Buying

| Newer Posts | Older Posts |

Comparison Shopping (For Homes) Is Difficult In A Low Inventory Market |

|

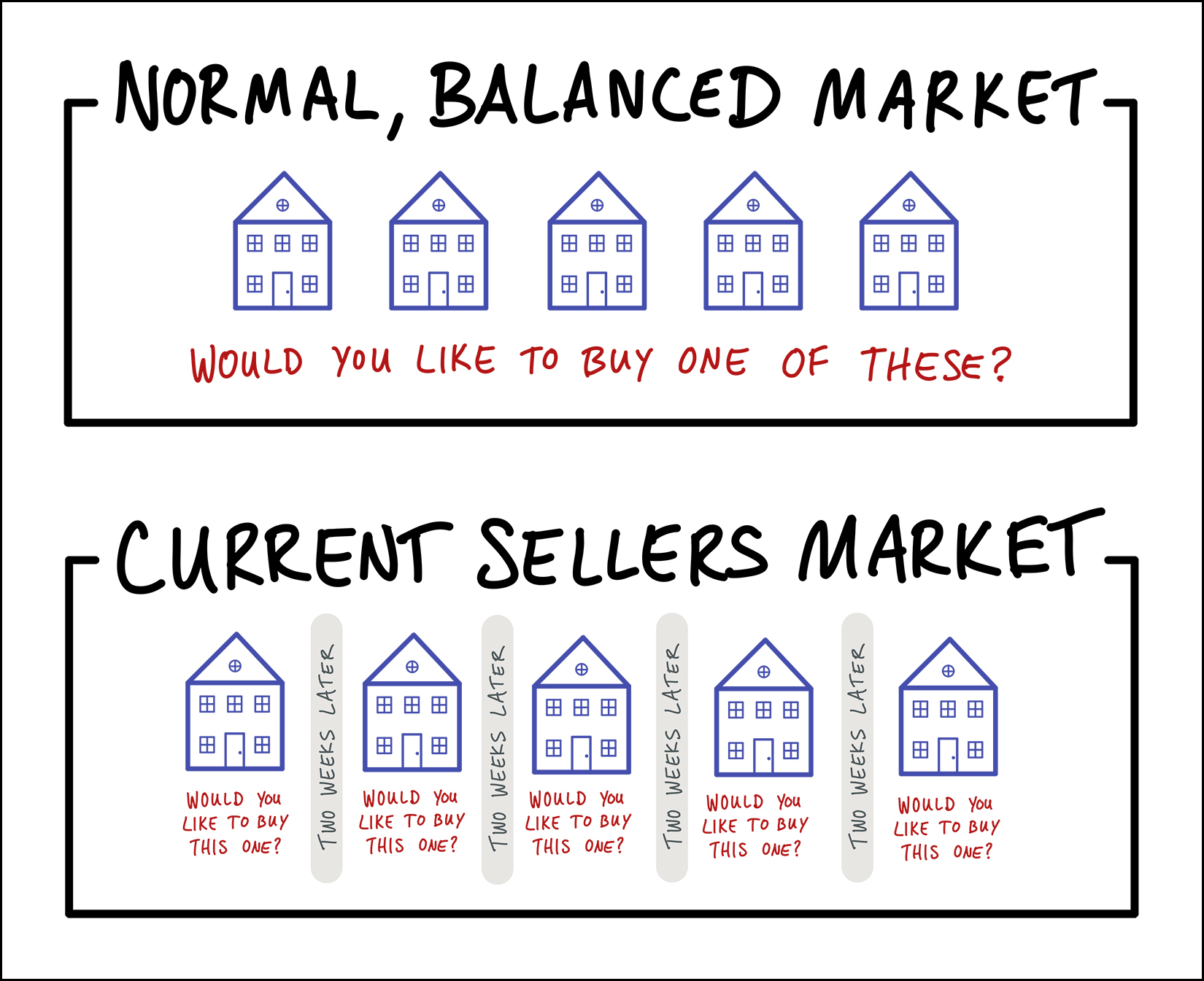

If you were going to buy a ____, it would probably be nice to look at multiple options, compare them, and then decide which one to buy, right? That is often possible with buying a home, whenever we have a balanced market (or a buyer's market) when buyers can find multiple houses on the market at any given time that might work for them. A buyer would then go view multiple houses, compare them, and decide if they want to make an offer on one of the available homes. These days (and for the past few years) we have been in a strong sellers market, with very low inventory levels. The same number of houses have typically been available for a buyer to consider... but they are often evaluating them one at a time, every few weeks... instead of all at once. Sorta like this...

Basically, home buyers have had to make a decision about whether to buy a house... one house a time... without the ability to compare multiple options that are available at the same time. That may eventually change, in some or most price ranges, if we start to see inventory levels increase over time. Until then, it can be a challenge to be a thoughtful and intentional comparison shopper when trying to buy a home! | |

So You Think Home Prices Will Decline? We Would Likely Need To See Much Higher Inventory Levels First! |

|

It's all about supply and demand. Over the past few years there have been plenty of home sellers... but WAY more home buyers. This resulted in buyers fighting over each new listing, competing to offer the most compelling terms, often being willing to pay a higher and higher price. Basically... [ Plenty Of Sellers ] + [ Way More Buyers ] = [ Rising Prices ] Some think that given higher mortgage interest rates and seemingly fewer buyers in the market, that we are certainly going to see home prices start to decline in this area. I suspect that will only happen if we see significantly higher inventory levels (of homes available for sale) such that sellers find themselves fighting over each new buyer, competing to be willing to offer buyers the most compelling terms, often being willing to accept a lower and lower price. (I'm exaggerating a bit here, but I just flipped the language above to show you what I mean.) That type of a market would look like this... [ Lots Of Sellers ] + [ Not Many Buyers ] = [ Falling Prices ] Until and unless we actually see measurable, significant increases in inventory levels, what I think we'll actually see is... [ Plenty Of Sellers ] + [ Fewer But Plenty Of Buyers ] = [ Stable Or Rising Prices ] Feel free to offer up your counterpoints or contrary perspectives. I'd love to hear them! | |

If You Bought A Home In 2020 Or 2021 You Should Be Retroactively Thrilled About Your Mortgage Interest Rate |

|

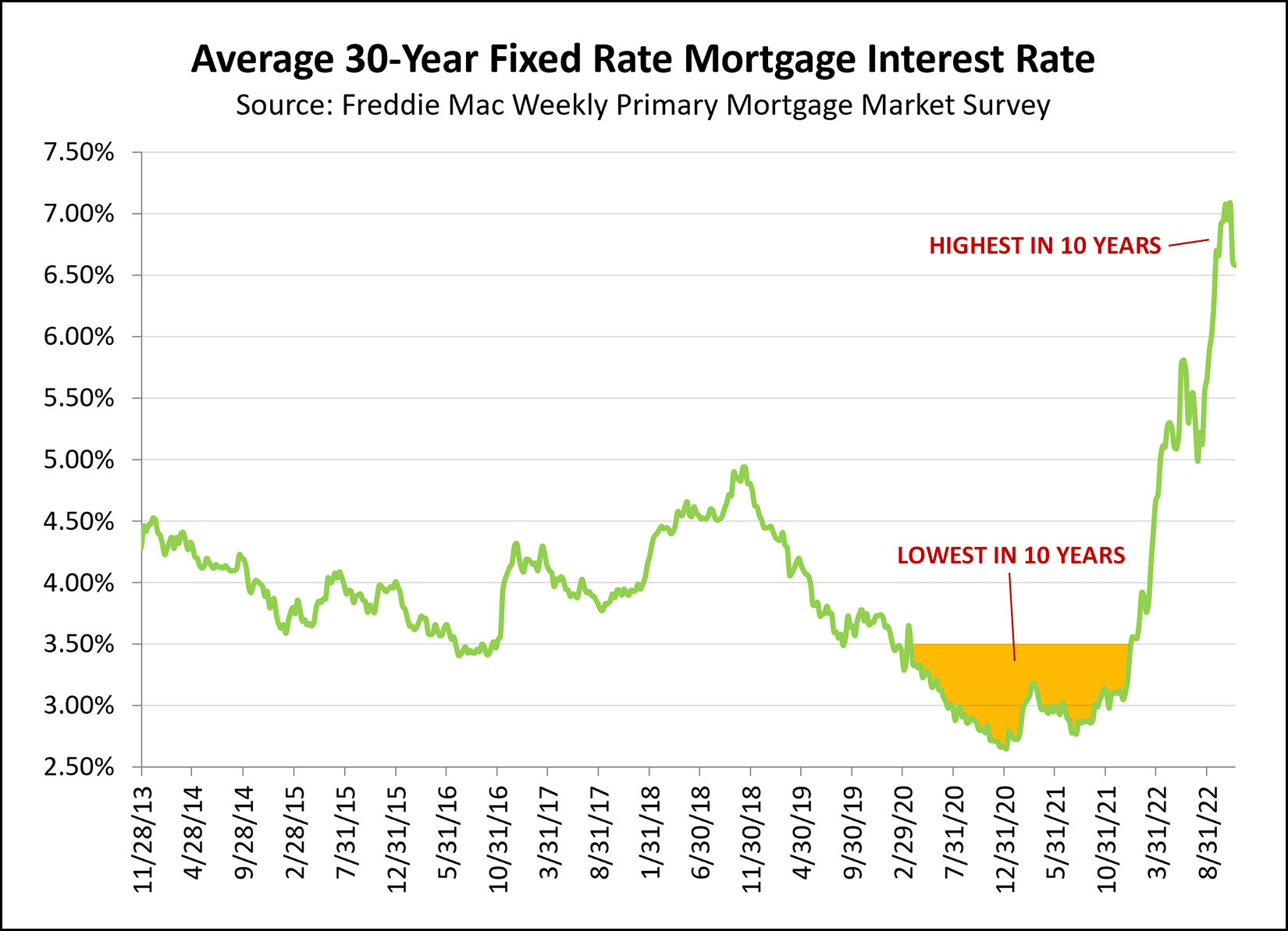

Did you buy a home in 2020 or 2021? If so, you likely locked in a mortgage interest rate that was the lowest we've seen in the past 10 years... and actually... the lowest we've seen... ever! So, for all of the buyers from the past two years, please look back and be thrilled that you were able to take advantage of that unique opportunity to lock in a very low interest rate on what is likely to be one of the largest purchases of your lifetime. Hopefully your home will work for you for many years to come and you will continue to enjoy the benefits of that super low interest rate. And... for would-be home buyers of 2022... yes, current mortgage interest rates are the highest we have seen in the past 10 years. In fact, we have to go all the way back to 2000 to find an interest rate above 7%. But... mortgage interest rates are starting to trend back down over the past month. They have dropped from about 7% to about 6.5%... and I have seen some recent prequalification letters much closer to 6%. Just as those record low mortgage interest rates didn't stick around forever, it seems unlikely that these record high mortgage interest rates will stick around forever... and they might pass more quickly than we realize. | |

The Conundrum Of What Price To Offer On A Slightly Overpriced New Listing |

|

Oh, silly sellers, why did you have to make this so difficult!? ;-) There's a fantastic new listing on the market... very likely worth $415K. But... the sellers listed it for sale with a price of $430K. Ugh. You want to make an offer on this house... you want to buy the house... but what do you offer? If the house had been priced at $415K, you would immediately make an offer of $415K. If the house had been priced at $420K, you may very well have made an offer of $420K. But the house is priced at $430K. So do you... [1] Offer $430K, the list price, ignoring the fact that you think this is too much to pay for the house? [2] Offer $415K, the likely value of the house, but $15K lower than the list price? If you offer $430K you are likely paying more for the house than it is worth in the current market. If you offer $415K the seller is almost certainly going to stall in responding to your offer, hoping for another offer that is higher... and is going to alert other interested buyers that they have an offer... which might result in other offers coming in as well. There is no easy answer to this question... it's situational in some ways... and your course of action should be guided by your level of interest in the house and the amount of other early interest in the house. But darn those sellers, pricing the house a bit of market value. ;-) | |

Are Things Slower Now In The Local Real Estate Market? |

|

This is the number one question I am asked these days when I am chatting with non-buyers and non-sellers around town. In other words, folks who are not currently buying or selling or trying to buy or trying to sell. Are things slower now? The answer is, as perhaps you might expect... yes and no. Yes, things are slower...

No, things are not slower...

So, things definitely feel slower - the hectic, crazed, frantic pace of 2020-2022 has cooled off. But in many ways (number of sales, price of homes sold) the market is just as strong, brisk, vibrant, as ever... it's just not over the top, unbridled exuberance as it has been for the past few years. | |

Some, But Not All, New Listings Will Still Have Multiple Offers Within Days! |

|

Some new listings are now remaining on the market for a week or two -- instead of a day or two -- before going under contract. That being the case, there are still plenty of homes going under contract in a matter of days, often with multiple offers. For example... in the past 60 days 175 properties have gone under contract... and of those, 62 of them were under contract within four days. So, yes, you may be able to pause for a day before making an offer, but keep in mind that plenty of properties are still going under contract quickly and they might require faster action. My advice... Go see a new listing of interest as quickly as possible, start working your way through your decision making process as quickly as possible, and ask to be notified if any offers have been received. | |

Many Home Buyers Now Find They Can Actually Think For A Minute Before Making An Offer |

|

For a few years now, many home buyers in Harrisonburg and Rockingham Countuy have felt the PRESSURE to make a decision QUICKLY after viewing a new listing. Monday, 8:00 AM - new listing hits the market Monday, 1:00 PM - go see the house Monday, 4:00 PM - make an offer Much of this mad rush, however, was due to an EXTREME number of home buyers pursuing every new listing. It was not uncommon to have 20+ showings on a new listing within 24 or 48 hours of the property being listed for sale. Higher mortgage interest rates have reduced overall levels of buyer activity and enthusiasm, resulting in many new listings having a more normal-ish three (or so) showings a day for the first few days that the house is on the market. As a potential buyer, when you are competing with other potential buyers -- instead of 19+ other buyers -- you have a bit more time to make a decision about whether you want to make an offer on a new listing. This change -- in my opinion -- is good, normal and healthy for our local housing market. It doesn't mean that houses aren't selling... or that they are taking ages to sell... or that they are selling for lower prices... it just means that sellers might have to wait a few days longer to have an exciting offer to review... and that buyers can actually take a minute to decide whether they want to make an offer on the exciting new listing. So, buyers... yes, let's go see houses quickly when they hit the market, but you might not need to make a decision about an offer within a matter of a few hours now... maybe you can sleep on the decision and let me know in the morning! | |

Fewer Than 10% Of Buyers Spend Less Than $200K On Single Family Homes In Harrisonburg, Rockingham County |

|

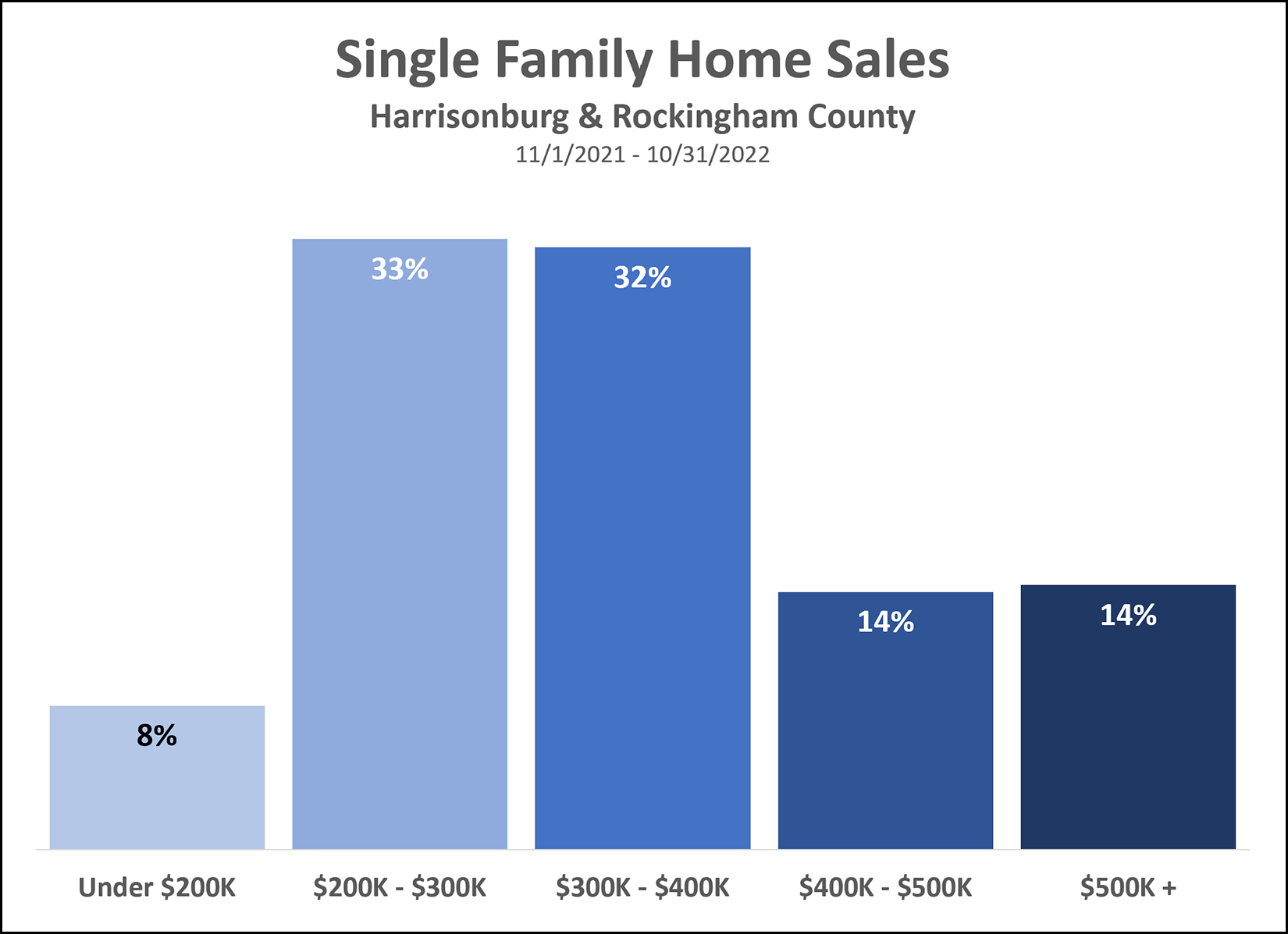

If you're hoping to buy a single family home for less than $200,000 in Harrisonburg or Rockingham County, you might find it challenging to do so. Only 8% of the single family homes sold in the past 12 months have sold for less than $200,000. Getting straight to the numbers... Total Detached Home Sales = 1,123 Detached Home Sales Under $200K = 86 | |

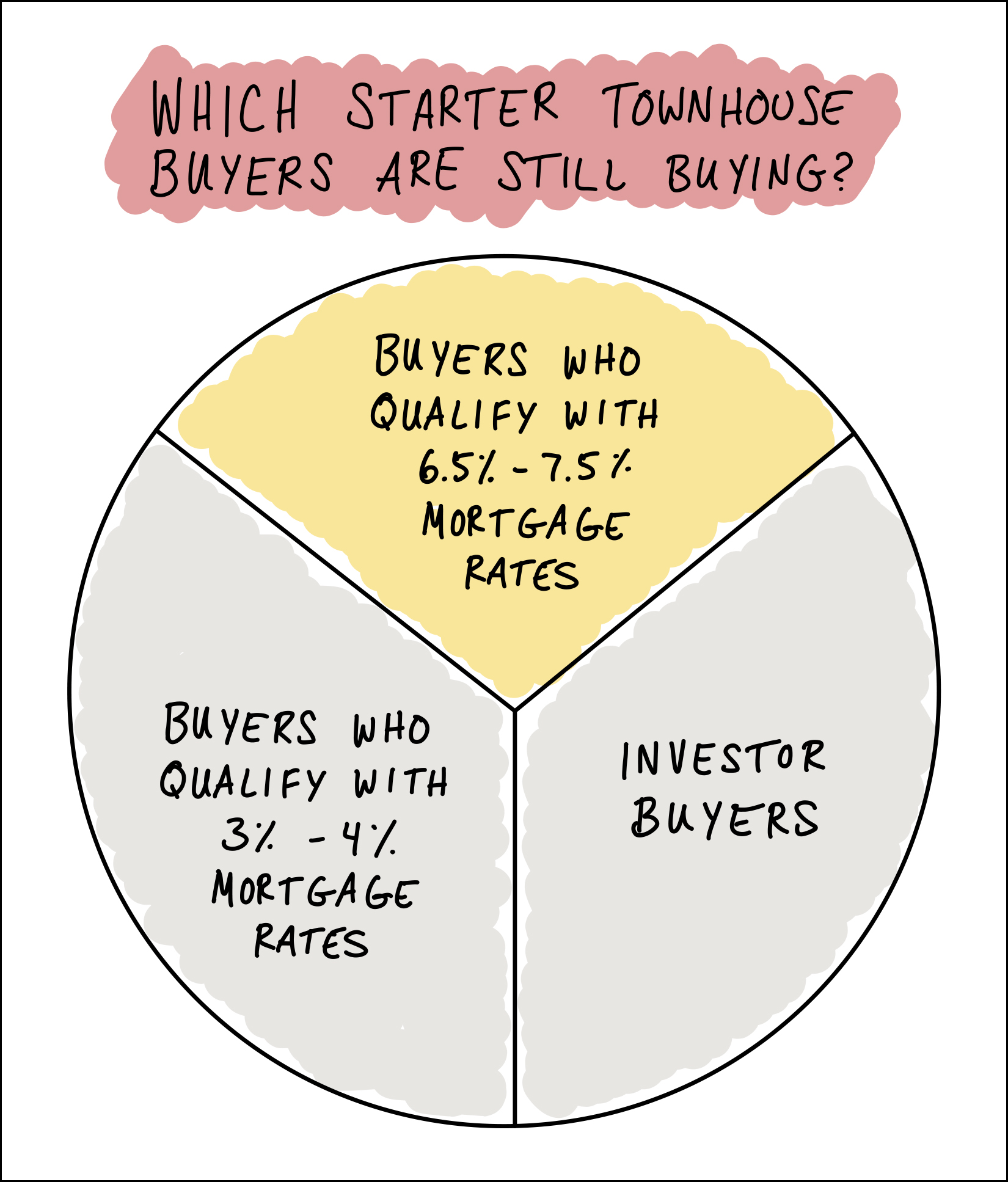

The Buyer Pool For Starter Townhouses May Be Smaller For Now |

|

Starter townhouses (think two story, 15 - 25 year old) in the City of Harrisonburg used to sell for $150K-ish but have increased in price over the past five years to a range of somewhere between $200K and $240K. Why have prices escalated so quickly? Similar to much of the market, it's largely related to low interest rates... [1] With mortgage interest rates of 3% to 4%, the pool of potential home buyers expanded considerably... lots and lots of potential first time buyers were delighted to find that they qualified to purchase a townhouse. [2] Real estate investors were also happy to scoop up these types of townhouses as they were able to finance those purchases with exceptionally low mortgage interest rates as well. Certainly, the interest rate would be higher for an investment purchase than for an owner occupant, but an interest rate that is higher than "very very low" is perhaps "very low" so plenty of investors were purchasing these properties as well. But now, mortgage interest rates are a bit higher... OK... twice as high. The current average 30 year fixed mortgage interest rate is 6.95%. As such, and as shown on the "not at all based on real numbers or data" graph above... [1] Would be home buyers who could only qualify to buy with a mortgage interest rate of 3% - 4% clearly do not quality any longer and thus are not buying. [2] Investor buyers who were delighted to buy when interest rates were quite low are also likely not buying right now. That just leaves owner occupant home buyers who still qualify with 6.5% to 7.5% mortgage interest rates. What does this actually mean for this segment of our local housing market? [1] There will likely be fewer buyers coming to see your townhouse if you are selling a starter townhouse in the City of Harrisonburg. [2] There will likely be fewer offers on said townhouse, and less competition from other buyers if you are trying to buy such a townhouse. [3] We might see these townhouses take a bit longer to sell. Maybe? [4] Maybe the price of these townhouses won't climb quite as quickly over the next year or two. Maybe? These are my observations about this segment of our local housing market, very unscientifically graphed above. Let me know if you have other observations, thoughts or questions about the market for this type of property moving forward into 2023. | |

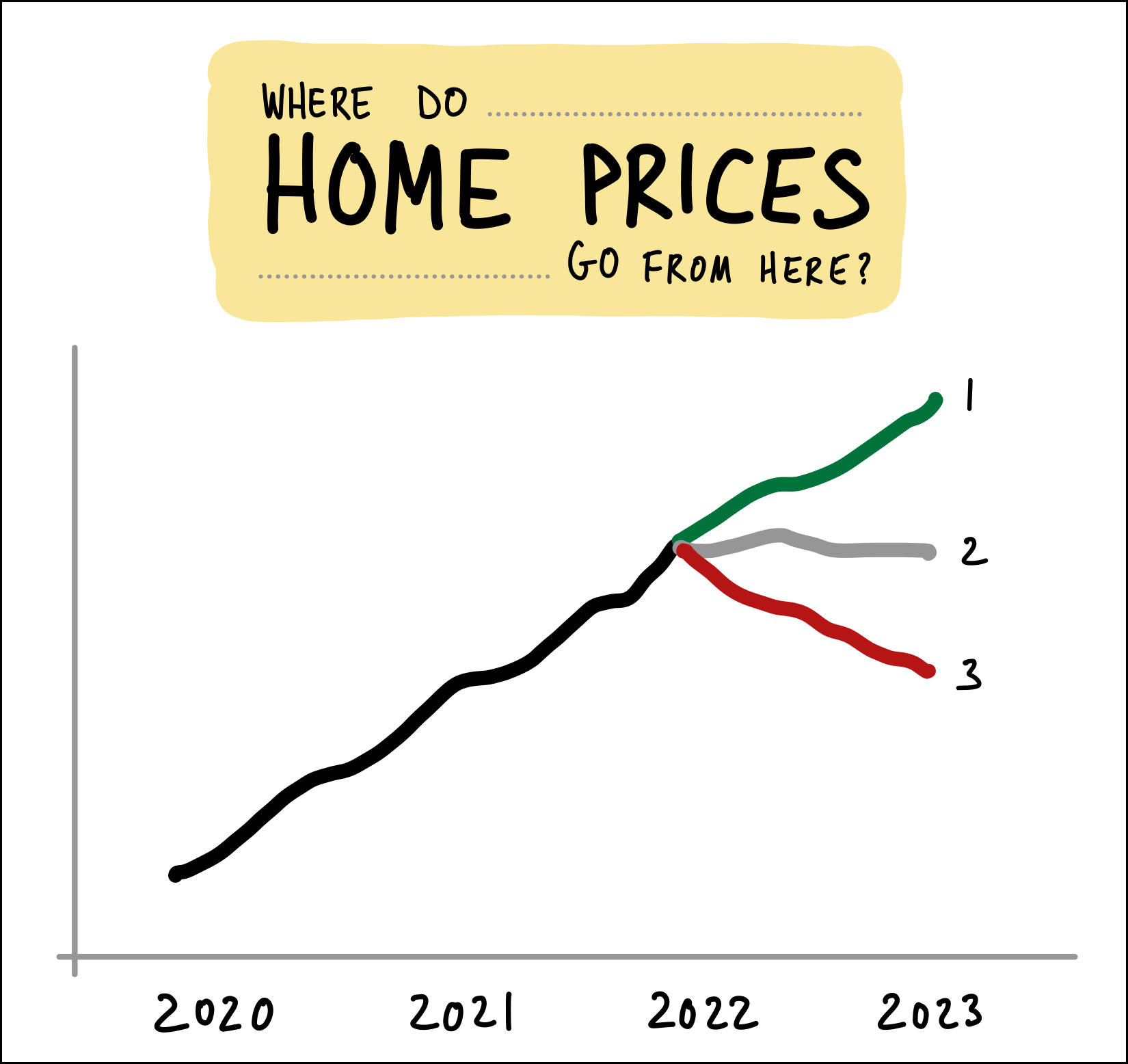

Where Do Home Prices Go From Here? |

|

This is a question very much on the mind of potential home buyers and potential home sellers in the local real estate market in late 2022... Where DO home prices go from here? As per the illustration above, do we see... 1. Home prices keep in rising, perhaps another 10% in 2023. 2. Home prices plateau in 2023, with similar prices as in 2022. 3. Home prices correct, drop, droop, decline by 10% in 2023. It's hard to imagine won't keep increasing (scenario one) given that they have through the first nine months of 2022 even in the context of quickly rising mortgage interest rates. But yet at the same time, it's hard to imagine that prices won't level out or decline some given those quickly rising mortgage interest rates. I can be convinced by those that I talk to (buyers, sellers, agents, bankers, appraisers) that prices will keep on rising in Harrisonburg and Rockingham County... and I can be convinced by those same folks (or a different set of them) that home prices will flatten out or decline slightly in 2023. So, I have absolutely zero answers as to what we should expect in 2023, but interestingly, even if home prices dropped by 10% in 2023... that would take us ALLLLL the way back to 2021 sales prices. ;-) | |

Talking Things Through With Multiple Lenders Makes Sense Again |

|

Over the past three or four years mortgage interest rates were sooooo low that there often wasn't too much of a difference in the interest rate quoted by one lender vs. another. Furthermore, buyers didn't have to think too creatively about different loan programs as far as fixed rate vs. adjustable rate, etc. The thirty year fixed mortgage rate was so exceptionally low that almost all buyers were purchasing with that program. But, now things have changed... Mortgage interest rates are quite a bit higher now... at or above 7% for a 30 year fixed mortgage rate! As such, savvy home buyers are... [1] Talking to more than one lender to see how interest rates and closing costs compare. [2] Considering fixed rate mortgages alongside adjustable rate mortgages that start out fixed for (usually) five or seven years. If you are buying a home in late 2022 or early 2023 it will matter now more now than ever that you talk to an experienced, professional, responsive, creative mortgage lender to make sure you are finding the financing program that is the best fit for your financial scenario and your plans for the coming years in your new home. | |

October 2022 Contract Activity Has Dropped Significantly, Sort Of |

|

Has the local real estate market slowed down? Oh yes, quite a bit! How so? Last October 156 homes went under contract in the first 27 days of the month... and this year only 81 homes have gone under contract in that time frame. Wow. Quite a bit slower! Indeed. -- So, yes, contract activity this month is much lower than it was last year during October... but as the graph above reveals, there may be more to the story. First of all, the orange and green bars represent 2020 and 2021 and I think we'll eventually look back and conclude that they were abnormal years, with buying activity super-charge by a worldwide pandemic, as unexpected as that was. So, the bright orange and bright green bars that tower above the rest of the months on the chart might be outliers. Looking for a moment, then, just at the blue bars... This August (2022) we saw a 13% increase in August contracts compared to August 2019. This September (2022) we saw a 10% increase in September contracts compared to September 2019. And...in October... we are dragging ever so slightly behind October 2019, but things aren't looking overly different from where things were three years ago, just before Covid. -- So... is this October slower than last October when it comes to contracts being signed? Yes, absolutely! Much slower! Is this October slower than the last pre-Covid October we have seen in this market? It's slower, but just barely. Is the pace of home buying slowing down in Harrisonburg and Rockingham County? Yes, it seems so... but by how much depends on whether we compare the present times to Covid times or pre-Covid times. | |

Engaging With A Lender Continues To Be Essential For Buyers And It Does Not Have To Be Scary |

|

The local real estate market might be slowing down, a touch. For the past year the median "days on market" has been five days... which means that half (or more) homes that sold were under contract within five days of hitting the market. That is fast! Perhaps we'll eventually get to a time where homes are taking a full week or two (gasp!) to go under contract. In this very recent speedy market it was absolutely imperative that you had talked to a lender before you went to see a house for sale. You would likely need to make an offer within 24 hours of seeing a home, so having a lender letter in hand was a must. But even if or as the market is slowing a bit it is and will continue to be very important to have a lender letter in hand when going to see a house... though for slightly different reasons this time. Before... you needed a lender letter in hand to accompany the offer that you might make hours after viewing a house. Now... you need a lender letter to accompany an offer as well as to make sure you know what your mortgage payment will be within the context of recent rapid increases in mortgage interest rates. So, if you're in the market to buy a home now, but it's been a while (six months, a year, etc.) since you have talked to a lender... you should do so now. Talking to a lender doesn't have to be scary. They'll need some basic financial information from you in order to help you understand the type of mortgage you will qualify for and thus the price range in which you should be searching for homes. If you need a recommendation or recommendations for a great local lender, let me know! Call/text me at 540-578-0102 or email me here. | |

Home Buyers Who Want To Buy A Home In The Next Year Likely Should Not Wait For Mortgage Interest Rates To Come Back Down |

|

If you are looking to buy a home right now you might be surprised by higher mortgage interest rates than we have seen for much of the past year... January = 3.45% February = 3.92% March = 4.16% April = 5.00% May = 5.30% June = 5.78% July = 5.51% August = 5.13% September = 6.02% Now = 6.94% How could mortgage interest rates be close to 7% after having started the year at 3.45%? Surely mortgage interest rates will start coming back down again soon, to 4% or 5%, right? Or even 6%? I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months. As such, if you are thinking about buying a home right now, you should see what your payments will look like at current mortgage interest rates and decide if that is a monthly payment that will work for you. If so, it may be worth going ahead and moving forward with a purchase rather than holding off in hopes of lower mortgage interest rates. While it is certainly possible that mortgage interest rates will start declining again, I don't think we can assume that is what will happen next. | |

Contract Activity Seems To Be Slowing Down (Quite A Bit) In October 2022 |

|

It's best not to get your face too close to the data. The closer we look at the data, at a smaller and smaller data set, the more likely we can find ourselves concluding one thing when another is actually true. So, as you ponder the meaning of the graph above, keep in mind that the last set of data (October 1 - 15) is a rather small set of data... from just two weeks in our local market... so it may or may not be indicative of an overall trend. But... with that length disclaimer having been thrown out there... After seeing modest declines in contract activity in August (-13%) and September (-15%) it seems that contract activity might be REALLY slowing down (-51%) in October. Last October, in the first half of the month, a total of 81 contracts were signed for buyers to buy and sellers to sell houses in Harrisonburg and Rockingham County. This year in those same 15 days, only 40 contracts have been signed. It's hard to say if this significant decline in contract activity will continue as we move through October and into November, but if things were slowing down slightly in August and September, they seem to be slowing down more quickly in October. | |

Income From A Short Term Rental In Your Home Can Make Housing More Affordable |

|

Home prices are higher than they have been anytime in the past decade. Mortgage interest rates are higher than they have been anytime in the past decade. And, thus, for many buyers, housing costs (mortgage payments) are higher than they have been anytime in the past decade. What is a home buyer in 2022 to do given these high housing costs? One strategy being pursued by some home buyers is to look for a property where they have the possibility of generating additional income with some portion of their home. In most cases, these days, that is considering renting out some part of a home on a short term basis via AirBNB or otherwise. Sometimes it might be a basement efficiency apartment, sometimes a space over a garage, or any number of other configurations depending on the property. There certainly aren't enough properties for sale (in any given timeframe) that offer this extra income possibility to match the number of buyers who would have interest in the configuration - but when these properties do become available, they can offer a buyer the opportunity to offset their total housing costs. | |

If You Will Be Buying A Home In The Next Year, Sooner Might Be Better Than Later |

|

Home prices have increased quite a bit over the past few years. Clearly, that's a bit of an understatement. ;-) Mortgage interest rates have increased drastically (doubled+) over the past year. As such, some would be home buyers might be wondering whether they should go ahead and buy a home now, or wait until next year. Waiting would make sense... if you thought home prices were going to decline and/or if you thought mortgage interest rates were going to decline. I think there is a relatively low possibility that we will see a significant decrease in home prices and/or mortgage interest rates over the next six to twelve months. Buying sooner rather than later would make sense... if you think home prices will either stay at about the same level or they might increase... and if you think mortgage interest rates will either stay at about the same level or they might increase. I think there is a relatively high possibility that home prices and mortgage interest rates will either stay at the same level or increase over the next six to twelve months. So, if you are almost certainly going to buy a home in the next 12 months, then the chances are sooner will probably be better than later. Clearly, this guidance is based on my best guesses (or your best guesses) about future trends in home prices and mortgage interest rates... so we're all just guessing. Only waiting and watching will show us what really will happen. Let me know if you want to chat further about this topic as it relates to your particular portion of the local housing market. | |

Buy A Home For You, Not Just The Next Owner |

|

As we walk through houses thinking and talking about if each house works well (or not) for you and your family... it can be tempting to start putting each house in a far future context... "Yes, this layout and these room sizes would be great for us... but will the next buyer like them?" "I love the backyard and gardens... but maybe the next buyer will think they are too small?" "I love this house and I don't mind at all that the bathrooms are a bit small in... but maybe that will be a sticking point for the next buyer?" Sometimes I see a home buyer fall IN LOVE with a home, but then talk themselves out of it because they aren't confident about whether they will find a future buyer that loves the house just as much to whom they can sell the house in the future. Yes, it is important to think a bit about future resale when you are buying a home... but it is even more important that you love the home that you are about to buy. Don't buy a home that you don't like, that will be easy to sell later. Don't decide not to buy a home that you like only because it won't necessarily be easy to sell later. Buy a home for you... not just the next owner! | |

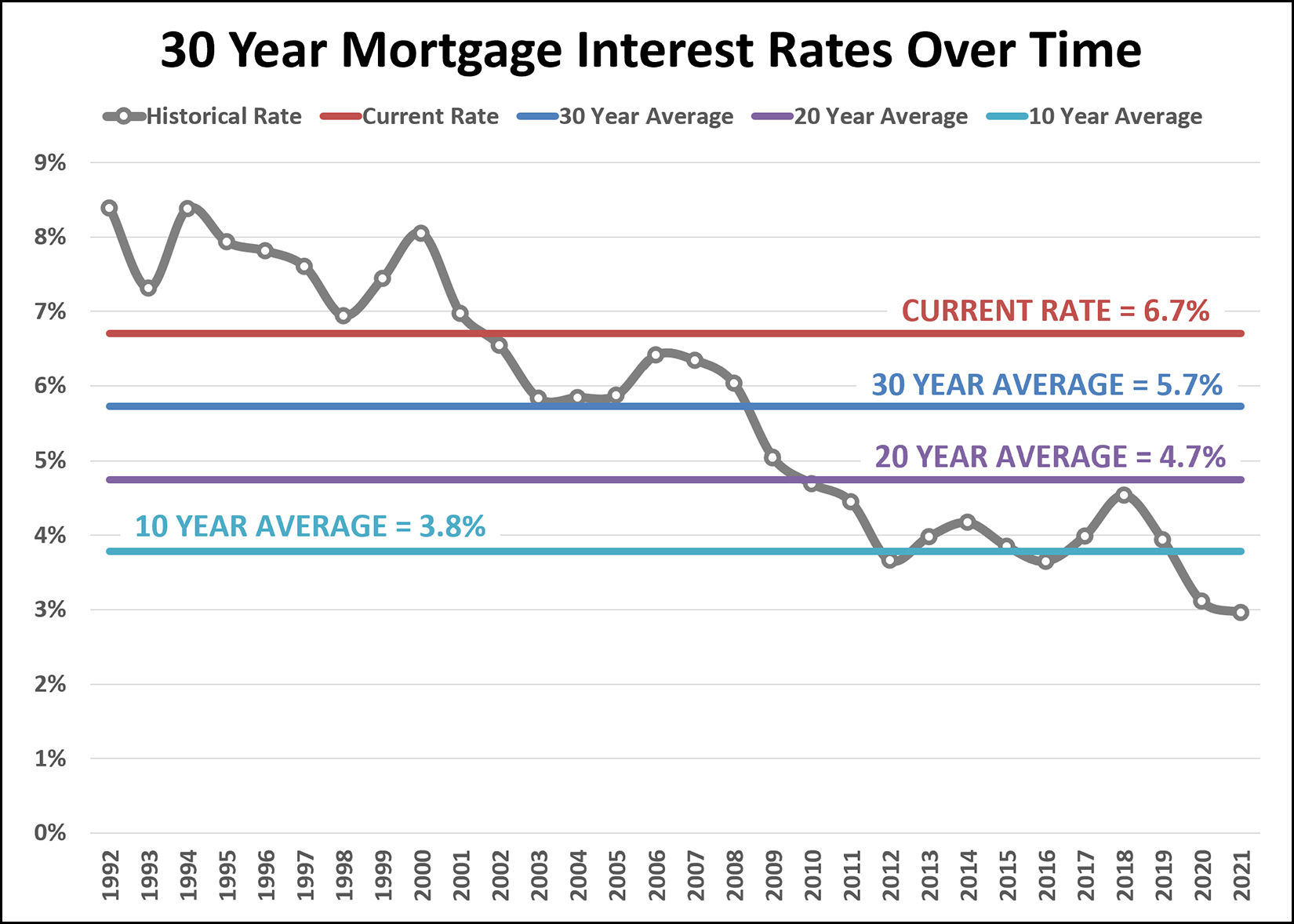

Where Might Mortgage Interest Rates Go From Here? |

|

30 year fixed mortgage interest rates were around 3% a year ago... and now they are up to 6.7%. Ahhhh! Some home buyers today, taking out mortgages at today's rates, are wondering whether it is likely that they will be able to refinance their mortgage anytime soon to get a mortgage rate lower than 6.7%. It's very difficult to know whether that would be likely... but a lot of that would have to do with what historical norm we may or may not gravitate back towards within the next few years. Are mortgage interest rates going to settle back down to 3%? That seems extraordinarily unlikely. Might they drop back down to the average rate over the past 10 years, of 3.8%? That seems somewhat possible, but still not necessarily likely. Might mortgage interest rates drop down to the average rate over the past 20 years, which was 4.7%? That seems quite possible, which would result in a 2% drop from today's 6.7% to the average over the past 20 years of 4.7%. Or, if you want to be even more conservative, we could look at the average mortgage rate over the past 30 years... which was 5.7%, still a full percentage point below the current rates. Another way to look at this is to note that mortgage interest rates were above the current 6.7% rate between 1992 and 2001... and below the current 6.7% rate between 2001 and 2021. Are we headed back towards mortgage interest rates we saw in the 90's? Or the early 2000's? As you might have gathered, I have no actual answers here other than to point to this historical data as a greater context for current mortgage interest rates. :-) | |

Well, I Suppose This Was One Way To Revive The Market For Future Mortgage Refinances? |

|

Sorry. Bad joke. Probably too soon. Mortgage interest rates have risen even further this week... with the current average rate on a 30 year mortgage now at 6.7%. One year ago it was 3.01%. Also one year ago, some said that every last person who could ever possibly think about refinancing their mortgage certainly must have done so. But now it seems some buyers are likely entering into fixed rate mortgages at rates that are high enough that they will be planning to refinance sometime in the next few years with the assumption that at some point we won't be looking at 6.7% interest rates any longer. I suppose it is also important to note that a 5/1 ARM is currently at 5.3%, which might be a MUCH better option for some home buyers. This mortgage interest rate would stay level at 5.3% for five years, and then have the potential to adjust once a year each year thereafter. It's a topsy-turvy time in the mortgage world right now, which can impact the home buying world, which can impact the home selling world. The steady increase in mortgage interest rates has certainly affected housing affordability, especially when piled on top of higher home prices. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings