Buying

| Newer Posts | Older Posts |

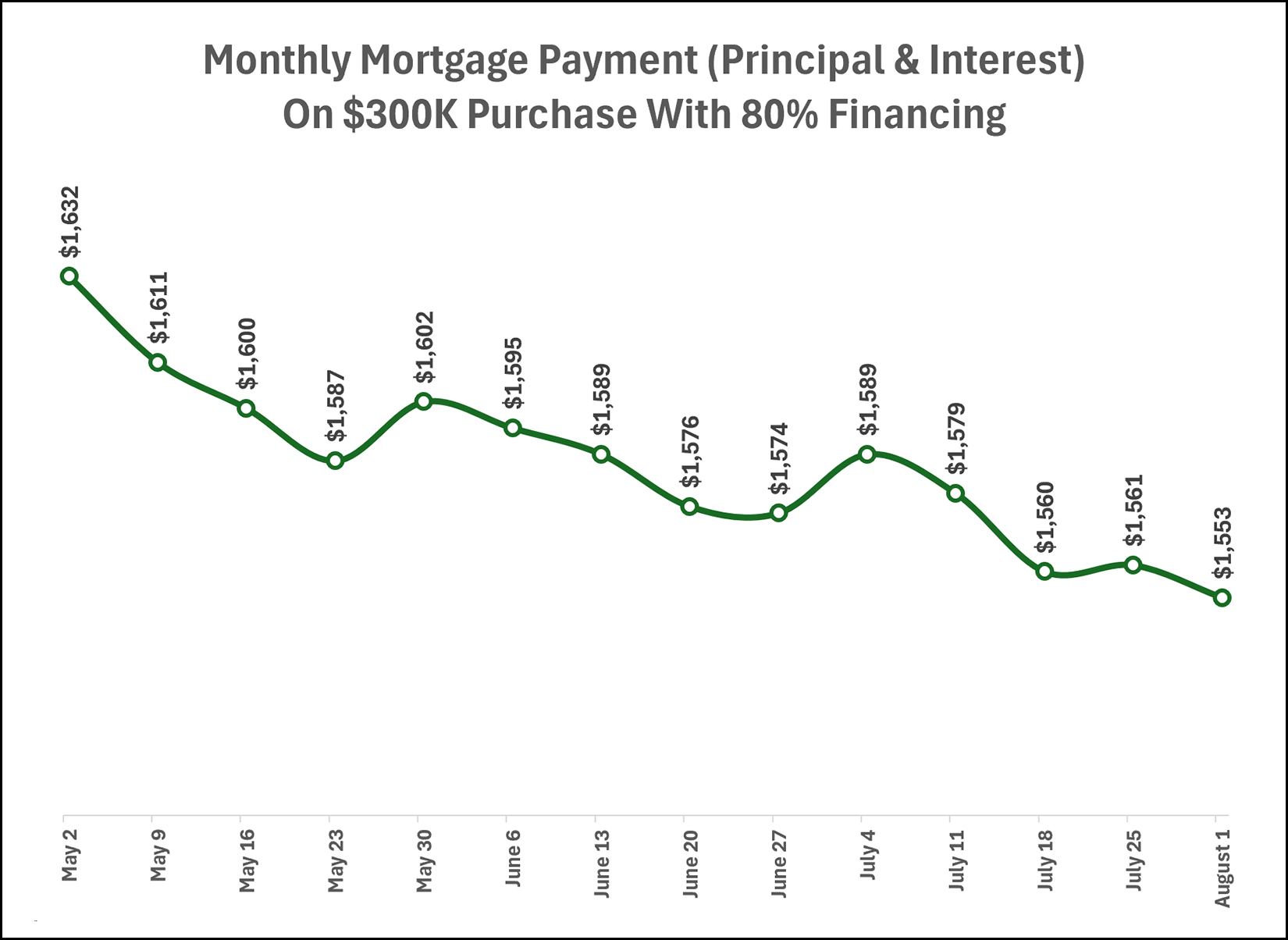

Mortgage Payments Drift Downward As Mortgage Interest Rates Slowly Decline |

|

The average mortgage interest rate on a 30 year fixed rate mortgage has been slowly declining over the past three months, from 7.22% on May 2nd to 6.73% on August 1. Thus, as you would expect, monthly mortgage payments are trending downward as well. The graph above shows the principal and interest portion of the mortgage payment for a $300K purchase with 80% financing given the average mortgage interest rates each week for the past three months. As you can see, this theoretical mortgage payment has declined by about $80 over the past three months... which provides almost $1,000 per year of savings to a buyer given the lower mortgage interest rates. | |

It Is Reasonable To Pay A Bit More Than Market Value If... |

|

Most home buyers do not want to pay more than market value for the home they will purchase. If a home is worth $325K in the current market, then they would prefer to pay no more than $325K... and actually, less than $325K would be even better! ;-) But... there can be circumstances where it is reasonable for a buyer to pay more than market value for a home. The two circumstances that most quickly come to mind are... 1. If a house fits this buyer particularly well. If a home buyer is looking for a home in a particular location, with a particular style, with a particular layout... with particular features... or some variation thereof... it's likely that most houses that come on the market don't fit a buyer's particular needs that well. Sometimes, a house will come on the market that fit a buyer perfectly, or nearly perfectly. For such a house, it would be reasonable for that buyer to pay a bit more than market value. 2. If houses that fit this buyer do not become available very often. If a home buyer is looking for homes in this location, in that price range, and with those features... it's possible that multiple homes come on the market each month that fit the bill... and it's also possible that homes only come on the market every few months that fit that description. If houses that fit a buyer's criteria do not come on the market that often, it would be reasonable for that buyer to pay a bit more than market value. So... most of the time a buyer only wants to pay market value for home... but sometimes it is quite reasonable to be willing to pay a bit more. For the home noted above, with an objective market value of $325K... a buyer might be willing to pay $335K if it is an absolutely perfect fit... and a buyer might be willing to pay $345K if it is an absolutely perfect fit AND homes like this only come along every few months or even less frequently. | |

Two Versions Of Paying Slightly More For A House Than You Had Hoped |

|

Sometimes a buyer loves a new listing but thinks it is priced a smidge higher than it should be - and they aren't sure what to do. Here are two versions of how such a scenario might play out... Scenario 1 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $545,000 for the house and secure a contract to buy it. You're happy but in the back of your mind wonder whether you should have only offered $535,000. Scenario 2 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $535,000 and the seller waits for a day to respond. You are then notified that they have received two other offers. You add an escalation clause to your offer to confirm your willingness to increase your offer as high as $550,000. Your escalation clause goes into effect and you end up paying $547,000 for the house. Or the not quite as exciting outcome... Scenario 3 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $535,000 and the seller waits for a day to respond. The seller informs you that they accepted another buyer's offer and when it goes to closing you see that the other buyer paid $545,000 for the house. If you love a house, and it's a new listing, and it's only priced a smidge higher than you think it should -- there can be merit in just going ahead and making that full price offer to try to secure a contract to buy the house that you love. | |

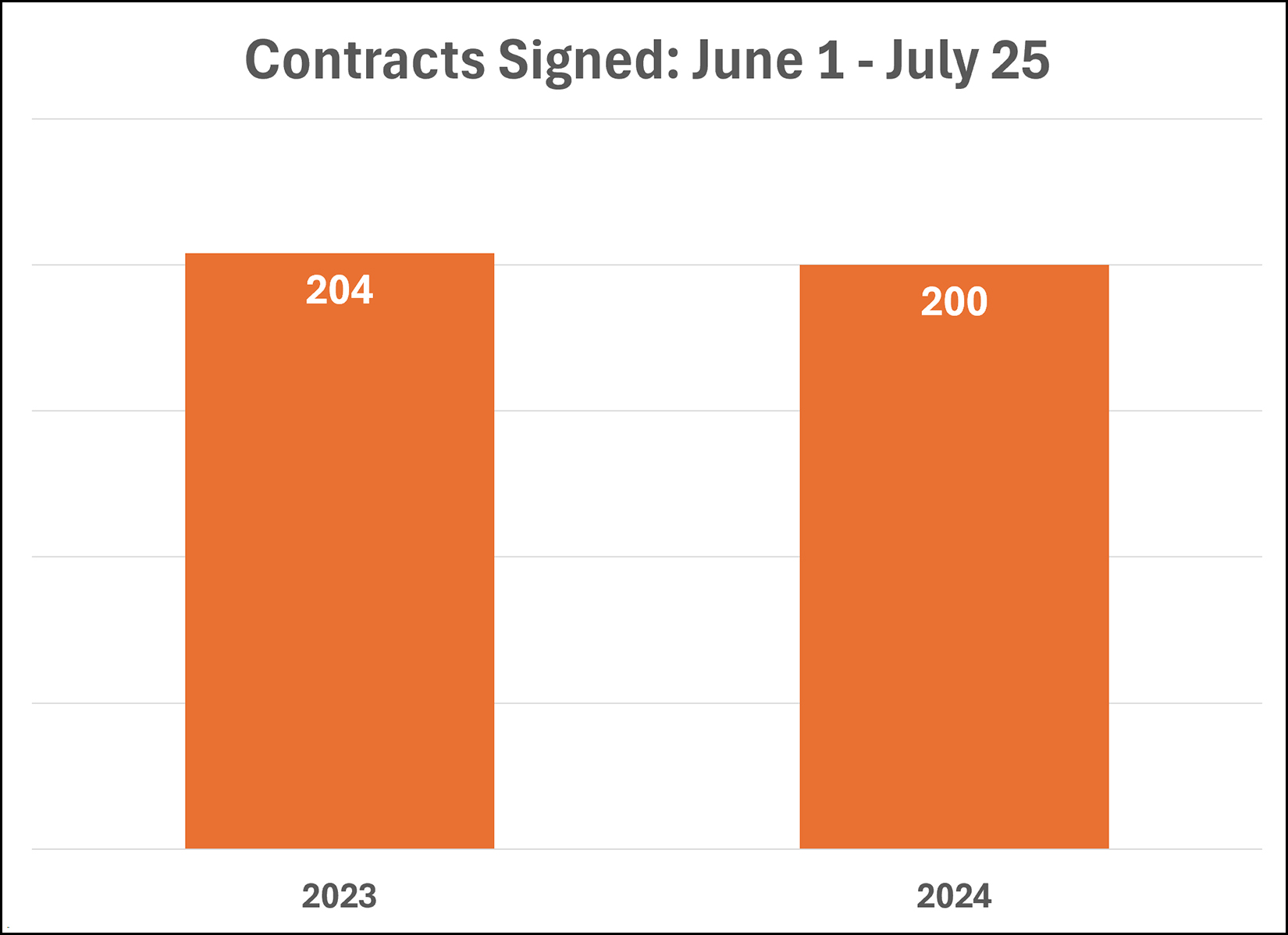

Another Busy Summer For Home Buyers (And Sellers) |

|

It has been another busy summer for home buyers and home sellers thus far this year. As shown above, 200 buyers (and thus, sellers) have signed contracts on homes in Harrisonburg and Rockingham County between June 1 and July 25... as compared to 204 last year during the same timeframe. We will likely continue to see relatively strong contract activity as we move into and through August - though things get a bit irregular in the second half of August as many folks are preparing for the start of the school year... either with kids who are students... or as teachers. | |

Ask About The Age Of The Roof And Heating System Before Making An Offer |

|

When the home inspector says "the roof is fine but probably will need to be replaced in three to five years" it isn't reasonable to ask the seller to replace the roof. When the home inspector says "the heating system is working just fine but is beyond it's statistical life expectancy" it isn't reasonable to ask the seller to replace the heating system. But... it is reasonable to think differently about the value of a home if the roof and/or the heating system will need to be replaced soon. So, simply put, ask about the age of the roof and heating system *before* making an offer! | |

As Your Home Search Continues, Will You Become More Or Less Picky? |

|

Every new listing isn't having multiple offers these days... but plenty of new listings are getting lots of attention... and some are having multiple offers. As a result, some buyers are still having a difficult time securing a contract to buy a home. If you are such a home buyers... who has been searching for a home for months and months... or who has unsuccessfully made offers on home after home... Will you become more or less picky as time goes on? Some buyers will get more and more flexible with their home search criteria as the months go on, as they just... want... to... finally... purchase... a... home. Some buyers will get more and more picky as their home search continues... figuring that if they've waited this long to find a home, they might as well wait a bit longer to find a home that is a great fit for their needs. If you are hoping to buy in a popular price range or location or property type such that you have lots of competition from other buyers... will you become more or less picky as time goes on? | |

I Know I Will Not Find A House With EVERYTHING I Want, But I Cannot Decide Which Compromises To Make |

|

This is a tough one, and many buyers feel this way these days with limited options of resale homes to consider purchasing... You might come to the table with five "must have" criteria for your next home and another five "would like to have" criteria. Or, maybe your list of requirements is even longer, or possibly shorter. Regardless, just about every would be home buyer is looking for a home that will meet as many of their needs and desires as possible. But if you can't find it all...

Which are you willing to sacrifice? You'll likely encounter many homes that match many of your criteria... and a few homes that fit most of your criteria... but you might not find any that do it all for you. Oftentimes you won't be able to decide in advance which of your "must have" criteria are actually negotiable. But as you enter each new listing as a home buyer, try to hold all of your criteria loosely, and give each a house a chance to convince you that it meets enough of your needs to be a home that you can enjoy for the coming years. | |

Home Sellers Usually Do Not Drastically Exaggerate Their Home Features |

|

Sometimes a home's description is a bit over the top, such as this AI generated description of a very small home that is trying its best to sound amazing... "Introducing the Ultimate Oasis: a marvel of architectural genius nestled in the heart of tranquility! This exquisite residence redefines opulence in a compact form, boasting an incredibly efficient layout that maximizes every square inch to deliver an unparalleled living experience. Envision yourself in this jewel box of a home, where elegance meets innovation." Again... most of the time we don't see listings where the description, or photographs or feature list or specs greatly outshine the house itself. But... occasionally I do run into such a house. For example, a house advertised as having four bedrooms... but one of them is 8' x 8' without a closet, one is 7' x 8' without a window, and you get to one tiny room by walking through the other tiny room. Or... a house advertised as having an unfinished basement... which turns out to be a five foot tall crawlspace. Or... a house advertised as having two full bathrooms... but it's really only full bathroom and two half bathrooms. Usually some of these not-quite-accurate descriptions can be understood by scrutinizing the photos... but sometimes it requires visiting a house in person to discover that... Oh, this house is not at all what I thought it was going to be!?! | |

If You Are Renting A House Now But Hope To Buy Soon, Start Looking At Homes Six Months Before Your Lease Ends |

|

So, you are renting a home in Harrisonburg or Rockingham County now... but you hope to buy a home within the next year? I recommend that you start looking at homes for sale about six months before the end of your lease. Many leases require you to provide 60 days notice (or more, or less) as to whether you will renew or not renew said lease. Thus, you shouldn't wait too long to start looking at homes you might purchase. Furthermore, there still aren't many choices of homes to purchase in many price ranges in Harrisonburg and Rockingham County. Thus, you will want more time to consider new listings that pop up over the course of a few weeks or a few months, rather than just choosing from homes that are available for sale at a single moment in time. This is best accomplished by starting to look at homes several months before you need to secure a contract to purchase one. Finally, the longer you look at homes for sale, the better context you will have for what types of houses sell for what types of prices - which will make you a more informed buyer when you are ready to make an offer on a home you hope to purchase. So... if you're renting now, but hope to buy at the end of your lease... start looking at homes six (or so) months before that lease ends. | |

When Multiple Offers Exist, Home Buyers Should Go Ahead And Make Their Strongest Offer |

|

If a house has been on the market for a few days without an offer, a home buyer may be inclined to attempt to negotiate somewhat on price and add contingencies related to a home inspection, appraisal, etc. All of that is fine, and can make sense. Until another offer exists. Once more than one offer exists, home buyers ought to go ahead and make the strongest offer that they would like to make - acknowledging that they are now not only negotiating with the seller but they are also competing with other buyers. For example... A home is listed for sale for $475,000. Five days go by with plenty of showings but no offers. A buyer offers $455,000 with an inspection and appraisal contingency. A second buyer makes an offer - clearly, with terms unknown to the first buyer. The first buyer does not modify their offer, or only makes a small change, not taking it all the way to the best terms they would be willing to offer for the house. The seller moves forward with the second buyer. The first buyer regrets not having made their strongest offer. Yes, negotiate if you must, or if you feel that you should, but if you are competing with another buyer, don't hold back if you really do hope to buy that house! | |

Are Homes Staying On The Market Longer These Days? |

|

Some homes certainly are staying on the market longer these days than they have been over the past few years. We haven't seen a noticeable shift in the "median days on market" statistic that I track on a monthly basis, but it is no longer the case that nearly all homes that are listed for sale go under contract within a week. For example... 1. There are (22) resale homes currently on the market with a "Harrisonburg" or "Rockingham" mailing address (ignoring towns or far flung properties) that are priced under $400K and have been on the market for at least a week. 2. Of those (22) homes, there are (18) that have been on the market for at least two weeks. 3. Of the (133) resales homes that have sold in that same geographic area over the past three months, only (76) had a "days on market" of a week or less, and (44) of them took longer than two weeks to go under contract. So, when we list your home for sale, will it be "off to the races" with an offer being received (and a contract signed) within days? Maybe -- but maybe not. Plenty of homes are taking longer than a week to sell -- and no, that does not necessarily mean that nobody will ever want to buy your house. :-) | |

Home Sellers AND Buyers Are Both Trying To Get Used To Home Inspection Contingencies Again |

|

For much of the past five years, in many price ranges, in many locations, we were seeing multiple offers, escalation clauses, and buyers willing to remove any and all contingencies. Home inspections were a thing of the past -- for a few years. But now, with somewhat fewer buyers in the market to buy (given higher mortgage interest rates) we are often just seeing a single offer, or only a few, rather than 5 to 10 offers on a popular new listing. As a result, home inspections are often taking place on transactions in Harrisonburg and Rockingham County. Since home inspections haven't been top of mind lately (given the heated market) here are a few reminders to home sellers and buyers related to home inspections... Sellers - Certainly, it would be ideal if the one offer you received did not have an inspection contingency, but you only have one offer, so it is probably reasonable to go along with the home inspection. Buyers - Try to focus on major issues in the home inspection report. It is not necessarily realistic to think a seller is going to address every minor issue identified in the inspection report. Sellers - Your buyer is (probably) not just trying to use the inspection report and contingency to renegotiate the deal. Assume the best about your buyer, that they are attempting to renegotiate the deal given the new information they discovered during the inspection process. Buyers - I do not recommend asking sellers to make elective upgrades to the home. Your home inspector might have pointed out items that would be done differently if the home was built today, but was normal at the time the house was built -- or they might point out areas where you could make improvements to improve energy efficiency, etc. These sorts of items are not typically repairs (or upgrades) that you should request from a seller. Sellers - If the unknown of what might be discovered during a home inspection worries you, it could be a good idea to have an inspection completed before listing your home to identify and resolve any significant issues. Buyers - Given how difficult it can be to line up a contractor or handyman these days, consider being willing to discuss a credit with the seller instead of requiring that repairs be completed. I suspect home inspections will continue to be (will return to being) a normal part of the home purchasing and selling process over the next few years. | |

If You Are The First Or Only Buyer To Make An Offer, Go Ahead And Include Those Contingencies |

|

Egads! The market is crazy right now -- would be home buyers have to include escalation clauses and they certainly couldn't include an inspection contingency or an appraisal contingency!?! Right? Well... yes... often... but not always. Sometimes you might be looking at a home that has been on the market for 3, 7 or 10 days -- without an offer on it as of yet. Should you offer full price, waive an inspection and opt out of an appraisal contingency? Not necessarily. As funny as it might be to say this... If a house has been on the market for a few days and does not have any offers, go ahead and go crazy... include that inspection contingency, and the radon test contingency, and the appraisal contingency, and... wait for it... maybe even try to negotiate a bit on price!?! Certainly, your offer might spur on another offer, and then you might be in a competitive offer situation where you are revising your offer and removing your contingencies... but you might just find success in buying a home with a few of those used-to-be-normal contingencies. ** results may vary based on property type, price range and location ** ;-) | |

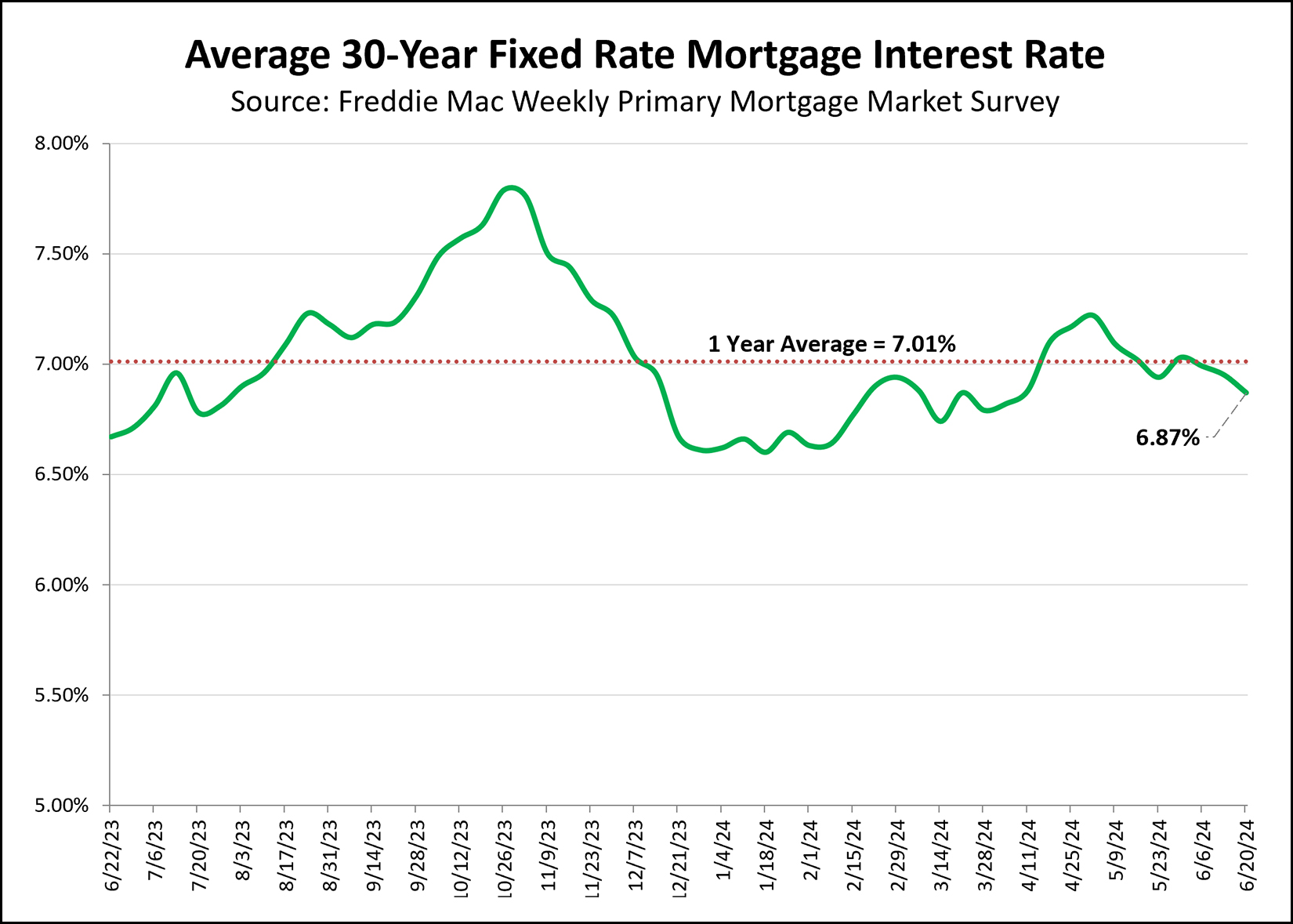

Mortgage Interest Rates Declining Steadily Through Start Of Summer |

|

Outdoor temperatures may have been HIGH during the first few weeks of summer... but mortgage interest rates have been falling! Over the past years, the average 30 year fixed mortgage interest rate has been 7.01%. The average rate peaked last October at 7.79% and then fell relatively steadily through December... but then (mostly) climbed again all the way through May when it hit 7.22%. Since that time we have seen a decline almost every week, and the average rate is now 6.87%. That is nearly a full percentage point lower than the high of 7.79% this past October. Home buyers are certainly enjoying these lower mortgage interest rates though they hope they will continue to decline. | |

I Just Contracted To Buy A House But An Even More Exciting House Was Just Listed For Sale!?! |

|

Thankfully, this doesn't happen too often, but I have had a few clients over the years who have been in this predicament. They finally, excitedly, ratify a contract on a house that they are thrilled to purchase... and then... a few days later... a house hits the market that is even more exciting! What is a conflicted buyer to do? 1. Remember that you are contractually bound to buy the home that you signed a contract to buy. There will likely be ramifications (financially and otherwise) if you do not complete the purchase. 2. Remember that you were excited about lots of other new listings in the past, all of which you were much less excited about after you toured the houses. Thus, even if the shiny new listing seems like a really exciting house, you might not actually like it as much as you think you will if you walked through it. 3. Remember that in a competitive market (which we are still in, for the most part) there isn't any guarantee anyhow that you'd be able to secure a contract on that newer and possibly more interesting listing. 4. Remember that this dynamic will always exist -- whether it's a few days later, a few months later or a few years later -- a home will inevitably come on the market that will be (or will seem to be) more exciting than the home you bought a few days ago, a few months ago or a few years ago. 5. Consider turning off your new listing alerts to avoid feeling conflicted? 6. Feel free to talk all of this through with me and I can try to help talk you off of the ledge if you are suddenly less excited about the house you just contracted to buy based on a new listing that just hit the market. | |

Listings Hitting The Market On Fridays Make It Important For Buyers To Have A Lender Letter Ready To Go |

|

A buyers says... I plan to buy a home as soon as "the right one" comes on the market. I talked to a lender six months ago and they didn't have any concerns with being able to approve me for a mortgage. I'll just wait until the right house hits the market and then I'll get a prequalification letter from my lender. This works out OK some of the time to most of the time - but not all of the time. Sometimes a new listing hits the market on a Friday. We might go see it on Saturday afternoon. By the time we are looking at the house there are already two offers in hand and a few more might be received at any moment. If you love the house, and want to make an offer, we might be in a tight spot, because... 1. An offer without a lender letter won't typically go anywhere. 2. An offer with a promise to deliver a lender letter on Monday won't typically go anywhere. Certainly, sometimes a seller won't be making a decision until Monday or Tuesday and sometimes offers don't materialize that quickly. But... if you want to be ready to make an offer on a house that you love when it hits the market, you should already have a lender letter ready to go. | |

Do Not Assume A Seller Will Say No To An Offer You Have Not Made |

|

It often goes something like this... "That house was listed for a sale a few days ago for $435K and I could probably only afford to pay $425K. I'm sure the seller would not accept my $425K offer, so I just won't make the offer." "I know that house has been on the market for two months priced at $650K without a price adjustment, but I'm sure the seller would not be willing to sell for $625K, so I won't even make the offer." "Even though that house has been on the market for a few months, they probably still wouldn't accept a full price offer because I would need to include a home sale contingency, so I probably shouldn't make an offer." In almost all cases, I recommend that all three of the fictional buyers above go ahead and make the offers that they chose not to make because they assumed a seller would say no to their offer. Certainly, a seller might really say no to your offer, but that's OK. If you never actually make the offer, you'll never have a chance to find out if the seller will say "no" -- or whether they would say "yes" or "no, but how about..." | |

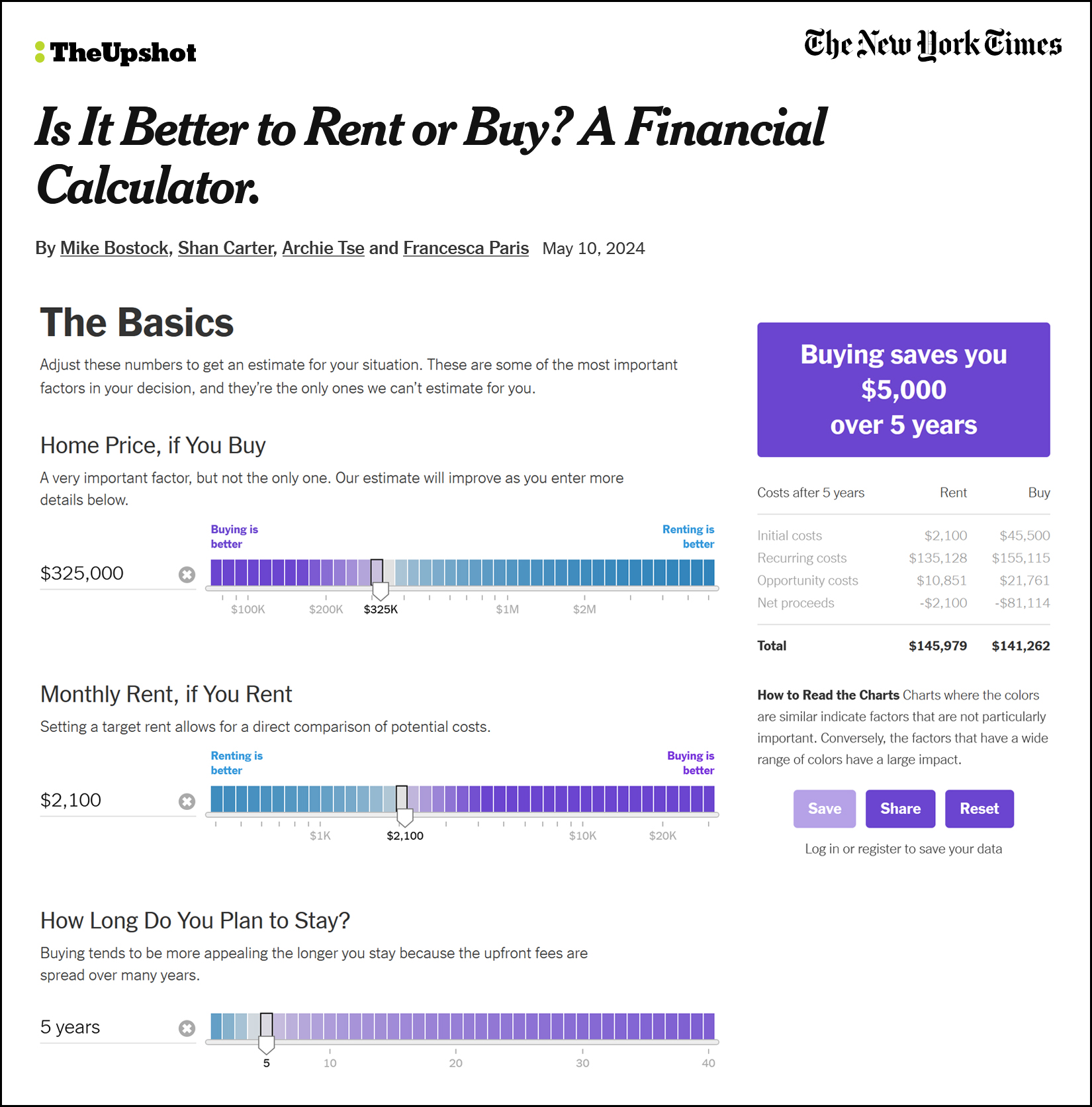

How To Determine Whether To Rent Or Buy A Home (via NYT) |

|

Buying a home is expensive these days, given high sales prices and high more interest rates -- but renting a home can be quite expensive as well! How can you best compare the financial impact of buying vs. renting? The New York Times has created a very helpful, interactive calculator that lets you dive into the details to better understand whether it will make sense for you to buy or rent based on the particular details of your situation. You'll start with some basic inputs including:

It is important to then adjust a few additional assumptions they have built into their calculator to match your scenario. The main sliders that seem important to adjust are...

The calculator will then show you your total costs of renting vs. buying over the timeframe you chose. In the fictional scenario I have illustrated above, it made more sense (barely) to buy over five years when comparing a $325K purchase to a $2100 rental rate. One final (important) note... the calculator assumes 3% growth in home prices. I don't necessarily recommend adjusting that to a higher percentage... BUT... over the past four years we have been seeing 10% growth in home prices each year. If we continue to see that type of home price growth it will almost always make sense to buy, regardless of your timeline. In summary... $325K purchase vs. $2100 rental rate over a 5 year horizon with 3% annual growth in home prices... it's better to buy, but barely. (If we see 5% growth in home prices per year for the next three years, it would be better to buy, even over that short three year timeframe) Explore the calculator and all of your possible scenarios here. | |

Almost All Houses Look Better Online Than In Person |

|

This isn't a secret to anyone who has bought a home in the past 10+ years... Almost All Houses Look Better Online Than In Person Real estate photographers do an EXCELLENT job at making each home look absolutely fantastic! Some of it is in the lighting, some in the angles, some in the cropping, some in the post production... but real estate photographers can make almost any house look better online than in person. That's not a criticism of real estate photographers (certainly!) and it is not a criticism of all those houses that in reality don't look quite as pristine as they did in the photos online. It is just a reality that home buyers should be aware of when clicking through photos of new listings, imagining that the house is 110% as wonderful as the amazing photos make it appear. I am merely pointing out the importance of seeing a house in person to be able to take in... [1] the condition of the walls and floors that photos don't show in great detail [2] the parts of the house that weren't as prominently displayed in the photos [3] the lot characteristics or surrounding properties that weren't highlighted Don't get me wrong... I want you to LOVE each house in person just as much as you did when you viewed it online... but once we start looking at a few you may notice that the photos REALLY made it shine, perhaps a bit more than it does in reality. And, just to flip things completely upside down for a moment... every once in a while I do still come across a house that looks much better in person than in the photos... which makes me wonder why the photos look as they do. Photos matter in real estate marketing... a lot... but buyers will almost always be making their decision when walking through the house and experiencing it in person. | |

Make The Strongest Offer You Are Comfortable Making And Acknowledge All The Possible Outcomes |

|

The market is still moving along pretty quickly in many price ranges. This often results in multiple offer scenarios, where you are making an offer and will be competing against one or more other buyers who are also making offers. You won't know how much the other buyers are offering... or if they are including escalation clauses... or if they are including inspection contingencies... or if they are including appraisal contingencies... or if they are offering cash. So, what then, are you to do as a buyer? I recommend that you make the strongest offer that you are comfortable making and acknowledge all the possible outcomes. Your offer might not be high enough to compete against other offers and the seller might select another offer. You might have included more contingencies than another buyer and the seller might select another offer. You might have the fewest contingencies and the seller might select your offer. You might have the highest offer and the seller might select your offer. Home inspection contingencies make sense to include as a buyer... as do appraisal contingencies... but both can limit your ability to win in a multiple offer scenario. So, make the strongest offer you are comfortable making and acknowledge all the possible outcomes. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings