Buying

| Newer Posts | Older Posts |

Higher Mortgage Interest Rates Might Be Resulting In More Buyer Competition In Moderate Price Ranges |

|

Clearly, the Harrisonburg and Rockingham housing market is still quite competitive right now, especially for homes under $400K. One reason for this might be related to current mortgage interest rates! Higher mortgage interest rates result in higher monthly costs. If some home buyers were looking in the $400K - $500K range when mortgage interest rates were around 3%, they may very well now be looking in the $300K - $400K range now that mortgage interest rates are above 6%. After all, if you're financing 80%... $450K purchase at 3.25% mortgage interest rate = $2,011 per month $350K purchase at 6.25% mortgage interest rate = $2,070 per month Yikes! So, if $300K - $400K purchasers were previously only competing with eachother, they might now find themselves competing with buyers who were previously planning to spend up to $500K! That said, it is of course also true that some $300K - $400K purchasers might also have had to reduce the target price for their home purchase as well. | |

Buyers Should Choose Their Words Carefully When Talking About A House While Walking Through It |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening. These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. So..... [1] Don't insult their house. It won't help during negotiations. [2] Don't discuss negotiations. You might be revealing your strategy. By the way, sellers, you'll need to disclose if there is a recording device in your home. There is a field in our local MLS specifically for this disclosure. | |

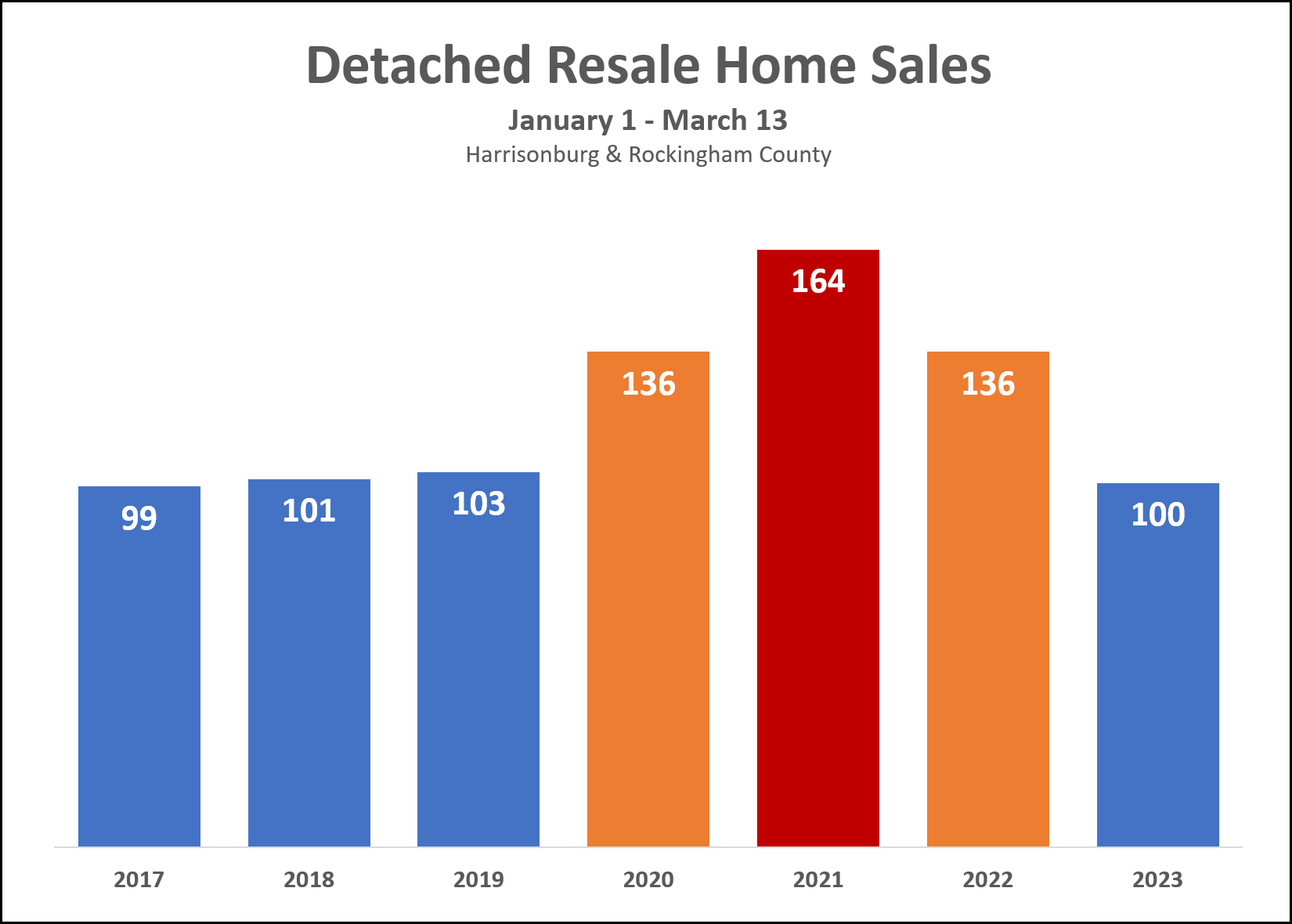

Detached Resale Home Sales Decline 39% In Two Years, Down To... Pre Covid Norm |

|

First, a definition... Detached Resale Home Sales = not townhouses, not duplexes, not condos, not new homes Now, then, an observation... Detached Resale Home Sales have declined 39% over the past two years when looking at first 2.5 (ish) months of the year. Oops, wait, another observation... Detached Resale Home Sales have dropped all the way down to... pre covid norms. In the three years leading up to Covid (2017, 2018, 2019) we saw home sales between January 1 and March 13 totaling 99, 101 and 103 home sales for each of the above referenced years. But then, the three most recent years showed a very different pace of sales... Jan 1 - Mar 13 of 2020 = 136 sales! Jan 1 - Mar 13 of 2021 = 164 sales! Jan 1 - Mar 13 of 2022 = 136 sales! But, then, back to what seems to have been the pre-Covid norm... Jan 1 - Mar 13 of 2023 = wait for it... 100 sales So, two things seem to be true right now... There are significantly (!!!) fewer detached, resale homes selling right now compared to how many we saw during the same timeframe over the past three years. But, yet, the number of detached, resale homes selling right now is quite normal per the historical trends before Covid started messing with the housing market. Prospective home buyers in 2023 should thus realize that... [1] There will likely be a historically normal number of homes that you could buy this year... if we ignore the three most recent years. [2] There will be far fewer options of homes to buy this year compared to last year and the year before. [3] There may very well be more competition from other buyers for that smaller number of homes that will be available for purchase. As you can see through all of this -- the decline in home sales is very much due to a restrained supply (only so many sellers willing to sell) rather than a restrained demand (only so many buyers wanting to buy). | |

Home Buyers Who Bought Homes Two Years Ago Thought They Were Paying Crazy High Prices For Their Homes |

|

I think those home buyers look at things a bit differently now. Three years ago the median sales price in Harrisonburg and Rockingham County was $222,150. One year later it had risen 11.5% to $247,700. Home buyers who were paying $247,700 thought they were paying WAY TOO MUCH for their homes. Why in the world did they need to pay 11.5% more than a similar buyer one year earlier!? My how those numbers look different today. Now, just two short years later, the median sales price has risen 22.9% (in two years) to $304,485. So, do you think those same home buyers who reluctantly paid $247,700 two years ago are upset for having paid 11.5% more than buyers were paying the previous year? Nope, not at all. They're delighted to have paid 22.9% less than buyers are paying today. Yes, this is an unusual time. I don't think we're going to see several more years of double digit annual increases in median sales prices. That said, I also don't think we're going to see home prices decline. So, while it can seem like today's home prices are high compared to home prices in the past -- your perspective might change a bit over the next few years when you're looking backwards at today's home prices. | |

How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? |

|

We will try to find you the perfect house to buy... that checks off all of the boxes on your list of needs and wants. If we happen upon a nearly perfect house... we should probably be asking ourselves... How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? These days, with relatively low inventory levels in many price ranges and for many property types... ...and with quite a bit of buyer interest in most of those price ranges... ...we may very well conclude that we are NOT likely to find a house that is a better fit for you in the next 90 days. The moral to the story, I suppose, is that in a low inventory (few sellers) competitive (many buyers) market... you might need to settle for a nearly perfect house instead of a perfect house. That way, you might actually end up with... a house! | |

Balancing Optimism, Pessimism And Realism When Thinking About An Almost Perfect House |

|

Yahoo! You have found an "almost perfect" house -- and you're thinking about making an offer. But... it's early spring (pre spring?) and there will be many more new listings coming on the market in the next few months, right? So... do you go ahead and make an offer on the almost perfect house now? Or do you wait to see what else hits the market that might be even more exciting!?? OPTIMISM tells us to wait for that perfect house. Don't compromise. There will be plenty of new options over the next 60 to 90 days. You won't want to miss out on the perfect house because you settled for an almost perfect house. PESSIMISM tells us that there probably won't be perfect houses, and if there are, there will be way too many buyers pursuing them, and your chances are low of winning a multiple offer scenario. REALISM tells us that (especially in the current fast moving, low inventory, real estate market) an almost perfect house is likely the perfect house to pursue. There are likely very few absolutely perfect houses, so if you have found one that is almost perfect, don't wait! It's tricky buying a home these days because you often can't compare one house to another, as the first will be under contract by the time the second house comes on the market. Thus, buyers often find themselves asking if "almost perfect" is perfect enough. | |

Thinking About Investment Properties Like Trees |

|

A (not very well sourced) proverb goes something like this... "The best time to plant a tree was 30 years ago, and the second best time to plant a tree is now." And so it goes with purchasing investment properties. The best time to purchase an investment property was (certainly!) 30 years ago... or 20 years ago... or even 10 years ago! (or in this crazy market, even five years ago) The second best time to purchase an investment property is now. A bit of explanation and plenty of caveats are necessary here... I've had a variety of conversations with real estate investors over the past few months as they have considered various properties that have come on the market for sale. We have lamented (together) that prices have risen so much that it's harder to justify some investment property purchases with today's prices and today's interest rates. On multiple occasions, my clients have said commented that they wish they had bought an investment property (or two... or five) about 5 to 10 years ago. But, as we have reflected further, we have realized that there is not likely going to be a future time when conditions will be more favorable for an investment property purchase. Prices do not seem likely to decline significantly (if at all) and while interest rates may decline some over the next year or two they seem unlikely to decline significantly. As such, if you didn't buy an investment property (or properties) 10 or 20 years ago... but you want to own one in 10 or 20 years, perhaps today is the best time to do so. OK, OK, plenty of caveats... [1] Investment property values do not always increase over all periods of time. I'm not trying to tell you that they do. Investing (in real estate or otherwise) includes risk. [2] You still need to make sure the numbers work from a monthly cash flow perspective, etc. [3] I do recognize that if you buy a property as an investment property it might keep an owner occupant buyer out of the market for buying that same property. This observation is not me telling you that you should not buy the investment property - but just an acknowledgement that any purchasing decision has other follow on consequences. If you're hoping to buy an investment property in the next few years (or this year!) let's chat sooner rather than later to make sure you understand what numbers to expect -- from a purchase price perspective and from a rental income perspective. And then... let's go find you a tree to plant... I mean... an investment property to purchase! | |

March Is Right Around The Corner And Every Would Be Home Buyer Hopes It Means Lots Of New Listings Are Coming Soon! |

|

Where are all of those houses for sale? Yes, I know, I know, they're already under contract. Plenty of homes are selling these days -- but because they go under contract so quickly -- there are rarely many on the market at any given time. But, March is coming! The spring market is often the busiest time of year for new listings, and we may start to see that surge of new listings coming at some point in March. And if not, April. While I'm thinking we will definitely see fewer resale homes hitting the market this year, we will likely start to see more of them coming on the market as we move through March and into April. So, if you're a hopeful home buyer, excited for whatever new listings might be coming on the market in March... or April... 1. Make sure you have an up to date lender letter. 2. Start tracking new listings to be amongst the first to know of new opportunities. 3. Get ready to jump on a new listing quickly -- seeing it quickly -- and then quickly deciding whether to make an offer. March is coming. Spring is coming. Hopefully, many more new listings are coming. | |

In A Multiple Offer Scenario, Consider Making The Strongest Offer You Are Comfortable Making |

|

It seems we might still be finding ourselves in plenty of multiple offer scenarios this coming spring in the Harrisonburg and Rockingham County real estate market. And sometimes... a buyer discovers that the house they have just walked into is one that works very, very well, for their needs. What sort of an offer should that interest translate into? I recommend that buyers make the strongest offer that they are comfortable making. PRICE - If the house we just viewed is listed for $400K, and we believe it is worth $400K, perhaps we offer $400K. Or, perhaps we include an escalation clause to demonstrate a willingness to pay as much as $410K, or $425K, given that this property fits your needs (and wants) very, very well, like no other house has to date. INSPECTION - If you are comfortable making an offer without a home inspection, based on your level of risk tolerance, and the condition and age of the property, and your available resources for making improvements, then perhaps we make an offer without an inspection contingency. Or, perhaps you are not comfortable making an offer without an inspection contingency. RADON - If you are comfortable testing for radon after you purchase the home, and installing a radon mitigation system at that time if needed, then perhaps we make an offer without a radon test contingency. APPRAISAL - If, based on the size of your downpayment, a slightly low appraised value would not affect your financing, and if you are comfortable paying the offering price regardless of what value the appraiser determines through their appraisal process, then perhaps we make an offer without a specific appraisal contingency. As you can see here, if we are going to be competing with other buyers and offers, we need to make a strong offer, but only as strong as you are comfortable making given your financial picture, the particular property, how well the property suits you, your tolerance for risk, etc. | |

Real Estate Has Seemed Like An Abnormally Liquid Asset Over The Past Few Years |

|

What is a liquid asset? Per Investopedia... "A liquid asset is an asset that can easily be converted into cash in a short amount of time." ...and further... "Liquid assets are often viewed as cash, and likewise may be called cash equivalents because the owner is confident the assets can easily be exchanged for cash at any time." ...and finally... "Generally, several factors must exist for a liquid asset to be considered liquid. It must be in an established, liquid market with a large number of readily available buyers. Ownership transfer must also be secure and easily facilitated." Real estate is generally understood to NOT be a liquid asset... as it can take time to sell real estate, the value for which a property will sell is not always certain, selling quickly to convert real estate to cash might result in a lower sales price, etc. But... over the past few years real estate has certainly SEEMED like a liquid asset for many property sellers. You want to sell your house? No problem. What to sell it quickly? We can make that happen. For an amazingly high price? Yep, that will happen too. So, while real estate was not (over the past few years) and is not (now) a liquid asset, it certainly seemed like it was to many property owners. Will this dynamic continue on into 2023 and 2024?

So, real estate -- which is definitely NOT a liquid asset -- might start to feel slightly less liquid over the next year or two based on the trends noted above. Or, maybe not. Maybe just about every home will continue to sell, without question, very quickly, at a very favorable price. The key takeaway here, as a buyer (or homeowner) is to remember that real estate is NOT a liquid asset. Don't buy a house today, paying any price, waiving all contingencies, if you might want to sell it again in 3, 6, 9 or 12 months. There are significant transactional costs of selling (and buying) a home and it is not a liquid asset - so it cannot always be quickly converted back into cash in your pocket. | |

Yes, More Houses Will Come On The Market For Sale In The Spring. Yes, More Buyers Will Be Competing For Them. |

|

It's a common question at this time of year... Will more houses come on the market in the spring? There don't seem to be many options at all right now. Great news... There will be more homes coming on the market in the spring. The spring season is one of the most active times of the year for new listings of homes for sale to be coming on the market. But... Bad news... There will also likely be more buyers competing for each of those new listings, as the number of buyers shopping for homes also typically increases significantly in the spring. So... Yes, more houses will come on the market for sale in the spring AND yes, more buyers will be competing for them. :-) :-( I suppose though, that as a buyer, it's still nice to have more listings from which to choose from, even if you have more competition as well? Even with higher mortgage interest rates (relative to the past few years) and even with prices edging higher and higher -- it still seems that the coming spring season will be quite an active one in the Harrisonburg and Rockingham County real estate market. | |

Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability |

|

Reflect with me for a moment on the definition of a paradox... paradox - a seemingly absurd or self-contradictory statement or proposition that when investigated or explained may prove to be well founded or true. Here's the paradox of the day... Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability Let's think it through together... Let's say you want to live in the infamous (and completely fictitious) "Riverside" neighborhood in Rockingham County. If you wanted to get a sense of whether it is possible to find housing in the Riverside neighborhood which method would you use? Method #1 for understanding housing availability... Look at how many homes are for sale in Riverside right at this very moment. There are currently zero homes for sale in Riverside, thus it is seemingly *impossible* to buy a home in Riverside, right? Method #2 for understanding housing availability... Look at how many homes have sold in Riverside during a particular timeframe, such as the past year. Oh, wait. There have been 15 home sales in Riverside over the past year. Thus, you likely will be able to buy a home in Riverside if you can wait for some new listings beyond what happens to be on the market at this very moment in time. As can be seen above, housing inventory levels were not a good indicator of housing availability in Riverside. -- Shifting gears a bit, let's consider whether housing inventory levels are a good indicator of housing availability in a real place, the City of Harrisonburg, but only examining homes priced under $300,000. Method #1 for understanding housing availability... Houses Currently For Sale in the City of Harrisonburg Under $300K = 5 houses Hmmm. Method #1 would lead us to believe that houses are not generally available in the City of Harrisonburg for less than $300,000. Method #2 for understanding housing availability... Houses Sold In The Past Year in the City of Harrisonburg Under $300K = 275 houses Wait a minute. There were 275 home sales under $300K in the City of Harrisonburg over the past year? That seems to point to a rather different conclusion about housing availability. -- And one more real example... Houses in Harrisonburg and Rockingham County combined priced under $200K: Currently Available Homes = 5 Sold Over The Past Year = 211 -- So... again... Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability Now, this does, of course, create the possibility that a would-be home buyer will simultaneously feel... 2. Encouraged... to know that there may very well be 270 more options in over the coming year. -- And one last point... If LOTS of homes sell each year in a particular location and/or price range but VERY FEW are available at any particular moment in time then two things would seem to be true... 1. Houses are generally available for purchase in this location and price range. 2. Demand for said houses likely exceeds supply, and if more such homes existed that could help bring more balance to that segment of the market. -- OK, fine, one more last point... If you are looking to buy a home in the coming year, yes, let's look at what's available now... but much more importantly, let's look at what has sold in the past year. The number of homes that have sold in the past year will likely be the best indicator of what to expect in the year to come. | |

This Is Completely Anecdotal, But Showing Activity Seems To Be Trending Upwards Again |

|

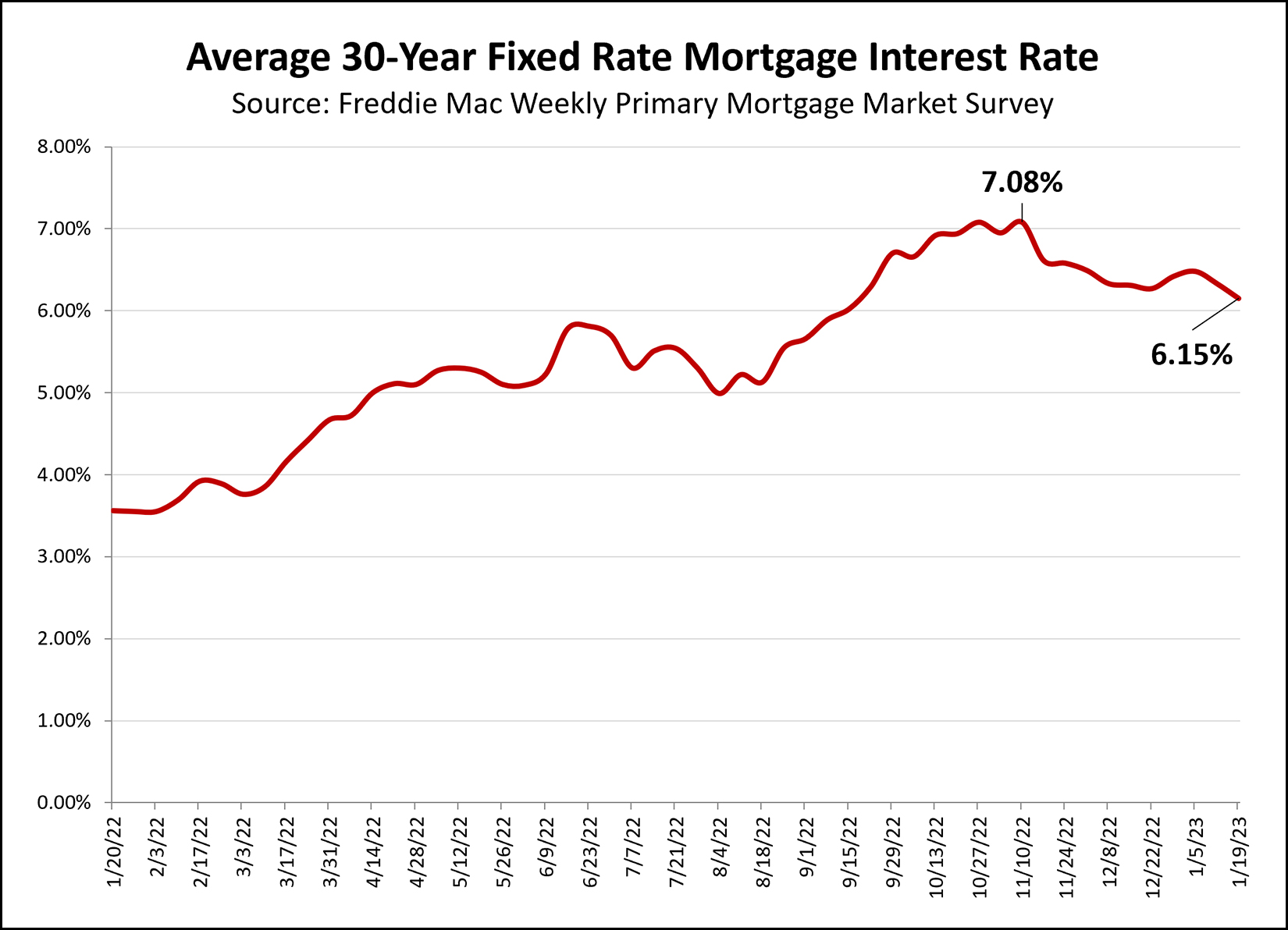

Clearly, showing activity (the number of showings on any listing) will vary from property to property, based on... - price range - property type - location - how competitively it is priced ...but, based on several of my recent listings, combined with conversations I have had with other local agents about their recent listings... ...it seems that showing activity is trending upward again. The number of buyers in the market to buy seemed to have trended downwards during November, December and January, but things now seem to be starting to speeding back up again. It's important to note that... [1] November, December and January are usually some of the slower (or slowest) months of the year, so it shouldn't be totally surprising that buyer activity might start increasing again as we move into and through February. [2] Mortgage interest rates climbed above 7% in November and then took there time during December and January drifting back down towards 6%. The average rate (for a 30 year fixed rate mortgage) is currently hovering around 6.1%. It shouldn't be totally surprising that buyer activity might start increasing again as rates settle in at or near (or just under!?) 6% -- if that is where they are over the next few months. [3] This is totally, totally, anecdotal. Over the next month or two (or three) we'll see what the actual data shows us as to the pace of buying activity. Until then.. just know that we're starting to see a few more buyers in the market, more showings on new listings, etc... after a few months of slightly slower buyer activity. | |

What Is An Affordable Home Purchase For A First Year Teacher? |

|

Q: What Is An Affordable Home Purchase For A First Year Teacher? A: Technically, $161K, but maybe more? Let's look at the numbers... It seems a first year teacher in the City of Harrisonburg would expect to be paid around $50,000 annually per this salary scale. A commonly accepted guideline for housing affordability is a housing cost, including utilities, that does not exceed 30% of a household's gross income. If we estimate utilities at around $125 per month, to include $40 for water/sewer and $85 for electricity, we would then conclude that this first year teacher could spend up to $1,125 per month on their mortgage payment. $50,000 x 30% = $15,000 for mortgage + utilities (per year) $15,000 / 12 = $1,250 for mortgage + utilities (per month) $1,250 - $125 utilities = $1,125 for mortgage How, then, does that translate into a potential purchase price of a home for this first year teacher? We'll assume a small-ish (5%) down payment for this first year teacher, and thus 95% financing, and a slightly above market rate of 6.5% for a 30 year fixed rage mortgage. To determine a housing budget for this first year teacher, let's look at a few mortgage payments (including principal, interest, taxes and insurance) given 95% financing at 6.5% and City taxes... $250K purchase = $1,748 / month $225K purchase = $1,572 / month $200K purchase = $1,398 / month $175K purchase = $1,223 / month $161K purchase = $1,126 / month $150K purchase = $1,048 / month So, a few things to note here... [1] An affordable home purchase for a first year teacher given the assumptions above would be priced right around $161K. [2] Let's tweak the numbers a bit. We'll look at a teacher's salary after three years ($52K) and we'll round utilities down a bit ($100 instead of $125) and we'll hope for a loan program with a slightly lower (6.25% instead of 6.5%) interest rate. This increases the monthly budget to $1,200 which translates into a $176K home purchase instead of $161K. So... a bit better, but not much. [4] Circling back to the original $1,125 per month figure... there are rental options at this price point even if it proves difficult to find a suitable home to purchase for $161K with that same $1,125 per month budget. [5] Certainly, if the first year teacher is married or is in a relationship such that there are two buyers instead of one, with two incomes instead of one, then all of this math changes... and they will find more housing options that will fit the affordable criteria. P.S. Do you come up with different numbers when you do that math? What assumptions above are too high or too low? What else am I not considering in this analysis? Let me know. | |

Resale Home Might Be Harder To Find This Year Than Last |

|

We saw a 14% decline in existing home sales (sales of resale homes) in 2022... Existing Home Sales in 2021 = 1,347 Existing Home Sales in 2022 = 1,159 With many homeowners having bought with or refinanced to long term mortgage interest rates below 4%, it seems likely that plenty of homeowners will not want to sell in 2023 based on mortgage interest rates alone. After all... if you bought a home in 2015, refinanced in 2021 at 3.5%, and now have the possibility of selling, paying off that 3.5% mortgage and taking out a new mortgage at 6% or higher... would you? Plenty of homeowners will sell because they are moving out of the area, because they really need to move into a larger home or really need to downsize... but I think there will be an overall decline in resale home sales this year. How low will it go? Will we see as few as 1,100 existing home sales this year? As few as 1,000? If you are looking to buy a home in 2023 -- and you're not planning to buy in one of the area's new communities -- keep in mind that resale listings might be coming on the market a bit less frequently than last year. | |

Home Buyers Happy To See Mortgage Interest Rates Continuing To Decline |

|

A year ago, the average 30-year fixed mortgage interest rate was 3.6%. Over the course of the past year that climbed... and climbed... and climbed... to a peak of 7.08% in October and November of 2022. As such, many buyers entered 2023 assuming we would likely see mortgage interest rates at or above 7% for much or most of 2023. Thankfully, that doesn't seem to be how 2023 is likely to unfold. After peaking at 7.08%, the average mortgage interest rate has been mostly declining... down to an average last week of 6.15%. I think it is extraordinarily unlikely that we would get back down to mortgage interest rates below 4% in 2023. It is also relatively unlikely that we'll see interest rates below 5%. But... I think it is now seeming unlikely that we'll see mortgage interest rates stick around above 7%. As such... we seem likely to see mortgage interest rates above 5% and below 7% in 2023... and if we give it a few more weeks we might conclude that rates might stay above 5% and below 6% for most of 2023. This is a trend that home buyers in 2023 are quite happy to see! | |

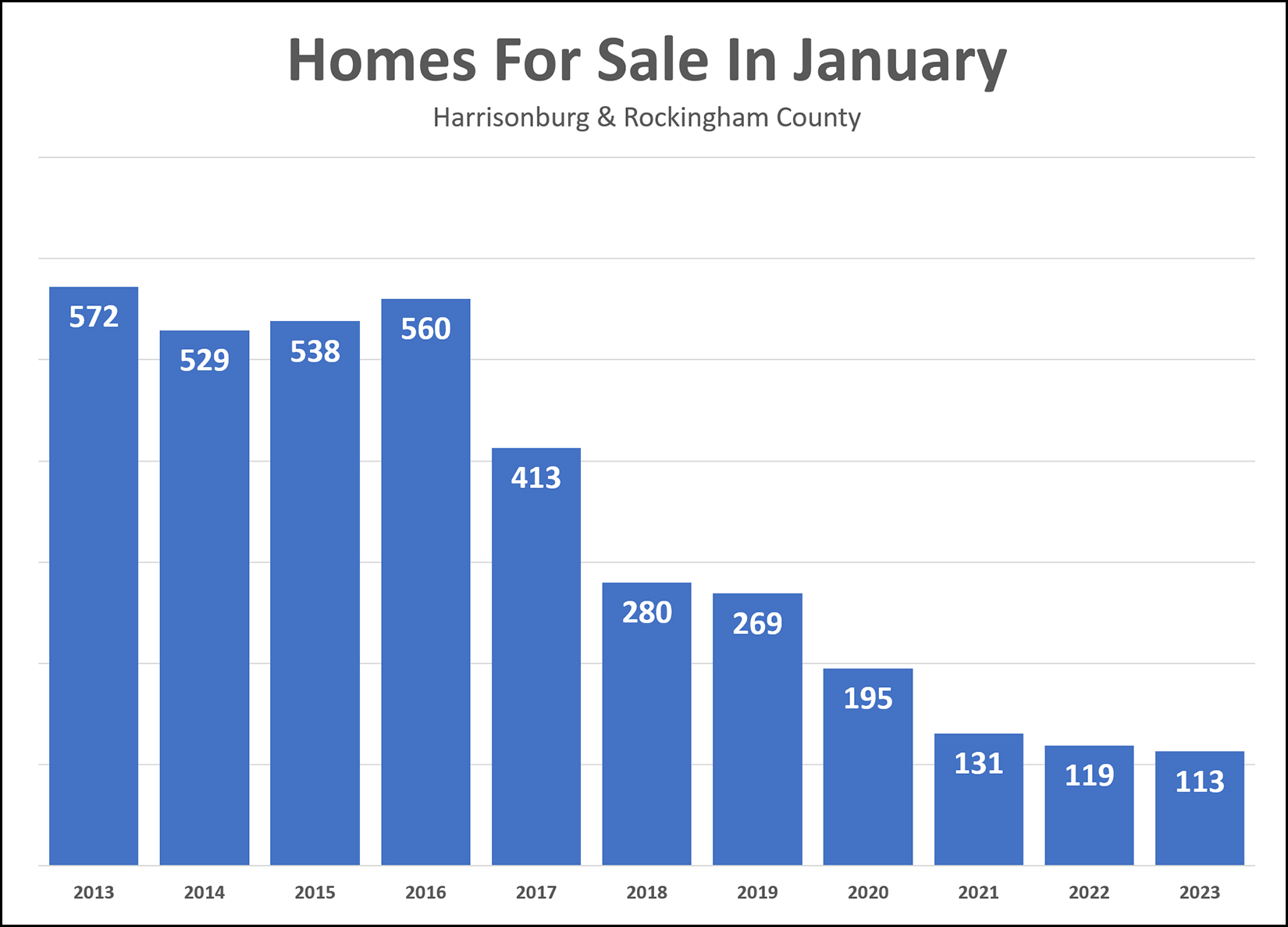

We Are Starting 2023 With Fewer Homes On The Market For Sale Than Anytime In The Past Decade |

|

Yet another reason why it seems relatively unlikely that we will see home prices start to decline in this area... One main factor that could cause downward pressure on home prices would be if inventory levels were starting to meaningfully rise. If more sellers wanted to sell homes than there were buyers to buy them... then we might see prices level out or decline. But... as shown above... we're starting 2023 with fewer homes on the market for sale than anytime in the past decade. So... there's that. Will we see meaningful increases in the number of homes available for sale at any given time during 2023? Buyers sure hope so... but it is not yet clear whether that will actually happen this year! | |

Maybe, Just Maybe, Buyers Might Be Able To Look At More Than One House At A Time In 2023?? |

|

The actual process of home buying has been a bit bananas for the past two years. Buyer: I want to buy a house. Me: Cool. Buyer: Let's go see a bunch later this week, K? Me: Every house for sale you might like is already under contract. Buyer: Ugh. Me: Wait, a new listing just came on the market, let's go see it, ASAP. Me, Two Weeks Later: Now there's another new listing! Me, Three Weeks Later: Ooooh, another new listing! Basically, many (most?) home buyers have only been able to consider one house at a time for the past two years. Homes were going under contract so quickly after they were listed for sale that it was rare for there to be two or more houses of interest on the market, not under contract, all at the same time. Which... lead to some less than ideal decision making for buyers. A buyer would have to decide whether to make an offer on each house, individually, without yet knowing what the other options would be (or might be) in the coming days or weeks. So, if the market starts to transition a bit in 2023 -- and if (a big IF) inventory starts to creep up a bit -- then maybe, just maybe, buyers will finally be able to look at more than one house at a time this year?? And compare and contrast them? What a novel concept! ;-) | |

Trading Up For A New House Will Likely Also Mean Trading Up Your Interest Rate |

|

For about three years (2019-2021) the average mortgage interest rate for a 30 year fixed rate mortgage was less than 4%. It even dropped below 3% at times. As such, anyone who bought a home during that timeframe likely has a mortgage interest rate below 4%... and many (many) other homeowners refinanced during that timeframe to lower their rate and their mortgage payment. So now we find ourselves in a situation where many mortgage holders have a mortgage interest rate below 4% or even below 3%. Thus, when any such holder of a low mortgage interest rates considers selling their home to trade up for a new house... they will also be trading up their mortgage interest rate. It was often an easy decision to sell a $300K home and buy a $400K home when you were paying off a 5% mortgage and taking out a new 3.5% mortgage. Now, if you're selling a $300K home with a 3.5% mortgage and are considering the purchase of a $400K home with a 6.5% mortgage... the math is going to work out a BIT differently. I suspect there will still be plenty of people selling and buying homes in 2023, even with these higher mortgage interest rates, but I think there will be fewer people swapping one house for another unless it is a significant upgrade in the house... because it will more than likely be a significant upgrade in the mortgage interest rate. :-/ | |

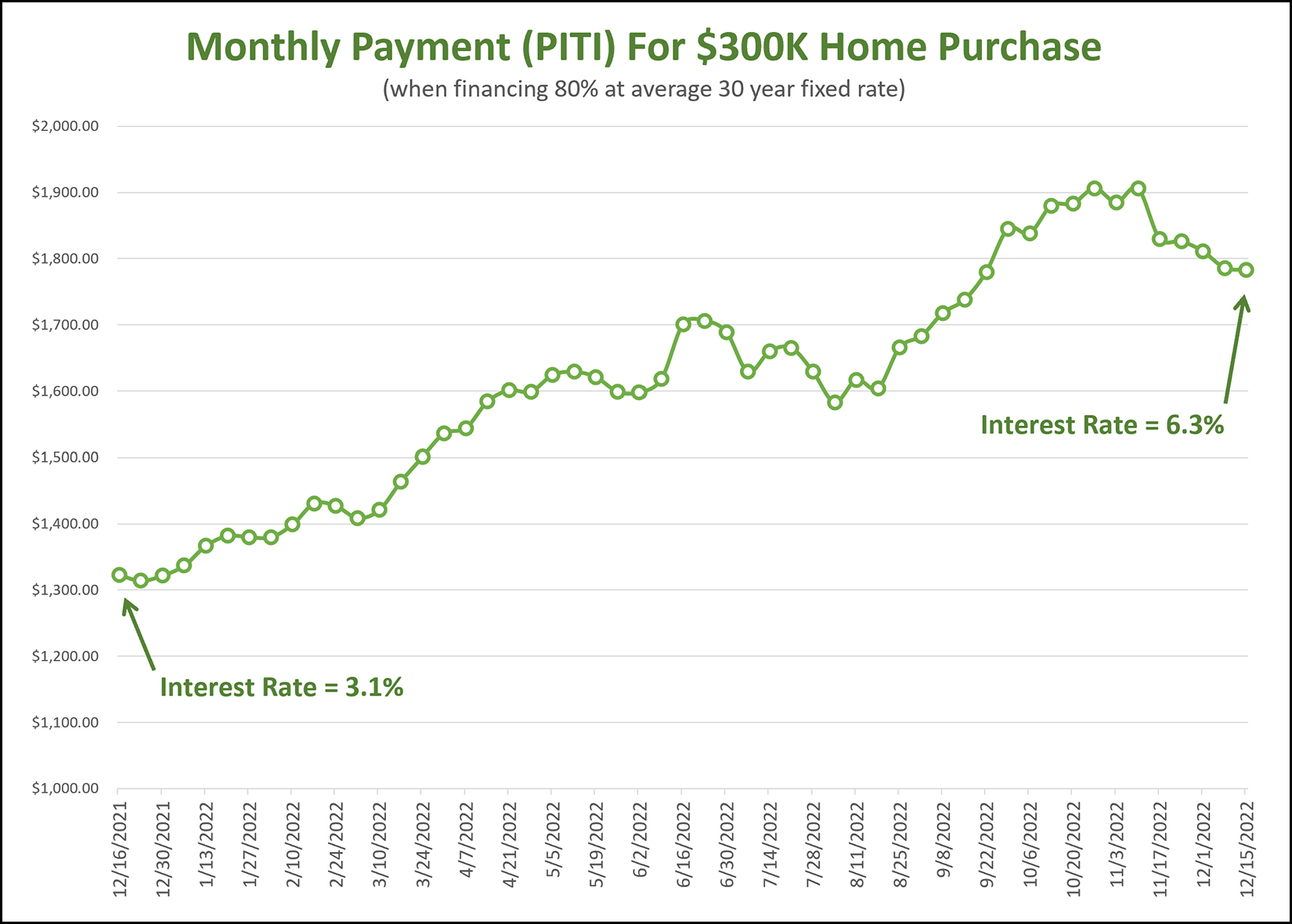

Monthly Housing Payments Have Changed A LOT In The Span Of A Single Year! |

|

With some regularity I take a look at trends in mortgage interest rates... but nobody really specifically cares about their mortgage interest rate... they really care about their monthly housing payment. The graph above shows how much monthly housing costs have changed over the past year. A year ago, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just over $1300 per month. Today, a home buyer purchasing a $300K house in the City of Harrisonburg, with a 20% down payment, would lock in a housing cost of just under $1800 per month. The slight bit of good news, I suppose, is that this potential monthly housing cost has been edging down over the past month-ish from over $1900 to under $1800 as mortgage interest rates have started to decline a bit. I don't think we're going to get back down anywhere close to the 3% ($1300) range in 2023 or 2024, but perhaps the monthly housing cost for a $300K home can work its way back down to $1700 (5.75%) or even $1600 (5.15%) over the next few years? | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings