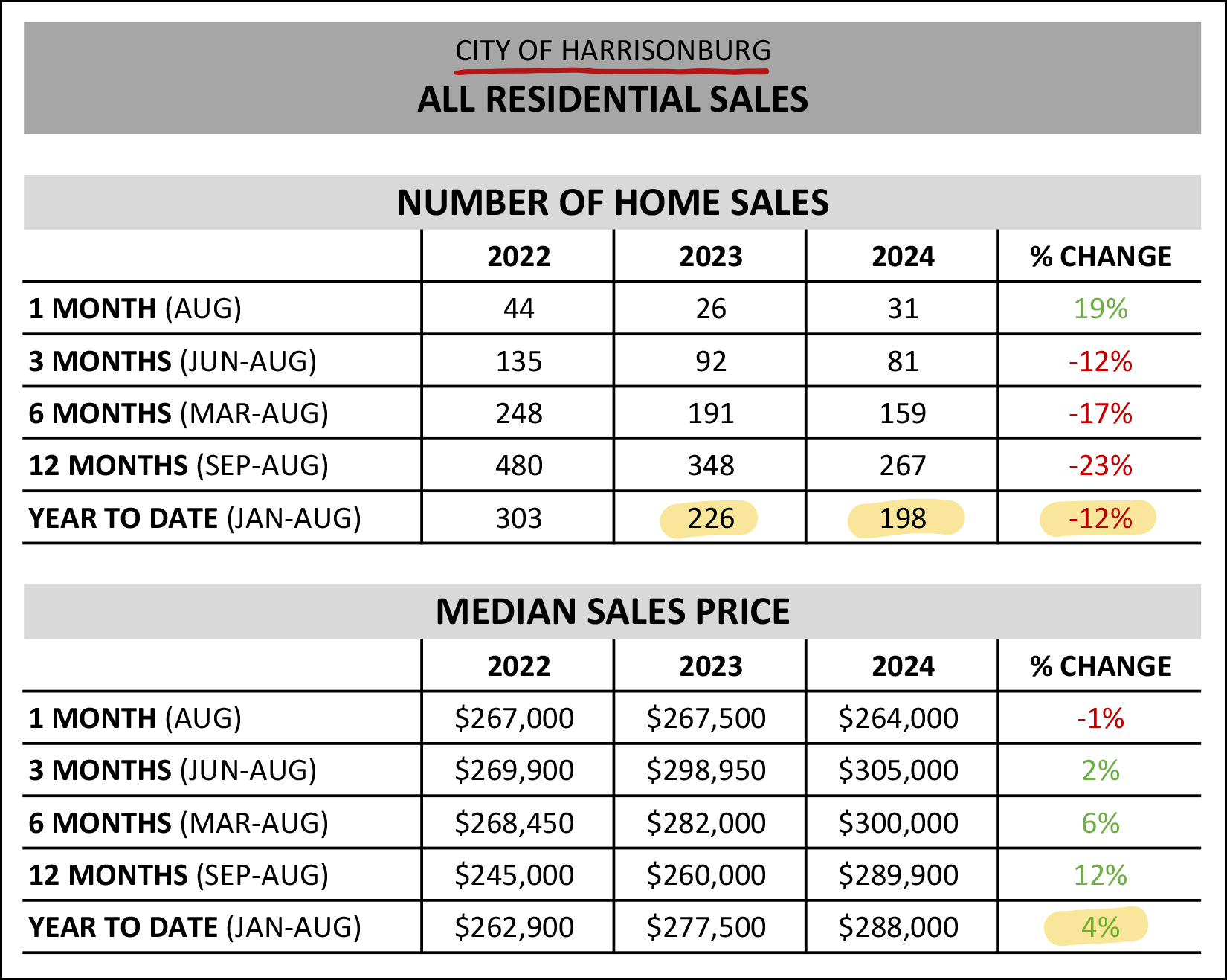

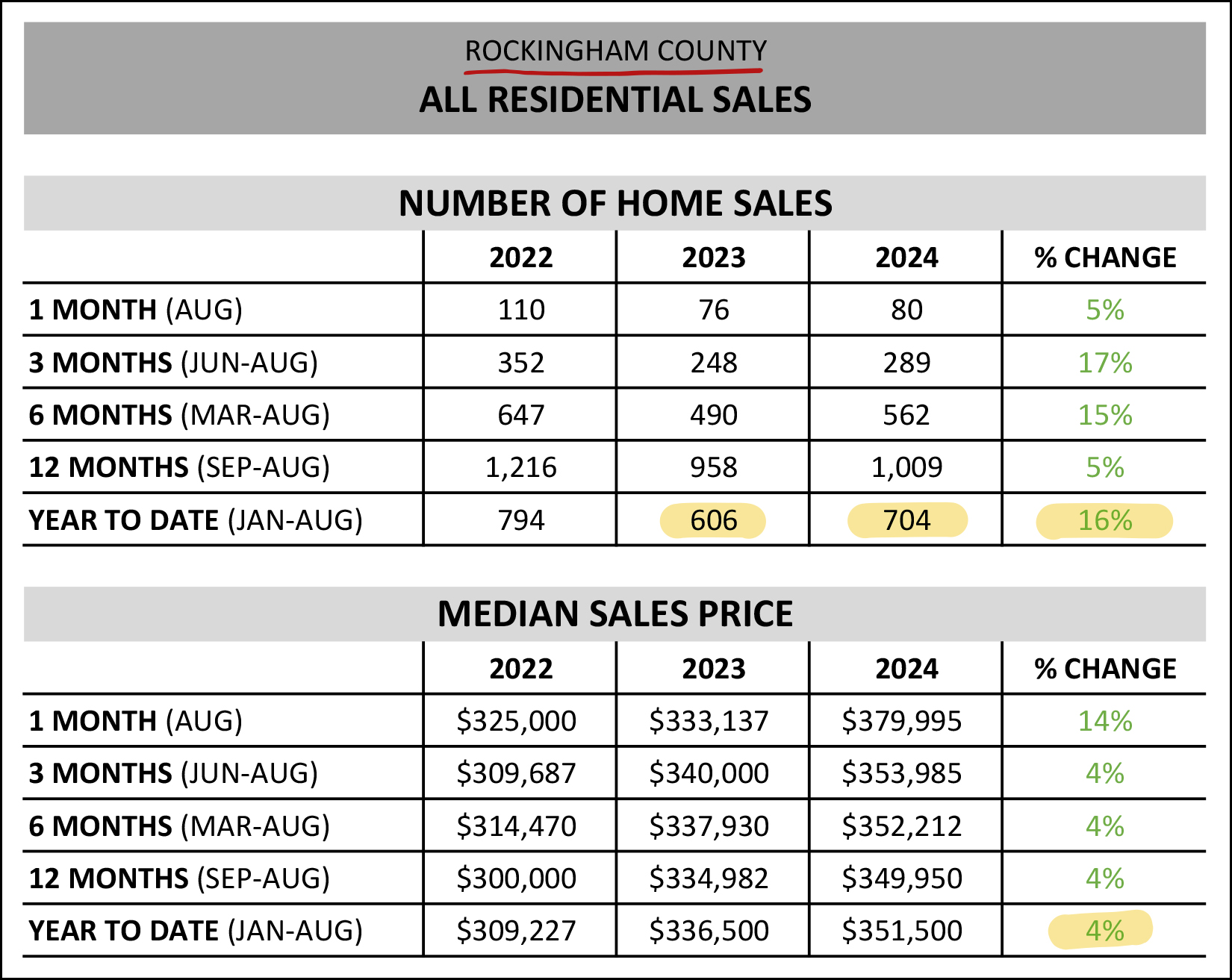

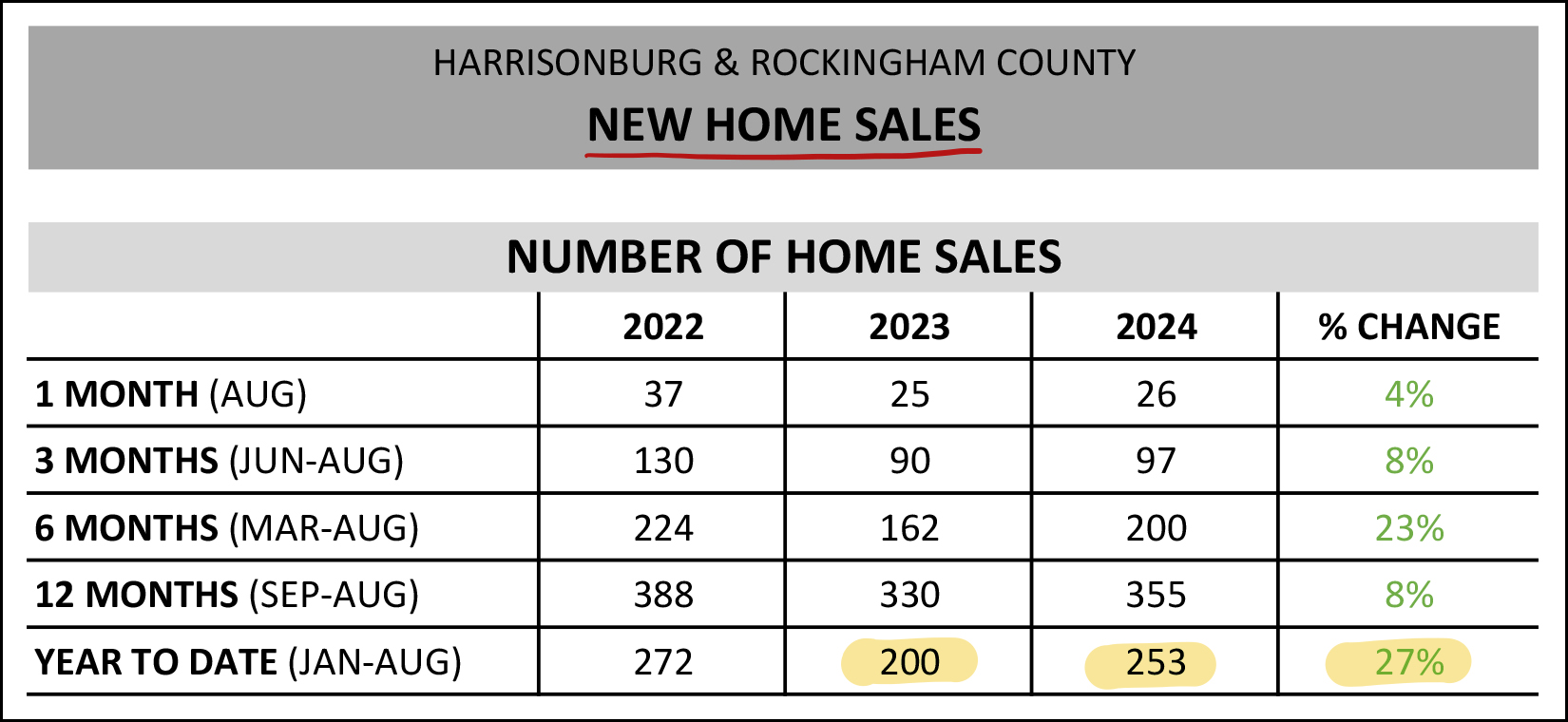

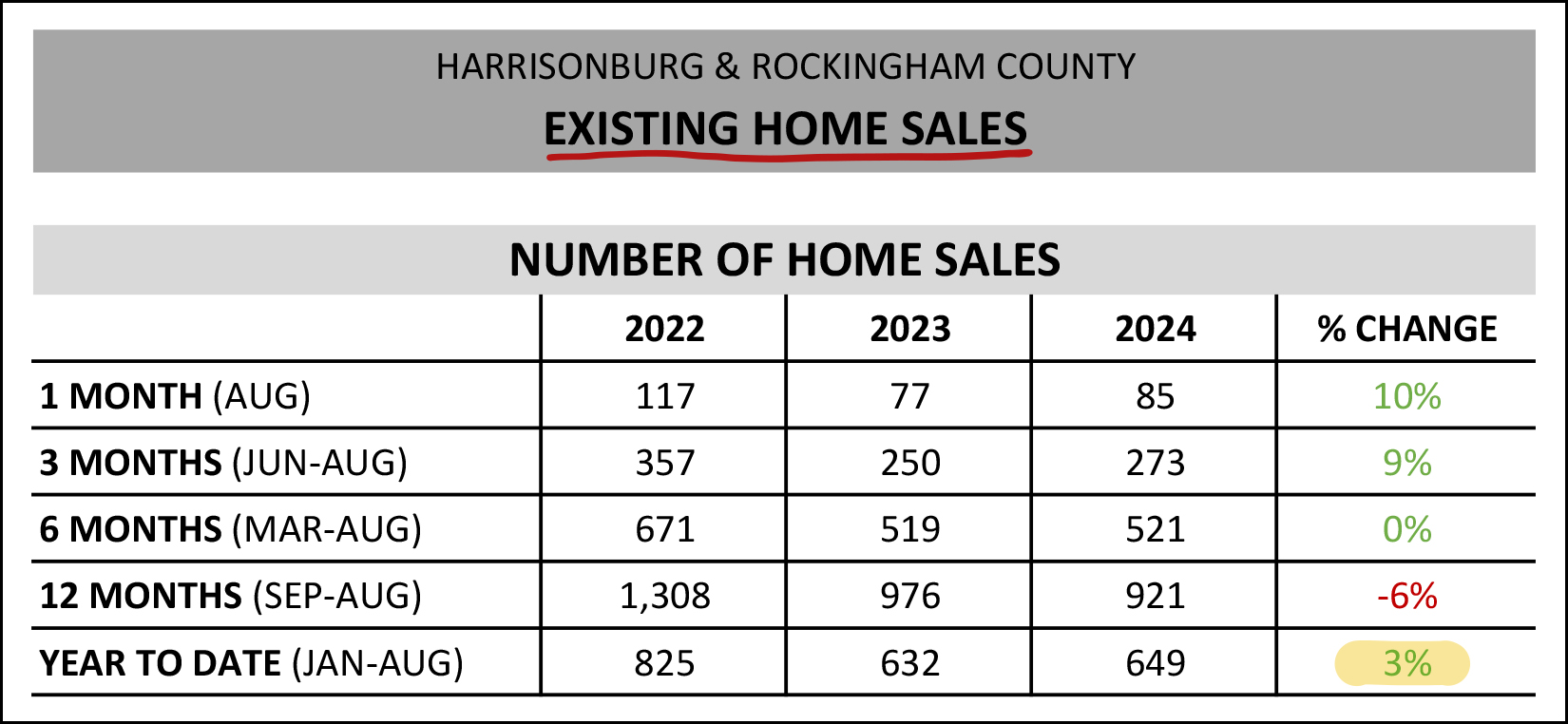

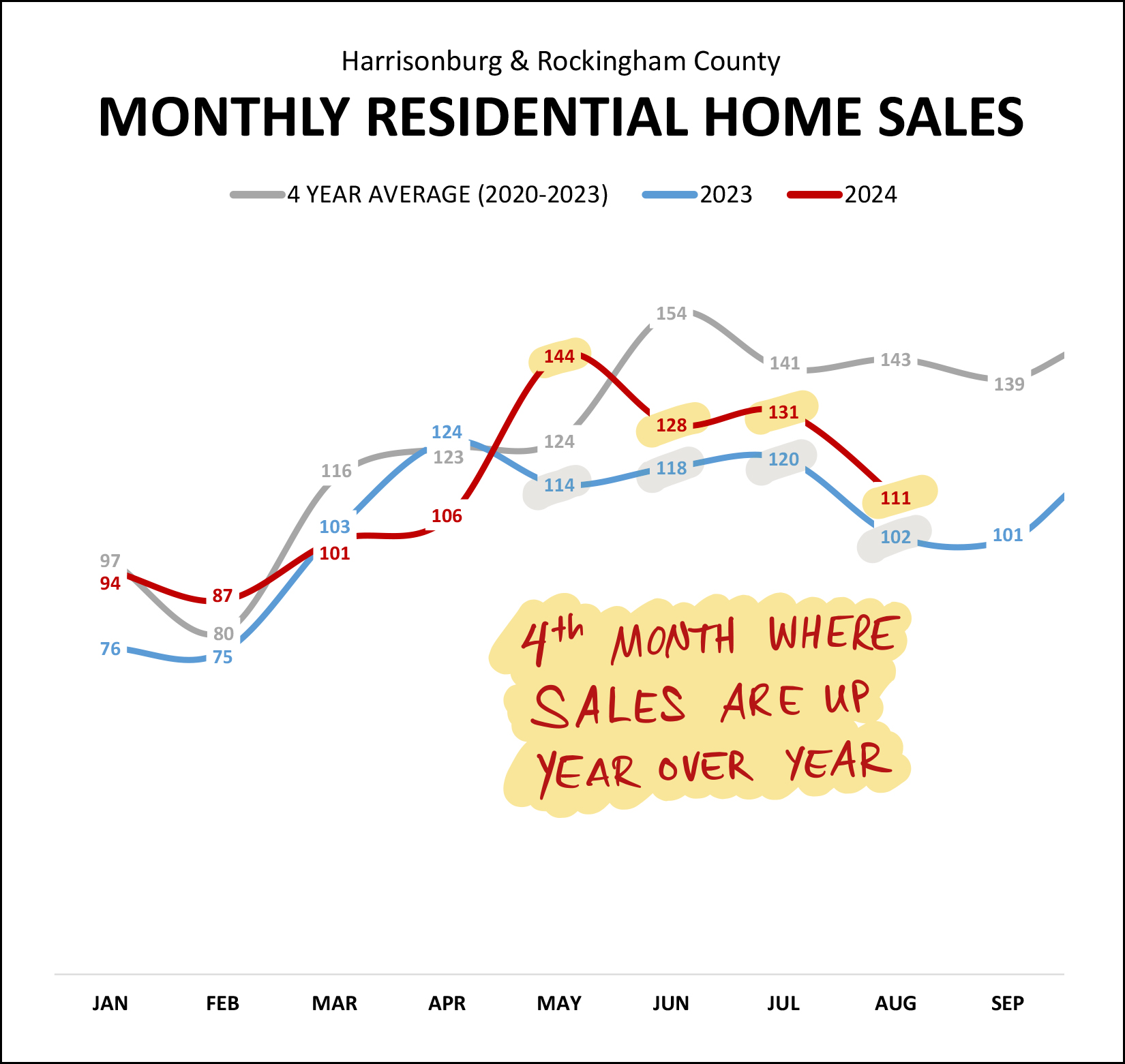

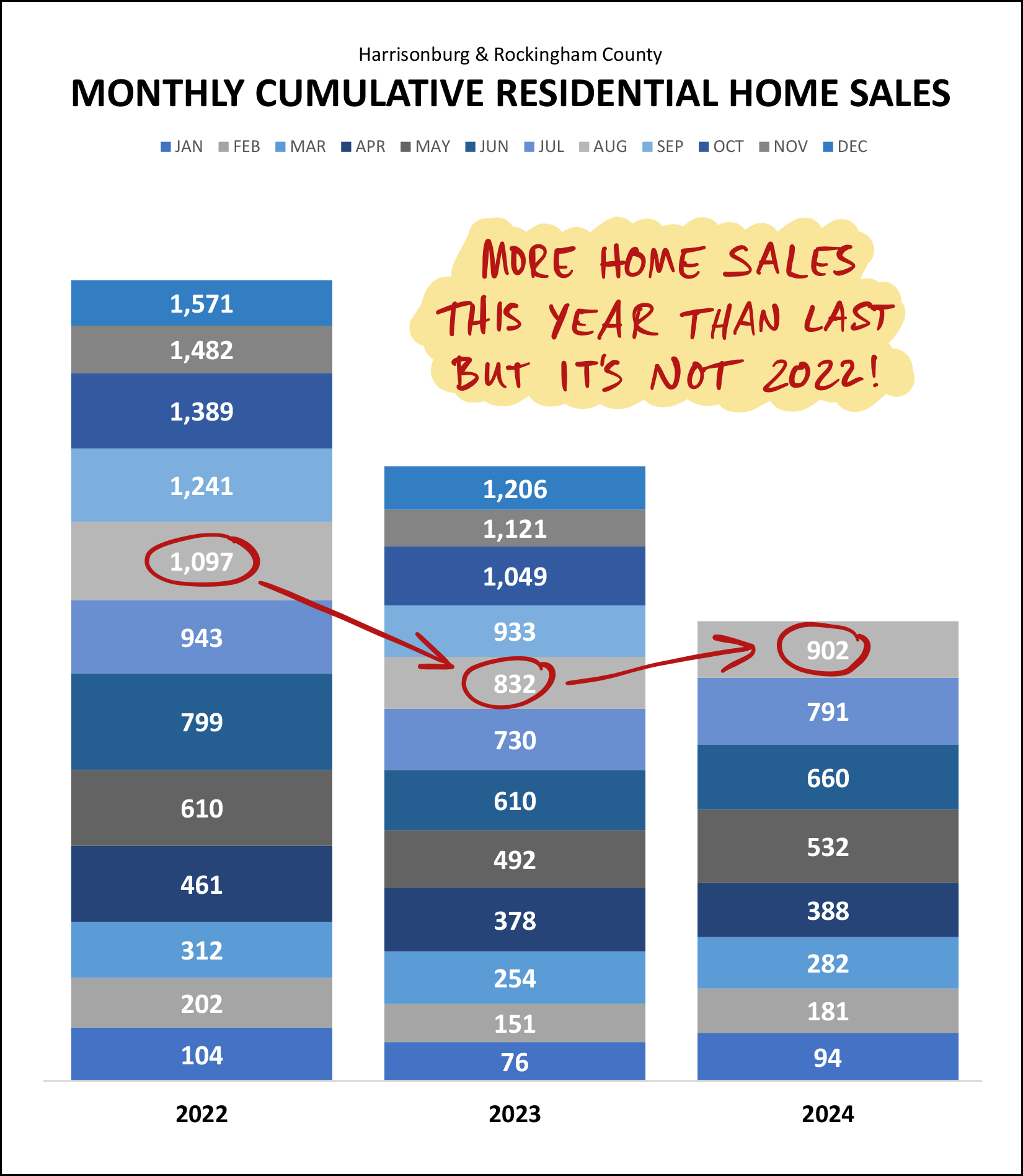

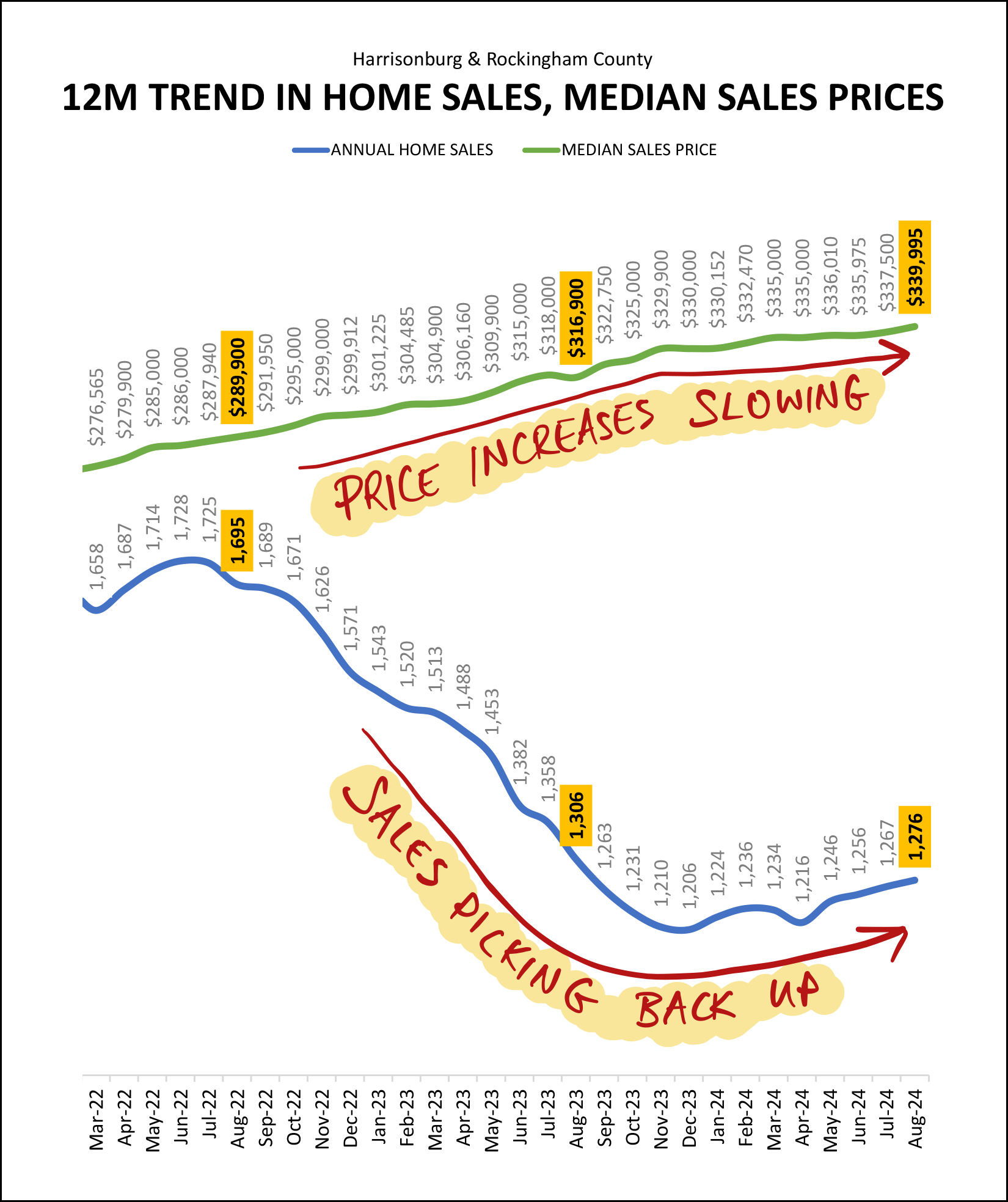

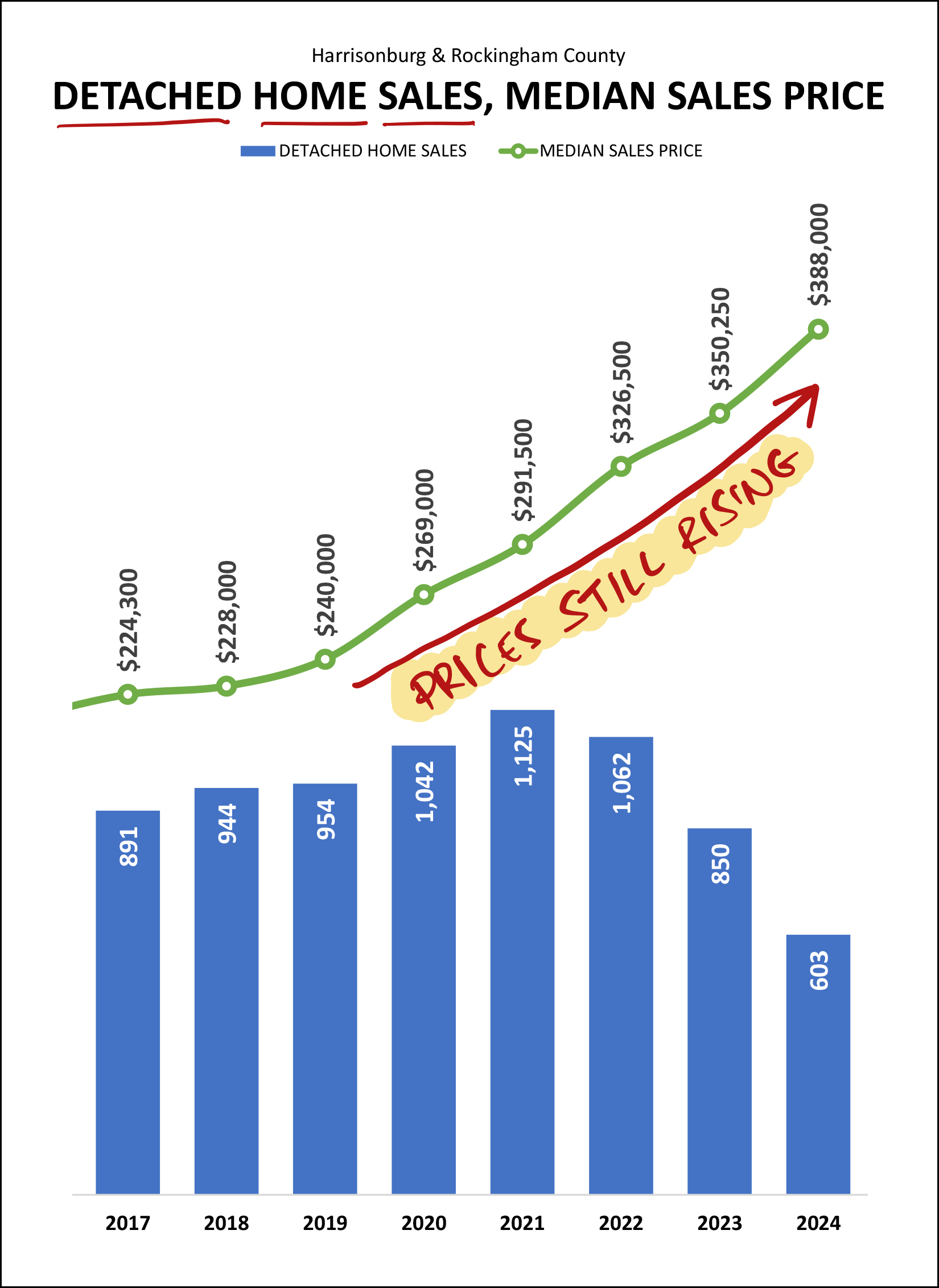

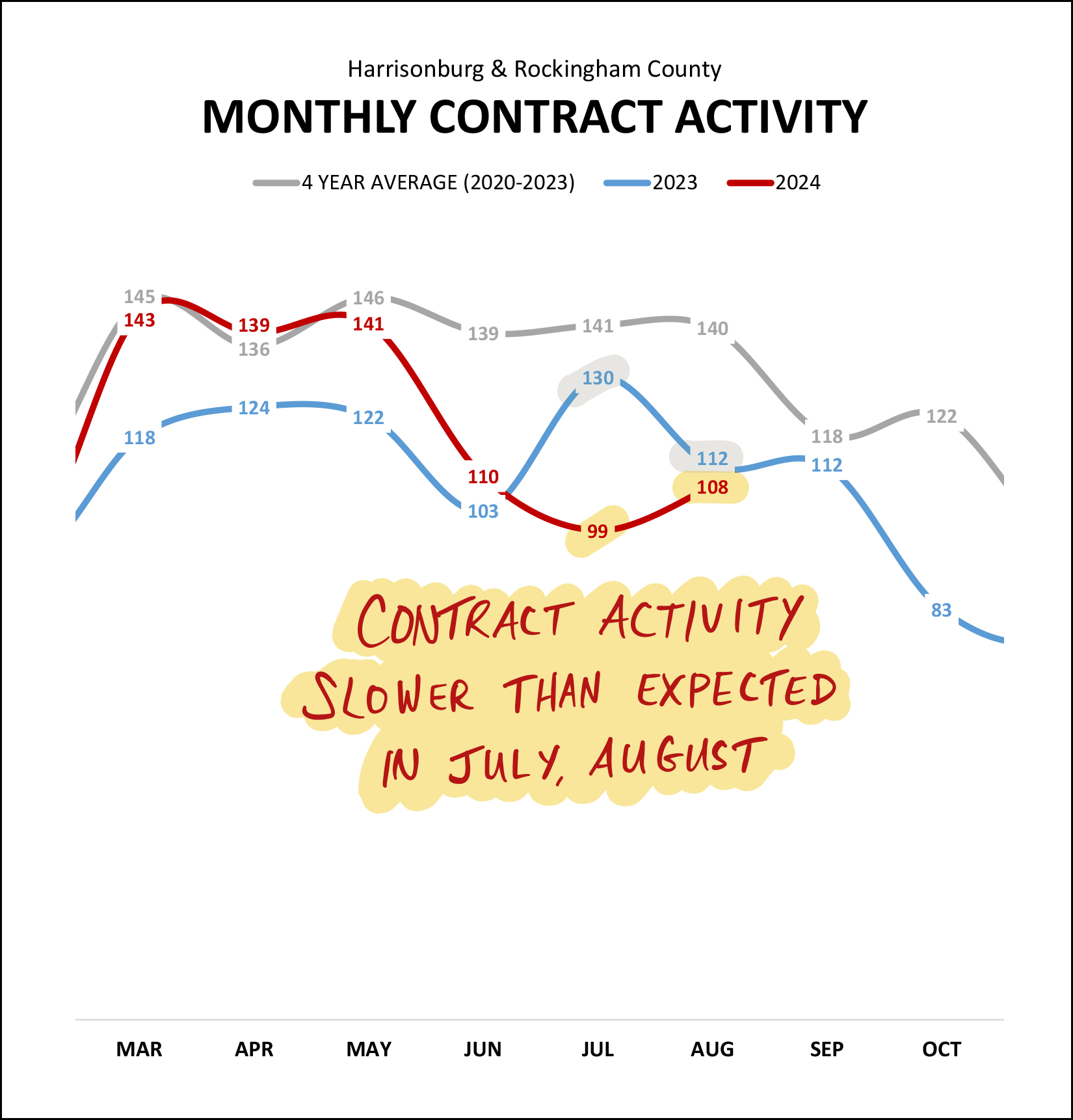

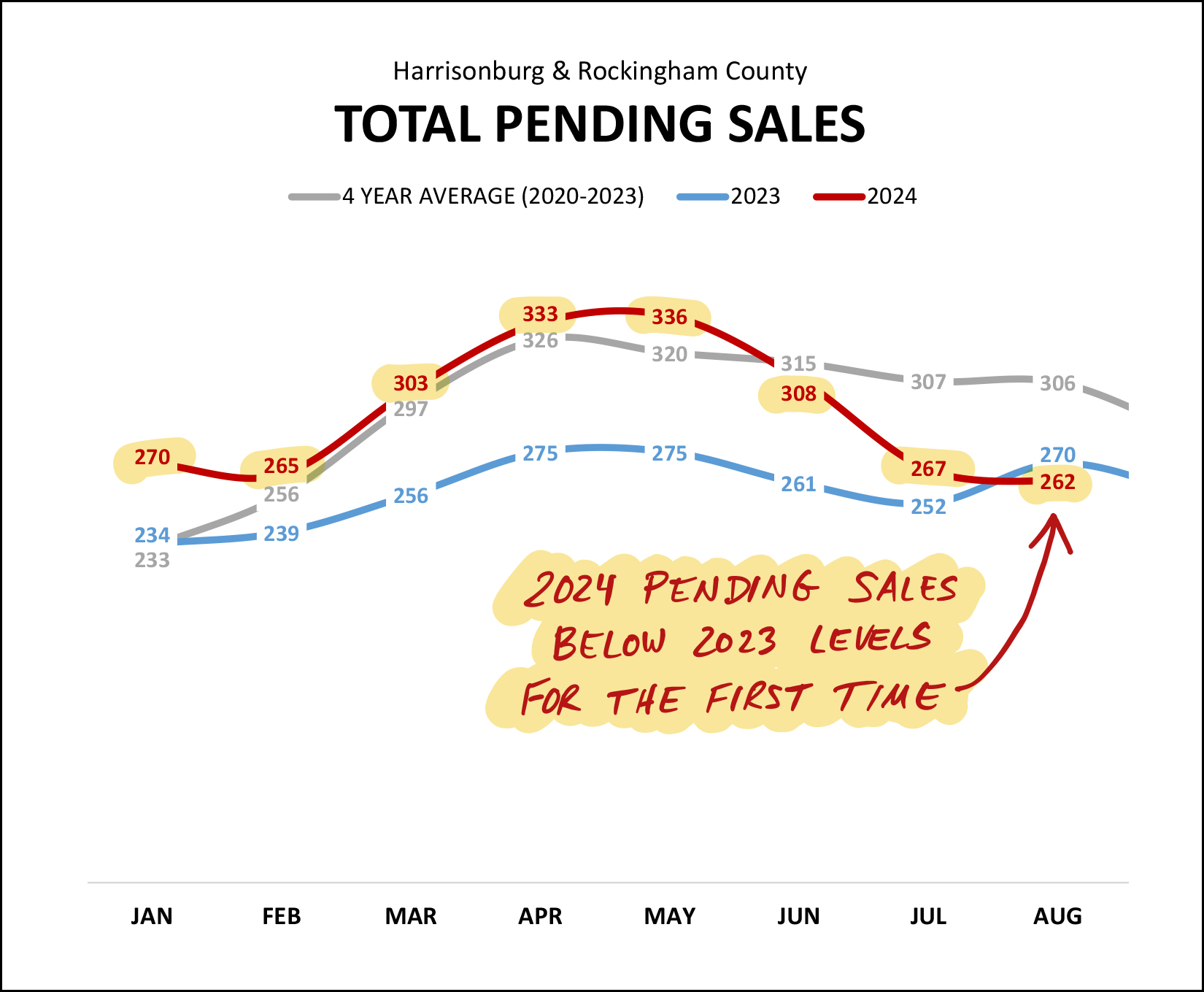

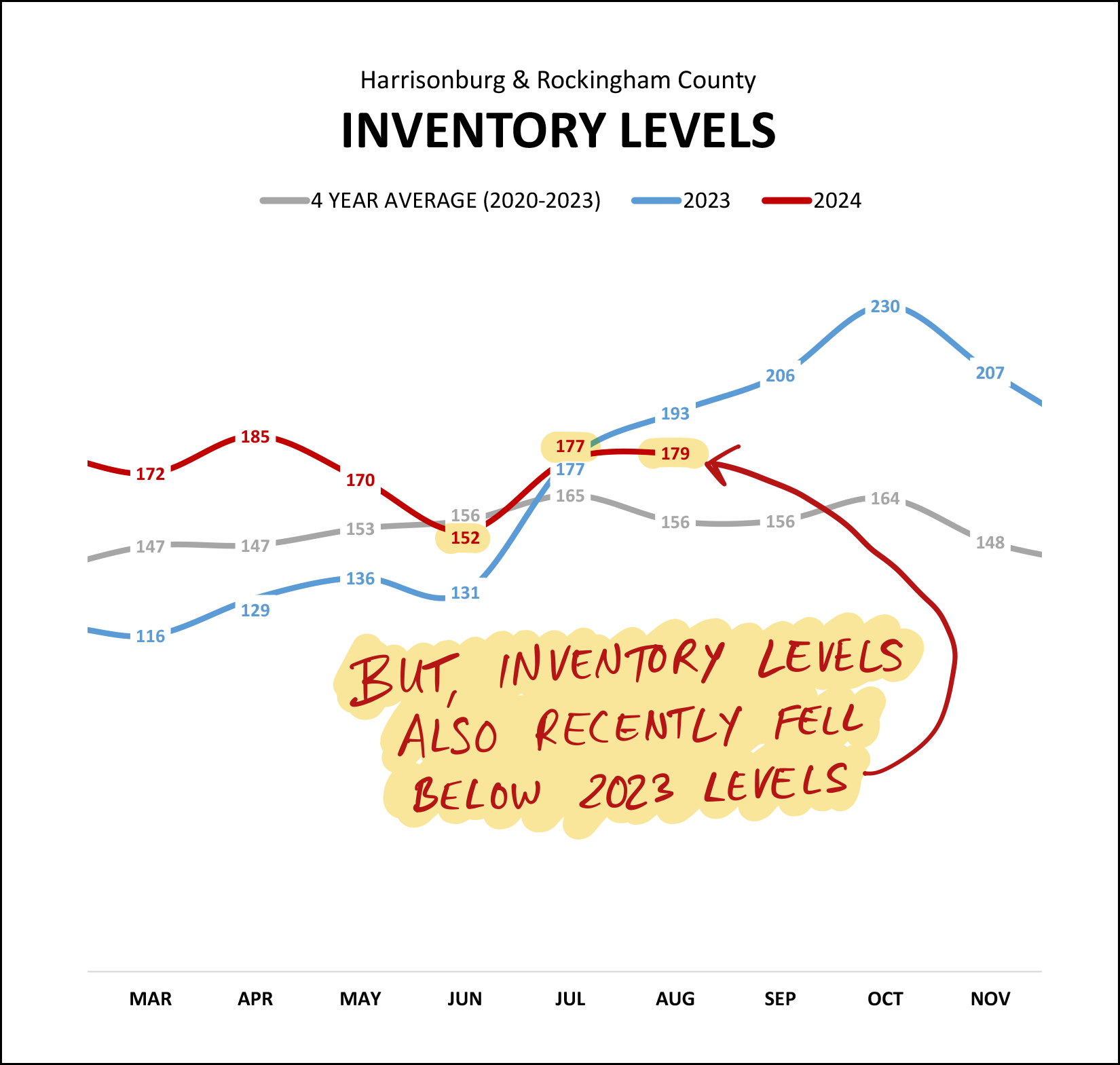

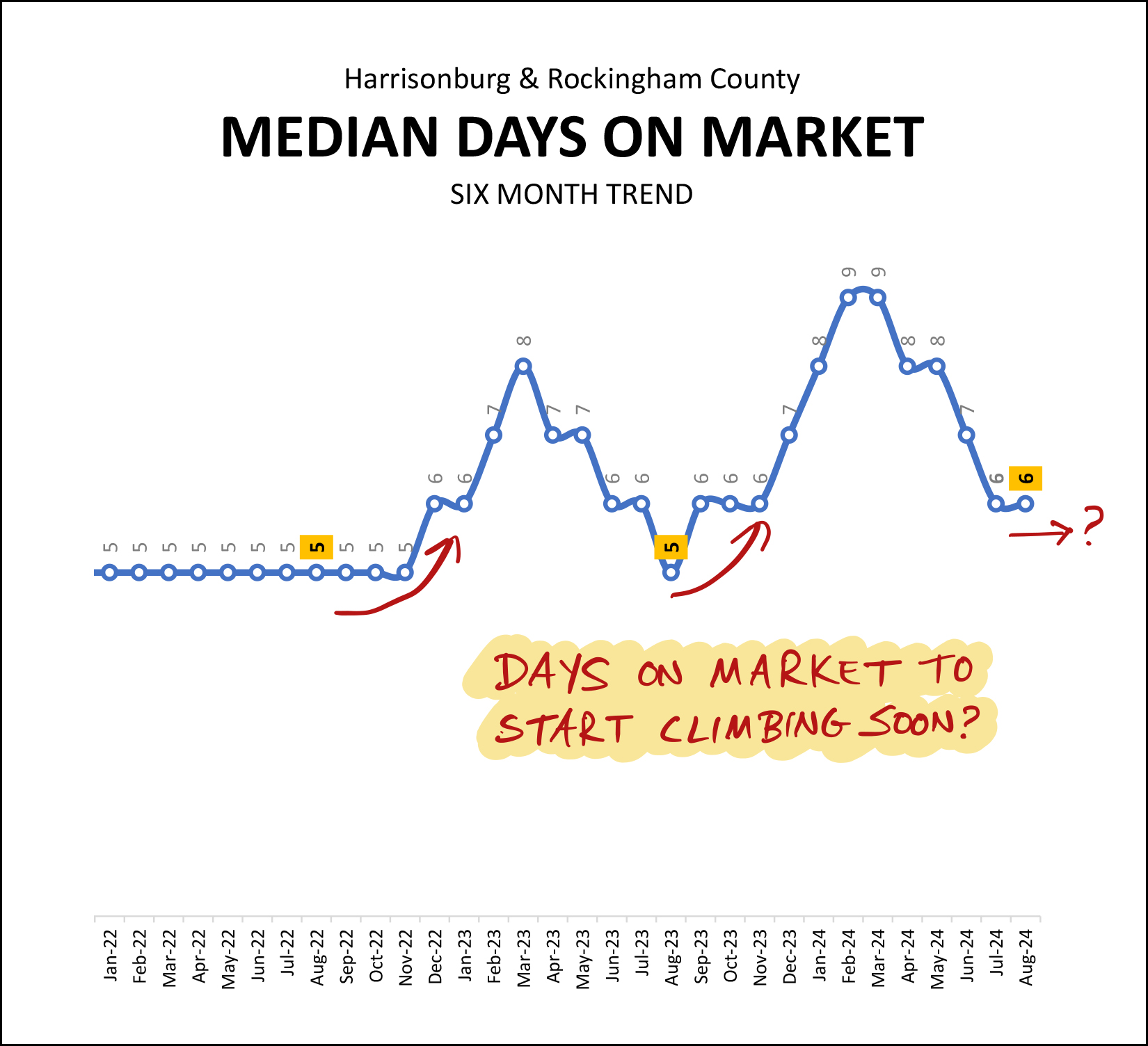

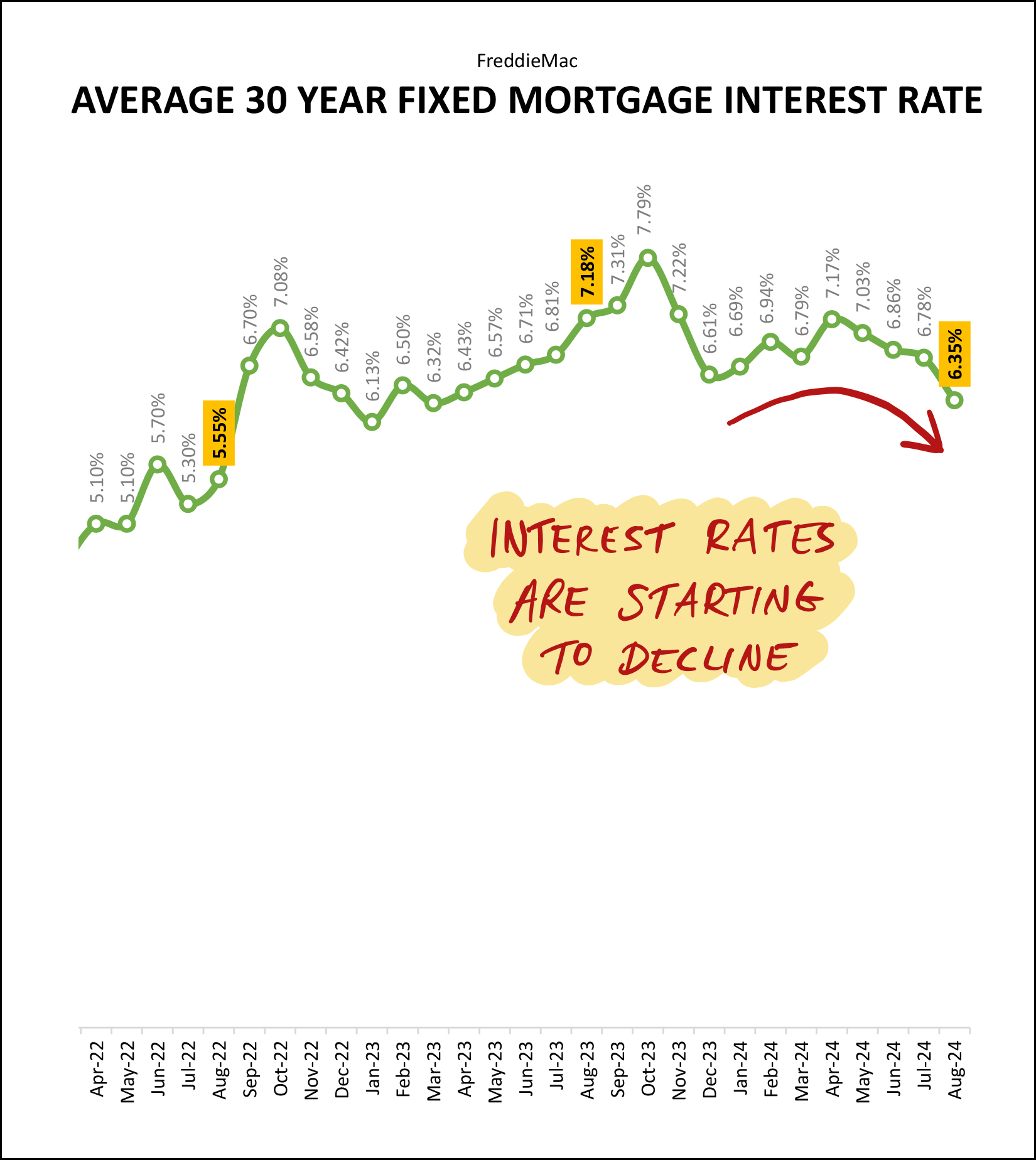

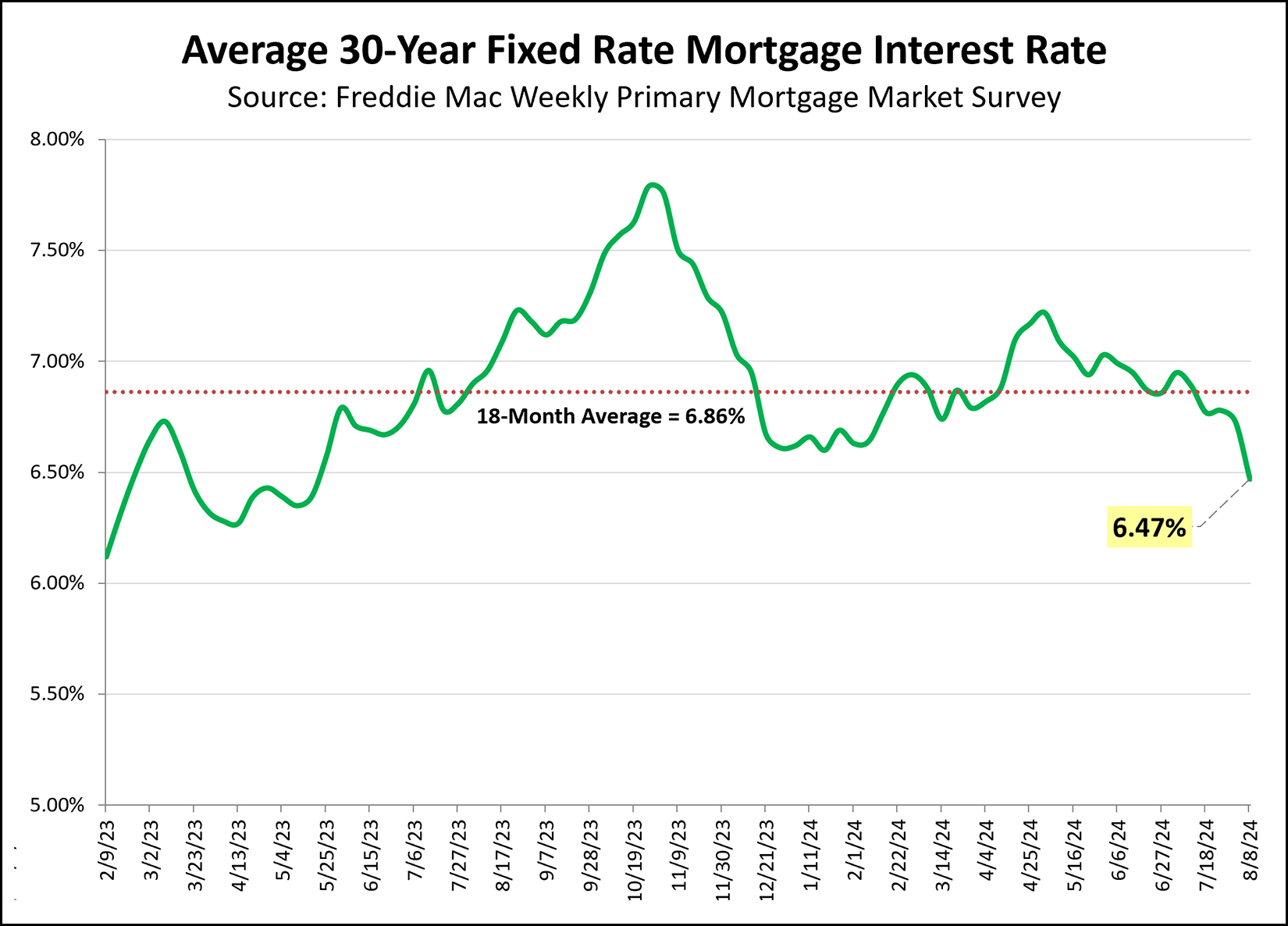

Happy Monday Morning, Friends! We are just six days from the first day of Fall... and it's starting to feel like it! High temperatures are peaking in the 70's instead of the 80's this week... the leaves are starting to change colors... and we're back to having fun watching JMU football games...  My niece, Sofia, just started college at UNC Charlotte, so Luke and I were excited to go down to visit her and to take in the first JMU football game of the season. Here's looking forward to some further fun as the season continues! Go Dukes!!! Before we dive into the real estate data... as one last reminder of summer... I'm giving away a $50 gift card to Sweet Frog. Yes, I know, we can enjoy Sweet Frog all year round, but it's particularly tasty on a warm summer evening. So, if you're a fan of Sweet Frog frozen yogurt (and all the toppings!) click here to enter the gift card. And now, on to the latest in our local real estate market...  Above you'll see a basic overview of the amount of homes that are selling these days, and the prices at which they are selling. A few things to note... # Sales: We saw more home sales this August than last (+9%) and even though we've seen fewer home sales over the past 12 months compared to the prior 12 months (-2%) we are seeing an increase (+8%) in the first eight months of 2024 as compared to the same timeframe last year. So... more homes are selling this year than sold last year, and... Prices: In every time horizon I explored above (1M, 3M, 6M, 12M, YTD) I found an increase in the median sales price. I'll focus in on the year to date number, however, where we see a 4% increase in the median sales price when looking at homes selling in the first eight months of this year (median of $342,490) compared to the first eight months of last year (median of $330,000). As we continue, we'll want to see how the performance of different market segments compare to this market wide 4% increase in the median sales price. First up, detached home sales...  Interestingly... [1] Despite an 8% market-wide increase in home sales thus far in 2024... we're only seeing a 4% increase in the number of detached homes that are selling. [2] Despite only a 4% increase in the median sales price in the overall market (detached + attached) we're actually seeing an 11% increase in the median sales price of detached homes in 2024. As we continue through this report, you'll note a variety of charts and graphs that indicate that price growth is slowing to only 4%... but that is the overall market, whereas detached home median sales prices still seem to be climbing more quickly than the overall market. Dialing in now on one specific geographic area... the City of Harrisonburg...  It has been increasingly difficult to find a house to buy in the City of Harrisonburg. As shown above, in the first eight months of 2022 we saw 303 home sales in the City, last year that dropped to 226 sales and this year only 198 sales. To be clear... this is almost entirely a supply side issue - there aren't enough property owners willing to sell their homes, and there isn't much new construction happening in the City these days. Despite that restriction in the market in the City of Harrisonburg, we are still seeing only a 4% increase in the median sales price when comparing the first eight months of this year to the first eight months of last year... and the median sales price in the City of Harrisonburg is still under $300K thus far in 2024. And how about out in Rockingham County? How are things going there?  We are seeing a significant increase (+16%) in the number of homes selling in Rockingham County thus far in 2024 compared to in the same timeframe in 2023. You can't see it from the chart above, but a lot of that increase in the number of homes selling is a result of new homes being built in the County. Median prices, however, continue to rise in Rockingham County at that same 4% in the first eight months of 2024 compared to the same timeframe last year. New home construction... it's on the rise? Yes, indeed, it is...  We've seen 253 new home sales thus far in 2024... which is a 27% increase from the first eight months of 2023... though interesting, it's slightly fewer than we saw two years ago, in 2022. I expect we will continue to see quite a bit of new home construction over the next few years... and we need it... as we continue to see high levels of demand from home buyers. So, if we're seeing a 27% increase in new home sales, how about those existing home sales? Are they also increasing at that pace? Ummm... nope...  In contrast to the 27% increase in new home sales thus far in 2024... we have only seen a 3% increase in existing home sales. Lots and lots of homeowners are just staying put and not selling their homes. Now, let's get to some of the graphs, to get a clearer picture of some of the trends we have been discussing...  August marks the fourth month in a row with more home sales (closed home sales) than during the same month last year. This has been an active summer of real estate closings... though homes often go under contract a month or two before they make it to closing... so this busy summer of real estate closings was the result of a busy late Spring and early Summer of contracts, which we'll see shortly. To put this year in the context of the past two years...  Home sales in 2024 are definitely exceeding 2023 levels... but pale in comparison to 2022. I expect we might see some further upward momentum in home sales later in 2024 if or when we see further relief in mortgage interest rates. More on that later. Here is an illustration of the two overall trends we're seeing right now in Harrisonburg and Rockingham County...  First off, at the top, home price growth is slowing. Testing your reading comprehension and short term memory... do you recall that the overall market is seeing only a ___% increase in the median sales price while the detached home segment of the market is seeing an ___% increase in the median sales price? ;-) Overall Market = 4% increase; Detached Homes = 11% increase. And... that second line (the blue one) at the bottom... shows us that aver steady declines from over 1,700 sales a year down to about 1,200 sales a year, we are now seeing some overall increases in the number of homes selling in our market. Back to those detached homes for a moment...  Here's you'll note the *absence* of a flattening out of the median sales price line in green. While the overall market is only seeing a 4% increase in median sales prices in 2024, thus far this year detached homes have been selling at prices that are 11% higher than last year. Earlier I talked about a busy summer of closings which was a result of earlier contract activity. This next graph shows current contract activity, which is a predictor of home sales activity over the next month or two...  On the left side of the graph above you can see quite a few months of much higher contract activity this year (red line) than last year (blue line) -- particularly in March, April and May. But then, contract activity declined in July and August to levels below where we were a year ago. Looking ahead, we will most likely see a similar number of homes going under contract in September as we did in August, before contract activity likely starts to decline even further in October. This recent slow down in contract activity has also shown up in the pending sales metric, which tracks how many homes are under contract at any given point...  After seven months of riding high above 2023 levels, we have now seen pending sales drop below 2023 levels in August. This is mostly a result of slower months of contract activity in July and August. It's certainly possible that we'll see pending sales pop back up again as we work our way through September and October... but the 2023 and 2024 trajectories have crossed as of the end of August. But wait... if pending sales are declining, that must mean inventory is rising?  Sorta kinda. Inventory levels dropped to their lowest levels at the end of June... but rose again in July and remained steady at that point in August. Of note... inventory levels consistently climbed last year between June and October... but that was during the exact same timeframe when mortgage interest rates were climbing to their highest levels in 20 years. I do not expect that we will see inventory levels climb that high in September and October this year. But speaking of climbing... will days on market start to climb soon?  After quite a few years of absurdly, consistently low median days on market, we have seen some variability in this metric over the past two years. That pace at which homes go under contract (days on market) slowed during each of the past fall/winter seasons, so perhaps we'll start seeing that again in 2024. Finally, that one little (or big) number that seems to have been having an oversized impact on the housing market over the past few years... mortgage interest rates...  After peaking at 7.79% last October (the highest level in 20+ years) we have started to see some relief in mortgage interest rates -- particularly over the past three to six months. As of June, the average 30 year fixed rate mortgage had fallen below 7%, and now we're closer to 6% than 7%. The Federal Reserve might be announcing a rate cut this Wednesday... though some say that the recent anticipation of that rate cut has already been priced into adjustments in mortgage interest rates. So, let's play a bit of up and down in 2024...

So, as we look ahead at the final three and a half months of the year (yes, that's all that remains) here are a few things to keep in mind... Home Buyers - Many segments of the local market are still rather competitive (multiple offers) but plenty of homes aren't going under contract within two days. Get preapproved now, go see houses quickly when they hit the market, and be prepared to make a rapid, but thoughtful decision about whether to make an offer. Home Sellers - Some, but not all, houses are going under contract quickly. The more broadly appealing your home is to buyers (based on size, location, house features, lot features, etc.) the more quickly we are likely to receive offers. If there are some attributes of your home that disqualify broad segments of the pool of potential buyers, then we are likely to have a longer wait for an offer... and we might have to adjust your list price more than the market data would otherwise suggest in order to inspire a buyer to make an offer. The data and observations I have presented in this market report are a high level overview of our overall market. If you're getting ready to buy or thinking about selling, we should be chatting more specifically about your segment of the market -- what you will be buying, or selling. Feel free to reach out anytime with questions or to set up a time to meet. You can contact me most easily by phone/text at 540-578-0102 or by email here. | |

When Is A Home Seller Likely To Consider Your Home Sale Contingency? |

|

So, you have a home to sell before you can buy your next home... and you are not able to arrange financing to be able to buy before selling? Let's think through when a seller is likely to consider -- or not consider -- your home sale contingency. 1. If your home is not yet on the market for sale, and a house you want to buy was just listed and has lots of showings and talk of offers -- the seller is not likely to consider your offer with a home sale contingency. 2. If your home is listed for sale, and under contract, and a house you want to buy was just listed and has lots of showings and talk of offers -- the seller might be willing to consider your offer with a home sale contingency, if they don't receive (or think they will receive) an offer without such a contingency. 3. If your home it not yet on the market for sale, but the house you want to buy has been on the market for a few months without going under contract -- the seller might just be willing to consider your offer with a home sale contingency to give you time to hopefully secure a contract on your home as well to be able to proceed towards closing. So... whether a home seller will accept your home sale contingency is related to whether your house is already listed for sale, and if your house is already under contract, and whether the house you want to buy is a recent listing and whether the house you want to buy has lots of other competing buyer interest. So, it's not impossible to buy a home with a home sale contingency -- but it won't allow you to successfully pursue every house that you might want to buy. | |

Educate Yourself On The Real Estate Market By Starting To Look At Homes Sooner Rather Than Later |

|

Buyer: I plan to buy a home next spring or summer, so I'll be back in touch in March to start looking at homes. Me: If you have the time and energy for it, we should start looking at homes now or soon. A home buyer's default tendency is often to wait to start looking at homes until they are good and ready to buy. But... there are some very good reasons why some home buyers start looking at homes before they are actually ready to buy. 1. Looking at homes now will familiarize you with the market and will start to help you understand the relative value of any given house. 2. Looking at homes now will help you clarify what you want or need in a next home - or will help you and your co-buyer talk those things through to reach a stronger consensus. 3. Looking at homes now will allow us to start to talk through the nuances of the home buying process. And then... when you are good and ready to actually buy... you'll already have some familiarity with market dynamics, you'll already have great clarity on your goals for your next home, and you'll already understand many aspects of the buying process. So... if you are thinking you might buy a home in the spring... it's not a bad idea to start looking at houses now. | |

If You Can Buy A House Before Selling Your Current House, Consider Keeping Your Current House As A Rental Property |

|

This isn't universally applicable advice for all homeowners who are selling and buying, but it's worth considering if you find yourself in this situation... If You Can Buy A House Before Selling Your Current House, Consider Keeping Your Current House As A Rental Property Here's what I mean and why... You might already be a homeowner... but find yourself ready to buy a new home. You might be considering selling the current home and buying a new one for a variety of reasons -- to get to a larger house, or a smaller one, or one with different rooms in different places, or to move to a new school district, and on and on. If you are in this situation... of getting ready to sell and then buy... you'll likely want to explore whether you have the financial capability to buy before you sell. After all, your offer to buy a house will look much more compelling to a seller if you do not have a home sale contingency in that offer. And thus, if you talk to your lender and find out that you can buy before you sell, it is often then reasonable to stop and consider whether you could buy... and then not sell at all! If you buy a new home and then do NOT sell your current home... 1. You can rent your current home, often for more or much more than your current mortgage payment. 2. You can put your excess rental income towards your new mortgage payment, while also putting some aside for maintenance costs on the house you are keeping. 3. The rental rate on the house you keep will likely continue to increase over time. 4. Your tenants will be paying down your mortgage on the home you kept instead of selling. 5. Over the long term, you will own two houses that are appreciating in value, rather than just one. There are plenty of reasons why you might not keep the house you are selling... because you don't want to be a landlord, or you don't like the larger financial risk, or you are moving out of the area... but if you can buy before selling, let's talk the "keeping the house" idea through before you commit to selling your current house. | |

Would You Sell Your Home If You Do Not Know What You Will Buy? |

|

For most folks, the answer is no... ...they would not sell their home if they do not yet know what they will buy. And, since there are still currently more buyers in the market than sellers... it likely makes sense to ensure you have a solid plan for what you will buy before you start down the path to selling. Otherwise... we might get your house on the market, get excited about quite a few showings, be thrilled about receiving several offers with highly favorable terms... only to realize that you aren't actually ready to commit to selling your home if you don't have a new home to purchase. So... if you're ready to move from one house to the next... let's make sure we're confident that we can sell your current home... but we might need to start by focusing on what you will buy... before starting the process of selling your current home. | |

Can Your Current Home Grow With You? |

|

I'd love for mortgage interest rates to not be the sub-text for most real estate conversations, but it's the world we live in right now. 30 year fixed mortgage interest rates were below 4% from May 2019 through March 2022. During that time, lots of folks bought homes, and lots of folks refinanced their mortgages to get to pretty low mortgage interest rates. Thus, many homeowners (with low mortgage interest rates) find themselves considering whether their current home can grow with them as their needs change. If you need another bedroom in your home (as your family grows, or as you start working from home) you could either... 1. Sell your home and buy a new, larger home. 2. Reconfigure our renovate your current home to get the extra space that you need. Given that most homeowners have super low mortgage interest rates, many such homeowners are leaning heavily into the second option -- staying and trying to allow your home to grow with your needs. But... it isn't always possible. Some homes just don't have the right amount of space, or the right space in the right space, to allow them to grow to fit your growing needs. And thus, some homeowners find themselves concluding that as much as they would like to stay in their home and keep their mortgage interest rate - they need to get to a new house to have a space that works for them for years to come. | |

Lower Mortgage Interest Rates Will Likely Bring More Buyers Into The Market But Maybe Not More Sellers |

|

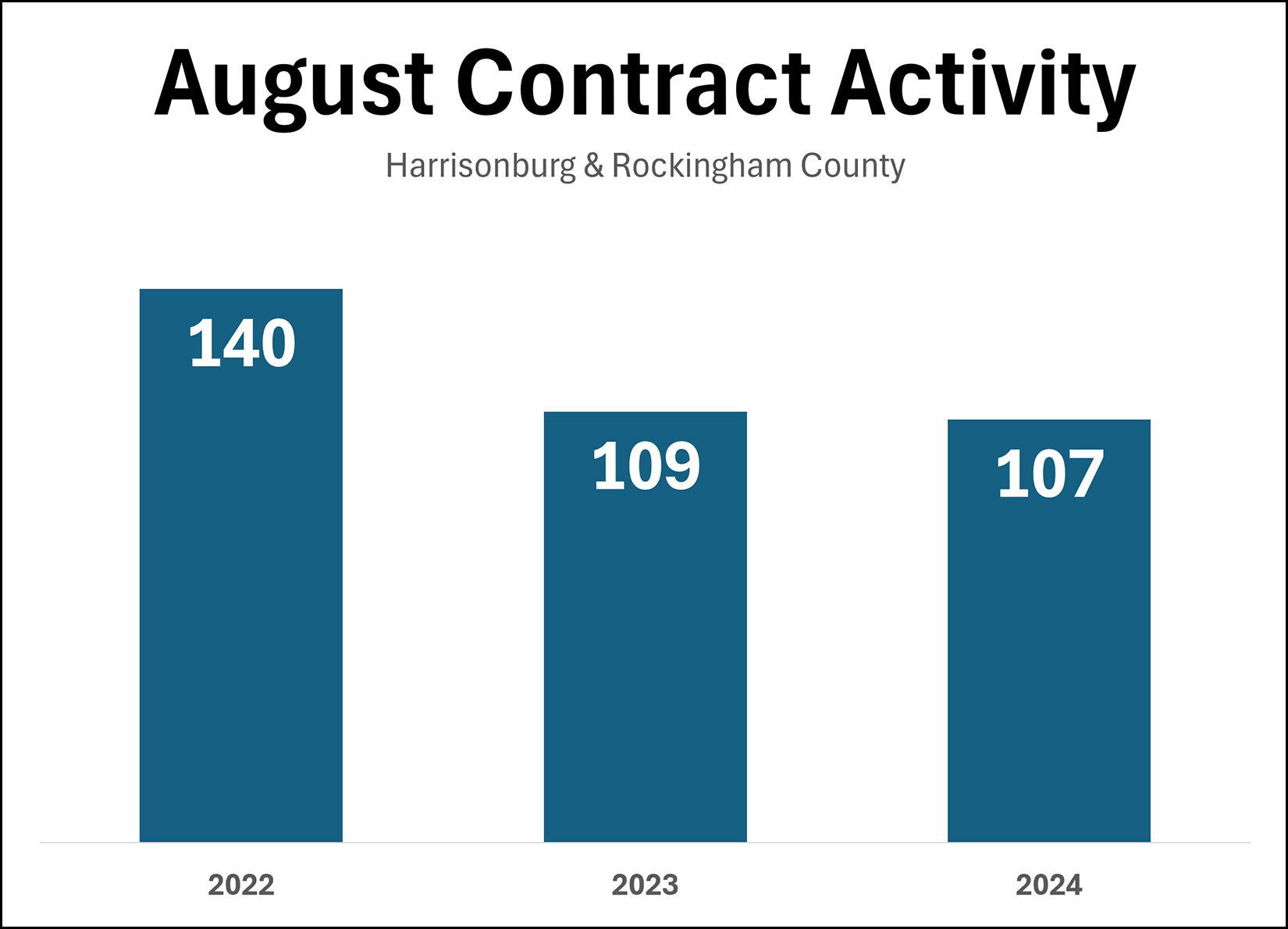

As noted yesterday... August 2023 & 2024 = higher mortgage interest rates, fewer contracts signed August 2022 = lower mortgage interest rates, higher contracts signed What's the connection? The higher the mortgage interest rates... 1. The fewer buyers who can and are willing to buy. ...but also... 2. The fewer sellers who are willing to sell and give up their (likely) low mortgage interest rate on their current home. So... if or when or as mortgage interest rates decline... will we see higher levels of contract activity? Maybe. Maybe not. As mortgage interest rates decline... 1. More buyers will be able and willing to buy. ...but... 2. Sellers might still be reluctant to sell, as lower mortgage interest rates won't necessarily be lower than their locked in mortgage interest rates. Thus, I suspect as mortgage interest rates decline, we'll see the pool of would be buyers expanding more quickly than the pool of would be sellers. | |

An Early Look At August Contract Activity |

|

August 2024 was another busy month of buyers and sellers signing contracts to buy and sell homes. While 109 buyers and sellers signed contracts last August (2023) we saw about the same number (107) sign contracts this August (2024). Looking in a slightly longer context, both of these months of August are a good bit below the 140 contracts signed in August 2022. For a bit more context, here is the average 30 year fixed mortgage interest rate at the start of August for each of the past three years... August 2024 = 6.73% August 2023 = 6.90% August 2022 = 4.99% I think it is very reasonable to conclude that the lower numbers of sellers being willing to sell and buyers being willing to buy in August 2023 and 2024 are related to the higher mortgage interest rate during those years. | |

Yes, Would Be Home Buyers Must Now Sign A Buyer Brokerage Agreement Before Touring A House |

|

Backing up a bit... In Virginia, written buyer brokerage agreements have been required for over 12 years... since July 2012. That is to say that... if an agent is representing a buyer in a real estate transaction, the buyer and buyer's agent must sign a written buyer brokerage agreement to outline the services to be provided, how long the services will be provided and any associated fees. But... one aspect of this requirement has changed this month... when a buyer brokerage agreement must be signed. In the past, a buyer and buyer's agent could go view a property (or several properties) without a buyer brokerage agreement being signed. If a buyer was ready, willing and able to buy a house then they needed to sign a brokerage agreement before touring a house, but otherwise, it did not need to be signed at the time of touring a house. Now, not so much. Now, an agent can't show you a house unless you have signed a buyer brokerage agreement. It's interesting to think about two main categories that buyers might fall into... Definite Buyers - These buyers are definitely going to buy a home. When, what, where, etc., are not yet certain, but they are definitely going to buy a home. These buyers likely have an established working relationship with an agent -- thus it likely won't be confusing or strange for these buyers to sign a buyer brokerage agreement with their agent. Possible Buyers - These buyers might possibly buy a home, but they are often in the early stages of the home search, or just casually exploring the possibility of buying. These buyers might be reaching out to an agent to go view a house for the very first time -- thus it might seem a bit overwhelming or off-putting for these buyers to consider signing a buyer brokerage agreement. Eventually, this requirement of having a signed buyer brokerage agreement before touring a home will feel like it has always been a requirement -- but that might take years. For now, know that even if you are just casually considering a home purchase, you will be asked by your agent to sign a buyer brokerage agreement before going to see the house. | |

How Will I Pay For The Services Of My Buyer Agent In Addition To Paying For The House? |

|

Some current or near future home buyers may be amidst conversations with their agent... learning that they need to sign a buyer brokerage agreement... that outlines that they will be paying for their buyer's agent's services... and might be wondering... How Will I Pay For The Services Of My Buyer Agent In Addition To Paying For The House? Two immediate thoughts come to mind... [1] Plenty of home sellers (maybe most of them?) will likely be planning to pay for the buyer's agent commission out of the sales price of the house that you are paying them. You shouldn't assume this is the case... but your buyer agent can ask if a seller is planning to pay the buyer agent's commission. If the answer is "no" you can always propose that as a part of the offer that you make. [2] For any sellers that are not planning to pay for the buyer agent's commission... some buyers will be more capable than others to pay for the house plus pay for their buyer agent's commission. This popular listings with many offers this will likely be more of an issue for buyers (help - I can't pay for your house plus for my agent's services) than it will be for sellers. | |

If You Are Buying A Home, Who Is Paying Your Agent? |

|

So you're buying a home, and you have a real estate agent representing you in that purchase? Excellent. Some of the roles that agent will likely fulfill include...

But... this agent that is representing you in the purchase... who is paying for their services to you? Since I started representing home buyers back in 2003, most people would have said "the seller" and here's why... The sellers of most homes listed for sale agreed in a listing agreement with their agent to pay a brokerage fee (commission) that would end up (in most transactions) being paid in part to the company and agent representing the seller and in part to the company and agent representing the buyer. So, most home sellers would likely say that they were paying for the services that the buyer's agent was providing to the buyer. And most home buyers would likely say that the seller was paying for the services that the buyer's agent was providing. Since a buyer now has to sign a buyer brokerage agreement with their agent before touring even a single property, a buyer will likely have more conversations about their agent's compensation earlier in the process. Most buyers will hopefully understand that they are paying a specific brokerage fee to compensate their agent for their services. That said, many (or most?) home sellers may still offer to and plan to pay the buyer's agent's compensation. If they do, it's less clear how to answer the question of who is paying for the buyer's agent's services. If a buyer agrees to pay ___ for their buyer agent's services... ...and the seller of the house they plan to buy agrees to pay ___ for the buyer's agent's services... ...then who IS paying for the buyer's agent's services!? In this scenario, while the buyer agrees to pay for the services, the seller agrees to deduct that cost out of the purchase price of the house. Or, alternatively... If a buyer agrees to pay ___ for their buyer agent's services... ...and the seller of the house they plan to buy does NOT agree to pay for the buyer's agent's services... ...then clearly, the buyer is directly paying for the buyer's agent's services. In that scenario, a buyer pays a price for the house and pays for their buyer agent's services as an additional fee. Have we gone around and around in a few circles here? :-) Email me with any follow up questions that you might have.

| |

So If I Want To Go See A House, I Have To Commit To A Long Term Agreement An Agent I Barely Know? |

|

It is a fair question... if you're just getting started on searching for a house, do you really have to sign a long term agreement with an agent when you might not have even met them yet!?! The answer is no... on the "long term" part of the question. Yes, home buyers now have to sign a buyer brokerage agreement before touring a house. The buyer brokerage agreement will outline what services will be provided, how long those services will be provided, and any associated fees. The agreement outlines the working relationship between buyer and agent. But if you're just getting started on your home search, you might not be ready to sign on to a long term relationship with an agent you haven't even (or have just) met. So, remember that... It doesn't have to be a six month agreement for the agent to represent you in the purchase of any house in Harrisonburg and Rockingham County. The signed buyer brokerage agreement could be a 30 day agreement for the agent to represent you in the purchase of any house in Harrisonburg or Rockingham County. Or, the signed buyer brokerage agreement could be a 30 day agreement for the agent to represent you in the purchase of the house located at 123 Main Street, which is the first house you would like to tour. If you are getting ready to buy a house... 1. You might be ready to sign on to a long term agreement with an agent to represent you in your home purchase, perhaps because you already know the agent, have worked with them before, or have heard great things about them from your friends. ...or... 2. You might not be ready to sign on to a long term agreement with an agent to represent you in your home purchase, perhaps because you have yet to meet the agent with whom you hope to have represent you in your home search process. Don't get overwhelmed with the perceived need to commit up front to a broad and long lasting relationship with someone you have only recently met. (It seems this probably applies to both home buying and life in general.) Chat with the agent whom you hope to have represent you in your home purchase and work towards terms of a buyer brokerage agreement that are comfortable for you. | |

If You Have Some Flexibility With WHEN You Buy Your Home Then Low Inventory Levels Are Less Of A Concern |

|

Housing inventory levels are low... just about any way you slice or dice the data. That doesn't mean there aren't any houses listed for sale. There are quite a few houses listed for sale. That doesn't mean the houses currently listed for sale won't be interesting to you. They very well may be interesting to you. But... depending on what you are looking for in your next home, you are likely to only have a few options from which to choose right now... and it will likely be the same next week and the week thereafter. But... if you have some flexibility in WHEN you buy your home, then these lower inventory levels shouldn't be as much of a concern for you. If you have to buy a house in the next two weeks, then low inventories will directly impact you and you will likely have very few options. If you can buy a house anytime in the next three months, then you should have plenty of options from which to choose during that timeframe, and low inventory levels will not affect you nearly as much. Let's chat about your timeline for making a purchase, as it relates to your move to the area, or as it relates to your current lease, and then we can get a sense of how concerned you should be about low inventory levels. | |

Average Mortgage Interest Rates Are Just That, Average Mortgage Interest Rates |

|

The average (30 year fixed) mortgage interest rate peaked at 7.8% last October. Now, the average rate is right around 6.5%. But... take that with a grain of salt... or however the expression goes... Home buyers that lock in their mortgage interest rate over the next week are likely to see rates anywhere from 6% to 7%, depending on...

So, yes, if you buy a home this week, you might have a rate of 6.5%... or it could be a decent bit lower... or higher. That average rate is just an average of the rates offered by lenders for 30-year fixed rate, conventional financing with an 80% loan-to-value ratio. So, don't ask your lender for that average rate... ask what rates are possible for you based on your credit, downpayment, loan program and points. | |

How Much Will You Compromise, And About What, When Buying A Home? |

|

Fair warning... most home buyers aren't able to actually figure this out until they have seen a house they want to buy. These days particularly (with fewer homes coming on the market for sale) it is likely that you will have to compromise a bit if you are buying a home. How, though, will you compromise...

Each home we go to view will likely have certain attributes that are just what you are looking for... and will also be missing some features that you would really like or you will really need. Thus, as we consider any given house, we'll be considering and discussing how the house fits your needs, what is still lacking, and whether the compromises that the house would cause you to make are ones you are comfortable with making. | |

Sometimes Buyer And Seller Price Expectations Conflict On New Listings |

|

Some home sellers decide they ought to round up their list price a bit because surely buyers will expect them to negotiate. This might result in a house worth $400K being listed for $410K. Some home buyers expect all listings to go under contract quickly at or above the list price. This might result in them assuming that house listed for $410K will really sell for $420K or $425K. In such an instance -- a home buyer deciding whether they are willing to pay $420K or $425K for a house they believe is worth $400K -- likely results in the buyer not making an offer at all. So... Sellers - Price your homes reasonably - don't round up too much, or any at all, above the market value of the house. Buyers - Consider the list price as the list price - don't assume every house will sell for $10K or $15K or $25K more than the list price. Some will, but not all, and probably not most. | |

Mortgage Interest Rates Fall, Again, To Lowest Levels In Over A Year |

|

I suppose this might become an ongoing theme over the next few months but mortgage interest rates have fallen, again. The average 30 year fixed rate mortgage interest rate is now 6.47%... which is the lowest average rate we have seen since May 2023. These lower mortgage interest rates are likely to spur on more home buying activity as each time the rates drop it makes a home buyer's dollars go a bit further. If you plan to buy a home this coming fall, talk to a mortgage lender sooner rather than later to understand what your mortgage payment would look like given current rates... and perhaps you'll be able to keep requesting updated payment information if rates continue to fall. :-) | |

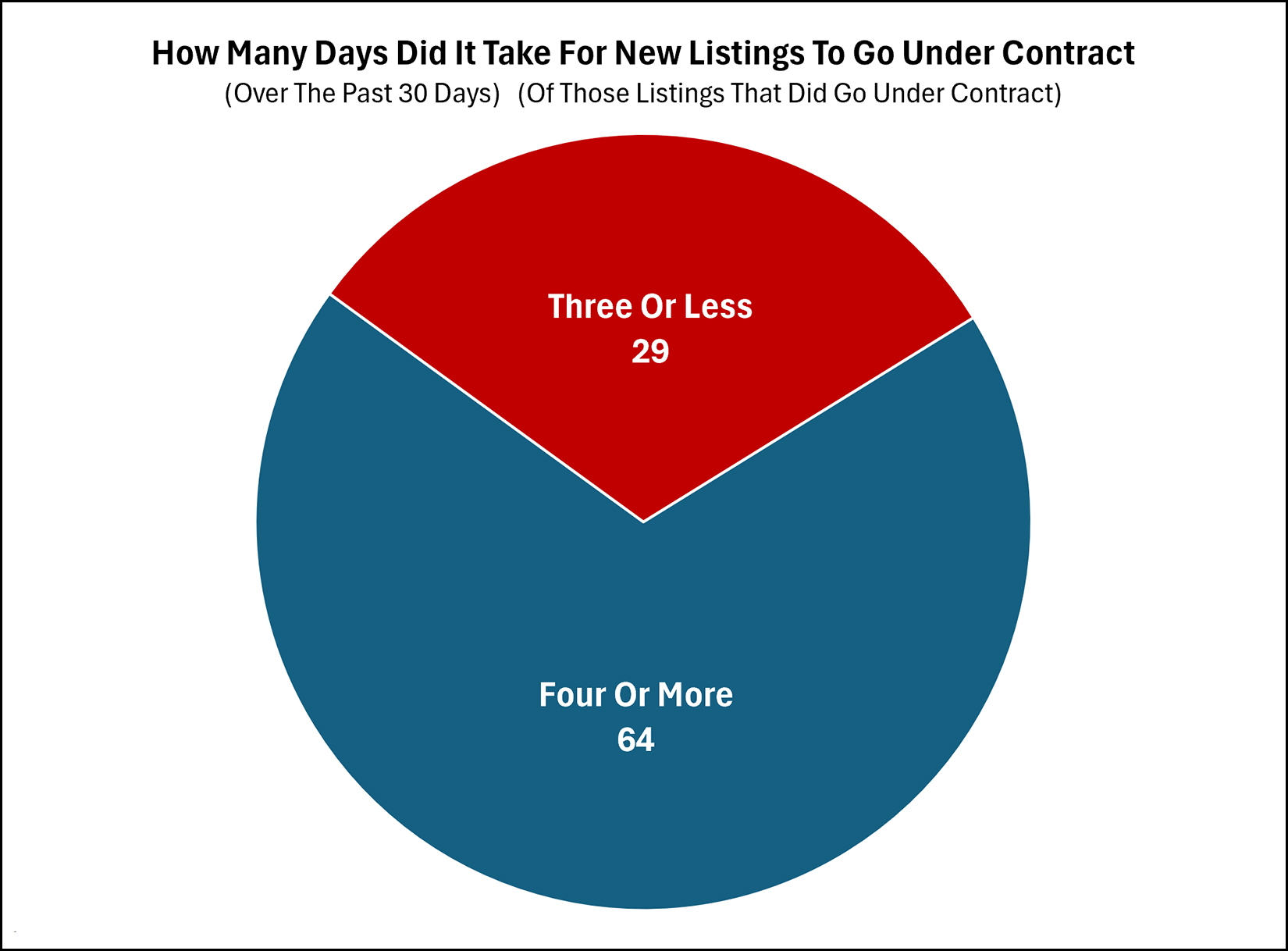

How Many Days Did It Take For New Listings To Go Under Contract |

|

All new listings are not receiving multiple offers. All new listings are not under contract in a matter of days. But plenty of new listings are going under contract plenty quickly! Of the homes that have gone under contract over the past 30 days... approximately a third of them have been under contract within three days! Thus, if you are looking to buy in the near future... go see homes within a day of when they come on the market (whenever possible) and make sure you have a lender letter ready to go if you want to make an offer! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings